When Americans run out of money to spend, is the US far from recession?

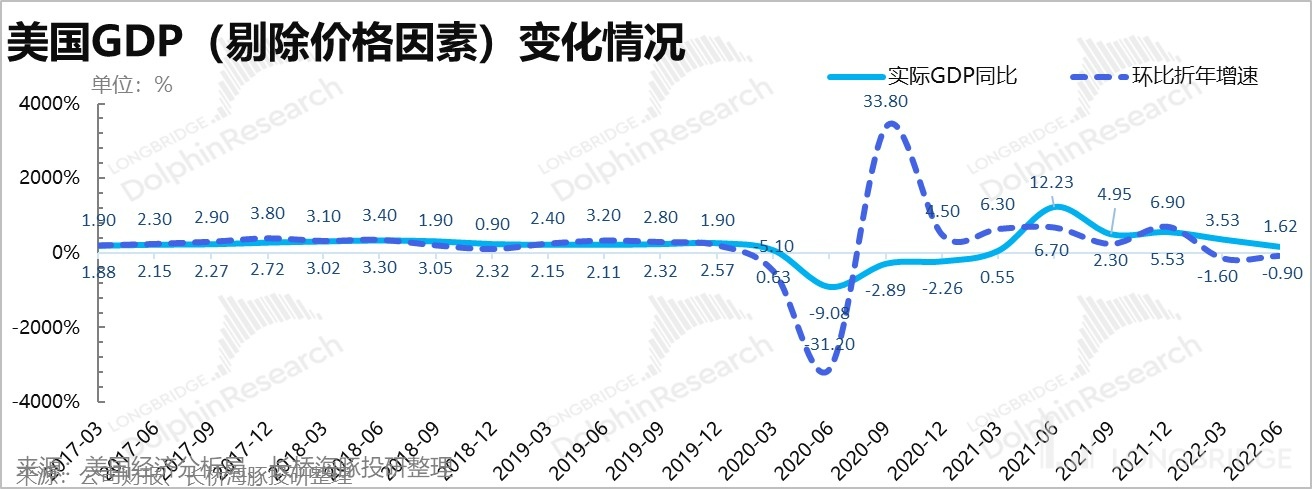

I. Continuous negative growth, stagflation in progress

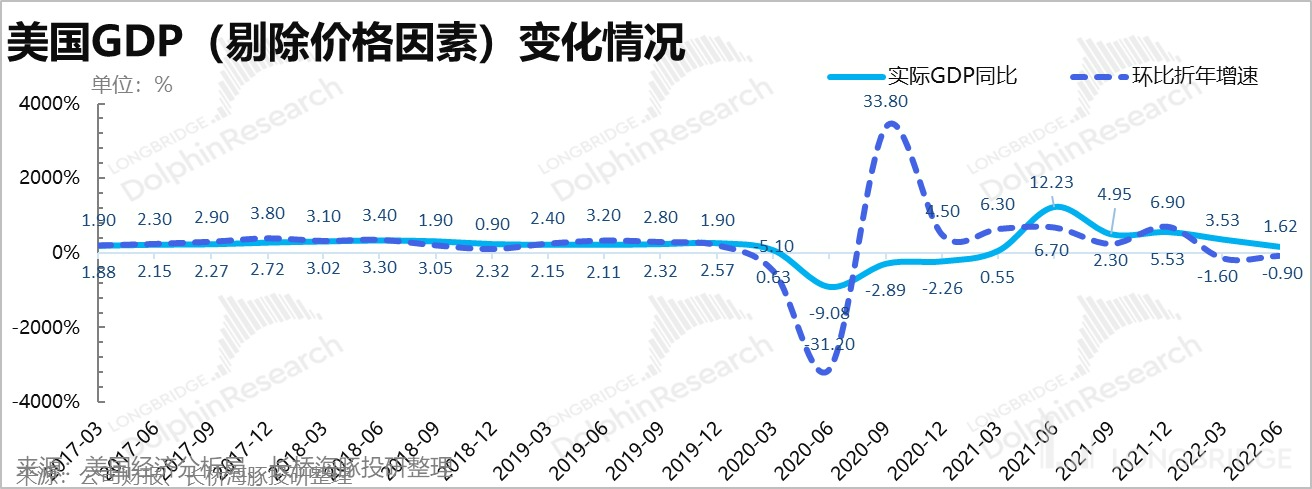

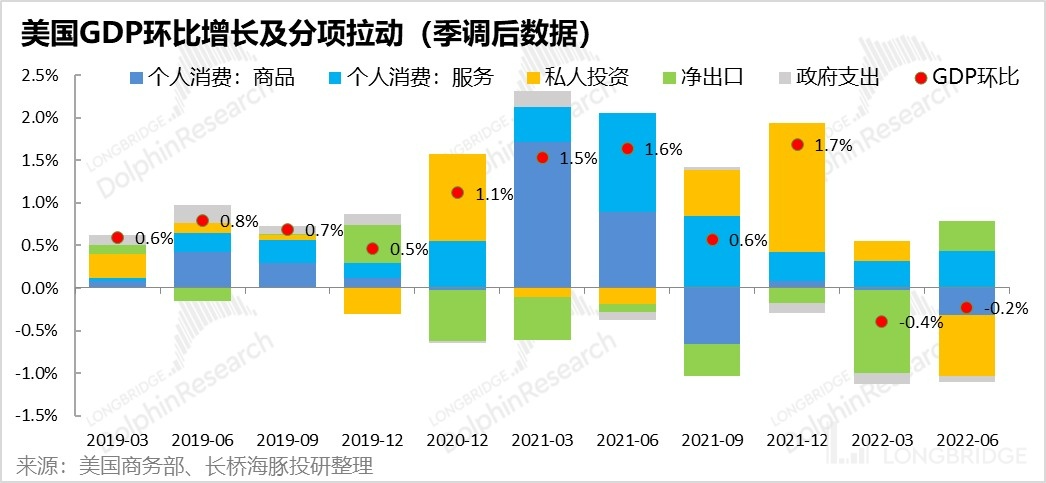

The US economic GDP for the second quarter is out, with a year-on-year growth of 1.6% in the second quarter and a total of 2.6% in the first half of the year. However, looking at the year-on-year growth of -0.9% (equivalent to the growth rate of 2022 GDP compared to the same period last year if each quarter this year progresses at the same quarter-on-quarter growth rate as the second quarter) calculated based on the seasonally adjusted quarter-on-quarter, it has been in negative growth for two consecutive quarters.

With the rapid slowdown of real GDP and the CPI under the high temperature barbecue mode in the first half of the year, the US economy is showing obvious stagflation.

II. Government investment stagnates, private consumption/investment cools down, only the trade deficit narrows

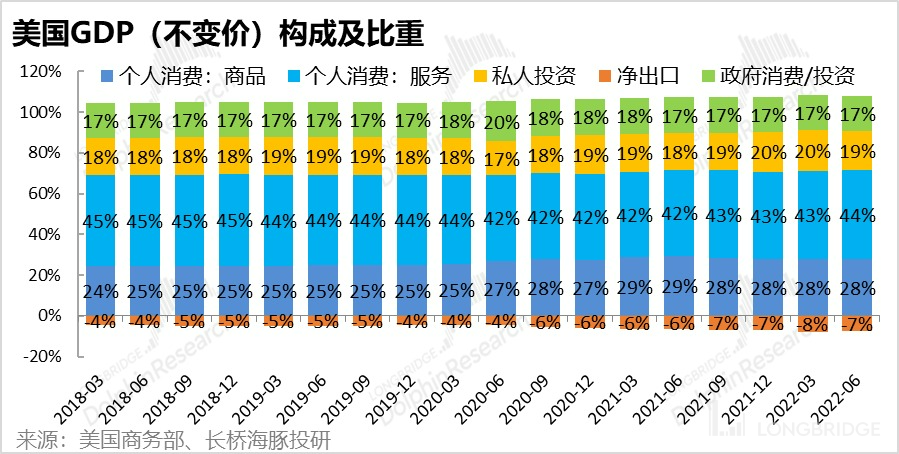

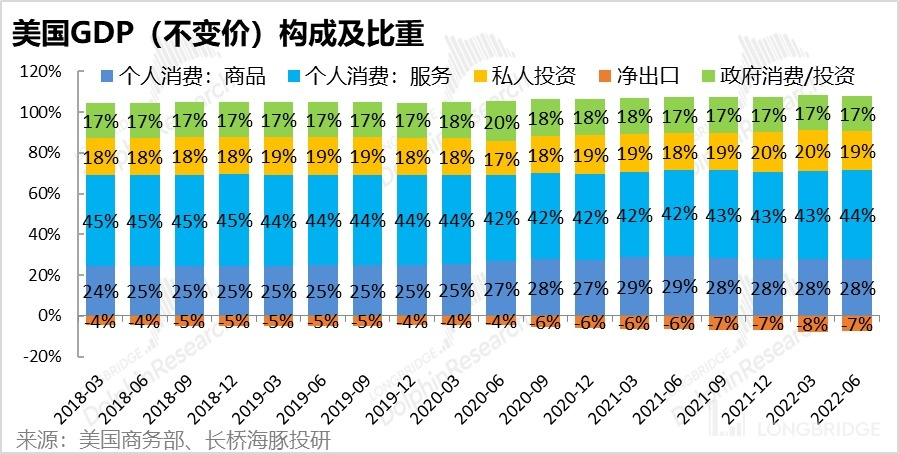

Among the three major contributors to GDP, the US relies more heavily on domestic demand than China, accounting for more than 70%. The second is private investment, followed by government investment/consumption, and the sustained deficit has always been a drag on its net exports.

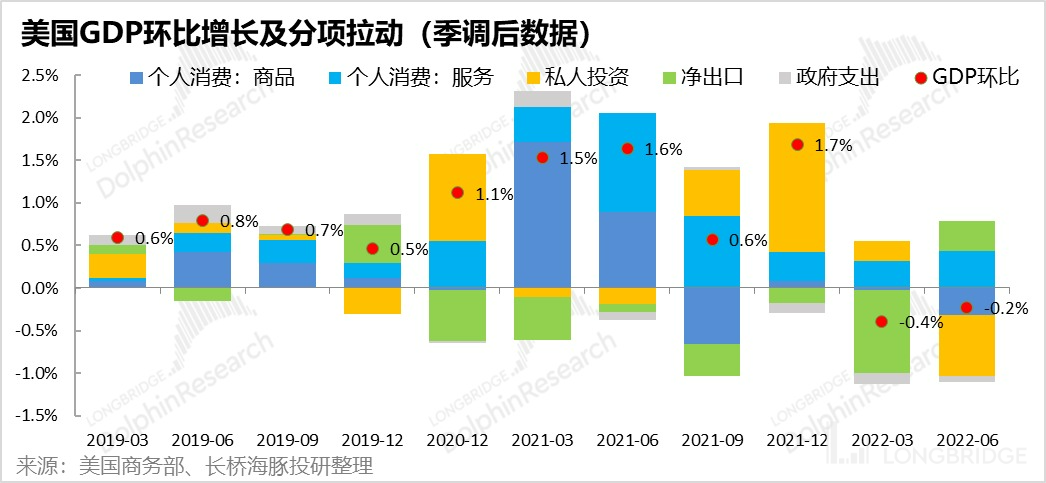

However, in the single quarter of negative growth of only 0.2% QoQ:

- Private consumption made a positive contribution to the overall consumption growth of 0.2 percentage points due to the better performance of service consumption offsetting the negative growth of goods consumption.

2. However, after three consecutive quarters of QoQ growth, private investment began to cool down significantly, making a negative contribution of 0.7 percentage points to GDP growth. The slowdown in investment has begun to be reflected in GDP.

- Due to weakened demand and slower imports, the trade deficit was slightly smaller than last quarter, making a positive contribution.

Overall, if last quarter's slowdown in GDP was due to excessive demand and large trade deficits, this quarter indicates a real economic slowdown.

In particular, the slowing pace of private investment, negative growth in investment amount, confirms what several major US stock market giants conveyed in their Q2 earnings call: slowing capital expenditure and varying degrees of layoffs.

III. Consumption: savings are disappearing, inflation is still powerful, will Americans be unable to make ends meet?

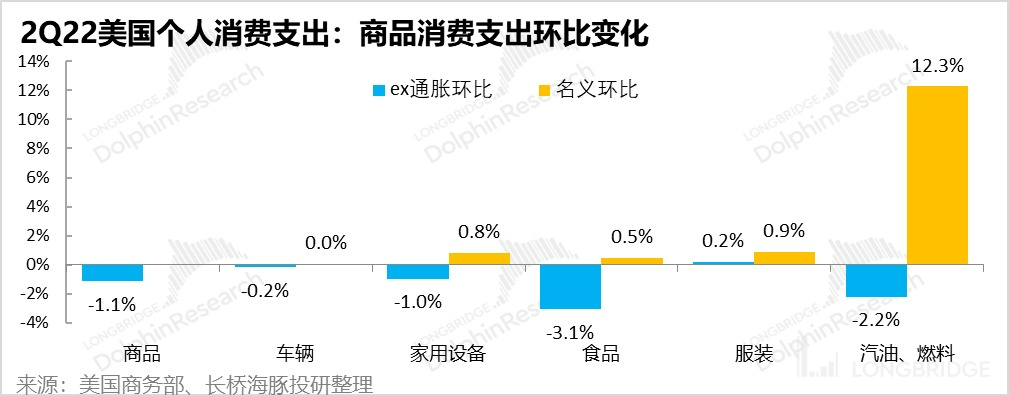

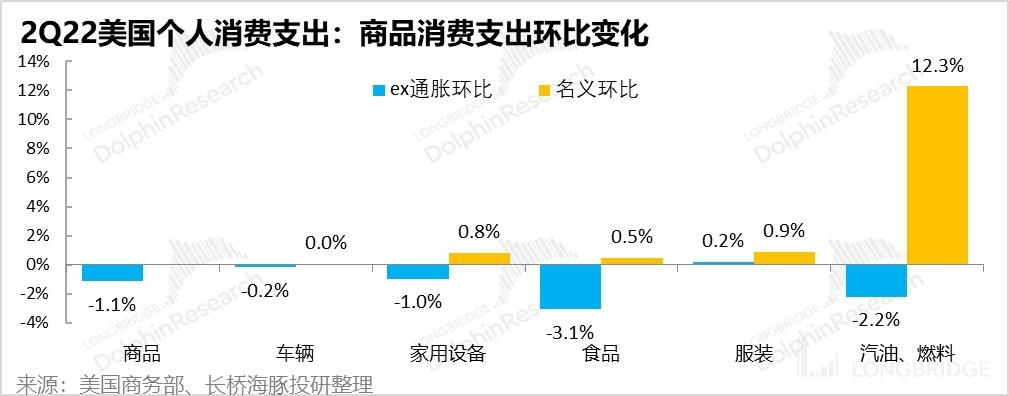

Looking at personal consumption, the largest component of GDP, goods consumption (seasonally adjusted) basically stalled in the second quarter. Although it is still nominally growing, it is clear that the severe squeeze on other goods consumption by gasoline and fuel consumption has caused a general slump in other goods consumption, and nominal QoQ growth is almost zero. Excluding inflation, real goods consumption is almost entirely negative.

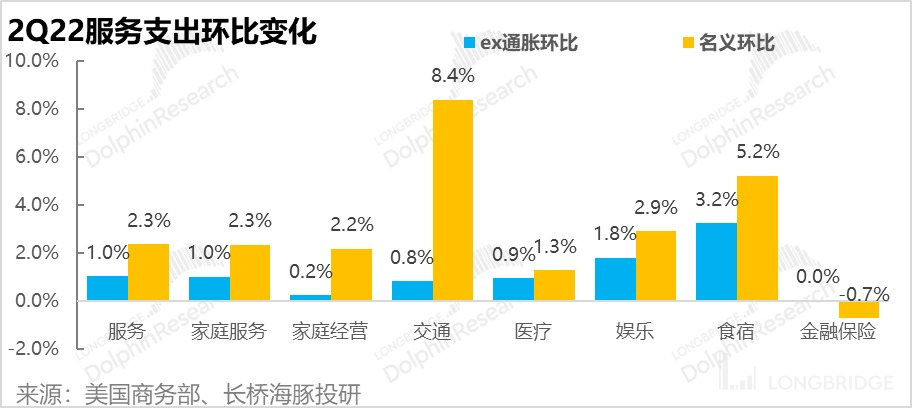

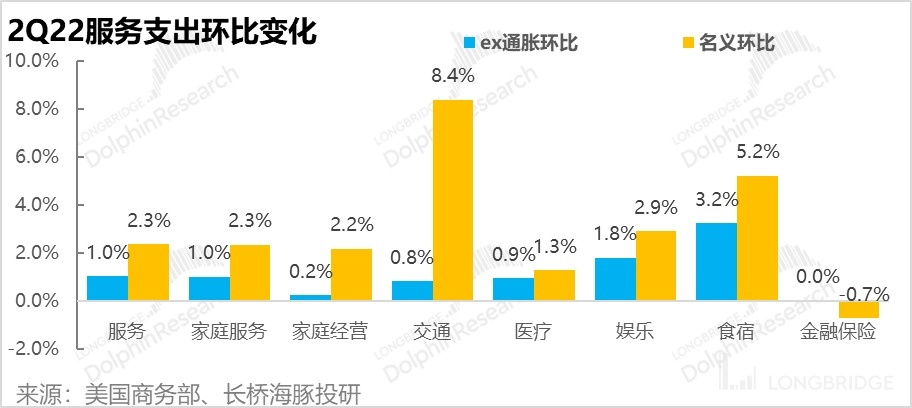

However, after the epidemic, while social activities recovered, service consumption is still recovering. Whether it is inclusive of inflation or exclusive, service consumption is actually still in recovery, especially with regard to food and accommodation-related service consumption.

Moreover, looking ahead to overall consumption, there is a high chance of stagnation:

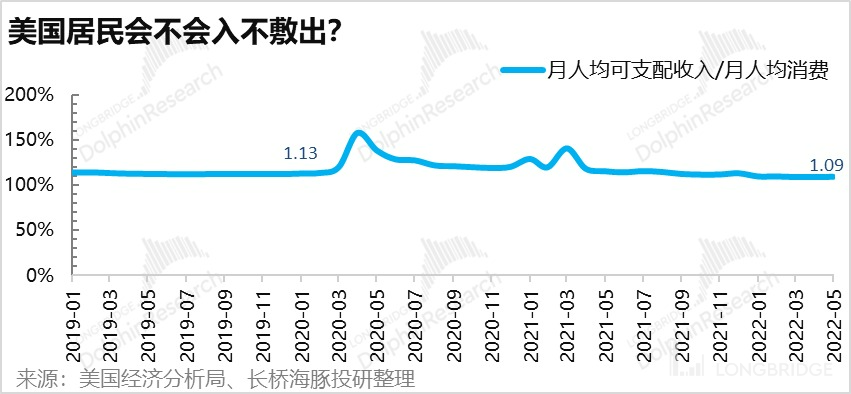

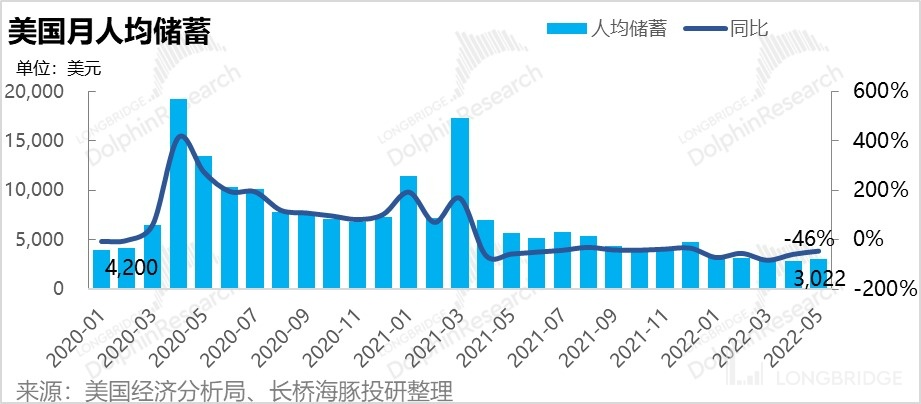

Per capita disposable income in the United States has already failed to keep pace with the growth rate of inflation, and it is actually continuing to decline. From the current monthly per capita disposable income of Americans corresponding to their monthly per capita consumption expenditures, it is now at most a tight balance.

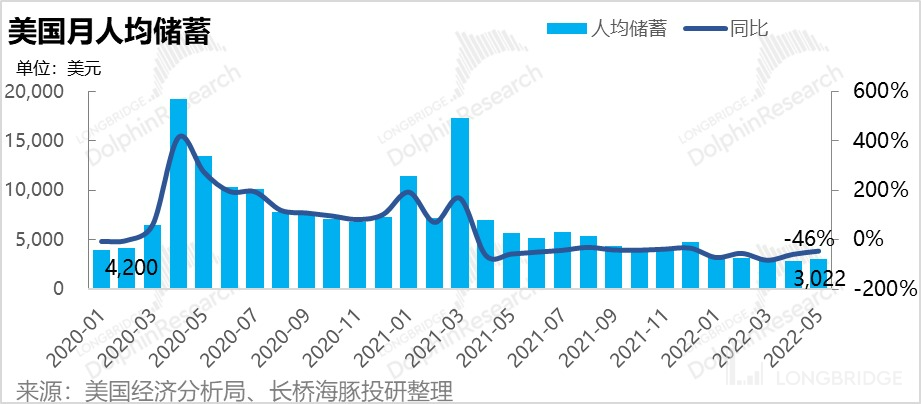

Simultaneously, regarding the average savings balance per person, after the government stopped distributing helicopter money, it is already down to only $3,000, which is below the average pre-epidemic savings level.

Overall, with disposable income being continuously eroded by inflation and only barely able to cover monthly expenditures, savings are gradually being exhausted. Furthermore, if money is borrowed to spend today, interest rates are increasing. Taken together, it can only be said that the good days when Americans spend extravagantly are over, and what remains is probably only a tightening of the belt to get by.

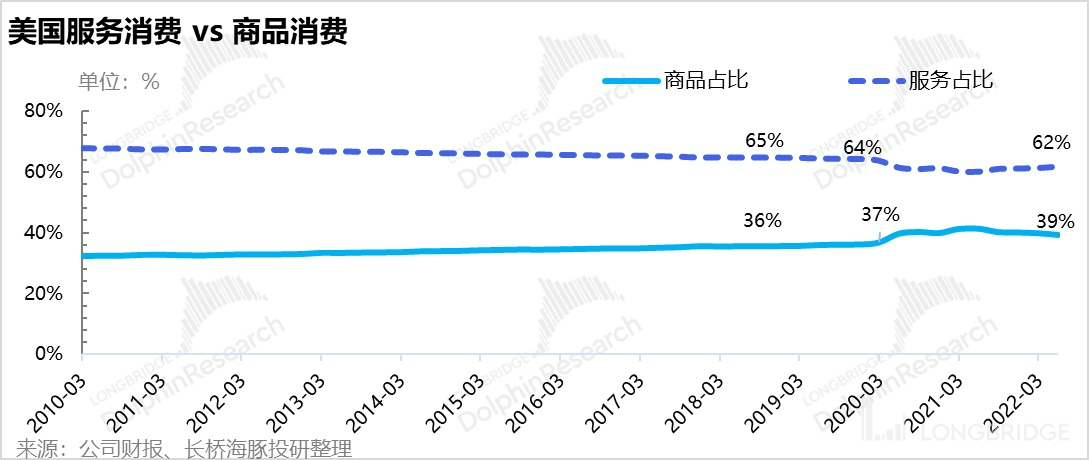

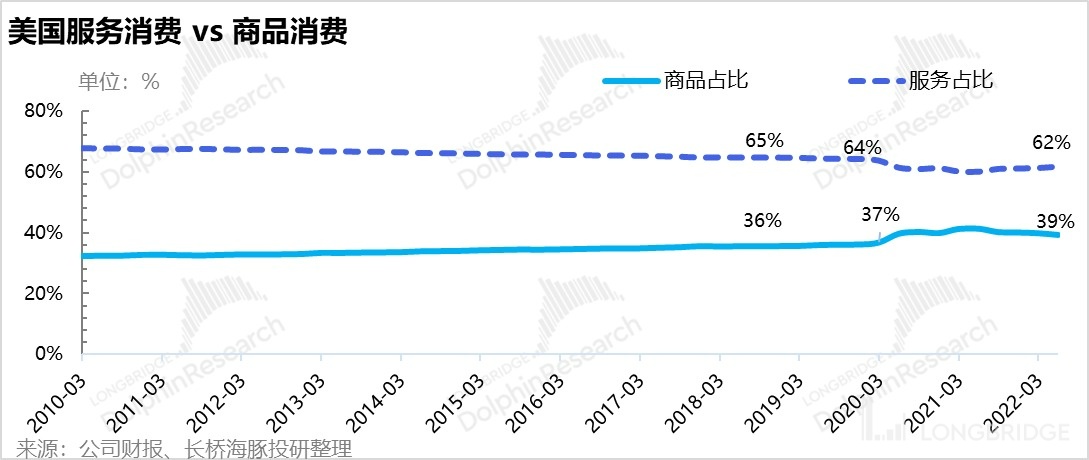

Regarding the short-term consumption structure, looking at the current proportions of service and goods consumption, the sacrifice is most likely to be goods consumption. This is because service consumption has not yet returned to the normal proportion of goods and service consumption prior to the epidemic, leaving 2-3 percentage points of room for improvement.

4. When consumption declines, how long can corporate activity persist in a demand-driven economy?

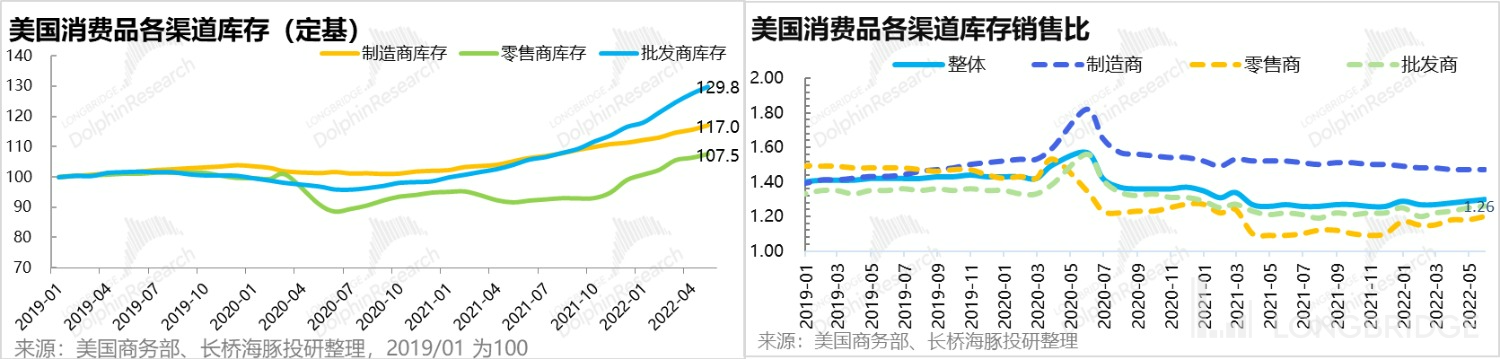

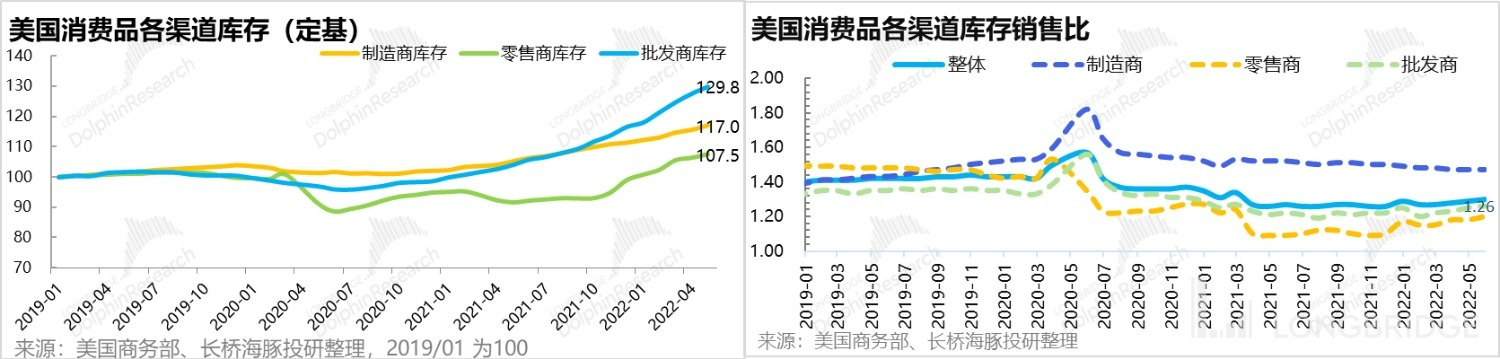

Currently, with respect to the inventory situation of goods consumption, wholesale inventory has already risen. However, since consumption is still cooling down, the turnover of goods consumption is still stable. Hence, it can be seen that the stock-sales ratio is still not under too much pressure.

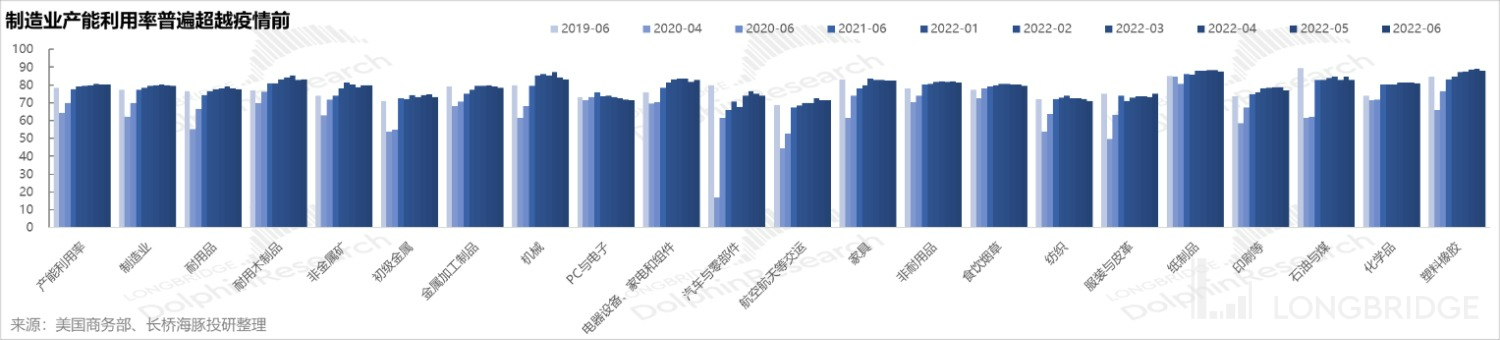

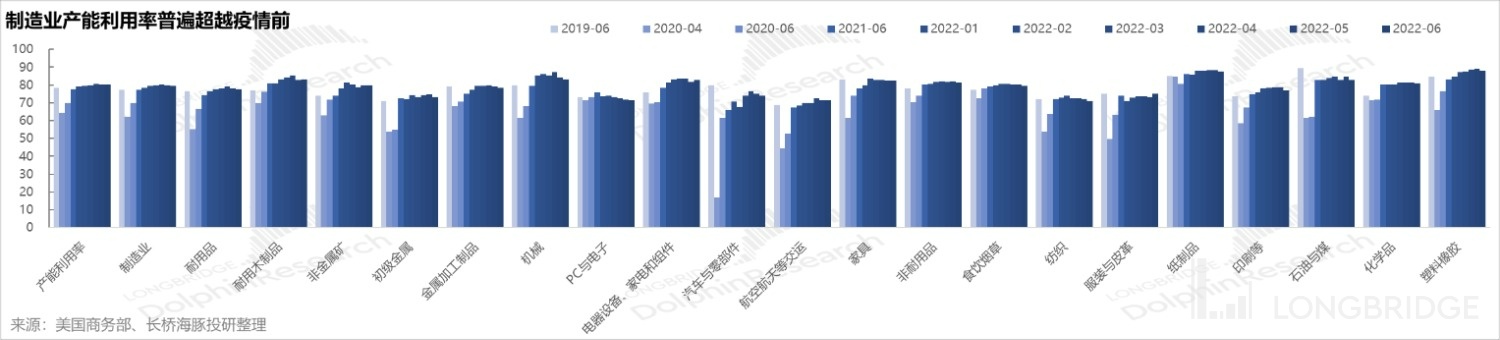

The problem lies only in the fact that if American consumers start tightening their belts in the future, whether or not the current situation in which the utilization ratio of US manufacturing from durable goods to consumer goods significantly surpasses that before the epidemic (excluding supply chain shortage sectors—cars, anti-environmental sectors— oil/coal, and shrinking consumption sectors—electronics/digital), means that inventory of manufacturers will also accumulate in addition to that of wholesalers. Entering a new inventory cycle?

In a nutshell, a consumer economy will not be absent from recession when consumers begin to be careful with their spending.