Luckin Coffee: Can it stand firm in the final leap?

Before the US stock market opened on the evening of April 30th Beijing time, $Luckin Coffee.US released its first-quarter report for 2024. The Q1 performance turned out to be much worse than expected, causing the stock price to plummet recently. In addition to the net loss, some operational indicators were also weaker than expected by Dolphin.

The key points of the financial report are as follows:

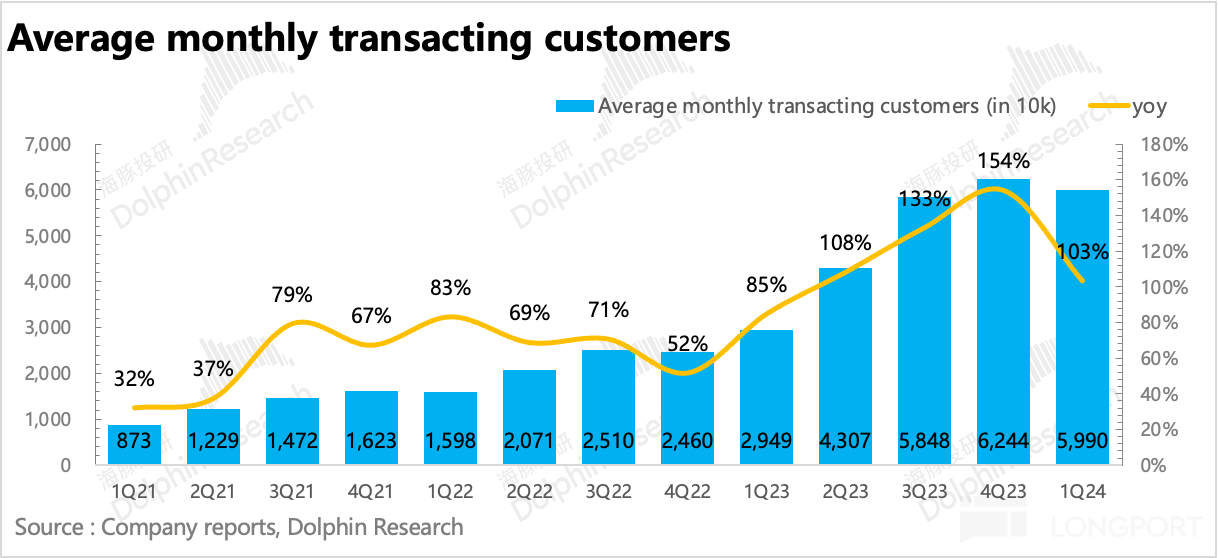

1. Industry reaching a plateau: Industry space has always been a concern for Dolphin compared to its competitors, and in Q1, the number of paid users decreased by 2.54 million to 59.9 million compared to the previous quarter. Although there was a decrease in coffee consumption by first and second-tier users returning home during the Spring Festival, especially in third and fourth-tier cities with fewer store layouts, it still indicates that the industry is approaching or has already reached a plateau.

As the industry gradually enters a temporarily relatively saturated state, unless there is a significant further change in user coffee habits, Ruixing can only rely on eating up Kudi, which is most similar to itself, to maintain growth.

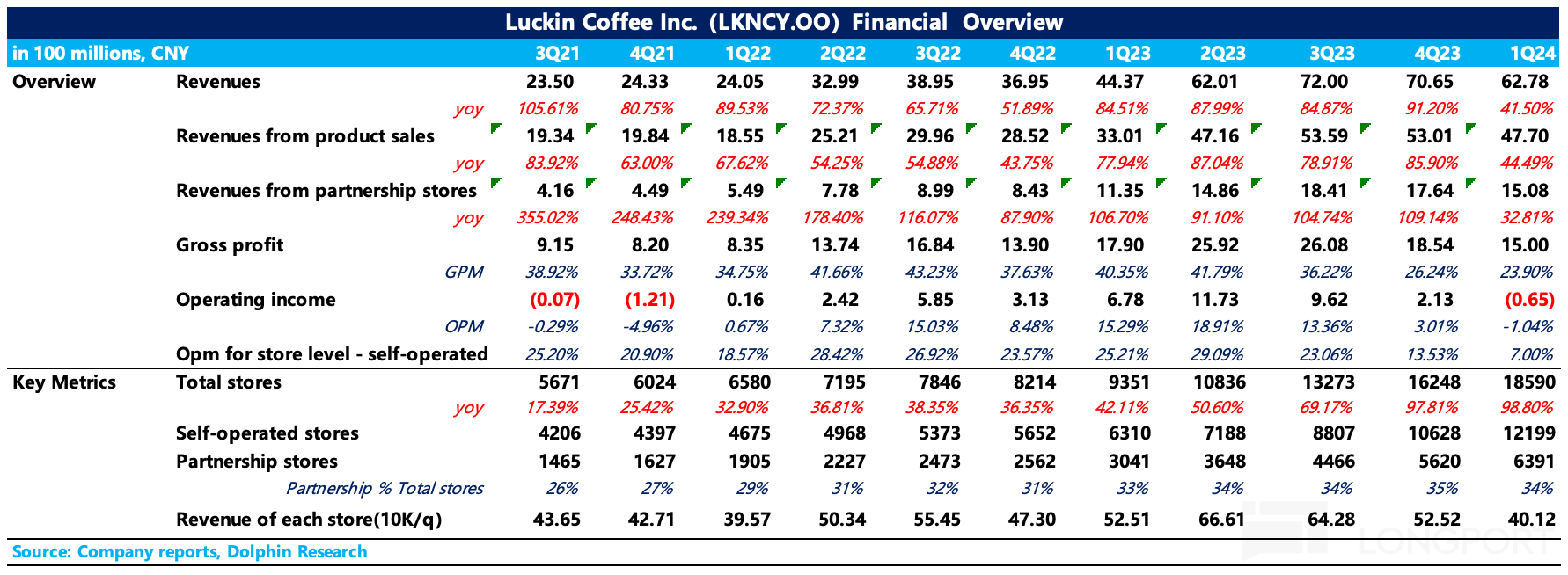

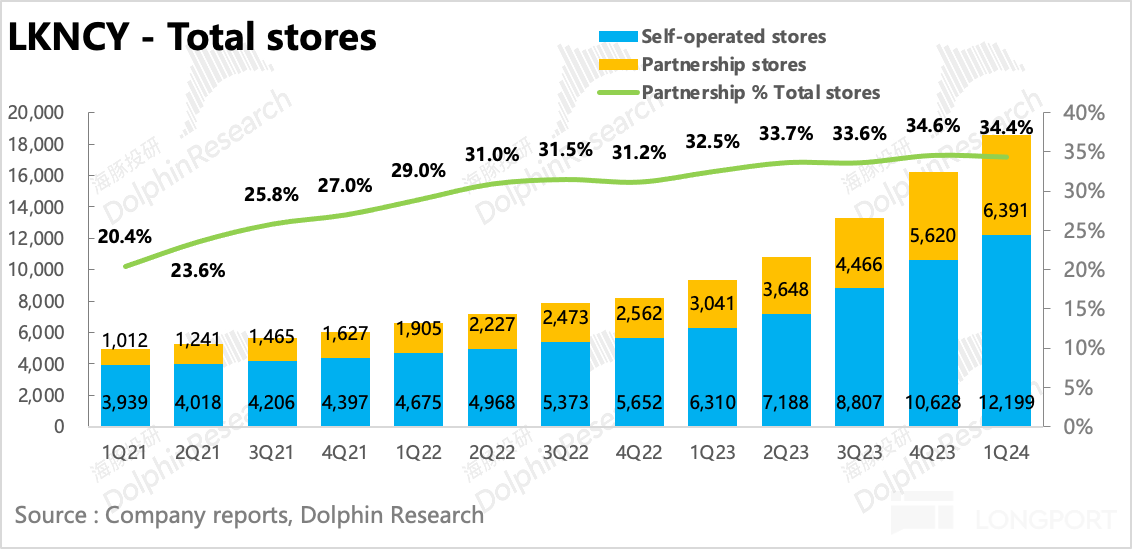

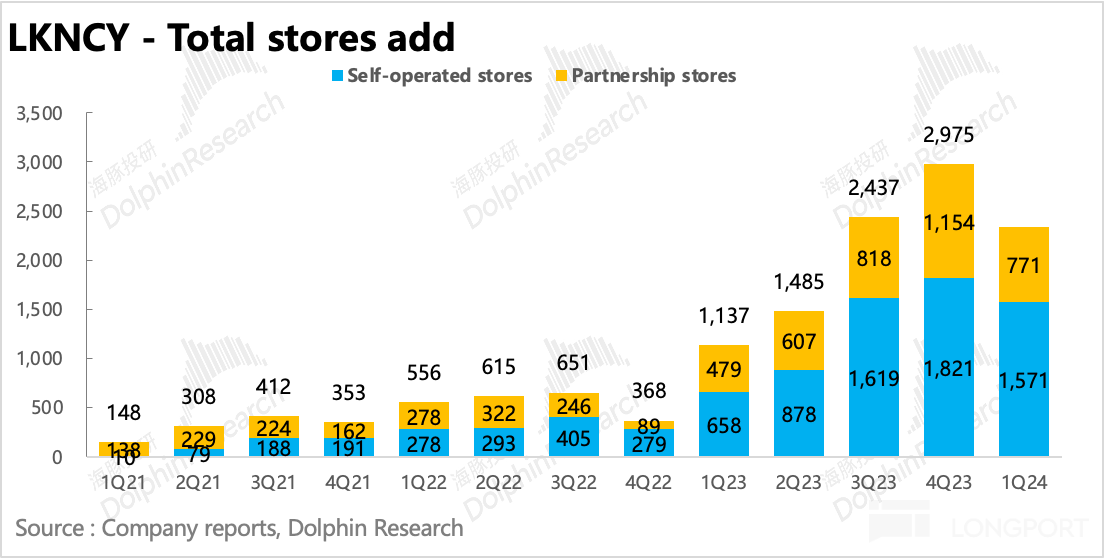

2. Backlash from rapid store expansion: Despite the industry possibly reaching a plateau, Ruixing maintained a high-speed store opening pace in Q1 (adding 2,342 stores compared to the previous quarter). It is evident that the company's current store opening decisions did not consider the impact of store diversion, but rather were more strategic considerations for early positioning.

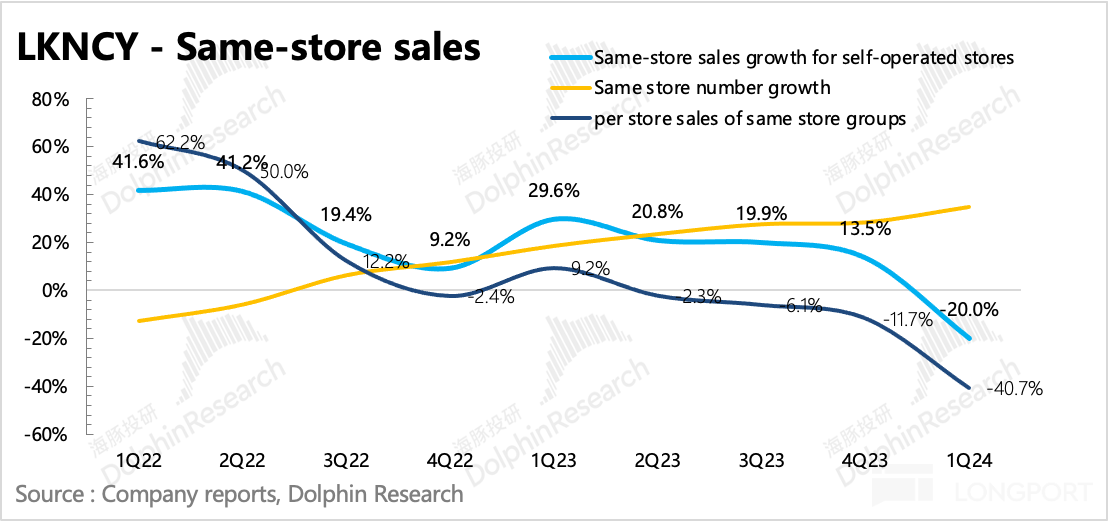

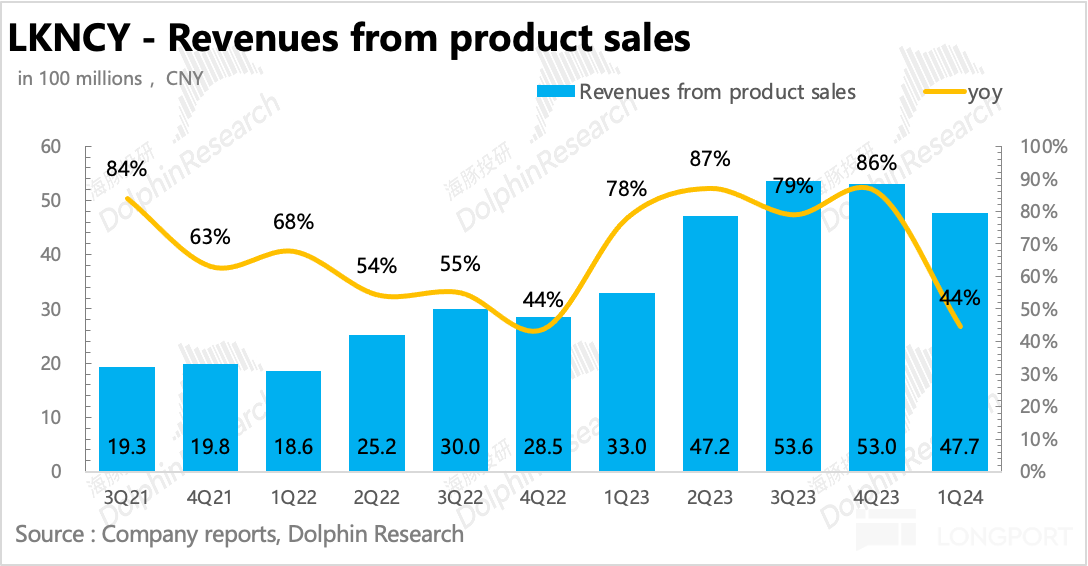

However, charging forward so aggressively as the plateau approaches directly increases the cost of Ruixing's encirclement by competitors, causing harm to oneself while attacking the enemy. In the first quarter, Ruixing's total same-store revenue fell by 20% year-on-year. If we exclude the impact of store expansion and look at individual store situations, revenue fell by nearly 40% year-on-year.

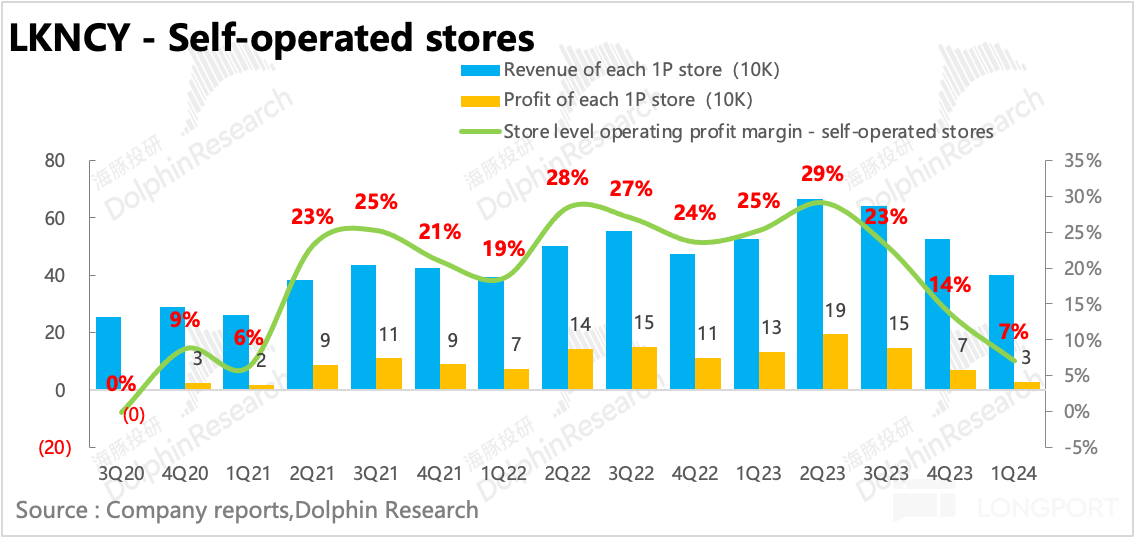

3. Deterioration of the single-store model: The significant decline in same-store revenue per store is mainly due to the dual impact of diversion and a subsidy of +9.9 yuan, which directly leads to the deterioration of the single-store model under cost rigidity. In the first quarter, the operating profit margin of Ruixing's self-operated stores dropped to 7% compared to the previous quarter, far below the normal operating level of over 20%.

4. Group's profit turning into loss: Self-operated stores occupying prime locations only have an operating profit margin of 7%, which continued to decline compared to the previous quarter, not to mention franchise stores. At the group level, due to the increase in subsidies to franchise stores in the first quarter, the decrease in franchise-related income was directly reflected, while the costs of raw materials and equipment are not controlled by Ruixing itself. It can be seen that the losses in the franchise business are further increasing, leading to an overall group operating loss of 65 million, compared to 680 million in the same period last year.

Dolphin's Viewpoint

The first quarter's issues are essentially a stronger version of the fourth quarter, exacerbated by the natural decrease in consumption after the Chinese New Year holiday as core users in first and second-tier cities return home, further deteriorating the operational situation. Although Dolphin has already expressed in "Unstable Luckin, Indestructible Luckin" that there is no hope for the fourth quarter and the first quarter of this year, the market clearly did not anticipate the extent to which the pressure period would erode the company's performance.

We believe that, although competitors are constantly jumping around (continuously extending the duration of high subsidy activities), the current situation in the first quarter, compared to Q4 last year, is more a result of the company's own strategic decision-making choices — in a temporary saturation period of industry development, the company would rather maintain a high-speed store opening pace at the cost of harming the enemy a thousand times and damaging itself eight hundred times, in order to secure an early position.

Indeed, counter-cyclical expansion is a decision often used by leading companies with heavy asset operations to squeeze out competitors. For the company itself, enduring the suffering period ensures that its cash flow can survive, but for investors, the longer the bottoming period, the later the reversal turning point, and the valuation will also adjust along with market expectations, greatly affecting the holding experience. Therefore, at such times, calculating the bottom price may lead to finding a relatively calm opportunity. After adjusting the growth expectations of different business indicators, Dolphin expects to achieve a net profit of 3 billion in 2025. Based on the valuation level of 10-12x PE for the leading catering company under low revenue growth, this corresponds to a conservative valuation of 4-5 billion USD.

Q1 can be said to be the final leap in performance, with marginal improvements in operations starting in March, but it also requires the management to provide clearer strategic planning and outlook, and to adjust the previously high market expectations reasonably.

Detailed Analysis Below

I. Rapid Store Openings to Secure Position as Market Nears Platform Period

Despite the performance pressure after the fourth quarter, Luckin's pace of opening new stores in the first quarter has not slowed down significantly, with a net addition of 2342 stores compared to the previous period. Among them, 1571 are self-operated stores, and 771 are newly added franchise stores. With the pressure on turnover due to diversion of stores, the motivation for franchisees to open new stores has significantly weakened.

Pushing forward with such high-speed store openings as the platform period approaches directly increases the cost of besieging competitors for Luckin, harming the enemy a thousand times and damaging itself eight hundred times.

Will the pace of store openings continue to be this fast this year?

From the perspective of the return on investment cycle for franchisees, Dolphin believes that with the comprehensive defeat of Luckin, reaching a store scale of around 23,000 in the short to medium term will be close to the platform period ("[Unstable Luckin, Indestructible Luckin](https://longportapp.com/zh-CN/topics/11144628?

2. Revenue growth below expectations, with both volume and price falling

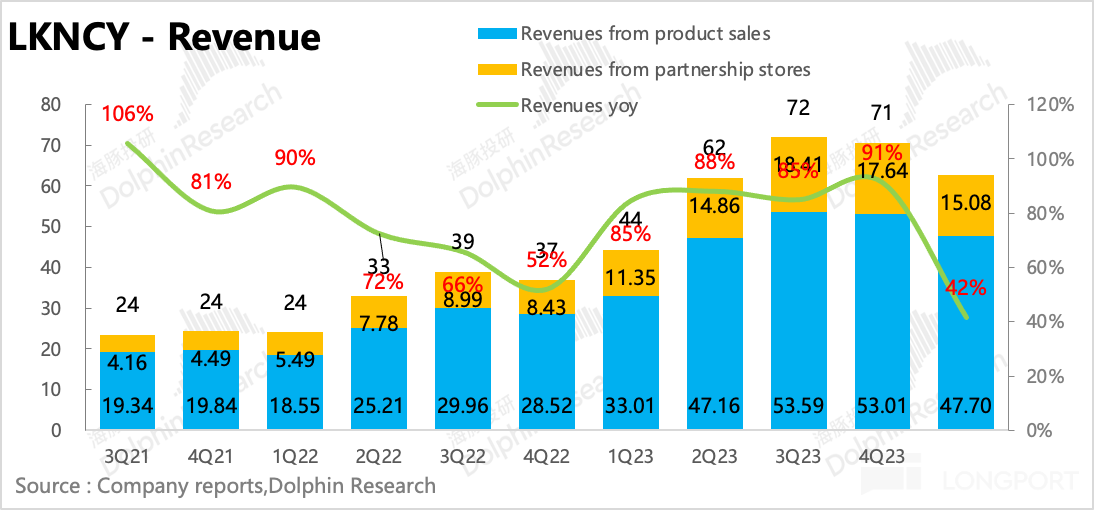

In the first quarter, Luckin Coffee's total revenue was 6.28 billion yuan, a year-on-year increase of 42%, lower than market expectations. Despite some 9.9 yuan promotions in Q1, there was a clear decline in user demand. Without strong new products driving sales, it becomes even more challenging to generate revenue during the off-season. In addition, in January, Luckin Coffee upgraded subsidies for franchisees, leading to lower net income after confirmation.

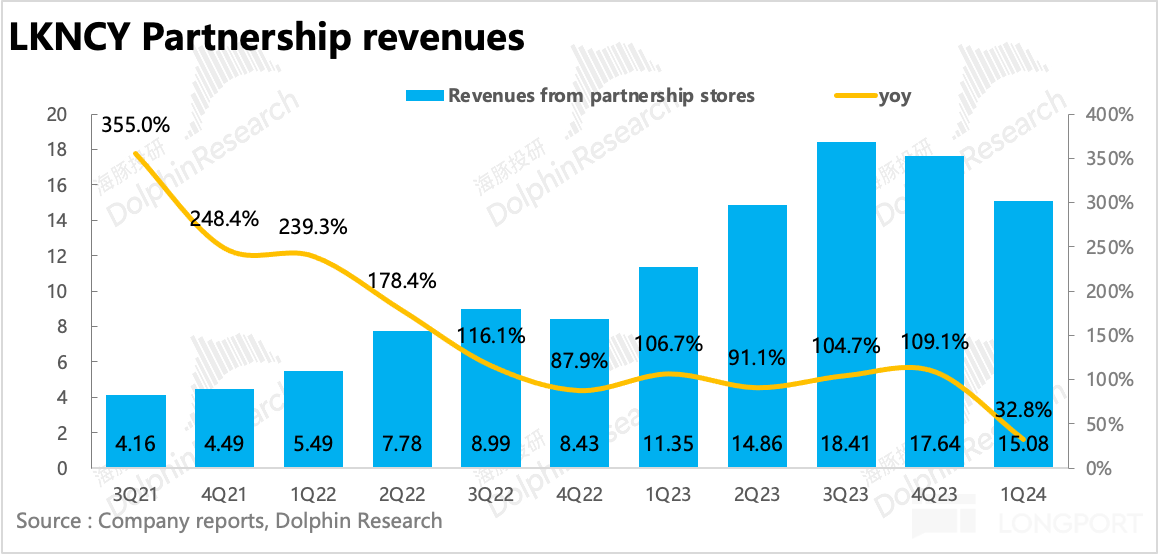

Looking into details, revenue growth from self-operated stores was 45%, mainly driven by the increase in the number of new stores. However, revenue growth from franchise stores significantly slowed down. This was due to poor performance of franchise stores resulting in less commission income, a decrease in the number of new franchise stores, and Luckin Coffee's subsidies to franchisees offsetting income, all dragging down revenue from the franchise side

3. Under the Rigidity of Expenditure, Pressure on Income Increases and Profit Deteriorates

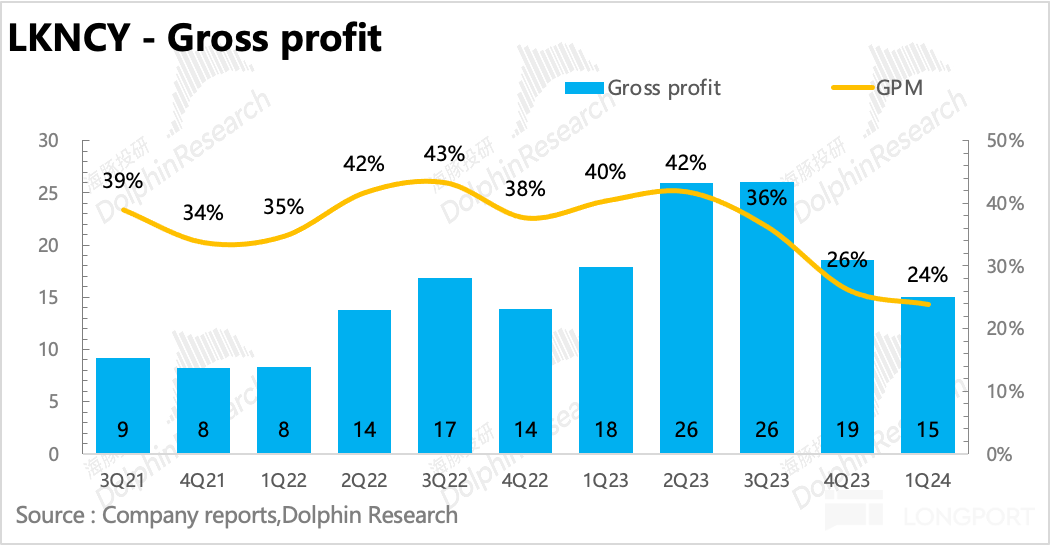

In the first quarter, Luckin's profit end was under pressure once again, exceeding market expectations. With a profit margin level in the low single digits of only 3% last quarter, this quarter turned into a loss directly under increased pressure on income, with the change in profit margin still due to the cost increase brought about by store expansion without synchronized revenue realization.

Specifically, in terms of actual operational issues, it can be summarized as a "strengthened version" headwind from the fourth quarter of last year.

(1) Self-operated store income: Low income and high costs squeezing from both ends. Dealing with the competitive 9.9 yuan low-price strategy, as well as the seasonal decline in high-priced Nara ice sales and the declining popularity of sauce-flavored Moutai, resulting in a decrease in single product ASP. At the same time, due to the rigid material costs (even higher per cup in winter hot drinks), it will naturally compress the single product gross margin.

Furthermore, the off-season affects overall sales demand, causing other fixed costs at the store level and some cost expenses at the company headquarters to not be covered by incremental revenue.

(2) Franchise business income: The more stores opened, the more subsidies offset the income from selling raw materials/coffee equipment to franchisees.

The above factors led to a further 2-point weakening of the overall gross profit margin in the first quarter.

On the expense side, it appears more stable compared to costs. It basically changes with revenue changes, essentially the natural expenses brought about by business expansion and headquarters expenses, overall not significantly increased, but not much optimized either. Ultimately, after the operating profit turned positive for two years in the first quarter, it turned into a 1% loss again.

Dolphin's "Luckin" Series Articles:

Financial Report Season

February 25, 2024 Conference Call "Luckin: The Strategic Opportunity Period for the Coffee Industry Now"

February 24, 2024 Financial Report Review "Luckin: The Darkest Before Dawn"2023 年 11 月 2 日电话会《市场广阔,但竞争远未结束(瑞幸 3Q23 业绩电话会纪要)》

2023 年 11 月 1 日财报点评《一路狂飙,瑞幸还剩多少好日子?》

2023 年 8 月 3 日电话会《瑞幸:频推新、猛开店、买家涨(纪要)》

2023 年 8 月 3 日财报点评《瑞幸 “万店” 狂奔,老大气势拿捏了》

2023 年 5 月 2 日电话会《瑞幸:预计万店目标提前实现》

2023 年 5 月 2 日财报点评《瑞幸:开店狂飙,满血回归》

2023 年 3 月 3 日电话会《23 年实现万店目标(瑞幸咖啡业绩会纪要)》

2023 年 3 月 2 日财报点评《新瑞幸 “浴火重生”》

深度

2024 年 1 月 16 日《站不稳的库迪,卷不死的瑞幸》

2023 年 3 月 14 日《挥剑斩毒瘤,瑞幸打赢翻身仗》

2023 年 2 月 14 日《瑞幸(上):咖啡下乡,火爆县城能否持续?》Risk Disclosure and Disclaimer for this Article: Dolphin Research Disclaimer and General Disclosure