Disney: Streaming Bubble Burst, Returning to Theme Park Roots

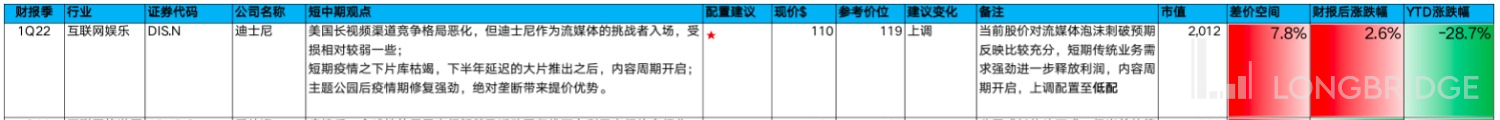

From 2019, the streaming business has been adding three years of imagination to Disney's valuation. As the competition in the entire industry worsens, it has gradually become the catalyst for the bursting of the current round of the US stock market bubble, leading to a continuous decline in Disney's market value.

"Once a sweet little girl, now a cow lady." It can be seen from the "plunge" after Netflix's two consecutive quarters of lower-than-expected financial reports that the current market's requirements for growth stocks in the streaming media sector have become harsh. As long as the performance falls short of expectations, it will immediately impose a punitive valuation cut.

In the foreseeable trend of valuation cuts, this is also the reason why Dolphin made a short-term avoidance judgment on the streaming media business in the previous quarter's summary. If forced to choose, Disney's traditional business repair may give it more resilience against the decline.

From a long-term perspective, in the article "Disney: The "Anti-Aging Technique" of a Centenarian Princess," we have also analyzed that Disney's relatively complete industry chain strategy can rely on its overall ecological advantages to have a relatively higher success rate. Although Netflix is working hard to catch up in this regard, such transformation is not easy without a relatively stable business that generates cash flow.

1. The "Ice and Fire" of Streaming Media and Theme Parks

From the performance of the first quarter financial reports in 2022, what we can see is:

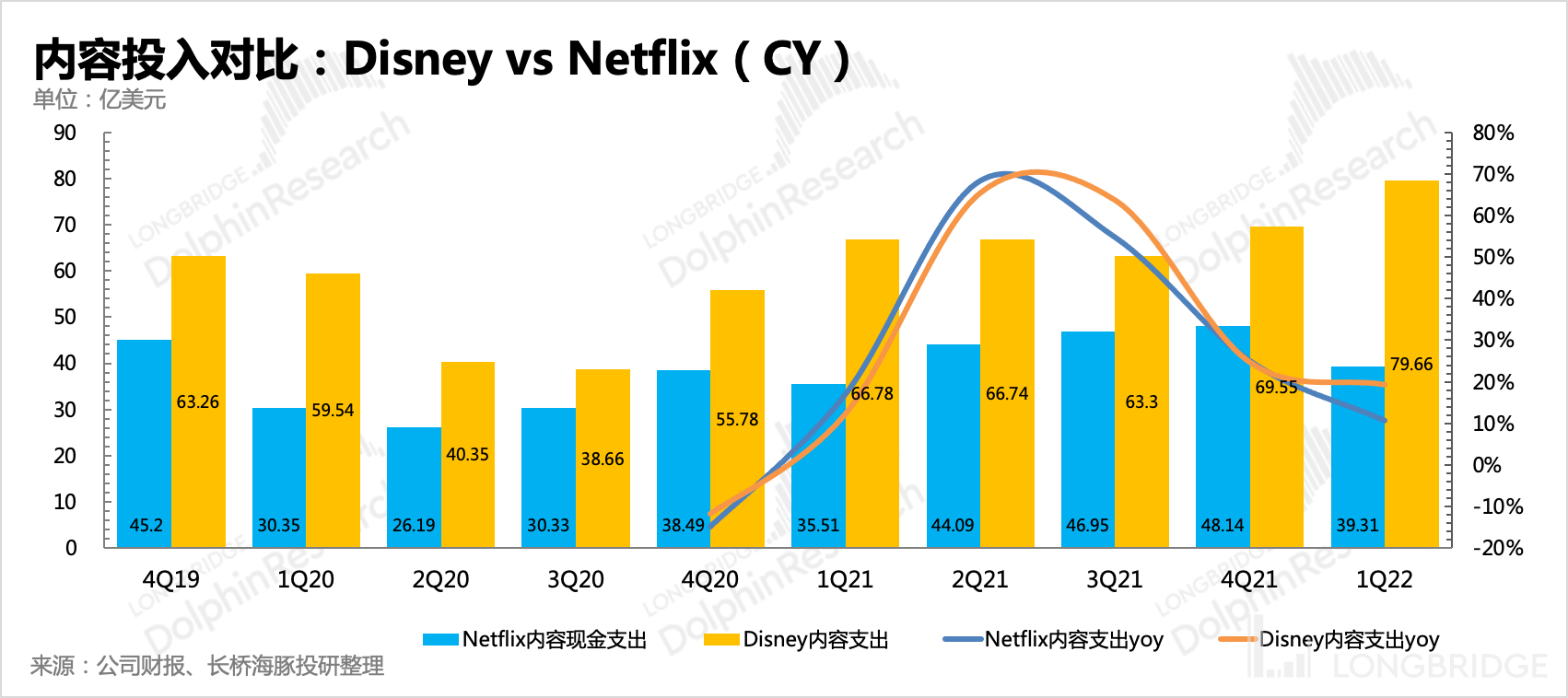

(1) Streaming media has collectively fallen into a state of confusion in the content arms race. The more high-quality content there is, the more platforms with deep pockets announce investment plans of billions of dollars in content. However, it is becoming increasingly difficult to persuade more users to willingly pay. For example, in the first quarter, Netflix's "Bridgerton Season 2" once again topped the viewing charts (even going so far as to forcefully insert an Indian protagonist to compete for the Indian user market), but this was accompanied by a decline in overall paid users.

Essentially, this is still a chaotic battle in the process of reshaping the competition landscape. Of course, the short-term contraction of the offline economy has also intensified the competition. And due to the disadvantages of the business model of long-form videos, such battles will be even longer and more brutal.

Although various platforms spare no effort to embellish the prospects, there is still plenty of room for "cord-cutting" penetration. However, from their actual actions (investment direction), it can be seen that there is already limited incremental growth in North America, and the remaining "stubborn" cable TV households have high migration costs. The greater potential for streaming media lies in South Asia and Africa-Europe regions.

(2) In contrast to the struggles of streaming media, theme parks and cinemas seem to have returned to a period of users willingly spending money. a. Since the second half of last year, Disney has taken full advantage of the retaliatory rebound in offline consumption by launching new value-added service products, achieving a "win-win" situation in terms of quantity and price. The disguised price increase did not significantly suppress the enthusiasm of visitors' consumption. Operating at full capacity, the theme parks have seen a double increase in profitability.

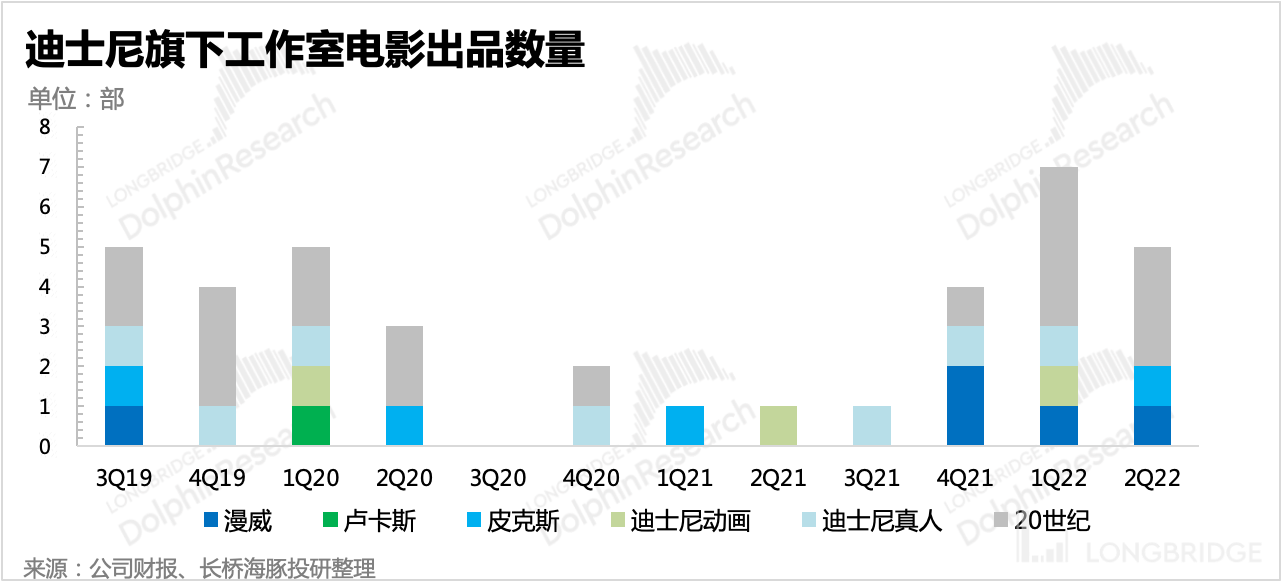

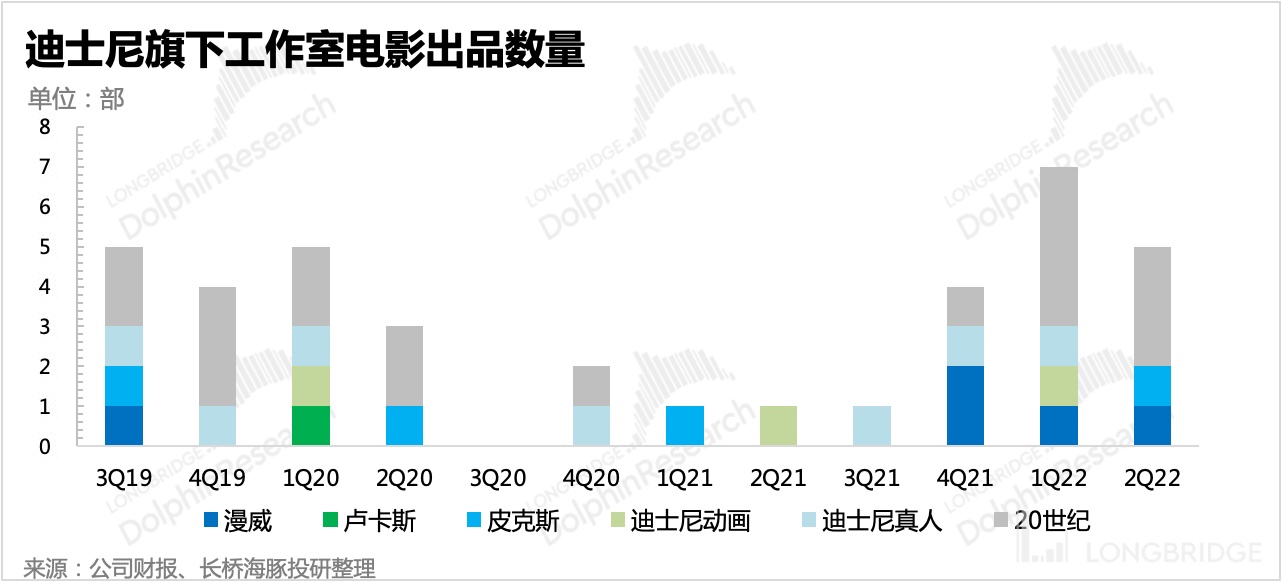

b. The impact of the epidemic on film distribution revenue is not only reflected in the suppression of box office revenue, but also in the delay of production progress, thereby affecting the overall film supply. Moreover, with the disadvantage in TV series, Disney+ also needs movie content to fill the gap. However, the performance of "Black Widow" after its simultaneous release on online and offline platforms indicates that the profitability of streaming media is not good at the moment. Although the release of blockbuster films on streaming platforms can attract new users, it is clearly less economical than movie theaters, resulting in an overall loss for Disney.

As we gradually emerge from the epidemic, starting from the fourth quarter of last year, we can see that Disney's film revenue has made significant strides in recovery as the film supply increases, with Marvel blockbusters still contributing the most.

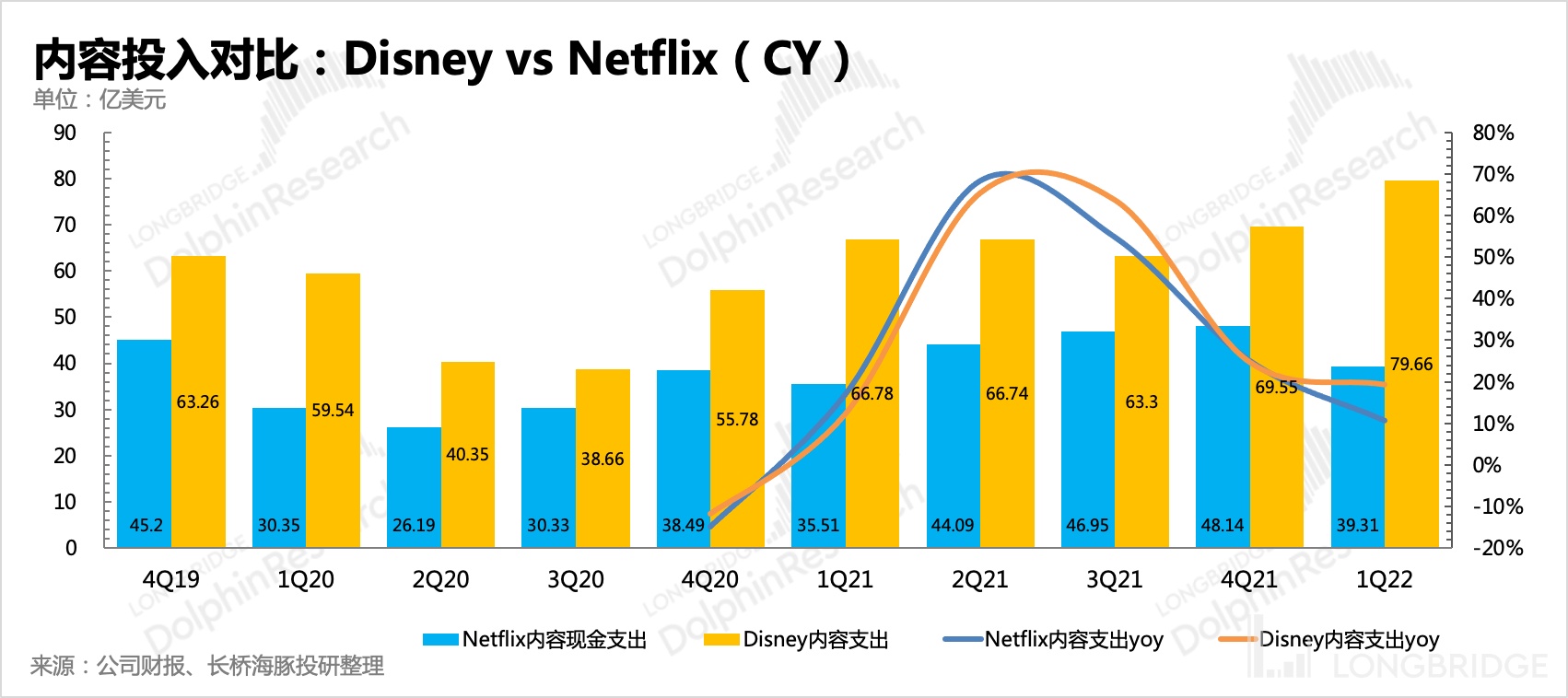

In the view of Dolphin, the cash-burning war in the streaming media industry is unlikely to stop before 2024. On the one hand, there is a time lag between content investment and output, especially when all companies are focusing on higher-quality localized projects, which require large investments and long production cycles. On the other hand, Disney has set a target of 230-260 million Disney+ subscribers by 2024, which requires further acceleration based on the current subscriber base in the next two years. Despite the intensifying competition in the streaming media industry, after Netflix's disappointing first quarter, Disney's management still expressed confidence in the 2024 target during the conference call, undoubtedly due to the confidence brought by the $32 billion content investment.

Therefore, in the current period of declining profits and valuations in the streaming media business, it is necessary to rely on traditional businesses, especially the recovery and rebound of theme parks and movie theaters, to provide support.

2. How long can the "fire" of traditional businesses burn? Pay attention to the risk of demand contraction under inflation

The prosperity of offline service-oriented demand has been evident in the retail data of the past three months, but with persistent high inflation, signs of shrinking consumer goods demand are becoming increasingly apparent. Concerns about service-oriented consumption have also emerged in the market. Although there is a logic for the recovery of offline activities, they are ultimately optional consumption items. In a situation where even essential consumption cannot be sustained, optional consumption will also face greater headwinds. (Refer to "Can Only One Recession Kill America's Inflation Tiger?")

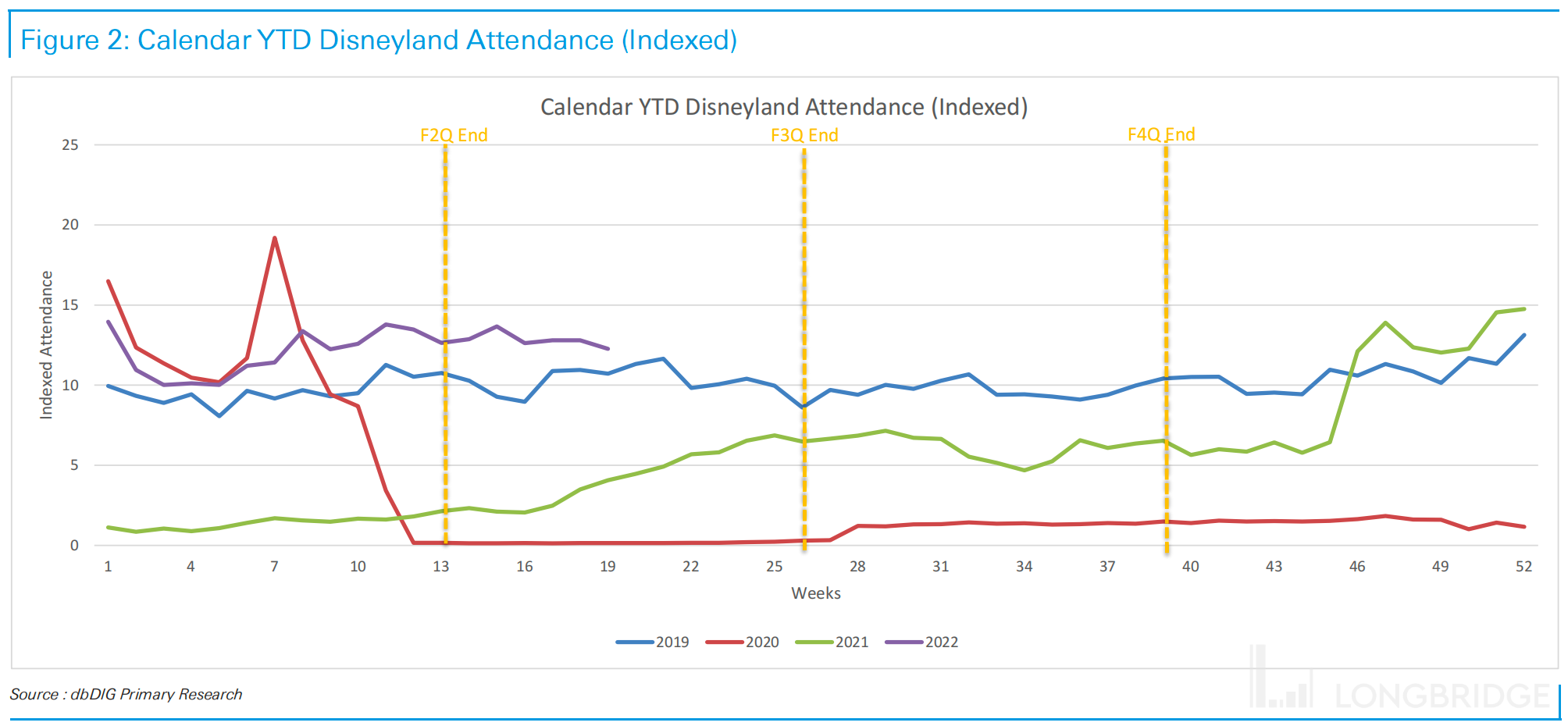

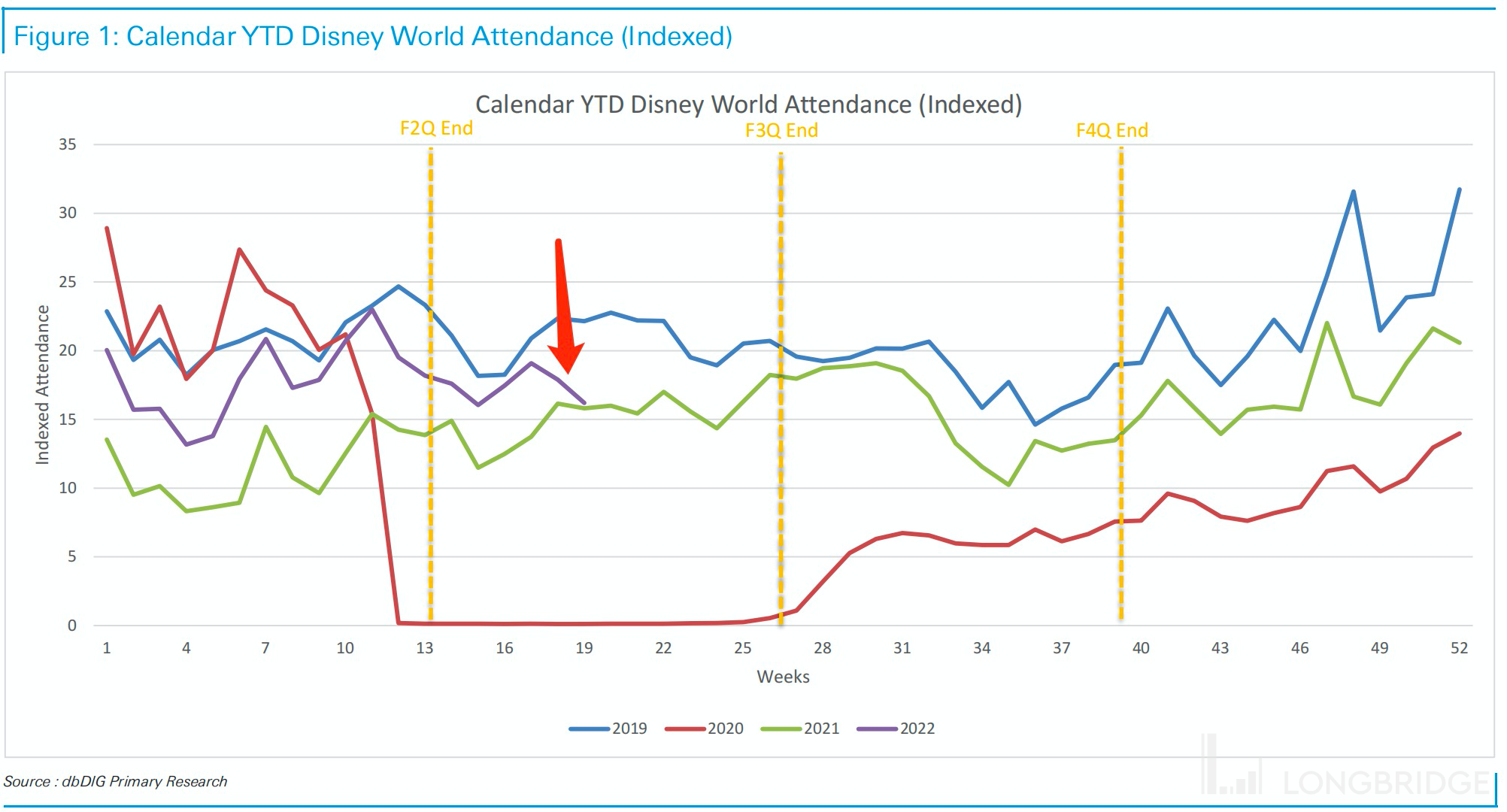

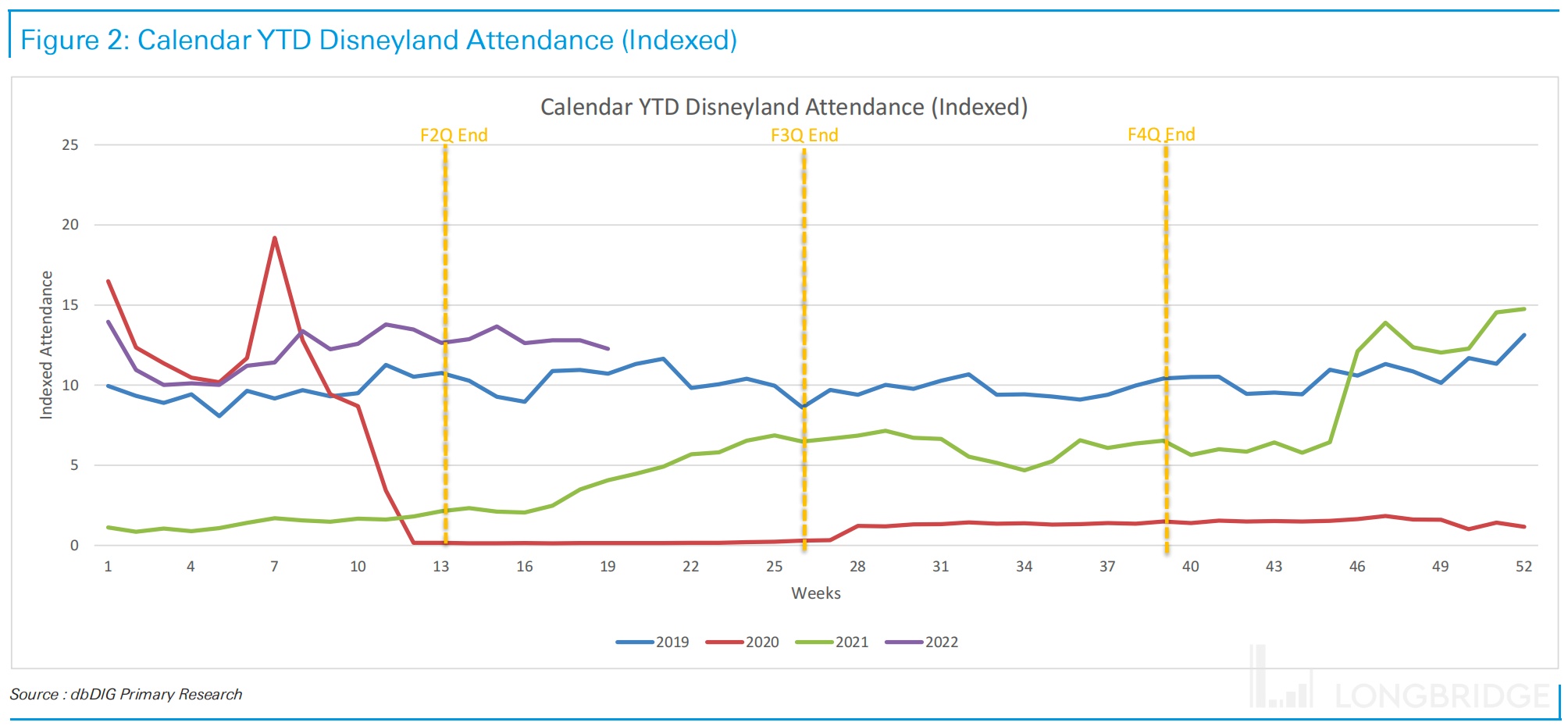

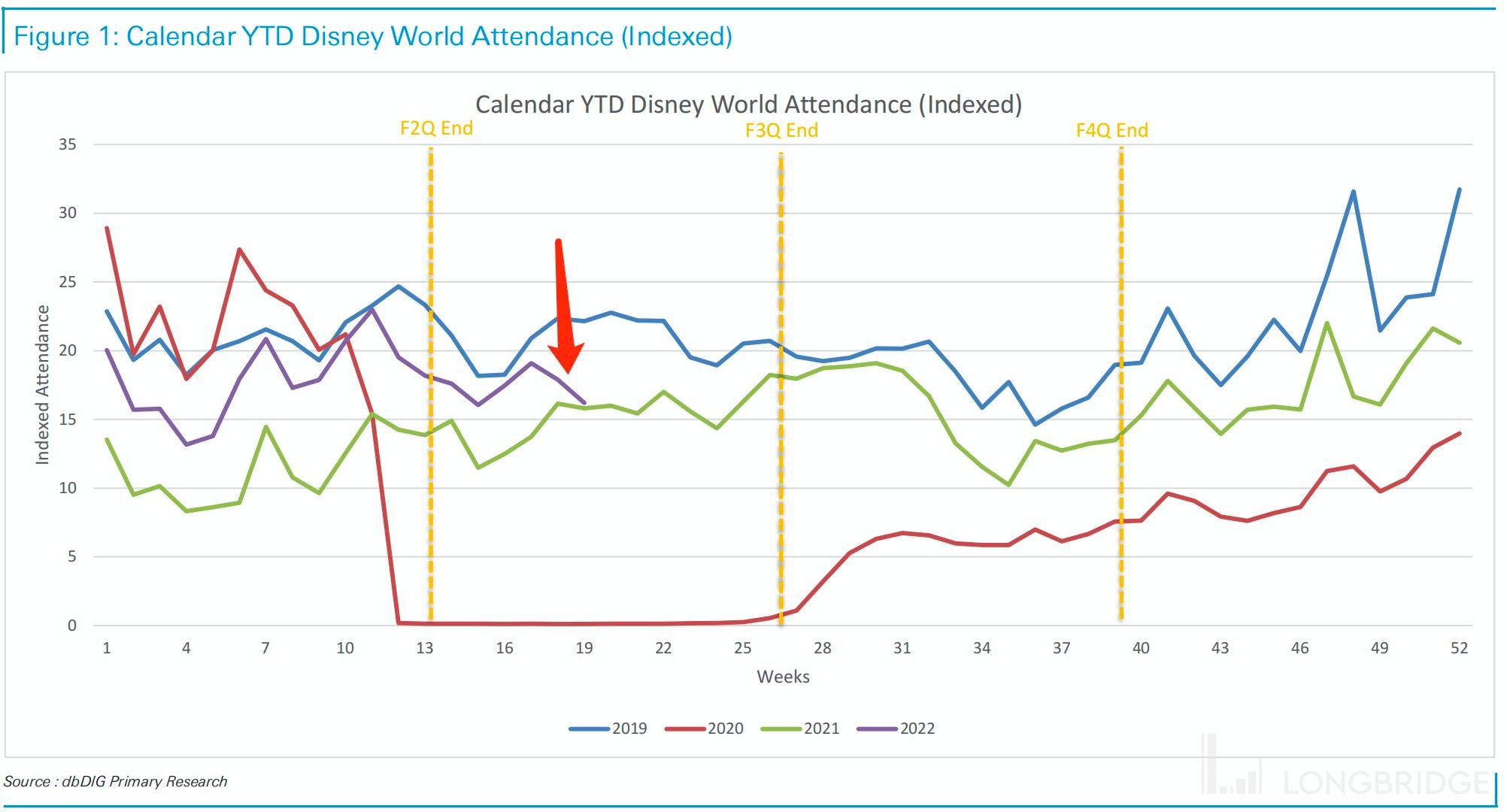

(1) The current capacity restrictions policy will bring future space release According to Deutsche Bank's continuous tracking of the admission situation at Florida Disney and California Disney, the current visitor admission levels are still higher than the same period in 2021, and California Disney has even exceeded the pre-pandemic levels of the same period in 2019. However, during the quarterly conference call (add assistant's WeChat ID "dolphinR123" for more information), management revealed that there are still capacity restrictions in place for the theme parks.

In late April, Disney completely lifted the mandatory mask requirement, but there hasn't been a significant increase in attendance at the two domestic theme parks in the United States. Meanwhile, Florida Disney experienced a noticeable decline in late May. Apart from the speculated deterioration of the relationship between Disney and the Florida state government (related to issues such as the "anti-LGBTQ bill" and the "Reedy Creek Improvement District" autonomy), another potential factor could be the impact of inflation, although further observation is needed to confirm this.

Dolphin will continue to monitor these indicators, as the potential impact of inflation is more worthy of attention compared to short-term frictional events.

Therefore, although management believes that the current trend of consumer demand for theme parks will be a long-term phenomenon, especially with the introduction of reservation services such as Genie+ to increase per capita spending and improve the profitability of the theme park segment, Dolphin believes:

a. The profitability in the past two quarters has already reached a relatively ideal level in the medium term, so it is appropriate to significantly slow down the optimization pace.

b. As capacity restrictions continue, if the impact of inflation begins to manifest in per capita spending levels, in the short term, it is still possible to compensate for and reduce the potential growth slump in revenue by opening more attractions, such as the Guardians of the Galaxy roller coaster in the Epcot area, and releasing more capacity.

(2) After two years of silence, Marvel's return is still popular

From the global box office success of "Spider-Man: No Way Home" in the fourth quarter, which grossed $1.9 billion and topped the 2021 box office charts, to the record-breaking opening box office of "Doctor Strange in the Multiverse of Madness," achieving such results despite offline lockdowns and the slow recovery of cinema screenings, not only demonstrates the appeal of Marvel heroes but also confirms the strength of offline consumption.

With demand remaining high, Disney will release several major Marvel films this year, especially in the 2023 fiscal year, marking the start of a new cycle of Marvel products after a two-year hiatus since 2019. Therefore, there is hope that they can leverage the short-term recovery momentum to withstand the continuous downward pressure on the economy. 3. Adjustments to Different Business Expectations

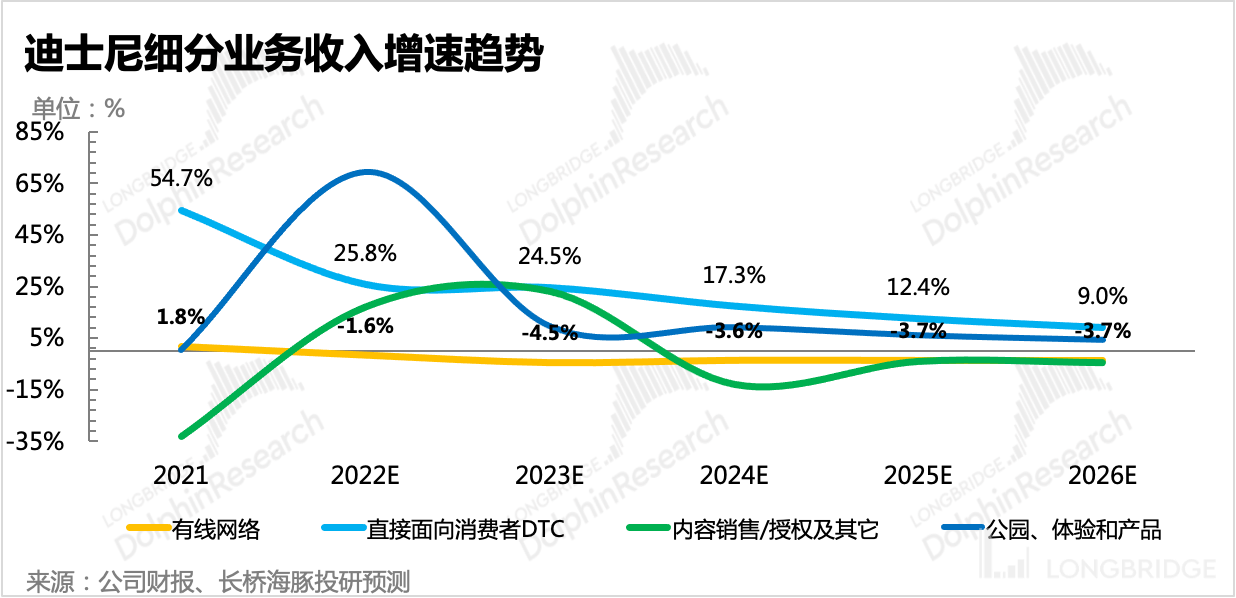

Based on the above logic, Dolphin has made the following adjustments to Disney's four major business expectations, in order to reflect the short-term changes in Disney's business and the inflation risks in the macro environment:

(1) Streaming Media

a. Considering the expected launch of an advertising package version in the second half of the year, the expected number of Disney+ users has been increased, with a minimum target of 235 million by 2024.

b. The pace of cost optimization will be further slowed down, and the content arms race will continue until 2024.

(2) Theme Parks

a. The average per capita spending for the fiscal year 2023 has been lowered to reflect the weakening of demand due to inflation.

b. Compared to the peak in 2019 before the pandemic, the recovery progress of domestic park visitor traffic will be accelerated to reflect the subsequent relaxation of crowd control policies.

(3) Film and Entertainment

a. The average box office revenue has been increased in the short term due to the intensive release of Marvel movies. Considering that some films will be exclusively released on streaming media, the long-term growth of average box office revenue will slow down and be lower than pre-pandemic levels.

b. The revenue from external content licensing has been significantly reduced due to the exclusive release of content on streaming media.

(4) Media Networks

a. With the expectation of economic downturn, the growth rate of advertising revenue for the next two years has been further lowered.

b. Due to the increased bargaining power for content copyrights, the content cost rate has been raised.

Overall, both the growth-oriented streaming media business and the repair-oriented traditional business are in a high-growth period in these two years.

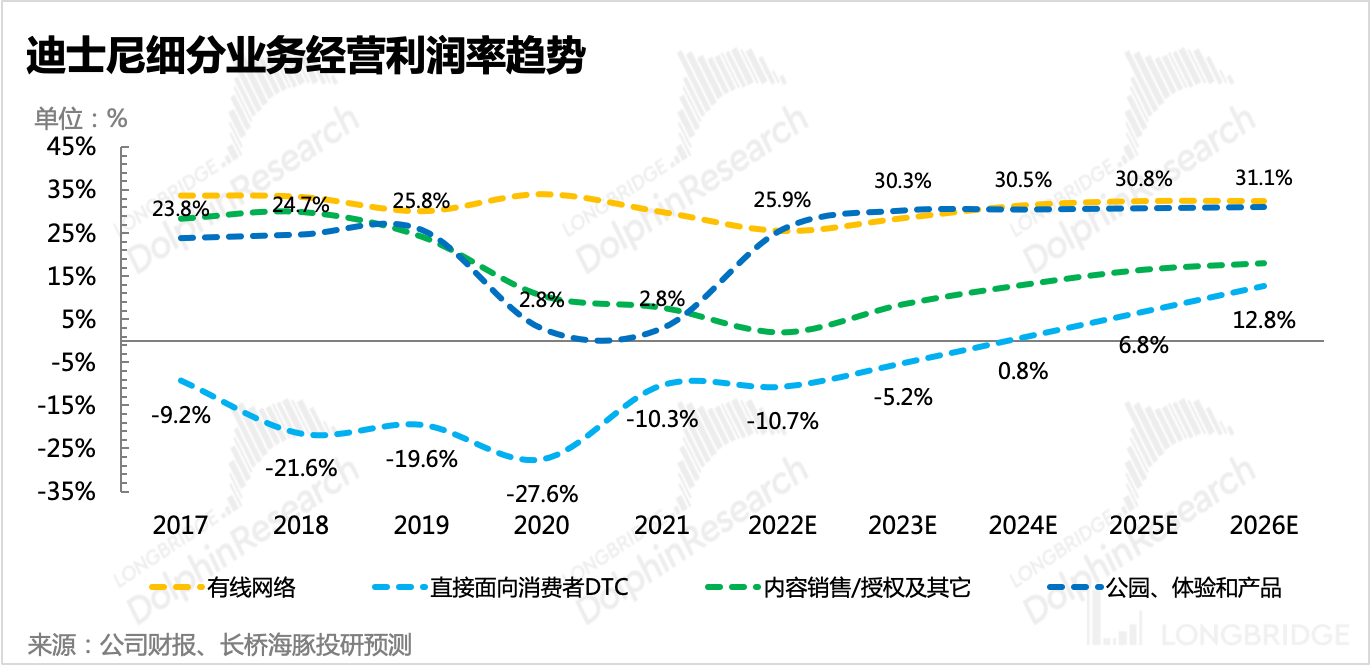

In terms of profitability, the streaming media business is expected to achieve breakeven in 2024, as the management expects. Other traditional businesses will also be restored to pre-pandemic levels as soon as possible in the next two years. Among them, the theme park business will have a higher profit margin under the optimization of product portfolio.

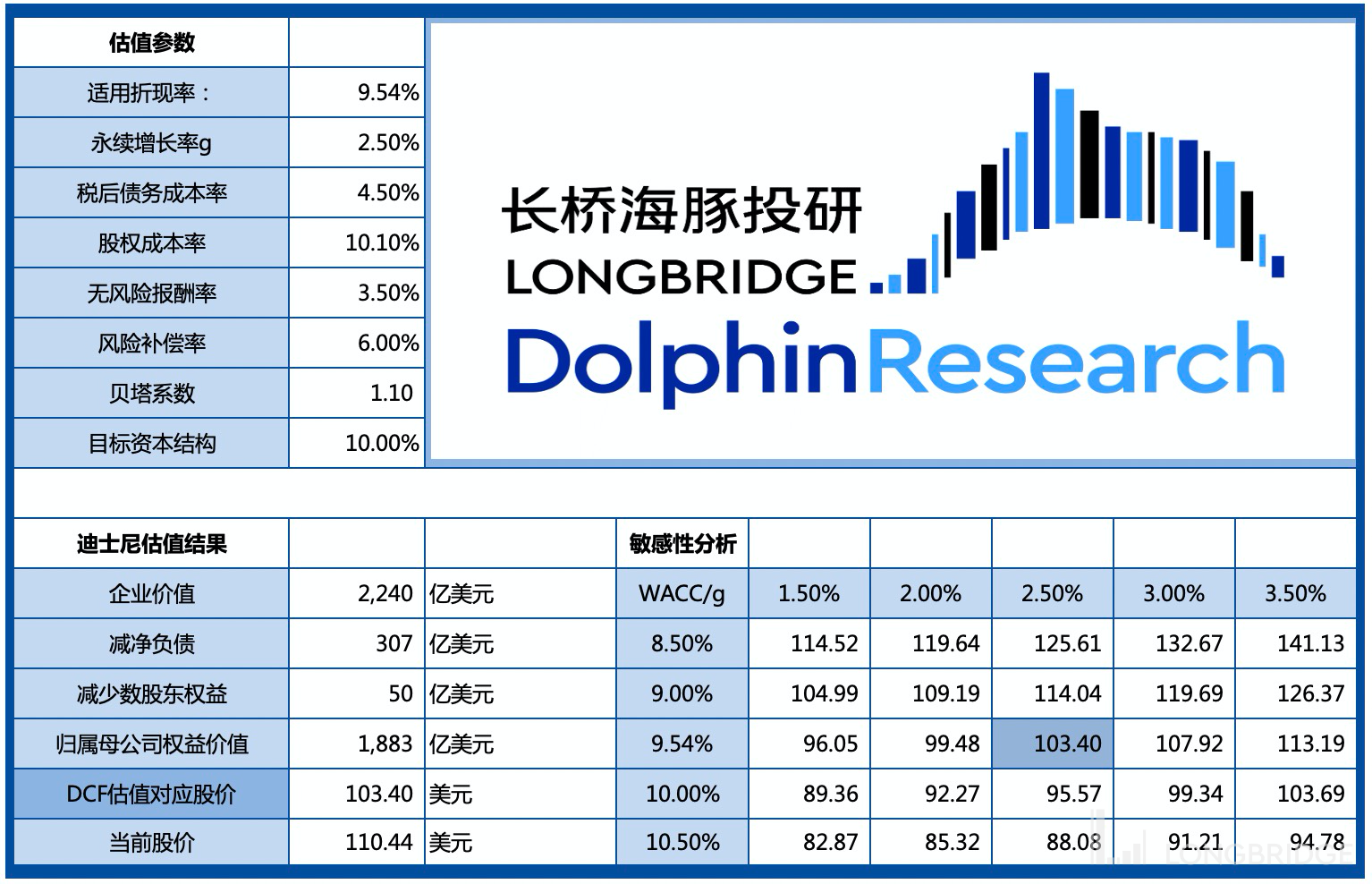

In the DCF valuation, considering the rise in the 10-year government bond yield, the risk-free rate has been increased from 2.5% to 3.5%. Under the assumption of WACC=9.54% and g=2.5%, the final valuation is $103 per share. In other words, the current stock price basically reflects the value under neutral and slightly conservative expectations. In addition to relying on the improvement of market sentiment, more premium will require continuous outperformance in performance to dispel market concerns about inflation impact.

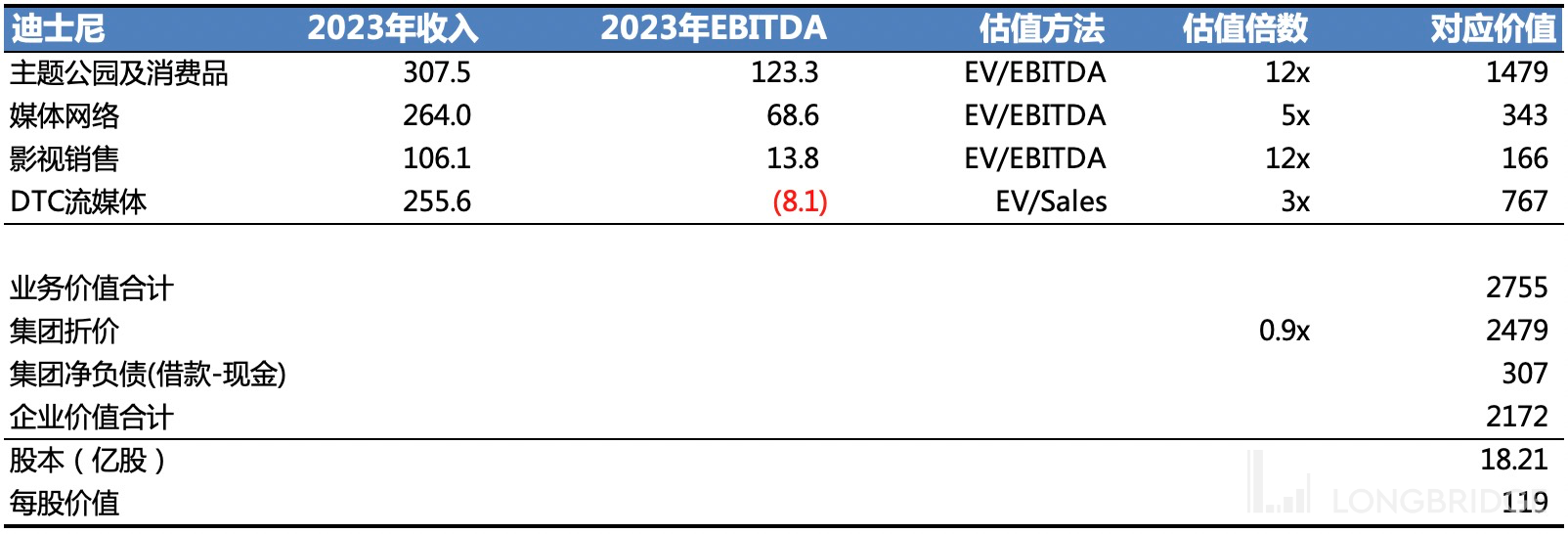

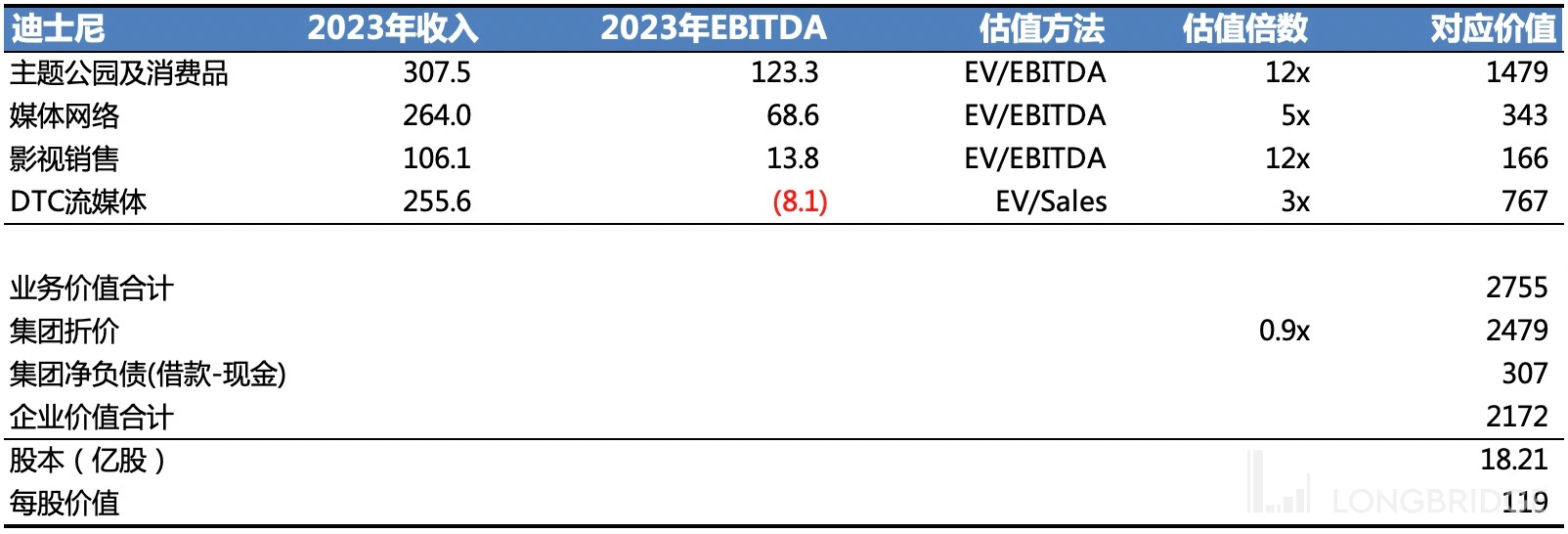

However, due to the significant cash flow loss in the early stage of the streaming business and the expectation that it will turn profitable after 2024, Dolphin used SOTP valuation to reflect the reasonable value of different businesses. The final valuation is $119 per share. Apart from adjusting the performance expectations, the valuation multiple of the streaming business was reduced from 6x to 3x, mainly reflecting the market sentiment towards growth stocks during the consolidation period.

Dolphin's "Disney" historical article review:

Earnings Season

May 12, 2022: "Disney: Accelerating Profits Release in Traditional Business, Striving to Support the Streaming Business"

February 10, 2022: "Entering the Content Cycle Gradually, Management Confident in Growth Targets (Disney Conference Call Summary)"

February 10, 2022: "Disney: Streaming Growth Regains Glory, Theme Parks Shine Even Brighter"

November 11, 2021: Conference Call "Disrupted by the Pandemic, Looking at Disney's Content Cycle in the Second Half of FY2022 (Conference Call Summary)"

November 11, 2021: Earnings Review "Sluggish Streaming Growth, Is Disney's Transformation Path Difficult?"

In-depth

February 16, 2022: "Overview of US Streaming: The Battle between Netflix and Disney+" 2021-11-13 "Long Video Battle is Coming: The American Version, Netflix and Disney are in Trouble?"

2021-10-10 "Disney: The "Anti-Aging Technique" of Centenarian Princess"

2021-10-15 "Can Disney, the Constant Dream Maker, Have a "Dreamy Valuation"?"

Risk Disclosure and Statement of this Article: Dolphin Disclaimer and General Disclosure