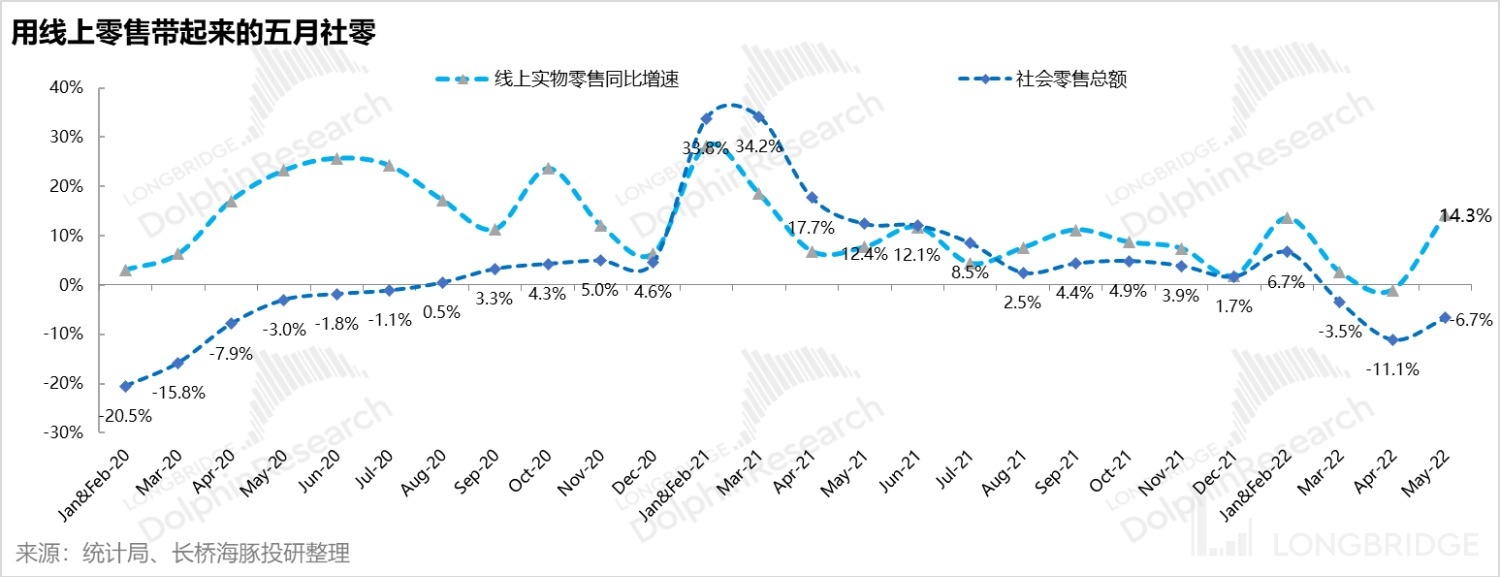

Apart from cooking, taking medicine, and refueling, May's social retailing relies entirely on online platforms.

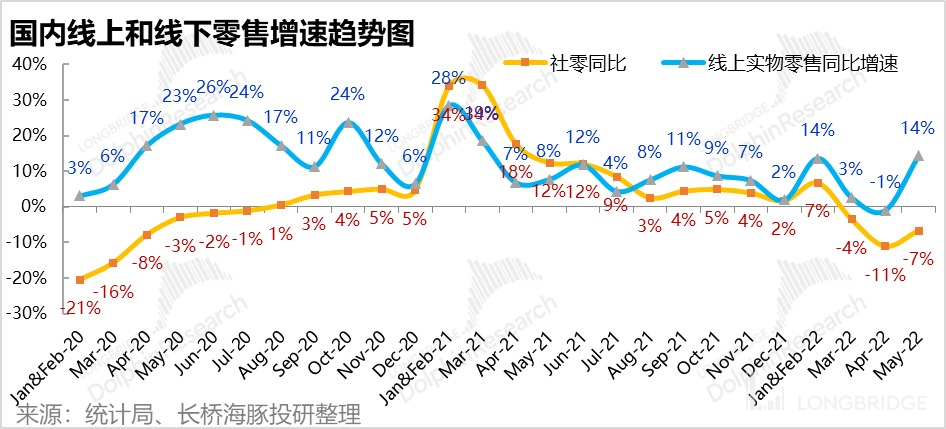

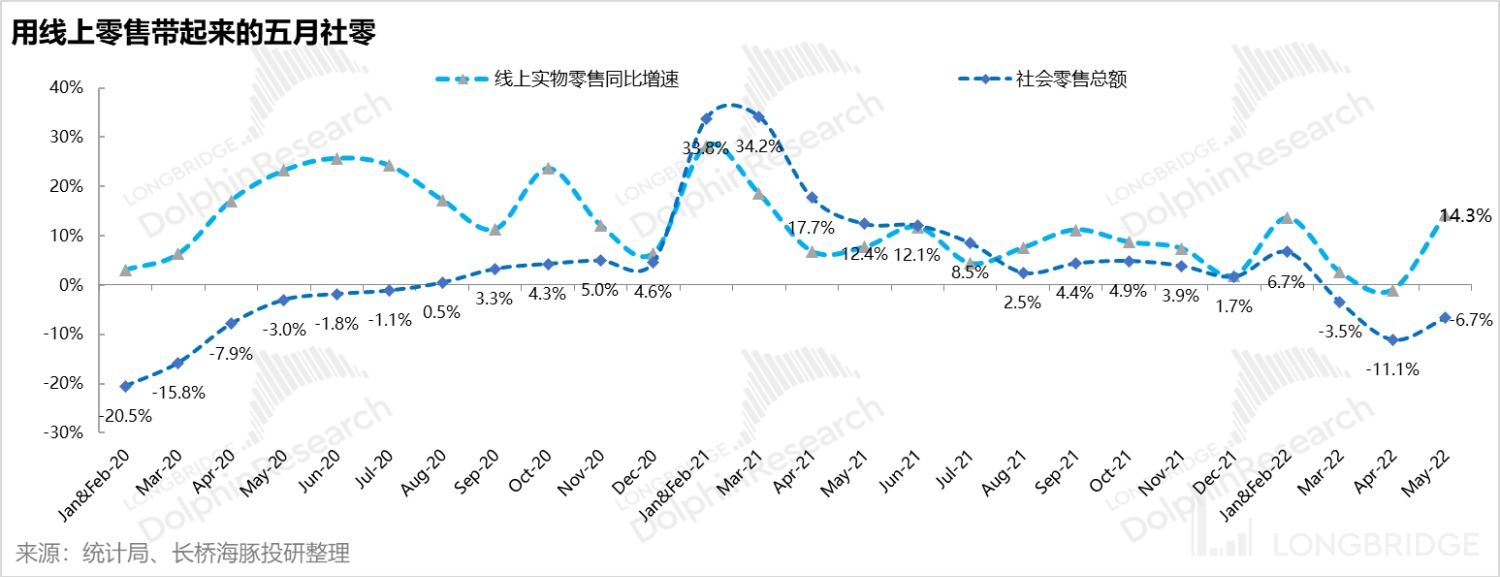

According to the latest data from the National Bureau of Statistics, in May 2022, the total retail sales of consumer goods reached 3.3547 trillion yuan, a year-on-year decrease of 6.7%. Among them, the retail sales of consumer goods excluding automobiles reached 3.0361 trillion yuan, a decrease of 5.6%.

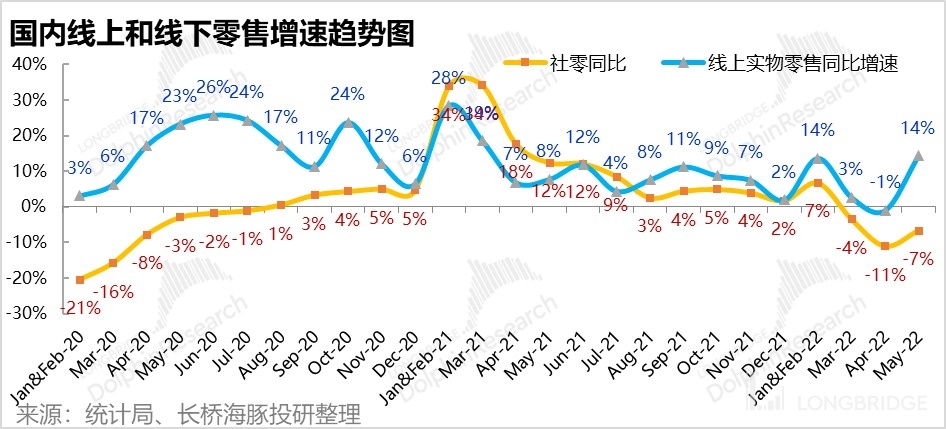

From January to May, the national online retail sales reached 4.9604 trillion yuan, a year-on-year increase of 2.9%. Among them, the online retail sales of physical goods reached 4.2718 trillion yuan, an increase of 5.6%, accounting for 24.9% of the total retail sales of consumer goods. In the online retail sales of physical goods, the sales of food and daily necessities increased by 16.0% and 6.3% respectively, while the sales of clothing decreased by 1.6%.

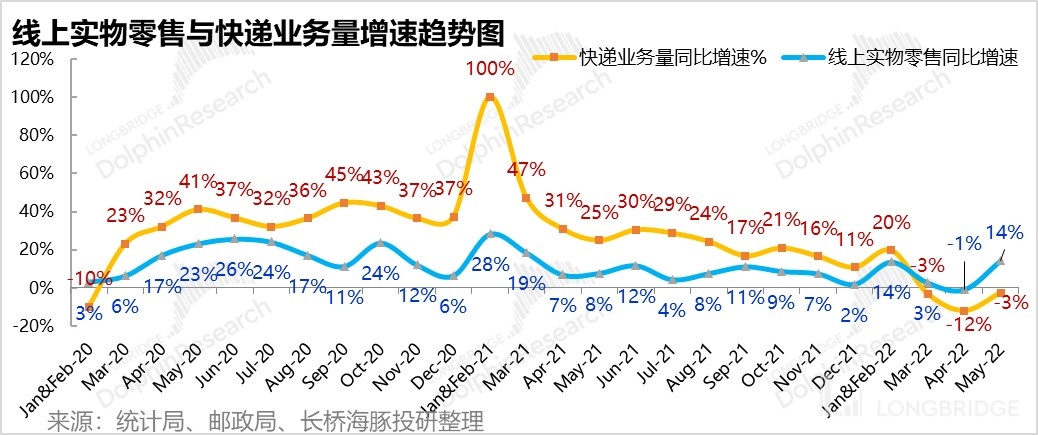

Looking at a single month, the year-on-year growth of online retail sales of physical goods in May was 14%, which is much higher than the growth level expressed in the May financial reports of e-commerce companies such as Alibaba and JD.com.

According to a small-scale communication from JD.com, "The performance in April and May was similar to the industry average, and we hope to recover from the impact in April in June. It is already good if we can achieve flat growth or a slight increase."

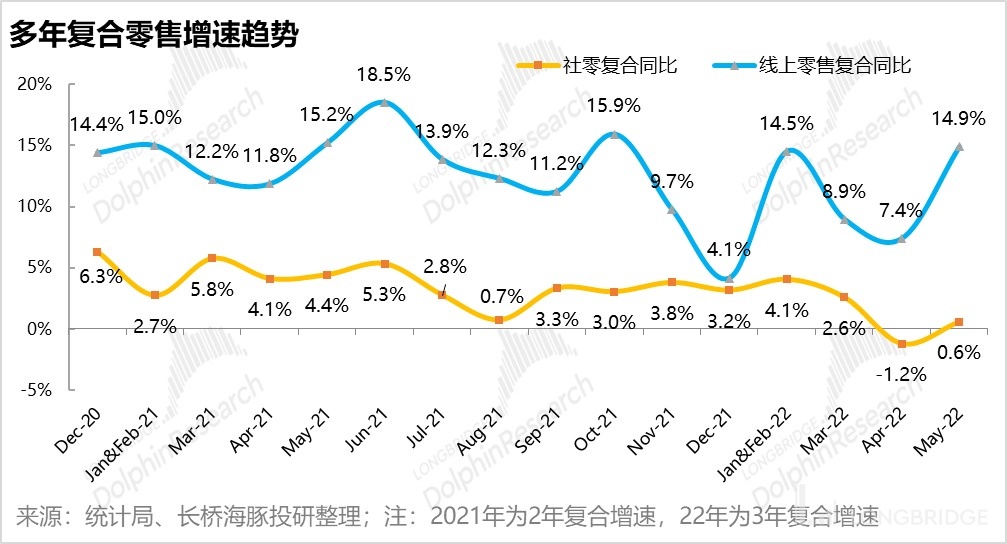

Now, according to the statistics bureau, the year-on-year growth of online retail sales of physical goods in the first two months of the second quarter has reached 7%.

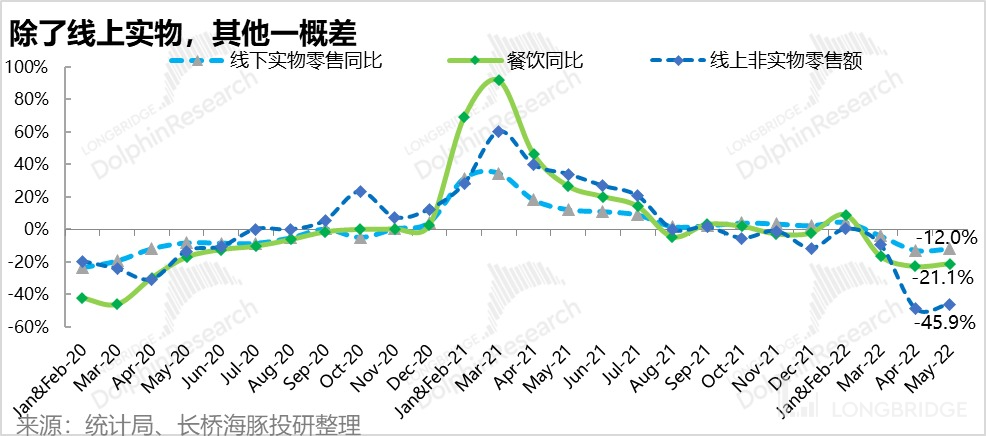

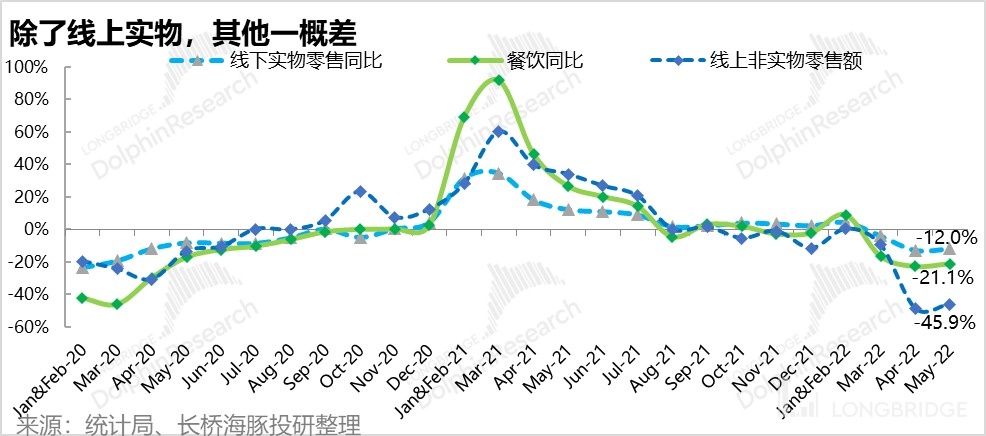

Of course, in addition to online retail sales of physical goods, other sectors such as catering retail, online virtual and service retail, and offline retail are also in a disastrous state.

Specifically, there are several points:

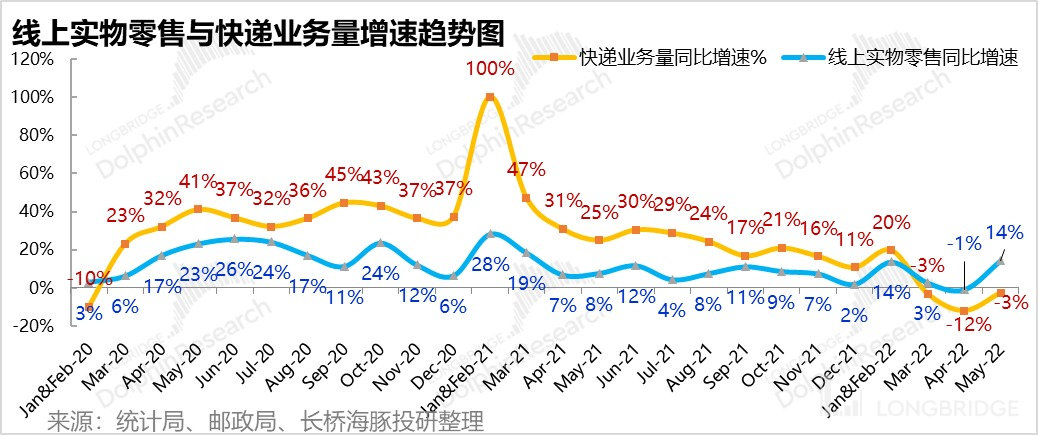

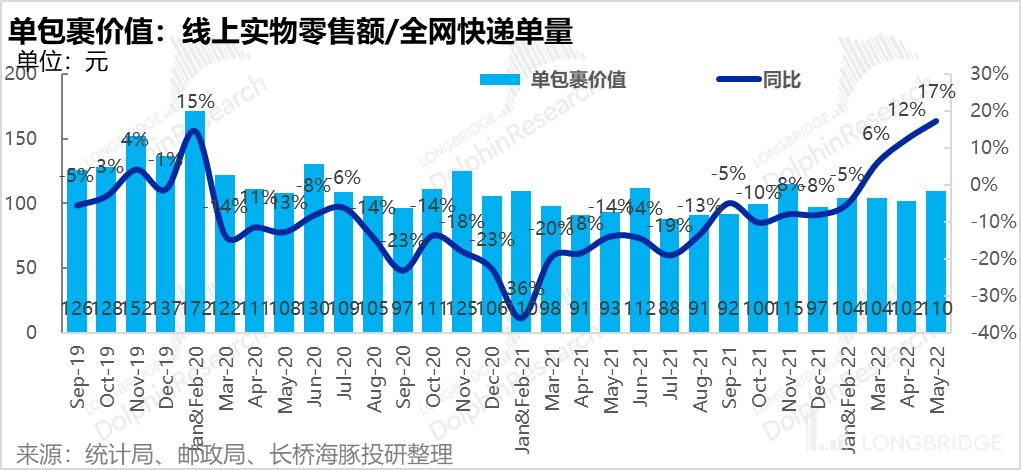

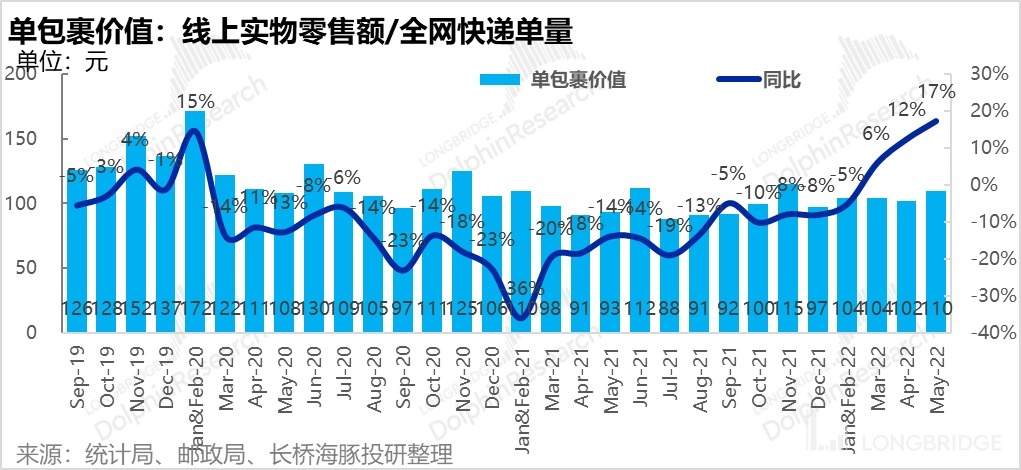

(1) Among the 14% year-on-year growth of online retail sales of physical goods, if we consider the relationship between quantity and price by combining the number of parcels from the postal bureau, the increase in the value of retail growth per package is due to the fact that the industry's express delivery volume announced by the post office is still shrinking by about -3%, which means that the value of parcels in May increased by 17% compared to the same period last year.

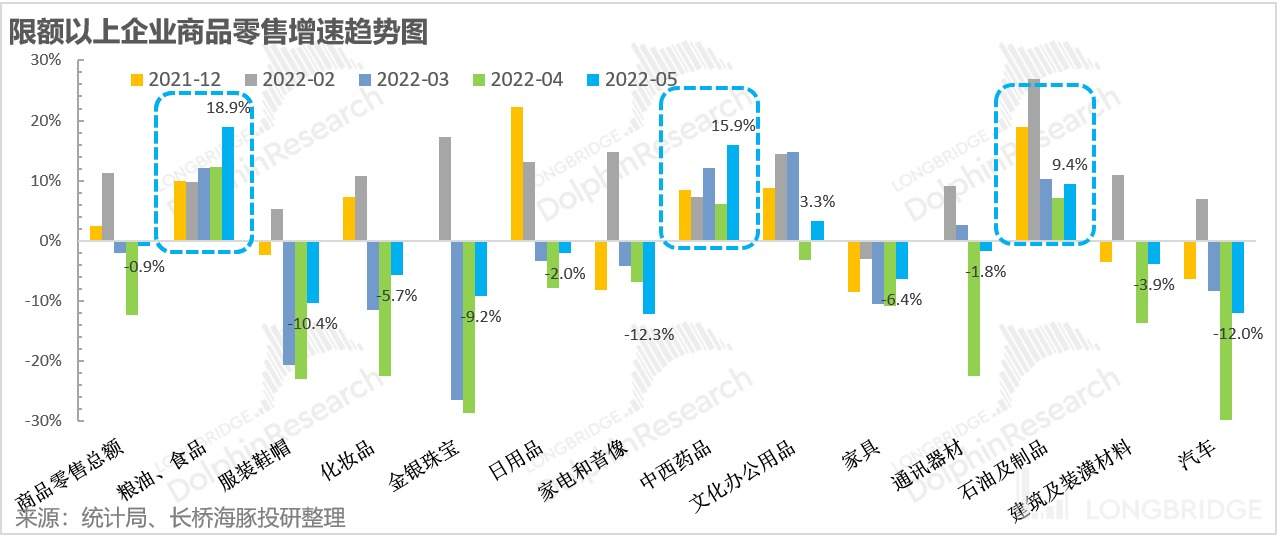

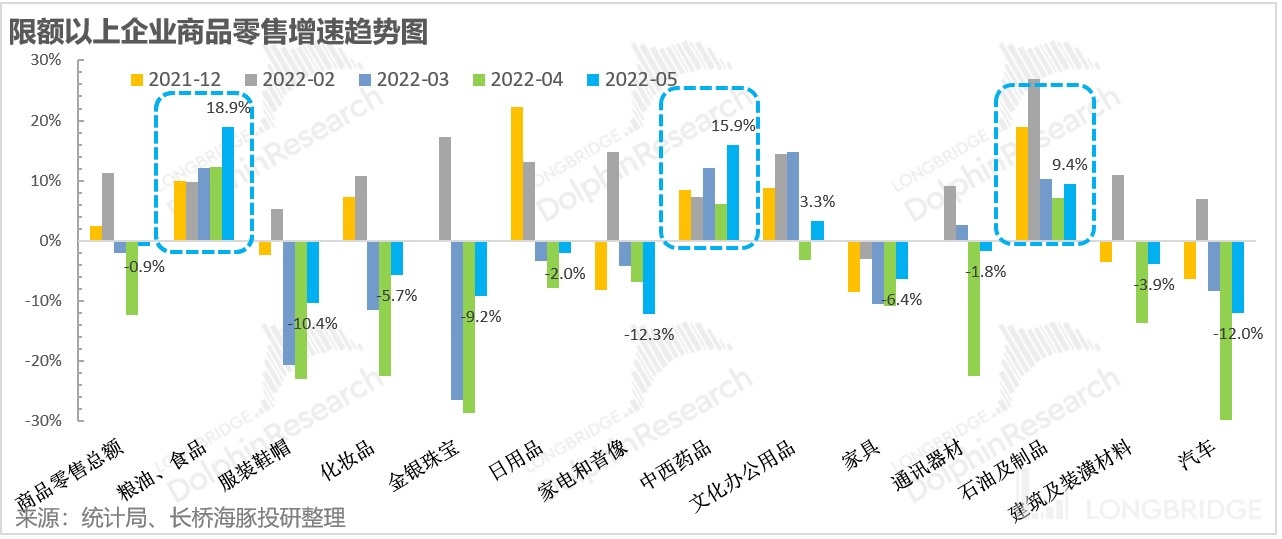

(2) In the overall sluggish situation of the retail industry, the sectors that continue to grow positively are home dining, medicine, and fuel consumption, corresponding to grain and oil/food, Chinese and Western medicine, as well as petroleum and petroleum products.

(3) The situation of catering retail is also very poor, with a decline of more than 20% year-on-year, which is no less than that of April.

1. Strong Performance of Online Retail Sales of Physical Goods

In May, despite the partial logistics lockdown caused by the COVID-19 outbreaks in Shanghai, Jilin, and Beijing, many orders were canceled or delayed. However, online retail sales in May performed quite well.

After a 1% year-on-year decline in April, there was a surprising 15% positive growth in May!

And from the perspectives of both quantity and price: The Post Office predicted a 20% month-on-month increase in express delivery volume in early June, so the corresponding trend of year-on-year growth in online express delivery volume for the entire industry is roughly as follows: There was a decrease of about 3% in volume in May.

And from the perspectives of both quantity and price: The Post Office predicted a 20% month-on-month increase in express delivery volume in early June, so the corresponding trend of year-on-year growth in online express delivery volume for the entire industry is roughly as follows: There was a decrease of about 3% in volume in May.

And these two numbers together imply a high probability of an upward trend in the value of individual packages: a 17% year-on-year increase.

The trend of this number in the past few years has been that the value of individual packages has been declining year-on-year due to consumer downgrading and the online penetration of cost-effective goods from platforms like Pinduoduo. The last time the value of individual packages increased year-on-year like in April and May was during the Wuhan epidemic in January and February 2020.

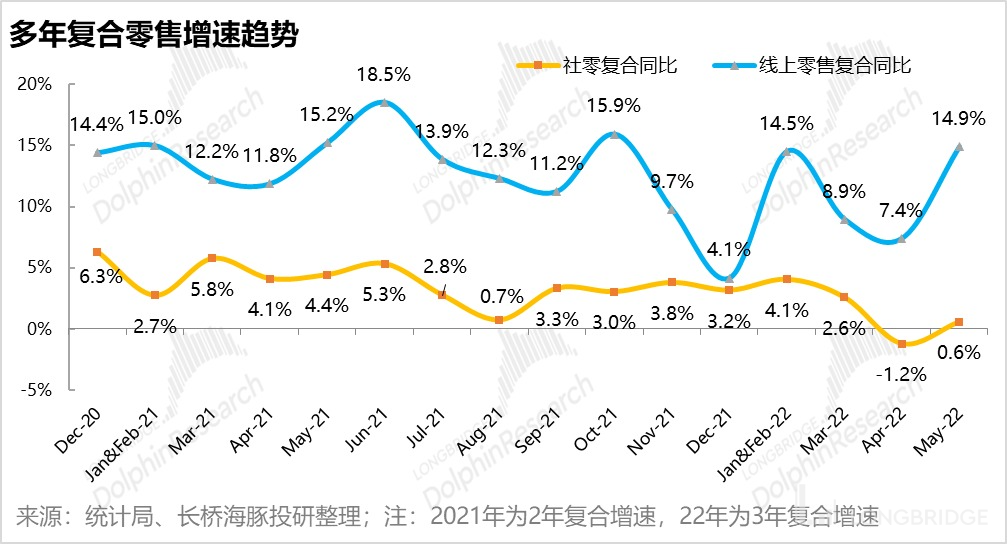

If we use 2019 as the base year for year-on-year comparison, the online retail growth in May is also relatively high.

If online retail can maintain a similar strong growth trend in June and correspond to the second-quarter revenue of individual e-commerce stocks at the micro level, it will further confirm that it is correct to focus on retail stocks in this wave of Internet stock valuation recovery.

2. Offline and virtual consumption are still in a worse situation

In May's social retail data, the only bright spot was the growth in online physical goods, or more precisely, the increase in the value of individual packages.

Other core retail sectors were basically in a worse situation: the largest offline physical retail sector saw a 12% year-on-year decline, similar to April; catering saw a 21% year-on-year decline, similar to April; online non-physical services (such as virtual travel and services on platforms like 58.com) saw a year-on-year decline of 46%.

Of course, in June, when the market has already been largely reopened, people are not so concerned about how the May data performed. The speed of recovery under normal economic conditions is the more critical issue.

In the end, the social retail data for May was mainly brought back by the strong performance of online retail: it declined by 6.7% year-on-year, showing some recovery compared to the 11% decline in April.

3. The only rigidity in an extreme market: food, medicine, and energy inflation

3. The only rigidity in an extreme market: food, medicine, and energy inflation

So, apart from grains and oils, Chinese and Western medicine, and petroleum products, there is no significant difference in who performs worse. In the case of subsequent unblocking, it is highly likely that there will be a wave of discounted inventory clearance for commodities. $Visa.USipshops.US, $PDD.US

<End of the article>

Risk disclosure and statement for this article: Dolphin Disclaimer and General Disclosure