Amazon: Profits will continue to rise, but the investment cycle is also restarting

Below is the summary of Amazon's fourth quarter financial report conference call in 2023. For financial report analysis, please refer to " Amazon: Profit Soars, Strong Performance Clashes with High Expectations "

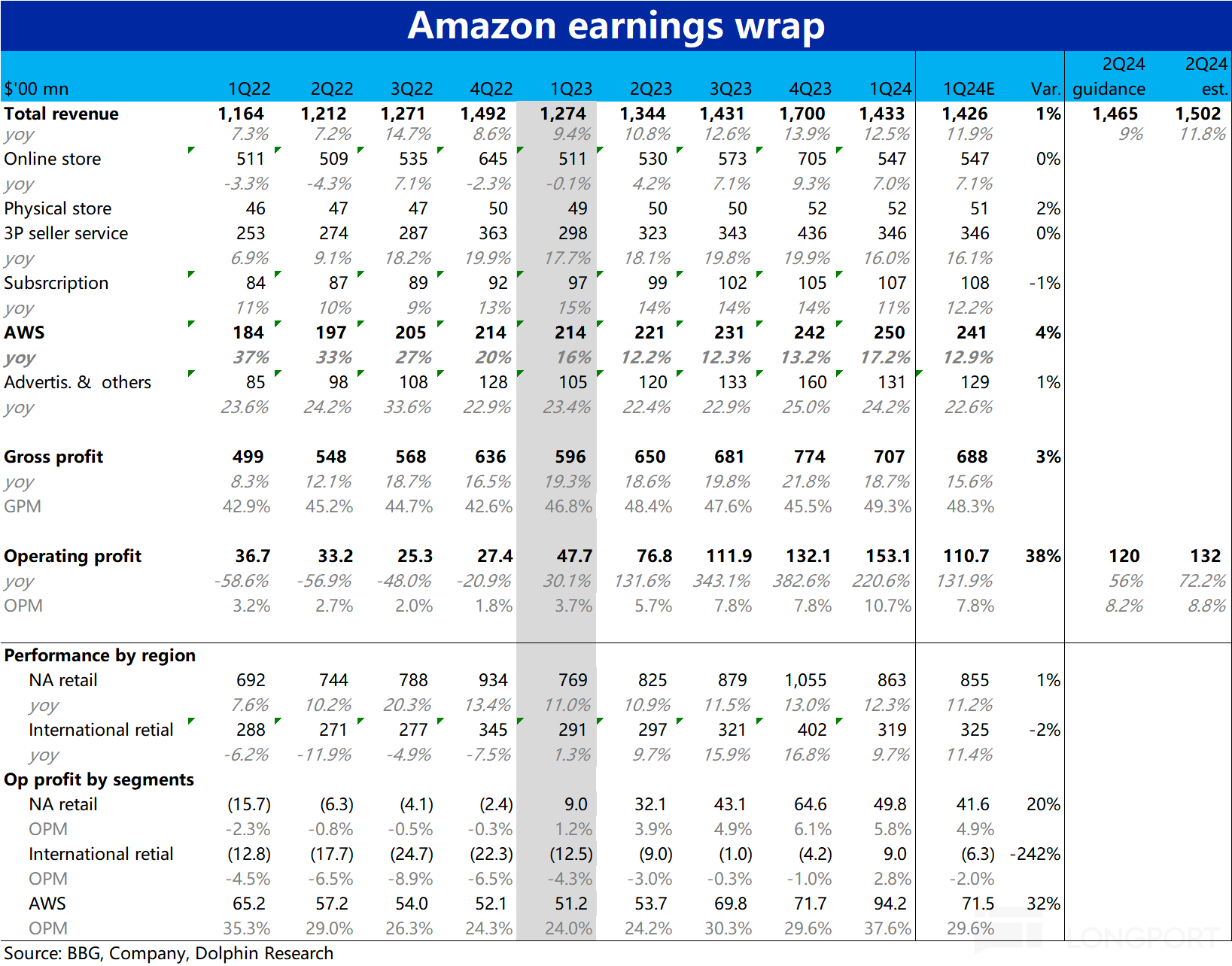

I. Review of Core Financial Information:

II. Detailed Content of the Financial Report Conference Call

2.1. Key Points from Executive Statements:

- Retail Business: ① Low Prices: Focus on ensuring daily low prices, as customers remain cautious and seek discounts. In Q1, shopping events were held globally, with the first spring discounts in Canada and the U.S., "Spring Deal Days" in Europe, and Ramadan events in Egypt, Saudi Arabia, and the UAE. This quarter, the Third-Party Seller Unit Mix was 61%, an increase of 200 basis points year-on-year.

② Regional Progress: Regional efforts help us reduce service costs. We consolidate more items into fewer packages, a key driver in cost reduction. Another example is our efforts to transform how goods are stored in the U.S., aiming to be closer to customers, which will be an iterative process over several years.

Extension of Server Depreciation Period: Starting from January 2024, the company will extend the server lifespan from 5 to 6 years. This will increase revenue by approximately $900 million for 24Q1.

Advertising Business: Strong performance in the advertising business is mainly attributed to Sponsored Products, offering significant opportunities in areas like Prime Video Ads for brand value. Regardless of whether brands sell on Amazon, they can enhance the impact of streaming TV ads on product sales or subscription registrations.

AWS: Revenue growth in Q1 accelerated from 13.2% in Q4 to 17.2%. Firstly, the company has completed most cost optimization efforts and shifted focus to updated plans. Our AWS customers are excited about using Gen AI to transform their customer experience and business. In the field of artificial intelligence, we have accumulated billions of dollars in revenue. Overall capital expenditure in 2024 is expected to significantly increase year-on-year, mainly due to higher infrastructure spending supporting AWS (including generative artificial intelligence) growth.

New Investment Project: Our emerging international store continues to grow and gradually become profitable. Our third-party logistics business continues to maintain good growth momentum, providing services such as buy with Prime, Amazon Shipping, and multi-channel delivery. We have just launched the Prime Delivery grocery delivery service, where customers only need to pay $9.99 per month to enjoy unlimited free grocery delivery. Prime Video continues to produce engaging content, with "Fallout" becoming our latest hit after the very successful "Road House" movie.

2.1 Q&A Analyst Q&A

Q: Historically, Amazon has cycled between large investment cycles and subsequent margin expansion, followed by even larger investment cycles. Currently, the company has a larger base of gross profit and overall revenue. When considering factors such as generative AI, capital intensity, grocery business, Kuiper, or healthcare, from an investment perspective, are there factors that could significantly impact the company's future profitability?

A: We often talk about the cyclical shift between profitability and investment in our history. Currently, we are in a phase where we are focusing on both profitability and investment, so we prefer to discuss ongoing investment projects and their potential impact on short-term prospects.

Over the past 18 months, the growth in our revenue and free cash flow has been largely driven by improvements in the store business and cost efficiency. We have discussed regionalization strategies, which are now expanding into inbound logistics. Meanwhile, the advertising business continues to show strong growth, and the AWS business is performing well, with its profit margin increasing by 800 basis points from the previous quarter, mainly due to overall revenue growth and cost structure reduction. However, we will significantly increase capital expenditures, primarily to support the development of AWS infrastructure and generative AI. This is expected to result in increased depreciation costs in these areas.

Capital Expenditure: In Q1, our capital expenditures reached $14 billion, which is expected to be the lowest point of the year. We have seen strong demand signals from customers, including long-term contracts and larger commitments, many of which include components of generative AI. These signals enhance our confidence in capital expansion in this area.

We continue to demonstrate strong capital expenditure performance in our store business. Most of the expenditure will be related to moderate capacity increases, including some upgrades to our same-day fulfillment network and Amazon logistics fleet. However, you will see that most of the capital expenditures will be primarily focused on AWS.

In the case of AWS, it is already a $100 billion revenue business, while over 85% of global IT spending is still done on-premises. If you believe this ratio will double - and we certainly do - it means we have a lot of room for growth ahead. This does not include the opportunities of generative AI. The opportunities of AI require a lot of work to move from on-premises to the cloud, and people do this because they derive value from it, which is also the reason for their modernized infrastructureQ: Regarding the capital expenditure intensity on AWS, the CEO of Anthropic has stated that the training cost for the next generation model is approximately $1 billion, which is at the high end of Claude 4. The training cost for the next generation model could be as high as $10 billion. This raises a question: 1) Will the industry make such a scale of investment on the AWS platform? 2) Does Olympus and other internal projects need to maintain technological leadership? Can others achieve this as well? 3) What impact do these trainings have on the observed acceleration of Company Q1's revenue growth in the United States?

A: I would like to point out three macro trends that we have observed in the past quarter, which have significantly contributed to AWS's performance: Firstly, the main phase of cost optimization is over. Companies have become wiser, learning how to operate infrastructure more efficiently in the cloud. With cost optimization completed, people are turning towards modernizing infrastructure and initiatives to create new value through generative AI.

We also see a strong drive for people to run generative AI on AWS. We already have billions of dollars in revenue coming from AI, although this is still in the early stages. Several factors driving this growth include: many companies are still building their models, from large-scale model builders like Anthropic to companies launching new models every 12 to 18 months. These models require a large amount of data and labeling for training, many of which are built on AWS, and more models are expected to be developed on AWS in the future.

People sometimes do not realize how many generative AI applications will emerge over time, and when you see significant run rates, most applications eventually go into production. The spending on inference is much higher than training over time because you only train periodically, but you are constantly making predictions and inferences.

We also see many companies building Gen AI applications for inference on AWS, which is closely related to our services. For example, tens of thousands of companies are building on Amazon Bedrock, which offers the widest selection of large language models and a range of features that make it easier to build high-quality, cost-effective, low-latency, production-grade Gen AI applications. Therefore, the growth in training and inference on AWS is very significant.

Furthermore, many companies' models and generative AI applications contain the most sensitive assets and data, so security around these applications is crucial to them. Events in the past year or two have shown that not all service providers have the same security record, and we have a clear advantage in AWS. As companies start to experiment seriously and deploy these applications into production, they are more inclined to run their Gen AI on AWS.

Q: 1) Regarding service costs, could you further quantify the main service cost targets for the next few years, and how this might impact the potential reasonable range of North American retail profit margins?2) If the service cost improves, even if capital expenditures increase, it should bring significant incremental cash flow. Apart from continuous long-term investments, how do you view the strategy of returning capital to shareholders?

A: Regarding dividends, buybacks, or other measures, we do not intend to share relevant information today. Our primary focus is to invest in opportunities within the business and long-term investments. We still have many opportunities, especially in the generative AI field, which we are passionate and confident about. We are currently using cash flow to repay the debt accumulated during negative free cash flow last year Q1, reaching a peak debt level. Since then, we will repay over $25 billion within this year. This is our top priority. Additionally, we have no other information to share at the moment.

- As for profitability, people often ask about our operating profit margin and how they compare to historical trends. We believe that even without relying on advertising revenue, we can achieve pre-pandemic operating profit margins. Although we have not yet reached this goal, we are exploring various methods, examining every process and logistics operation to reduce costs, speed up processes, and improve selectivity. Cost control is a central issue for us in enhancing selectivity and meeting customer demands.

Q: Regarding logistics, you launched Amazon Supply Chain Services in September. Can you help us understand this opportunity you see? How are you building it into a service model globally? Does this require increased capital expenditures?

A: I think the business we have built in the third-party logistics field is very interesting. With the growth of the business, we found it quite challenging to import goods from overseas, pass through customs, and then transport the goods to various facilities. We prefer to use low-cost storage facilities upstream and need a mechanism to automatically replenish from these storage facilities when supplies become scarce at fulfillment centers.

We first built fulfillment capabilities for ourselves to serve our own delivery needs. Subsequently, we opened up fulfillment services as a standalone service to sellers. We provide sellers with a range of services: helping them move goods through customs and borders, from customs to various facilities, whether our own or the sellers'; allowing them to store goods in our low-cost upstream warehouses and automatically replenish to our fulfillment centers or transfer to their other facilities; we also offer services to directly deliver goods to end customers, whether selling on Amazon or shipping to the sellers' end customers.

Additionally, we introduced the Buy with Prime option, allowing our Prime members to purchase goods from third-party Prime sellers' websites, which has increased conversion rates by 25% compared to their own website operations, benefiting our Prime members as wellWe expect these businesses not to become our main capital investment direction. We already need to build these capabilities to operate our store business, and to accommodate third-party sellers, we only need to moderately increase investment on this basis. Third-party sellers believe that it is more valuable for them to have us manage these processes, while also saving costs in the process.

Q: Regarding the growth of Prime Video, could you share more information, has it met your expectations? Do you think it may contribute significantly to advertising revenue in the future? Thank you.

A: Regarding Prime Video advertising, although it has only been launched for a few months, it has already had a positive start. Advertisers are excited about expanding their advertising cooperation in the video field, including Twitch, free channels, and programs and movies on Prime Video. They believe that the relevance and measurability of Prime Video advertising provide a unique platform. Prime Video has had a very good start in the early stages, so we remain optimistic about it.

Q: Regarding the grocery business, you seem to be adjusting the threshold for free delivery or subscription prices. Could you explain the current contribution to growth? Do you think the business has passed the initial growth stage? Are you optimistic about it becoming an important category?

A: Regarding the grocery business, we continue to be optimistic about its development. Our grocery business is large and consists of several different parts.

We have a significant business in non-perishable grocery items, including consumer goods, canned foods, pet food, health and beauty products, and this part is growing very rapidly. At the same time, we have an organic grocery business in Whole Foods Market, which is a pioneer in the field and is also experiencing steady growth. We will launch a new small store format, the Daily Shop concept, at Whole Foods Market in Manhattan in the fall.

Over the past 18 months, we have been working to adjust the trajectory of the business and are satisfied with its development. To meet our grocery needs in our goals, we must have a perishable goods business and a large-scale physical presence, which is also the direction we have been working on with Amazon Fresh. In recent months, we have mainly launched V2 format physical stores in Chicago and Southern California, and we are very pleased with the initial results, which are significantly better in almost all aspects than before. Although it is still in the early stages and there are some issues to be resolved, we are positive about what we have seen so far. We will continue to explore the best promotion of these services over time.

We have also introduced a grocery benefit for Prime members: pay $9.99 per month for unlimited deliveries. This service is very valuable for customers who order at least once a month from Whole Foods Market or Amazon Fresh, especially when the order amount is less than $40, and it has had a good startWe have various ways to continue helping customers meet their grocery needs and have some infrastructure in place that may change how they split grocery orders over time. I remain optimistic about the continued growth of our business.

Q: I would like to inquire about international profitability. 1) After Q1, our international business profit margin was 2.8%, which is roughly in line with the level at which we are achieving sustained profitability in international business. We are following a development trajectory similar to that of North America in enjoying the benefits of inter-regional relationships. 2) We also observed a 25 km decrease in the average shipping distance per package, etc. Can you provide some insights on how the inbound fulfillment architecture continues to benefit faster shipping, same-day delivery, next-day delivery, and other services?

A: 1) I will start with the topic of international profitability. In this quarter, our operating profit reached $902 million, an increase of $2.2 billion compared to the same period last year, showing a steady growth trend that we are satisfied with. This growth can be attributed to several key areas.

Mature countries in Europe, Japan, and the UK are following a development trajectory similar to that of the United States. These regions are increasing product selection, introducing new features such as grocery services, and incorporating them into the benefits of Prime membership. Much of the work we have done in the United States has also had a positive impact on these regions.

Emerging markets. Over the past seven years, we have launched multiple country markets, each with its unique development path in profitability. Our initial focus is on providing a high-quality customer experience that encourages people to sign up for Prime membership, with Prime Video benefits often driving this. As we scale, we aim to optimize cost structures, including leveraging advertising. The ultimate goal is to achieve breakeven in country markets, followed by positive income and free cash flow, further contributing to the positive growth of international business. Currently, we see improvements in both emerging and mature markets, and we are pleased with this trend. We expect this trend to become more pronounced over time.

- We will continue to focus on improving cost structures. First, I want to talk about regionalization. Many of our experiences in regionalization are actually inspired by our observations in Europe, where the close distances between countries have built a regional network in many aspects. I believe the lessons we have learned from regionalization practices in the United States will also apply to our international business.

We see opportunities to increase efficiency in many areas. Take, for example, how and where we import goods into the country. The current architecture involves importing goods centrally to a few locations and then distributing them to other places, a process that requires a lot of effort and cost. We believe that by more efficiently utilizing the inbound network and collaborating with sellers, we can improve efficiency. We have adjusted seller fee structures, significantly reduced outbound costs, and added incentives to encourage sellers to import goods to locations that can improve our cost-effectiveness, thereby sharing the benefits of cost savings between us and sellers. We are optimistic about thisI believe there is still a lot of room for optimization in the quantity of each package, which will bring various positive effects. Many people think that improving delivery speed will increase costs, but in fact, our same-day delivery facilities are actually the lowest cost. Currently, the number of such facilities in the United States and other regions globally is still only a small part. With the increase in the number of facilities, it will help us optimize cost structure while improving delivery speed.

So I believe we have not reached the limit of what we can do. These changes will not all happen within a year, and we will continue to work hard and innovate in the coming years.

Risk Disclosure and Statement of this article: Dolphin Research Disclaimer and General Disclosure