The slightly upgraded iPhone has become Apple's last 'fig leaf'.

On the early morning of July 29th Beijing time, Apple announced its financial report for Q3 FY2022 (ending in June 2022) after the US stock market closed.

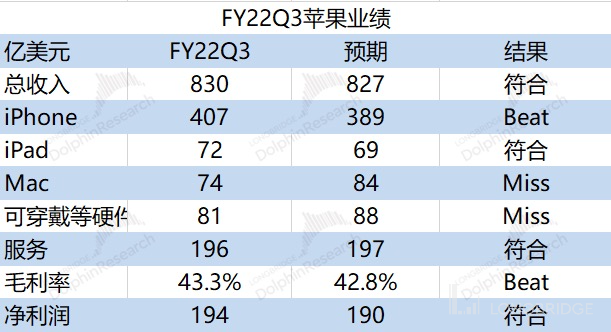

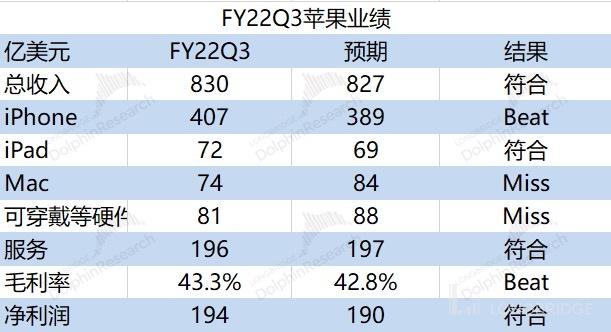

1. Overall performance: basically meeting market expectations. Apple achieved a revenue of 83 billion US dollars this quarter, a year-on-year increase of 8.6%, slightly exceeding the Bloomberg consensus expectation (82.7 billion US dollars). The reason why this quarter met market expectations is mainly due to the better-than-expected performance of the iPhone business. Apple's gross profit margin this quarter was 43.3%, a year-on-year increase of 1.2 points, slightly higher than the Bloomberg consensus expectation (42.8%). The software gross profit margin remained at above 70%, while the hardware gross profit margin continued to decline this quarter due to the cost pressure brought by inflation etc.

2. iPhone: the only area that performs better than the market in this round. The iPhone business is the only area that clearly surpassed market expectations this quarter. With the impact of the pandemic and inflation, the global mobile phone market has declined by nearly double digits. However, the iPhone business still achieved a counter-cyclical growth, demonstrating the strength of Apple's phone products. Smartphones are ultimately a mature market, and Apple's growth this quarter also comes from an increased market share in the industry. High growth is difficult to reproduce.

3. Other hardware except iPhone: lack of innovation plus the impact of the pandemic, all product categories have declined. The Mac business fell far short of expectations this quarter, mainly due to the overall sluggish PC market and the decline in production. The iPad business stabilized its sharp decline trend and is expected to continue to bring in 7 billion in revenue for the company. The wearable business saw a year-on-year decline for the first time due to economic downturn and insufficient product innovation affecting demand for optional consumer products.

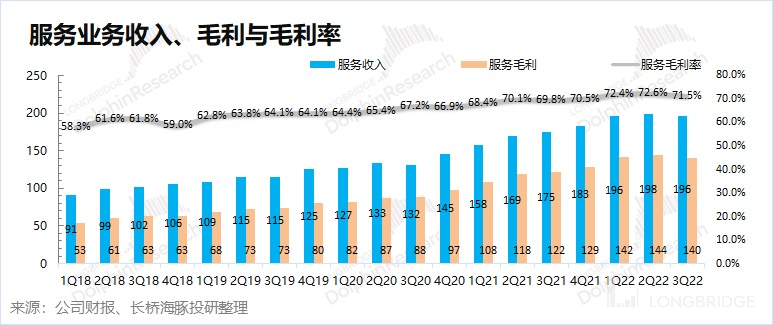

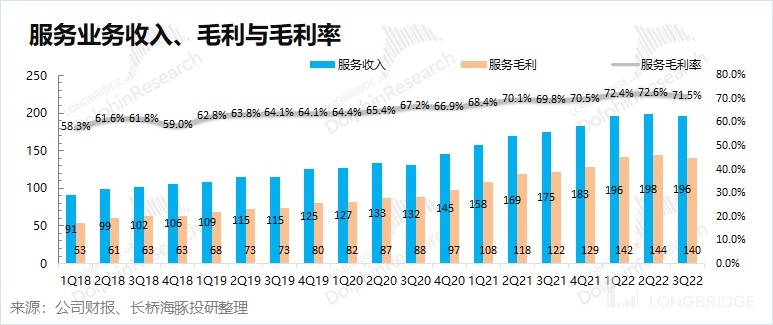

4. Software services: growth rate fell to a historical low. The revenue of software services this quarter was 19.6 billion US dollars, basically meeting the Bloomberg consensus expectation (19.7 billion US dollars). Since Apple has a hardware and software integrated model, when the growth of hardware stalls, it will also affect the growth rate of Apple's software service users.

Overall view: Apple's financial report for this quarter ultimately met market expectations. Upon closer inspection of this financial report, the low-growth iPhone business surprisingly became the "fig leaf" of Apple's financial report this quarter. Among all business areas, only the iPhone business clearly exceeded market expectations, offsetting the poor performance of products such as the Mac and the wearable.

Although this report has met and slightly exceeded market expectations, other product categories except for the iPhone business have underperformed. Mac and wearable fell short of market expectations, the iPad business continued to decline, and the growth rate of software services also fell to a historical low. Why would this be the case? As Dolphin Analyst worried in the last quarter's financial report, two problems are still reflected in this report:

① Where does the future growth of the hardware side come from? Consumer electronics products are ultimately optional consumption, and economic recession and lack of innovation will affect downstream demand; ② Will the software side's growth rate also decline? Apple is a company that integrates hardware and software, and the growth of hardware shipments brings the expansion of software user scale. Now that hardware growth is no longer high, the growth rate of software services has also begun to decline.

In short, Apple needs to sell its hardware products in order to grow its user base and form a positive cycle. The lack of innovation is the problem that Apple is facing now, and it's also what Cook frequently mentioned in the conference calls this year, "Apple has been looking for potential acquisition opportunities. If necessary, Apple does not rule out the possibility of acquiring large companies."

In the short term, Dolphin Analyst believes that the mobile phone is still Apple's largest source of income. Although faced with many unstable factors such as the epidemic this year, the performance of the iPhone this quarter is still good (specifically, it should not have been so bad). Although in the next quarter when the epidemic impact weakens, Apple's revenue growth may improve to some extent. However, looking at the mobile phone market, the reason why Apple continues to win in the "internalization" market of smartphones is not because of its own continuous innovation. After Jobs, Apple’s own innovation has become less and less, and more of the relative advantage generated by the "pulling down" of competitors.

In the long run, Apple still needs new products or innovations to drive continued growth, which is also a factor that Apple continues to lay out and develop in emerging fields such as automobiles and virtual displays.

For specific analysis of Apple's financial report, please see below:

I. Overall performance: Basically consistent with market expectations

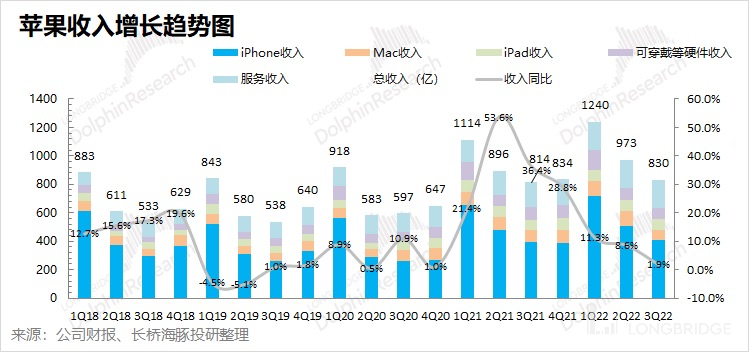

1.1 Revenue: In the third quarter of fiscal year 2022, Apple achieved revenue of US$83 billion, a year-on-year increase of 1.9%, which is in line with Bloomberg's consensus expectation (US$82.7 billion). Apple's revenue growth this quarter mainly comes from the iPhone business and software services, while all other hardware products except the iPhone have shown varying degrees of decline.

Apple's revenue growth rate continued to decline this quarter, verifying Dolphin Analyst's point of view in the previous quarter's review《Apple's Crazy Money-Making, Should Start Worrying About Growth! | Financial Report Season》, "When the mobile phone market enters a stable pattern and hardware innovation single products are no longer selling well, Apple also urgently needs to find new growth points."

Considering the bleak situation of smartphones in the first half of the year, the market has lowered its expectations for Apple's iPhone business. However, this quarter's financial report showed that the iPhone business still achieved counter-trend growth, which exceeded market expectations. As for the sluggish performance of other hardware products (Mac, wearable products, etc.) this quarter's report, it reflects that the overall consumption of electronic products is low in the first half of the year, not just the mobile phone market. The growth of the iPhone comes from the fact that the company has achieved more market share in the internalized smartphone market. From the perspectives of hardware and software:

Apple's hardware business growth rate this quarter fell to -0.9%, the first negative growth in seven quarters. Although the company's operations were affected by unstable factors such as the pandemic in the second quarter, the current situation of insufficient innovation in consumer electronics cannot be ignored. Although the mobile phone sector still achieved growth by relying on product competitiveness, other hardware products showed significant signs of decline.

Apple's software business still achieved 12.2% growth this quarter, but the growth rate continued to decline. The slowdown in user growth due to the significant decline in shipment growth of hardware products influenced the growth of the software business.

From the perspective of each region: The revenue growth rate of all major regions of Apple globally showed significant decline, mainly due to the overall economic downturn. Among them, the Greater China region experienced a 1.1% decline in revenue due to the impact of factors such as the pandemic, while the revenue of the Japanese region declined by 15.7%, with the additional factor of significant depreciation of the Japanese yen.

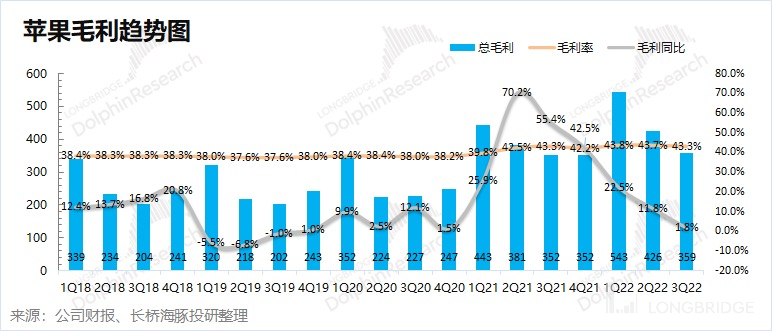

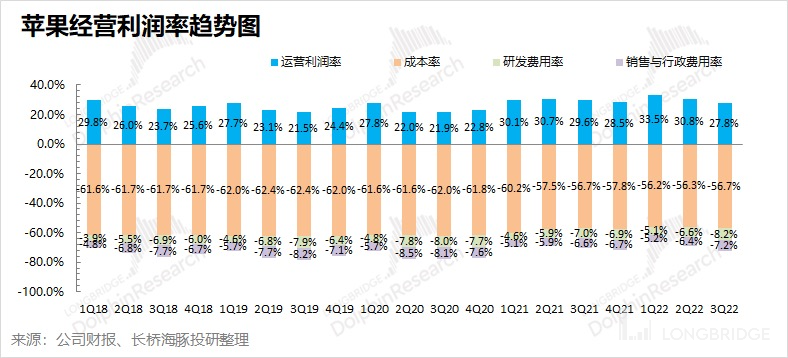

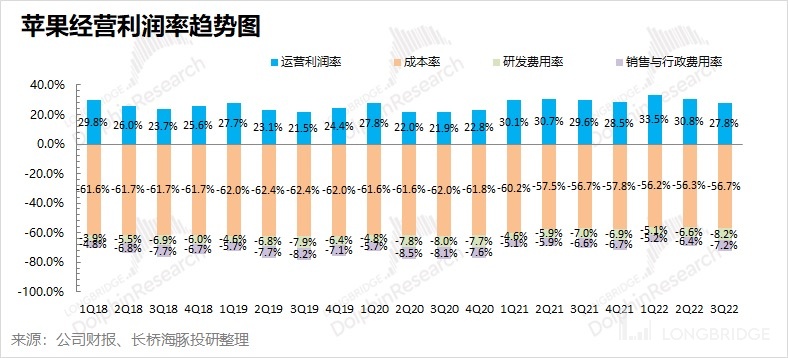

1.2 Gross Margin: In the third quarter of the 2022 fiscal year, Apple's gross margin reached 43.3%, which was the same as the previous year and slightly exceeded Bloomberg's consensus expectations (42.8%). Although there was a slight loosening in gross margin this quarter, Apple still maintained a high level of above 43%.

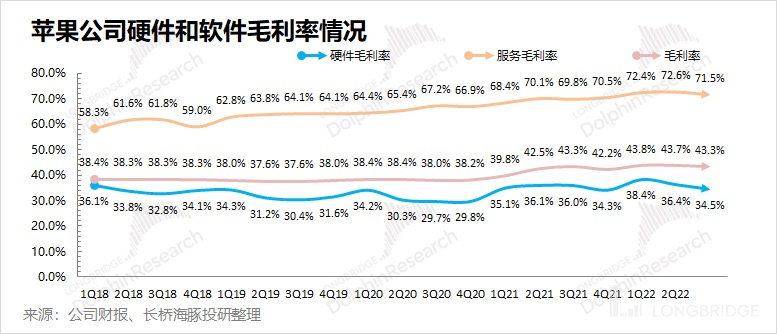

Viewed by Dolphin Analyst, the breakdown of software and hardware gross margins is as follows:

This quarter, Apple's software gross margin had a slight decline, but it still maintained a high level of over 70%. However, the market still pays close attention to the gross margin level of the hardware aspect. In this quarter, Apple's hardware gross margin declined significantly to 34.5%. Affected by factors such as the pandemic and inflation, Apple's hardware aspect continued to face cost pressures this quarter.

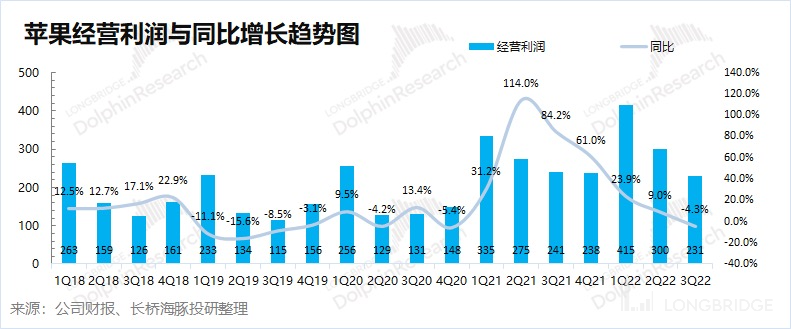

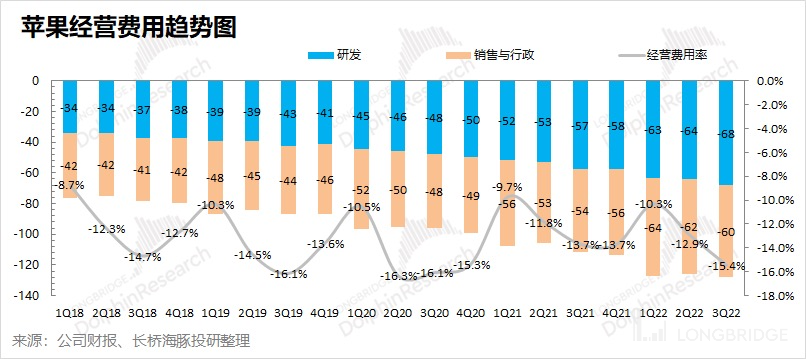

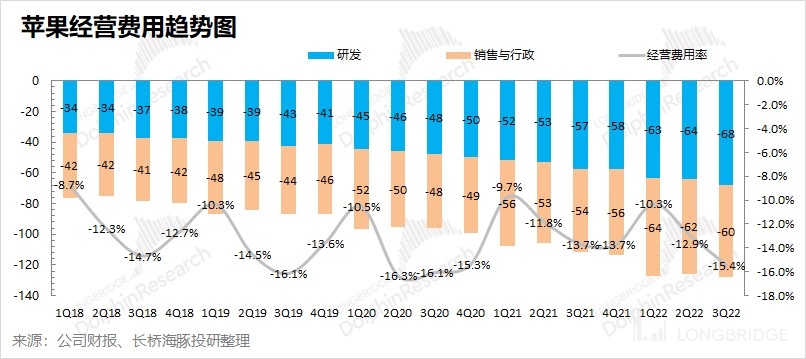

1.3 Operating Profit: In the third quarter of the 2022 fiscal year, Apple's operating profit was 23.1 billion US dollars, a year-on-year decrease of 4.3%, which slightly exceeded Bloomberg's consensus forecast (22.6 billion US dollars). It was the first negative growth in the past seven quarters, but still slightly exceeded market expectations. The outstanding performance of operating profit this quarter was mainly due to the outperformance of gross margin. Apple's operating expense ratio this quarter is 15.4%, up 1.7pct year-on-year, basically in line with market expectations. Sales, administrative expense ratio, and research and development expense ratio all increased this quarter, as expected by the market. It is expected that research and development expenses will increase significantly as wages rise after the epidemic.

2. iPhone: Counter-trend growth in internal competition

In the third quarter of the 2022 fiscal year, iPhone business revenue was US$40.7 billion, a year-on-year increase of 2.8%, exceeding Bloomberg's consensus expectation (US$38.9 billion). The better-than-expected performance of the iPhone business this quarter is mainly due to the overall weakness of the smartphone market, and Apple has gained a market share increase with its own product strength. As Dolphin Analyst mentioned in the previous article "Consumer electronics are ripe, Apple is tough and Xiaomi is suffering", "Apple's hardware business can withstand the pressure of industry decline."

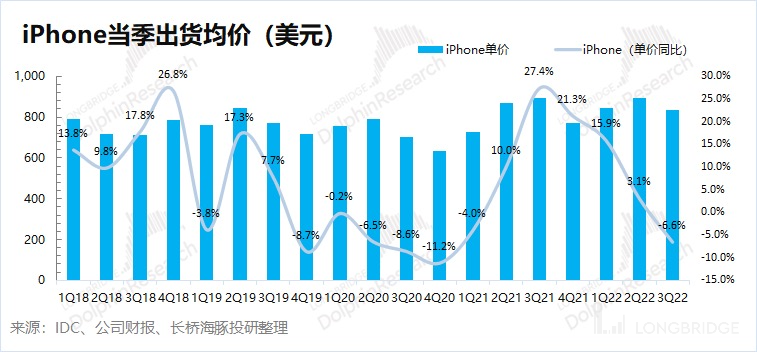

Based on the relationship between quantity and price, let's look at the main sources of growth for the iPhone business this quarter from the perspective of Dolphin Analyst:

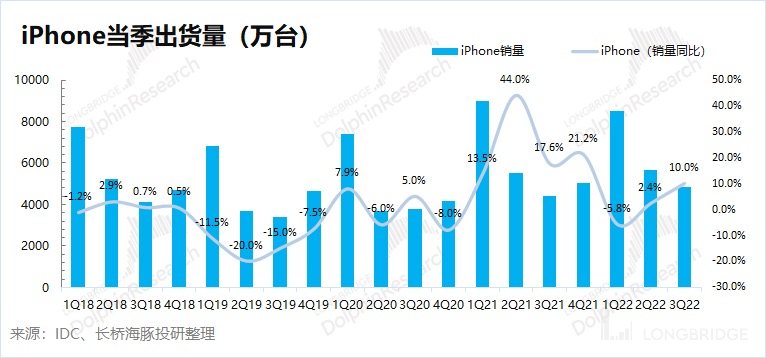

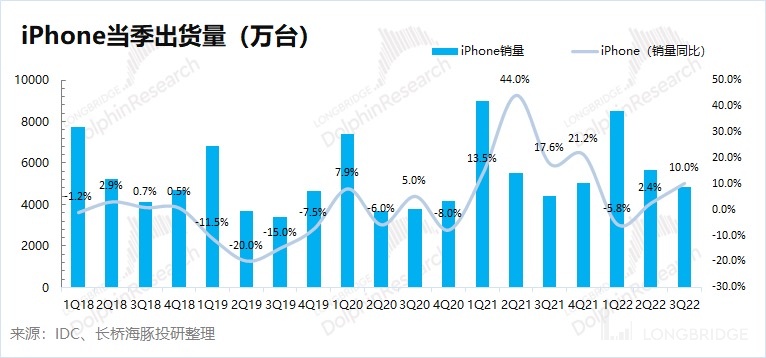

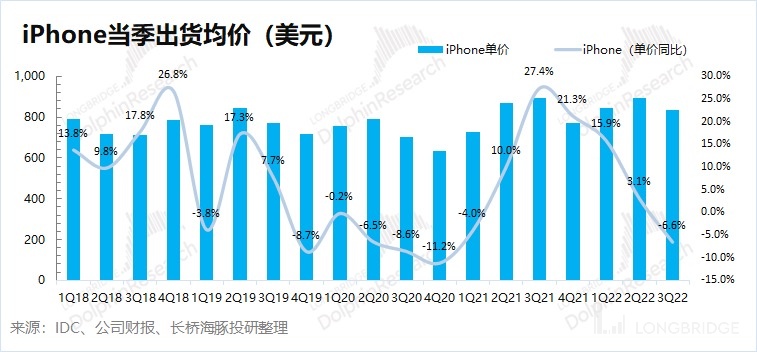

1) iPhone shipments: Before the quarterly report was released this quarter, Canalys had already disclosed the shipment situation of various brands for the quarter. Influenced by the epidemic and inflation, the global smartphone market in the second quarter of 2022 declined by 9% year-on-year. Apple's market share increased from 14% to 17% with its product strength. Based on this, under the overall low tide of the industry, the shipment volume of iPhone mobile phones this quarter still achieved positive growth in the "internal competition", which is not easy.

2) iPhone Average Selling Price (ASP): Due to the disclosure of Canalys data, the iPhone shipment volume this quarter has been digested by the market. Combined with iPhone business income and shipment volume calculations, the average selling price of the iPhone this quarter has decreased year-on-year, but still reached more than $830. Low-priced models of iPhones achieved nearly doubled growth in the Indian market in the second quarter, which had a downward impact on the overall ASP.

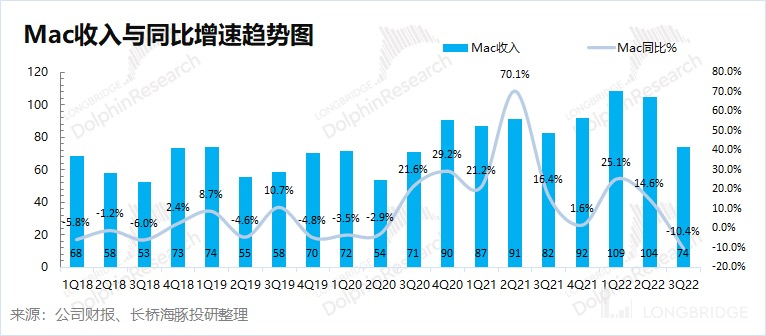

3.1 Mac Business

Mac business revenue for the third quarter of fiscal year 2022 was $7.4 billion, down 10.4% year on year, far below Bloomberg's consensus expectation of $8.4 billion. The Mac business in this quarter was lower than expected, mainly because 1) the overall PC market demand was stagnant, with double-digit decline in this quarter; 2) the production side of Apple was also affected by factors such as the pandemic.

According to IDC's report, global PC shipments in this quarter fell by 15.3% year on year, while Apple's shipments fell by 22.5% in the same quarter. This was mainly due to the decrease in Apple's production capacity. It is expected that Apple will increase its Mac production in the second half of the year.

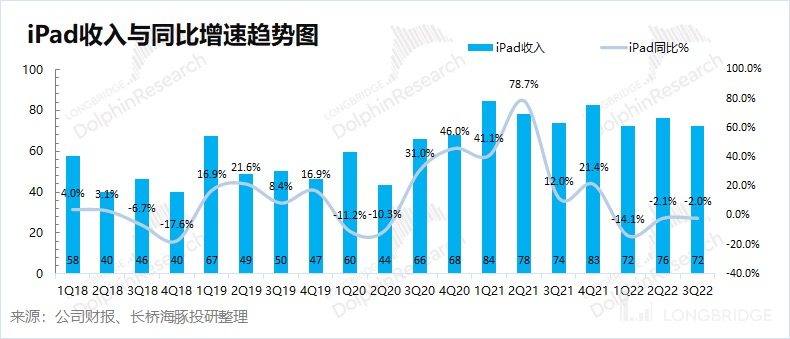

3.2 iPad Business

iPad business revenue for the third quarter of fiscal year 2022 was $7.2 billion, down 2% year on year, in line with Bloomberg's consensus expectation of $6.9 billion. Previously, due to the lifestyle of working, studying and entertainment at home driven by the pandemic, iPad business experienced high growth. However, with the weakening of the pandemic impact, the overall demand of the tablet market has declined, and the market has therefore lowered its growth expectations for Apple's iPad business.

Although the iPad business in this quarter was down year on year, the double-digit decline in the business has stabilized overall. Unless there are major innovations or replacements for iPad products, the overall business will remain relatively stable.

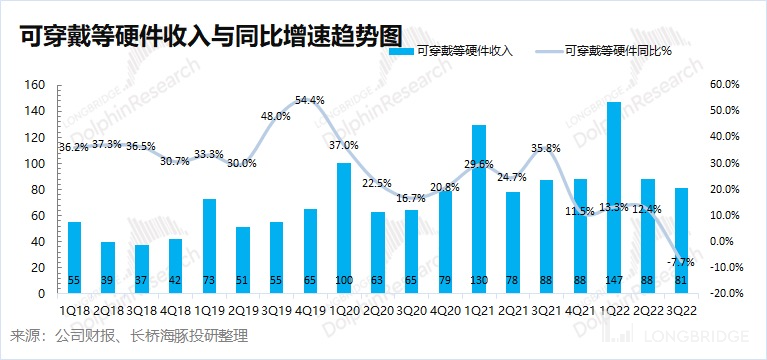

3.3 Other Hardware such as Wearable Products

Revenue from other hardware such as wearable products in the third quarter of fiscal year 2022 was $8.1 billion, down 7.7% year on year and below Bloomberg's consensus expectation of $8.8 billion. Apple's wearable and other hardware business saw a year-on-year decline for the first time, mainly due to the lack of product innovation.

Wearable and other hardware products are optional consumer goods mainly driven by innovation. Just like the previous popular product Airpods Pro, the demand was mainly driven by functional innovation such as noise reduction and in-ear wearing. However, the lack of innovation in wearable and other hardware products makes it difficult to stimulate continued demand growth. Although Apple will still release new products in the second half of the year, it will be difficult for wearable and other hardware businesses to return to their previous high growth before the next explosive product/innovation appears.

IV. Software Services: Growth Rate Drops to Historic Low

"In Q3 FY2022, the software services revenue was $19.6 billion, a YoY growth of 12.2%, which is basically in line with Bloomberg's consensus estimates ($19.7 billion)." Although software services still maintain double-digit growth, the growth rate has returned to an all-time low. "This is because Apple's software and hardware are integrated. When the growth rate of hardware in the previous quarter is no longer high, it will also affect the growth rate of users on Apple's software service side." Apple's software service growth rate has been declining continuously.

"In software services, the most concerning factor is the gross profit margin level of software services. In this quarter, the gross margin rate of software services has declined slightly on a QoQ basis, but still remains above 70%. In the overall downturn of the online advertising industry, Apple can still achieve a gross margin rate of over 70%, highlighting the importance of hardware entrance." Apple's software services have continued to increase in recent years and have now stabilized for four consecutive quarters at over 70%.

Apple has over 860 million paid subscription users, an increase of 160 million in the past 12 months. Apple has not disclosed the number of users for each service, and the growth mainly comes from strong growth of Apple TV+ and Apple Arcade.

Dolphin Apple's historic retrospective articles on earnings calls are as follows:

Earnings Call Quarter

April 29, 2022 Conference Call summary "Apple gives weak guidance amid multiple challenges (Conference Call Minutes)"

April 28, 2022 earnings review "Despite earning crazy money, Apple should worry about growth! | Earnings Call Quarter"

January 28, 2022 Conference Call summary "Apple: Supply crisis eases, innovation ignites true technology (Conference Call Minutes)"

January 28, 2022 earnings review "Apple's Hard Strength is Sweet and Fragrant Again | Read Earnings" 2021 年 10 月 29 日电话会《业绩预期落空后,苹果管理层交流了什么?》

2021 年 10 月 29 日财报点评《预期扑空,苹果答卷尬了》

2021 年 7 月 28 日电话会《苹果五项全能大超预期后,管理层的解读(附完整 Q&A)》

2021 年 7 月 28 日财报点评《苹果:优秀的定义,五项全能大超预期》

2021 年 4 月 29 日电话会《苹果 2021Q2 业绩会纪要》

2021 年 4 月 29 日财报点评《优秀的公司总是不断超预期,新财季的苹果够硬气!》

2021 年 4 月 25 日财报前瞻《霸气侧露的一季报后,苹果新一季财报会持续爆发吗?》

深度

2022 年 6 月 17 日《消费电子 “熟透”,苹果硬挺、小米苦熬》

2022 年 6 月 6 日《美股巨震,苹果、特斯拉、英伟达是被错杀了吗?》

2022 年 2 月 28 日《苹果:转嫁成本压力,就服你!》

2021 年 12 月 6 日《苹果:双轮驱动渐显乏力,“跛脚” 硬件急需大单品续力》

直播

2022 年 4 月 29 日《苹果公司 (AAPL.US) 2022 年第二季度业绩电话会》 On January 28, 2022, Apple Inc. (AAPL.US) 2022 Q1 Results Conference Call was held.

On October 29, 2021, Apple Inc. (AAPL.US) 2021 Q4 Results Conference Call was held.

On October 19, 2021, Apple October New Product Launch was held.

On September 15, 2021, Apple 2021 Fall Event was held.

On July 28, 2021, Apple Inc. (AAPL.US) 2021 Q3 Results Conference Call was held.

On April 29, 2021, Apple Inc. (AAPL.US) 2021 Q2 Results Conference Call was held.

On April 21, 2021, Apple Spring New Product Launch was held.

Risk disclosure and statement of this article: Dolphin Analyst Disclaimer and General Disclosure