Lousy performance, yet still rising? XPeng still needs to "reshape its bones".

Xiaopeng Motors released its Q3 2022 financial report after the Hong Kong and U.S. stock markets closed on Nov. 30th. At first glance, everything seems to be going downhill too fast:

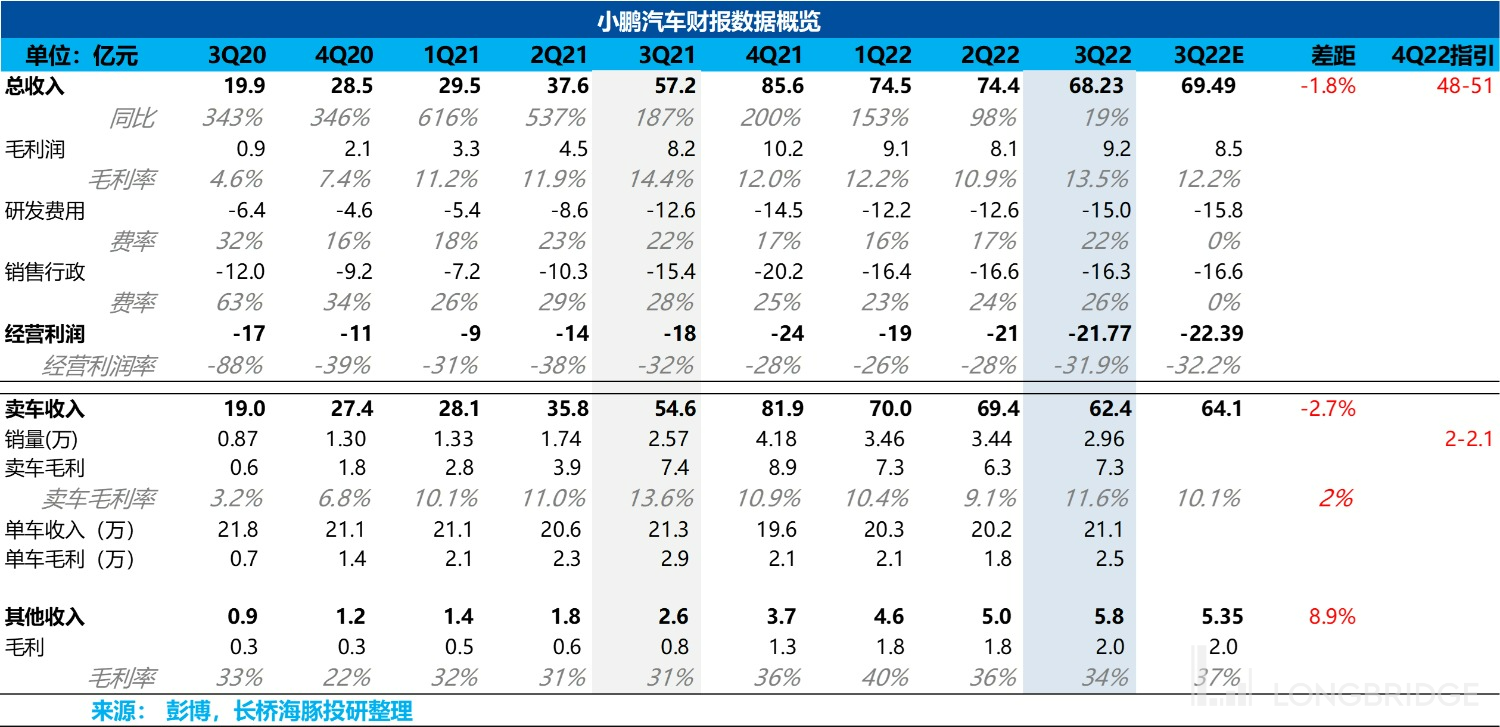

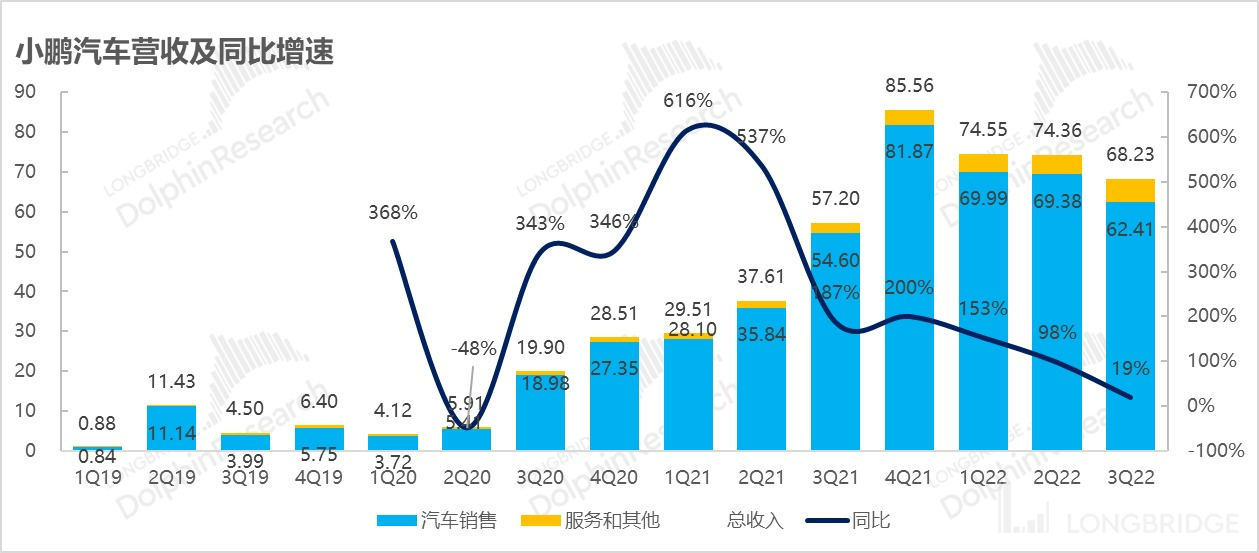

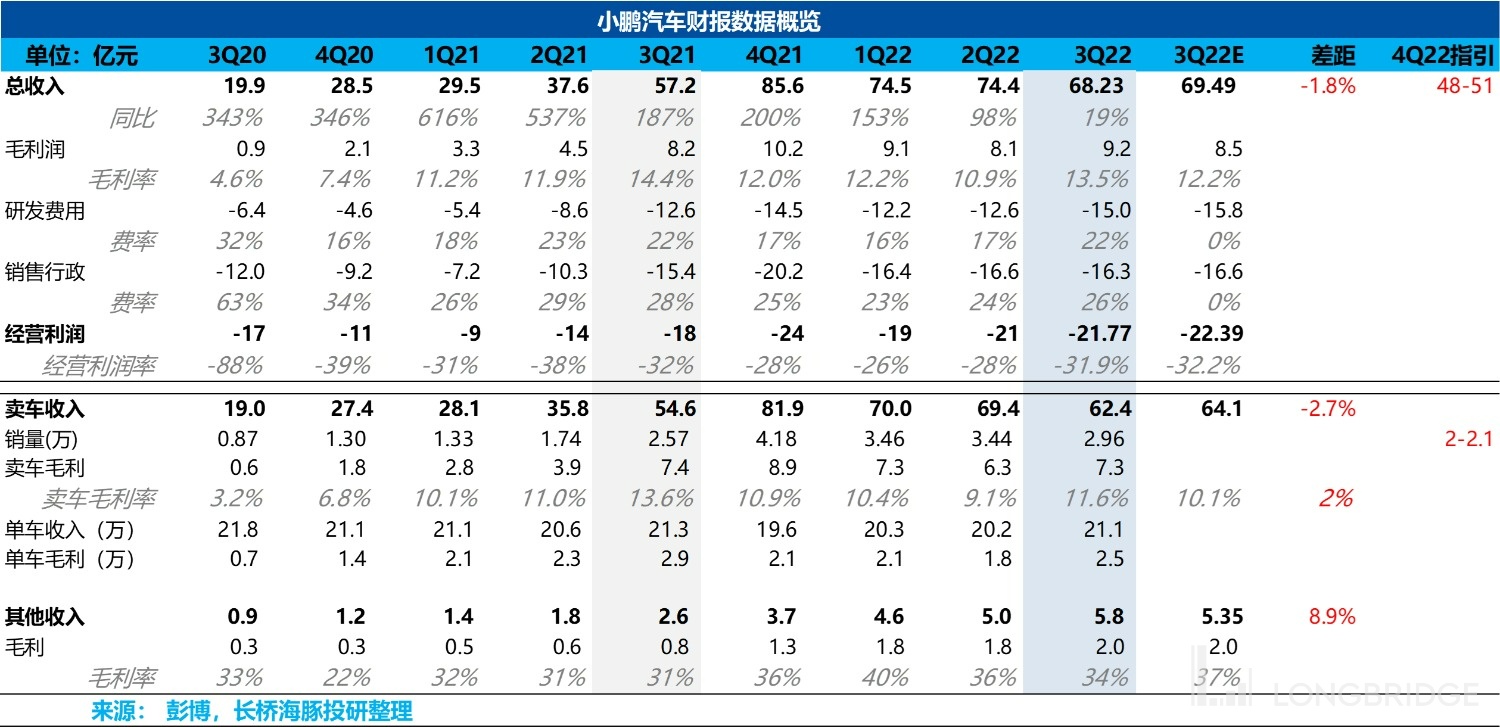

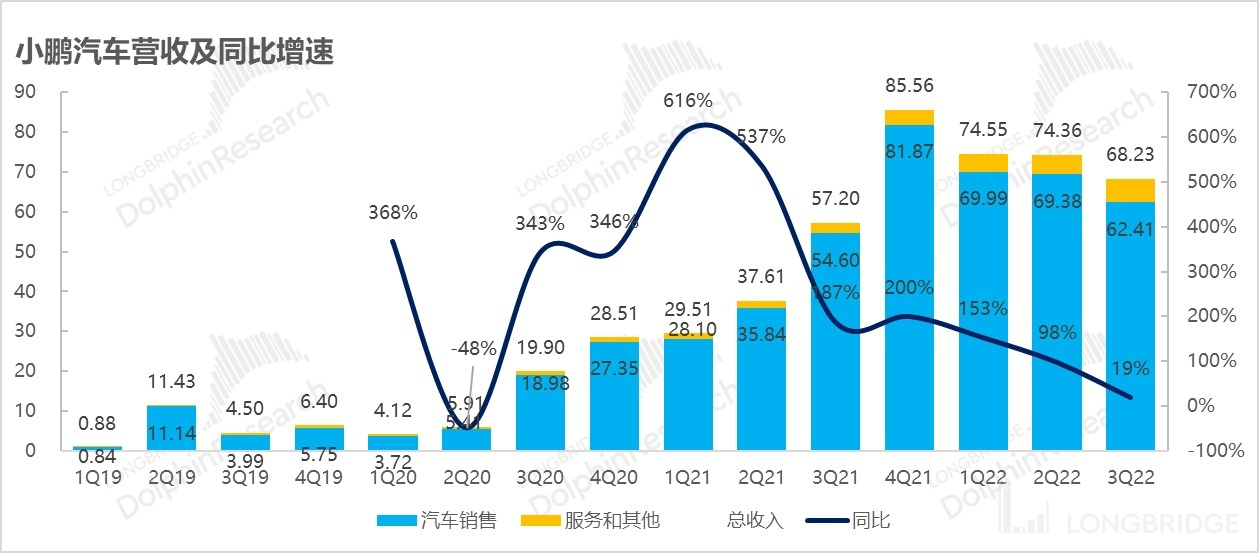

1. "Boxed in" Revenue by Sales: Xiaopeng Motors-W.HK (Xpeng) sales in Q3 slowed down too quickly, and revenue was difficult to come by as expected. Revenue for this quarter was more than 6.8 billion, a year-on-year increase of only 19%, which is about one billion lower than expected. Mainly because Xpeng raised prices and then promoted sales, the actual average selling price per vehicle, even with the G3 (the cheaper car model) selling less, wasn't as good as expected.

2. Sales Guidance Gap, But Not Negative: The company expects sales in Q4 to be between 20,000 to 21,000 vehicles. Considering that the sales figures were around 5,100 in October and estimated to be around 5,000 based on the number of registrations in November (the market had originally expected a rebound in sales in November), this implies that the G9 model (with approximately 10,000 orders secured) will only begin to be delivered in December, and about 10,000 will be delivered in December. It can only be said that after the stock price was halved in a single quarter, it is no longer negative for the excessively pessimistic market expectations.

Also, from the sales guidance, the company estimates that the unit price in Q4 is likely to exceed 220,000 yuan for the first time, and the unit price will continue to rise with the increasing proportion of G9 deliveries. At the same time, because sales have been so poor, the company's revenue guidance of 4.8-5.1 billion corresponds to a 40-44% revenue decline.

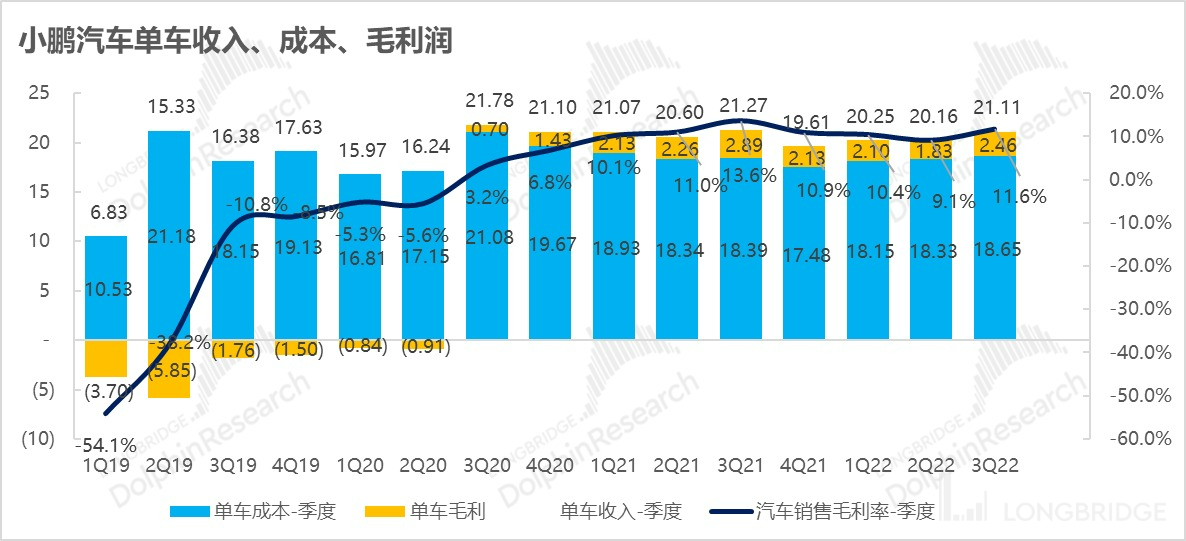

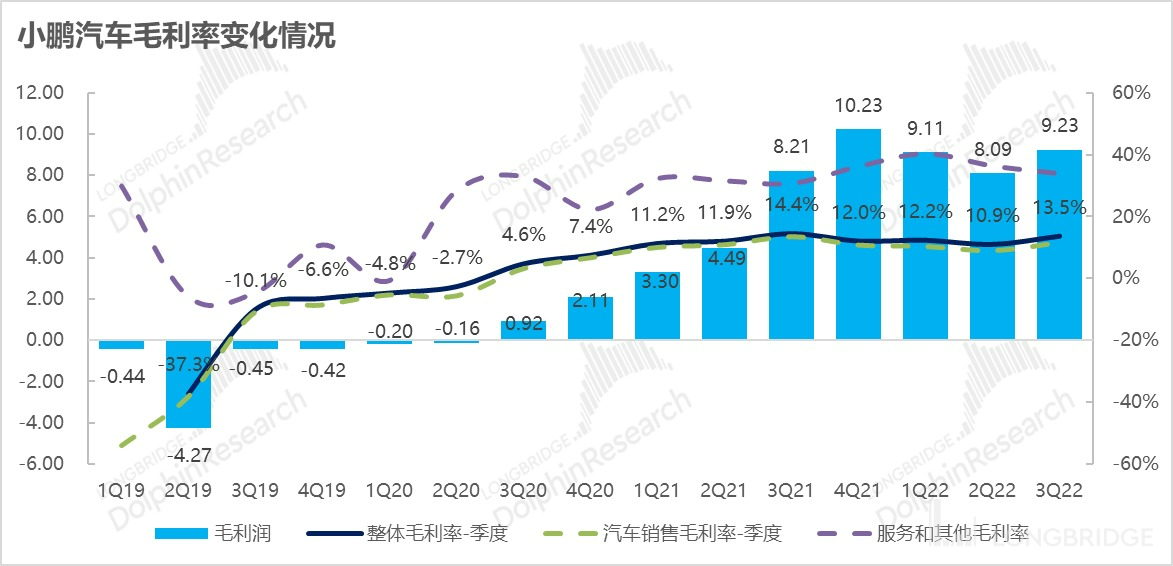

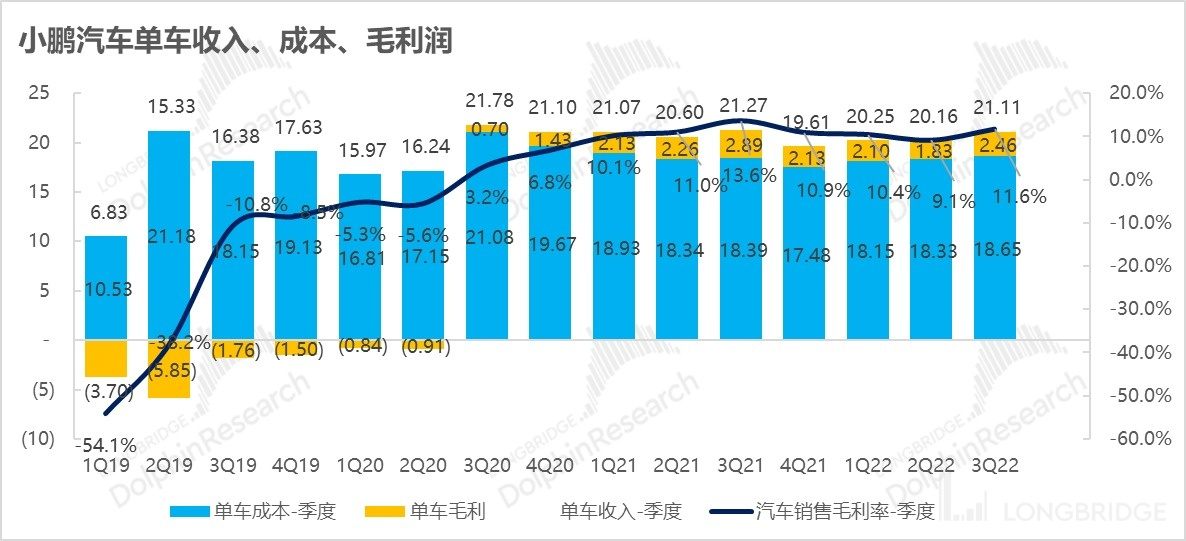

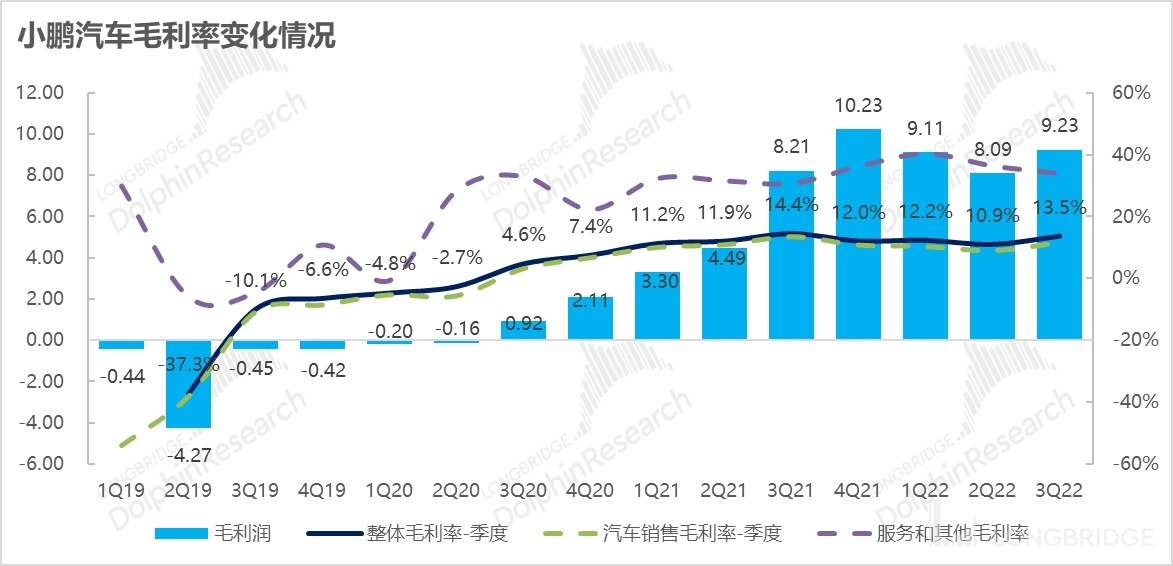

3. Single Vehicle Gross Margin is the only bright spot: Being the automaker with the lowest gross margin among Weilai (Nio), Xpeng, and Li Auto (Li), Xpeng has finally increased its car sales gross margin from single digits to above 10% this quarter, reaching 11.6%, slightly higher than market expectations. This is the only real surprise to the upside in this quarter.

This should be related to the low percentage of low-priced and low-gross-margin G3 deliveries in the vehicle delivery structure and the price increases across the model lineup. However, whether this gross margin can be further improved is still a big question: Model Y, the main competitor to the G9, has lowered its price, and the price of lithium carbonate has reached a new high. It is difficult to say how these factors will change the gross margin in Q4.

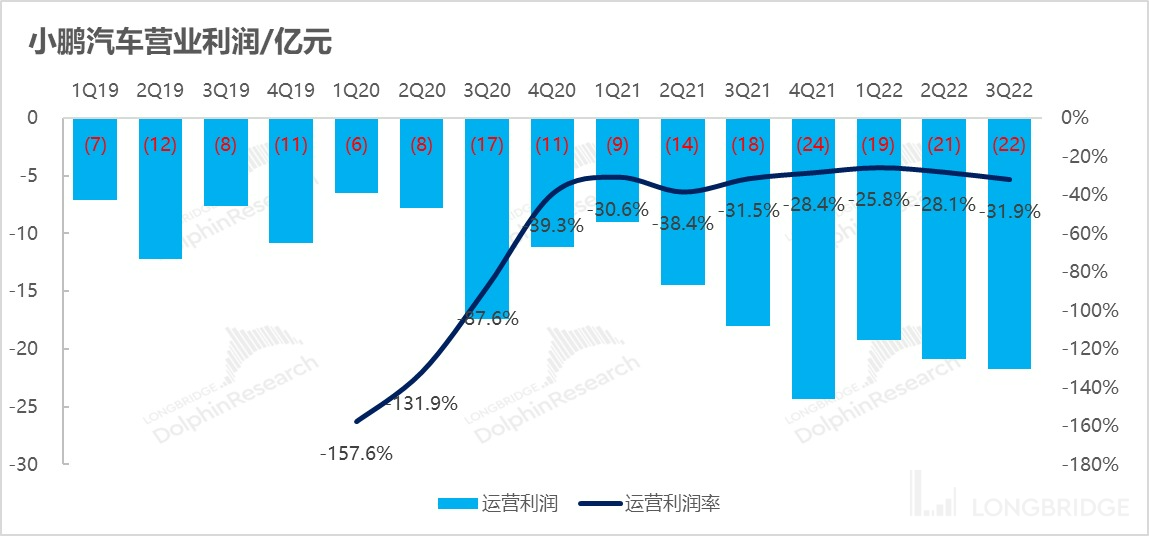

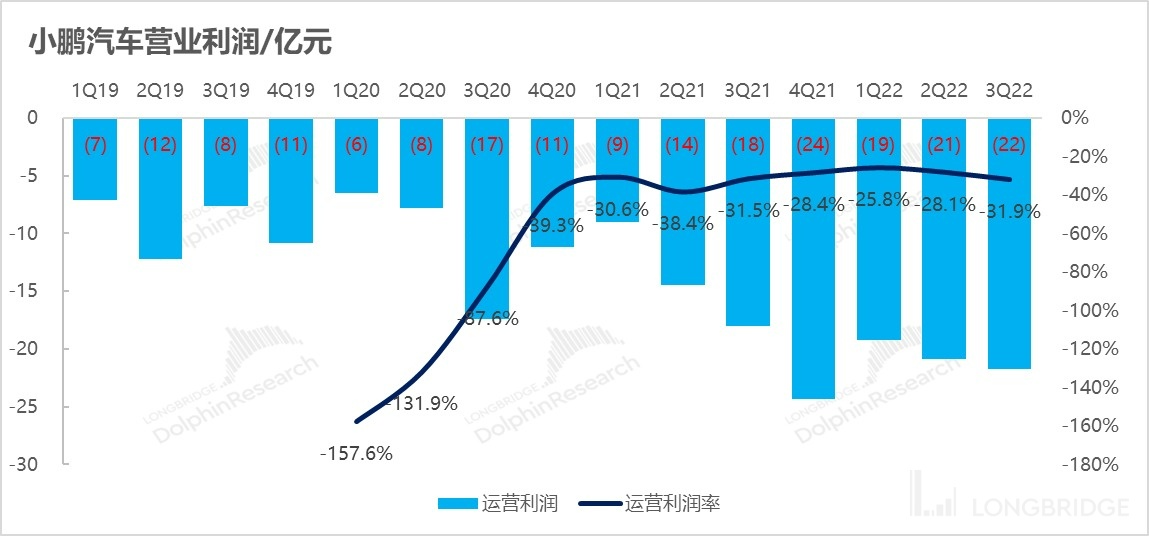

4. Rigid Expenses and Poor Sales Lead to a Decline in Operating Profit Margin: Although the overall gross margin increased under the improvement of the automobile gross profit rate, due to the continuous high growth of research and development and sales expenses, especially the R&D expenses have continued to rise in each quarter. Xpeng still adopts the direct selling and dealership dual sales model, and while revenue growth has slowed down, it continues to expand its stores and promote new car model launches, leading to relatively rigid expenses. The slightly increased sales expenses cannot offset the increase in expenses brought by store expansion and new car model promotion, resulting in a decrease in the expense ratio that can only be diluted by increasing sales scale. However, the weak sales in this quarter have further widened the operating loss ratio, which is even more severe than that in Q2 under the impact of the Shanghai epidemic.

Dolphin Analyst's Overall Perspective:

Dolphin Analyst's Overall Perspective:

From a performance perspective, Xiaopeng Motors has flatlined in almost all areas except for gross profit margin from car sales. While rigidities in R&D and sales costs were expected, the "culprit" behind the decline in operating profit margins is actually a slowdown in revenue growth. The root cause of all problems can be traced back to sales volume and sales volume expectations.

Xiaopeng's primary issue is that sales have essentially collapsed. With the resolution of issues in the automotive supply chain and sufficient capacity, sales have now become entirely a matter of consumer demand. There is no longer any blame to be shifted onto the "supply side".

The weakness in sales can be attributed to problems with product competition and product positioning strategies within the "people and organization" structure of the company. However, Dolphin observes that although Xiaopeng's performance has been poor, following a major personnel change in the company—the resignation of founder Xia Heng from his position as executive director—its stock still surged by over 10% in pre-market trading.

At the same time, the company has ample cash reserves (with over 40 billion yuan in cash reserves, losses of two to three billion yuan for a quarter), giving it certain operational flexibility. Despite being valued relatively low (with a market value of over 6 billion U.S. dollars and a P/S ratio of only 1.7, or even lower than Zero Run), the market is willing to bet that Xiaopeng may not perform as poorly as its market valuation suggests. Nonetheless, the company still has a lot of obstacles to overcome, such as the effectiveness of its organizational structure and delivery of its vehicles.

Below is Dolphin's specific analysis of Xiaopeng's financial report:

I. Does the sales forecast imply that sales will only recover in December?

Delivery volume is always the number one priority for new automakers. Therefore, in light of the abysmal deliveries in October, Dolphin's first step was to look at delivery guidance for the fourth quarter.

1.1., Is there a possibility of selling 20,000 to 21,000 vehicles, with the sales forecast being that they will sell 12,000 in December?

The pricing confusion and subsequent adjustment of Xiaopeng's heavy-duty new car G9 are now almost common knowledge, and Xiaopeng's sales have been essentially ruined since October.

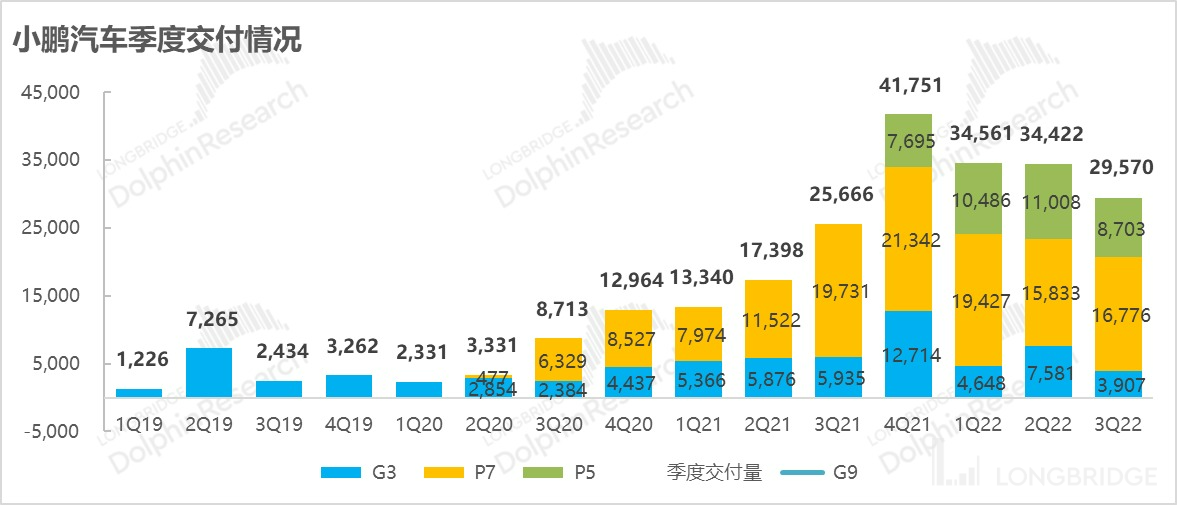

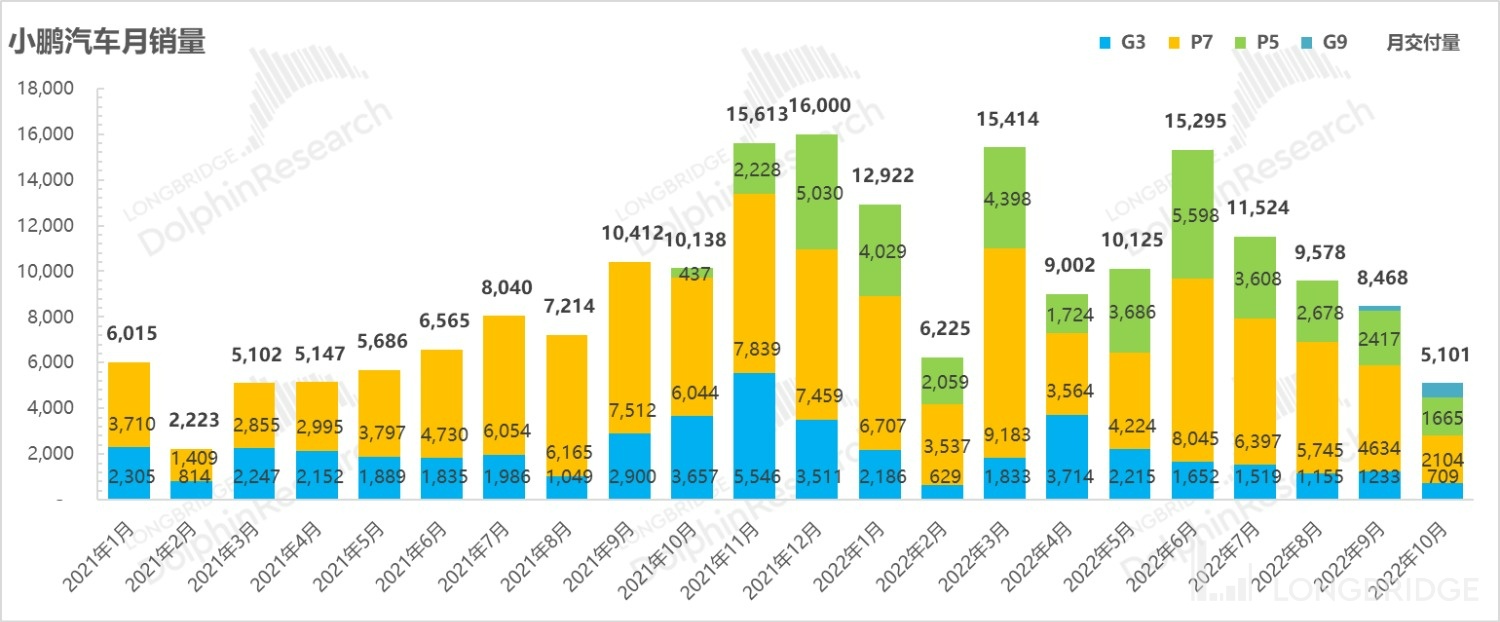

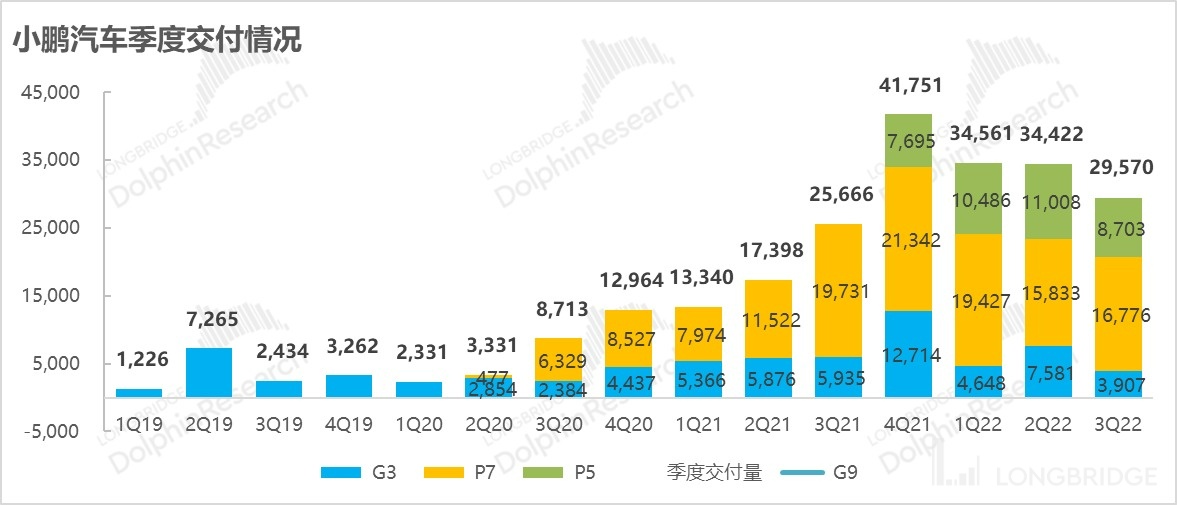

In fact, Xiaopeng's sales had already declined in the three months leading up to this, with the company's vehicle deliveries dropping below 30,000 (to 29,500) in the third quarter of 2022. The company's guidance was between 29,000 to 31,000 vehicles, barely within the shrunken guidance.

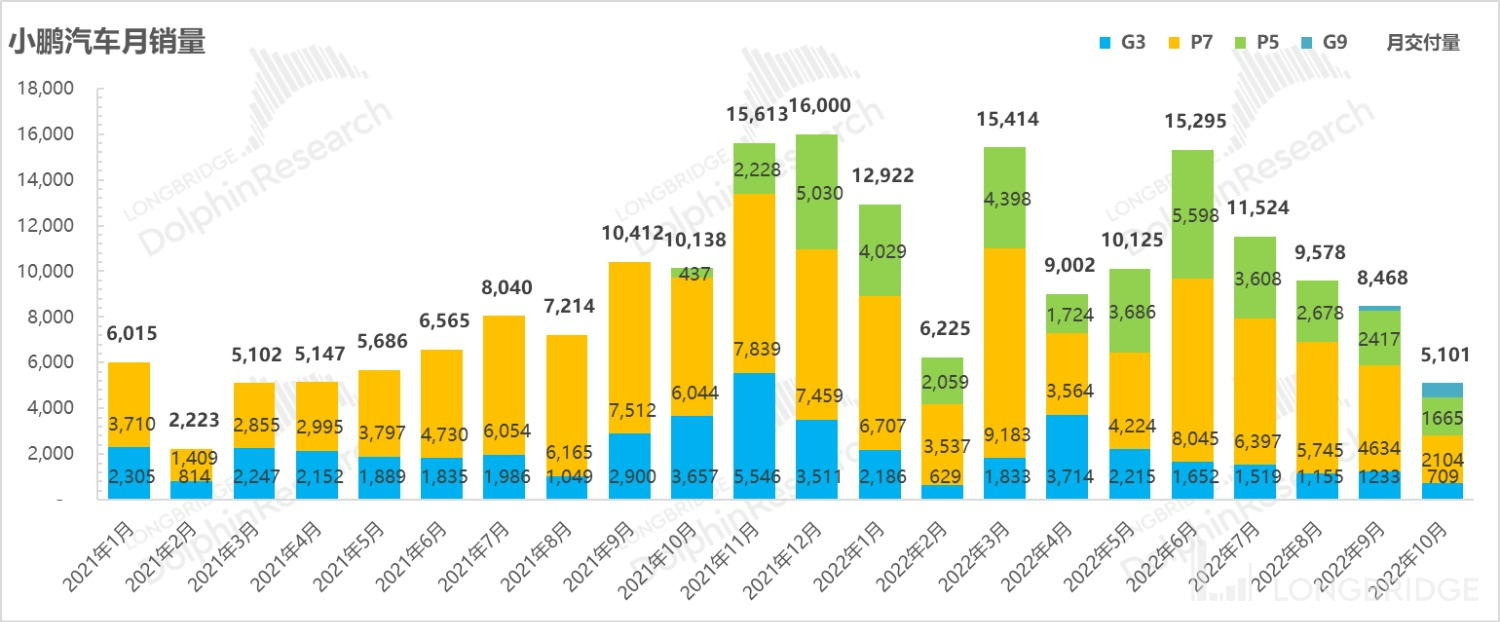

However, this is not the problem. The key issue is that the company's sales plummeted in October due to increased competition and a period of product iteration, with monthly sales quickly dropping from around 10,000 vehicles to just 5,100 vehicles, becoming the lowest among all of Weilai's sales data.

The new car G9 was only officially delivered at the end of October, and by November, the company had stated its intention to begin batch deliveries of G9 as transportation capabilities increased. Given the backlog of G9 orders upwards of 10,000 vehicles, the market had expected Xiaopeng's sales to start showing a clear bottoming in November. But according to the car registration data in November, Xiaopeng's sales volume is probably only around 5,000 vehicles, which means that Xiaopeng did not bounce back as expected by the market in November.

However, Xiaopeng has set the sales target for the fourth quarter at between 20,000 and 21,000 vehicles, implying that sales in December may be around 10,000 vehicles, which may be rapidly delivered before the end of December.

As for the guidance itself, this sales target is clearly below the sellers' expectations in early October, but due to Xiaopeng's stock price already reflecting poor sales performance and the expectation of competition from Model Y price cuts, the stock price has fallen sharply, reflecting the low sales and pricing errors of G9, and even reflecting the problem of Xiaopeng's organizational efficiency.

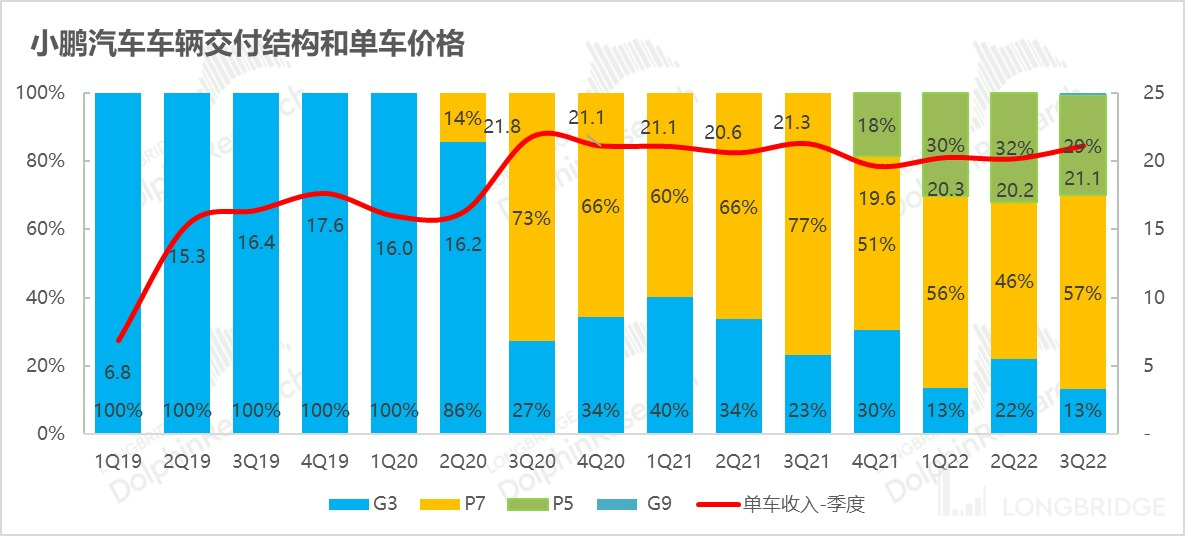

Looking at the vehicle models delivered in the third quarter, with G9 still basically undelivered, the earliest SUV model G3 has seen a significant decline, relying mainly on the two sedan models P7 and P5 to support sales, and the sales decline of the main model P7 in October is also very obvious.

1.2. Is Xiaopeng's survival a problem?

1) Cash reserve has room for error tolerance: Already crossing the threshold of life and death, Xiaopeng responded to the downward pricing by competitors and its own upward pricing, and pushed out the premium product G9. However, G9 did not perform well and the market is concerned that Xiaopeng will face the threshold of life and death again next year, during the intense competition for complete cars.

As of the end of this quarter, the company's cash and cash-equivalent assets (including long and short-term deposits) reached 40 billion yuan, down from 41.3 billion yuan at the end of the previous quarter. Based on the company's quarterly losses of 2-3 billion yuan, this cash reserve still has a certain margin of error tolerance for the company's product errors.

2) Structural adjustments, Xia Heng resigned as executive director: **After the pricing error of G9, Xiaopeng Automobile has already carried out introspection, attributing it to "organizational disintegration and cultural failure," and has made adjustments to the management team of four or five people in the company, establishing a virtual organization of a five-member committee to make decisions and solve the problem of each department independently making decisions.

According to the latest released information, Xia Heng, the founding partner of Xiaopeng Automobile and the company’s second-in-command who graduated from Guangzhou Automobile Group Technology Research Institute, no longer serves as an executive director. According to media reports, Xia Heng is similar to He Xiaopeng in terms of technical capabilities, but is not very good at interpersonal communication. This adjustment may be regarded by the market as a relatively good signal.

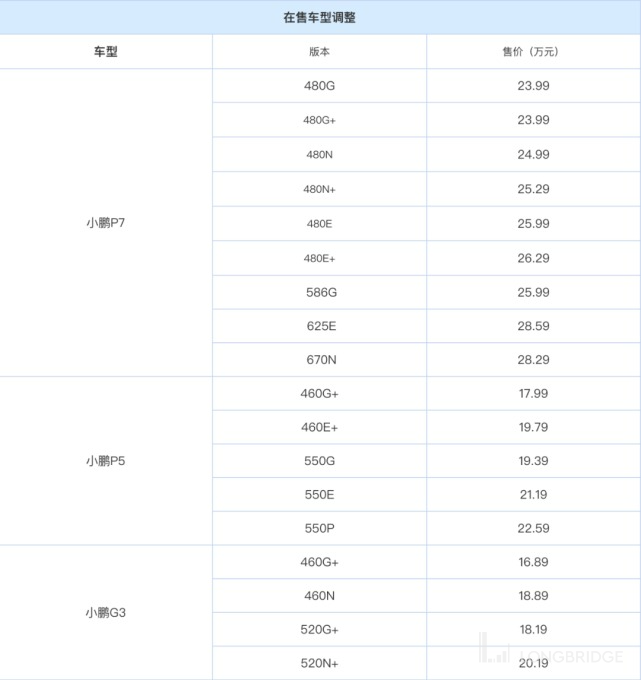

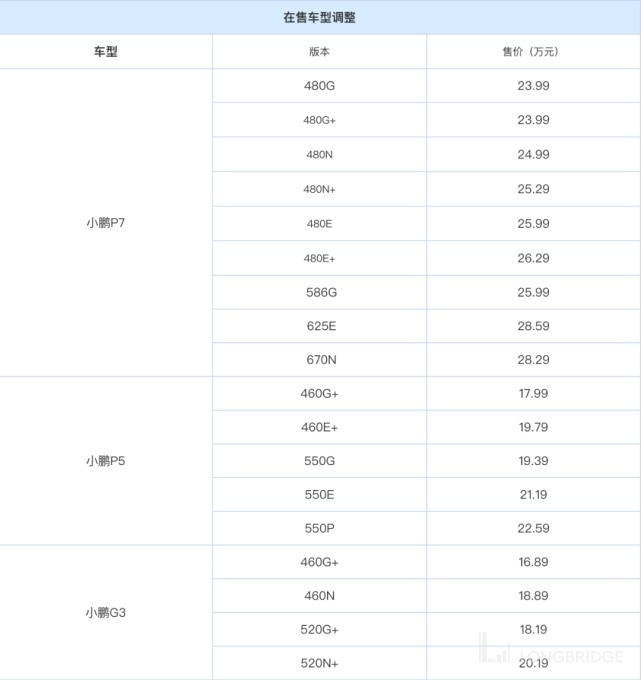

3) Lingering effects of G9's error, product continues to be streamlined: In addition, as a reflection of the pricing error of G9, Dolphin Analyst noticed that the original 773 model has also undergone SKU slimming, with G3 reduced from 7 models to 4; P7 retained 9 models and P5 stopped production of 5 models and kept 5 models.

After analyzing these information, it seems that Xiaopeng, with sufficient cash reserves and good flexibility as a small company, will not go bankrupt due to the failure of a single car, but it is hoped that Xiaopeng can iterate quickly and avoid the pricing errors like G9 in the future while the cash reserves are still sufficient.

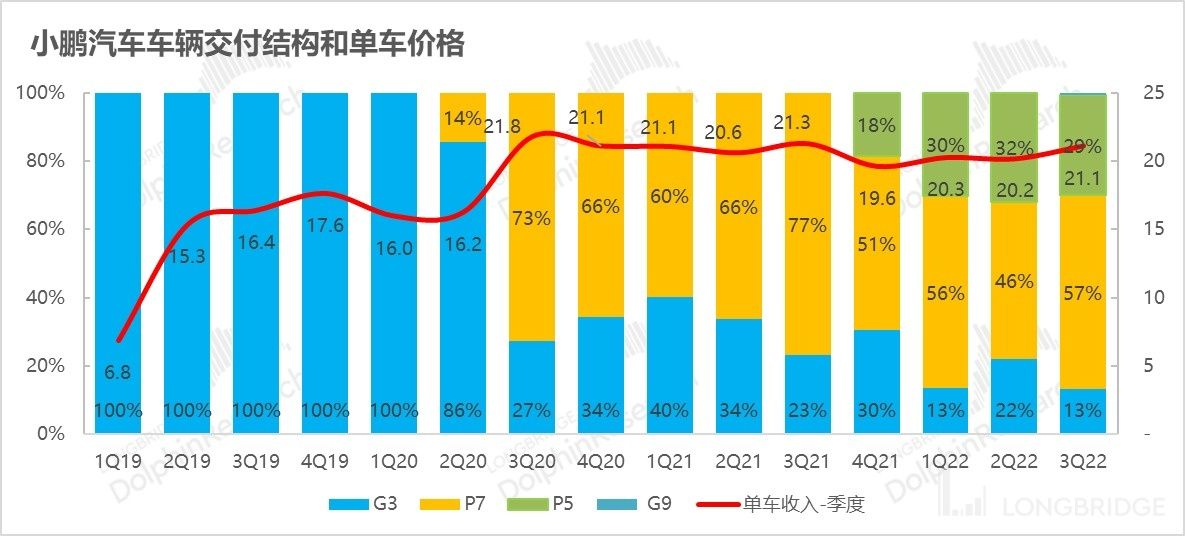

1.3 Sales of low-priced cars sharply declined and overall ASP of vehicles returned: Based on the company's revenue of 6.24 billion from car sales, we can estimate that the income per car is 211,000, which increased by 9,500 compared to the previous quarter. One reason is that Xiaopeng's three car models increased in price after promotions, and the actual price still went up. In addition, the lowest-priced G3's contribution to sales volume has declined passively.

Regarding price increases, Xiaopeng faced a battery price hike at the end of March and raised the price of the 753 model across the board by between 14,000 and 37,000. After the end of the Shanghai outbreak in the third quarter, sales were under great pressure and promotions began, resulting in discounts of up to over 20,000. Although there was a price increase, the effect of this price increase was greatly weakened by the promotions.

1.4 Good recovery of gross profit on a per-car basis

In addition to sales guidance, another very important indicator in each financial report is the gross profit per car: in this quarter, the gross profit per car sold was 24,600 yuan, which increased by 6,300 yuan compared to the previous quarter. This is also due to changes in product structure and price increases.

When designing each type of car, the platform used mostly decides its cost level, while the gross profit space is mostly supported by the premium of the selling price relative to this cost when pricing.

The low pricing of the G3 has obviously dragged down the overall gross profit level of Xiaopeng's automobile sales. When the sales contribution rate of the G3 quickly dropped from the 20-30% level to over 10% in the third quarter, it passively improved Xiaopeng's vehicle gross profit rate.

Another reason is that after the price increase and promotion, there was still a price increase, which to some extent improved the gross profit level per car. The gross profit rate per car this quarter was 11.6%, and the market expectation is around 10% or slightly higher.

Also, due to the unexpected rebound of the automobile sales gross profit rate, Xiaopeng's overall gross profit rate is good this quarter. The 920 million gross profit exceeded the market expectation of 850 million, and the gross profit rate of 13.5% exceeded the market expectation of 12.2%.

2. After poor sales, the income gap is in line with expectations

This quarter, Xiaopeng's total revenue was 6.8 billion yuan, a year-on-year increase of 19%, slightly lower than the market's expected 6.9 billion yuan. The core reason should be that the unit price was slightly lower than expected.

a) Car sales revenue: Due to the previous price increase, the market originally had higher expectations for its unit price, believing that it had the possibility of exceeding the 213,000 yuan in the third quarter of last year, when the highest-priced P7 accounted for 77% of the sales. However, the actual unit price dropped slightly, and the final automotive sales revenue was slightly over 6.2 billion yuan, a year-on-year increase of 14%, slightly lower than the 15% year-on-year sales growth rate in the same period.

b) Services and Others: This quarter, service and other income was close to 600 million yuan, a year-on-year increase of 124%, accounting for about 9% of automotive sales revenue. Dolphin Analyst noted that this proportion has a slightly upward trend, possibly related to Xiaopeng's strengths in autonomous driving services.

3. Rigid costs and poor sales lead to a further decline in operating profit margin

Xiaopeng Motors is positioned to empower sales and brand with intelligence, which means that R&D needs to be continuously strengthened to form and consolidate advantages. At the same time, the company is in a rapid expansion phase, and investments in sales and service networks need to be increased. Based on the company's long-term strategy, it is difficult to reduce costs in the short term, which will also exert pressure on profit release.

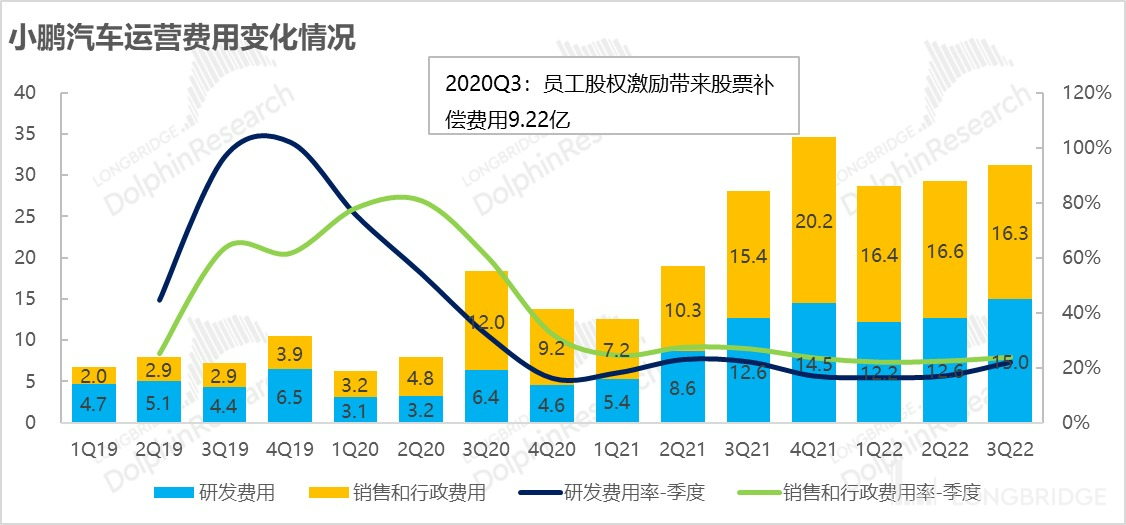

From the situation of this quarter, Xiaopeng's R&D expenses reached 1.5 billion yuan, still relatively rigid, and have been climbing every quarter, with an R&D cost rate of 22%, which is also a new high in the past four quarters.

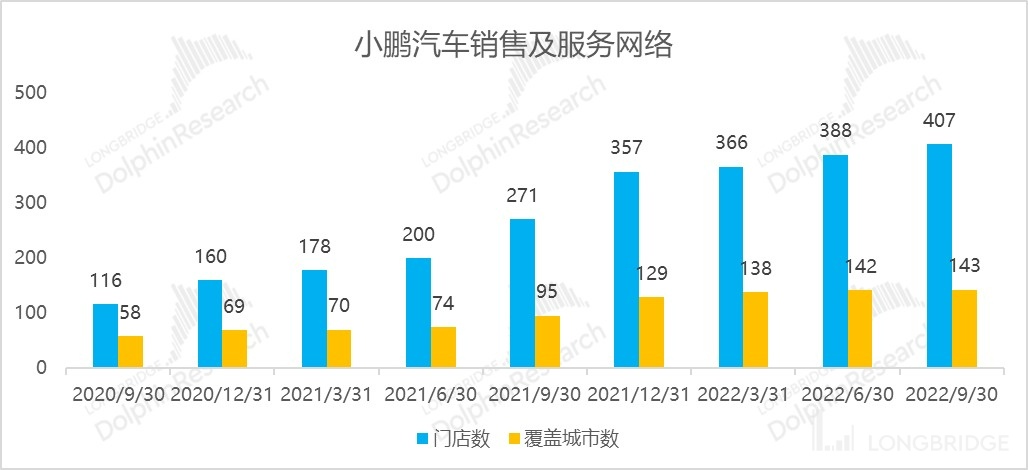

In terms of selling and administrative expenses, this quarter was slightly restrained. While the stores are still expanding, the absolute value of administrative and sales expenses did not continue to rise compared to the previous quarter and even decreased slightly, to be precise, 1.63 billion yuan.

Especially considering that Xiaopeng is committed to quickly increasing sales, the company opened franchise stores in 2021 (all direct-operated by NIO and Li Auto), and sales commission for franchise stores began to be reflected in the financial reports in the second quarter of 2021.

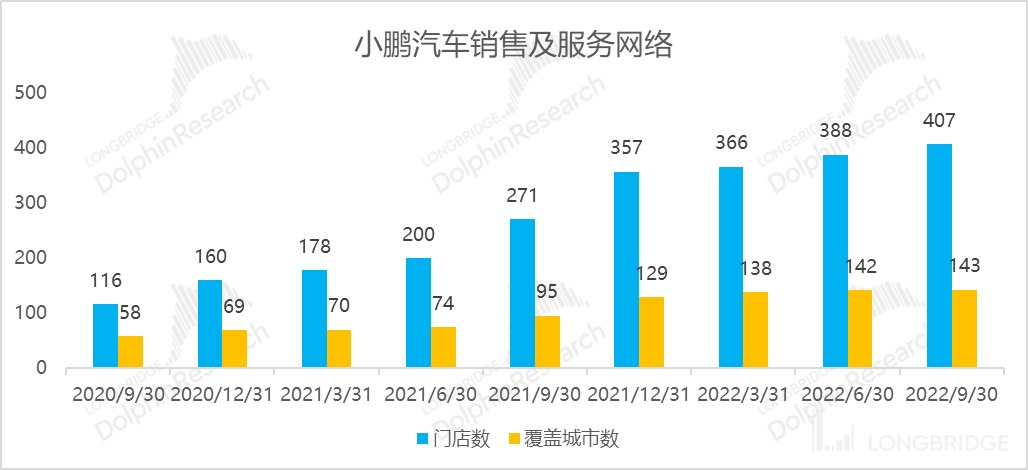

This quarter, the stores are still rapidly expanding. At the end of this quarter, it had nearly 20 more stores than the previous quarter, with a total of 407 stores and coverage in a newly developed city.

However, due to the rapid slowdown in car sales, the expense ratio could not be continuously diluted, and the expense ratio of the company began to rise again. These two factors combined accounted for 46% of revenue, causing the operating profit margin to worsen further, with an operating loss rate of 32% and a loss of 2.2 billion this quarter, despite the gross profit margin rebounding.

However, due to the rapid slowdown in car sales, the expense ratio could not be continuously diluted, and the expense ratio of the company began to rise again. These two factors combined accounted for 46% of revenue, causing the operating profit margin to worsen further, with an operating loss rate of 32% and a loss of 2.2 billion this quarter, despite the gross profit margin rebounding.

"Moreover, the net loss in this quarter was 2.4 billion, which is two billion more than the operating loss of 2.2 billion. This is mainly due to the generation of more exchange losses again this quarter, but it is not related to the main business itself, so the focus on profit should be on operating profit."

The above is a interpretation of the third-quarter report of Xiaopeng Motors. Regarding next year's automotive competition trend, gross profit trend judgment, organizational structure adjustment progress, new car planning, intelligence, and self-development progress, Dolphin Analyst will track whether there are relevant interpretations in the company's performance briefing and sort them out.

[End]

Dolphin Analyst's in-depth research and tracking comments on Xiaopeng's include:

Comparative Study of Three Fools - First Part: "New Forces in Car Making (Part 1): Choose the Right Person, Do the Right Thing, and Review the People and Things of the New Forces."

Comparative Study of Three Fools - Second Part: "New Forces in Making Cars (Part 2): Market Enthusiasm Wanes. What Does Three Fools Rely on to Consolidate Its Position?"

Comparative Study of Three Fools - Third Part: "New Forces in Car Making (Part 3): Fifty Days of Doubling, Can Three Fools Continue to Run Wild?"

Analysis of the 2021 First Quarter Report: "Xiaopeng Motors: Tesla in a Negative Light and Xiaopeng, Who Will You Pick?"

Analysis of the 2021 Second Quarter Report: "Xiaopeng Motors: A Healthy Financial Report and a Full Deck of 'Intelligent' Cards"

Summary of the 2021 Second Quarter Report Conference: "Xiaopeng Motors: Roll Up Your Sleeves and Work Hard"

Analysis of the 2021 Third Quarter Report: "Small Steps to Achieve the Goal of Being the annual Champion of New Forces: How Far Away is Xiaopeng from 'China's Tesla'?"

Summary of the 2021 Third Quarter Report Conference: "Xiaopeng: Exploring Robotaxi Operations and Advancing Intelligence (Telephone Conference Summary)". 2021 Q4 Review: "Selling More and Losing More, Is Xiaopeng (XPeng) Just a Pretender or a Real Challenger?"

Minutes of the 2021 Q4 Conference: "Rapid Channel Expansion Unlocks the Potential of XPeng's Deliveries".

2022 Q1 Review: "Top in Sales, King of Losses, Can XPeng Still Sway the Market?"

Minutes of the 2022 Q1 Conference: "XPeng: the Third Quarter is When the Price Hike Results and Gross Margin Significant Rebound will be Seen".

2022 Q2 Review: "XPeng is Far from Profitability".

Minutes of the 2022 Q2 Conference: "G9 and B-class Model Y, XPeng's Last Try (22Q2 Conference Call)".

Risk Disclosure and Statement of Disclaimer in this Article: Dolphin Research - Disclaimer and Disclosure