UBS: Seven Reasons to Overweight Gold Stocks

UBS believes that the current valuation of gold stocks is relatively low, with a price-to-earnings ratio 40% below the average level. Furthermore, the trend is decoupled from the price of gold. If gold stocks were to conform to a normal relationship with the price of gold (with a beta coefficient of 190/90, i.e., 2 to 1), the stock price should rise by 45%

Against the backdrop of economic uncertainty and escalating geopolitical tensions, the trend of gold this year has become the focus of the market's attention. Recently, as geopolitical risks have eased, gold has continued to decline this week. Has the gold price peaked? UBS bluntly stated that the upward trend of gold will continue, recommending an overweight position in gold stocks.

Spot gold prices have experienced a pullback. As of the time of writing, spot gold rose slightly by 0.24% to 2321.75, with a cumulative drop of over $76 since the beginning of the week. In terms of futures, COMEX gold futures prices fell by over 3% on April 22nd, and fell by over 1% again on April 23rd. At the time of writing, COMEX gold futures fell by 0.56%, to $2328.90 per ounce.

On April 24th, a team led by UBS strategist Andrew Garthwaite released a report stating that the trend of gold has broken the pricing model, continuing to overweight gold stocks. In the long term, seven factors including central bank gold purchases, high U.S. fiscal deficit, inflation-protected securities (TIPS) yields and a weakening U.S. dollar, as well as overall investor positioning, are expected to support the upward momentum of gold prices and gold stocks:

With global risks escalating and geopolitical tensions rising, central banks around the world are implementing diversified allocations. Central bank gold purchases have become the main factor driving gold price changes in recent years.

As U.S. fiscal risks increase, investors are moving funds into gold. The U.S. fiscal situation has increased the credit risk of U.S. government debt (Fitch downgraded U.S. government debt in August), stabilizing the proportion of U.S. government debt to GDP and maintaining a low unemployment rate is the only feasible way to keep real interest rates significantly low, which will greatly boost gold.

Concerns about gold being replaced by cryptocurrencies are no longer valid. Gold continues to be seen as a safe haven asset and a tool for portfolio diversification, while cryptocurrencies are more like a risky investment.

Meanwhile, macroeconomic headwinds are turning into tailwinds for gold: TIPS yields and a weakening U.S. dollar, these "conventional" macro factors may drive gold prices up by another 10%.

After adjusting for inflation, gold has not yet returned to its historical high in real terms (to reach this level, gold would need to rise by 40%), compared to other physical assets such as stocks, gold prices are not high.

Market positioning (i.e., overall investor positioning) has not fully reflected the recent movement in gold prices. The GLD options market has not shown overly optimistic sentiment, with open interest in call options decreasing relative to put options.

Gold stock valuations are low, with price-to-earnings (P/E) ratios 40% below normal levels. Gold stocks have decoupled from the trend of gold, and if following the usual relationship between the stock prices of gold mining companies and gold prices (beta coefficient of 190/90, i.e., 2 to 1), stock prices should rise by 45%.

Central Bank's Gold Buying Demand

UBS predicts in its report that the strong gold buying spree by central banks around the world is likely to continue. There is a significant difference in gold reserves between central banks of developed countries and those of emerging markets. Most central banks in emerging markets hold less than 10% of their reserves in gold. It is expected that as central banks around the world continue to implement diversified allocation:

- Central banks in developed markets have held large amounts of gold since the gold standard era, but many central banks in major economies have a low proportion of gold reserves in their total reserves (such as Japan and South Korea).

- Among central banks in emerging markets, the amount of gold held varies between different countries. If more than 10% of reserves are allocated to gold (the Federal Reserve and the Eurozone have 76% and 57% of their reserves in gold, respectively), they would need to purchase approximately $12 trillion worth of gold. This is equivalent to 75% of the current market value of gold (using the World Gold Council's estimate of above-ground gold stocks).

- Although this scenario is not the base case, it is expected that central banks around the world will continue to diversify their gold holdings. Given that historically central banks in emerging markets had zero or very little allocation to gold, building gold reserves makes sense.

- Escalating geopolitical tensions further support the move towards diversification into gold. Global central banks may consider US Treasury bonds to be structurally more risky now (due to both dollar risk and the level of fiscal deficits).

High US Deficit Rate

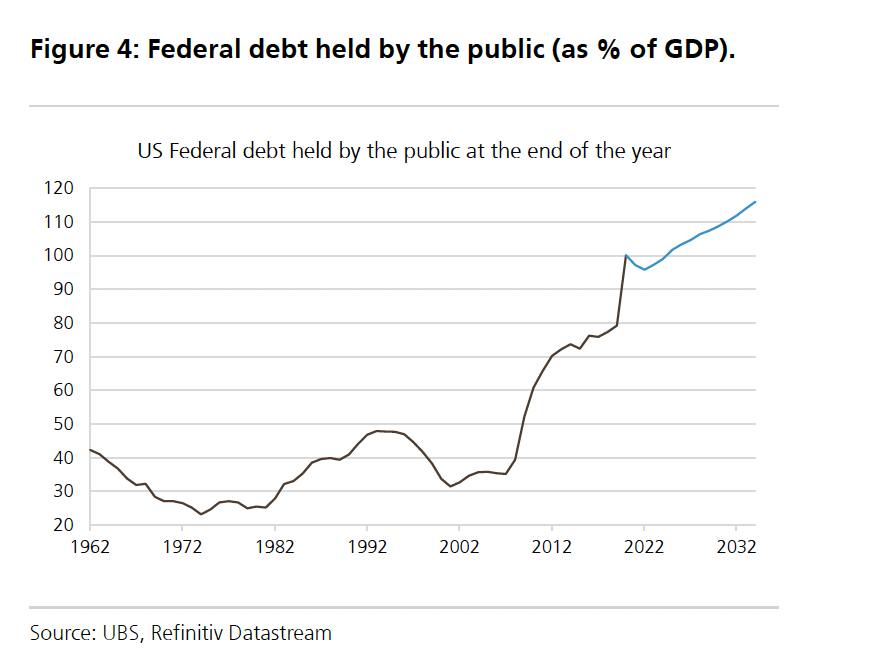

UBS states in its report that the massive US fiscal deficit is increasing fiscal risks. To stabilize the proportion of US debt to GDP, real interest rates need to be kept at significantly low levels, which will greatly boost gold:

- The unsustainable growth of US debt has increased credit risks for US government debt (S&P downgraded US government debt in August). The only feasible way to stabilize the proportion of US government debt to GDP and maintain low unemployment rates is to keep real interest rates at significantly low levels, which will greatly boost gold.

- If we take the worst-case scenario for the US, the required fiscal tightening would be 5% of GDP. The issue is that in the US, this level of tightening needed to stabilize the proportion of government debt to GDP would lead to an economic recession, which in turn would cause deflation and a significant drop in real bond yields.

- Therefore, we believe that lower real interest rates are needed to maintain a stable proportion of government debt to GDP while achieving stable but low employment rates. Another option is government default (we believe this risk is almost zero, but if it were to happen, it would be very favorable for gold) UBS believes that the problem lies not only in the level of US government debt and deficits, but also in the structural changes in the fiscal expenditure philosophy of countries like the United States - that is, governments may continue to spend money until problems arise (with Europe being an exception):

The Congressional Budget Office (CBO) predicts that by 2024, the US government budget deficit will reach 5.3% of GDP, and will remain close to this level in each year until 2032, with the government debt-to-GDP ratio expected to rise to 119% by 2029.

The IMF stated in its baseline Fiscal Monitor that data shows that last year, fiscal deficits in developed economies such as the Eurozone were under control, but the United States experienced a "considerable fiscal slide," with the deficit reaching 8.8% of GDP, more than double that of 2022.

Macroeconomic Tailwinds

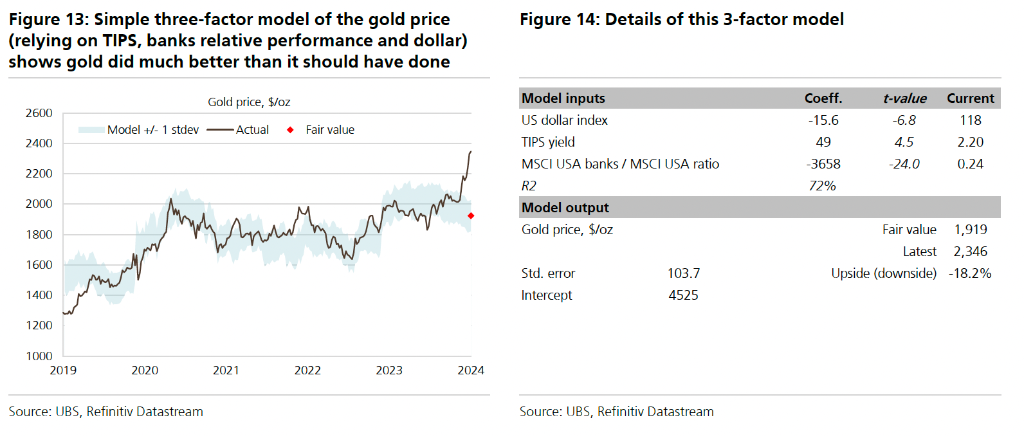

UBS pointed out in its report that the global stock strategy model indicates that the price of gold is usually driven by three key variables:

The price of financial risk (represented by the relative performance of banks or the price of bank credit default swaps CDS);

Real bond yields (represented by 10-year Treasury Inflation-Protected Securities TIPS);

The US dollar (gold is priced in US dollars, and the vast majority of gold demand comes from outside the United States).

UBS believes that based on the current situation, the above three major macro factors will boost the price of gold:

We believe that the Fed's rate cuts may exceed market expectations, and the yield on 10-year Treasury Inflation-Protected Securities TIPS will decline. For every 1% decrease in TIPS yield, the price of gold is expected to rise by about 9%.

It is expected that by the end of 2025, the yield on 2-year Treasury bonds will reach 3.3%. If the yield on 2-year Treasury bonds decreases, the yield on 10-year Treasury bonds will also decrease. We believe that the yield on Treasury Inflation-Protected Securities TIPS may eventually fall to the range of 1%-1.5% (if the term structure of the inflation-protected bond market is the same as that of the traditional bond market, then the TIPS yield should be 0.8%).

With a weakening US dollar, according to our precious metals strategy team's model, for every 1% decrease in the US dollar index, the price of gold is expected to rise by about 0.8%. Our foreign exchange strategy team predicts that the US dollar will slightly rise by the end of the year, but will decline from the current level by the end of 2025In the long-term valuation model, the US Dollar Index is overvalued by 5.5%. The US dollar is influenced by the difference in real interest rates. If we look at our forecast for the end of 2025, the rate cut in the United States will be higher than that in the Eurozone.

Gold and Gold Stocks Still Have Room to Rise

UBS stated in a report that from certain indicators, the market positioning of gold (i.e., the overall position of investors) is relatively high, but it has not shown excessively optimistic sentiment.

Although CFTC data shows that long positions in gold futures are close to historical highs, they have not exceeded the highs of 2019-2020 and 2022. GLD ETF also saw a small inflow, but it is not significant compared to historical large inflows.

At the same time, the GLD options market has not shown excessively optimistic sentiment, with the open interest of call options relatively decreasing compared to put options. Similar to other commodities such as oil, the skewness of gold is often inverted, meaning that the options market usually expects volatility to rise when spot prices rise, and vice versa. The call option skewness has increased locally, but is still far below historical extremes.

UBS concluded that when central banks buy a large amount of gold, they actually provide a downside support for the gold price, forming an "implied put option" that drives gold higher. Compared to other major events in history, the current rise in gold is not significant. Investor sentiment may need to warm up further to support a more sustained rise:

We analyzed moments when gold "spot prices rise/volatility increases," such as the dot-com bubble (possibly referring to the late 1990s internet bubble), the global financial crisis (possibly referring to the 2008 subprime crisis), and the oil embargo (possibly referring to the 1970s oil crisis).

Compared to these historical events, the current upward trend in gold prices is not significant. Although prices are rising, the magnitude of the increase and volatility may be far below the levels seen during historical major events.

UBS believes that compared to the price of gold, gold stocks are undervalued and abnormally lagging behind the trend of gold prices:

The relative P/E ratio of gold mining stocks is 40% lower than normal levels, and they are decoupled from the price of gold. If they follow the normal relationship with the price of gold, stock prices should rise by 45%. We can see that gold stocks are quite an effective investment tool compared to the price of gold, but their beta coefficient is 190/90 (i.e., 2 to 1) If this relationship is maintained, then gold stocks should rise by about 45%