Focus Media: "Desperate Sanlang" that goes against the tide and changes fate.

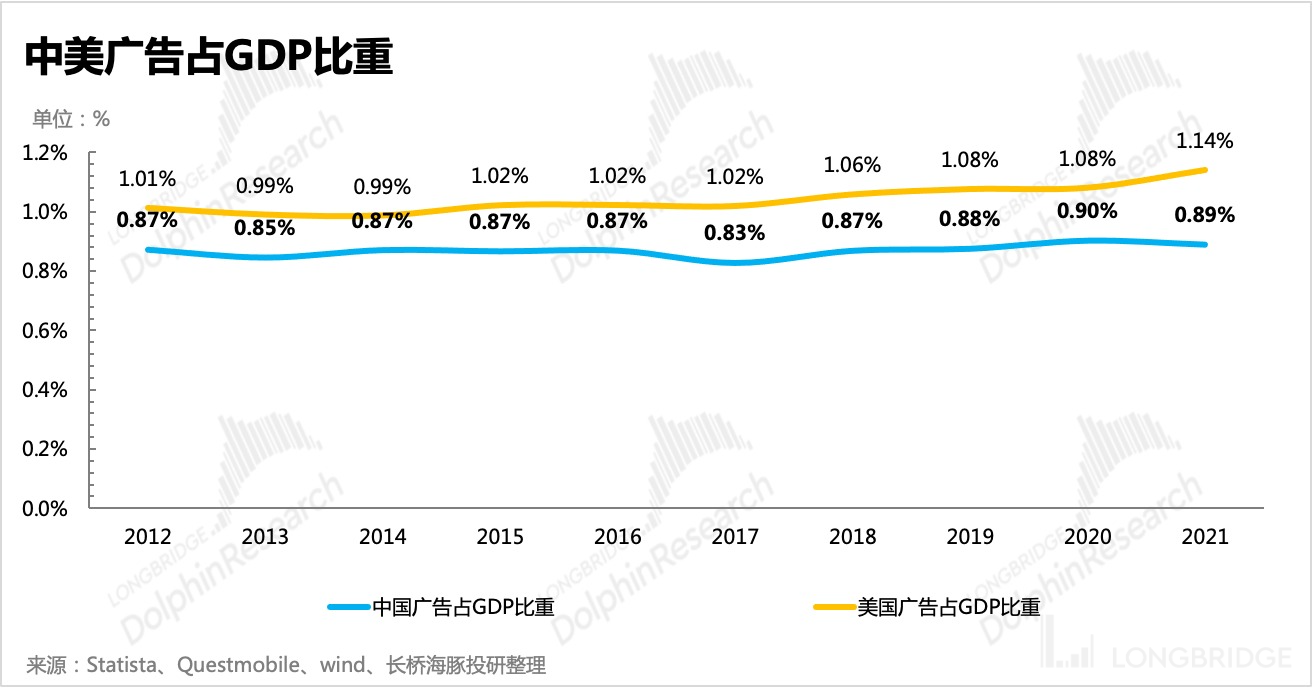

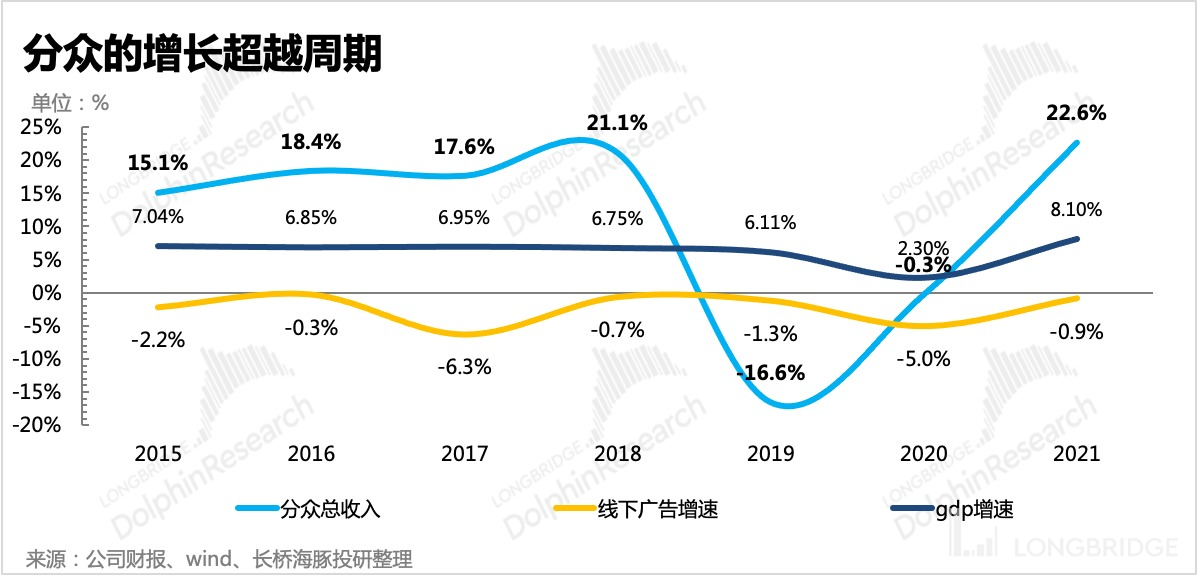

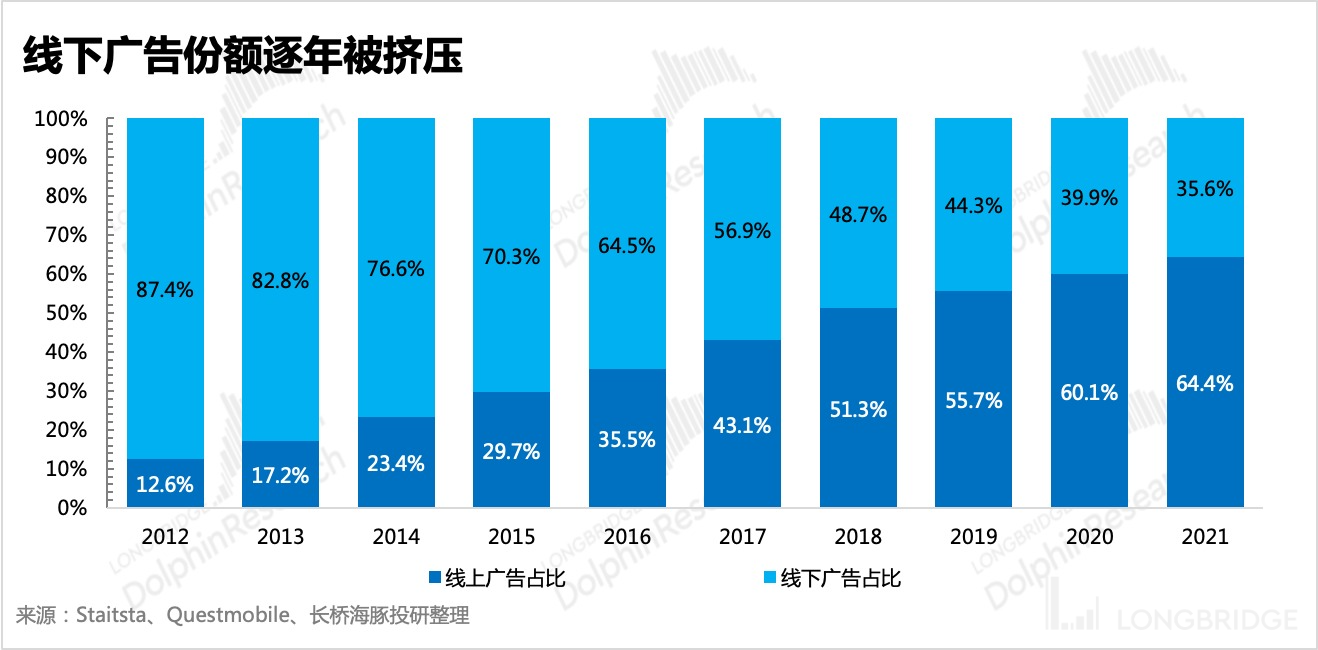

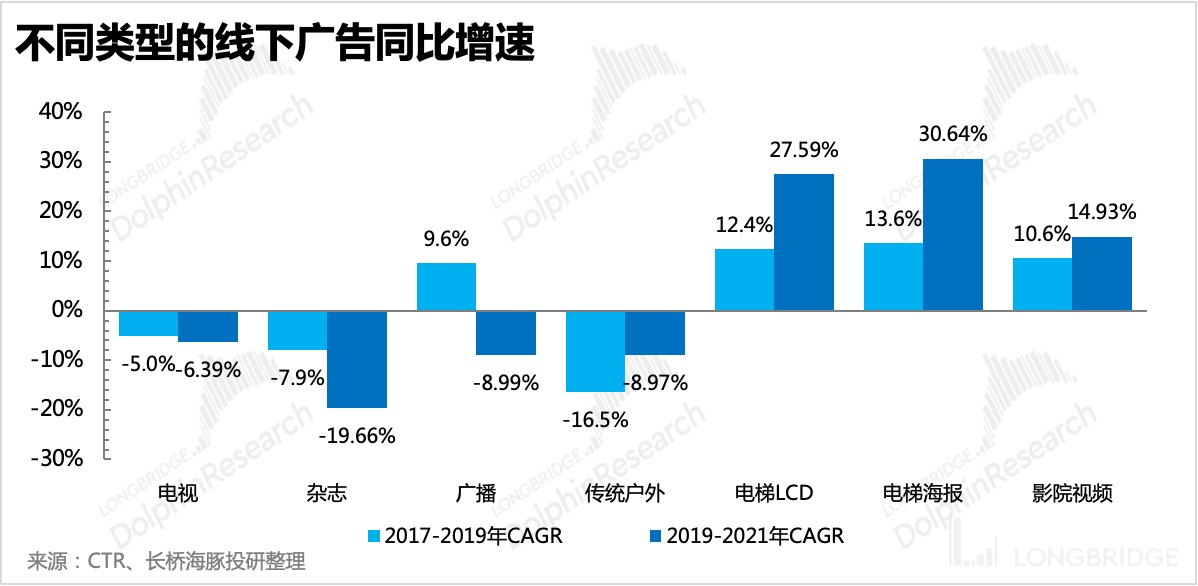

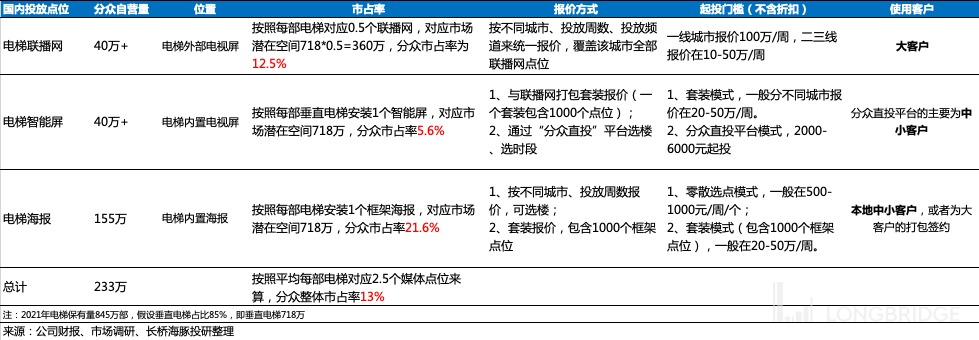

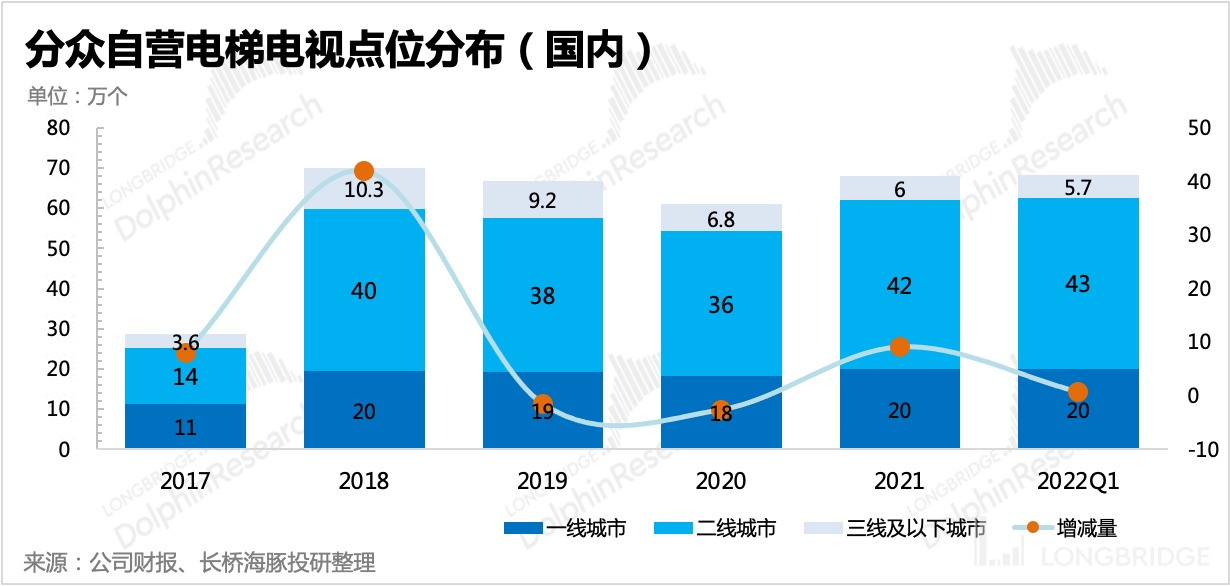

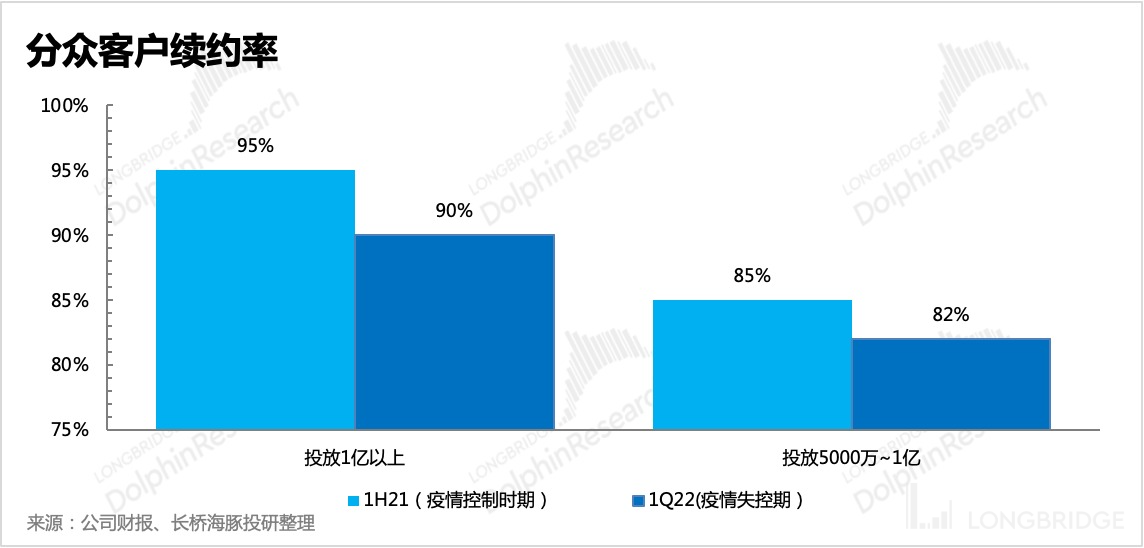

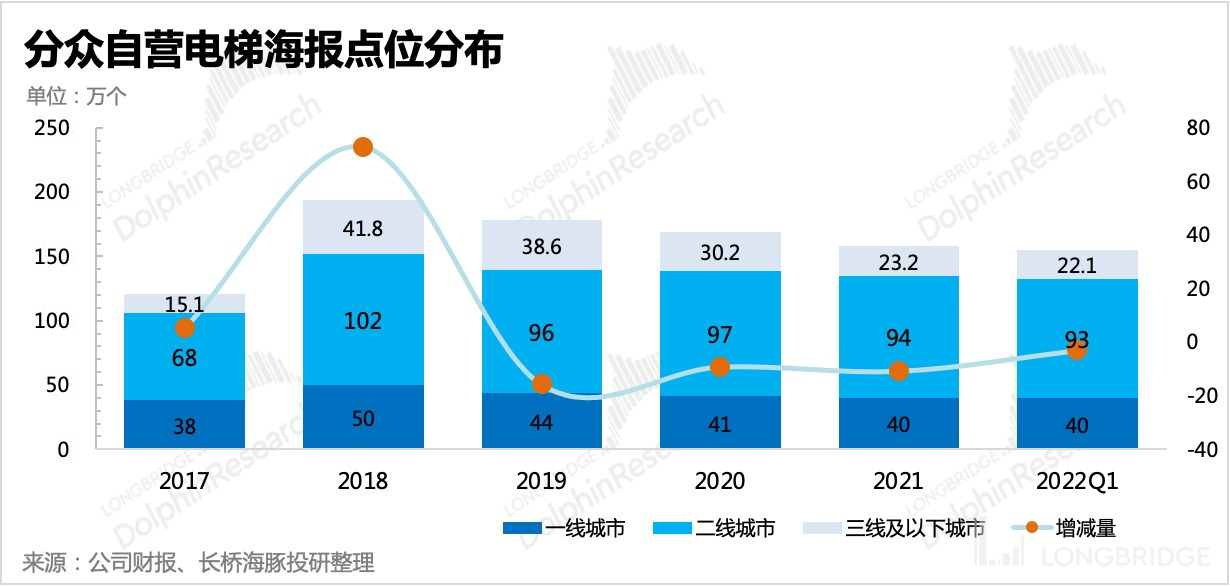

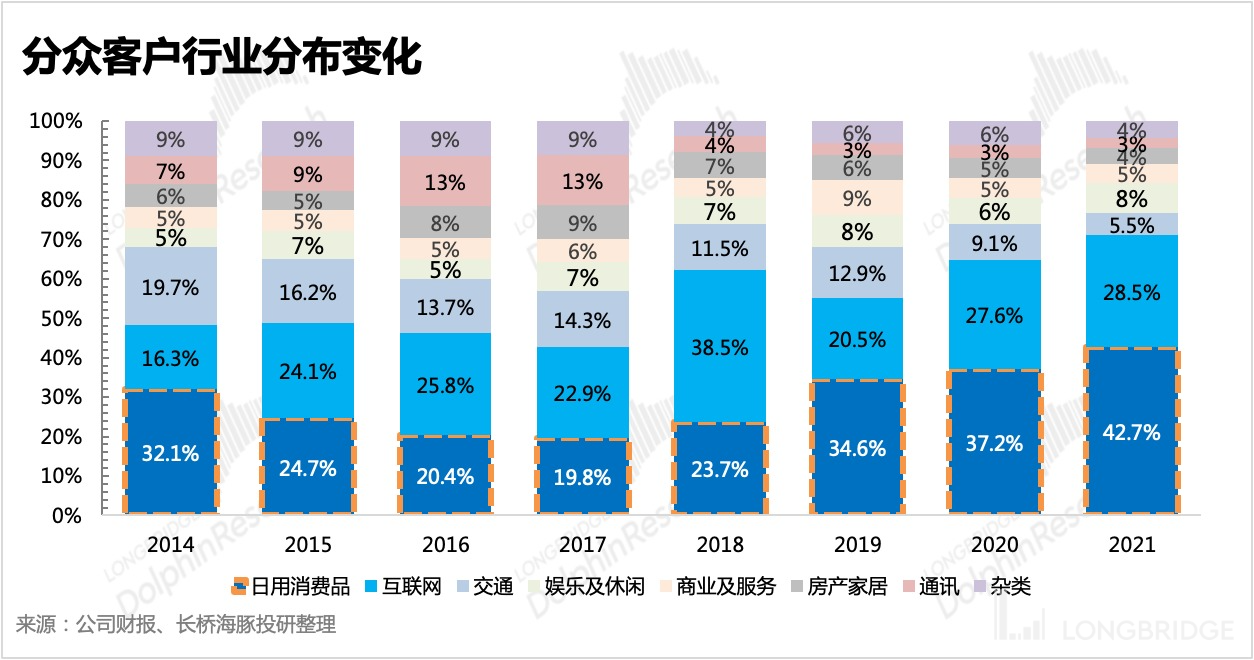

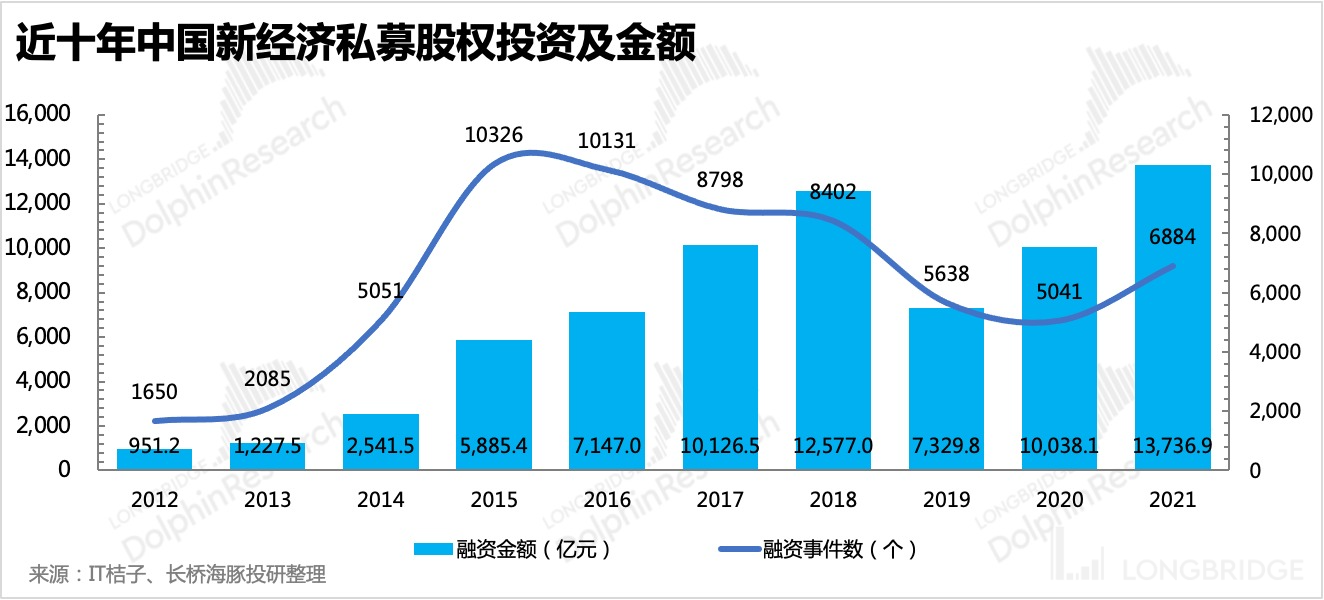

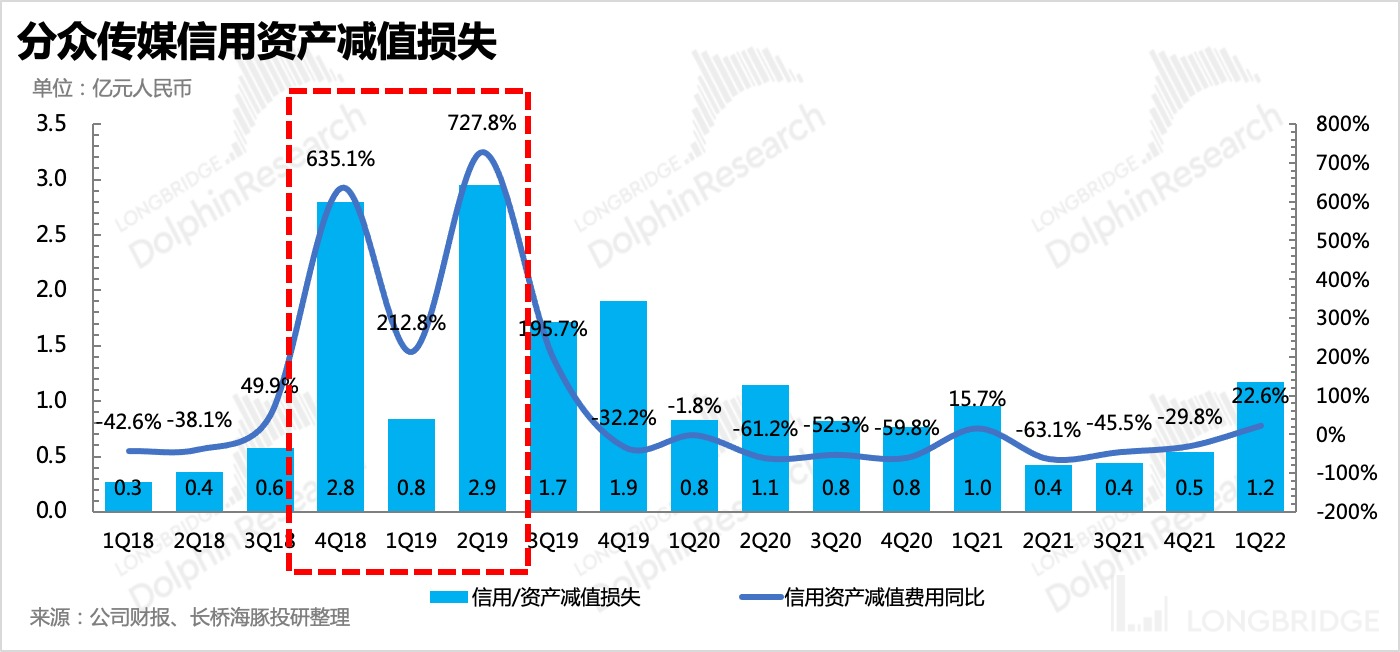

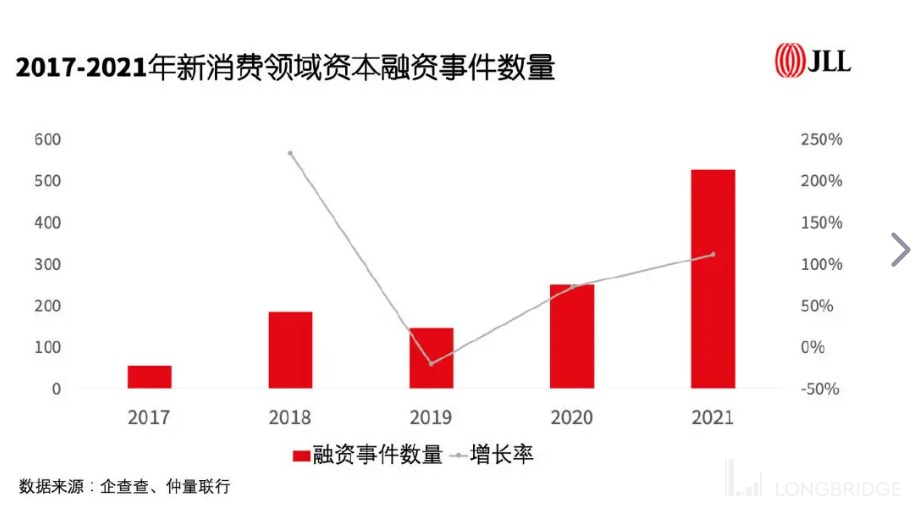

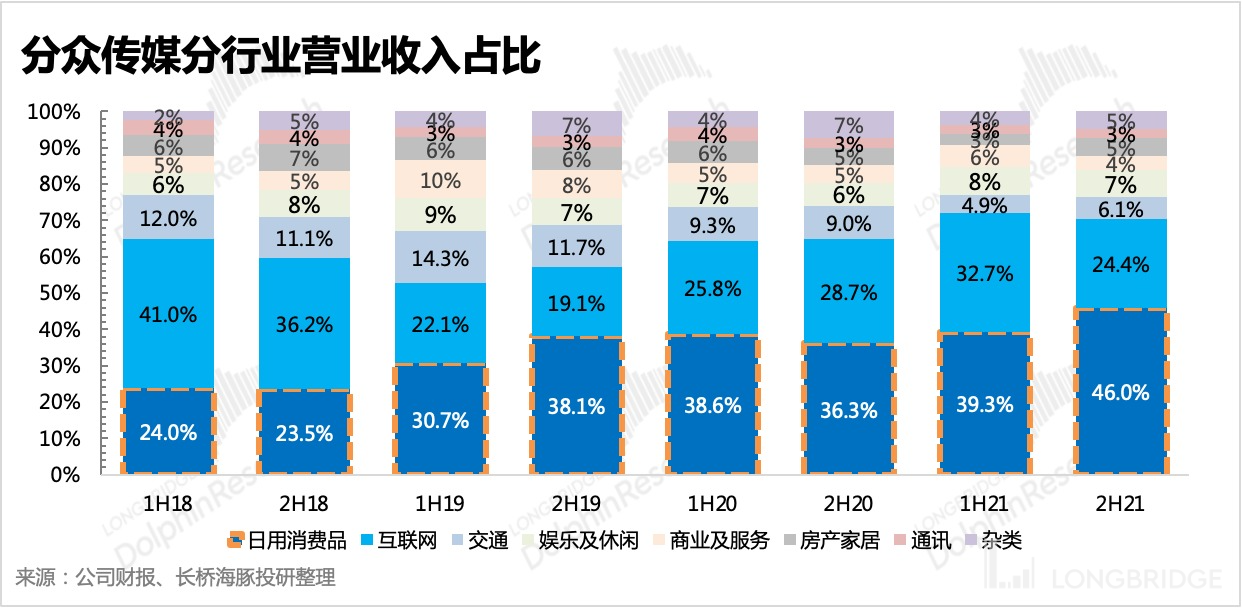

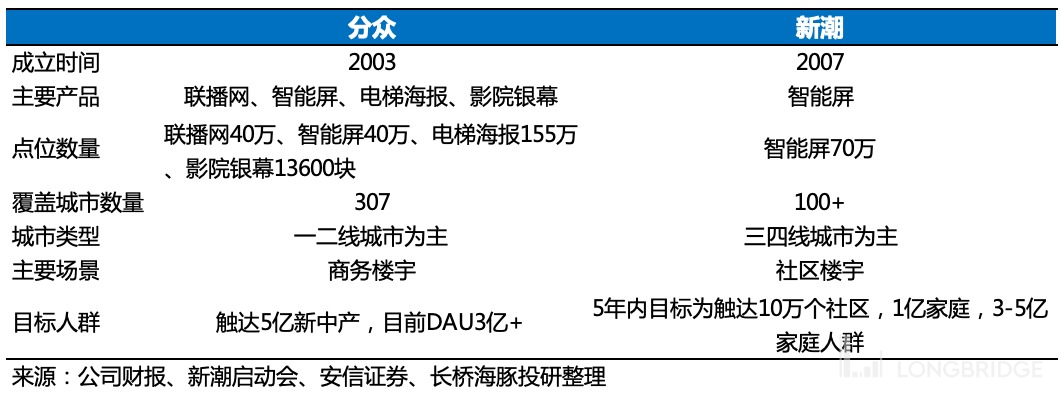

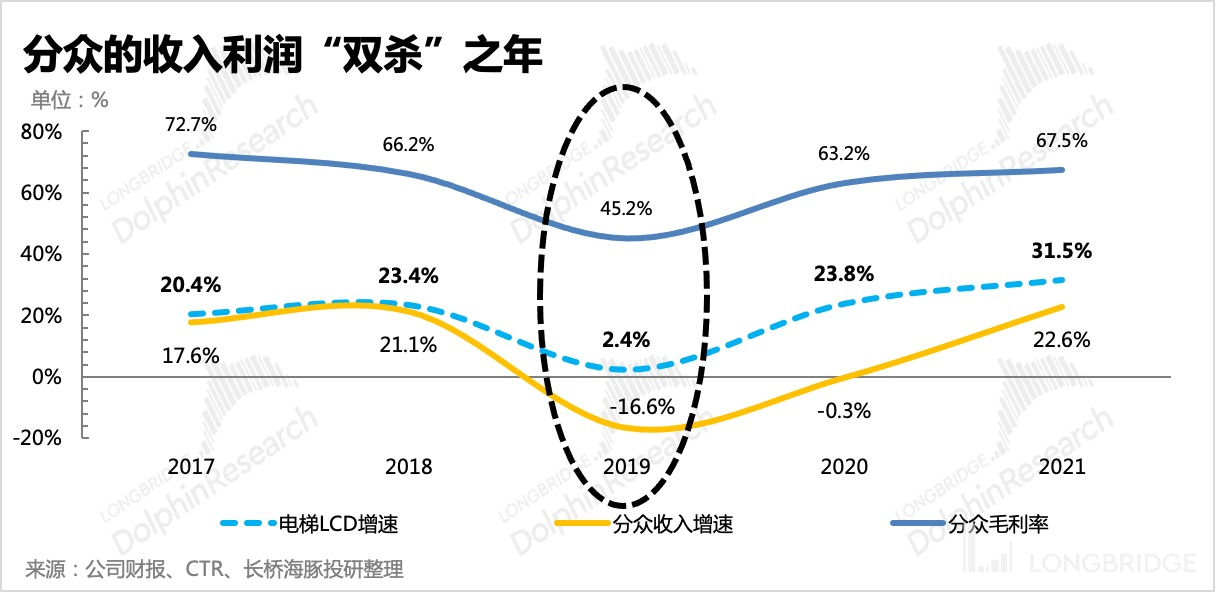

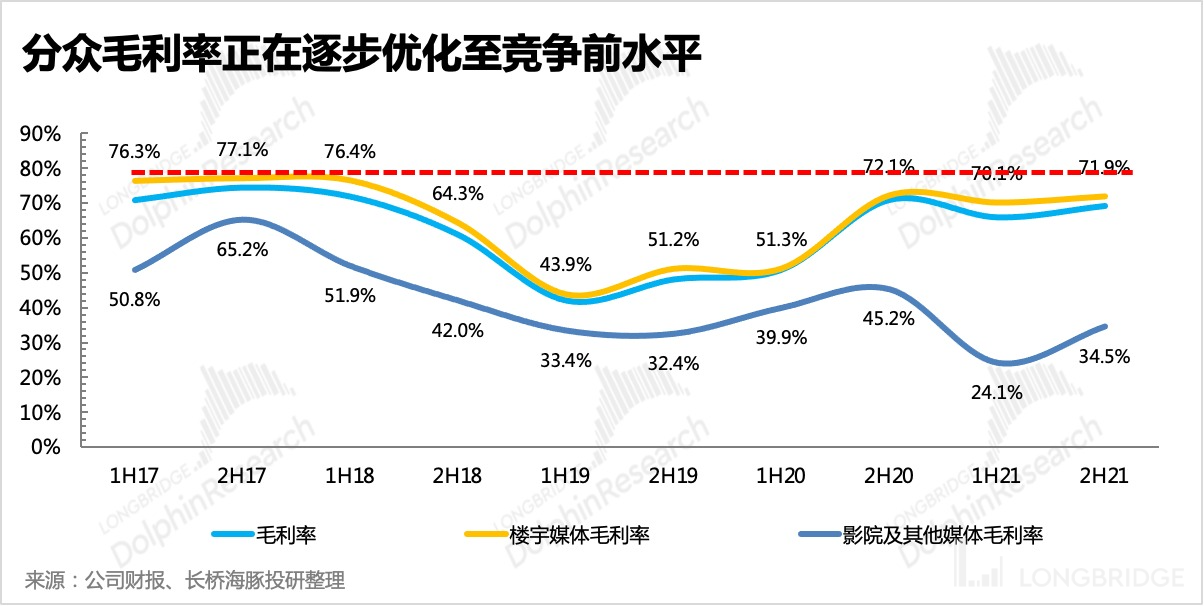

Hello everyone, I am Long Bridge Dolphin King! In the past ten years, the general trend of Internet advertising in China and even the world has been the migration of advertising from online to offline, such as from graphics to short videos, from search to information flow, and the logic behind the migration of advertising is the migration of users' attention (traffic). The whole process is accompanied by the traditional advertising giants TV, paper media, radio is the river, online media one after another, the middle of the creation of large market value companies are well known. And offline media is basically a failure, so most people talk about offline media completely disdain, instinctively think that offline advertising is what else to see? But in fact, in a messy offline advertising market, but there is an advertising platform with accurate traffic card, through online and offline competition, through the peer fight, hard to survive, and even more than the early wave of popularity of the PC media-portal. This company is Focus, but the problem at the moment is that, through the ups and downs of the past decade, through the industry trough and industry competition brought about by the double kill, in this round of epidemic kill, Focus's share price once again knelt in the pit. Then, in the online wolves surrounded, how did the focus live to the present? How to get out of the peer bloodletting attack? Is there a real moat after all. **This article will focus on the business model of Focus, reviewing the reasons why Focus still maintains its competitive advantage under several market ups and downs, and giving Dolphin Jun's logical inflection point and value judgment analysis of Focus in the next article. **_For more research on" Focus Media "and high-quality Hong Kong-US stock companies, you can add a small assistant WeChat" dolphinR123 "to the group for communication. _How does 1. pure advertising stocks cross the cycle? Focus is well known as a leader in the ladder media circuit, and then extends to the cinema advertising market through acquisitions, joint ventures, etc., basically targeting key cities, key regions and key groups. Focus, as a relatively pure advertising stock, is significantly affected by the economic cycle. According to the data of previous years, the scale of China's advertising market basically accounts for about 0.8 of GDP. Although there is still room for improvement in the overall industry compared with 1% in the United States, European and American consumer giants pay more attention to brand marketing than in China. Therefore, to make up for this gap with the United States, we cannot expect to achieve it overnight, but from the other side, this is also one of the long-term drivers that can support growth.! China's economic growth rate has dropped to single-digit growth since 2011, and the pressure is increasing year by year. At the same time, the offline advertising market to which the focus belongs is also gradually being favored by advertisers in the wave of mobile Internet. The overall market is directly on a downward trend. However, the focus of the same period, except for the 19-year vicious competition period, the performance at other times is "thriving".! Chart, Line Chart Description Has Been Automatically Generated Dolphin Jun, through backtracking the development process of focusing on the masses, found that its combustion improver beyond the cycle, in addition to the advantages of the ladder media itself, but also through the high-quality business model to stabilize the basic disk, while capturing several small waves under the big cycle. * * 1, advertising online migration, elevator advertising alone beautiful * * e-commerce will move the transaction link to the online, but also attracted advertisers in the hands of the budget to the online concentration, in recent years, offline advertising market share continued to be squeezed, basically no parry.! But joys and sorrows are not the same, offline advertising market segments, the business climate is very different. And elevator advertising is the representative of the boom, "the light of offline advertising".! Therefore, in the past few years, although the media such as focus will be affected by online advertising, they can maintain a good growth rate by eroding the scale of other traditional offline advertising. The advertiser's budget follows the user's attention (flow). The * * flow in the elevator scene is fixed and high frequency * * (stable weekday flow, at least twice a day by elevator), * * the user's attention is less * * (closed space, time length, weak signal, low probability of using mobile phone), so the impact is obviously less under the trend of online. * * In addition, elevators in commercial buildings cover medium and high-level consumer groups, and this part of users are very suitable for the user label of the new consumer brand under the concept of "consumption upgrade" * *, and ladder media has naturally become a marketing weapon that advertisers refuse to give up. 2, scale advantage to achieve double-headed deep bundling For Focus, the upstream is the property side (including the business committee) and the downstream is the advertiser. If the focus is compared to an Internet platform, then focus is to bind high-quality traffic () by signing a lease agreement with the property owner for 2-3 years of elevator video and elevator frame points, and then realize the value of traffic through advertising. * * There is a controversial issue here * *: the real owner of these traffic is the property. Although the owners' committee will also participate in the external leasing process of the elevator media location, in fact, the decision to which advertising company the elevator location is rented is mostly made by the property. The owners' committee's participation is mainly to share a sum of income from the final payment of the advertising company. Therefore, as the real owner of the traffic, why doesn't the property company end up doing this business by itself? It's not that no property company has ever moved this idea. Among them, the more well-known head property brand-Country Garden Service, the most powerful action. Despite its well-known brand reputation, Country Garden Property is still mainly dependent on the market share of Country Garden Property. If the property management area undertaken as a third party is added, the overall market share is about 6% (52% of the top 100 property enterprises in 2021 and 11% of Country Garden in the TOP100 property enterprises). Such a position is not enough to win more bargaining power for head brand advertisers. What Focus can bring to the property brand is a "drought and flood" rental income, and almost zero cost. This is the most worry-free choice for most property companies when the market is relatively fragmented. * * Bound the property, that is, bound the traffic, but to be able to make money, you have to tap the value of these traffic. **Here we are going to discuss the practice of focusing on deeply tying customers (advertisers): we take the revenue share of about 80% of the ladder media revenue (excluding the impact of the epidemic on cinema advertising) as an example, according to different carrier media, there are three main ways in which focusing provides customers with advertising cooperation. First on the picture summary! **a. TV screen: used to bind big brands * * this kind of launch point is the core product of focus, and it is also the foundation of focus so far. The TV screen includes a network and a smart screen. The smart screen was officially launched on a large scale after Ali became a shareholder in 2018 and was used to open up online and offline data to realize time-by-time precision marketing. As of the first quarter of this year, the total number of TV screens in the country is 780000, and the absolute value does not seem to be high, but in fact it has covered more than 90% of commercial buildings in first-and second-tier cities with high value, and its gross profit margin is relatively high. The revenue contribution is also close to 50%.! * * The quotation method of TV screen is often aimed at brand advertisers with certain financial strength. * * With the city as the location unit and the week as the time unit, set up 4 sets of simulcast schemes to quote. The actual operation is somewhat similar to that of local TV stations. After the customer chooses which set, all the focus screens in the city will play the customer's advertisement, which can achieve full coverage of the target users. Therefore, the corresponding quotations are also relatively high, such as the first and second tier cities such as Beishangguangshen, basically have to be 1 million/week/city. If according to this price, the annual cost will need 50,000,001 cities, only counting the four first-line north, Shanghai, Guangzhou and Shenzhen, so the marketing budget will have to be close to 0.2 billion. Although the focus will give some discounts, the rough calculation of the annual light delivery cost is estimated to be about 0.1 billion. According to the general 20-30% of the consumer company's sales expense rate, if the online and offline scale of each half, then the 0.1 billion ladder media delivery budget corresponding to the annual total revenue is generally 50-10 billion level, which is obviously not the scale that small and medium-sized companies can achieve. For big brands, a complete city plan can save themselves and multiple advertising agencies, property negotiation costs, while a unified delivery plan can also ensure quality control, reduce advertisers one-to-many supervision and accountability costs. Therefore, for big brand advertisers, * * as long as the share of focus media points they like does not decline (traffic does not migrate), then offline brand marketing, focus is a good choice for them. * * According to the data disclosed by the management, the higher the budget, the higher the renewal rate of medium and large brand advertisers in the focus, which can prove the binding effect of focus on large customers.! However * * With the introduction of smart screens, advertisers can select specific smart screens according to the point and time period through the "focus on direct investment" system. At present, the number of smart screens in the country is over 300,000. Through this back-office system, customers can place orders by themselves, and the delivery method is more flexible. The starting threshold is not high (the monthly delivery amount in different cities exceeds 2000/4000/6000 yuan). * * This cooperation mode makes up for the defects of the original package scheme and brings more small and medium-sized merchants into the target market. * *! Source: Focus Direct Investment Platform B. Elevator Poster: Small and Medium Customers Suitable for Local Needs Elevator Poster is also called Frame Media, which is an early business developed by Focus through the acquisition of Frame Media. Compared with the elevator TV screen, the elevator poster quotation is very "friendly", but it is also due to its lack of attention, exposure and conversion rate is low. According to different cities, the general quotation is several hundred to several thousand yuan per week. Therefore, most of them will attract some local service-oriented enterprises, such as beauty salons, restaurants and so on. As of the first quarter of this year, Focus's own framework media has 1.55 million points nationwide, but in recent years the stock has been lower year by year, **including Focus's own 18 years of over-expansion in response to competition, active choice of optimization contraction, but also the impact of the epidemic. In addition, the launch of the smart screen "focus direct investment" system has also diverted the budgets of many small and medium-sized businesses. * * Behind the smart screen is to open up the user portrait collection library of Ali's e-commerce data, which is conducive to the accurate delivery of users, that is, "thousands of floors and thousands of faces" as the focus calls, so as to improve the ROI of advertisement delivery.! In short, judging from the above building ladder media advertisement, focus mainly realizes the deep binding of large customers, but it is also the core gold owner of brand advertisement. 2, seize the big cycle under the wave Although the overall economy is slowing down in the big cycle, but the focus or with its unique traffic card position, catch the mobile Internet, national goods trend, new consumption these three waves of the industry track spring breeze. It can also be seen from the revenue structure of Focus that the early Internet industry accounted for the highest proportion of advertising, while the current fast-food advertising has become the largest.! Focus's main brand marketing is usually needed when enterprises seek to enhance their brand influence to expand their scale. For a new brand, although brand advertising does not seem to be effective, direct advertising is cost-effective, * * but the role of brand advertising lies in a long-term brand effect: * * through repeated brand promotion to occupy the user's mind, triggering the user's brand memory. That is to say, according to the research, in the previous mobile Internet take-off period, we are familiar with some new economy companies, in the primary market financing stage, generally brand advertising and effect advertising on the budget ratio of 3:7, **and this 30% of the brand marketing budget must be spent. Therefore, as with stable high-quality elevator traffic **, it is only right to be able to enjoy the dividends of the track take-off, from another perspective, the growth of the focus is highly related to the business climate of the venture capital market. Comprehensive <1-2>, it is precisely because of a stable basic market (large customers), coupled with the help of several waves of investment high boom period, Focus to achieve growth through the cycle. Although competition in the industry continues due to attractive profit levels, Focus's monopoly has never been subverted. The strategy of "flow card position" + "deep bundling upstream and downstream" makes the competitive cost of new entrants very cruel, such as an input-output account that cannot be calculated behind the invasion of the new wave. And focus is also holding this immediate self-damage eight hundred also want to damage the enemy one thousand momentum, aimed at when the competitor Xiao he just show sharp corners to give a heavy blow, until the other side to die down. * * 2. used to be "pit" and "pit" * * The last time Focus Stock Price hovered at the bottom was 18 or 19 years (excluding the special period of the epidemic in 2020). The market's concerns mainly stem from the worrying operating environment of Focus, not only including the slowdown of macroeconomic growth and the cold winter of capital, but also the visible deterioration of the competition pattern, which is also the key reason for Focus's expectation of "high gross profit being cut, however, it took me less than a year to cure the crowd: 1. During the economic downturn, especially in the cold winter of primary market capital, the story chain of mobile Internet burning money for growth was broken, and more market share was concentrated in the head, while the small and medium-sized platforms withdrew regretfully, leaving a bad debt on the book of the crowd that could not be collected.! ! * * Following the new consumption wave to promote the transformation of customer structure is a powerful medicine for the masses * *, since the consumption of the Internet is temporarily stalled, then change your thigh. Since 2020, the new consumer track investment and financing hot, the overall industry financing project growth outbreak, but also the emergence of a large number of now we are familiar with the brand-the original gas forest, Nai snow tea, perfect diary and so on.! From the feedback of the results (financial results), it can also be clearly seen that the largest customer of the focus group has changed from the "gold swallowing beast" new economy Internet to the "mint machine" fast consumer goods with stable cash flow.! * * 2. The fierce competition, among which the trendy media on Baidu and Jingdong platforms are the most powerful. * * The trendy choice to cut in is due to the high gross profit margin of over 70% on this track. However, due to the strong share of the focus in the first and second tier ladder media, and the contract with the property is signed once every 2-3 years, the cost of directly grabbing the share of the trendy will be relatively high. Therefore, it chose misplaced competition and adopted the offensive line of "encircling the city from the countryside". However, the flow of office buildings on the 3rd and 4th lines is limited, so the trendy focus more on the 3rd and 4th line community ladder media. However, due to the differences in consumption levels in their regions, the attractiveness of community media to advertisers is difficult to reach the level of commercial building media, so the trendy publication rate (20%-30%) and single-screen realization value are not as good as the focus (60%-70%). According to the announcement of the major shareholder Gu Jia Home, the profit level of trendy 2017-2018 * , * is too far from CEO Zhang Jidong's ideal requirement.! Review the fierce attack of the new trend on the focus during the 18-19 years, especially focusing on the competition for advertisers with more than 0.1 billion investment. a. On the one hand, foreign (advertisers) to give "the same effect, half the price" preferential policies, as well as the value of tens of millions of trendy advertising resources. B. on the other hand, the internal (employees) will be given a radical commission reward, "where the business commission is issued at 200 of the original standard for customers with a total of 100 million yuan". * * The two-pronged approach did work * *, with Focus's 2019 revenue down 17 percent, while overall offline advertising revenue fell only 1.3 percent in the same year, while elevator advertising (including elevator LCD and elevator posters) still had positive growth of about 2-3% year-on-year. At the same time, Focus's gross margin slipped to half of its previous steady state in 2019 due to Focus's challenge. It can be said that this year's trendy "double kill" effect on the focus of the most significant.! The community ladder media was not the main position for the focus at that time, especially in the third and fourth tier cities. In order to prevent the other side from taking away the points, the focus will sign the points in advance at a relatively low price that the other side cannot afford, and use abundant surplus food to kill a competitor whose cash flow is still unstable. But there is no denying that this counter-cyclical expansion approach, in the short term will also be self-damaging eight hundred (rapid occupation of points, the publication rate can not keep up with the resulting weakening of profit margins), **so the market is worried that Focus's future gross margin will be discounted, and long-term return to the original level, so Focus's share price has been under pressure during that time. **But the follow-up situation we have also seen, under the catalysis of the epidemic, the opponent first can not carry the" active truce ". Since then, Focus turned around and began to optimize the media points that were hastily occupied (increasing the publication rate, stopping the low-efficiency points, etc.), at the same time, with the rise of new consumption, the rise of the national trend, as well as the easing of the epidemic unsealing, Focus's ladder media gross margin is gradually approaching the level before the vicious competition.! Chart, line chart description has been automatically generated From this, it can be seen that the whole track of the ladder media itself has a relatively rigid demand for delivery, that is, the competition for the focus comes more from within the industry. The advantage of economies of scale is a powerful tool that can help focus on binding upstream and downstream, but the advantage of scale can only be effectively played if it first occupies high-quality points (binding high-quality traffic). Back to the moment, the impact of the first half of the epidemic, directly reflected in the focus of the first quarter of the tragic results, but the stock price also in the financial report disclosure first see "pit". But from the perspective of value regression, is Focus now finished? The next article will focus on the analysis of the current stock price "out of the pit" drivers, especially the current important marginal changes, while giving different expectations of our value judgment of Focus. * * long bridge dolphin investment research "focus media" historical article: * * earnings season April 29, 2022 telephone conference "March revenue fell 45%, focus too difficult (minutes of telephone conference)" April 29, 2022 earnings review "focus" blood into a river "? After a desperate situation, there is an opportunity" on November 4, 2021, the financial report review "from the focus: the expectation of internet advertising is worth" lowering and then lowering "" on August 26, 2021, the telephone conference "shrunk, gone, standardized, business is not easy in the second half of the year (focus summary)" on August 25, 2021, the financial report review "focus: looks good? In fact," thunder "" April 23, 2021 telephone conference "send a incomplete minutes of the focus telephone conference" Risk Disclosure and Statement for this article: Dolphin Investment Research Disclaimer and General Disclosures