Microsoft: Can They Safely Navigate the Economic Downturn? (1Q23 Call Minutes)

Microsoft released its Q1 financial report for the 23rd fiscal year, with a video version jointly released with Midou-jun (Dolphin Analyst) via the cooperation of Meitou-jun. Here, Dolphin Analyst will only extract the core points, and a detailed analysis will be released in the subsequent video.

The main points are as follows:

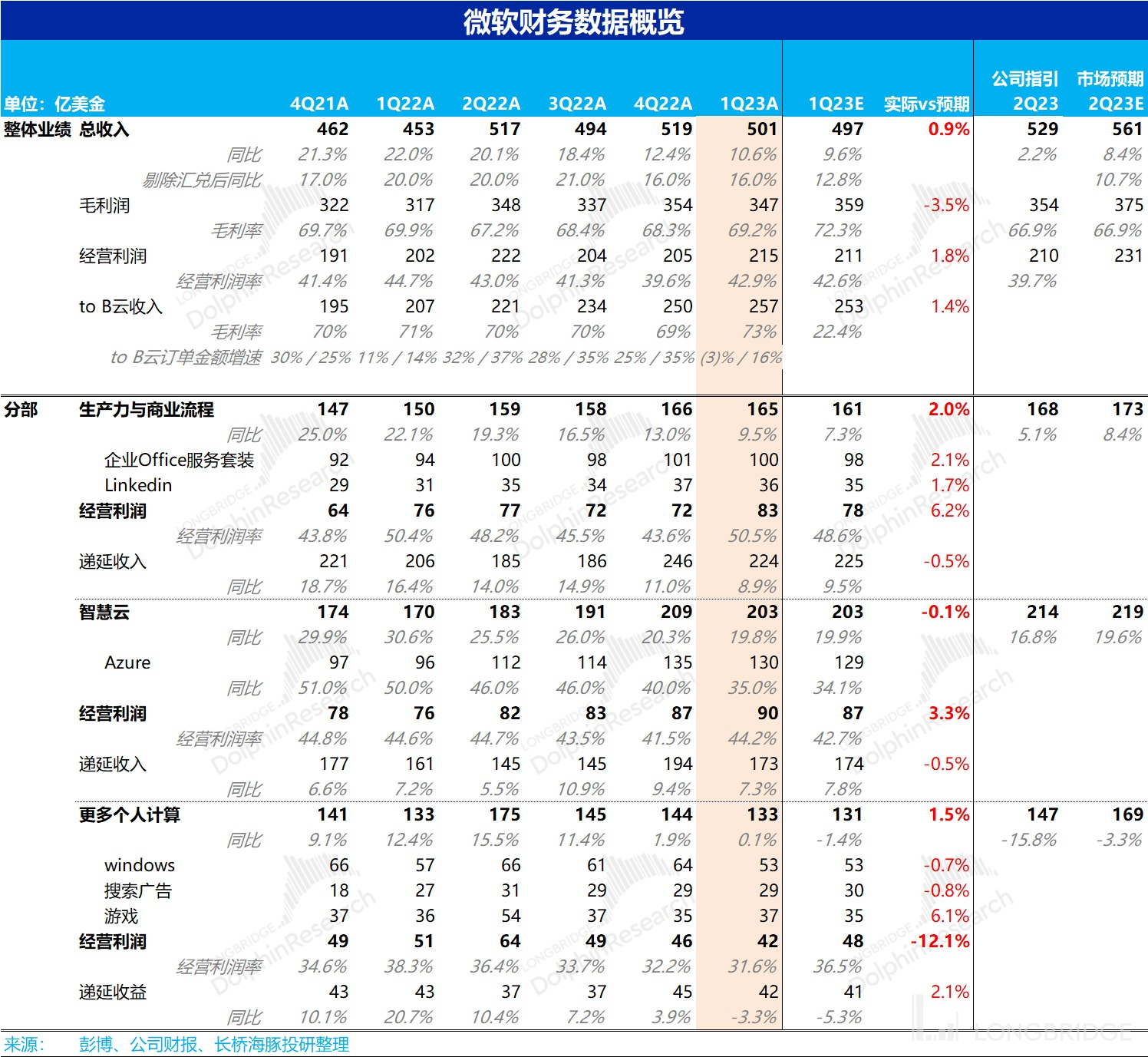

1. Overall performance this quarter is still good, but exchange rate factors had a significant impact: Microsoft achieved total revenue of $50.1 billion this quarter, slightly higher than the market's expected $49.7 billion, and a YoY growth rate that has slightly slowed down to 10.6%. This quarter's operating profit was $21.5 billion, slightly higher than the expected $21.1 billion. However, in an environment of slowing demand and high inflation, the operating profit margin YoY decreased by nearly 1.7pct, resulting in the operating profit's YoY growth rate of only 6%, which has entered into vicious circle of revenue growth without profit growth.

But due to the appreciation of the US dollar by over 10% YoY, and with Microsoft's overseas revenue accounting for nearly 50%, the exchange rate has had a significant adverse effect on its revenue. If exchange rate factors are excluded, the company's actual revenue growth rate would be 16%, which is basically on par with last quarter. So, overall, Microsoft's performance this quarter is still good.

2. Although exchange rates must bear the brunt, it is a fact that growth has slowed down: However, excluding exchange rate factors and just looking at the revenue growth rate domestically in the US, this quarter still saw a slowdown from last quarter's 15.1% to 13.3%, indicating that the slowdown in demand is also a fact. At the same time, Microsoft's most important business, Azure cloud services, saw its revenue growth rate decline by 5pct to 35% this quarter, and even if the exchange rate effect is excluded, the growth rate also decreased by 4pct. The intelligent cloud segment contributes nearly 60% of Microsoft's valuation, and Azure accounts for almost all of the incremental space for this segment. Therefore, the continuous slowdown in core business growth has to worry the market.

According to the company's conference call, assuming a stable exchange rate, Azure's revenue growth rate will further decrease by 5%, or around 30% on a QoQ basis. The main reasons for the slowing growth rate are as follows:1) For usage-based billed users, they are optimizing their usage to save costs, 2) Growth of monthly paid users with higher revenue certainty is significantly slowing down.

3. The slowdown in growth of deferred revenue increases uncertainty for Microsoft's short-term: In addition to the slowdown in revenue growth this quarter, the "leftovers" of the company's core 2B cloud business — the growth rate of deferred revenue balance has also slowed down from 34% last quarter to 31%. However, the QoQ slowdown of FY21 Q1 to FY20 Q4 is a seasonal rule. With a scale of over $100 billion, a growth rate of more than 30% is still considerable. Therefore, Microsoft's long-term leftovers are still worry-free, but its short-term leftovers are slightly at risk.

According to Dolphin Analyst's estimation, the absolute value of new 2B contracts signed this quarter is about $28 billion, shrinking by 3% YoY instead of increasing. This reflects that enterprises' new investments in cloud services are weakening. The deferred income that represents the short-term "leftovers" was $43.9 billion at the end of this quarter (over 90% will be confirmed as income within one year), and its growth rate was only a single-digit 7%, which continued to slow down from last quarter's 10%. It can be said that the long-term certainty of enterprise cloud services is still strong, but in the context of a weakening macro economy, its short- to medium-term certainty is still somewhat dim.

4. Disappointing Improvement in Gross Margin, Companies Begin "Consumption Downgrading":

Due to the company's announcement to extend the server depreciation period, the market originally expected the overall gross margin of the company to improve by nearly 4pct to 72.3% on a month-on-month basis, but the actual figure was only 69.2%. If the favorable impact of depreciation extension is excluded, the gross margins of the company's Smart Cloud and Productivity plateaus have actually declined on a month-on-month basis, and the gross margin performance is significantly lower than expected. The reason behind this is that the product structure used by users is tilted towards low-priced products, or in other words, users are "consuming downgrades".

As verification, the company's average revenue per user for Enterprise Office 365 in this quarter is down 3% YoY, with the company explaining that most of the new users are small and micro-enterprises, and users subscribe to low-priced services more, thereby dragging down the ARPU and gross margin. This is the fundamental reason why the company's profit growth is slower than revenue growth this quarter. If users continue to downgrade their consumption and ARPU remains difficult to increase, the company may continue to be stuck in a vicious circle of increasing revenue but not profit in the midterm.

5. Further Slowing of Revenue Guidance in the Next Quarter:

If Microsoft's performance this quarter is acceptable, the guidance for the company's performance next quarter is causing the market to feel cold. The median guidance for revenue is USD 52.9 billion, implying a YoY growth rate of only 2.2%, which is far below market expectations of USD 56.1 billion, and the guidance for the three major plateaus is also lower than expected. Even after excluding the impact of exchange rate fluctuations, the actual revenue growth rate for next quarter is only around 8%, which is still over half out of this quarter's 16% revenue growth. It shows a more sluggish and dim performance outlook for the market.

Dolphin Analyst's Perspective:

Overall, although Microsoft's financial report this quarter is still acceptable, and the exchange rate appreciation is responsible for a large part of the exchange rate loss, the actual operating trend revealed in this quarter's financial report shows that: 1) the growth rate of core cloud services is significantly slowing down even after excluding exchange rates. Although cloud business users can give the company a high degree of long-term business certainty after signing contracts, when the economy is in a downturn, internal users can still reduce their expenditure by reducing usage. Therefore, the short- to medium-term revenue growth rate of cloud business will also have higher uncertainty; 2) Small and micro-enterprise users will face greater pressures in a stagnant or possible recessionary environment. Although these users cannot completely stop using Microsoft's office products, they will also reduce the grade or price of products used, thereby reducing expenses.

Both of these points indicate that Microsoft's short- to medium-term performance may face significant pressure and fluctuations in an economic downturn cycle. The growth rate of the company's contract balances slowing down and conservative guidance for next quarter also reflect the expectation of poor performance. If Europe and the United States really fall into recession, the actual situation is likely to be worse than the company's expectations. (In addition, Microsoft's poor performance in the cloud business also means that Amazon's third-quarter report, which relies mainly on AWS to support profits, may also have risks, and investors need to be vigilant). Therefore, although Microsoft's long-term logic has not been shaken, the advantages of industrial Internet and cloudification are still reflected in this financial report. However, in the short to medium term, Microsoft is also unable to avoid the downturn cycle in this round of Europe and the United States. The company's current P/E valuation level is still above the 10-year average, and it does not have a high valuation safety margin, so there is a risk of double-kill of valuation and performance in the future. Therefore, for companies like Microsoft that are worry-free in the long run, buying the dip will be a good investment logic after the company is oversold.

The following are the minutes of Microsoft's 1Q23 conference call:

I. Recent business progress

-

The number of users of Azure Arc has exceeded 8,500, which has doubled from the same period last year.

-

The annual revenue of Github has reached 1 billion US dollars, and more than 90 million global users use Github services.

-

The monthly active users of Power AI applications have exceeded 15 million, a year-on-year increase of more than 50%, and the monthly active users of Power Automate have exceeded 7 million.

-

The number of enterprise users in the Teams business has increased by nearly 60%.

-

Large enterprises are accelerating the configuration of Windows 11 system.

-

LinkedIn currently has 875 million users.

-

The subscription volume of PC Game Pass has increased by 159% year-on-year, and more than 2 million users have used Microsoft's cloud gaming services.

II. Review of this season's performance

-

PC sales deteriorated significantly in September, affecting the company's Windows and Surface businesses. The reduction in advertising investment by enterprises also affected advertising and LinkedIn businesses, but recruitment business performed relatively well.

-

Large, long-term Azure and Office 365 contracts are steadily growing. More than 50% of Office 365 E5, which has an order amount of over 10 million US dollars, are subscribed.

-

45% of the remaining balance of the company's 180 billion enterprise business contract will be recognized as revenue within 12 months, a year-on-year increase of 23%, and the remaining part that will be recognized as revenue after one year has increased by 38% year-on-year.

-

Excluding the impact of changes in the depreciation period, the company's gross profit margin in this quarter fell by nearly 3pct, due to changes in the company's product structure, Azure gross profit margin decline and the impact of Nuance.

-

The total number of company employees increased by 22% year-on-year.

-

The number of cloud business users charged by subscription increased by 18% year-on-year to 232 million users.

-

The revenue of HoloLens increased by nearly 2% year-on-year, but the sales of Surface declined by a double-digit percentage.

III. Next quarter's performance guidance

-

The gross profit of Microsoft's cloud business will increase by 1pct year-on-year, and if depreciation is excluded, the gross profit will decrease by 2pct.

-

The fixed exchange rate revenue growth rate of enterprise Office 365 will remain unchanged from the previous quarter, while the revenue of Office Suite will decrease by about 30% year-on-year.

-

The revenue growth rate of personal Office business has decreased by several percentage points.

-

After the demand for resilient recruitment and weak advertising demand are offset, LinkedIn's year-on-year growth rate will be in the high single digits, and on a fixed exchange rate basis, in the mid to low double digits.

-

The growth rate of Dynamics will be in the low double digits, and on a fixed exchange rate basis, around 20%.

-

Azure's revenue growth rate will decline by 5pct on a quarter-to-quarter basis (fixed exchange rate).

-

The revenue of on-premises server business will decrease by a low single digit year-on-year, and the demand for hybrid cloud and SQL 2022 will offset the adverse effects of exchange rate fluctuations.

-

Windows OEM and hardware sales revenue will both decrease by about 30% year-on-year.

-

Windows products and cloud services will grow by single digits to low double digits year-on-year.

-

Advertising and search services will see a low to mid-double-digit growth rate year-on-year.

-

The gaming business will decline by a low to mid-double-digit rate year-on-year.

IV. 2023 Full Year Performance Guidance

-

The operating profit margin in dollars is expected to decline by about 1pct year-on-year; on a constant currency basis, the operating profit margin is expected to remain unchanged year-on-year in fiscal year 23.

-

On a fixed exchange rate basis, full-year revenue and operating profit will grow by double digits year-on-year, and the 2B business will grow by 20% year-on-year.

V. Q&A

Q: Azure's constant currency growth rate has been below expectations for two consecutive quarters. Investors are concerned that there may be inherent unpredictability in this business? How should we view Azure's growth for the full year?

A: There is some inherent volatility, but Azure's current growth rate is still quite high, growing in all segments and all regions.

As the macroeconomic environment becomes more complex, we will continue to monitor this issue. Customers' digital budget spending is still growing, but users are also considering how to increase efficiency and reduce usage.

In the SMB market, we rely on partners to help customers optimize and prepare workloads, which is the ultimate way to increase market share, build customer loyalty, and help customers grow.

Q: Why is Azure's growth guidance for the next quarter further lowered?

A: First, enterprises are beginning to optimize their usage of cloud services to improve efficiency (save costs), and the growth of business billed per seat is facing headwinds.

Q: It was mentioned last quarter that the SMB market was weak. What is the situation this quarter?

A: We have seen a sustained impact this quarter, but there is no significant difference from the previous quarter. We see good sales of E5 in the high-end market, but new orders in the SMB market are somewhat weak. But we are optimizing the E3 product to adapt to the SMB market. Q: Your artificial intelligence has made many breakthroughs in many aspects this quarter, such as GitHub, CoPilot, image generation, and product design. What factors have driven this? Is it related to OpenAI?

A: OpenAI is a very important partner for us. We have built supercomputing capabilities within Azure to support large-scale training of platform models or foundational models.

We then productized it as a part of the Azure OpenAI service, and we have made a lot of progress in our GitHub Copilot business. We believe that AI will improve all types of products within a company.

Q: You mentioned that Azure's profit margin is low due to high energy costs. Can we quantify this impact at $200 million per quarter? What cost controls do you have?

A: We have not seen such a large change. Of the $800 million impact this year, some will occur in the first quarter, but the majority will appear in the second to fourth quarters. You can understand it as approximately $250 million per quarter, although it is not accurate, it is a good assumption for the rest of this year.

Q: Considering that the Windows business is relatively weak, why not cut operating expenses to counter the pressure brought by Windows?

A: The personal computer market is cyclical. My view is that the personal PC business will be a major hurdle for us this year, but overall, the installation of Windows and our growth based on Windows are still strong. Maintaining investment in this downturn can allow us to gain more profits when the market rebounds.

To save costs, our number of employees will increase at the minimum level from the first quarter to the second quarter. The increase in operating expense investment (Opex) will decrease significantly.

Q: The growth of the Office business is largely driven by the growth of subscription users. Can you tell us where the incremental users come from? As time goes on, will we see growth momentum shift from the number of subscription users to ASP?

A: The continued growth of subscriptions is actually much longer than many investors expected, and it will continue. We continue to focus on the growth of small and medium-sized enterprises, and have launched many new products, including Viva, and Teams. I believe that the growth of SMB subscriptions will continue.

In the long run, the number of subscriptions will continue to grow. But changes in ASP will depend more on changes in product structure.

Q: How do you predict the two factors affecting cloud computing demand in the short to medium term? One is the impact of economic pressure on the consumption willingness of some customers, and the second is the impact of soaring energy costs.

A: Macro environmental pressure makes every user optimize their business. Our top priority for most customer-facing organizations is to actively help them optimize and help customers "spend less money and do more."

From the customer's point of view, the best way to maintain expenditure and uncertain demand is to migrate to the cloud. Because public clouds help enterprises offset the risk of demand. On the other hand, there are risks associated with supply chain or energy costs. The best way to avoid energy costs is to shift to cloud computing.

Q: Netflix will launch an ad subscription model supported by Microsoft next year. What are Microsoft's advertising goals for the next 3-5 years?

A: Our core advertising business has a component that I call LinkedIn's B2B advertising. Obviously, we are leading in terms of coverage and ROI quality, although it will be subject to cyclical impacts, but we believe LinkedIn user engagement continues to grow.

Secondly, overall active devices on Windows grew by 20% during the pandemic, whether it's Bing and search or information flow.

And finally, our third-party partnership with Netflix. We will work hard to turn Netflix into a successful partner, and we will continue to develop third-party businesses on the advertising platform.

These are the three areas of our advertising: LinkedIn, search and push advertising, and third-party advertising businesses.

Microsoft's previous research:

Financial report review

July 27, 2022 Conference Call "How Does Microsoft View Its 23rd Fiscal Year Performance? (Conference Call Summary)"

July 27, 2022 Financial Report Review "Microsoft: More Confidence Under Soft Collapse"

April 27, 2022 Conference Call "Microsoft's Journey is the Real Starry Sea (Summary of Third Quarter Conference Call)"

April 27, 2022 Financial Report Review "Strong Microsoft Is the Strongest Pillar of the US Stock Market

January 26, 2022 Conference Call "Nadella: "Microsoft is strong at seeing trends ahead of consensus""

January 26, 2022 Financial Report Review "Don't worry about Microsoft, it's still "reliable""

October 27, 2021 Conference Call "Is Digital Technology the Deflationary Force of Inflationary Times? Please See Nadella's Explanation (Conference Call Summary)"

October 27, 2021 Financial Report Review "Microsoft: The Most Beautiful Giant in the Post-Pandemic Era! | Dolphin Analyst" invite-code=032064) "

In-depth Research

May 30, 2022, "Microsoft Did Nothing Wrong, Lowering Prices Makes It Even Better."

February 15, 2022, "Microsoft: Don't Stare at Poor Expectations, Having Orders and Reserves Is the Only Way to Go."

November 22, 2021, "Why Is Microsoft Aging Gracefully While Alibaba and Tencent are Not?"

Risk Disclosure and Statement for This Article: Dolphin Analyst Disclaimer and General Disclosure.