Will the United States' oil inflation lead to the growth and strengthening of China's new energy vehicles?

Let's take a look at the major challenges facing Biden:

- Powell's interest rate hike meeting and congressional testimony last night emphasized that the Federal Reserve's policy tools can affect inflation excluding energy and food, while energy and food inflation are more influenced by the supply side of commodities, making it difficult for the Federal Reserve to control.

Since the Federal Reserve is blaming part of the inflation on energy, let's take a look at the biggest factor in energy - oil.

- When it comes to oil, besides exploration, the main activities in the United States are development, transportation, and refining.

- Expanding production requires billions of dollars in investment and is a long-term supply-demand business rather than short-term price speculation. In the long run, the United States aims to phase out fossil fuels - by 2026, the penetration rate of new energy vehicles in new car sales is planned to reach 17% (5% in the first quarter of this year), and gasoline consumption is expected to decrease by 200 billion gallons by 2050. The California government even plans to ban the sale of traditional fuel vehicles within ten years. The Securities and Exchange Commission also requires risk disclosure for climate risks, and so on. These factors make it difficult for short-term expansion and pose long-term risks.

- Even if refineries increase their production capacity, profits will be eroded by rising crude oil prices. To keep up with production, crude oil production needs to increase.

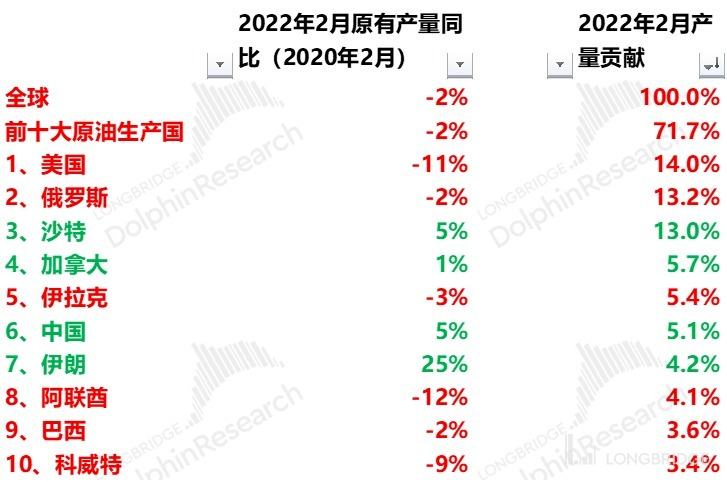

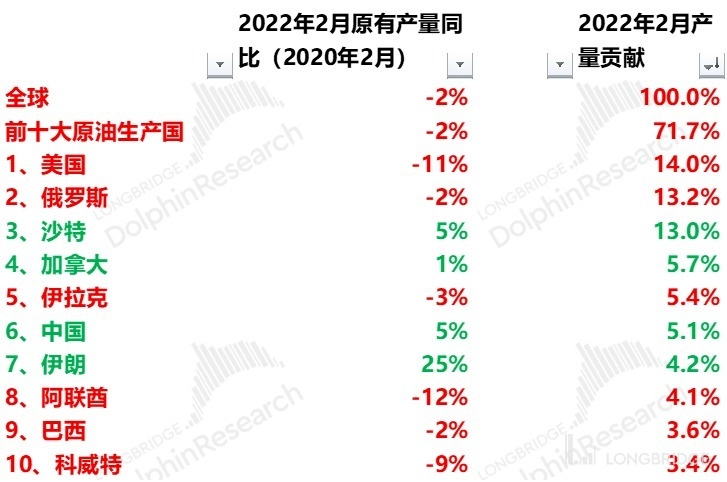

Among the top three oil-producing countries, only Saudi Arabia has managed to increase its production. As for why the United States is slow to increase production, according to some media reports, the reasons given by some shale oil companies are not much different from those of oil refineries - shareholders disapprove, unfriendly regulatory environment, and it is more profitable to use high oil prices for share buybacks.

Looking at it this way, inflation in the United States is indeed a difficult problem to solve:

- Companies make decisions based on the market, expectations, and policy formulation.

- The oil companies' platforms won't start pumping oil immediately with just a presidential order.

Energy and food are important raw materials and components of most goods and services. If their prices do not ease, inflation may persist. Even if demand declines, there is a historical precedent of persistent high inflation and high unemployment, known as "stagflation."

Old forces don't just go away without a fight. Behind the rise of electric vehicles is the strategic transition between new and old energy sources. Behind the promotion of electric vehicles in China is the use of coal for power supply as a backup. The United States is constantly torn between green energy and traditional energy. Can we seriously imagine the global rise of China's new energy vehicle manufacturing industry?