Rate Hike Enters Second Half, "Performance Thunderstorm" Season Opens

Hello everyone, I'm the Dolphin Analyst!

This is the fifth weekly update of the Alpha Dolphin simulated portfolio officially launched by Dolphin Analyst. Before updating the progress of the virtual dolphin portfolio, let's review the market and macro situation of last week:

I. Overseas: When Interest Rates Enter the Second Half, Is the Recession Far Behind?

The biggest event that dominated the rise and fall of global markets last week was the soaring inflation level in the United States in June. You can click here for Dolphin Analyst's comments on this. Of course, with the White House spokesperson issuing a preemptive statement, the public was psychologically prepared.

However, as we have crossed the halfway point of 2022, it is more important to look ahead. The question is when will the United States enter a recession, especially for industrial resources such as copper, which have already experienced a sharp decline. It is more important to predict the recession than to focus on the current recession.

Below is a chart showing the market's expectations for rate hikes at each Federal Reserve meeting in the current year and next year (the different colored lines represent each month).

When these expectations are put together, some interesting changes can be seen: Since March, the market has been unilaterally raising its expectations for the Fed's rate hike every month. When you think that the future rate hike has been fully priced in, new price data always squeezes the market upwards towards higher inflation expectations.

After the latest CPI data came out, the latest expectations are as follows:

-

Most of the market had expected a 75 basis point rate hike, but the latest average expectation is for an 80 basis point rate hike, higher than the previous 75 basis points, indicating that a few institutions have begun to estimate a 100 basis point rate hike at the end of July.

-

After raising rates to 2.25%-2.5% at the end of July, the policy rate will enter the region of long-term neutral rates, and the rate hike will gradually slow down.

-

By the end of 2022, the policy rate is expected to be raised to around 3.5%. The rate hike cycle will end.

-

In 2023, the policy rate may take a slight break and enter a rate cut cycle.

In other words, many institutions in the market now believe that the U.S. economy will enter a definite recession at the end of this year or early next year, causing the Federal Reserve to enter another rate cut cycle.

Although the interest rate hike cycle has entered the second half and the CPI has reached new heights, when the market begins to anticipate when it will enter a rate cut cycle, the market game becomes more apparent. The sector begins to differentiate based on expected performance, rather than simply being dominated by the mindless valuation of "falling over at the first sight of inflation."

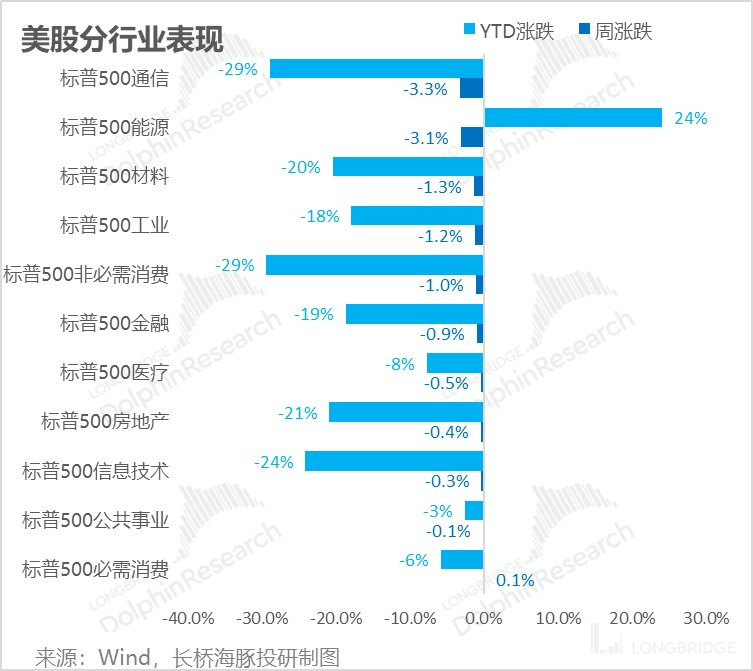

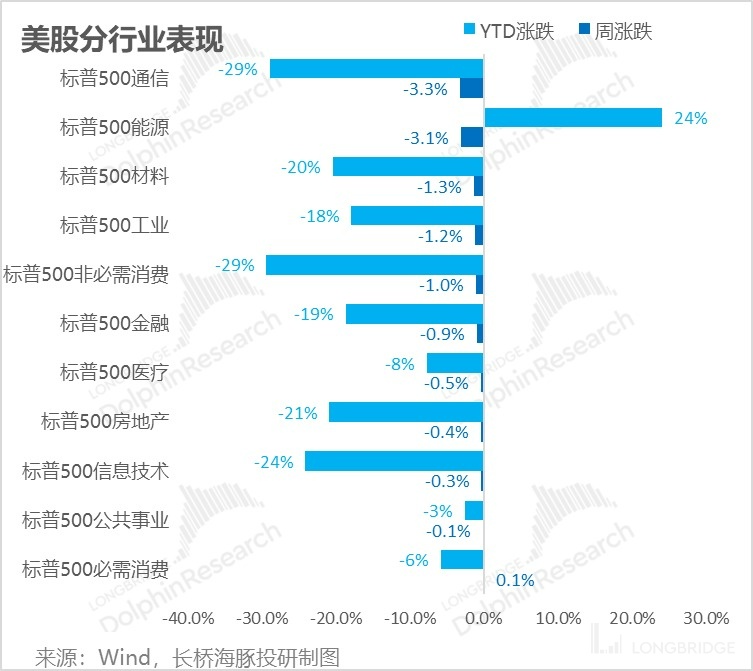

For example, taking the communications sector in the S&P 500 (with components such as Google, META, Disney, and AT&T, mainly on the C-end of the media and entertainment), and the IT sector (such as Apple, Microsoft, and NVIDIA, mainly on hardware and industrial internet), although both are in the category of big technology, the C-end soft internet and entertainment, The performance of the software sector, especially semiconductor, was clearly inferior to that of the hardware sector last week due to TSMC's performance dragging down the semiconductor industry.

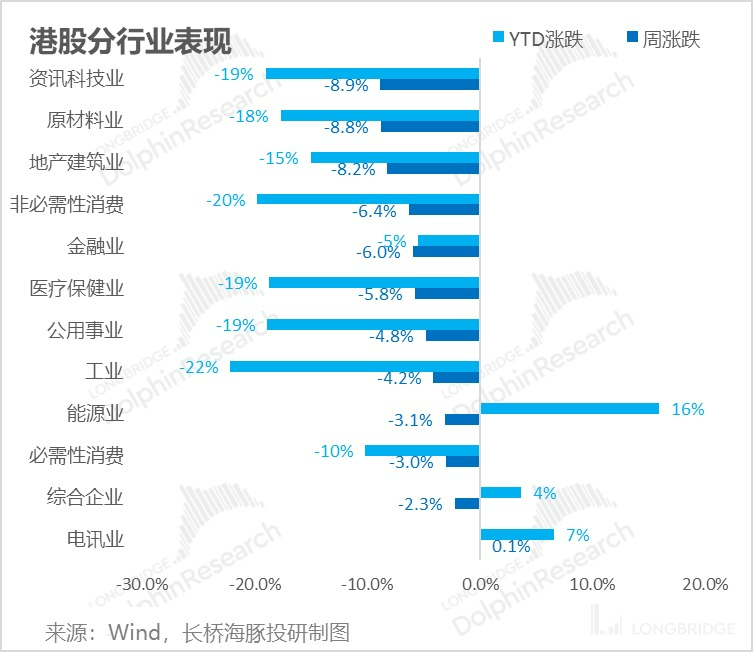

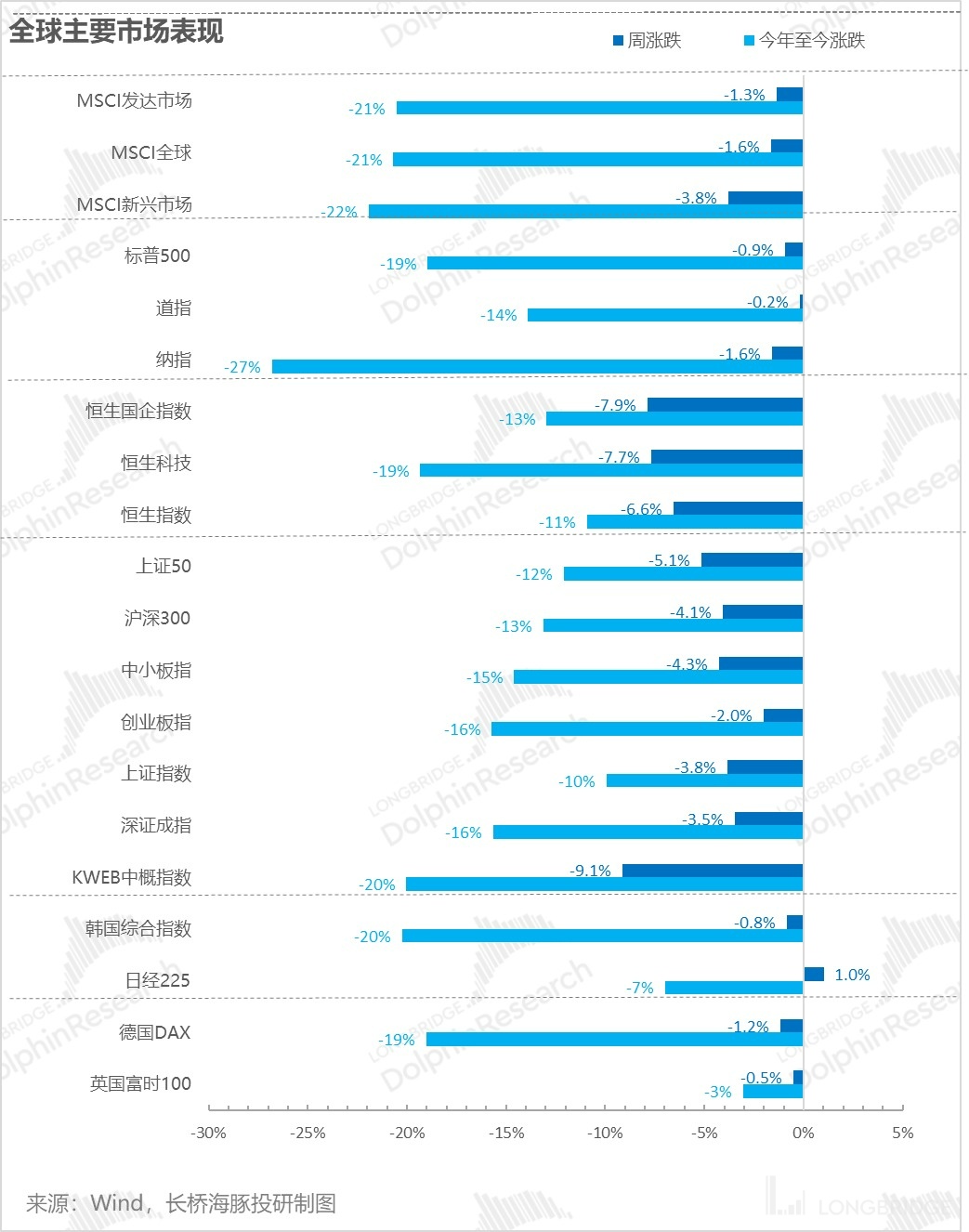

Looking at the global market last week, it fully reflected the strengthening of expectations for US interest rate hikes and the stronger impact of the return of the US dollar on emerging markets than on developed markets. As can be seen, the decline of global emerging markets, including Hong Kong, was significantly higher than that of developed markets.

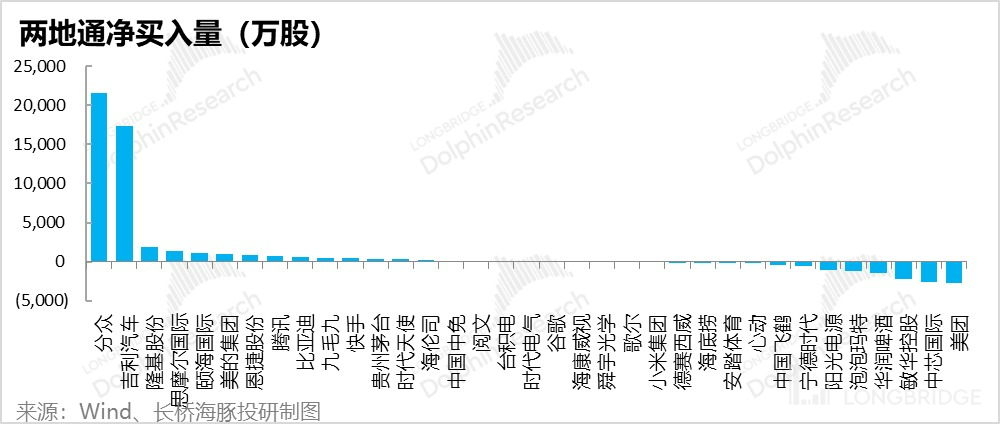

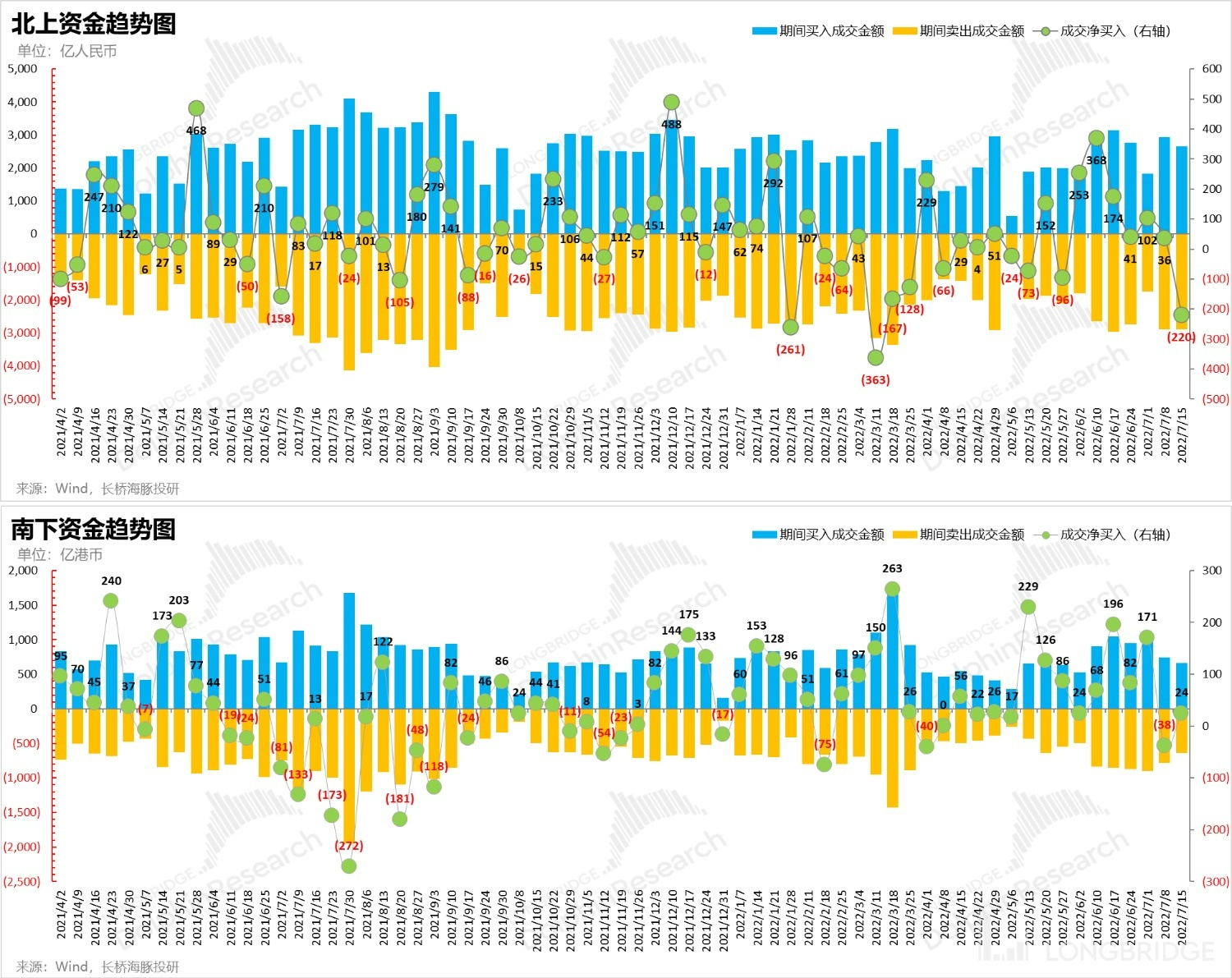

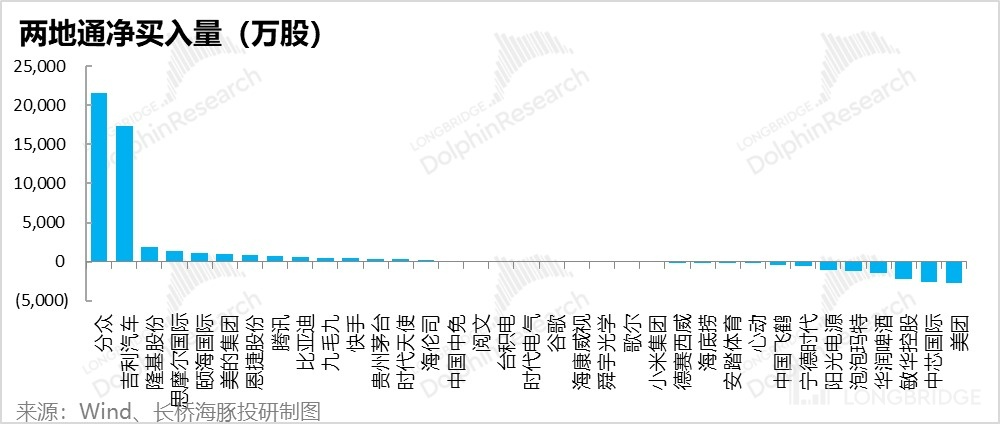

The domestic market was no exception. The recovery of the domestic market requires stability in the peripheral market's expectations of interest rate hikes to avoid the return of the US dollar and marginal reduction of funds. This corresponds to the significant withdrawal of Northbound capital last week, with the weekly net selling rate second only to that of the unstable international situation and the period of China concept panic at the beginning of the year.

II. Domestic market: Stalled loans spreading, retail showing decent numbers

Last week, in addition to the further expectations of interest rate hikes in the peripheral market, the domestic real estate, which has always been a big problem, encountered trouble once again. Coupled with the downward adjustment of real estate sales in the first week of July, which fell by more than 40% YoY, real estate stocks and bank stocks were dragged down. Related comments can be found by clicking here.

In addition, a series of macro data last week, such as Dolphin Analyst's focus on June's social retail data, looked good at first glance. After the unsealing of Shanghai, consumption saw some recovery. For details, please click here.

However, at this point, the market is more concerned about the micro-level, with individual companies sharing their Q2 operating data. This year's Q2 is basically a season of "putting out mines" for performance that is evident. After a period of market recovery, funds have the consideration of temporarily avoiding risks during the financial report season, especially for industries and companies with weaker fundamentals.

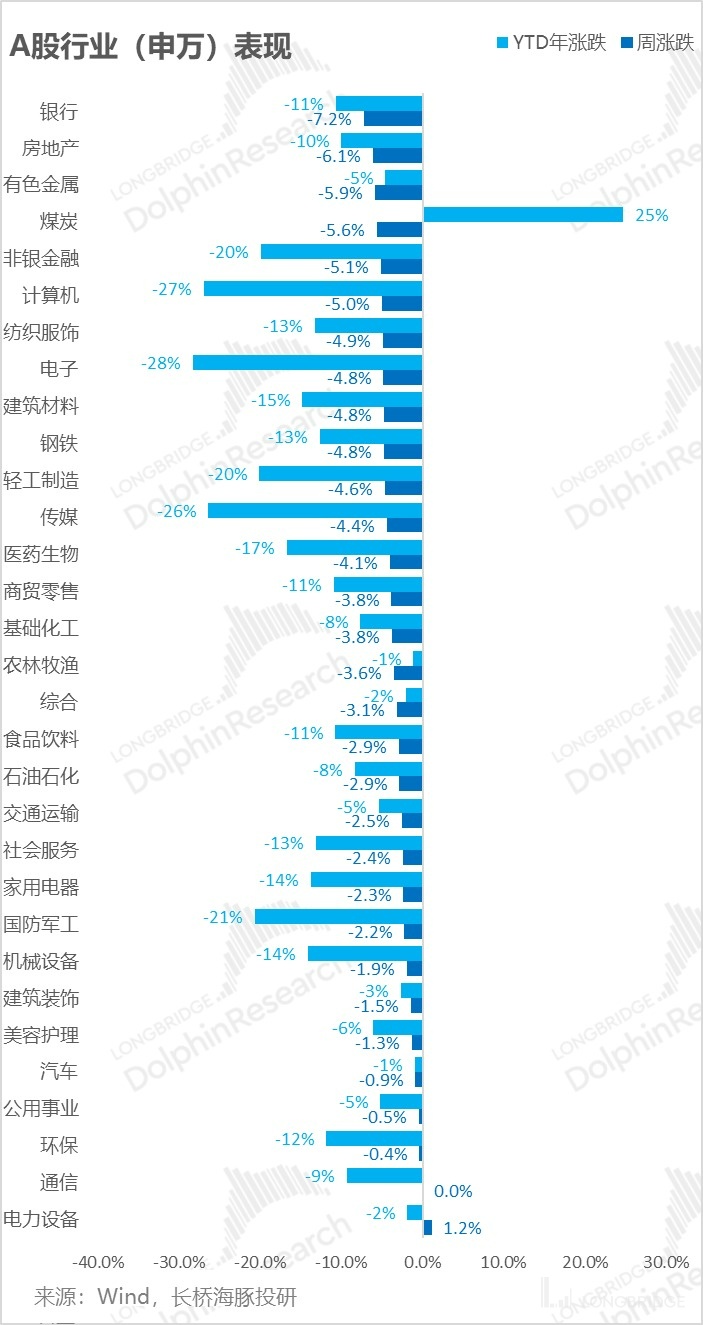

Therefore, in last week's trading, new energy (electric power equipment), as the only performance-determined track, once again became the direction for funds to huddle and keep warm, and the only sector that rose last week.

As the domestic version of NASDAQ, Hong Kong stocks suffered heavy losses last week as earnings season approaches and Alibaba faces regulatory questioning again, causing a drop in tech stocks. Looking ahead, with US CPI hitting record highs and the second half of US rate hikes underway, the chances of a larger-than-expected rate hike are reduced. Stable external market expectations mean lower external risks, and after avoiding second quarter earnings risks, the focus will shift to the repair of Chinese assets, including Chinese concept stocks, assuming no major outbreaks of the pandemic. Selecting companies with alpha capabilities becomes even more important.

As the domestic version of NASDAQ, Hong Kong stocks suffered heavy losses last week as earnings season approaches and Alibaba faces regulatory questioning again, causing a drop in tech stocks. Looking ahead, with US CPI hitting record highs and the second half of US rate hikes underway, the chances of a larger-than-expected rate hike are reduced. Stable external market expectations mean lower external risks, and after avoiding second quarter earnings risks, the focus will shift to the repair of Chinese assets, including Chinese concept stocks, assuming no major outbreaks of the pandemic. Selecting companies with alpha capabilities becomes even more important.

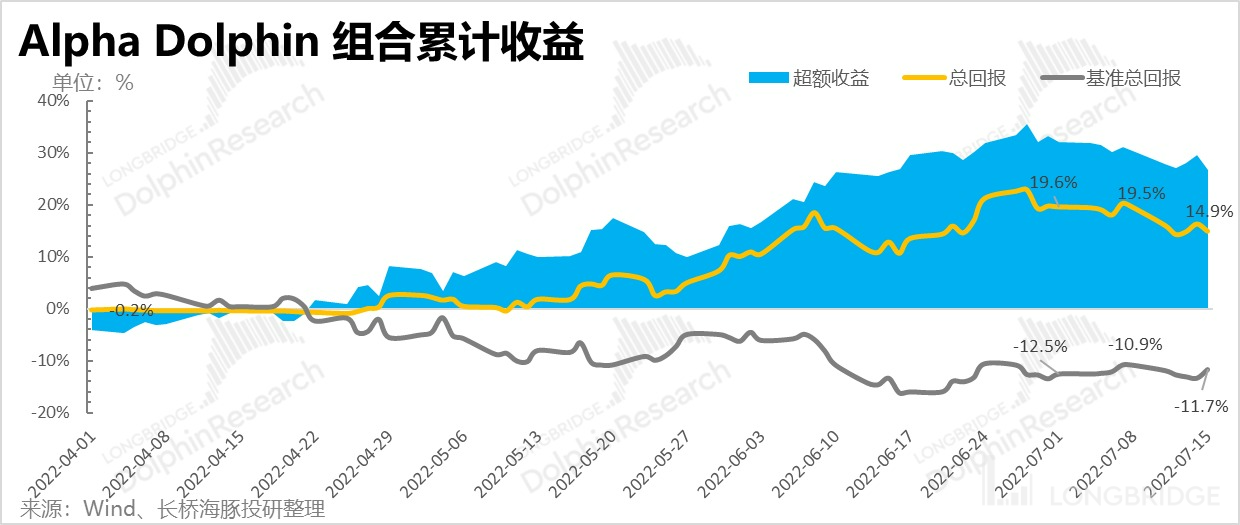

Alpha Dolphin Portfolio Returns: Overall, the decline in Chinese assets was significant, with the Dolphin Analyst Alpha Dolphin portfolio falling by more than 4% last week (Jul 11-15), significantly underperforming last week's S&P 500 index (down 0.9%), but on par with the SSE 300 (-4.1%), and stronger than HSI Tech's performance of -7.7%.

Since the portfolio began testing until last weekend, the total return of the portfolio was 15%, with a relative return of 27% compared to the S&P 500.

Small market capitalization means weaker logic and greater losses, with Alibaba leading the way: in shadow of earnings reports last week and with delisting rumors resurfacing, Chinese concept stocks fell sharply once again, with consumption no exception, as photovoltaics-related Sunvim and Longji once again became the only stocks to hold.

To summarize the reasons for the sharp rise and fall of key stocks:

In terms of capital flow last week, Longji, which has continued to see northbound capital inflows, saw a good rise in the past week. In addition, northbound capital is still buying into Focus Media. Considering the extremely dismal earnings warning issued by Focus Media last week (click here for more information), it is surprising that the share price has remained so resilient. Dolphin Analyst had expected a drop, but has not seen one, and will publish the second part of its research on Focus Media soon. Focus on analyzing the investment value of Focused and stay tuned.

In addition to selling Semiconductor Manufacturing International Corporation and Meituan last week, note that although Sunergy achieved a huge increase in market value last week, the northward capital was sold at a net.

3. Distribution of Combined Assets

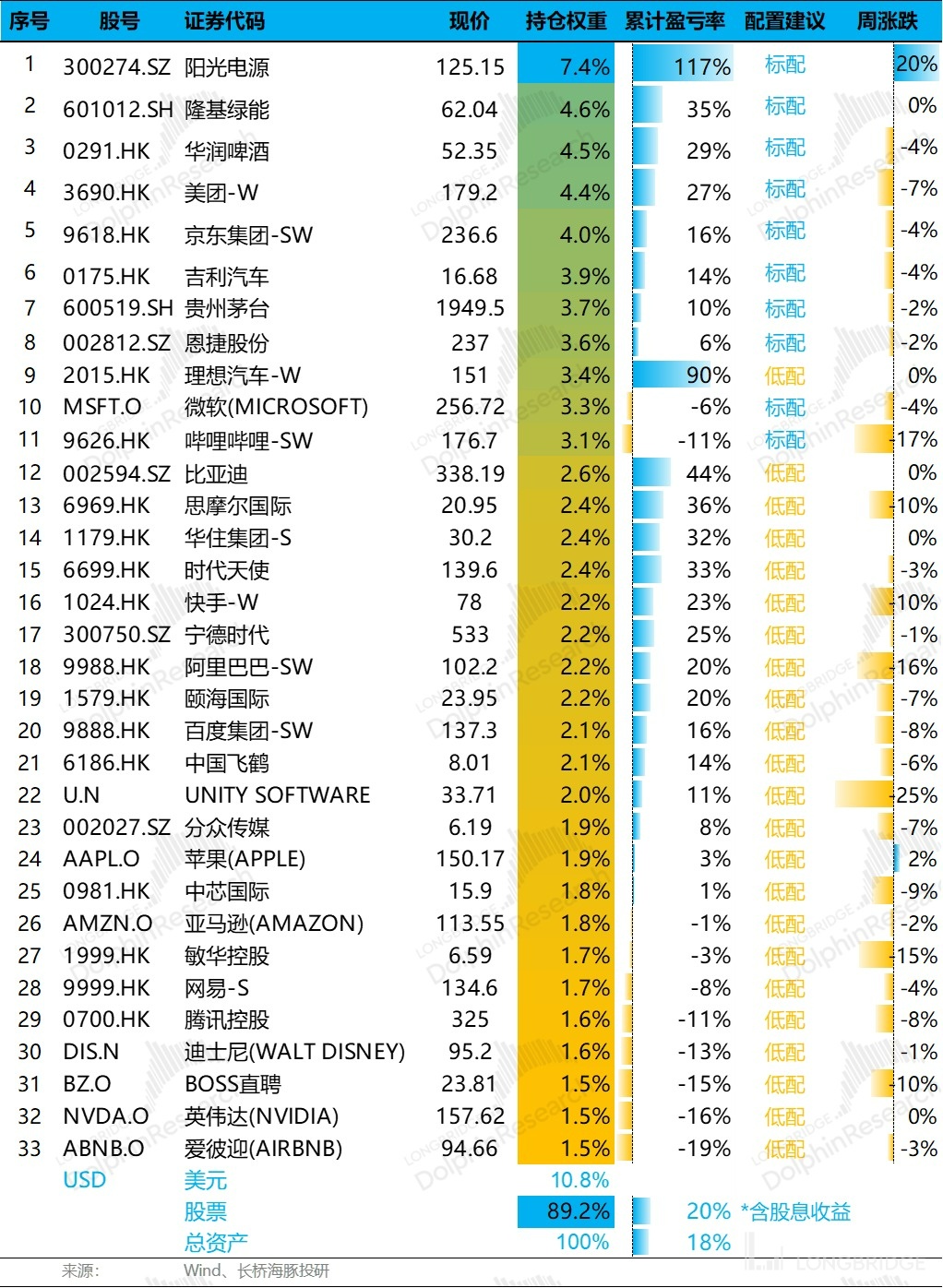

If we look at the internal test launch point on March 1, the overall return of the Dolphin Alpha Dolphin portfolio as of last Friday was 18% (including dividend income).

Last week, Dolphin Analyst did not adjust the portfolio. The portfolio invested in a total of 33 stocks, including 10 core stocks and 23 non-core stocks.

As of last weekend, the asset allocation and equity asset holdings of Alpha Dolphin were as follows:

4. Key focus

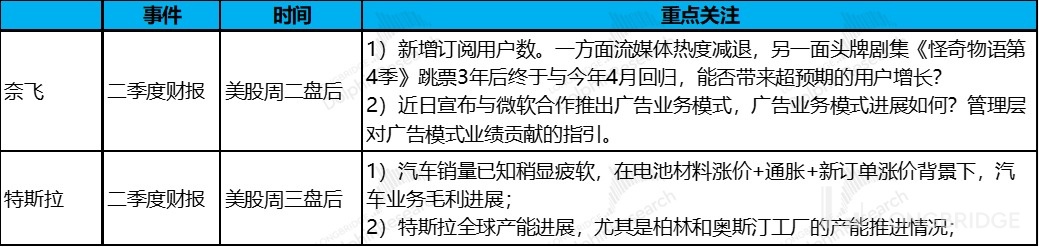

Starting this week, after TSMC, the US earnings season formally begins. Among the companies monitored by Dolphin Analyst, Netflix and Tesla will be the first to present their earnings reports.

During US earnings season, each company will provide outlook for the next quarter. At the current stage, the future outlook is more important than the current performance, especially when many companies lower expectations in the middle of the cycle and if there is any unexpected bad news, it will happen more often during this period.

Dolphin Analyst summarized the key points of the two companies releasing their earnings reports this week. Interested users can follow the Dolphin Analyst's interpretation of the financial report.

For recent Dolphin portfolio weekly reports, please refer to:

The Return of the Epidemic, The Recession of the U.S., and the Change of Capital

The Chinese assets right now: "No news is good news" for US stocks

The wild growth, but will US only face economic recession? 《2023 Is America in Recession or Stagnation?》

《US Oil Inflation, Can China's New Energy Vehicles Grow Stronger?》

《Fed Accelerates Rate Hikes, But China's Asset Opportunities Prevail》

《US Stock Inflation Breaks Records Again, But How Far Can the Rebound Go?》

《The Most Grounded Portfolio, Dolphin's Investment Portfolio is Now Live》

Risk disclosure and statement for this article: Dolphin Disclaimer and General Disclosure