Some translations of unique terms: '奔赴' -> 'to rush towards' 'Square' -> 'Square' '泡沫' -> 'bubble' '挤' -> 'pop' ====== There were a lot of rush towards but none were fulfilled; the bubble of Square still needs to pop.

Through the summary of the US payment industry in the previous article, we found that bank cards are still the mainstream payment method in the United States, whether online or offline (70% and 51%, respectively). In contrast to the current situation in the domestic electronic wallet market that has unified the payment market (80% online, 50% offline), the digital payment industry in the United States still has huge room for growth.

Referring to the successful cases of Alipay and WeChat in China, Dolphin Analyst believes that a digital wallet that wants to surpass bank cards as the preferred payment method for residents needs to stand out in the following two points:

- Have a wide range of payment scenarios, that is, have a large number of supported merchants distributed widely, and offline scenarios are more important than online (online retail accounts for less than 20% in the United States; Amazon, which occupies 40% of the market share, does not support third-party digital wallet payments. Offline payment scenarios are more common and scattered, so they are more difficult to penetrate, and payment companies have more bargaining power.)

- Digital wallets need a large number of C-end users (to encourage merchants to accept digital wallets as payment methods), and users need to have high stickiness and frequency of openings for the digital wallet to become the user's subconscious preferred payment method (for example, embedded social, chat, entertainment and other functions)

Based on the above two points, we believe that Block (Ticker: SQ.US) which has both Square merchant business to provide a stable system-wide payment scenario, and Cash App 2C business to have a large number of C-end users, is one of the players that have hopes to stand out from the "jungle stage" of the digital payment sector in the United States. Therefore, in this article, we will use Block as the target and analyze its profit model, market value scale, growth driving factors, and current valuation cost-effectiveness in detail.

First of all, Dolphin Analyst believes that Block's investment logic for this period is mainly based on the following points:

- Upgrading merchant composition: The company's original main service objects are small and micro merchants with annual sales less than US$125,000. Due to their small scale and thin profits, the usage rate of more ancillary services is not high except for basic payment services. The company is now vigorously developing merchants with annual sales of US$500,000. With the upgrading of the merchant structure and the increase in the average annual sales per merchant, we expect that the total GPV of the company can be increased by 2.8 times with only a 1.4-fold increase in merchants. In addition, larger merchants have a higher usage rate of the company's high value-added services than small and micro merchants, which can bring more subscription service income to the company in addition to payment processing fees.

- More than just payments, loan-type financial services can bring more income and profits: The company's operating loans provided to merchants and the buy-now-pay-later service provided to consumers through the acquisition of AfterPay can bring more financial service revenue to the company beyond basic payment services, and the gross profit margin of such revenue is high. Moreover, most of the loans offered by the company will be sold exclusively to third-party investors, so the actual financial pressure and credit risk borne by the company is very low, and it belongs to the "low input, high output" type of business.

- Promoting C2B Payment with Digital Wallet to Seize Mainstream Payment Position: The core function of digital wallets in the current US market is still limited to P2P payments, and there are few applicable scenarios for C2B payments at offline merchants. Block is vigorously promoting the Cash App Pay business, allowing users to pay directly through Cash App (rather than through linked bank cards), making it the first shot to replace bank cards and become the mainstream payment method for US residents. As the company owns both the Square merchant ecosystem and the Cash App consumer ecosystem, it can promote Cash App Pay among existing Square merchants, forming a cycle within the system. Therefore, there is a greater chance of attacking C2B payments from digital wallets in the future.

Looking to the future, Square is indeed on a vast and endless track, but it has been on the road, and the company is currently vigorously expanding multiple new businesses and seeking to break through. It has just completed the acquisition of AfterPay.

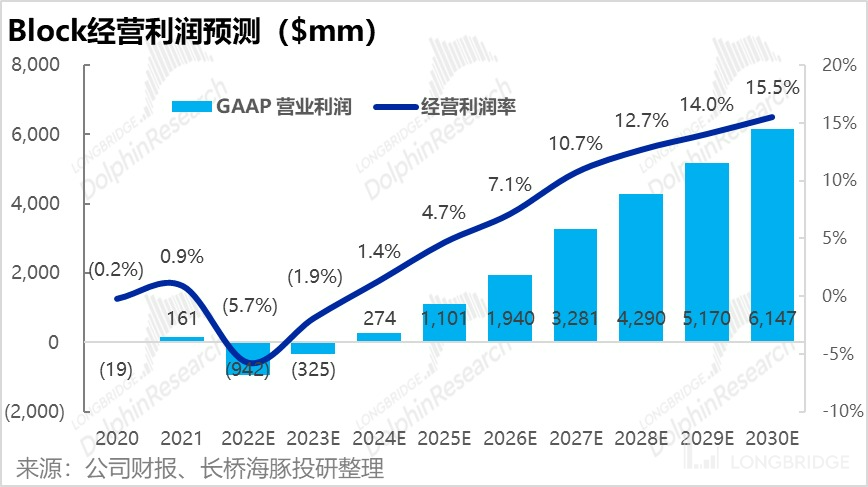

Therefore, the company's three expenses will rapidly expand in the short to medium term, severely dragging down its profits, and it will likely achieve a net operating loss in 2022-2023.

Based on LongBridge Dolphin Analyst's calculation, before the new business scales up significantly, the current price of Square is not friendly, with too much premium on the story, and there is not enough safety cushion.

Under Dolphin Analyst's neutral valuation, even if the cash flow loss caused by investment in the next two years is not considered, and only the positive cash flow in the future is estimated, there is still a 15% downside compared to the current stock price.

Dolphin Research focuses on interpreting global core assets across markets for users, grasping the deep value of enterprises and investment opportunities. Interested users can add WeChat ID "dolphinR123" to join the Dolphin Research community and discuss global asset investment perspectives together!

For specific business and logic, please refer to the article:

I. Square Merchant Business Ecosystem

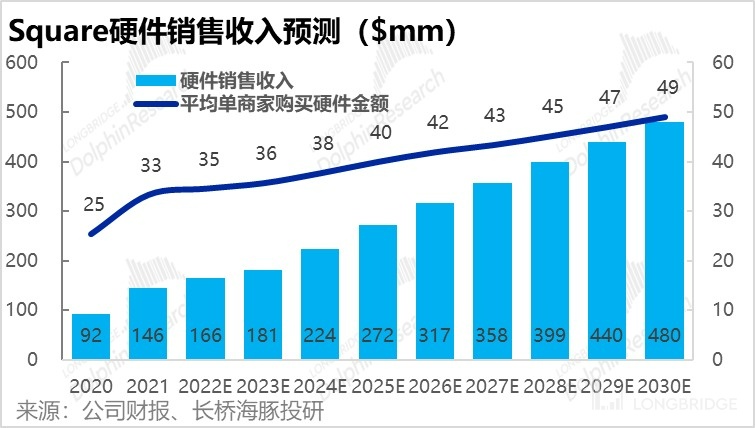

1. Square's Profit Model -- Soft and Hard Integration, Hardware "Feeds" Software

Let's start with Block's basic plate -- the merchant business under the Square brand. At the beginning of Block's establishment (at that time, the company was still named Square), it entered the payment market by providing simple and low-cost card reading hardware to small merchants who had difficulty obtaining traditional POS machines. However, despite starting with hardware sales, just like Xiaomi selling phones and Microsoft selling Xbox, they all adopt a business model of low gross profit or even loss on hardware sales, using low selling prices to acquire customers and relying on various software services as the main revenue source.

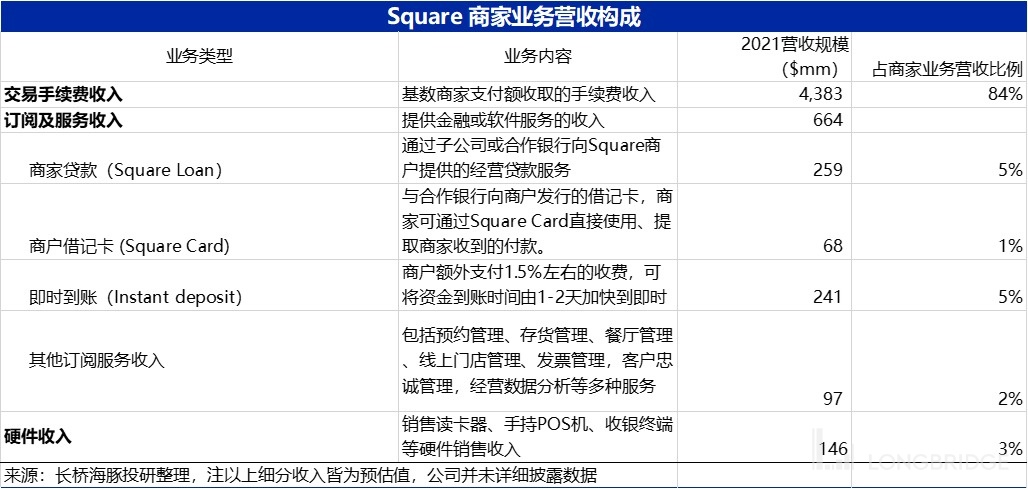

Therefore, based on the user base brought by hardware sales, the main revenue of Square merchant business actually comes from payment processing fees (generally 2.6% -3.5% of the payment amount), as well as various subscription and service revenues provided to merchants, mainly including:

- Providing short-term and small (up to $250,000) operating loans (Square Loan) to merchants who use Square's services;

- Instant deposit, for merchants who have higher requirements for the timeliness of the funds and are willing to pay an additional 1.5% fee outside of the payment processing fee, they can receive the payment instantly without waiting for 1-2 days of settlement time. (Essentially accounts receivable financing)

- Providing various CRM, ERP services for merchants, such as reservation management, inventory management, online store management, customer loyalty management, wage management, business data analysis, and so on.

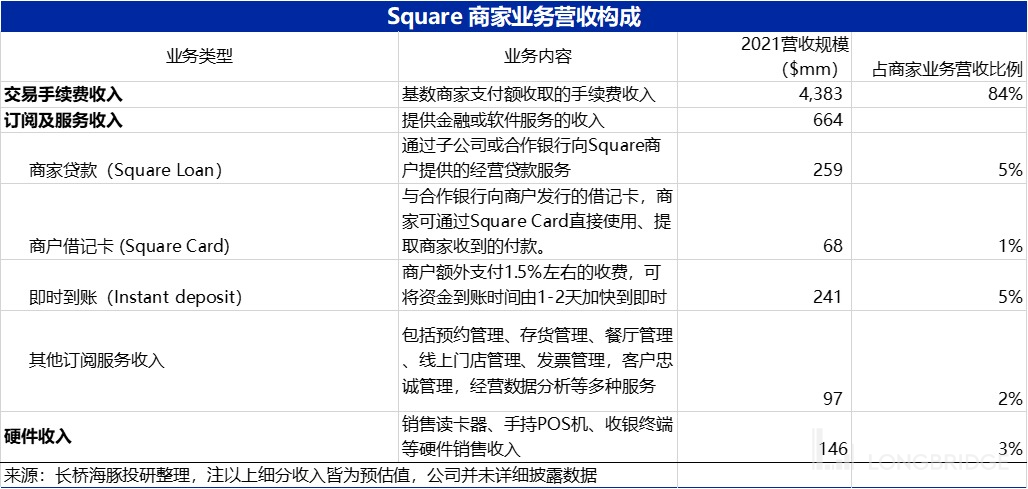

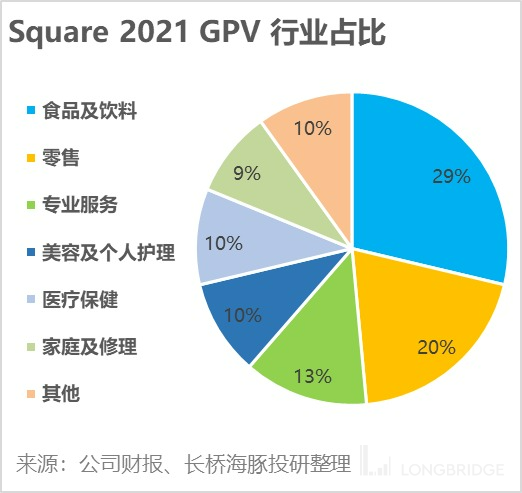

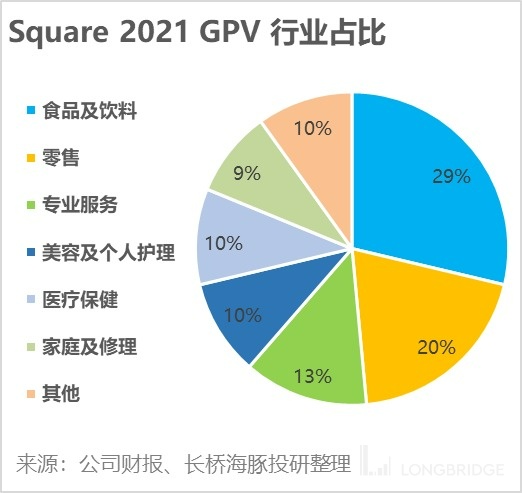

From the revenue scale, payment processing fees are the most important source of income for Square's merchant business, contributing 84% of the total revenue; the size of financial business ranks second - operating loan and instant deposit each contribute about 5% of the revenue; while high-value-added SaaS subscription services, although there are many types, have a relatively small actual revenue scale, contributing only about 2% of the revenue in 2021.

In summary, payment services are still the absolute mainstay of Square's merchant ecosystem, and financial services (merchant loans and instant deposit, etc.) also have a certain penetration rate among merchants and have considerable growth elasticity; the story-like SaaS services have not been widely adopted by merchants, although there is imaginative space, the business progress is not smooth at present.

- How large is the payment industry in the United States as a whole? And how much can Square get?

As seen in the previous section, payment processing fees are the main source of revenue for the company's merchant business. So, looking purely at the US market, how large is the potential market size of the payment industry?

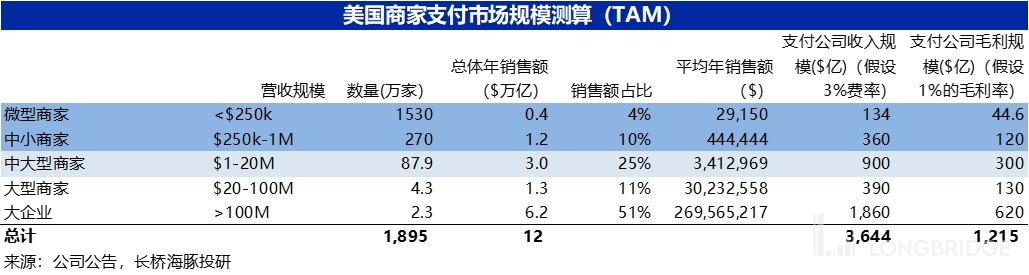

According to the company's statistics, there are about 19 million merchants in the United States that require payment services, of which the primary target of Square - small and micro merchants with annual sales below $1 million have an overall annual payment of approximately $16 trillion (accounting for 4% of the total payment scale), while the potential annual payment of medium and large merchants (with annual sales between $1 million and $20 million) that Square can penetrate is $3 trillion (accounting for 10% of the overall total).

For enterprises with higher annual sales, since they are more likely to cooperate with traditional payment companies, Dolphin Analyst does not view them as potential customers of Square.

Therefore, the total transaction volume that Square can penetrate in the United States is $4.6 trillion per year, and assuming a 3% payment processing fee, the corresponding payment processing fee revenue would be approximately $140 billion. However, Square's market share corresponding to $4.8 billion in payment processing fee revenue in 2021 is only 3.1%, indicating a broad room for improvement. Market scale is large, so how much market share can Square grab in the US payment market? The key issue, according to Dolphin Analyst, is how many merchants can Square serve. For most of Square's business types, their revenue driver model can be broken down into: merchant count x service penetration rate x single merchant contribution income. So in this analysis, we first predict the future number of merchants as a basis for later analysis.

Because the company only discloses the composition of total payment GPV (gross payment volume), but not the number of merchants, we use the method of "number of merchants = GPV/single merchant payment amount" to calculate Square's number of merchants.

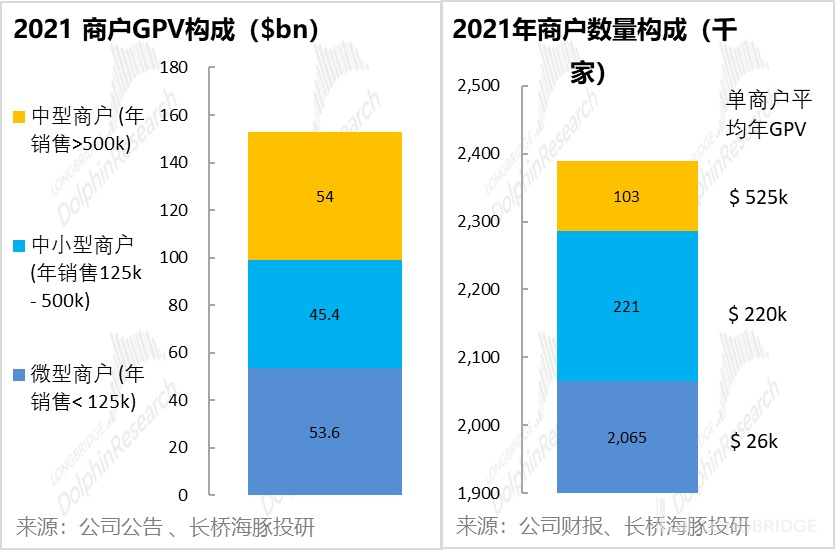

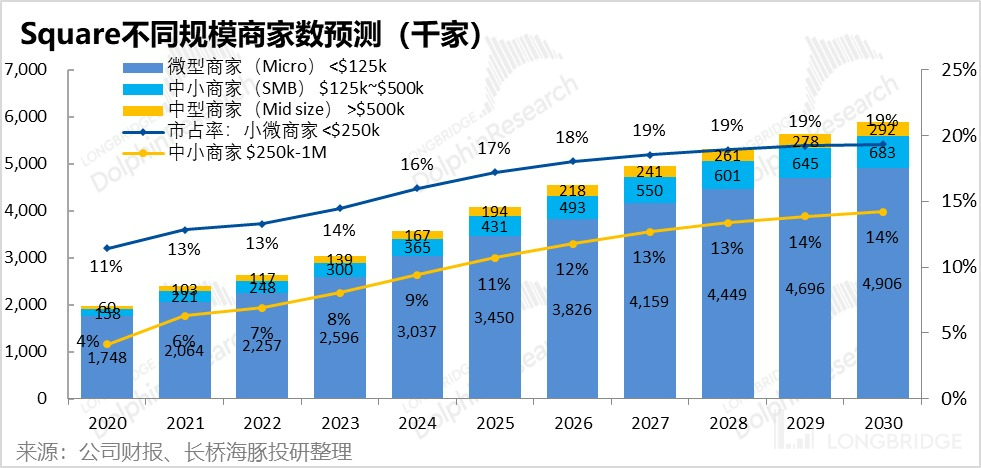

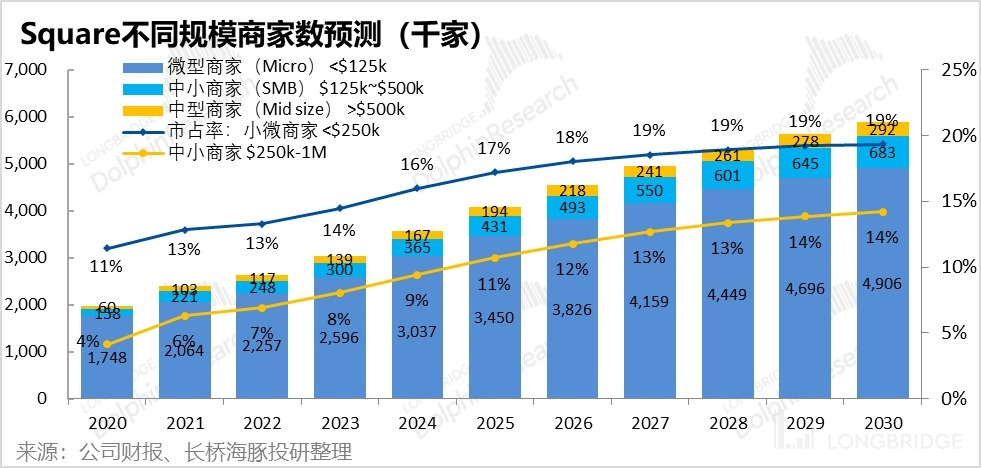

After calculation, Dolphin Analyst estimates that Square had approximately 2.4 million active merchants in 2021. Of those, about 2 million were micro-merchants, about 220,000 were small and medium-sized merchants, and about 100,000 were medium-sized merchants, accounting for approximately 13% and 6% of the total number of merchants, respectively.

(Sharp-eyed readers may have noticed that the annual payment amount we estimated for merchants of different scales is lower than their average annual sales amount. This is mainly because we believe that some of the merchants' payments are made in cash, which is not cleared through Square, and for smaller businesses, the proportion of cash payments should be higher.)

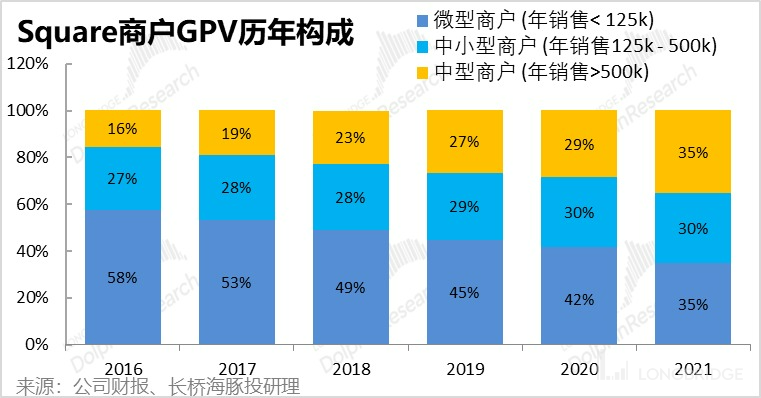

For the future growth prospects of the number of merchants, medium-sized merchants with annual sales of over $500,000 are currently Square's main target for development. According to the annual GPV composition disclosed by the company, the proportion of medium-sized merchants has grown from 16% in 2016 to 35% in 2021. We believe that Square's medium-sized merchant users will continue to grow at a good rate, and we expect that the growth in the number of medium-sized merchants will continue to be higher than that of small and micro merchants.

Therefore, combined with the total number of merchants in the US mentioned earlier, Dolphin Analyst predicts that by 2030, Square's market share among merchants with annual sales of less than $250,000 will increase from 13% to 19%, and that among merchants with annual sales of $250,000 to $1 million will increase from 6% to 14%. Therefore, Square's merchant scale is expected to grow from approximately 2.4 million in 2021 to approximately 5.8 million in 2030.

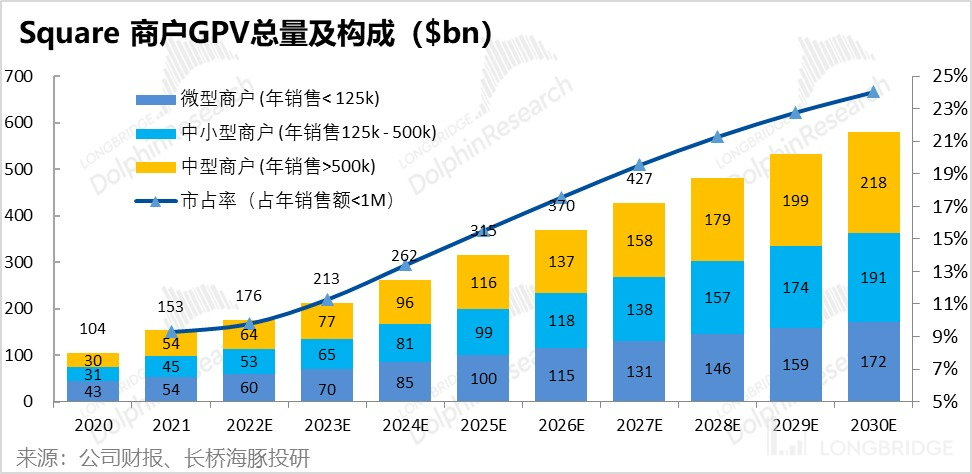

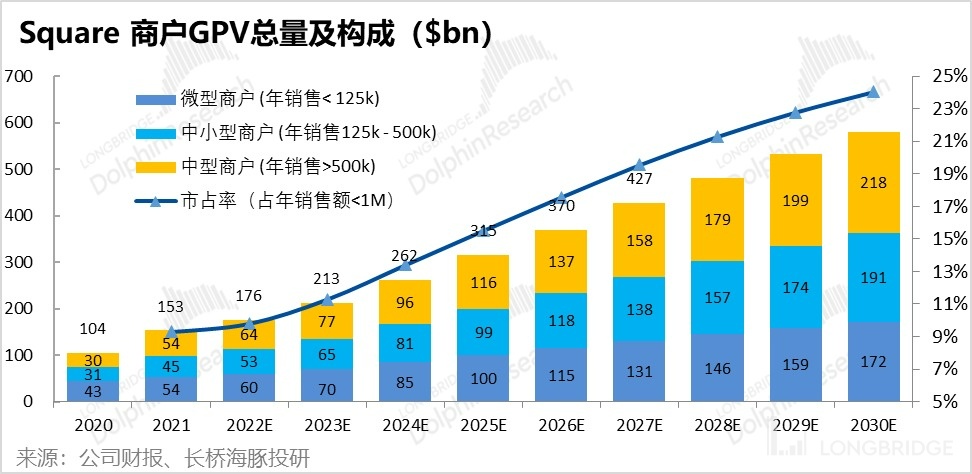

By multiplying the number of merchants by their average annual payment amount, we calculate that Square's merchant payment amount will increase from $153 billion in 2021 to $580 billion in 2030. This means that Square's market share among merchants in the US with annual sales of less than $1 million will increase from 9.3% in 2021 to about 24% in 2030.

We expect that more than 70% of the incremental GPV will come from small and medium-sized merchants with smaller numbers but higher average payment amounts. Therefore, due to the increase in the proportion of larger and higher average payment amount merchants, between 2021 and 2030, although we expect the total number of merchants to increase by only about 1.4 times, GPV will be able to increase by 2.8 times.

3. Revenue forecast for various business segments within the Square merchant ecosystem

Based on the predicted number of Square merchants and GPV, we will now separately predict the revenue growth prospects for each segment of the Square merchant ecosystem.

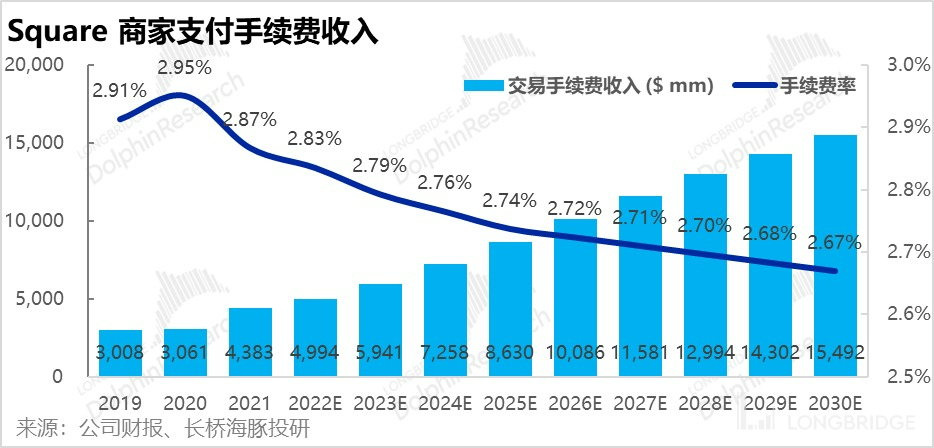

- First, for the main revenue contributor, transaction processing fee income, the prediction logic is relatively simple, payment processing fee income = GPV * average processing fee rate. We already have the prediction for GPV, so the remaining step is to judge the trend of the average fee rate.

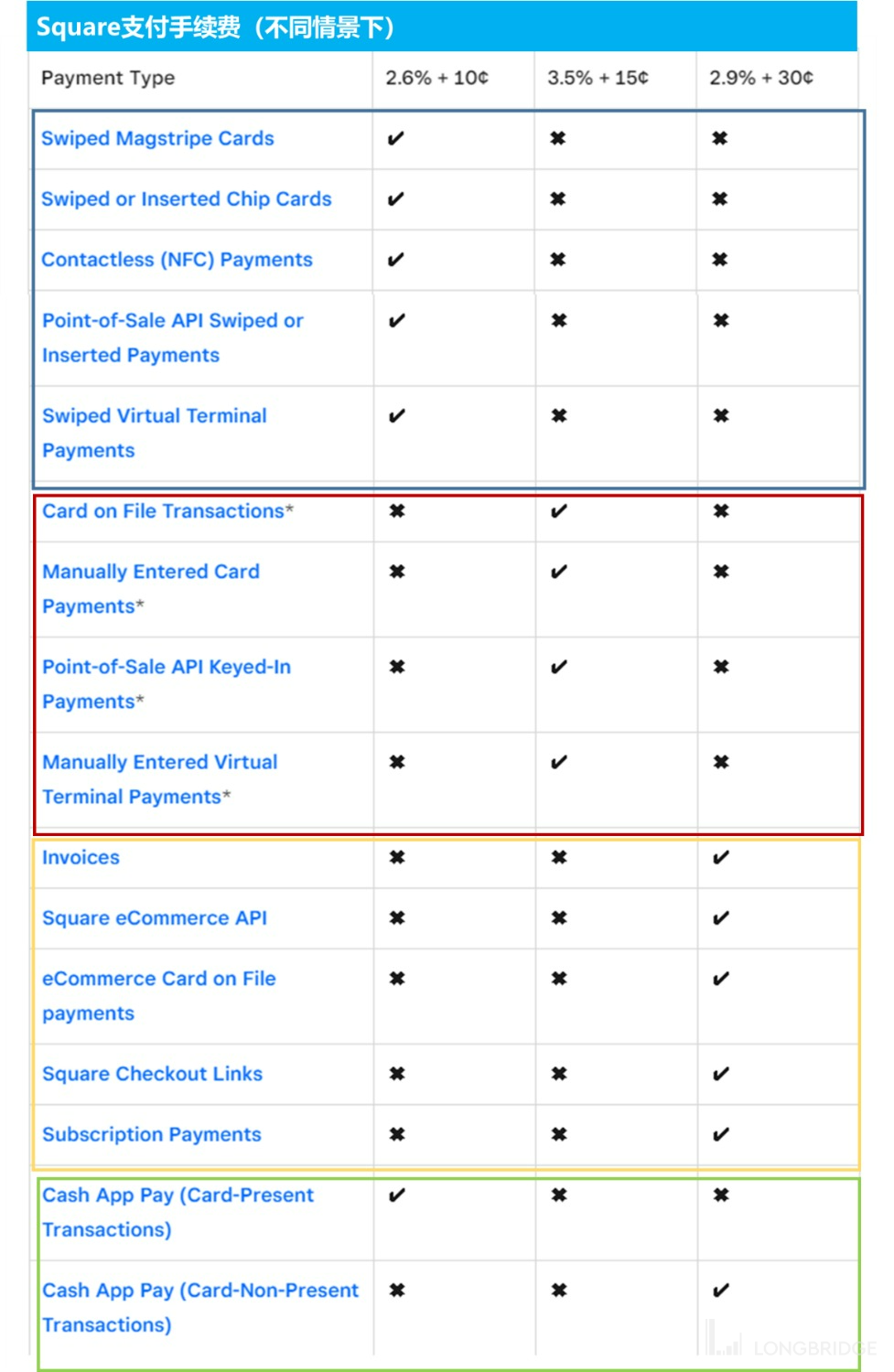

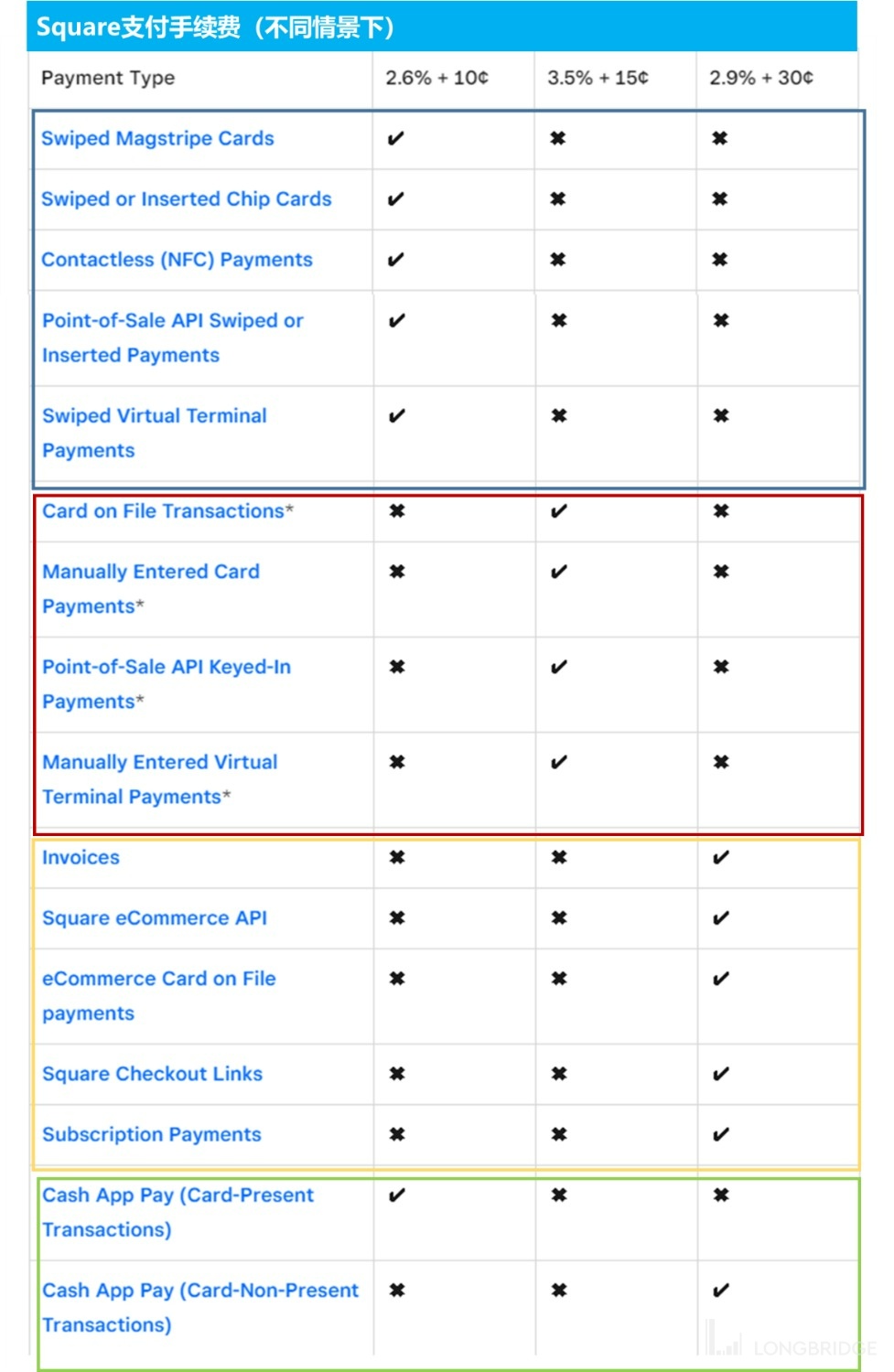

According to the company's official website, the payment fees charged by Square are mainly divided into three tiers: the lowest is 2.6% + $0.1 for regular card transactions, the second tier is 2.9% + $0.3 for online payments, and the third tier is 3.5% + $0.15 for cardless payments. According to the company's financial report data, the company's actual average payment processing fee rate in 2021 was 2.87%, and it has been continuously decreasing over the years.

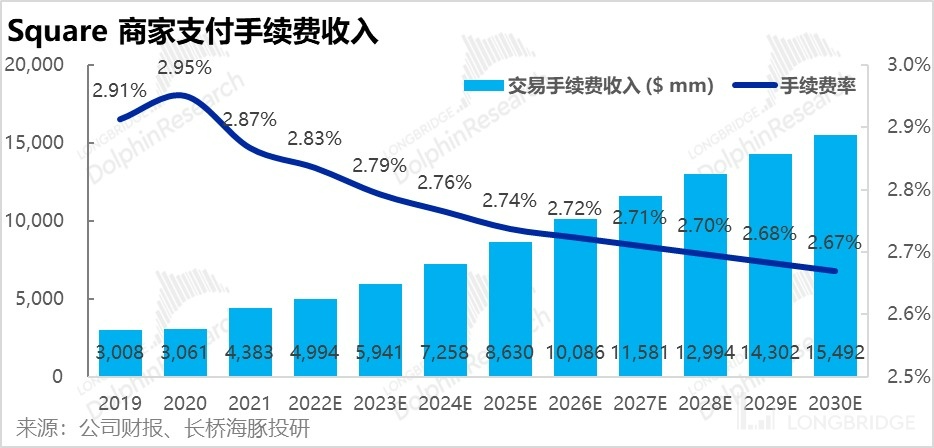

Looking ahead to the future, we believe that the processing fee rate will continue to decrease. The reason is that the proportion of larger merchants in Square's merchant base will continue to increase, and larger merchants have higher sensitivity and bargaining power for processing fees. At the same time, payments are a homogeneous channel business and are purely expenses for merchants, and cannot bring more income like e-commerce advertising. Therefore, there is naturally not much room for payment fees to increase, and payment companies also tend to reduce fees to attract or retain customers as they increase in scale. Based on the above logic, we expect that the payment processing fee rate will slowly decrease from 2.87% in 2021 to 2.67% by 2030. Multiplying this by $580bn GPV for 30 years, we can calculate that Square's payment processing fee revenue in 2030 will reach approximately $15.4 billion.

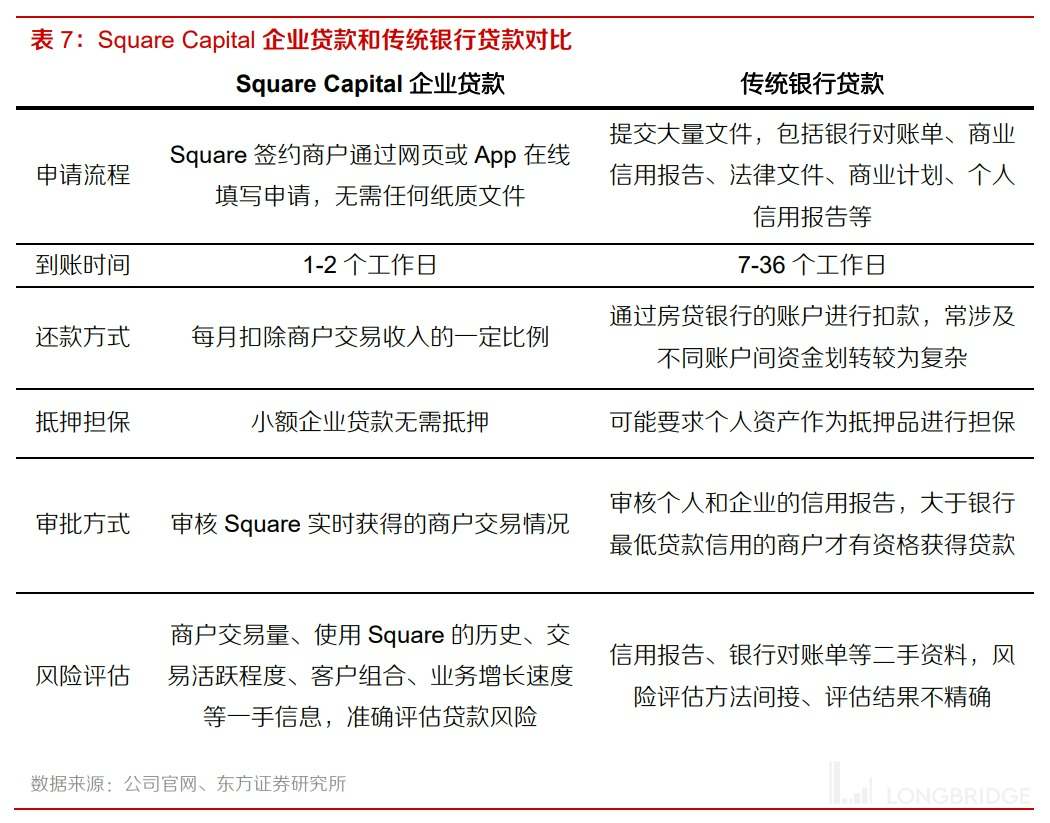

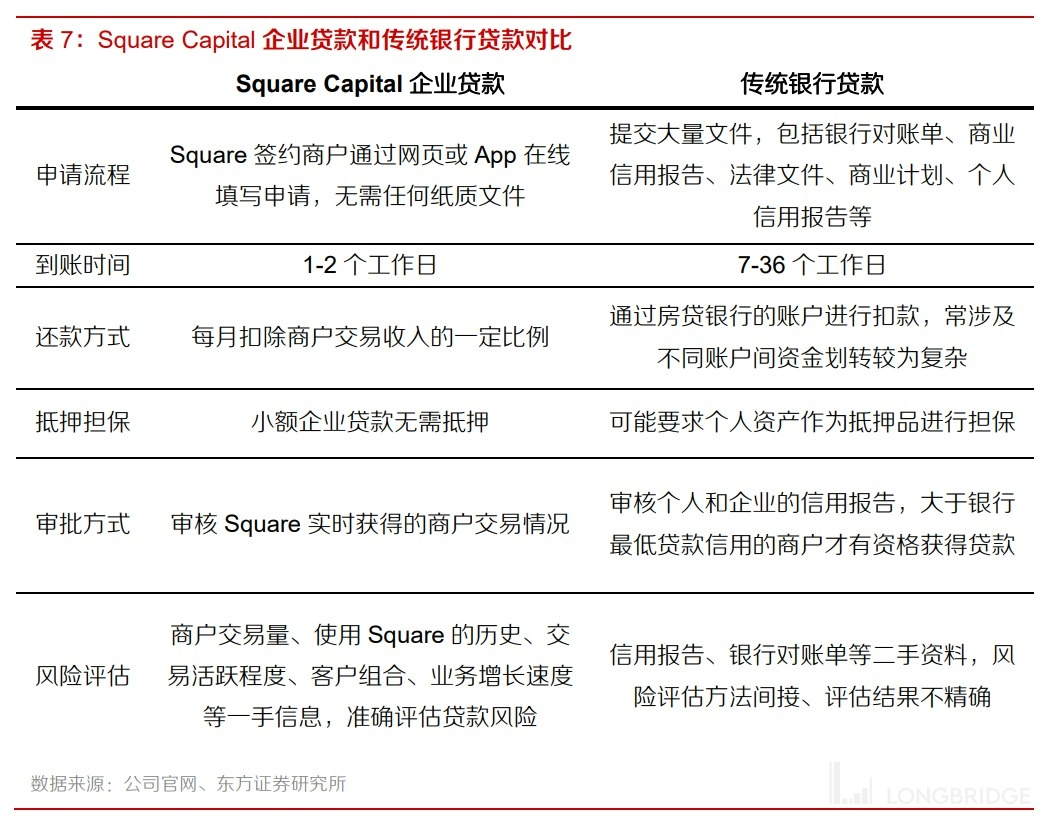

- Square Loan, a short-term operational loan service provided by the company to cooperative merchants through its subsidiary (Square Financial Service) with a lending license. The general loan amount is between $300-$250k. For merchants, the advantages of Square Loan are its simple application process (it can be applied quickly through their Square account), quick approval (the money can be received within 1-2 working days), and no collateral or credit review required (Block reviews based directly on the merchant's sales and payment situation).

For the company, the risk assumed in the Square Loan business is also very low.

Firstly, Block will automatically extract a certain percentage from the merchant's daily payment flow as repayment. If the merchant's flow is not enough to repay the loan, the company can directly deduct the repayment from the bank account linked to the Square account. Therefore, the risk of maliciously defaulting on a loan is low unless the merchant is really unable to repay.

Furthermore, most of the commercial loans issued by the company have been discounted and resold off the balance sheet. Under this model, the company assists in collecting repayments from merchants and transferring them to creditors, and collects a certain service fee as revenue from the creditors. Therefore, in this business, Block actually assumes very little funding requirements and bad debt risks; it is essentially a "win-win" channel-assisted lending business. For the small portion of loans that have not yet been resold and remain on the balance sheet, the company records revenue based on the interest rate charged to the merchant.

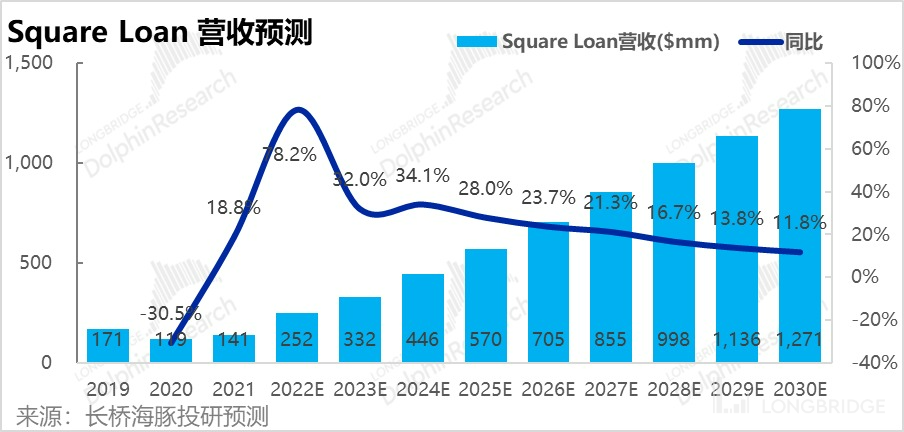

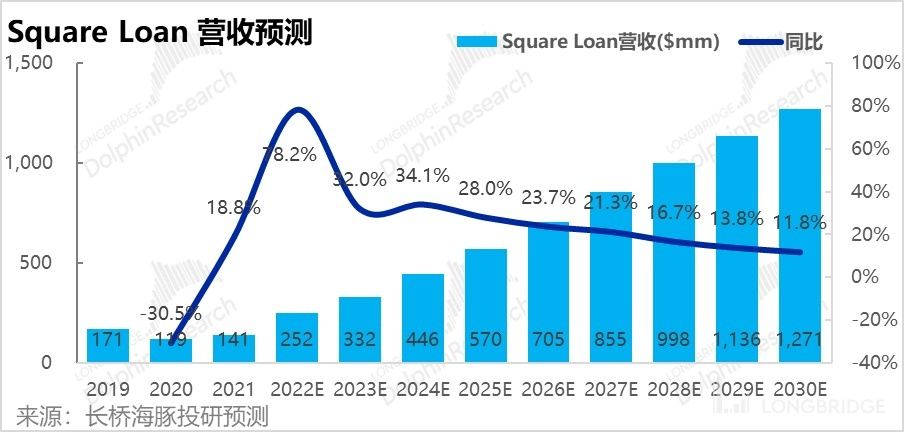

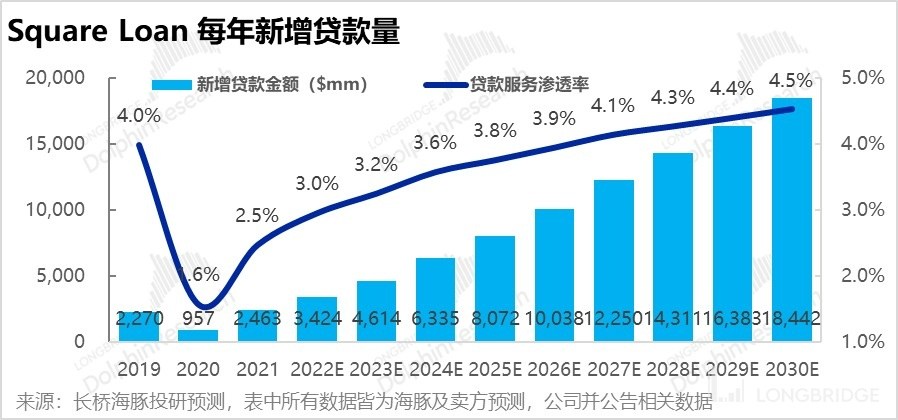

We can predict Square Loan revenue based on the logic that Square Loan Revenue = Total Merchant Payments (GPV) * Loan Penetration Rate * Channel Fee Rate (or Interest Rate).

As commercial GPV has been predicted earlier, we can consider loan penetration rate now. Since the loan amount provided by the company is also related to the size of the merchant's GPV, and larger merchants have stronger awareness of and ability to repay commercial loans, we believe that the penetration rate of Square Loan in merchants will gradually increase with the increase in larger merchant proportions within the Square merchant structure. However, the bargaining power of larger, better credit-rated merchants (obtaining funds channels) is stronger, so we expect the loan fee rate to decrease in the future. And when collecting fees, in addition to charging a higher handling fee (about 4%) when issuing new loans, for existing loans, the company will charge a lower fee based on the amount of outstanding loans. Therefore, as the number of new loans increases each year, the amount of outstanding loans will also rapidly expand, thereby bringing high revenue elasticity.

Based on the above assumptions, we predict that the revenue of Square Loan can grow from 140 million in 2021 to 1.27 billion in 2030, indicating significant growth potential.

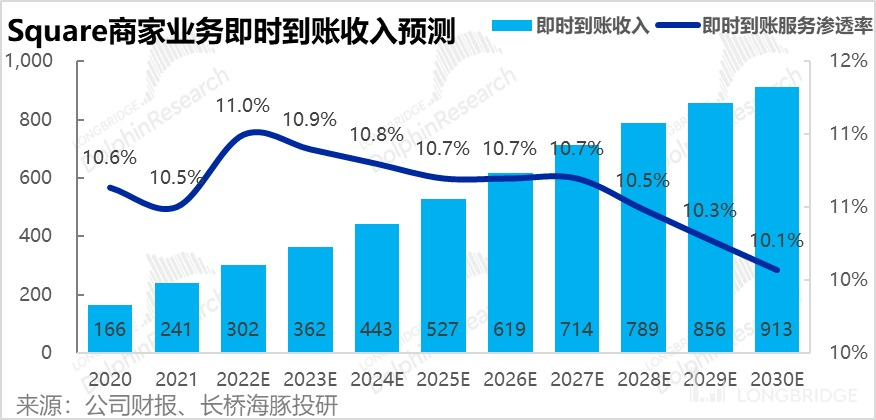

3) Instant Transfer Service: In addition to the basic payment processing fee, merchants can pay an additional fee to receive customer payments instantly, without having to wait for a clearing time of 1-2 days, thus enabling faster fund turnover and alleviating the pressure of operation funds. The revenue forecast logic for this business can be broken down as follows: Instant payment income = Total GPV of merchants * Percentage of instant transfers required * Instant transfer fee rate.

Dolphin Analyst believes that small and micro merchants have a higher demand for instant payment due to less stable and fewer reserves of funds. Conversely, larger merchants have more stable cash flow and a certain amount of fund reserves, thus their willingness to pay extra fees for instant payment should be lower.

As the proportion of small and medium-sized merchants increases in the future, we believe that the penetration rate of this service among all merchants will tend to decrease. As for the fee rate, we assume it will be relatively stable in the long term, with a slight decrease.

Taking the above assumptions into account, we predict that the instant payment income of merchant business will increase from 240 million in 2021 to 910 million in 2030.

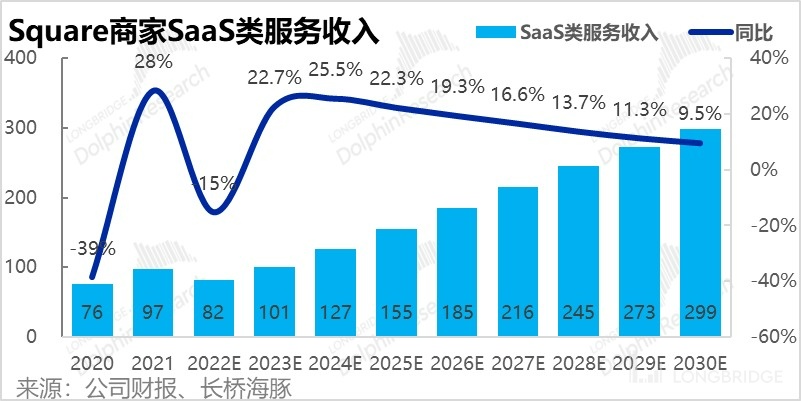

4) Merchant Software (SaaS) Services:

After accumulating a certain market share and merchant resources in the payment industry, Square extended various types of SaaS services for small and medium-sized merchants who generally lack professional management and operation systems. These services can be broadly divided into three categories, and Dolphin will briefly introduce the content of each service.

-

The most popular retail or catering store management software among Square merchants, which supports menu management, order management, table reservation, and can also connect with third-party platforms for online reservations, such as Postmates and DoorDash. In the back-end, it supports barcode-based inventory management, real-time inventory analysis, warning alerts, etc.

-

Various services such as universal customer management, business analysis, team management, etc.. For customer management, it includes establishing a member profile, points system, promotion and advertising templates, and corresponding marketing impact analysis, promotional conversion rates, etc. Business analysis services include multidimensional analysis of payment and sales data (by category, time, location), helping merchants to understand sales and profit trends and the main driving factors. Team management includes employee clock-in and clock-out management, automatic salary payment services, and more.

-

Online store management: As Square mainly targets offline payment scenarios, online payment has always been a weakness of the company. However, against the background of the COVID-19 pandemic in 2020, which caused consumption to shift online, the company seized the opportunity to promote online store management services. Merchants can use the tools provided by Square to easily set up online stores, and Square provides end-to-end services such as product shooting, store design, order management, and online payment.

According to the company, GPV paid through online channels in 2Q2020 once reached up to 25% of the total volume, indicating that the company's disadvantage of lacking online payment scenarios has somewhat improved. (Afterwards, the company did not regularly disclose the proportion of online channels. Dolphin Analyst believes that after the easing of the epidemic, the proportion of online channels should have fallen back.)

However, although the company has launched various services mentioned above, it only contributed USD 97 million in revenue by 2021, accounting for only 1% of merchant service revenue. This shows that the current acceptance of such services by merchants is not high.

Dolphin Analyst believes that one of the main reasons is that the vast majority of Square's customers are small and micro businesses with annual sales of less than USD 100,000. However, small-scale businesses such as street vendors or self-employed individuals do not have a high demand for systematic management and operational software. Instead, the demand for such services will be higher for relatively large-scale merchants (such as small chain stores, restaurants with a certain scale, etc.). Therefore, as the company's future customer structure tilts towards medium and large businesses, we believe that the usage rate of SaaS services will be higher than the current rate.

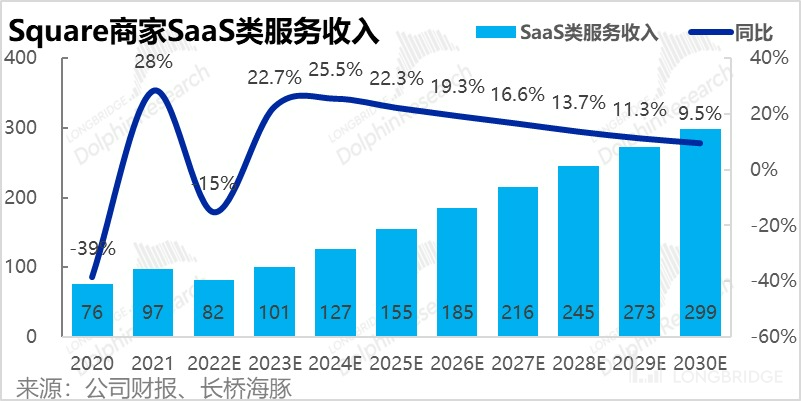

In predicting specific revenue in the future, due to the lack of underlying data, we simply predict it based on growth rate. And because we believe that the usage rate of SaaS services will increase, we assume that the growth rate of SaaS revenue will remain higher than that of merchant GPV growth. Specifically, we predict that SaaS service revenue will increase from USD 97 million in 2021 to USD 300 million in 2030.

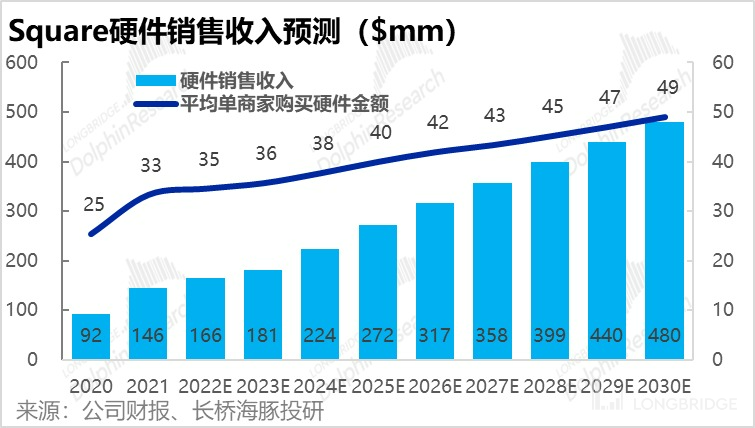

5) Hardware sales data

As shown in the table below, the payment hardware sold by the company includes various applicable products with prices and functions ranging from free portable card readers to multifunctional payment terminals priced at USD 799. Due to the fact that our company had previously served small and micro-enterprises and the future structure will be upgraded to more expensive but feature-rich hardware, the proportion of hardware sales revenue obtained from individual new merchants is likely to increase. Therefore, we expect that the growth rate of hardware sales revenue will also be higher than that of merchant growth rate. Specifically, we expect that hardware sales revenue will grow from 150 million in 2021 to 480 million in 2030.

II. Cash App Consumer Business Ecosystem

1. Cash App ecosystem segmented business introduction

In addition to the merchant ecosystem under the Square brand, the consumer-oriented ecosystem centered on Cash App is another core business of the company, and its growth prospects and imagination space are even better than those of the merchant business. However, unlike the simple and direct profit model of the 2B business, the business provided to Cash App's C-end users is more complex, and most of its main functions are free to attract and retain users. Instead, revenue is earned through some additional services or by charging third-party users. Therefore, we first briefly introduce the main functions of Cash App according to whether they charge users.

First, the free services that Cash App provides to users include (partially charged to merchants):

-

P2P transfer: As a P2P wallet, the most core function of Cash App is to provide free P2P transfer services. Individuals can use the balance in the wallet or the bound debit card to receive or send money to (from) anyone, and Cash App does not charge any fees based on the transfer amount or account management.

-

Instant deposit and payment: Users can set up direct deposit of salaries or tax refunds to their Cash APP Pay account (rather than a bank account), which can be credited 1-2 days earlier than traditional transfers to a bank account. In addition, users can use the funds in their Cash App account to make payments directly at supported merchants, and users do not need to pay any fees, but the company will charge merchants a payment processing fee.

-

Cash Card Debit Card: As a bank-directed debit card issued to Cash App users, Cash Card can be bound to the Cash App account, and users can use the funds in the App account to make payments at any supported merchant through Cash Card. As the issuer of the card, the company will charge payment fees to merchants.

-

Stock investment: Users can use the funds in their Cash App or the funds in their bound bank card for stock and ETF trading, and Cash App does not charge any commissions and supports fractional trading, with a minimum investment of 1 USD. And charging services for users include:

-

Instant Deposit and Credit Card Payments: When users transfer funds from Cash App to a banking account, they can pay about 1.5% fee to make the funds instantly available instead of waiting for 1-2 days for settlement time. Additionally, if users make P2P payments and have no balance in their Cash App account, they can pay about 3% fee to use credit card payments.

-

Cash for Business: If the corporate Cash App account receives payments, the company will charge a certain percentage of the fee.

-

Bitcoin Transactions: Users can directly buy or sell bitcoins on Cash App. And it's worth noting that Cash App acts as a dealer and directly buys or sells bitcoins from users, rather than a exchange that matches buying and selling transactions between different users. So the company will record the total selling price of bitcoins to users as revenue (rather than the price difference), and the purchase price of bitcoins as the cost, which makes the revenue scale of the bitcoin business look relatively large (other income are mostly recorded as net commission income).

-

Cash Advance: A short-term cash advance that has been piloted since 2020, which can borrow between $20-200 and must be repaid within 4 weeks and is a pilot business.

In terms of revenue scale, as Cash App Pay is still in its initial stage and supports a limited number of merchants.

2. How big is Cash App's potential user base?

After a brief introduction of the various businesses under the Cash App system in the previous section, there should be a basic understanding of this comprehensive payment and financial app. For a C-side app, the main driving factor for its growth is naturally the size of its user base.

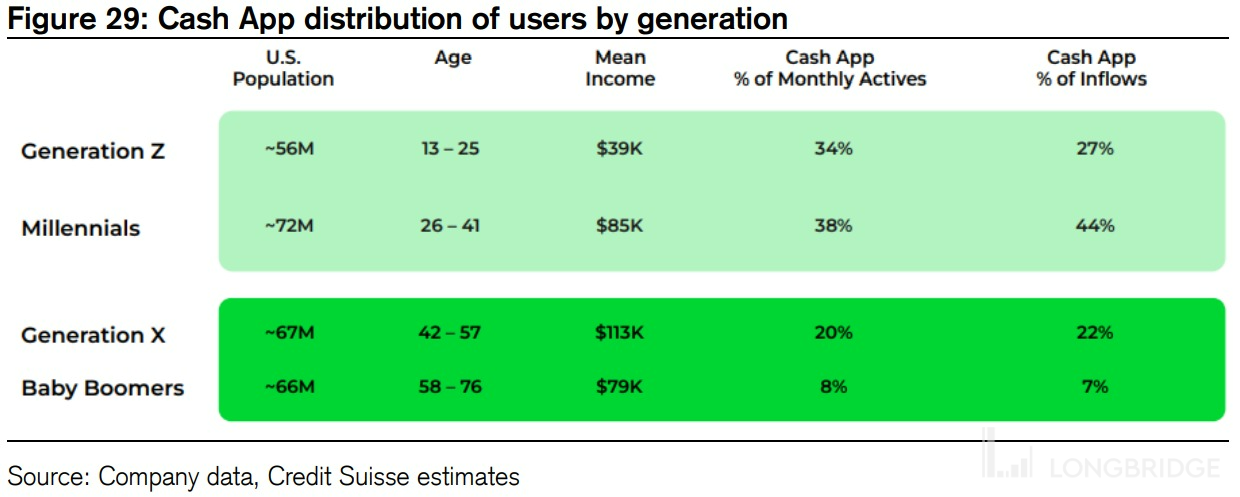

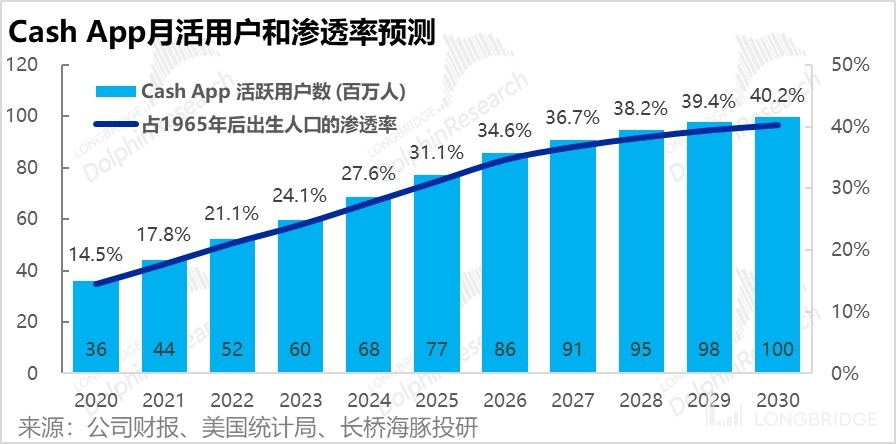

Currently, Cash App has about 44 million monthly active users, and its usage is higher among young people with relatively low incomes and more receptive to new technologies. Although most middle-aged people still prefer traditional payment methods, Cash App also has a certain penetration rate. And as Cash App's penetration rate further increases in the young demographic, it will also drive the usage of other demographics.

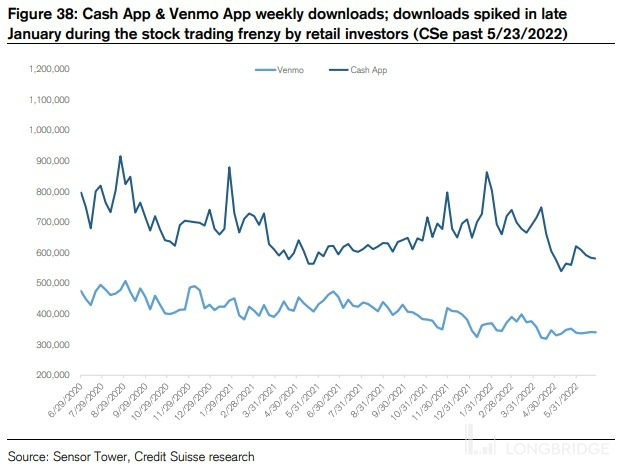

In terms of market competition, Cash App and Venmo under PayPal are the giants in the current market, both of which have P2P transfer and payment as their core functions. In addition, Cash App has more comprehensive and stronger financial and investment functions, while Venmo has more social functions.

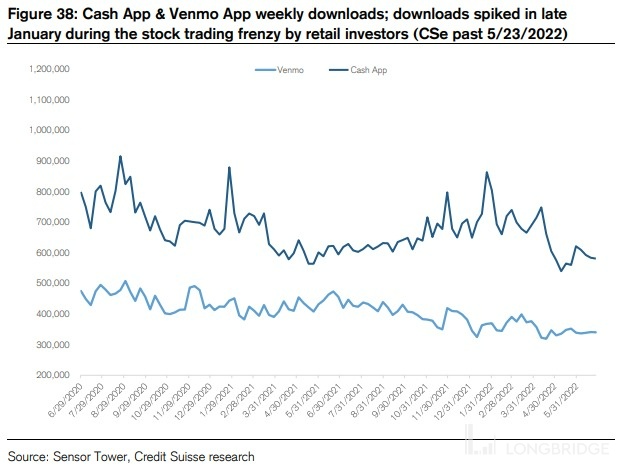

Compared to the domestic market, Cash App is more similar to Alipay, while Venmo is more like WeChat (of course, the two American products are still far from the dominance of their Chinese peers in their respective fields). From the perspective of growth rate, Cash App's momentum has been higher than Venmo's since 2020 (as shown in the figure below, Cash App's download volume is significantly higher); and Cash App's more financial features also give it more monetization channels and potential beyond payments, so Dolphin Analyst believes that Cash App is likely to win in the fierce competition of digital wallets in the United States.

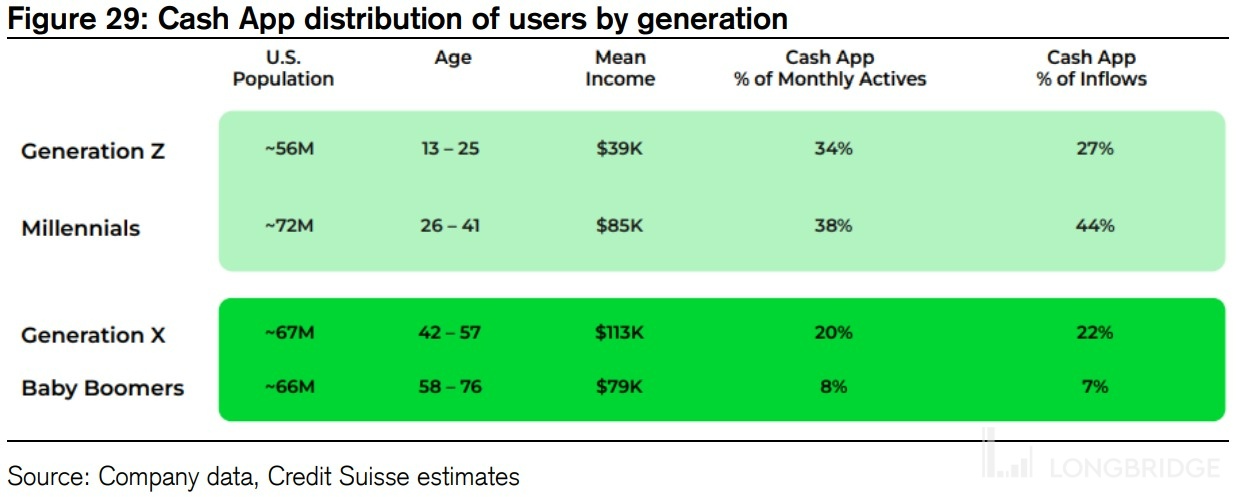

According to the disclosure of the company at the Investor in 2022, 72% of Cash App's 44 million monthly active users come from the Z and millennial generations aged 13-41, and others come from the older X generation and Baby Boomers. Combined with current population data in the United States, the penetration rate of Cash App in the Z and millennial generations has reached 24%, while the penetration rate in the X generation is also 14%.

Looking to the future, we assume that by 2030, Cash App's penetration rate among the middle-aged population (Z and millennial generations) in the United States will increase to 55%-60%, and assuming that the penetration rate of the population under 12 years old will increase to 30% benchmarked against the current Z generation by 2030, while the penetration rate of the X generation and Baby Boomers is expected to decline due to aging.

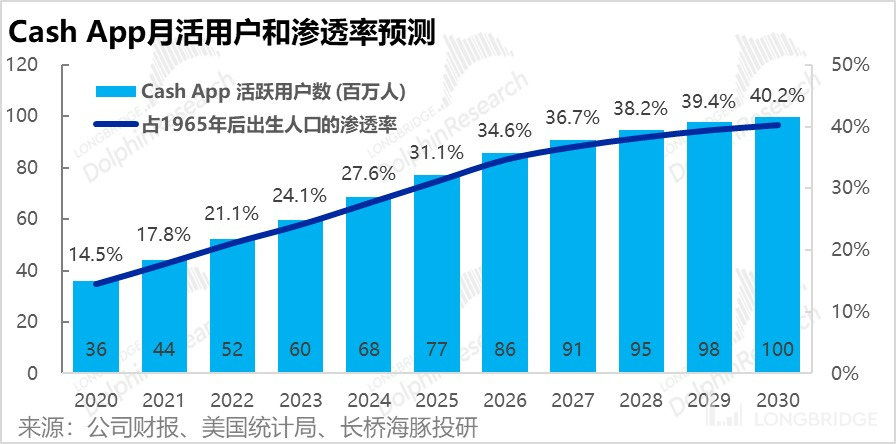

Based on the above assumptions, we expect Cash App's monthly active users to grow from 44 million in 2021 to nearly 100 million in 2030, with a compound annual growth rate of 9.5% from 2021 to 2030. See the annual forecast values in the following figure.

3. Cash App Ecological Business Revenue Forecast

As long as Cash App can maintain its current market position, even under relatively neutral assumptions, its user base still has more than twice the growth potential. So, driven by the growth of user scale, how much room for growth does each business under Cash App have? Let's take a look:

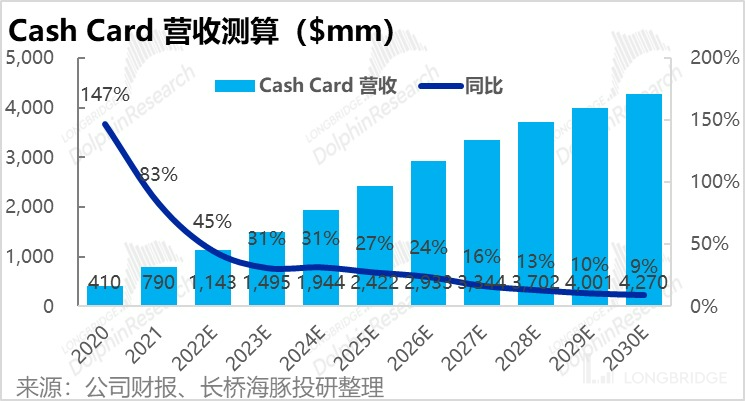

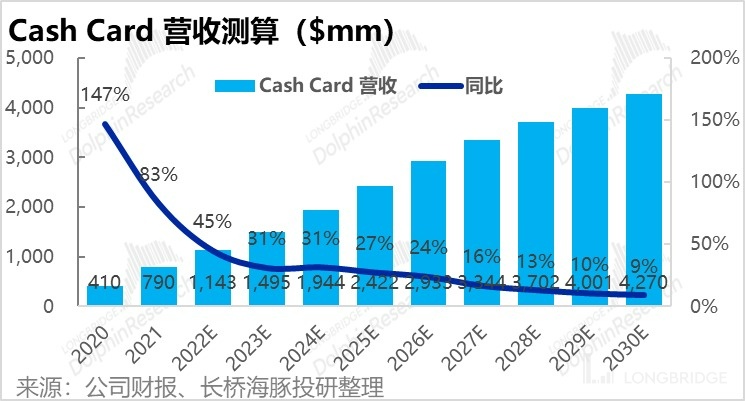

1) Cash Card Debit Card Business: The forecast logic for this business is Cash Card revenue = Cash App total users * Cash Card penetration rate * per capita card payment amount * company commission. According to the company's disclosure, the current monthly active users of Cash Card are around 15 million, and the penetration rate has increased from about 17% in 2018 to nearly 33% currently. Dolphin Analyst believes that since Cash Card (i.e. ordinary debit cards) has a wide applicability and can greatly facilitate the use of funds within Cash App, the penetration rate of Cash Card is expected to further increase. We assume a conservative scenario that the penetration rate of Cash Card will slowly increase to 44% by 2030.

According to industry estimates, the average annual card usage amount of Cash Card is currently about $5,000 per person. I believe that during the high period of the user growth of Cash Card, the growth of the average card usage amount will be dragged down by a large number of new users. Only after the number of users stabilizes will it accelerate growth with the development of user habits, and reach around $9,000 per year by 2030.

In the Cash Card business, the company's role is the issuer, and therefore receives a fee of approximately 1%-1.5% for each Cash Card transaction. In the long run, the fee rate should slowly decrease as the scale increases.

Based on the above key assumptions, driven by all three factors of user volume, penetration rate, and average usage amount having room for growth, we predict that Cash Card's revenue is expected to increase from less than $800 million in 2021 to $4.3 billion in 2030.

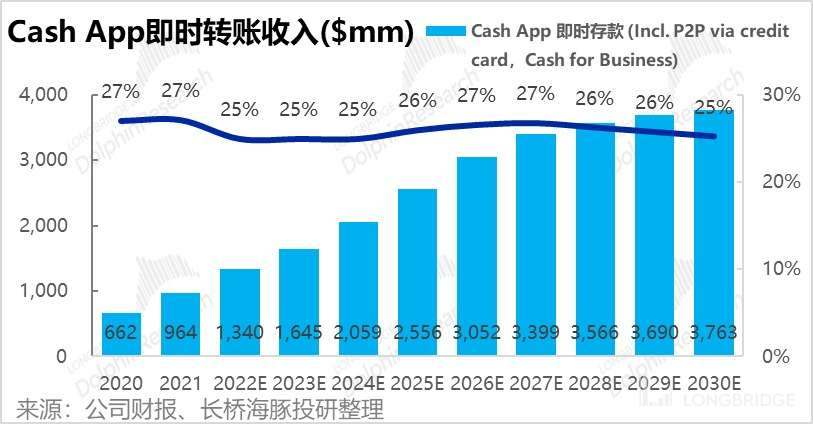

2) Instant transfer income: The income received by the company for the service fee when users transfer funds from Cash App to their bank accounts. The prediction logic can be divided into instant transfer income = total amount of funds flowing within Cash App * transfer-to-bank ratio * service fee rate.

Regarding the frequency of using instant transfer, we believe that unlike commercial users whose demand for instant arrival may decrease as the scale grows, as personal users retain more funds in their Cash App accounts, the demand for transferring funds from their accounts to their banks may increase. As for the fee rate, we still believe that it will slowly decrease.

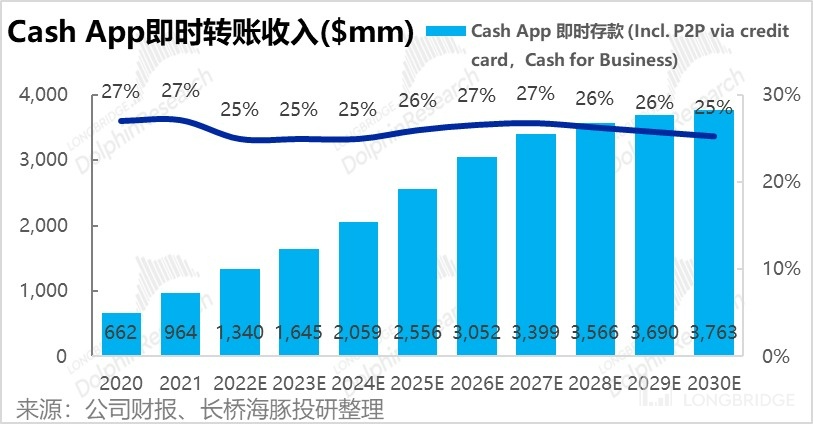

Based on the above assumptions, we predict that Cash App's instant deposit income is expected to increase from $960 million in 2021 to $3.8 billion in 2030.

3) Cash App Pay B2C payment business: Customers make payments directly to merchants through Cash App (excluding through the bound Cash Card), and the company collects payment fees from merchants based on the payment amount. This mode is similar to Alipay and WeChat's QR code payment in China and represents the "highest level" of digital wallets. However, the core functions of current US digital wallets are mainly limited to P2P transfers, with very low penetration of B2C payments. Although B2C payments for digital wallets have immense room for growth, progress in the short term is not easy.

However, one of Block's core advantages is that the company has both B-side merchant payment business and C-end digital wallet business. The company can first promote Cash App Pay within Square merchants through internal cooperation, create stable payment scenarios and user usage habits, and then use Cash App's vast number of C-end users to gradually force non-Square merchants to accept Cash App Pay.

Furthermore, Cash App Pay no longer relies entirely on bank cards, so the company's share of the transaction fee paid to issuing banks can be reduced, allowing for more profit retention than traditional B2C payment businesses.

Based on the above analysis, we predict that the Cash App Pay business scale will not grow rapidly in the next few years, but in the medium to long term, as the C2B payment scenario for digital wallets becomes more widespread, Cash App Pay business growth will increase.

Assuming that the per capita annual payment amount for Cash App Pay increases to $940 by 2030 (estimated to be 3% of the per capita consumption level in the United States, according to Dolphin Analyst), then Cash App's revenue is expected to reach nearly $2.5 billion in 2030.

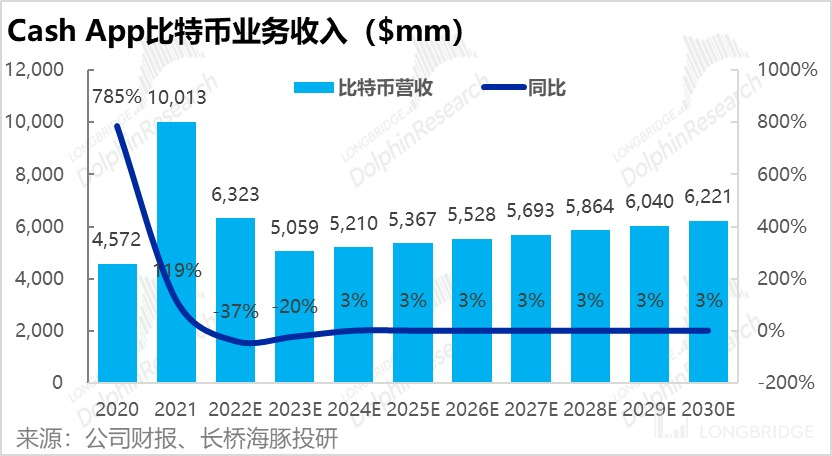

- Bitcoin business: Due to the high uncertainty of Bitcoin prices and trading volumes, and the company's direct participation in investment, rather than the role of the most transaction intermediary, further increases the risk of this business. The capital market generally does not regard Bitcoin business as Block's core business. Moreover, after the Fed drastically reduced liquidity, speculative funds flowing into the currency circle are also flowing out significantly. Therefore, we conservatively estimate that the company's Bitcoin business revenue in 2022 and 2023 will decrease significantly compared to the previous year and return to the level of 2020. In the future, we assume that the revenue growth rate of the Bitcoin business will remain at a very low level of around 3%.

Three, AfterPay, internationalization, Spiral, Tidal, TBD - how much more is there to Block's story?

In addition to the above two core ecosystems of Square and Cash App, Block's other business lines and international business have been actively expanding in recent years. In January of this year, Block completed the acquisition of Afterpay, a buy-now-pay-later company. In addition, Block has acquired Tidal, a music streaming platform, in recent years, and launched Spiral and TBD open-source development platforms to promote the development of Bitcoin and decentralized information exchange technologies.

However, Tidal, Spiral and TBD currently belong to experimental business and are not related to the company's core digital payment business. Therefore, we will not discuss these three businesses in detail, and the following article will mainly focus on AfterPay and the prospects of the company's international business.

1. Acquisition of AfterPay for Strong Complementarity

AfterPay, which specializes in buy-now-pay-later services, is similar to the interest-free installment payment of Huabei or JD white bill in China. Its business model is that when a customer purchases a product, AfterPay first advances the payment to the merchant, deducting a portion as a handling fee, which is also the company's source of revenue. The customer then pays the amount to AfterPay in installments without interest. Therefore, the commercial essence of buy-now-pay-later is that the merchant pays a certain service fee to the buy-now-pay-later company, which stimulates customer consumption by providing installment payment services and transfers the risk of the accounts receivable to the buy-now-pay-later company; For C-end users, they can browse shopping in the AfterPay application and enjoy interest-free installment shopping services.

So what is the intention behind Block's acquisition of AfterPay, and what synergies can be generated after the two companies merge?

In general, Dolphin Analyst believes that AfterPay, as a business that combines both C-end and B-end resources, can help Block better and faster integrate the company's existing Square merchant ecosystem and Cash App consumer ecosystem. For details, see below:

1) Sharing of user resources: First of all, according to the company's disclosure, AfterPay has a total of 20 million users worldwide, of which only 32% are also Cash App users, so the overlap between AfterPay and Cash App users is not high. Both have tens of millions of users and have the potential to convert each other and increase the user base of AfterPay and Cash App at the same time.

2) Introducing buy-now-pay-later to enrich product types: In addition to the conversion of C-end users, the buy-now-pay-later business obtained through the acquisition of AfterPay can also enrich the breadth of services provided by the company to existing C-end and B-end users.

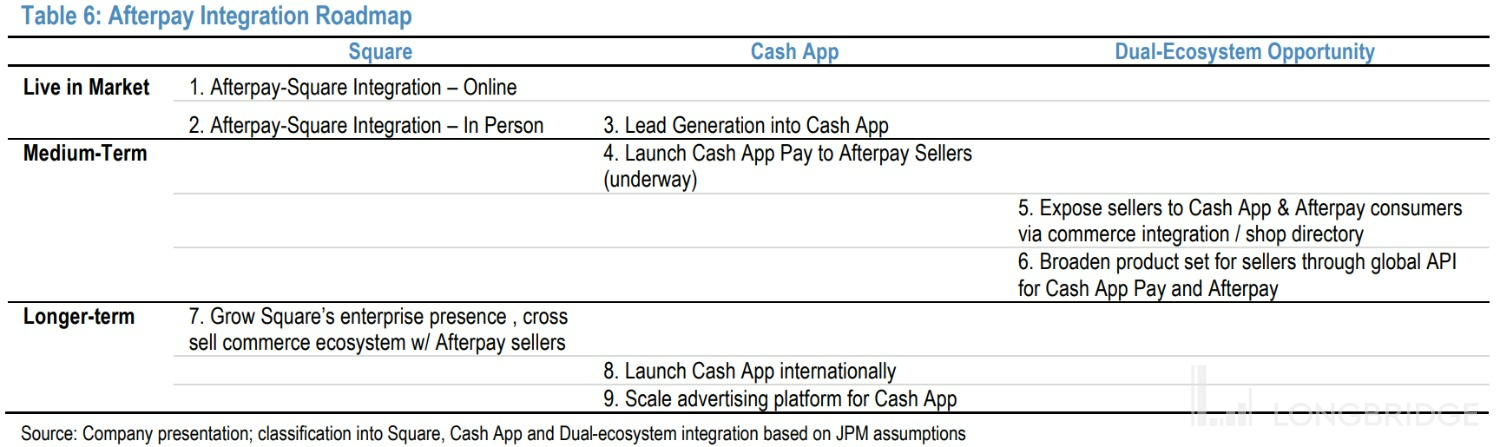

The table below shows the company's short, medium, and long-term integration plans. In the C-end, by integrating AfterPay's installment payment function into Cash App, it can make up for the lack of online shopping and payment scenarios in Cash App, and also promote the company's Cash App Pay payment function to AfterPay merchants. In the B-end, the company can provide buy-now-pay-later services to existing Square merchants, and both can promote Square's other services to AfterPay merchants. 3) AfterPay Benefits International Development of Block Business:

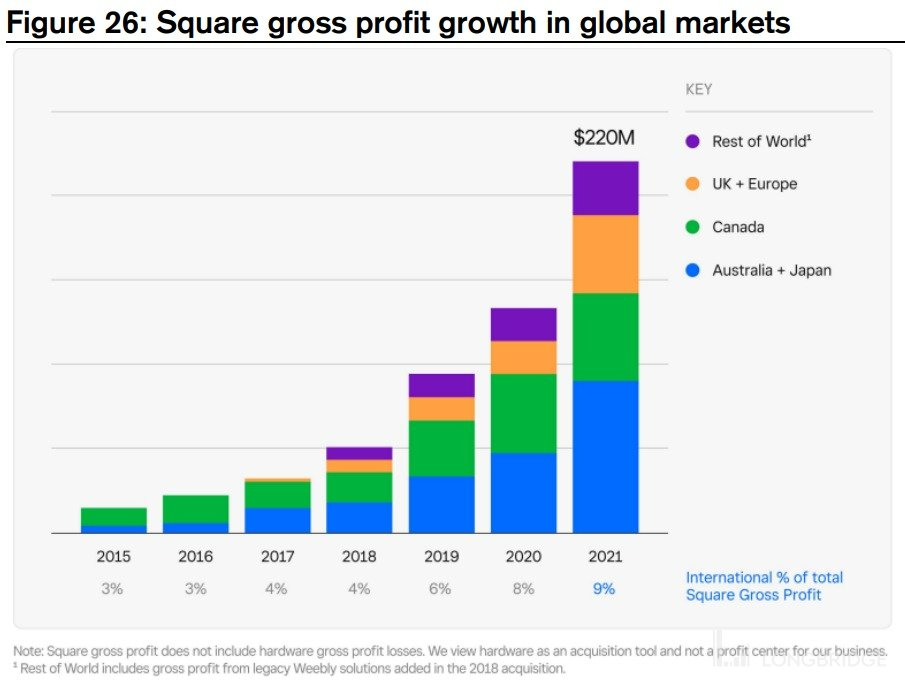

In addition to having enormous development potential in the United States, Block is also promoting merchant payment services in Canada, Europe, and the Asia-Pacific region (with the international promotion of Cash App on the C side being relatively more difficult). In 2021, gross profit from outside the United States accounted for 9% of the company's total gross profit.

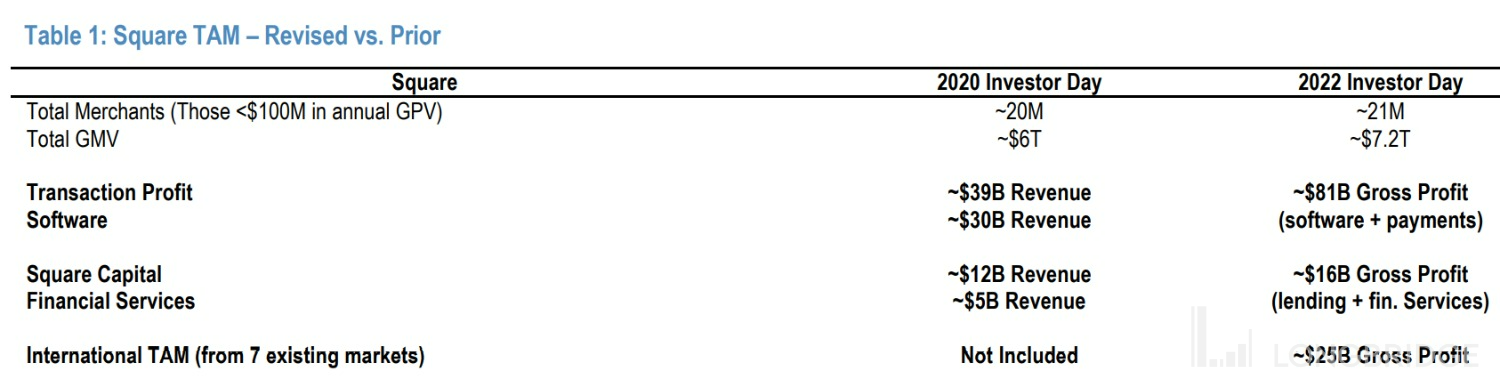

According to the information recently disclosed by the company at the 2022 Investor Day, the potential market size of Square in seven other countries outside the United States is $25 billion (gross profit margin basis), equivalent to one-third of the United States.

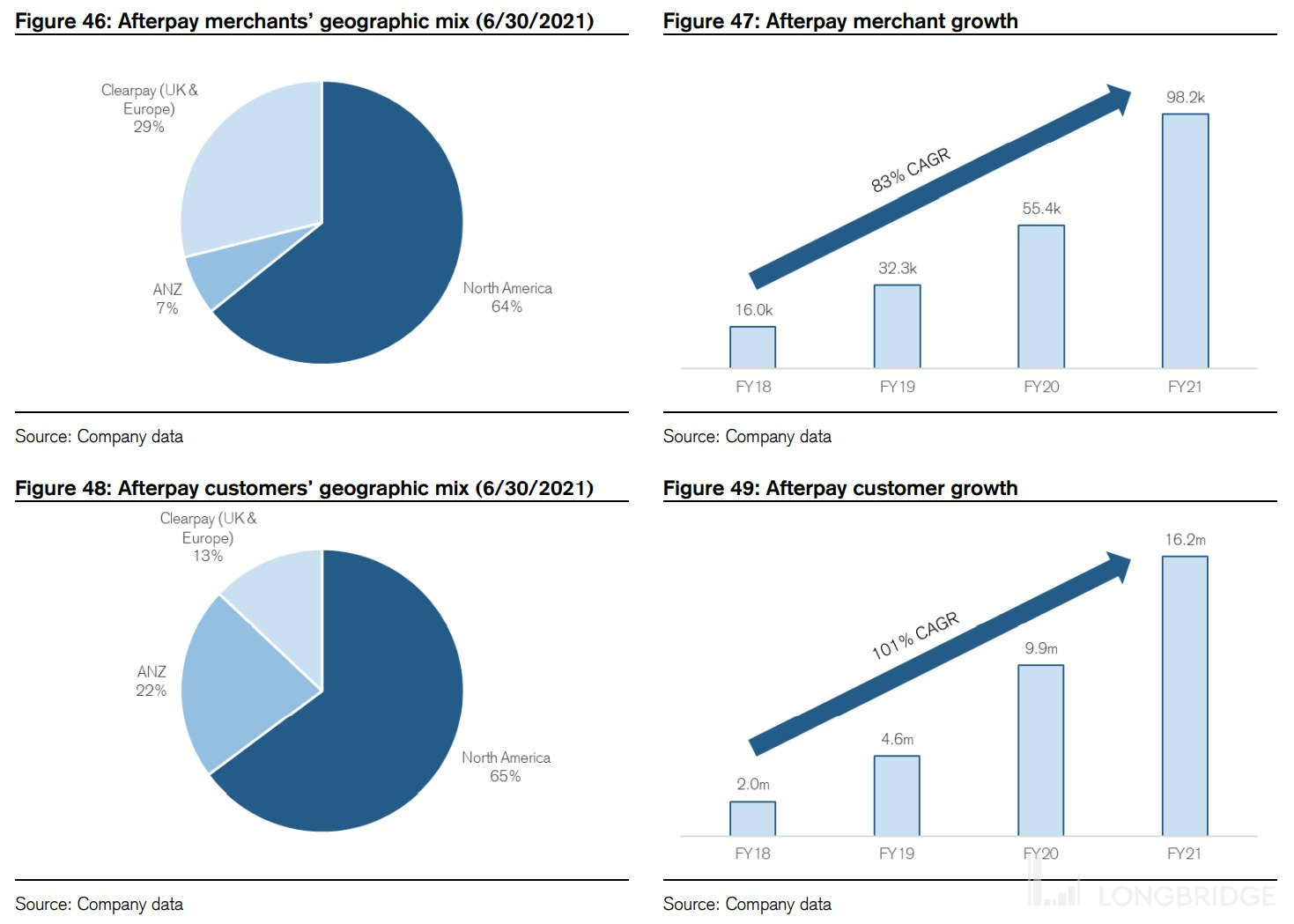

In AfterPay's merchant structure, 36% are in the UK and the Asia-Pacific region, and the company can help expand Square's business overseas by leveraging AfterPay's existing merchant resources.

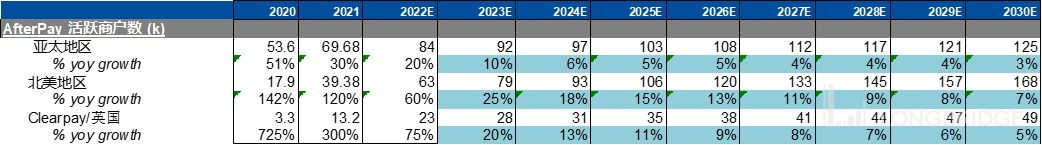

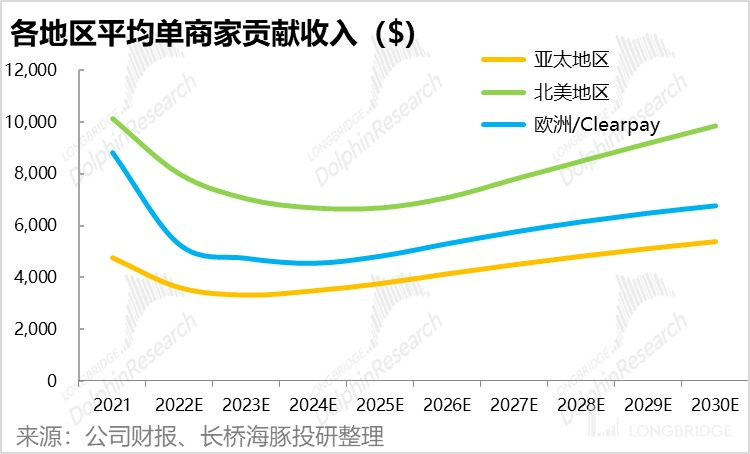

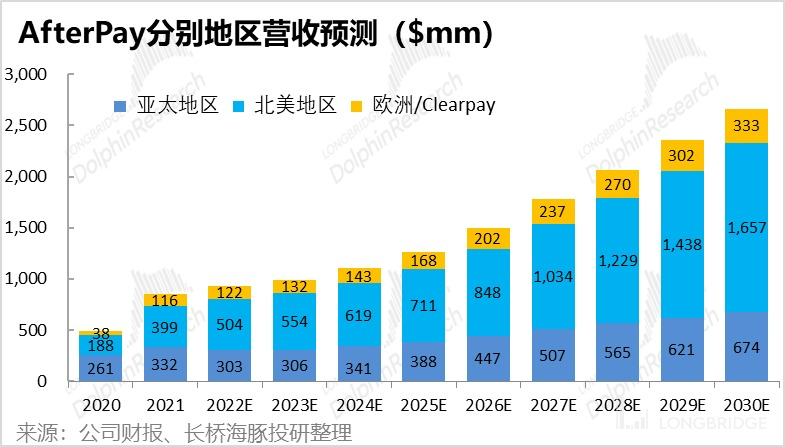

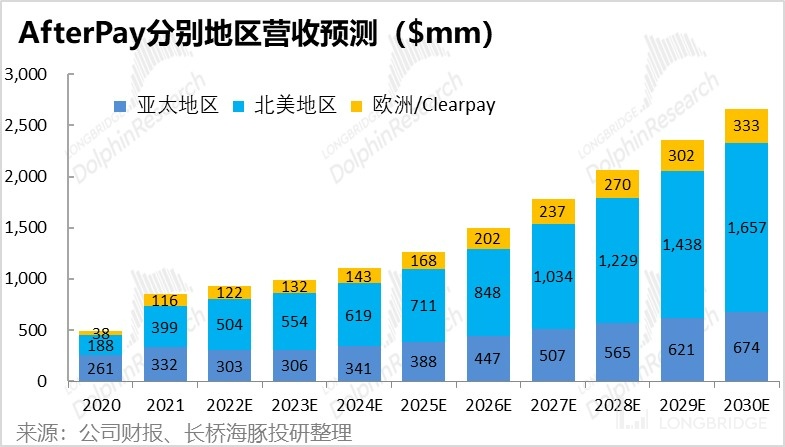

As for AfterPay's revenue forecast, the revenue channel factors of AfterPay revenue can be split into AfterPay revenue = number of merchants * single merchant GMV * company take rate. Block's abundant merchant resources in North America help to improve the usage scenarios of AfterPay, and we expect AfterPay to achieve the fastest growth in North America. Growth in the UK and Europe is relatively slower than in the United States; while in Australia, the business is already quite mature, and the economic growth potential in the region is lower than in Europe and the United States, so the growth rate in the Asia-Pacific region is expected to be the lowest. Detailed forecasts are as follows.

At the same time, we expect that the recent decline in single merchant GMV contribution will be under pressure due to the growth of new merchant numbers, and that single merchant GMV will accelerate growth again after the merchant growth rate slows down. Based on the assumptions above, Dolphin Analyst estimates that AfterPay's total revenue is expected to increase from 850 million in 2021 to 2.66 billion in 2030, of which 1.25 billion will come from North America.

IV. Profit and Valuation Forecast

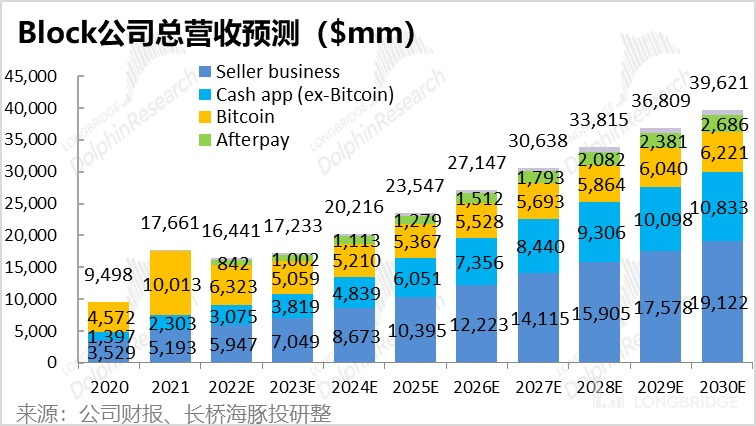

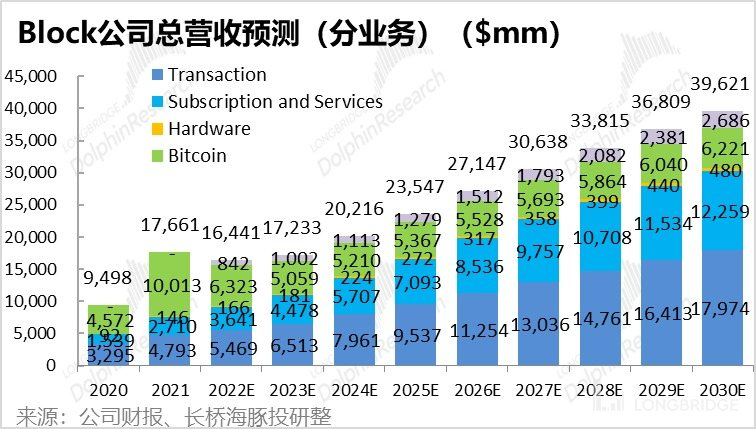

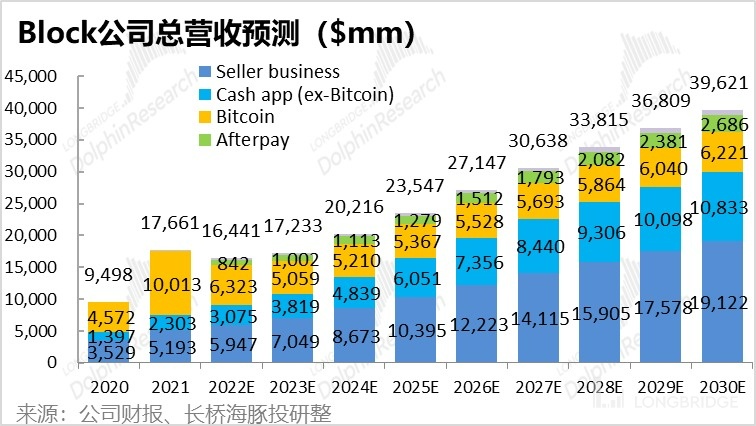

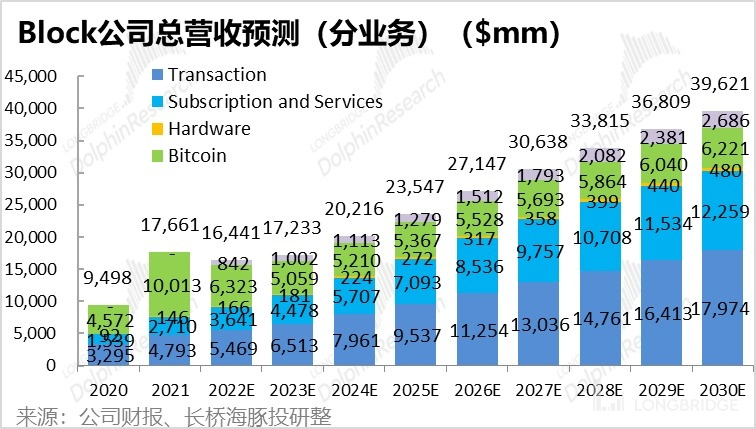

Based on the above forecasts of Block's various businesses, we expect Block's total revenue to grow from 17.7 billion in 2021 to 38.7 billion in 2030; however, if we exclude the impact of Bitcoin business, the company's revenue will increase from 7.6 billion to 39.6 billion, with a growth potential of 4.2 times.

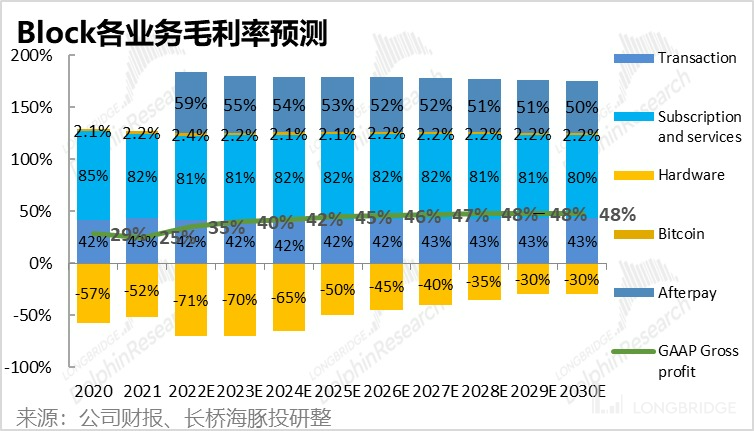

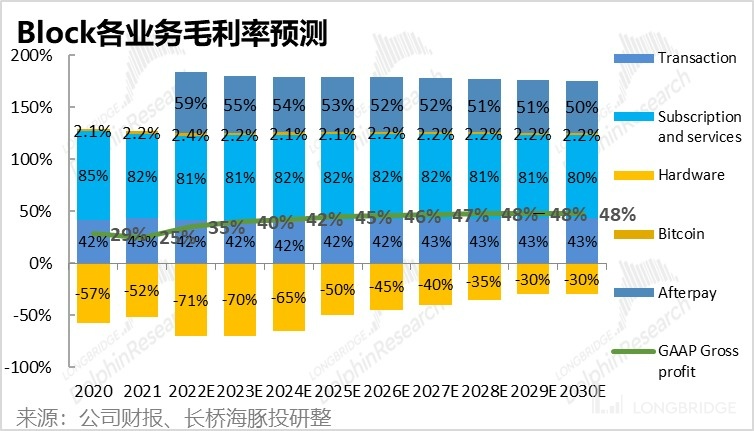

Regarding gross profit margin, Dolphin also made separate forecasts for each business, but due to space limitations, we will not elaborate here, only give the logic of the forecast.

As Dolphin believes that the various payment processing fees of the company all have a long-term trend of downward, we conservatively estimate that the gross profit margins of each business will slowly decrease. For the hardware business, Dolphin believes that after the company's growth stabilizes, it should gradually reduce its subsidy efforts, so we expect the gross loss margin to narrow from around -50% to -30%.

However, due to changes in the revenue structure, the proportion of low-margin businesses (such as Bitcoin, hardware sales, and payment processing fee income) will decrease, while the proportion of high-margin subscription and other services will increase, resulting in an overall upward trend in the company's gross profit margin. The following is a detailed forecast of the gross profit margin.

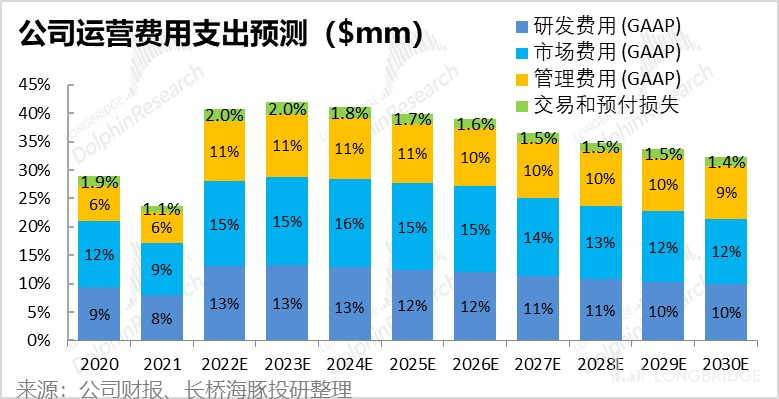

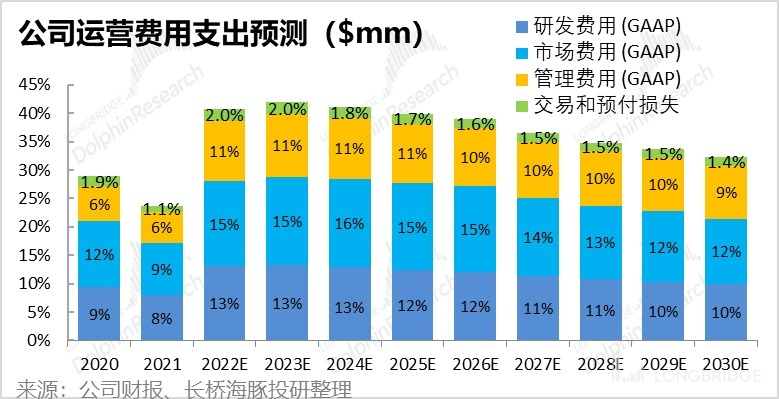

As for the company's three expense items - operating expenses, selling and marketing expenses, and general and administrative expenses - due to the acquisition of AfterPay and the company's attempt to cultivate multiple new businesses, and the simultaneous expansion of multiple business lines, the three expenses will rapidly expand. According to the company's management guidance, Non-GAAP three expenses will reach around $5.5 billion in 2022, compared with $3.4 billion in the same period in 2021, indicating the significant expansion of expenses.

Regarding the increase in management and research and development expenses, Dolphin believes that it is mainly due to the growth of the company's business lines, the development needs arising from the merger of AfterPay and Cash App, among other factors.

With regard to the increase in marketing expenses, the company's explanation is that, 1) The Square business is becoming more convenient, and with the growing scale of service merchants, they require more customized services tailored to their specific industries rather than general services suitable for small and micro businesses. Accordingly, the company is transitioning from a sales team composed of generalists to one composed of industry-specific specialists. In order to increase the number of places where Cash App Pay can be used, the company has increased its ground promotion efforts to bring Cash App Pay to more merchants (including those outside of the Square system). According to the company, sales personnel may double as a result.

Therefore, the company's three expense expenditures will expand significantly in 2022-2024, seriously affecting the company's operating profit. However, Dolphin Analyst believes that as the company's new business gradually matures and the company's revenue scale expands, three expense expenditures will steadily decline, and operating leverage will reappear.

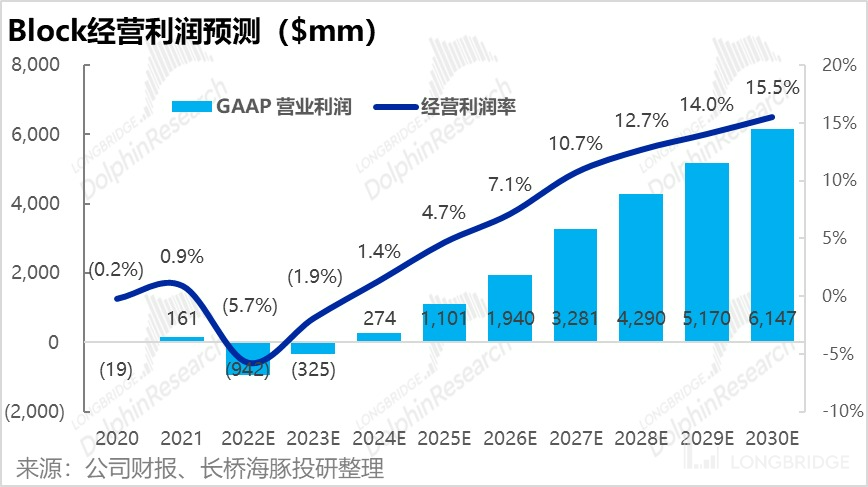

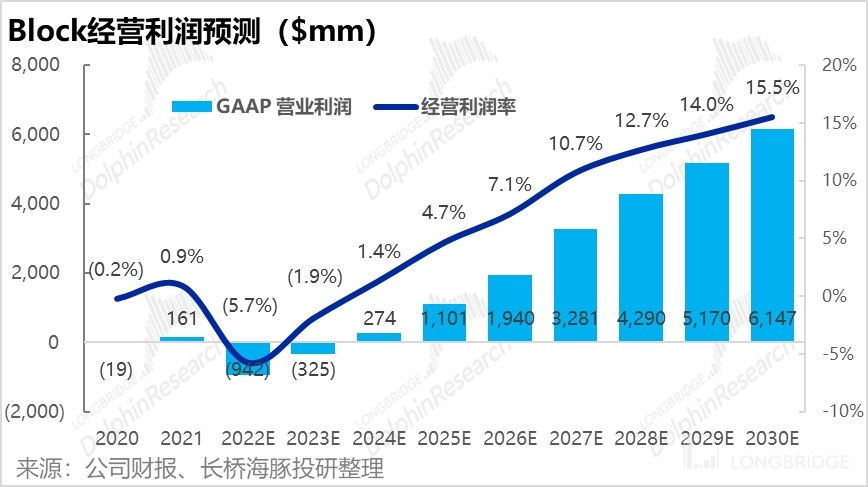

Combined with our previous forecasts for revenue and gross profit, and the significant expansion of three expenses in the near future, Dolphin Analyst predicts that Block's operating profit will have a significant loss in 2022-2023, but will return to positive by 2024. And by 2030, the operating profit margin is expected to reach 15.5%.

Based on the above neutral performance forecasts and valuation, considering that it will increase its marketing expenses later, enter a new investment period, and expand new businesses, Dolphin Analyst uses the profit after turning losses in 2024 as the starting point to discount cash flows, corresponding to a single share value of 56 US dollars with a perpetual growth rate of 3% and a discount rate of 11%. Compared with the stock price of 65 US dollars, there is still about 15% discount space.

Overall, mobile payments in the United States have skyrocketed under speculative hype, but the fundamental acceptance and popularity of mobile payments, especially among users, is far below that of China, resulting in slow progress, and mobile payments are mostly targeted at enterprises, with weak overall logic. Square has a vast sea ahead, but it has been in a rush mode for a long time, and now it has entered a new investment period, which is marginally downward from a financial perspective, and the current valuation is still significantly overpriced.

Previous Articles:

2022-06-21《 Million-choice payment: Who can stand out between Square and PayPal 》

Risk Disclosure and Declaration of this Article: Dolphin Investment Research Disclaimer and General Disclosure