Thunder roars, Nvidia's performance plummets.

Nvidia (NVDA.O) Beijing time, on the evening of August 8th, released a "rare" profit warning for the second quarter of the 2023 fiscal year (ending June 2022) before the US stock market opened:

-

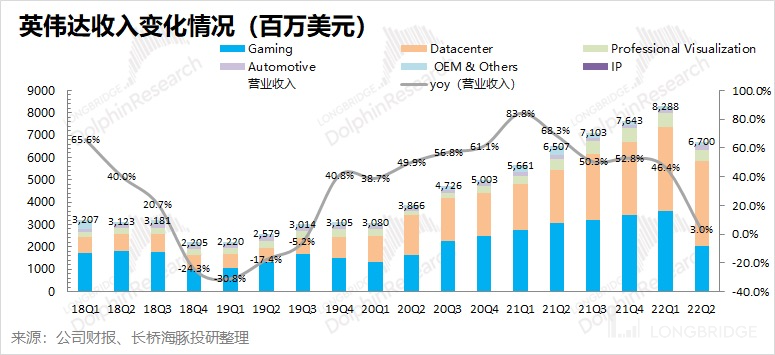

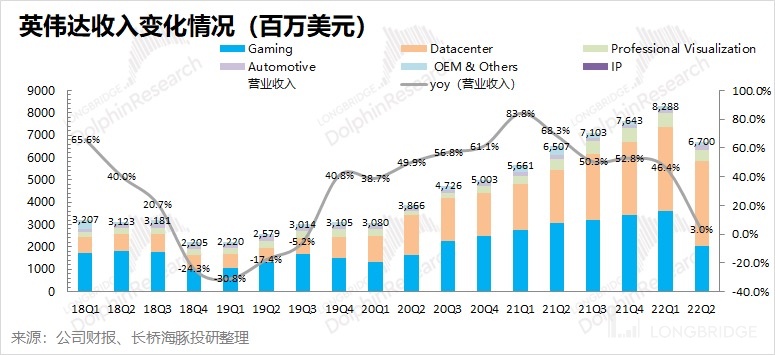

Revenue self-explosion: Q2 revenue was $6.7 billion, which greatly contradicts the quarterly guidance of $8.1 billion given by the company itself at the end of Q2 (the end of May). Compared with the growth rate of more than 45% in the previous quarter, the growth rate fell into a free fall of 3%.

-

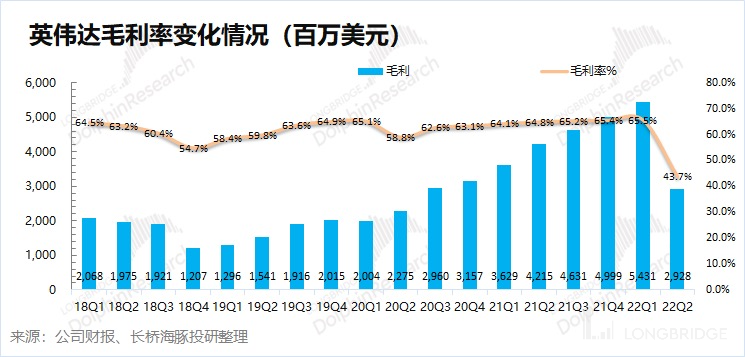

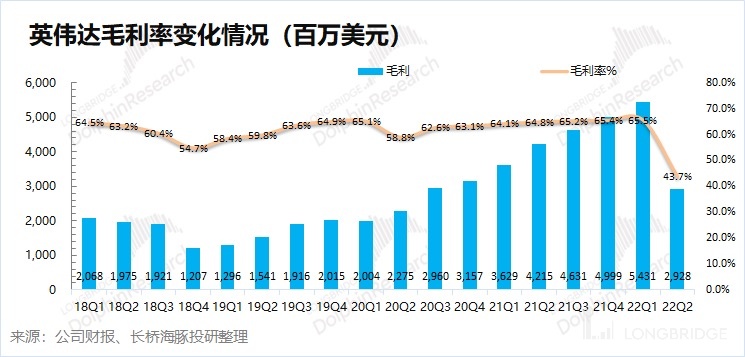

Gross profit margin is more dismal: Only 43.7% (plus or minus 0.5%), much lower than the company's previous guidance (65.1%, plus or minus 0.5%). In addition, it was worse than the low point of 2018 and should be due to high inventory and severe discounts.

-

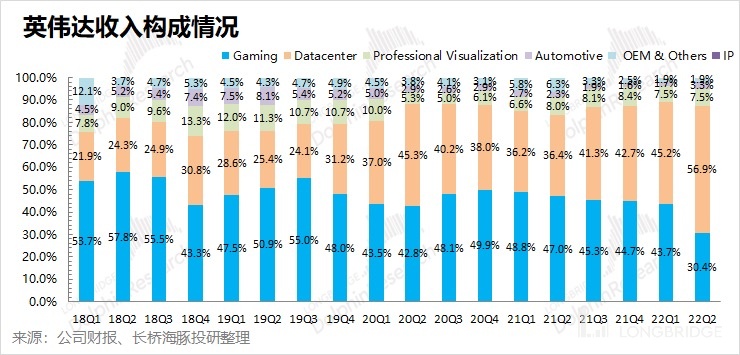

Core business situation: Gaming business thunderous, and data center hides concerns. Nvidia's gaming and data center businesses are the two largest in terms of revenue, accounting for more than 80% in total.

-

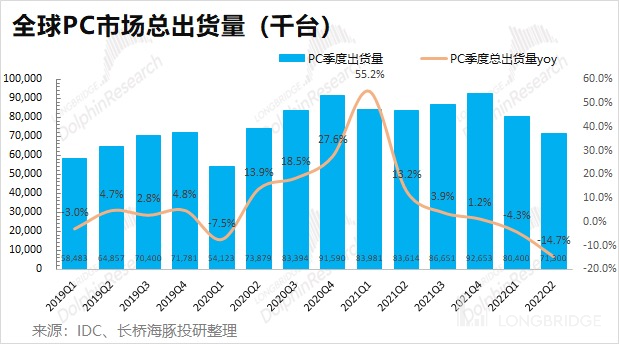

This quarter's gaming business exploded and is the main reason for poor performance. Dolphin Analyst believes that the main reason for the significant decline in gaming business this quarter is: ①the global PC market has shown a significant decline in the second quarter, weakening the demand for the gaming end; ②virtual currency prices have continued to decline this year, weakening the related needs for mining; ③distributors have high inventories, directly affecting current shipping momentum.

-

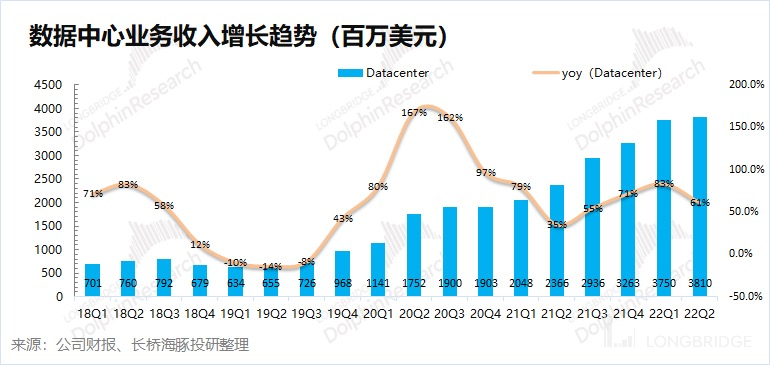

This quarter's growth in data center business has also slowed down, with a MoM increase of only 1%. As US technology giants begin to slow down capital expenditures, the company's data center business also has "risks".

Overall view: Nvidia's sudden profit warning this time greatly missed market expectations. As Dolphin Analyst worried in the report "Nvidia (Part 2): No Longer Driven by Two Wheels, Davis Double-Kills Coming in a Wave?" in September last year, "After experiencing high growth, Nvidia is facing pressure for growth slowdown, and the downstream prosperity of part has also shown signs of decline". It was also verified in this quarterly report that dual-wheel drive has become "single-leg support".

The unexpected results of this financial report, and the market's response to it, was a fall. For investment, it is more about buying the company's expectations. Looking back at Nvidia's history, Dolphin Analyst believes that the current Nvidia is somewhat similar to 2018, where the sluggish electronic market plus the constantly declining virtual currency prices resulted in Nvidia's "double kill" in revenue and gross profit margin.

Dolphin Analyst expects that in the short term, Nvidia's gaming business has a very high possibility of:

① Gaming business: Although the "cut order" shock from distributors in Q2 has gradually subsided, considering Nvidia's current high inventory level, it is estimated that it will continue to be sluggish for several quarters. The return of high-growth gaming business requires a large number of new products and the recovery of virtual currency prices. ②Data center business: Previous high growth performance is gradually fading away. With the gradual contraction of spending by American tech giants, capital expenditures in the data center end may be downgraded, which may cause the company's business to miss market expectations;

③Gross Margin: The gross margin in Q2 showed a cliff-like decline, which was caused by a decrease in orders from distributors and product inventory backlog leading to price reduction. In the future, as new products are sold and distributor inventory is depleted, the company's gross margin will rebound, but it is difficult to return to the high level of 65% in the short term.

After this Q2 report, the Dolphin Analyst believes that the market will have some loss of confidence in Nvidia's two main businesses, and there will also be a wave of downward market expectations. Even under the current performance expectations, Nvidia's performance growth rate is unlikely to support the valuation of more than 40 times this year. Therefore, although Nvidia's long-term logic and market position are still intact, there is still a risk of killing performance in the short term, and the Dolphin Analyst has temporarily adjusted Nvidia from "Low Allocation" to "Alpha Dolphin" portfolio.

Below is Longbridge's Dolphin Analyst's specific analysis of Nvidia's Q2 FY2023 performance forecast:

I. Overall Performance: Revenue and Gross Margin, both significantly lower than guidance

1.1 Revenue: Nvidia achieved revenue of $6.7 billion in Q2 FY2023, an increase of 3% YoY, far below the company's guidance ($8.1 billion). The "disastrous performance" of the company's revenue in this quarter is mainly affected by the "collapse-style" decline of the company's gaming business. There are also obvious signs of a slowdown in the growth rate of the company's data center business this quarter, which the market is concerned about.

1.2 Gross Margin (GAAP): Updated Nvidia's gross margin (GAAP) expectation for Q2 FY2023 is 43.7% (plus or minus 0.5%), far lower than the guidance expectation (65.1%, plus or minus 0.5%), almost falling freely, and 10 percentage points lower than the previous trough.

The significant decline in gross margin this quarter is mainly due to the slowdown in downstream shipments of products, and the company has begun to adjust the shipment prices of its products. Under the current macro background, it is difficult for Nvidia's gross margin to return to the high level of 65% in the short term.

II. Core business situation: Disappointing gaming business, hidden worries in data center business

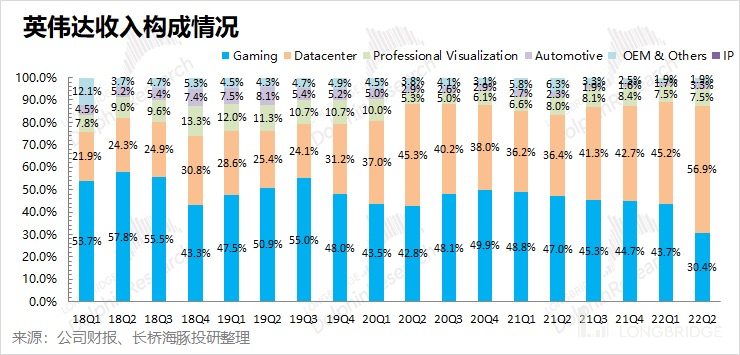

As the gaming business performed too poorly, the revenue proportion of Nvidia's data center business in Q2 FY2023 exceeded half for the first time, becoming the company's largest source of revenue.

The "disastrous" performance of the gaming business this quarter caused its share in the company's overall business to drop to 30%.

Gaming and data center are the most important businesses that affect the company's performance, with a combined revenue share of over 80%.

2.1 Gaming Business: NVIDIA's gaming business achieved revenue of US$2.04 billion in the second quarter of fiscal year 2023. This quarter's gaming business did not cover up the "slowdown" in growth rate, but instead directly plummeted by more than 30%.

The Dolphin Analyst believes that the reasons for the gaming business's collapse this quarter are mainly:

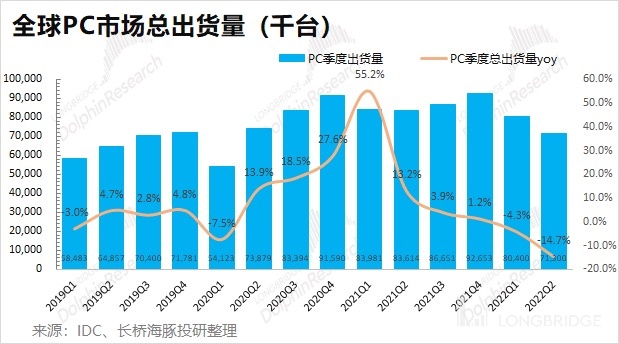

1) The global PC market has significantly declined in the second quarter, weakening the demand for gaming. According to IDC's latest data, the global PC market shipped 71.3 million units in the second quarter of 2022, a year-on-year decrease of 14.7%. Since graphics cards are mainly used in the gaming field on PCs, and the market demand for PCs has significantly declined in the post-pandemic era, it has also weakened the market's demand for gaming graphics cards;

2) The continuous decline in virtual currency prices this year has weakened the demand for mining. As both mining and gaming require high computing power, part of the graphics cards are used for mining. Since the price of virtual currencies has been falling continuously since the fourth quarter of last year, it has affected the demand for graphics cards in the "mining market." Taking Bitcoin as an example, the price of Bitcoin has fallen below US$20,000 from the high point of US$69,000 in the second half of 2021.

Source: Wind, Dolphin Research and Analysis

3) High inventory levels of distributors directly affect current hauling momentum. The sales model of distributors hoarding goods has accelerated this quarter's "failed expectations." Last year, driven by the booming demand for the PC market under the pandemic and the demand for mining virtual currencies, the retail price of the RTX3070 series graphics card, which was priced at around 4,000 yuan, was once speculated to be over 10,000 yuan.

However, since the second half of last year, the shrinking demand in the PC and virtual currency markets has directly affected the retail prices of distributors. Since 2022, the prices of many products in the graphics card market have fallen by more than 50%, and many products have fallen below the suggested retail price. The shrinking demand in the graphics card market and the price decline have squeezed distributors' profit margins. The decline in hauling momentum of distributors was transmitted to the company's shipment situation in this quarter, resulting in a significant decline. 海豚君 in June's "Is Semiconductors changing?" report mentioned that "Affected by the decline in PC market sales, inventories of PC manufacturers such as Dell Technologies and Lenovo Group have shown signs of increase since this year, and Nvidia's inventory has also tended to increase". Looking back at the company's 2018, the downstream industry's weak demand also led to increased inventory of the company, which in turn caused the company's performance to "crash". sea elephant believes that Nvidia's gaming business needs new product volume and the recovery of virtual currency prices to stimulate downstream demand.

2.2 Data Center Business: In the second quarter of the 2023 fiscal year, Nvidia's star-of-hope - the Data Center business, achieved revenue of USD 3.81 billion, a year-on-year increase of 61%, but it is already evident that the momentum is not enough on a quarterly basis, as it only increased by 1%. Although Nvidia's performance this quarter was mainly dragged down by gaming business, the data center business with hidden growth risks cannot be ignored as well.

In the macro backdrop of slowing growth and inflation, the US technology giants such as Amazon and FB have started layoffs and cost-cutting. Affected by the large companies' downward adjustment of capital expenditures, there are also risks of downward adjustment in Nvidia's data center business growth expectation.

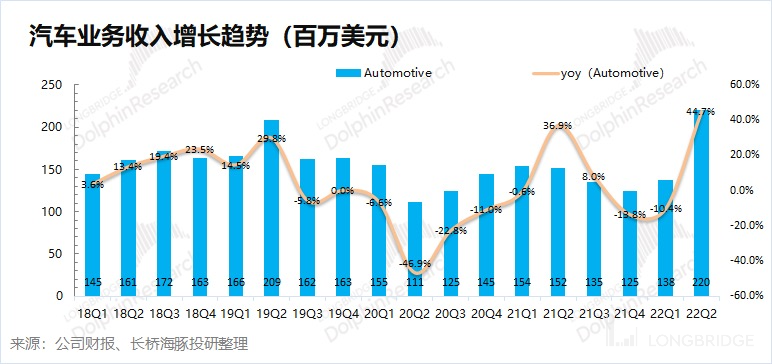

2.3 Automotive Business: In the second quarter of the 2023 fiscal year, Nvidia's automotive business achieved revenue of USD 220 million, a year-on-year increase of 44.7%.

The automotive business is a super-growth item that exceeded expectations this quarter, setting a new quarterly historical high. With the continuous penetration of applications such as automatic driving, the automotive business is expected to bring new growth to the company.

However, with only over two hundred million dollars in automotive revenue contribution, which accounts for only 3% of the total revenue, it is too fictional to carry the weight of the story. The Dolphin Analyst will continue to pay attention to the progress of Nvidia's automotive business.

Completed. 2021 December 6th "Nvidia: Valuation cannot be sustained by imagination alone."

2021 September 16th "Nvidia (Part 1): How did the chip giant that multiplied twenty times in five years come about?"

2021 September 28th "Nvidia (Part 2): Double drive no more, Davis double kill here to come again?"

Earnings season

May 26th, 2022 Telephone Meeting "The epidemic, coupled with the lockdown, dragged the second quarter's performance due to declining gaming sales (Nvidia Telephone Conference)"

May 26th, 2022 Financial Report Review "The 'epidemic fat' is gone and Nvidia's earnings outlook is bleak"

February 17th, 2022 Telephone Meeting "Nvidia: multi-chip push, data center is the company's focus (telephone meeting summary)"

February 17th, 2022 Financial Report Review "Nvidia: Hidden worries behind better-than-expected performance | Reading the financial report"

November 18th, 2021 Telephone Meeting "How does Nvidia build the Metaverse? Management: Focus on Omniverse (Nvidia Telephone Conference)"

November 18th, 2021 Financial Report Review "Earnings explosion, Metaverse blessing, will Nvidia continue to bull?"

Live broadcast

May 26th, 2022 "Nvidia (NVDA.US) Q1 FY23 Earnings Conference Call"

February 17th, 2022 "Nvidia Company (NVDA.US) Q4 2021 Earnings Conference Call" channel=n7429)》

November 18th, 2021 "NVIDIA Corporation (NVDA.US) Q3 2022 earnings conference call"