Current Chinese Assets: "No news is good news" for US stocks.

Hello everyone, I am Dolphin!

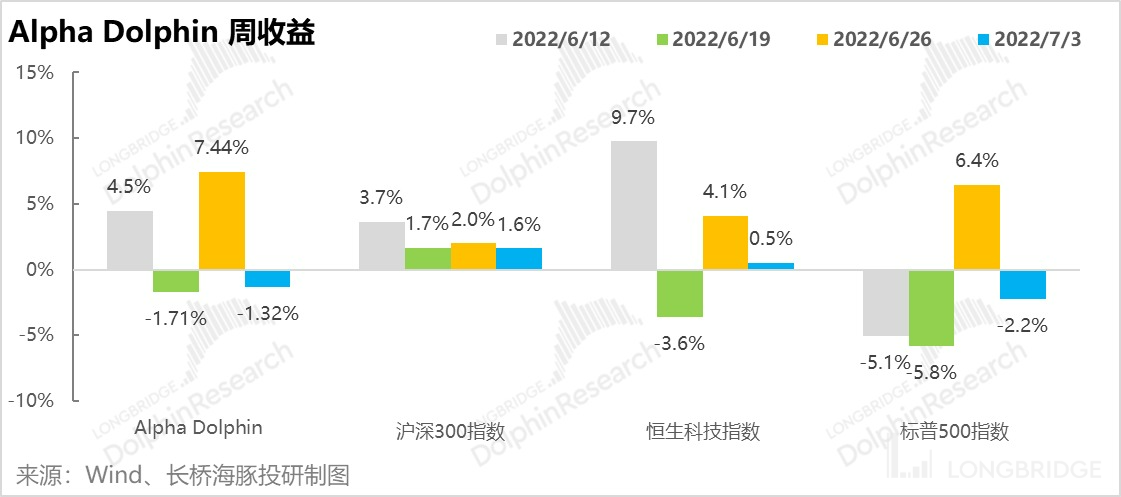

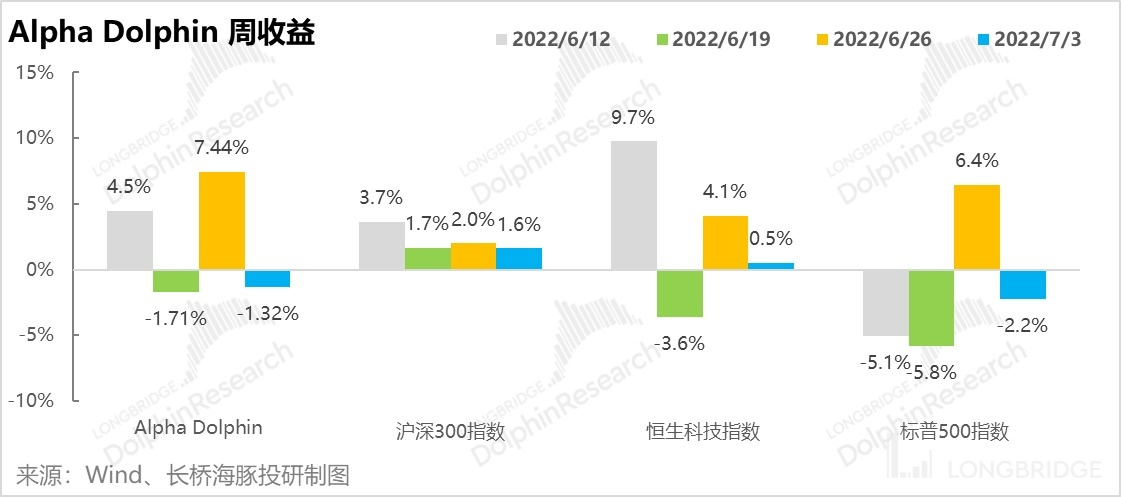

This is the fourth week's dynamic update of the Alpha Dolphin simulated portfolio launched by Dolphin. Last week (6/27-7/1), the portfolio's weekly return dropped by 1.3%, and the weekly return of individual stock holdings decreased by approximately 1.4%.

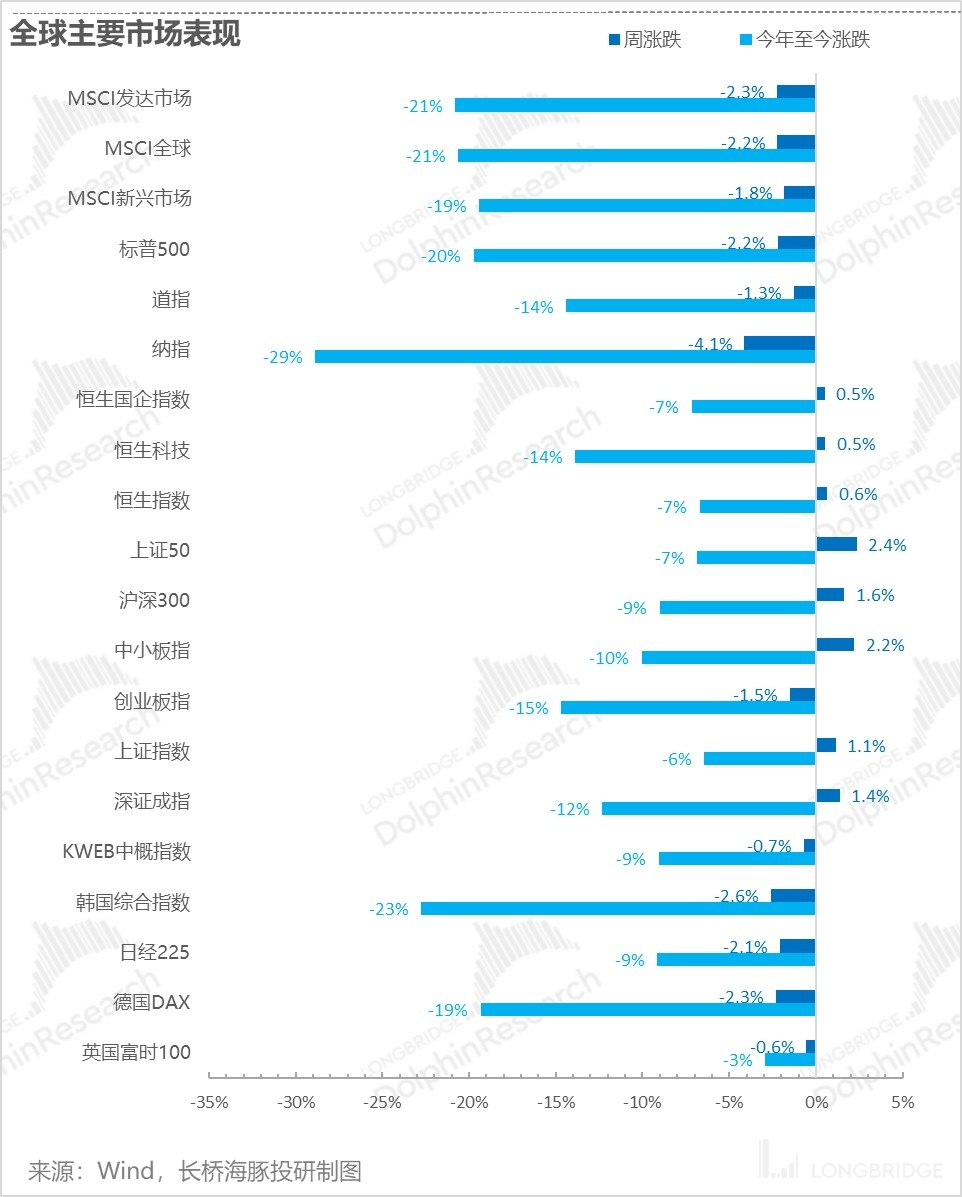

Compared to the benchmark index, the S&P 500, which fell by 2.2% last week, the portfolio is still slightly outperforming, but it is significantly lower than the positive returns of 1.6% for the CSI 300 and 0.5% for the Hang Seng Tech Index.

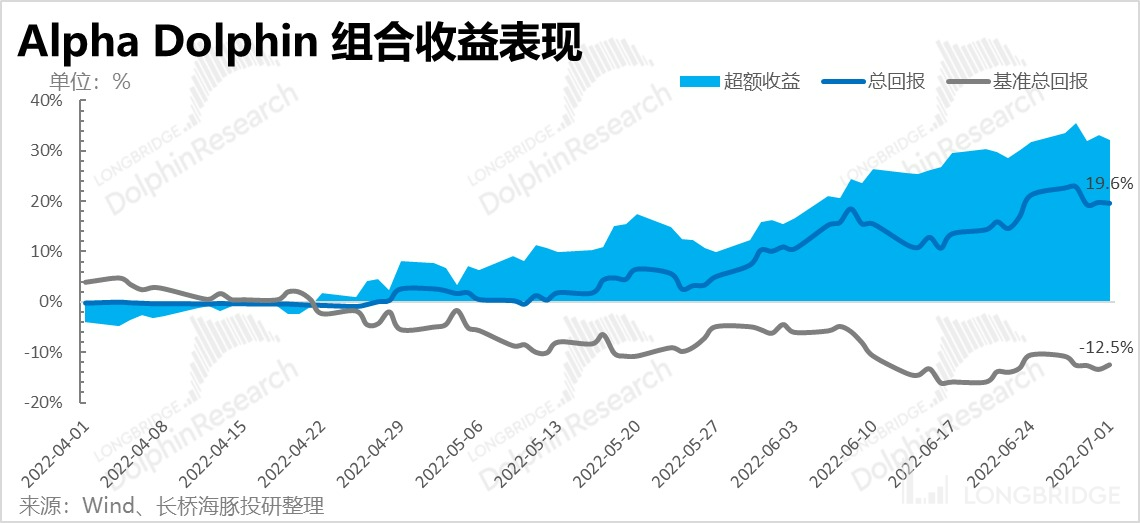

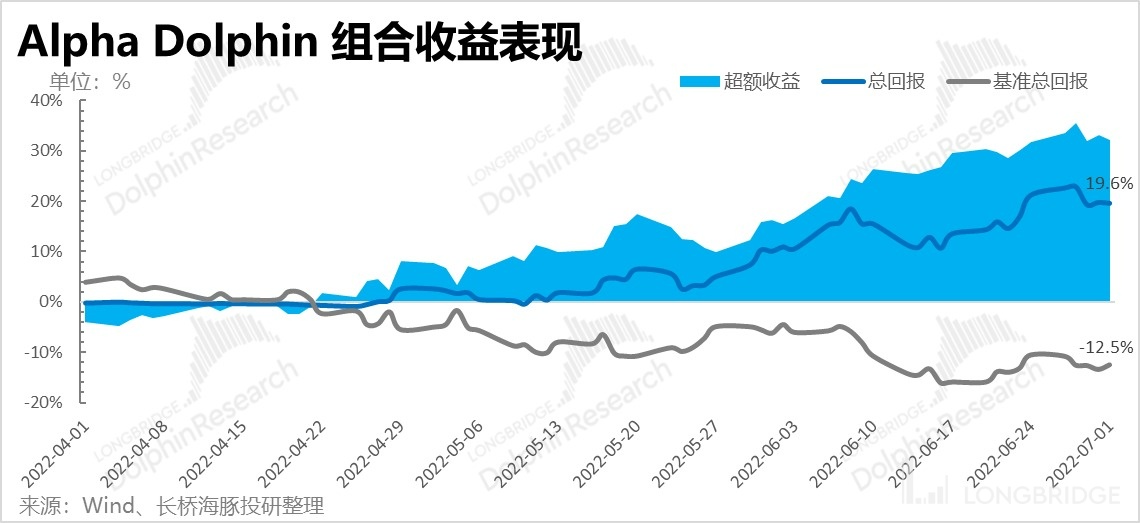

Since the start of the portfolio testing until the end of last week, the total return of the portfolio is 19.6%, with a relative return of 32% compared to the S&P 500.

II. Emerging from the Haze of the Pandemic: Taking Turns to Shine in the Business and Social Services Sector

After experiencing significant growth driven by the new energy sector in the previous week, the portfolio's performance was relatively average last week.

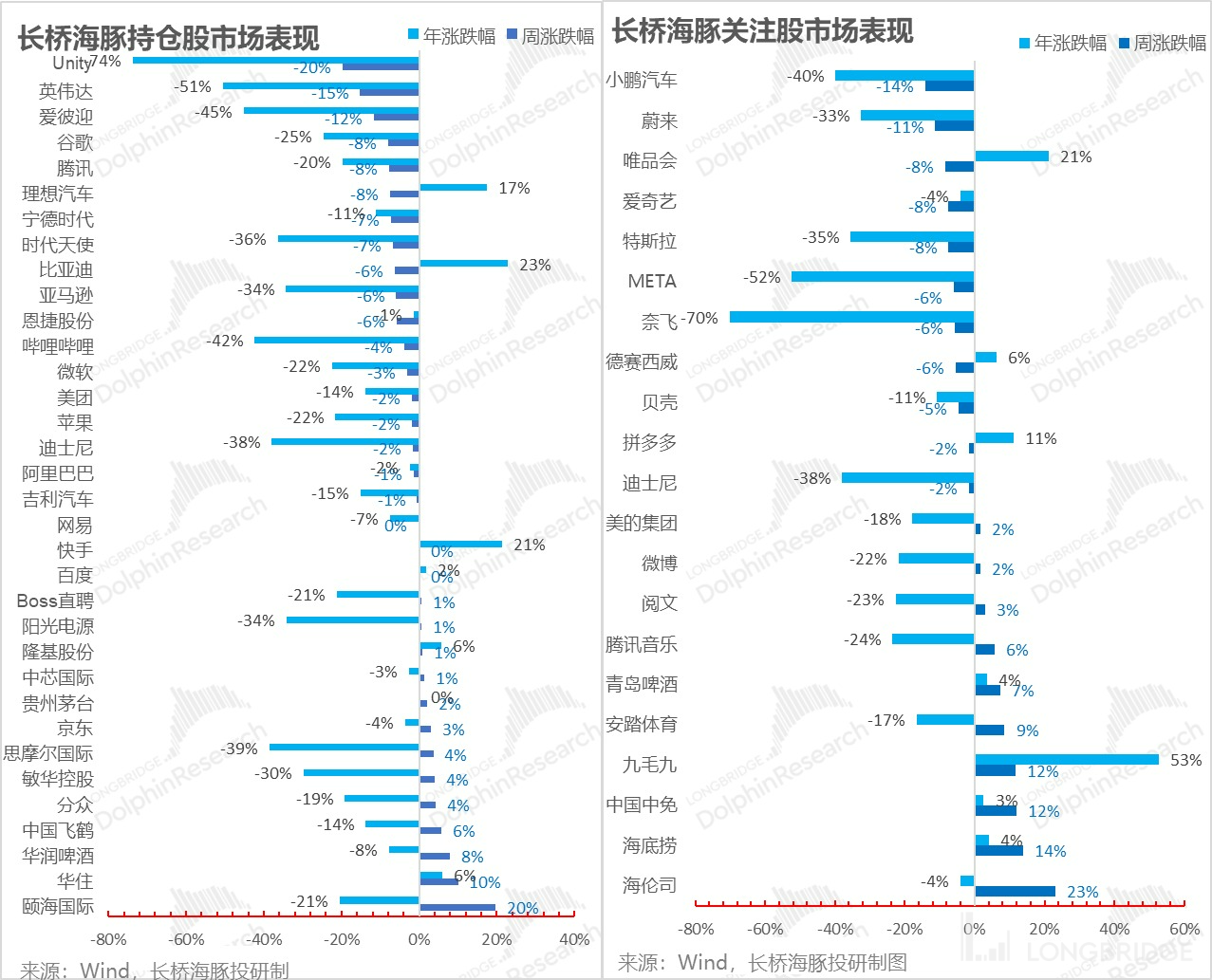

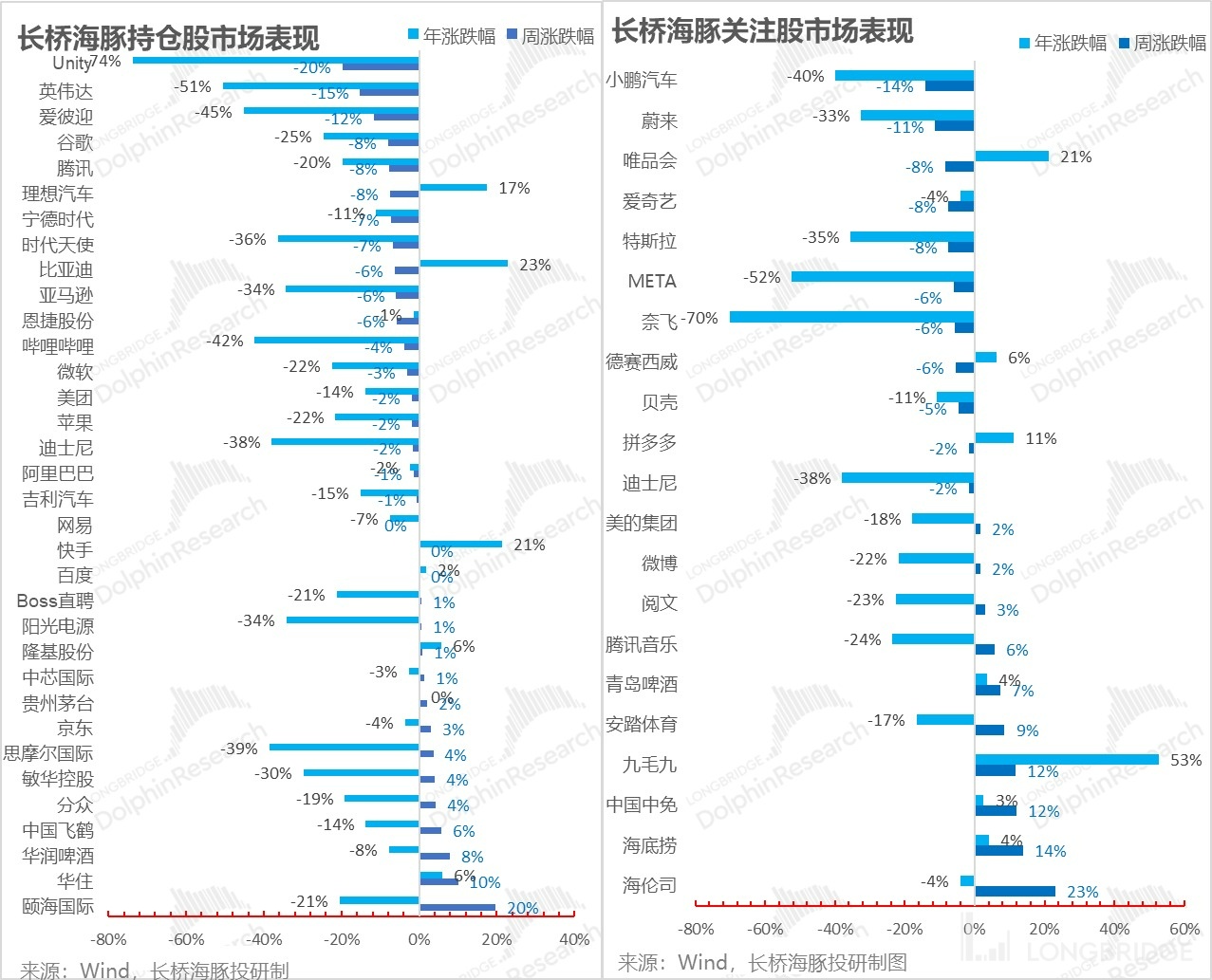

- Regarding Chinese assets: On the one hand, there was a certain degree of pullback in the overall performance of automobile and electric power stocks due to factors such as the announcement of financing by Ideal Auto after a sharp rise and the scrutiny of NIO by short-selling institutions, which released short-selling reports, etc.

Meanwhile, the market frenzy last week came from the business and social services sector, with the most significant factor being the policy announcement by the Ministry of Industry and Information Technology to cancel the "star" designation on travel cards. At the same time, dining in restaurants in Shanghai was finally allowed.

As can be seen, both the Alpha Dolphin portfolio held by Longbridge and the business and social services assets that are not included in the portfolio but are being closely monitored, such as Huazhu Hotels, Yihai International, Haidilao, Helen's, China Duty Free, and Jiulianjiu, all showed good gains.

- Recent underperformance of US stocks: Last week, Micron Technology, a semiconductor company, released its earnings report with a disappointing forward guidance. At the same time, news of order cancellations in the industry resurfaced, leading to a sluggish performance in the entire semiconductor sector. Additionally, some retail companies issued profit warnings.

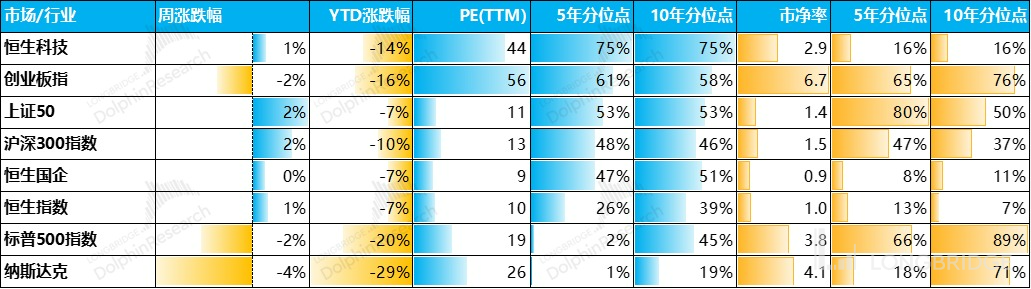

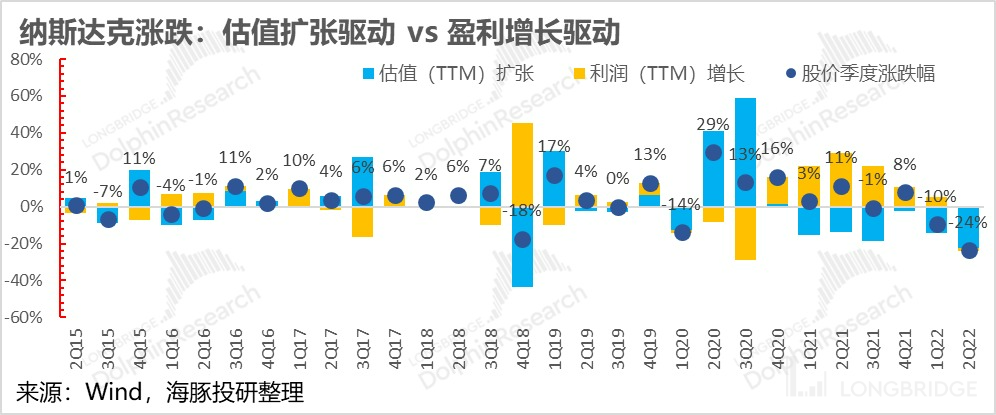

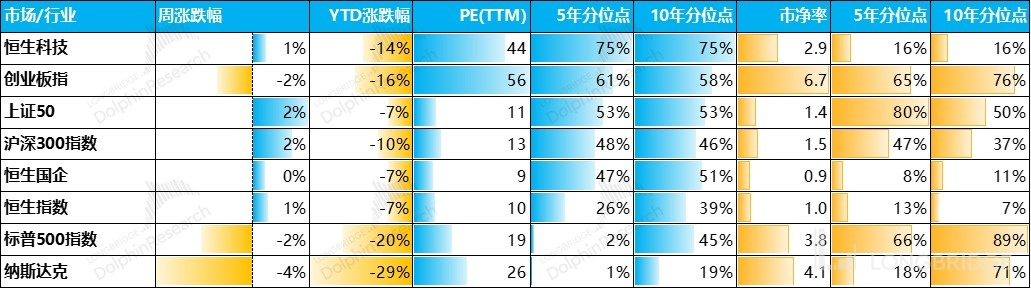

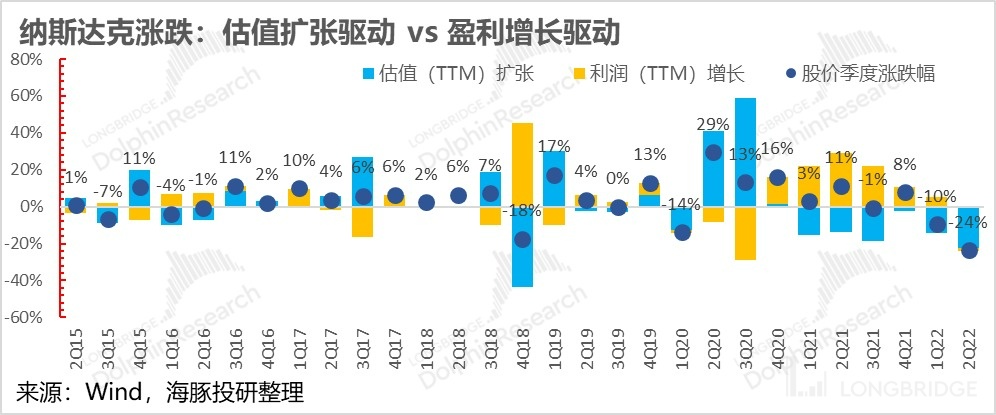

A series of negative news about earnings dampened market sentiment once again. Although the P/E ratio (TTM) of US stocks is only around 1% over the past five years, and the recent major sell-offs have mainly targeted valuation, the market remains fearful.

But in case the future profits cannot support it, when the profit margin declines, the so-called "cheap" may not hold up at all, and after killing the valuation, another round of killing performance may come.

But in case the future profits cannot support it, when the profit margin declines, the so-called "cheap" may not hold up at all, and after killing the valuation, another round of killing performance may come.

Therefore, as the second quarter earnings season approaches in the US stock market, Dolphin will focus on the performance guidance for the third quarter and the upcoming investment activities (mainly reflected in capital expenditures + corporate recruitment) of various companies in China.

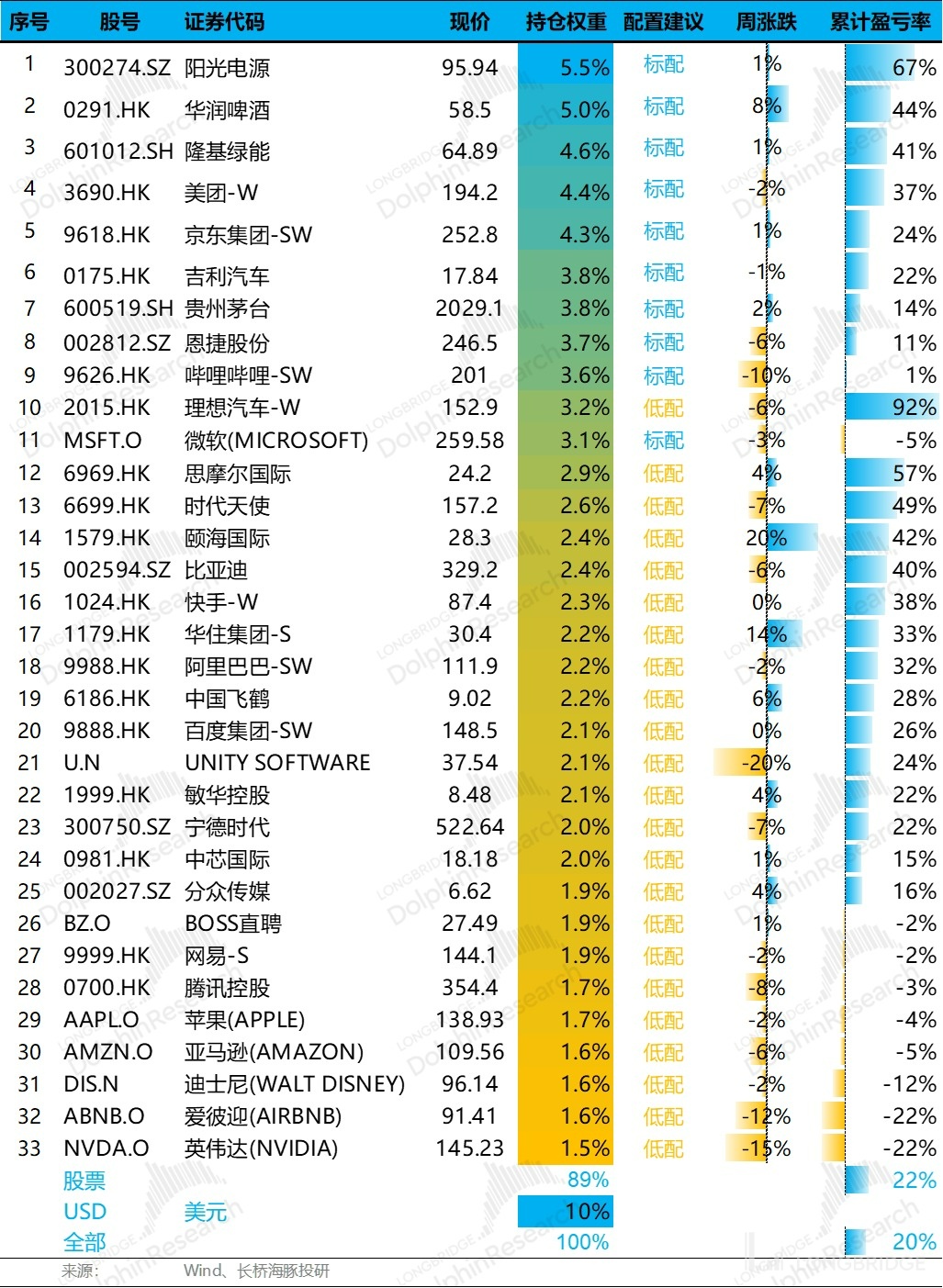

Also under the fear of killing performance, the US stock assets held by Dolphin have continued to decline—Unity, NVIDIA, and Airbnb are all in a deep adjustment state.

Here is Dolphin's analysis of the reasons for the significant rise and fall of the stocks it is closely monitoring:

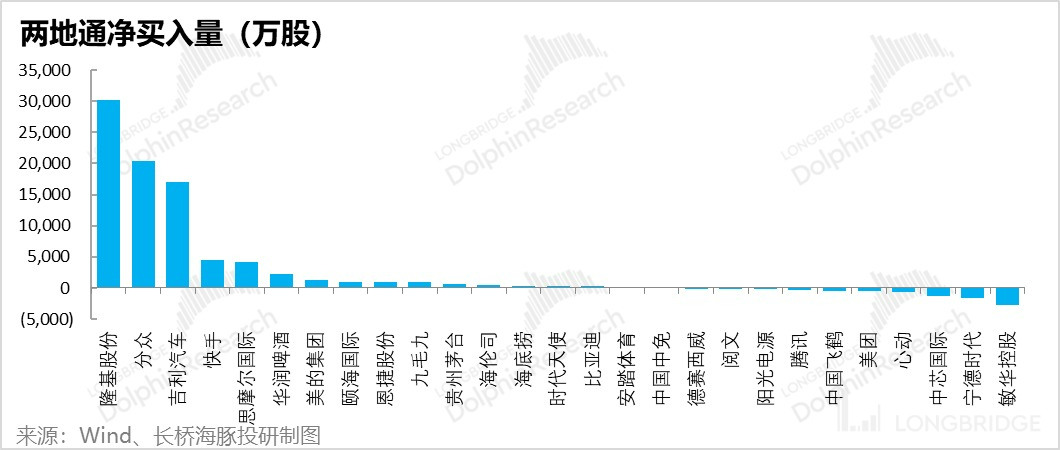

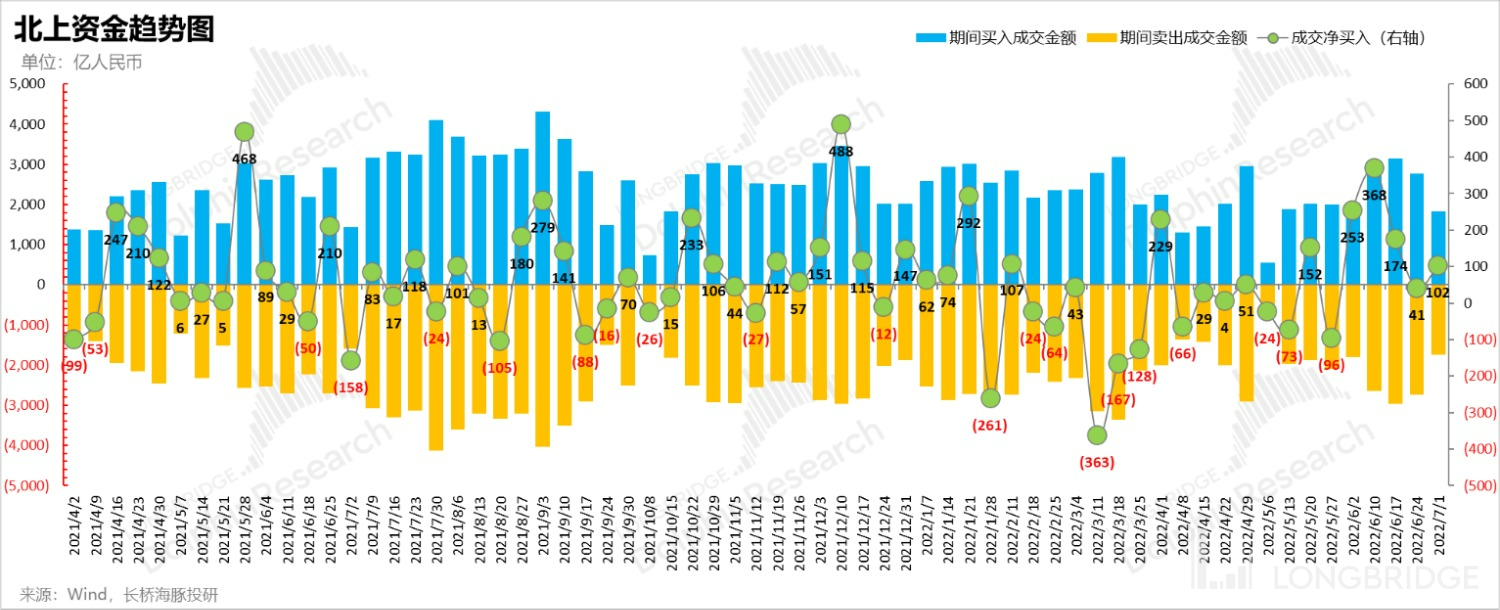

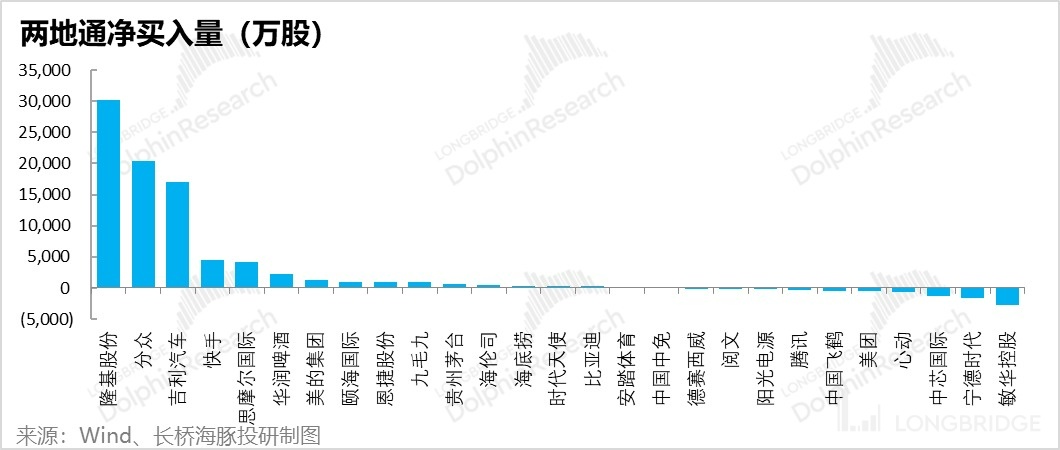

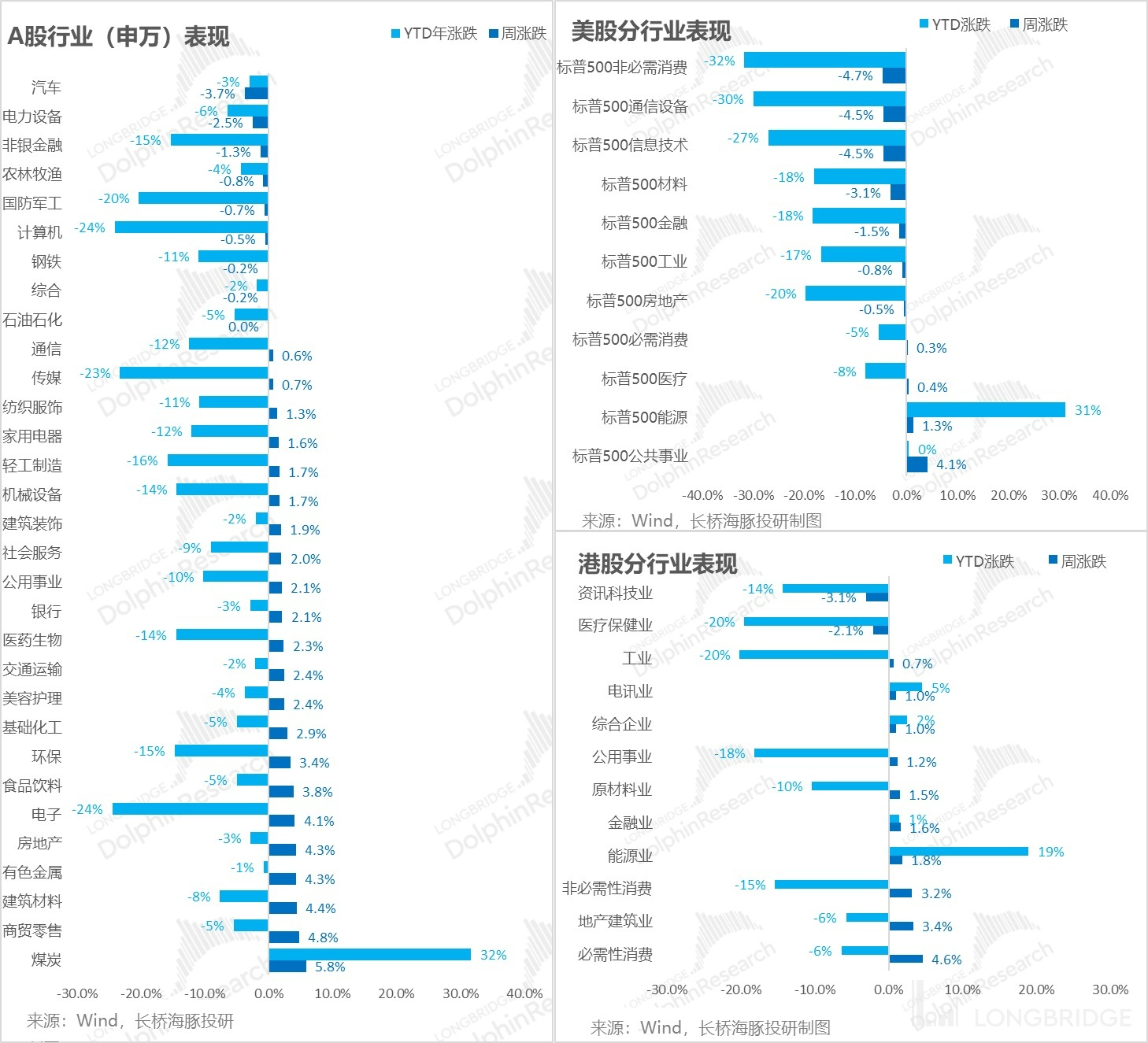

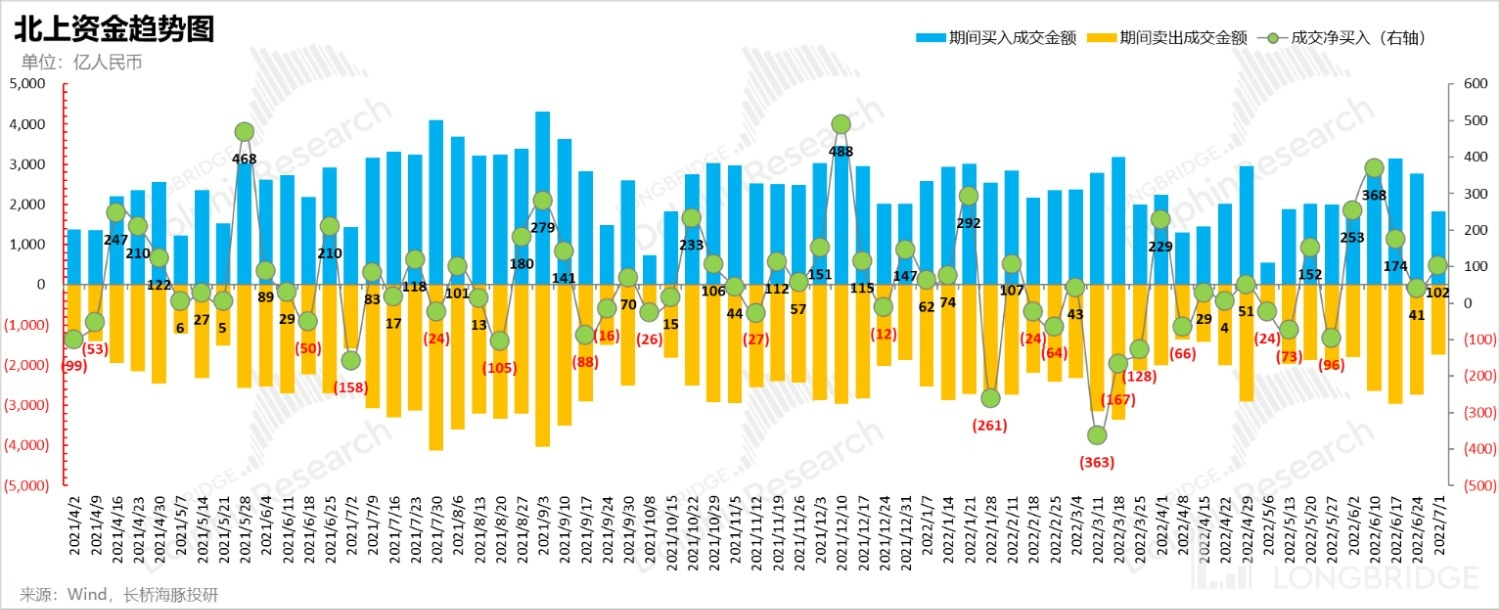

In addition, among the holdings and focus stocks of Dolphin in the two places since last week, Focus Media has continued to buy in large quantities for the past two weeks, while CATL, after a week of marginal increase and northbound selling, has been sold by northbound investors last week, and the stock price is also in a correction.

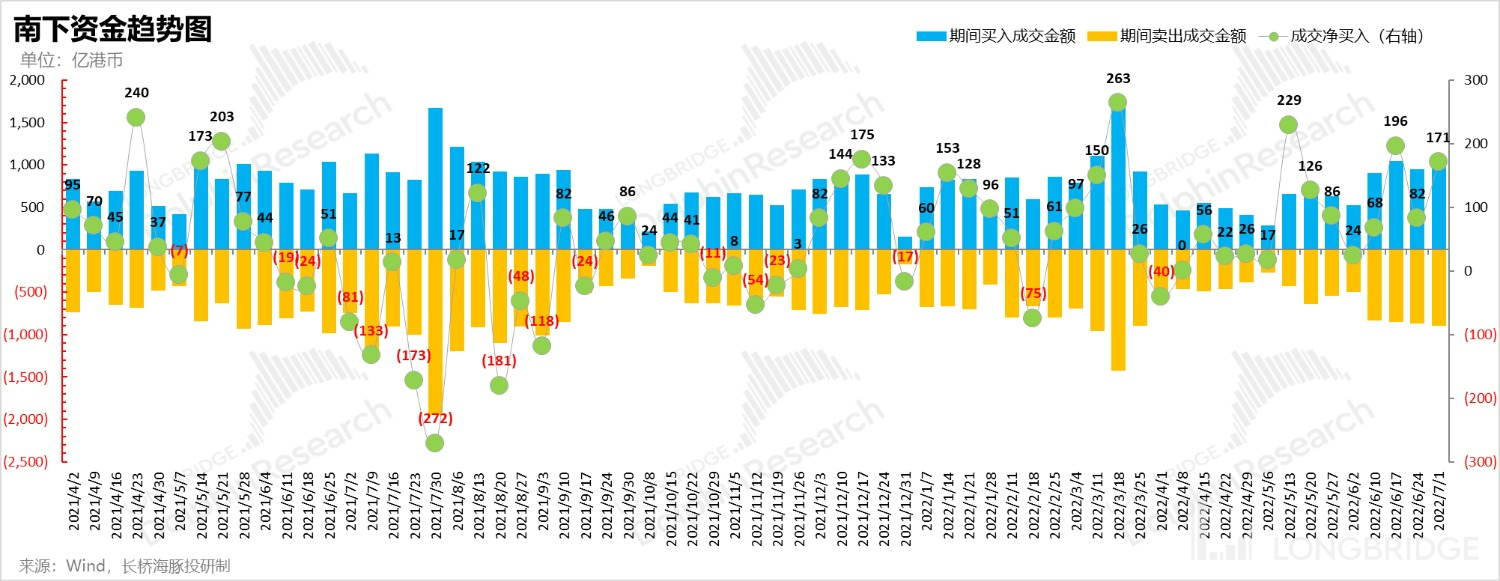

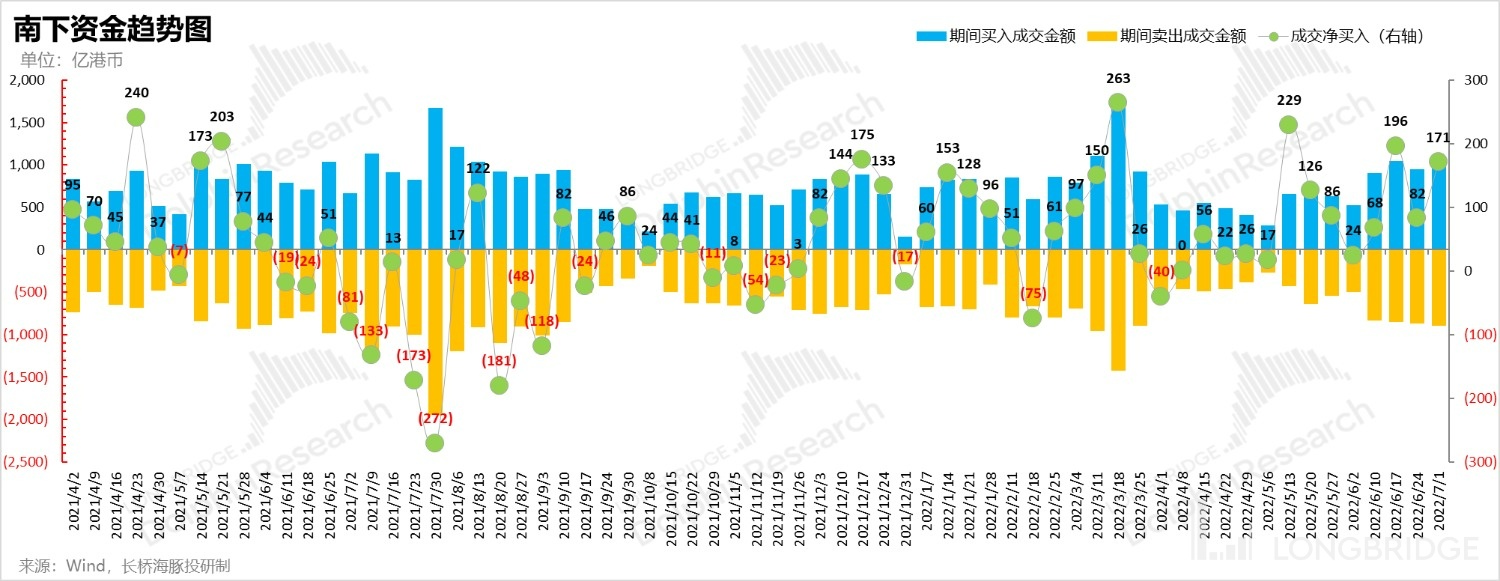

In addition, this week, southbound funds have been buying a lot of Geely, Kuaishou, and SMIC, while selling Semiconductor Manufacturing International Corporation (SMIC) and Mindray.

III. Distribution of Portfolio Assets

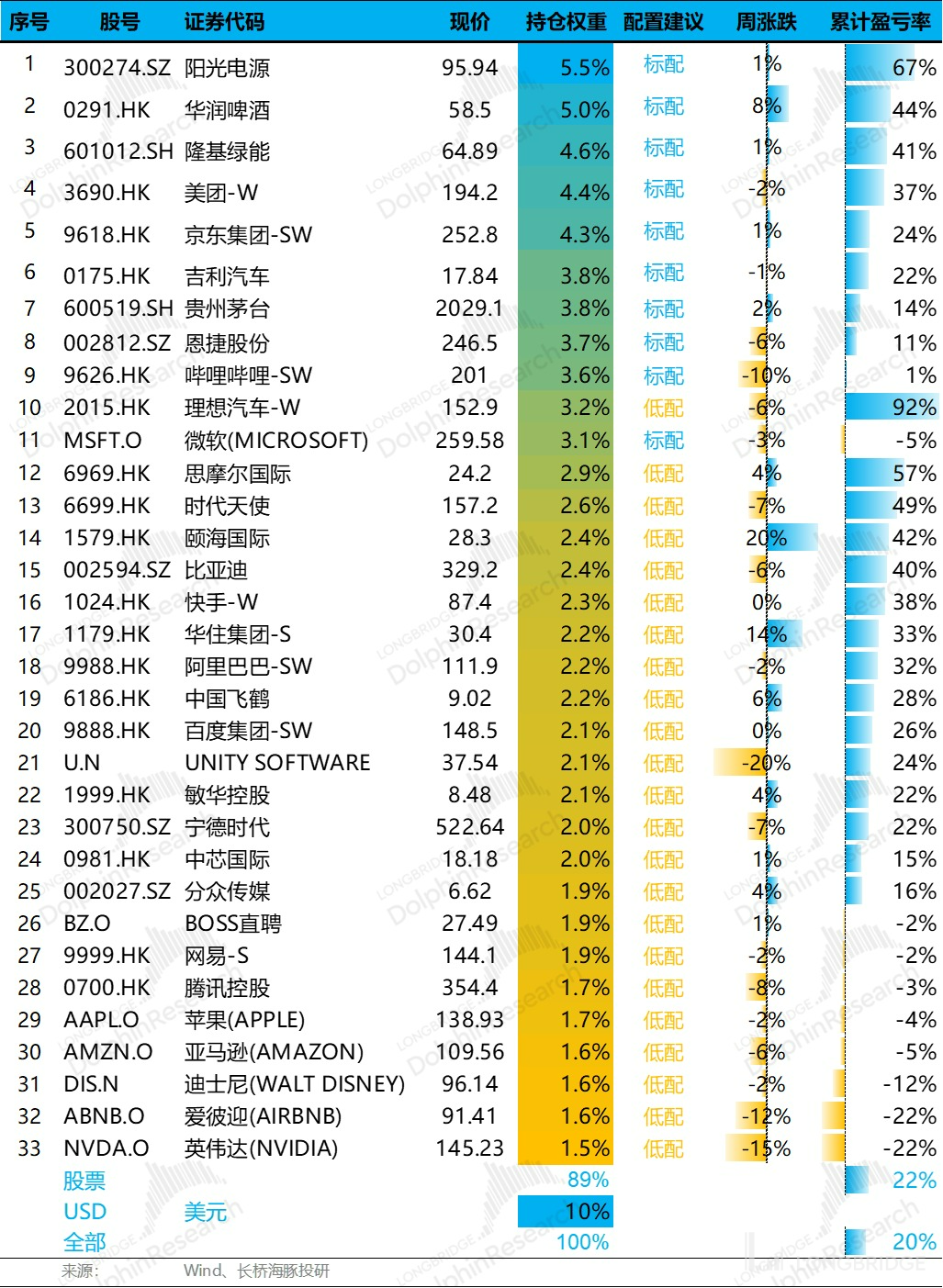

If we look at it from the perspective of the internal testing launch on March 1st, the overall return of Longbridge Alpha Dolphin portfolio as of last Friday was 19%.

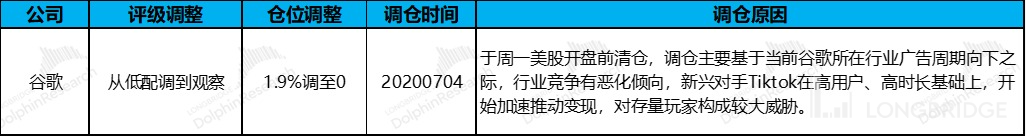

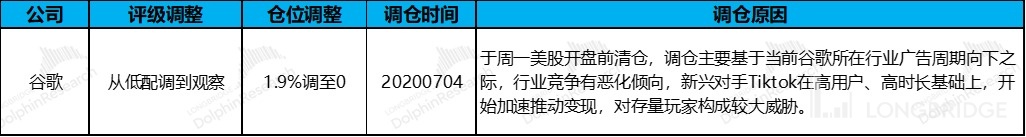

On the fourth week since the official launch of the portfolio, based on Dolphin's judgment on the US internet advertising industry last week, Google has been completely sold out of the Alpha Dolphin portfolio. The specific adjustments are as follows:

For detailed reasons why Google was removed from the portfolio, please log in to the Longbridge APP and refer to Dolphin's in-depth analysis "TikTok Wants to Teach the 'Big Brothers' a Lesson, Google and Meta Are Going to Change".

After selling out Google, the Alpha Dolphin portfolio currently holds a total of 33 stocks, with the standard allocation unchanged at 10 stocks, but after removing Google from the low allocation, there are currently 23 stocks in the low allocation. There is currently no new equity asset allocated after Google was removed.

As of last weekend, the asset allocation and equity asset holding weights of Alpha Dolphin are as follows:

V. No disturbance from external macro news, Hong Kong, A-concept, and sectors are confidently pulling up

V. No disturbance from external macro news, Hong Kong, A-concept, and sectors are confidently pulling up

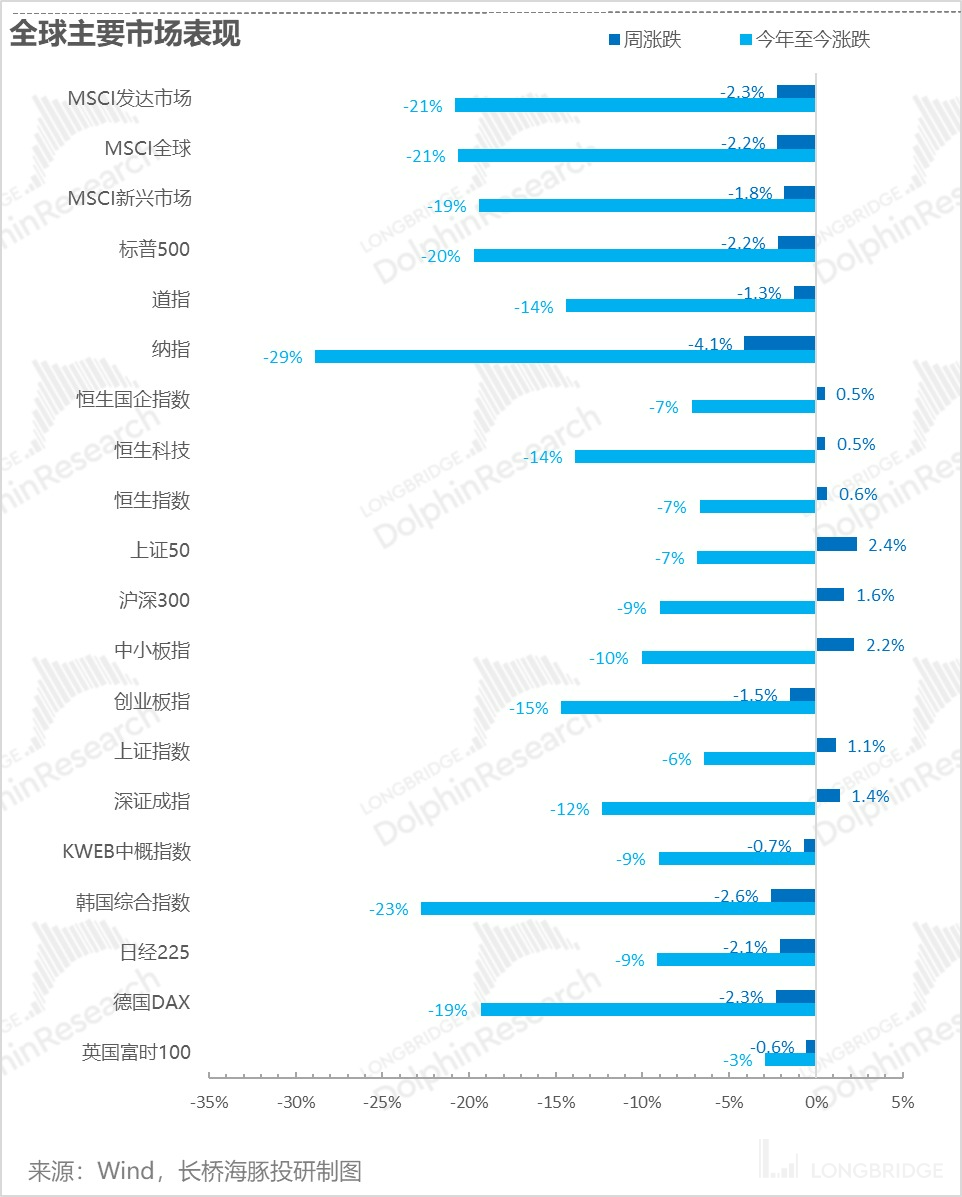

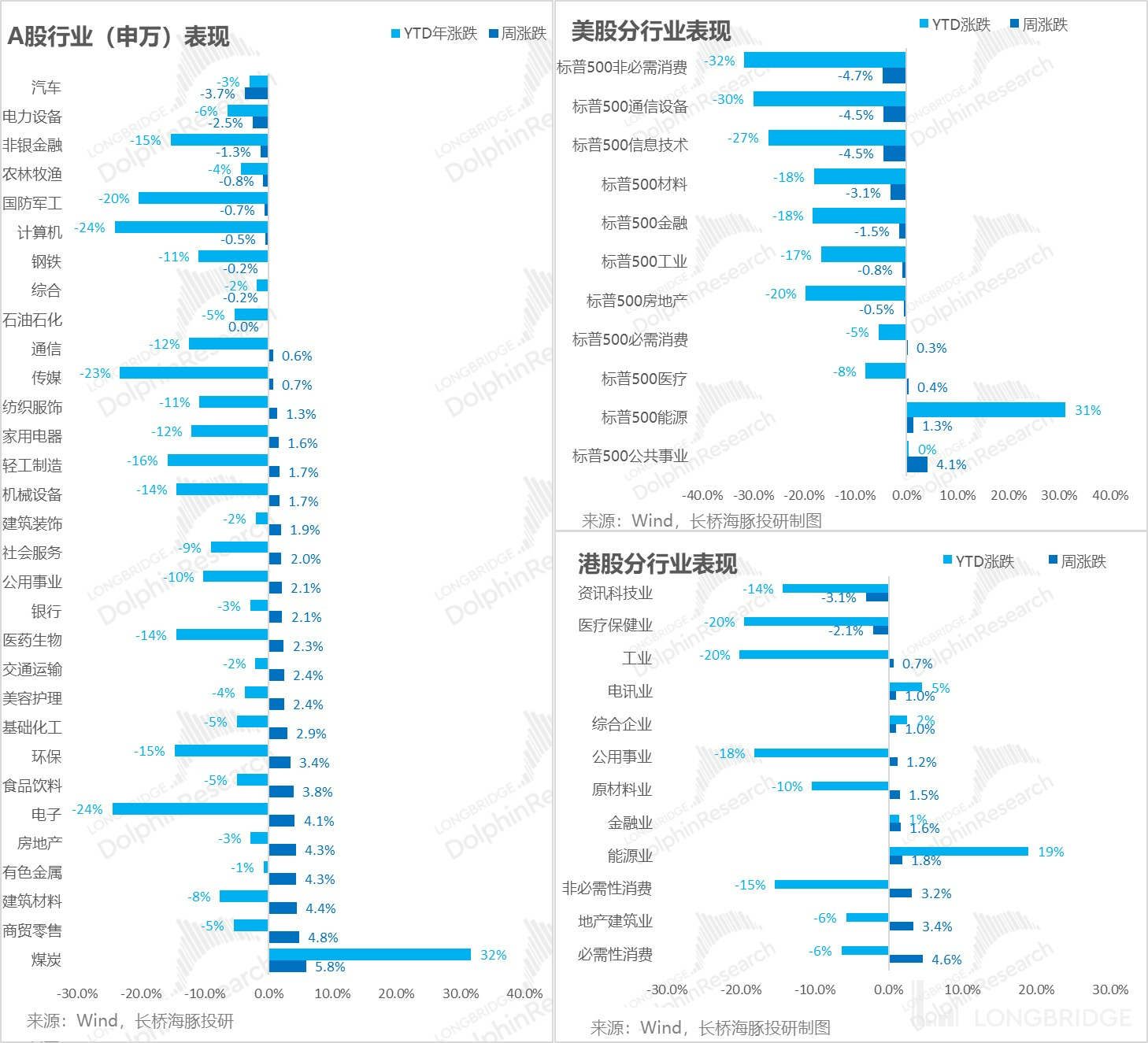

Looking at the global market situation, there were no major macro data releases to disrupt the US stock market last week. The Hong Kong and A markets performed exceptionally well, while other markets experienced a widespread decline, especially the Nasdaq, which saw an adjustment of over 4% due to fears of individual stock performance.

In particular, from a global market perspective, energy stocks have rebounded after the decline, with the energy industries in Hong Kong, the US, and China all showing signs of recovery. If we consider the stock market as a leading indicator, to some extent, the tug-of-war over important energy prices may imply the risk of "stagflation" after the US stock market tightens inflation through interest rate hikes.

Looking at the flow of funds between the two markets, southbound funds accelerated their inflow into Hong Kong stocks last week, particularly in the purchase of consumer concept stocks. Although northbound funds are still in a significant net buying position, overall trading volume has noticeably declined. Perhaps it is necessary to find assets that can truly withstand the end of the pandemic valuation repair logic and have a solid underlying foundation.

For recent articles related to Dolphin's weekly reports, please refer to:

"Growth is Already a Carnival, but Does it Mean the US is Definitely in Recession?"

"Is the US in Recession or Stagflation in 2023?"

"US Oil Inflation, Will China's New Energy Vehicles Grow Stronger?"

"As the Fed Accelerates Interest Rate Hikes, China's Asset Opportunities Arise" 《US Stock Inflation Explodes Again, How Far Can the Rebound Go?》

《This is the Most Down-to-Earth, Dolphin Investment Portfolio is Launched》

Risk Disclosure and Statement of this article: Dolphin Research Disclaimer and General Disclosure