Microsoft: The confidence beneath the software paralysis

Microsoft $Microsoft.US announced its Q4 2022 financial results as of the end of June after the U.S. stock market closed on July 27, with the following highlights:

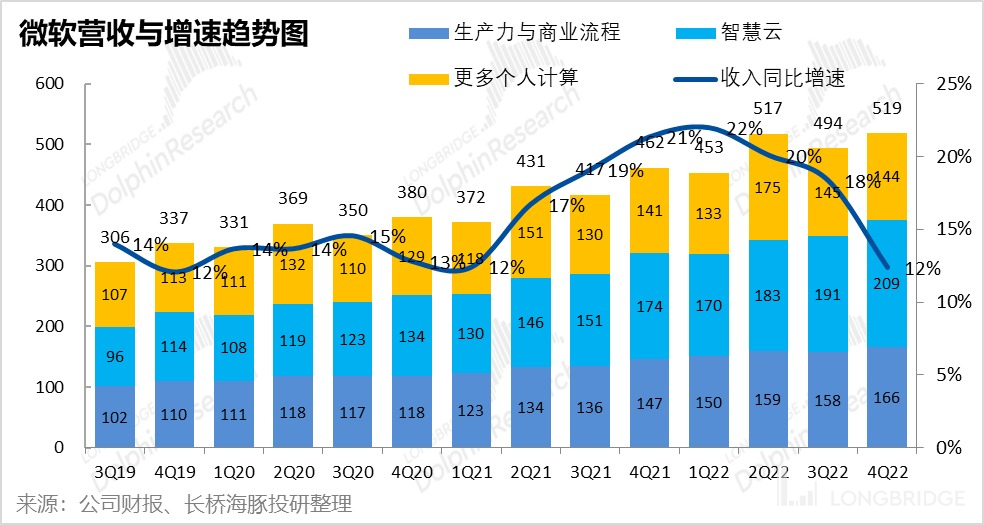

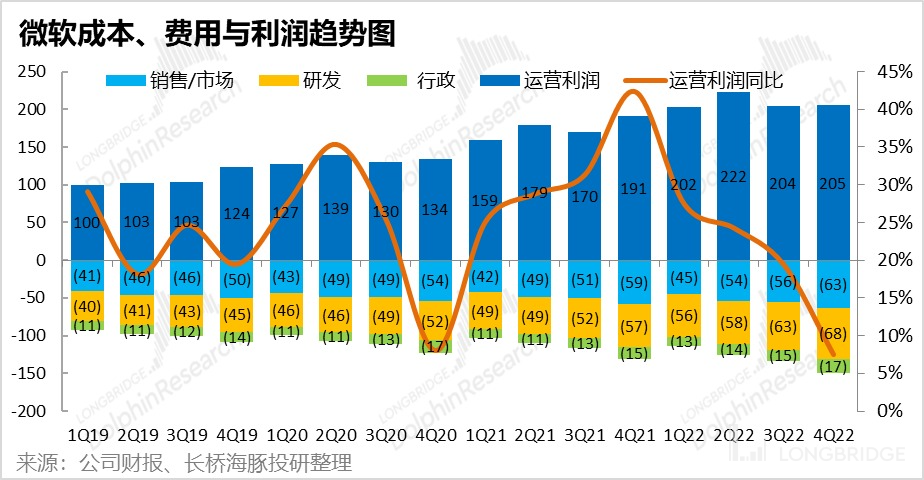

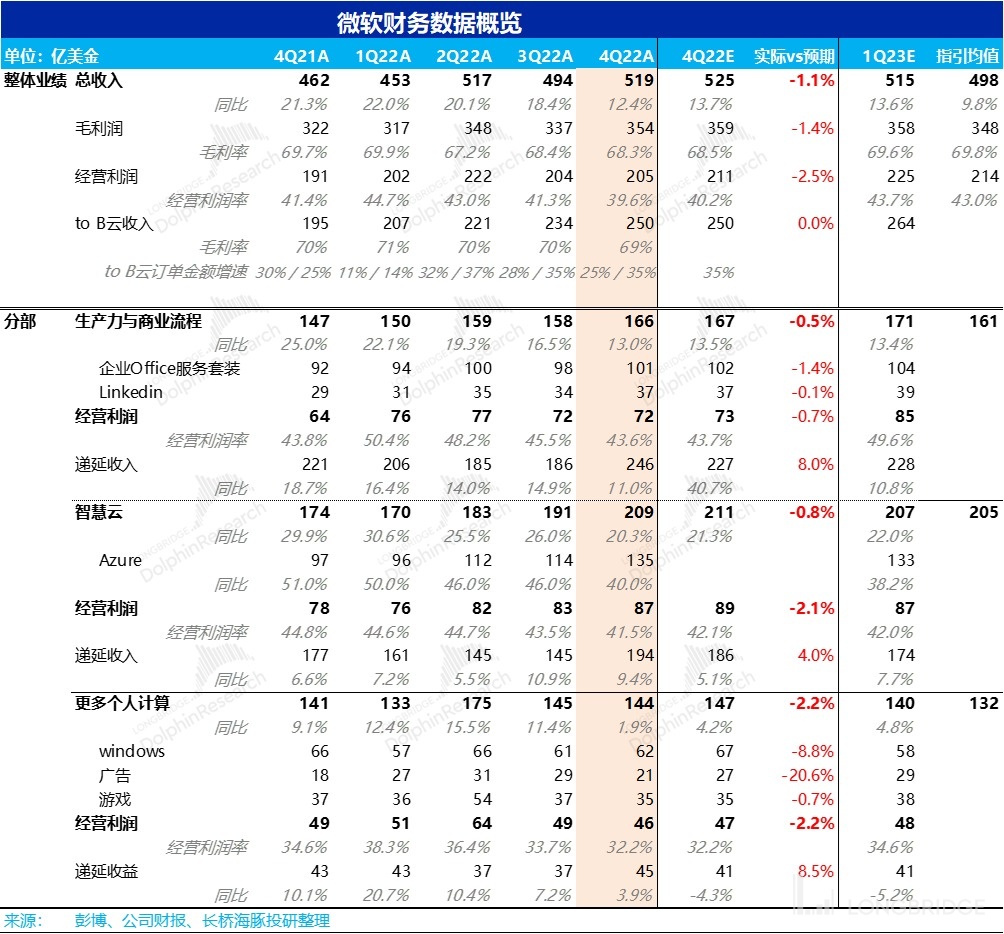

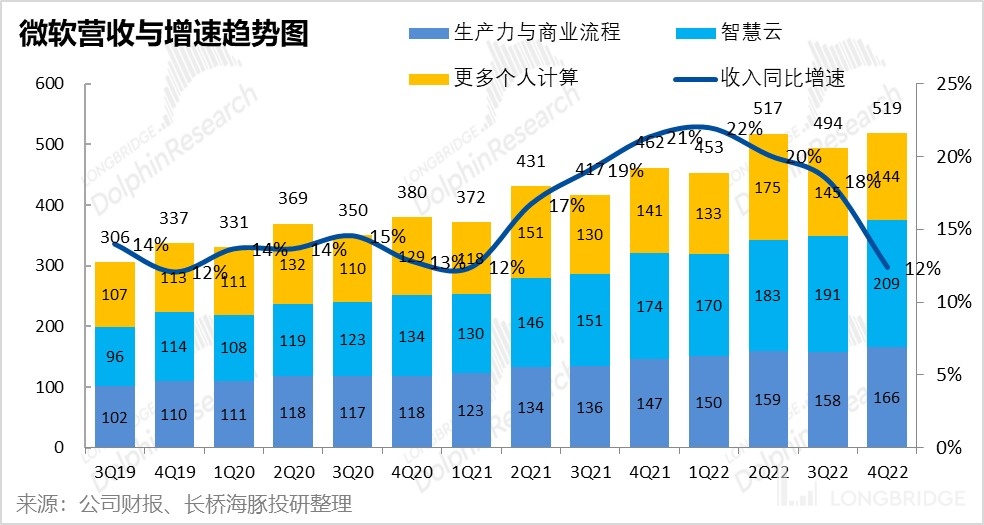

1.Overall performance slightly below expectations: Microsoft achieved a total revenue of USD 51.9 billion this quarter, slightly lower than the market expectation of USD 52.5 billion. The operating profit this quarter was CNY 20.5 billion, also slightly below the expected CNY 21.1 billion. The main reason for the below-expectation performance was the negative impact of inflation in Europe and the United States, the COVID-19 pandemic in China, and the appreciation of the U.S. dollar in the macro background on the company's revenue, which was greater than expected.

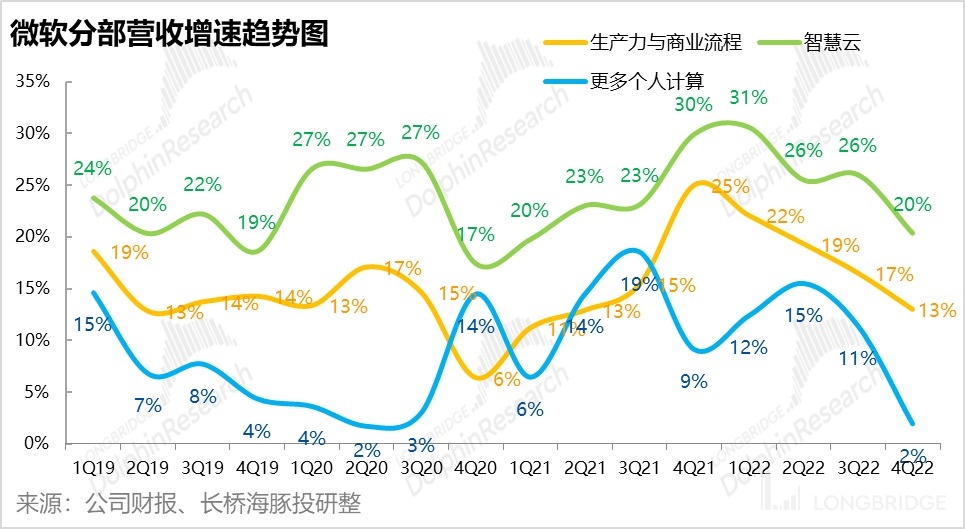

2.All business units have slowed down; 2B business is relatively resilient: Due to the slowdown in economic growth and the decline in investment in IT facilities such as cloud services by European and American companies due to the Fed's liquidity reduction, Azure cloud services and the enterprise version of Office 365 services in Microsoft's core businesses have experienced significantly slower revenue growth this quarter, but still maintained growth rates of 40% and 15%, respectively. The C-end personal computing business had the worst resilience in the downturn, with only 2% growth this quarter.

3.Revenue growth slowed this quarter, but deferred revenue accelerated expansion: Whether it is the remaining USD 189 billion contract balance at the end of this quarter or the USD 74.1 billion newly signed 2B contracts this quarter, both set historical new highs year-on-year and quarter-on-quarter, and even accelerated growth. The growth of contract amount, combined with the slowdown in revenue growth, indicates that enterprises have only postponed rather than cancelled their IT-related investments under the unfavorable macro environment. The trend towards cloudification and SaaS remains very stable in the long run. Therefore, the long-term certainty of Microsoft's performance remains high.

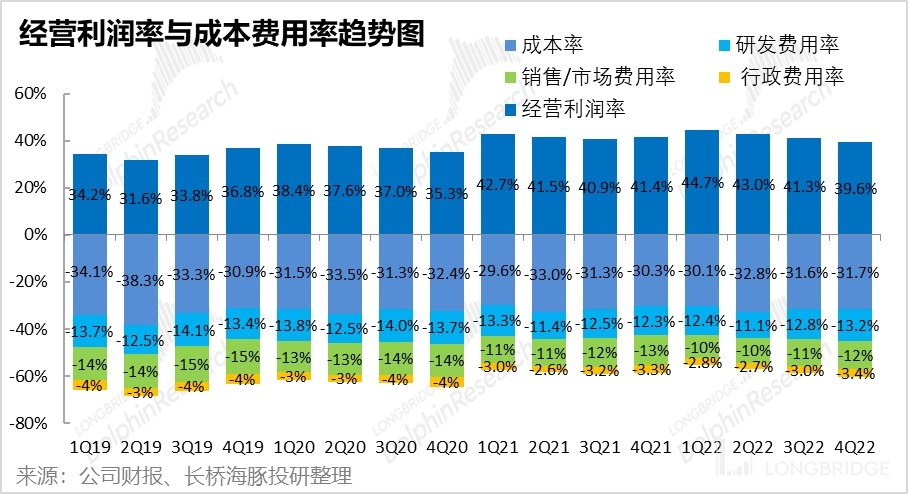

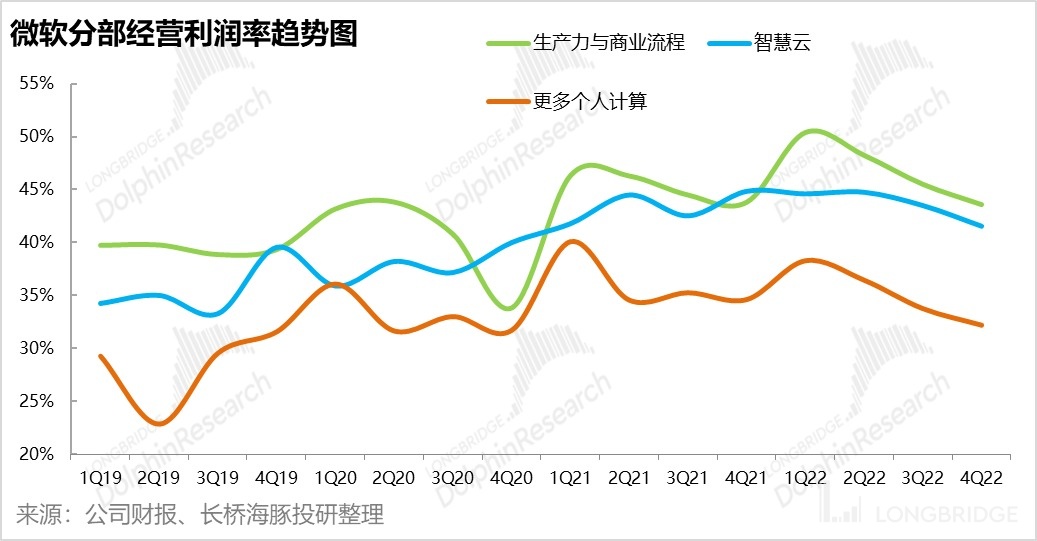

4.Revenue guidance for next quarter continues to slow down, but annual guidance improves significantly: For the next quarter, the impact of the slowdown in economic growth will continue to be released, leading to a further decline in revenue growth rate. At the same time, Microsoft will continue to take cost control measures to partially offset the impact of inflation and avoid further dragging down profits, resulting in a slight decline in the company's operating profit margin to 43%.

However, for the full year of FY2023, the company expects revenue and operating profit to grow by double digits, and the single-digit growth rate given for Q1 guidance indicates that the revenue and operating profit growth rate for the remaining quarters of FY2023 is expected to significantly improve to achieve the full-year target.

One-sentence summary: Although Microsoft's performance this quarter was disappointing, it was mainly due to short-term headwinds in the macro environment. The logic of the company's 2B cloud business remains strong, and Microsoft is still the most resilient and certain target in the U.S. stock market.

Dolphin Analyst will share the summary of the conference call with Dolphin users through the Longbridge App, and users who are interested in it can add the WeChat account "dolphinR123" to join the Dolphin Investment Research Group and get the summary of the conference call in the first time. 1. Introduction to Microsoft's business structure

Due to the complexity of Microsoft's business, you can first get a brief understanding of Microsoft's business structure and status through the following figure, so as to better understand the following text.

Among the many assets mentioned above:

-

The "Productivity and Business Processes" business, mainly consisting of Office, has gradually transformed from traditional software to cloud-based and subscription-based SaaS models, and has become a major highlight of the company's performance in the cloud era.

-

Azure, the core of the intelligent cloud business, is also the biggest support point for Microsoft's revitalization, and Azure is still on a high-speed growth trajectory. These two key businesses form the two core pillars of Microsoft's charge in the cloud era, which are the highlights of Microsoft's quarterly financial reports.

-

More personal computing businesses, such as Surface, Xbox, gaming, Bing search, and Windows, are mostly assets left over from Microsoft's failed attempts in the mobile era, and have the lowest strategic position among the three major businesses.

2. Performance of core businesses

1. Cloud business growth has slowed down due to economic slowdown pressure, with growth rate falling as expected

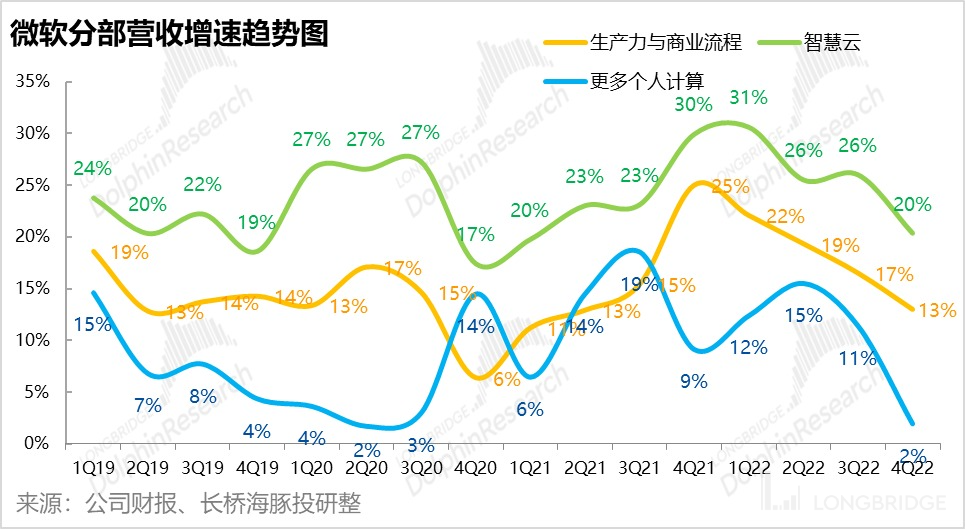

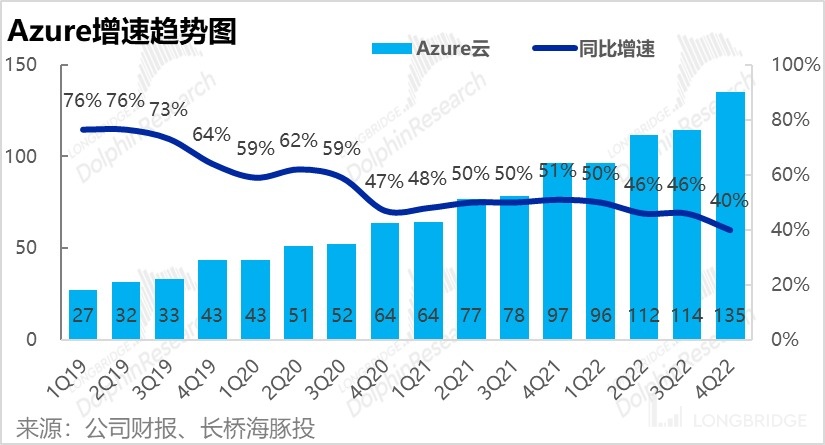

Let's first look at Microsoft's most core and revenue-contributing intelligent cloud business: Azure, the flagship product. In early 2021, it passed through the outbreak of the epidemic and entered the "prosperity" phase of major investment, with a growth rate once soaring to over 50%. However, after the U.S. Federal Reserve hinted at tightening liquidity and enterprises' expectations of economic growth turned weak, Azure's growth rate has been declining, and this quarter it has dropped from 46% in the previous quarter to 40%.

In Dolphin Analyst's view, the sellers' expectation for Azure's growth rate is generally low 40%, and it has barely met the market expectation's lower limit.

However, considering that Azure's revenue scale has reached $13.5 billion, under the suppression of such a large base and macroeconomic negative factors, a YoY growth rate of 40% is still considerable. And after excluding the negative impact of the appreciating US dollar caused by the interest rate hike, Azure's revenue growth rate was actually 46%, only slightly lower than the 49% in the previous quarter.

Overall, the Azure business this quarter was only slightly less satisfactory than its previous impressive performance and the market's resilient performance.

Due to the slowdown in the growth rate of the Azure business, as well as the shrinking revenue growth rate of non-Azure services (SQL Server, Visual Studio, etc.) from low double-digit growth in the previous quarter to -3% this quarter, the overall revenue of the intelligent cloud business in this quarter was $20.9 billion, slightly lower than the market's expected revenue of $21.1 billion. 2. Is the bonus of Office Business Cloudification fading away?

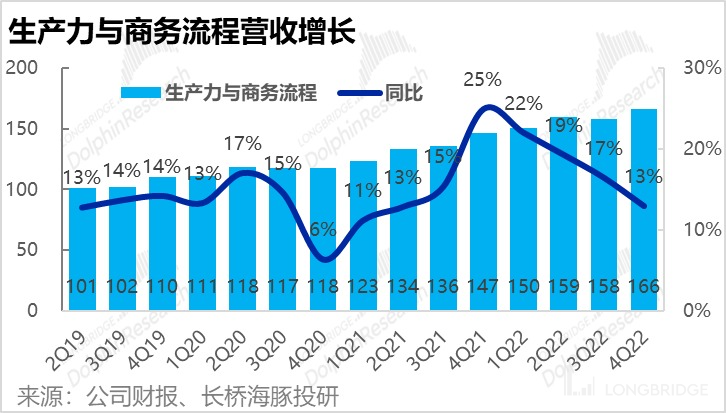

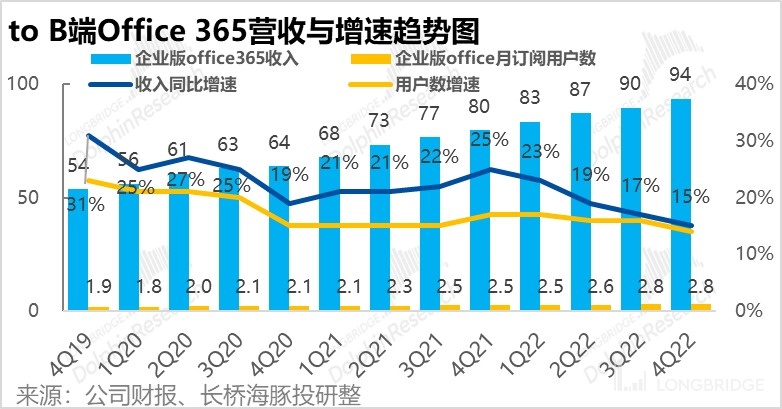

The year 2022 fourth quarter saw that Microsoft's SaaS product Office 365, designed for enterprises, generated a revenue of USD 9.4 billion, a YoY growth of 15%. In the late phase of cloudification bonus, the revenue growth rate continued to slow down.

This business growth is driven primarily by two factors: ①growth in the number of enterprise subscription users for Office 365; ②average revenue generated by a single enterprise user, ASP.

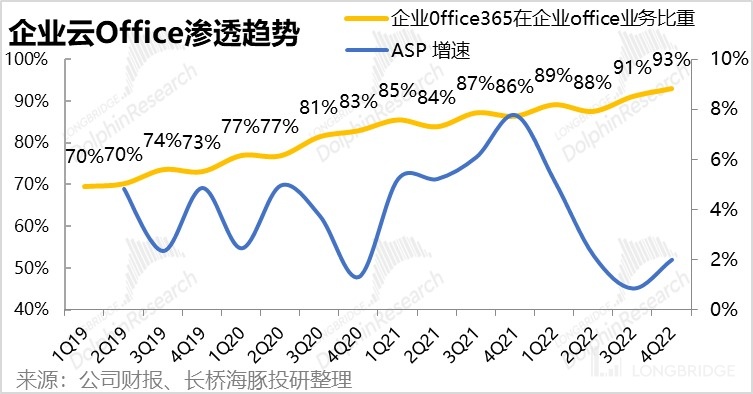

By the end of this quarter, although the monthly subscription customer of Office enterprise grew by 14% YoY, the number of enterprise users worldwide using Office 365 remained at about 285 million, with almost no growth QoQ. Under the current circumstances, cloud adoption by enterprises is temporarily stagnating.

At the same time, the rate of increase in customer unit price has also hit a bottleneck, growing only 1-2% since the second quarter of the fiscal year 2022 (as the US dollar remained strong, offsetting the impact of the increase in Office product prices). This growth rate has clearly slowed down compared to the previous 5-8% per quarter.

In this quarter, cloud-based Office 365 accounted for 93% of the overall revenue of enterprise Office, and the space for further increase in the proportion is very limited.

It is clear that the Office cloudification bonus is estimated to have gradually reached its peak. Subsequent growth may rely more on an increase in the customer unit price (product price increase + increased product usage by single user).

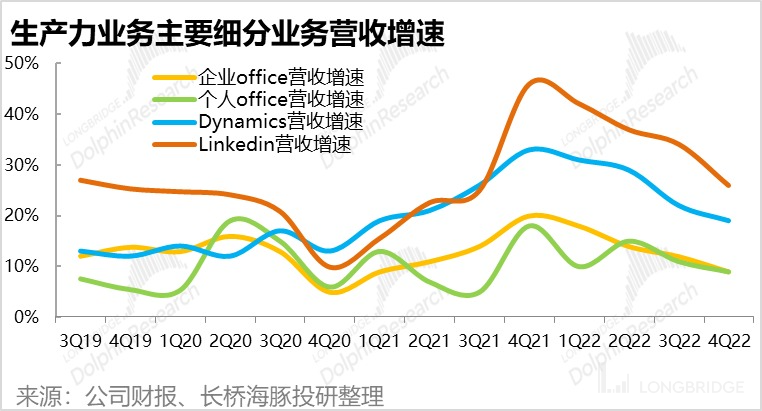

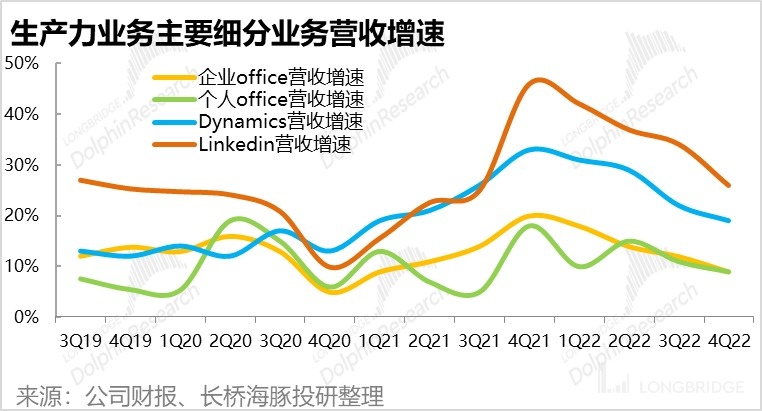

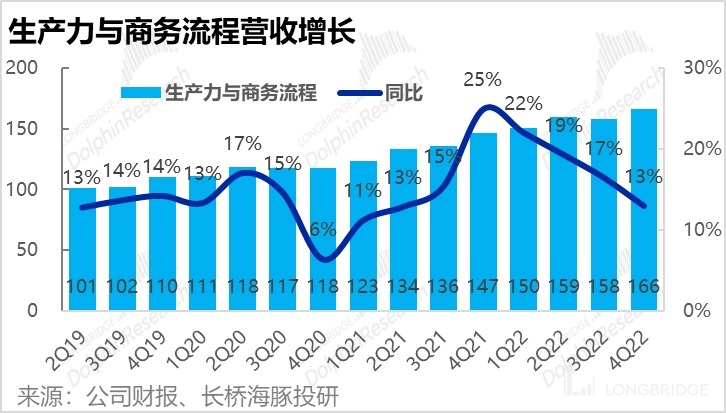

Apart from the core enterprise Office business, other businesses within the productivity and business processes sector have also exhibited similar revenue growth slowdowns.

Among them, the LinkedIn business with the highest absolute growth rate generated revenue of USD 3.7 billion this quarter, and its growth rate dropped from 34% in the previous quarter to 26%, corresponding to the macro environment of weakening corporate recruitment demand.

At the same time, the growth rate of Dynamics, the ERP/CRM product, has also slightly declined from 22% to 19%.

As the growth rate of each sub-segment business has slowed down, the overall revenue of Microsoft’s productivity and business process segment this quarter was CNY 16.6 billion, basically in line with the market's expectation of CNY 16.7 billion, and the YoY growth rate continued to decline from the previous quarter's 17% to 13%.

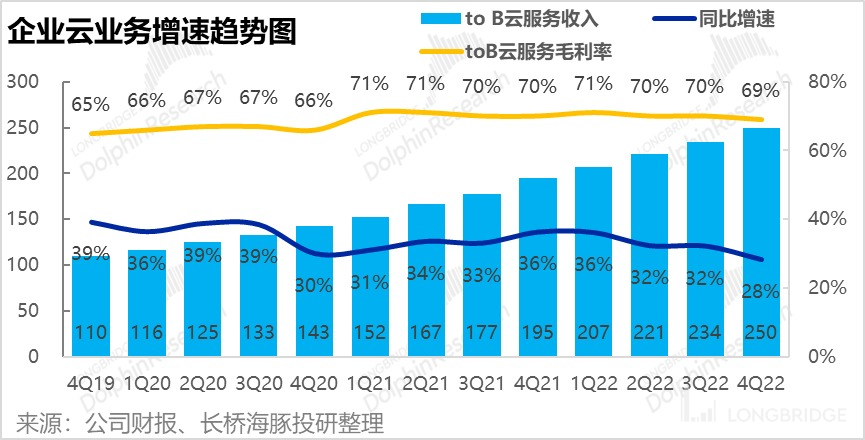

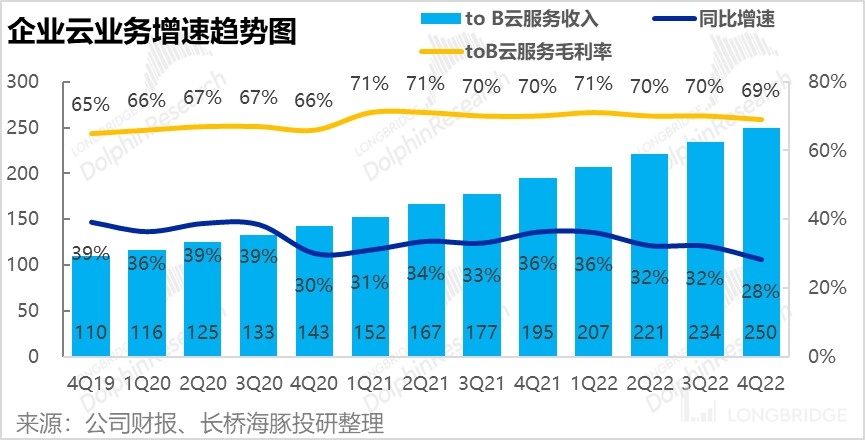

3. Enterprise (Industry) Cloud Service Penetration Rate Continues to Increase, but with Some Slowing

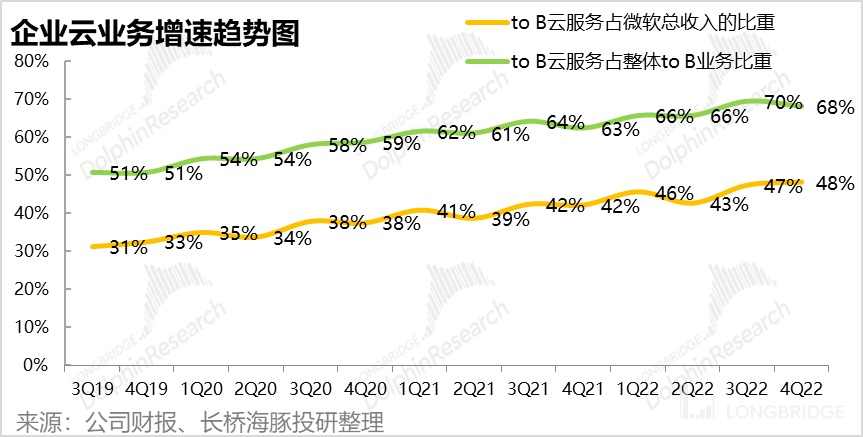

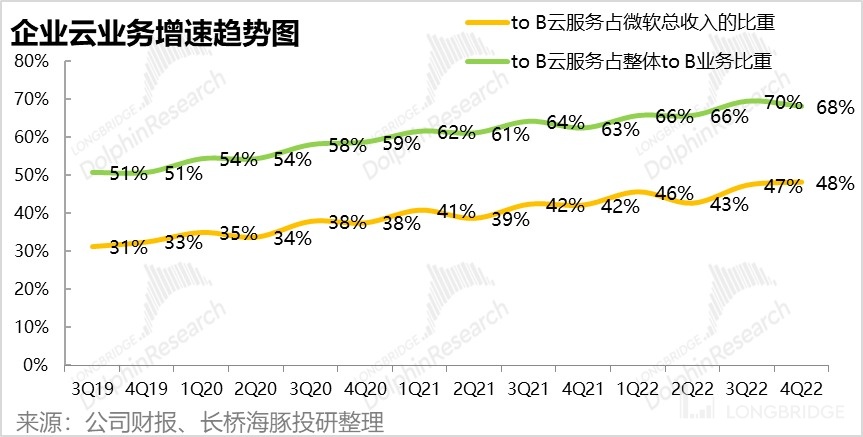

To better evaluate the performance of cloud-based businesses, Microsoft aggregated enterprise cloud service revenue from the Smart Cloud and Productivity segments (including Enterprise Edition Office 365, Dynamics 365, Enterprise LinkedIn, and Azure) and reported separately that enterprise cloud revenue reached 25 billion, a year-on-year growth of 28%, with growth continuing to slow slightly.

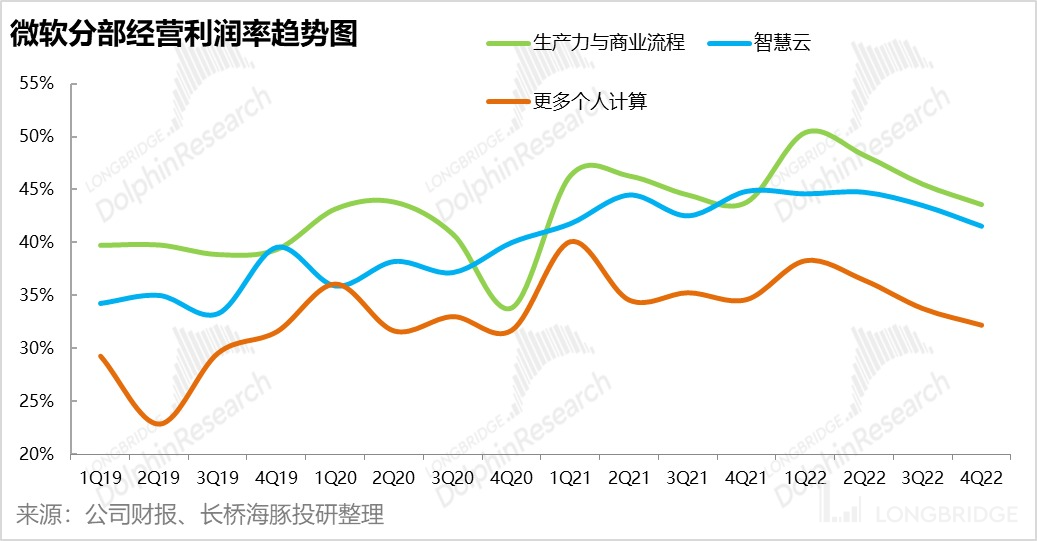

At the same time, Microsoft's gross margin for enterprise cloud services also fell 1 percentage point to 69% this quarter.According to the company, the main reason for the decline in gross margin was the increasing proportion of Azure in revenue structure.

As the revenue growth rate of Microsoft's enterprise cloud business slows down, the proportion of 2B cloud business revenue in Microsoft is also slowing down, but still continuing.To Dolphin Analyst's calculation, 2B cloud business accounts for 48% of the company's revenue, up another 1 percentage point from the previous quarter.

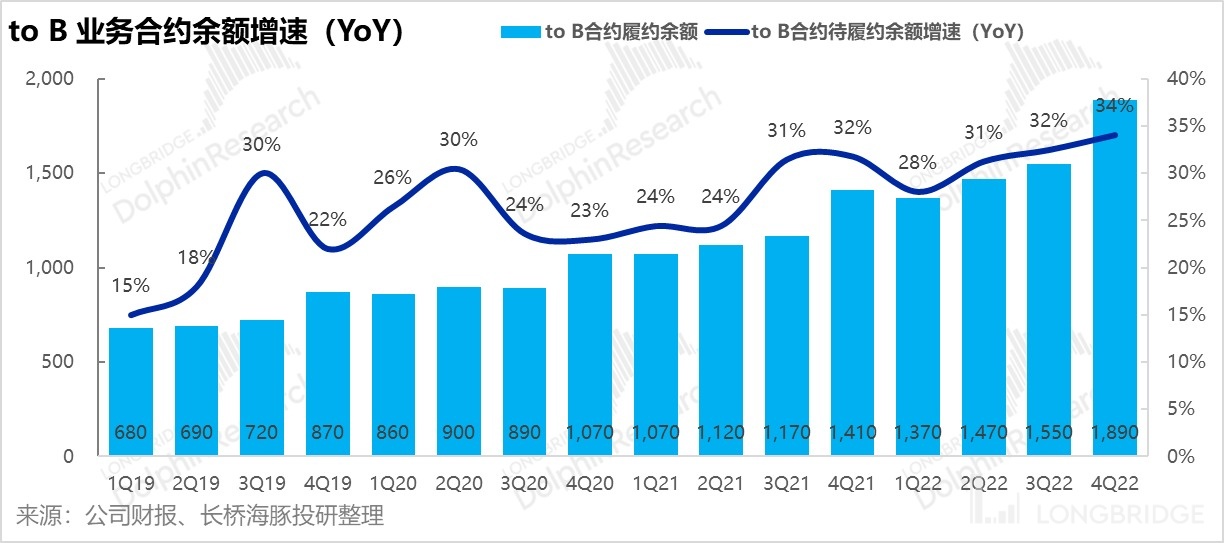

4. Slowdown in Revenue this Quarter, but Plenty of Leftovers (Unrecognized Revenue)

Although revenue growth rates for both cloud and Office businesses have slowed down this quarter, in addition to this quarter's performance, the market is more concerned about the future growth prospects of the business. In fact, there are leading indicators to follow in Microsoft's financial statements, in simple terms:

Cloud services are charged in two ways, based on user-based prepayments-subscription payments, and based on actual usage of post-payments.

SaaS-based services such as Office365 are mainly based on user subscriptions, with a large number of actual payments received but still awaiting confirmation as unrecognized revenue. This type of deferred revenue has very high confirmation certainty.

Azure is currently mainly based on post-payment mode. When customers use Azure services, these contracts will generate larger contract amounts, so the contract amounts will increase significantly, but the actual usage in the current period is limited, so it does not generate a large amount of current revenue or deferred revenue.

Due to the huge cost of cloud service migration and the high certainty of contract amount conversion into revenue, high growth in contract balances basically means high growth certainty for Azure.

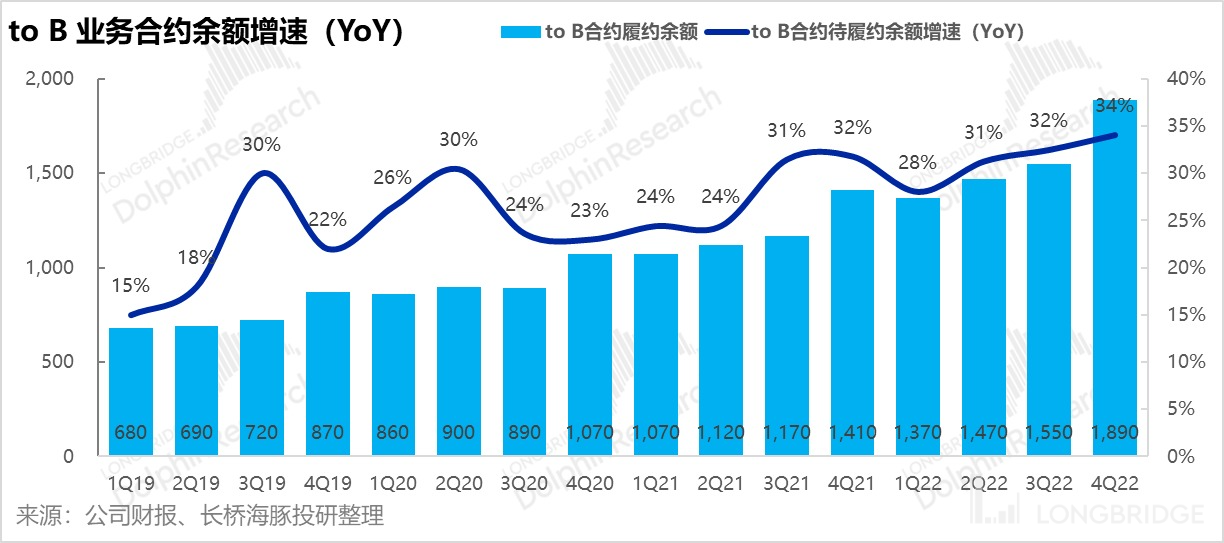

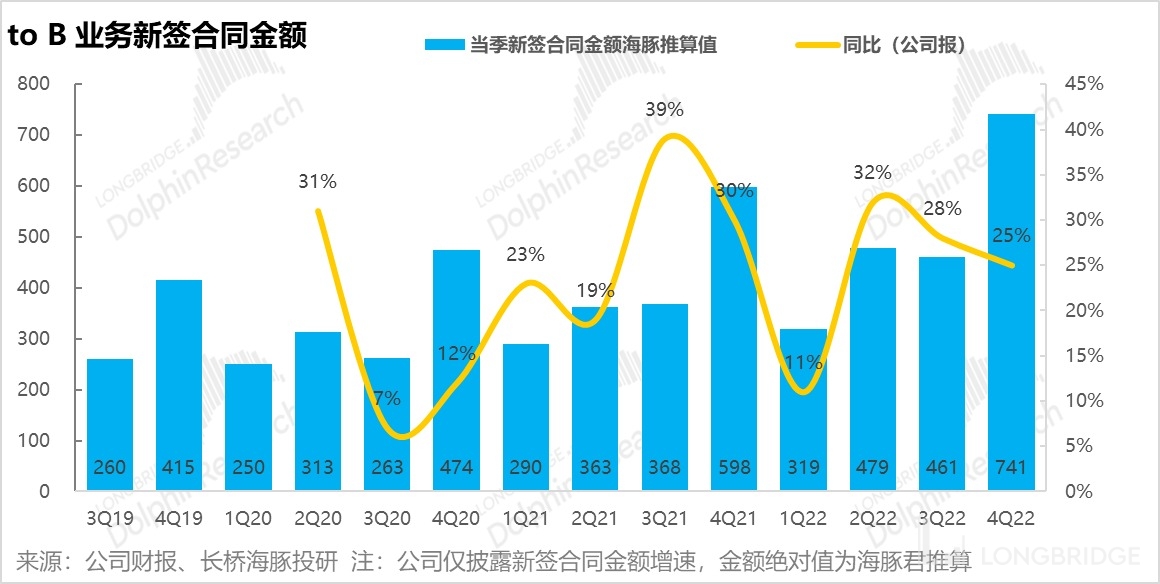

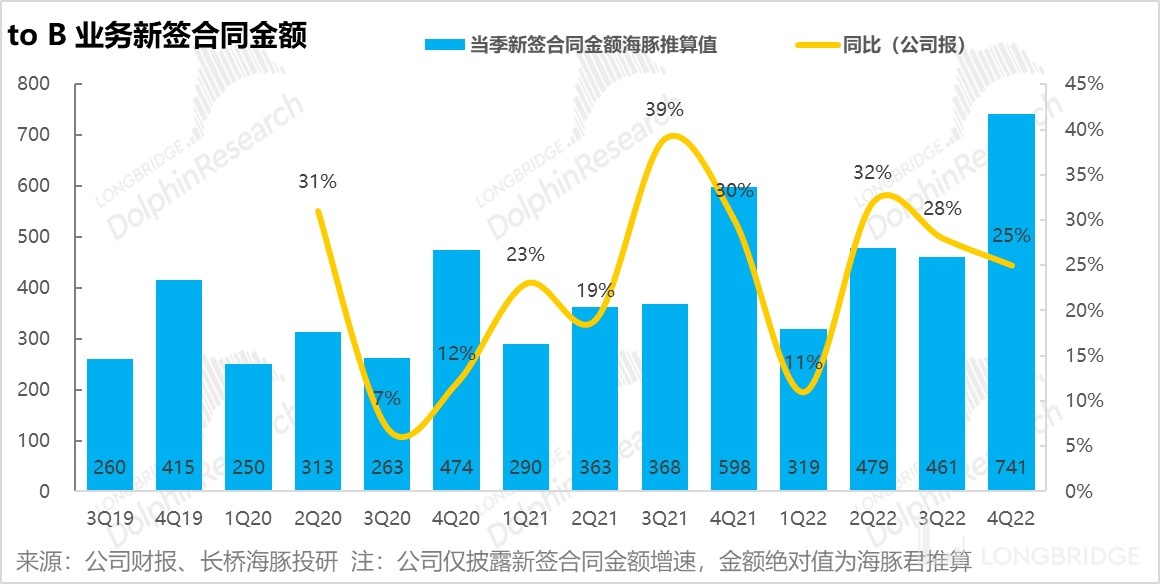

First, let's take a look at the most important To B business contract balance: The balance of contract amount for the enterprise end, i.e. the deferred revenue plus unconfirmed revenue, is 189 billion yuan in this quarter, which not only reaches a new high in absolute terms, but also has an accelerating year-on-year growth rate of 34%. Although the pace of confirming revenue has slowed down this quarter, there is still a considerable amount of unconfirmed revenue to be accounted for in the future.

At the same time as the accelerated growth in contract balance, Microsoft's newly signed 2B contract amount reached 74.1 billion US dollars this quarter. Although the year-on-year growth rate has slightly declined, it is mostly due to the growth of the base. The absolute value of the newly signed order amount increased by 14.3 billion yuan compared to the same period last year, reaching a new high again.

Combining the acceleration of contract balance and newly signed contract amount growth, it can be seen that the long-term growth certainty and visibility of Microsoft's 2B business are quite high. Although enterprises have temporarily reduced their spending on cloud services in the current macro environment, the long-term trend of IT services cloudification and SaaS remains unchanged.

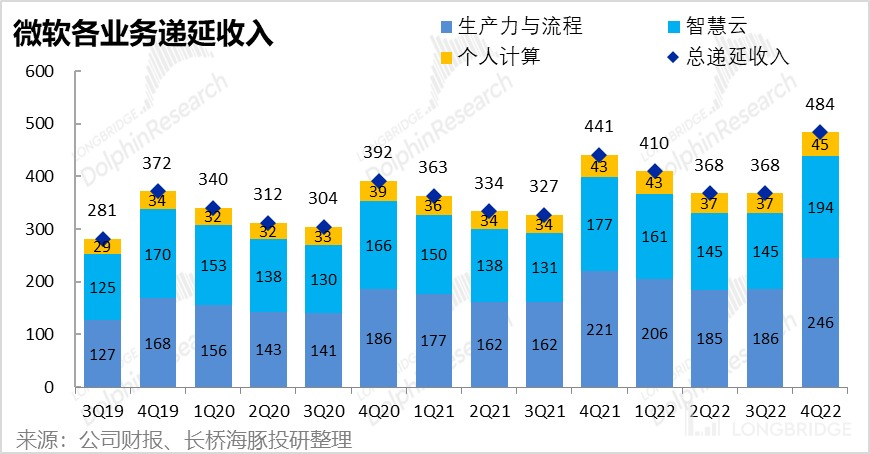

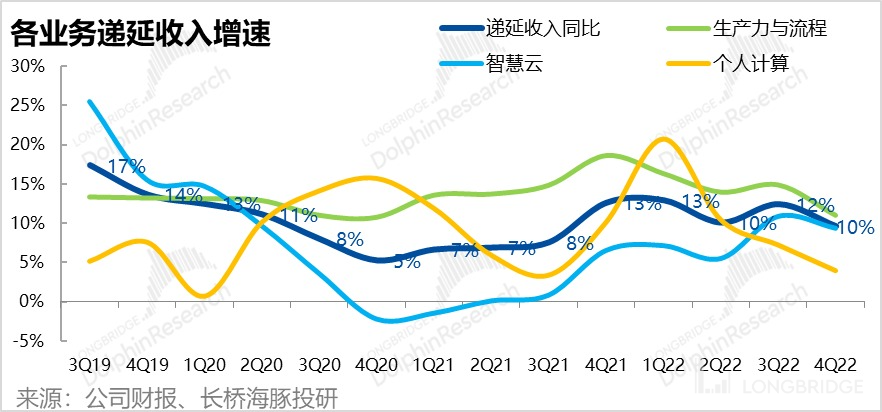

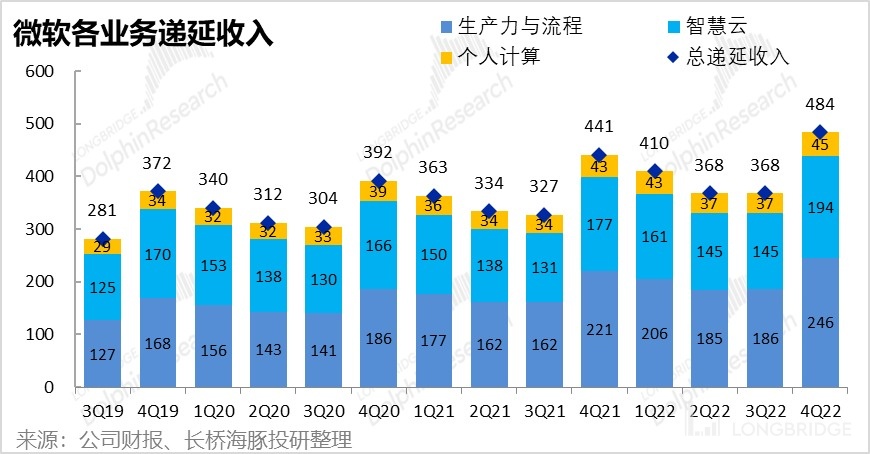

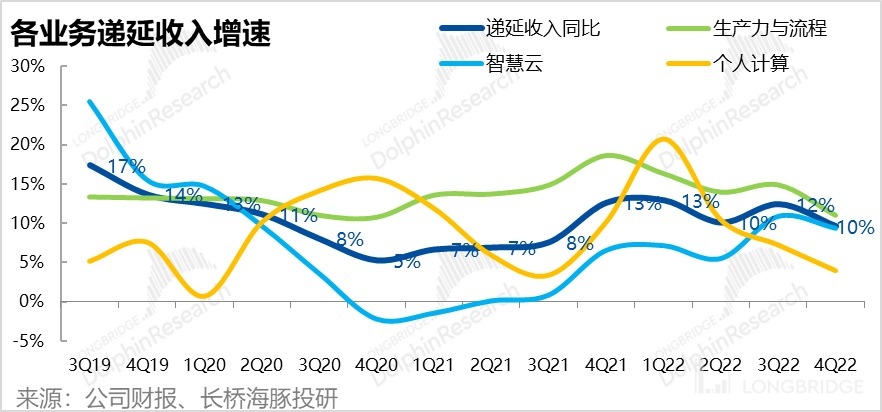

Focusing more on the company's short-term residual income and Office business, Microsoft's deferred revenue reached 48.4 billion US dollars at the end of this quarter (more than 90% of which will be confirmed as revenue within one year), with a year-on-year growth rate of 10%, a slight decrease.

From a structural point of view, the deferred revenue growth rates of each business have fallen to some extent, but the personal computing business, which is "insignificant", is the most obvious one to decline. The growth rates of deferred revenue in the key productivity business and intelligent cloud services have not decreased significantly. Therefore, the short-term residual income of Microsoft's core business is still worry-free.

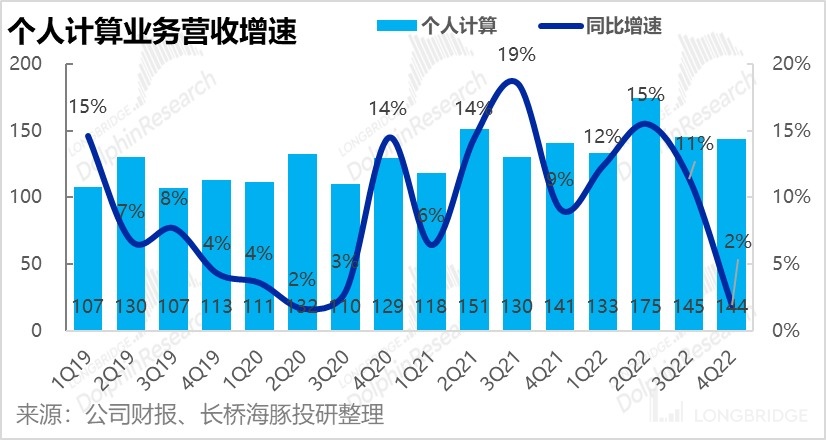

5. Economic slowdown, personal computing business of C-end is more affected

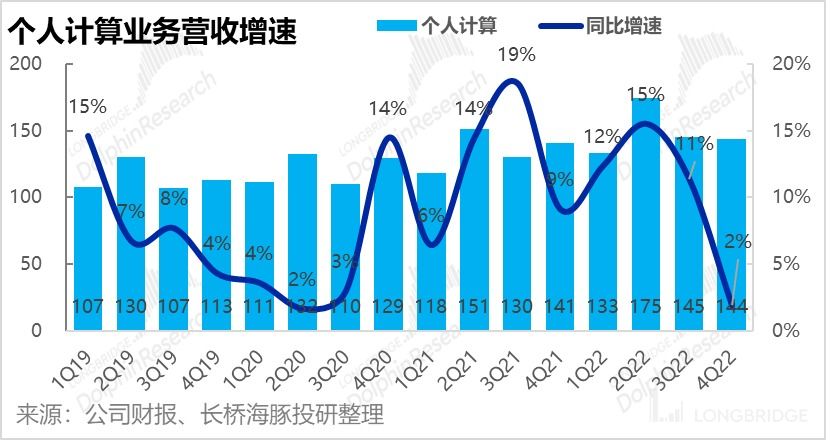

Compared with the cloud business and productivity business which are more oriented to the B-end, Microsoft's personal computing business, which is more C-end oriented, is relatively less concerned by the market and belongs to the "legacy" business of Microsoft in the PC Internet era. Overall, under the influence of epidemic control in China and inflation in Europe and the United States, personal consumers' spending on products such as PC has significantly decreased. Therefore, the revenue of the company's personal computing business is more significantly slowed down than that of the B-end business. The revenue growth this quarter is only 1.9%, basically stagnating.

Subdivided view, this segment is composed of various relatively independent product lines - Windows, gaming software and hardware, search and advertising, Surface and other devices.

Subdivided view, this segment is composed of various relatively independent product lines - Windows, gaming software and hardware, search and advertising, Surface and other devices.

-

Among them, the growth of Windows OEM revenue has dropped significantly this season, down to -2%,

-

The gaming segment (including gaming member subscriptions, 1P/3P gaming products, Xbox hardware), the acquisition of Activision Blizzard has not been consolidated. When users return to normal life and reduce non-essential spending, revenue growth this season turned negative to -7%.

-

The search and advertising services that reflect the demand of the US macro advertising have also slid to 18% in revenue growth this quarter after removing the cost of purchasing quantity.

5. Overall performance:

1) Microsoft's overall revenue growth has slowed this quarter: The company recorded revenue of $51.9 billion this quarter, just below the expected $52.5 billion and the company's guidance of $52.5 billion to $53.2 billion. The impact of macroeconomic slowdown is larger than expected. As analyzed above, the slowdown of C-end business revenue is significantly higher than that of B-end cloud services and productivity services.

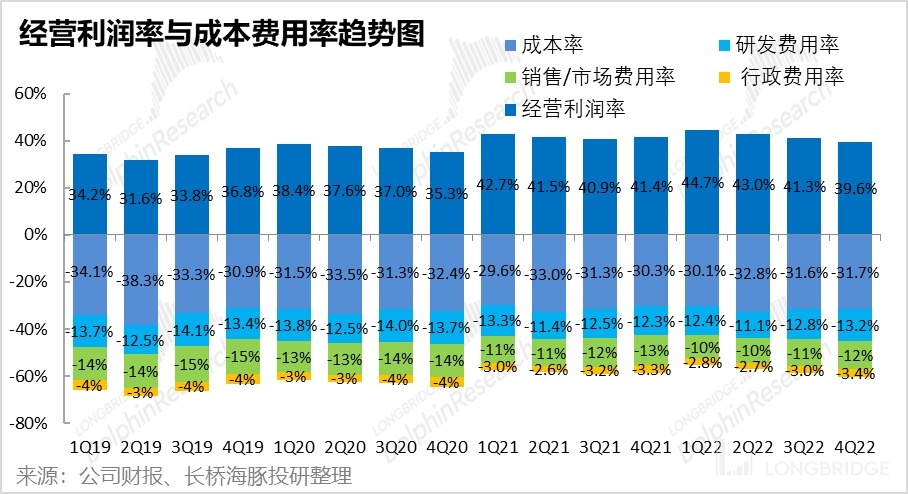

2) On the gross profit performance: this quarter achieved a gross profit of 35.4 billion, slightly lower than the market expected 35.9 billion and a gross profit margin of 68.3%, slightly lower than the market expected 68.5%. The lower-than-expected gross profit this season was due to both lower-than-expected revenue and a slight decrease in gross profit margin.

(3) Although gross profit is slightly lower than expected, the company's cost control measures have worked well. The company originally guided operating expenses to be between $14.8 billion and $14.9 billion this quarter. In the environment of inflation, actual expenses amounted to $14.9 billion, which did not exceed the guidance. A detailed look at the three expenses shows that only the key research and development expense ratio has expanded, while marketing investment and administrative expense ratios have basically remained stable or even narrowed under control, so it has not further dragged profits.

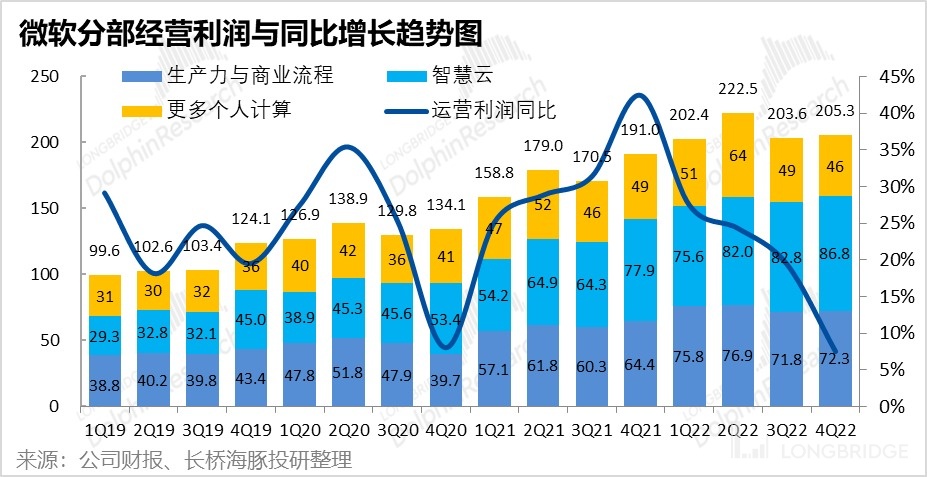

Overall, the company achieved operating profit of $20.5 billion, which was $700 million lower than market expectations, roughly equal to the magnitude of revenue below expectations. Therefore, the overall profitability of the company has not deteriorated significantly, but more from the impact of slowed revenue growth.

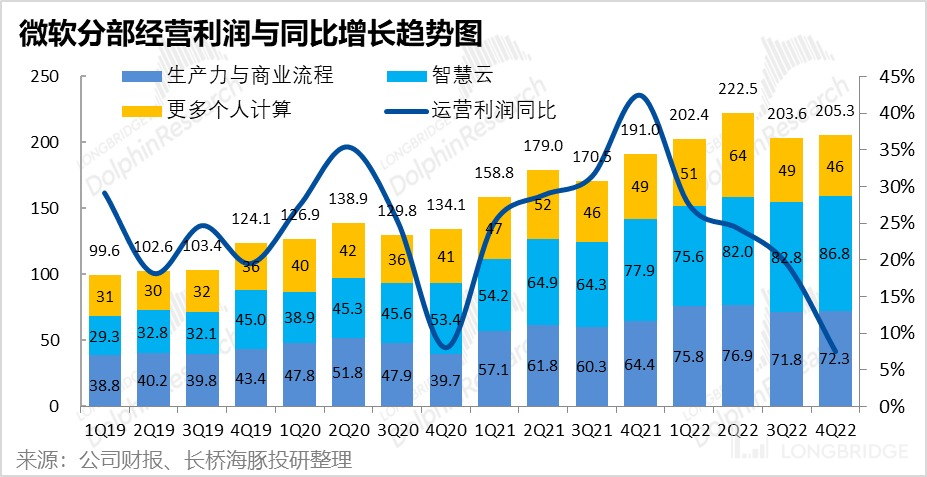

From the perspective of sub-business segments, the absolute value of the operating profit of the Productivity segment and the Intelligent Cloud segment continued to grow this quarter (regardless of the year-on-year and quarter-on-quarter comparison). The decrease in the absolute value of the operating profit of the Personal Computing segment has mainly dragged down the overall profit of the company.

From the perspective of sub-business segments, the absolute value of the operating profit of the Productivity segment and the Intelligent Cloud segment continued to grow this quarter (regardless of the year-on-year and quarter-on-quarter comparison). The decrease in the absolute value of the operating profit of the Personal Computing segment has mainly dragged down the overall profit of the company.

Previous research:

Financial report comment

April 27, 2022 conference call "Microsoft's journey is the real starry sky (summary of the third quarter conference call)"

April 27, 2022 financial report comment "Strong Microsoft is the coolest support for US stocks"

January 26, 2022 conference call "Nadella: "Microsoft is strong in being able to see trends before consensus""

January 26, 2022 financial report comment "Microsoft is reliable without worrying too much - Dolphin Analyst"

October 27, 2021 conference call "Digital Technology is the Deflationary Force of the Inflationary Age? Please see Nadella's explanation (conference call summary)"

October 27, 2021 financial report comment "Microsoft: The Most Beautiful Giant Head in the Post-Epidemic Era! | Dolphin Investment Research"

In-depth research

May 30, 2022 "Microsoft is flawless, killing the price is more perfect"

February 15, 2022 "Microsoft: Don't just stare at poor expectations, having orders and surplus is the hard truth"

November 22, 2021 "Why are Alibaba and Tencent aging before they prosper and why is Microsoft old and stronger?" This article's risk disclosure and statement: Dolphin Research's Disclaimer and General Disclosure