BYD: Automotive Business Profit Margin "Dominating All Sides", Successfully Crossing the Trough?

BYD (002594.SZ) released its first-quarter performance after the Hong Kong stock market closed on the evening of April 29th. The key points are as follows:

1. Continued decline in car prices: Due to the launch of the Honor version models, prices are generally 1-3 thousand yuan lower compared to the 23 Champion version models. Although the proportion of high-end models in sales structure has declined this quarter, the increase in sales proportion of BYD's overseas models has partially offset this. However, the average car price still decreased by 0.9 thousand yuan compared to the previous quarter.

2. Strong gross profit margin: The gross profit margin of the automotive business (including battery business) this quarter reached 28.1%, which is 3% higher than the previous quarter when sales were booming, far exceeding domestic peers. Despite the decrease in car prices to 140,000 yuan this quarter, maintaining a leading gross profit margin level implies that in the price range of 100-200 thousand yuan, BYD's sales volume is almost invincible. The vertically integrated consolidated cost barrier makes it difficult for other car companies to compete.

3. Operating expense ratio increased, first-quarter profit margin declined: Although the gross profit margin this quarter increased due to the excellent performance of the automotive business, the marketing of the Honor version new car and increased investment in intelligence slightly exceeded market expectations. As a result, the net profit for this quarter was 4.77 billion yuan, with a net profit margin of 3.8%.

Dolphin's overall view:

BYD delivered a decent performance in the first quarter. Although the revenue was slightly lower than market expectations, the highlight was the gross profit margin in the car manufacturing sector this quarter. The market originally expected the gross profit margin of the automotive business (including batteries) to decrease from 25.1% in the previous quarter to 20.5% this quarter due to the price reduction of the Honor version. However, surprisingly, the gross profit margin of the automotive business (including batteries) this quarter almost reached a historical high of 28.1%! This gross profit margin level in the car manufacturing business is far ahead of domestic competitors, even with a car selling price of only around 140,000 yuan.

Looking closely at this unexpected gross profit margin, the single-car income indeed matched Dolphin's expectations. Due to the price reduction of the Honor version, the single-car price decreased from 150,000 yuan in the previous quarter to 141,000 yuan this quarter. However, the main reason behind this is the greater decrease in single-car costs. Apart from the continued decline in lithium carbonate prices this quarter and the usual 3%-5% annual decline from component suppliers, it still reflects BYD's extreme cost advantage under its vertically integrated layout.

Although sales volume was under pressure in the first quarter, mainly due to the off-season sales in January and February and the impact of BYD actively destocking, the launch of the Honor version significantly boosted sales, quickly bringing BYD's March sales volume back to the normal level of over 300,000 units.

BYD is about to switch to DMI 5.0 products, marking the beginning of a new product cycle. The launch of the Honor version is not only to further clear the joint venture fuel vehicle market share and optimize the competitive landscape, but more importantly, to prepare for the switch to DMI 5.0 products and bridge the price gap between DMI 4.0 and DMI 5.0 productsForming a situation where old and new models coexist. Although BYD's unit price in the first quarter was affected by the price reduction of the Honor version, the switch to DMI 5.0 products is expected to lead to an increase in unit prices.

Overall, in the 24th year, BYD's inventory risks have gradually been resolved. BYD can use the advantage of the low price of the Honor version + the new technology advantage of DMI 5.0 (claimed fuel consumption of 2.9L per hundred kilometers, and a range of over two thousand kilometers) to consolidate its sales base, continue to clear out the share of joint venture fuel vehicles, and the overseas increment of 500,000 vehicles this year, as well as the smart driving models that BYD will launch in the second half of the year, will further drive the breakthrough in high-endization. Currently, BYD's annual sales target of 3.6 million vehicles for this year is still relatively conservative, and there is a high possibility of exceeding sales expectations this year.

Currently, the company's market value corresponds to a PE ratio of approximately 18-20 times in 2024, which is not too high. The dawn of BYD is just ahead. In 2023, when investing in BYD, attention should be paid to the risk of chasing highs, while in 2024, more attention should be paid to reversal opportunities.

PS: BYD is a company with a complex business structure, covering businesses such as automobiles, mobile phone components and assembly, secondary rechargeable batteries, and photovoltaics. However, the in-depth articles on BYD completed by Dolphin in July last year, "BYD: The Best Electric Vehicle Manufacturer" and "BYD: Steady Wealth After Soaring", have already identified the core for everyone. Although the business is too diverse, the core is still the automotive business. For those who need to understand this company, you can start by reviewing the above two analyses.

Here is a detailed analysis:

I. Automotive Business (including battery business) gross profit margin reaches 28.1%, far ahead of peers

1. Gross profit margin of the automotive business this quarter greatly exceeds expectations!

BYD's gross profit margin of the automotive business, excluding BYD Electronics, reached 28.1% in the first quarter, a 3% increase compared to the previous quarter, far exceeding the market's expected 20.5%. The increase in gross profit margin this quarter is mainly due to BYD's further cost reduction, consolidating its cost advantage.

From the perspective of per vehicle economics (including a rough estimate of the battery business), breaking down the gross profit margin greatly exceeding market expectations this quarter:

Per vehicle price: The unit price in the first quarter has slightly decreased, with a per vehicle price of 141,000 yuan, a decrease of 9,000 yuan compared to the previous quarter.

The continued decline in per vehicle price this quarter is mainly due to:

- The launch of the Honor version models, with prices further lower than the Champion version's suggested price: BYD's Honor version is generally priced 1-3 thousand yuan lower than the 23 models of the Champion version, with the starting price of BYD Qin DM-i reduced to 79,800 yuan, truly achieving "electric cheaper than fuel" and accelerating the capture of the fuel vehicle market.

- The proportion of high-end sales structure has slightly decreased, with high-end models priced above 200,000 yuan, represented by models such as Han, Tang, Tengshi, Yawang, and Fangchengbao, accounting for 20.5% in the first quarter, a decrease of 0.8% compared to the previous quarter

BYD's overseas expansion process is accelerating, with the proportion of overseas models (priced higher than domestic sales models) increasing by 5.3% to 15.6% compared to the previous period, which to some extent offset the above factors, resulting in a decrease of 0.9 thousand yuan in the average price per vehicle.

Vehicle cost: The per-vehicle cost has decreased significantly, driving the gross profit margin for this quarter well above expectations.

In the first quarter, the per-vehicle cost was 101,600 yuan, down by 11,000 yuan compared to the previous period. The market itself expected that due to the decline in sales volume this quarter, the decrease in production capacity utilization would lead to an increase in per-vehicle fixed costs, thereby driving up per-vehicle costs.

However, the main reason for the decrease in per-vehicle costs this quarter is the significant decrease in variable costs. Apart from benefiting from a 3%-5% annual decrease in parts suppliers and the average price of lithium carbonate dropping from 140,000 yuan/ton in the fourth quarter of last year to 100,000 yuan/ton in the first quarter of this year, more importantly, it is the extreme cost reduction under BYD's vertical integration advantage (especially in the early layout of the battery end, bringing incremental gross profit margin).

According to McKinsey's estimation, only when the automobile production scale reaches 500,000 vehicles and the battery production scale exceeds 15GWh, can self-developed batteries have cost advantages. There are not many players in the domestic new energy vehicle market that have reached this scale, and self-developed batteries are also limited by production experience. BYD has successfully verified that through vertical integration advantages, it has built a cost barrier.

- Vehicle gross profit: With a decrease of 0.9 thousand yuan in per-vehicle price and a decrease of 1.1 thousand yuan in per-vehicle cost, BYD earned a gross profit of 0.7 thousand yuan per vehicle in the last quarter. The overall gross profit margin of selling vehicles (including battery business) increased from 25.1% in the previous quarter to 28.1% in the first quarter.

2. Sales volume decreased quarter-on-quarter, but the launch of the Honor Edition brought sales back to a growth trajectory

The company's automobile sales volume in the first quarter was 626,000 vehicles, a decrease of 34% compared to the previous period. The decline in sales volume in the first quarter was mainly due to the impact of the Chinese New Year holiday, BYD's proactive destocking, and the off-season sales in January and February. However, the launch of the Honor Edition quickly boosted BYD's sales in March, with sales in March returning to a stable level of over 300,000 vehicles, returning to a growth trajectory.

In January and February, BYD was in a period of model transition and destocking, which put pressure on the sales end, leading to a rapid decline in market share. However, starting from mid-February, BYD quickly launched the 2024 models, with multiple Honor Edition new models launched, further lowering prices compared to the champion models.

The launch of the Honor Edition made BYD a "price butcher" in the 50,000-200,000 yuan price range. The Honor Edition is generally priced 10,000-30,000 yuan lower than the 23 champion models, with the starting price of the BYD Qin DM-i reduced to 79,800 yuan, truly achieving "electric cheaper than oil," further clearing the share of joint venture fuel vehicles and optimizing the competitive landscapeBYD further strengthened the competitiveness of its vehicle models at the terminal with the ultimate cost-effectiveness of the Honor Edition. As inventory gradually adjusted, BYD's sales in March quickly rebounded, with monthly sales returning to a stable level of over 300,000 units, and market share continues to rise.

BYD's market share in March reached 36%, a 9% increase compared to February, with the main benefit coming from the increase in market share of hybrid models, with a 15% increase in plug-in hybrid market share compared to February.

3. About to switch to DMI 5.0 technology, new product cycle is about to begin

The market has some doubts about the sustainability of the sales growth brought by the price adjustment of the Honor Edition and its impact on profit margins. However, unlike the passive price reduction to save the gradually declining market share of the Champion Edition last year, the launch of the Honor Edition is a strategic choice made by the company to proactively reduce prices.

The launch of the Honor Edition is BYD's choice to further clear the share of joint venture fuel vehicles and optimize the competitive landscape. However, because the Honor Edition still carries DMI 4.0 technology, the leading advantage in hybrid technology is gradually being caught up by domestic competitors. BYD uses the low price of the Honor Edition to further consolidate its competitive advantage, but more importantly, to prepare for the switch to DMI 5.0 products, creating a price range between DMI 4.0 and DMI 5.0 products, forming a situation where old and new models coexist.

DMI 5.0 technology has made significant breakthroughs in fuel consumption and endurance technology (fuel consumption reduced from 4L/km to 2.9L/km, achieving a range of 2000 km on full tank and full charge), and will be first installed on Qin L in the second quarter, gradually covering main models such as Song, Tang, Han, and Destroyer in the future.

The starting price of Qin L is over 120,000 yuan, which is significantly higher than the starting price of 79,800 yuan for the Qin PLUS Honor Edition. Although the unit price in the first quarter was affected by the price reduction of the Honor Edition, the price per vehicle will continue to rise as the DMI 5.0 products are switched.

4. The process of going global has accelerated, with an expected increase in sales of 400,000 to 500,000 units in 2024

BYD's two main directions to increase profit margins are high-end and going global, and the performance of going global in this quarter is still good.

In the first quarter, BYD's overseas sales volume was 98,000 units, which was basically flat compared to the 97,000 units in the fourth quarter of last year. However, the overseas sales volume in March reached 38,000 units, reaching a historical high. Due to the low overall sales volume of BYD in the first quarter, the proportion of overseas sales increased from 10.3% in the fourth quarter of last year to 15.5%

In this quarter,the overseas production capacity of the company will play a crucial role this year. BYD is expected to start production in Thailand (150,000 capacity), Brazil (150,000 capacity), and Uzbekistan (currently 50,000 capacity, expanding to 300,000 capacity) this year. In 2024, as more models accelerate their overseas debut and new production capacity begins production, BYD is expected to achieve an export target of 500,000 vehicles this year and 1 million vehicles in 2025, contributing to the company's sales target and gross margin improvement.

5. Revenue lower than expected due to a decrease in unit price

Excluding BYD Electronics, BYD achieved revenue of 124.9 billion RMB in the first quarter of 2023, a year-on-year increase of 4%, but lower than the market's expectation of 132.5 billion RMB.

In this quarter, car sales were 626,000 units, a decrease of 33% compared to the previous quarter, slightly lower than the market's expectation of 630,000 units. This was mainly due to the continued decline in unit price to 140,000 RMB due to the introduction of the Honor version. BYD not only increased market share by lowering prices but also improved the gross margin of the automotive business through extreme cost reduction achieved by vertical integration.

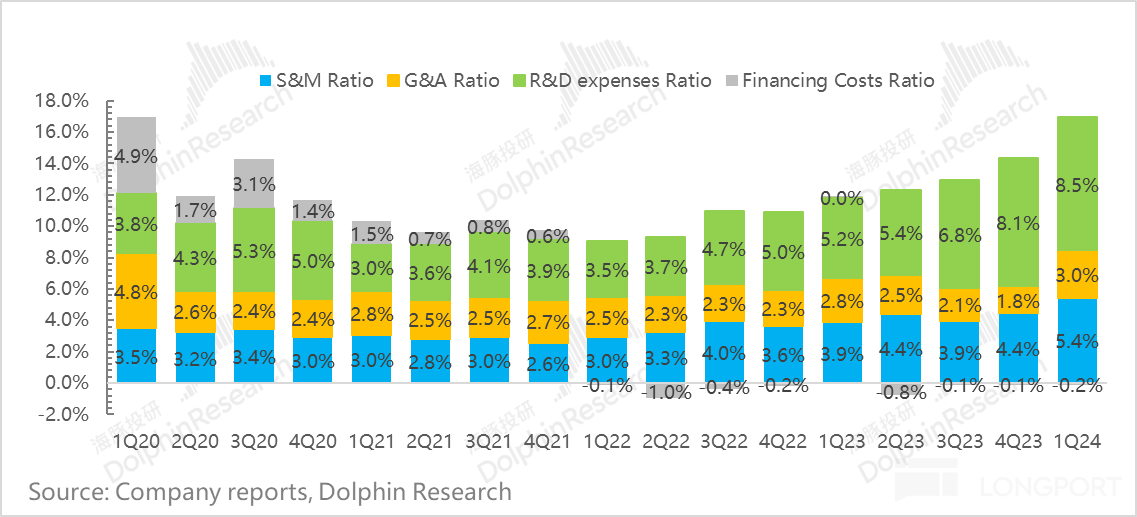

6. All three expenses exceeded market expectations this quarter

1) Research and Development Expenses: Filling the gap with intelligent and high-end development

In the first quarter, R&D expenses were 10.6 billion RMB, a decrease of 4 billion RMB compared to the previous quarter, but exceeded the market's expectation of 9.7 billion RMB. The R&D expense ratio was 8.5%. The higher-than-expected R&D expenses this quarter were due to an increase in both the compensation and number of R&D personnel (currently 90,000 employees, including a 4,000-member intelligent driving team), mainly used for catching up in intelligence and investing in new technology platforms (DM5.0 and E4.0 platforms).

In the first half of the competition in new energy vehicles, BYD is already very mature in electrification, with core technological advantages in battery, motor, and electronic control, as well as the ability to quickly launch new models to the market with the electric E3.0 platform and hybrid DM4.0 dual platform.

At the same time, BYD has strong vertical integration capabilities, with over 75% of components self-made, giving BYD a superior gross margin (BYD can earn gross profit from raw materials to vehicle assembly and sales throughout the entire chain).

However, in the second half of the competition focusing on intelligent development, BYD lags behind its competitors. The main reason for this lag is that most of BYD's models are priced below 200,000 RMB, where intelligence is not a necessity. BYD's previous strategic focus was more on cost control, and the market's valuation of the added value of BYD's intelligence part is therefore conservative.

But with the launch of high-end models such as Tang, Yuan, and Qin Plus, intelligence is also a key focus of competition in mid-to-high-end models. Intelligence is a task that BYD must address. BYD is expected to launch a batch of NOA models priced below 200,000 RMB in the second half of this year, achieving high-level intelligent driving options for 200,000 RMB+ models and standard high-level intelligent driving for 300,000 RMB+ models, which will also help BYD break through in high-end modelsBYD's advantage in continuous catching up in intelligence lies in high R&D investment + economies of scale, being able to obtain resources and prices from global suppliers of intelligent driving hardware, achieving a combination of self-research and leveraging the strengths of others.

2) Marketing Expenses: Investment in channel construction for high-end brands + marketing expenses for the launch of the Honor Edition

Sales expenses in the first quarter were 6.8 billion, exceeding market expectations of 5.7 billion.

BYD currently mainly uses a dealership model for its Wangchao and Ocean models, with dealers accounting for nearly 90%. However, for its high-end models such as Tang, Yuanwang, and Fangchengbao, BYD mainly adopts a direct sales model, with plans to continue investing in the construction and expansion of stores for high-end brands.

At the same time, this quarter, due to model changes, it is expected that marketing expenses will be invested in the launch of the Honor Edition and promotional expenses for old models. Sales expenses for this quarter are still at a relatively high level.

3) Administrative Expenses: Increased slightly

Administrative expenses in the first quarter were 3.77 billion, a decrease of 590 million from the previous quarter, higher than the market expectation of 3.33 billion. Administrative expenses increased slightly this quarter.

7. Net Profit per Vehicle Decreased Compared to Previous Quarter

The core operating profit margin in the first quarter was 3.2%, a decrease of 2 percentage points compared to the previous quarter. Although the gross profit margin increased compared to the previous quarter, the operating leverage of the three expenses was not released this quarter, and the operating expense ratio increased by 2.6% compared to the previous quarter.

BYD's net profit also decreased slightly compared to the previous quarter. In addition to a significant increase in the operating expense ratio, other income (mainly government subsidies) also decreased compared to the previous quarter. Finally, BYD's net profit per vehicle (including energy business) was 6,700 yuan, and the profit margin decreased from 5.6% in the previous quarter to 4.7% in this quarter.

II. Slowdown in Energy Business Growth

BYD's installed capacity of power batteries and energy storage (including self-supply and external supply) had reached 29.7GWh by the first quarter, a year-on-year increase of 10%, indicating a slowdown in energy business growth.

Breaking it down, the growth of the energy business this quarter mainly came from the increase in shipments of energy storage batteries. The energy storage battery shipments in the first quarter were 11.3GWh, a 72% increase year-on-year. However, the growth rate of power battery business slowed down, with power battery shipments in this quarter at 18.4GWh, a 10% decrease year-on-year. Meanwhile, the growth rate of new energy vehicle sales increased by 13% year-on-year, with power battery shipments lower than the growth rate of new energy vehicle sales during the same period, leading to a continuous decline in the market share of power batteriesIII. BYD Electronic Business

In the first quarter, the revenue of the mobile parts and assembly business operated by BYD Electronics reached 36.5 billion yuan, a year-on-year increase of 38%, exceeding the market's expected 31.6 billion yuan.

In the first quarter, BYD Electronics' gross profit margin was 6.9%, lower than the market's expected 9.7%.

The growth on the revenue side is mainly benefited from:

Consumer electronics: According to IDC, the global smartphone shipment volume in 1Q24 continued to grow by 7.8% year-on-year. With the recovery of market demand, it is expected that the company's Android complete machine assembly and parts business will grow year-on-year, as well as the increase in market share of overseas major customers, driving the growth of the consumer electronics business.

Automotive business growth: Benefiting from the year-on-year growth in sales of new energy vehicles by its parent company BYD, as well as a large amount of research and development driving technological innovation to expand the category of automotive parts, the shipment volume of intelligent driving-related accessories has increased, and the growth brought by the increase in the value of parts per vehicle.

Dolphin's Historical Articles:

Earnings Season

March 27, 2024, earnings review "BYD, the 'Price Butcher': Blood Battle with Bright Weapons, Dawn is Near"

March 29, 2024, conference call "Sales target for 24 increased by 20% on the basis of 23"

October 30, 2023, earnings review "BYD, Racing Towards 'Money', Is That Enough?"2023 August 28 Financial Report Review "BYD: The Embarrassment After the 'Windfall', What Ace is Left?"

2023 August 29 Conference Call "Company's Profit is Not a Problem Under Price War, Sany's Third Quarter Profit Will Be Better (BYD Minutes)"

2023 April 28 Financial Report Review "BYD: In the Electric Car Price War, Making Money is the Real Skill"

2023 March 29 Conference Call "BYD Minutes: High-end Supports Profit, Mid-to-Low-end Spreads Costs, Internationalization Reconstructs BYD"

2023 March 29 Financial Report Review "BYD: Counterattacking Buffett's Selling Pressure After the 'Windfall'"

2022 October 29 Financial Report Review "Abandoned by Buffett? BYD Hands in a Dominant Performance"

2022 August 31 Conference Call "BYD: Using Procurement to Suppress Prices and Digest Subsidy Decline, Annual Production to Reach 4 Million Vehicles Next Year (Conference Call Minutes)"

2022 August 30 Financial Report Review "The Moment of Tearing Labels: Is BYD About to Make a Magnificent Transformation into a 'Money-making Machine'?"

2022 April 28 Financial Report Review "BYD: Sales Volume Guaranteed, Smoothly Passing the Year-Opening Bottom Inspection"

2022 March 30 Conference Call "Black Technology Helps Product Upgrades, BYD's Sales Volume Remains Strong in 2022 (Meeting Minutes)"March 30, 2022 Financial Report Review "BYD: Selling Cars is Easy, Making Money is Hard"

October 28, 2021 Financial Report Review "Beyond Sales, BYD Falls Short"

August 28, 2021 Financial Report Review "BYD: Performance Falls Short of Expectations, Investment Logic Discounted"

Hot Topic

July 12, 2022 "Buffett Selling BYD? Case Solved"

In-depth

August 10, 2021 "BYD Shares (Part 2): After the Surge, Seeking Stability in Wealth?"

July 23, 2021 "BYD Shares: The Best Battery-Making Car Manufacturer | Dolphin Research"

Risk Disclosure and Statement for this Article: Dolphin Research Disclaimer and General Disclosure