US stock inflation has once again skyrocketed. How far can we expect the rebound to go?

Hello everyone, I am Dolphin!

Last week, when Dolphin launched the Dolphin Alpha Portfolio, it mentioned that it would regularly update everyone on the portfolio's performance. Starting from this week, Dolphin will submit its report every Monday.

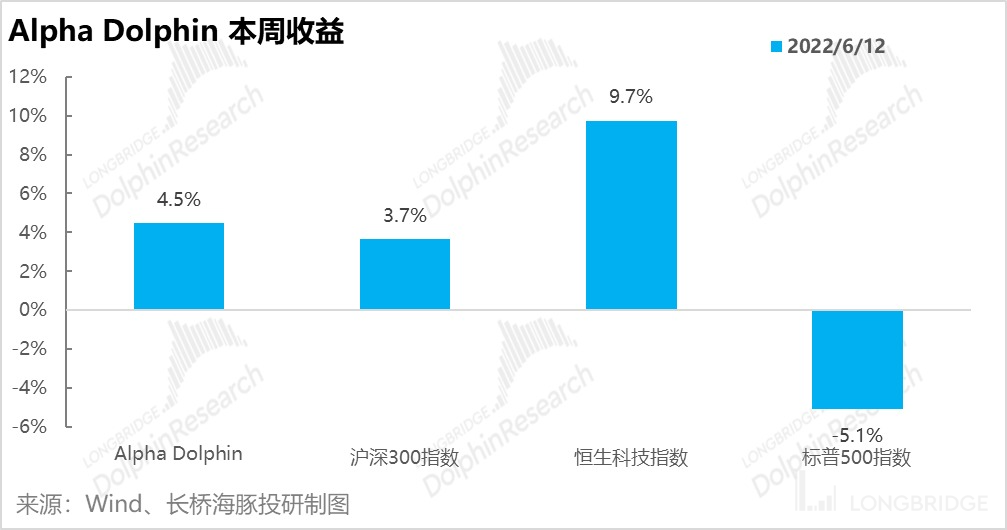

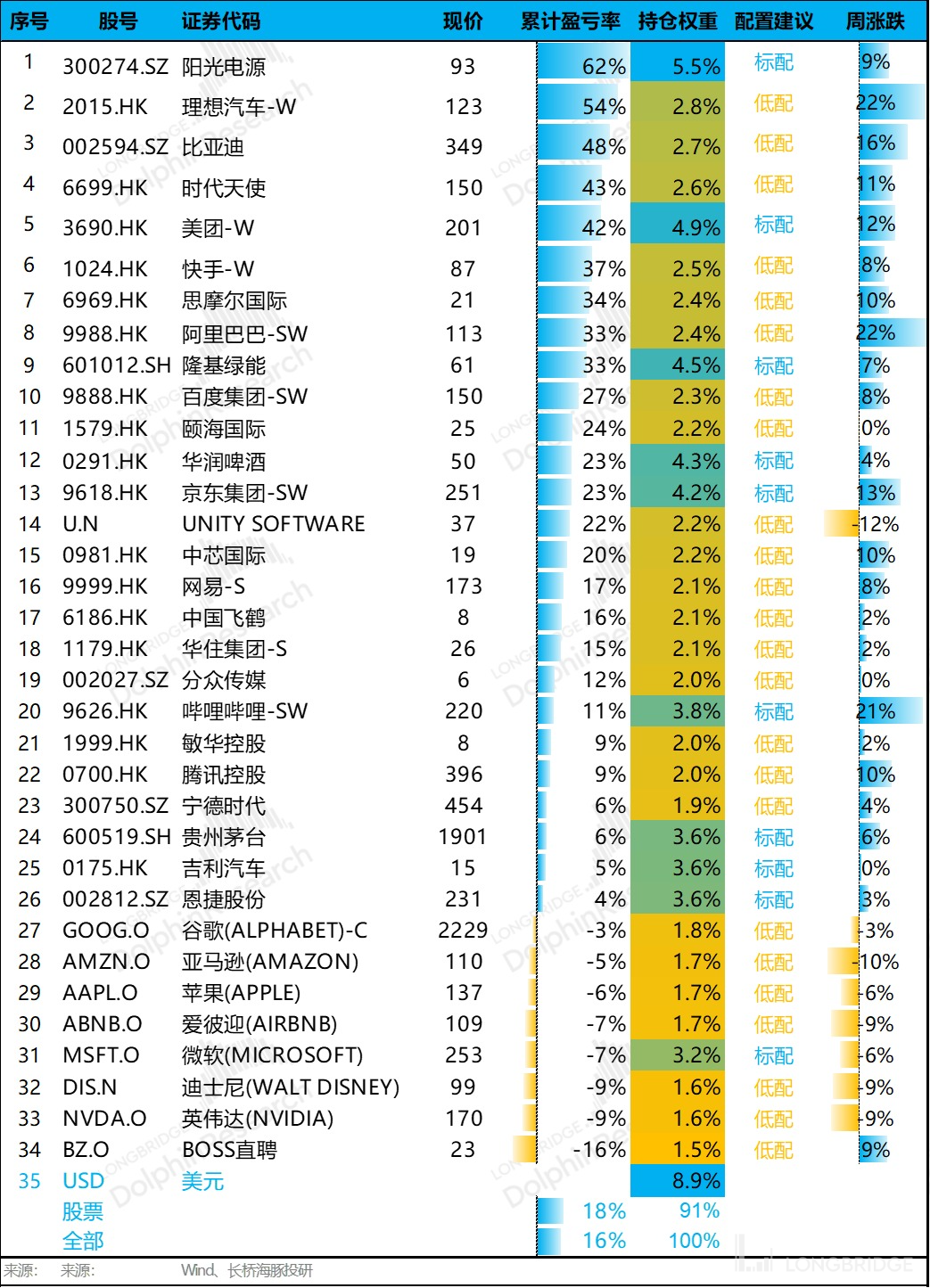

1. Portfolio Performance Last Week:

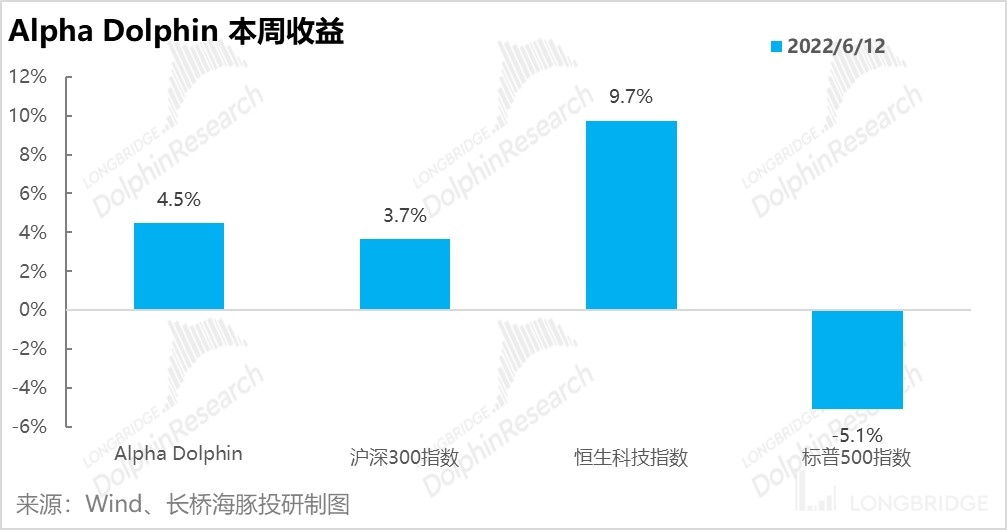

Alpha Dolphin had a weekly return of 4.5% (June 6th - June 10th). If we exclude the cash weight of nearly 9% in the portfolio, the equity assets had a weekly return of 5.5%. Whether compared to the CSI 300 or the S&P 500, it outperformed both benchmarks.

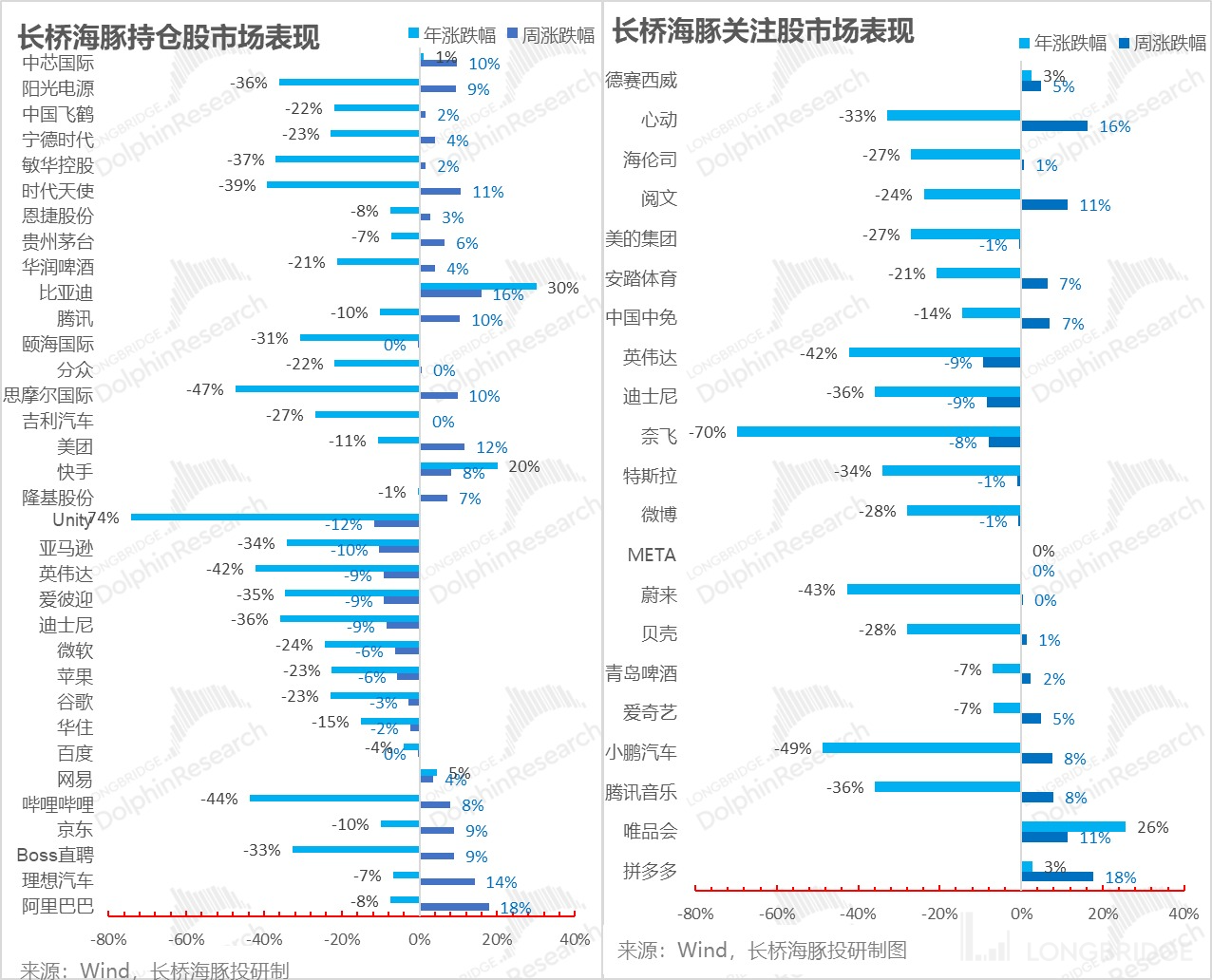

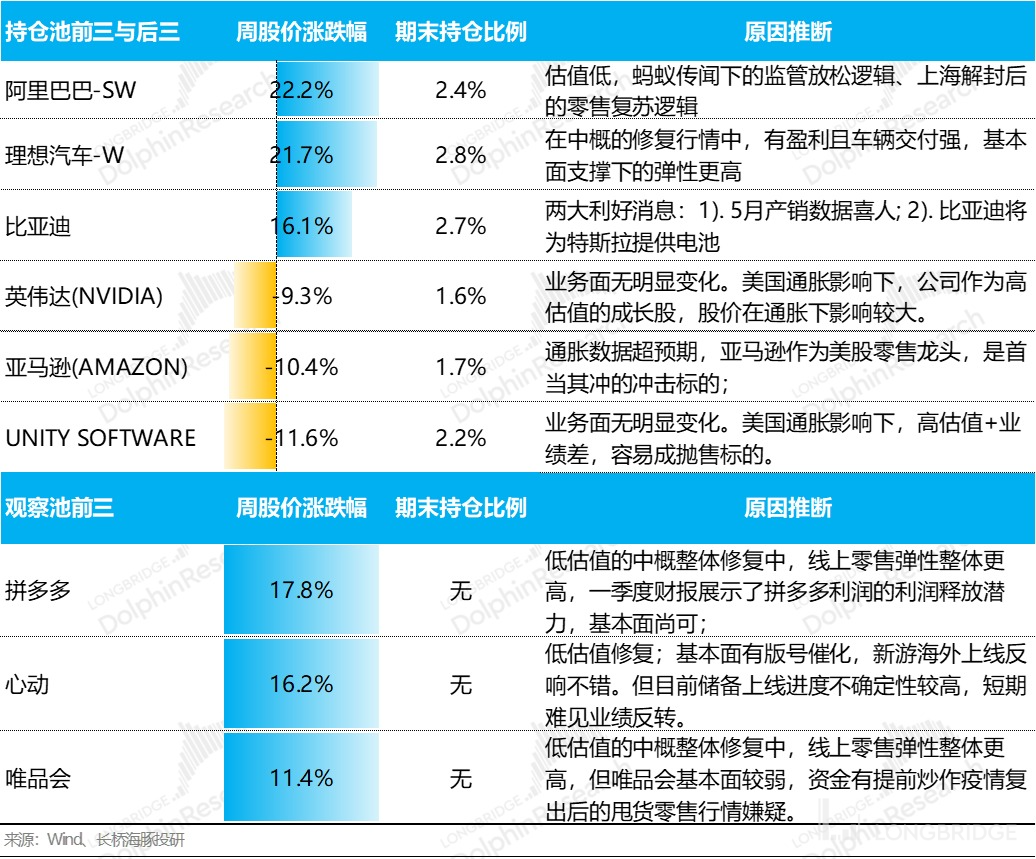

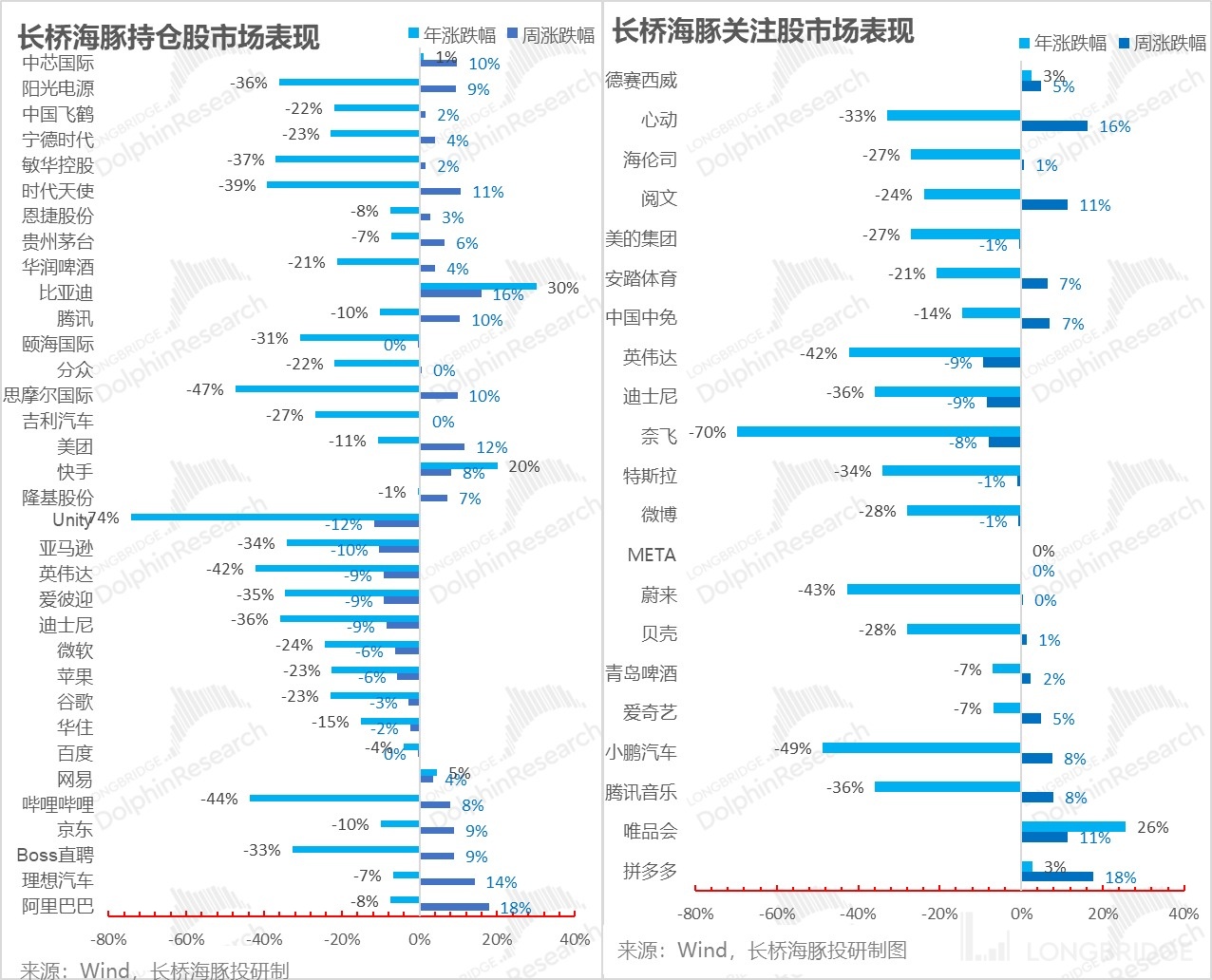

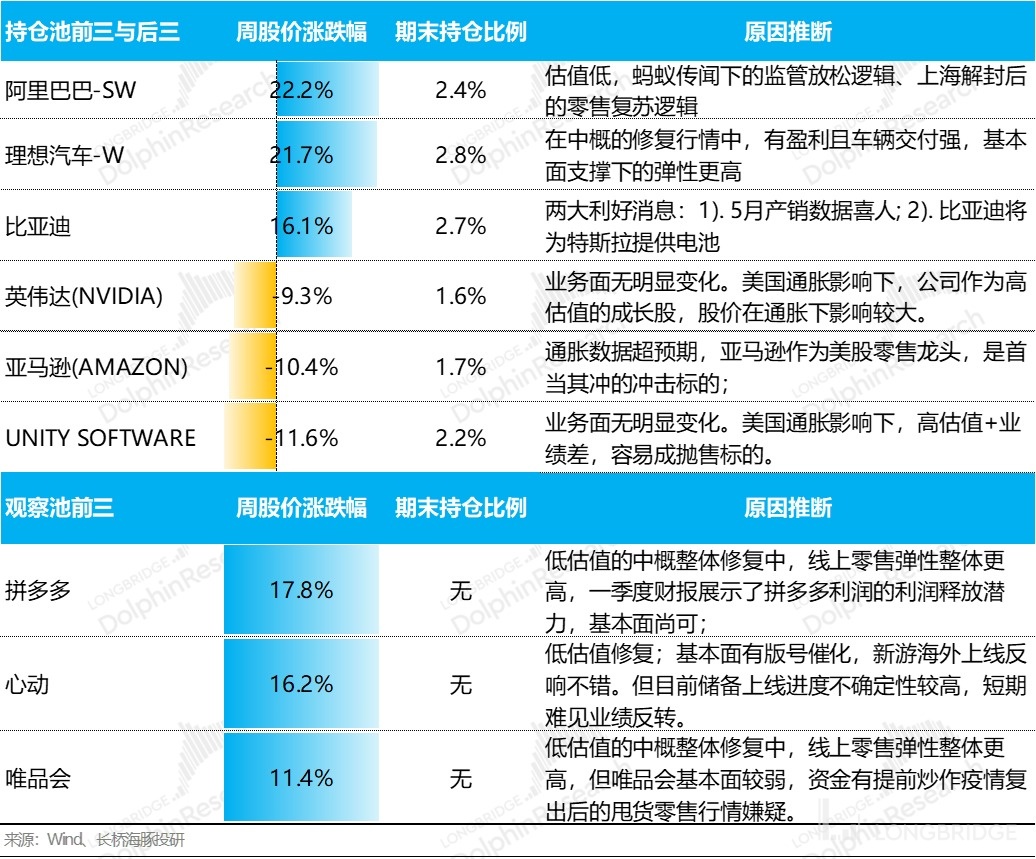

2. Contribution of Individual Stocks: Retail Recovery Leading, New Energy Continues to Soar

In terms of contribution to the portfolio's performance, last week was a week where Chinese concept stocks, after being neglected and abandoned for a year, finally showed some resilience. Considering the stock price performance of various sectors, Dolphin believes that the underlying logic is as follows: although the Shanghai epidemic has been lifted, the offline economy that has contact is still recovering at a slower pace compared to the contactless online economy. Among the online economy, the rebound in online retail stocks is stronger than the more discretionary pan-entertainment sector.

In Dolphin's simulated portfolio, Chinese concept retail stocks such as Alibaba, JD.com, and Meituan performed well. In the asset pool that Dolphin focuses on but did not include in the simulated portfolio, Pinduoduo and Vipshop also had good returns, and the performance of the pan-entertainment sector was also impressive.

New energy stocks also performed exceptionally well, which is consistent with Dolphin's judgment when including them in the portfolio - upward momentum in the industry and strong fundamental support. The correction in prices was healthy, and the price recovery was dominant. Last week, Ideal and BYD were the leaders in the new energy sector of the portfolio.

As for the two companies in the pan-entertainment sector that experienced significant gains last week - Bilibili (held) and Xindong (observed) - both are companies without profit support, and their stock prices rebounded after being oversold. The fundamental performance of these companies in the current stage is not good, and last week's rebound was mainly driven by emotional valuation recovery.

Here are Dolphin's specific thoughts on stocks with significant price changes:

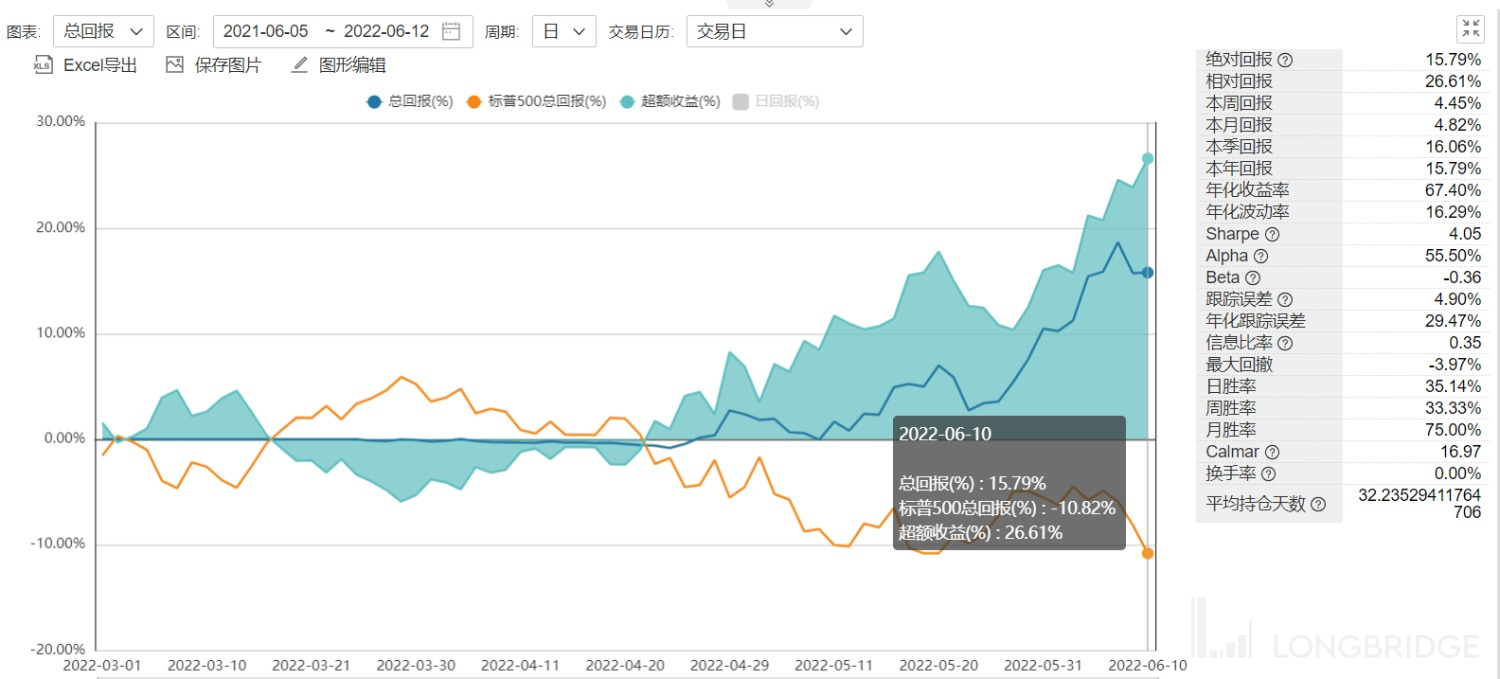

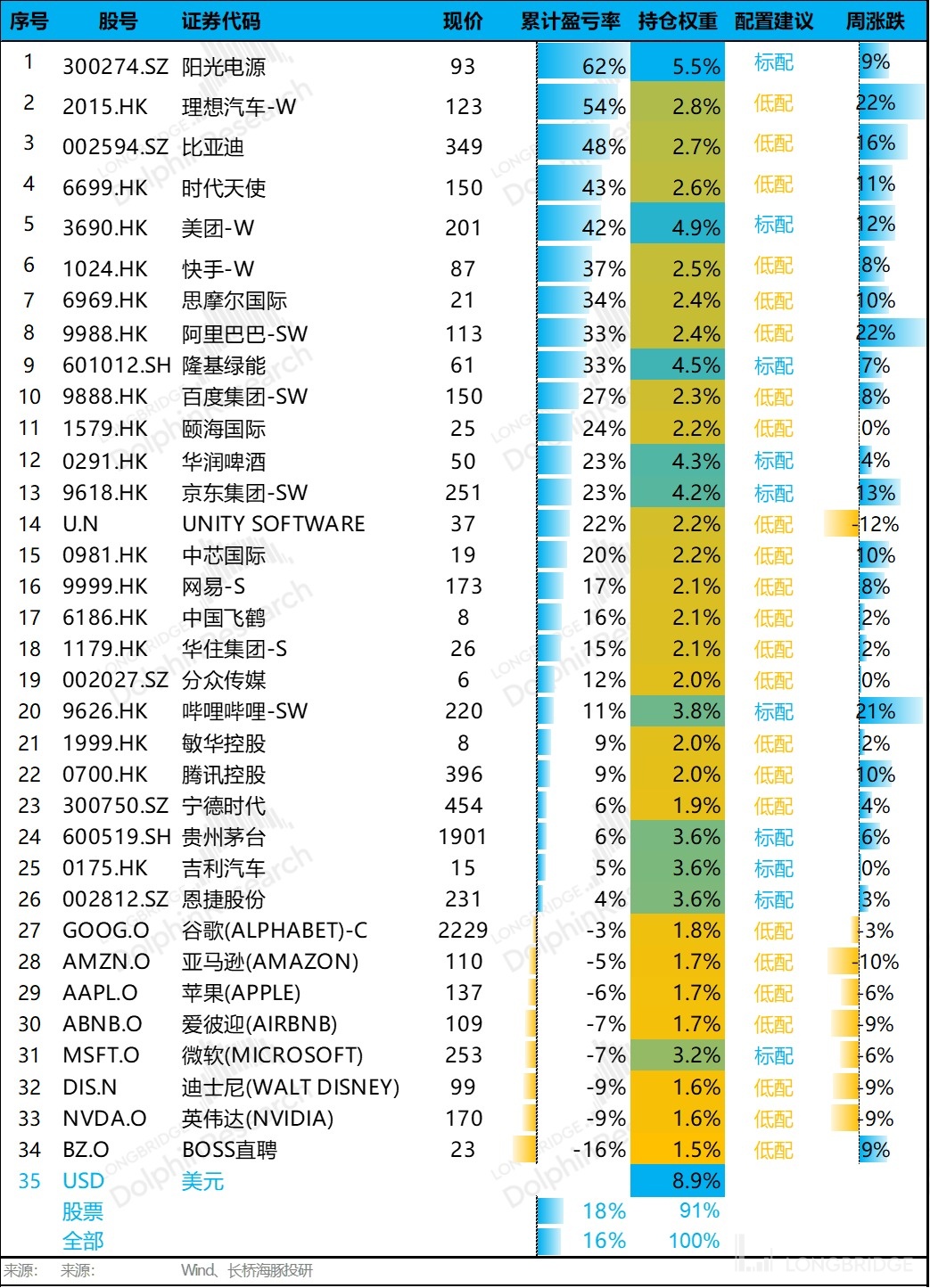

Three. Current Performance of the Portfolio:

Three. Current Performance of the Portfolio:

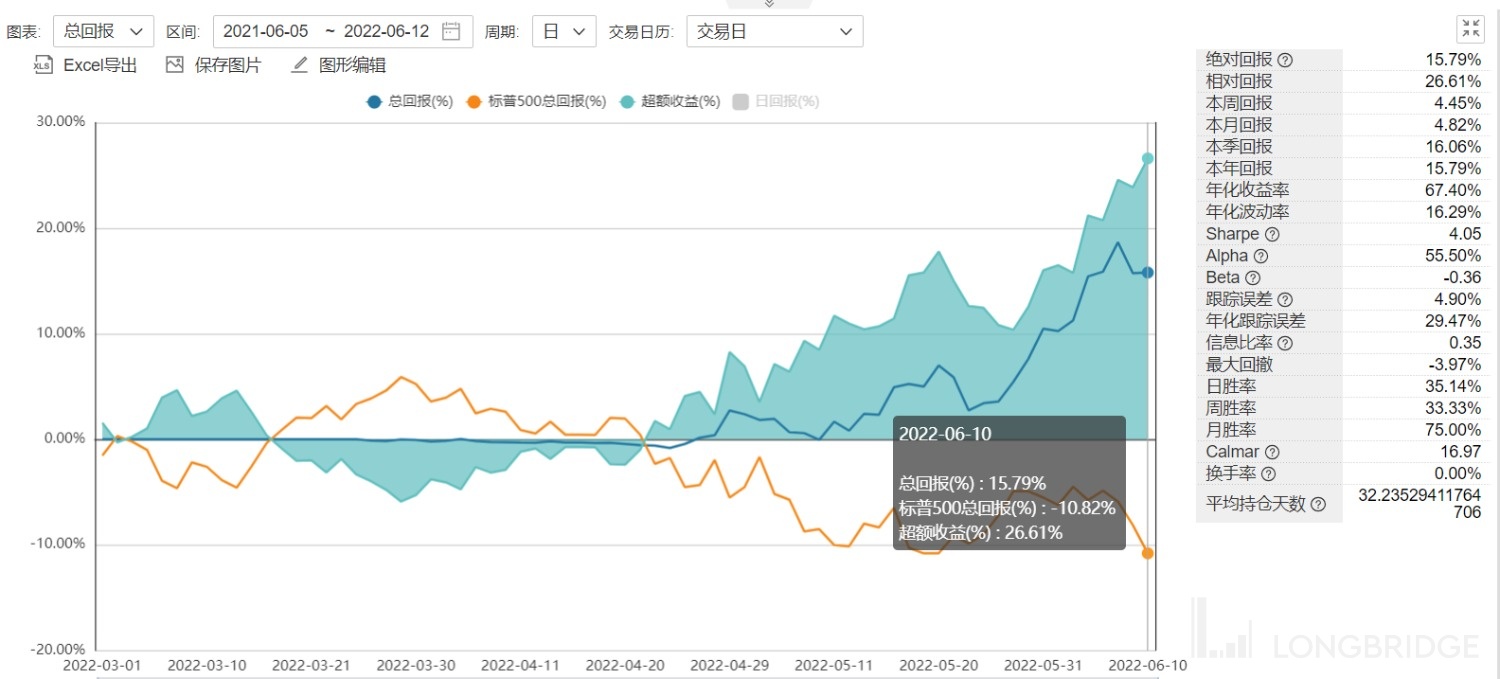

If we look at the overall returns of the Longbridge Alpha Dolphin portfolio from the internal testing launch on March 1st until last Friday, it has achieved a 16% return.

Since the launch of the portfolio last Tuesday, there have been no adjustments made, and it still consists of 10 core stocks and 24 underweighted stocks, with no overweights. From a weighting perspective, we will pay close attention to whether the core stocks have reached critical levels.

This week, we will focus on updating our assessment of Bilibili, one of the core stocks. If any adjustments to the allocation are necessary, we will inform everyone through the Longbridge app as soon as possible.

Four. Positive Outlook

Behind the fluctuations of individual stocks lies the rapidly changing market sentiment. This year, it is dominated by macro narratives, including global inflation, the tightening of monetary policy by central banks around the world, the geopolitical tensions between China and the United States, the conflict between Russia and Ukraine, and China's efforts in combating the pandemic, among other events.

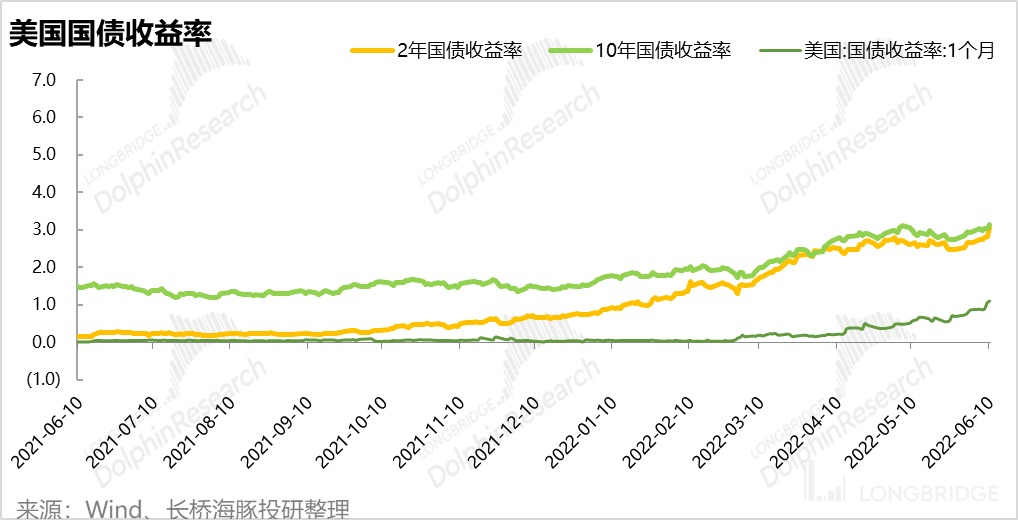

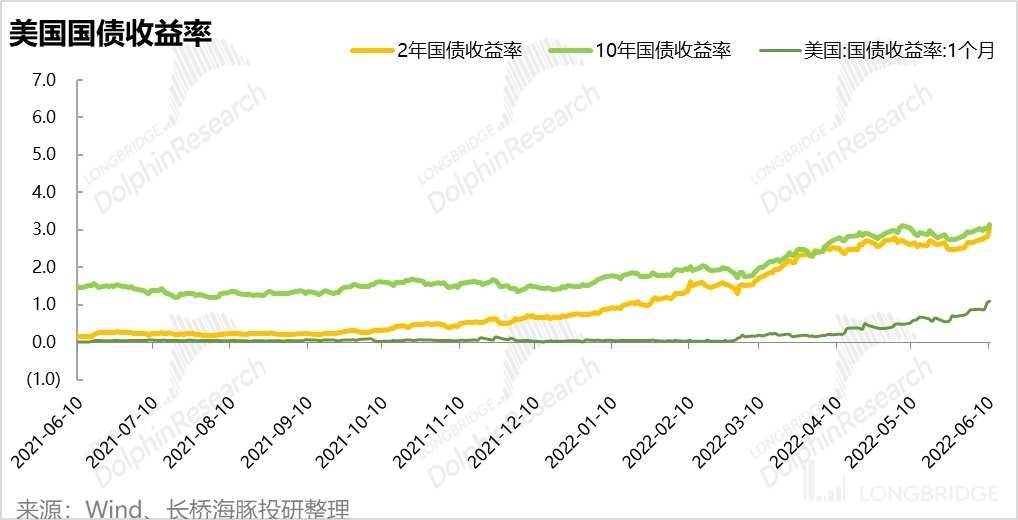

In the view of Dolphin, before the release of the CPI data last week, the market was mainly concerned about the possibility of economic recession amid expectations of peaking inflation. This was reflected in the stabilization of short-term interest rates since mid-May and the continuous decline of the 10-year Treasury yield after reaching a high of 3% on May 3rd.

It is precisely based on the assumption of stable external expectations (stabilization of US interest rate hike expectations, clear and definite path of quantitative tightening, no more "surprises" being created) that Chinese concept stocks, which have been heavily impacted by regulatory crackdowns and suppressed demand due to the pandemic, experienced a rapid rebound and valuation recovery last week, as policies reached their bottom and the pandemic was gradually brought under control.

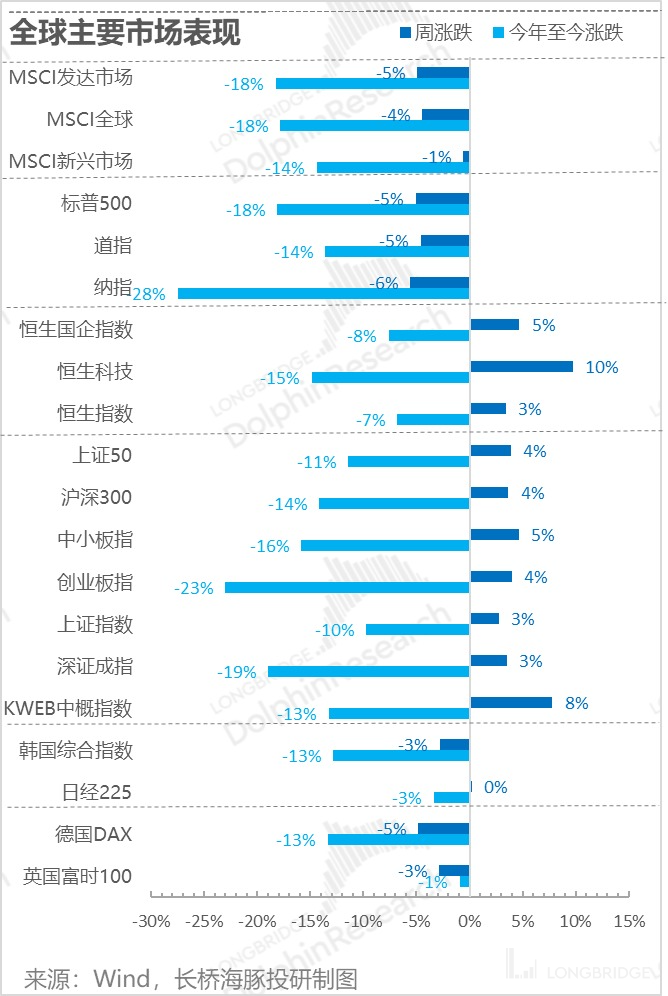

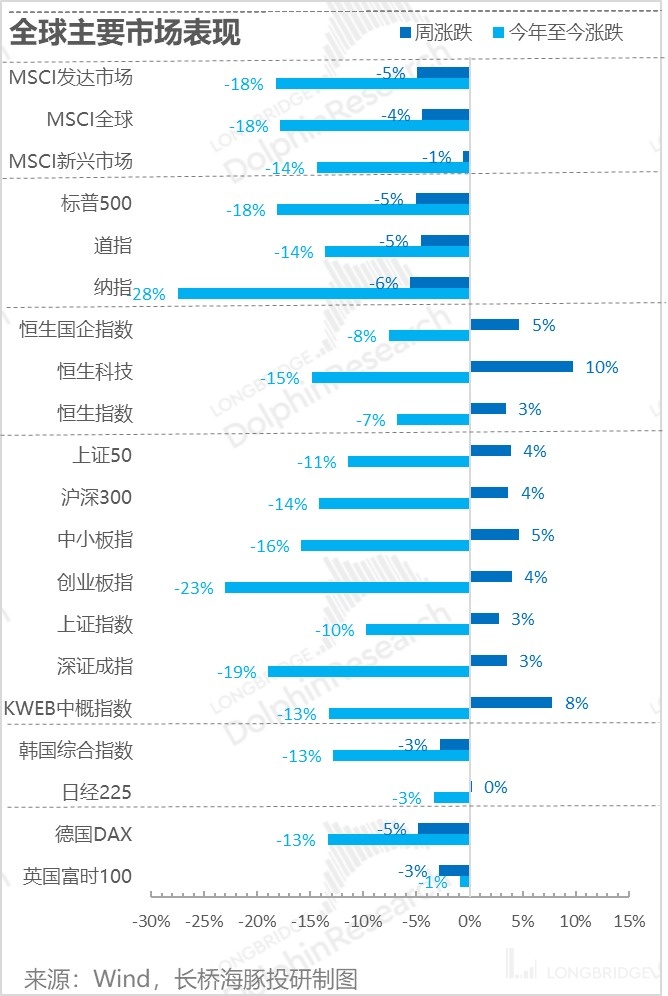

Five. Market Performance: Chinese Concept Stocks Finally Bounce Back

With a more optimistic market outlook, last week, major global markets and indices performed well. As the US CPI data was not released during the trading session, Chinese concept stocks and the Hang Seng Tech Index were the best performers, followed by the overall performance of the Hong Kong stock market and the A-share market, which were also relatively good.

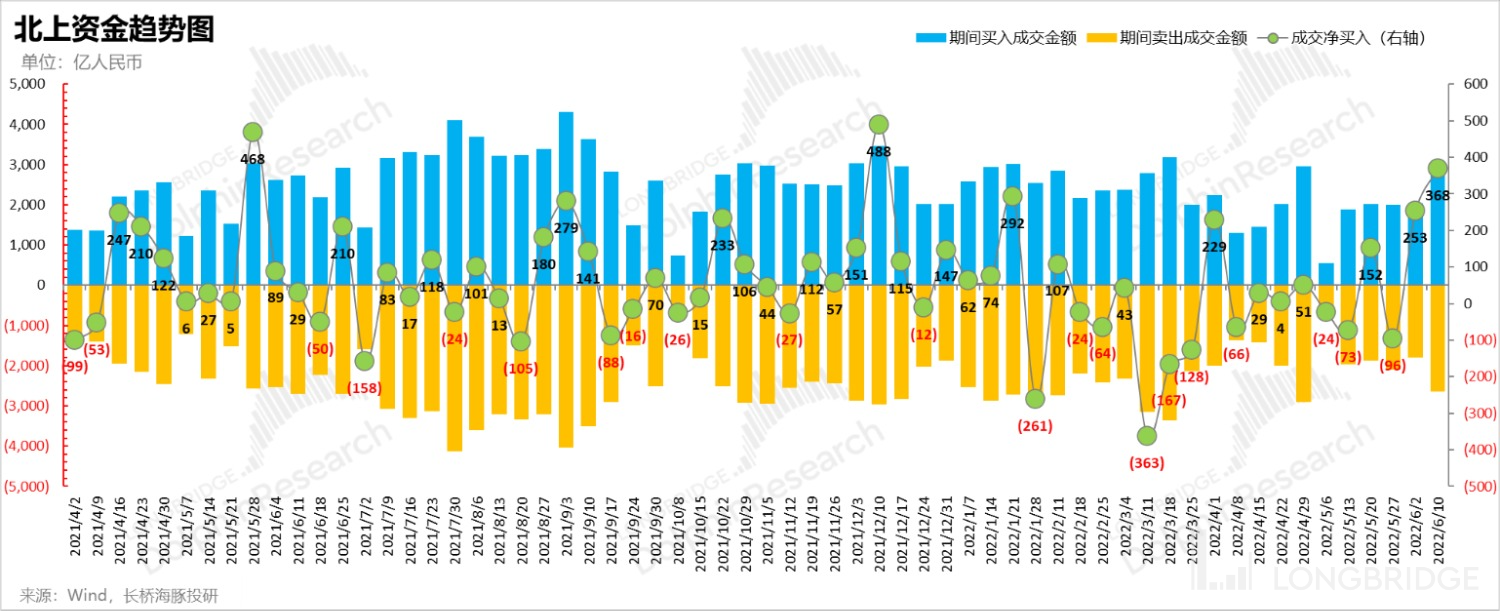

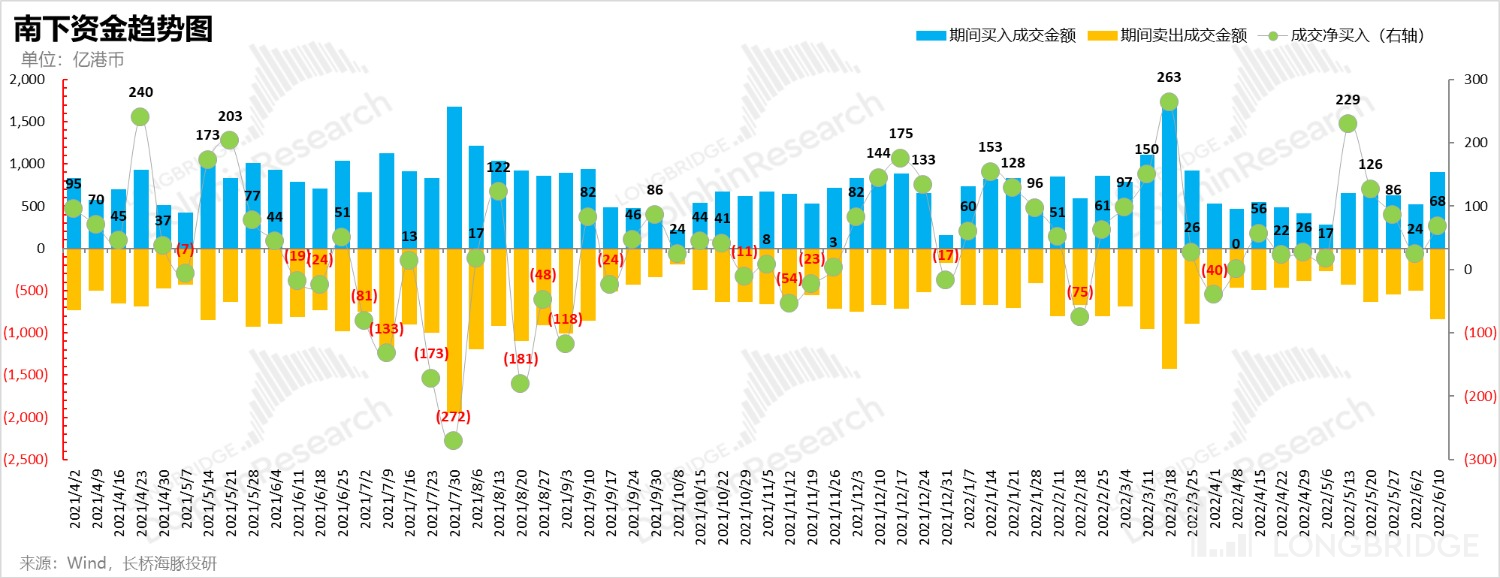

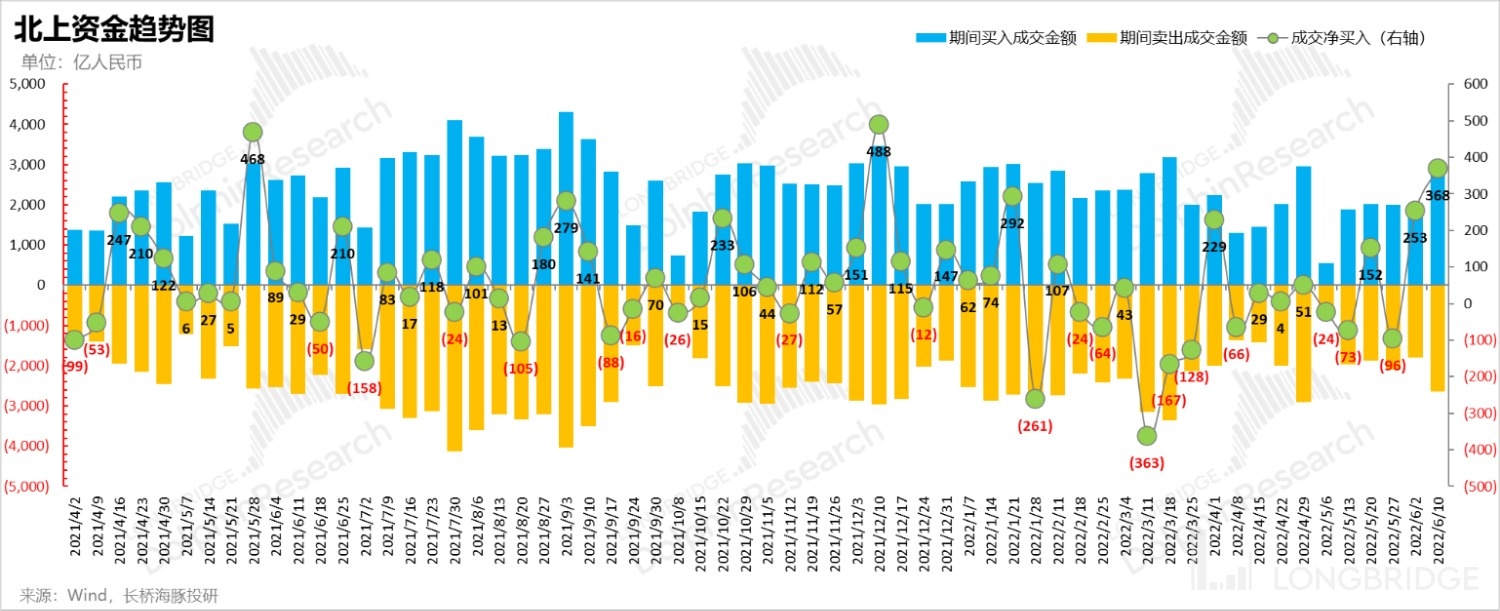

This is reflected in the inflow of funds from the northbound and southbound channels:

Since the official reopening of the Shanghai Stock Exchange after the Dragon Boat Festival, northbound funds have been continuously buying domestic assets, with net inflows reaching a new high.

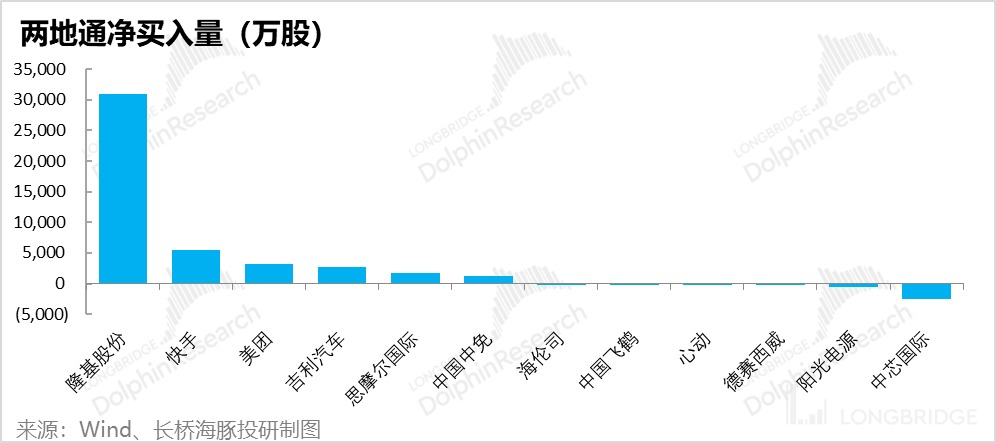

Southbound funds, on the other hand, have been proactive since mid-May, starting to buy undervalued Hong Kong-listed technology stocks, and they continued to be net buyers last week. In Dolphin's coverage pool, the stocks with the highest net buying volume (in shares) last week were Longi, Kuaishou, and Meituan; while the stocks with net selling volume were SMIC and Sungrow, which were just included in the Hang Seng Index.

The worst-performing market last week was the US stock market: in the US stock market, some funds had already started trading in anticipation of the CPI exceeding expectations on Thursday, and the CPI data released on Friday indeed disappointed, causing a sharp drop in US stocks.

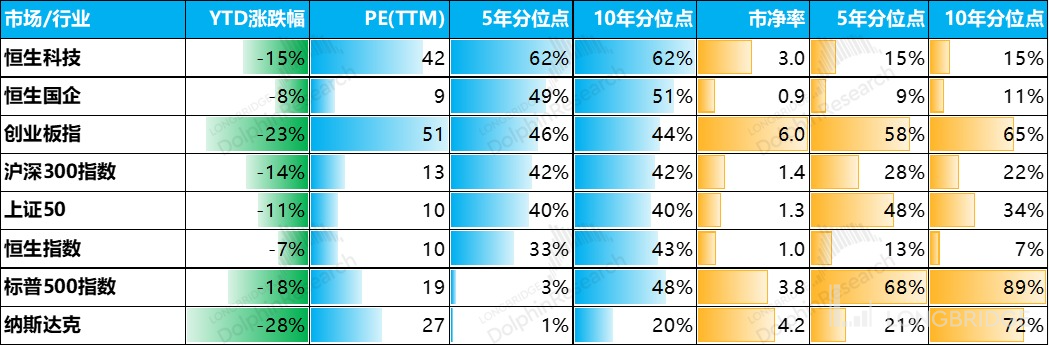

From the perspective of valuation percentile, under the pressure of inflation and contraction expectations, although the five-year PE percentile has become extremely cheap, the market is concerned that there may be performance risks ahead, and current profits may not be sustainable. With the emergence of inflation, assets are still being sold off.

Fifth, the harsh reality: high inflation in the United States "welded shut"

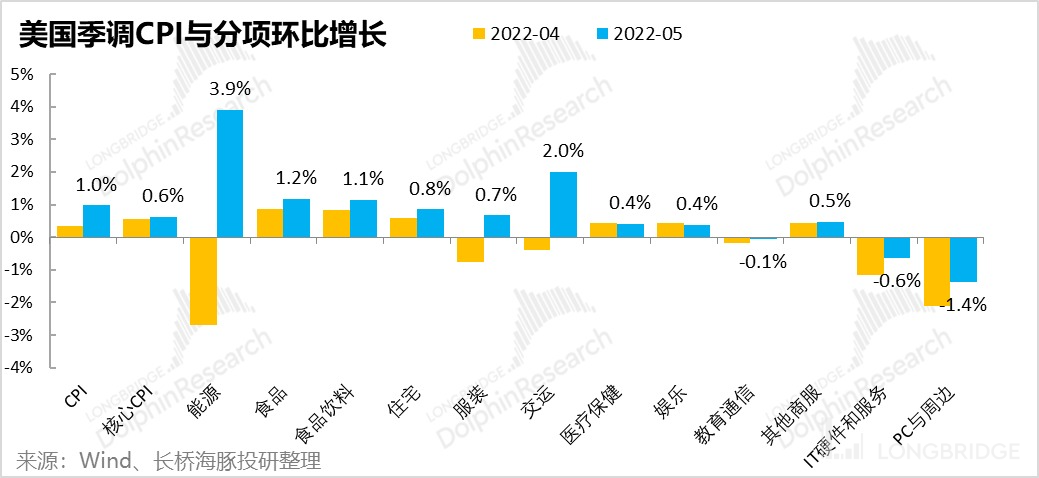

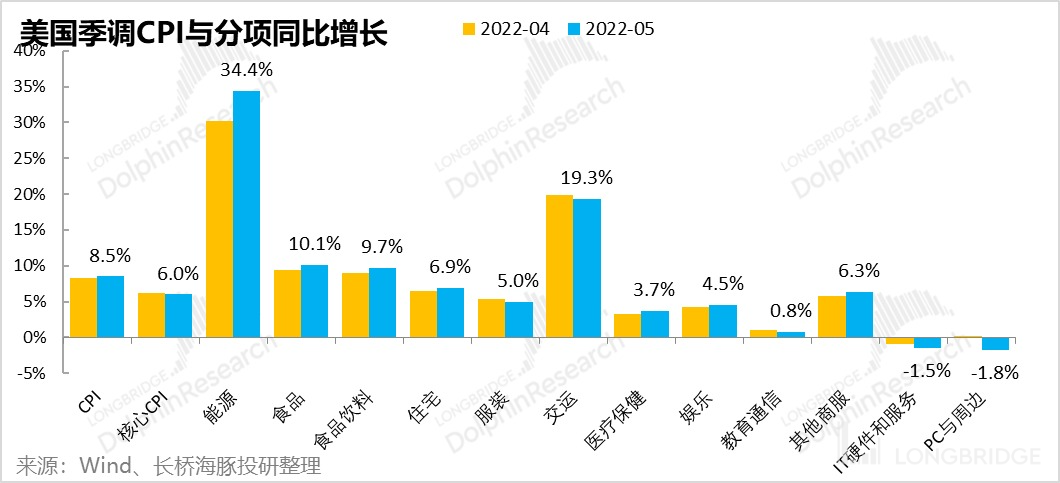

In fact, the US CPI released last Friday still showed no signs of easing. Let's look at the month-on-month seasonally adjusted data for US CPI in May:

In addition to sustained high growth in energy and food prices, prices of services mainly driven by labor force are also rising. Commodities prices, which could have helped suppress inflation, such as clothing, are also rising rapidly. The only deflationary products are IT hardware and PC and other general-purpose devices.

For such sustained high inflation, the market's response is that short- and long-term bond yields have soared, while the yield spread between short- and long-term bonds has narrowed, and there is a strong expectation of a future economic recession.

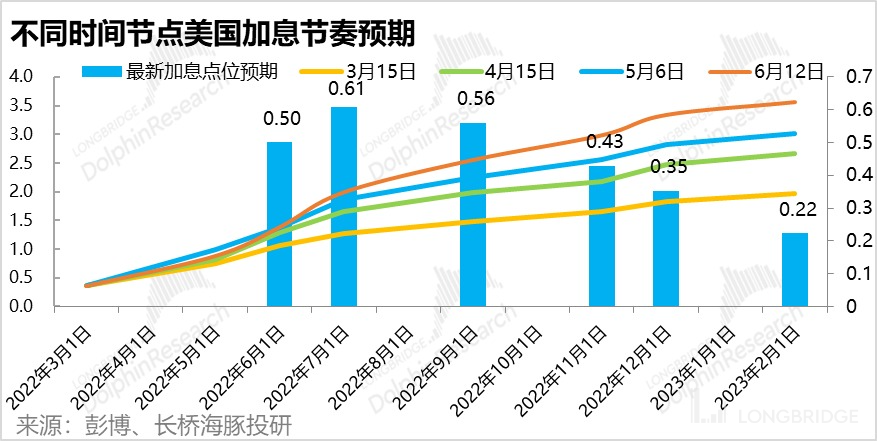

With inflation data firmly anchored in expectations, current inflation has not improved, and the market's expectation of a rate hike by the Federal Reserve is increasing every month.

According to the latest expectations shown in the chart below, the average expected rate hike on July 27th is 61 basis points, indicating that some people in the market are already expecting a 75 basis point rate hike in July.

In this situation, considering that most of the assets covered by Dolphin, except for new energy, still have very weak overall performance, and in the first quarter, they were in a state of struggling to survive. In the future, we still need to see the recovery of performance to make investors more confident in entering the market. In the absence of performance support and with high inflation still burning in the United States, The possibility of stock price hovering and fluctuating is greater than continuing a strong rebound.

6. What to look at next?

The key focus at the current macro level in the United States remains the inflation expectations of the U.S. stock market. As the current path of U.S. interest rate hikes and balance sheet reduction has become clear, inflation and inflation expectations are the core variables that disrupt the current roadmap.

In addition to CPI, the other key indicator to observe is the supply and demand situation in the labor market. Since the main cost composition of service prices is mainly labor, if the labor market continues to face a shortage of supply, inflation is likely to persist. Furthermore, Dolphin will continue to monitor the demand-side situation, such as the inventory situation in the U.S. retail sector, to understand the possibility of a performance slump in the U.S. stock market.

In the case of the continuous narrowing of the PPI-CPI gap in China, the main problem lies in weak demand. After the intensive implementation of stimulus and relaxation policies, and the conclusion of the National People's Congress, there is still a period of implementation left. By looking at social financing data, especially long-term loans to enterprises and households, we can assess the recovery of demand and confidence.

Only when U.S. inflation expectations stabilize, can the pure U.S. stock assets covered by Dolphin possibly stabilize. Undervalued Chinese concept assets and general consumer assets can truly emerge from the bottom of performance in a stable external environment and with the recovery of domestic demand, coupled with their own cost reduction and efficiency improvement.

Of course, Dolphin will continue to conduct fundamental research on individual stocks and select companies with hopes of a turnaround through portfolio adjustments.

Risk disclosure and statement for this article: Dolphin Disclaimer and General Disclosure