Is growth already a carnival, but is the United States definitely in decline?

Hello everyone, I am Dolphin!

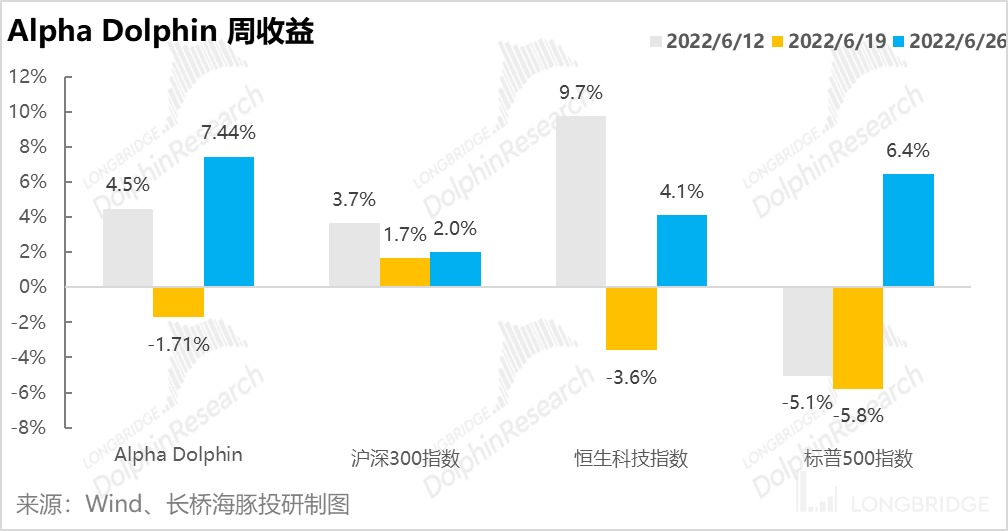

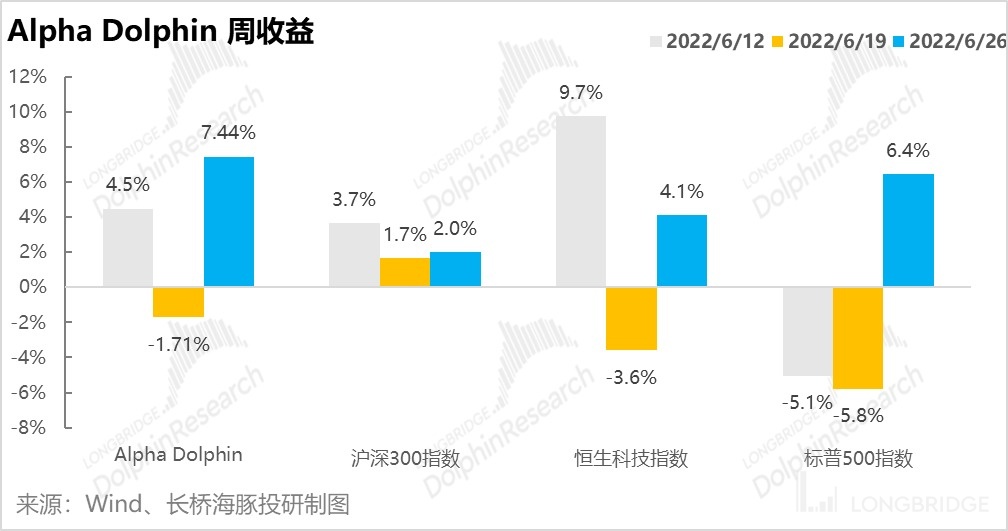

This is the third week's portfolio update since the official launch of the Alpha Dolph simulated portfolio by Dolphin. Last week (6/20-6/25), the portfolio's weekly return increased by nearly 7.5%, and the individual stock return was close to 8%.

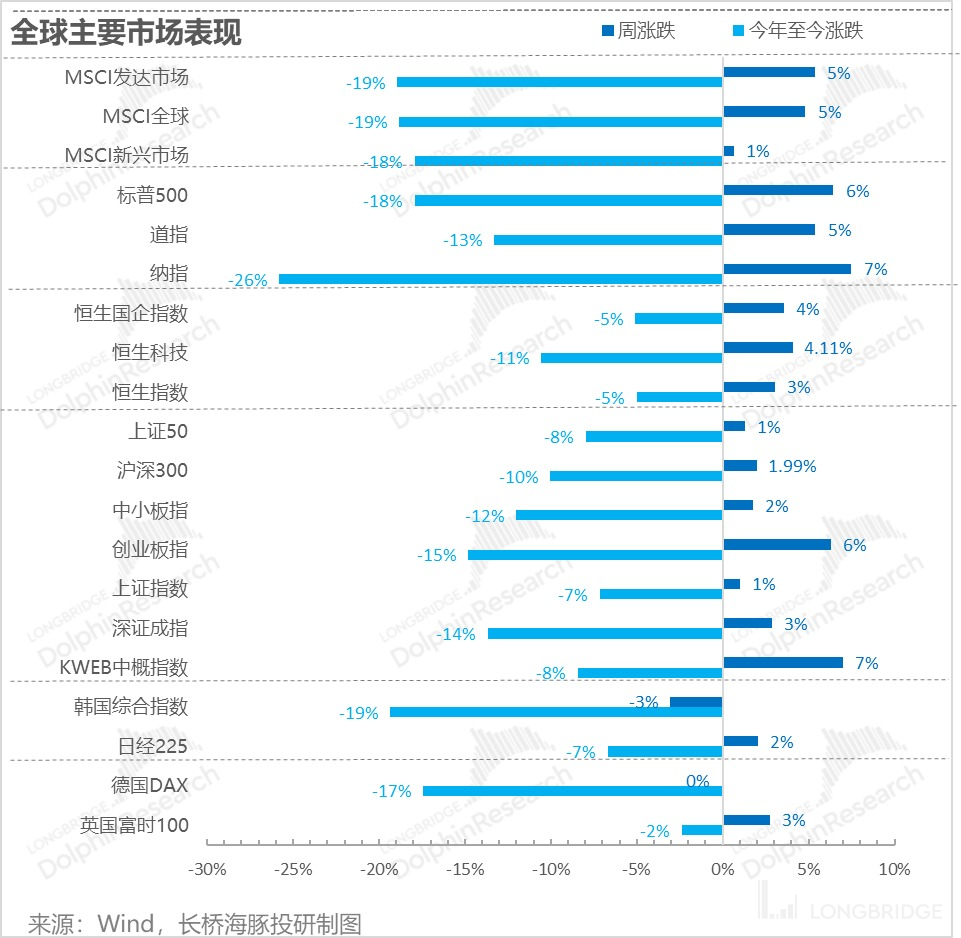

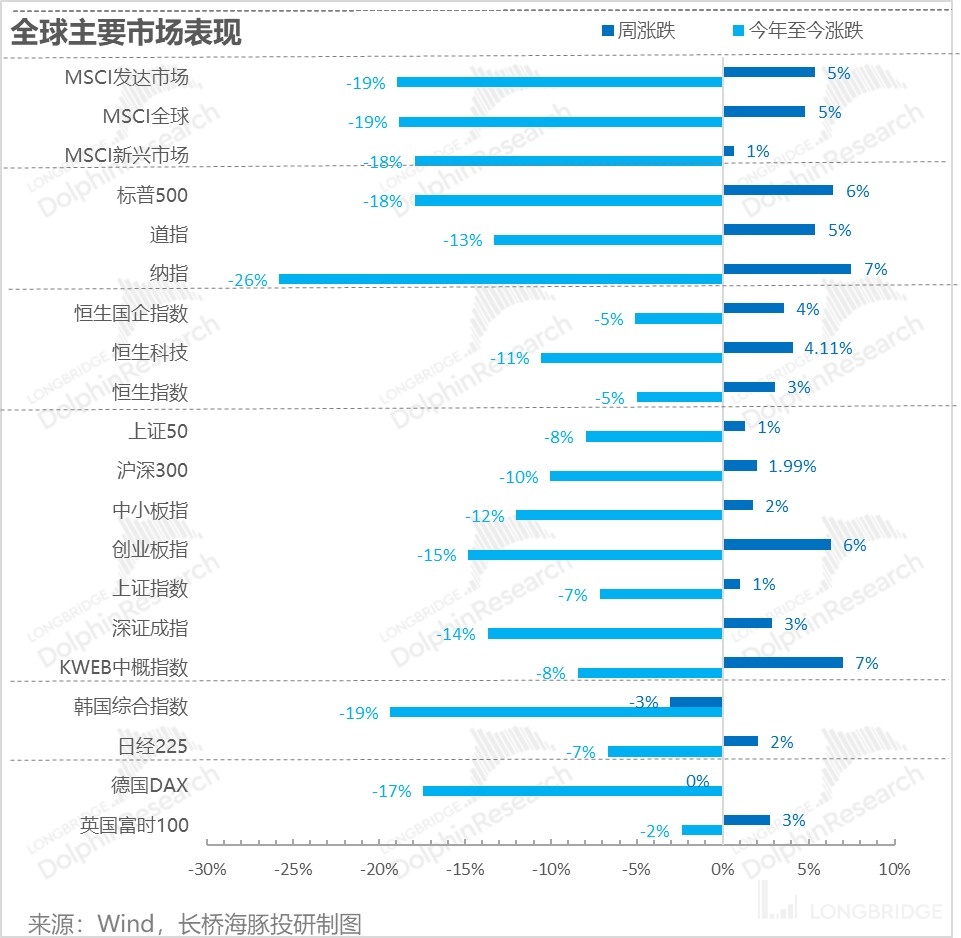

Although global stock indices rebounded last week, the Dolphin portfolio still outperformed the benchmark indices - the Shanghai and Shenzhen 300 Index rose by 3.7% during the same period, and the S&P 500 Index rose by 6.4%.

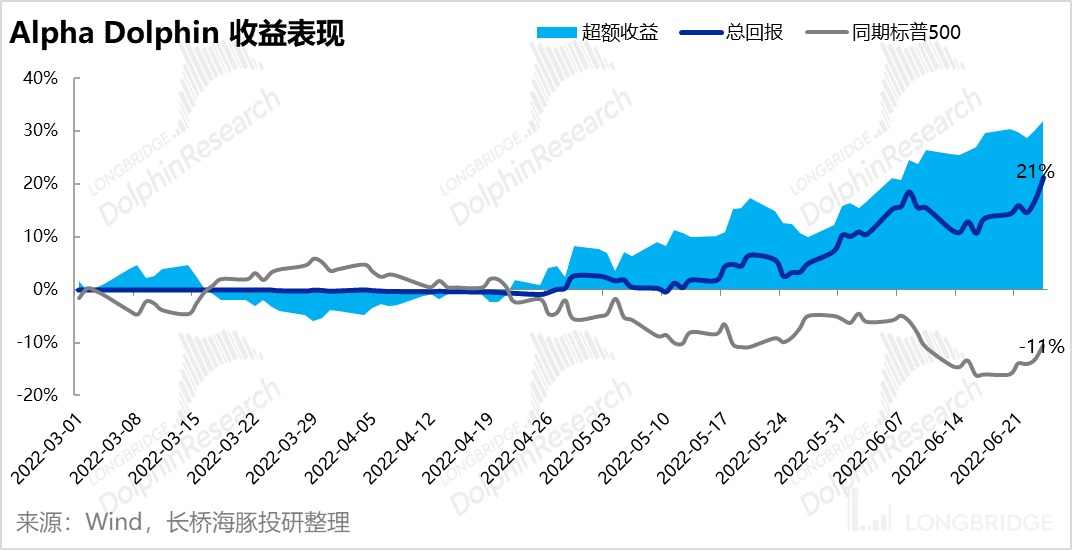

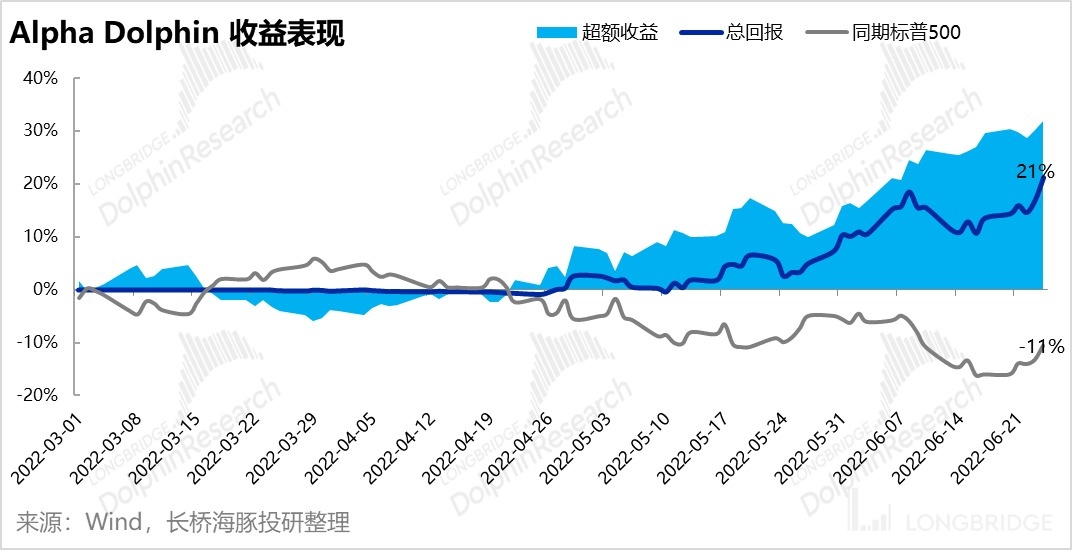

Since the start of the portfolio testing until the end of last week, the total portfolio return was 21%, with a relative return of 38% compared to the S&P 500.

II. Vehicle frenzy, Chinese concept stocks rise, US stock market recovers

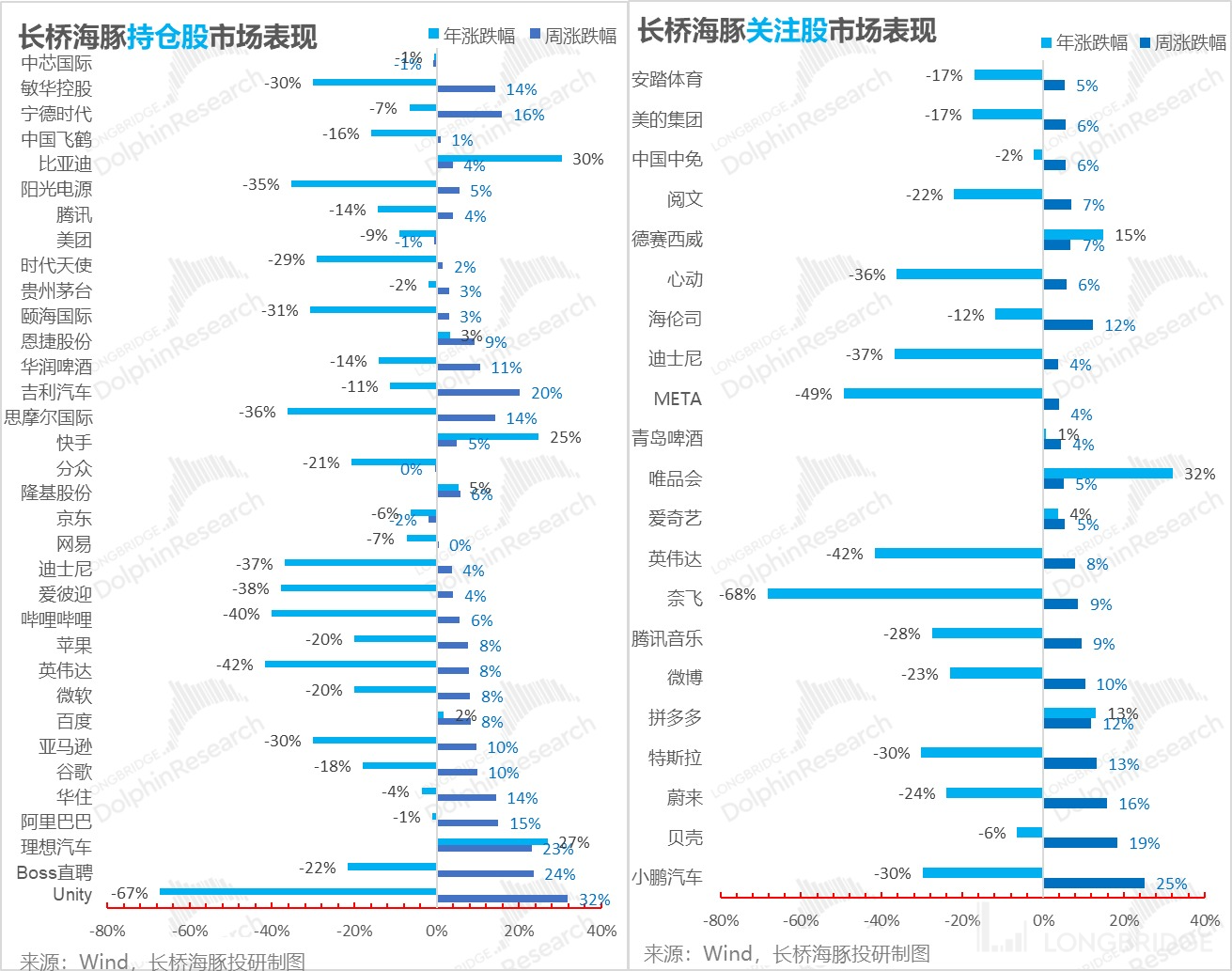

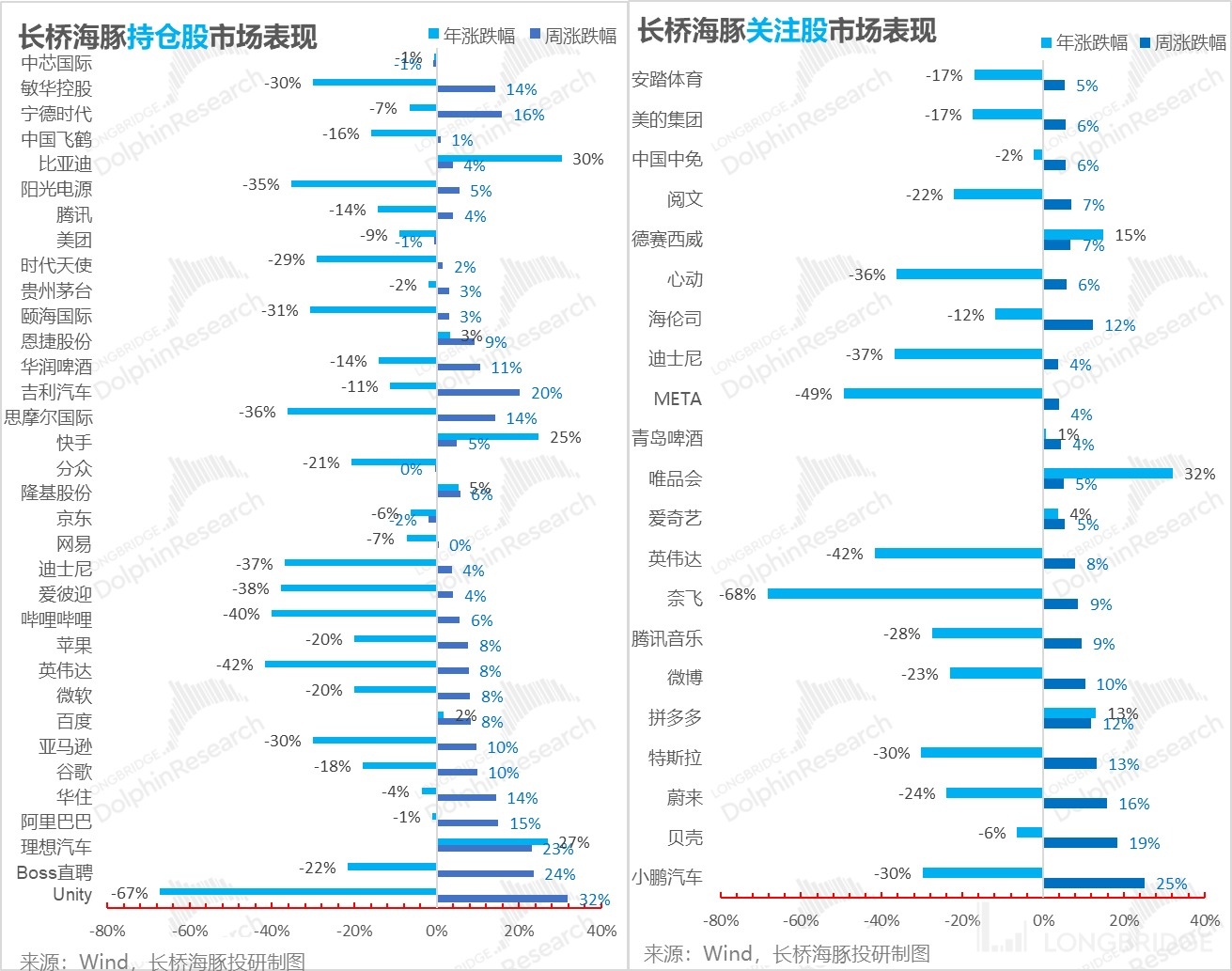

In terms of the contribution to the portfolio's returns: in addition to the frenzy of Chinese assets led by the automotive sector, it is evident that the US assets in the Dolphin portfolio are no longer lagging behind. For example, Unity, as a representative of SaaS stocks in the Dolphin portfolio, quickly recovered by more than 30%+ after the short-term inflation concerns subsided last week.

Among domestic assets, last week, the automotive sector benefited from the policy support for automobile consumption announced by the National Development and Reform Commission, as well as the exciting flagship products of leading companies in the industry after the pandemic, such as Ideal L9, Kirin Battery, etc., leading to a comprehensive celebration in the entire automotive sector.

In addition, while observing the issue of US oil inflation last week, Dolphin also noticed the tug-of-war between green energy and polluting energy in the United States/Europe, which may add relative competitiveness to China's new energy vehicle industry chain to some extent and open up future possibilities. Please refer to "US Oil Inflation, Will China's New Energy Vehicles Grow Stronger?".

In terms of sector allocation, Dolphin has a relatively heavy position in the new energy sector (for the handling of weight allocation, please refer to the explanation when Dolphin's initial portfolio was launched), such as $Loews.USi Auto.US, $GEELY AU TO.HK, $XP.USeng.US, $NIO.US, $CATL.CN, and other stocks all rose.

In addition, the US stocks in the portfolio were "quiet" in terms of interest rate hikes last week. Under the expectation of "recession," the market started to push for the recovery of US technology stocks, resulting in a certain degree of recovery in stocks such as $Unity Software.USnity Software.US, $Agilent Tech.USgilent Tech.USlphabet.US, $Agilent Tech.USgilent Tech.USmazon.US, and others in the Dolphin portfolio.

Meanwhile, consumer stocks in the portfolio, such as Huazhu and Minhua, also had good gains due to the expectation of a decrease in social additions, relaxation of control, and a rebound in real estate sales.

The only poor performance in the portfolio last week was the stocks that were previously seen as bullish, such as JD.com, Meituan, NetEase, and others. Their stock prices had remained relatively strong in the early stage, and in the view of the Dolphin, they have already reached a relatively "neutral" state. We are considering making adjustments around the interim report.

Here are some explanations from the Dolphin about the relatively large fluctuations in individual stocks last week:

In addition, among the holdings of Dolphin in both regions last week, there was a significant net buying volume for Focus Media, which had a mediocre performance last week, while Ningde had a large net selling volume despite its high increase.

In addition, among the holdings of Dolphin in both regions last week, there was a significant net buying volume for Focus Media, which had a mediocre performance last week, while Ningde had a large net selling volume despite its high increase.

III. Performance of the Portfolio to Date

If we look at the overall returns of the Longbridge Alpha Dolphin portfolio as of last Friday since its internal testing launch on March 1st, it has achieved a 21% return.

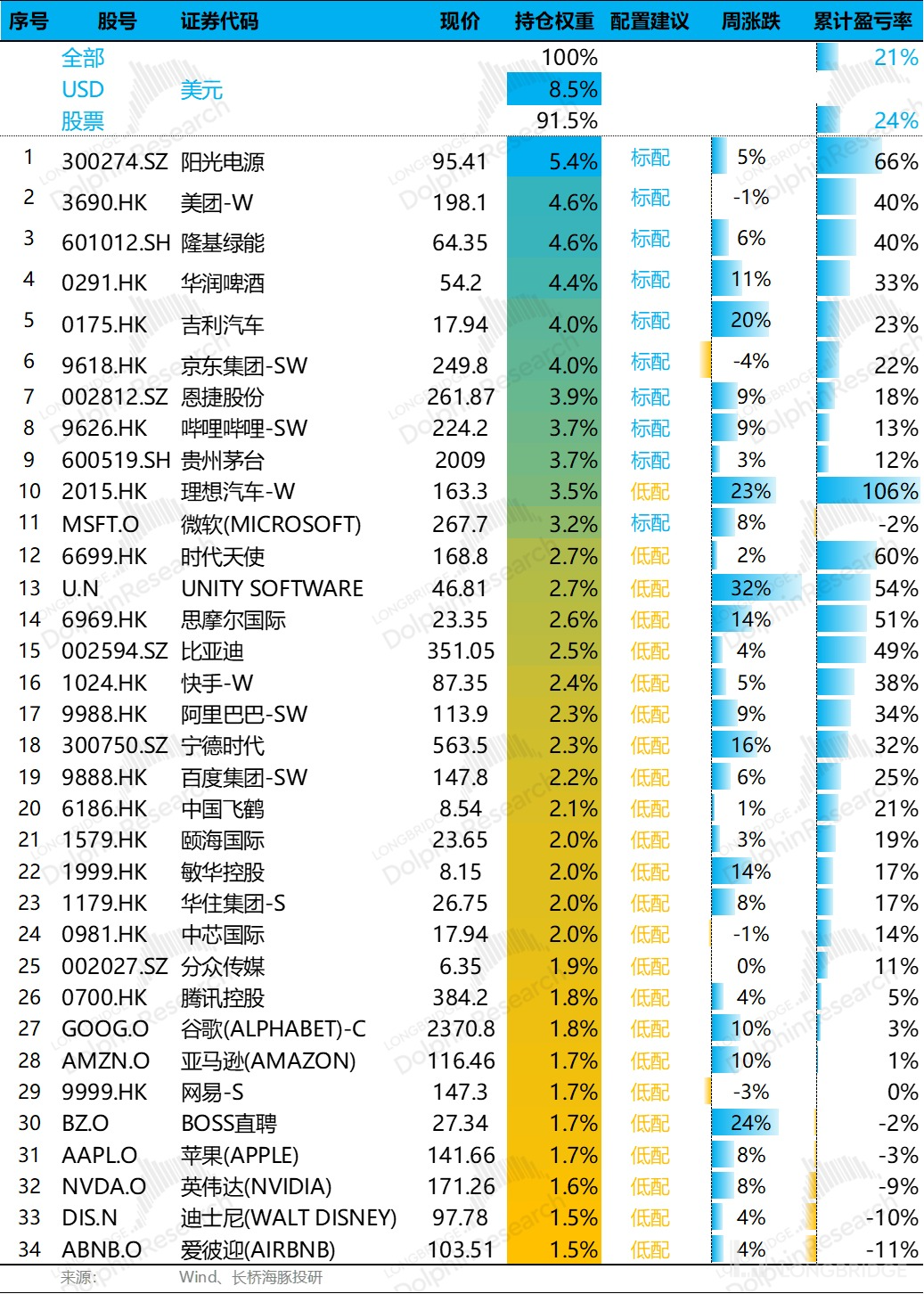

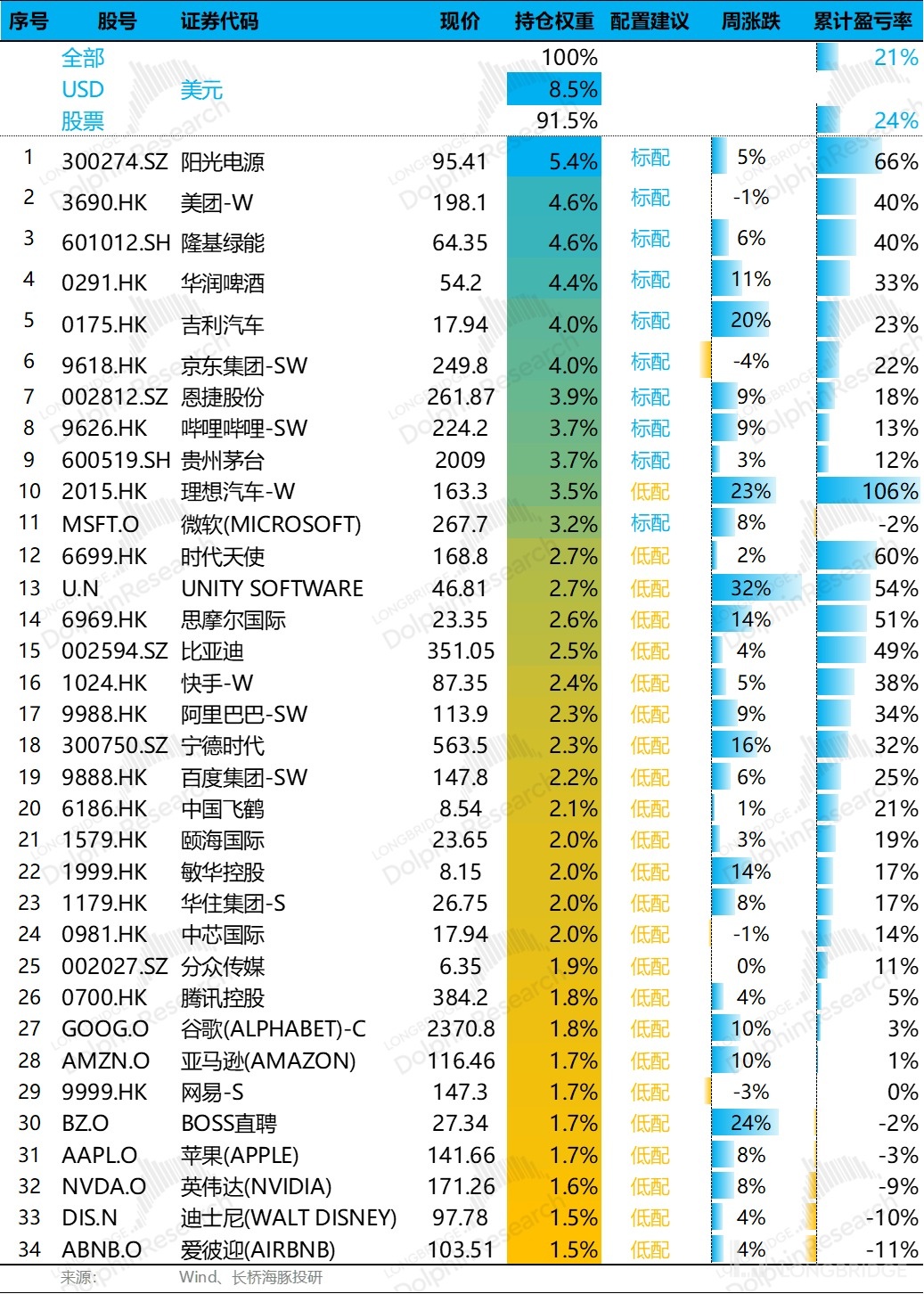

There were no adjustments made to the portfolio in the third week since its official launch. Currently, there are still 10 standard stocks and 24 underweight stocks, with no overweights.

The allocation weights of the holdings and the current portfolio weights are as follows:

IV. Research Focus: Is Short Video the Invincible Track?

In terms of research progress this week, Dolphin plans to complete the valuation assessment of Jiumojiu. Considering the recent recovery of the real estate market and the significant increase in Beike's stock price, Dolphin will also update its assessment of Beike.

In terms of sector research, in the U.S. internet advertising market, as the cycle deteriorates, the short video track is starting to disrupt "monetization". We know that the last time Apple used its operating system to reallocate the internet advertising cake, Meta was cut out.

This time, as the short video track enters with strong "monetization" capabilities, who might fall? Dolphin's research this week will attempt to understand this question regarding the U.S. short video track.

In the semiconductor sector, we will open up a new sector - the panel industry, with a focus on BOE Technology. This is mainly due to the fact that panel prices have been falling for some time, and the prices have even fallen below the production cost line before the previous round of price increases. The real opportunity may take some time, but the bottom is forming.

V. Macro Review Last Week: Expectations of Inflation Decline

The past three years have been a typical macro market, but Dolphin has paid less attention to macro data interpretation in individual stock and sector research. Therefore, Dolphin will pay more attention to the macro and market conditions in the portfolio dynamics.

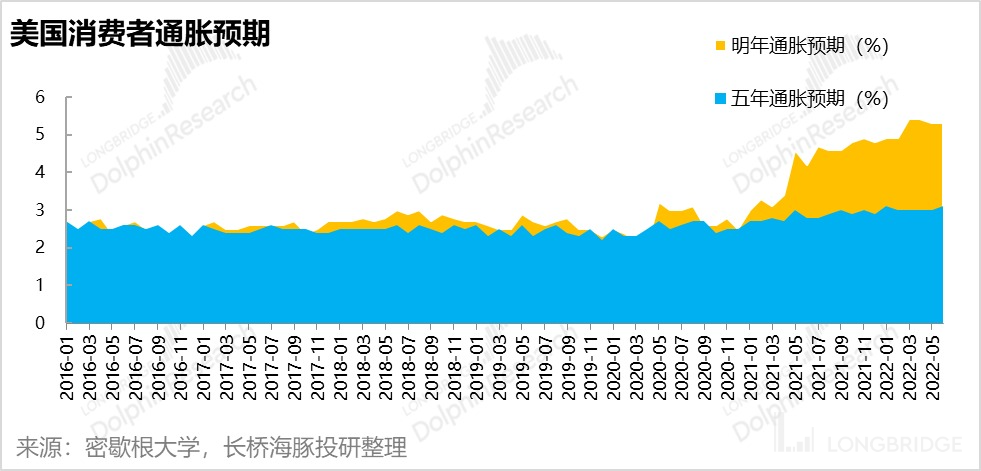

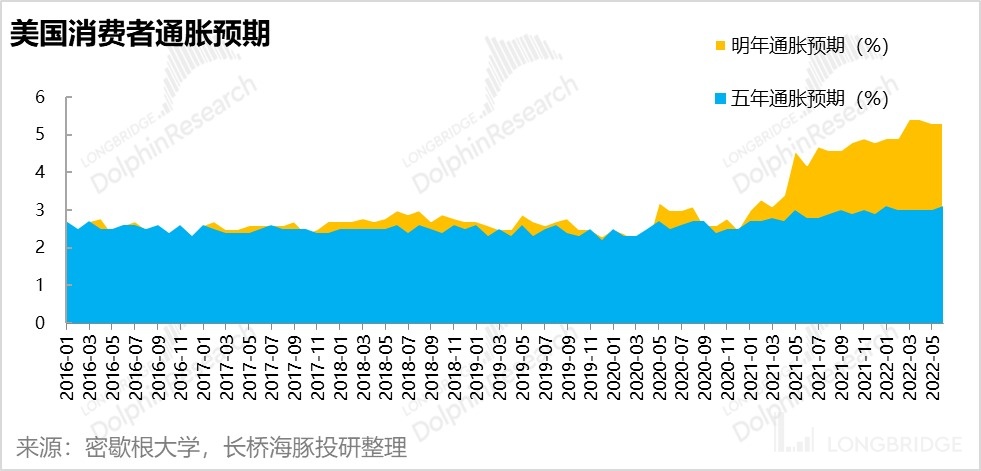

And the biggest macro event recently is the rate hike by the Federal Reserve. Powell previously mentioned that there are two key data points that determine the pace of rate hikes by the Federal Reserve: one is inflation data, and the other is consumer inflation expectations. The Federal Reserve is most afraid of the "long-term inflation expectations" growing stronger, as employees will demand higher wage increases based on these expectations, leading to a self-fulfilling prophecy.

After the significant rate hike by the Federal Reserve last week, consumers' inflation expectations for the next year and the next five years have slightly declined compared to the beginning of the month (1-year inflation expectation 5.3% vs. 5.4% at the beginning of the month, 5-year inflation expectation 3.1% vs. 3.3%).

After the expected slight cooling, the indices represented by growth and resilience, such as the Nasdaq, A-share Growth Enterprise Board, and KWEB, entered a phase of recovery together with global stock indices after a week of hesitation, quickly entering the rhythm of "recession expectations" in the market.

After the expected slight cooling, the indices represented by growth and resilience, such as the Nasdaq, A-share Growth Enterprise Board, and KWEB, entered a phase of recovery together with global stock indices after a week of hesitation, quickly entering the rhythm of "recession expectations" in the market.

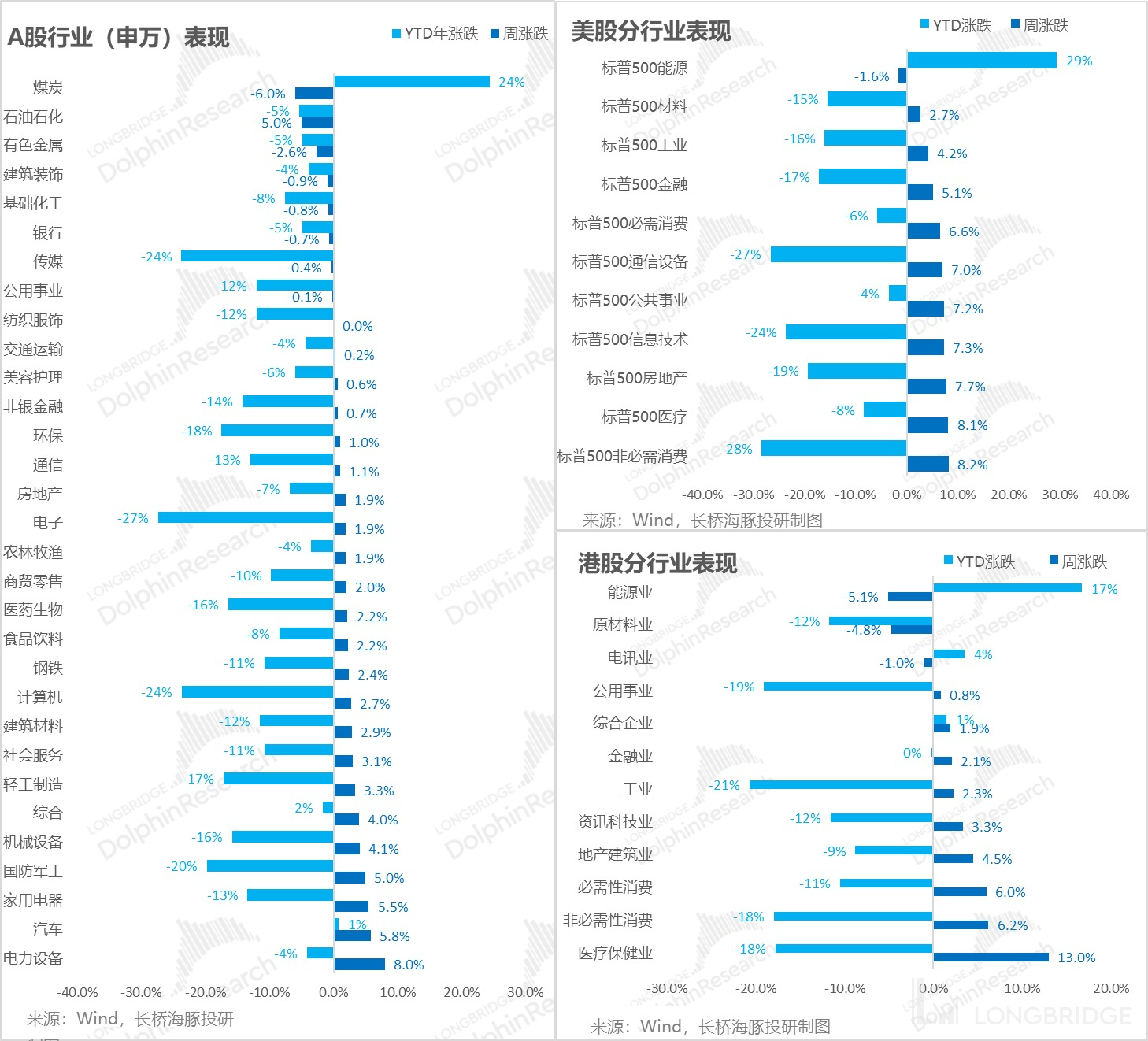

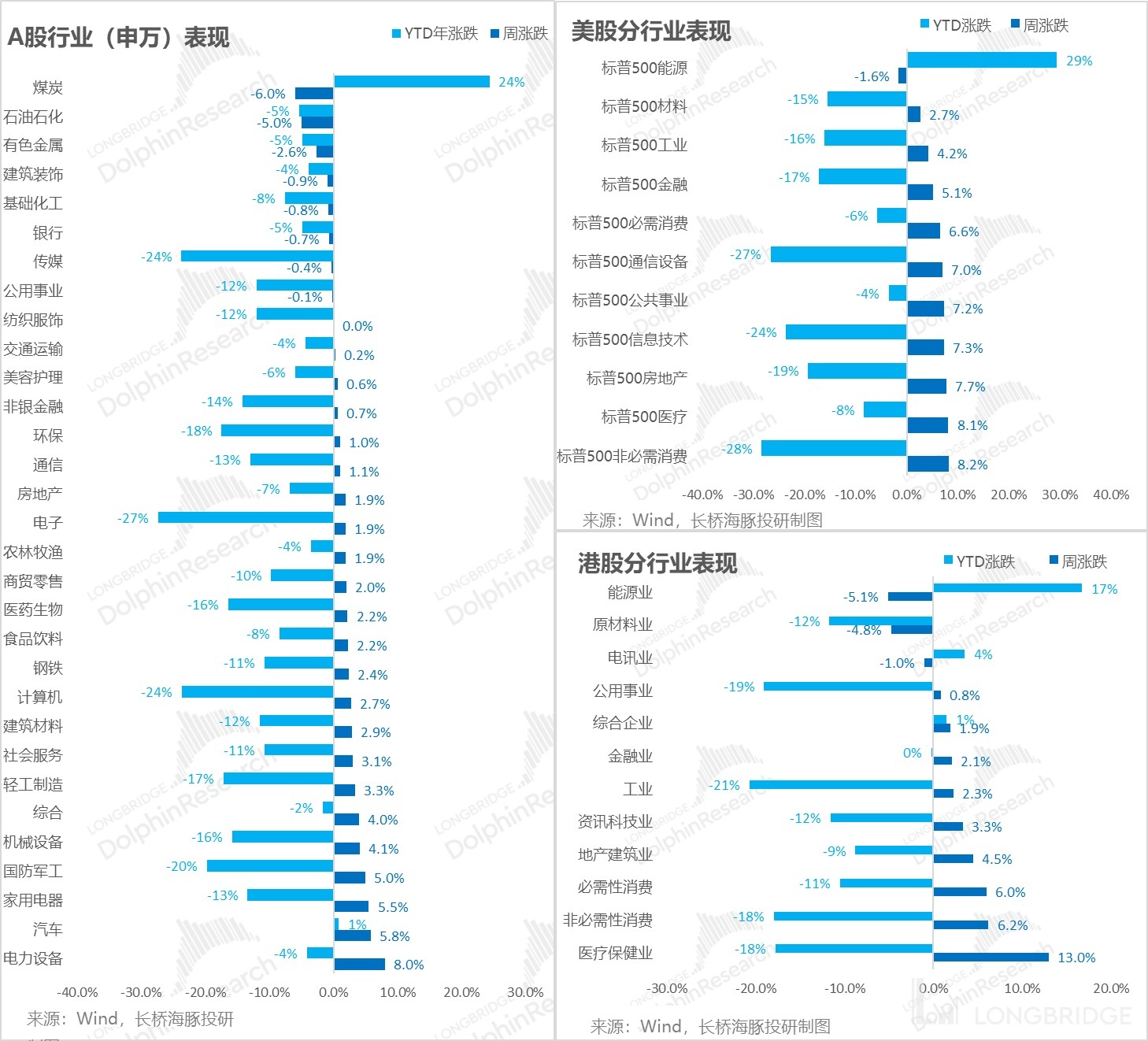

In addition, looking at various sectors, under the expectation of recession, the prices and stock prices of basic resource products such as energy have fallen consistently in major markets last week.

However, the surge in new energy vehicle stocks is mainly seen in the A-share market, while other markets do not show significant changes, seemingly in line with Dolphin's previous judgment on oil inflation.

Furthermore, the recovery of the real estate sector driven by property sales and the recovery of discretionary consumption are more apparent.

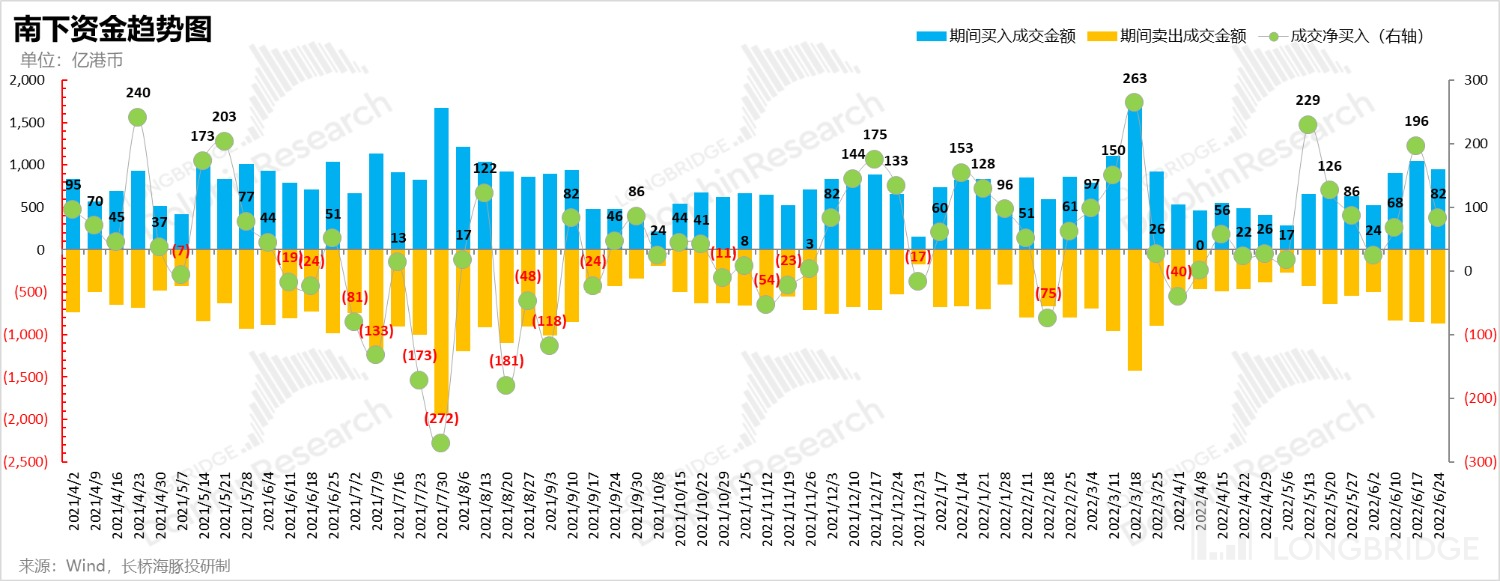

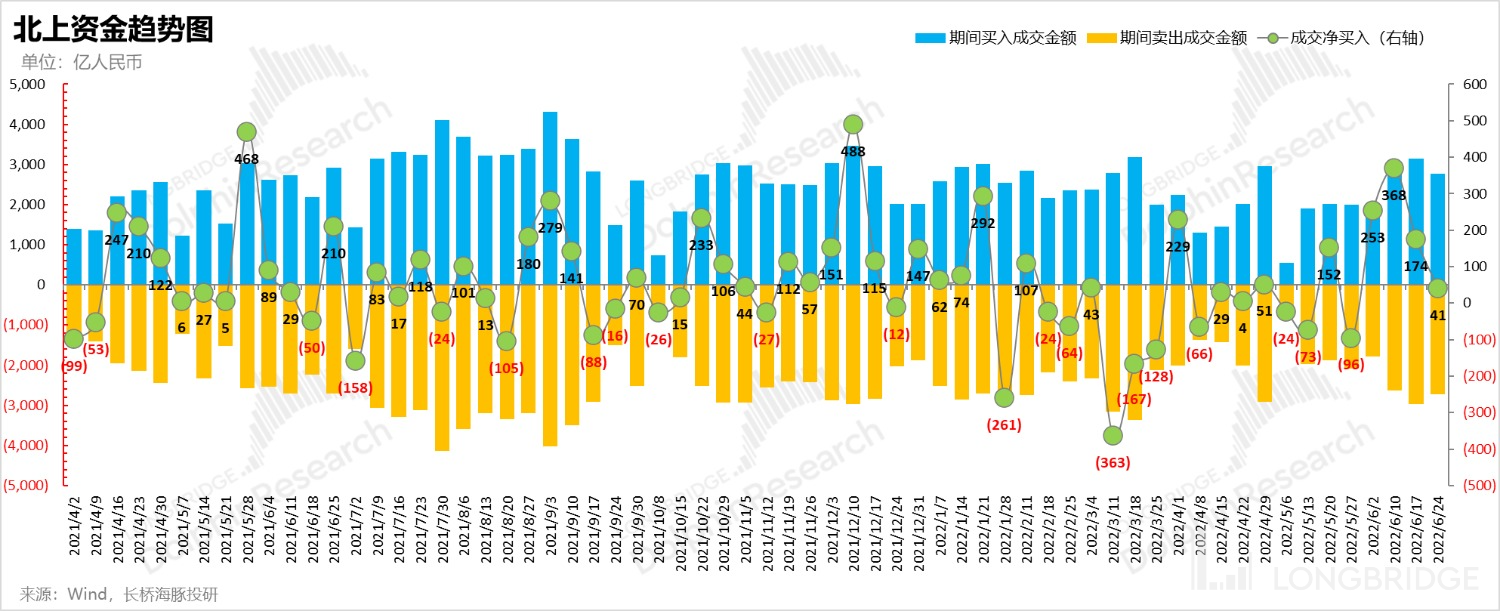

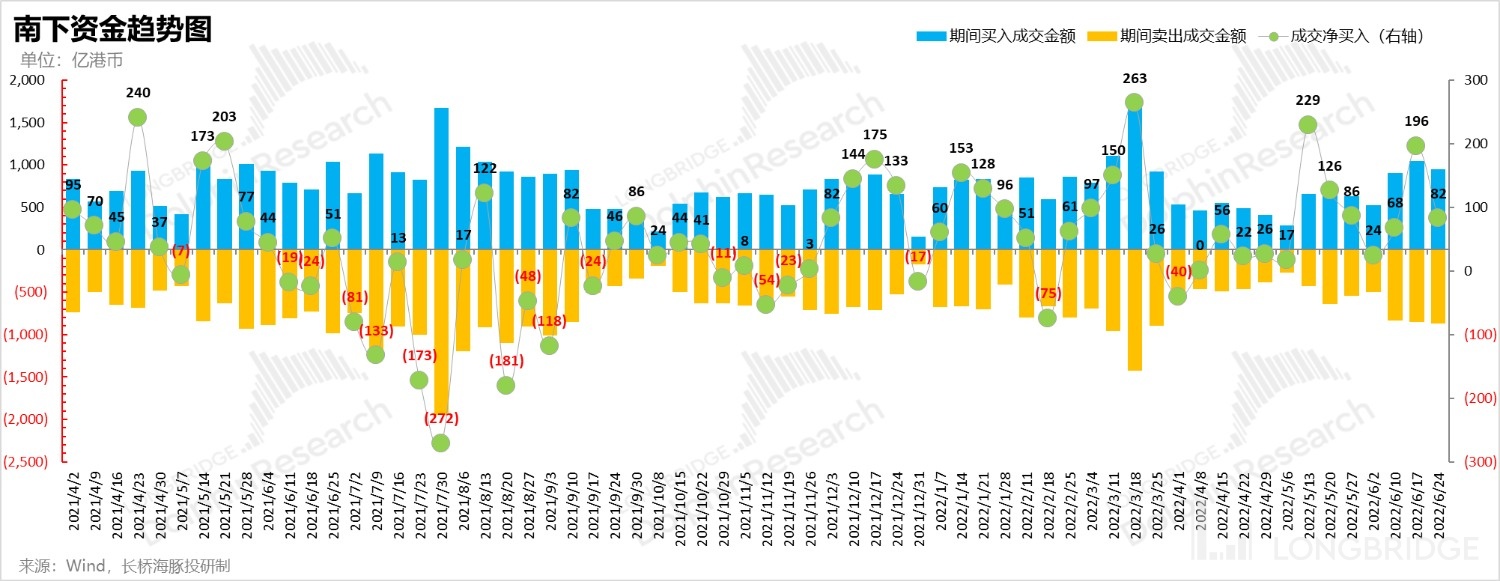

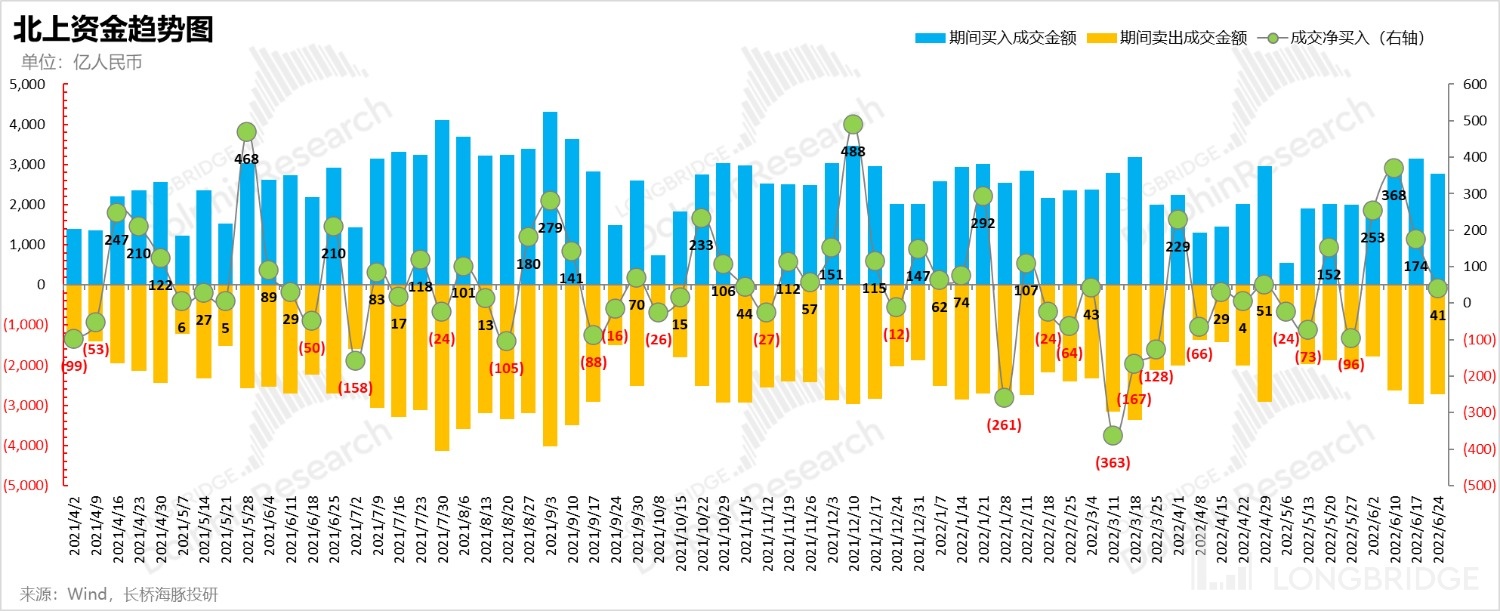

In terms of fund flows, after a round of gains, the pace of northbound funds entering the market has slowed down. However, on the eve of the 25th anniversary of Hong Kong's return, the net volume of southbound funds is still relatively high.

Overall, the market as a whole has a general expectation of a recession in the United States, but there are differences in the timing of the recession. Last week, the overall trading was based on this expectation.

However, Dolphin also mentioned another point in the macro observation last week. In the case of a shortage of oil supply, we should also consider the possibility of "stagflation" in the future, in addition to the recession.

Unlike the decline in interest rates supporting growth under recession expectations, stagflation will suppress policy adjustment space and is not conducive to growth stocks. Therefore, Dolphin's portfolio will not increase its position in US stocks quickly. Instead, it will consider removing some stocks in industries where competition is deteriorating.

For recent articles related to Dolphin's portfolio weekly report, please refer to:

"Is the United States in Recession or Stagflation in 2023?"

"US Oil Inflation, Will China's New Energy Vehicles Grow Strong?" 《Fed hikes interest rates, but Chinese asset opportunities still arise》

《US stock market inflation soars again,how far can the rebound go?》

《Grounded and practical: Dolphin portfolio takes off》

Risk Disclosure and Statement of this article: Dolphin Analyst Disclaimer and General Disclosure