Is Bilibili, the Carnival, Going Back to Its Original Form?

After the Hong Kong stock market closed on June 9th Beijing time, Bilibili.US released its first-quarter performance for 2022. In early May, Bilibili announced its plan to make Hong Kong its primary listing venue (i.e., dual primary listing), and also updated its guidance for the first quarter, while disclosing some information about user growth during that period. Overall, the company took into account the impact of the COVID-19 outbreak in Shanghai and other parts of China in April, and lowered its expectations for revenue growth in advertising and e-commerce.

Subsequently, during the period from early to mid-May, as Bilibili's stock price plummeted by 25%, most of the market's expectations for poor growth in the first and second quarters had already been priced in. With the improvement of the COVID-19 situation in Shanghai in late May, along with the rapid lifting of restrictions and a shift in policy signals towards a more positive direction, Bilibili, which had experienced a significant decline in the short term, had the greatest potential for valuation recovery in this round of expectation reversal.

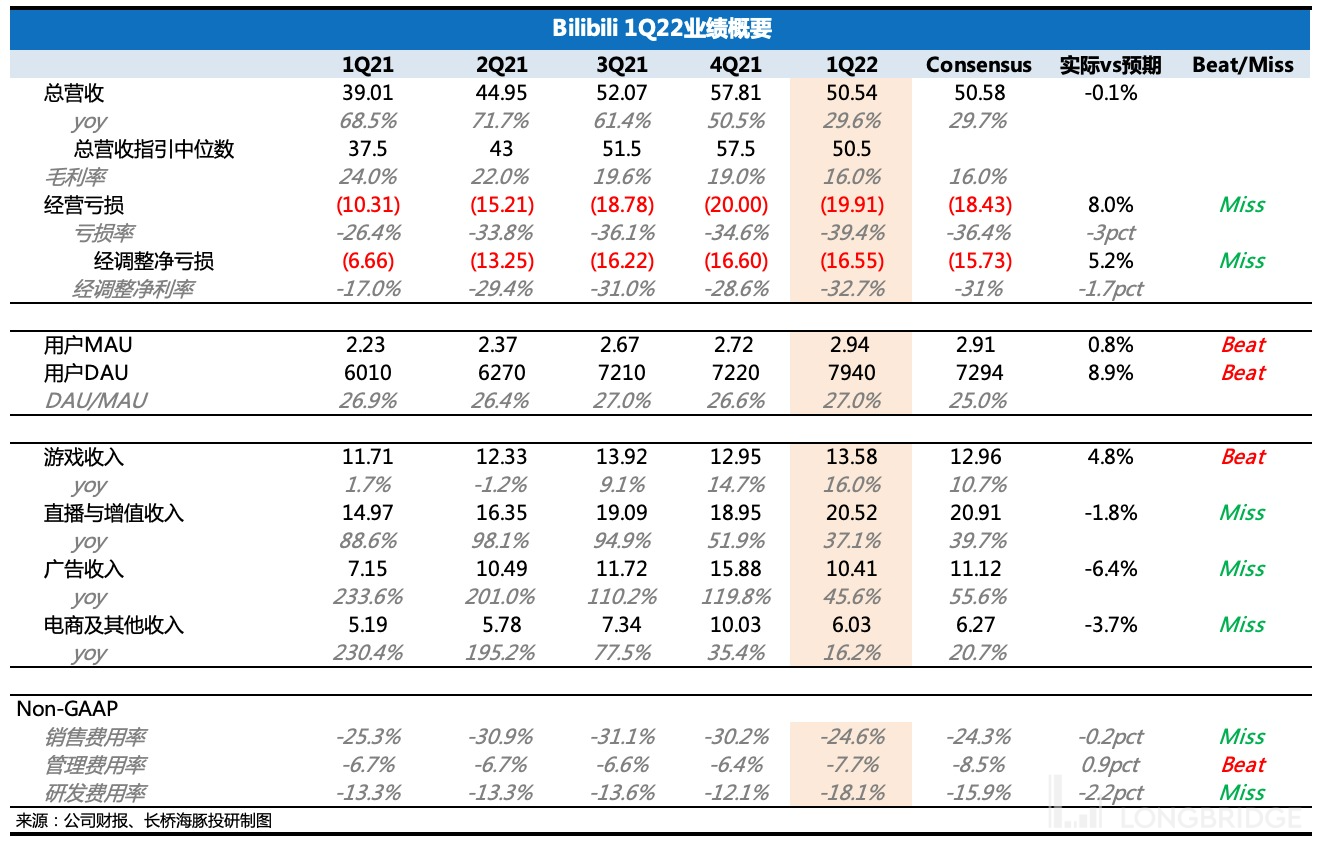

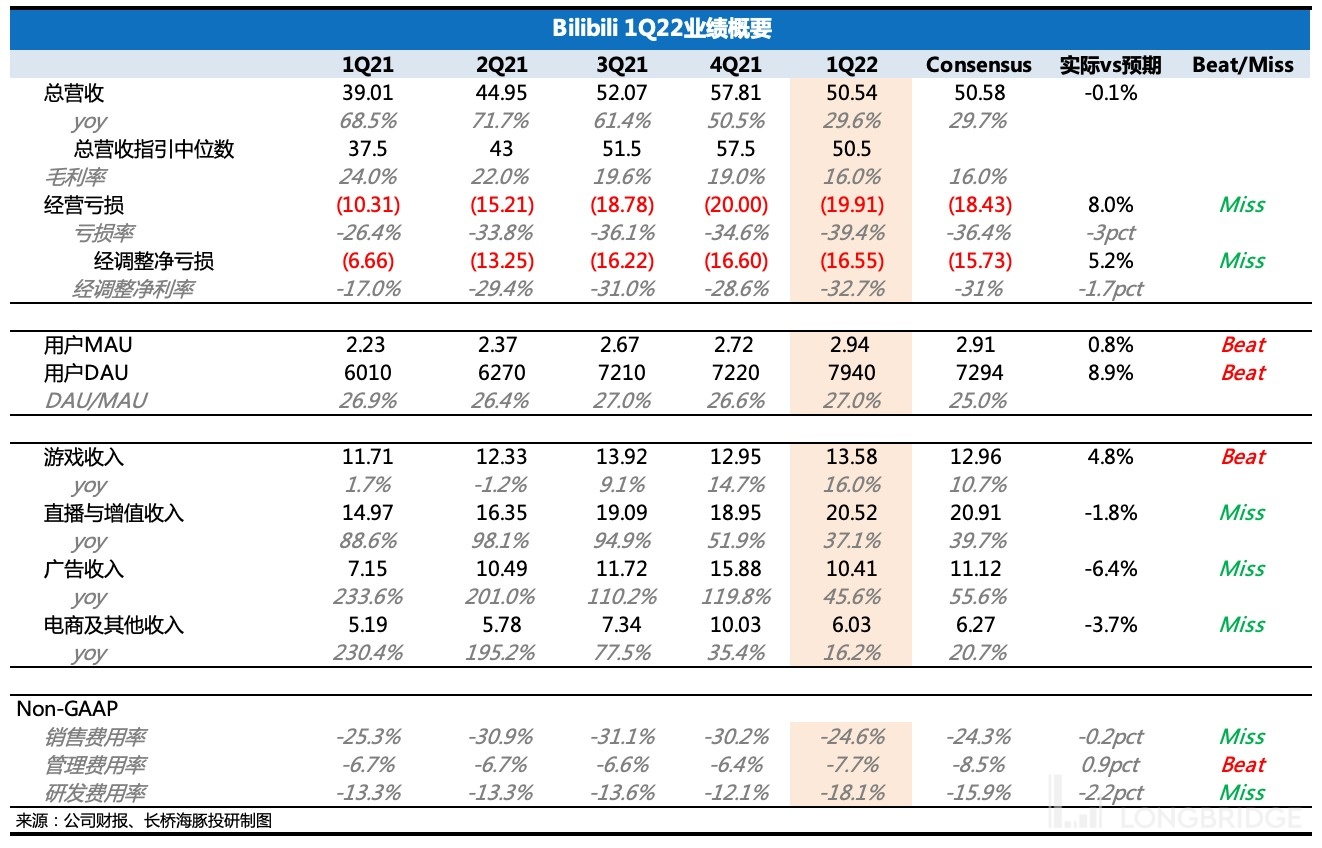

Turning back to the financial report for this quarter, apart from the user side, the overall performance was unsatisfactory compared to market expectations, mainly due to the lackluster effect of loss reduction:

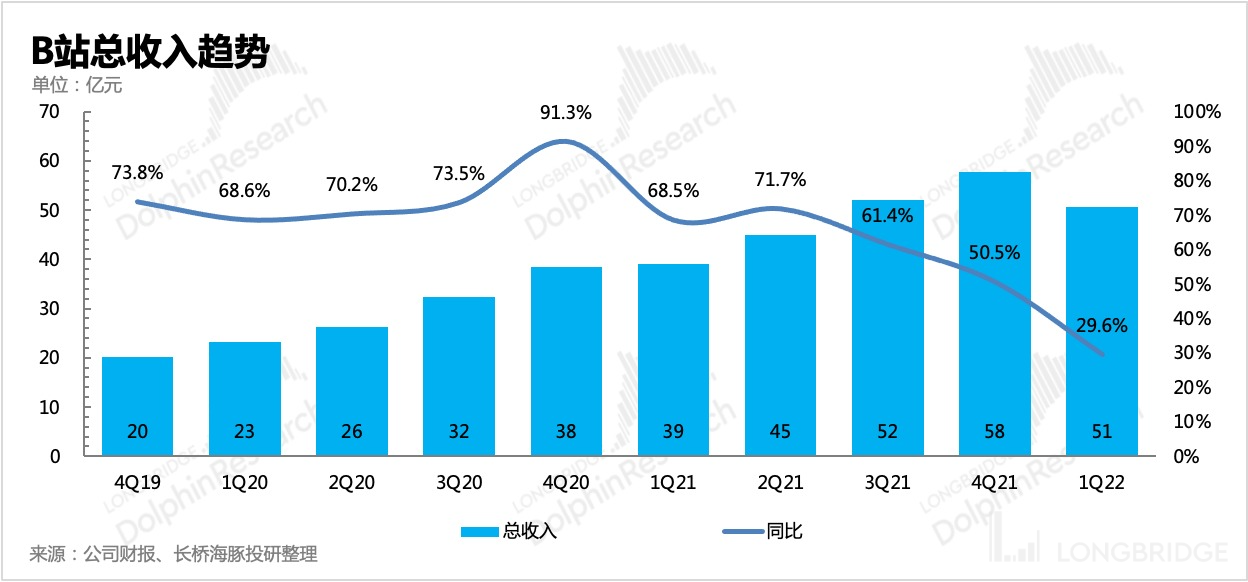

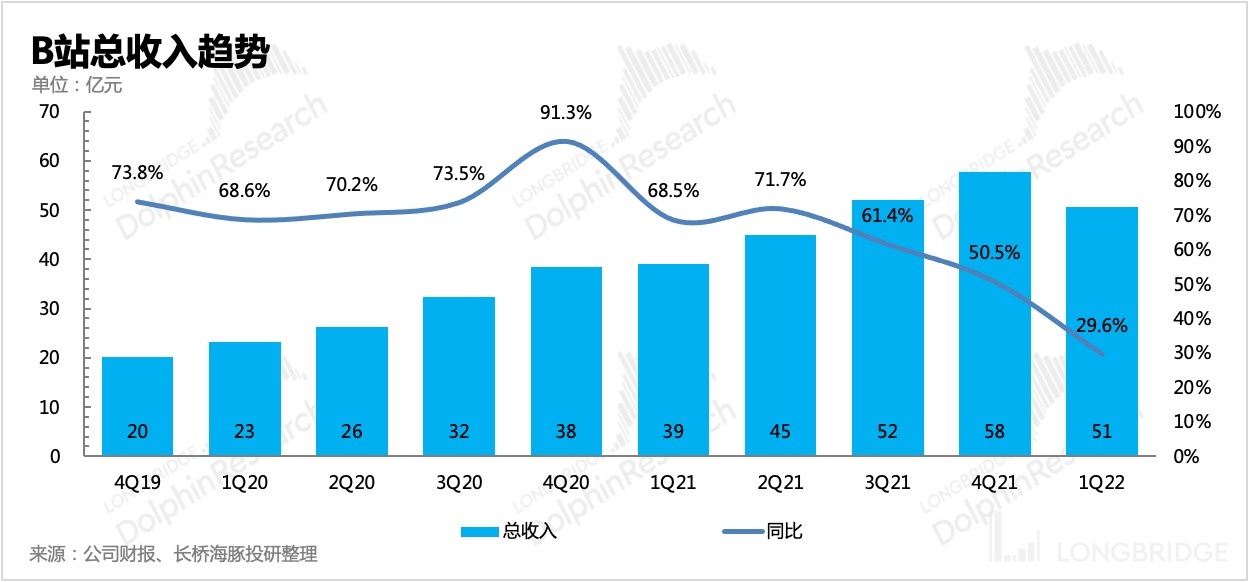

(1) Total revenue met expectations, with a year-on-year growth of 30%. The revenue guidance for the next quarter is between CNY 4.85 billion and 4.95 billion, slightly higher than the market's expectation of CNY 4.85 billion. In terms of business segments, the gaming segment exceeded previous guidance, while the growth rate of the e-commerce segment slowed significantly due to logistics disruptions caused by the COVID-19 pandemic.

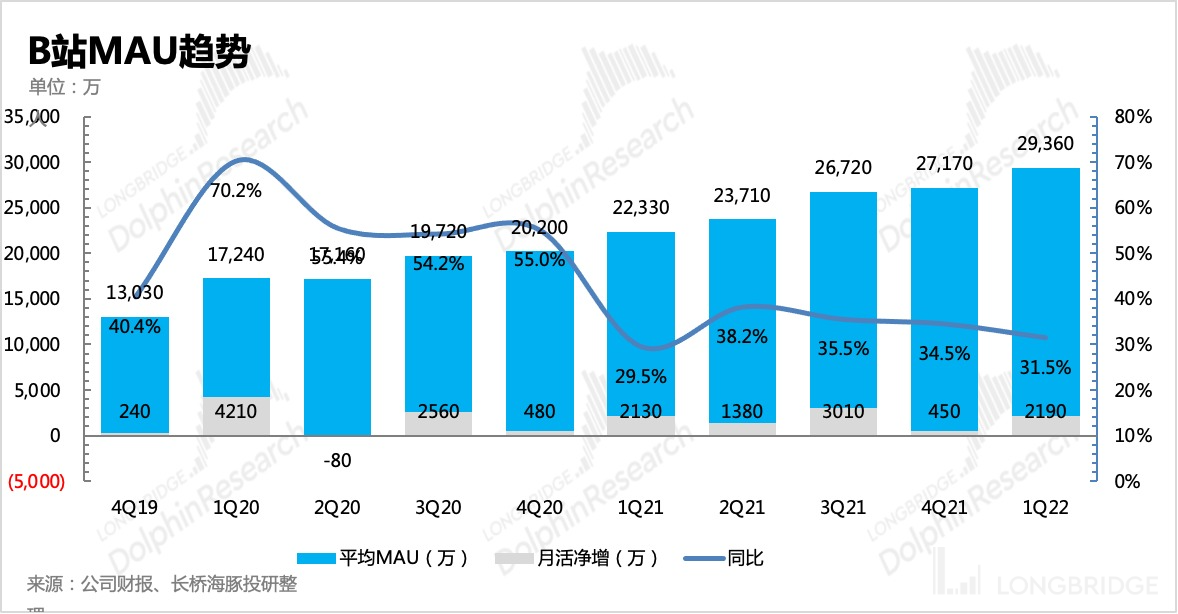

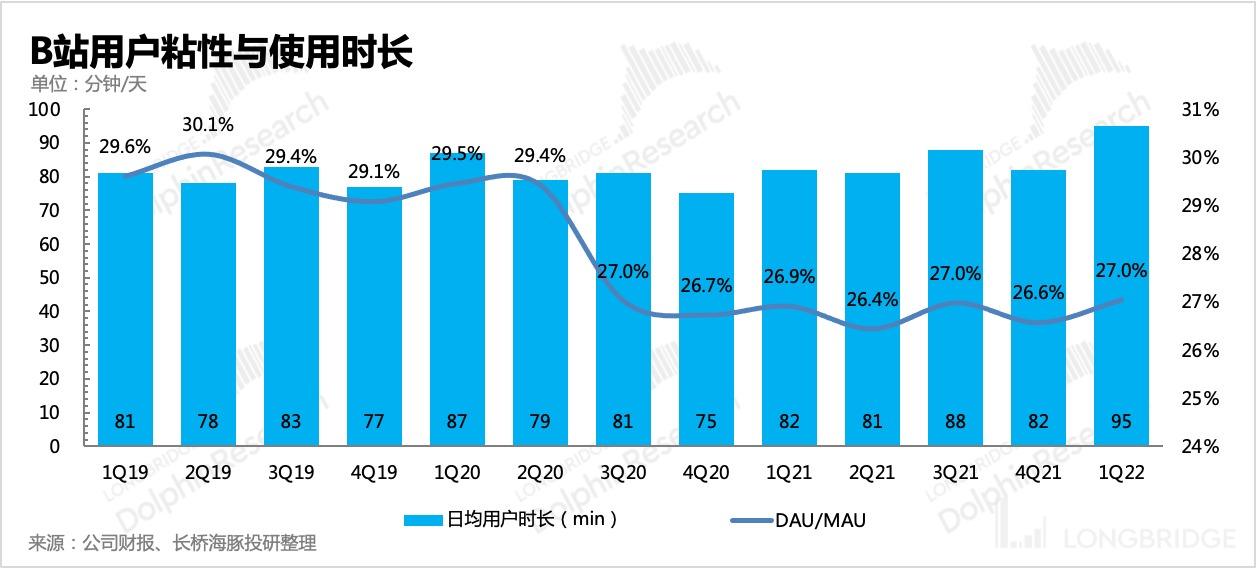

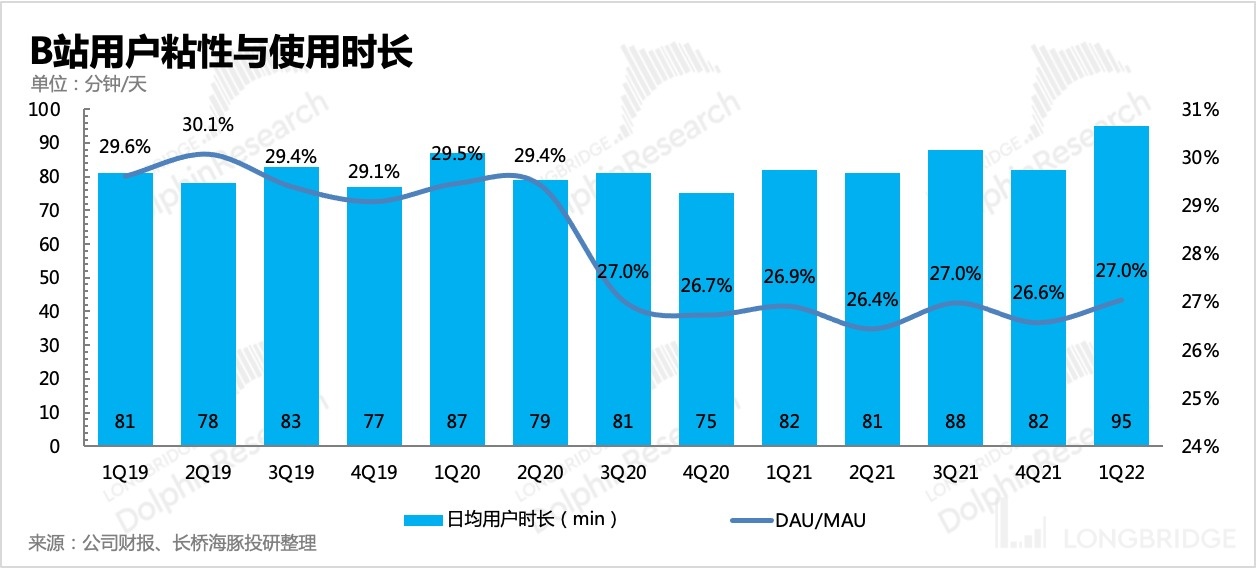

(2) User growth continued at a steady pace of 30%, with high-quality growth and improved user stickiness on a month-on-month basis. Additionally, due to the holiday effect, average daily usage time increased to 95 minutes.

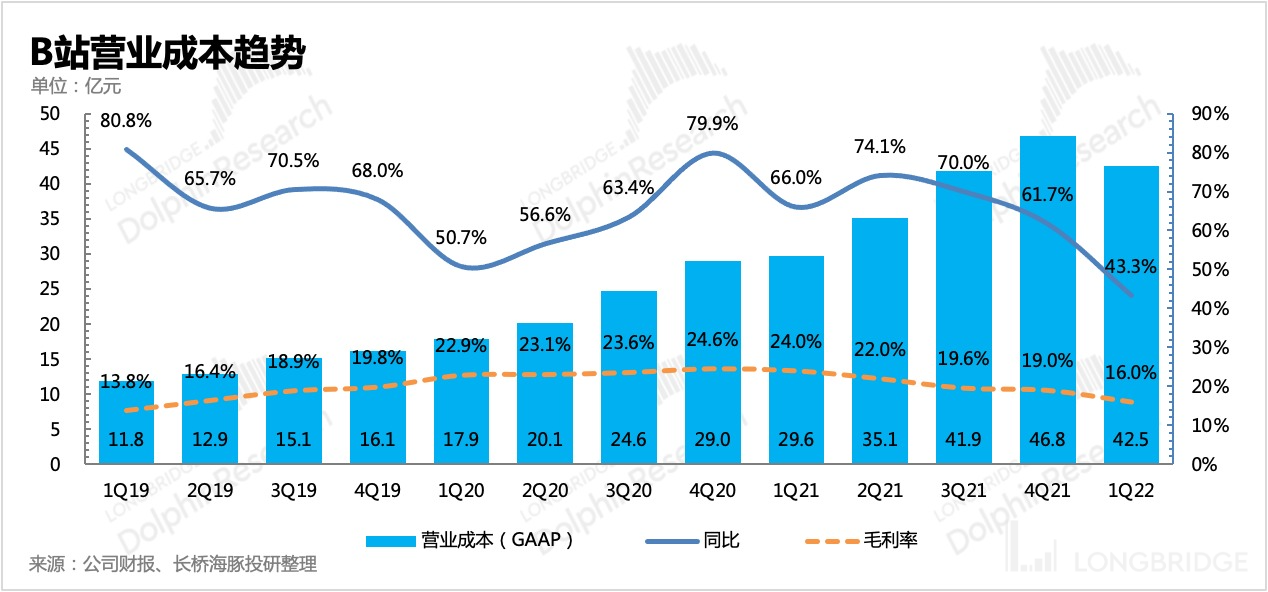

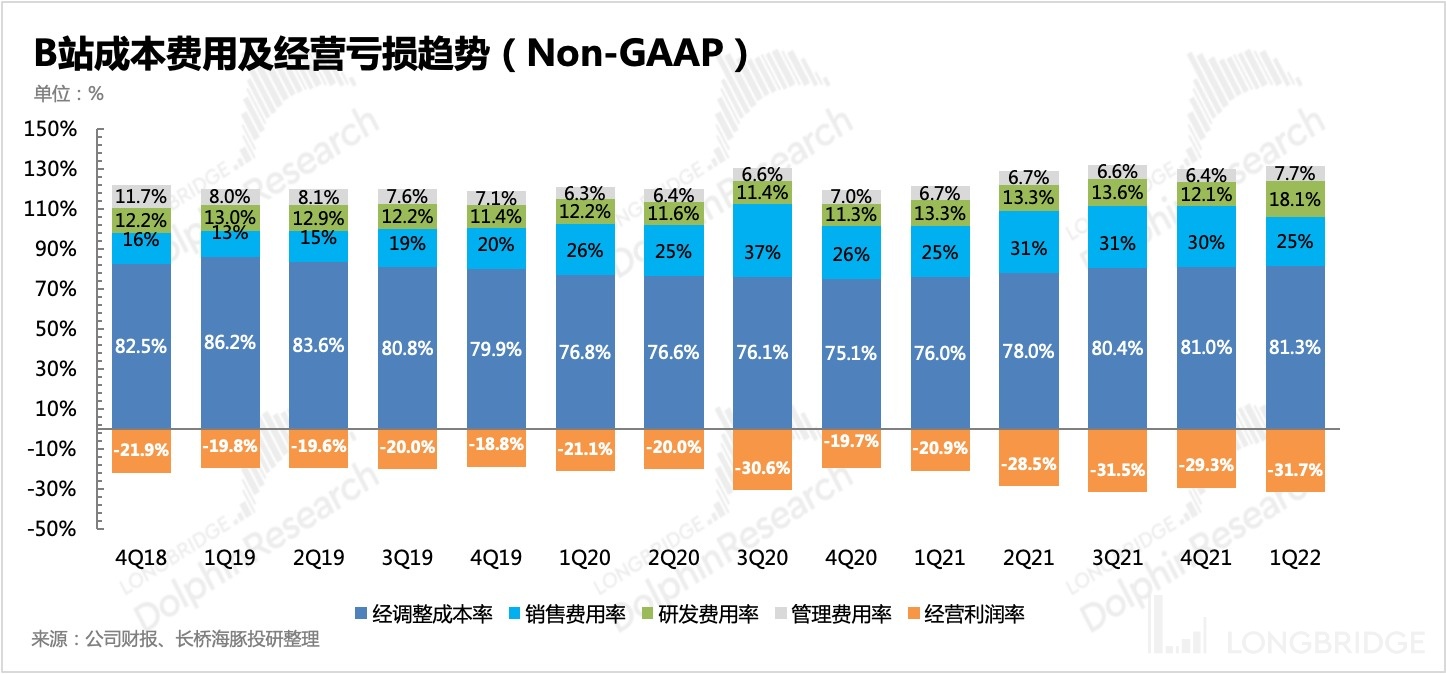

(3) The gross profit margin decreased to 16% due to the slowdown in advertising revenue growth, which is similar to the previous guidance.

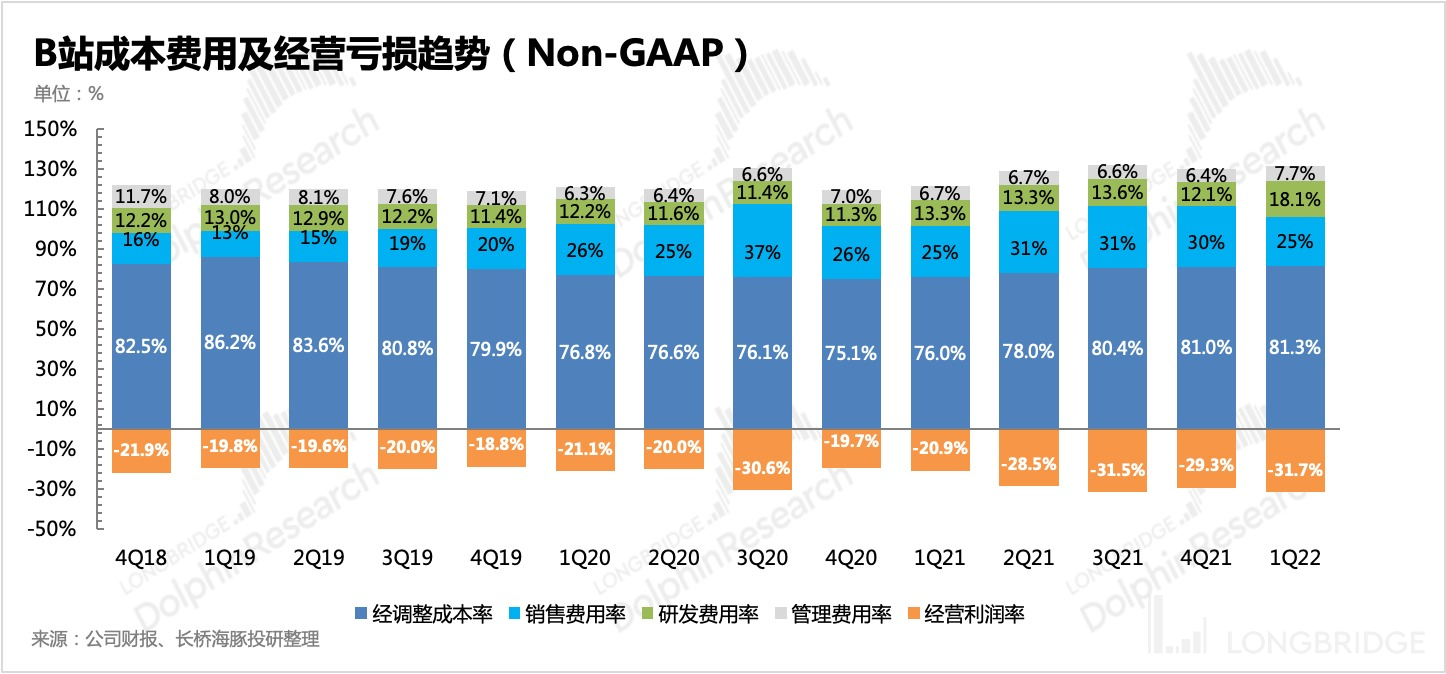

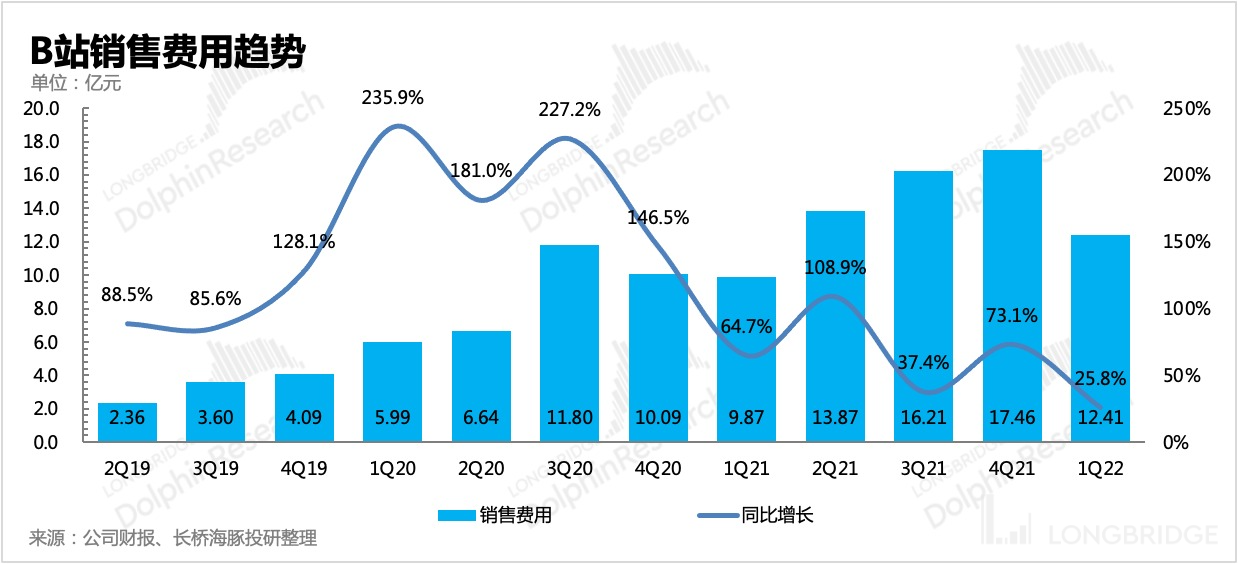

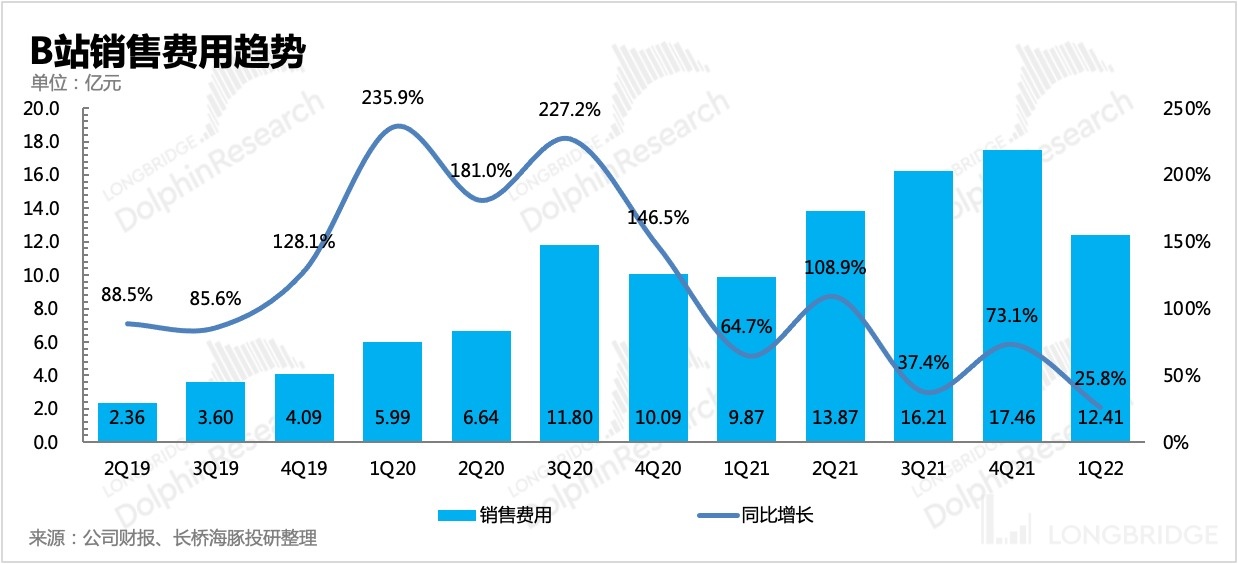

(4) Although there is no obvious optimization in the expense ratio, the growth rate of sales expenses has clearly decreased. The "high" marketing expense ratio is mainly due to the slowdown in revenue growth. However, research and development (R&D) investment is still expanding rapidly, which may be related to the inclusion of personnel expenses from the acquisition of gaming companies in the first quarter.

Although there was no significant improvement in the expense side in the first quarter, there have been frequent reports of significant optimization efforts by the Bilibili team since the second quarter, especially in the gaming business, which mainly corresponds to R&D expenses. It is expected that the high R&D expense ratio will gradually improve after the second quarter.

(5) The final result was a non-GAAP operating loss of CNY 1.713 billion and a net loss of CNY 1.655 billion, both of which are still expanding rapidly. The loss ratio was 33%, which was worse than market expectations.

Dolphin's Investment Research Perspective

Compared to the previous quarterly report, the first-quarter performance is clearly worse in terms of financial performance. While revenue and user growth were in line with market expectations, the loss situation is difficult to satisfy the market. However, the panic-driven decline in early May also presented a long-term opportunity worth considering. In addition, since the guidance was updated at the beginning of May, there have been several marginal changes regarding Bilibili, and it seems that signs of a turning point may be seen in the near future.

① Apart from the alleviation of external pressures (platform regulation, epidemic control);

② Whether it is from the management's guidance on growth and profitability in the past three years during the last quarterly earnings conference call;

③ Or the recent actions taken by Bilibili (official launch of immersive short videos, changes in incentives for content creators, team optimization, etc.), all undoubtedly confirm Bilibili's ability to alleviate concerns about its profit model while ensuring user growth.

④ Moreover, the early release of game licenses is also conducive to improving expectations for game growth.

Although the Dolphin has also mentioned that Bilibili's unique business model (heavy content sharing) has made it difficult for the platform to reduce costs and increase efficiency in this round of industry-wide efforts,

However, Bilibili is different from long videos that focus more on content assets. Due to the significant difference in bargaining power between the upstream parties (content suppliers) of the two platforms, Bilibili's medium- to long-term prospects will not be as bleak as iQiyi.

Therefore, the recent surge is more of a valuation rebound driven by speculation about policy relaxation and expectations of economic recovery. The real turning point in performance has not yet arrived, and there are still doubts about Bilibili's profitability in the market. The Dolphin believes that the current "profitability challenge" of Bilibili is fundamentally due to the rhythm and approach of commercialization, and although the road may be bumpy, we believe the destination will be beautiful.

Regarding the study of Bilibili and Kuaishou's profit models, due to space limitations, the Dolphin will write a dedicated article next week to discuss it with everyone. Stay tuned.

Detailed interpretation of this quarter's financial report

I. Revenue under pressure, losses have not improved

In the first quarter, Bilibili achieved a net revenue of 5.06 billion yuan, a year-on-year increase of approximately 29.7%, which is basically in line with management's guidance and market expectations.

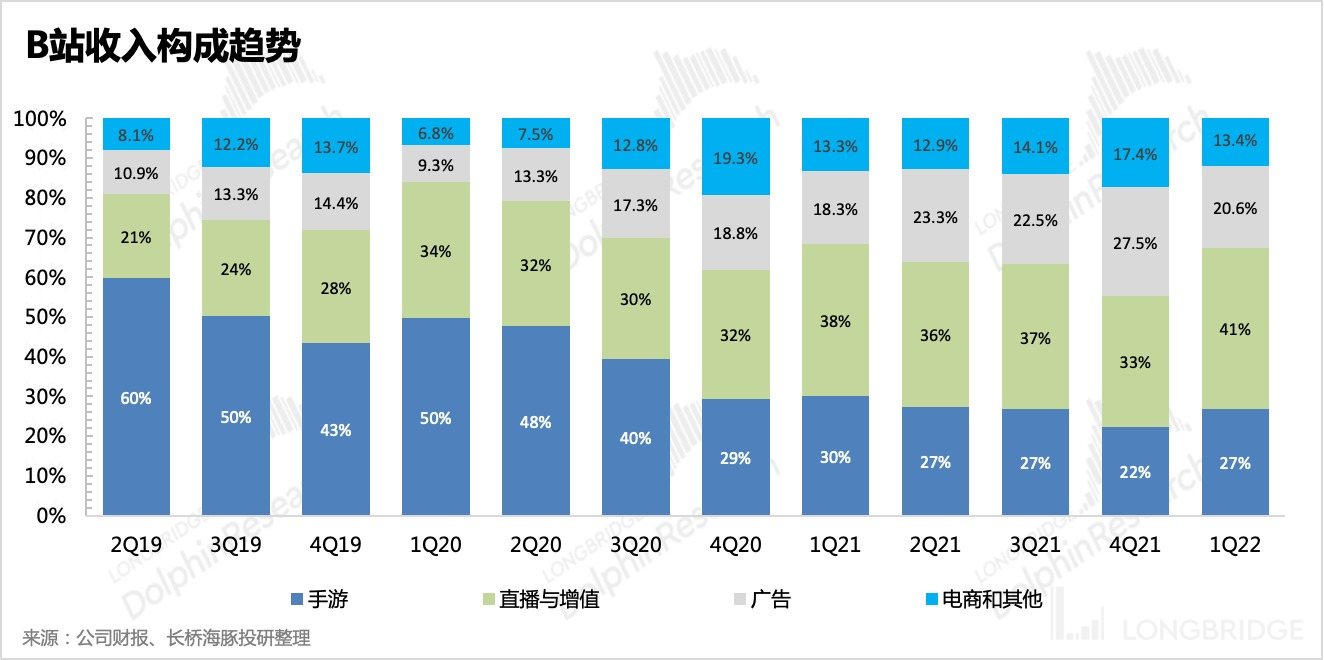

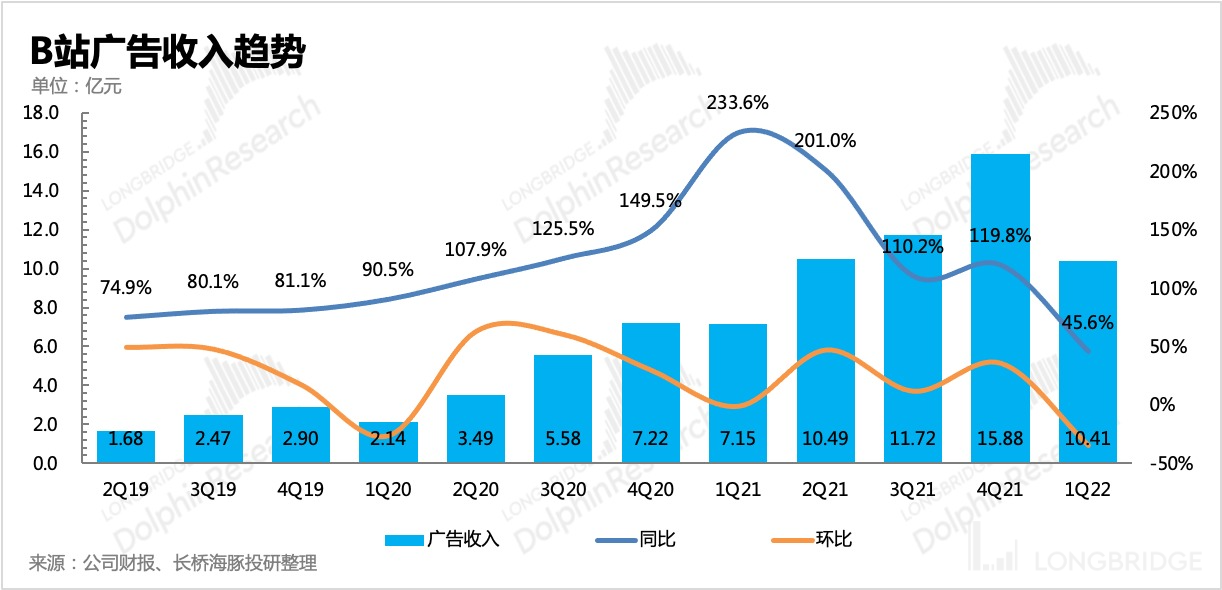

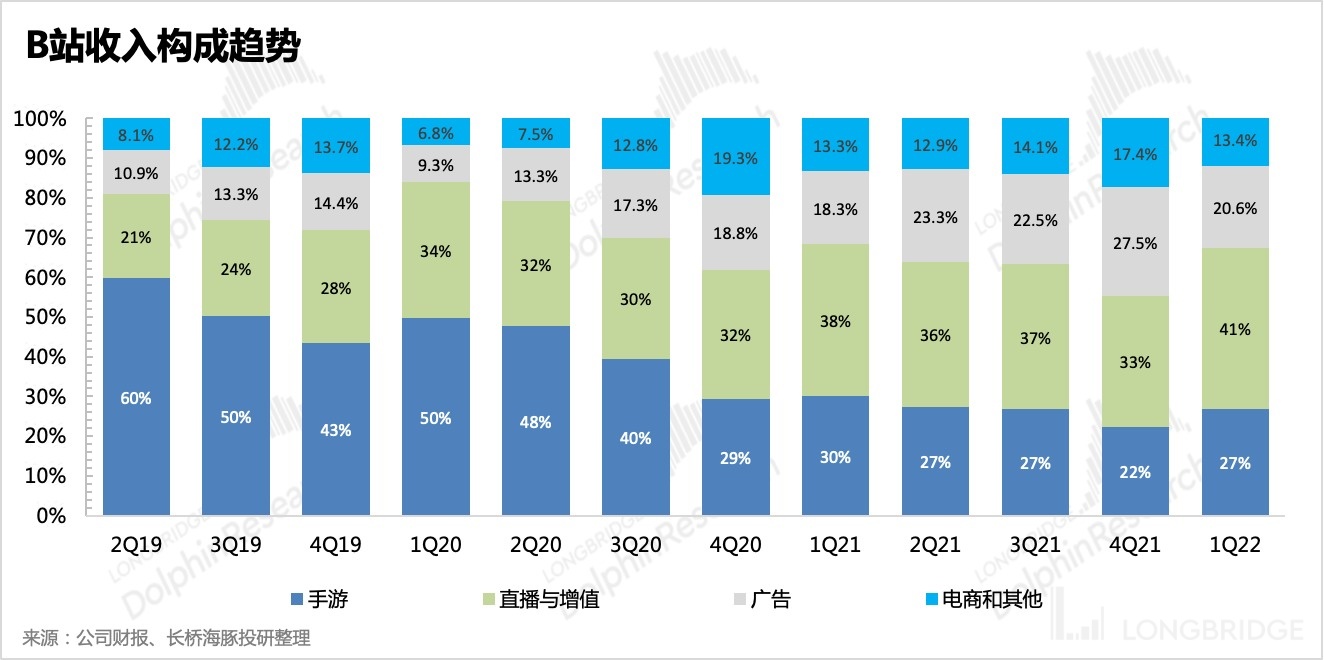

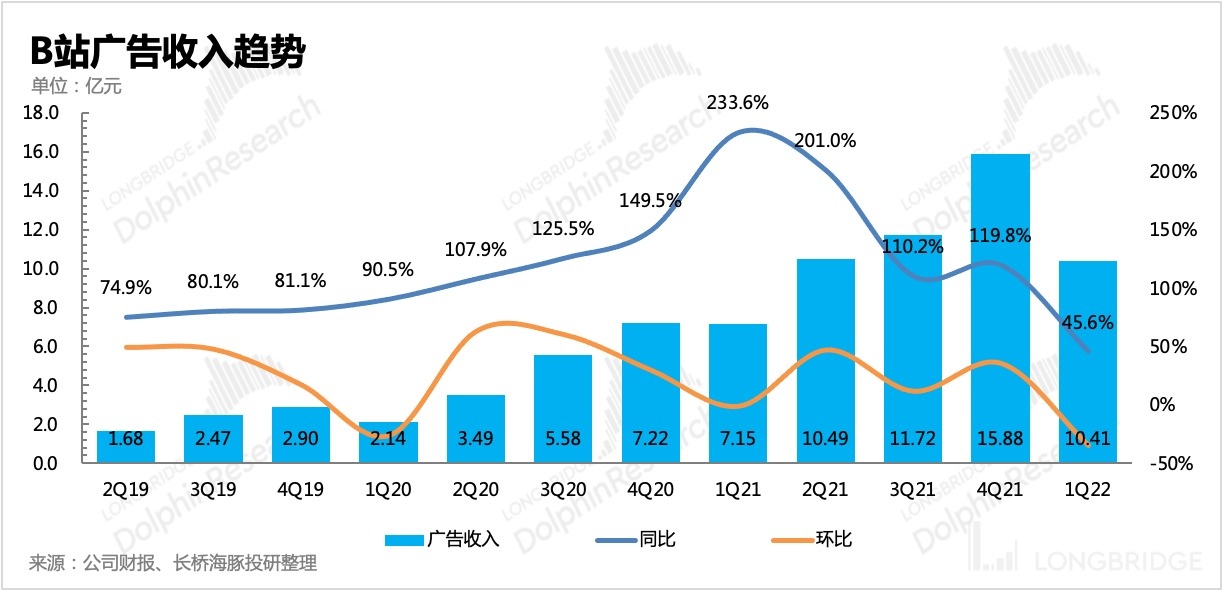

Advertising, which is most sensitive to macroeconomic conditions, is expected to experience a slowdown in growth, but it is still the main driver of revenue growth, currently accounting for 21% of total revenue. Management's expectation for advertising is that it will contribute more than 30% in the medium term (estimated by the Dolphin to be in 2024).

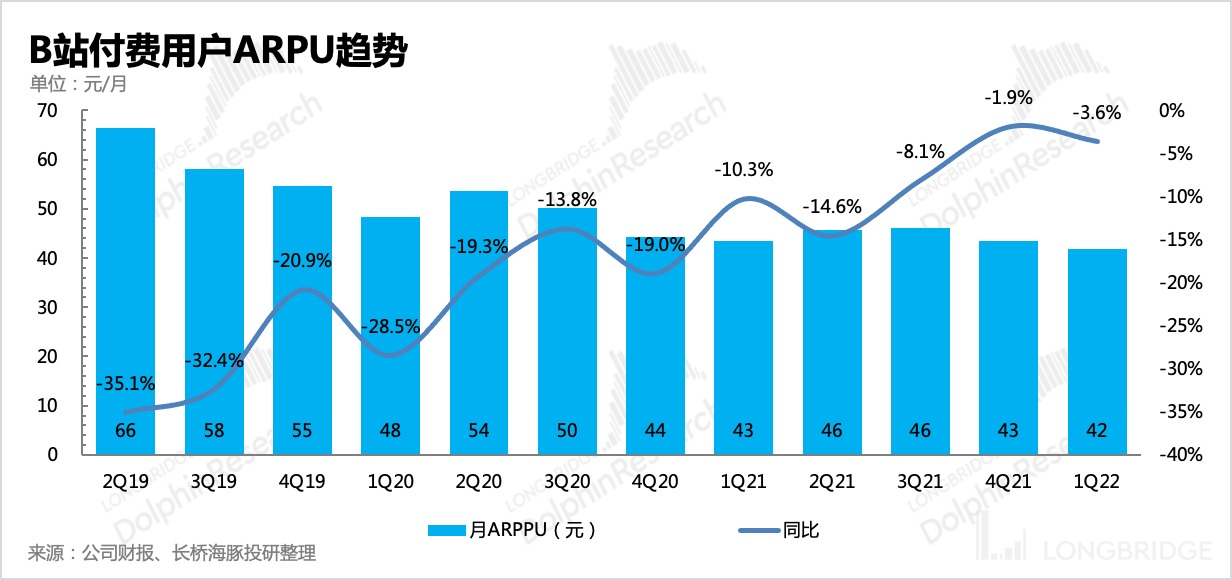

Advertising and games are the two businesses with the highest gross profit margin among Bilibili's current main operations. Therefore, in order to improve the gross profit margin in the future, in addition to the need for value-added services to improve profitability, the greatest hope lies in the increase in the proportion of these two businesses. **Q1 gross profit margin was 16%, weakened on a MoM basis due to a significant slowdown in advertising growth compared to the previous quarter.

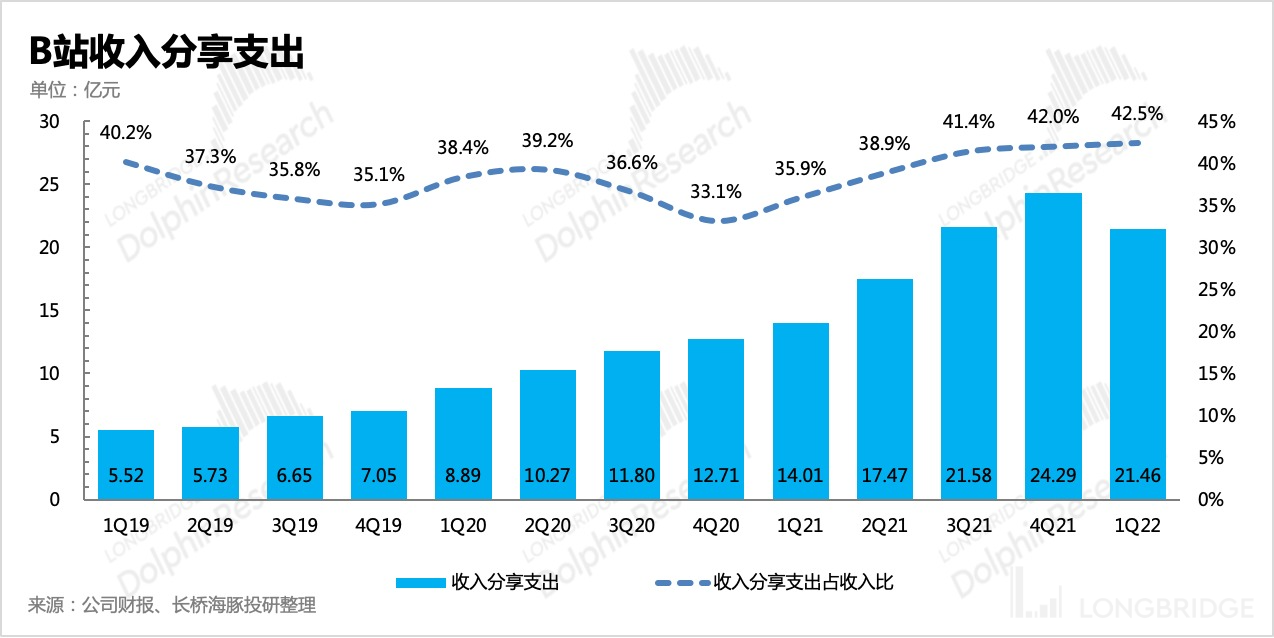

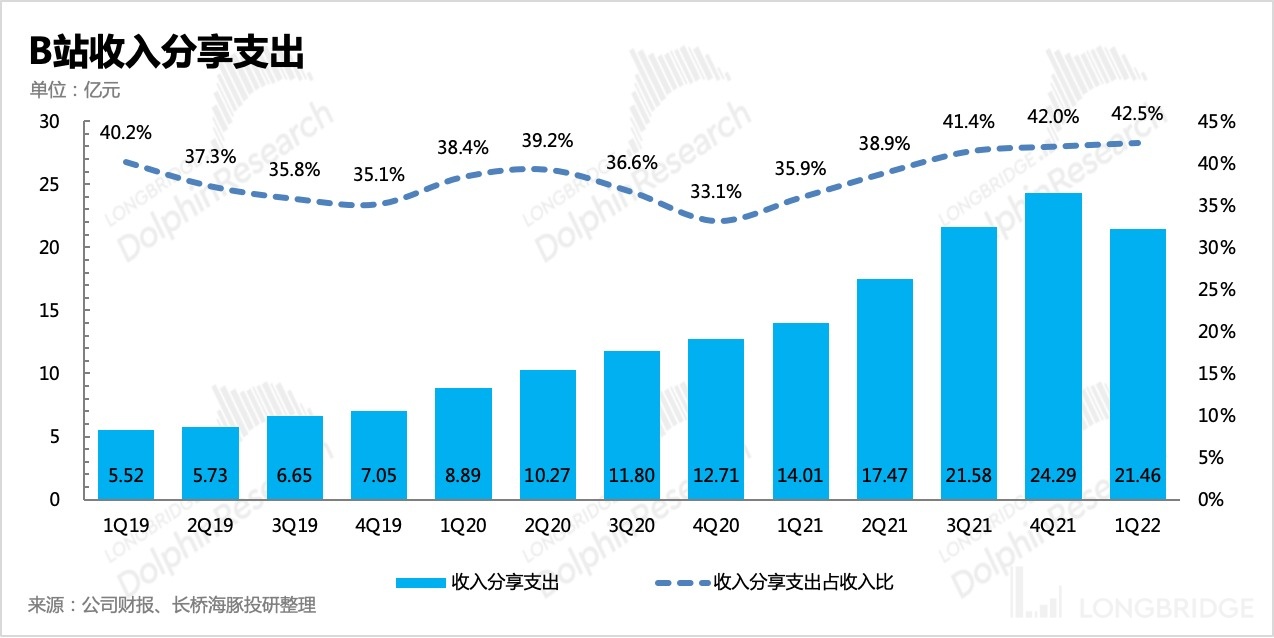

With the contraction and expansion of marketing investment, the company has more control. However, Bilibili's external revenue sharing, which accounts for 44% of the total revenue on the platform (including game revenue sharing, content creator incentives, and live streaming revenue sharing), has a significant impact on the stability of the platform's ecosystem until Bilibili's own commercial value is fully realized.

According to expert research, among the content creators who have already monetized their content, nearly 45% of their income still comes from cash incentives, which means they are taking advantage of Bilibili's platform.

Therefore, Dolphin has always believed that the key to solving Bilibili's profitability dilemma is to fully embrace commercialization. For example, implementing overlay ads or brand advertising, the latter of which requires Bilibili's own influence as a platform. Although the commitment of "no overlay ads" has somewhat constrained Bilibili's commercialization efforts, we can also see that since the second half of last year, Bilibili has been continuously exploring various ad formats, such as immersive short videos and ads placed below videos.

In particular, the introduction of ads placed below videos has enabled the platform to automatically match ads, resulting in an increasing number of content creators partnering with Firework ads.

From Dolphin's personal experience, some content creators have already started integrating pre-made ad videos into their own content. Currently, Bilibili as a platform has not yet been involved in the collaboration process, but it is not impossible in the future.

Compared to Kuaishou, Bilibili's operating expenses, especially sales expenses, are not excessive. However, there is still room for improvement in efficiency in the medium to long term. Generally speaking, Bilibili's marketing expenses are not primarily focused on customer acquisition incentives, but rather on game promotion and brand building.

Looking at the operating expense ratio in Q1, there was no improvement, but the absolute growth rate compared to the previous period was...

2. User Scale: High-quality and Stable Growth

2. User Scale: High-quality and Stable Growth

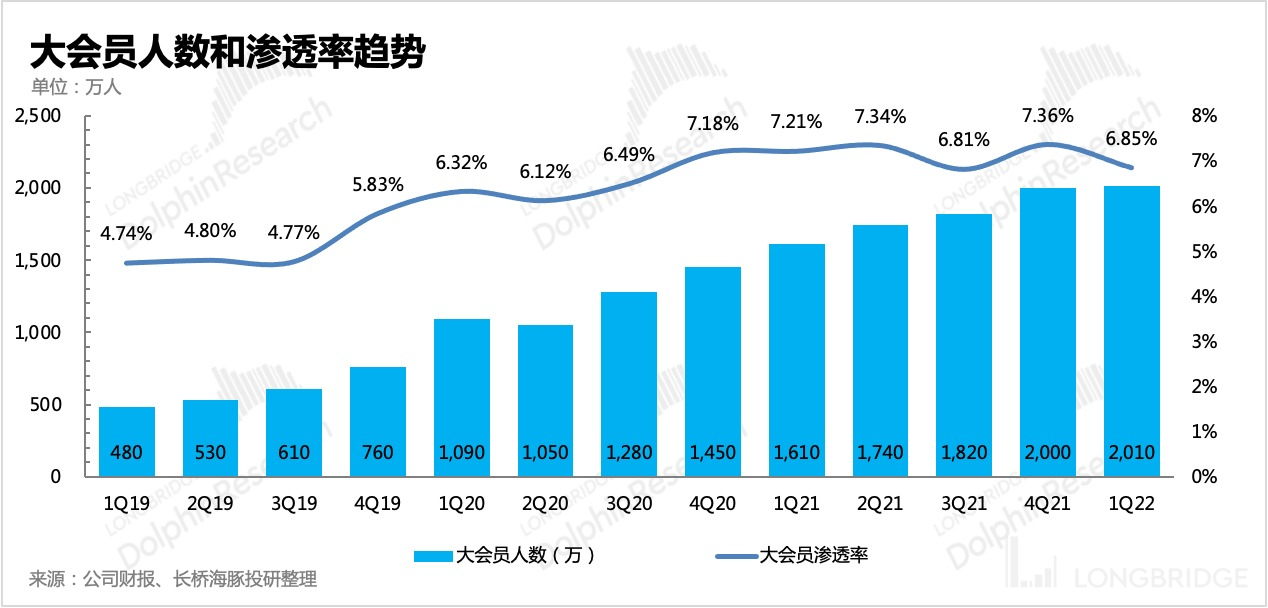

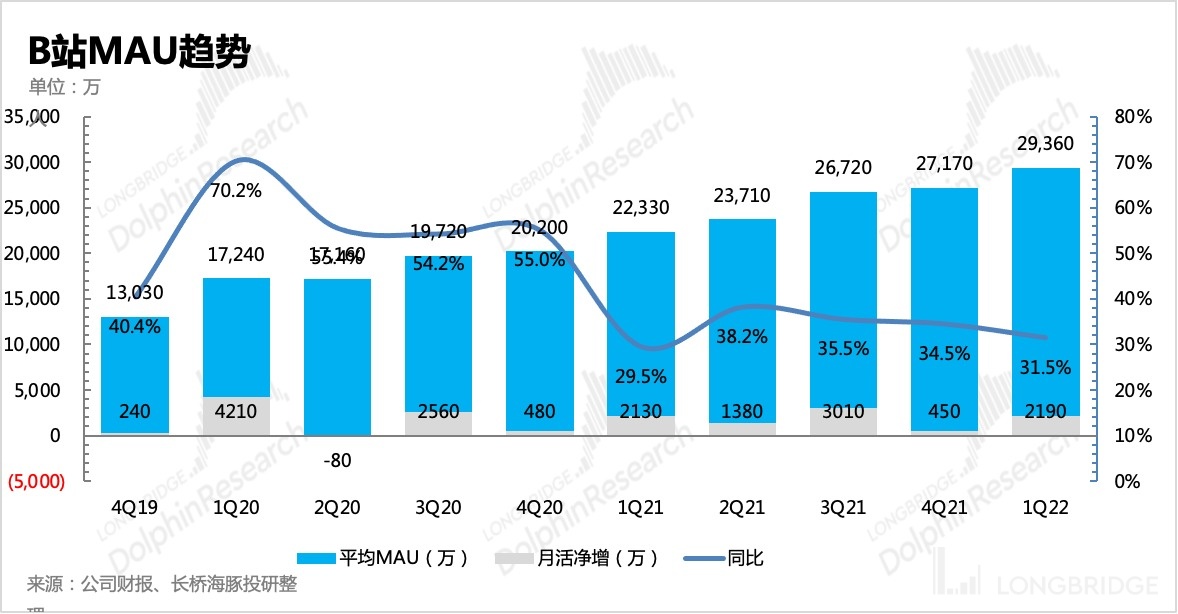

In the first quarter, Bilibili's user base grew by 31.5%, with an average monthly active user count reaching 294 million, a net increase of 21.9 million people, which is in line with market expectations. The first quarter includes the New Year and Spring Festival holidays, which are often the peak periods for user acquisition for Bilibili throughout the year.

In the previous quarter's conference call, the management mentioned that Bilibili's active user base on the TV platform is also growing rapidly, to some extent compensating for the usage scenarios on the mobile end. It is expected to help Bilibili achieve its goal of reaching 400 million users by the end of 2023.

The indicator reflecting user stickiness, DAU/MAU, has increased to 27% on a month-on-month basis, and the average daily user duration has increased from 82 minutes last year to 95 minutes. With the official launch of single-column immersive short videos and with reference to the user stickiness and duration trends of platforms like Kuaishou, Bilibili still has room for improvement.

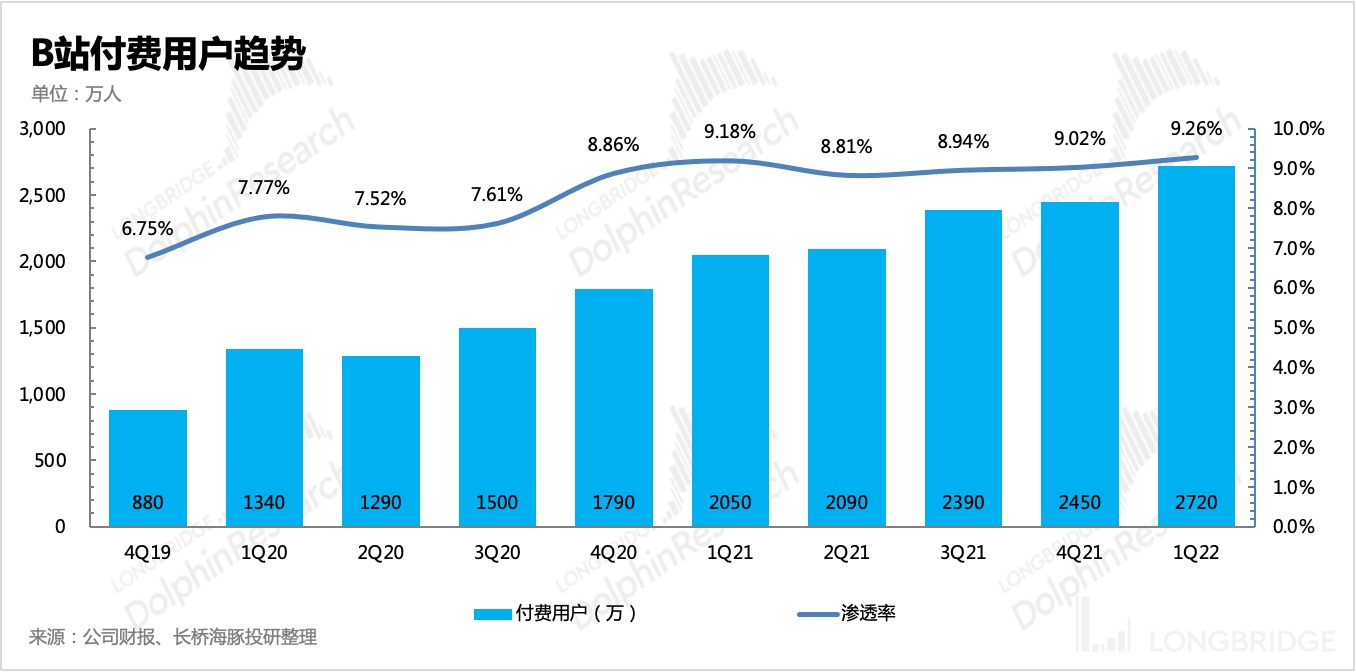

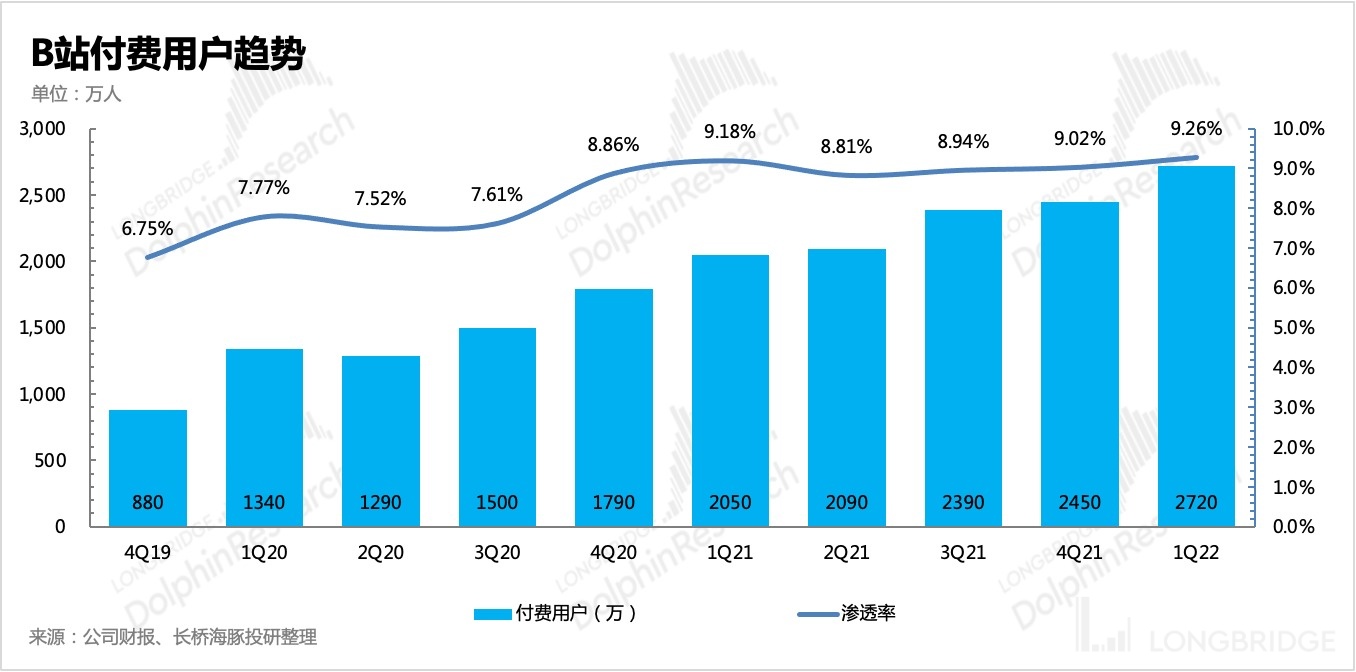

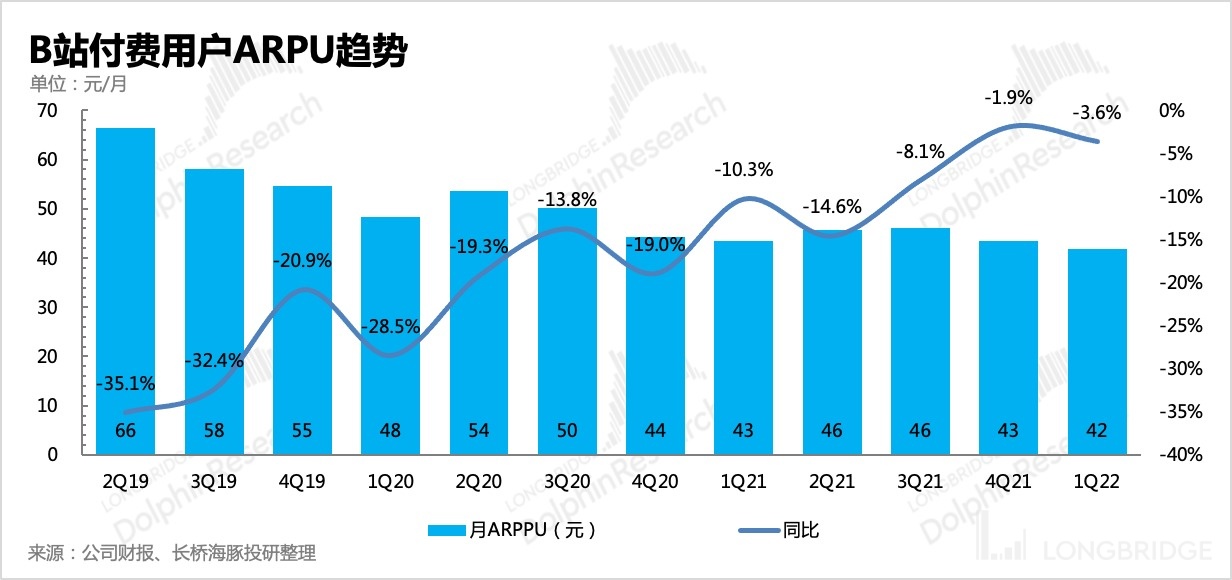

In the first quarter, the overall number of paying users reached 27.2 million, with a net increase of 2.7 million compared to the previous quarter, and the penetration rate of paying users reached 9.3%, further stabilizing and improving.

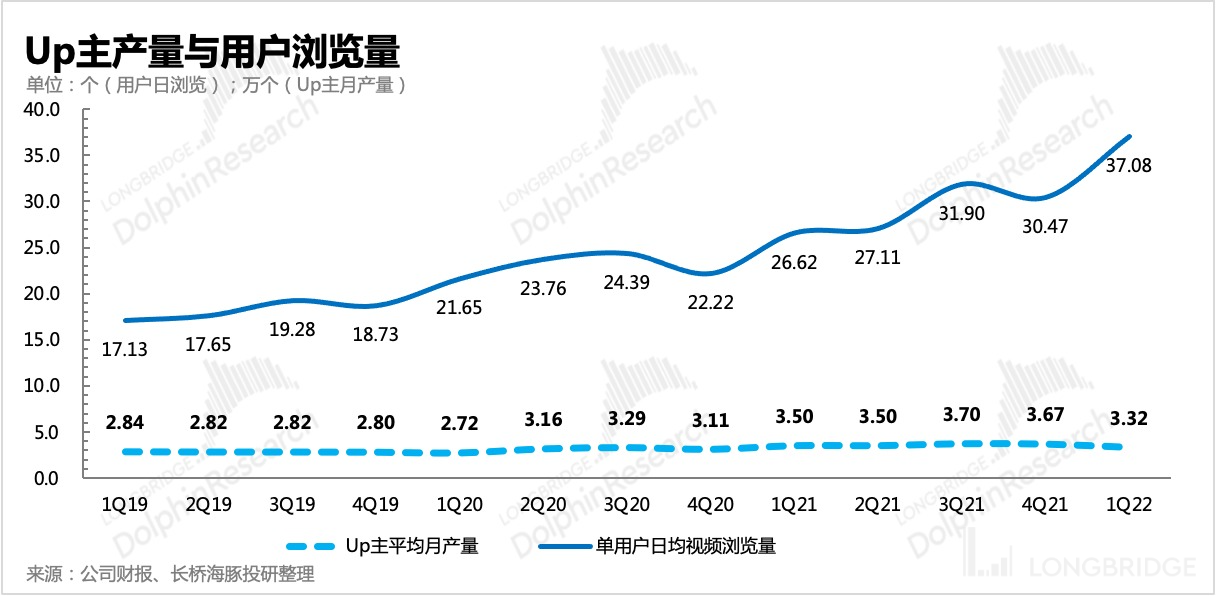

Finally, regarding the ecological balance between Upstreamers and users:

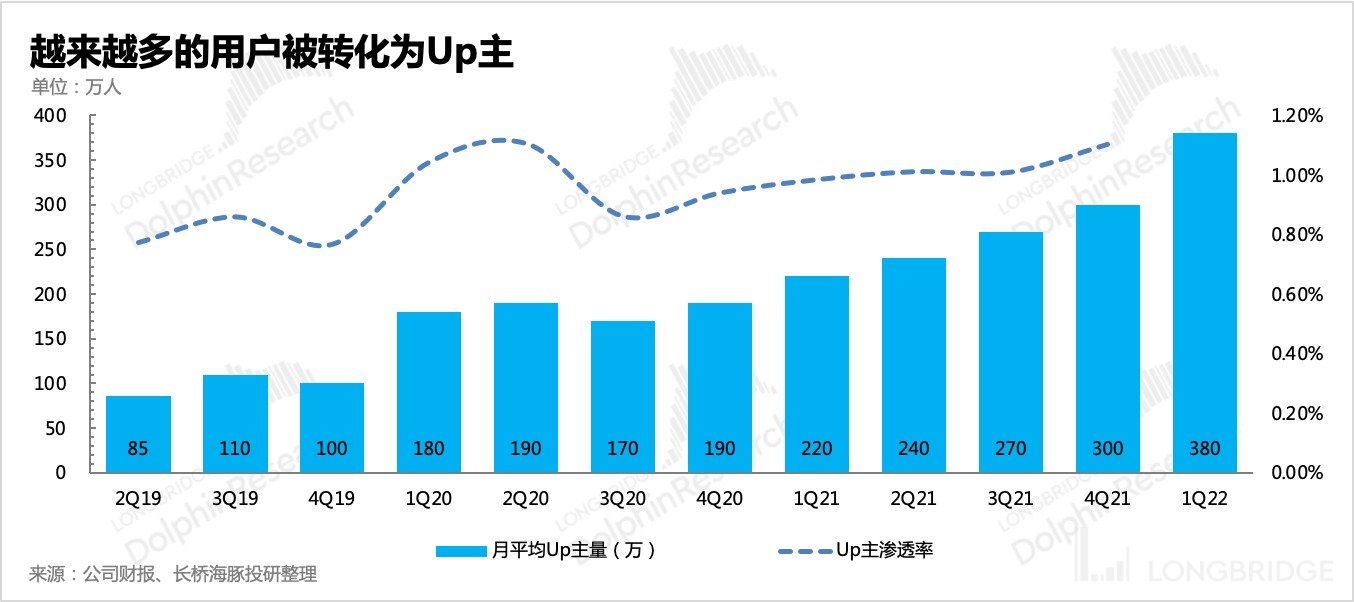

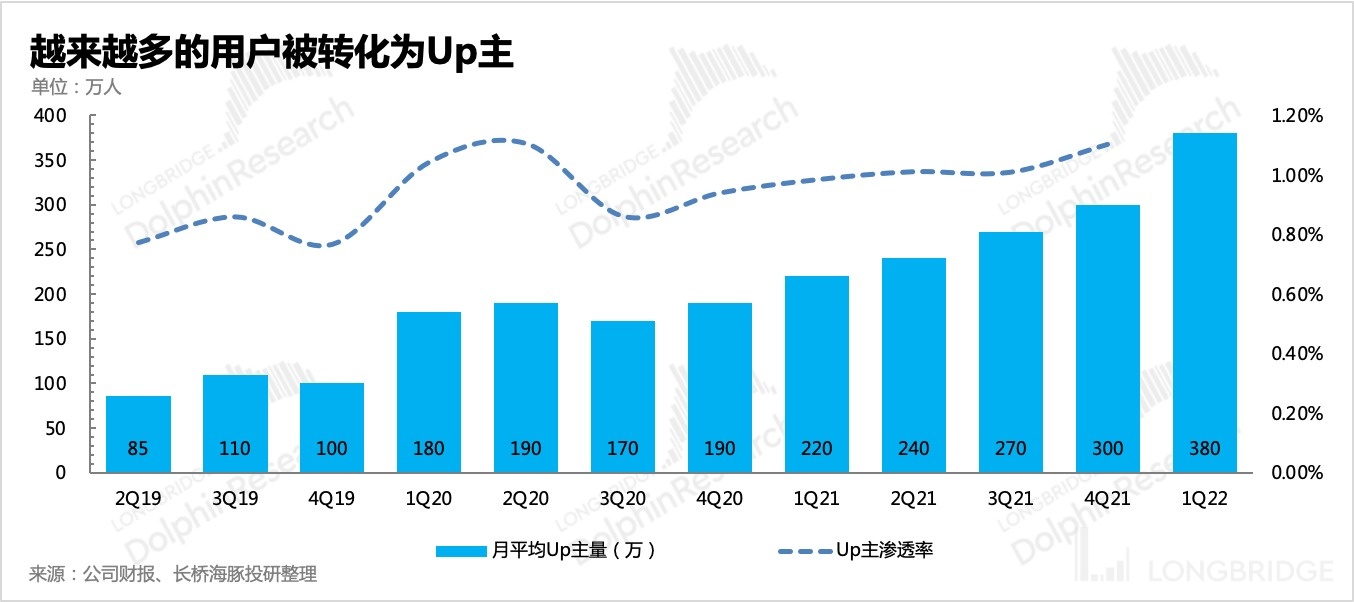

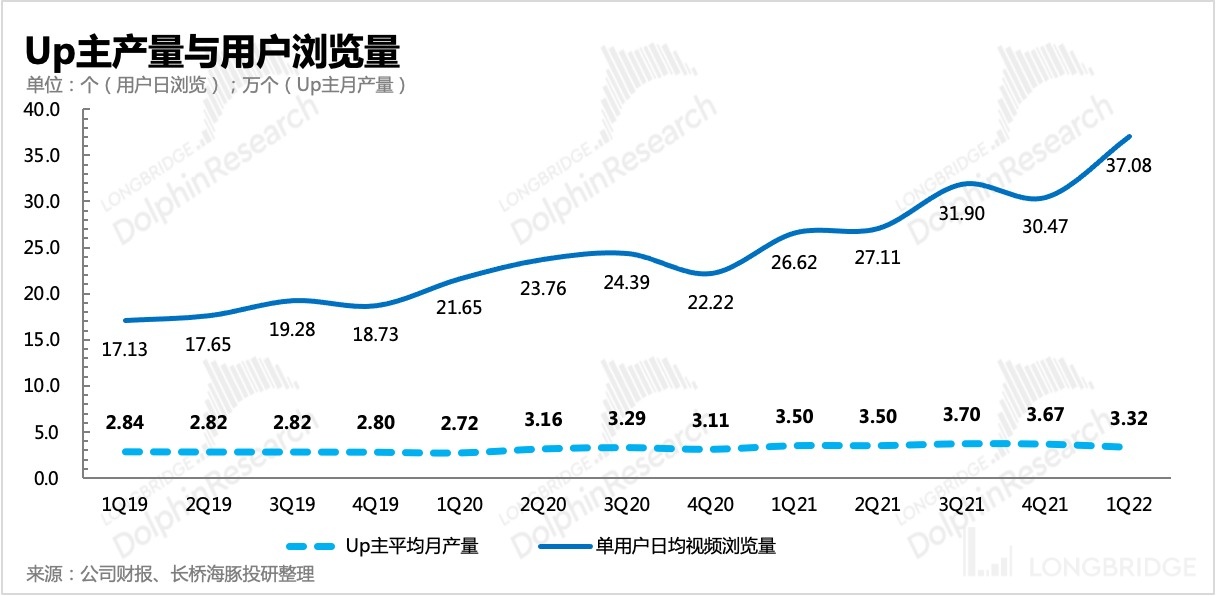

① First of all, the penetration rate of Upstreamers is still increasing, which is conducive to improving the user stickiness within the ecological circulation system.

② Secondly, the daily video viewing volume per user has increased significantly. In addition to seasonal factors, the penetration rate of short videos (Story Mode) is also increasing. Short video production has a low threshold, which can increase the frequency of Upstreamers' content release, deepen the interaction between Upstreamers and users, and also contribute to the increase in platform stickiness and duration, laying a solid foundation for future attempts at short video advertising.

III. Segment Analysis: Game Recovery Exceeds Expectations, Greater Pressure on E-commerce and Advertising in Q2

III. Segment Analysis: Game Recovery Exceeds Expectations, Greater Pressure on E-commerce and Advertising in Q2

Let's take a closer look at the segment analysis:

1. Advertising

Due to the impact of the economy and the pandemic lockdown, advertising revenue growth has significantly declined. Although it is in line with previous guidance, market expectations were higher. When compared horizontally with other platforms in the same industry, although it is significantly better than most entertainment platforms, the 33% growth on top of the advertising revenue base of around 9 billion in a single quarter for Kuaishou is not impressive compared to Bilibili's 46% growth rate.

Looking ahead to the second quarter, the impact of the lockdown on advertising placements by businesses has increased, which is also within market expectations. However, Bilibili has officially launched its short video feature (previously in testing), and the user penetration rate reached 20% last quarter. It is expected to accelerate the commercialization process in the future. Pay attention to the disclosure of the first-quarter short video penetration rate by the management during the conference call.

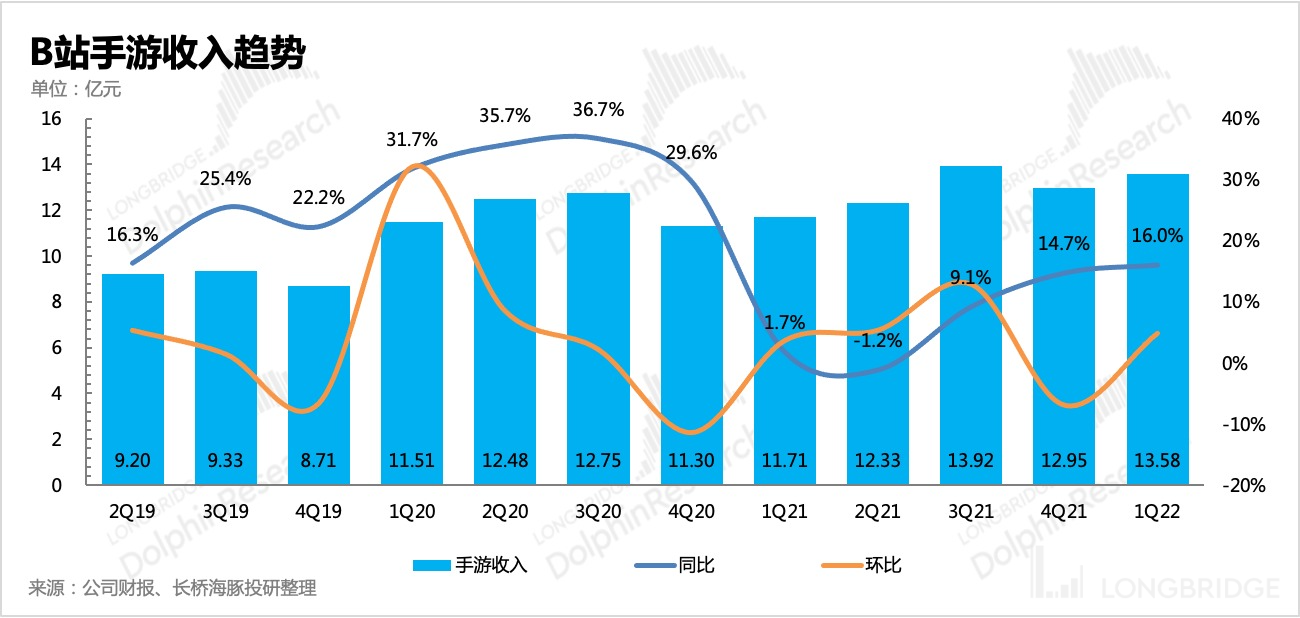

2. Gaming

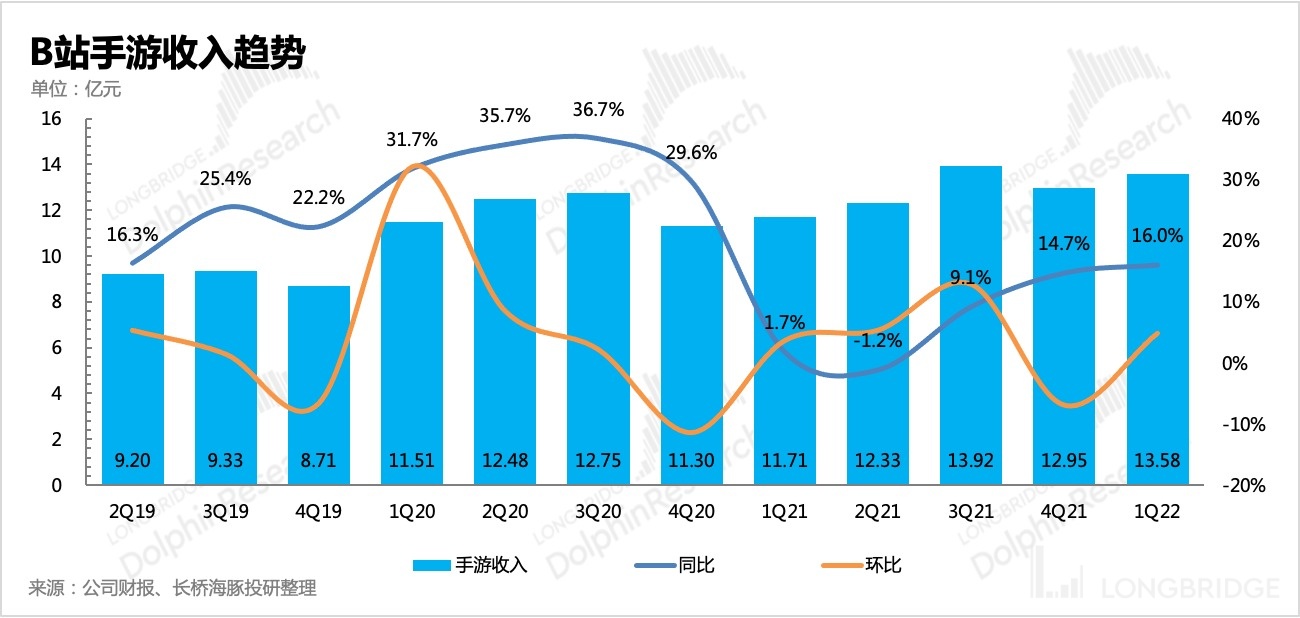

Gaming revenue exceeded guidance this quarter, and the market's expectation of 10% growth is also in line with the guidance, but the actual growth rate reached 16%. Last year, Bilibili's gaming segment experienced a downturn due to the rapid cooling of the industry under strict regulations, including the suspension of game approvals in the second half of the year. Apart from relying on games from major developers in the fourth quarter and the success of four exclusive games, Bilibili's gaming segment has been criticized by the market for insufficient reserves.

Therefore, achieving a growth rate of 16% in the first quarter clearly exceeded market expectations. With the resumption of game approvals in mid-April, although the number was halved, signs of the industry's winter fading away can be seen. Among the games approved in June, there are many anime-style games highly relevant to Bilibili's platform, as well as game developers closely cooperating with Bilibili.

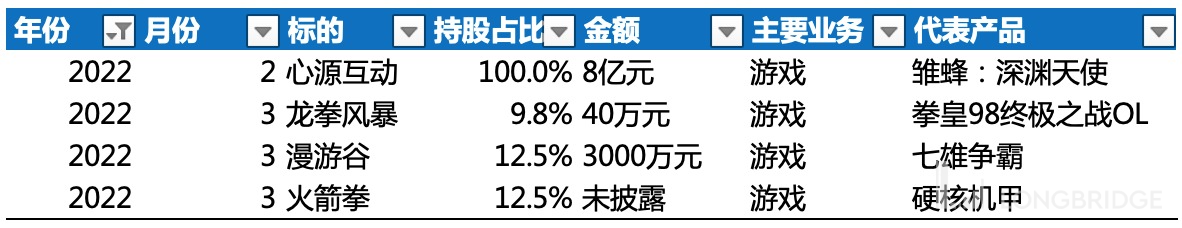

However, currently, Bilibili's self-developed games contribute very little to the revenue, mainly relying on exclusive and cooperative games. The management previously disclosed that they will gradually see the output of self-developed games in 2023. Although Bilibili has made continuous acquisitions and increased stakes in multiple game developers since the beginning of the year, objectively speaking, it is difficult to see Bilibili's own blockbuster games in the short term, and it still relies on the overall prosperity of the industry.

3. Value-added Services

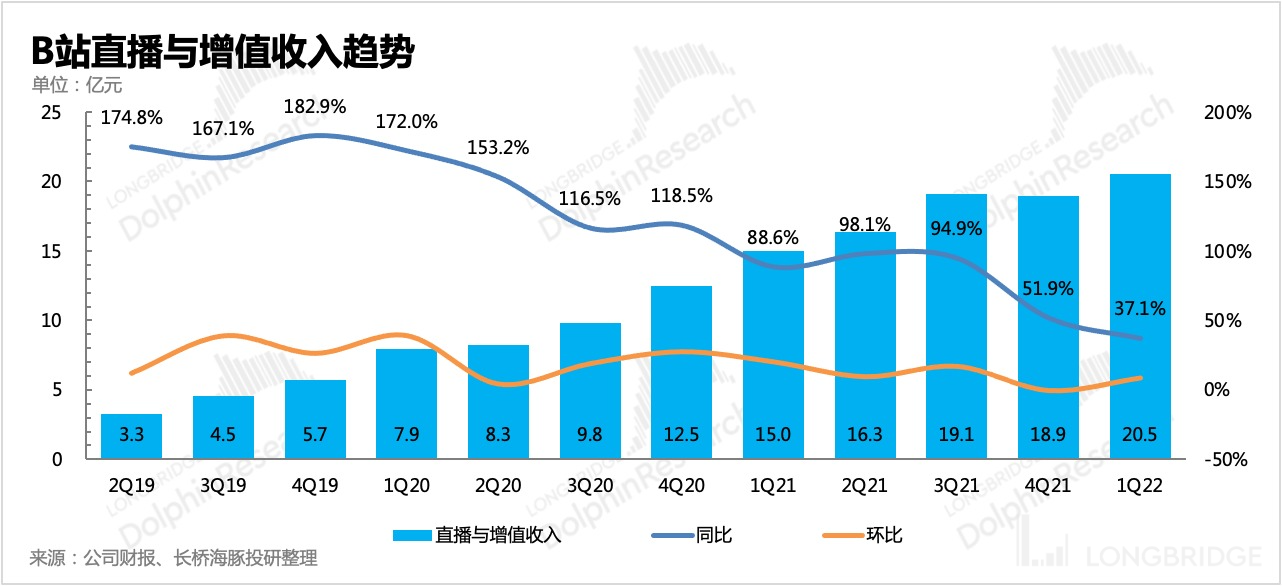

Value-added services mainly include live streaming and premium membership subscriptions. In the first quarter, it achieved 2.1 billion in revenue, a year-on-year growth of 37%, and it is still in a high-growth stage. This should also be the main source of revenue growth from an increase in paid users. E-commerce and Others

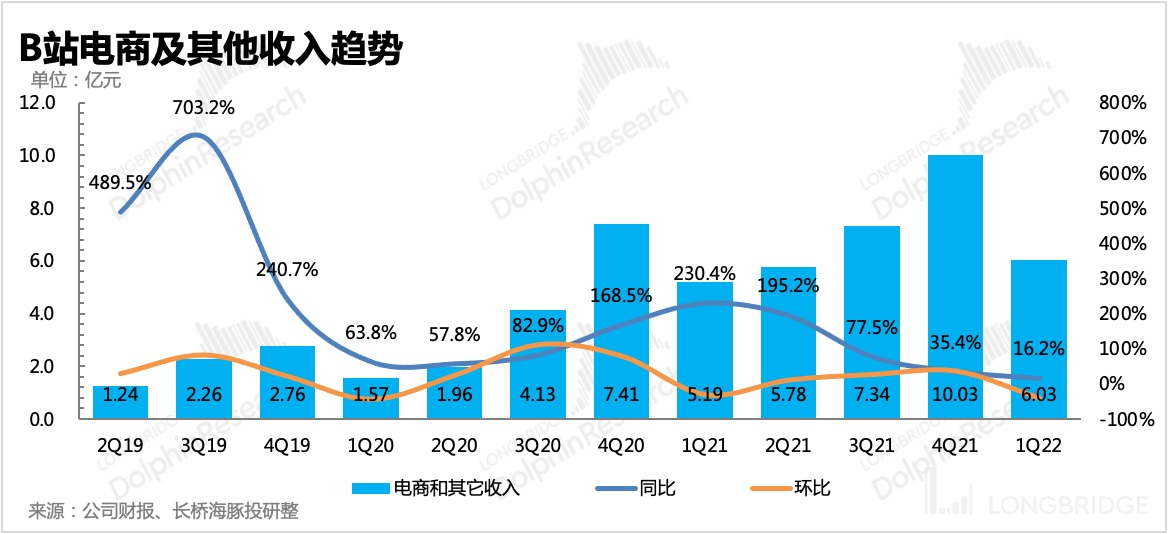

In the first quarter, the e-commerce business was estimated to be greatly affected by the Shanghai epidemic control measures, with a significant decline in overall business growth. Bilibili's main warehouse is located in Kunshan, and after the Shanghai epidemic worsened in March, all transportation routes between Jiangsu Kunshan and Shanghai were cut off, undoubtedly having a huge impact on the self-operated e-commerce business. Shanghai remained under strict control measures in April and May, so the data for the second quarter may be very pessimistic.

Therefore, overall, for the performance of the second quarter:

① Both the company's guidance and market expectations imply that the logistics stagnation and weak consumer demand under the epidemic control measures will put pressure on the growth of the advertising and e-commerce businesses. At the same time, online entertainment businesses such as gaming and live streaming will be relatively less affected by the epidemic.

② In terms of cost and expenses, although there have been news of reducing incentives for content creators and optimizing the Bilibili team since early March, Dolphin predicts that it will still be difficult to immediately improve profitability under the pressure of overall revenue.

③ Therefore, although there has been a recent rebound in valuation, the turning point in performance is still expected to come in the second half of the year.

In the medium to long term, Dolphin is not so pessimistic about Bilibili's platform positioning and competitive advantages, and regarding the questions raised in the market about Bilibili's profit model, I will publish a dedicated article next week to discuss it, so please stay tuned. The summary of the conference call will be released on the research and investment group and the Longbridge app as soon as possible. If you are interested, you can add the assistant's WeChat account "dolphinR123" to get it.

Dolphin "Bilibili" Historical Report Review

Earnings Season

March 3, 2022 Conference Call: "Generating Revenue through Advertising, Steady User Expansion, Cost Reduction, and Fee Deduction: Bilibili Wants It All"

March 3, 2022 Financial Report Review: "A Mediocre Answer Leads to a Rise? Bilibili's Faith Comes from the Wise Emperor" invite-code=032064)"

Telephone Meeting on November 17, 2021: "The Power Source for the 400 Million Target? Bilibili Management: Focusing on TV Screens" (Bilibili Telephone Meeting)

Financial Report Review on November 17, 2021: "Is Bilibili Spending Money Again? Continuing to Break Boundaries for Your Viewing Pleasure"

Telephone Meeting on August 19, 2021: "Bilibili's Second Quarter Meeting Minutes: Confident in Achieving 260 Million Users This Year, Surpassing 400 Million by 2023"

Financial Report Review on August 19, 2021: "Is Bilibili's Sprint Coming to an End?"

Telephone Meeting on May 14, 2021: "Bilibili's First Quarter Telephone Meeting Minutes"

Financial Report Review on May 13, 2021: "Review of Bilibili's First Quarter Report: Advertisers Have Long Been Interested in the Small Station"

Telephone Meeting on February 25, 2021: "How Will Bilibili Perform Tonight? I Think This Telephone Meeting Will Be Enough"

Financial Report Review on February 25, 2021: "Longbridge Research: Advertising Monetization Exceeds Expectations, Bilibili's Expansion Continues to Accelerate"

Financial Report Review on November 19, 2020: "Longbridge Research: Confirmed! The Small Station is Still the Shining Star in the Entertainment Circle"

In-Depth Analysis

May 5, 2022: "Breaking the Boundaries of Entertainment: Exploring Tencent, Bilibili, and the Vast Ocean of Stars" 2021 March 22nd "Dropping in value while remarrying, is Bilibili a trap or an opportunity?"

2021 March 12th "Longbridge Research | Bilibili Series 2: Can Bilibili really sustain without ads?"

2021 March 9th "Longbridge Research | How far is Bilibili from its four hundred million user target?"

Hot Topics

2021 December 14th "The carnival is over, back to being a small platform? Bilibili needs "ads"!"

2021 July 27th "Bilibili, a social platform for the Z generation, still has scarcity"

Risk Disclosure and Statement for this article: Longbridge Research Disclaimer and General Disclosures