Top Performer Announcement: A shares are like running water, while Maotai remains a solid bet.

Hi everyone, I'm Dolphin Analyst!

On August 2nd, Beijing time, Guizhou Maotai (600519.SH) released its 2022 semi-annual financial report after the A-share market closed. The main points are as follows:

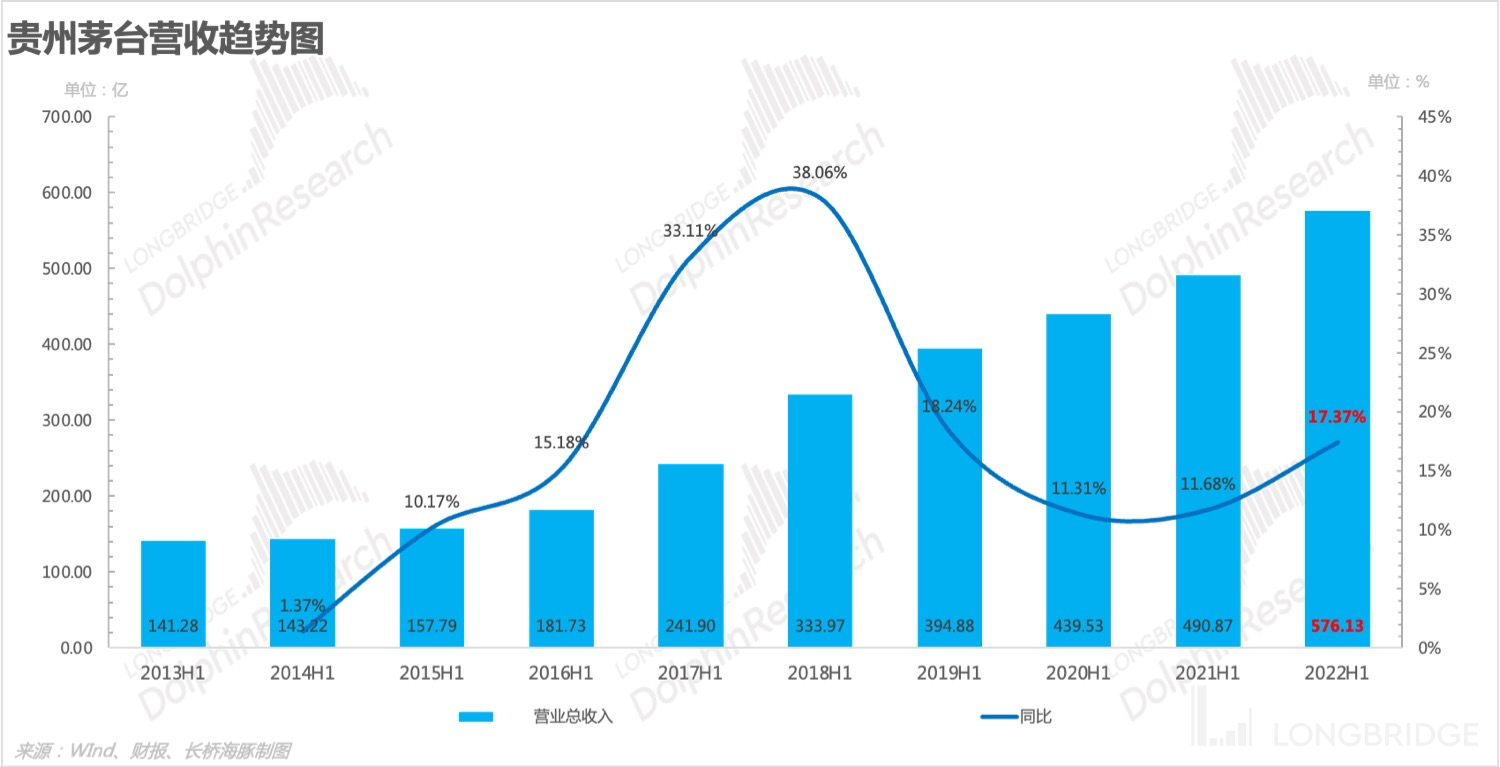

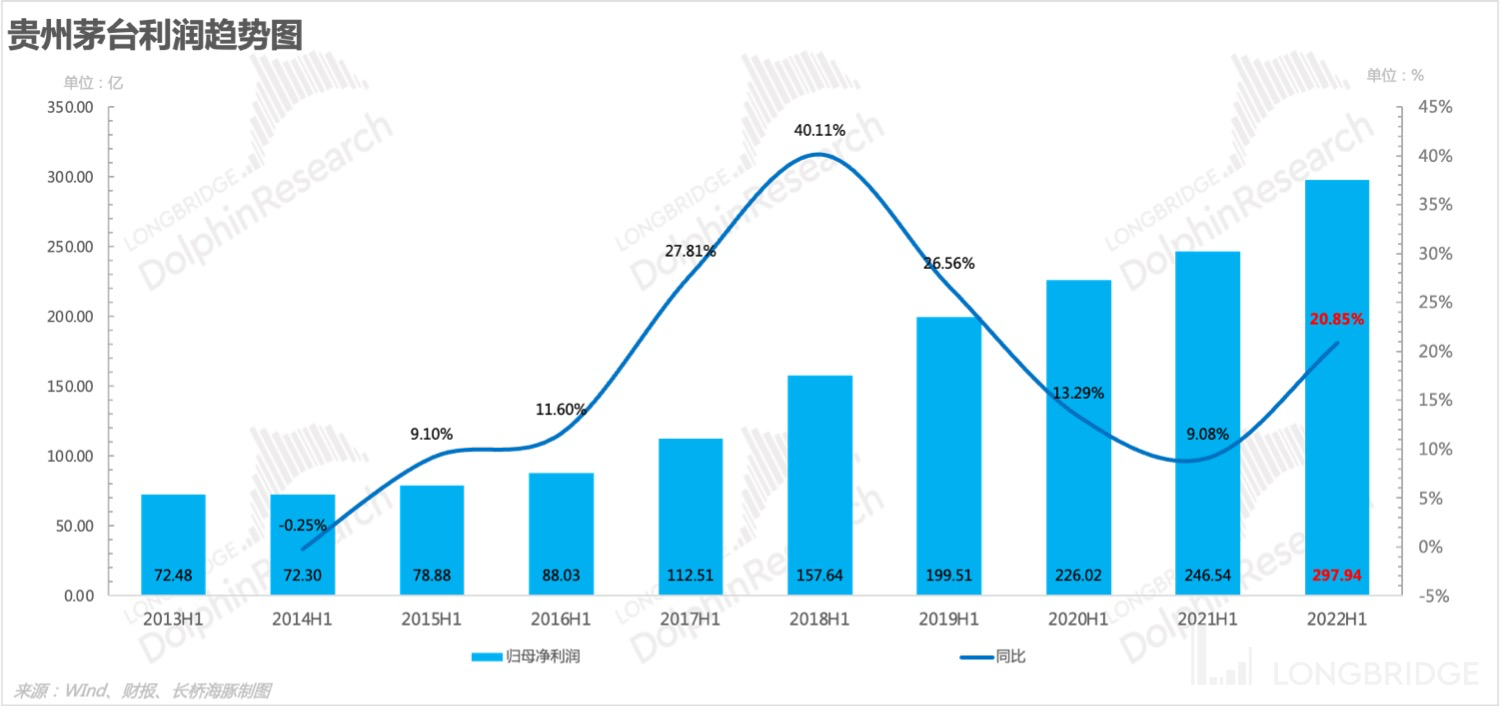

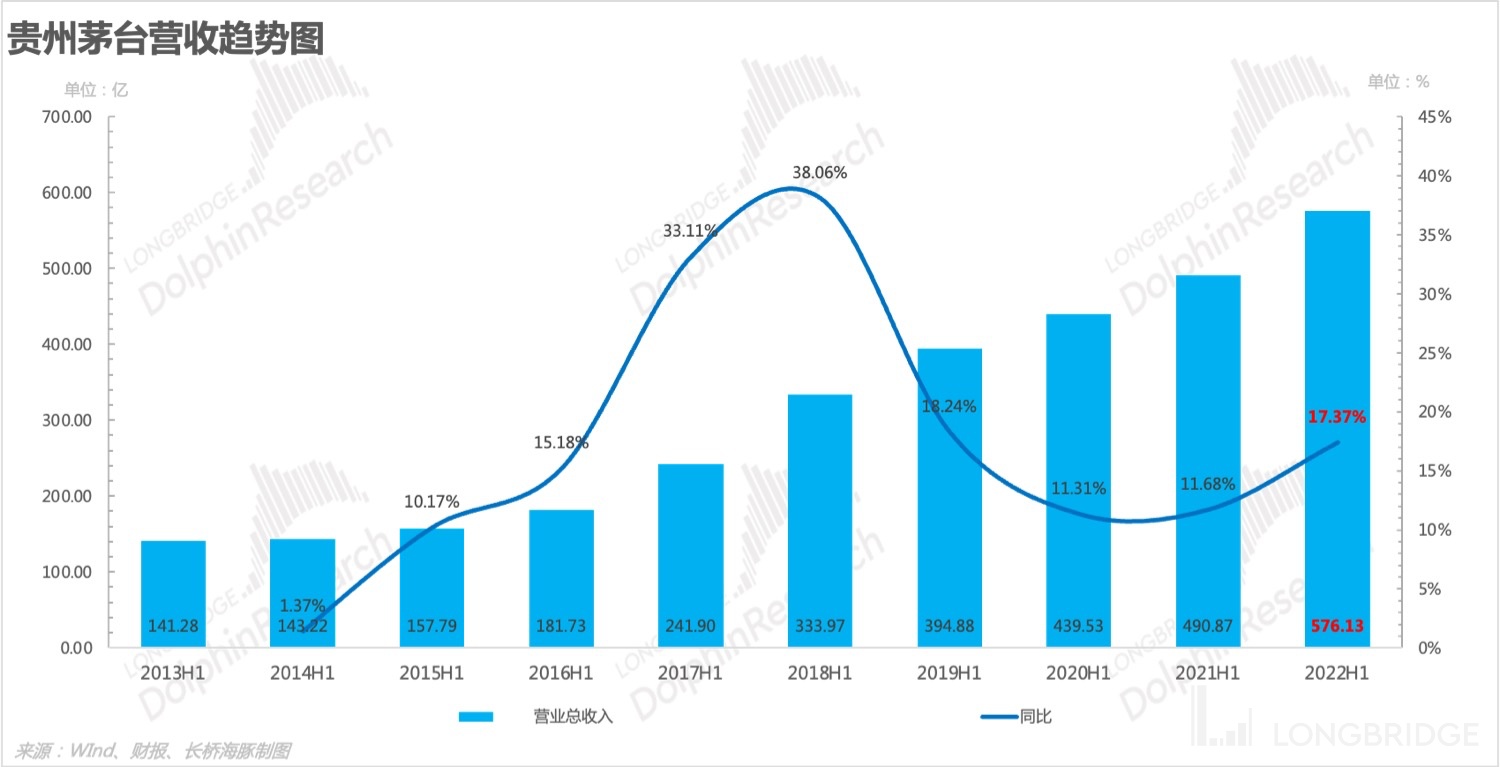

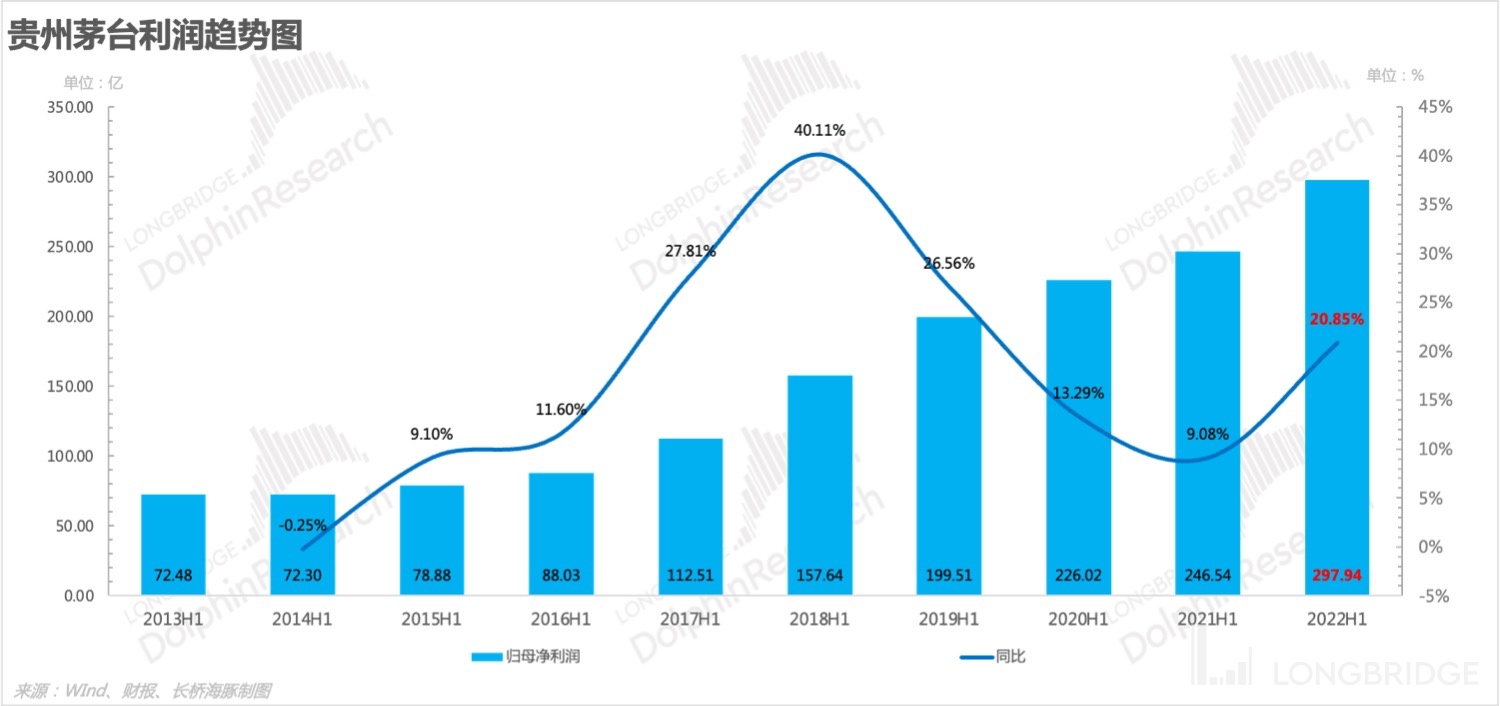

1. Overall performance slightly stronger than market expectations: In 2022 H1, the overall consumption was severely affected by the epidemic, which caused partial loss in the consumer scenario of Baijiu. However, Maotai achieved slightly better-than-expected performance by virtue of its super-strong brand awareness and channel influence. With the help of the iMaotai platform, it achieved a revenue of RMB 57.613 billion in 2022 H1, a year-on-year growth rate of 17.37%, slightly higher than the company's target growth rate of 15%. In addition, the net profit attributable to the parent company reached RMB 29.794 billion, a year-on-year growth rate of 20.85%, returning to the double-digit growth range.

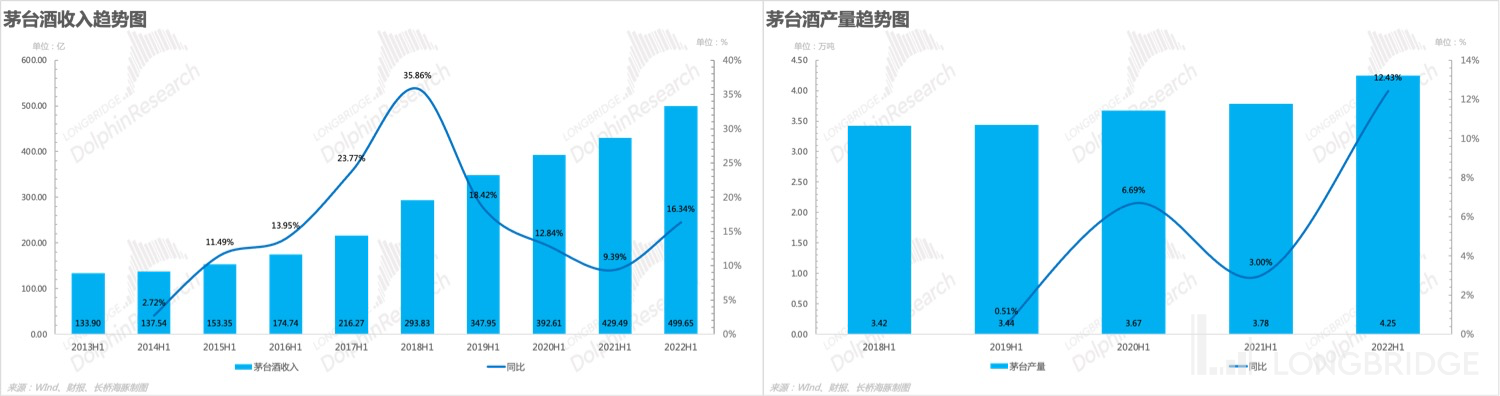

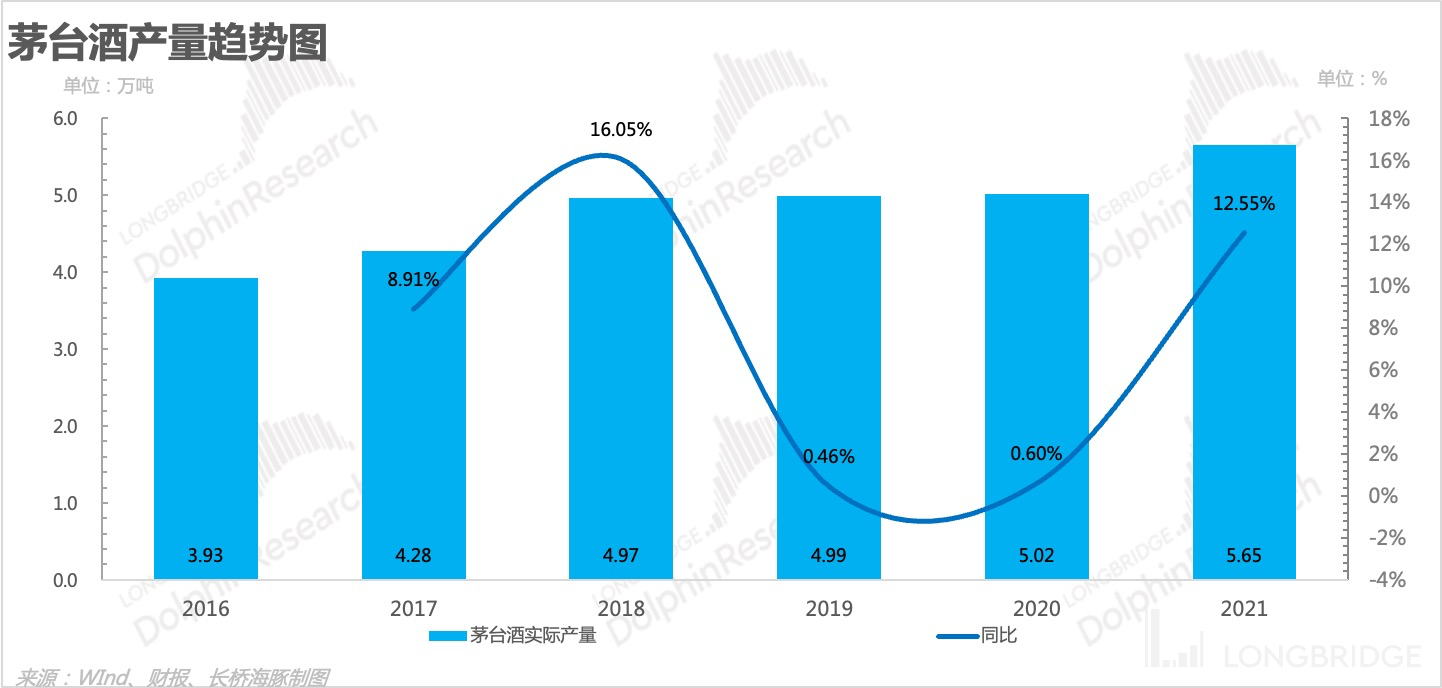

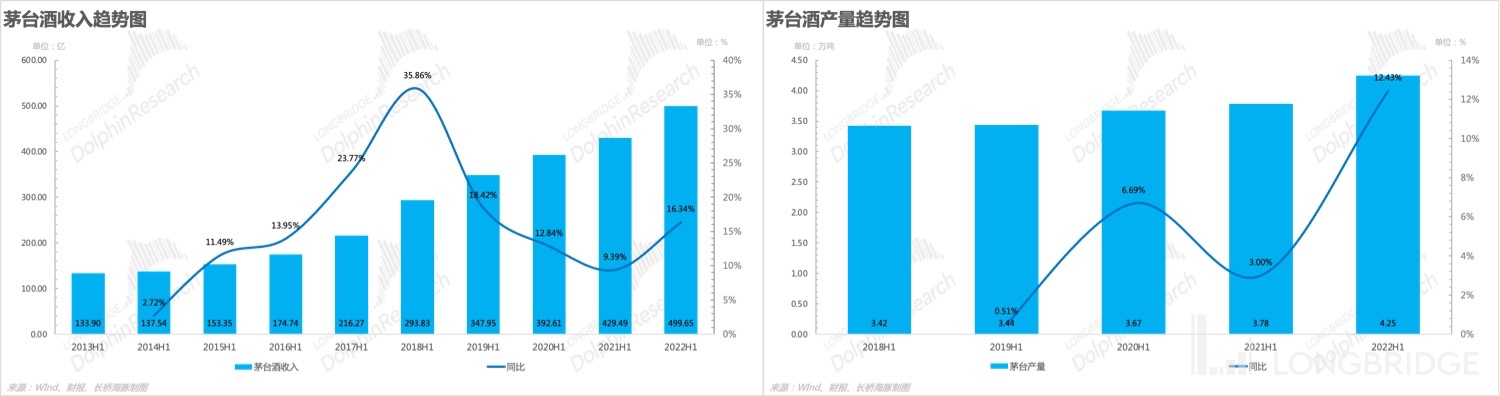

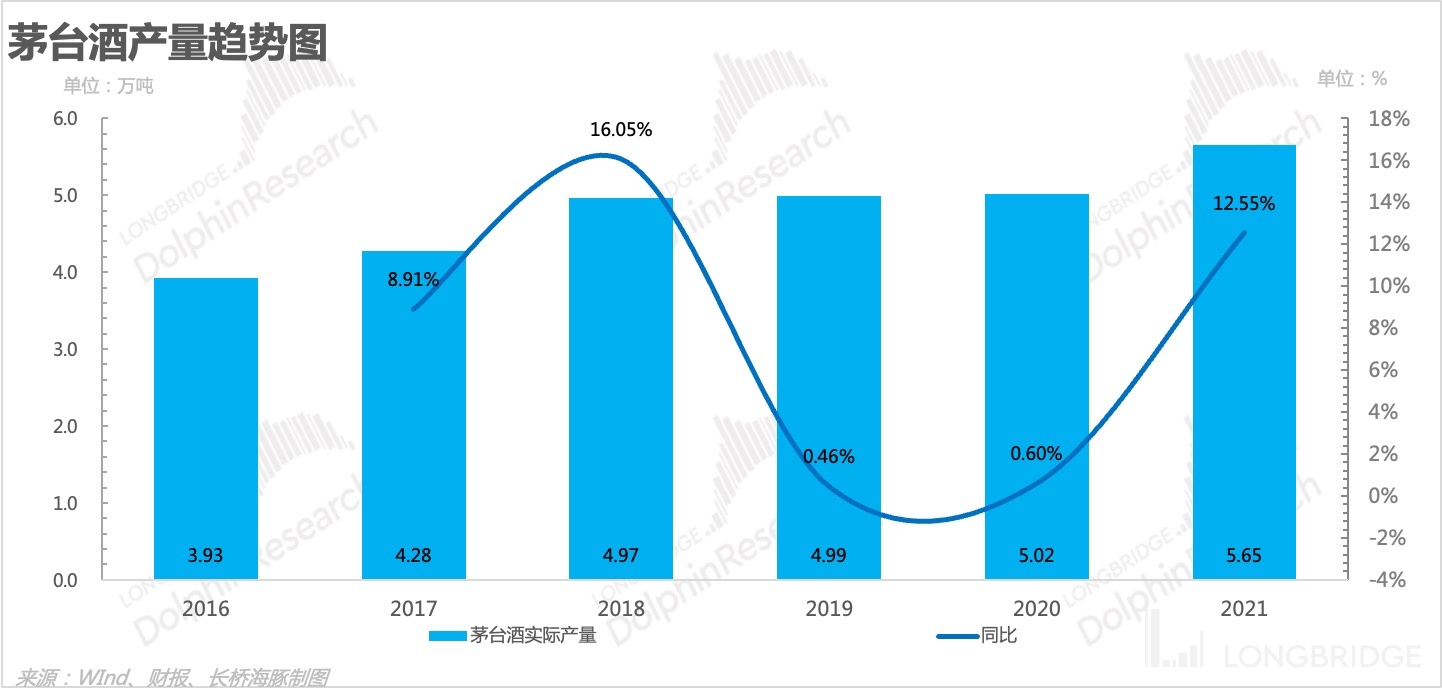

2. Maotai's liquor production and revenue growth rate accelerated: The year-on-year growth rate of Maotai's liquor production reached 12.43% in 2022 H1, the highest level in nearly four years, laying a foundation for future volume growth. In addition, the high production in 2018 effectively supported the increase in volume in the first half of this year. Moreover, with the sales of the 100ml 53-degree Feitian Maotai on the iMaotai platform, Maotai's overall liquor sales reached RMB 49.965 billion, a year-on-year growth rate of 16.34%.

3. The series of liquors achieved product structure optimization, and is expected to help increase ton price in the future: In 2022 H1, Guizhou Maotai further cleaned up and integrated the series of liquors, launched the Year of the Tiger zodiac Maotai, Treasure Maotai, Maotai 1935, and 100ml 53-degree Feitian Maotai, clarified the price range and consumption scenario of each liquor, and plans to create pillar products.

4. Perfect direct sales channel layout, iMaotai faces consumers directly: In 2022 H1, the iMaotai marketing platform was launched, and its popularity and sales volume were impressive, achieving the expected results. Through the iMaotai platform, the company not only faced consumers directly and understood them better, but also shortened the circulation link and regained the role of channel profit. In the future, with the continuous increase in sales ratio, it is expected to become an important means of price increase and price stabilization. Overall: Guizhou Maotai 2022H1 continues its reform path. The product end has cleaned and integrated the series of wines, giving a clearer price range and positioning to existing products, and plans to make each product a pillar product in its price range; the channel end has launched the i Maotai marketing platform, becoming another direct sales channel in addition to stores and an important channel for Maotai to stabilize and increase prices. The production capacity end will continue to expand, with the goal of achieving a combined production capacity of 100,000 tons of Maotai wine and series wine by 2025.

Dolphin Analyst will subsequently share the telephone conference summary with the Longbridge App and Dolphin user group. Interested users are welcome to add the WeChat account "dolphinR123" to join the Dolphin Investment Research Group and obtain the telephone conference summary in the first place.

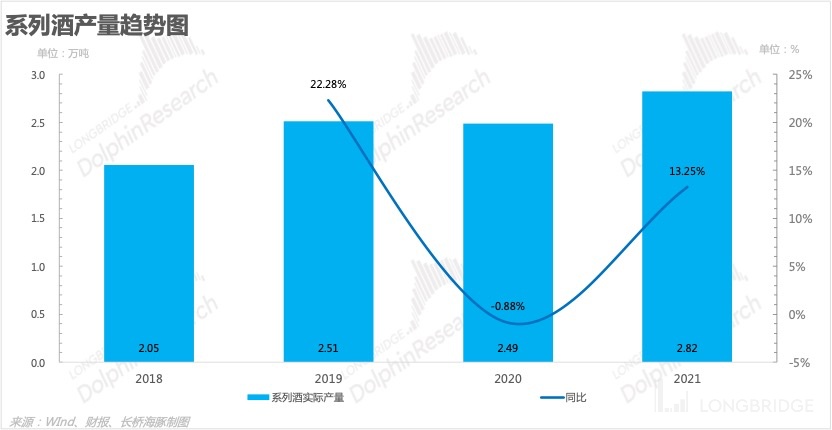

Since 2018, Maotai's volume and price growth have been limited: 1) In terms of volume, the sales growth rate of Maotai wine has declined from double digits in 2018 to single digits, mainly due to the fact that the production of base wine from 2013 to 2016 hardly increased (base wine production generally takes about 4 years to complete storage and finished wine blending), and the series wine was also affected by the same production capacity, with sales hovering around 30,000 tons since 2017 with no significant changes; 2) In terms of price, based on maintaining the price level of the flagship single product Feitian Maotai, Maotai has not adjusted the ex-factory price of Feitian Maotai for many years, and raising the prices of other products with small revenue contributions cannot effectively promote an increase in ton price, so price increases are also limited.

Dolphin Analyst believes that the increase in Maotai's production capacity is relatively limited and the ceiling is obvious, so the feasibility and sustainability of Maotai's price increase are higher. In contrast, the production capacity limit of series wine is weaker than that of Maotai wine, and it can generally be brewed within the core production area of Maotai town. Although the brand and product strength of series wine are relatively weaker than that of Maotai wine, it still has a certain influence in the market, so there is hope for better volume and price increases.

Based on the above views, Dolphin Analyst analyzed Guizhou Maotai's financial report from the perspective of volume and price, as detailed below:

I. Volume Perspective

1. Maotai Wine

The market demand for Maotai wine is strong, and its sales are mainly limited by production capacity. Therefore, increasing production capacity can effectively support sales growth. 2018 was a high-yield year for Maotai's base wine considering Maotai's production process, with base wine storage for about 3 years and blending requiring about 1 year of storage. Therefore, it is expected that the release volume of Maotai wine in 2022 will increase significantly and will most likely be primarily directed at the direct sales channel.

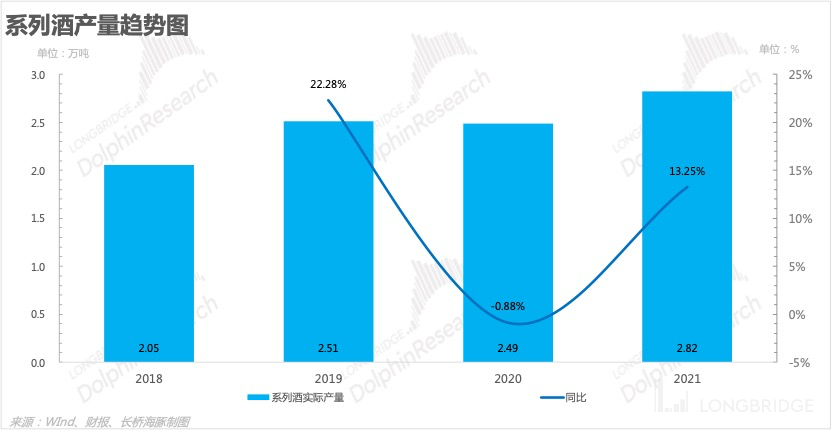

2. Series of Liquor

The production cycle of the series of liquor is about three years, so it is expected that the volume will be realized in 2022, supporting the increase in sales of the series of liquor. Dolphin Analyst believes that in the situation where it is difficult to expand the production of Moutai liquor and the ceiling is relatively low, by increasing the production capacity and sales volume of the series of liquor, it can drive the rise of the quantity and price of Moutai.

2. Dimension of Price

Under the market conditions where price increase is possible, the inability to freely increase prices is one of the reasons for the slowdown of Moutai's growth, and it is also Moutai's pain. However, after the new chairman took office, he hopes to alleviate or even solve this pain point through reform. Dolphin Analyst described Moutai's ways of raising prices as two methods: direct and indirect. Although Feitian Moutai has the market basis for price increase, considering the importance of price stability, Dolphin Analyst thinks that the probability of direct price increase is not high in the short term. On the contrary, the overall effect of indirect price increase is better, and it can gradually create conditions and foundations for direct price increase through indirect price increase.

1. Direct Price Increase

Between 2000 and 2012, Moutai basically increased its product prices once every 1-2 years, and the channel profits exceeded 40% each time. However, from 2013 to 2016, during the restriction of public consumption, the ex-factory price remained stable. In 2017, when the channel profit exceeded 40% again, they chose to raise prices, and since then, mainstream products have not increased in price until 2021. During this period, the channel profits kept soaring. For example, the channel profit of the current major product Feitian Moutai exceeded 150%. Therefore, Dolphin Analyst believes that most of Moutai's products currently have the basis for price increase, and the core factor affecting whether to raise prices is the stability of the price range. For example, raising the price of Feitian Moutai is only a matter of time, but the impact of the price increase on the price range will be fully considered. Whether to raise the price of other products mainly depends on market factors.

A) Moutai liquor: Moutai drastically raised the price of its annual liquor in 2022H1, with a 37.4% increase for Moutai 15-year liquor, a 20% increase for Moutai 30-year liquor, and a 12% increase for Moutai 50-year liquor.

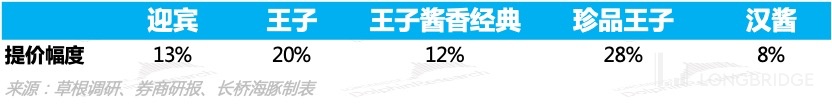

B) Series of liquor: In 2022H1, Moutai raised the prices of many products in its Gold Prince and Prince series by 10%-20%.

2. Indirect Price Increase

2. Indirect Price Increase

The core methods of indirect price increase can be classified into two types: increasing the proportion of direct sales to recover channel profits and achieve the effect of price increase; or optimizing product structure and achieving product upgrades to achieve the effect of price increase. Dolphin Analyst believes that indirect price increase is currently the most suitable. Increasing the proportion of direct sales is conducive to Longbridge's control of the overall price range and lays a foundation for direct price increases in the future. Optimizing and upgrading product structure can further sort out its products, develop series of wines, improve the product matrix, and increase overall competitiveness.

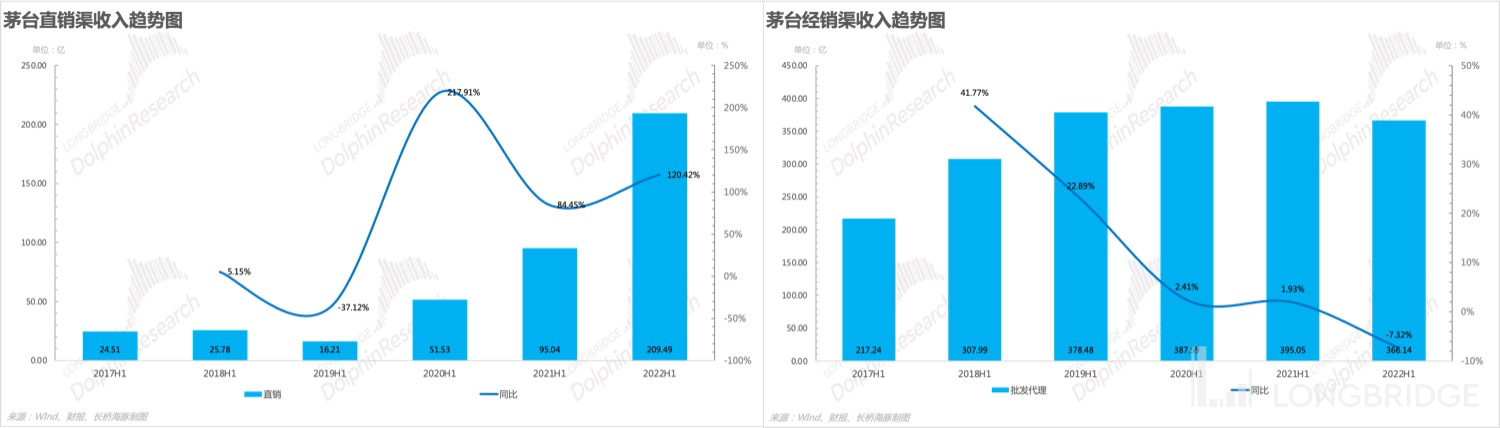

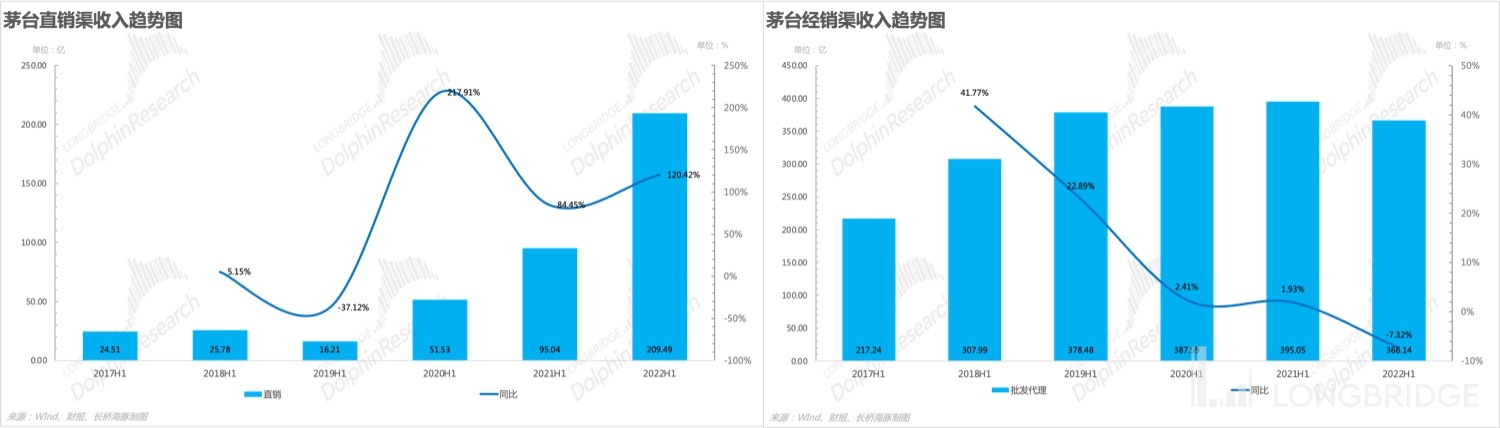

A) Increasing the Proportion of Direct Sales and Recovering Channel Profits

Increase the Direct Sales Channel Investment: In recent years, Longbridge has invested most of its incremental wine in direct sales channels. For example, for some products such as boutique Maotai, zodiac Maotai, and vintage Maotai, Longbridge chooses to allow the dealer to pay and pick up the goods from its own store at a price slightly lower than the guide price. Through this method, dealers can achieve indirect price increases while Longbridge can recover some channel profits. Data shows that the revenue of Longbridge's direct sales channels continues to increase, while the revenue of its distribution channels is declining.

Launch iMaotai and Improve Direct Sales Channels: In 2022 H1, Longbridge launched the iMaotai App directly facing consumers, through which consumers can purchase Maotai products. Longbridge can achieve indirect price increases. Dolphin Analyst believes that in the future, with the optimization of the iMaotai model, the company's own direct sales channels will be further improved, and the proportion of direct sales channels can be further increased as the investment in iMaotai increases, which would be beneficial to Longbridge's control and influence on prices.

Due to the importance of iMaotai, Dolphin Analyst analyzed and summarized its effects as follows:

1) Improve Direct Sales Channels: Most of Longbridge's incremental wine in recent years has been invested in its own channels, which has obtained a higher increase in revenue than dealers, but its self-operated store channels cannot distinguish and reduce gray-market "scalpers" or directly serve consumers. Therefore, launching iMaotai can supplement the direct sales channels, directly face consumers, and reduce gray-market "scalpers" through big data and blockchain technology.

2) Traffic Entrance: iMaotai can become a traffic entrance. By selling products at a fair price, it can quickly gather traffic and popularity, and then drive sales of other products.

3) Stable Price Range: Continuous price increases by Longbridge will lead to channel reluctance to sell and lower consumer willingness to open bottles, which would cause high inventory levels in both channels and society, and bring negative effects to Longbridge's long-term development. However, iMaotai can effectively adjust supply and affect the wholesale and terminal prices. For example, the introduction of Tiger Zodiac wine in bottles on iMaotai has led to wholesale and retail prices of around 3700 and 3200 yuan respectively, effectively suppressing wholesale prices' rise. B) Optimizing Product Structure

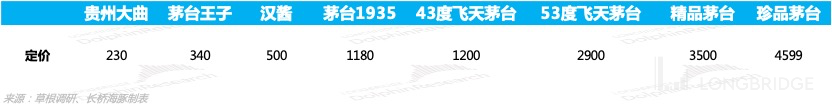

Firstly, Moutai has made a clearer positioning for Moutai liquor and its series of liquor, with the main differences being in the production area and cycle. Moutai liquor has a production cycle of about 4 years, while the series of liquor has a production cycle of about 3 years. Secondly, Moutai has optimized the product structure of Moutai liquor and its series of liquor, highlighting the price range and consumer scenarios. Dolphin Analyst believes optimizing the product can better achieve differentiated positioning, cover different consumer groups, and also help to increase the ton price.

The ways in which Moutai optimizes and upgrades product structures mainly include:

1) Product cleaning and integration: Moutai has optimized the product structure by cleaning and integrating existing products, clarifying the price range and consumer scenarios of existing products. In the first half of the year, Moutai continued to clean and integrate its products, clearing out 6 low-priced products below 200 yuan, and clarifying the price range and consumer scenarios of the remaining products, achieving differentiated positioning. For example, the new Moutai 1935 at 53 degrees is positioned for wedding banquets, while the 43-degree Feitian Moutai is the main product for home scenarios, and the 53-degree Feitian Moutai is the main product for high-end business banquets. The 100ml 53-degree Feitian Moutai is mainly for old friends gathering.

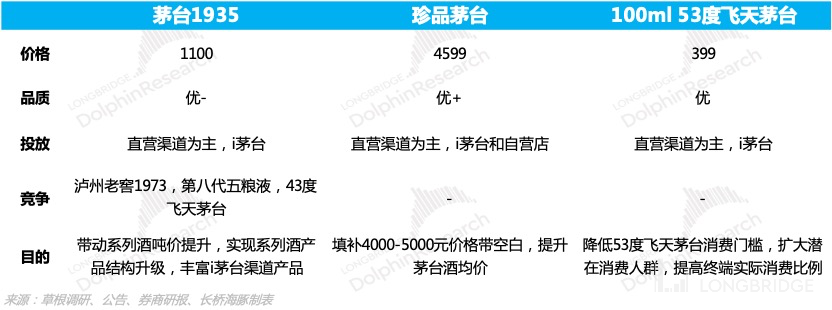

2) Launching new products: In the first half of 2022, Moutai mainly launched three new products: Moutai 1935, Zhenpin Moutai and 100ml 53-degree Feitian Moutai, which have obvious differentiation from existing products, realizing the product upgrade of series of liquor and the expansion of Moutai liquor consumption scenarios, which will help to increase volume and price.

a) Moutai 1935: The predecessor of Moutai 1935 was Zunyi 1935, which was discontinued in 2020. Before it was discontinued, Zunyi 1935 was positioned in non-circulation markets. The quality of the wine was higher among the series of liquor and the batch price was 1200-1300. The market foundation was good. This time, Moutai further improved the product by blending a small amount of Moutai base wine into the Zunyi 1935 base wine and renamed it Moutai 1935 to enhance the brand strength, hoping to compete with it in the thousand yuan price range and boost the ton price of the series of liquor to implement the product structure upgrade.

b) Zhenpin Moutai: Zhenpin Moutai has a long history and originated in 1986. It is priced at 4599 yuan, between boutique Moutai and Moutai 15 years, filling the price range of 4000-5000 yuan. In addition, Zhenpin Moutai blends modern flavor analysis technology and wine body design concept in production process, attempting to determine the quality and flavor in a quantitative way.

c) 100ml 53-degree Feitian Moutai: The 100ml Feitian Moutai is a new specification developed this year, mainly for the scenario of drinking with old friends, and has only been launched on i Moutai so far, with a price of 399 yuan. Dolphin Analyst believes that this product has lowered the consumption threshold for Feitian Moutai and can help increase actual consumption at the end. In addition, as the volume continues to increase, it will help boost the ton price of Maotai liquor.

Dolphin Analyst's historical articles on "Guizhou Maotai":

Financial report season

July 30, 2021 Financial Report Review "Performance is not the core contradiction, beware of valuation risks"

October 23, 2021 Financial Report Review "New coach, new outlook, Maotai is still worth believing in"

March 31, 2022 Financial Report Review "Continuous Marketing Transformation, Maotai can continue to "fly" without raising ex-factory prices"

April 26, 2022 Financial Report Review "Continuous direct sales efforts, Maotai continues to rise"