Nine Nine (Part 1): The Cultivation Method of "Fat Fish"

These past three years have been tough for the catering industry, and JIUMAOJIU is no exception:

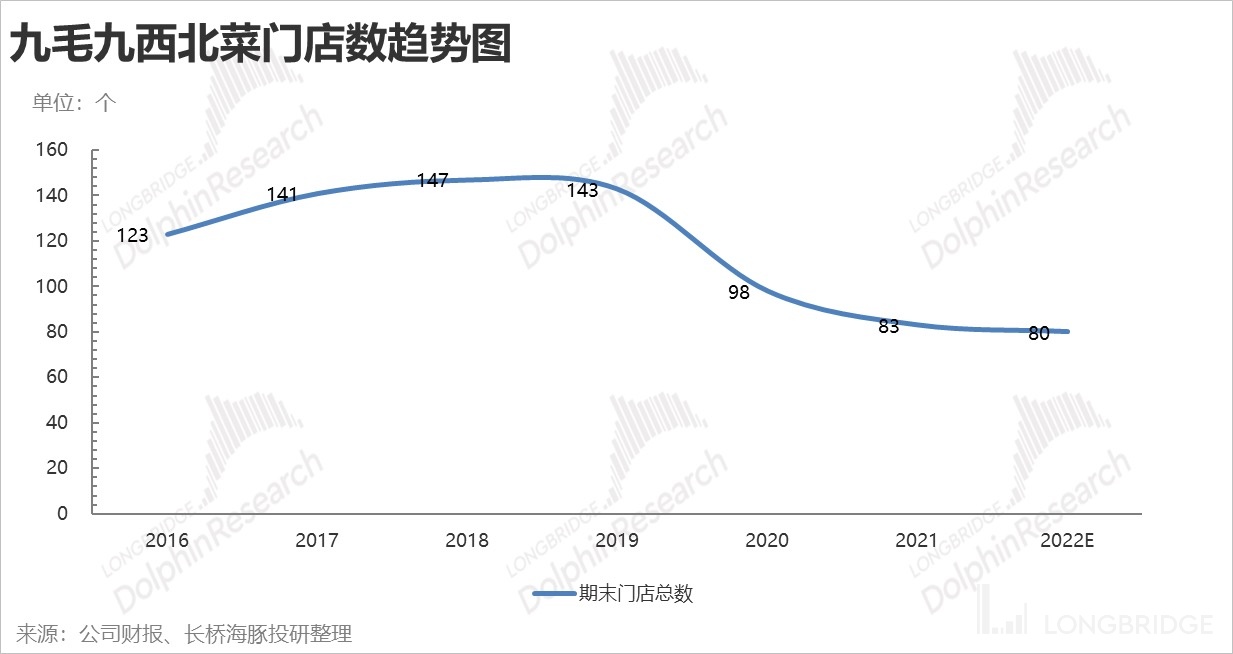

In 2020, JIUMAOJIU.HK was hit hard by the pandemic. Shopping centers closed, stores couldn't operate, new stores couldn't expand, and both customers and the company suffered.

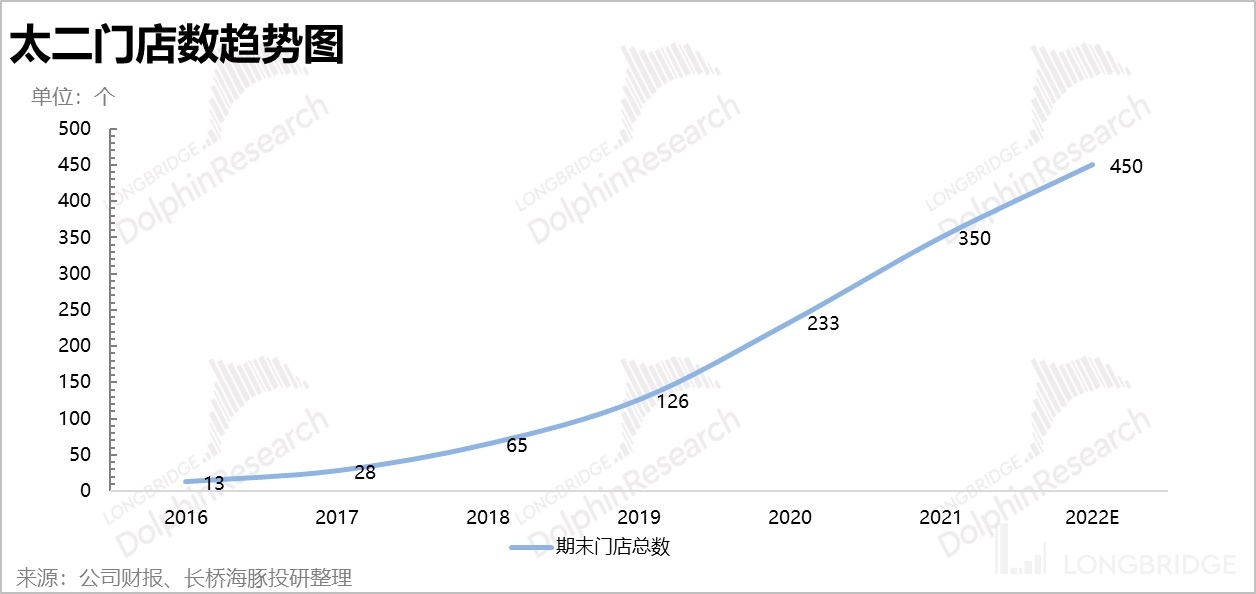

In 2021, although the occupancy rate rebounded, it was far from the pre-pandemic level. The good news is that Tai'er, a subsidiary of JIUMAOJIU, resumed its store expansion pace, providing significant support to the revenue.

In the first half of this year, with the resurgence of the pandemic, the expansion of JIUMAOJIU's catering stores slowed down, and the occupancy rate remained low. Regarding the two core catering brands, Tai'er and JIUMAOJIU:

-

Tai'er, which is still in the stage of opening new stores, experienced a decline in occupancy rate and only opened 15 stores in the first half of this year.

-

Before the successful incubation of Tai'er, the main brand JIUMAOJIU had a poor turnover rate, and the stores were undergoing adjustments. The only positive aspect this time is that they took the opportunity to complete "store contraction".

Of course, the current anti-epidemic policies do not provide a great opportunity (many supermarkets in Shanghai do not encourage dining in), and there may be some pain before things get better. However, after experiencing two years of losses, there seems to be a faint glimmer of hope on the horizon. Dolphin is starting to prepare in advance.

The focus of this article is on JIUMAOJIU's research, with a core focus on the Tai'er brand and its key drivers, namely the occupancy rate and store expansion. The research on JIUMAOJIU will revolve around the following four points:

-

Does JIUMAOJIU have enough internal strength to support the expansion of its stores?

-

Can Tai'er maintain a high occupancy rate?

-

What is the store layout and space of Tai'er?

-

How much valuation space does JIUMAOJIU have?

This article will primarily address the first question, and the second article will delve into the "mind-boggling" questions.

This article is an original piece by Dolphin Research. Unauthorized reproduction is prohibited. Interested readers are advised to add the WeChat account "dolphinR123" to join the Dolphin Research community and discuss global asset investment perspectives together!

The following is the main content:

Internal Strength: Can it support rapid expansion?

Brand Matrix

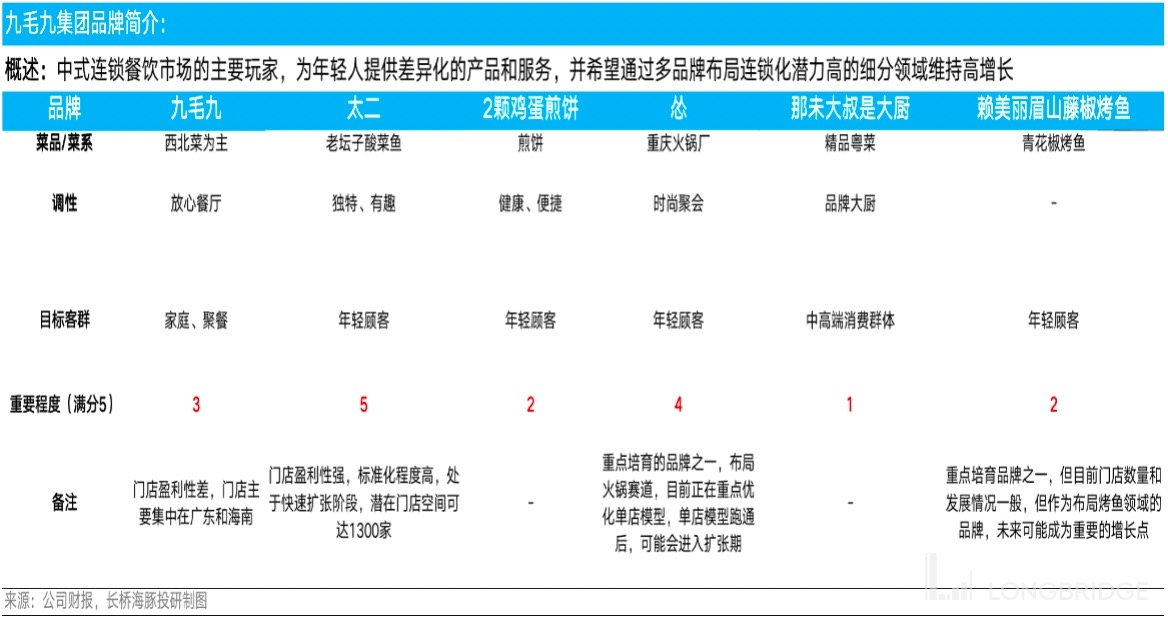

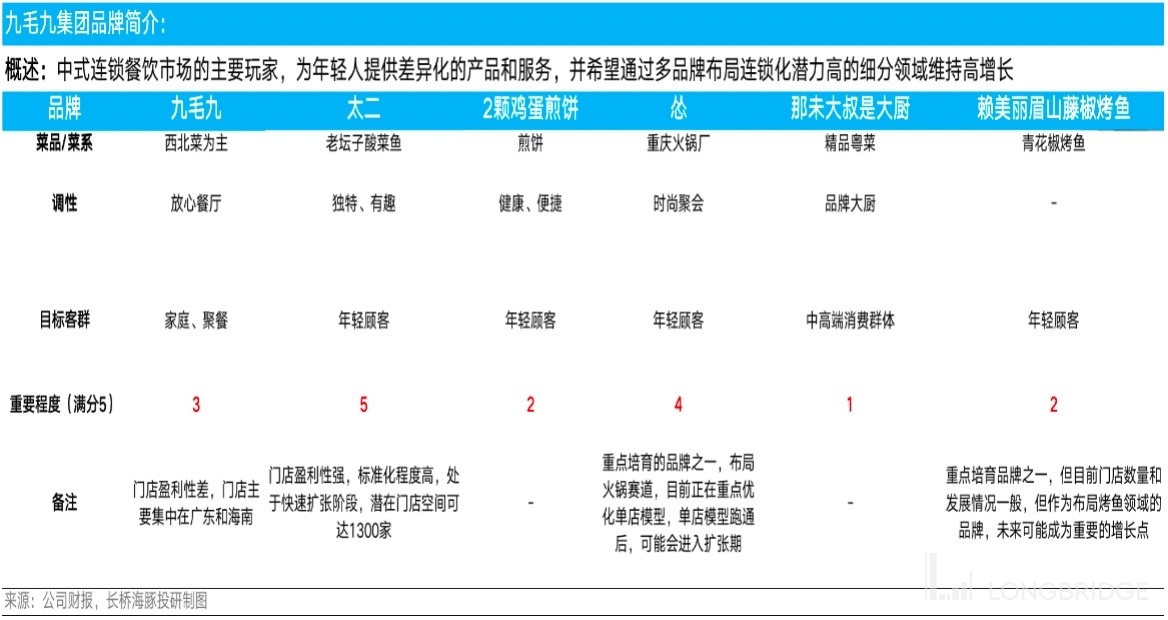

Before JIUMAOJIU's Northwestern cuisine brand declined, they successfully incubated Tai'er, which laid a solid foundation for the next 2-3 years of development. At the same time, the group is incubating new brands. Here, Dolphin would like to emphasize the Chongqing Hot Pot Factory under the JIUMAOJIU brand. Please pay attention to it.

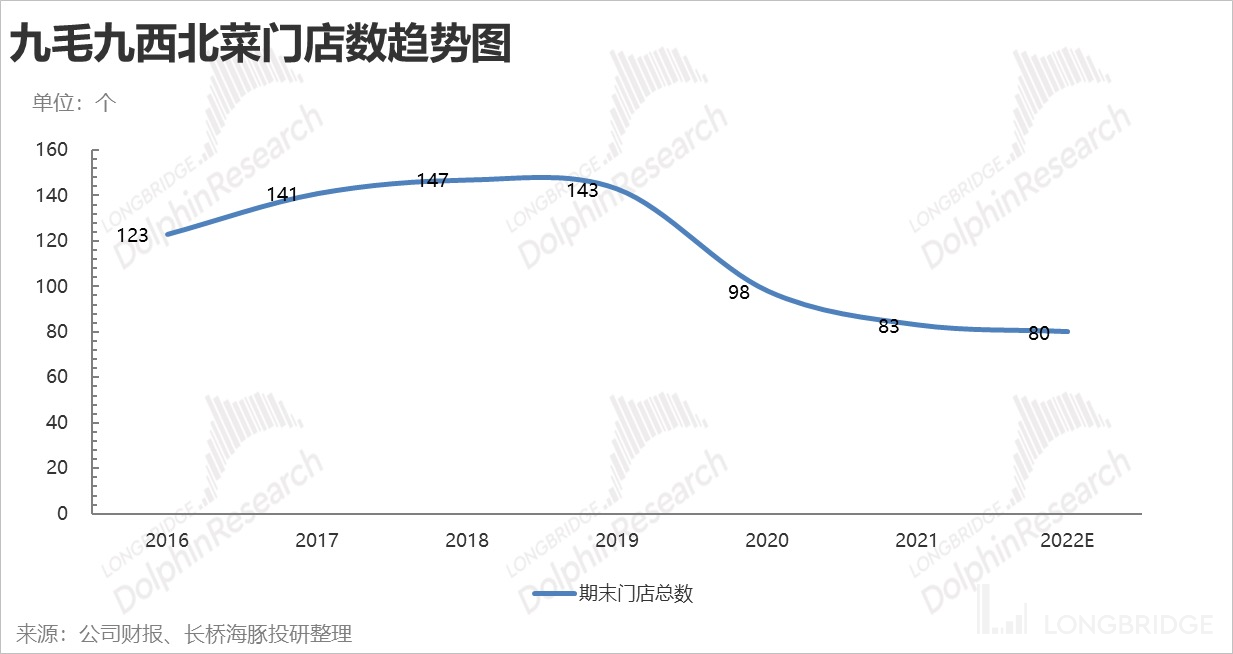

1. The Rise and Fall of JIUMAOJIU Northwest Cuisine: Ultimately unable to escape the industry curse of limited lifespan, how tragic!

1. The Rise and Fall of JIUMAOJIU Northwest Cuisine: Ultimately unable to escape the industry curse of limited lifespan, how tragic!

In 1995, Boss Guan opened the first Shanxi noodle restaurant in Haikou. Later, the restaurant expanded to Guangzhou. In order to make more money selling noodles, Boss Guan started standardized management of the noodle restaurant in 2005. In the following years, there were highlights such as opening stores in shopping centers for 10 years, expanding the market to the north in 2012, and reaching the peak of store numbers in 2018. However, in the end, the momentum of upward development could not be maintained, and the number of stores shrank to the current 83. In the next few years, Dolphin believes that JIUMAOJIU Northwest Cuisine will basically maintain its current scale and operate steadily. In addition, Dolphin would like to add that during the rapid development of JIUMAOJIU Northwest Cuisine, the group has made significant progress in management, system, and supply chain construction at the corporate level, achieving substantial internal development.

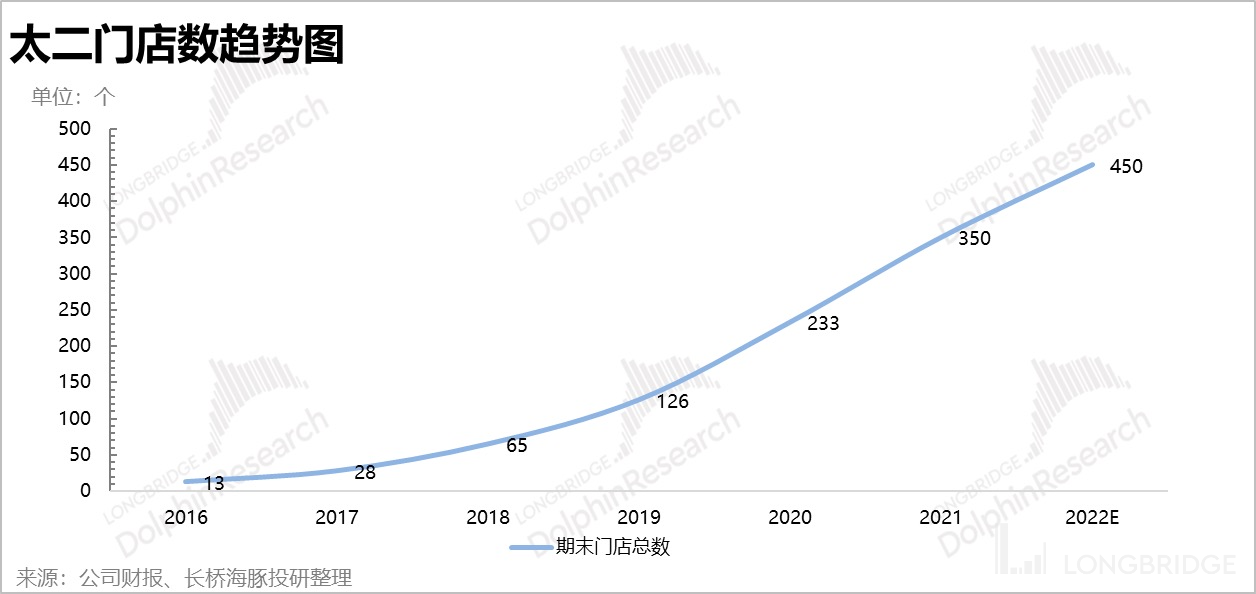

2. The Success Story of Tai'er Pickled Fish: Carrying the banner of diversified development, helping the group achieve a listing on the Hong Kong Stock Exchange, truly commendable!

After experiencing the growth pressure of JIUMAOJIU Northwest Cuisine, which made people lose their hair, Tai'er Pickled Fish was established in 2015. It successfully explored the model of a flagship dish combined with strong marketing, emphasizing the business philosophy of "delicious, attractive, and fun." Through personalized style and differentiated positioning, it successfully captured the taste and hearts of young people, becoming the second growth curve of the group and helping the group achieve a listing on the Hong Kong Stock Exchange in 2019. Currently, the occupancy rate remains low due to the impact of the pandemic, but it is expected to gradually improve starting from 2H2. In addition, Dolphin believes that the group entered the path of multi-brand development in 2015 and embarked on a struggle to resist the short lifespan of restaurant brands.

3. The Incubation History of New Brands: Refining the store model, committed to taking over Tai'er and creating the third dream growth curve, keep it up!

Dolphin believes that it is difficult for a single restaurant brand to avoid the curse of a short lifespan. Therefore, in order to achieve long-term development, companies need to continuously incubate new brands, improve the success rate of new brand incubation, and then rely on new brands to continue the life of old brands. Taking reference from JIUMAOJIU and Haidilao and other restaurant companies, Dolphin realizes that incubating new brands is challenging. However, as a listed restaurant company that needs growth and performance, it can only rely on continuously incubating new brands and continuous experimentation to support performance and valuation with new brands before the old brands clearly decline, to prevent being double-killed.

Looking ahead, the brand that is most likely to support the valuation of JIUMAOJIU in the future is "Sǒng" (Chongqing Hot Pot Factory). Sǒng fully learns from the playfulness of Tai'er Pickled Fish, enters the spicy hot pot track with a wide audience, high standardization, and strong addictiveness, embarking on a path of outperforming other existing brands, committed to becoming the king of hot pot, fulfilling its mission, and supporting the valuation. Organizational Incentives

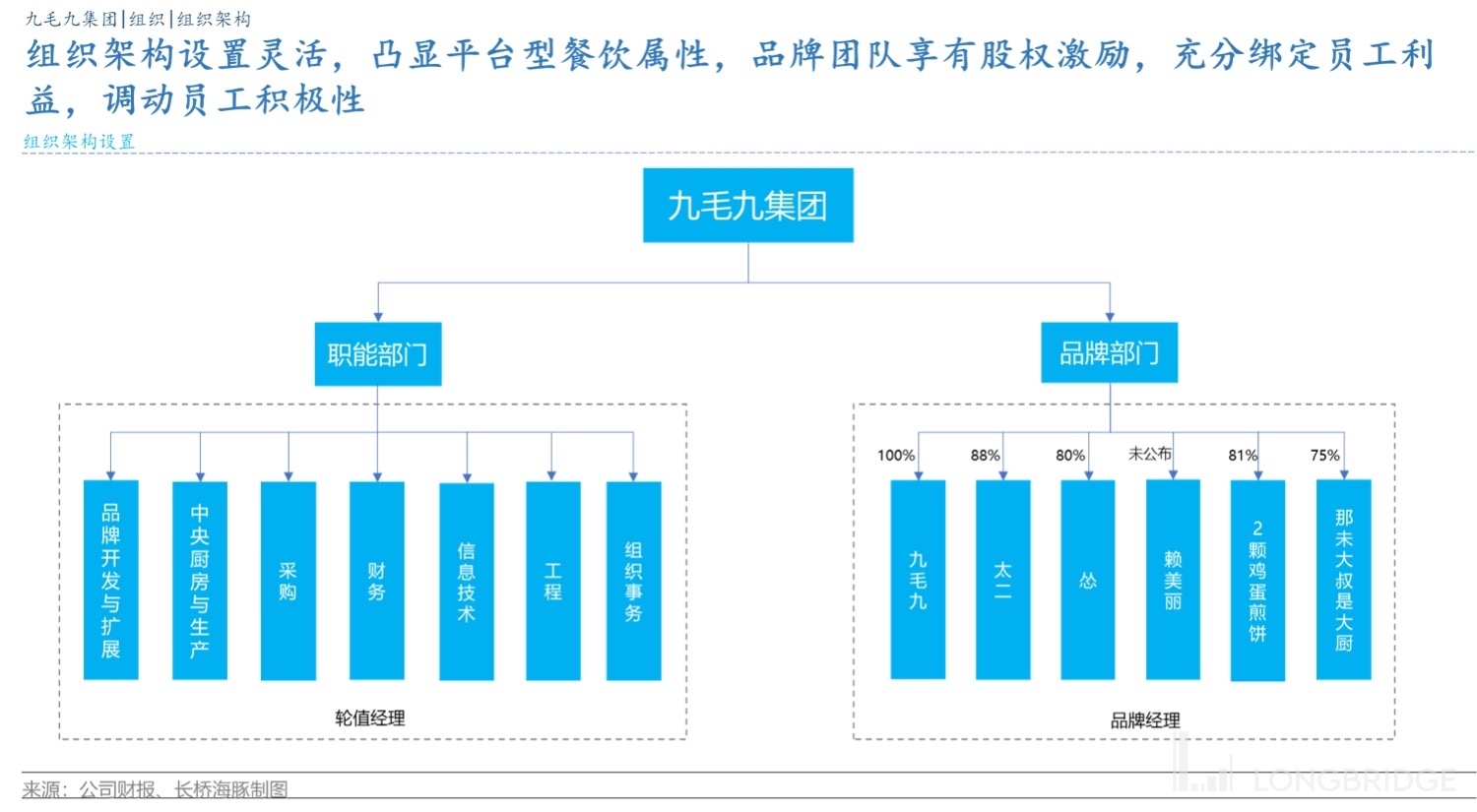

JIUMAOJIU's organization has platform attributes and is not stingy with its employees. Both parties can achieve a mutually beneficial relationship. Therefore, Dolphin believes that everyone can work together to expand and make money. JIUMAOJIU tends to let young people be responsible for brand operations, which is more conducive to serving young people. They rely on the enthusiasm of young people to boost the company's stock price.

1. Organizational Structure: The organizational structure is designed to facilitate store expansion and increase profitability together!

JIUMAOJIU's organizational structure adopts a combination of platforms and business units. The headquarters has 7 functional departments, mainly responsible for back-office affairs, including incubating new brands, ensuring taste consistency and cost reduction through a centralized kitchen, centralized procurement, and digital system construction.

The business units mainly operate in the form of brands. Generally, a business unit consists of operational, product development, brand promotion, human resources, and customer research departments. The brand teams are responsible for operating the business units and hold shares. The brand team of Tai'er holds 22% of the shares, and the brand team of Song holds 20%. In addition, the leaders of the core brands are relatively young. The leader of Tai'er brand is from the post-85 generation, and the leader of Song brand is from the post-90 generation. They have previously been in charge of projects such as "Don't Fear the Tiger" and "Song's Cold Pot Skewers". Dolphin believes that the platform-based organizational structure allows young brand teams to participate more deeply, which helps to achieve resonance between the brand and consumers.

2. Equity Incentives: After JIUMAOJIU went public, core middle and senior management were given equity incentives to align interests and promote collective development and wealth creation.

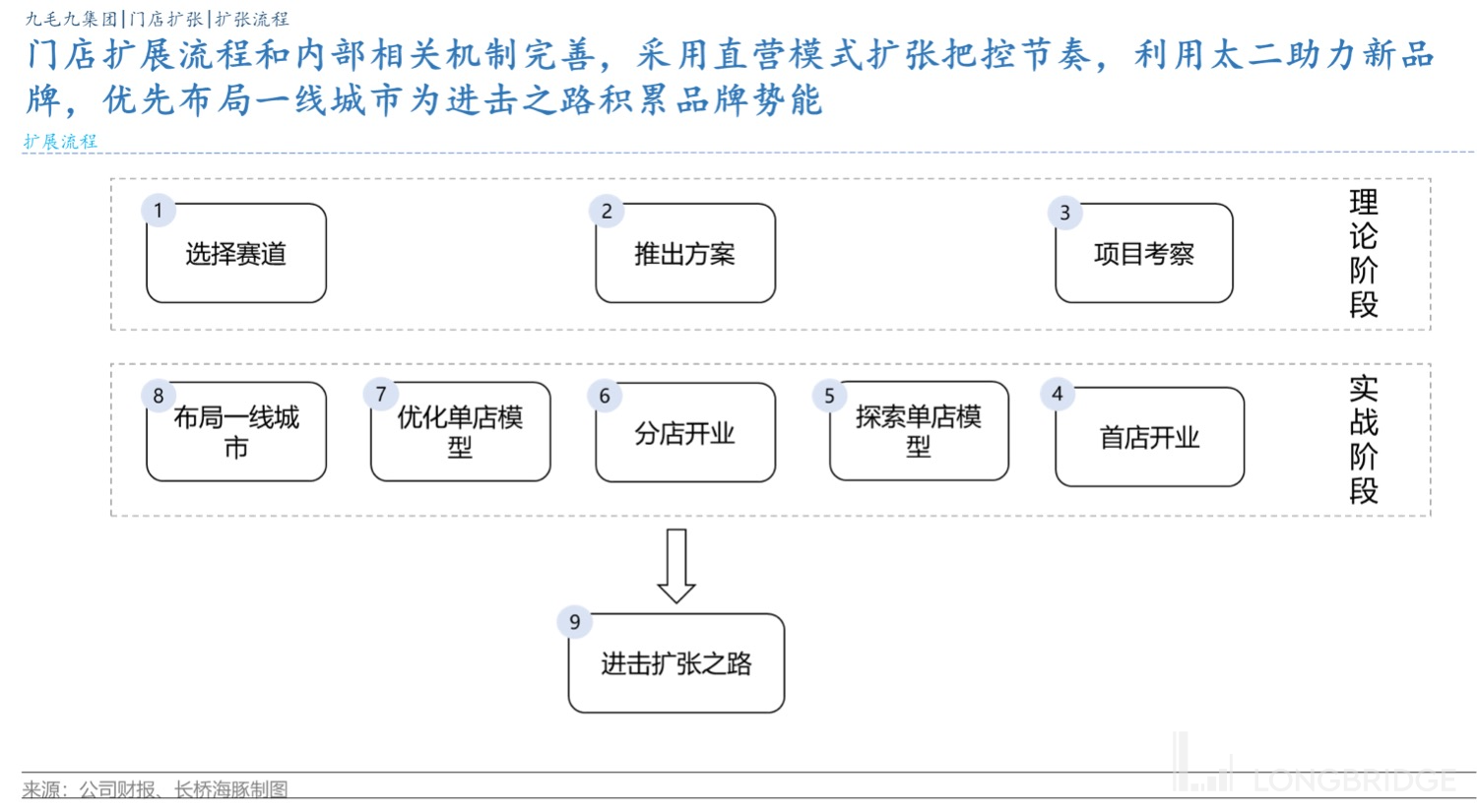

Expansion Mechanism

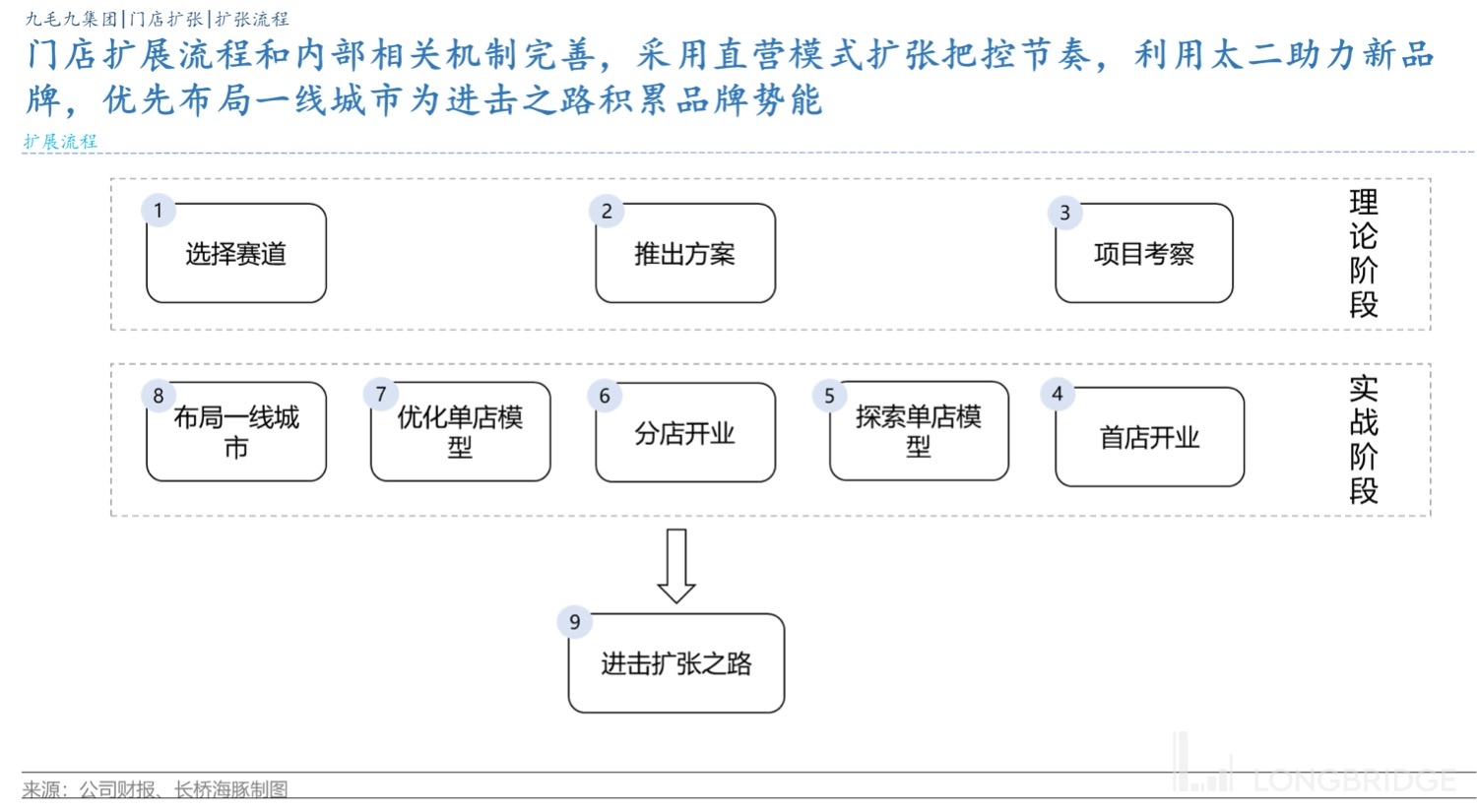

The store expansion mechanism of JIUMAOJIU is well-established and highly replicable. Moreover, it can receive ample support from high-potential brands during the expansion process. Dolphin believes that JIUMAOJIU's store expansion mechanism is well-designed, and as the negative impact of the epidemic weakens in the later stage, the speed of store expansion can keep up.

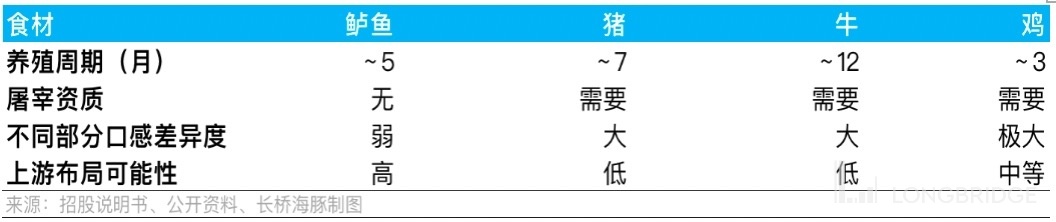

1. Track Selection: All choices are made for the purpose of achieving scale and chain operation.

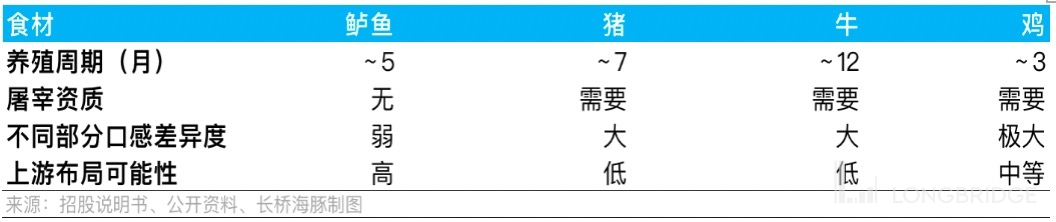

Dolphin has found that JIUMAOJIU tends to choose niche tracks that have a certain scale and chain potential, such as hot pot and grilled fish. Dolphin believes that the premise of chain operation is standardization. With a high degree of standardization, the reliance on chefs can be reduced, labor costs can be lowered while ensuring taste consistency, and the pressure on the supply chain during expansion can be relatively small. 2. Grand Opening of the First Store: Leveraging Sister Brands for Promotion and Attraction!

After completing the preparatory stage in theory, JIUMAOJIU is ready to put it into practice by opening its first store. The opening of the first store often relies on the influence of sister brands to promote and attract attention, especially the influence of Tai Er. Dolphin believes that the new brand can improve its success rate and shorten the incubation time by leveraging the resources of high-energy brands. In this case, everyone can refer to the strategies of Seng and Lai Meili.

3. Expanding into First-tier Cities: Building Brand Momentum in High-tier Cities and Rapid Replication in Lower-tier Cities.

After exploring the store model and starting branch operations, JIUMAOJIU begins to accumulate brand momentum by expanding into first-tier cities. Through store operations and marketing, the brand's exposure and reputation are continuously enhanced, laying the foundation for future expansion. Currently, Seng is in the stage of accumulating energy in first-tier cities, and with the improvement of the epidemic situation, Seng is expected to embark on the path of expansion.

4. Advancing on the Path of Expansion: Initial Expansion in Encrypted Cities, Beware of Risks.

After accumulating brand momentum in first-tier cities, JIUMAOJIU will start expanding into lower-tier cities in an encrypted manner. This stage usually lasts for 3-5 years. In the early stages of expansion, the brand enjoys the happiness brought by Davis's double-click. However, in the middle and later stages, attention should be paid to the negative impact of increasing the number of stores on turnover rate, as well as the risk of the brand's life cycle coming to an end.

Building the Supply Chain

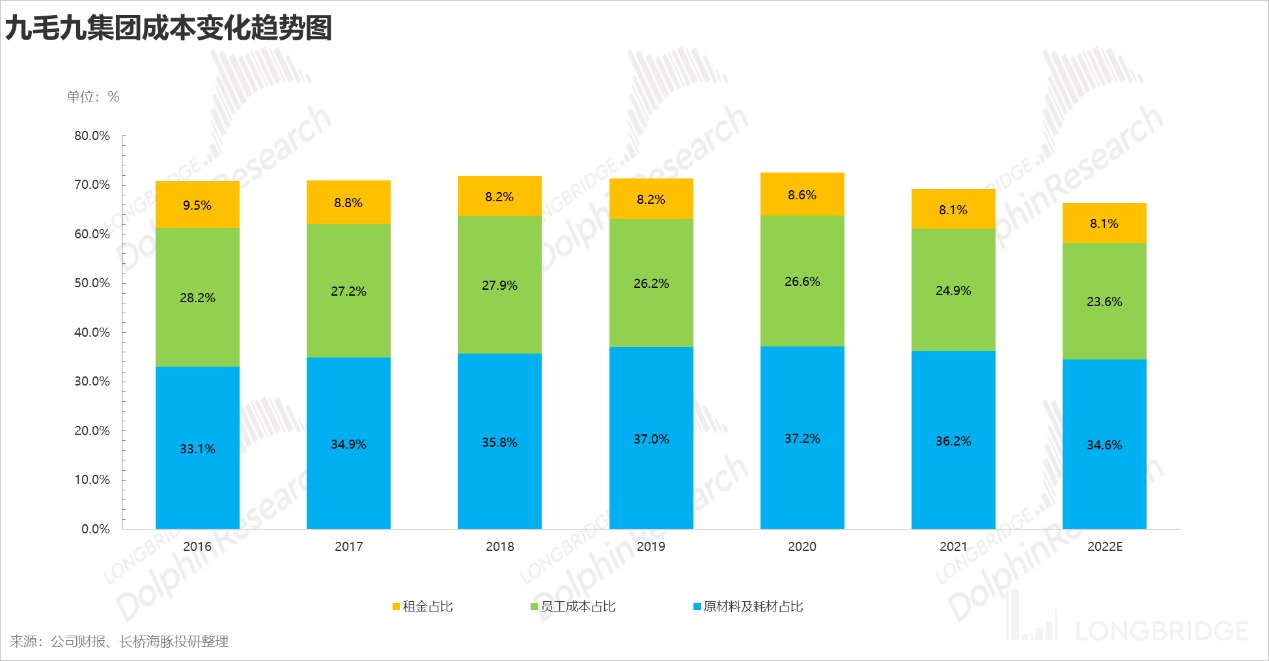

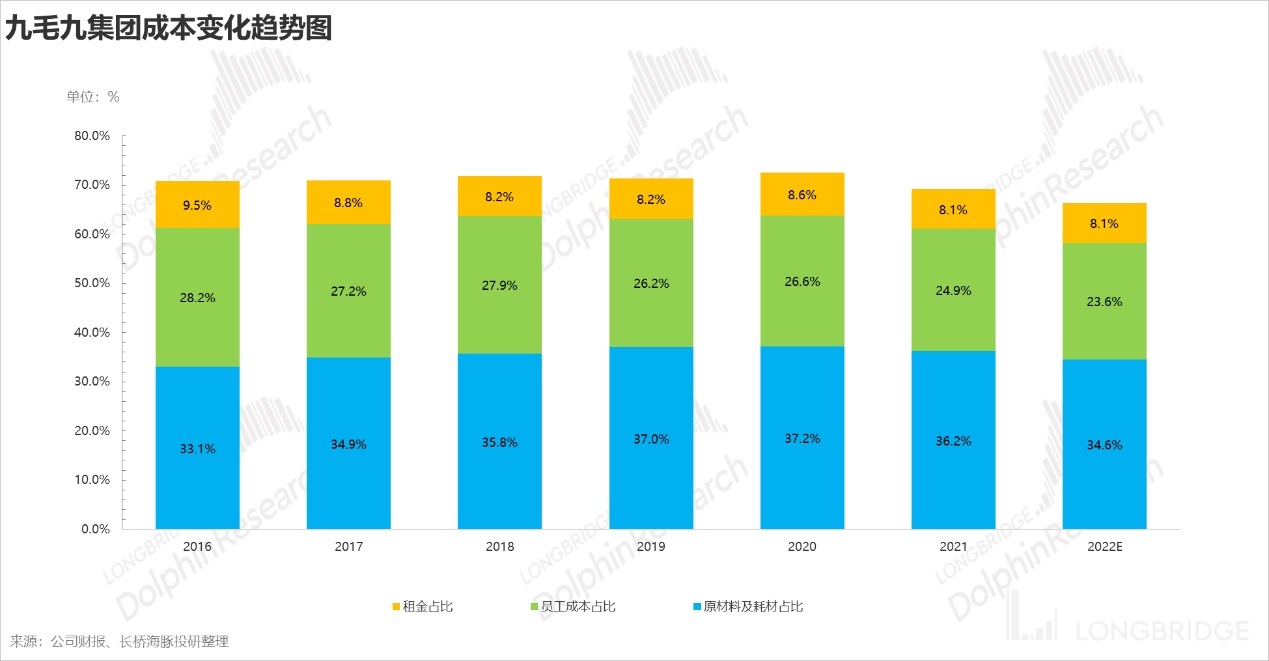

By establishing the upstream core raw material supply, not only can costs be reduced, but also the quality of dishes can be guaranteed. Dolphin believes that improving the supply chain can enhance the ability to withstand fluctuations in raw material prices. It is well known that the cost of ingredients often accounts for the largest proportion in the catering industry.

1. Upstream: Establishing the Upstream Supply to Reduce Costs and Increase Profits.

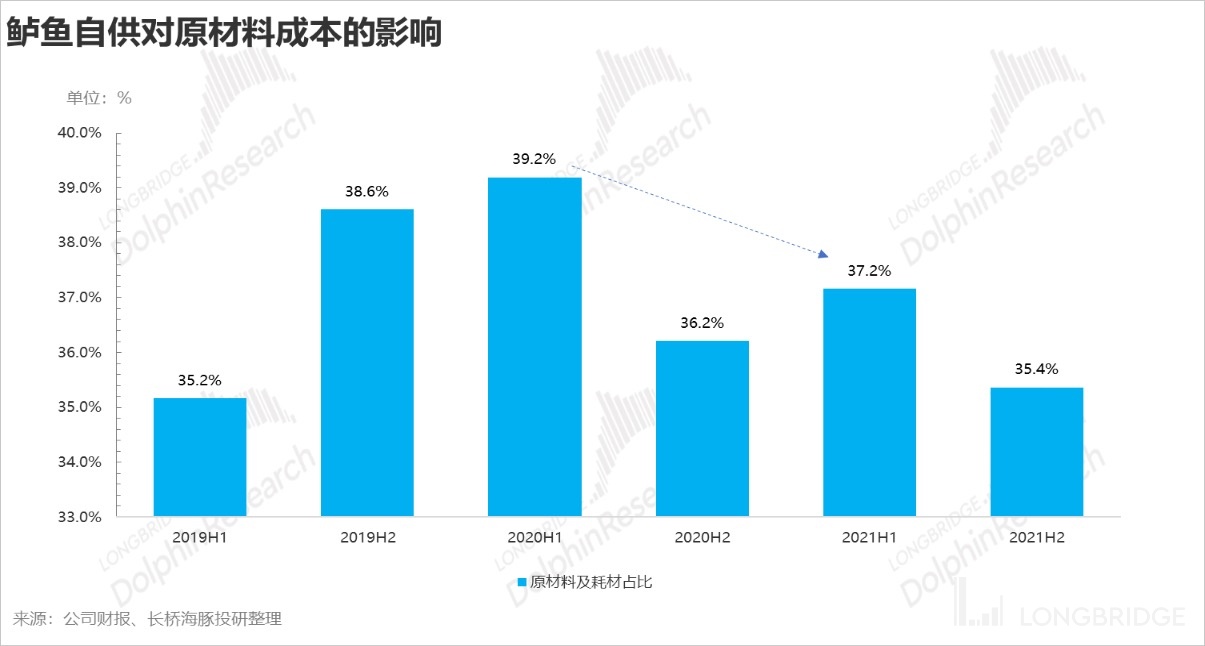

a) Sea Bass: Establishing upstream sea bass farming to satisfy customers' taste buds and increase profits.

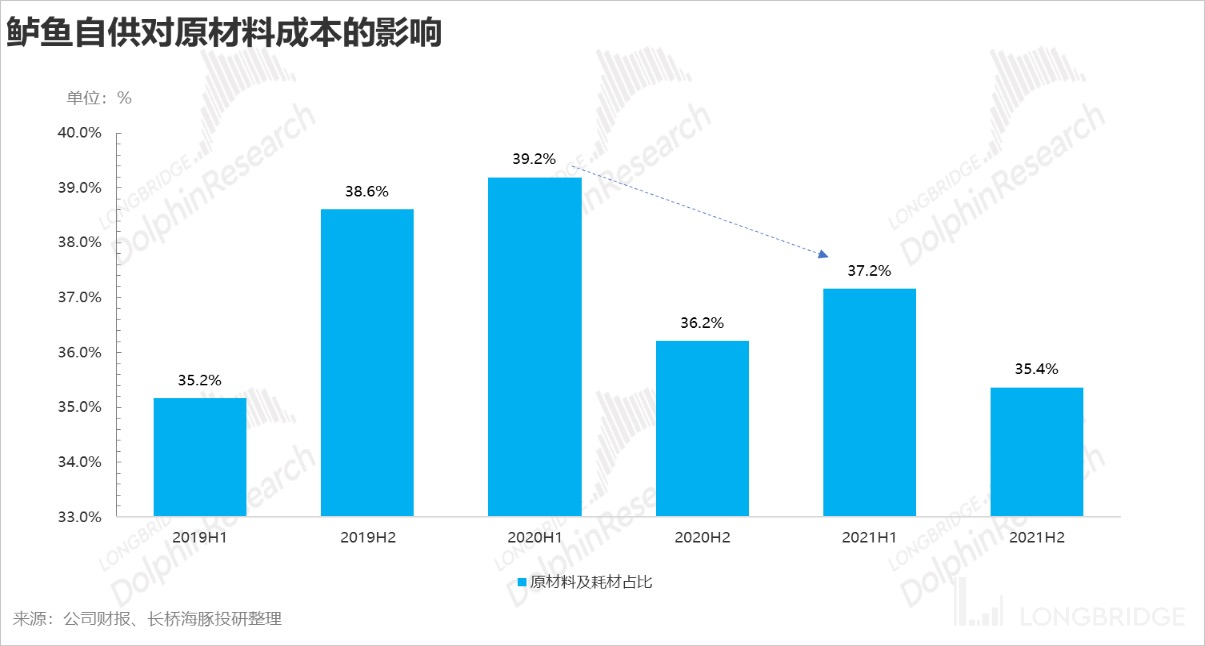

Considering the relatively short breeding cycle of sea bass, the absence of slaughter qualifications, and the weak taste differences among different parts of the sea bass, JIUMAOJIU started cooperating with two sea bass suppliers in the second half of 20XX. The factories are located in Guangdong and Hubei respectively. The suppliers raise sea bass according to Tai Er's requirements and standards, striving to ensure the quality and taste of the sea bass dishes.

The first supplier among the two has been supplying since 20XX, and in 21H1, the purchase volume reached about 38% of the total purchase volume. After implementing this operation, the group's raw material cost decreased from 39.2% in 20XXH1 to 37.2% in 20XXH1. In addition, the second supplier has also started supplying in 20XX and will gradually meet all of Tai Er's purchasing needs. Dolphin believes that with other costs remaining unchanged, achieving internal procurement of all sea bass can bring about a 4% reduction in raw material costs.

b) Sauerkraut: Ensuring the quality of sauerkraut and maintaining consistent taste of dishes.

The quality of sauerkraut has a significant impact on the taste of dishes. Therefore, JIUMAOJIU has chosen to establish a pickling base in Sichuan with sauerkraut suppliers and requires them to pickle according to the standards of Tai'er. Only Yunnan mustard greens are selected as raw materials. During the pickling period of about one month, the temperature and humidity must meet the requirements. Finally, a unique flavor is stimulated through natural fermentation.

2. Midstream: Establishing central kitchens to ensure consistent quality and taste of dishes, and reduce labor costs at stores.

JIUMAOJIU is building central kitchens in Guangdong, Hainan, and Hubei to serve stores within a 200-kilometer radius. In addition, JIUMAOJIU acquired the land use rights of approximately 39,000 square meters in the Nansha Economic Zone of Guangzhou in 2021, which will be used to build JIUMAOJIU's national supply chain center base, including central kitchens, warehousing, logistics, quality control, research and development, and training facilities, to meet the needs of approximately 1000 stores.

Dolphin believes that the construction of central kitchens can help JIUMAOJIU in the following aspects: 1) Central kitchens can help stores improve meal serving speed by pre-processing ingredients, which is conducive to increasing table turnover rate; 2) Central kitchens reduce the manpower required in store kitchens, achieving the effect of reducing labor costs; 3) The existence of central factories is conducive to supporting rapid expansion of stores, reducing the probability of negative changes in product quality and taste during expansion.

Digital Systems: Dolphin believes that as the number of stores managed by the group increases, digital systems can expand the management radius, improve management efficiency, and reduce the probability of increasing revenue without increasing profits. At the same time, Tai'er's customer base highly overlaps with Sōng Huǒguō and Lài Měilì. The improvement of the data middle platform in the future will help JIUMAOJIU better understand consumers and then increase table turnover rate through operational efforts.

1. Front-mid Platform: Building self-developed front-mid platform business components to improve operational efficiency.

In order to improve operational efficiency, save costs, provide better support for Tai'er store expansion, JIUMAOJIU has completed the optimization of the front-mid platform.

2. Management Backstage: Planning to continue improving the management backstage, hoping to achieve synergies and support the development of new brands.

After optimizing the management middle platform (data middle platform), it can more accurately understand user profiles, achieve precise positioning of user behavior, and considering the high overlap of customer bases between Tai'er, Sōng, and Lài Měilì, it can fully tap into customer needs and support the development of new brands.

Table Turnover: The Lifeblood of the Catering Industry

Let's imagine the basic logic of opening a restaurant:

After handling decoration, rent, and waitstaff, the way for a store to maximize profit by diluting costs is to have a large customer flow with continuous queues and fast table turnover. A single store can earn more money, and the financial figures of a single store look impressive. This will enable rapid expansion of chain stores, achieving high overall profits from both individual store profits and the number of total stores. Therefore, the phased high turnover and rapid store expansion correspond to the "Davis double-click" moment for the catering sector.

However, the inherent characteristic of the catering industry is the ever-changing "customer preferences." When a restaurant opens in any location, without the driving force of increased store openings, it can only rely on raising the frequency of dining among customers within a few kilometers to increase turnover.

But customers usually get tired of eating the same thing and then try other flavors. After reaching a certain level of repeat purchases, it becomes difficult to further increase frequency, and instead, it is easy to decline. If turnover cannot be increased, profit release can only rely on cost reduction and efficiency improvement, resulting in store closures or a cycle of opening and closing stores. The maturity of the brand corresponds to the end of the cycle, and the valuation plummets.

Throughout this process, it is generally more opportune to invest in the catering sector during periods of high popularity rather than holding long-term positions.

The core of this entire process is the single-store model: only when the single-store model is reliable and profitable can it enter the phase of scaling up store openings.

The essence of the single-store model is actually the customer flow.

Customer flow refers to the specific retail model supported by offline stores, including goods and services. Some call it sales per square meter, such as supermarkets and convenience stores, while others call it occupancy rate, such as hotel rooms. In the catering industry, it is called turnover rate.

The turnover rate in catering refers to how many waves of customers a table or seat can serve in a day. A high turnover rate, for example, five times, means that the table serves five waves of customers in a day. Generally, there is no breakfast, but there are usually two waves at lunchtime and three waves in the evening. Intuitively, this is already considered high.

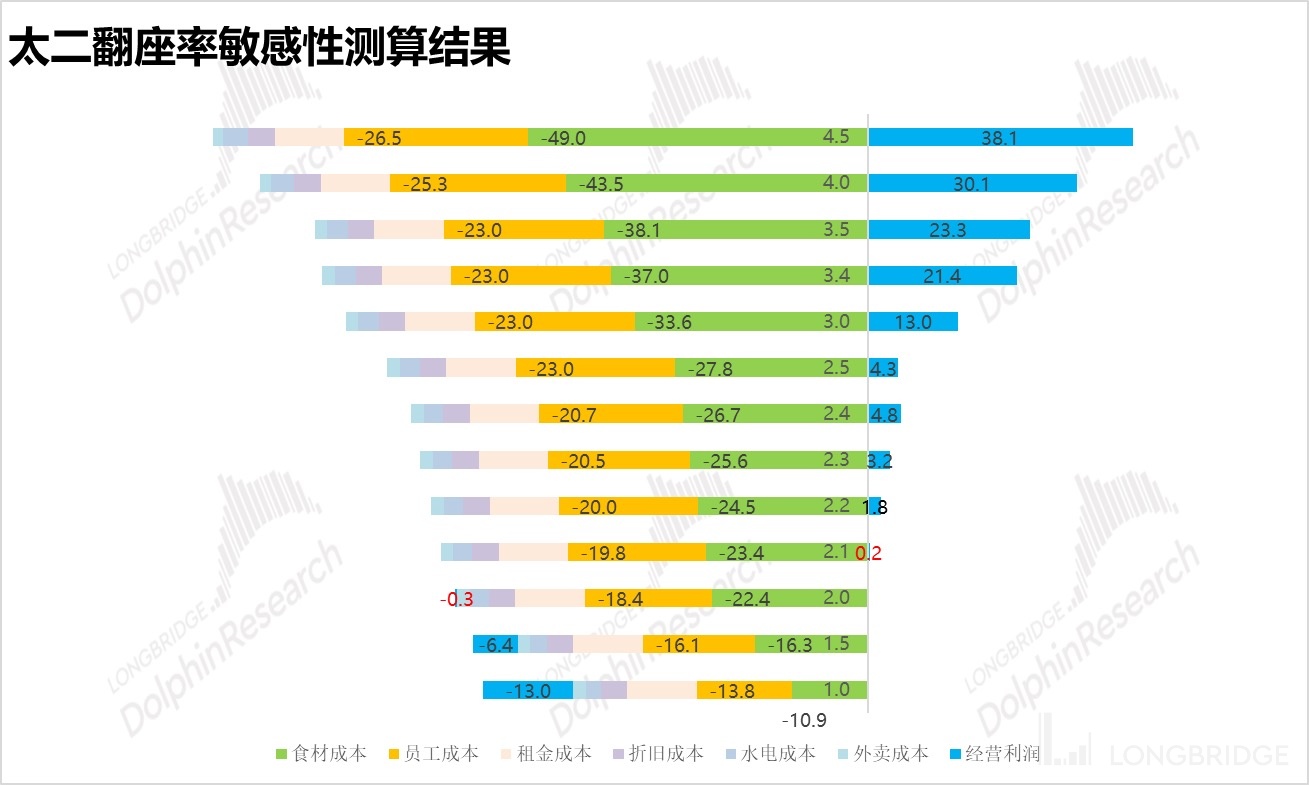

Based on the current store composition, turnover rate, and even the profitability of a single brand, JIUMAOJIU believes that the turnover rate is almost the only core valuation support logic. Based on the operating data of 2021, JIUMAOJIU has conducted sensitivity calculations on the turnover rate of the single-store model of JIUMAOJIU.

The key conclusion is that the breakeven point is reached when the turnover rate is between 2.0 and 2.1. In addition, as the turnover rate increases, the increase in store operating profit is greater, indicating a larger elastic space.

In the next article, Dolphin will provide a detailed introduction to our calculation logic and approach, estimate the store expansion potential of JIUMAOJIU, and provide a valuation judgment. Stay tuned.

Risk Disclosure and Disclaimer for this Article: