AMD: "Chicken ribs" like guidance, pouring cold water on AI

AMD (AMD.O) released its first quarter financial report for 2024 after the US stock market closed on the morning of May 1, 2024, Beijing time, with the following key points:

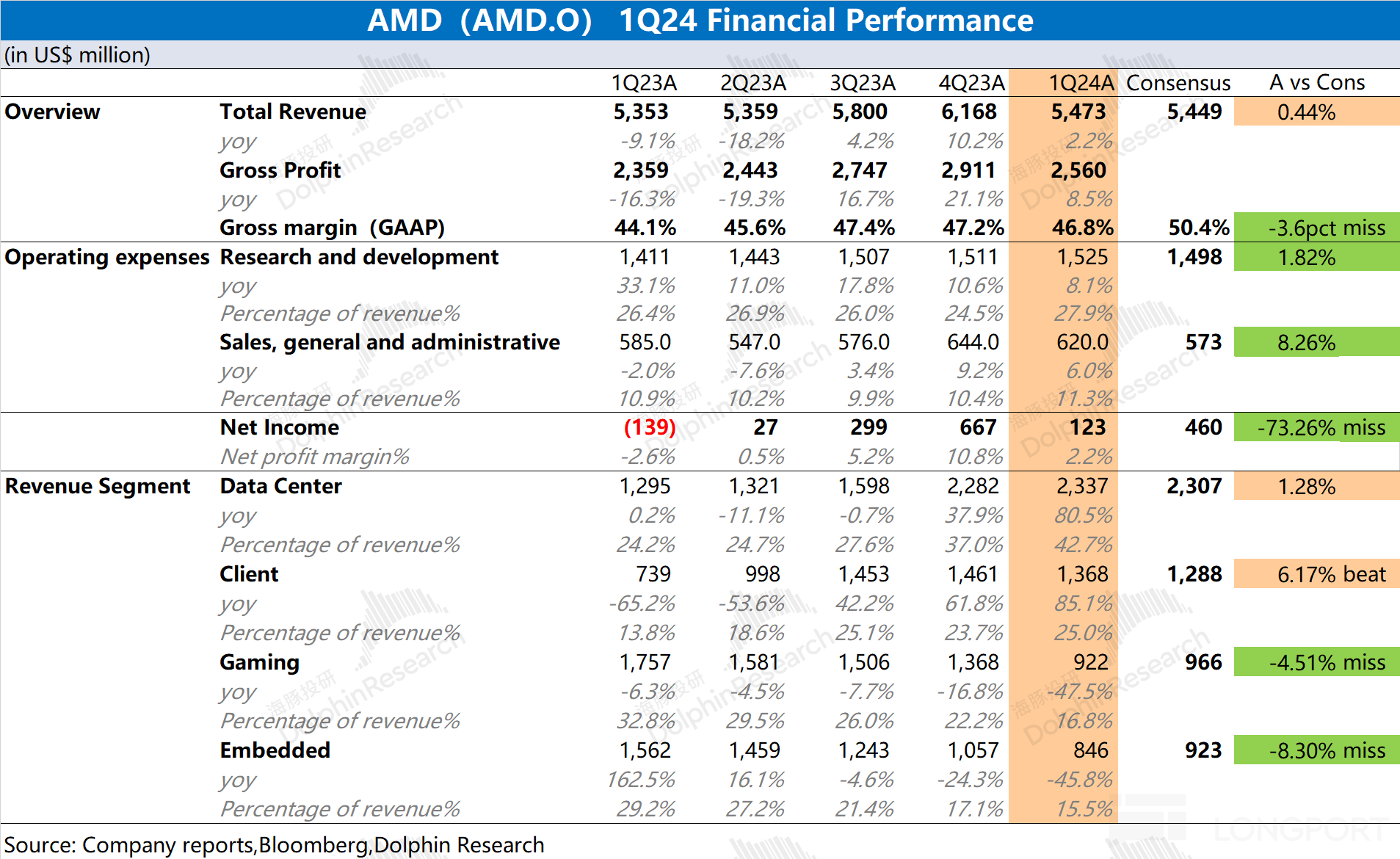

1. Overall Performance: Revenue is mediocre, profits collapse again. In the first quarter of 2024, AMD achieved revenue of $5.473 billion, a year-on-year increase of 2.2%, basically meeting market expectations ($5.449 billion). Although the data center business performed well, the PC client business and gaming business experienced a decline compared to the previous quarter. In the first quarter of 2024, AMD achieved a net profit of $123 million, with a significant decline in profit compared to the previous quarter, mainly due to the decline in demand in the gaming business and other sectors.

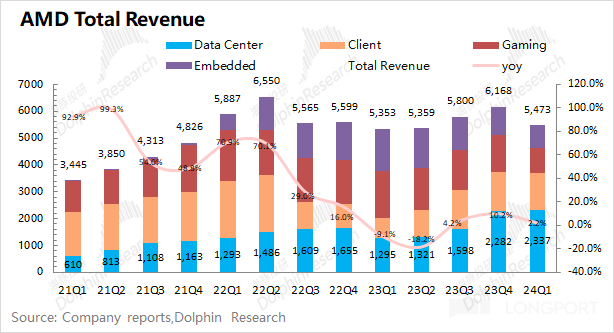

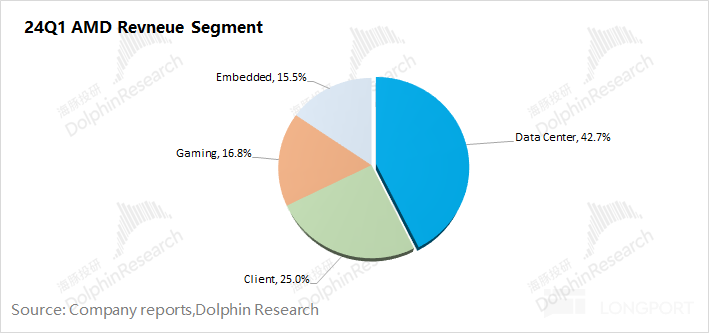

2. Business Segmentation: AI is doing well, others are declining. Looking at the breakdown of $AMD.US, with the growth of the data center business, its share has exceeded 40%. The remaining three businesses maintained a share of around 20%. In this quarter, only the data center business continued to increase compared to the previous quarter, while the other businesses all declined to varying degrees, mainly due to insufficient downstream demand.

3. AMD Performance Guidance: For the second quarter of 2024, expected revenue is $5.4-6 billion (market expectation $5.717 billion) and non-GAAP gross margin around 53% (market expectation 53.04%). Revenue is expected to grow in the single digits compared to the previous quarter, although there is a significant decline in gaming business demand, AI chip demand remains strong.

Dolphin's Viewpoint:

Overall, AMD's financial report this time is not ideal. Although the revenue data met market expectations, profits once again saw a significant decline. Although part of the performance was affected by deferred expenses from previous acquisitions, even after excluding this impact, the company's core operating profit was only $415 million, a 45.1% decrease compared to the previous quarter, mainly due to the impact of insufficient downstream demand.

Looking at the segmented business, while the data center continues to grow, both the client business and gaming business have declined to varying degrees, directly affecting the company's operational performance. Considering the company's next quarter revenue guidance ($5.4-6 billion) and non-GAAP gross margin of 53%, although both figures meet market expectations, there are still no clear signs of improvement. Dolphin expects that AMD's profit in the next quarter will remain relatively low in the single digitsCombining the previous guidance from Intel, the insufficient demand in the PC industry chain will continue to affect the company's client business and gaming business. AMD's current business highlight lies in the data center business, but the company's full-year sales expectation for the MI300 series products is only $4 billion, with no clear signs of acceleration.

Although major U.S. stock giants have raised capital expenditures, the benefits to AMD's data center business do not seem obvious. Even though AMD's stock price has dropped significantly in the past two months, its market value of $250 billion still corresponds to a valuation of nearly a hundred times. If the company cannot provide the market with enough confidence, the stock price will continue to be under pressure.

Here is Dolphin's specific analysis of AMD's financial report:

1. Overall Performance: Revenue is barely satisfactory, profits collapse again

1.1 Revenue

In the first quarter of 2024, AMD achieved revenue of $5.473 billion, a year-on-year increase of 2.2%, meeting market expectations ($5.449 billion). Looking at a quarter-on-quarter basis, the company's revenue has declined this quarter. Although the data center business is still doing well, there is a quarter-on-quarter decline in PC client business and gaming business, with a more significant decline in gaming business demand.

1.2 Gross Profit

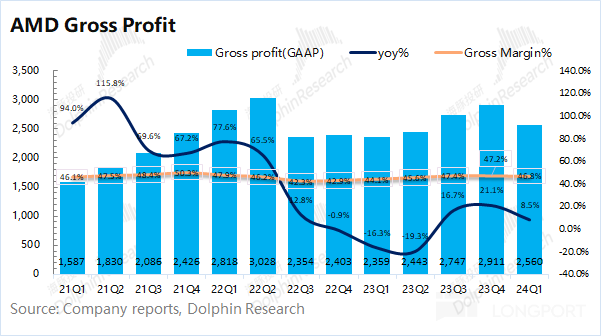

In the first quarter of 2024, AMD achieved a gross profit of $2.56 billion, an 8.5% increase year-on-year. The growth rate of gross profit exceeded that of revenue, mainly due to an increase in gross profit margin this quarter.

AMD's gross profit margin in this quarter was 46.8%, a 2.7 percentage point increase year-on-year, below market expectations (50.4%). The gross profit margin declined quarter-on-quarter, interrupting the consecutive six quarters of quarter-on-quarter growth, mainly due to the decline in gaming business demand affecting the overall gross profit margin.

1.3 Operating Expenses

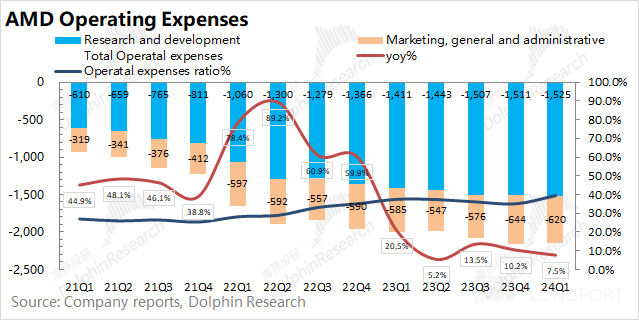

In the first quarter of 2024, AMD's operating expenses were $2.145 billion, a 7.5% increase year-on-year, with expenses relatively stable quarter-on-quarter.

Breaking down the specific expenses:

1) Research and Development Expenses: The company's R&D expenses this quarter were $1.525 billion, an 8.1% increase year-on-year, showing a consistent upward trend in R&D expenses. As a technology company, the company continues to prioritize research and development. Even in a period of low performance, the company's R&D efforts are still increasing;

2) Selling and Administrative Expenses: The company's selling and administrative expenses this quarter were $620 million, a 6% increase year-on-year. The situation of expenses on the sales side is closely related to revenue growth speed

1.4 Net Profit

AMD achieved a net profit of USD 123 million in the first quarter of 2024, with a net profit margin of 2.2%, which fell again compared to the previous quarter.

Due to the significant deferred expenses generated by AMD's continued acquisition of Xilinx, it will continue to erode profits for some time. Therefore, Dolphin believes that "core operating profit" is more relevant for the actual operating conditions of this quarter.

Core operating profit = Gross profit - Total operating expenses

After excluding the impact of acquisition costs, Dolphin calculated that AMD's core operating profit for this quarter was USD 415 million, a decrease of 45.1% compared to the previous quarter. The significant decline in demand for gaming business directly affected the company's performance this quarter.

2. Various Business Segments: AI is Doing Well, Others Are Declining

Looking at the company's segmented business situation, with the growth of the data center business, it has accounted for over 40%. The remaining three businesses maintain a share of around 20%.

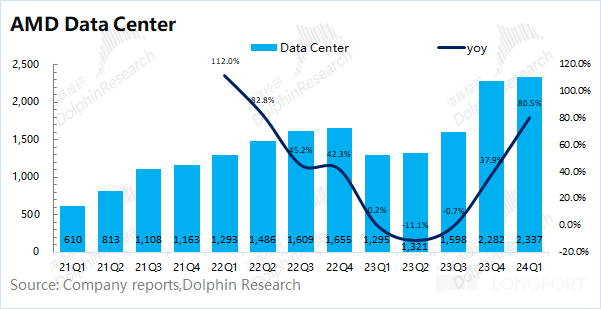

2.1 Data Center Business

AMD's data center business achieved revenue of USD 2.337 billion in the first quarter of 2024, an 80.5% year-on-year increase, which is basically in line with market expectations (USD 2.307 billion). This is mainly due to the increase in sales of the company's AMD Instinct GPUs and the fourth-generation EPYC (Xiaolong) CPUs.

In the data center business, since the fourth quarter of 2023, sales of MI300 have contributed USD 1 billion. Currently, AMD's Xiaolong processors support nearly 900 public clouds, including Amazon, Google, Microsoft, and others.

Dolphin believes that AMD's data center business performance is still good, with revenue reaching a new high this quarter, mainly driven by downstream demand for AI chips.

2.2 Client Business

AMD's client business achieved revenue of USD 1.368 billion in the first quarter of 2024, an 85.1% year-on-year growth, outperforming market expectations (USD 1.288 billion).

The growth in the client business is mainly attributed to the sales volume of the Ryzen 8000 series CPUs launched this quarterCombining with Intel's previous financial report, Dolphin believes that the company's performance in the PC client segment this quarter is better than expected.

Intel's client business saw a double-digit decline this quarter, while the company only experienced a slight decrease, mainly due to AMD's increase in CPU market share this quarter.

Although the company's market share has increased, it is worth noting that global PC shipments have once again fallen below 60 million units, indicating overall market demand remains insufficient.

2.3 Gaming Business

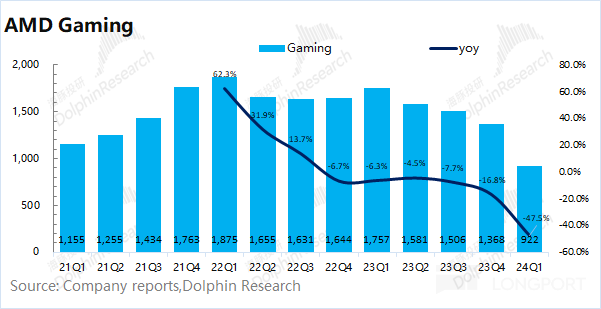

AMD's gaming business achieved revenue of $922 million in the first quarter of 2024, a year-on-year decrease of 47.5%, lower than market expectations ($966 million). The decline in the gaming business was influenced by the decline in semi-custom business revenue and Radeon GPU. Dolphin believes that the demand for PC and gaming graphics cards has not significantly improved, putting continued pressure on performance.

2.4 Embedded Business

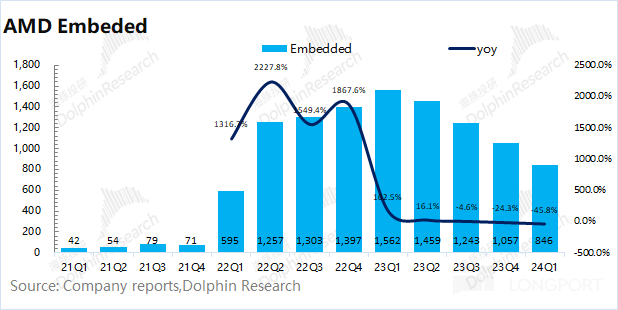

AMD's embedded business achieved revenue of $846 million in the first quarter of 2024, a year-on-year decrease of 45.8%, lower than market expectations ($923 million). The company's embedded business is mainly based on the previously acquired Xilinx, and this quarter continued to be affected by customer inventory adjustments, leading to a further decline in shipments.

Dolphin Research on AMD and the computing chip industry

AMD In-depth

March 8, 2024, "The Continued Soaring of NVIDIA and AMD, Is There a Bubble?"

June 21, 2023, "AMD's AI Dream: Can MI300 Snipe NVIDIA?"

May 19, 2023, "AMD: Millennium 'Second Place', Can It Make a Comeback?"

AMD Earnings SeasonFinancial Report Review on January 31, 2024: "AMD: PC Bows Down, AI Only Has Three Minutes of Heat?"

Financial Report Review on November 1, 2023: "Without NVIDIA's Explosiveness, AMD's Recovery is Too Slow"

Conference Call on November 1, 2023: "AI PC, a New Wave of Productivity (AMD 23Q3 Conference Call)"

Financial Report Review on August 2, 2023: "AMD: Climbing Out of the Valley, PC Leading the Recovery"

Conference Call on August 2, 2023: "Continuous Growth in Data Centers, Gross Margin Rising Again (AMD 2Q23 Conference Call)"

In-depth Analysis of NVIDIA

February 28, 2022: "NVIDIA: High Growth is Real, But Cost-Effectiveness is Still Lacking"

December 6, 2021: "NVIDIA: Valuation Cannot Rely Solely on Imagination"

September 16, 2021: "NVIDIA (Part 1): How Did the Chip Bull with Twentyfold Growth in Five Years Come About?"

September 28, 2021: "NVIDIA (Part 2): No Longer Driven by Dual Engines, Will Davis Double Kill?"

NVIDIA Financial Season

Conference Call on May 25, 2023: "Emerging from the Low Point, Embracing the AI Era (NVIDIA FY24Q1 Conference Call)"

Financial Report Review on May 25, 2023: "Explosive NVIDIA: AI New Era, Future is Already Here"February 23, 2023 Conference Call "Performance hits bottom and will rebound, AI is the new focus (NVIDIA FY23Q4 Conference Call)"

February 23, 2023 Financial Report Review "Surviving the cyclical crisis, embracing ChatGPT, NVIDIA's faith returns"

November 18, 2022 Conference Call "Will the continuously rising inventory be digested in the next quarter? (NVIDIA FY2023Q3 Conference Call)"

November 18, 2022 Financial Report Review "NVIDIA: Profits halved, when will the turning point come?"

Risk Disclosure and Statement of this article: Dolphin Research Disclaimer and General Disclosure