The period of "strong medicine" for the US Federal Reserve's interest rate hike has finally passed.

On July 27th, the Federal Reserve raised interest rates as planned by 75 basis points, officially pushing the policy rate to the neutral rate of 2.25%-2.5%.

As the Fed has reached the neutral rate, there was no expectation range for the next rate hike, unlike the previous times.

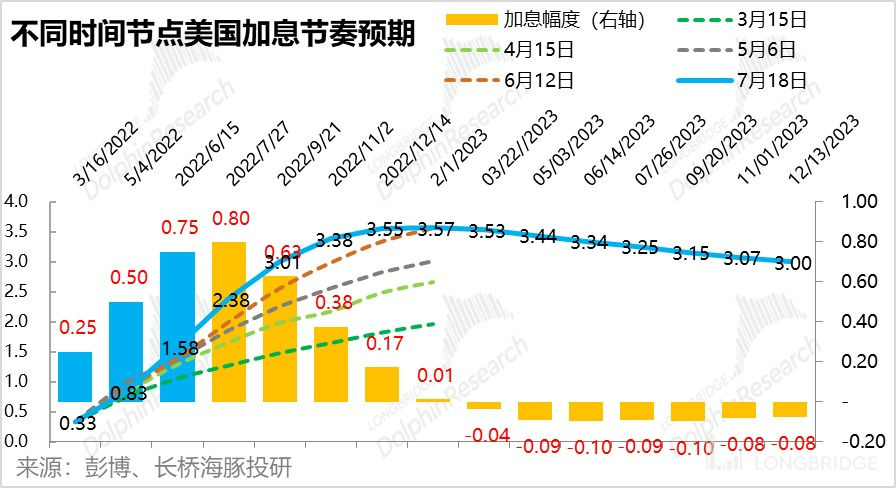

However, the overall path outlook maintained the same critical position for interest rate hikes: "From the end of this year to 3.25-3.5%, it is estimated that next year's interest rates will be 50 basis points higher than the end of 2022".

If the three meetings from now to the end of the year have a combined interest rate increase of 100 basis points, the possible path would be a 50 basis point interest rate hike on September 21st, a 25 basis point interest rate hike on November 2nd, and another 25 basis point interest rate hike on December 14th. Market expectations are roughly in line with this.

Next year, the market and the Fed's expectations will truly diverge. It seems that the market generally expects the Fed to enter a new interest rate cut cycle from March next year, while the Fed's expected guidance is still an increase of 50 basis points. The core reason behind this is that the Fed believes that the US is not in recession, while the market believes the contrary.

After two consecutive significant rate hikes of 75 basis points, the most aggressive rate hike seems to be over, and there may be a slowdown in the future. Finally, the heavily weighted US stock market can take a breath.

In the next two months, the focus will mainly be on observing the economic, employment, and business activity data after the interest rate hike. However, Powell did not give a definite answer, only saying that there were "more significant rate hikes to come, depending on the data."

In addition to interest rate tools, the Fed also has a quantitative tightening tool. This time, they said they would stick to the previous plan and increase the tightening scale starting in September. The impact of this tightening on long-term interest rates is more evident, and whether the plan will change requires special attention.

The risk disclosure and statement for this article can be found at Dolphin Analyst.