Iron-handed layoff of 100,000 employees, Amazon finally "recovers"

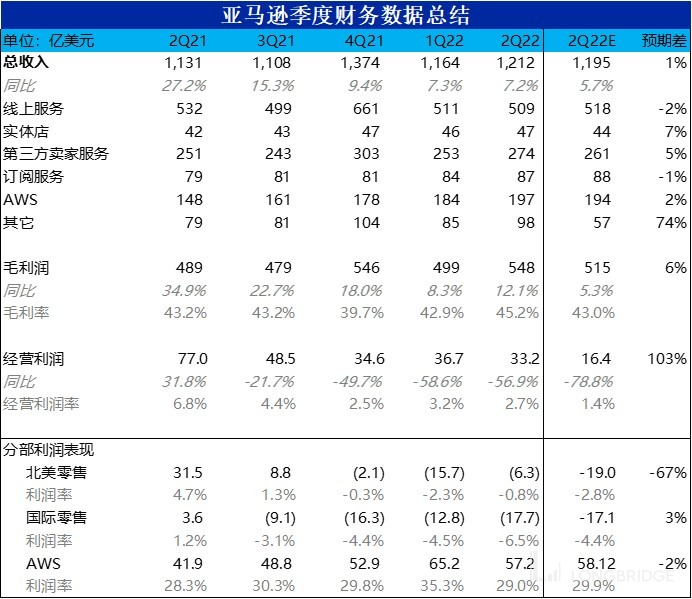

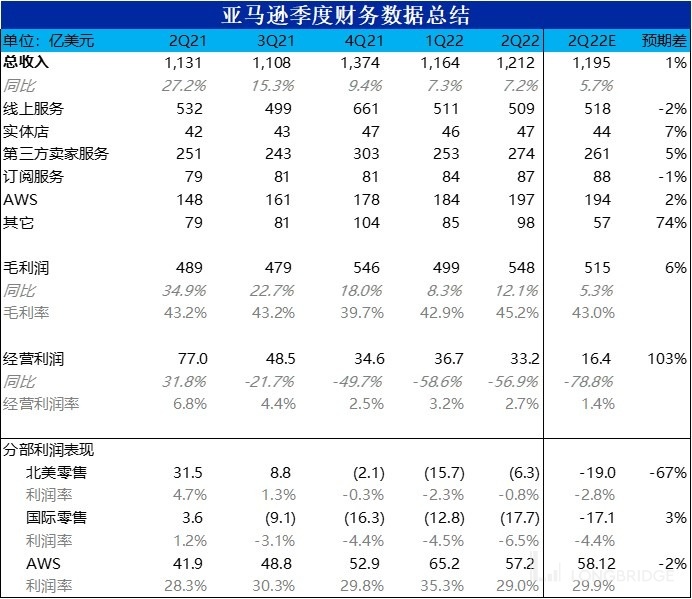

On the evening of July 29, US Eastern Time, Amazon released its Q2 2022 earnings after hours. Overall, both revenue growth and profit release exceeded market expectations. As a result, the company's stock price also rose more than 10% after hours. The details are as follows:

1. Revenue and profit are better than expected overall

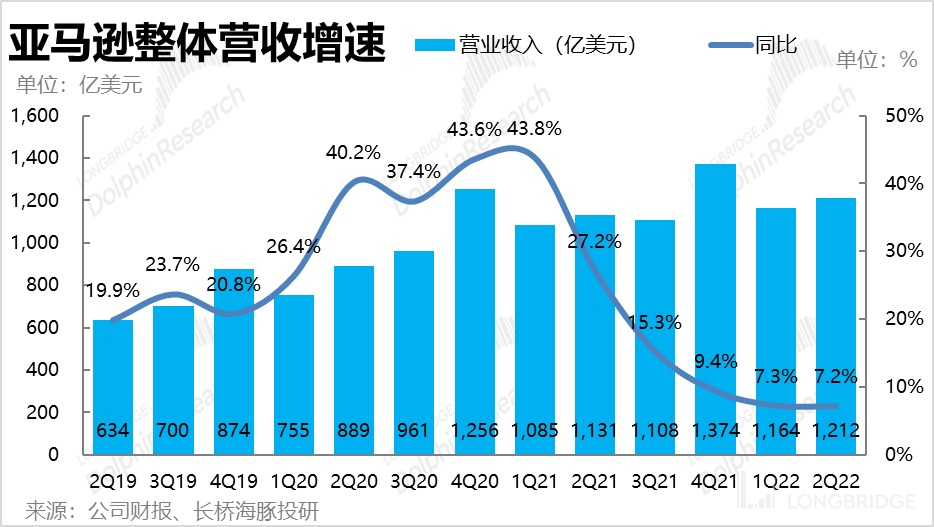

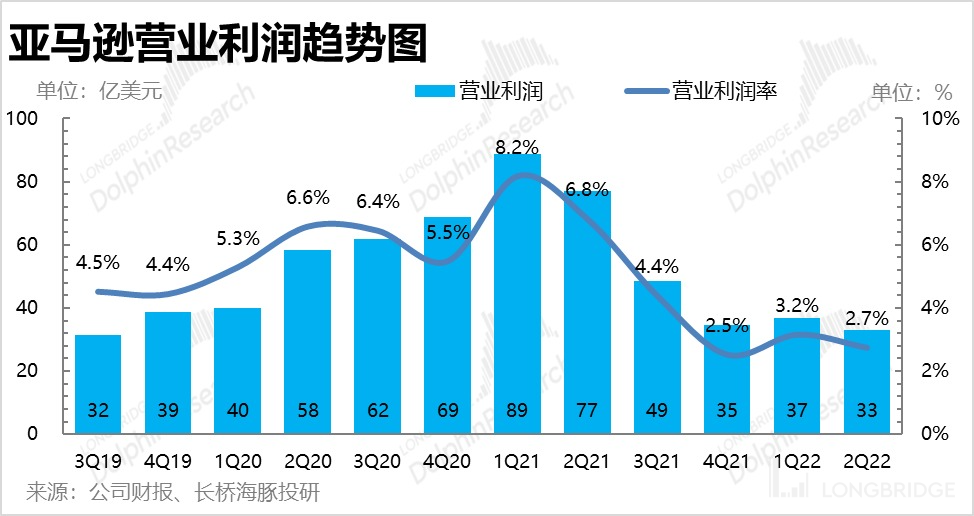

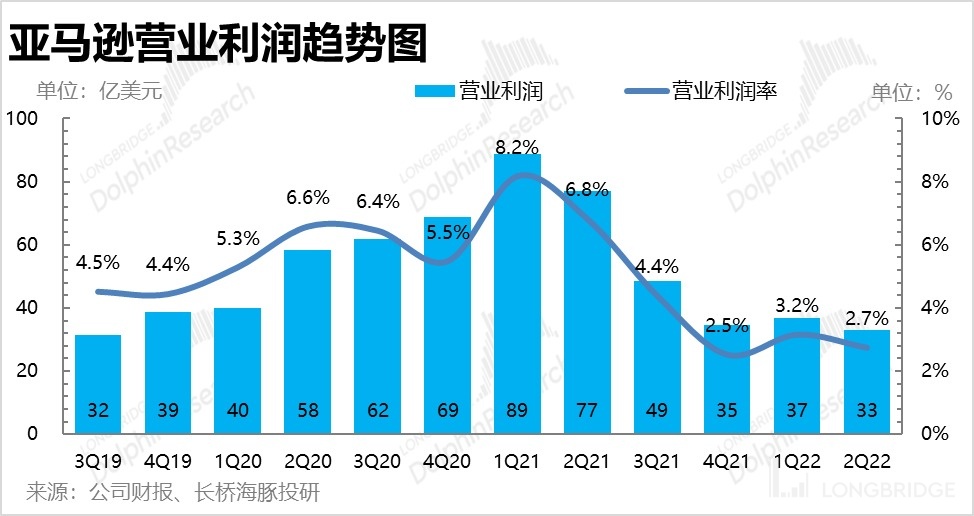

In terms of overall performance, the company's revenue this quarter was USD 121.2 billion, a year-over-year increase of 7.2%, which was consistent with last quarter's growth rate and did not slow down as expected. The actual revenue also slightly exceeded the upper limit of guidance and market expectations. The operating profit for this quarter was USD 3.32 billion, also exceeding the upper limit of guidance and market expectations by USD 1.64 billion. The points that exceeded expectations were mainly due to better resilience in the retail business than expected, and the speed of cost-cutting measures was faster than expected.

2. North America rebounds, retail business shows resilience

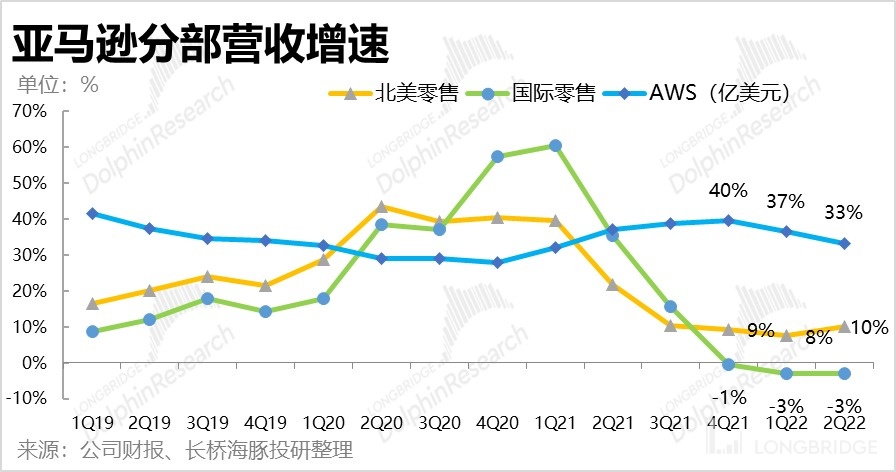

Excluding AWS, the revenue of the retail business in this quarter increased by 3.3% year-over-year (compared to 3.1% last quarter), rebounding from last quarter, breaking the market's concerns that the retail business may further decline. Specifically, the points that exceeded expectations are mainly from two aspects.

First, after the FBA price increase, the growth of third-party buyer services began to rebound, with a growth rate of 9.1% this quarter, compared to 6.9% last quarter. Revenue exceeded market expectations by 5%.

Second, the overall growth rate of North American retail business also began to rebound, with revenue growth rate close to 10% this quarter, exceeding 8% in the previous quarter. Although the growth rate of the North American retail market is still slowing down in the second quarter, Amazon's performance is more resilient than the industry.

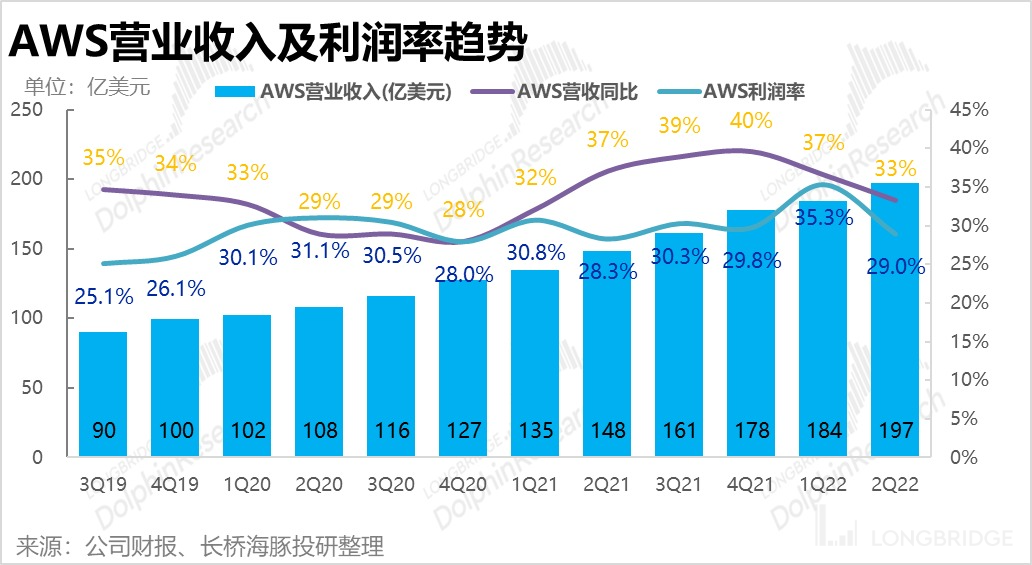

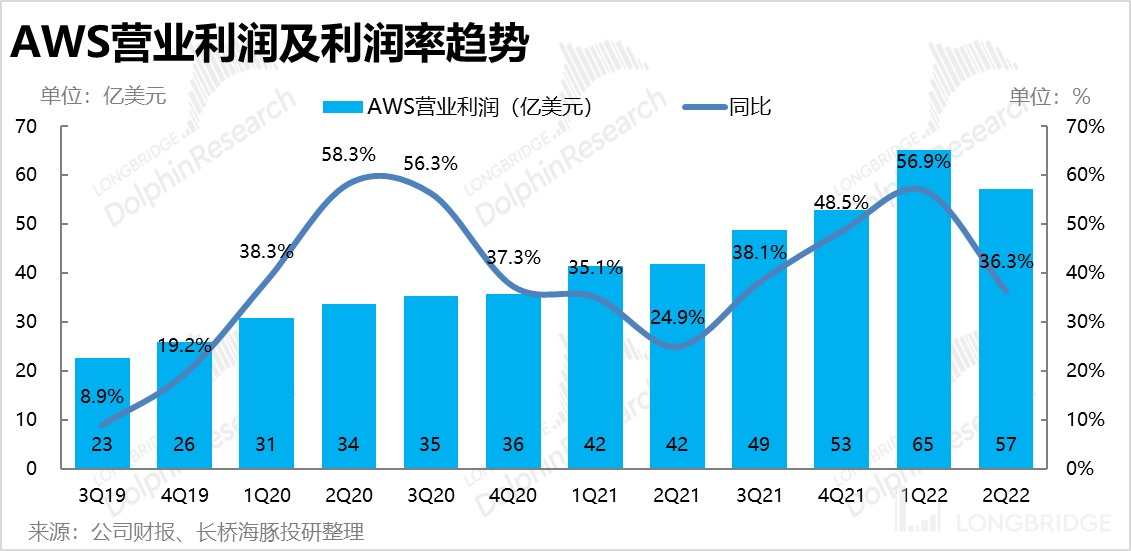

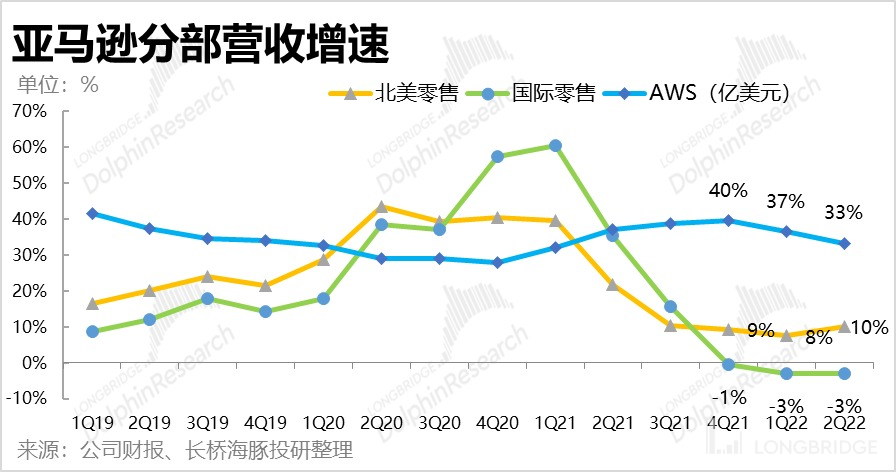

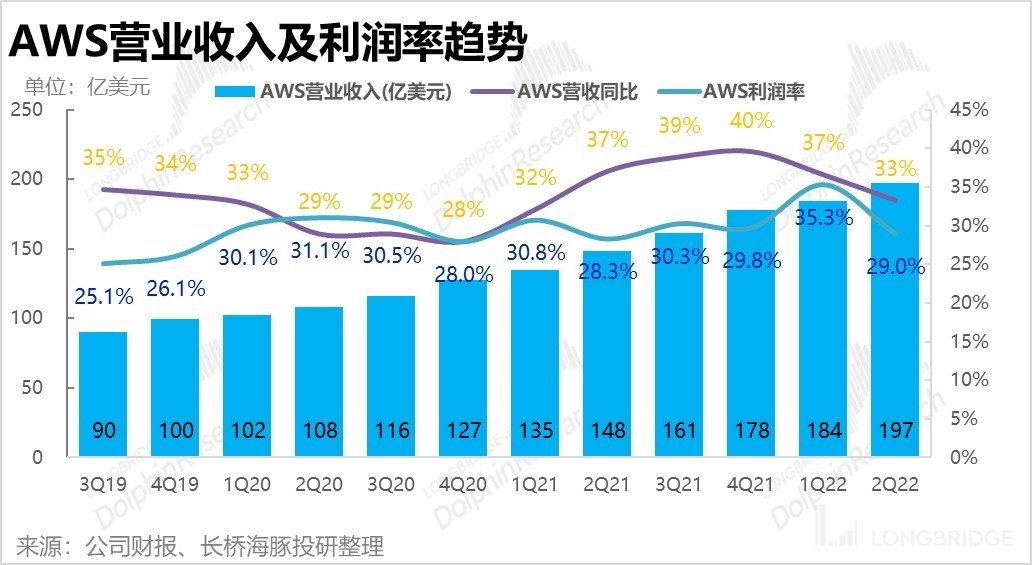

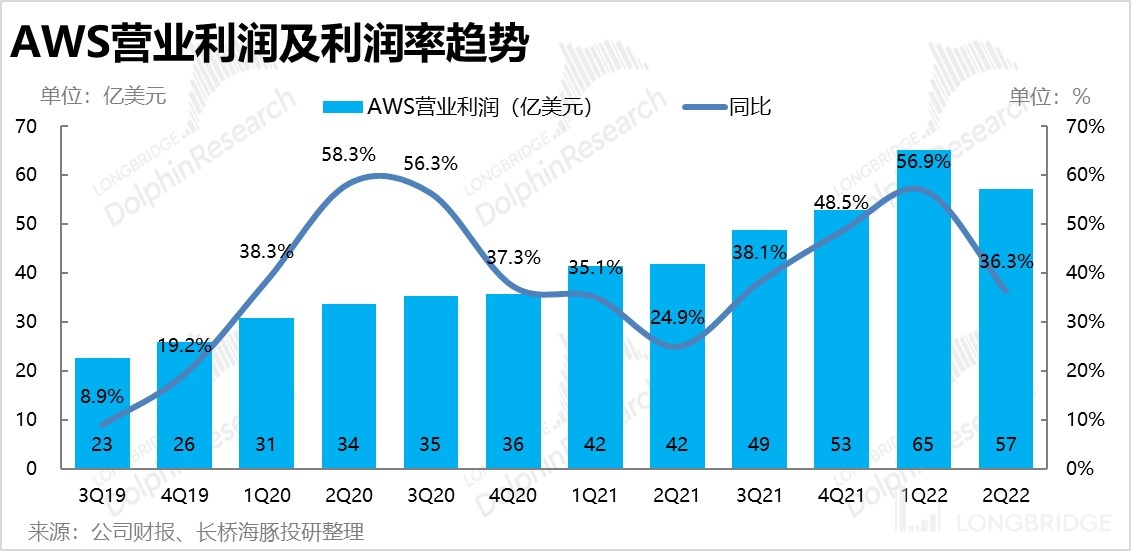

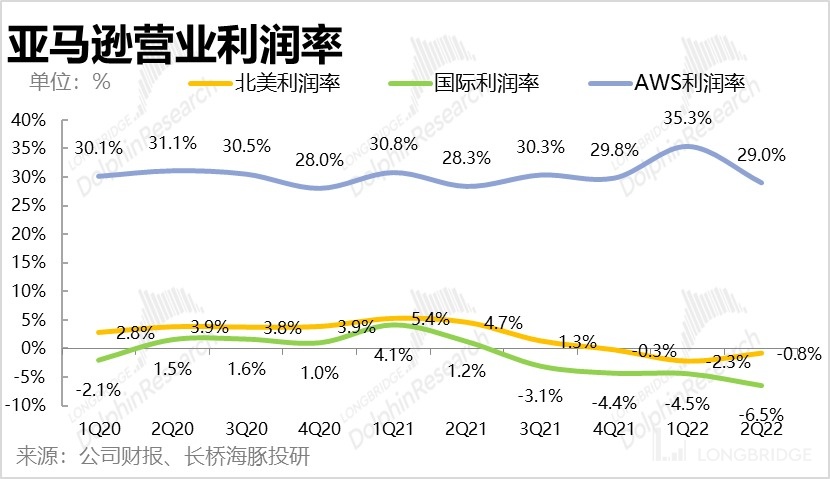

3. AWS is steady

Compared with the better-than-expected retail business performance, this quarter's AWS business performance is no longer stunning, but still steady. The revenue growth rate fell further from 37% to 33%, but it was consistent with market expectations. In terms of profit, the favorable depreciation period extension in the previous quarter has weakened, and the R&D rate, mainly based on AWS, increased by 2pct this quarter, leading to a return of AWS's operating profit margin to the normal level of 29%. This can be further explained in the company's conference call.

However, combined with Microsoft's performance, it can be seen that European and American companies have temporarily delayed their investment in IT under macro headwinds. Therefore, the slowdown of AWS business this quarter is also reasonable, and the growth potential of AWS's normal growth rate can be better reflected in the later disclosed contract balance growth rate, which is worth paying attention to.

4. Price increase + layoffs, reduce costs and maintain profitability

In addition to the resilience of the retail business, the results of cost reduction this quarter are another point that exceeded expectations. Specifically, the points that exceeded expectations mainly came from cost reduction, while expenses continued to expand under the pressure of inflation.

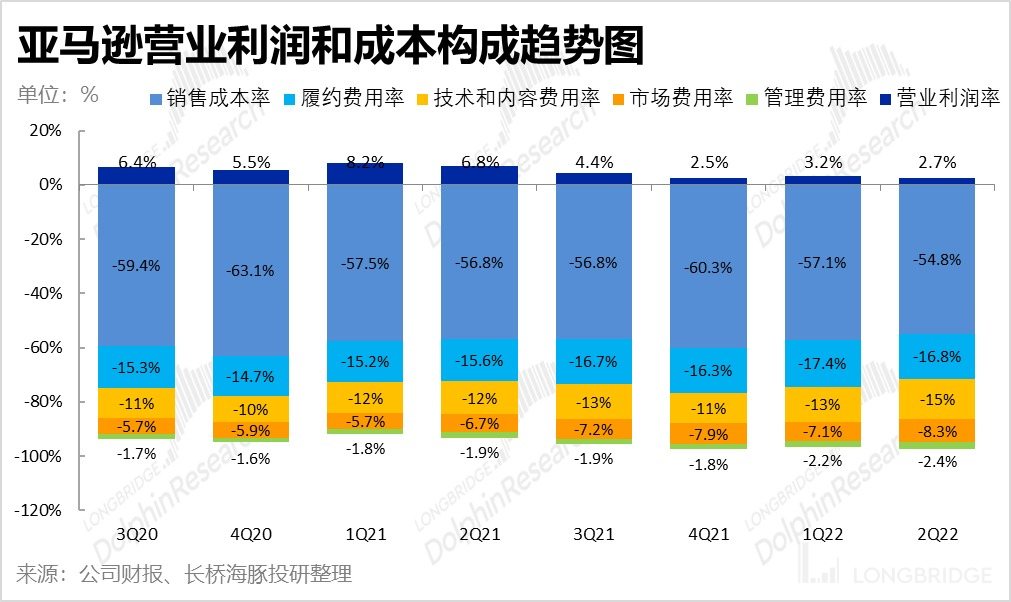

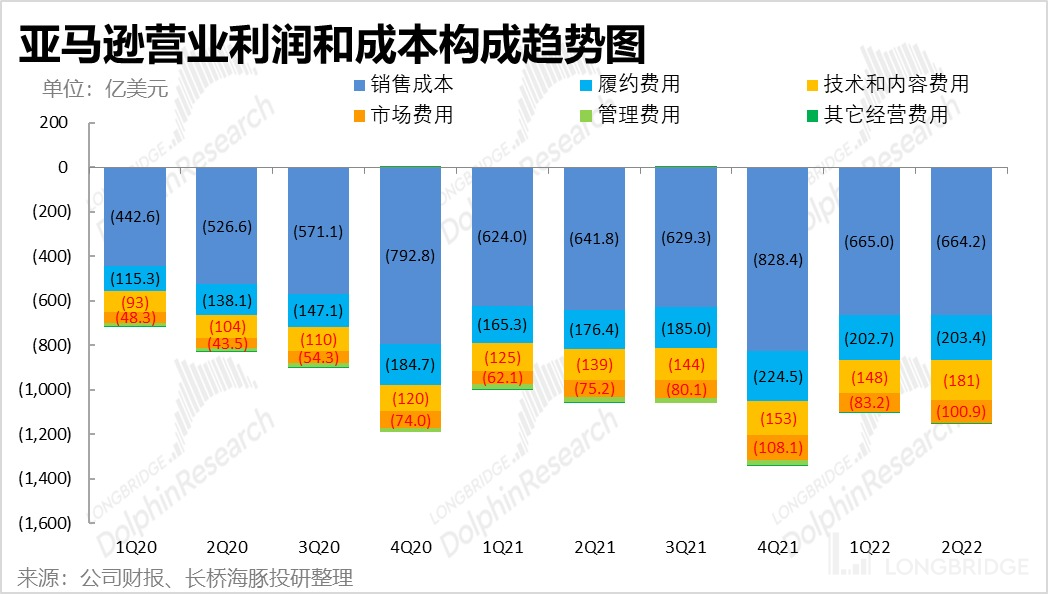

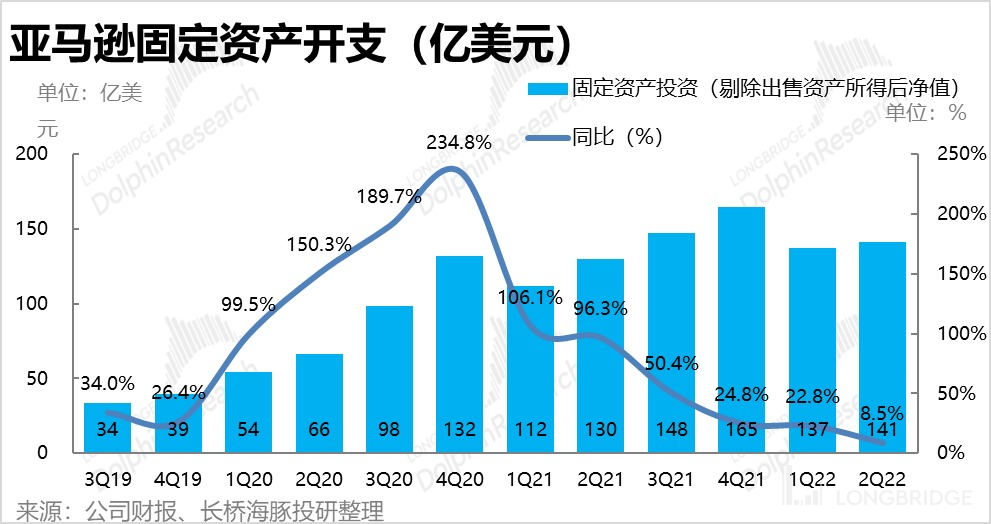

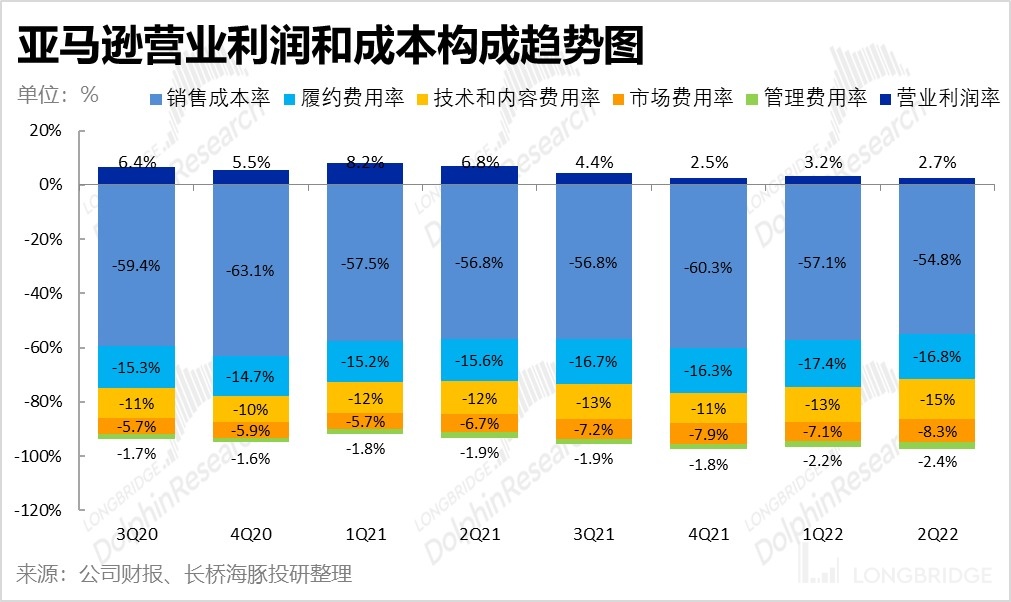

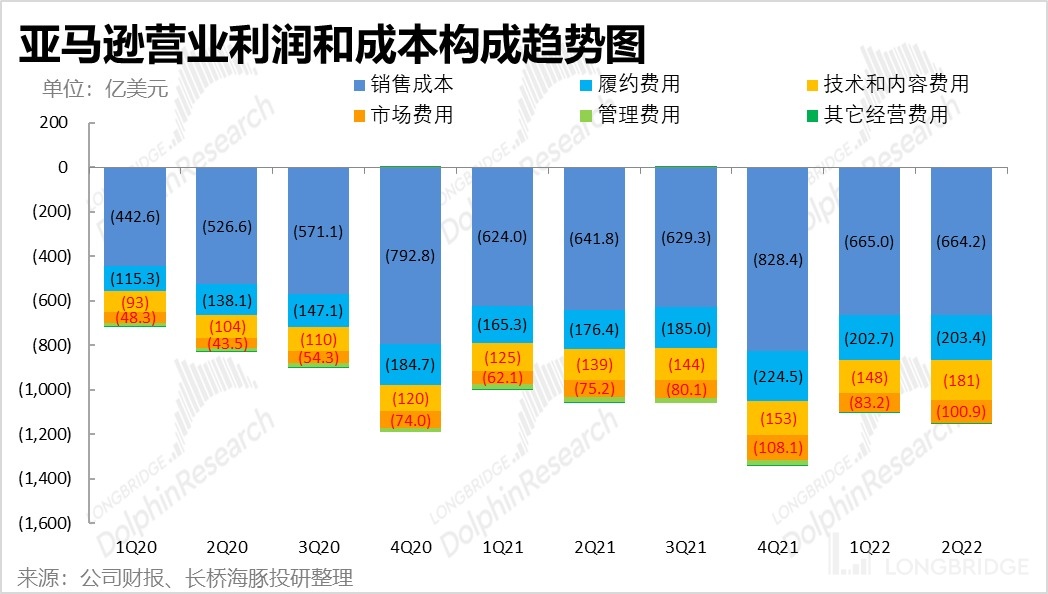

This quarter's gross margin has improved significantly, reaching 45.2%, not only improving month-on-month, but also increasing by 2pct year-on-year. Dolphin Analyst believes that the improvement in gross margin is mainly due to the company's multiple FBA price increases and the price increase of North American Prime membership, which have effectively transferred cost pressures. In addition, the company decisively laid off approximately 100,000 people this quarter (mostly express delivery personnel), and the growth rate of capital investment also slowed to 8.5%, further reducing cost pressure. However, the cost can be offset by price increases, but the expansion of internal operating expenses caused by inflation is real. Both the market and management expense ratio continue to expand whether viewed on a year-on-year or month-on-month basis. The combined cost rate of research and development, marketing, and management has increased by 3.5% on a month-on-month basis.

5 indicators show that the turning point of growth is coming

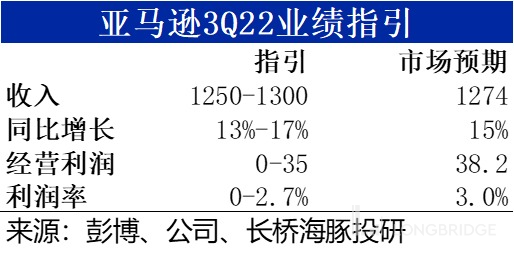

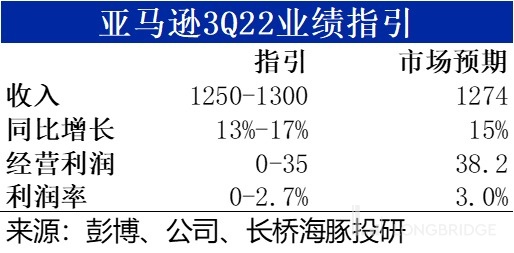

The company guided its revenue for the third quarter to be between US$1,250-1,300, a year-on-year increase of 13-17%. Although it did not exceed market expectations, the key point is that it indicates that the company's growth turning point is coming, compared with the growth rate of 7.2% in the current quarter.

The guidance for operating profit is between 0-3.5 billion, which is also an improvement from this quarter. Although it seems lower than market expectations, based on the upper limit of the profit in this quarter, the "actual" guidance is basically the same as expected.

Dolphin Analyst's Opinion: Compared with the unsatisfactory revenue and profit in the first quarter, the guidance is even worse. This quarter, the company's revenue growth resilience exceeded expectations, and the results of cost reduction and profit release were even better than market expectations. Overall, the core reason for exceeding expectations is still Amazon's strong bargaining power as the industry's first and its ability to transfer costs. At the same time, the speed and execution of the company's operational strategy transition from expansion to efficiency improvement after falling into a low point is also convincing.

Looking ahead, the company's guidance indicates that Amazon's turning point is coming. After layoffs and slowing down investments, the internal core problems of Amazon, such as too fast expansion pace and mismatched revenue, have been relieved. As a giant, its ability to resist risks relative to the industry has reappeared; the remaining concerns mainly depend on the beta level of the US economy and the level and span of consumer decline.

Dolphin Analyst will later share the phone meeting summary with Longbridge App and Dolphin's user group. Interested users are welcome to add the WeChat account "dolphinR123" to join the Dolphin Investment Research Group and get the phone meeting summary as soon as possible.

Detailed comments are as follows:

I. What do we need to know about Amazon?

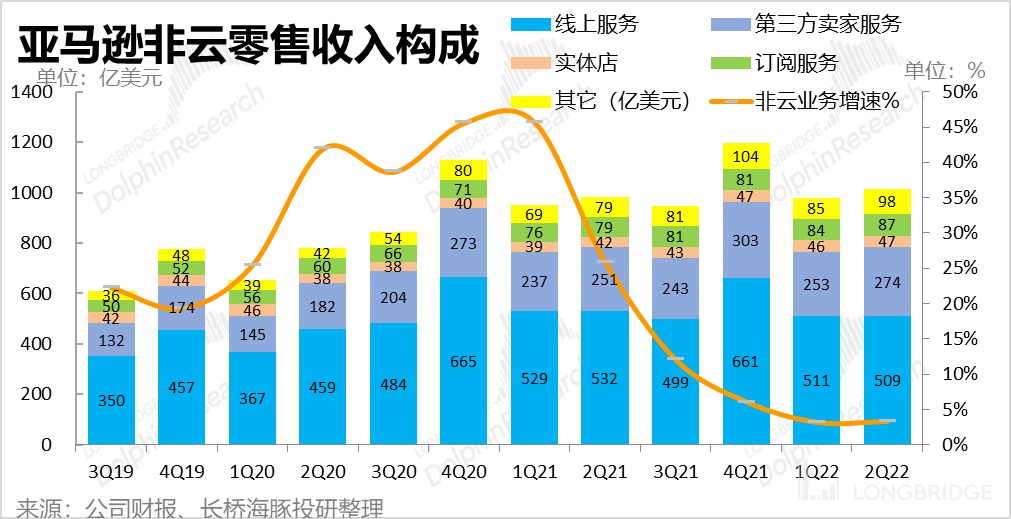

From the perspective of revenue structure, Amazon's business is mainly divided into two categories: retail-related businesses and cloud services. Among them, the retail category can be subdivided into online self-operated, online 3P seller services (commission and performance fees), online advertising, membership and subscription services, and offline retail operations.

From the revenue structure, Amazon's self-operated retail business still accounts for more than half of the share, but the proportion is gradually decreasing. However, from the perspective of operating profit, the company's AWS cloud service business contributes most of the profits with about 15% revenue share. Therefore, although Amazon still focuses on retail businesses, its nature has changed from a "retailer" to a "technology company" that mainly provides online services, with the gradually increasing proportion of high-profit revenue such as cloud services, advertising, and merchant platform services.

Source: Dolphin Analyst

2. Retail Business -- Steady Growth, Strong Backbone

First of all, looking at the overall picture, Amazon's Q2 2022 total revenue was $121.2 billion, a year-over-year increase of 7.2%, with growth rate remaining stable compared to last quarter, and did not continue to slow down as expected. Additionally, actual revenue this quarter exceeded the company's upper guidance of $121 billion and the market's expected value of $119.5 billion.

Although there are not many beats, from all angles, they performed better than the market's worry and expectation of further decline in revenue (especially in the retail business).

Excluding AWS cloud services and only looking at the company's retail business, this quarter's revenue growth rate is 3.3%. Although the absolute growth rate is still very low, compared to last quarter's growth rate of 3.1%, this quarter not only did not continue to decline but also slightly improved, which was better than expected.

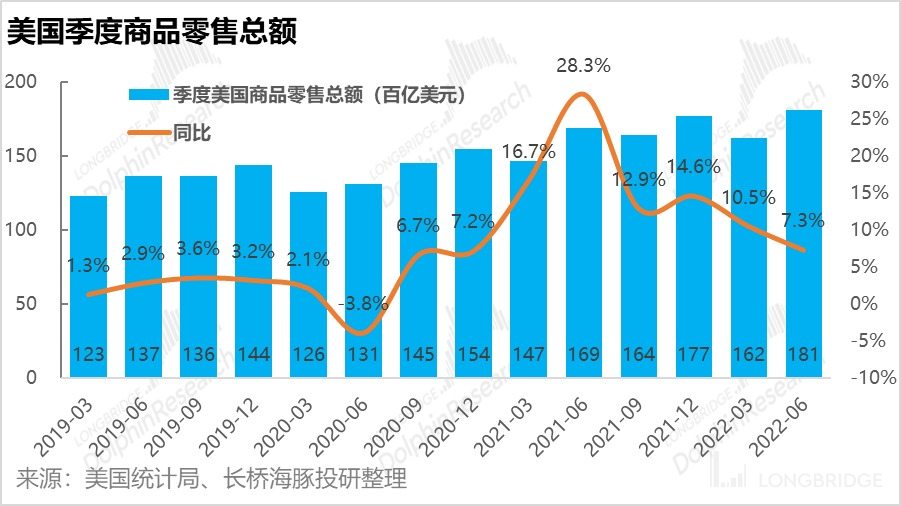

On a macro level, the growth rate of total U.S. retail sales for the second quarter was 7.3%, continuing to fall compared to the previous quarter, so Amazon's revenue growth rate is more resilient compared to the environment.

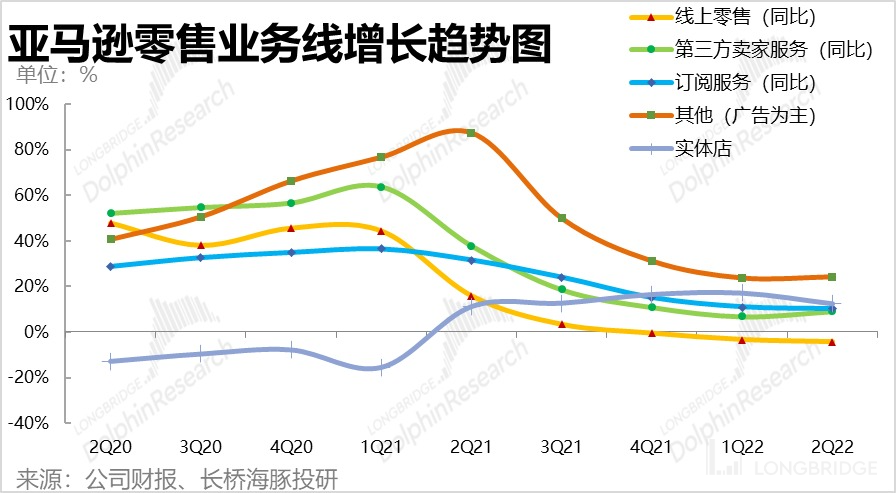

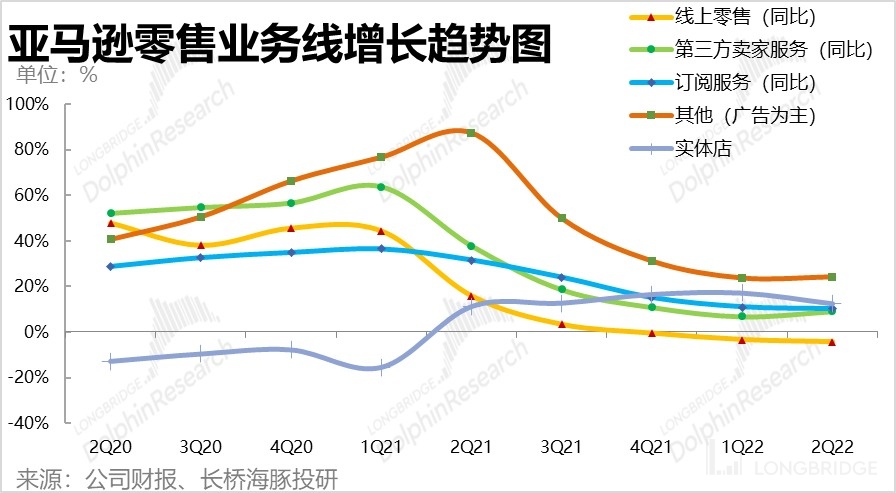

Looking at each subdivision of the retail sector, except for the continued decline in self-operated retail business, other businesses are stable, and third-party seller services have even accelerated, as detailed below:

-

The online self-operated retail business decreased by 4.3% year-over-year, continuing to decline by 1% compared to the previous quarter. Combined with the higher growth of 3P seller services, the trend of the company's online retail structure shifting from 1P to 3P continues.

-

The most surprising point is that the growth rate of third-party seller services increased against the trend this quarter. The revenue this quarter was $27.4 billion, exceeding the market's expected value of $26.1 billion by 5%. At the same time, revenue growth rate increased from 6.9% in the previous quarter to 9.1%, which was a surprise. Dolphin Analyst believes that in order to offset cost pressures, the company's multiple increases in FBA logistics service prices should have facilitated the counter-trend rise of seller services.

-

Subscription services' revenue growth rate remains resilient at 10.1%. As the company continues to invest in video streaming and gaming entertainment, and according to media reports, the company will raise Prime membership prices by around 20% to 40% in European countries such as the UK, France, and Italy in the near future, the future revenue growth of subscription services should still be quite strong. ④In addition to the 88 billion in advertising services revenue from merchants, which grew at a YoY rate of 17.5%, there were also 10 billion in other revenue this quarter. This still represents a relatively high growth rate, but the rate of growth has slowed significantly. As Dolphin Analyst previously predicted, since the advertising business depends on the macroeconomic environment to a large extent, the future growth rate of this business should continue to converge with the overall growth rate.

Overall, the company's retail sector has shown more resilience than expected in the context of the continuing decline of the overall retail market in the United States.

3. AWS Cloud Business - Steady Progress

While the performance of Amazon's retail business is encouraging in difficult times, AWS continues to make steady progress.

This quarter, the company's cloud business generated revenue of $19.7 billion, up 33% YoY. Although the growth rate continues to decline, it is reasonable considering the base effect of growth and short-term reduction in IT investment by businesses. The actual performance also slightly exceeded market expectations of $19.4 billion.

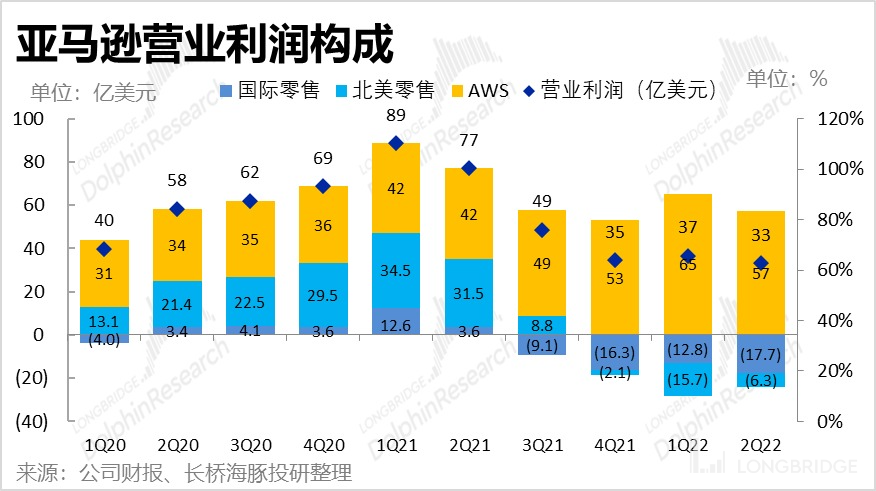

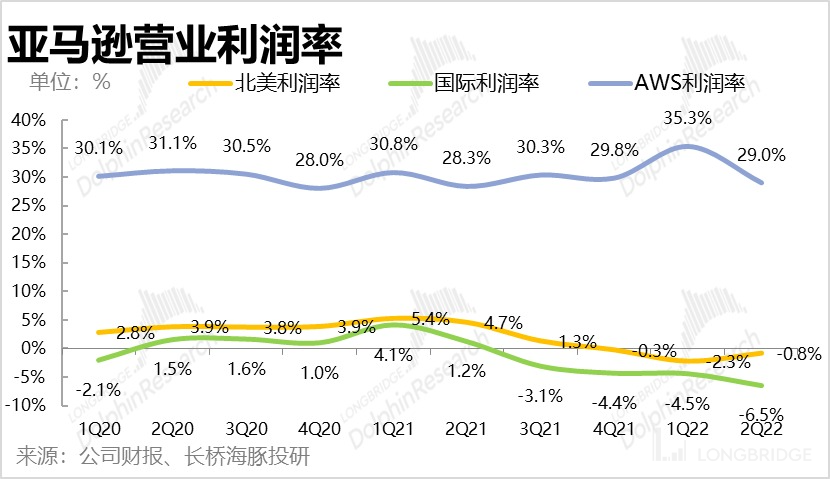

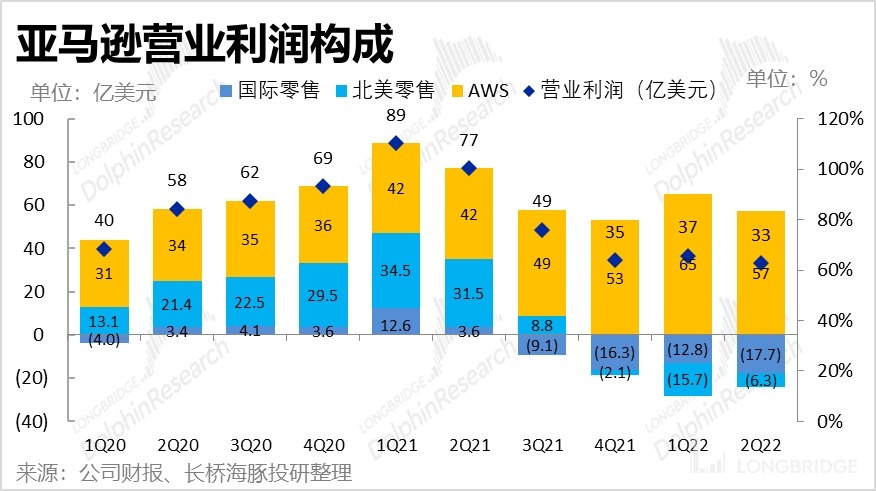

The benefits of extending the depreciation period of servers and other equipment enjoyed by the company in the previous quarter have faded somewhat. Coupled with the fact that R&D expenses, mostly on AWS, have increased significantly this quarter, the operating profit margin of AWS has clearly fallen back. This quarter, it achieved an operating profit of 5.7 billion with a profit margin of 29%, slightly lower than the market expectation of 5.8 billion.

Microsoft's previous financial reports revealed that businesses in Europe and the United States have delayed their IT expenditures, including cloud services, in the current challenging macro environment. Therefore, the performance of AWS this quarter, although no longer amazing, is still steady and within expectations.

Moreover, most of the expenditures on IT are not cancelled, but only postponed. Therefore, the AWS contract balance (which can guide future growth rates of AWS) that the company will disclose later is worth paying attention to.

4. Higher Profit than Expected from Price Increases and Layoffs

Against the backdrop of soaring inflation, Amazon has stated multiple times that it will partially transfer the cost and expense pressure caused by inflation through price increases and slowing down investment. Based on the results of this quarter, these measures have indeed had a certain effect.

First of all, the gross profit margin this quarter improved significantly, reaching 45.2%, an increase of 2 percentage points compared to the same period last year and also a significant improvement on a QoQ basis. The improvement is driven by the fact that the company's revenue structure is shifting from retail-oriented to service-oriented business. The increase in prices for FBA logistics services and North American Prime membership fees earlier this year were the main driving factors behind the better-than-expected gross profit margin this quarter. In addition, by the end of this quarter, the total number of employees in the company was 1.52 million, which decreased by about 100,000 compared to the end of last quarter. Dolphin Analyst believes that most of them were FBA logistics employees. The company had previously stated that the rapid expansion of logistics equipment and manpower led to uneconomical scale, and this layoff should also be for "cost reduction and efficiency improvement."

However, costs can still fall on the company's books due to price increases on the revenue side to offset the expansion of internal operating expenses caused by inflation. As can be seen, except for the fulfillment cost rate, which improved marginally due to FBA price increases and layoffs, other technical start-up, marketing, and management expense ratios continued to expand both year-on-year and quarter-on-quarter. The combined R&D, marketing, and management expenses ratio increased by 3.5pct quarter-on-quarter.

However, when the company released its performance for the previous quarter, it had stated that the equity incentive for employees this quarter would increase from 3.3 billion to 6 billion, which is also one of the driving factors for the obvious expansion of three expenses this quarter.

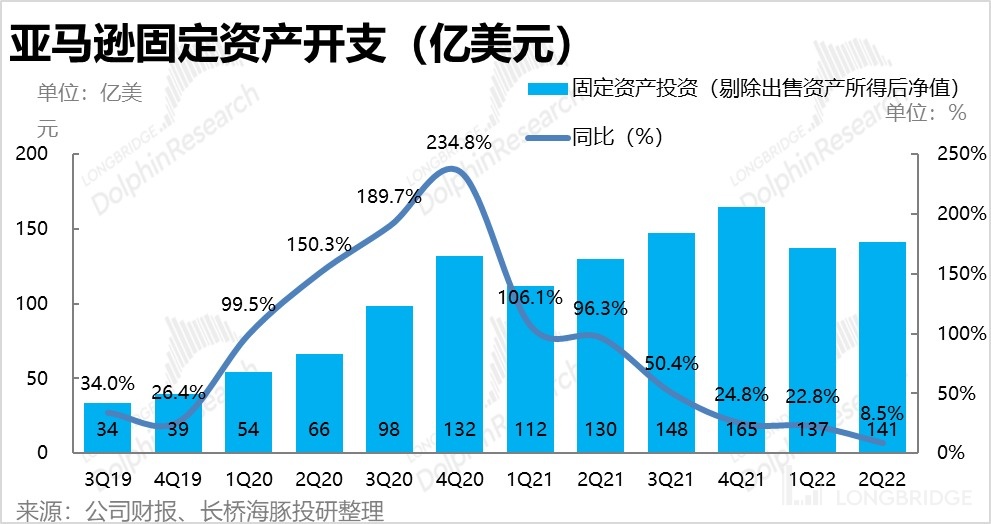

In addition, the company's fixed asset investment this quarter was 14.1 billion, and the year-on-year growth rate dropped significantly from the previous 20% to 8.5% this quarter. It can be seen that Amazon's total number has begun to slow down compared to the mismatch in revenue growth rate, and the pace of capital investment has seriously dragged down the company's profits.

Due to the effectiveness of price increase measures, the company's operating profit this quarter was close to 3.3 billion yuan, exceeding the upper limit of the company's previous guidance range from negative 1 billion to 3 billion yuan, and the profit release was significantly better than the market expected 1.64 billion.

V. Performance by division: North American retail begins to recover, and international business is still dragging down

From the perspective of departmental revenue, the growth rate of North American retail business this season is close to 10%, and the growth rate has begun to rebound from the low point of last quarter. However, the revenue of international business (mainly in Europe) still fell by 3% year-on-year without improvement.

From the perspective of operating profit, the operating losses of North American retail business this season have also been significantly reduced to US$630 million, and the loss rate is 0.8%, which improves significantly compared to last quarter and is also significantly higher than the market expected loss of US$1.9 billion. However, the loss of the international retail business continued to expand to ¥1.77 billion, dragging down the overall profit of the company. It can be seen that both the revenue and profit of the North American retail business have significantly improved, and all of the company's unexpected profits come from the North American retail business.

Previous research:

Financial report review

April 29, 2022 Telephone Conference Call, "American giants also talk about reducing costs and increasing efficiency, Amazon Conference call minutes"

April 29, 2022 Financial Report Review, "Inflation "eating" profits, this time AWS can't save Amazon"

February 4, 2022 Telephone Conference Call, "Market ups and downs, Amazon on its own way (Conference call minutes)"

February 4, 2022 Financial Report Review, "AWS saves the day, Amazon is lucky"

October 30, 2021 Telephone Conference Call, "Amazon's performance is poor, but management seems confident? (Minutes)"

October 29, 2021 Financial Report Review, "Revenue slowdown, profit drop, Amazon "deep squatting" surges"

In-depth analysis

May 30, 2022, "Macro headwinds too strong, Amazon can't hide in the cloud"

December 3, 2021, "They both don't make money, why is Amazon more popular than Alibaba?"

Risk disclosure and statement in this article: Dolphin Research Disclaimer and General Disclosure