The dual business flywheel stops, SEA is deeply trapped in the pain period of transformation.

The $ Sea.US (Dolphin Group), which encompasses the three most valuable and monetizable internet businesses - gaming, e-commerce, and digital finance, was once regarded as the ultimate form of integration between "Tencent + Alibaba + Alipay" internet companies. It has high growth potential and a similar market space, making it a darling of the capital market.

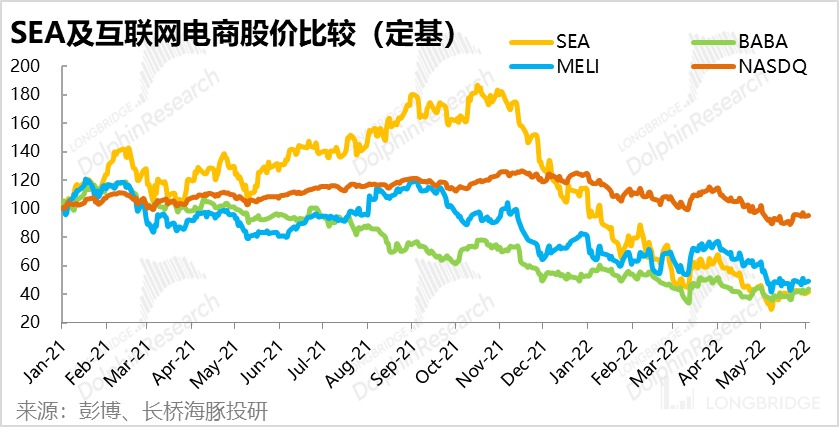

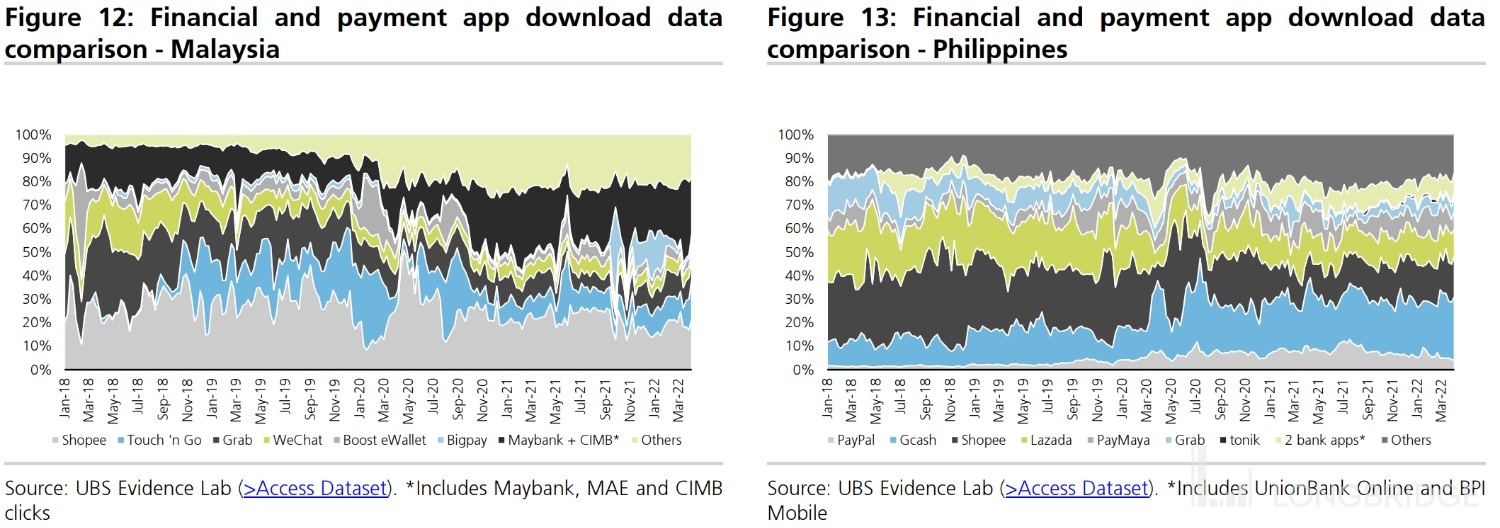

However, since the disclosure of the company's Q3 report in 21, SEA's stock price has been on a continuous downward trend. The reasons for this are twofold. Firstly, the company was previously overvalued, and after the liquidity and market sentiment declined, the valuation bubble burst. But fundamentally, the market's previous optimism about SEA was based on the core logic of using the cash flow-generating gaming business as the cornerstone, which rapidly grew the loss-making e-commerce business through large subsidies and cost-effectiveness strategies. However, with the Q3 report, SEA's gaming revenue growth rate rapidly slowed from 65% to 29%. The growth engine of using gaming to support e-commerce has begun to collapse, and this quarter's gaming revenue has declined. The dual business growth engine has basically collapsed. Due to the collapse of the core logic, the company's stock price naturally continued to plummet, reaching the valuation bottom line.

Currently, the key issues for SEA, in the opinion of Dolphin, are as follows:

① The current product line is thin and aging, and it is highly likely that users and revenue will continue to decline. Although the company has identified the problem and started to develop games in-house, the results of new games will not be seen until 2023-24 based on the current development progress.

② The rapid expansion of the e-commerce business will come to an end, and the focus will shift to improving profitability to alleviate the cash flow pressure caused by the decline of the gaming business. However, although the above-mentioned goals can be achieved by increasing monetization rates and reducing marketing expenses, it will also weaken the cost-effectiveness of the Shopee platform and its attractiveness to merchants and consumers. A development process similar to Pinduoduo's may occur, where cost control and profit release may lead to a rapid slowdown in e-commerce growth. If the growth logic collapses, what other core competitiveness does Shopee have to dispel market doubts? Cost reduction and efficiency improvement in e-commerce are more of a forced self-rescue measure.

Therefore, overall, SEA is currently in a painful period of transformation with no clear investment logic. The current valuation is only slightly undervalued and does not provide sufficient safety cushion. The best choice at the moment is to continue to observe.

However, when the following turning points are observed, SEA's investment fundamentals and stock price may experience a wave of recovery: ① In the new game product line, an unexpected "blockbuster" appears, bringing substantial revenue to compensate for the decline in Free Fire's revenue; ② Free Fire is allowed to re-enter the Indian market and maintains its previous popularity, bringing considerable revenue; ③ The profitability of Shopee's e-commerce business improves beyond expectations, and GMV growth does not significantly decline despite the decrease in subsidies or the increase in monetization rate. I. Garena Games: The Bitter Fruit of a Thin Product Line, Difficult to Reverse in the Short Term

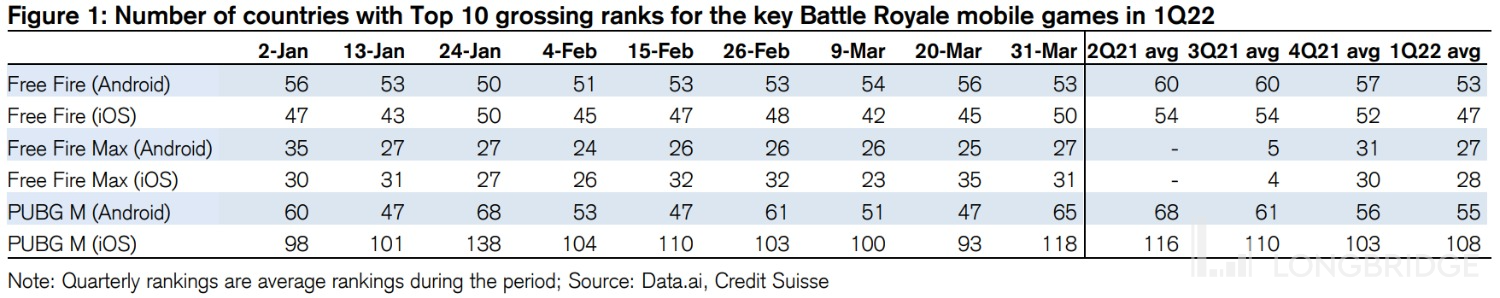

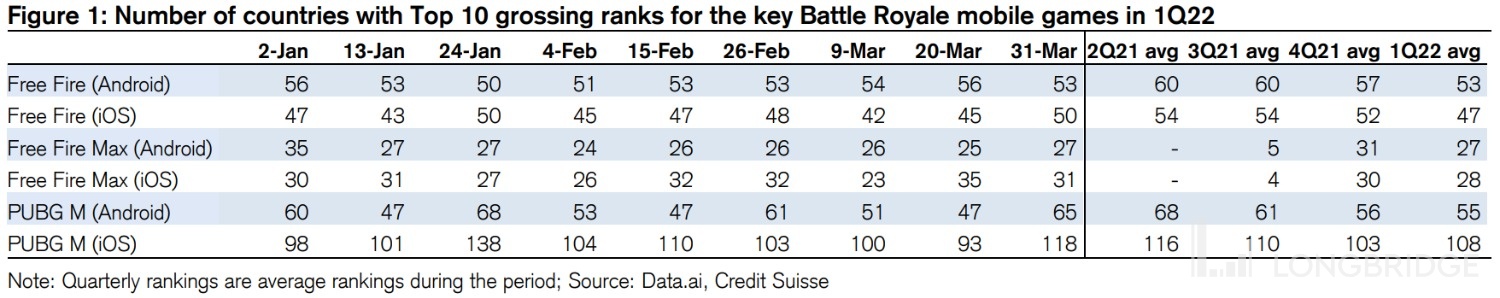

The core pain point in the current investment logic of SEA lies in the gaming and e-commerce dual wheels - the rapid loss of users and revenue contraction in the gaming business. We believe that the underlying reasons behind this are the macro factors of the fading of offline activities due to the epidemic, the reduction in money and time spent by residents on online entertainment after economic recovery, and the shifting user preferences of Southeast Asian players from battle royale games (Free Fire and PUBG) to MMORPG and action games. (As can be seen from the chart below, the popularity of FF and PUBG has been declining since 2Q21)

However, from the perspective of SEA's own strategy, Dolphin has always believed that the SEA game product line is relatively thin and overly dependent on a single game, Free Fire. Therefore, the existing games are entering the end of their product life cycle, and the lack of popular new games to fill the gap is the fundamental reason for the loss of users and revenue contraction in the company's gaming business.

As can be seen from the chart below, the games that contribute substantial revenue to Garena were all released before 2019 (except for the HD Max version of Free Fire). In other words, the company has not been able to launch successful new games in the past 3 years, bringing new blood and growth momentum to the aging product line. Therefore, as the existing games enter their 3rd to 5th year of the life cycle, it is inevitable that the heat will fade, players will be lost, and revenue will decline.

Looking at the new games released by the company in the past 22 years, they are mostly overseas releases of works produced by Chinese and Korean companies, and there has not been a blockbuster hit that can become popular across regions. However, Garena recently announced that it will release the multiplayer survival game Dawn Awakening, produced by Tencent's LightSpeed Studio, overseas. It is a high-quality work worth paying attention to its future promotion overseas.

In addition to the thin and aging product line, the lack of self-developed game capabilities is also a major drawback for SEA in the gaming business. Apart from Free Fire, most of SEA's existing and new games are developed by third parties, so the company itself has difficulty controlling the quality of the games and can only rely on the level of cooperation developers.

Furthermore, SEA's previous rise also relied on Tencent and its games' overseas distribution rights. However, with Tencent significantly reducing its stake in SEA, Tencent's priority authorized cooperation agreement with SEA will end in 2023, and Tencent also has the intention to directly enter overseas markets without relying on agents, thus competing with SEA. SEA itself also intends to break free from the "Tencent" gene in order to better internationalize. Therefore, the future cooperation between Tencent and SEA may not be as close as before, and the research and development capabilities of SEA itself will become even more important once it loses Tencent's enormous resources.

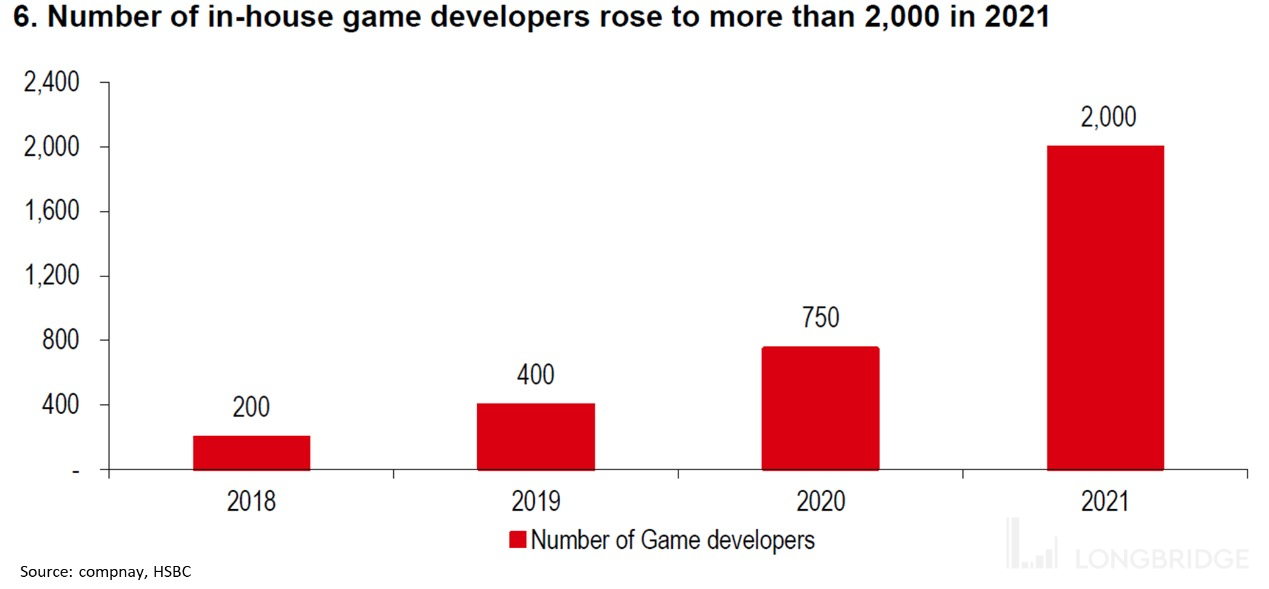

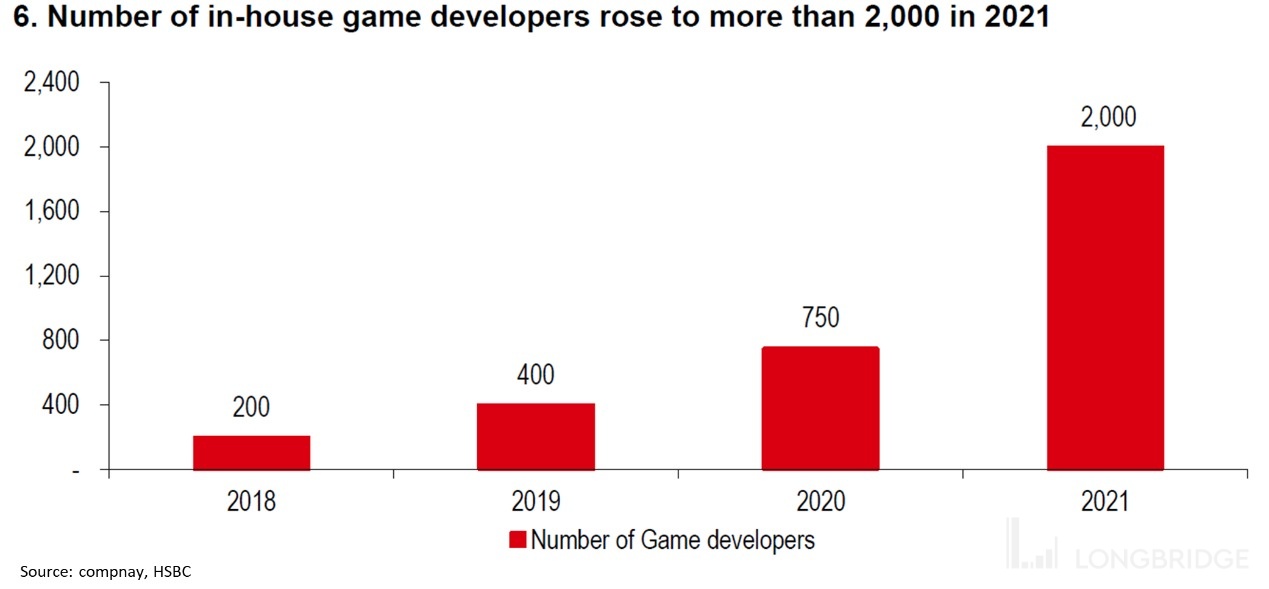

Of course, the management also recognizes the problems of product line aging and insufficient self-developed capabilities. The performance in the past few quarters has repeatedly emphasized increasing investment in self-developed games. According to the disclosure in the company's 2021 annual report, the company's game development team has doubled from 750 people in the previous year to 2,000 people.

However, up to now, the progress of the company's self-developed games is not fast. According to market research, SEA currently has a total of 8 major self-developed games. The fastest progress is a MOBA+RPG game similar to King of Glory, which is expected to be launched by the end of this year. The others are expected to be announced in 2023-2024.

Therefore, it is difficult to see the results of SEA's self-developed games in 1-2 years. The company's game business still relies on the current aging product line. The game revenue is unlikely to rebound significantly in the medium term, and due to increased investment in self-development, the profit level of the game business is also trending downward in the short to medium term.

2. Shopee e-commerce: Accelerating monetization and profit release, but at what cost?

Due to the weakening ability of the game business to generate profits, the management is slowing down the expansion pace of the e-commerce business strategically, focusing on improving profitability to reverse the trend of continuous expansion of the company's overall losses.

Dolphin believes that Shopee's previous exits from the Indian and French markets basically indicate that Shopee will not open up new markets in the short to medium term, and will focus on market share and monetization capabilities in Southeast Asia and South America.

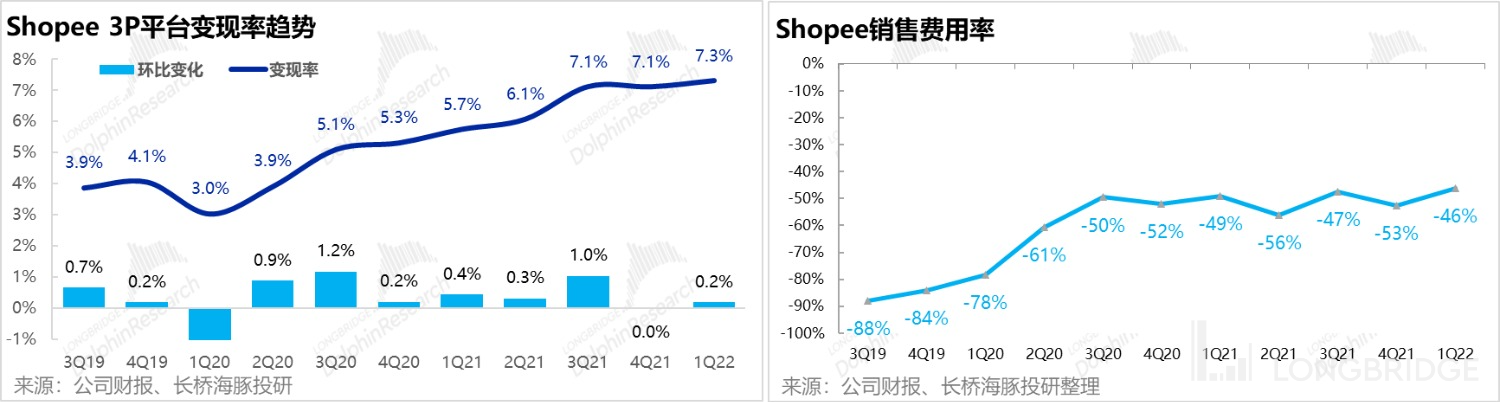

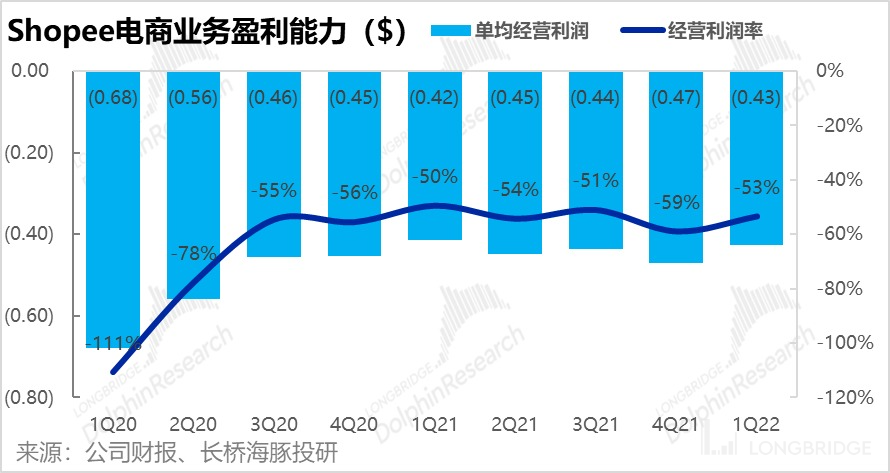

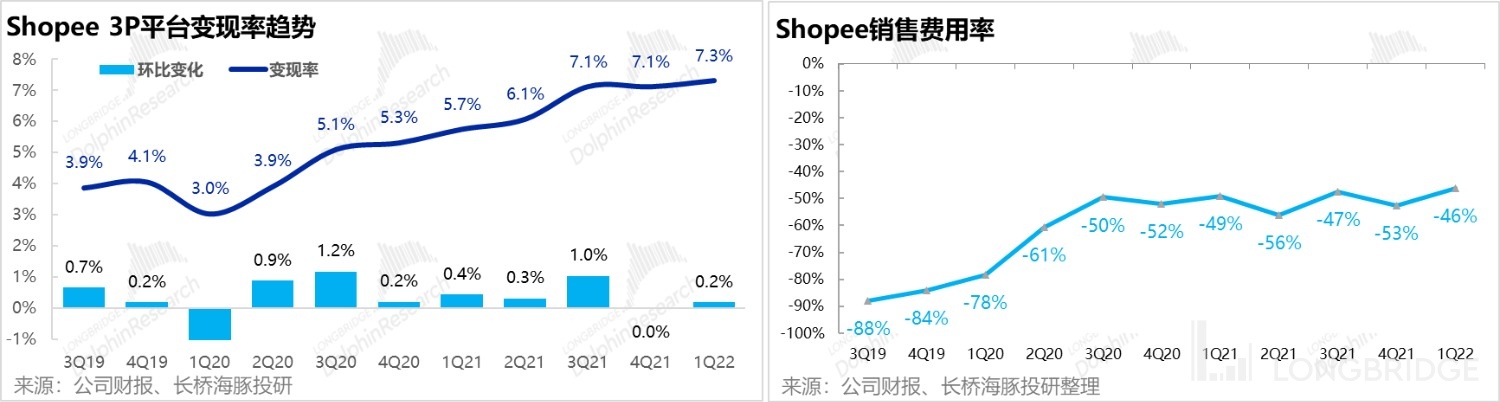

As can be seen from the chart below, Shopee's monetization rate has been steadily increasing, while the sales expense ratio has been continuously narrowing. It clearly shows us the strategic direction of the company, which is to reduce marketing and promotion expenses such as user subsidies while increasing the commission rate charged to merchants in order to improve the profitability of the e-commerce business.

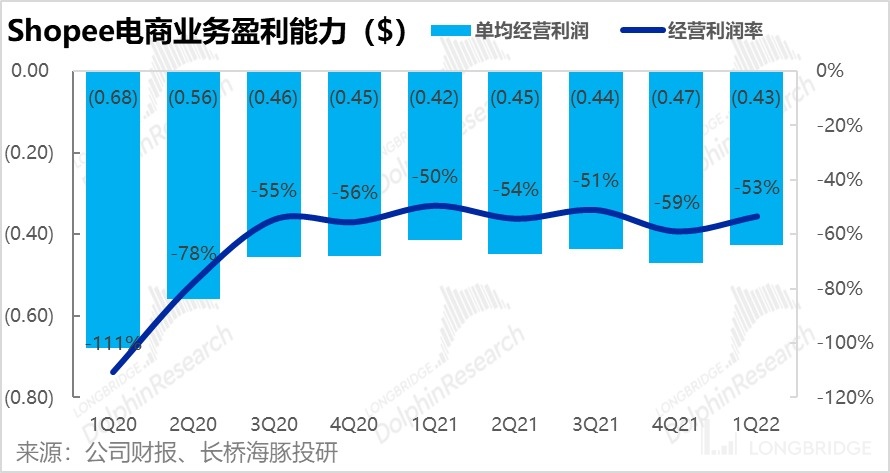

However, despite this, Shopee's average operating loss per order has fluctuated within a range since a significant improvement in 3Q20 and has not continued to increase. Therefore, Dolphin believes that if the company wants to substantially improve the profitability of the e-commerce business, it needs to aggressively increase the monetization rate or drastically reduce marketing expenses or management costs. However, while these operations bring profits, they will inevitably greatly weaken the "cost-effectiveness" characteristics of the Shopee platform, as well as its attractiveness to customers and merchants, resulting in further slowdown of revenue growth. Reference to the experience of Pinduoduo, another cost-effective e-commerce platform, after significantly reducing its marketing investment, although it did release considerable profits, the cost was a noticeable slowdown in user and GMV growth, as well as the collapse and reconstruction of valuation logic. Therefore, when paying attention to the operational progress of Shopee, it is necessary to simultaneously focus on its growth and profitability. If revenue slows down, investors will worry about losing the "cost-effectiveness" and wonder what core competitiveness Shopee has to maintain its market position. And if profitability does not improve, the company's expanding losses will be difficult to make up for, leading to chronic bleeding. Any of the above scenarios could trigger investors to vote with their feet.

III. SeaMoney Digital Finance: A rapidly advancing new business, can it become the company's savior?

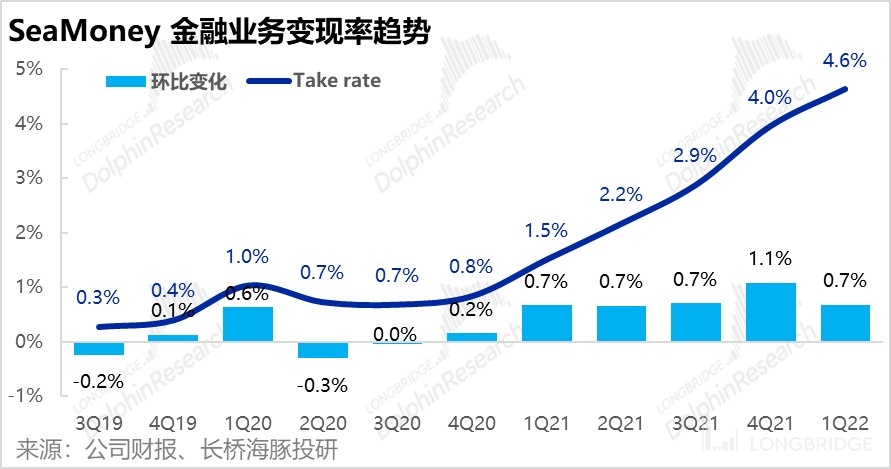

Amidst the overall gloomy performance of the company, SeaMoney's digital finance business, which maintains a high growth rate, is undoubtedly a highlight worth paying attention to. In the first quarter, revenue continued to soar at a YoY growth rate of 360%, and it is expected to contribute around $1 billion in revenue for the full year of 2022, accounting for approximately 10% of the company's total revenue, gradually transforming into the company's true pillar business.

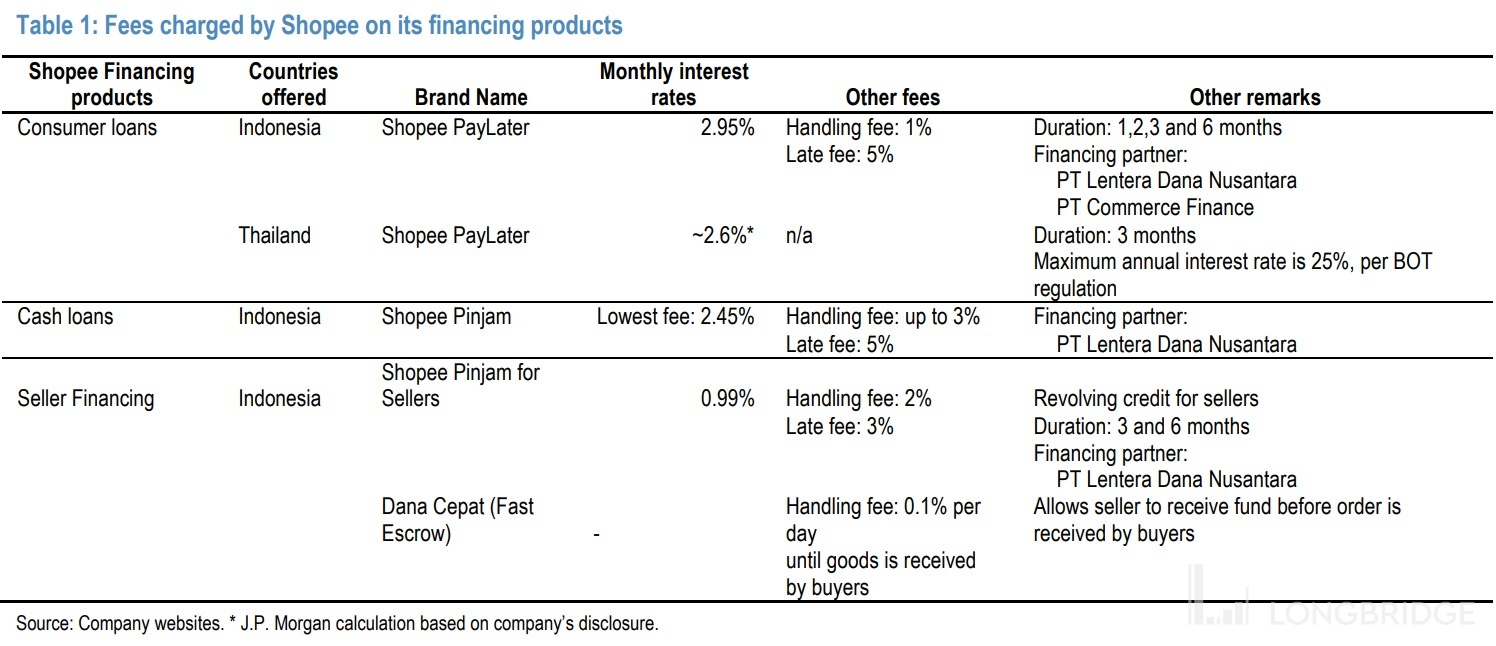

Specifically, SeaMoney's business consists of three main parts: ① ShopeePay, an online payment service similar to WeChat Pay; ② SpayLater, a Buy Now Pay Later service that is currently popular overseas (similar to Huabei in China, essentially short-term consumer loans); ③ Operational loans provided to Shopee sellers; ④ Comprehensive banking services provided through the acquisition of BKE Bank in Indonesia and the establishment of an online bank in Singapore.

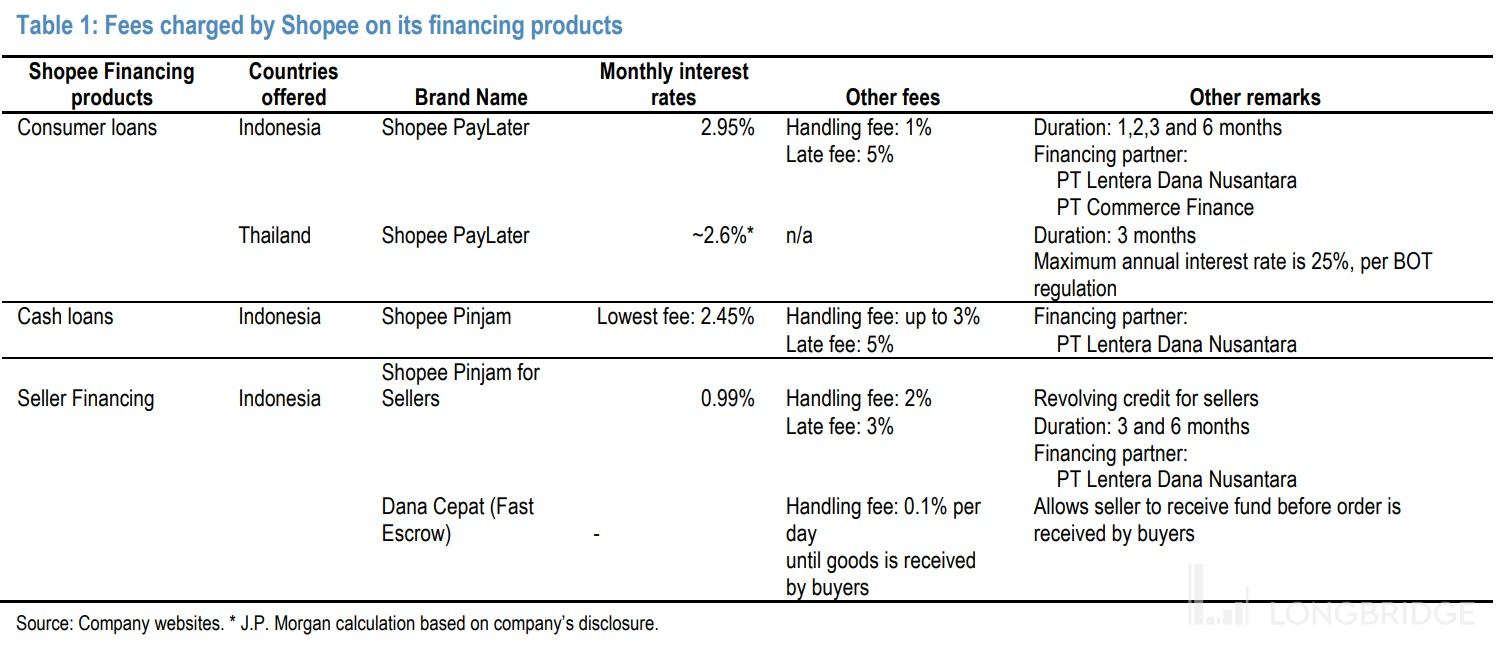

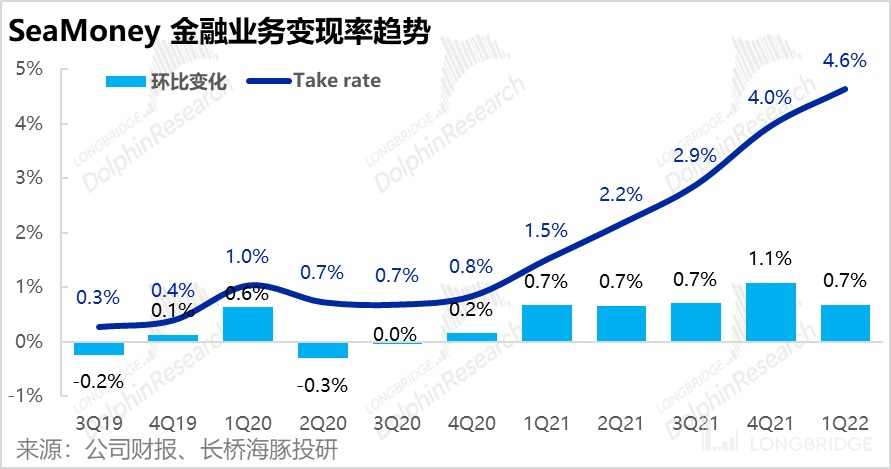

According to Dolphin's understanding, ShopeePay charges merchants a service fee of around 1%, while the monthly interest rate for the PayLater consumer loan business is around 2.5%-3%, in addition to a one-time service fee of approximately 1%. The cost of merchant operating loans is about 1% monthly interest rate and a one-time service fee of 2%. It can be seen that the monetization ability of the digital finance business is quite considerable. From this perspective, SEA's financial reports show that the monetization rate of the financial business, which continues to soar, still has considerable room for growth.

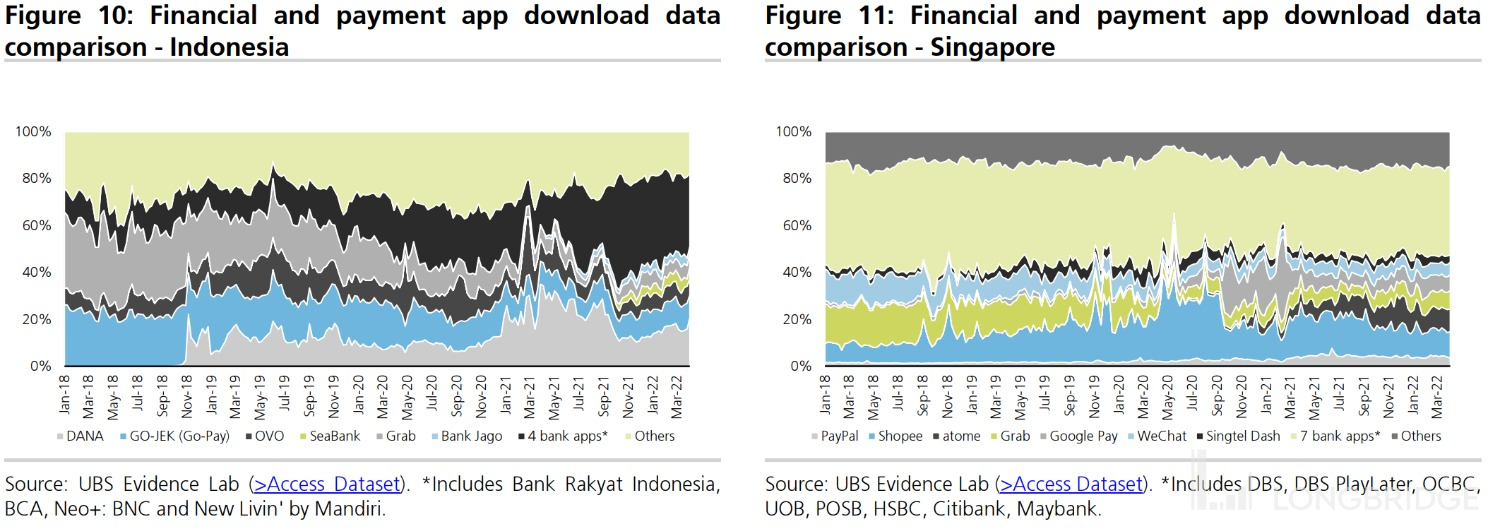

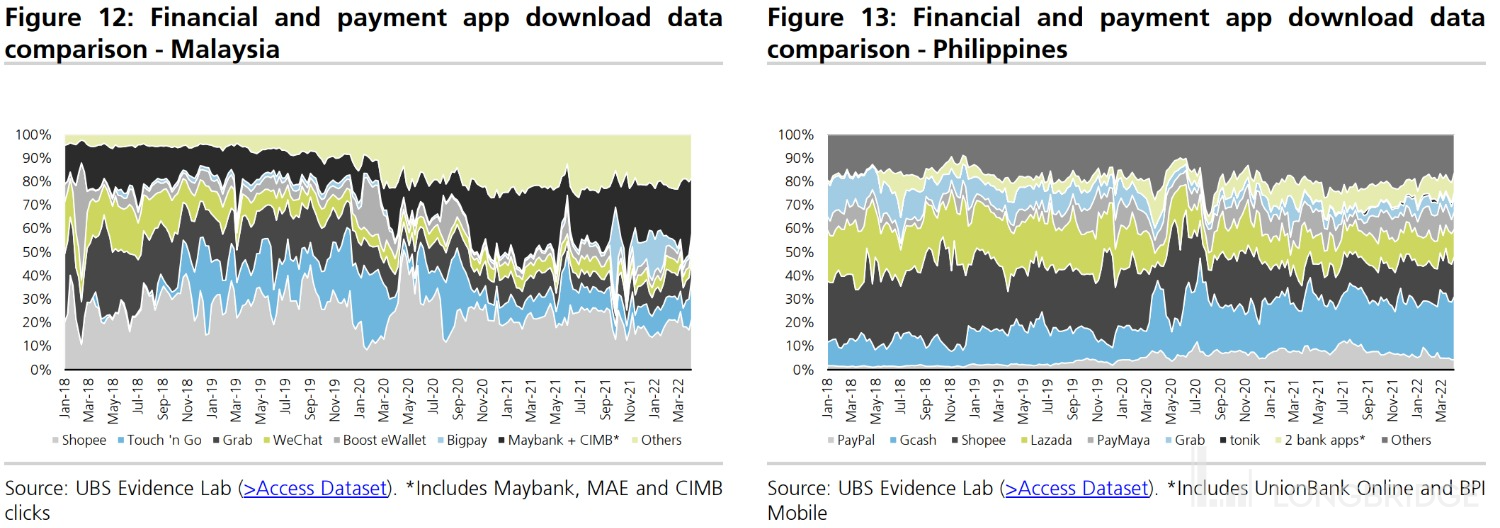

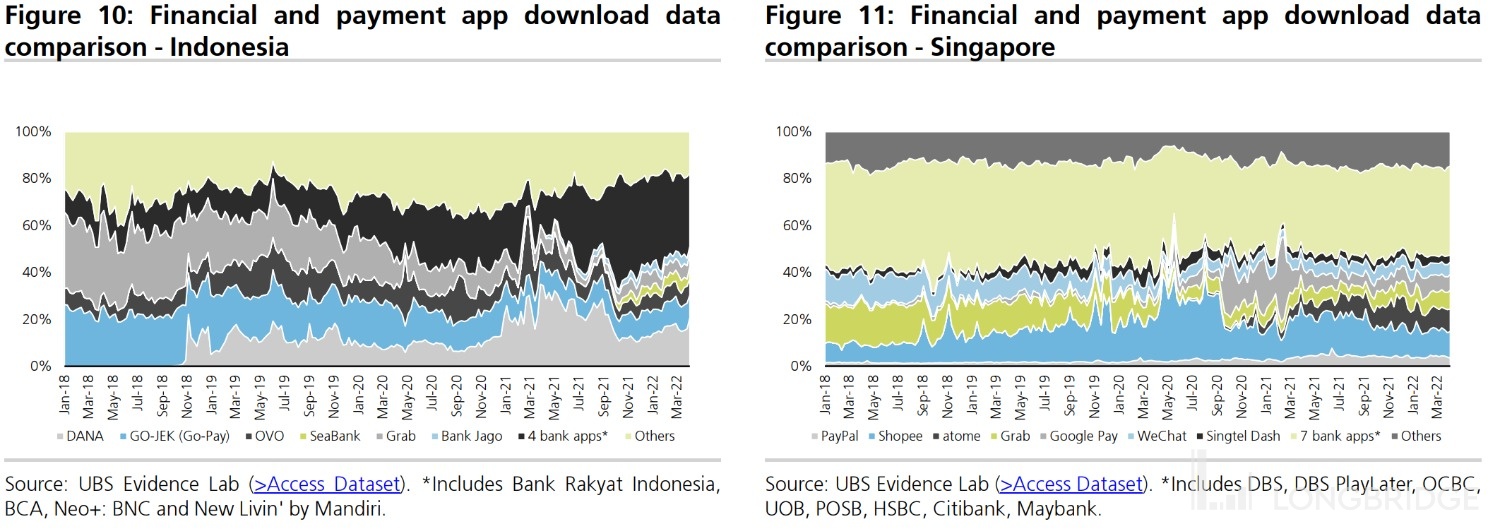

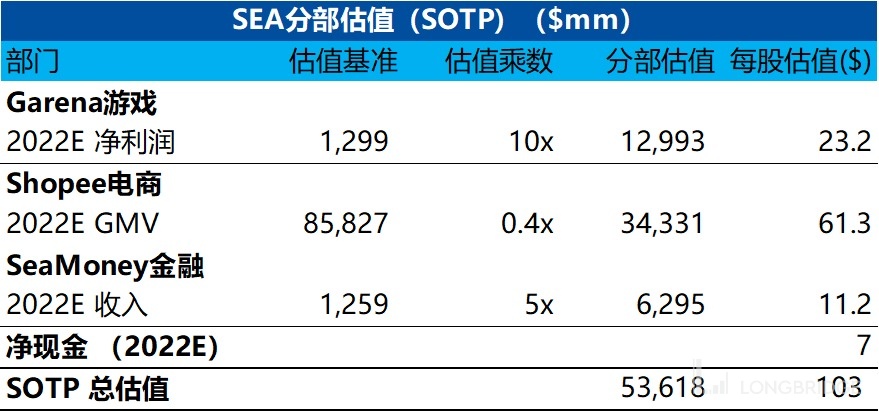

However, the digital finance business in Southeast Asia is currently in a state of fierce competition, with each country having its own dominant digital payment brands. There is no player with a clear advantage in the entire market yet, but it also means that each player still has a chance to emerge victorious. From a long-term perspective, currently, all players are still in the stage of diverting traffic from downstream applications (whether it's e-commerce, ride-hailing, or food delivery) to upstream payment software. However, considering the development process between Alipay and Taobao in China, once the business matures and the payment services have higher usage frequency and a wider user base, they will become important traffic diversion tools and operational barriers for downstream consumer applications. Therefore, the competition for payment gateways may be a key factor in determining the direction of the Southeast Asian internet market in the next decade. (The following figure shows the download share of online payment apps in various countries)

V. Valuation: Has the SEA bubble burst?

To summarize the previous discussion, SEA is clearly going through a period of transformation. The negative impact of the gaming business has not been fully released, the cost reduction and efficiency improvement in the e-commerce business are self-rescue measures, and it will take time for the digital finance business to truly grow. It can be said that SEA currently does not have a solid investment logic.

However, we also need to consider that SEA's stock price is no longer above $300 as it was before, but has fallen to around $80. Coincidentally, based on the price at the beginning of 2021, SEA, Alibaba, and Mercado Libre, three closely related e-commerce companies, have all returned to a similar level after experiencing different price curves. So, has SEA's valuation reached a safe boundary?

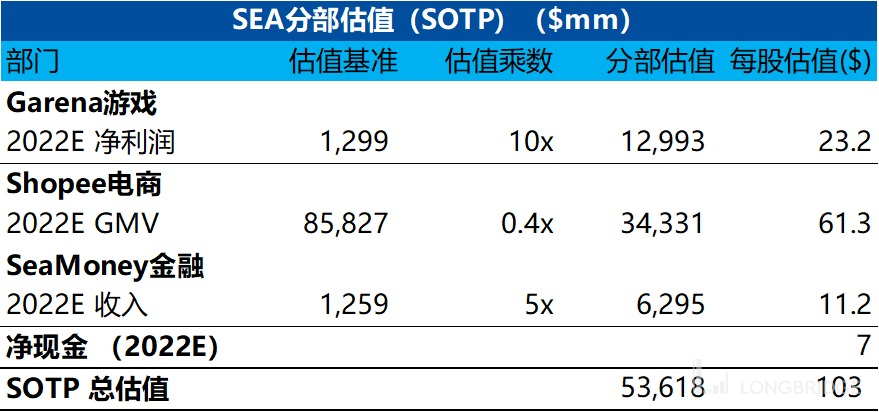

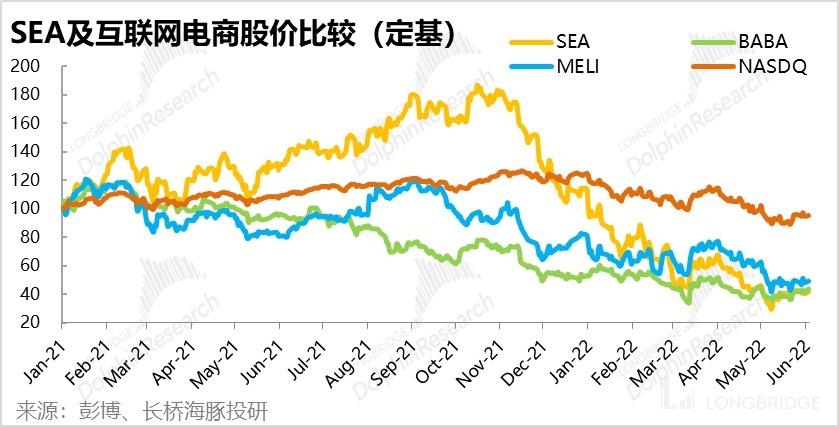

Since SEA is still in an overall loss-making situation, and it is difficult to predict when it will become profitable and there are significant uncertainties in its medium to long-term performance prospects, we currently only use the highest visibility 2022 performance as the valuation benchmark.

Firstly, for the gaming business, we take the estimated net profit for 2022, which is most likely the lowest point of its performance, as the basis and give it a valuation of only 10x P/E, considering the poor prospects of this business.

For the e-commerce business, we refer to the valuation multiple of Pinduoduo, a similar platform, which is 0.2x P/GMV. However, considering Shopee's better market position and higher growth potential, we give it a valuation of 0.4x P/GMV, equivalent to 4.4x P/S.

For the digital finance business, we refer to the current valuation of PayPal, a giant in online payments, which is 3.5x its 2022 revenue. Considering SeaMoney's higher growth potential, we give it a valuation of 5x P/S. After adding the assumption of net cash, the estimated valuation of Dolphin is around $103, which is about 19% higher than the current price. It can be seen that based on relatively conservative assumptions, the current valuation of Dolphin is relatively reasonable. However, considering the company's current high level of uncertainty, a 19% buffer is not safe enough. It is still advisable to wait and see. It would be a better investment opportunity if the company's fundamentals do not deteriorate further and a safety cushion of more than 30% can be provided, or if there is a turning point in the company's fundamentals/expectations with increased certainty.

Previous Research:

May 17, 2022 Conference Call: "Diversify Gaming Business, Profit from E-commerce Business (Summary of Dolphin Conference Call)"

May 17, 2022 Earnings Review: "SEA: Gaming "Aging", E-commerce Holding the Fort Alone"

March 2, 2022 4Q21 Conference Call: "Summary of SEA Conference Call: Strategic Reversal, Gaming and Entertainment Diversification, E-commerce Efficiency Improvement"

March 2, 2022 4Q21 Earnings Review: "SEA Wants to "Split": E-commerce and Gaming Have Different Fortunes"

January 10, 2021: "Is Southeast Asia Still the "Land of Dragon's Prosperity" for SEA?"

January 24, 2021: "Integration of "Taobao + Tencent + Alipay", The Ultimate Form of the Internet - SEA's Journey Beyond a Hundred Billion Dollars"

January 5, 2022: "Is "Little Tencent" Scaring Tencent's Little Brothers? This Matter is Different for Sea"

Risk Disclosure and Statement for this Article: Dolphin Disclaimer and General Disclosures