Airbnb: Growing Momentum, but Low Valuation for Money

1. Post-pandemic, enthusiasm for travel among European and American residents continues to soar

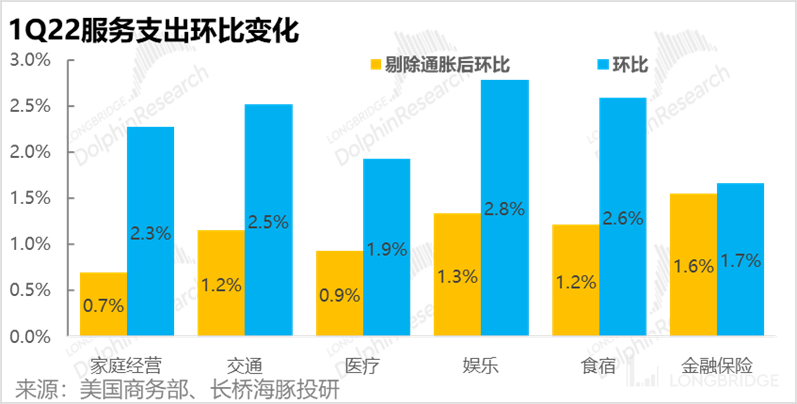

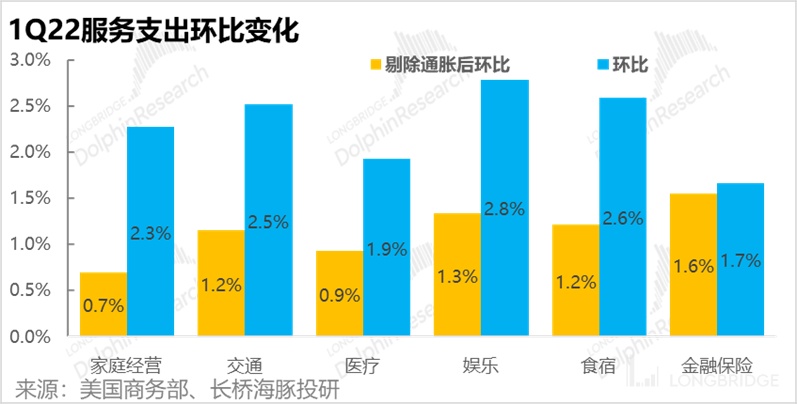

Based on our analysis and outlook of the macroeconomic situation in the United States in the first quarter, we have found that despite the sluggishness in consumer goods spending among US residents against the backdrop of high inflation and monetary tightening, the overall growth in service expenditure remains strong as the impact of the Omicron variant subsides and epidemic prevention measures are lifted. The growth in transportation, entertainment, dining, and accommodation expenditure is particularly prominent. Even if the macroeconomic momentum in Europe and the United States continues to decline in the second half of the year, we believe that the pent-up demand for leisure and entertainment among local residents will be released in a retaliatory manner, leading to relatively robust performance in the travel and tourism-related industries.

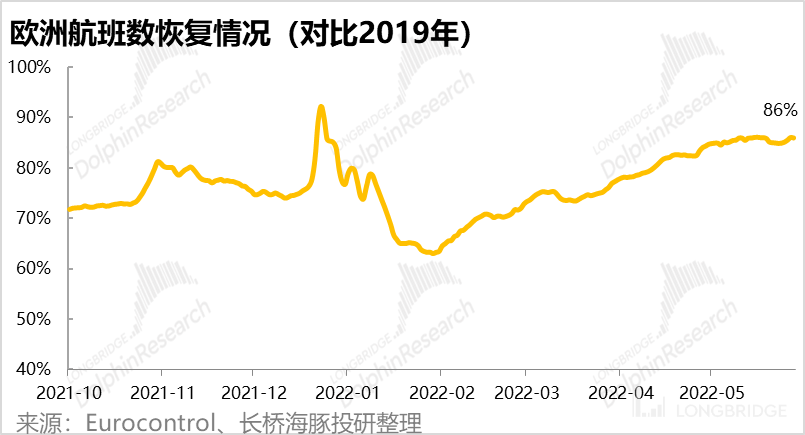

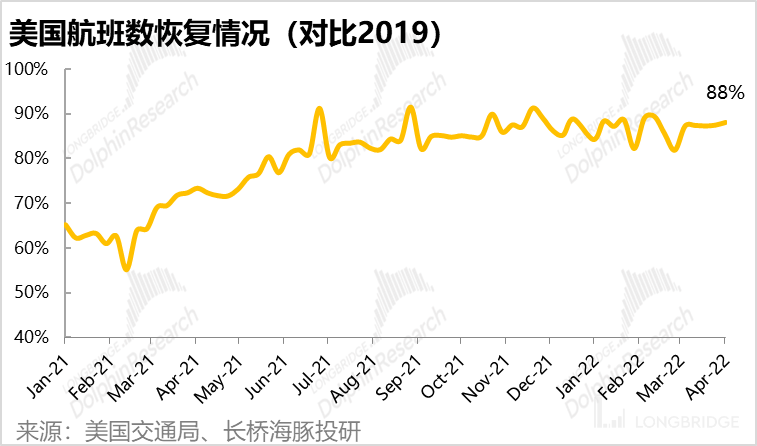

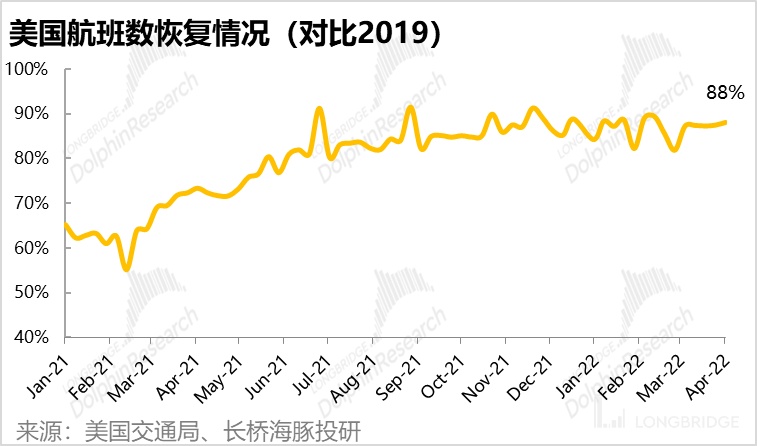

Firstly, from the perspective of travel among European and American residents, Europe, which had lagged behind in terms of travel recovery, has also experienced a strong rebound since February 2022. As of the end of May, the number of flights in Europe has recovered to 86% of the level in the same period in 2019, which is comparable to the recovery level in the United States. At this point, the enthusiasm for travel among European and American residents has almost returned to pre-pandemic levels.

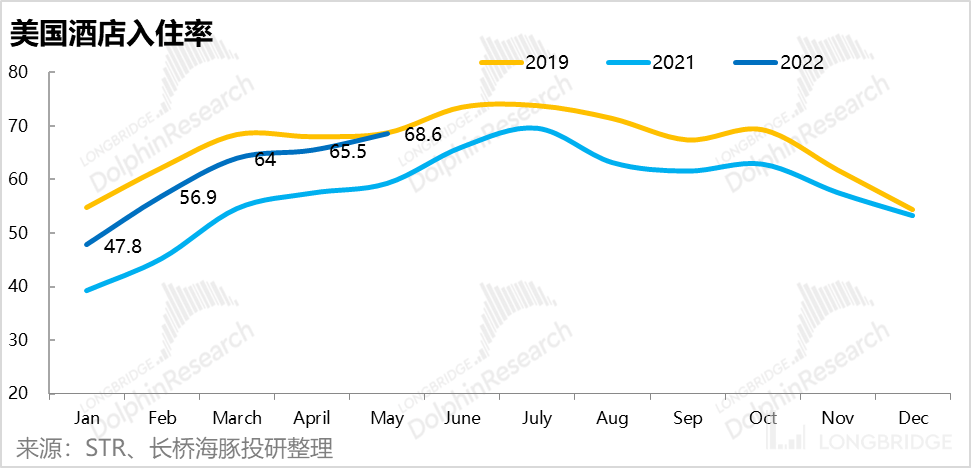

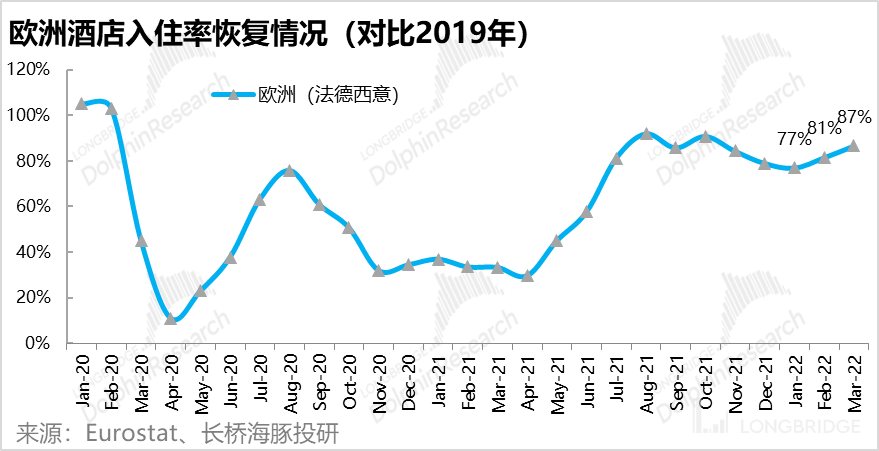

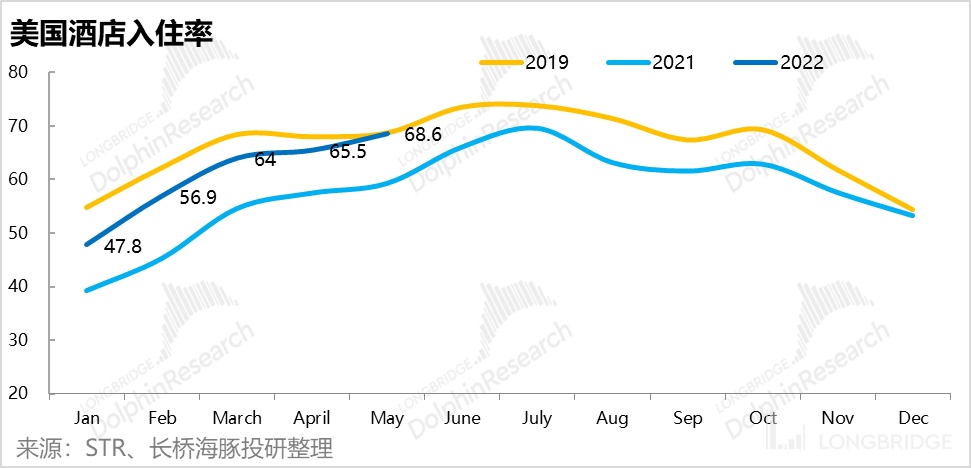

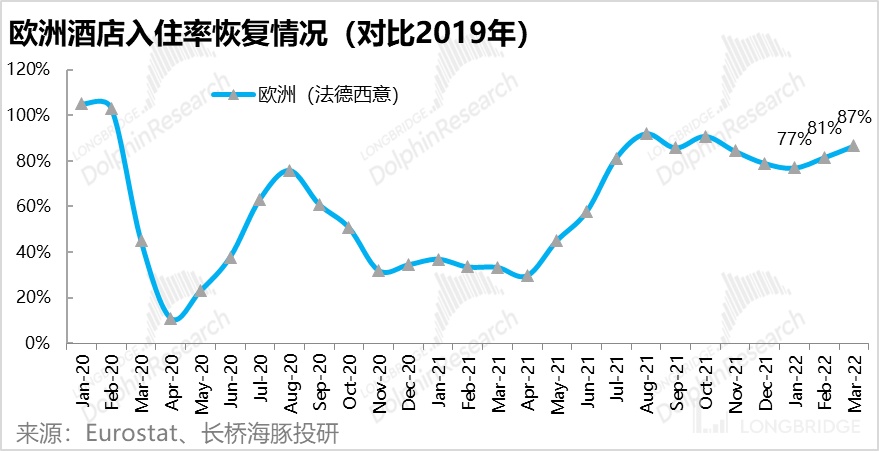

Compared to the number of flights, the recovery of hotel occupancy is even more optimistic. By May, the occupancy rate in the United States had recovered to 68.6%, reaching the same level as the same period in 2019 for the first time since the outbreak of the pandemic in 2020. Although the recovery of hotel occupancy in Europe is slightly lagging behind, it has been steadily increasing since 2022 and had recovered to 87% of the level in the same period in 2019 by the end of March. We believe that it will continue to improve further in the second quarter. Therefore, overall, the travel and accommodation demand in Europe and the United States has returned to normal and is still trending upwards at present.

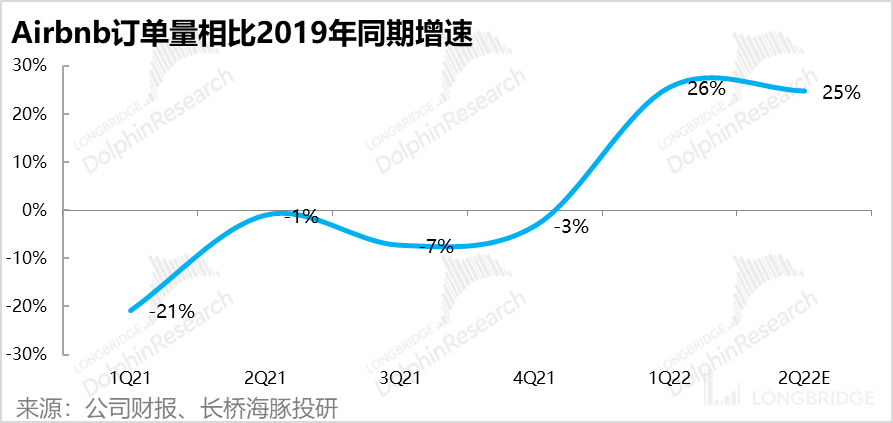

2. The homestay sector possesses both growth potential and risk resistance In the context of the overall recovery in the travel and accommodation industry, Dolphin believes that all cultural and tourism-related enterprises can benefit from the favorable winds. However, in addition to the industry's positive outlook, Airbnb continues to leverage its unique advantage in the field of unique accommodations. Referring to the guidance on 2Q22 performance from the three major OTA platforms, Airbnb, Booking, and Expedia, as well as the forecasts from international banks, Airbnb's order volume in 2Q is expected to be more than 25% higher than the same period in 2019. In comparison, Booking's order volume is projected to increase by 10%+ compared to the same period in 2019, while Expedia's volume is expected to remain below the level of the same period in 2019.

Although the sluggish economic growth in the United States and Europe raises concerns about the future consumption capacity of European and American tourists in travel and accommodation, Dolphin still believes that Airbnb's business model, which is based on personal residences rather than commercial hotels, provides the company with stronger risk resistance during economic downturns. The underlying logic includes:

① Unlike commercial hotels, renting personal residences does not require much additional operating costs.

② Personal landlords have a greater incentive to rent out their properties to generate additional income during economic downturns when their actual income decreases.

③ The vacation rental industry was born to reduce accommodation costs, and during economic downturns, tenants are more likely to prefer lower-priced accommodation options.

Therefore, even if the actual consumption capacity of European and American residents declines under the influence of inflation, the unique accommodations sector may still benefit relatively within the accommodation industry.

- The "downgrading of consumption" in inflation may have a negative impact on the company's gross margin.

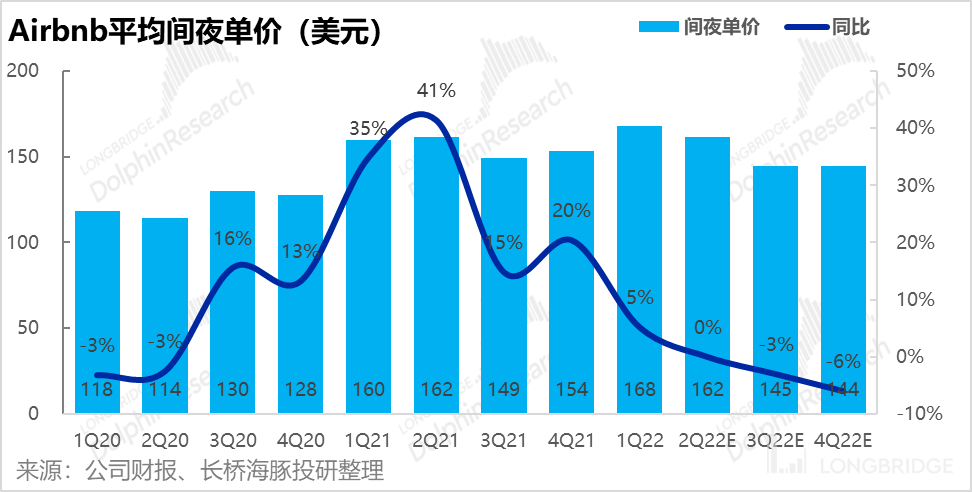

Following the trend of European and American residents downgrading their consumption in an inflationary environment, there is a preference for lower-priced accommodations. Although this may be beneficial to the demand for vacation rentals, it will also impose additional drag on the company's Average Daily Rate (ADR).

Originally, as travel and accommodation in Europe and the United States returned to normal, Airbnb's order structure was expected to shift from high-priced vacation accommodations to normal city accommodations, resulting in a decrease in the proportion of high-priced orders in the United States. Therefore, without considering inflation, Airbnb's ADR was already trending downward from the peak during the pandemic towards normal levels. The "downgrading of consumption" may further intensify this downward trend.

Although an increase in volume can compensate for the trend of price decline, Airbnb's total order amount can still rise. However, from a profitability perspective, a decrease in the proportion of high-priced orders will inevitably have a negative impact on the company's gross margin. Moreover, the company's operating expenses and labor costs are already under pressure in the inflationary environment. Therefore, with the combination of these two negative factors, the company's profit performance in the financial reports for the coming year may potentially fall below market expectations. 4. Forecast and Valuation Adjustment

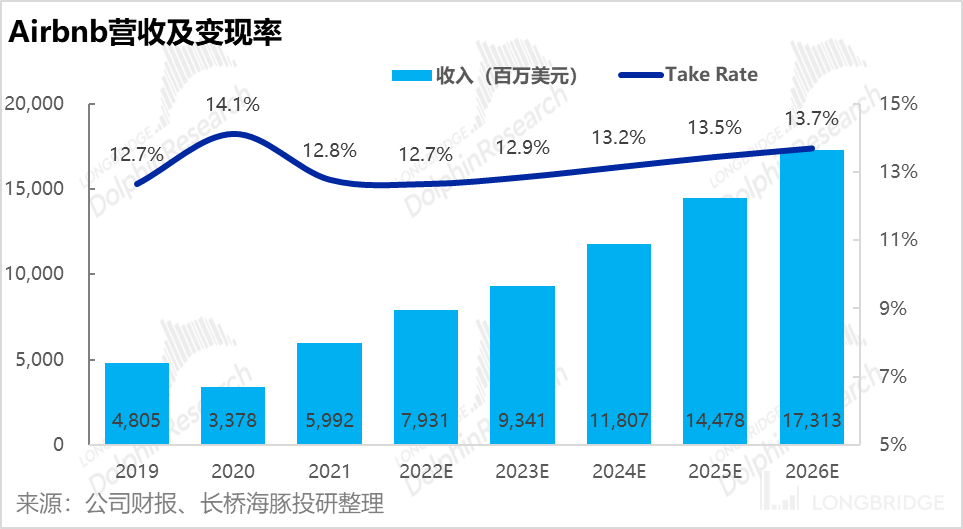

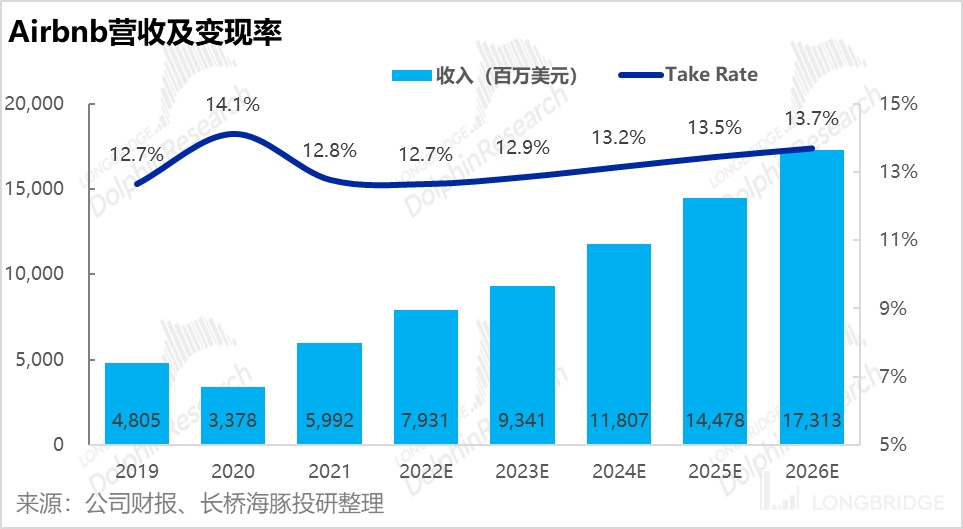

① Revenue: Due to better-than-expected first-quarter revenue and continued strong recovery in accommodation demand, we have raised the growth rate of order volume. However, considering the trend of "consumption downgrading," we predict that the average daily rate (ADR) in the second half of 2022 will decrease compared to the same period last year. Nevertheless, overall, the total order amount and revenue are still adjusted upward.

In the long term, after the expected recovery in travel within 2022, considering the possibility of slight macroeconomic downturn in 2023, we predict that the company's revenue growth rate will also decline, but it will return to normal growth trajectory in 2024.

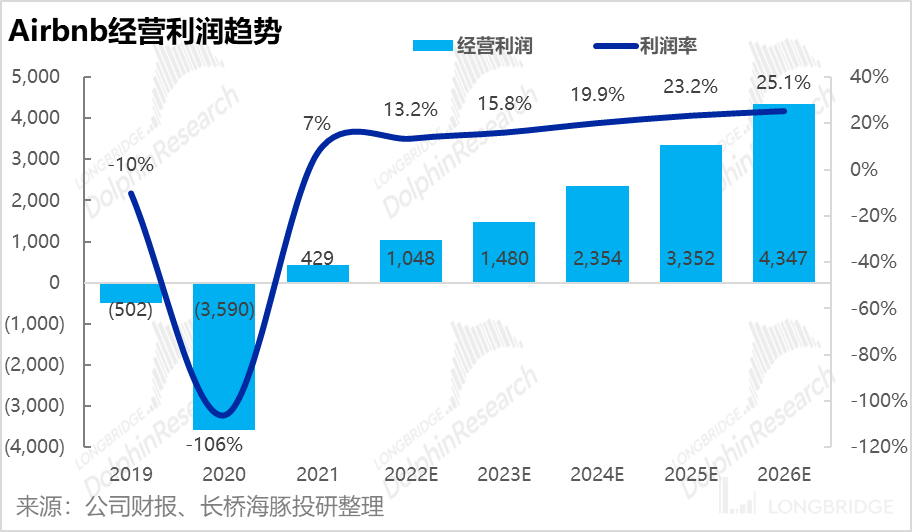

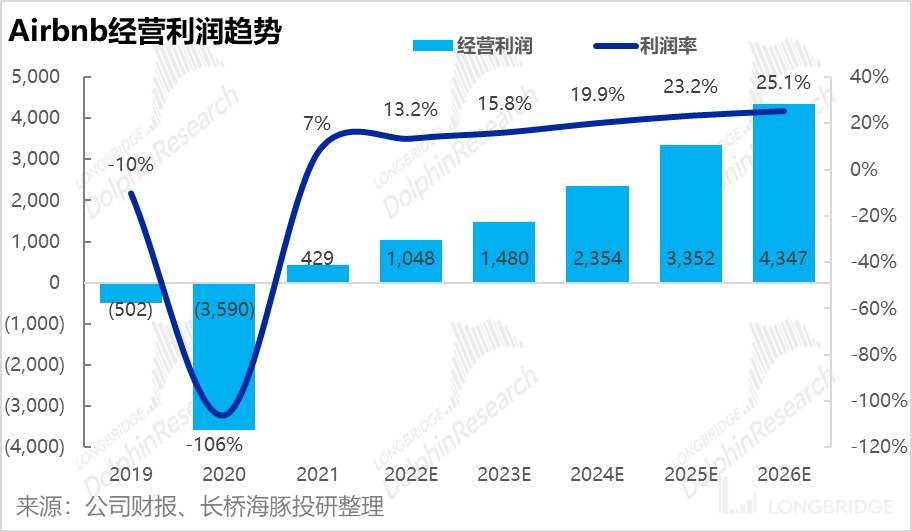

② **Profit: **Considering the downward trend of ADR, we expect the gross profit margin to decline year-on-year in the second half of 2022. However, due to the significant improvement in the company's operating leverage in the first quarter and a slight decrease in operating expense ratio, we predict that the enhancement of economies of scale can offset the cost increase caused by inflation, resulting in only a slight increase in operating expense ratio in the second half of 2022.

In the long term, as the company's profit margin steadily increases with the release of economies of scale and operating leverage, it will approach the current operating profit margin level of Booking.

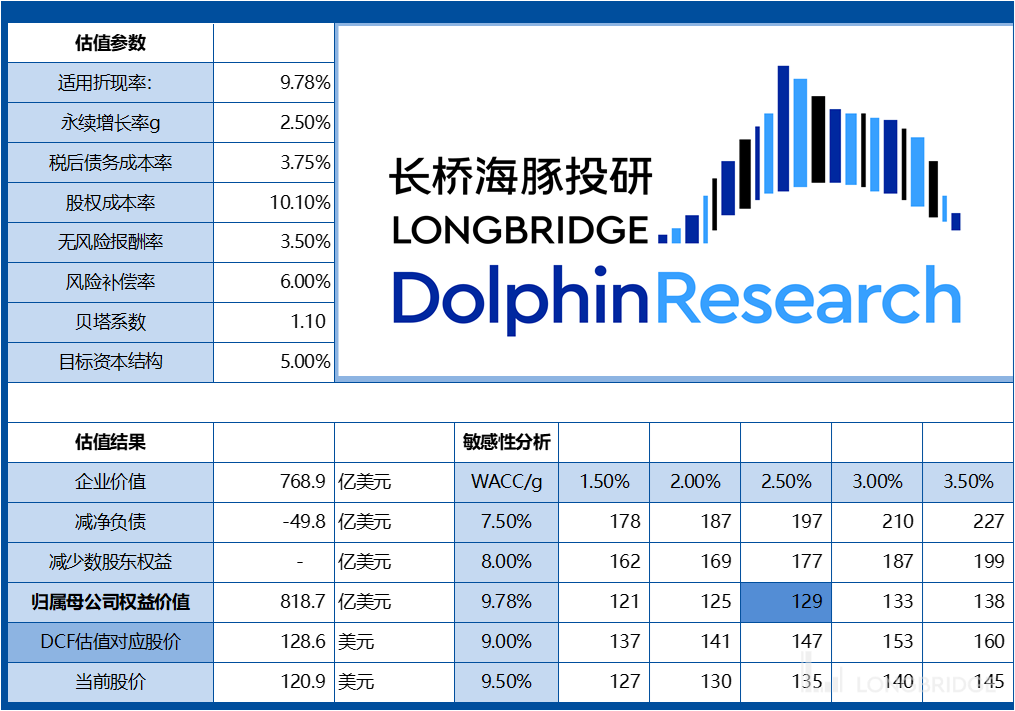

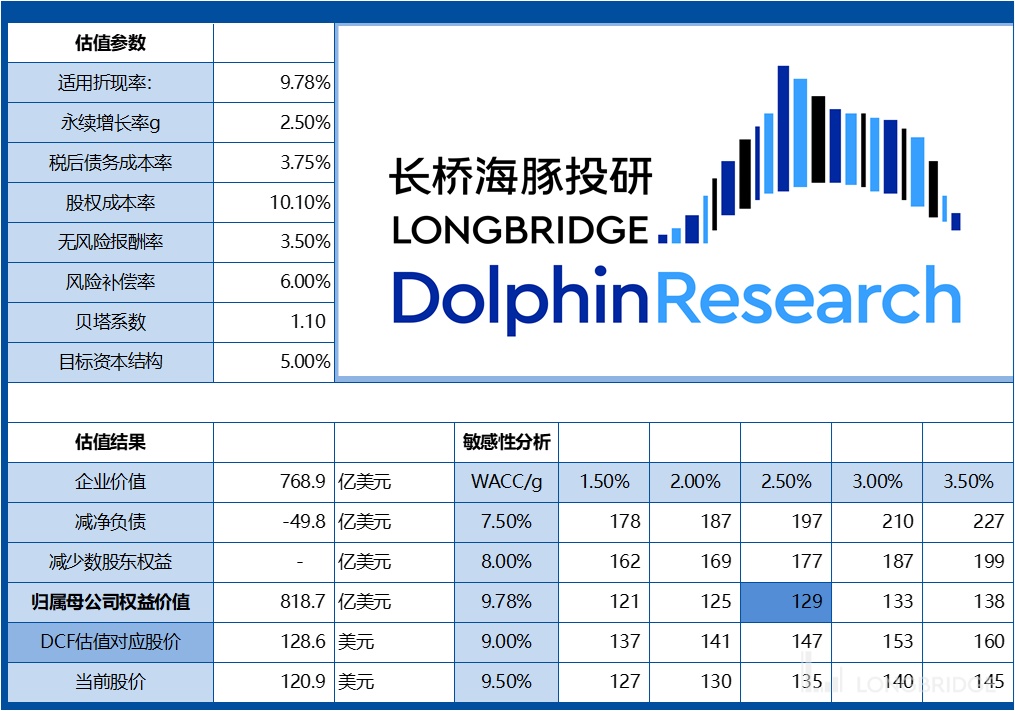

In terms of valuation, although we have raised the company's revenue expectations, considering the current expectations of interest rate hikes, we have increased the risk-free interest rate from 2.5% to 3.5%. The fair valuation calculated by the Dolphin DCF model has decreased from the previous $142 to $129, slightly higher than the current market price of $120.9. Therefore, although the company's stock price has declined from its peak, it has only fallen from an overvalued level to a reasonable level. Even though we have raised performance expectations and the current stock price already reflects strong growth prospects, the valuation is considered reasonable. If the stock price further declines due to market sentiment, it will present a better entry opportunity.

Dolphin's Previous Research on Airbnb:

Earnings Season

May 4, 2022 Conference Call: "Riding the Recovery Wave in the Sharing Economy (Summary of Airbnb Conference Call)"

May 4, 2022 Earnings Review: "As COVID Recedes, Airbnb Returns as the King" Deep Dive

On April 6, 2022, "Airbnb: A Different Path in the Pandemic, How Did It Turn the Tables on Others?" was published.

On April 7, 2022, "Airbnb: The Crown is Too Heavy, Valuation is Running Too Fast" was published.

Risk Disclosure and Statement for this Article: Dolphin Disclaimer and General Disclosures