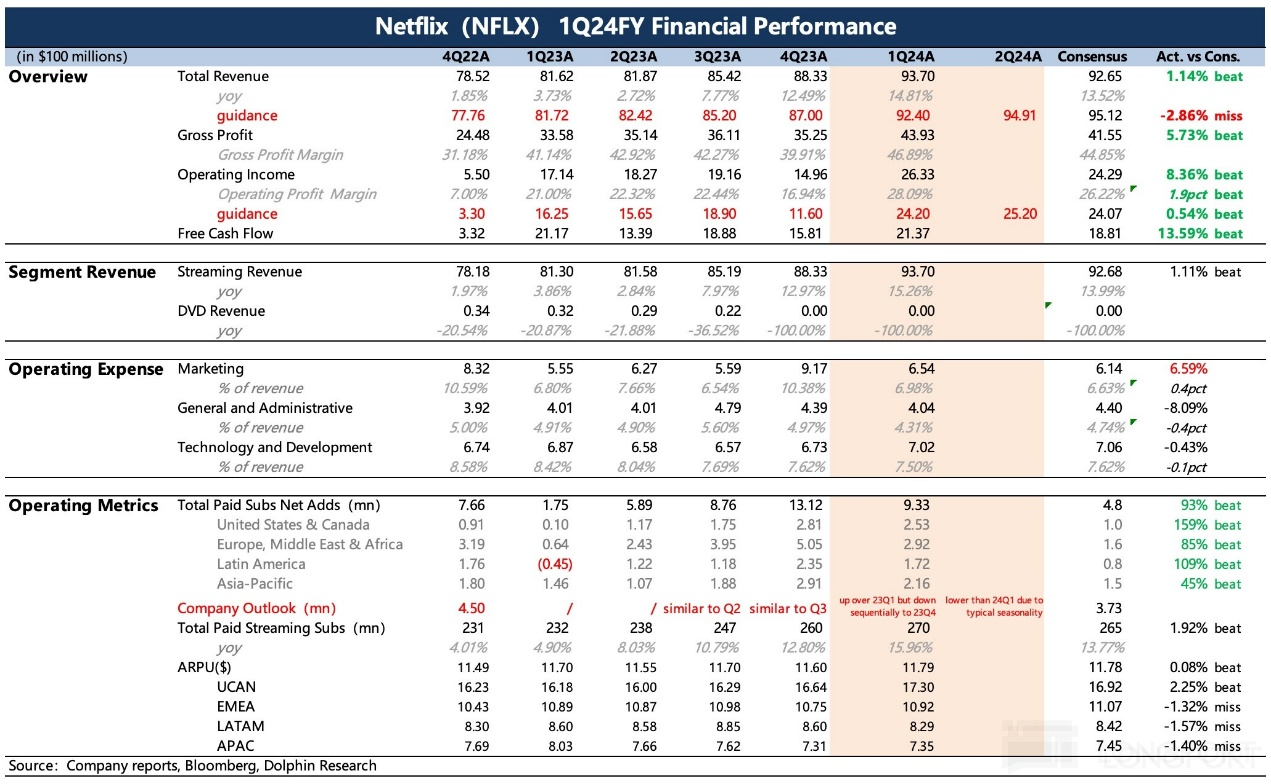

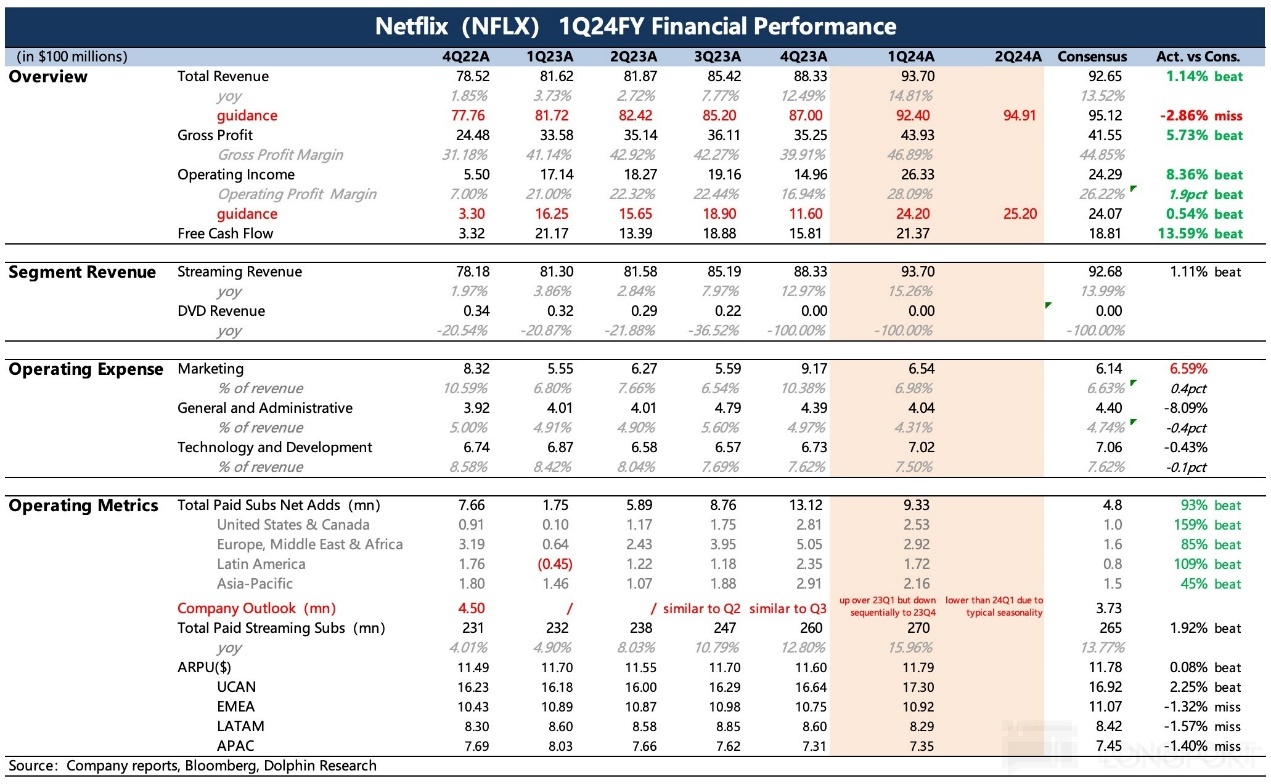

Netflix: Focus on user engagement metrics rather than just the number of users (1Q24 conference call minutes)

Below is the summary of the first quarter financial report conference call for Netflix in 2024. For financial report analysis, please refer to " Netflix: Strong Now, But About to "Collapse"? 》

I. Review of Key Financial Information:

II. Detailed Content of the Financial Report Conference Call

Q: What is the reason for the company's decision to stop reporting quarterly member and ARM (Average Revenue per Member) data in 2025? Since you believe success starts with user engagement, how will the company consider expanding the disclosure of this information?

A: The main reason is due to the evolution of its business model. As the company continues to grow and add new sources of revenue, such as advertising and additional member features, these new revenues are not directly related to the number of members. At the same time, the company's pricing and plans have become more complex, with significant price differences between different countries and tiers, resulting in different impacts of each new member on the business. Therefore, the traditional simple calculation method (number of members multiplied by monthly price) can no longer accurately reflect the company's business situation.

To more accurately reflect the company's operations, the company will change its reporting focus to concentrate on more key metrics such as revenue, operating profit, net profit, earnings per share, and free cash flow. Additionally, the company will provide new annual revenue range guidance to offer a longer-term business outlook. Although member numbers will no longer be reported regularly, relevant information will still be updated when significant milestones are reached. The company will give everyone time to adapt to this change and will continue to report member numbers in the first quarter of the next year to align with the 2025 annual revenue guidance, providing an effective bridge for the transition.

Currently, user engagement data is disclosed semi-annually, covering approximately 99% of company viewing activities, and the company plans to further enhance the detail of this report. The company values user engagement because it believes it is the best indicator of member satisfaction with its services and a leading indicator for long-term retention and acquisition of new members. Satisfied members watch more content, maintain their membership long-term, and recommend to friends, thereby driving growth in engagement, revenue, and profit, which are the company's core goals.

Q: From stagnant member growth two years ago to significant improvement now (excluding the impact of shared payment plans), what changes within the company and the industry can explain this growth?A: This growth is due to the company's ability to launch high-quality content at scale in multiple cultures and regions, including popular TV shows and movies from different countries. Looking back at the last quarter, in the first 11 weeks of this year, our streaming movies ranked first for 8 weeks. In the first 11 weeks, our original series ranked first for 9 weeks. Local unscripted programs are a relatively new endeavor for us, and we have also achieved great success in this area, such as the second season of "Physical 100" launched in South Korea and the Swedish version of "Love Is Blind". These are successes that are hard to replicate, and we are getting better at it every day, all built on a strong foundation of technology and products.

The success of the company not only relies on high-quality series, movies, games, and live events but also on the ability to find the audience for these excellent works. The company is committed to connecting more viewers to their favorite works through effective product strategies, thereby reaching the largest audience for the works. Additionally, the company strives to promote works from around the world on a global scale while seeking to expand the influence and cultural impact of these works. These efforts help to increase member satisfaction, the impact of works, and the recognition of creators, thereby driving the overall business growth.

Q: What factors have led to the decline in annual revenue growth from 15% to 16% in the first and second quarters to 13% to 15% for the full year? Will the growth of subscription users in the second quarter be higher or lower year-on-year?

A: Over the past 18 months or so, we have accelerated our business and revenue by improving core services, launching paid sharing, and introducing our advertising business, which truly began to accelerate in the second half of 23. Regarding the forecast for annual revenue growth, the growth in the second half of the year will slow down compared to the first half mainly due to a high base and the impact of a stronger US dollar. Despite these challenges, the company still expects to achieve healthy double-digit revenue growth for the full year, which is the set target.

Looking ahead to future growth prospects, the company faces significant growth opportunities, as TV market share in various countries is still below 10%, there are still hundreds of millions of households yet to become company members, and the advertising business is just getting started. The key to the company's development lies in continuous improvement of services, increasing user engagement, and adding member value. With the advancement of these efforts, the company will attract more members and have the opportunity to reflect these values through pricing, while providing advertisers with a large audience with high engagement. The net addition of paid users in the second quarter of this year will be lower than in the first quarter, showing a fairly typical seasonal variation.

Q: Can you explain the driving factors behind the annual revenue forecast, especially the relationship between subscription user growth and ARM growth, and how these two factors will impact the revenue forecast?

A: Regarding the annual revenue forecast, it is mainly driven by membership growth, benefiting from the full-year impact of the paid sharing feature and a continued strong trend in acquisition and retention. While we have also seen growth in ARM (average revenue per user), the impact is relatively small. The current progress in pricing changes is going smoothly, which is also a reason for the strong trend in acquisition and retention, proving an overall improvement in service valueHowever, price changes mainly occurred in a few major markets and only targeted certain plan levels. Therefore, the main feature of this year's growth is that most countries have not adjusted pricing in the past two years. Additionally, there are some headwinds in terms of ARM, such as planned hybrid transitions, with the introduction of paid sharing, where the hybrid plan level prices for new paid members are slightly lower than long-term members.

Nevertheless, the paid sharing feature has a positive impact on revenue growth and is expected to continue throughout the year. The company's advertising business is also steadily growing, although the monetization rate of advertising revenue lags slightly behind the growth. National hybrid transitions are also a contributing factor. These factors collectively result in relatively moderate ARM growth, especially in the first quarter and expected for the full year. However, the key is that the company is managing the business transformation in a healthy manner to promote overall revenue growth, as evidenced by a 15% revenue growth this quarter and a strong full-year outlook. Furthermore, the company is further penetrating these households through a robust paid sharing solution. Therefore, we will increasingly see this hybrid model reflected in revenue growth, which has already begun to show this year.

Q: Will the trajectory of profit margin growth continue on its current path in the coming years? Can it reach a profit margin level comparable to traditional media?

A: The company's focus is on maintaining healthy revenue growth and annual profit margin growth. The profit margin reached 21% last year, an improvement from 18% the year before. The target for this year is 25%, slightly higher than the initial guidance of 24%. The company will continue to take a disciplined approach to balance profit margin improvement and investment growth. Historically, the company has managed this balance well, achieving growth in content investment, profit, profit margin, and cash flow. In the future, the company will continue to do so, but the annual profit margin growth rate may fluctuate due to foreign exchange and other investment opportunities. However, the company is committed to increasing the profit margin annually and believes there is still significant growth potential in the long term.

Q: In terms of implementing the paid sharing policy, what stage are we currently at? Two years ago, it was stated that 100 million users shared passwords with 30 million UCAN users. How many people are estimated to be borrowing passwords now?

A: The company has already implemented the paid sharing policy and has incorporated it as part of the standard mechanism to convert more entertainment value (such as movies, series, games, and live events) into revenue. The company is iterating, testing, and improving on this to better attract participants, whether they are password borrowers, previous members (rejoining), or individuals who have never been company members. The company is looking for appropriate calls to action, offers, and prompts to prompt them to convert at the right time. The company believes there is still room for improvement in this process, has identified opportunities to improve value conversion mechanisms, and expects to contribute to business growth in the coming quarters.

All improvement measures help us effectively attract more than 500 million smart TV households to register as members, with hundreds of millions of potential users waiting to join, which is one way we attract more members. While we expect to continue growing subscription users, overall business growth now has additional leverage and drivers, such as plan optimization, increased additional members, advertising revenue, and more reasonable pricing, which are also becoming increasingly important parts of our growth modelQ: What is the most important factor driving the expansion of advertising tiers when considering adjustments to pricing and plans, partner bundling, and marketing? How can people overcome psychological barriers to accept a few minutes of ads per hour and still provide a very good experience at the right price?

A: The important factors driving the expansion of advertising tiers include partner channels, device integration, bundled sales, integrated payments, etc., which are all important tools for growth and also apply to non-advertising services. Increasing consumer awareness of the quality of the advertising experience is also important, especially compared to the linear TV advertising experience, which is relatively poor in many countries. Low prices are also important for consumers, as seen in the $6.99 advertising package offered by the company in the United States, which includes multi-stream playback and full HD downloads, with a relatively low amount of ads. These mechanisms and other factors together drive the expansion of advertising tiers. Over the past few quarters, the company's advertising business has been growing rapidly, with growth rates remaining high, indicating an increase in absolute growth each quarter.

Q: Can you update the thoughts on the optimal price difference between advertising tiers and ad-free tiers? Has there been a significant improvement in ARPU (Average Revenue Per User) after excluding subscription fees compared to the range of $8 to $9 mentioned last year? What trend will ARPU show if supply does not exceed demand?

A: We do not have a fixed optimal pricing strategy for price differences, and usually iterate based on signals from customers such as package acceptance rates, conversion rates, and churn rates to find the right pricing. The correct pricing is not static and will change in response to the continuous evolution and improvement of products and services. In the long run, a good guiding principle is that the overall revenue from advertising packages and ad-free packages should be roughly equal. Ultimately, which package is most suitable for a specific user should be chosen by the user themselves.

With the rapid growth of inventory, current monetization has not fully kept up with the growth in scale and inventory, as the company is still building sales capabilities and advertising products. However, this is an opportunity as the company still operates in an environment with high-quality content and highly engaged audiences, and the scale is expanding. Therefore, CPM (Cost Per Mille) remains strong, and the company is strengthening its capabilities. Over time, revenue will follow audience growth, and there has already been decent growth on a small base. Currently, ARM (Average Revenue per Thousand Impressions) is somewhat hindered due to inadequate monetization relative to supply. But over time, the company expects revenue from advertising packages (including subscription and advertising revenue) to be similar to revenue from non-advertising packages. Therefore, this is a long-term building process.

Q: How to approach this year's upfront advertising sales activities? Do you believe that the advertising-supported user base has now reached a certain scale, allowing upfront advertising commitments to drive significant changes in advertising revenue and become a contributor to ARM growth by 2025?

A: The company will share a range of exciting programs in this year's upfront advertising sales activities. We plan to showcase upcoming new seasons of shows such as "Bridgerton" and "Sweet Tooth," as well as "The 90s Show," among othersIn addition, the company will also showcase some large non-scripted events, such as Tom Brady's satire show, as well as new series like "Dead Kid Detective" and Sean Gillis' new series "Tire". The company will also allow advertisers to preview programs set to launch in the second half of this year, including the new season of "Cobra", "Emily in Paris", "Nightwalker", "The Bund Chronicles", the new season of the popular series "Squid Game", and the new season of "Monsters" produced by Ryan Murphy. Additionally, they will showcase new original series and limited series, such as Peter Berg's "American Primitive Times", the star-studded "Heartache" (starring Nicole Kidman and Lev Schreiber), a limited series about Brazilian Formula One driver Senna, and a series of highly anticipated films, such as Eddie Murphy's return as the classic character Axel Foley in "Beverly Hills Cop Axel Foley" and the large new animated feature "Magic World".

The company believes that the advertising pre-sale event is an opportunity to reconnect with advertisers and showcase the advantages of its advertising products. The company has many well-known brands wishing to collaborate on exciting programs, and the user engagement at its advertising level is also high, with further growth opportunities. The company is rapidly expanding, which is also a primary demand for advertisers. In addition, the company has made progress in technical features and advertising products, and looks forward to integrating these advancements into a comprehensive advertising solution for advertisers. At the same time, the company also looks forward to receiving feedback from advertisers in order to continue improving. Although the advertising business is relatively small compared to the company's large existing business, it is growing rapidly and is expected to continue growing in 2025 and beyond.

Q: With the current very favorable background for the company, why not increase investment in acquisitions and licensed content? Is it possible to increase cash spending on content to over $17 billion this year?

A: Regardless of the availability of licensed content, we have always been very focused on discipline in business and investment. We achieve high returns by carefully producing programs and acquiring suitable content. While there are indeed increased opportunities to acquire licensed content now, we remain focused on content that can drive the business. Our current spending levels match our current growth rate, and we are happy to maintain spending levels slightly below expected growth rates.

Q: How will more second-round licensed content affect profits and free cash flow?

A: The company has both seized opportunities and maintained prudent constraints and discipline in spending. While there are indeed more opportunities for licensed content, the company's content spending is primarily used for original programs, and this situation may continue. Additionally, the company will use high-quality licensed content to complement original programs, providing members with more diverse and high-quality choices, but original content remains the company's future focus.

Q: What are the characteristics of the upcoming Jake Paul vs. Mike Tyson match that make you willing to invest in this type of sports program? How does this content benefit your membership base and advertising growth goals?A: The company is developing live shows, which is seen as an expansion of its content offerings, similar to movies, unscripted shows, animation, and games. Despite on-demand and streaming providing consumers with more choices and control, the experience of gathering in the living room to watch the same content still has its unique charm. The company believes that cultural events like the "Jake Paul and Mike Tyson" match are the kind of TV experience they want to provide for members. Additionally, the company plans to launch other live content such as comedy shows from the company's Netflix Is A Joke Festival and weekly WWE RAW sports shows, believing that real-time viewing of these contents will bring true value to members. Judging from the early popularity of the Jake Paul vs. Mike Tyson match, there will be a large global audience watching this match live late at night. These large cultural events are not only attractive to members but also to advertisers.

Q: As Netflix's scale continues to expand and its potential influence grows, how might its sports strategy change to surpass the current focus mainly on sports entertainment?

A: The company is not against sports but is pursuing profit growth. Its core goal is to increase user engagement, revenue, and profit. If there is an opportunity to achieve all three goals simultaneously, the company will try in a broader field of high-quality entertainment content. The company has found such an opportunity through its partnership with WWE and will consider replicating this successful model in other areas, including the sports field. The company is not a leader in losses, so it is confident in continuing to grow along this path. The company will approach these opportunities with the same discipline as it does when discussing content playback with filmmakers and TV networks.

Q: The internal communication of Dan Lin, the new head of Netflix's new film department, mentioned in a New York Times article, that "the goal is to make Netflix's movies better, cheaper, and less frequent," and that he hopes the team will become more actively developing original content rather than waiting for projects from producers and agents. What does this strategy shift reflect? How does Dan Lin's strategy shift compare to that of the former film head Scott Stuber? How should we view this strategy shift?

A: The quote in the New York Times article is not from Dan Lin, and Netflix was not involved in the writing of the article. The company has not reduced its willingness to produce movies but always aims to make better movies. Dan Lin's addition brings fresh thinking and vitality. Netflix's content strategy still focuses on diversity and quality. As the new head of the film department, Dan Lin has thrown himself into work in a short period. The movies he has produced for Netflix in the past, such as "The Two Popes" and "The Willoughbys," have received positive feedback, showing his deep understanding of Netflix and audience needs. His success in live-action and animation fields is also well recognized in the industryQ: Given that paid sharing has basically been completed, can you update the current user participation trends?

A: The company competes for every hour of viewing time every day in all operating locations. The company considers user engagement reports and this metric to be very important as it is the best indicator of measuring customer satisfaction. According to Nielsen's streaming data, the company has had the most popular movies and series at various times this year. Despite dealing with password sharing issues that may result in some non-paying viewers losing viewing time, the company believes that its user engagement remains healthy. Despite facing pressure from strong competitors, the company's user engagement remains stable among specific user groups (such as "owner households"). Additionally, the company still has significant room for user engagement growth, as even in its most mature markets, its share of TV viewing time is still less than 10%.

Q: With the company's continued expansion, do you think there is an upper limit to pricing? If there is an upper limit, how far away is it in mature markets? Does Netflix envision having more content to continue expanding content types and further segmenting customer groups?

A: The company does not have a fixed position on pricing limits, but sees it as a process that can be adjusted as more entertainment value is provided. The company will continue to invest wisely, increase entertainment value, and then ask subscribers to pay more to maintain this virtuous cycle. The company believes that its room for growth in TV viewing time and the number of "real moments" won (i.e., moments of interaction between users and content) are important indicators for assessing its potential for growth.

Even in the most mature markets, the company only accounts for less than 10% of TV viewing time, indicating there is still significant room for growth. Additionally, the company also considers its total consumer entertainment spending in competitive markets, which accounts for about 5% to 6%, further indicating that the company still has a long way to go and needs to continue investing, providing more value, and adjusting pricing accordingly.

Q: What is the progress of canceling basic plans in the UK and Canada? When can a similar promotion be expected in the United States?

A: The company has started gradually canceling basic plans in Canada and the UK, aiming to make this transition as smooth as possible. Before taking further action, the company will listen to member feedback. There are currently no further announcements on this matter, and the company hopes to observe the progress of this process. While this change is an adjustment for basic members, the company believes it provides more attractive options, including more streaming services, higher definition, and download capabilities, at a lower price. Additionally, members can still choose an ad-free plan if they prefer.

Q: How will the changes in capital allocation strategy brought about by the new investment-grade status affect investors?

A: The company's capital allocation strategy has undergone some moderate adjustments to better reflect its investment-grade status. Nevertheless, the company will continue to adhere to the same financial policies and principles, including prioritizing profit growth through reinvestment in core businesses, maintaining a healthy balance sheet and ample liquidity, and returning excess cash to shareholders through share buybacks once a certain amount is reachedNow that the company has become an investment-grade company, although it will still hold hundreds of millions of dollars in cash, it no longer needs to maintain cash reserves equivalent to two months of income, which will make the company more efficient in capital utilization.

In addition, the company has expanded its revolving loan facility from $1 billion to $3 billion, providing the company with more capital sources and better cash efficiency. In the future, the company plans to return excess cash to shareholders and will continue to adhere to a strategy of development primarily through internal construction rather than acquisitions. At the same time, the company plans to refinance existing debt as needed in the future, but does not intend to increase leverage through stock buybacks to maintain balance sheet flexibility.

Q: What is the latest view on the appropriate level of content spending after 2024? In the past, a cash content spending to amortization ratio of 1.1 has been mentioned, is this ratio still applicable? Under what circumstances would you consider exceeding this framework?

A: The company still adheres to managing to approximately a 1.1 times cash content spending to amortization ratio. The company will continue to focus on driving revenue growth, developing the business, and improving profitability, while exercising discipline when investing in content in historically high-impact areas. The company aims to increase free cash flow and believes it can manage cash content spending relative to expenses on the income statement at around 1.1 times, leading to overall revenue growth, profit and margin improvement, and increased free cash flow. This management strategy continues to provide the company with numerous opportunities to invest in various content and entertainment areas discussed by Greg and Ted.

Q: What is the impact of short video consumption on the competitive landscape?

A: The content people watch is closely related to their viewing choices and available time. The short video format offered by the company is mainly to provide members with the ability to watch series clips to accommodate their limited viewing time. Additionally, short videos on platforms like YouTube and TikTok sometimes complement the company's viewing content, such as trailers or creators' enthusiastic expressions about the company's programs that may increase the fan base of the shows. However, some content on these platforms also directly competes with the company, just like the content other media companies provide to YouTube. The key is to find a balance. Furthermore, these platforms also provide opportunities for the emergence of new voices, and the company is also paying attention to these platforms, trying to discover the next generation of outstanding storytellers.

Q: What are the opportunities for the company in the near and long term to utilize generative AI technology? With the rapid development of generative AI technology, what do you think creators should focus on?

A: The company has been using advanced technologies such as machine learning for nearly two decades, which form the basis of recommendation systems, helping the company reach the largest audience and provide maximum satisfaction to members. As new technologies emerge and develop, the company will continue to enhance these systems. The company believes it is well positioned to be an early adopter and implementer of these new methods, thanks to its general capabilities and existing systems. Additionally, the company also has the opportunity to develop new tools for creators to tell stories in a more engaging way, which is beneficial for creators, stories, and members alikeAs for what storytellers should focus on, respondents believe they should focus on excellent storytelling itself, as presenting engaging stories through movies, TV series, and games is very difficult and complex, and storytellers play a unique and crucial role in this regard, which will not change.

Risk Disclosure and Statement of this Article: Dolphin Research Disclaimer and General Disclosure