Microsoft: Azure Carries Everything, Firm Anchor of the US Stock Market

Microsoft $Microsoft.US announced its fiscal third-quarter results for the 2024 financial year ending March 31st after the U.S. stock market closed on April 25th. While Microsoft rarely delivers surprises of more than "+-10%," its strength lies in consistently delivering slightly better results than expected each quarter, bringing a sense of "happiness." Here are the key points:

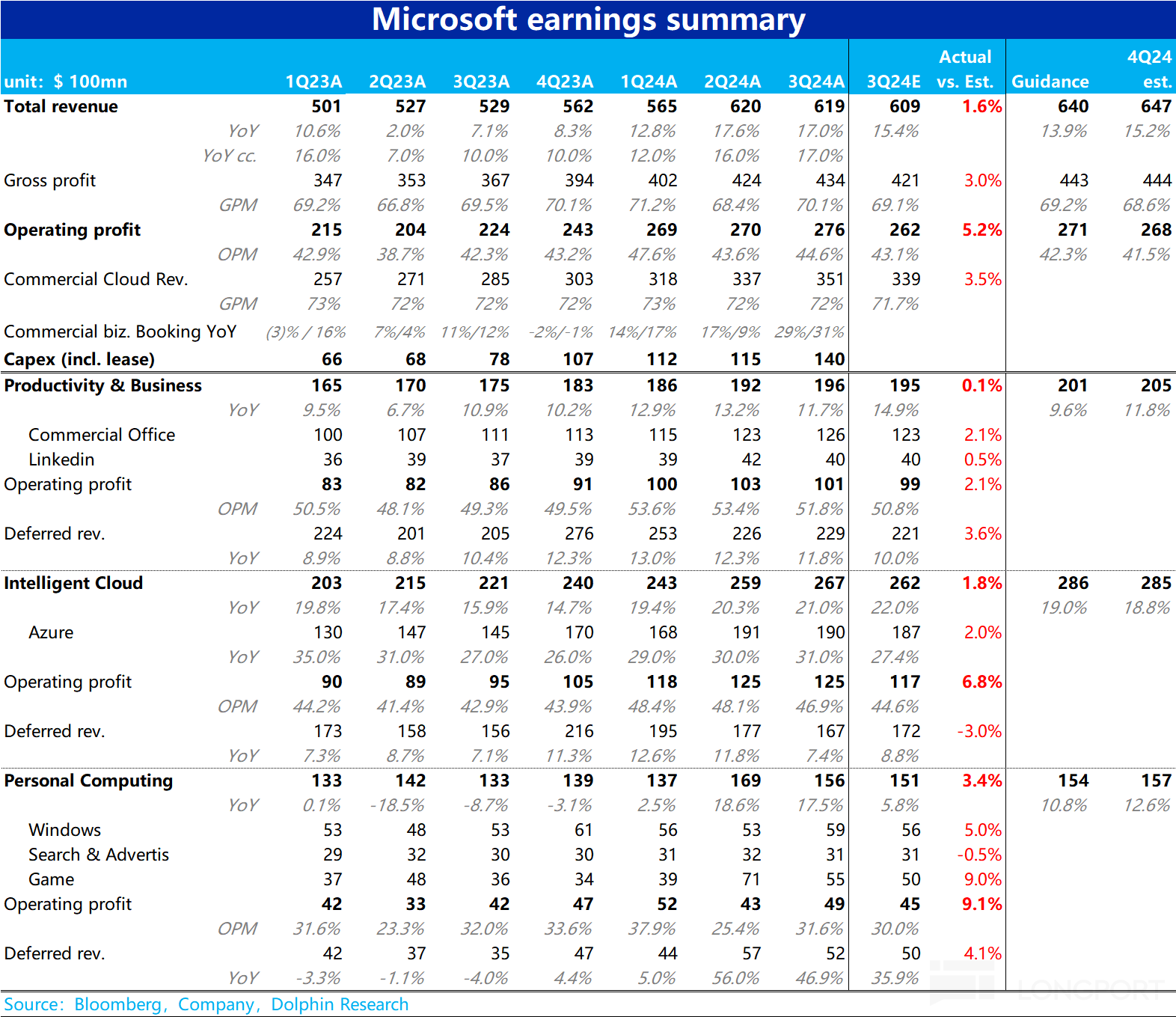

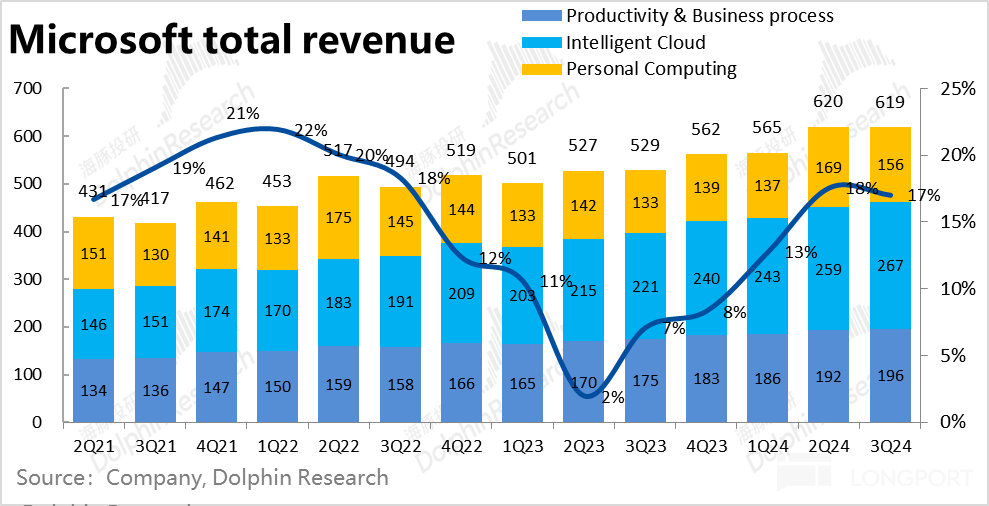

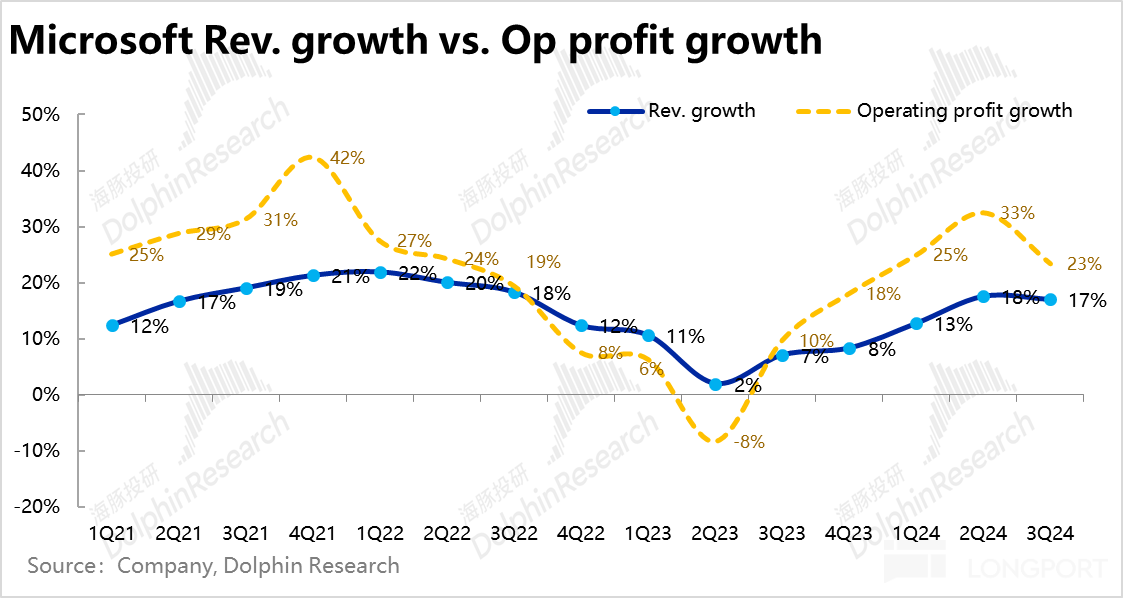

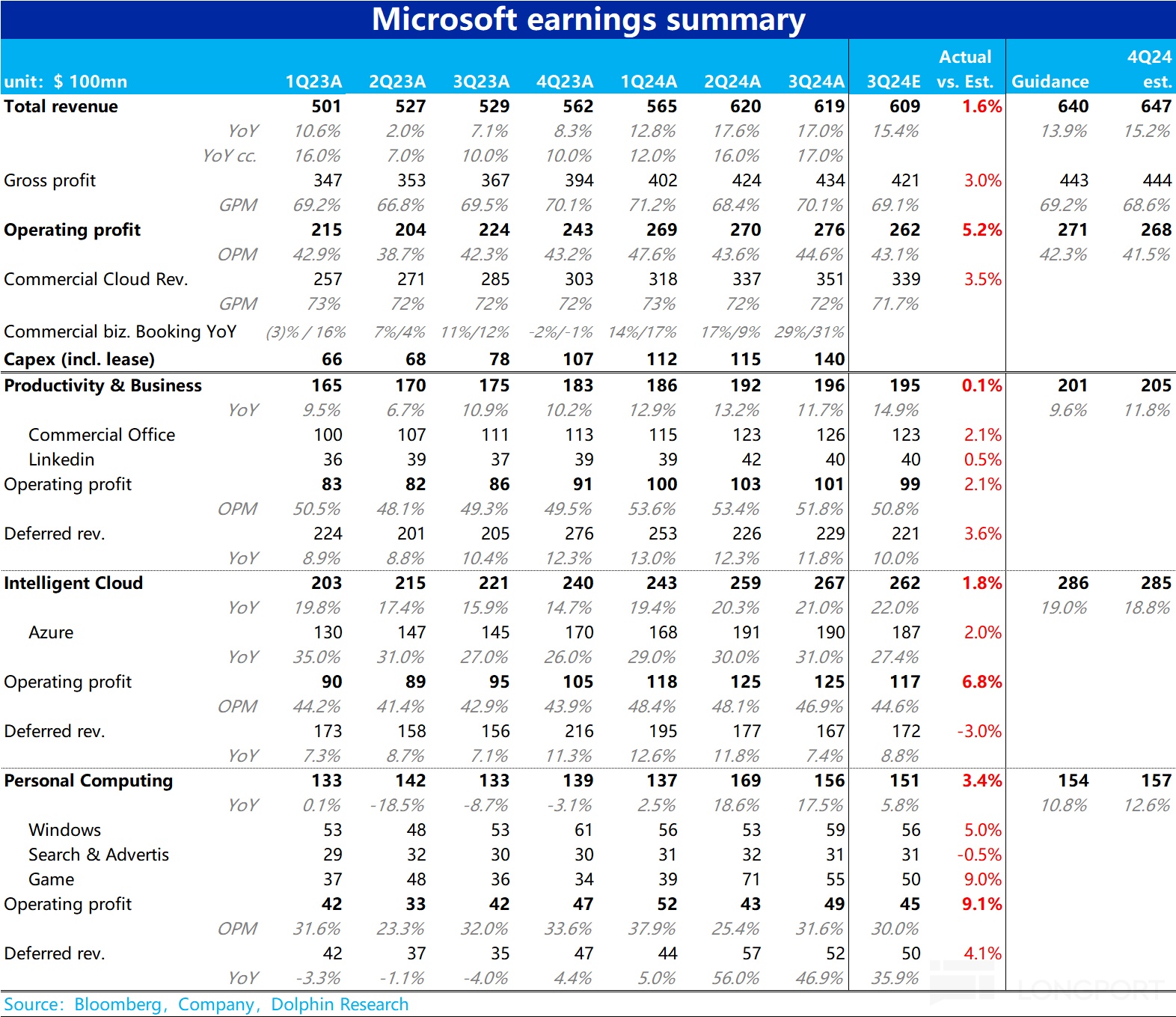

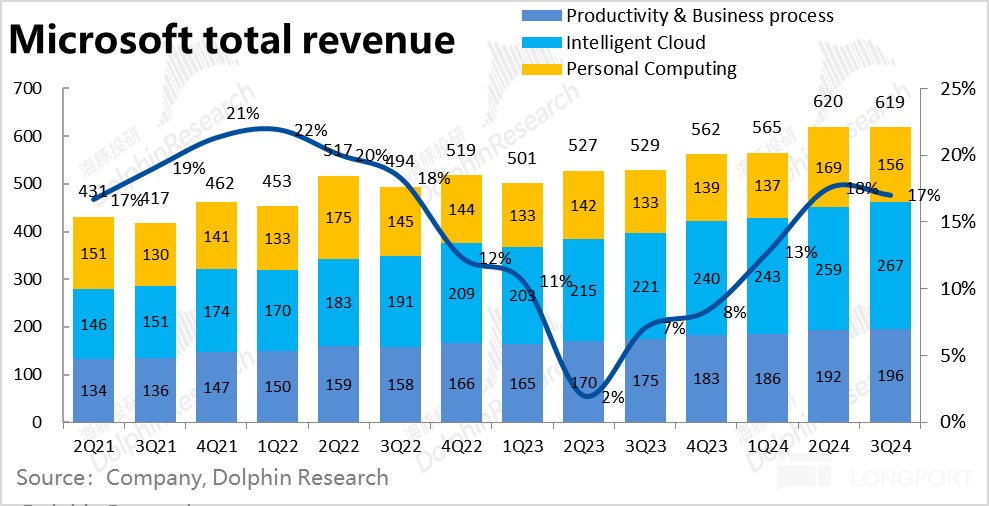

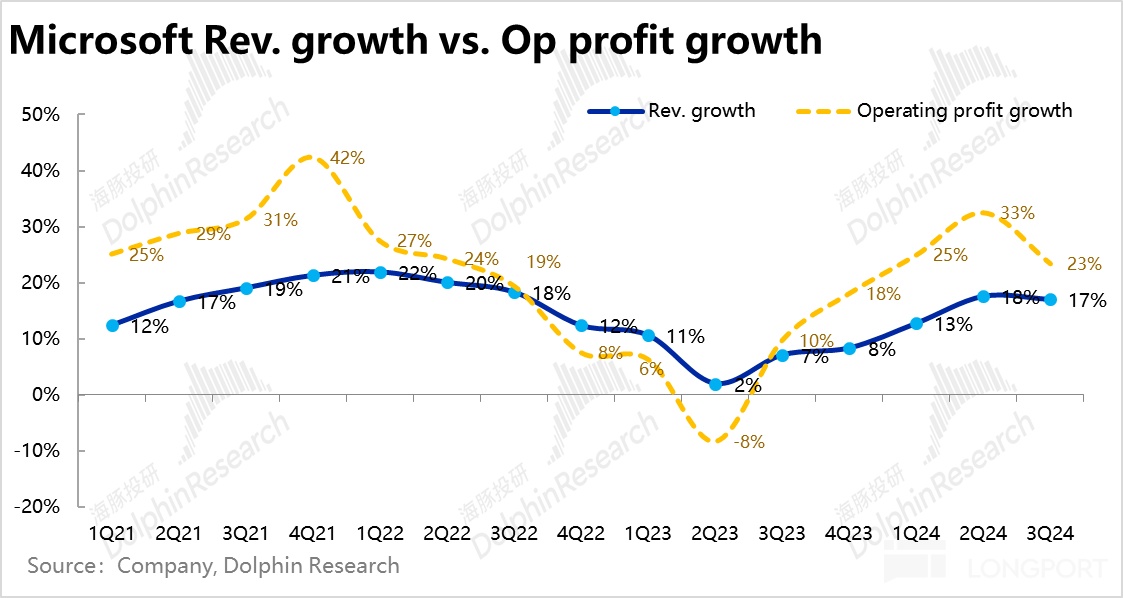

1. Revenue growth rebounds, impressive profit release: Looking at the overall performance, Microsoft achieved revenue of $61.9 billion this quarter, approximately $1 billion higher than expected. This was mainly driven by the Intelligent Cloud segment led by Azure and the Personal Computing segment driven by the acquisition of Blizzard, which exceeded revenue expectations by $500 million each.

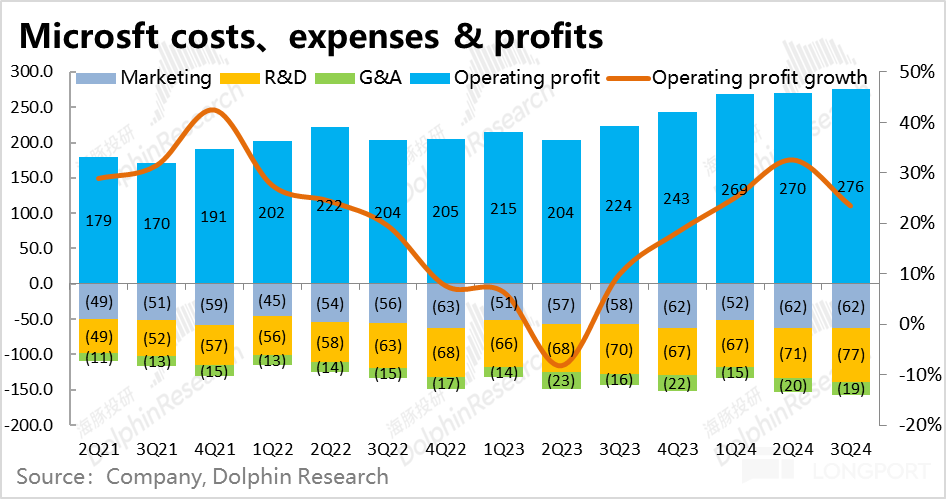

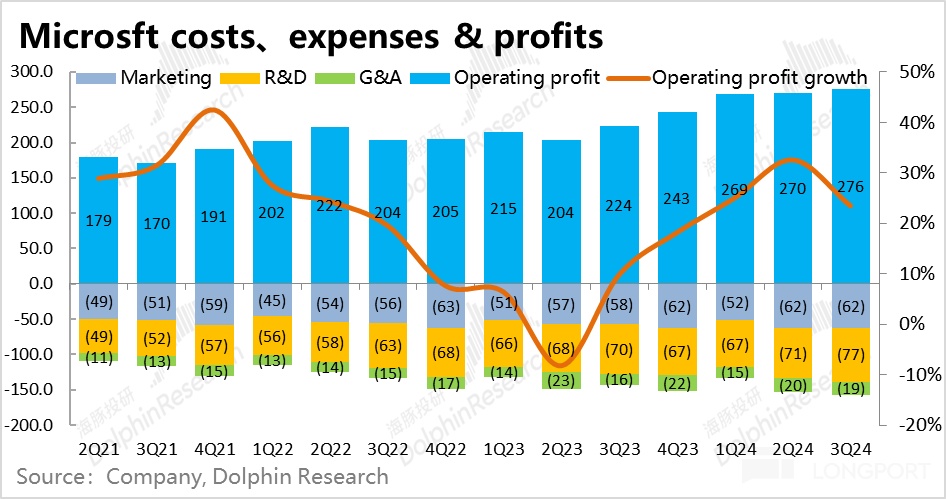

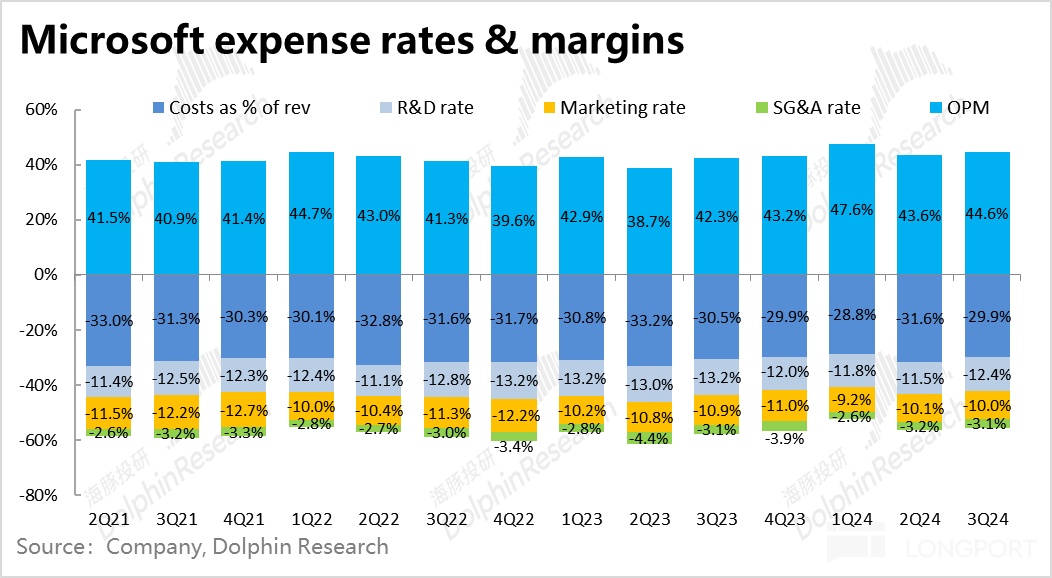

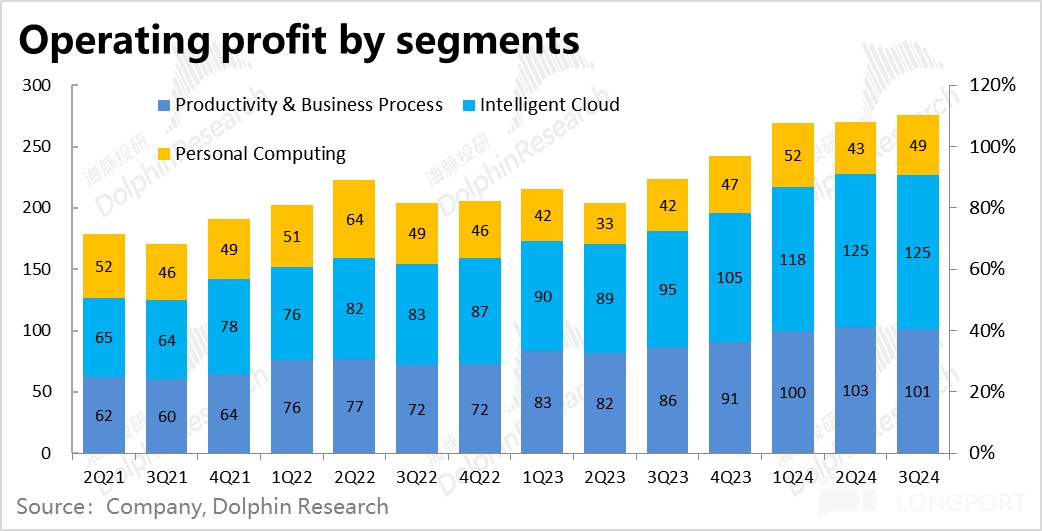

Moreover, both costs and expenses roughly met the lower end of the company's previous guidance, leading to a slight increase in operating leverage. As a result, operating profit exceeded expectations by $1.4 billion (+5.2% above expectations). Profit growth continues to outpace revenue. Based on past experience, the increase in Microsoft's performance after earnings is generally in a 1:1 ratio with the profit exceeding expectations.

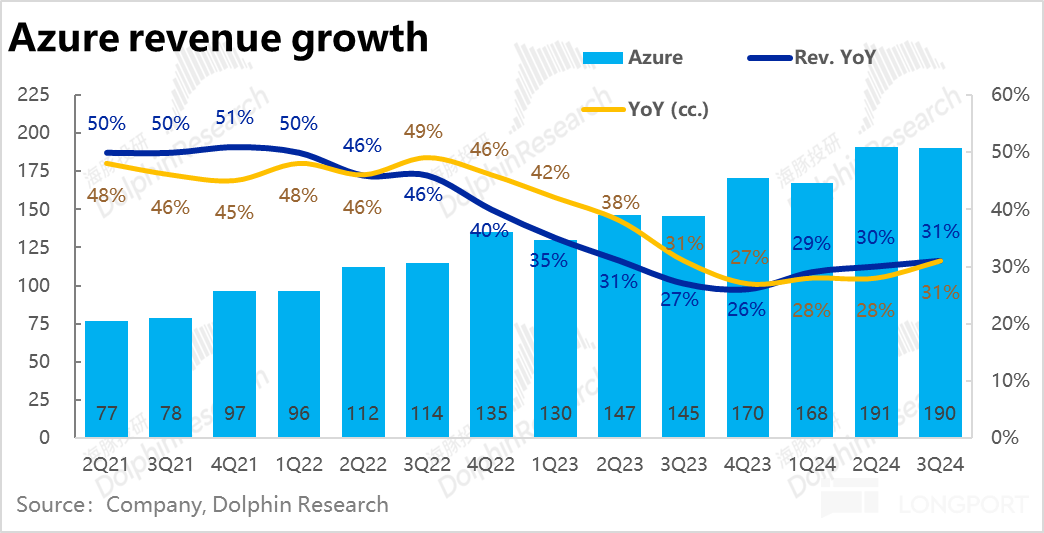

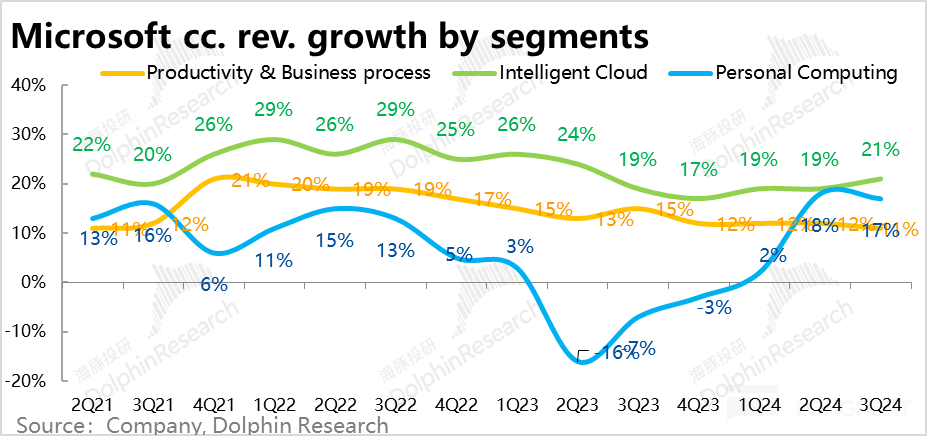

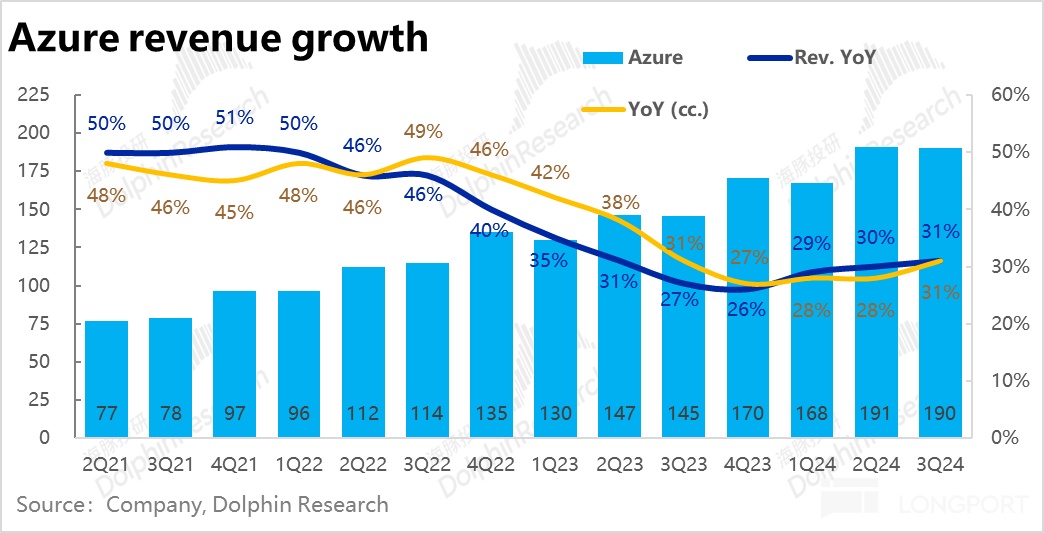

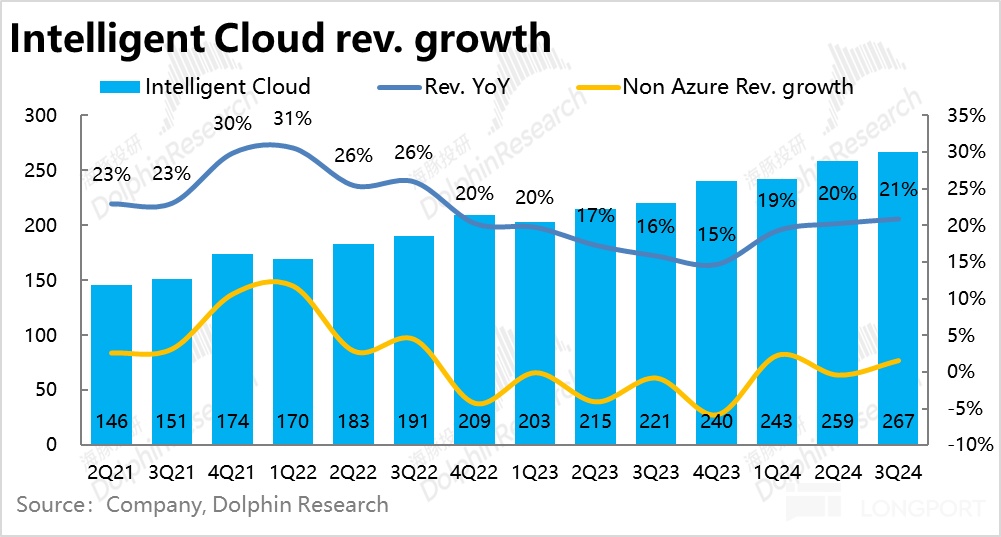

2. Azure, the "pillar," shows strong performance: The core Azure segment achieved revenue of $19 billion this quarter, with a nominal and constant currency growth rate of 31%, accelerating by 1 percentage point and 3 percentage points compared to the previous quarter, respectively. Compared to the previous guidance of constant currency growth rate remaining flat from the previous quarter, the actual growth was significantly stronger, further indicating an upward inflection point in Azure's growth.

It was disclosed that AI-related demand contributed 7% of Azure revenue, approximately $1.33 billion in incremental revenue. Meanwhile, traditional demand contributed around $3.28 billion in incremental revenue this quarter, consistent with the previous quarter. It is evident that the optimization cycle for traditional Azure demand has essentially ended, with no significant drag expected in the future. The growth brought by AI is gradually being realized, indicating a high probability of continued growth for Azure in the future.

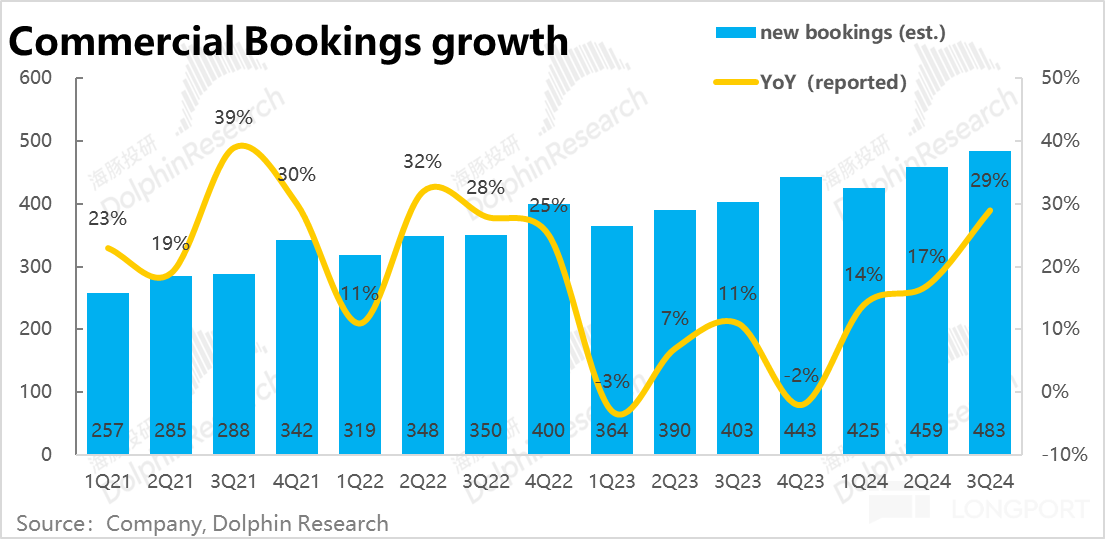

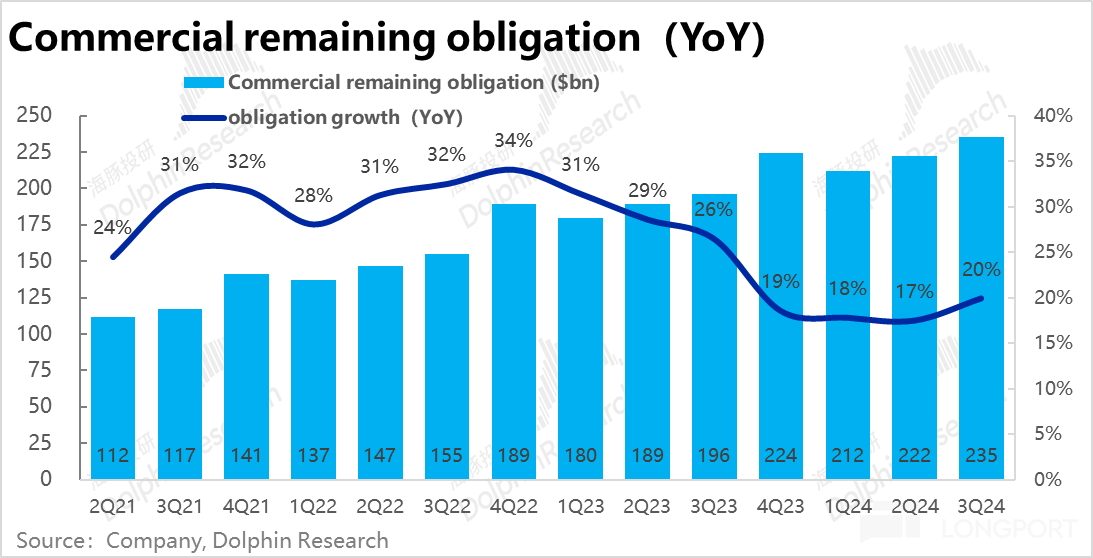

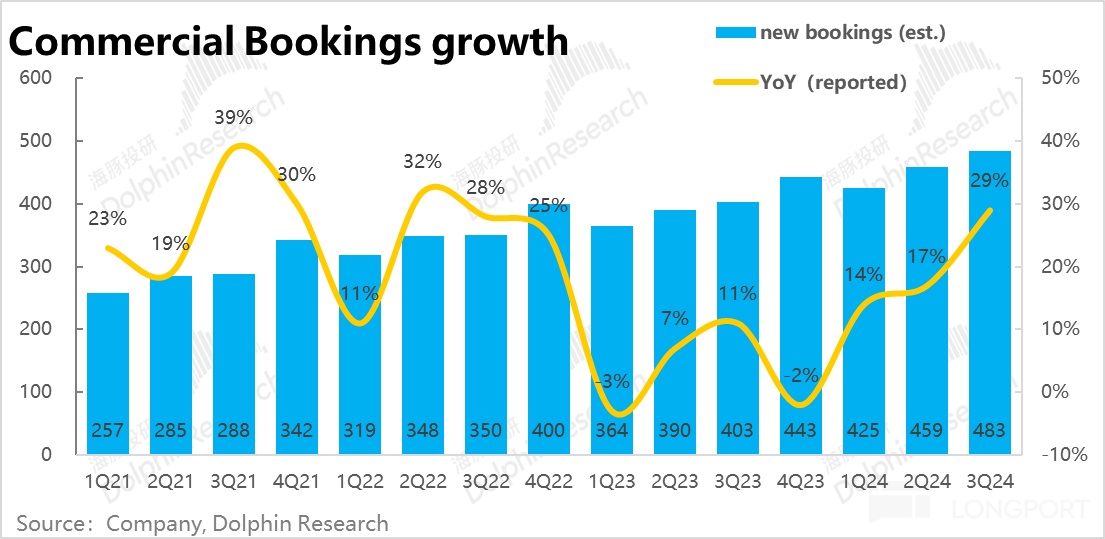

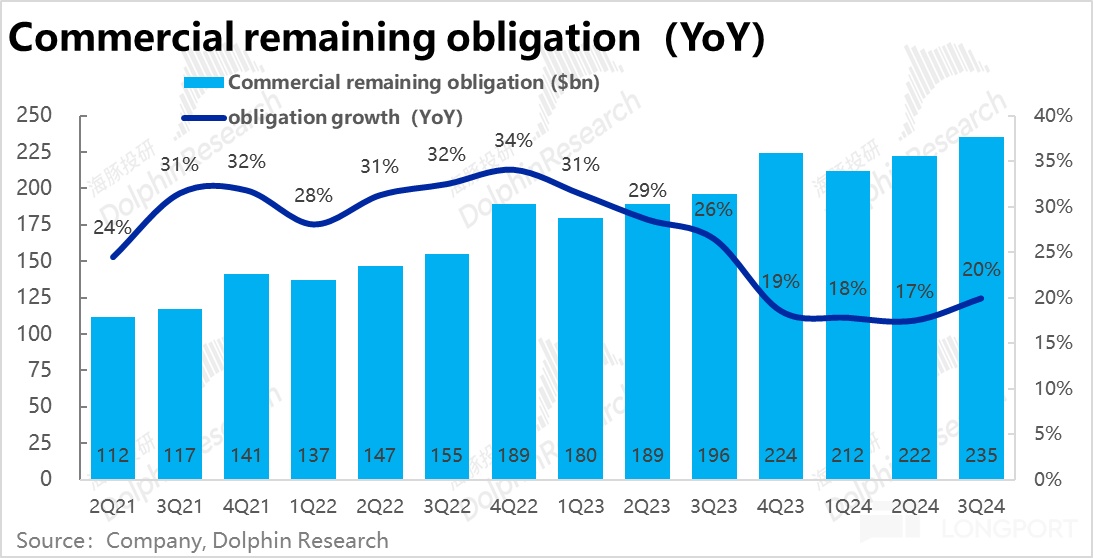

3. Positive trends in "residual" indicators: In addition to the upward trend in cloud computing growth this quarter, the amount of new enterprise cloud business contracts that can be converted into future revenue saw a significant increase from 17% in the previous quarter to 29% this quarter. This also confirms the substantial demand for AI cloud computing that has yet to reach its peak, while the optimization cycle for traditional demand is nearing its end. Enterprises are increasing their IT investments rapidly. The total remaining performance obligations (deferred revenue + contract liabilities for payments received but not yet recognized as revenue) this quarter amounted to $235 billion, with the year-on-year growth rate also increasing from 17% to 20%.

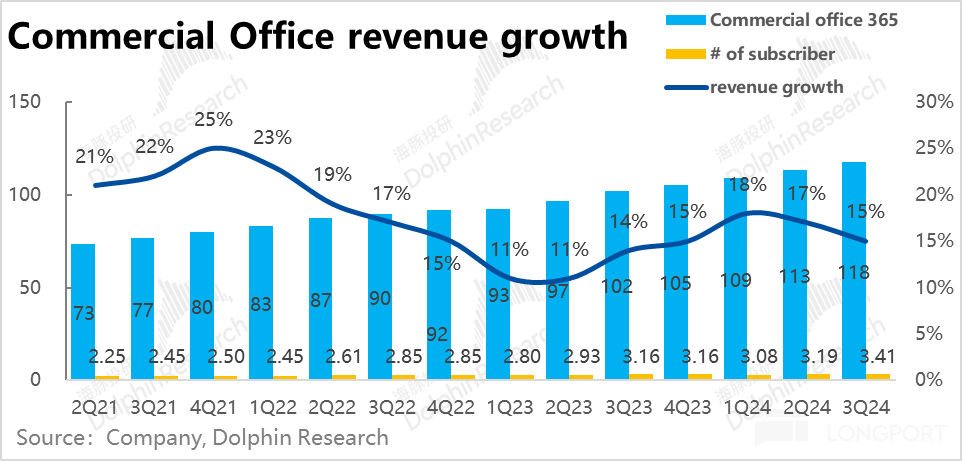

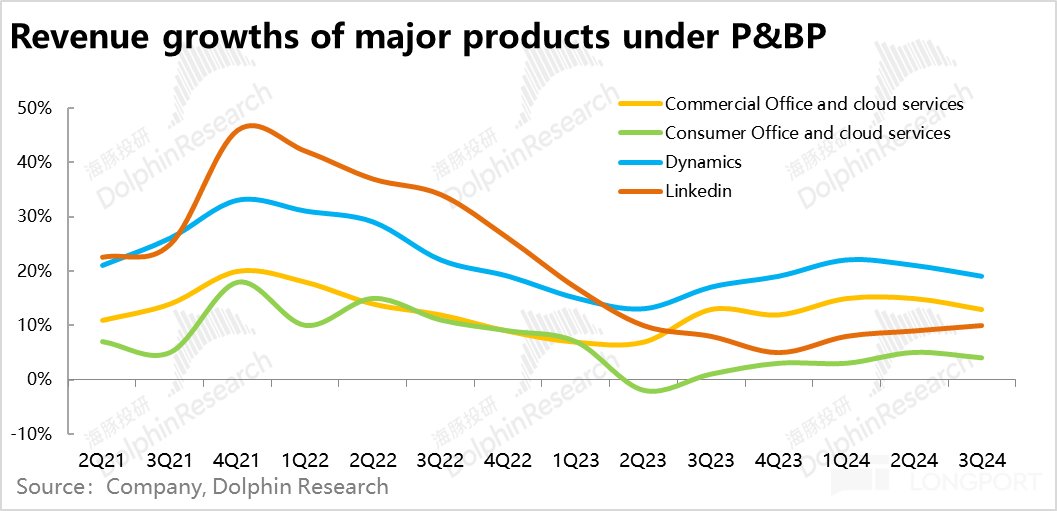

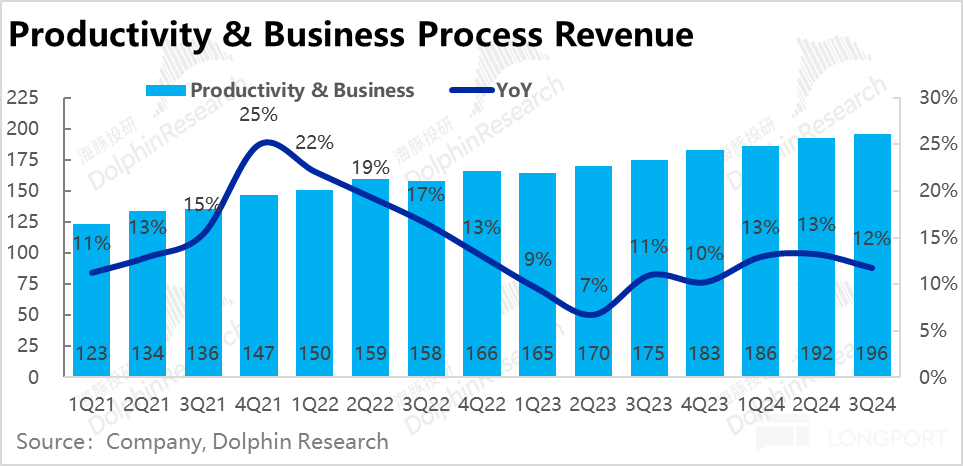

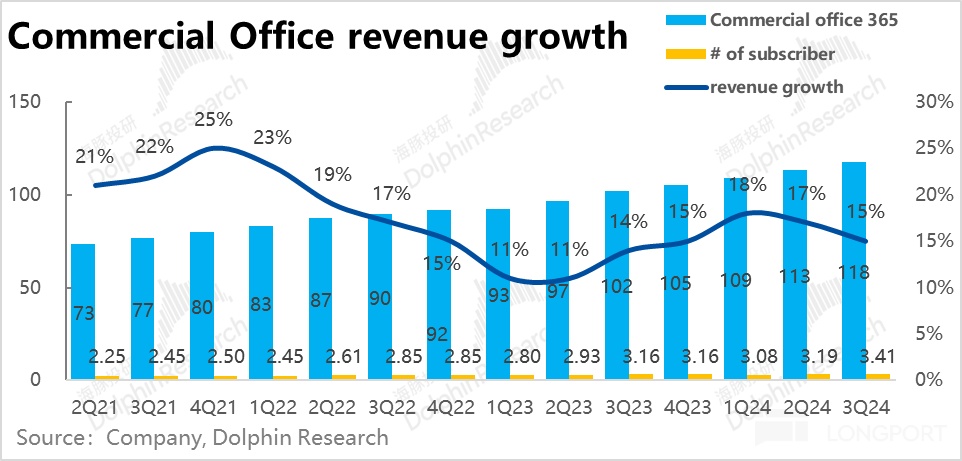

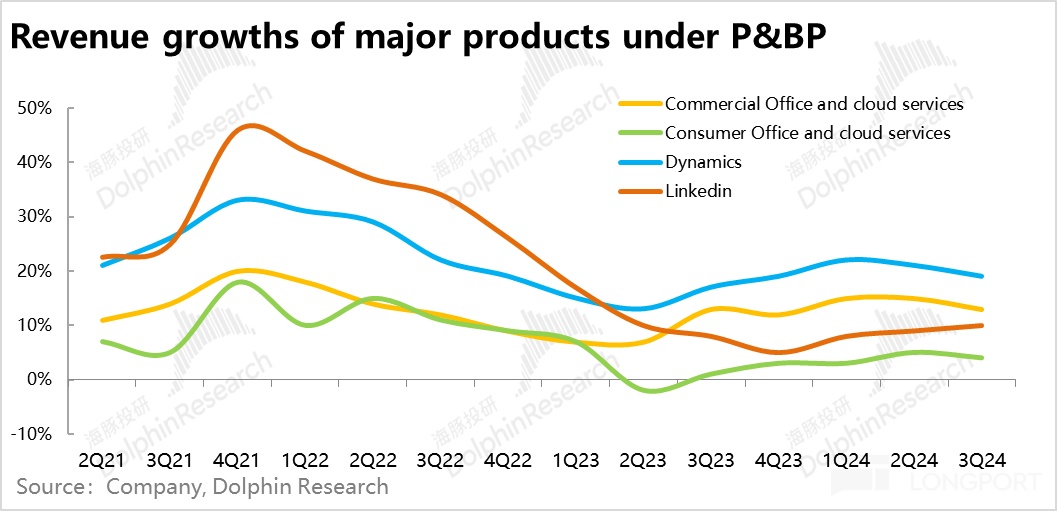

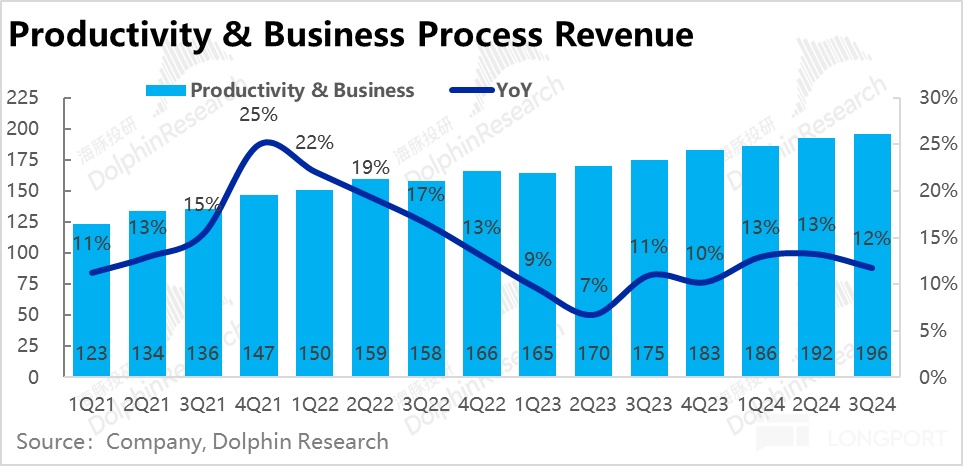

4. Productivity segment yet to feel the heat of AI: In another core business of the company, Enterprise Office 365 grew by 15% this quarter, a decrease from the 17% growth in the previous quarter. According to research, progress in the adoption of AI features like Copilot has been slow and has not accelerated the growth of the Office business As for other businesses in the sector, they generally show a trend of slowing growth. Therefore, the productivity process sector's revenue growth this quarter is 12%, a decrease of 1 percentage point from the previous quarter, with no outstanding performance.

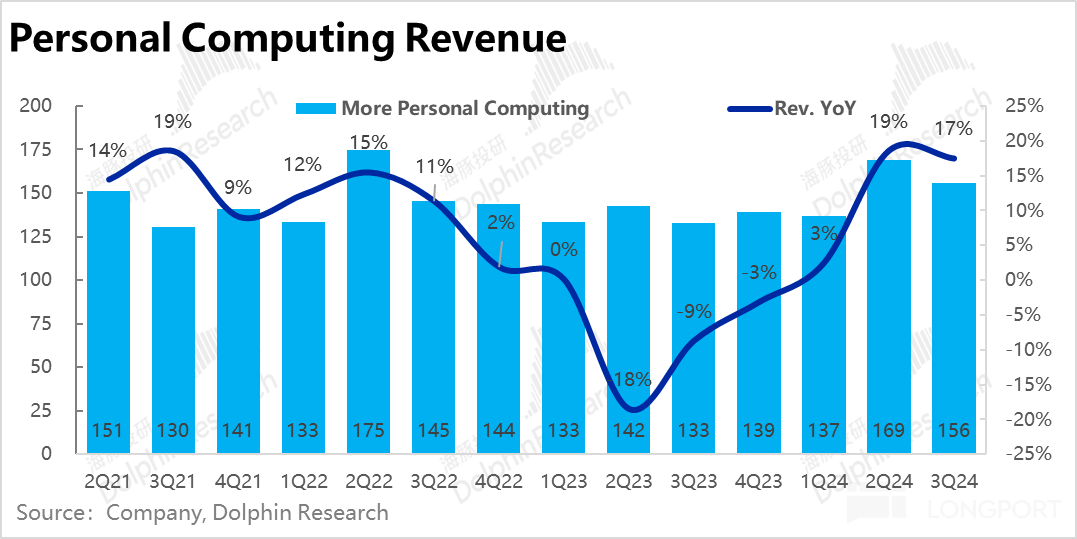

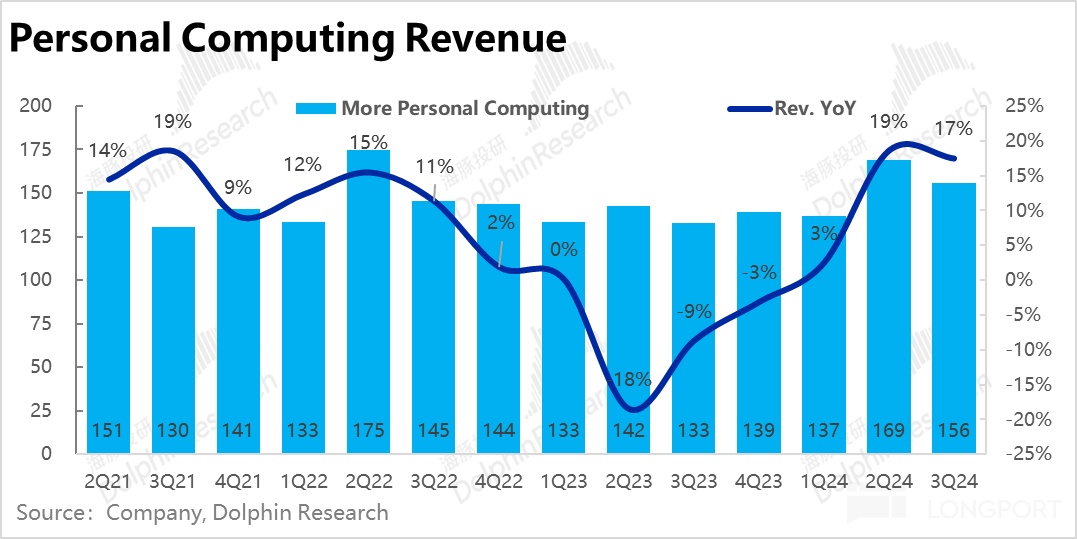

5. The real turning point for personal computing still needs to look at "AI PC": The nominal year-on-year growth rate of the personal computing sector this quarter is 17%, but after excluding the impact of acquiring Blizzard, the comparable growth rate of the original business is only 2%, which is not good. The revenue of the original game and hardware business excluding Blizzard still experienced a year-on-year negative growth this quarter, indicating that the real demand is not good. The growth rate of the Windows business improved slightly from 8% to 11%, but for the sector to truly turn around, it may still need the replacement cycle brought by "AI PC" landing.

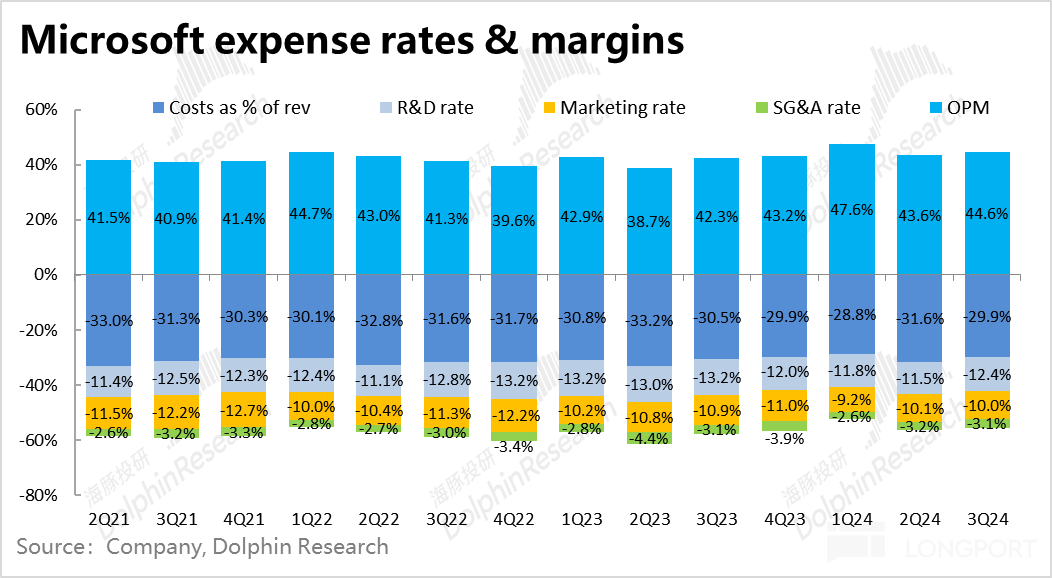

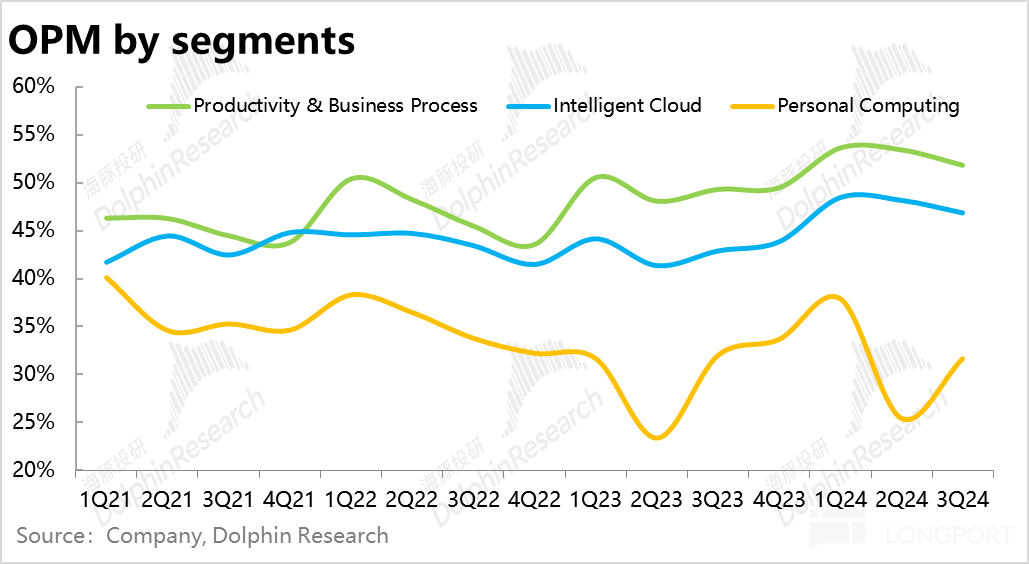

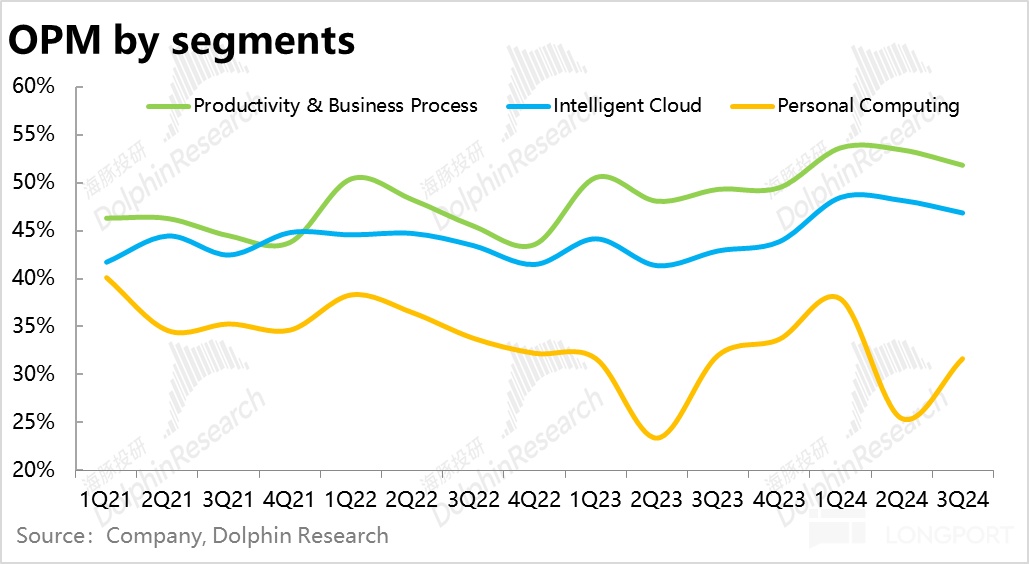

6. Revenue growth with stable expenses, continued operating leverage release: On the profit side, due to revenue exceeding expectations while costs and expenses were slightly lower than guidance, profit growth remained higher than income. Specifically, the gross profit margin was 70.1%, slightly higher than the expected 69.1%, amplifying the revenue exceeding expectations. The company explained that the increase in gross profit margin was mainly due to the improvement in cloud demand and Office unit price.

In terms of expenses, Microsoft's cost control ability remains reliable. Operating expense ratio continued to decrease year-on-year. Research and development expense ratio and marketing expense ratio decreased by 0.8 percentage points and 0.9 percentage points respectively. In the end, Microsoft's operating profit this quarter reached $27.6 billion, exceeding expectations by $1.4 billion, a 23% year-on-year increase.

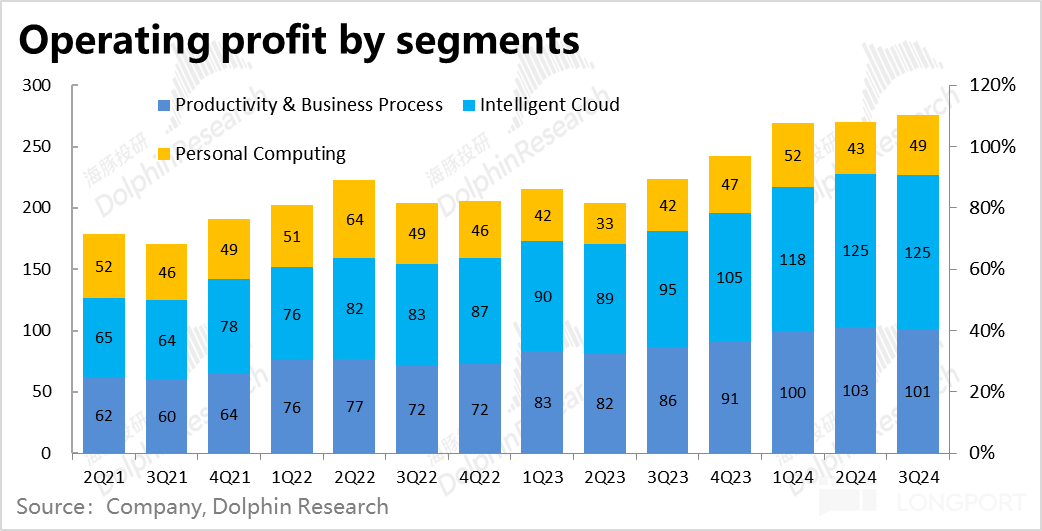

Looking at the segments, the operating profit of the Intelligent Cloud and Personal Computing sectors exceeded expectations by 7% and 9% respectively.

7. Performance guidance is still modest but stable small happiness: For the last quarter of the 24th fiscal year, the company's revenue midpoint guidance for the Productivity and Personal Computing businesses was slightly lower than the market's previous expectations, resulting in a total revenue midpoint guidance about $700 million lower than expected. However, the key Intelligent Cloud sector performed better than expected. Moreover, Microsoft's actual deliveries in the past generally met or exceeded the upper limit of guidance, so the revenue guidance issue is not significant. On the profit side, the company's guidance for expenses is less than the market's expectations, therefore the implied midpoint of operating profit guidance is slightly higher than expected by $300 million, which is also a small but stable improvement over expectations.

Dolphin Research View:

Overall, Microsoft deserves the title of "stabilizing needle" in the U.S. stock market. Although there were no huge surprises in performance, once again it delivered a slightly better certainty than expected. Total revenue exceeded expectations by approximately $1 billion, while costs and expenses were generally in line with the company's previous lower limit guidance, resulting in total operating profit exceeding expectations by approximately $1.4 billion (+5.2%) However, specifically speaking, the over-performance is mainly driven by the Intelligent Cloud segment led by Azure. The key Azure revenue growth rate reached 31% (at fluctuating/constant exchange rates), surpassing the growth rate of the previous quarter and the company's guidance of 28% at constant exchange rates. Among them, the revenue contribution from AI-related demands reached 7%, an increase of 1 percentage point from the previous quarter. It is evident that the AI-related cloud computing demands have indeed accelerated Azure's growth, and looking at the new contract signings, the growth is expected to further accelerate in the second half of the year.

However, the other key productivity segment has not yet benefited from the dividends brought by AI, as the penetration progress of Office Copilot is not rapid. While the personal computing segment is better than expected, the actual performance trend still shows a significant amount of business in a negative growth state. A new wave of replacement is needed to truly reverse the downward cycle of personal PCs since the pandemic. Therefore, overall, the entire burden of Microsoft falls entirely on Azure, which aligns with our view that the most certain benefit of the AI wave is the 2B cloud computing demand, and the subsequent changes in growth rate are key factors affecting valuation. Although consumer applications on the 2C end may have a large user base, it will take time for them to contribute real revenue and profits.

Overall, Microsoft's current valuation of over 30x PE is widely recognized as premium. However, in the current investment cycle of prosperity, Microsoft's financial report for this quarter clearly demonstrates that Microsoft (mainly its cloud computing business) is one of the companies benefiting the most from the AI wave, and the incremental revenue brought by AI is likely to accelerate. As long as the performance continues to improve, the high valuation will not be an obstacle.

Below is a detailed analysis of the financial report:

I. Core Business: Focusing on Azure

1.1 AI Demand Gradually Unleashed, Azure Growth Rate Turns Upwards

The flagship product of the Intelligent Cloud segment, Azure, achieved revenue of $19 billion this quarter, with nominal and constant currency growth rates both at 31%, representing an increase of 1 percentage point and 3 percentage points compared to the previous quarter, respectively.

Previously, the company's guidance was that Azure's growth rate at constant exchange rates for this quarter would be in line with the previous quarter, but the actual growth significantly exceeded expectations, showing signs of an upward inflection point after a long period of growth deceleration from 2022 to 2023.

According to the company's disclosure, AI-related demands have contributed approximately 7% of Azure's revenue, equivalent to around $1.33 billion in incremental revenue. Calculated, traditional demands contributed approximately $3.28 billion in incremental revenue this quarter, consistent with the previous quarter. It can be seen that the optimization cycle of Azure's traditional demands has essentially ended, with no significant drag expected in the future. The growth brought by AI is gradually being unleashed, indicating that there is a high probability of Azure continuing to rise and reaching a higher level in the future According to calculations, other server businesses in the sector have also reversed the trend of continuous negative growth from last year, achieving single-digit growth, which also implies that the optimization cycle of IT expenditures such as cloud computing has basically come to an end.

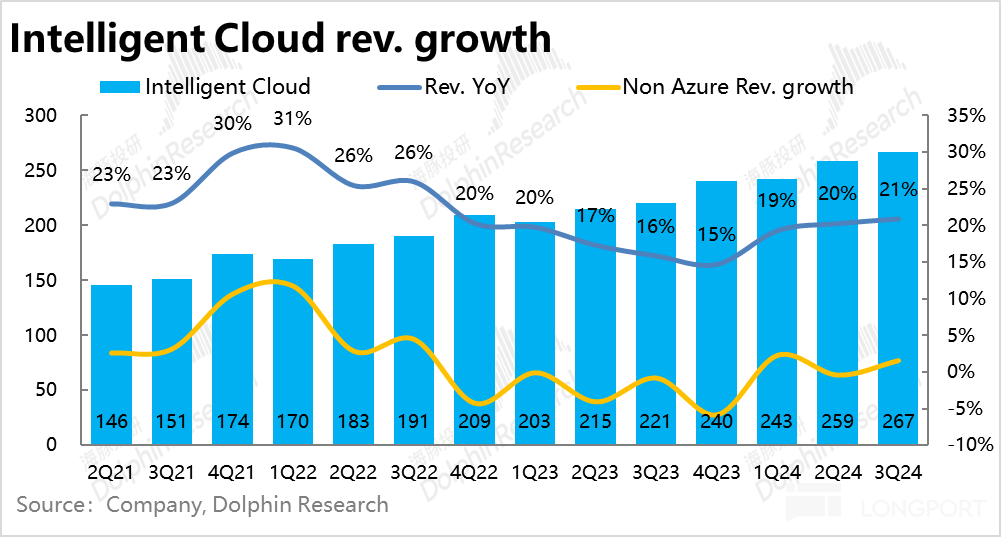

Overall, with the contribution from Azure, the nominal growth rate of the Intelligent Cloud segment has also increased by 1 percentage point, accelerating by 2 percentage points at constant exchange rates. Actual revenue was $26.7 billion, about $500 million higher than market expectations.

1.2 Copilot penetration is slow, Office has not yet benefited from it

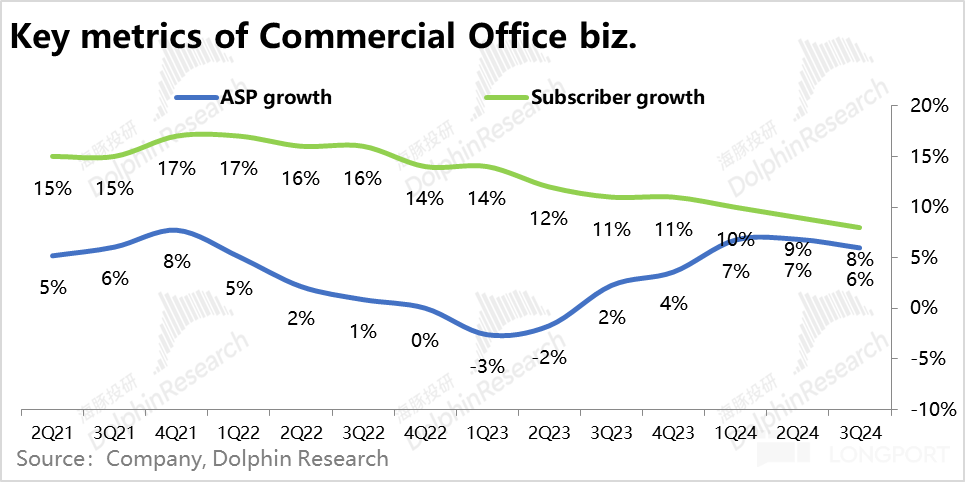

Another core business of the company, Enterprise Office 365, grew by 15% this quarter, slightly slower than the 17% growth in the previous quarter. Combined with research from foreign banks, the progress of user adoption of related AI features such as Copilot is not fast, thus not driving the growth acceleration of the Office business.

From a quantity and price perspective: 1) This quarter, the number of Enterprise Office 365 subscription customers increased by 8% year-on-year, continuing the trend of continuous slow decline since 2022. Due to the quantity aspect, the penetration rate of Office in medium and large enterprises has tended to saturate, and the slower growth is logical. Subsequent growth turning points may only come with a significant increase in the penetration rate in small and medium-sized enterprises.

- With the premise that it is difficult to significantly accelerate user growth, pricing is the main and only driver of revenue growth, according to our calculations, this quarter's Office 365 ARPU remained the same as the previous quarter, increasing by 6% year-on-year, likely driven by the shift to high-priced products such as E5. The $20 Copilot service has not brought a significant increase in ARPU.

As for other businesses in the productivity segment, they generally show a trend of slowing growth as they follow the base. Only LinkedIn's revenue growth rate continued to slightly increase by 1 percentage point to 10% Overall, due to the lack of advancement in AI capabilities to accelerate the core business of Commercial Office, and all other businesses except LinkedIn are also experiencing a steady slowdown. Therefore, the revenue growth of the productivity process sector this quarter increased by 12%, a decrease of 1 percentage point from the previous quarter, with no surprises.

2.the Personal Computing sector exceeded expectations, but the trend has not improved significantly yet

The nominal year-on-year growth rate of the Personal Computing sector this quarter is 17%, mainly driven by the incremental revenue impact of the acquisition of Activision Blizzard. Excluding the impact of mergers and acquisitions, the original business growth rate is only 2%, and the actual growth of the Personal Computing sector is not significant. However, from the perspective of expectation deviation, the market expected gaming sector revenue to be $50 billion, but it reached $55 billion in reality, making the gaming business another major contributor to Microsoft's total revenue exceeding expectations this quarter, apart from Azure.

However, aside from expectation deviations, in terms of performance trends:

- Windows OEM business revenue increased by 11% year-on-year, continuing to rise from the 9% level in the previous quarter. Although there is an impact from the low base last year, if the "AI PC" can truly undergo significant upgrades in the future, the personal PC sector may experience a substantial refresh cycle.

- Hardware sales revenue, mainly driven by the Surface product line, continued to decline by 17%, with the decline widening. The company explained that this is mainly due to Microsoft shrinking its hardware product line, focusing on high-end products, and streamlining low-priced products with high volume.

- After the acquisition of Blizzard, Xbox content and hardware revenue within the gaming business increased by 51%, with the acquisition contribution growth rate at 55%. Excluding mergers and acquisitions, the original gaming revenue growth rate is -4%, which is also not optimistic.

- Similar to the revenue trend of LinkedIn, search advertising business growth, excluding acquisition costs, increased by 12%, an improvement from the previous quarter's 8%. Microsoft shows signs of strength in advertising business, possibly also contributed by AI capabilities.

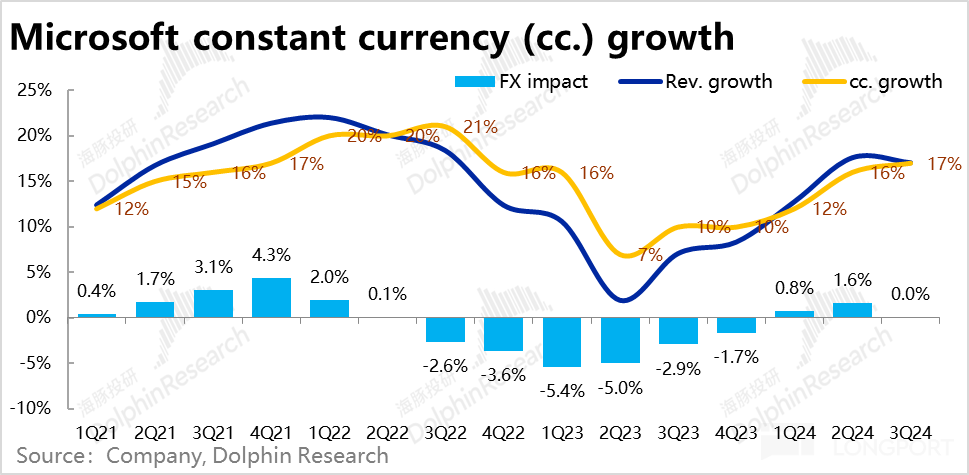

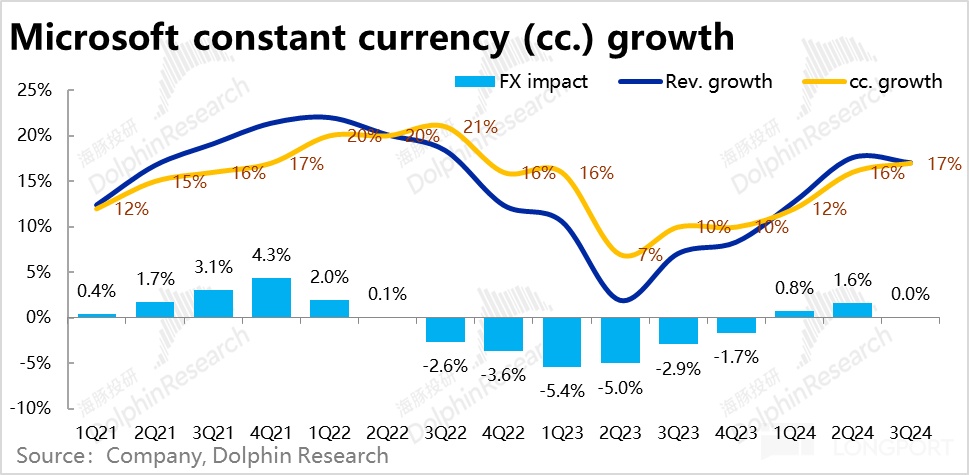

3, revenue growth is all about Azure

Overall, Microsoft achieved revenue of $61.9 billion this quarter, with nominal growth slowing slightly from 18% in the previous quarter to 17%. However, at constant exchange rates, the growth rate is 17%, an increase of 1 percentage point from the previous quarter Looking at it from a segmented perspective, after excluding the impact of exchange rates, only the growth rate of Intelligent Cloud has increased compared to the previous quarter. Productivity processes have slowed down steadily, and personal computing has slightly declined this quarter after reaching a peak in the previous quarter due to the acquisition of Blizzard. It can be seen that the driving force for revenue growth has completely shifted to the cloud computing demand driven by the AI wave.

4, a rapid increase in new contract signings, is the subsequent growth even more substantial?

As can be seen from the above, the biggest highlight of Microsoft this quarter lies in Azure's revenue accelerating beyond expectations driven by AI demand. The amount of new enterprise cloud business contracts signed, which reflects the demand growth for the quarter, has increased significantly from 17% to 29% according to the company's disclosure. Such a significant increase seems to also validate the substantial AI cloud computing demand waiting to be unleashed, as well as the end of the optimization cycle, with enterprises ramping up investments again, and the momentum is "rapidly approaching."

The remaining contractual liabilities balance (deferred revenue received but not yet recognized + contract amount signed but payment not received) for this quarter is 235 billion, with the year-on-year growth rate also increasing from 17% to 20%. This also implies that the subsequent growth of Microsoft's enterprise cloud is likely to further accelerate. The peak of the AI demand cycle has not yet arrived.

5, revenue increased while expenses remained stable, leading to continued profit growth

In this quarter, Microsoft achieved a gross profit of 43.4 billion US dollars, approximately 1.3 billion higher than expected, mainly due to revenue exceeding expectations by 1 billion. The gross profit margin was 70.1, slightly higher than the expected 69.1%, further amplifying the extent of the gross profit exceeding expectations. According to the company's explanation, excluding the impact of changes in depreciation periods, the increase in cloud demand and Office unit price led to an increase in gross profit margin.

In terms of expenses, Microsoft's cost control ability remains reliable. Operating expenses continued to decline year-on-year. Research and development expense ratio and marketing expense ratio decreased by 0.8 percentage points and 0.9 percentage points respectively. In summary, the total operating expenses amounted to 15.77 billion, exactly at the lower limit of the previous guidance

Therefore, with revenue exceeding expectations and expenses sticking to the lower limit of guidance, Microsoft's operating profit for this quarter reached $27.6 billion, exceeding expectations by $1.4 billion. Year-on-year growth of 23% continues to lead revenue growth.

Looking at the segments individually, similar to the situation of revenue exceeding expectations, the operating profit of both Intelligent Cloud and Personal Computing segments exceeded expectations. The operating profit of these two segments exceeded expectations by 7% and 9% respectively.

End of the text

Dolphin Research on Microsoft:

Financial Report Reviews

October 25, 2023 Conference Call " Microsoft: AI Function steadily advancing, driving demand recovery"

October 25, 2023 Financial Report Review " AI" Microsoft is here, is the Internet entering the Microsoft era again?"

July 26, 2023 Conference Call " Microsoft: All in AI"

July 26, 2023 Financial Report Review " Despite the beautiful vision of AI, Microsoft's reality remains stark"

April 26, 2023 Conference Call " What will be the impact of AI on Microsoft's performance?"

April 26, 2023 Financial Report Review " "Giant" Microsoft emerges from the trough, can it take off again with the help of Chatgpt?" January 25, 2023 Conference Call "Inevitable Slowdown (Microsoft Conference Call Minutes)"

January 25, 2023 Financial Report Review "Resilient Azure Can't Save Microsoft in the Downturn Cycle"

October 26, 2022 Conference Call "Can Microsoft Safely Navigate the Economic Downturn? (1Q23 Conference Call Minutes)"

October 26, 2022 Financial Report Review "No One is Immune to the Cycle, Microsoft is Struggling Too"

In-depth Research

July 5, 2023 "AI 'Rebuilding' Microsoft? Not That Easy"

May 30, 2022 "Microsoft is Flawless, Killing the Price Makes it Even More Perfect"

February 15, 2022 "Microsoft: Don't Focus Solely on Missed Expectations, Having Orders and Reserves is the Real Deal"

November 22, 2021 "Alibaba, Tencent Aging Before Declining, Why is Microsoft Growing Stronger?"

Risk Disclosure and Statement of this Article: Dolphin Investment Research Disclaimer and General Disclosure