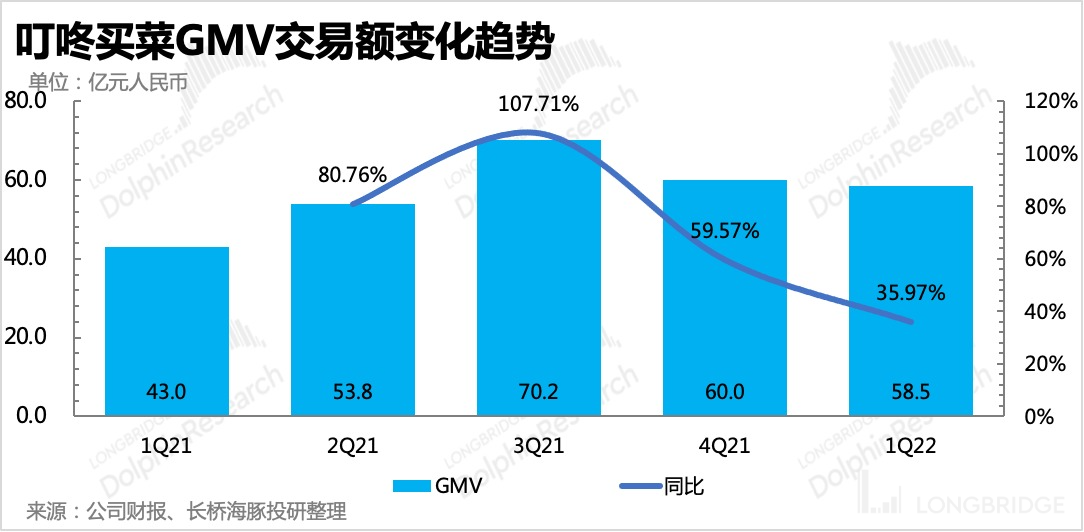

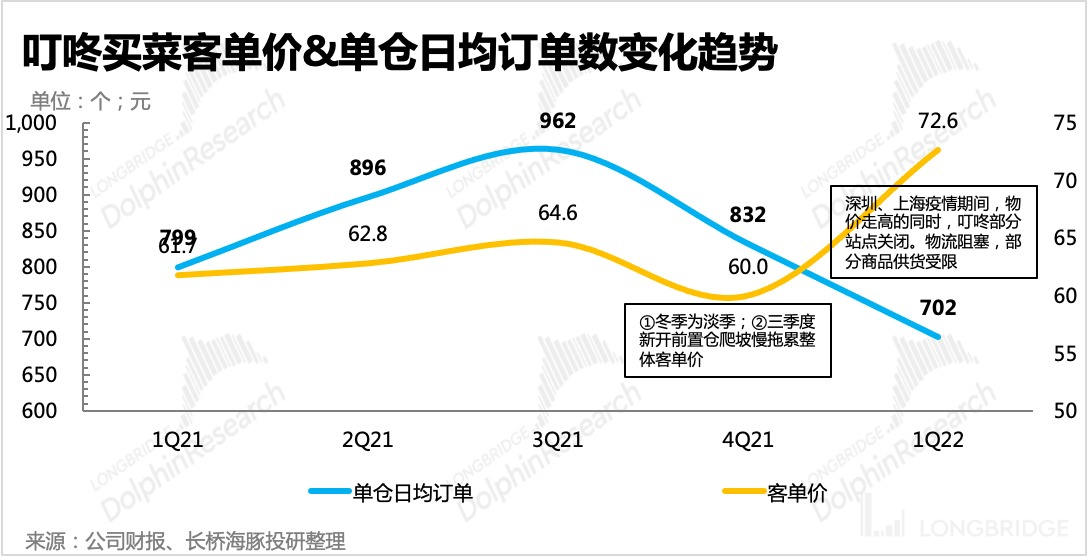

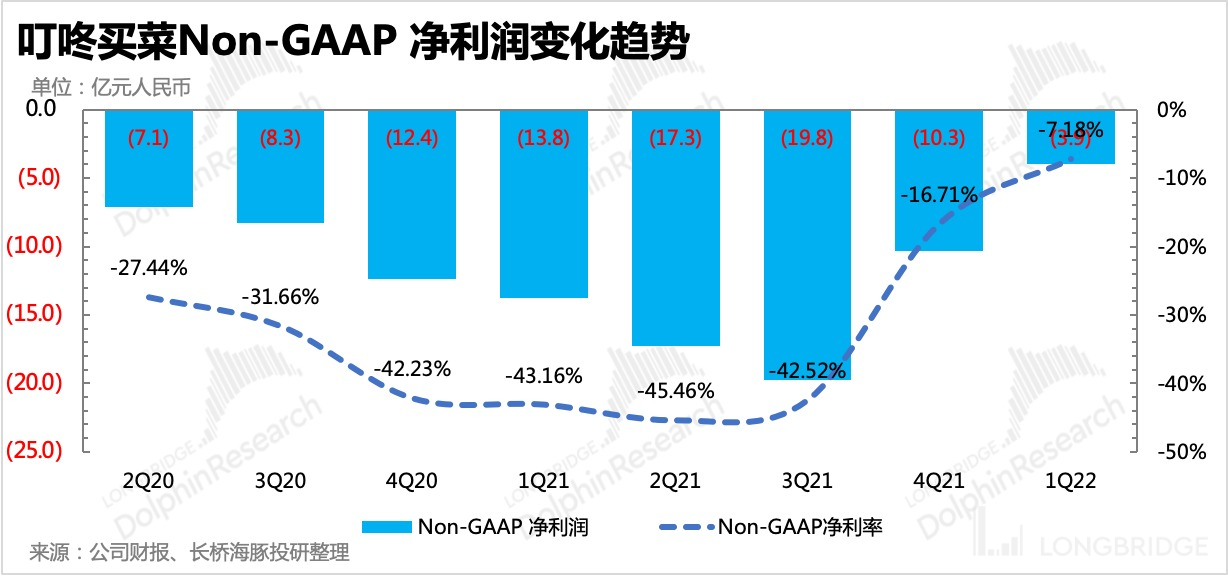

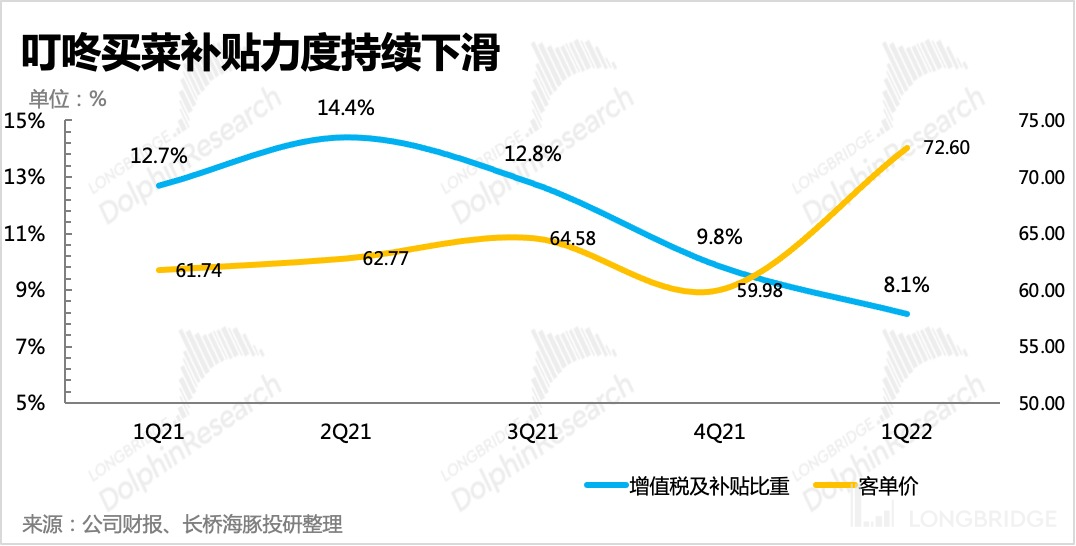

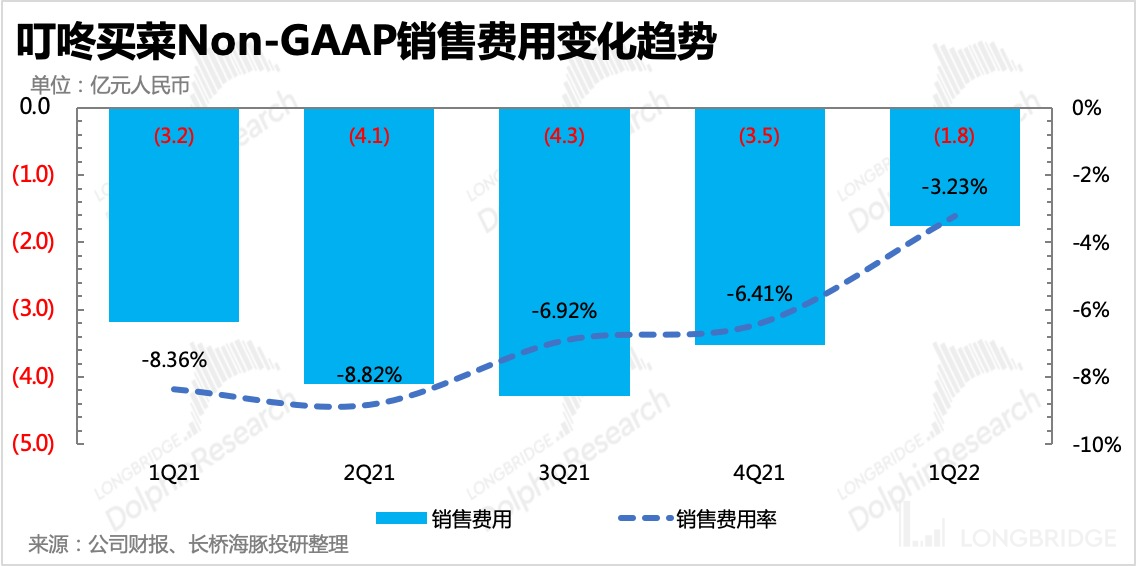

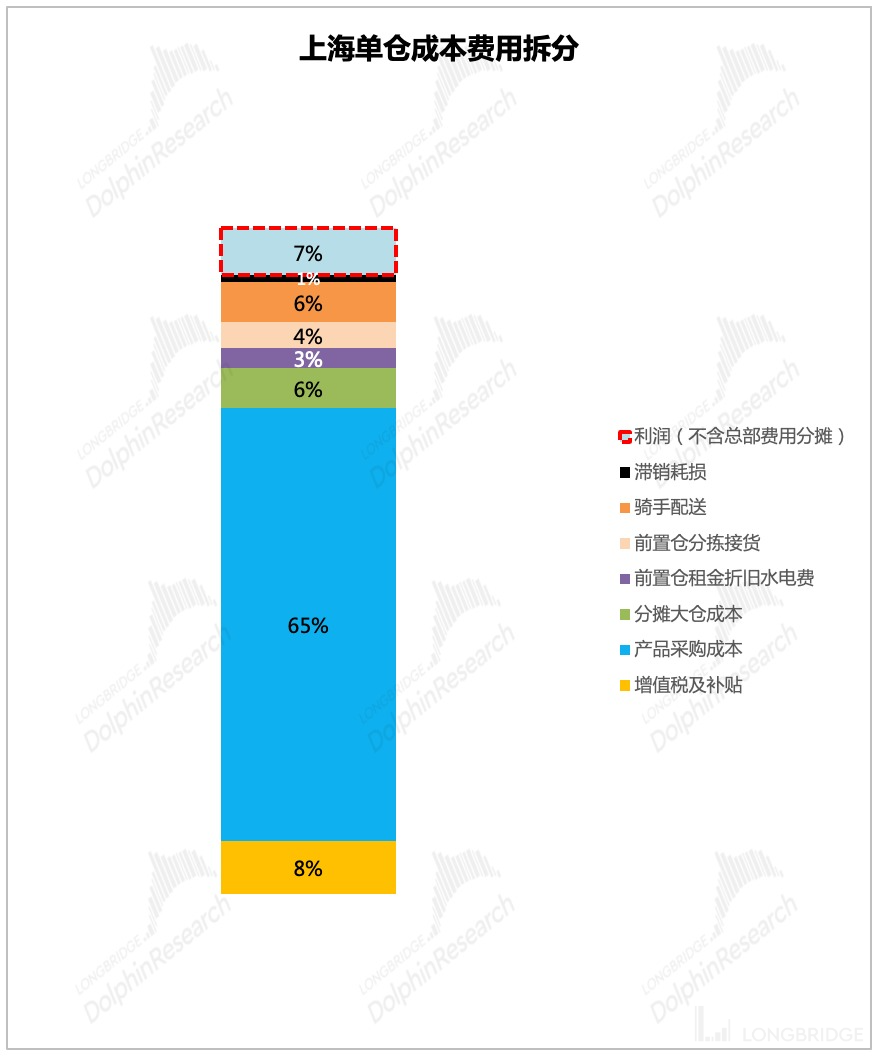

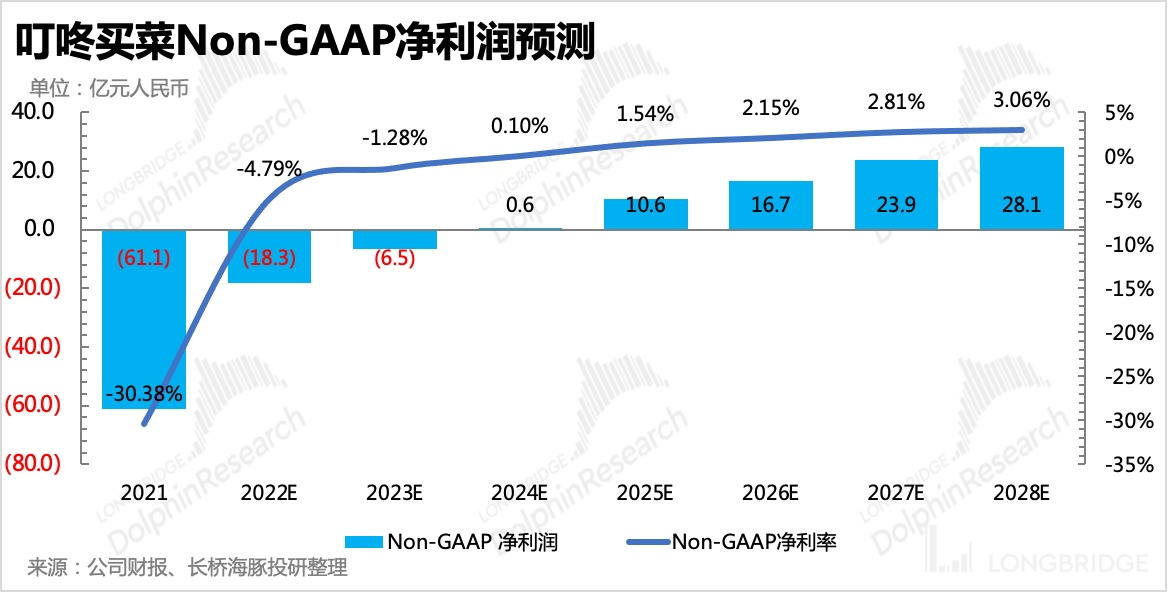

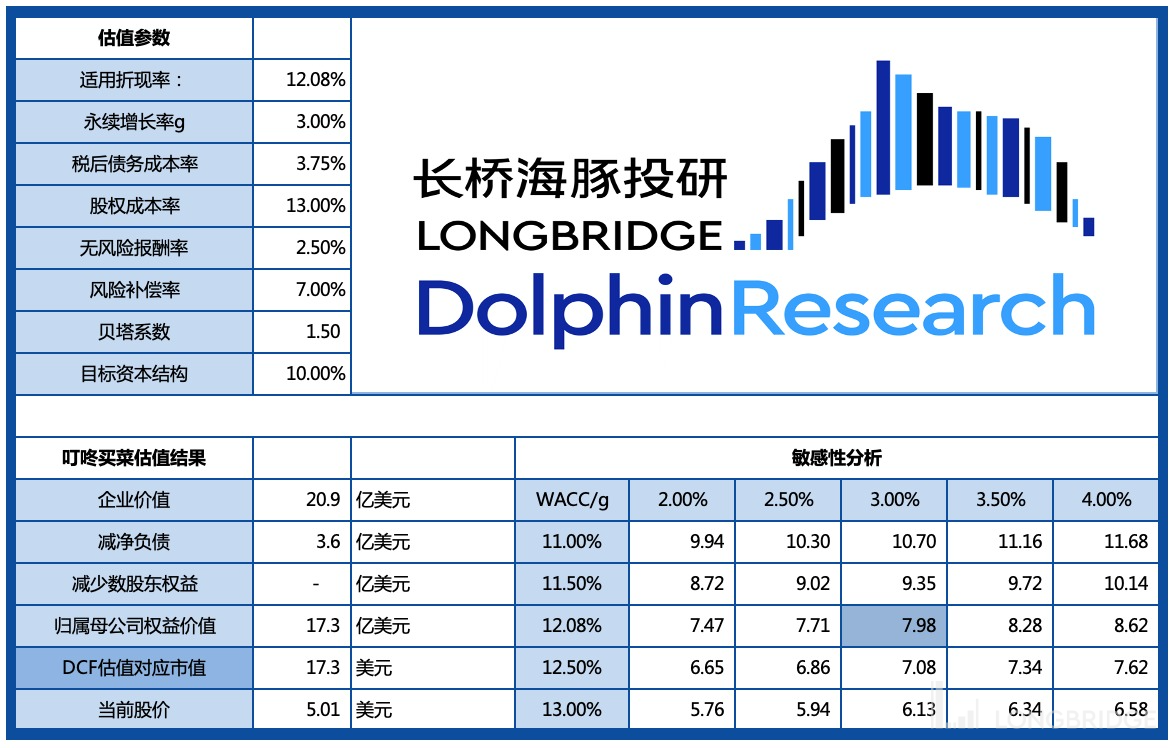

Profit turning point is imminent, DingDong is not so desperate.

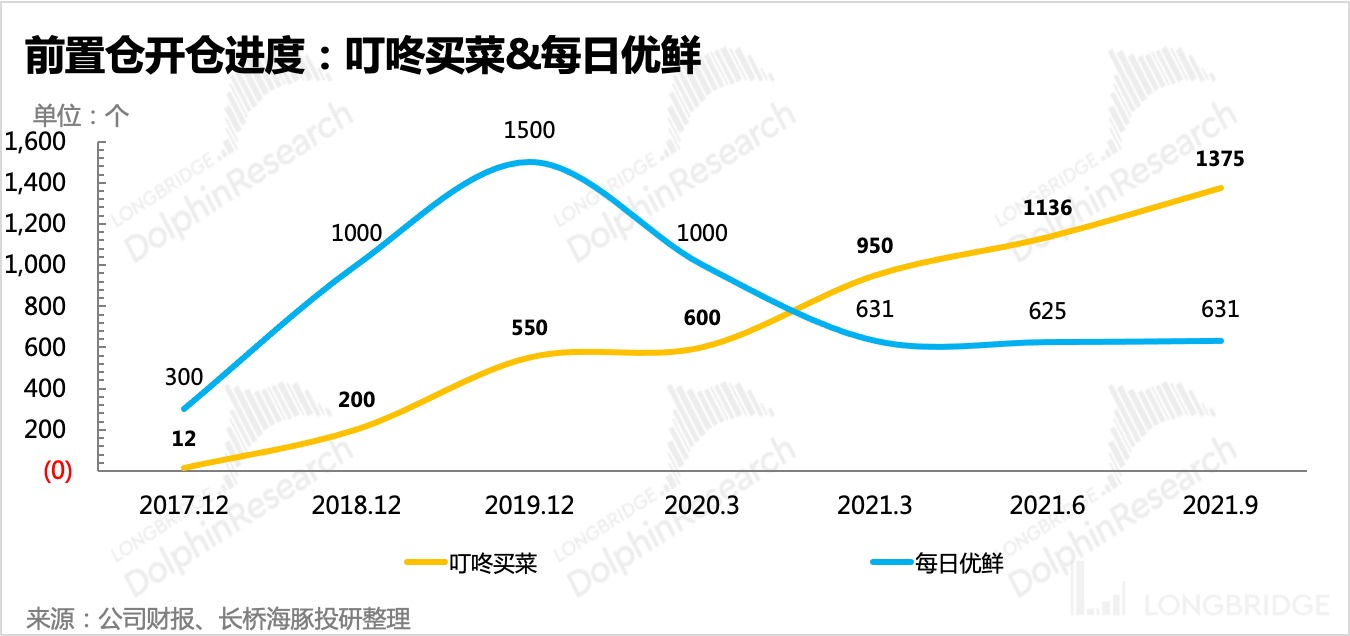

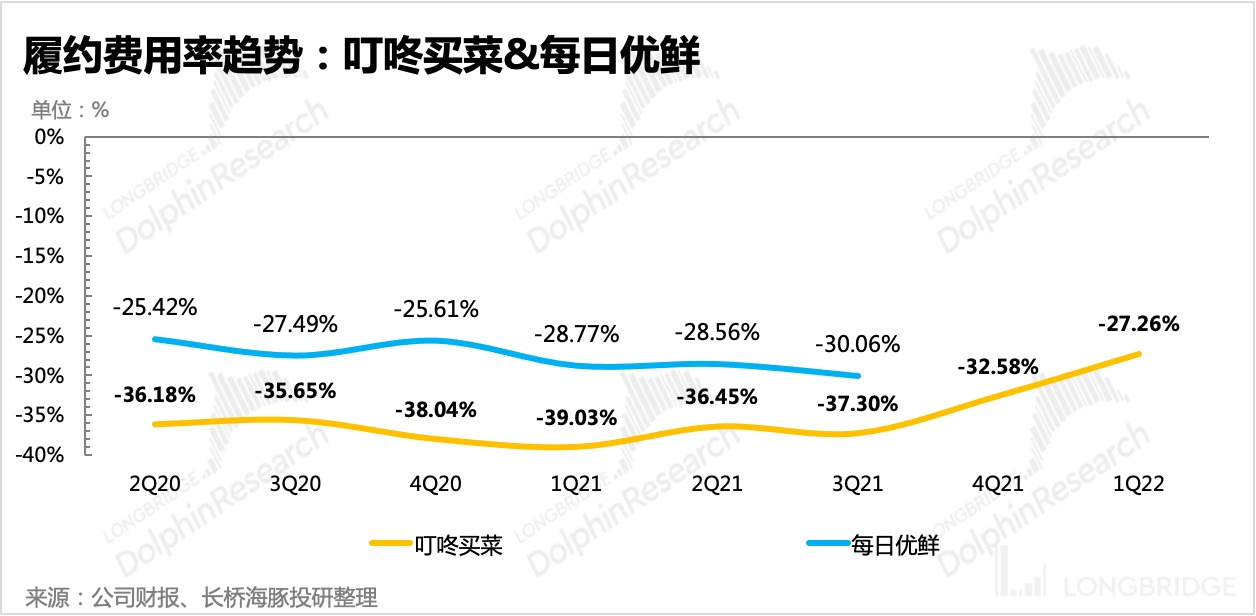

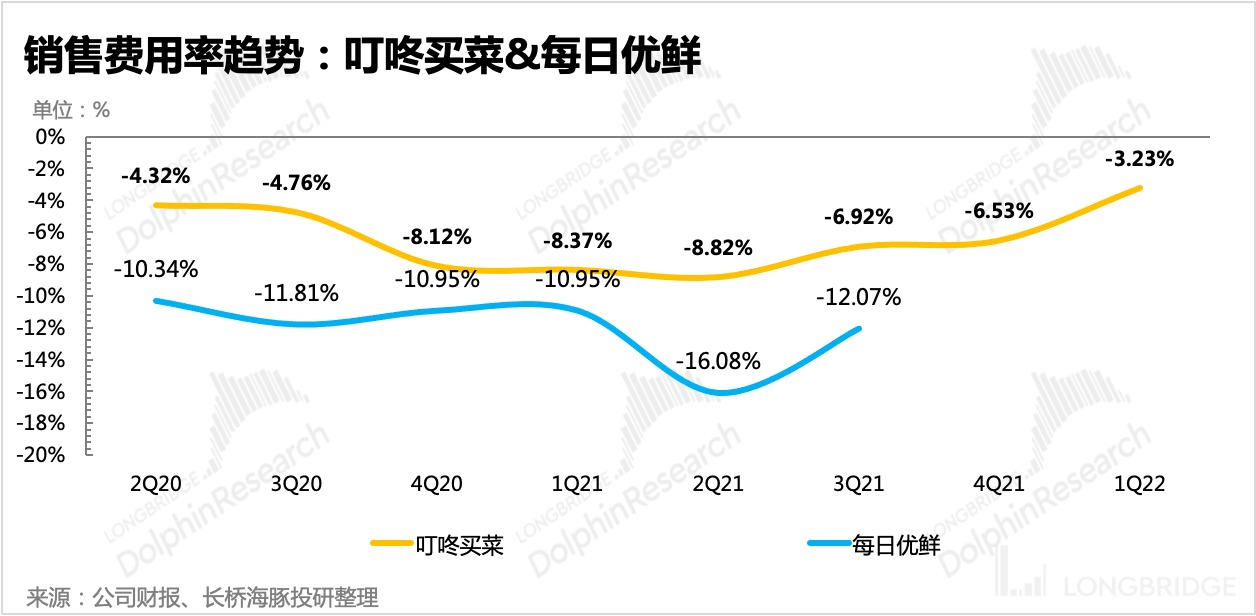

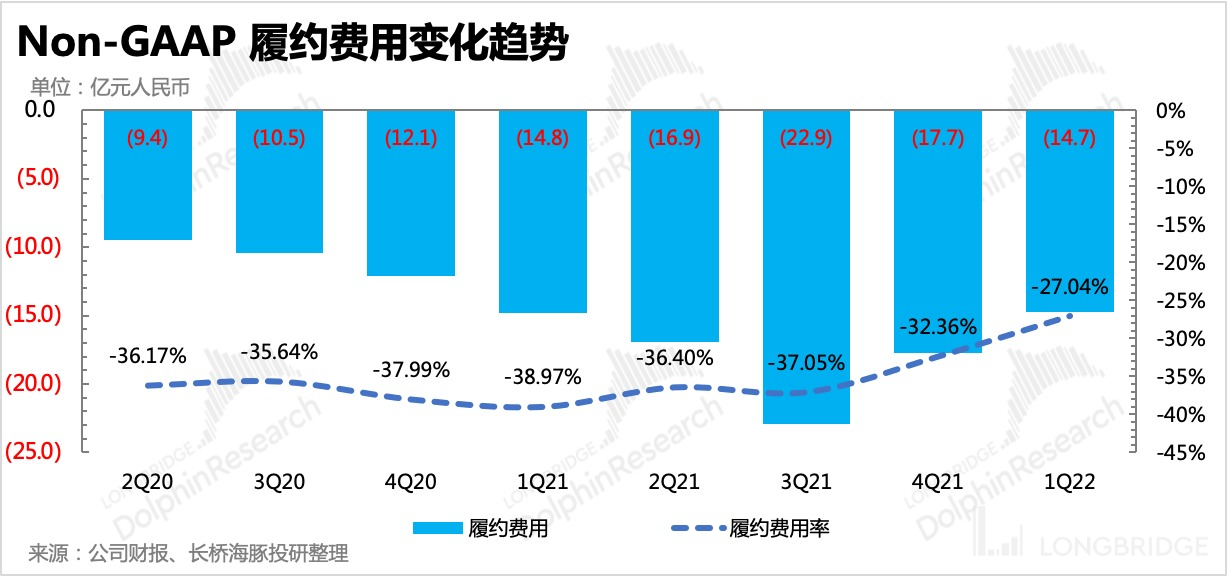

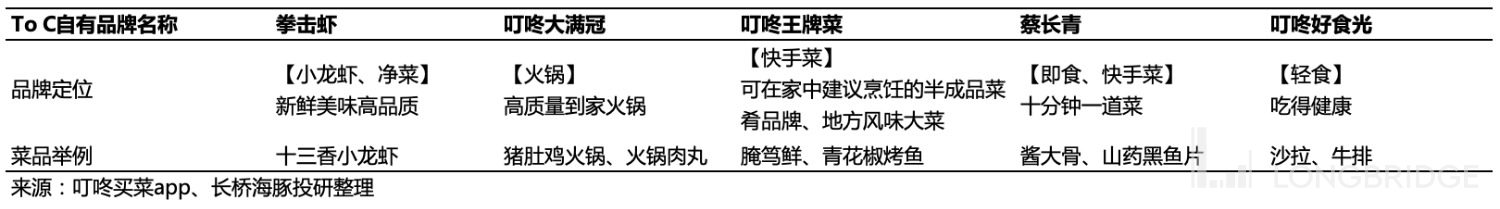

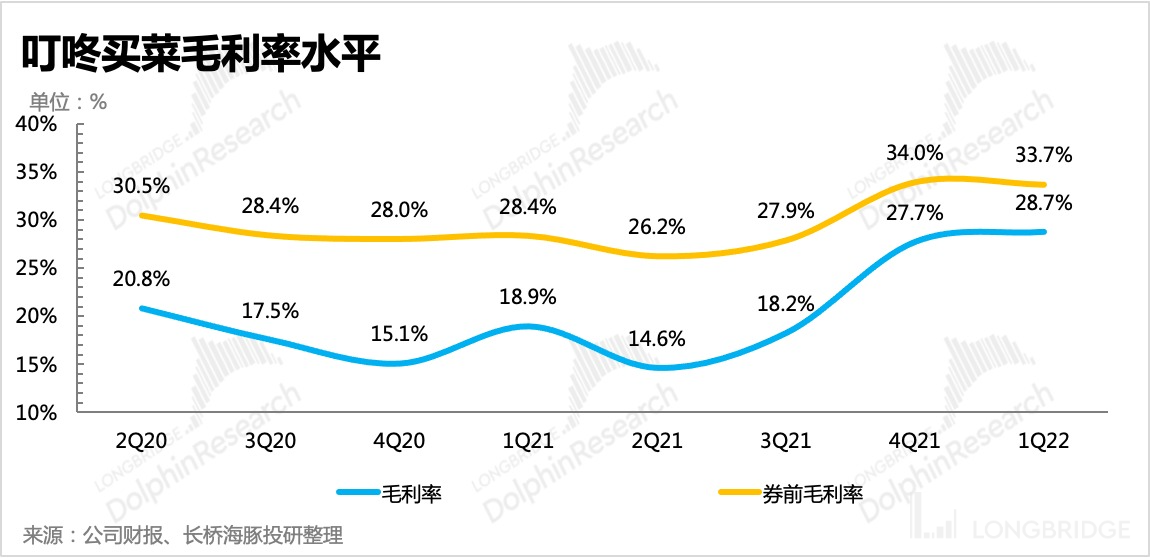

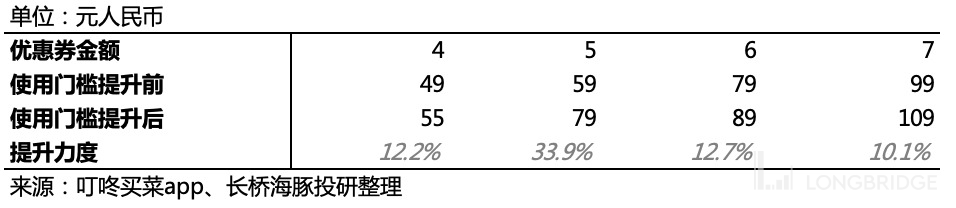

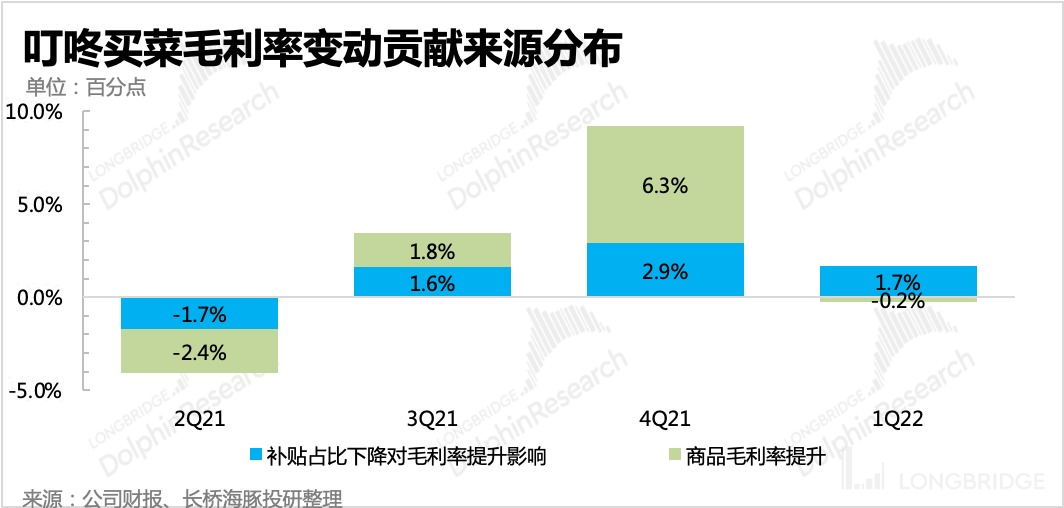

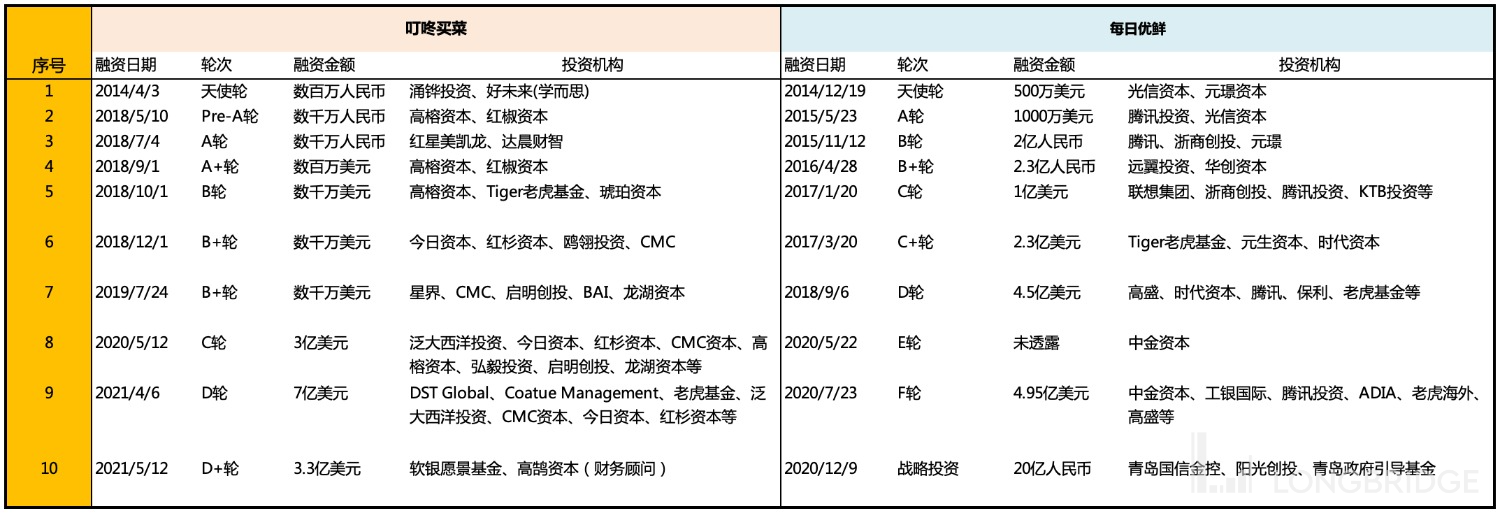

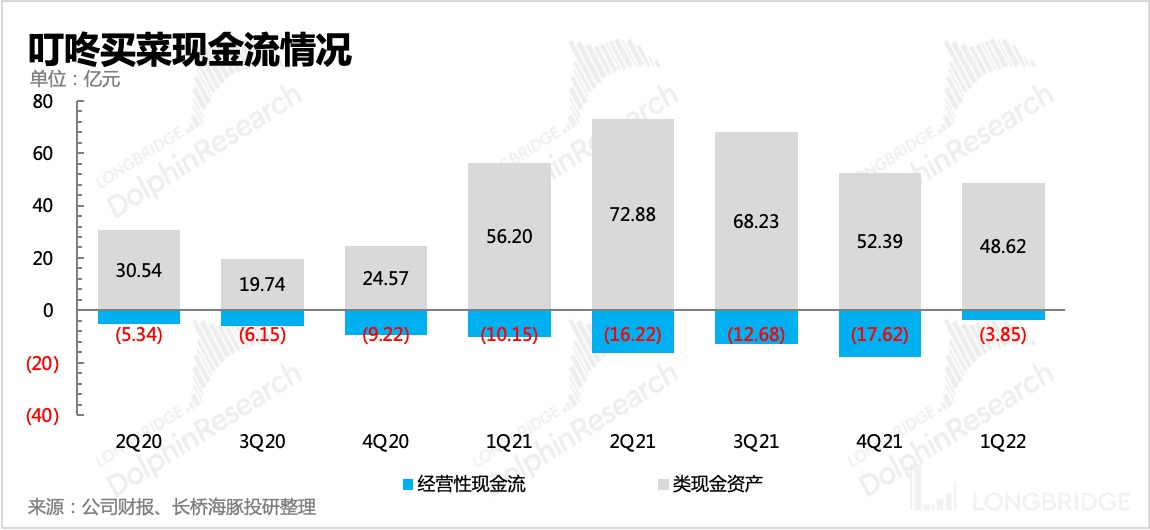

Three years of repeated outbreaks, fresh e-commerce accelerated into the lives of ordinary people. The just-concluded Shanghai epidemic, "burst single" to the need to rely on fascia guns to grab the DingDong of food, visibility is also growing in the first and second tier cities, but the market value is all the way down. In addition to its own risk of Chinese stocks, the point of capital hesitation is that when the DingDong is still losing money, the e-commerce giant's entry to reduce the dimension of the blow, fresh e-commerce track competition prospects are not clear. However, the front-end warehouse model has never been less questioned. At the end of last year, CEO Hou Yi of Box Horse made another conclusion: "The front-end warehouse model is not reasonable". As of now (June 20), the latest market value of DingDong is 1.075 billion, which is 80% lower than the IPO price. Before the DingDong went public, Dolphin Jun had a more detailed study of it, "DingDong (above): The Missing Front Position Pearl?" and "DingDong (below): Valuation depends on imagination, now is not a good opportunity". Due to the high market sentiment at the beginning of the listing, Dolphin Jun also gave an extremely optimistic valuation, but considering the operating conditions of the DingDong at that time, there are still many conditions to be reached from the profit inflection point, and the uncertainty is high, so we did not do in-depth tracking afterwards. Looking back on last year, after the listing of the DingDong, the first to take the strategy of accelerating expansion to occupy the market, "siege to open positions" progress far more than Dolphin Jun originally expected, but at the cost of continued high performance costs drag down the optimization of the UE model, thus increasing huge losses. This will undoubtedly accelerate the abandonment of capital during the environmental water harvest period. Fortunately, the company in August last year, rapid strategic adjustment, from the first half of the "grab scale" back to the DingDong is better at "operational efficiency priority", from the last two quarterly reports (4Q21, 1Q22), the DingDong revenue growth rate did not drop, losses at the same time in the steady narrowing. In particular, the key indicator, the single front-end warehouse UE model, is expected to accelerate the walk-through under the rapid optimization of performance costs. When the single warehouse model goes through, the real profit turning point will also be approaching. Intensified competition does not mean that there is no DingDong value. At least judging from the operating data in recent quarters, DingDong still has certain competitive advantages and first-mover foundation. Therefore, Dolphin Jun decided to pick up the tracking of DingDong again and explore the driving factors and sustainability of the optimization of its performance cost. _More Hong Kong and U.S. stock research information can be added to the small assistant micro signal "dolphinR123" to enter the investment research group to obtain, welcome to exchange global asset investment. _**1. old problems reappear: scale or efficiency first? * * In" DingDong (Part II): Valuation Depends on Imagination, Now Is Not a Good Time ", Dolphin King made a PK of DingDong and Daily Youxian. After comparing the strategic and operational differences between DingDong and Daily Youxian in detail, he came to the conclusion that_DingDong that pay more attention to operation and have more advantages in operational efficiency, the success rate of coming out is higher. However, the daily premium fresh of blindly opening positions quickly before the single position model has passed is likely to fall into the mire of being dragged more and more heavily by the infrastructure. _But after getting a huge blood transfusion of 0.5 billion US dollars on the market, DingDong immediately started to attack the city. The number of front positions expanded rapidly from 989 before the listing to 1375 at the end of the third quarter of last year, an increase of up to 40% in half a year. The pace of this expansion is somewhat similar to the daily excellent fresh in 2019. However, Dolphin King has previously calculated the industry space ("DingDong (Part I): The Missing Front Warehouse Pearl?"). Even if all the first-and second-tier cities meet the demand for high-quality online fresh food, they will need less than 2000 front warehouses in total from the perspective of use efficiency. However, when DingDong had nearly 1300 front positions at the end of last year, many of the 35 cities involved were third-and fourth-tier cities (Maanshan, Taizhou, Xuancheng, etc.). In Dolphin Jun's view, the third and fourth-tier cities are not the most suitable for the demand scenario of fresh e-commerce in the front warehouse.! The continuous opening of the city in the short term will indeed bring about an increase in the number of users placing orders, thus promoting GMV growth. However, the common problem of opening positions too quickly is that it is too late to locate the needs of new users and the polishing of the supply chain system, resulting in low overall operational efficiency and serious losses in the single position model. Therefore, we can see that in the third quarter of last year, the DingDong experienced an obvious strategic adjustment: ① in the first half of last year, the main goal was to open positions and expand, focusing on covering more cities and residential areas, and even reaching some third-and fourth-tier cities. But the target population of the front warehouse model, need a certain basic purchasing power to do support (according to the assumption in the dolphin king market space measurement, the per capita annual expenditure is greater than 30000), **in the consumption level is not high in the city, the front warehouse" instant delivery "attractiveness is difficult to compete with the cost-effective market. In the previous in-depth study, we believe that the single-position UE model needs to meet certain requirements at the same time, "customer unit price" and "order density", otherwise the operation of the front position can only bring losses. In cities where the consumption level is not enough, the unit price and order density can not meet the standard, then the basic cost of the upfront investment (front warehouse decoration costs, equipment purchase, ground push costs, etc.) can only be wasted, eroding the company's profits and cash flow. Coupled with the general environment of capital tightening, no one wants to hear the story of the need to burn money for growth time. ② Therefore, in the second half of the year, the company rapidly transformed from" scale first "to" efficiency first ", slowed down the progress of opening positions, closed poorly operated front positions, and even exited some cities with little hope of operation. * * On the other hand, daily excellent food * * has always chosen to actively lay out To B smart food market on the basis of the original To C, aiming at eating all the "online fresh food crowd" and "high-end food market crowd". But in fact, these two models are contradictory in judging the evolution of future trends. The potential users of both belong to the population with higher purchasing power, and this population does not account for a high proportion of the large base, so there will be traffic cannibalization between the two businesses, making it difficult for either business to exert economies of scale to dilute costs. Coupled with the company's own capital is not much, the old business is not yet profitable, and then promote a need for "short-term high research and development investment, long-term to see the technical effect of the new business, will make the company's book figures more "ugly". To sum up, "new and old businesses divert users from each other and new businesses are launched at an inappropriate time" is one of the reasons why Dolphin Jun thought it was more difficult to get fresh daily than DingDong at the beginning of listing. Dolphin King does not expand here. Friends with different opinions are welcome to add small assistant micro signals (dolphinR123) to the group for communication. The differences and changes in strategy have led to different trends in the operating conditions presented in the financial statements of the two companies. From the comparison of operating and financial data, the gap between daily excellent fresh and DingDong is widening. ① Let's first look at the performance costs, which both parties account for the largest proportion, DingDong after the strategic adjustment in the third quarter of last year (return to efficiency first), two consecutive quarters of major strides to optimize. However, on the daily excellent fresh, the original part of the franchise model brought about by the performance cost advantage, but gradually by the DingDong to catch up.! ② And in general operating expenses, the optimization speed of DingDong is also ahead of the daily excellent fresh. Sales costs, in particular, have been rising over the past year, but the revenue growth rate has not been as fast as the cost expansion. DingDong in the "Kaesong Jiancang", the promotion expenditure did not expand significantly, after the "closed warehouse retreat" is significantly lower, at the same time, this period does not hinder the growth of transaction volume, indicating that the brand has a certain degree of popularity, advertising well spent.! Chart, line chart description has been automatically generated ③ Finally, compare the ratio between product sales revenue and transaction volume to reflect the subsidy given by the platform to users. Also starting in the second half of last year, the number of coupons issued by DingDong has been shrinking (the proportion of subsidies has dropped from 15% to 10%), while the daily premium is increasing subsidies (the proportion of subsidies has increased from 13% to 20%), but the DingDong is still better at GMV growth. Through the comparison of DingDong and daily operation of excellent fresh products in the past year, it is not difficult to find that for DingDong, the third quarter of last year was a turning point, and the improvement of all operating data was mainly in the second half of the year. And this corresponds to the DingDong return to the" efficiency first "strategy action, such an adjustment has the impact of objective factors in the current environment (economic downturn, consumption upgrade slows down; capital winter, burning money model ended), but fundamentally still scale and efficiency who is more priority. Different from the traditional catering or mass consumer goods e-commerce, the front warehouse fresh e-commerce is a well-known heavy asset operation, and the loss of fresh products on the supply chain and operational turnover requirements are very high, so for the platform, in terms of attention, operational efficiency also needs to give a higher weight. * * 2. performance cost optimization is the biggest marginal change after the strategic transformation * * From the DingDong operating data, in addition to the general expenses (sales expenses, research and development expenses, management expenses) with the improvement of the company's team operating efficiency and gradually optimize, the big stride improvement of performance costs is also a point worth thinking about.! For the front warehouse model, the performance expense consists mainly of two turnaround platforms for the commodity, from:! GUI description automatically generated ① The construction and operation costs of the sorting center (urban large warehouse), including the rent of the sorting center, the purchase of equipment, the labor cost of quality control packaging materials, and the expenditure of utilities. The construction and operating costs of the front warehouse include the rent, renovation and equipment costs, sorting personnel costs and utilities expenses of the front warehouse, and finally the labor costs of rider distribution. * * Among the above expenditures, there are three places that can be optimized in theory: * * (1) First of all, with the growth of GMV, especially with the full release of the demand for continuous adaptation of specific front positions, the overall expenditure rate will be optimized; (2) Secondly, the fixed costs related to * * infrastructure * (decoration, equipment costs, etc.) can be diluted with the increase of operating years and total transaction volume; (3) With the development of users' usage habits, the specific front warehouse has a deep understanding of the consumption tendency of the residents in the surrounding coverage area, which will be helpful to the matching of the SKU and demand of the front warehouse and the improvement of the efficiency of the sorting personnel, which is expected to bring about the optimization of the cost of * * unsalable consumption and sorting labor cost. (4) There is also the cost of * * rider distribution * *, because a single front warehouse generally radiates within 1-3 kilometers of the surrounding residential area, so if the user's penetration rate and the frequency of placing orders increase, the rider's trip can send more orders. When distribution efficiency is improved, labor costs for riders are also significantly optimized relative to overall revenue. * * Falling on the DingDong, corresponding to the above-mentioned optimization approach one by one, some traces of change can be seen: * * (1) GMV is growing at a high speed, and the volume and price are driven at the same time during the peak season (high temperature in summer has a high demand for fresh instant distribution). In addition to the fourth quarter is the fresh off-season, there is also the impact of the new front-end operation is not ideal, in addition to the outbreak during the disturbance factors, driving growth continuity is still to be seen.! Image contains application description automatically generated! Chart, line chart description has been automatically generated (2) In a front warehouse, the fixed cost mainly includes decoration and equipment purchase expenses. According to research, this expenditure in first-tier cities is basically around 500000 yuan, and depreciation and amortization are carried out according to 4 years. The DingDong had 12 front positions when it was established in 2017, which grew to 200 by the end of 2018, accounting for 15% of the current total, and nearly half of these front positions have now depreciated the previous renovation and equipment purchase costs, so it is helpful for the optimization of financial data. In addition, as GMV grows, this fixed expenditure as a percentage of total revenue declines rapidly, accelerating overall operating efficiency. (3) At the telephone conference at the end of last year, the company repeatedly stressed that the overall consumption of DingDong front positions is about 2%, significantly better than the 10% consumption of traditional retailers. Although the current level of attrition rate has not improved compared to a year ago, the DingDong is still expanding this year. There is a climbing period for the newly opened front warehouse, and the corresponding attrition rate is not low. In a city like Shanghai, which has been rooted for many years, the overall attrition is only about 1%. Therefore, as more energy is devoted to polishing and refining operations, the attrition rate is still possible to optimize. (4) Shanghai is the stronghold of DingDong, with high user penetration and high order frequency. According to management disclosure, last year Q4 single rider can deliver 89 orders per day on average, significantly higher than the overall average of 74 orders per day, especially in DingDong new second-tier cities, single rider daily delivery orders during climbing may be only 50-60 orders. * * 3. brand premium + customer efficiency is also the driving force for loss reduction * * DingDong in the first quarter report released at the beginning of this month, the loss reduction rate is very bright, the Non-GAAP net loss rate narrowed to 7% from 43% in the first quarter of last year.! Graphical user interface description has been automatically generated In addition to the contribution of a significant decrease in the performance cost rate when the total transaction volume increased by 36% year-on-year, the optimization of the profit model also came from two surprises. **① Increase in overall gross margin after the introduction of more high gross margin goods + decrease in subsidies. * * For goods with high gross profit margin, in addition to expanding SKU categories, DingDong own brands were launched one after another in April last year. According to research, last year's pre-coupon gross margin of its own brand was as high as 33.8, much higher than the overall pre-coupon gross margin of 26% in the same period. However, with the continuous development of new self-research brands in the second half of last year, products that meet the current season will be introduced, and special classification columns will be customized according to different demand scenarios of users, such as strict selection of Baoma (baby-raising category), light-raising planet (light-food category), cool summer, nutritious breakfast, etc. to help different groups choose products, thus increasing the unit price and gross profit margin of customers.! The picture contains a table description that has been automatically generated! The medium credibility description in the chart has been automatically generated In addition, the increase in the threshold for coupon use is also one of the major adjustments made by the company in the second half of last year, which can be clearly perceived by member users.! In the financial report, the overall proportion of "value-added tax + coupons" in GMV decreased from 13% in the first quarter of last year to 8% (if the comprehensive value-added tax does not change much, it is mainly due to the decrease in the proportion of subsidies). Assuming that the consolidated VAT rate remains unchanged, we simply split the source of contribution to the increase in gross margin. Among them, the increase in the overall gross profit margin in the fourth quarter of last year was mainly contributed by the increase in the gross profit margin of the overall commodity itself, while the first quarter of this year was mainly due to the reduction of subsidies. In the first quarter, the proportion of GMV of private label goods with high gross profit margin fell to 7% from 10% in the previous quarter, which may also lead to little room for gross profit margin of short-term overall goods. But the use of "reduce subsidies" of fast-acting drugs may have a greater negative impact on the user side, **so the future optimization of gross margin or to focus on the expansion of high gross margin and private-brand goods penetration rate. * *! And in terms of customer unit prices, the effect of higher coupon thresholds on the customer unit price pull-up is not obvious ($72.6 in the first quarter had an epidemic disturbance effect). However, considering that the threshold is raised at the same time, the DingDong is also an expansion period, and the unit price of new warehouse users in cities in the climbing period is lower, which may also drag down the effect of raising the coupon threshold.! ② Expansion at the same time, the efficiency of the promotion of customer acquisition The first three quarters of last year are basically in a "open city expansion" stage, into the new city or the deployment of new front warehouse, in addition to the above-mentioned infrastructure costs, the necessary promotion investment is also indispensable. In particular, online fresh food is essentially competing with the vegetable market for users, so more often offline promotion is given priority to attracting users to download app and guiding users to complete the ordering process. However, after adjusting the strategy in August, the opening progress of DingDong has slowed down, and some city sites that do not meet the needs are still being closed. However, with the overall number of front positions still increasing, sales expenses have first declined in the fourth quarter from the previous quarter. In the first quarter of this year, sales expenses were hit to a rate of 3.2 per cent, down 45 per cent year-on-year. Due to the large changes in a single quarter, this indicator recommends continuous attention. If such a level of delivery is maintained without affecting the growth of revenue and users, the company's brand influence and high customer acquisition efficiency can be highlighted.! * * 4. the single warehouse model goes through, the valuation is no longer based on imagination * * in "DingDong (2): valuation depends entirely on imagination, the present is not a good opportunity", the original dolphin king gave the DingDong profit turning point to 2027, the expected assumption period is too long, the uncertainty is high, and it is not suitable for DCF valuation. At that time, it was more out of consideration for the high mood after the listing, and the PS relative valuation method was used to shoot a space under extreme optimism. However, as the DingDong's operational efficiency has exceeded expectations and management has given a point in time for the company's earnings expectations (Non-GAAP operating profit turns positive in the fourth quarter of 2022). The DingDong earnings inflection point may be earlier than we originally expected, so it is necessary for Dolphin to give DingDong a relatively neutral valuation. Combined with the marginal change in <two -three>, the first effect is the adjustment of the single-bin model. According to management disclosures, Shanghai's single-warehouse UE model ran through in the fourth quarter of last year, and Dolphin Jun split the various income expenses as follows. ①The company's overall single warehouse model, according to the data of the first quarter (gross profit margin of 28.7, performance rate of 27%), the gap with Shanghai mainly comes from the pre-coupon gross profit margin, the proportion of large warehouse expenses, the proportion of rider costs, the consumption rate of four aspects of optimization space. Eventually, a gap of 7 per cent with Shanghai's profit (without taking into account headquarters cost sharing) was created. Compared with the level of a year ago (11% loss of a single position), the main optimization is also a. gross margin (increase in gross margin before coupons, decrease in subsidies) B. Share the proportion of large warehouse expenses. The Yangtze River Delta region open warehouse density increased, a city sorting center can radiate more front warehouse, infrastructure investment and construction costs are further diluted. C. the frequency of users placing orders increased. during the climbing period of the new warehouse, the overall monthly average of 3.37 orders still increased to 3.55. After the order density comes up, the rider's distribution efficiency improves. ! In addition, it is the superior gross margin that affects the release of profits, as well as the head office expense component, I .e., selling expenses, research and development expenses, and administrative expenses. In the first quarter of this year, not only the sales expenses specifically mentioned above, but also the absolute value of research and development expenses and management expenses were also declining month-on-month, but the decline was not as large as the sales expenses. Dolphin Jun believes that the current operating expenses are relatively extreme relative to peers, and there is little room for further decline in absolute value. For profits to be released, this is when the revenue side needs to continue the high growth trend. At present, the company's pace is to save food and grass, suspend the opening of the city, and focus more energy on the Yangtze River Delta region and other urban belts that fit the advantages of the front warehouse, which means that the progress of new warehouse construction will also slow down significantly. **Behind this strategic choice, there is a need to rely more on high-frequency consumption and high unit price consumption from the existing stock of users. Of the two drivers, Dolphin Jun believes that it is more difficult to increase the unit price. * * 1) In addition to relying on the natural improvement of user consumption, the increase in customer unit price needs to broaden the category. In China, where e-commerce is especially developed, if the DingDong breaks away from the characteristics of fresh and instant products and expands more non-instant categories, it means that it needs to directly compete with other e-commerce platforms for users. I'm afraid this is not the current preference. 2) **Therefore, what is more promising is the frequency of user consumption. * * According to Dolphin Jun's calculation, the average number of orders placed by DingDong users is about 3.6 per month, but the number of orders placed by green card members is as high as 7.4. The gap is also a huge space that can be improved after constantly cultivating user habits. Along the lines above, Dolphin Jun has made neutral expectations of the DingDong's future operating assumptions: 1) significantly slow down the progress of future opening, mainly to polish the operating efficiency of the stock warehouse. The size of the front position in the medium-term steady state is 1500. 2) Lower the growth rate of customer unit price, order frequency does not adjust the original expectations. 3) Increase the rate of gross margin improvement over the previous period, mainly adjusting the pre-coupon gross margin and subsidies. Assuming a constant share of VAT and subsidies in GMV, the long-term steady-state gross margin level is 31% and the 1Q22 level is 28.7. 4) Optimize the performance cost split after the expenditure, the overall performance cost rate decreased faster than previously expected. 5) General operating expenses basically maintain the level of the first quarter (8-9%, here mainly consider the current rate has been very extreme, further optimization space is limited) in the expected assumption of Dolphin Jun, 2024 Non-gaap net profit turned positive, long-term steady state, profit margin of about 3%. Under WACC = 12.09 and g = 3%, DCF is valued at US $1.73 billion, equivalent to US $8/share, which is a premium of nearly 60% over the current situation. **The above valuation and operating assumptions imply a prerequisite for the Company's non-outliers in the first quarter and that this optimization trend will be maintained subsequently. From a risk-return perspective, the current share price is cost-effective. **If data from subsequent quarters (no outbreak disturbance) can further confirm the DingDong business inflection point, then positive sentiment does not rule out higher resilience.! ! Medium Credibility Description in Table Has Been Automatically Generated * * * Risks 5. Magic Tickets Have to Talk about * * * 1, Low Trading Activity * * * From the Capital Favorite Before Listing to the Current Few Interest, the DingDong of falling all the way has almost exhausted the market's interest. In the past six months, the daily trading volume has only reached the level of one million shares. Compared with the total circulating shares of 0.3 billion, the turnover rate is very low. Only in the early days of the Shanghai outbreak, the market speculation was high, April 5 trading volume was driven to the order of 50 million shares. Therefore, trading liquidity risk is something that investors need to consider. 2, big money sell-off risk bit It is worth mentioning that the DingDong and front position track before the listing by the primary market sought after, a number of star investment institutions have bets. As of the first quarter of 2022, among the top ten shareholders of the company, there are Tiger Fund, Softbank, Pan Pacific Investment, CMC and Today's Capital, with a shareholding ratio of more than 5%. These companies were all active in the DingDong C and D rounds of financing, and they increased their investment in DingDong at a cost valued at US $2 billion and US $5.3 billion respectively. Looking at the current market value of 1 billion, it means that these institutions on the pyramid have been deeply buried.! Graphical user interface, text, application description have been automatically generated Therefore, for these institutional investors, the demand for quick release is very high. If the subsequent DingDong business situation continues to improve, the stock price should rise during the period, need to pay attention to the risk of selling large institutions. * * 3. Cash Flow Risks * * Finally, let's look at the cash flow risks that money-burning companies must pay attention to. From the current point of view, the balance of cash assets (cash and cash equivalents, restricted cash and short-term investments) in the DingDong account is 4.8 billion yuan RMB, which greatly improved the operation in the first quarter and narrowed the operating cash outflow to 0.385 billion yuan. Again, if the operating conditions in the first quarter can be maintained and profits continue to be squeezed out subsequently, then the DingDong cash flow risk is not great.! Long Bridge Dolphin Investment Research "DingDong" Historical Report: July 15, 2021 "DingDong (Part II): Valuation Depends on Imagination, Now Is Not a Good Time" July 8, 2021 "DingDong (Part I): Missing the Pearl of the Front Warehouse?" Risk Disclosure and Statement for this article: Dolphin Investment Research Disclaimer and General Disclosure