Qualcomm: Can "mediocre" phones rely on AI to stand out?

Qualcomm (QCOM.O) released its second quarter financial report for the fiscal year 2024 (ending in March 2024) after the US stock market closed on the morning of May 2, 2024, with the following key points:

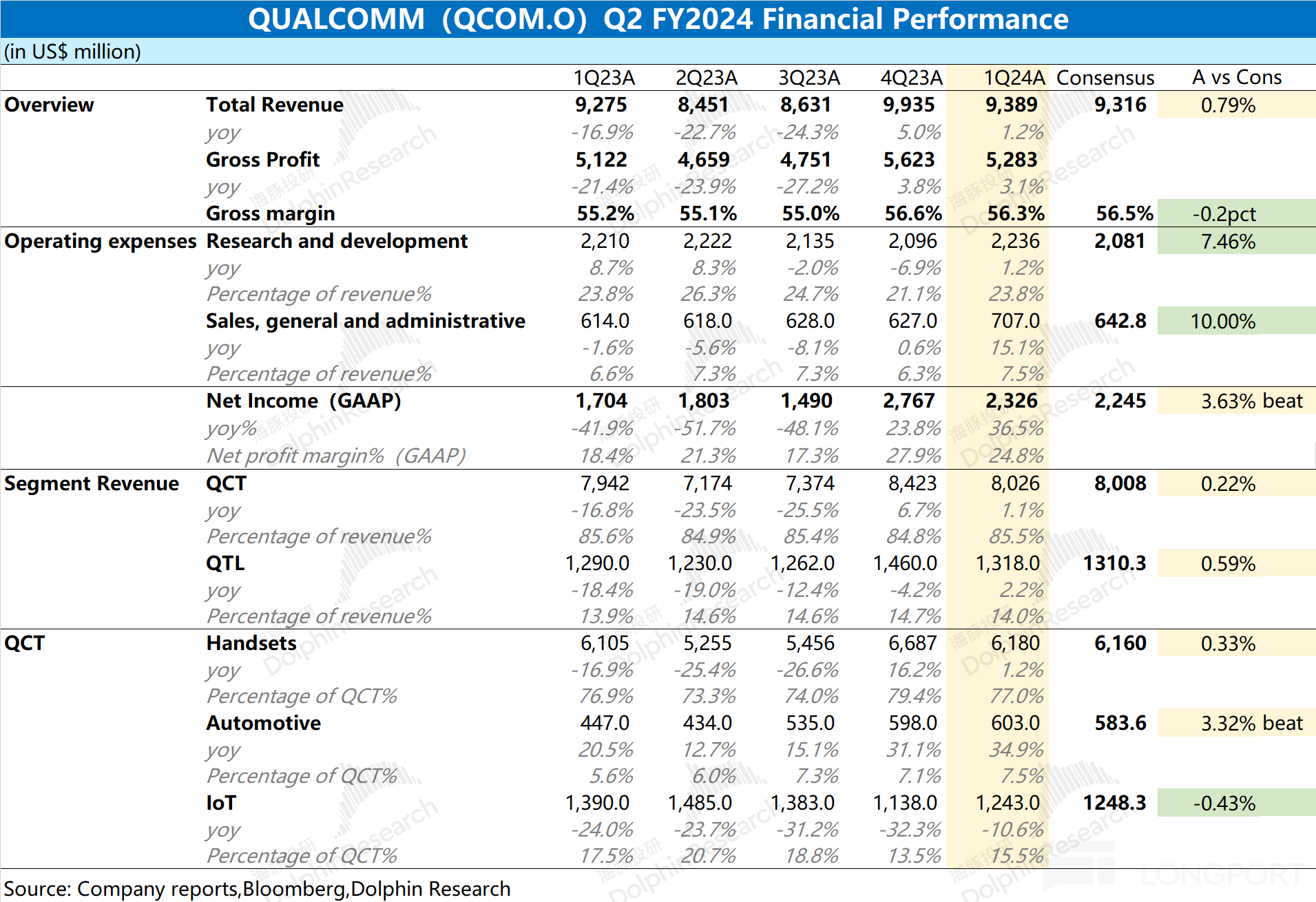

1. Overall Performance: Mediocre. In the second quarter of the 2024 fiscal year (24Q1), Qualcomm achieved a revenue of $9.389 billion, a year-on-year increase of 1.2%, basically meeting market expectations ($9.316 billion). The company's revenue growth rate fell again this quarter, mainly due to the impact of the smartphone business; the company achieved a net profit of $2.326 billion this quarter, a year-on-year increase of 36.5%, exceeding market expectations ($2.245 billion), with the growth mainly coming from non-operational factors.

2. Business Segments: Lack of sustained demand in the smartphone sector. Smartphones are still the largest segment in Qualcomm's various businesses, accounting for over 60%. Affected by insufficient demand in the smartphone market, the growth rate of the company's smartphone business declined this quarter, significantly impacting the company's performance. Although the automotive business still maintains double-digit growth, it currently accounts for less than one-tenth.

3. Qualcomm's Performance Guidance: Expected revenue of $8.8-9.6 billion for the third quarter of the 2024 fiscal year (24Q2) (market expectation of $9.08 billion) and adjusted earnings per share of $2.15 to $2.35 (market expectation of $2.11).

Dolphin's Viewpoint:

Overall, Qualcomm's financial report this time is mediocre. The revenue side basically meets market expectations, and the better-than-expected profit side mainly comes from non-operational factors. Excluding non-operational impacts such as investment income, the company's core operating net profit for this quarter has slightly increased compared to last year.

Considering the guidance provided by the company for the next quarter: expected revenue of $8.8-9.6 billion for the third quarter of the 2024 fiscal year (24Q2) (market expectation of $9.08 billion) and adjusted earnings per share of $2.15 to $2.35 (market expectation of $2.11). There are no clear signs of improvement in revenue and profit performance, indicating an overall stability.

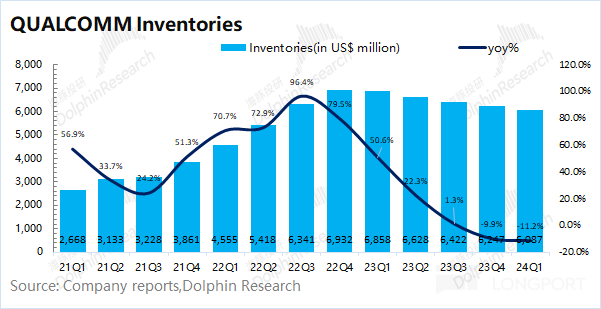

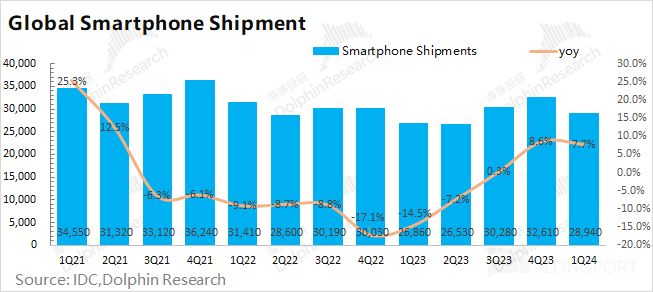

As the majority of the company's business structure is still in the smartphone business, the condition of the smartphone market will have a significant impact on the company's performance. Dolphin believes that although the smartphone market has shown some recovery from the bottom, current market demand is still insufficient: 1) Global quarterly smartphone shipments have not yet stabilized at 300 million units 2) The company's inventory turnover has improved but remains relatively high; 3) The company's guidance data also does not provide clear expectations for improvement.

Although the company's stock price has returned to a high level, Qualcomm's performance is still relatively weak. With the current market capitalization of nearly $200 billion, corresponding to a valuation of nearly 20 times PE, the stock price has already factored in expectations of industry recovery. For the stock price to continue to rise, the company will need to deliver more performance that exceeds expectations in terms of performance or AI.

Here is Dolphin's specific analysis of Qualcomm's financial report:

I. Overall Performance: Mediocre

1.1 Revenue

In the second quarter of fiscal year 2024 (24Q1), Qualcomm achieved revenue of $9.389 billion, a year-on-year increase of 1.2%, basically meeting market expectations ($9.316 billion) . The company's revenue growth rate has once again slowed down this quarter, mainly due to the impact of the smartphone business. With quarterly revenue still below $10 billion, the company's operational side has not seen a significant recovery.

1.2 Gross Margin

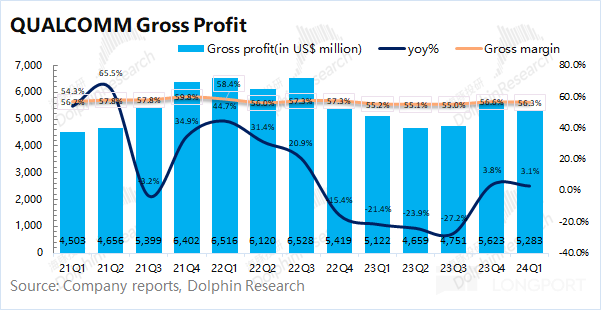

In the second quarter of fiscal year 2024 (24Q1), Qualcomm achieved a gross profit of $5.283 billion, a year-on-year increase of 3.1%. The year-on-year growth rate of gross profit is faster than that of revenue, mainly due to the increase in gross profit margin.

Qualcomm's gross margin for this quarter is 56.3%, up 1.1 percentage points year-on-year, basically meeting market expectations (56.5%) . The company's gross margin remains relatively stable, reflecting its bargaining power in the industry chain. With the recovery of the smartphone market, the company's gross margin has also seen a rebound from the bottom.

Qualcomm's inventory in the second quarter of fiscal year 2024 (24Q1) was $6.087 billion, a year-on-year decrease of 11.2%. The company's inventory continues to decline but remains at a relatively high level, which to some extent also affects the recovery of the company's gross margin.

1.3 Operating Expenses

Qualcomm's operating expenses in the second quarter of fiscal year 2024 (24Q1) were $2.943 billion, a year-on-year increase of 4.2%, mainly due to increased investment in sales and management expenses.

Looking specifically at the expense side:

1) Research and Development Expenses: The company's R&D expenses for this quarter were $2.236 billion, a year-on-year increase of 1.2%. As a technology company, R&D expenses remain the largest item of investment for the company, with little year-on-year change; 2) Sales and Administrative Expenses: The company's sales and administrative expenses for this quarter amounted to USD 7.07 billion, a year-on-year increase of 15.1%. Sales and administrative expenses are somewhat correlated with revenue.

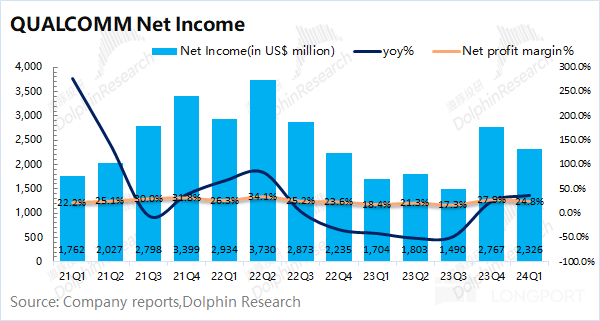

1.4 Net Profit

In the second quarter of the 2024 fiscal year (24Q1), Qualcomm achieved a net profit of USD 2.326 billion, a year-on-year increase of 36.5%, slightly better than market expectations (USD 2.245 billion). The net profit margin for this quarter was 24.8%, maintaining profitability at the 20% level.

After excluding non-operating impacts such as investment income, the company's core operating net profit for this quarter showed a slight improvement compared to the same period last year, mainly benefiting from the increase in Android smartphone shipments. However, the company's performance has not fully recovered from the bottom.

Business Segmentation: Mobile Demand, Lack of Sustainability

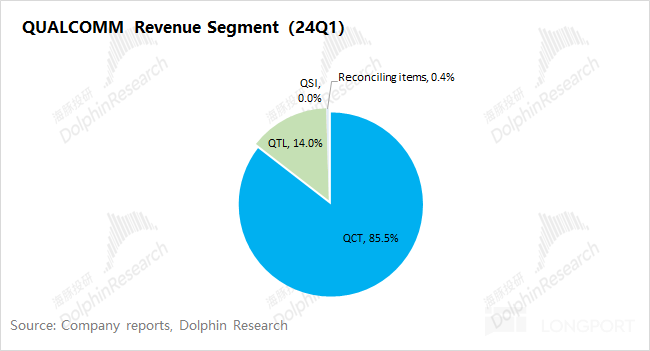

Looking at Qualcomm's business segments, QCT (CDMA business) remained the company's largest source of revenue this quarter, accounting for 85%, mainly including chip semiconductor business; the remaining revenue mainly came from QTL (technology licensing) business, accounting for around 14%.

The QCT business is the most important part of the company, with the following specific breakdown:

Mobile Business

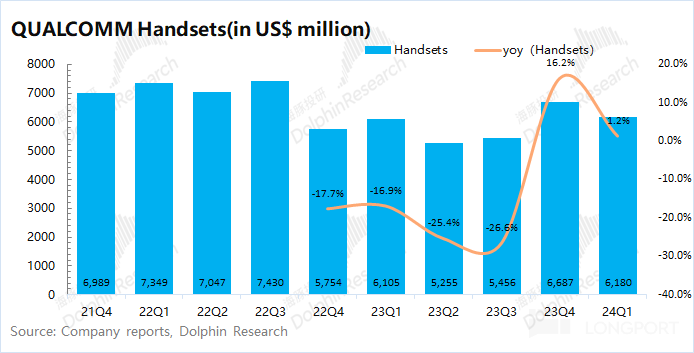

Qualcomm's mobile business achieved revenue of USD 6.18 billion in the second quarter of the 2024 fiscal year (24Q1), a year-on-year increase of 1.2%, driven by the recovery in demand from Chinese OEM manufacturers. The company's mobile business returned to above USD 6 billion from the bottom, but the growth rate has slowed down, mainly due to the overall impact of the mobile industry market.

According to industry data, global smartphone shipments in the first quarter of 2024 were 289 million units, a year-on-year increase of 7.7%, with a slowdown in growth rate. Although smartphone shipments have improved from the bottom, they are still relatively low, mainly due to insufficient overall demand Mobile Business in QCT Business Accounts for 77%, and Its Impact on Qualcomm's Overall Performance Exceeds 60%.

Therefore, if the Mobile Business does not continue to recover, the company's performance will continue to remain at a relatively low level.

2.2 Automotive Business

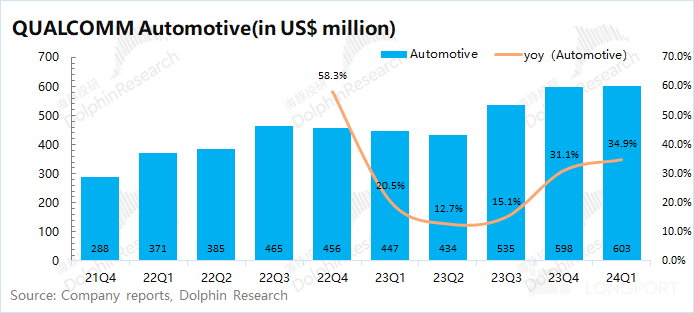

Qualcomm's automotive business achieved revenue of $603 million in the second quarter of the 2024 fiscal year (24Q1), a year-on-year increase of 34.9%. The automotive business is the fastest-growing among the company's main businesses, maintaining a growth rate of over 30%, mainly benefiting from the increasing demand for smart cockpits and autonomous driving in cars.

Although the company's automotive business still maintains a high double-digit growth rate, the current contribution of the automotive business to the company's total revenue is still less than 10%, with a relatively small impact on the company's overall performance.

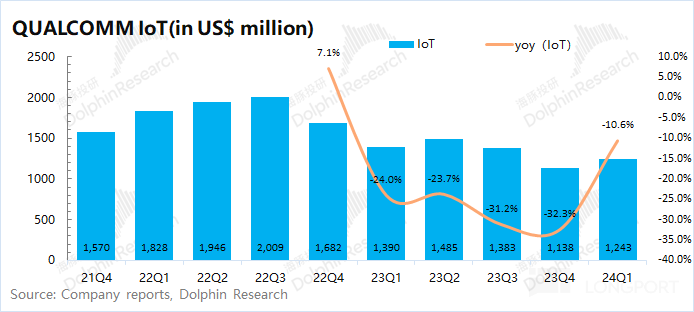

2.3 IoT Business

Qualcomm's IoT business achieved revenue of $1.243 billion in the second quarter of the 2024 fiscal year (24Q1), a year-on-year decrease of 10.6%. The decline in IoT business has narrowed, but it still maintains a double-digit decline.

Qualcomm's IoT business mainly includes consumer electronics, edge networking, and industrial products. Although there are various types of businesses, Dolphin Jun speculates that the sluggish demand for consumer electronics products such as XR is the main factor contributing to the decline in the IoT business.

海豚投研 related research on Qualcomm

In-depth

December 20, 2022, "Qualcomm: Making Hundreds of Billions a Year, Is the Chip King Worth Only 10 Times PE?"

December 8, 2022, "Qualcomm (Part 1): The Behind-the-Scenes "Big Shot" of Android Phones"

Financial Report Season

February 1, 2024, Earnings Call "Mobile Revenue, Expecting Double-Digit Recovery (Qualcomm FY23Q4 Earnings Call)"

February 1, 2024, Financial Report Review "Qualcomm: Without the Leading Brother, How Far Can the Mobile Recovery Go?"2023 年 11 月 2 日电话会《 手机收入,将有两位数的回暖(高通 FY23Q4 电话会)》

2023 年 11 月 2 日财报点评《 高通:安卓一哥 “冬眠期” 终于要结束了?》

2023 年 8 月 3 日电话会《 未见明显回暖,继续推进控费(高通 FY23Q3 电话会)》

2023 年 8 月 3 日财报点评《 高通的寒冬,还要再 “熬一熬”》

2023 年 5 月 4 日电话会《 高通:去库存是当下的首要任务(高通 Q2FY23 电话会)》

2023 年 5 月 4 日财报点评《 高通:芯片 “大佬” 藏大雷,寒冬还要久一些》

直播

2023 年 5 月 4 日《 高通公司 2023 财年第二季度业绩电话会》

本文的风险披露与声明: 海豚投研免责声明及一般披露