Meta: Plans Multi-Year Investment in AI, Will Not Overly Concern With Short-Term Profitability (1Q24 Earnings Call Summary)

Below is the summary of the first quarter financial report conference call for $ Meta Platforms.US in 2024. For financial report analysis, please refer to "Meta: Nightmare of a Crash Again? More Scary Than Thrilling" here 》

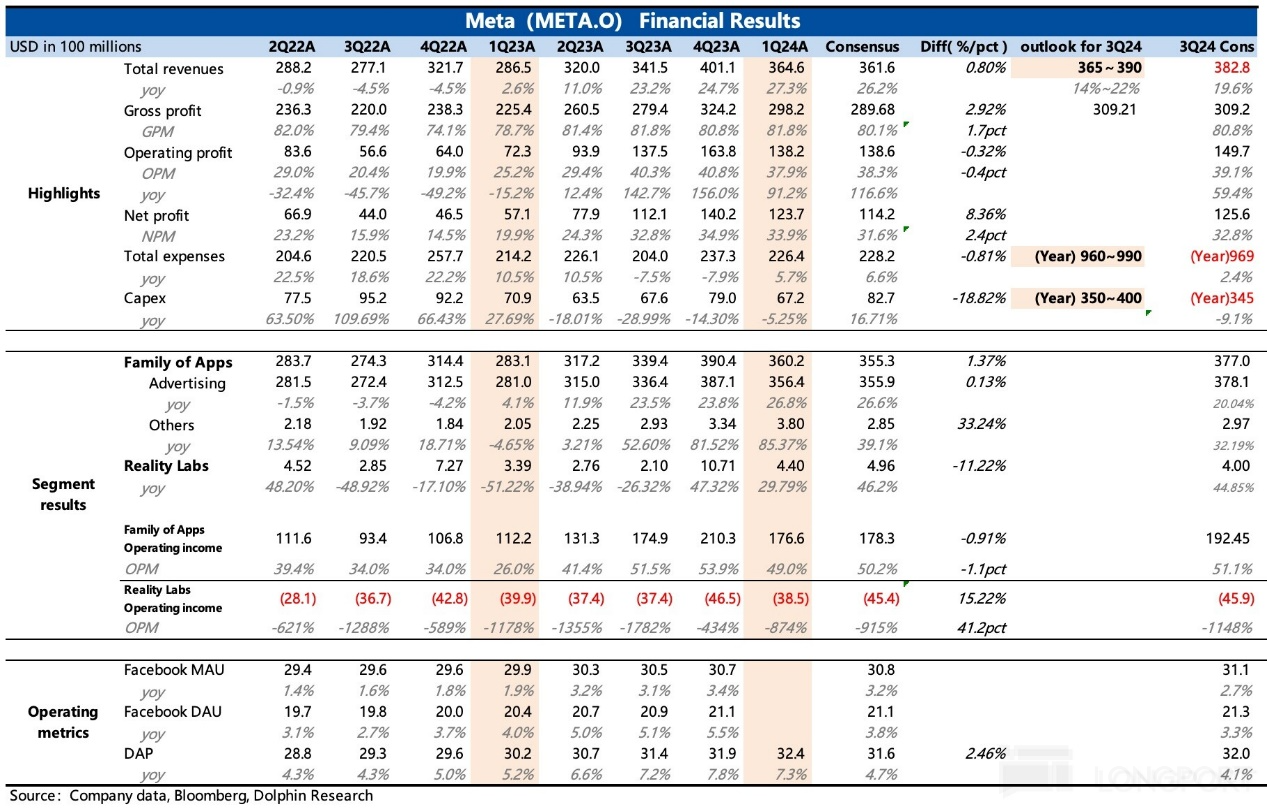

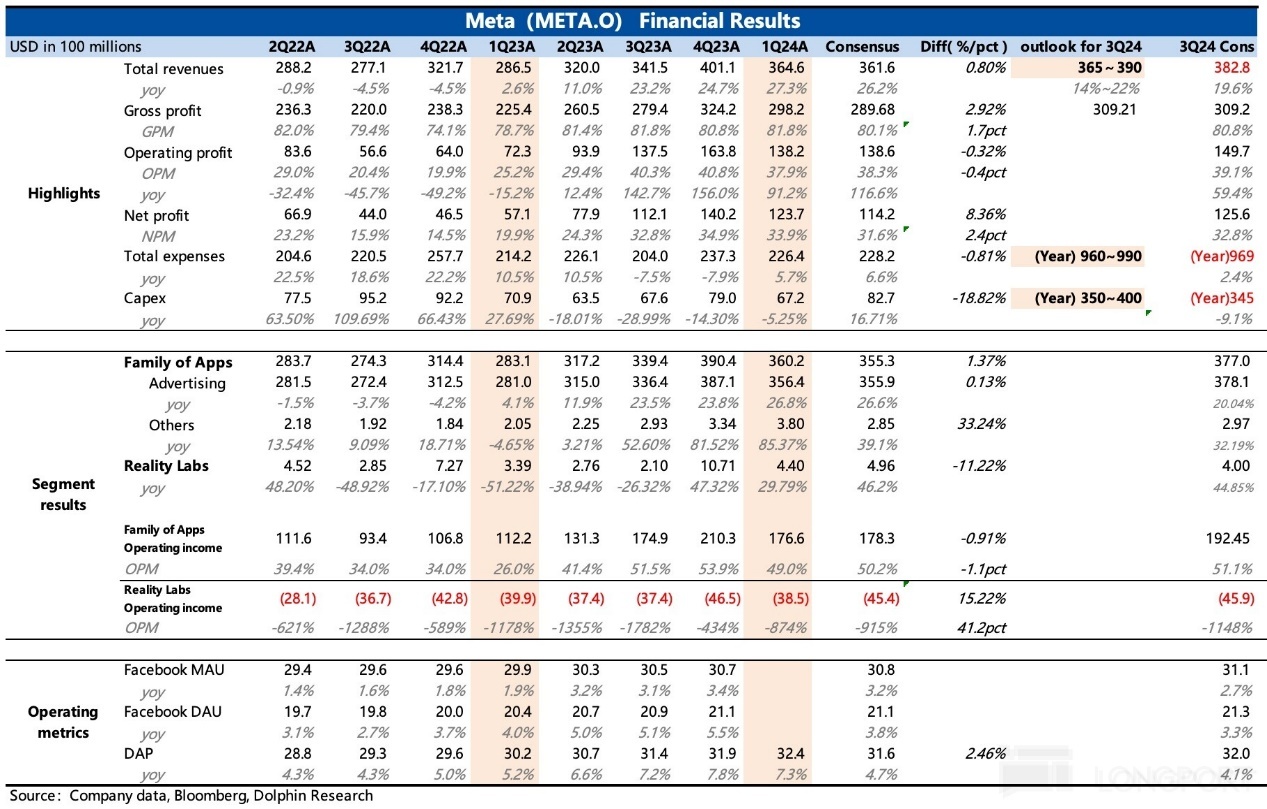

I. Review of Key Financial Information:

II. Detailed Content of the Financial Report Conference Call

2.1. Key Points from Executive Statements:

- Business Development: The company has had a strong start in product momentum and business performance, with at least 3.2 billion people using one of the company's applications daily, especially notable growth of WhatsApp in the United States.

a) Product Launch: Released a new version of Meta AI supported by the Llama 3 model, aiming to become a world-leading artificial intelligence service; Meta AI has been launched in some English-speaking countries and will expand to more languages and countries in the coming months; the company adopts an early version release strategy, first releasing to a limited audience, collecting feedback for improvement, and then promoting to a wider user base.

b) Capital Expenditure and Energy Expenditure: With the development of artificial intelligence, the company will increase capital and energy expenditure while focusing on the efficient operation of other departments.

c) Product Monetization: Despite shifting many existing resources to artificial intelligence, the company still plans to expand investment scope before new products bring significant revenue; it is expected to have a multi-year investment cycle before services like meta ai and commercial artificial intelligence become profitable; the company has experience in monetizing new technologies and plans to achieve profitability through expanding messages, advertising, and paid content; artificial intelligence helps increase app engagement, boost advertising revenue, and income from artificial intelligence tools Advantage Plus Shopping and Advantage Plus App Campaigns has more than doubled since last year.

d) Efficiency Improvement: The company will continue to focus on cost efficiency by improving model training and operation methods, as well as contributing to the open-source community to enhance efficiency; the company has made progress in self-produced chips to improve operational efficiency and reduce costs.

e) Product Progress: Sales of Ray-Ban Meta glasses in collaboration with Essilor Luxottica have been good, and the company plans to introduce more styles;The company announced the opening of Meta Horizon OS to promote the development of the mixed reality ecosystem;

On Instagram, Reels and video content have driven engagement, with Reels accounting for 50% of in-app spending time; Approximately 30% of posts on Facebook feed and over 50% of content on Instagram are provided by artificial intelligence recommendation systems; Facebook has launched a new full-screen video player that integrates different forms of video content.

e) Threads growth: Monthly active users exceed 150 million, showing a good growth trend. f) Taylor Swift joining the Threads platform has attracted widespread attention.

- First-quarter performance:

a) Overall situation: Total revenue for the first quarter was $36.5 billion, up 27% on a reported and fixed exchange rate basis; Total expenses for the first quarter were $22.6 billion, up 6% from last year; Cost of revenue increased by 9%, mainly due to increased infrastructure-related costs, partially offset by inventory-related valuation adjustments from Reality Labs; Research and development grew by 6%, mainly due to increased personnel-related expenses and infrastructure costs, partially offset by lower restructuring costs; Marketing and sales decreased by 16%, mainly due to lower restructuring costs, professional services, and marketing expenses; General and administrative expenses increased by 20%, as higher legal-related expenses were partially offset by lower restructuring costs; At the end of the first quarter, the company had over 69,300 employees, up 3% from the fourth quarter; Operating income for the first quarter was $13.8 billion, with an operating profit margin of 38%; The tax rate for this quarter was 13%; Net profit was $12.4 billion, or $4.71 per share; Capital expenditures (including principal payments on financing leases) were $6.7 billion, driven by investments in servers, data centers, and network infrastructure; Free cash flow was $12.5 billion; The company repurchased $14.6 billion of Class A common stock and paid $1.3 billion in dividends to shareholders; At the end of the quarter, the company had $58.1 billion in cash and marketable securities and $18.4 billion in debt.

b) Family of apps: Around 3.2 billion people used at least one of the app series daily in March; Total revenue for the app series in the first quarter was $36 billion, up 27% year-over-year; Advertising revenue for the app series in the first quarter was $35.6 billion, up 27% and 26% on a fixed exchange rate basis; Online commerce verticals were the largest contributors to year-over-year growth, followed by gaming, entertainment, and media; Advertising revenue growth was strongest in the rest of the world and Europe, reaching 40% and 33% respectively, with 25% growth in the Asia-Pacific region and 22% growth in North America; Ad impressions increased by 20%, with the average price per ad increasing by 6%; Other revenue for the app series in the first quarter was $380 million, up 85%, mainly driven by business messaging revenue from the WhatsApp business platform;In the first quarter, the expenditure on the App series was $18.4 billion, accounting for approximately 81% of the total expenditure; Family of Apps generated revenue of $17.7 billion, with an operating profit margin of 49%.

c) Reality Lab Department: In the first quarter, revenue was $440 million, a 30% increase mainly driven by Quest sales; Reality Lab expenses were $4.3 billion, a 1% decrease year-on-year, offset by increased employee-related expenses due to inventory-related valuation adjustments and restructuring costs; Reality Labs operated at a loss of $3.8 billion.

3) Business Outlook:

a) Revenue growth is driven by the ability to provide engaging community experiences and enhance the effectiveness of profit participation.

b) Video content accounts for over 60% of time on Facebook and Instagram, with Reels being a major growth driver.

c) Launching a unified video experience in the US and Canada, supported by the next-generation ranking architecture, is expected to provide more relevant video recommendations.

d) Integrating generative AI more deeply into applications, including using Meta AI for search in chat interfaces and Facebook groups.

e) Improving monetization efficiency is the second driver of revenue performance, involving optimizing ad levels and enhancing marketing effectiveness.

f) Optimizing ad display timing, location, and targeting based on user preferences to reduce ad interference and innovate ad formats.

g) Surfaces with lower levels of monetization such as video and messaging will be additional growth opportunities.

h) Through the Advantage Plus product portfolio, providing a higher level of automation for ad campaign settings, including fully automated ad campaigns.

4) Next Quarter Guidance:

a) Investment Plan: The company will continue to invest in improving core business in the short term and seizing opportunities in generative AI and RL in the long term; significant infrastructure investments are expected in the coming years to support the development of advanced recommendation models and the training needs of generative AI; the company will continue to make significant investments in RL and observe the overlap of AI and RL work, for example, Ray-Ban Meta smart glasses using multi-modal Meta AI assistant to perform daily tasks, generative AI is expected to play a greater role in mixed reality products; the company believes its strong financial position will support these investments and return capital to shareholders through stock buybacks and dividends.

b) The company is monitoring positive regulatory environments and legal resistance that may have a significant impact on business and financial performance, with a jury trial expected in June regarding a lawsuit in Texas involving the use of facial recognition technology, which could result in fines.

c) Financial Guidance: Total revenue for the second quarter of 2024 is expected to be between $36.5 billion and $39 billion, with a 1% resistance from foreign exchange to total revenue growth; total expenses for the full year 2024 are expected to be between $96 billion and $99 billion due to increased infrastructure and legal costs;Due to investment in product development and ecosystem expansion, Reality Labs is expected to see a significant year-on-year increase in operating losses; it is projected that the full-year capital expenditure in 2024 will be between 35 billion to 40 billion US dollars, to support the artificial intelligence roadmap.

The capital expenditure is expected to continue to increase in 2025 to support artificial intelligence research and product development; if the tax landscape remains unchanged, the full-year tax rate in 2024 is estimated to be around 15%.

2.1 Q&A Analyst Q&A

Q: How should investors view the length and depth of this investment cycle, especially regarding AI and the broader Reality Labs and mixed reality? From a consumer perspective, what metrics or phenomena are you focusing on to assess whether the adoption of AI is in line with this investment cycle?

A: It is difficult to directly infer the current situation from past investment cycles, but typically we spend several years focusing on product building and scaling. Before new products reach significant scale, we usually do not pay too much attention to the profitability of these new areas, as it is more advantageous for them to improve the profitability of other products before the new products scale up.

As we enter this stage, investors will see products expanding in scale and realize that even if revenue has not been realized, there are clear profit opportunities. We have had similar experiences in the past with Reels, Stories, and transitioning to mobile, where we first build inventory for a period of time before focusing on profitability.

During the scaling process, sometimes not only will new products not make money, they may actually impact the revenue of other products. If products can successfully scale, they will eventually become very large businesses. As consumer product scales up, the meaningful launch of Meta AI is a major focus for this year and the foreseeable future.

Q: Regarding opportunities for improving recommendation engines and increasing model relevance, what areas of improvement can be seen from the current position? In terms of incremental application of AI tools to drive advertisers' adoption, what are the main obstacles encountered, and how will these issues be addressed during 2024 and 2025?

A: In the past, each recommendation product had its own AI model, but now they are developing a new model architecture that can support multiple recommendation products. Last year, they began partially validating this new model, applying it to Facebook Reels, and saw a significant increase in watch time. This year, the plan is to extend this single model architecture to content recommendations for Facebook Reels and Facebook video tags. While specific results cannot be shared yet, there is optimism about the potential of the new model architecture in providing increasingly relevant video recommendations.

In terms of advertising, a new model architecture called Meta Lattice has been deployed, integrating smaller and more specialized models into larger models that can better learn characteristics to improve ad performance, applicable to multiple surfaces (such as Feed and Reels) and various types of ads and objectivesThis has already improved advertising performance in 2023 and plans to further enhance model performance in 2024, while adding support for networks, applications, and return on investment. Therefore, Meta is making significant investments in the underlying model architecture for organic engagement and advertising, expecting this to continue to improve advertising performance over time.

In the short term, the focus is on Gen AI advertising creative features, which have been incorporated into ad creation tools and are gradually being adopted by advertisers in different industries and of different scales. Particularly, small businesses are very actively adopting image extension features, which will be a key area of focus in 2024. At the same time, improvements to the base model are expected to enhance the quality of generated outputs and support the development of new features.

Looking ahead in the long term, Business AI is another important direction. Tests are currently underway to allow businesses to set up AI to chat with customers on their behalf, starting with supporting shopping use cases such as responding to customer inquiries about products or availability requests. This testing is currently in a very early stage, has been tested with a few businesses on Messenger and WhatsApp, and has received positive feedback. Businesses have reported significant time savings with these AI, and consumers have noticed more timely responses. Through these tests, the team is continuously improving the performance of the AI. These tests will be expanded over the next few months and time will be taken to ensure their accuracy before widespread promotion.

Q: Considering that Reels now occupies a significant amount of user time on Instagram and Facebook, how do you plan to achieve the next stage of monetization growth from the current stage? Besides ad insertions, can you share more specific information about future plans? We have heard a lot about contributions from Chinese advertisers, can you share more specific information about the trend of this spending?

A: Revenue from Reels on Instagram and Facebook continues to grow, thanks to higher user engagement and improved monetization efficiency through enhanced ad ranking and delivery. While not disclosing quantified future impacts of Reels, it remains a positive contributor to overall revenue. The company expects to continue to have opportunities to improve performance and increase supply. In terms of performance improvement, the company is investing in ongoing ranking improvements to make ads more easily and intuitively interactive, and optimizing ads to make them more tailored to the native style of Reels.

Additionally, the company has introduced Gen AI image extension tools, which have been widely adopted by small businesses. While the ad load on Reels has increased over the past year, the ad load per unit of time is still lower compared to Feed and Stories. Therefore, the company will continue to look for opportunities to cautiously increase the ad load on Reels and invest in innovative ways to address structural supply constraints brought about by the higher volume of video content in Reels format, including improving experience density and format, as well as increasingly personalized adjustments to ad loadChinese advertisers saw strong growth and spending in the first quarter, driven mainly by the online commerce and gaming industries. This is reflected in the Asia-Pacific region, where the advertising sector remains the fastest-growing region year-on-year, reaching 41%. Meanwhile, advertisers in other regions also showed robust growth, with total revenue for North American advertisers accelerating by 6 percentage points. Given the recovery of Chinese advertisers from the headwinds brought by the epidemic in 2023, it is expected that there will be increasing strong demand in 2024.

Q: What are the biggest changes in the company's business and opportunities compared to three months ago? Are there any specific areas in advertising market revenue that you are paying more attention to? Are AI opportunities larger than expected, thus requiring more investment than anticipated? How will you consider maintaining the growth rate in the coming quarters as the advertising revenue base expands?

A: Previously, the company released the Llama 2 model and believed that it would lay the foundation for building a variety of valuable and socially integrated things. However, with the launch of the latest model, it has brought more additional opportunities to the company beyond the most obvious ones. The success of Llama 3 and Meta AI is a true validation of the technology, proving the company's capabilities in talent, data, and expansion infrastructure.

Furthermore, the goal of Meta AI is to become the most widely used and best AI assistant in the world, which will bring tremendous value. Therefore, the company will continue to invest to maintain its leading position in this field, despite the current products not yet being profitable. As 2024 progresses, the company will face a period of increasing demand, with expectations that investments in AI-based content recommendations and video work will continue to attract user engagement. At the same time, the company will continue to improve ad performance, making ads more effective and providing more value to advertisers. The company's conversion rate growth in this quarter outpaced exposure growth, indicating an improvement in conversion rates as a way to enhance ad performance.

Q: In terms of capital expenditure, is it possible to shift some of the metaverse spending to AI? Do they overlap to some extent, allowing funds to be reallocated from other areas to support AI? What is the expected return on capital invested in the next two to three years?

A: AI investments are divided into two categories: core AI work and strategic investments. For core AI work, the company takes an ROI-driven investment approach and has seen strong returns in improving user engagement and ad performance, with these improvements translating into revenue growth. Strategic investments are in a more early stage, with significant long-term potential, but requiring more funding to develop more advanced models and expand product usage before generating meaningful revenue.

The company is reallocating resources from other areas to drive AI work, whether in computing resources or other aspects. Regarding Reality Labs, there is still optimism about building these new computing platforms, with glasses being one of the key platforms for the future. With the successful performance of glasses products in collaboration with Ray-Ban, the outlook for Reality Labs has improved and is expected to become a meaningful and growing platform soonerQ: What impact will the upcoming TikTok ban have on Meta? How large is the spending scale of Advantage+ on the platform, and what impact does it have on stabilizing the overall cost per mille (CPM)?

A: The company is closely monitoring the TikTok-related events, but it is still too early to assess its impact on the company's business.

Regarding Advantage+, its product portfolio has shown good momentum, including automated solutions for individual steps and end-to-end processes. Since the fourth quarter, Advantage+ Audience, an automated product for individual step audience creation, has become the default audience creation experience for most advertisers, showing significant growth and adoption rates. This helps advertisers improve ad effectiveness by using audience inputs as suggestions rather than strict constraints. According to our tests, advertising campaigns using Advantage+ Audience targeting have seen an average decrease of 28% in cost per click or per target compared to conventional placements. End-to-end automation products like Advantage+ Shopping and Advantage+ App Ads are also showing strong growth trends.

Since last year, the revenue generated by these two products has more than doubled. The company is working to provide more conversion types for Advantage+ Shopping, and in the first quarter, we began expanding the list of conversions that businesses can optimize. Previously, it only supported purchase events, but now we have added 10 other conversion types and continue to expand adoption across vertical industries.

Q: How should the relationship between revenue and cost growth of the Family of Apps be considered during the upcoming product investment period? Regarding the growth of general and administrative expenses (G&A) in the first quarter, were there any one-time factors leading to the increase in legal expenses in the first quarter?

A: The growth in general and administrative expenses (G&A) was mainly influenced by legal expenses. Regarding the long-term profit margin of the Family of Apps, no direct guidance was given, but it was emphasized that since 2023, the company has been operating business with efficiency in mind and has been very cautious in allocating new resources. This is a capability that the company has gradually developed in 2023 and is considered crucial for the company's future development. The company will continue to emphasize this, especially considering the scale of the Family of Apps business.

Q: In terms of the long-term development of Meta AI, will it eventually bring in search advertising revenue? Do you think it should wait until people start using it before considering adding a premium subscription layer to profit? Meta AI is building artificial intelligence tools for businesses and creators. How do you view the evolution of the business model when these tools develop to interact with celebrities like Taylor Swift for merchandise, tickets, etc.?

A: Meta AI's collaboration with Google and Microsoft primarily focuses on obtaining real-time information, which is different from the search business. Although Meta AI is not currently focused on producing search ads, it may introduce advertising and paid content in the future, such as larger models, more computing resources, and advanced featuresIn addition, Meta AI's biggest opportunity may lie in Business message, aiming to increase engagement and ad quality for enterprise applications, allowing businesses and creators to easily leverage AI for community interaction.

For businesses and creators, this may involve sales, commerce, customer support, and more engaging interactions. Currently, the monetization level of business messaging is relatively low, but AI is expected to reduce interaction costs, increase engagement, and improve ad quality, thus bringing about near-term business opportunities.

Overall, as Meta AI expands, there will be its own monetization opportunities, but the main goal for now is to get more people to use Meta AI as a core part of their work.

Q: How can large language models enhance Meta's existing features and services? What changes might occur in Meta's overall experience in the coming months or years? What are Meta's long-term goals and plans in the field of artificial intelligence and messaging?

A: Future artificial intelligence models will not be limited to simple chatbot functions, but will evolve into more complex agents capable of handling more complex tasks. These agents will autonomously perform multiple queries and operations based on user intent or goals to help users achieve their objectives. For businesses, this multi-turn interaction and reasoning planning capability will enable them to better support customers, position products, and encourage purchases. The capabilities demonstrated currently are just the beginning, and future agents will be even more powerful, bringing significant business opportunities. Meta has made progress in building leading models and will continue to invest in this area in the long term.

Risk Disclosure and Disclaimer for this article: Dolphin Research Disclaimer and General Disclosure