Stock price plummeted by 23%, Q3 performance changed drastically, Super Micro Computer encountered "Black Friday"

Super Micro Computer's stock price plummeted by 23%, experiencing a "Black Friday". The company is about to announce its third-quarter performance without providing a forecast, triggering investors to reduce their holdings. Its stock price has risen from over $280 to over $1200 this year, but with investors questioning the AI industry bubble and speculation, Super Micro Computer is facing danger. The company focuses on high-performance servers, and its strong performance benefits from the growth in demand for AI servers. However, compared to NVIDIA, Super Micro Computer has lower technological barriers and business gross margins. The company's gross margin for Q2 of the 2024 fiscal year was 15.5%, a year-on-year decrease of 3.2 percentage points and a quarter-on-quarter decrease of 1.2 percentage points

On April 19th, it was a "Black Friday" for Super Micro Computer Inc. (SMCI.US), which has always been known as the "hottest AI stock". As the company is set to announce its third-quarter financial results on April 30th without providing the usual preliminary performance forecast, this risky signal has led investors to massively sell off the stock, dragging down tech stocks such as NVIDIA, Arm, and AMD.

Since the beginning of this year, Super Micro Computer's stock price has surged from over $280 at the beginning of the year to over $1200, a rocket-like rise that even AI chip giant NVIDIA cannot match. However, looking at it now, with more and more investors questioning how much bubble and hype exist in the AI industry, Super Micro Computer seems to have reached a dangerous crossroads.

Strong Earnings Growth Exceeding Expectations, Yet Doubts Remain About Real Technological Strength?

According to the Wise Finance APP, Super Micro Computer focuses on high-performance servers, with products ranging from servers, storage systems, network switches to software, used for website servers, data storage, and AI training, making it one of the top three server manufacturers globally.

Recently, Super Micro Computer's strong performance has been mainly driven by the high demand for AI servers. From the fiscal year 2019 to 2023, Super Micro Computer recorded a compound annual revenue growth rate of 19.4% and a compound annual net profit growth rate of 72.7%. In particular, the performance in fiscal year 2022 and 2023 accelerated significantly, with revenue growth rates of 46.06% and 37.09%, and net profit growth rates of 154.92% and 124.43% respectively.

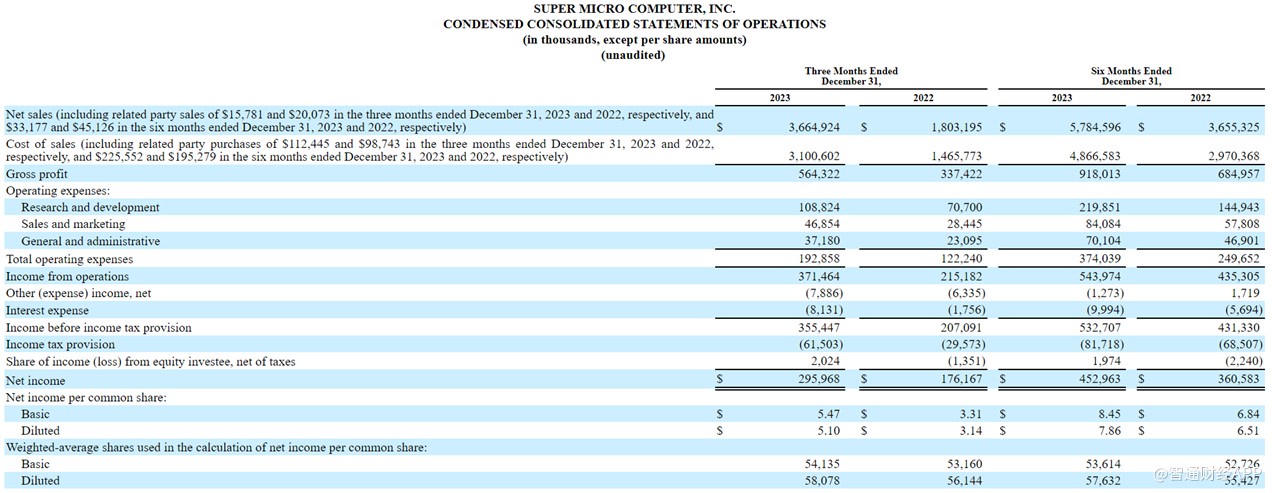

The latest financial report shows that the company's revenue for the second quarter of 2024 (fourth quarter of the 2023 calendar year) was $3.66 billion, a 17% year-on-year increase, with adjusted earnings per share of $5.59, significantly exceeding analysts' previous estimates.

Behind the impressive performance, it is worth mentioning that compared to chip leader NVIDIA, Super Micro Computer's server business actually has low technical barriers and much lower gross profit margins than NVIDIA. The company's gross margin for Q2 of fiscal year 2024 was 15.5%, a 3.2 percentage point decrease year-on-year and a 1.2 percentage point decrease quarter-on-quarter.

As a manufacturing company leaning towards the mid-to-low end, the reason why Super Micro Computer's performance and stock price can both surpass NVIDIA's is largely attributed to "personal factors" beyond the data.

It is understood that Super Micro Computer's founder, Liang Jianhao, and NVIDIA's founder, Huang Renxun, were both born in Taiwan, China. Thanks to the personal relationship between the two founders, Super Micro Computer and NVIDIA have had a cooperation relationship for over 20 years. When NVIDIA was developing AI GPUs, Super Micro Computer also provided hardware support. Therefore, after NVIDIA officially launched AI chips, Super Micro Computer could always follow up in a timely manner, providing customers with a variety of GPU-spec server products Even market rumors suggest that Super Micro Computer has obtained "priority" access to NVIDIA chips among many server manufacturers, undoubtedly ensuring that Super Micro Computer fully benefits from this wave of AI dividends.

However, on the other side of this extraordinary "friendship," it is clear that Super Micro Computer is heavily dependent on NVIDIA. From a business perspective, the substitutability of the mid-to-low-end manufacturing industry to which Super Micro Computer belongs is relatively strong, with many strong competitors in the server field, and its performance is easily affected by changes in the upstream and downstream.

According to the 2023 global AI server market share report released by Jibang Consulting, Inspur currently ranks first in AI server market share, followed closely by Dell, HPE, and others. It can be seen that Super Micro Computer does not have a significant lead in market share.

TrendForce predicts in its latest research that the global server shipment volume in 2024 is expected to be approximately 13.654 million units, with an annual growth rate of 2.05%, of which the proportion of AI servers is about 12.1%. The organization points out that in 2024, Super Micro Computer's server shipment volume is expected to remain stable, with the possibility of a doubling in AI server shipments, but general-purpose server shipments have not shown significant recovery, which will to some extent drag down performance.

Looking at the revenue breakdown of Super Micro Computer's server and storage system products in Q2 of the 2024 fiscal year, server and storage system product revenue accounts for 94%, while subsystem and accessory product revenue accounts for 6%. OEM equipment and large data center market revenue is $2.15 billion, accounting for 59% and being the fastest-growing market, while enterprise and channel market revenue is $1.48 billion, accounting for 40%. Revenue from 5G, telecommunications, and edge/IoT markets is only $35 million, accounting for 1%.

Looking ahead, Super Micro Computer has raised its revenue expectations for the 2024 fiscal year, expecting sales to be between $14.3 billion and $14.7 billion by the end of the 2024 fiscal year (ending June of this year), far exceeding the previous forecast of $10 billion to $11 billion.

Currently, Super Micro Computer's production capacity utilization is mainly limited by the supply of NVIDIA chips. With various tech giants entering the AI chip market and the easing shortage of NVIDIA chips, there is further room for Super Micro Computer's performance to rise.

According to the Zhitong Caijing APP, to ensure future production capacity, Super Micro Computer has begun to add two new factories near Silicon Valley and build a new factory in Malaysia, with a future annual production capacity expected to exceed $25 billion. In addition, the company is also constructing liquid-cooled 100KW to 120KW racks, with production capacity expected to reach 1,500 units per month by Q4 of the 2024 fiscal year At the same time, it cannot be ignored that the company's profit margin may be further compressed by intense market competition, and the label of low-end manufacturing industry also makes investors more inclined to short-term holdings, with the possibility of sharp fluctuations in stock prices in a short period of time.

Investment Banks Warn of Stock Price Bubble: Will the AI Industry Cool Down This Year?

If we observe the stock price of Supermicro this year, we will find that it has experienced significant ups and downs. As early as mid-February, it experienced a drop of about 20%, and on April 19th, it fell by 23.14% to $713.65, down more than 40% from its high of $1229 in early March within two months.

Comparing the turnover rates of Supermicro and NVIDIA, we can see that Supermicro's turnover rate is mostly above 20%, while the latter's turnover rate fluctuates between 1-3%. This essentially means that the high stock price of Supermicro is mainly supported by short-term positive performance and AI prospects, with most investors preferring to cash out at high levels rather than hold long term.

However, not everyone has always maintained an optimistic attitude towards the development trend of AI. In October 2023, analysis firm CCS Insight pointed out that with the "gradual weakening of speculation around AI technology itself", "rising costs of running AI", and the increasing calls for "regulating AI", generative AI may face a downturn in 2024.

In Goldman Sachs' "Top of Mind" report, Gary Marcus, CEO and founder of the startup Robust.AI, pointed out that "current artificial intelligence is far from intelligent enough", and humans are still far from the goal of General Artificial Intelligence (AGI).

Morgan Stanley also issued a warning about the AI frenzy in the secondary market 8 months ago, stating that based on historical background, NVIDIA's stock price surge is in a "late" stage, which may signal that the bull market has peaked and the "bubble" in the artificial intelligence industry is about to burst.

On April 19th, the sharp drop in the stock prices of Supermicro and NVIDIA led to a general decline in US technology stocks, reflecting the market's concentrated concerns about the potential bubble in the AI field. At the macro level, geopolitical tensions combined with the weakening expectations of a Fed rate cut have led market funds to shift towards safer havens such as precious metals and blue-chip stocks; at the micro level, ASML's first-quarter performance in 2024 fell more than market expectations, and TSMC lowered its full-year performance guidance, seemingly indicating that the industry's progress in 2024 may not be as "rosy" as imagined.

For Supermicro, despite being backed by NVIDIA, the subsequent growth in performance has a considerable level of certainty. However, if it cannot shed the label of contract manufacturing, even a high stock price is just a castle in the air, a flash in the pan. How to improve its competitiveness and reverse investors' perceptions will be a pressing issue for the company's management to consider