Luckin Coffee: Q2 still faces challenges, with market share as the development goal (1Q24 conference call minutes)

The following is the summary of Luckin's first quarter performance conference call in 2024. For a review of the financial report, please refer to " Luckin: Can it stand firm in the final leap? "

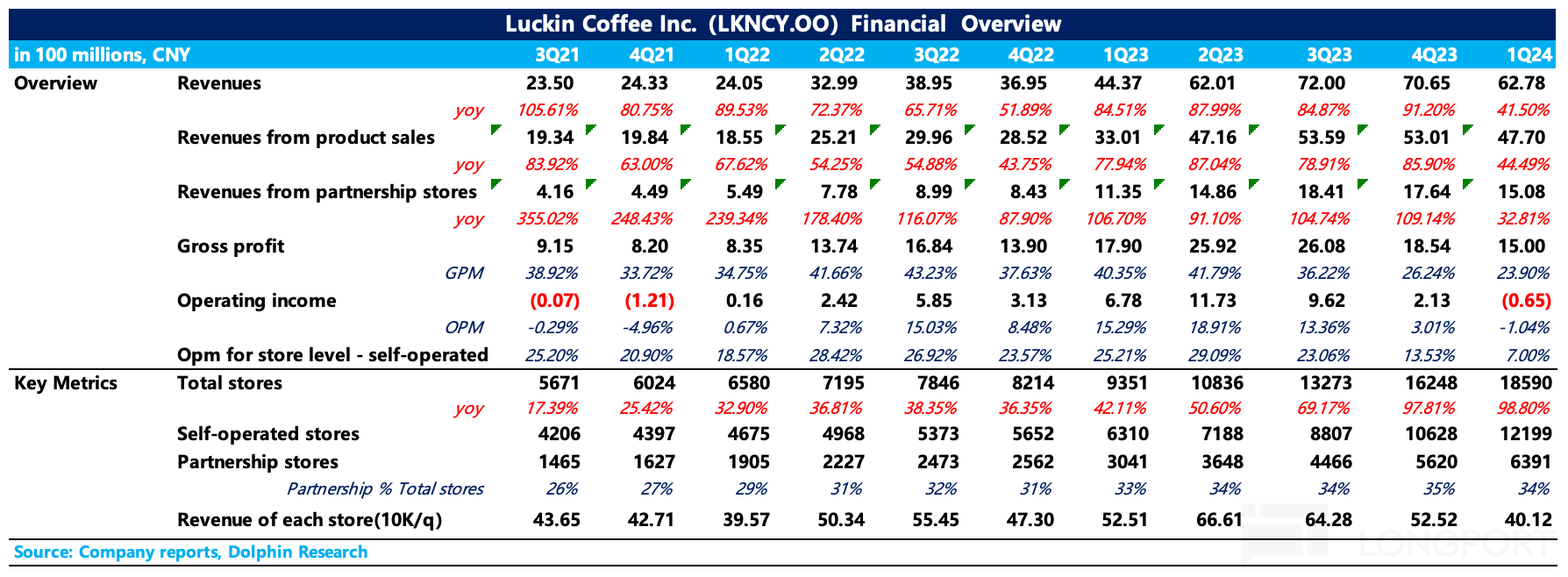

I. Core Financial Indicators

II. Business Review

Despite challenges in the market environment, Luckin achieved rapid revenue growth and a record high number of stores through its advanced business model, product innovation, and scale advantages. However, profits have declined due to intense industry competition, the impact of the pandemic, and macroeconomic fluctuations.

With the rapid expansion of stores, our cumulative transaction user base continues to reach new highs. In the future, we will steadily advance according to our established strategy, continue to expand market share while rewarding customers, and provide consumers with high-quality, convenient, and cost-effective premium coffee to drive the continuous development of the Chinese coffee market.

(1) Business Performance: Quarterly revenue grew strongly year-on-year, but profits declined due to seasonal factors (cold weather) and intense industry competition. Total net revenue was RMB 6.28 billion, an 11.5% year-on-year increase. Operating profit was -RMB 65.11 million, with an operating profit margin of -1%. Self-operated store profit was RMB 320 million, with a self-operated store profit margin of 7%. The total net increase in the number of stores in the first quarter was 2,342, with an average monthly transaction user base of 59.91 million.

The significant profit decline was mainly due to the average pricing decrease of our products, ongoing promotion of high-quality coffee at RMB 9.9, and increased store rent, labor, and other costs as a result of our rapid store expansion. However, from the perspective of economies of scale, this impact may be mitigated.

(2) Number of Stores: Luckin Coffee added a net of 2,342 stores (2 in Singapore) in the first quarter, bringing the total number of stores to 18,590. Among them, there are 12,199 self-operated stores and 6,391 joint venture stores.** At the end of the first quarter, stores were operating in 315 cities in China, and we also plan to expand the system market to more cities.

We continue to lead the market, expanding our corresponding advantages over competing brands. As competition in the Chinese coffee market intensifies, we will continue to focus on customer demand, implement a steady and sustainable store opening strategy, increase the number of stores in key cities, and accelerate expansion into lower-tier cities through joint venture models. Observations during the Spring Festival period highlighted the purchasing power in lower-tier cities and the emergence of holiday consumption patterns, demonstrating the vast potential for coffee market development and further proving the forward-looking nature of Luckin's development strategy.

At the end of March, Luckin Coffee opened 48 themed stores in Shenzhen in cooperation with Guizhou Maotai. The sauce-flavored latte launched by Luckin Coffee in collaboration with Guizhou Maotai has been well received by young consumers, with the user base exceeding 25 millionAs a leading brand in the Chinese coffee and Baijiu (white spirits) industries, Luckin Coffee and Moutai are connected by high quality, promoting further development of their long-term strategic partnership.

(3) Cash Situation: Following the restructuring in 2022 and the settlement of the federal class action lawsuit, we have fully redeemed our offshore bonds. As of March 31, 2024, our cash holdings (including restricted cash and short-term investments) were approximately RMB 2.4 billion, a decrease from RMB 3.8 billion at the end of 2023, mainly due to property and equipment purchases, as well as raw materials to support the company's rapid store expansion. In the fourth quarter, our net operating cash outflow was RMB 264 million, compared to a net operating cash inflow of RMB 1.1 billion in the same period last year.

(4) Product-wise, in the first quarter, Luckin Coffee launched 22 new products, introducing new items such as the Chu Orange Latte and Little White Pear Latte, with the latter's first week sales exceeding 7.24 million. Luckin's classic products also received high praise from consumers. In April of this year, on the third anniversary of the launch of the Fresh Pear Latte, single sales exceeded 700 million cups, and the annual sales of Orange C Americano also exceeded one billion cups. In the future, we will continue to innovate products, providing customers with high-quality and more rewarding consumption experiences.

Behind the rapid growth of our products lies the love and support of consumers. This quarter, Luckin added 22.92 million new users. While our new user base continues to grow, we also continue to promote the brand, deepening the popularization of coffee culture. This year, Luckin Coffee's professional action team once again gathered in Yunnan to kick off the 2024 Global Action Plan, delving deep into the source to discover high-quality coffee beans. In April, Luckin Coffee became the official coffee exclusive partner of the Asian Badminton Championships.

(5) Sustainable Development: In response to the national carbon neutrality goals, we will integrate low-carbon and sustainable concepts into raw material procurement, production, operations, and communication with consumers at all levels. In March of this year, Luckin Coffee's first fresh fruit processing plant in Baoshan has an annual fresh fruit processing capacity of up to 5,000 tons, with processing technology at a leading global level, helping Luckin Coffee further optimize its high-quality supply chain and promote the scale, standardization, and sustainable development of Yunnan's coffee industry. The processing plant uses a micro-water fresh fruit processing production line and maximizes the reduction of exhaust emissions in the coffee bean drying process. The plant will also establish a training center to provide training on coffee planting, processing, and related knowledge to enterprise employees and local coffee farmers, promoting the concept of regenerative agriculture and sustainable production.

On April 20, Luckin Coffee's Jiangsu Roasting Base officially started production in Kunshan, Suzhou, with a total investment of USD 120 million and an annual roasting capacity of 30,000 tons, making it the largest single coffee roasting base in the domestic coffee industry to date. With the advantage of intelligence, it deeply integrates the coffee vertical supply chain, empowers industry quality upgrades with new productivity, and leads the industry in a new trend of high-quality and sustainable development. The base will incorporate green operation concepts into various production processes, utilizing sponge city design for rainwater recycling, solar photovoltaic power systems for power supply, environmentally friendly low-energy consumption air conditioning systems, and intelligent energy consumption monitoring to reduce industrial energy consumption, strengthen energy management, and achieve dust-free emissions from production wasteReducing Waste Emissions

II. Financial Review

Marketing Expenses: This trend is related to the increase in the number of operating stores and the increase in the number of products. Therefore, compared to last year, this year saw an increase in expenses such as wages, rent, utilities, and other operating costs. The percentage of sales and marketing expenses to revenue increased to 5.2%, up from 4.5% in the same period last year, with an absolute value growth of about 63.4% year-on-year. This reflects our specific investments in increasing brand awareness, expanding product education output, and strengthening market position through diversified channels to attract new customers and retain existing ones.

Platform Commissions: Commissions paid to third-party delivery platforms also continued to grow to accommodate the increase in delivery orders.

Other Expenses: Expenses related to previous reported fraudulent transactions and related restructurings amounted to a negative RMB 52.5 million, as the company received approximately $7.3 million (about RMB 52.7 million) in compensation from its main D&O insurance company in the first quarter of 2024 based on an arbitration award.

III. Q&A

Q: How does the company view the significant decline in first-quarter profits in 2024? Will there be adjustments to the store expansion strategy?

A: The decline in first-quarter profits is both due to objective factors and proactive adjustments.

On the objective side, the first quarter was affected by winter cold waves and significant temperature fluctuations, impacting customer travel. At the same time, the Chinese coffee industry is in a strategic period of rapid growth, with increasing competition in the industry.

Facing opportunities and competition, the company considers market share as a core goal of company development, adjusting the pace of store openings to quickly expand and further distance ourselves from competitors. Due to structural adjustments in stores, seasonal variations are stronger in shopping malls and street stores, and with the emergence of holiday consumption patterns, the company's foundation is more balanced.

Currently, with rising temperatures, overall cup volume has improved, but the second quarter business still faces many challenges. In the current environment of intensified competition, as a leader in the Chinese coffee market, Luckin Coffee will adhere to a steady and sustainable store opening strategy, maintain opening standards, and ensure store opening quality. We will continue to consolidate our market-leading position through continuous product innovation, customer feedback, and pricing strategies, striving to create long-term value.

Q: Has the company's strategy in the capital markets changed?

A: As communicated previously, we will continue to monitor the U.S. capital markets, but our primary focus remains on implementing the company's business strategy and focusing on development. There is currently no clear timetable for returning to the main board. Our primary task remains to practice the company's strategy by providing excellent products and services to customers, striving for a higher market share, and providing sustainable long-term value to company shareholders.

Risk disclosure and statement for this article: Dolphin Research Disclaimer and General Disclosure