Unity's crazy capital operation, and MiHoYo's difficult short-term hidden worries

Hi everyone, I'm Dolphin Analyst!

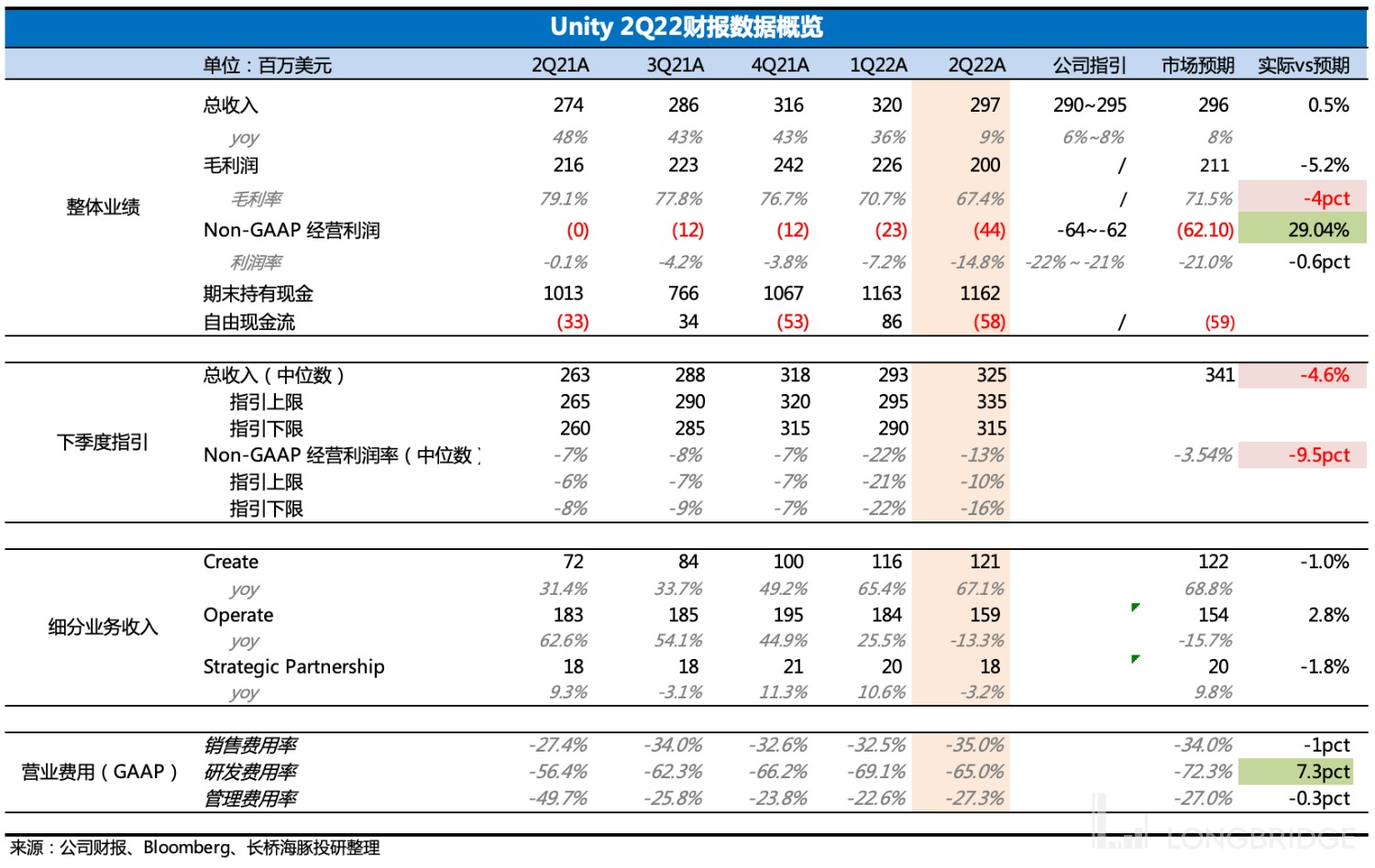

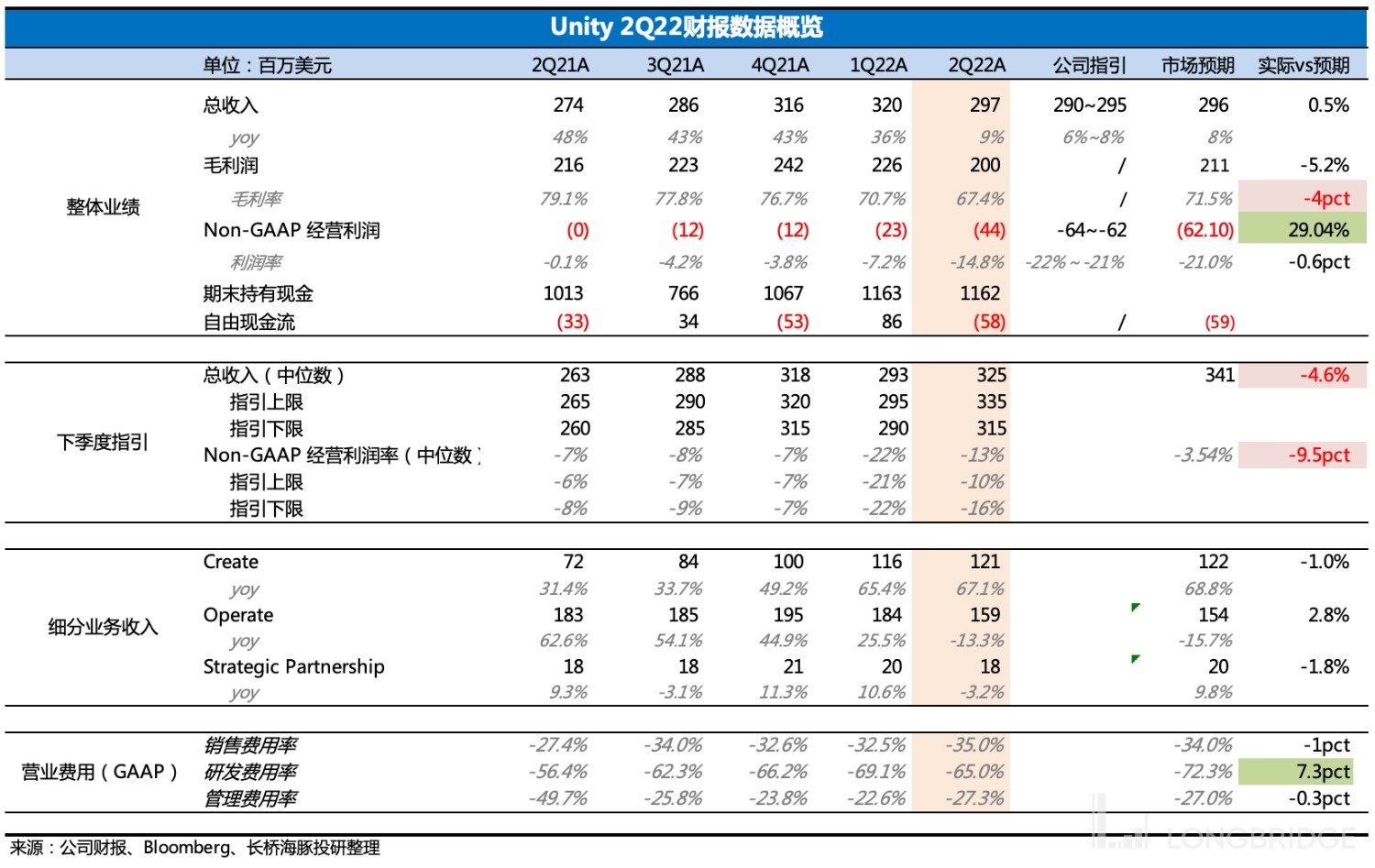

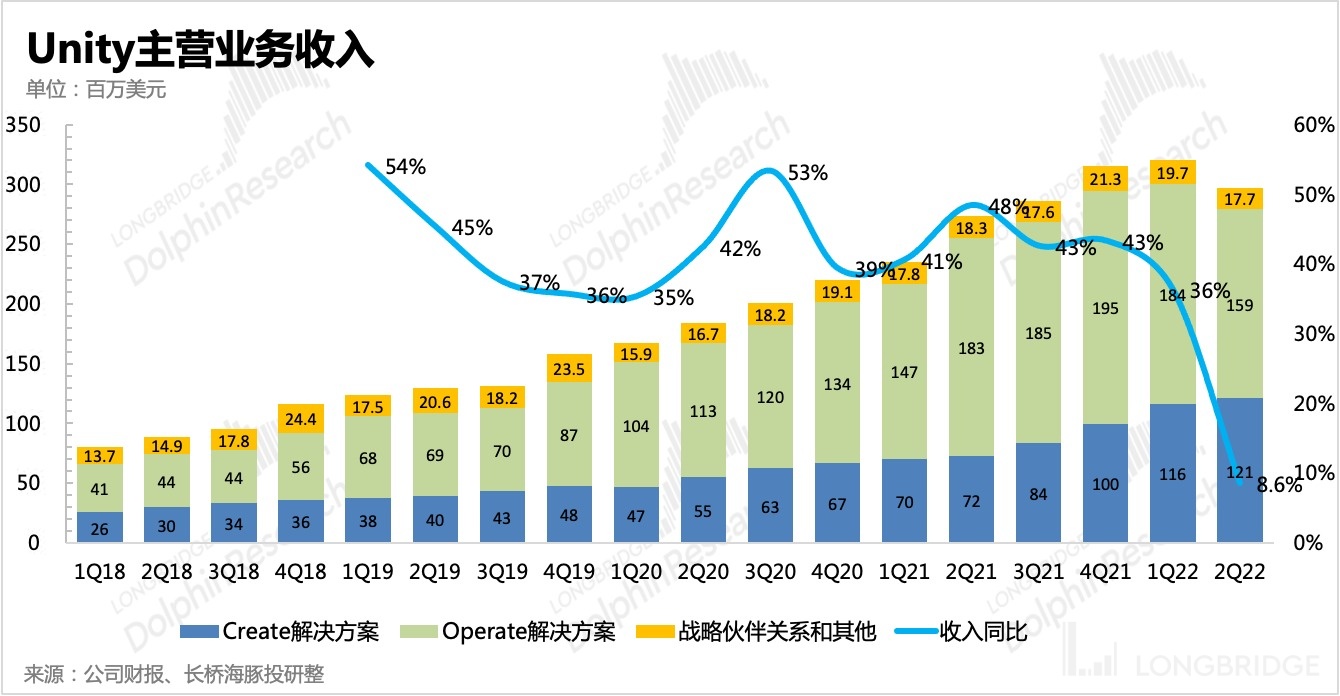

After the US stock market yesterday morning Beijing time, game engine leader Unity released its Q2 2022 results. Looking only at revenue and profit, since the company had revealed in mid-July that Q2 revenue slightly exceeded the upper limit of guidance, the revenue side basically met market expectations. Cost expenditure was lower than previous guidance, and ultimate profitability was better than both company guidance and market expectations. However, from some detailed indicators, the company still faces some growth pressure in the short term.

(1) Total revenue in Q2 was CNY 297 million, a YoY increase of 9%, basically in line with guidance and market expectations. Non-GAAP operating loss was CNY 44 million, significantly better than guidance.

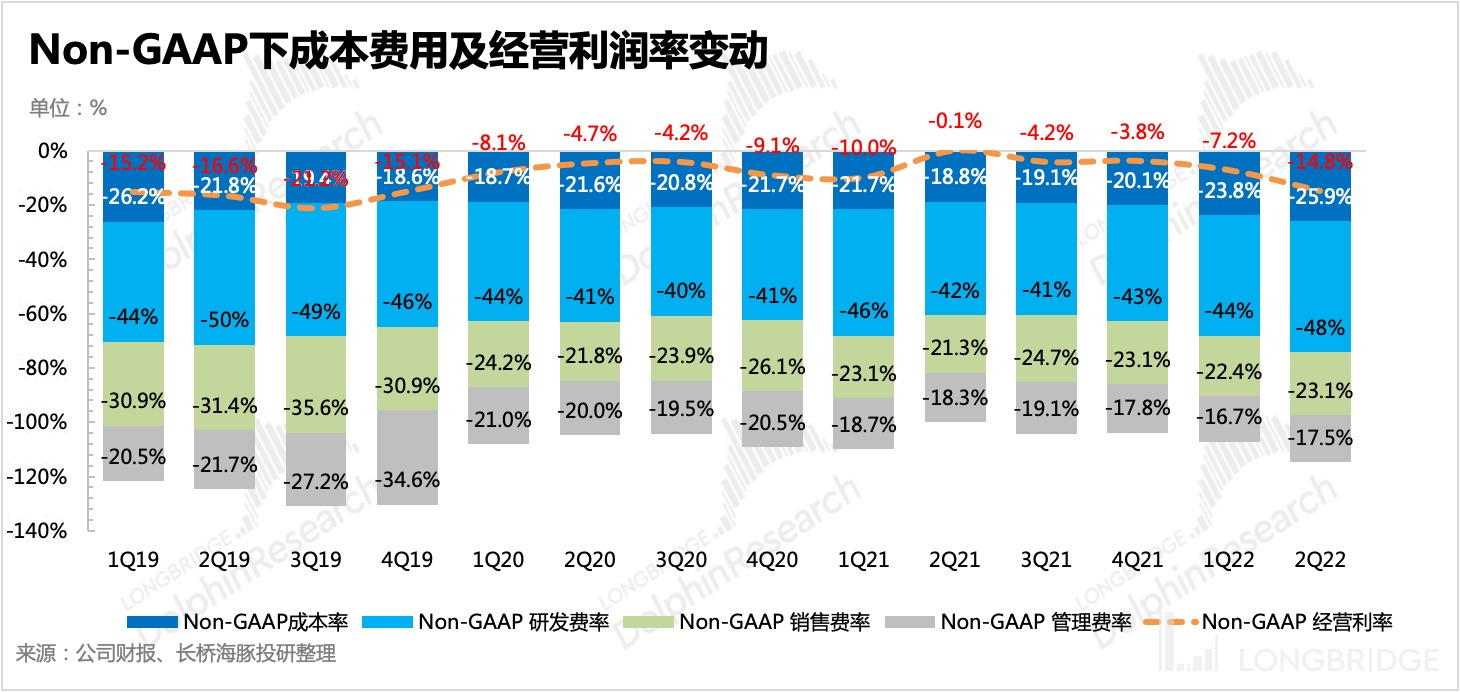

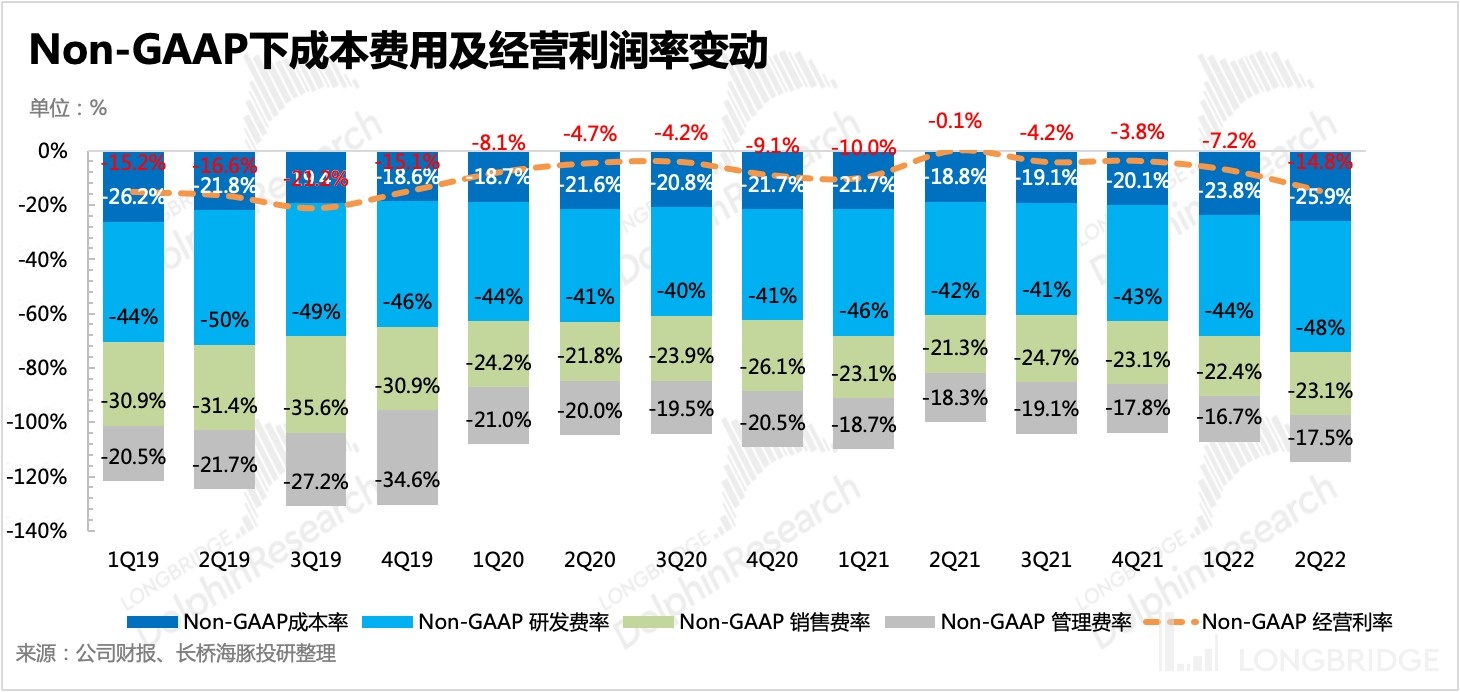

Looking at cost expenditure itemization and market expectations, the main point of over-expectation came from R&D expenses. In addition, excluding the impact of equity incentives, mergers and acquisitions, same-store sales and management expenses saw a significant slowdown in YoY growth.

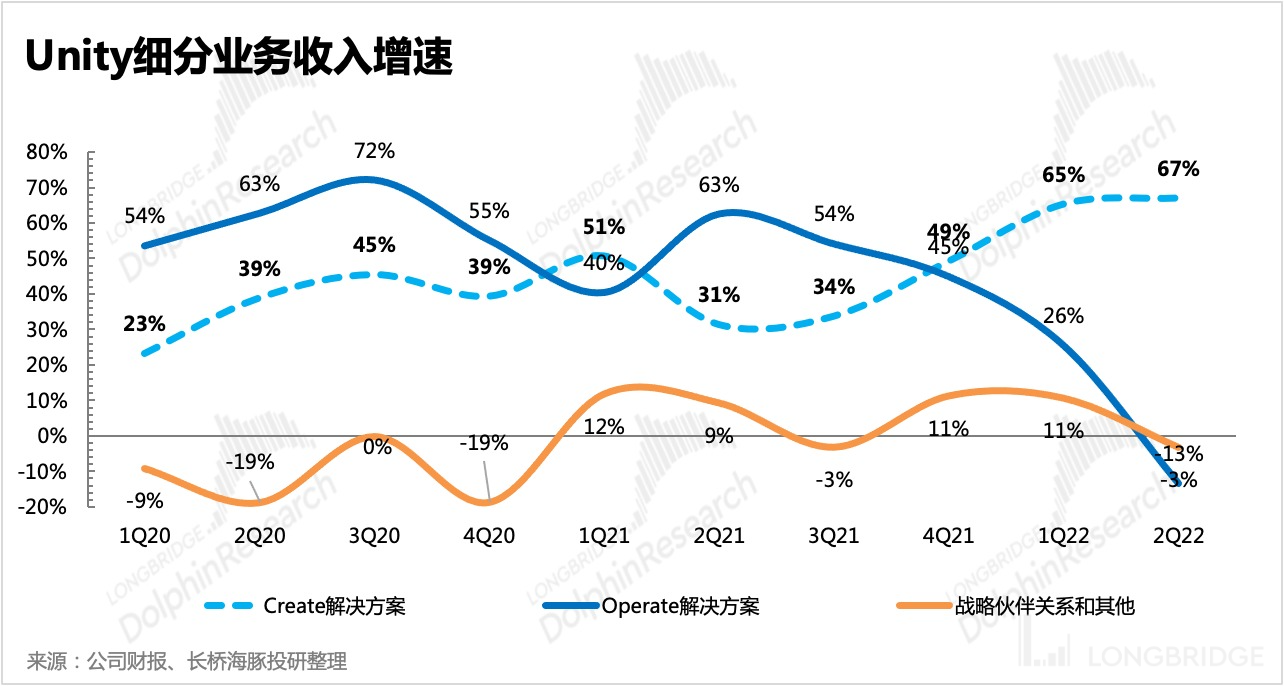

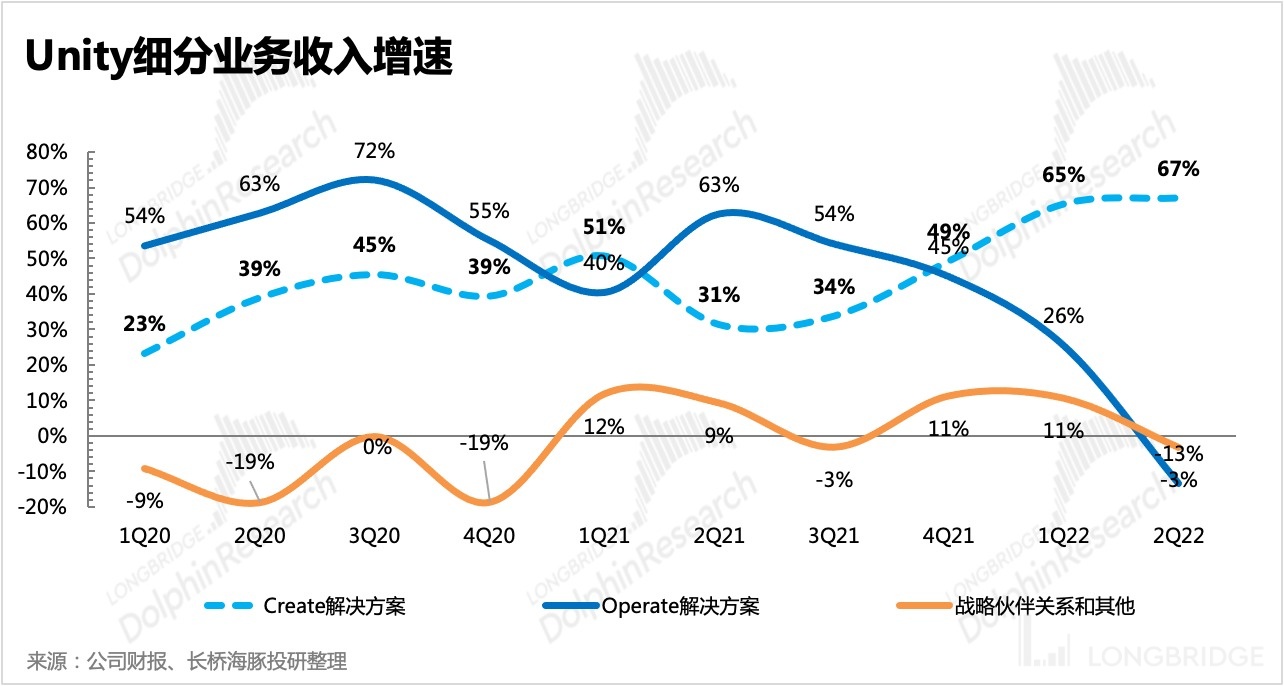

(2) Among Unity's three businesses, Create still maintains 67% high-speed growth, and after exploring non-gaming sectors last year through two acquisitions (Weta and Ziva), Create's business can continue to enjoy growth momentum in the short and medium term.

Operate's performance continues to lag behind, with advertising business being a major drag as warned in the previous quarter.

Looking at the trend of changes in royalties payable to developers, Q2 advertising revenue decreased by nearly 28% YoY. However, the revenue guidance for Q3 shows that the company already has some repair expectations for this business.

(3) Some operational indicators reflect short-term growth pressure, which is influenced by both company-specific and industry environmental factors:

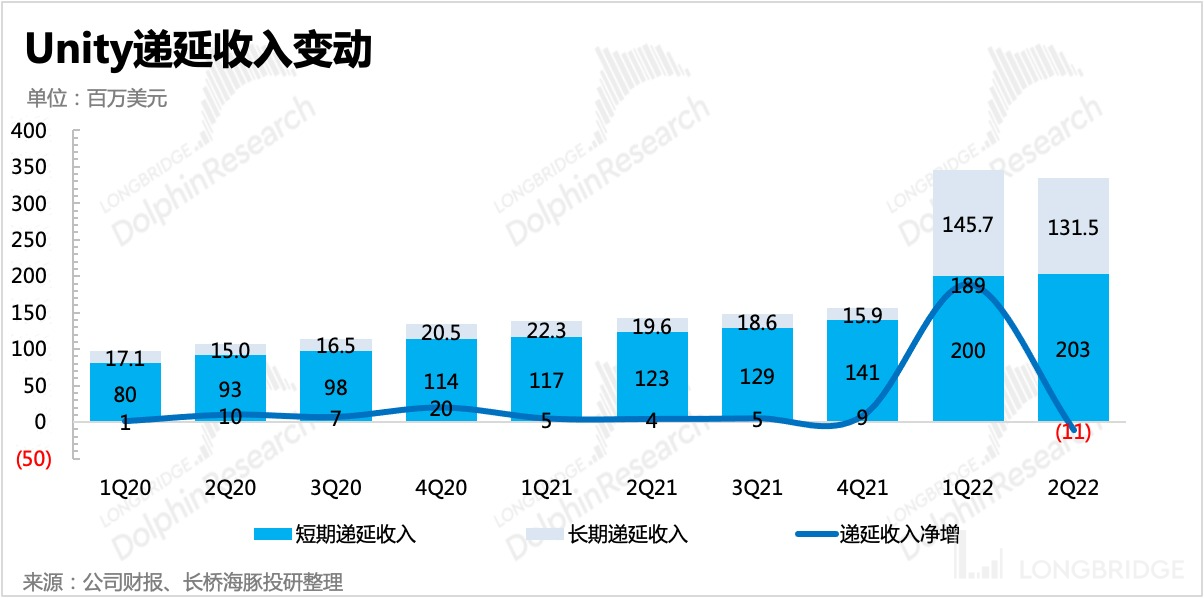

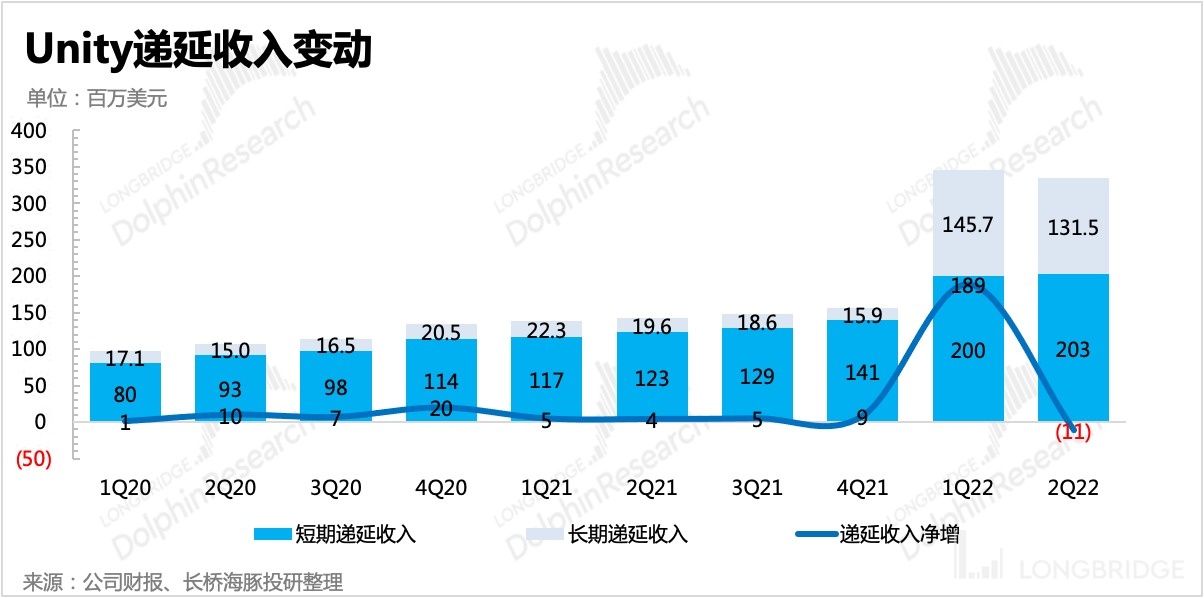

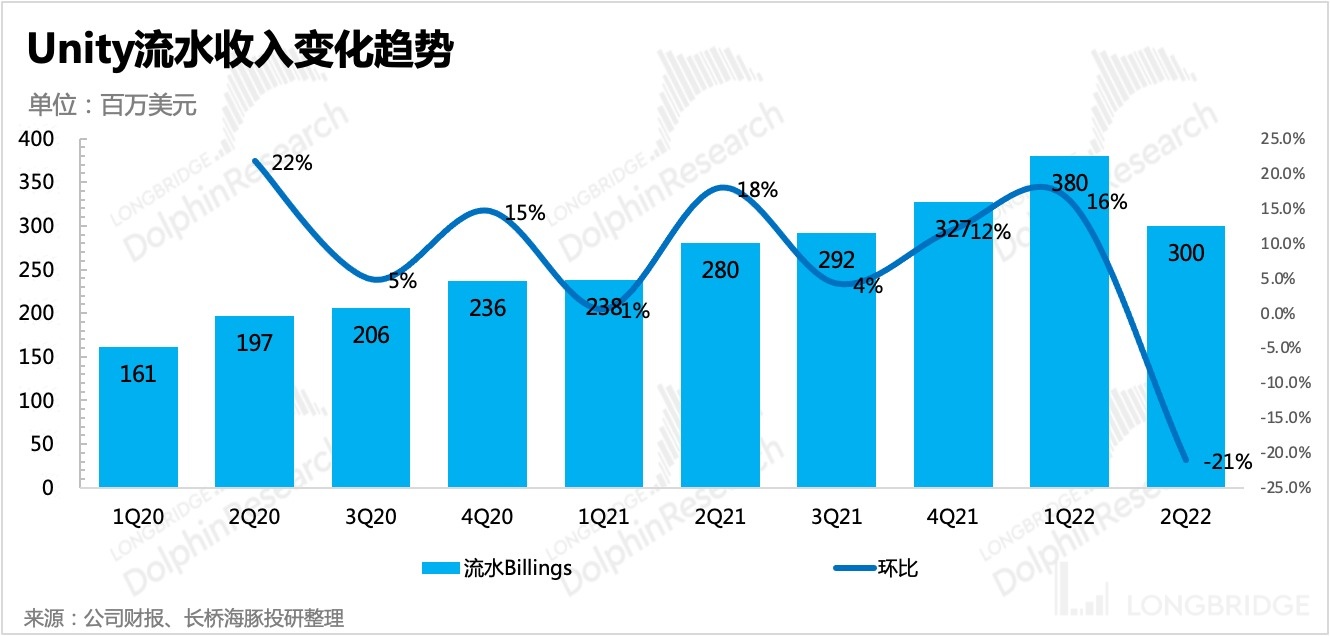

a. Total deferred revenue decreased MoM, mainly due to the decrease in long-term deferred revenue. This indicates that many customers have uncertainties about their long-term business continuity, so there has not been much increase in customers choosing to renew their Create subscriptions.

In addition, new revenue for the period also decreased MoM, implying that short-term subscription growth may have also been affected.

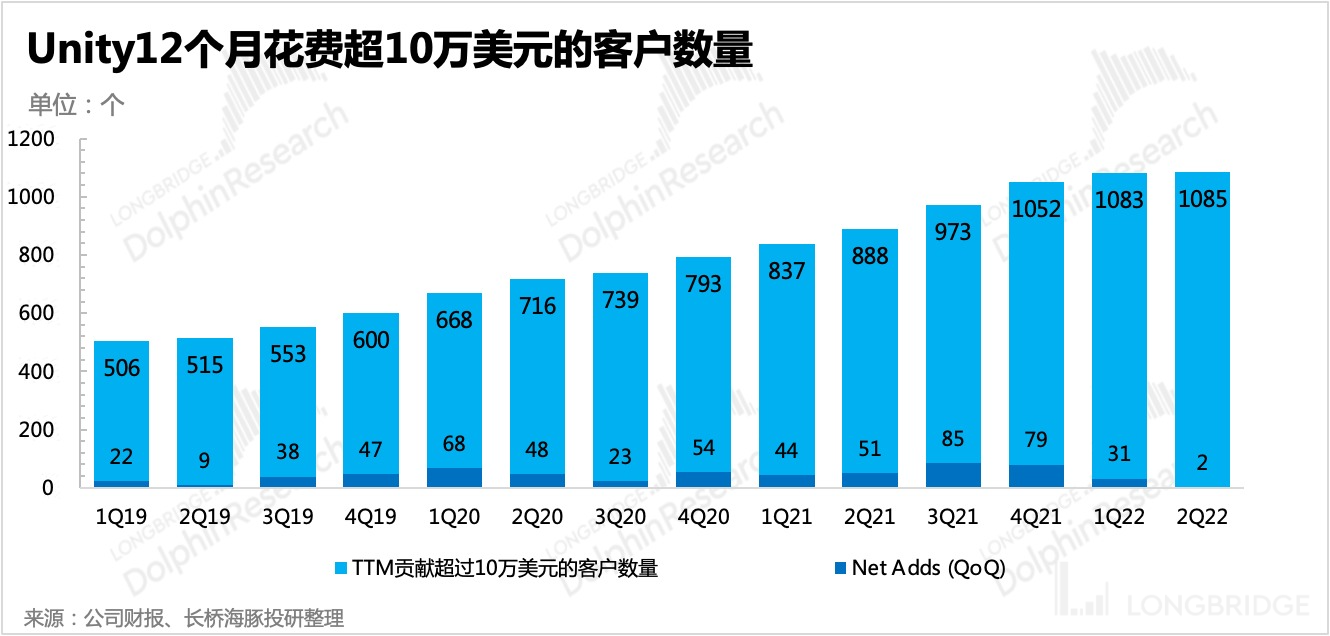

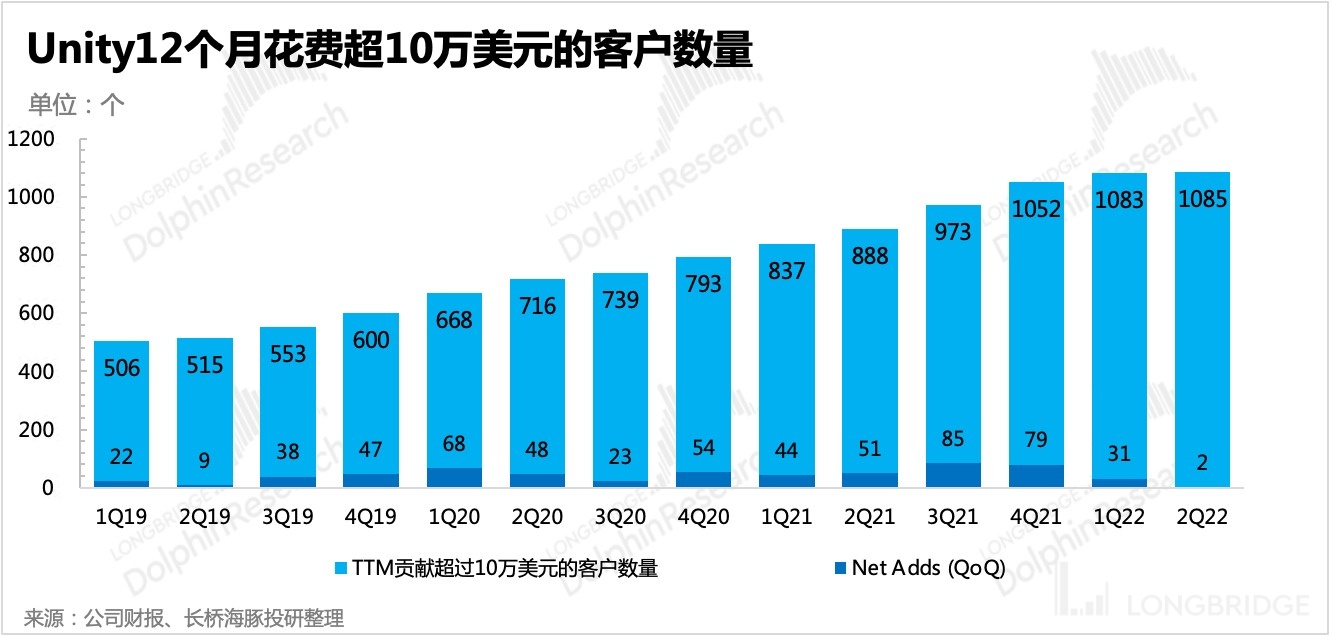

b. The number of high-spend customers (those who have created revenue of more than $100,000 in the past 12 months) has basically not increased, and we estimate that this is mainly due to Operate's short-term technical issues, but high-spend customers may also be lost as a result, leading to a gap in long-term revenue growth.

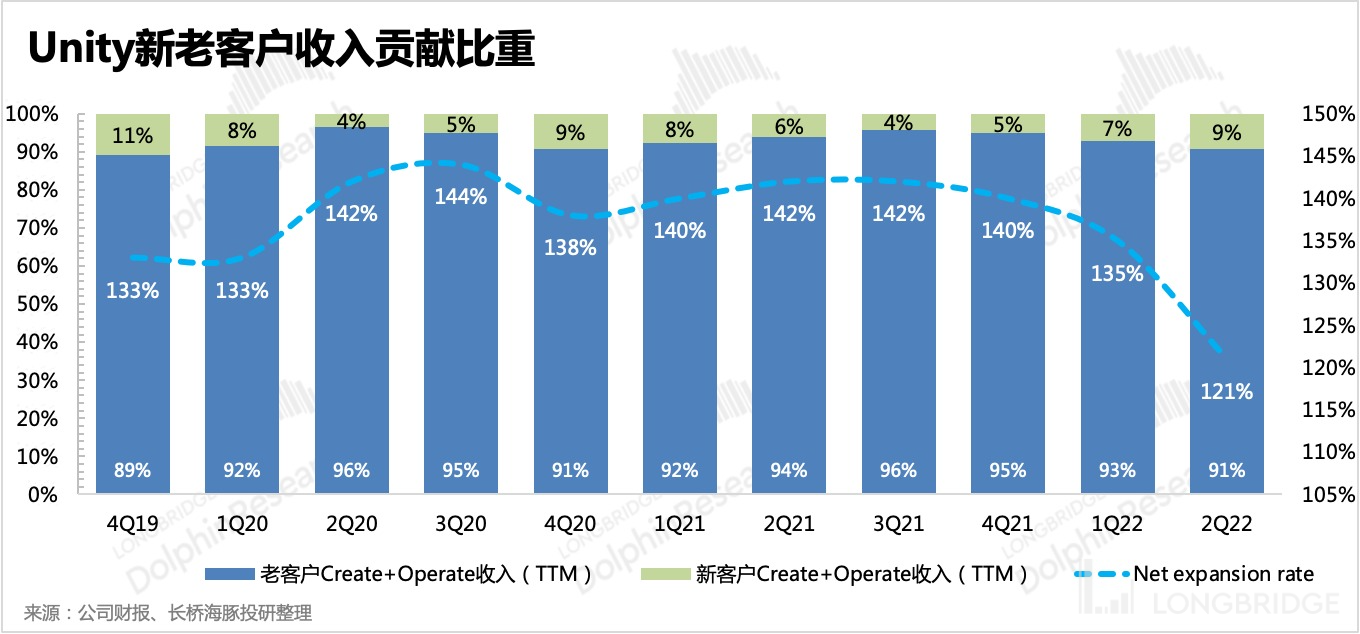

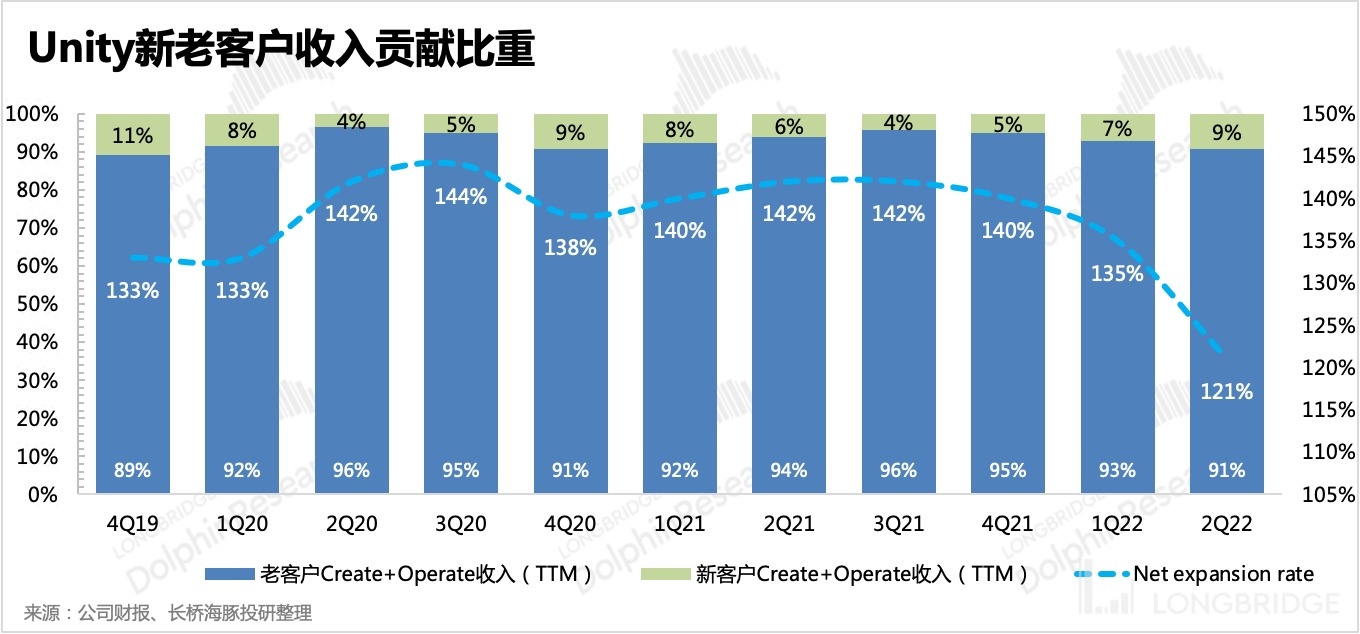

c. The expansion rate of long-term customers' income denominated in USD has fallen MoM to 121%, lower than the market's expected 136%, indicating that there is not much impetus for short-term increases in ARPU for long-term customers. Operate's drag is still the main factor, but in reality, Unity has not stopped launching new products and services, so we believe that the impact of industry prosperity is still greater.

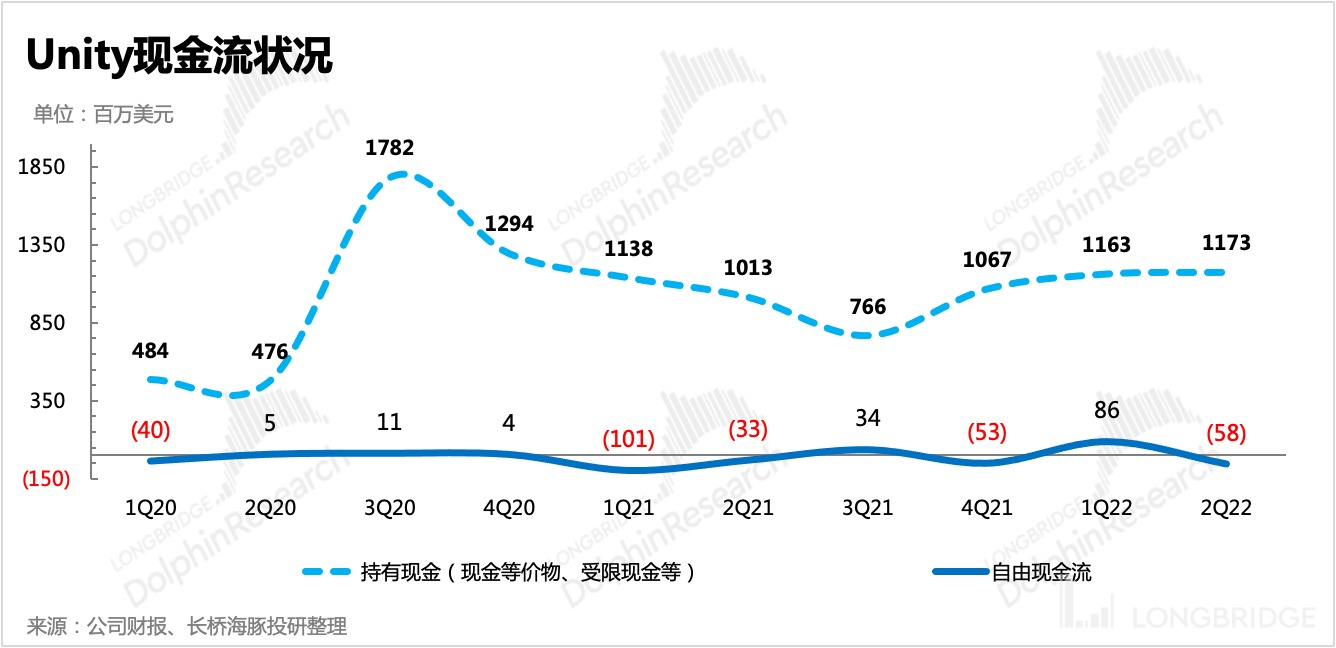

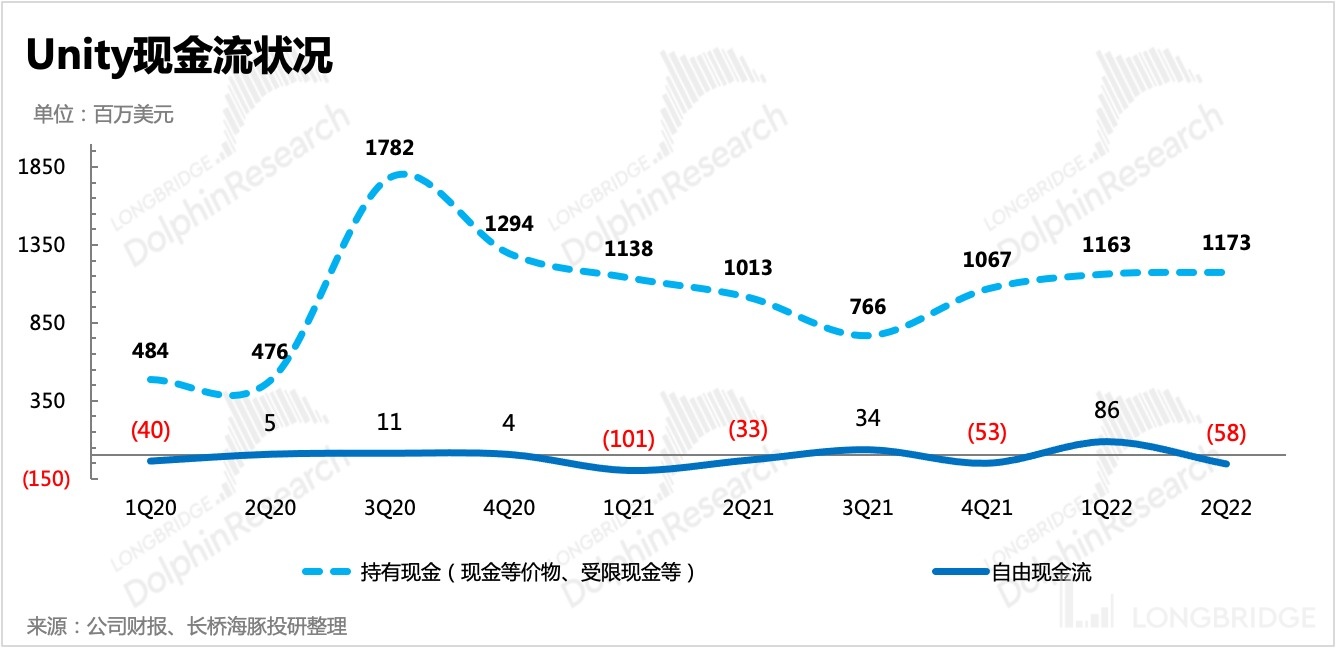

(4) As for guidance for Q3, total revenue is expected to be in the range of CNY 315-335 million, and non-GAAP operating loss is expected to be in the range of CNY 35-50 million, in line with the gradual recovery trend of operations, but the middle values of both indicators are lower than market expectations. **However, luckily the full-year guidance (CNY 1.3-1.35 billion, YoY 17%-21%, not including IronSource) has not been adjusted again after being revised downward in mid-July. **(5) As of the end of the second quarter, the company had a cash balance of 1.17 billion and 590 million in securities. The second quarter of free cash flow was negative (about -58 million), mainly due to the expansion of losses resulting in net cash outflow from operating activities of 43 million. The cash flow in the previous quarter was supported by the prepaid long-term contract payment, but this quarter's user acquisition wasn't smooth, and the cash flow situation has restored to normal; there is no cash shortage under normal business operations for the time being.

In addition to the second-quarter performance, the market is more concerned about the management's outlook for the second half of the year, especially the self-owned technology Audience Pinpointer's precision repair effect that has been deeply affected since the second quarter, and in the complex economic environment where even giants could not give a clear answer, what signals will Unity's management release.

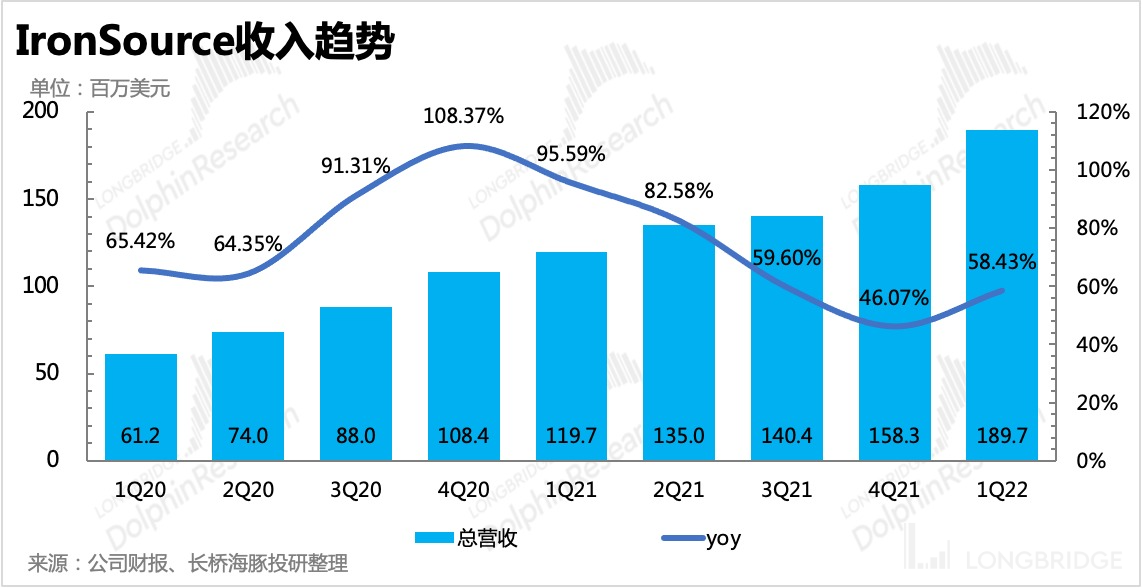

Furthermore, IronSource, which was acquired for 4.4 billion in stock, supplemented Unity's ability to release games on the game industry chain, and increased Unity's influence in the hyper-casual gaming arena. Nevertheless, it is still a "small" company with an annual revenue of less than 1 billion, with nearly 85% of its revenue dependent on the gaming market. Whether it can play a synergistic role and continue to achieve high growth across economic cycles is another question the market is concerned with.

There is little discussion about the above-mentioned issues in the business report, and Dolphin Analyst recommends investors to pay attention to the management's answer in the conference call. Dolphin Analyst will publish the conference summary on Longbridge's app community platform or investment research group at the first time. If interested, please add the "dolphinR123" WeChat account to join the group and get the summary.

Dolphin Analyst Viewpoint

Although Unity's second-quarter performance met market expectations, Dolphin Analyst is not entirely satisfied with some of the operating indicators, with the only bright spot being that the cost expansion was not as fierce as the market had imagined.

Regarding the complex economic environment for the second half of the year, Dolphin Analyst believes that it is best to hear what the management says in the conference call. Given the outlook of several companies' management that have already released their earnings reports and the growth expectations implied by Unity's operating indicators, Dolphin Analyst holds a relatively conservative attitude.

However, with the strong rebound of Unity's stock price recently, Dolphin Analyst believes that in addition to the gradual absorption of the short-term negative impact of the high premium stock-for-stock merger of IronSource, the split of China business to introduce strategic investors, and the acquisition application of Applovin are also related. Compared to repairing logic that looks at the worst fundamentals, it is apparent that the market atmosphere of event-driven hype is more dominant.

Dolphin Analyst's Opinion on the above-mentioned events:

(1) Optimistic about the merger with IronSource. There are many institutions on the market who are not optimistic about the merger with IronSource, but Dolphin Analyst believes that although the transaction method is not generous enough to small and medium shareholders, it seems to be an operation of Unity's "covering up" its inability to sustain growth in the short term. However, from the perspective of long-term integration of industry chain capabilities, enhancing competitiveness, and strengthening customer stickiness, the acquisition of IS by Unity implies strategic long-term planning. It's not just about "filling" the growth gap.

(2) Optimistic about splitting off Chinese businesses and introducing strategic investors. Last night, Unity announced that its investment partners include "hardcore" partners such as Alibaba, Douyin, MiHaYou, Jibite, and China Mobile. Unity chose to re-enter the Chinese market through joint ventures. In addition to avoiding future data regulatory risks, it also aims to expand its influence through local institutional resource relationships.

(3) Applovin's acquisition may not be reliable. Before the market opened yesterday, Applovin submitted an application for a merger and acquisition, which requires Unity's consent to implement. However, Dolphin Analyst believes that after Unity has decided to merge with IronSource, accepting a merger with Applovin, which directly competes with IronSource (and the offer is not high, especially after including IronSource), seems quite suspicious. Without considering the factors of manipulating stock prices together, Dolphin Analyst believes that Applovin's merger proposal may not receive a positive response from Unity.

Basic introduction to Unity's business

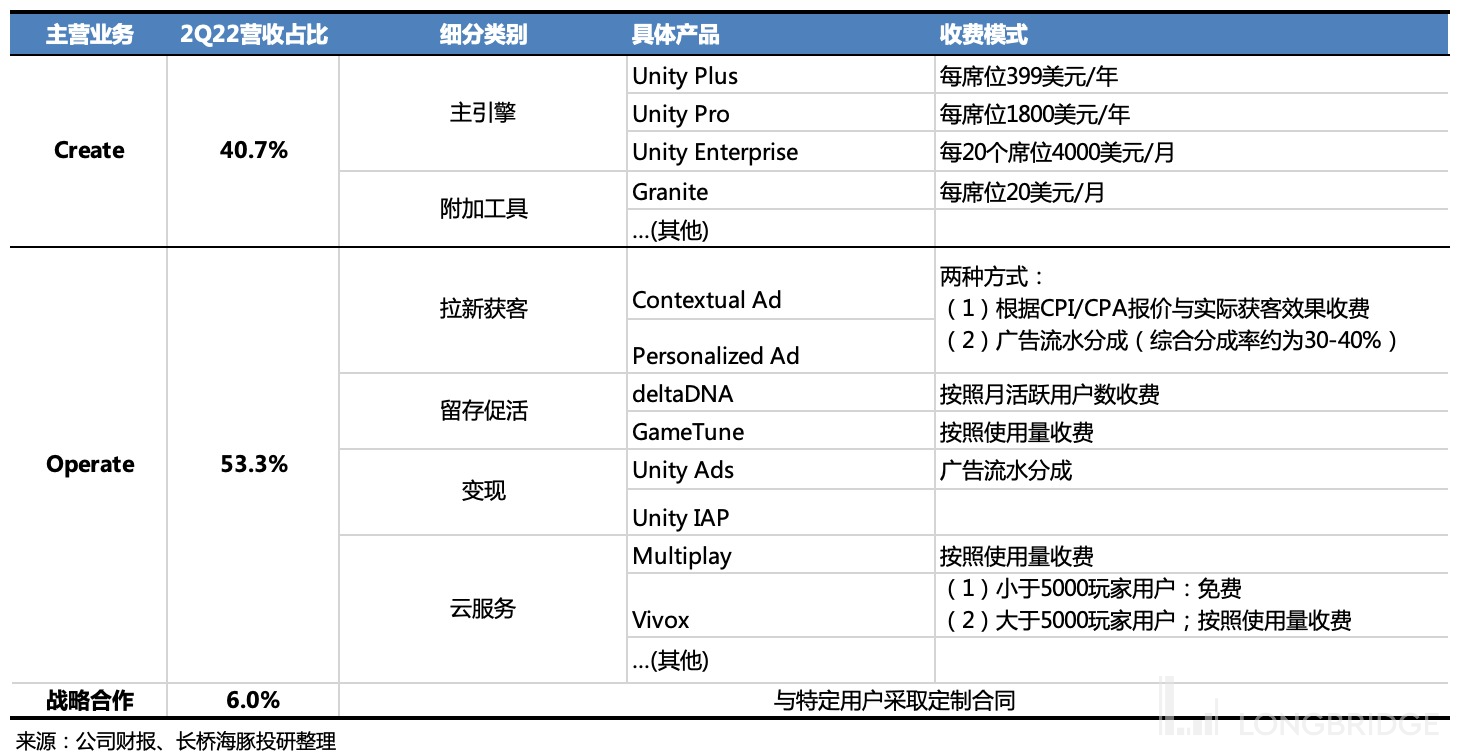

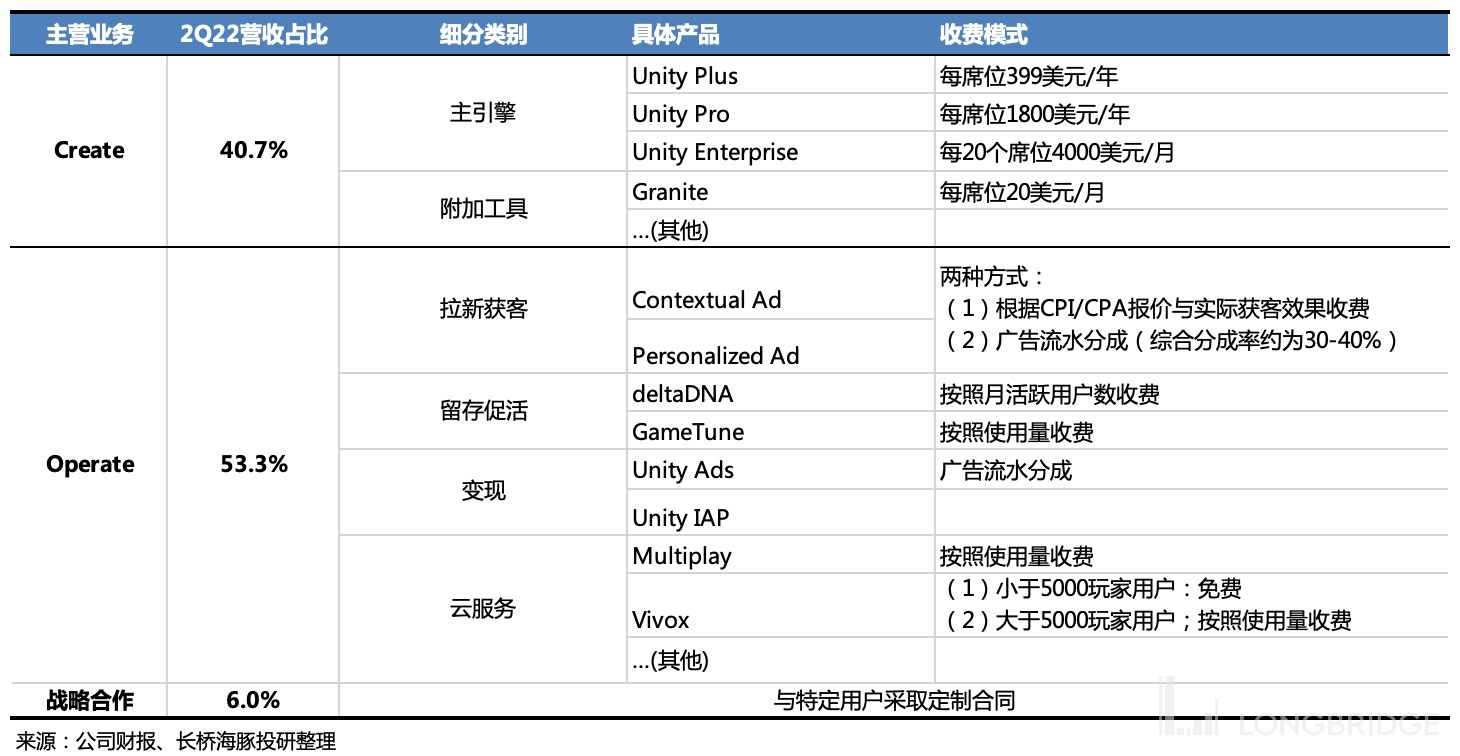

Unity mainly consists of two businesses, Create and Operate, and revenue contributions come from seat subscription revenue for game development engines and advertising platform revenue responsible for matching bidding.

-

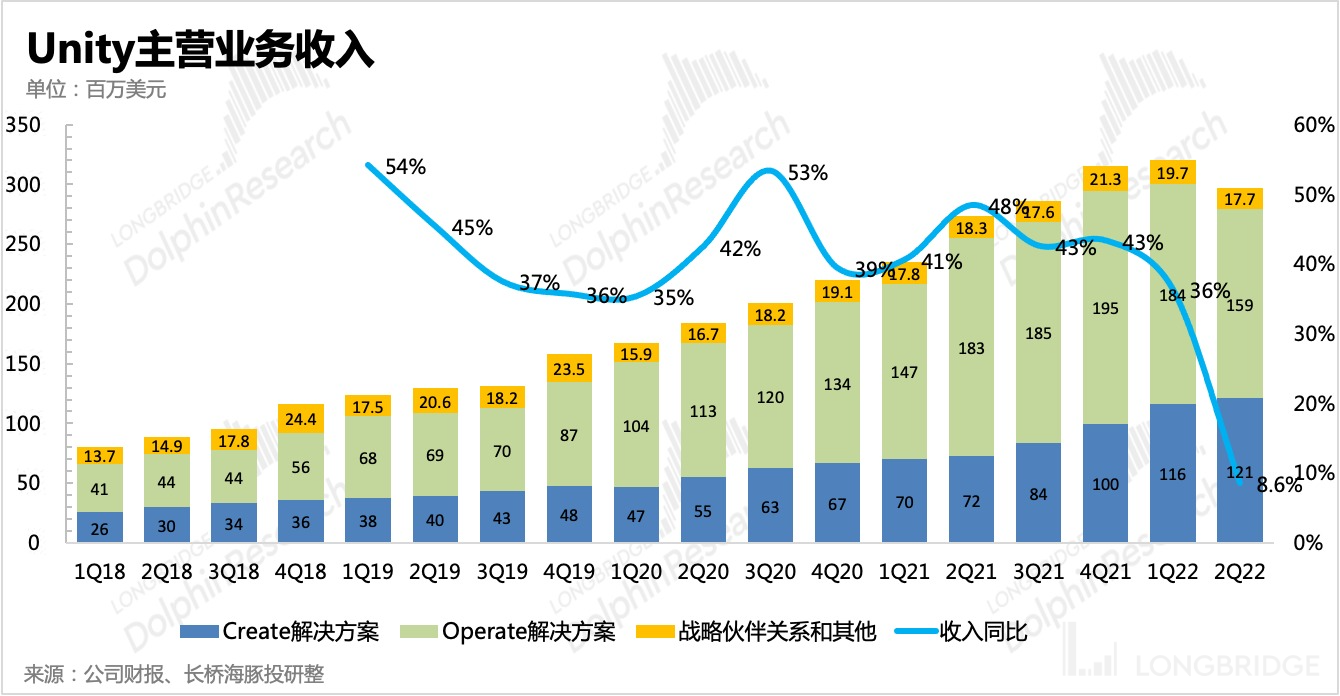

From the business structure of Unity in the past few years, although Unity is famous for its absolute monopoly in the hand game development engine market, the contribution rate of Create solution business to overall revenue is not the highest. And as the growth of incentive advertising games accelerates, Operate's advertising revenue also rises rapidly, playing a greater role in supporting Unity's revenue, especially profit.

-

Looking back at Unity's performance in the past two years, Create's revenue has basically maintained a growth rate between 30% and 50%, which is in line with the performance of a relatively steady-state SaaS platform, that is, the user penetration rate has reached the stage ceiling, but the high stickiness renewal rate is guaranteed. The annual revenue growth relies on users using more tools or software or platform pricing effects.

For SaaS platforms, after experiencing the customer acquisition period, the steady-state period, the profit margin will continue to improve, and the platform value will also be realized. This is also one of Unity's medium and long-term logics.

-

Although Unity is currently operating at a relatively large loss, mainly due to the lower realization rate of the main engine compared to its peers, Create's profit model has not yet started, and the company has continuously increased investment in non-gaming fields in recent years.

-

Before the main business becomes profitable, it is not shy to invest money in new markets. This is an advance exploration of Unity's new growth drivers, which has also been mentioned in several speeches by the management. The current strategic focus of the company is to seize more markets. But it also brings concerns about the profitability model and company cash flow.

-

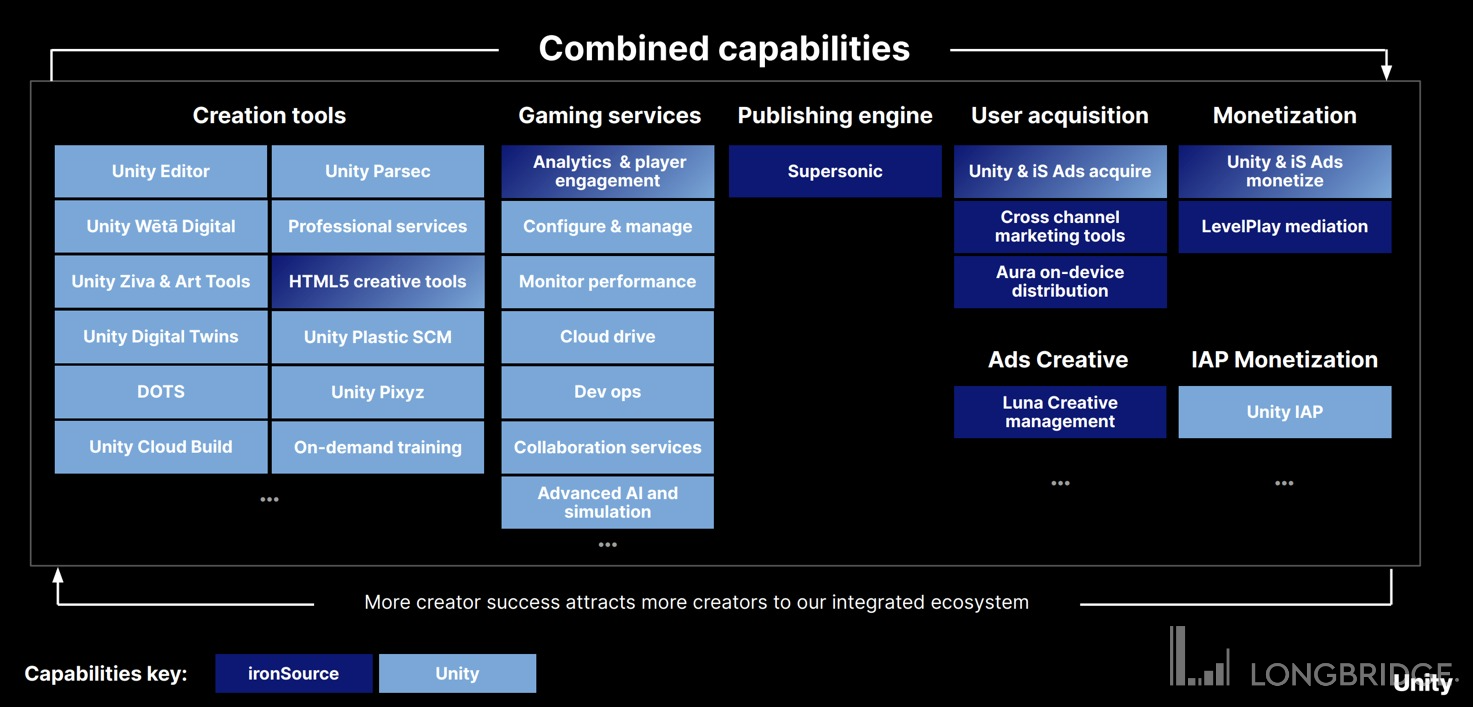

Merge with IronSource, on the one hand, can provide Unity with the ability and resources to make up for the distribution link in the game industry chain (mainly for hyper-casual games), earn a higher percentage of gaming revenue, and on the other hand, help Unity expand its usage penetration in independent game studios, which is beneficial for Unity to explore the gold in the meta-universe era.

(More information on the IronSource merger will be discussed at the end of the article.)

Detailed interpretation of this financial report

I. Revenue meets expectations, but guidance is not optimistic

1. Overall situation

In the second quarter, Unity's overall revenue was 297 million yuan, with a year-on-year growth rate of 8.6%, exceeding the upper limit of the guidance as scheduled. However, the company's guidance for the third quarter (315-335 million yuan) is significantly lower than the market expectation of 340 million yuan. However, the guidance for the whole year, 1.3-1.35 billion yuan, has not been adjusted. That is to say, to achieve the super guidance for the whole year, the year-on-year growth in the fourth quarter needs to be at least 26% or more.

Dolphin Analyst believes that there are already signs of a US economic recession. If it really enters a slump, it will not be easy to achieve more than 26% growth without the IronSource merger.

2. Segmented business

From the revenue structure, although the Operate business is still the main contribution pillar in absolute value, the Create business is accelerating its catch-up. After the precision of the advertisement decreased, Operate became directly dragging for growth. Therefore, based on the trend of the increasingly competitive mobile advertising industry, Unity has decided to merge with IronSource.

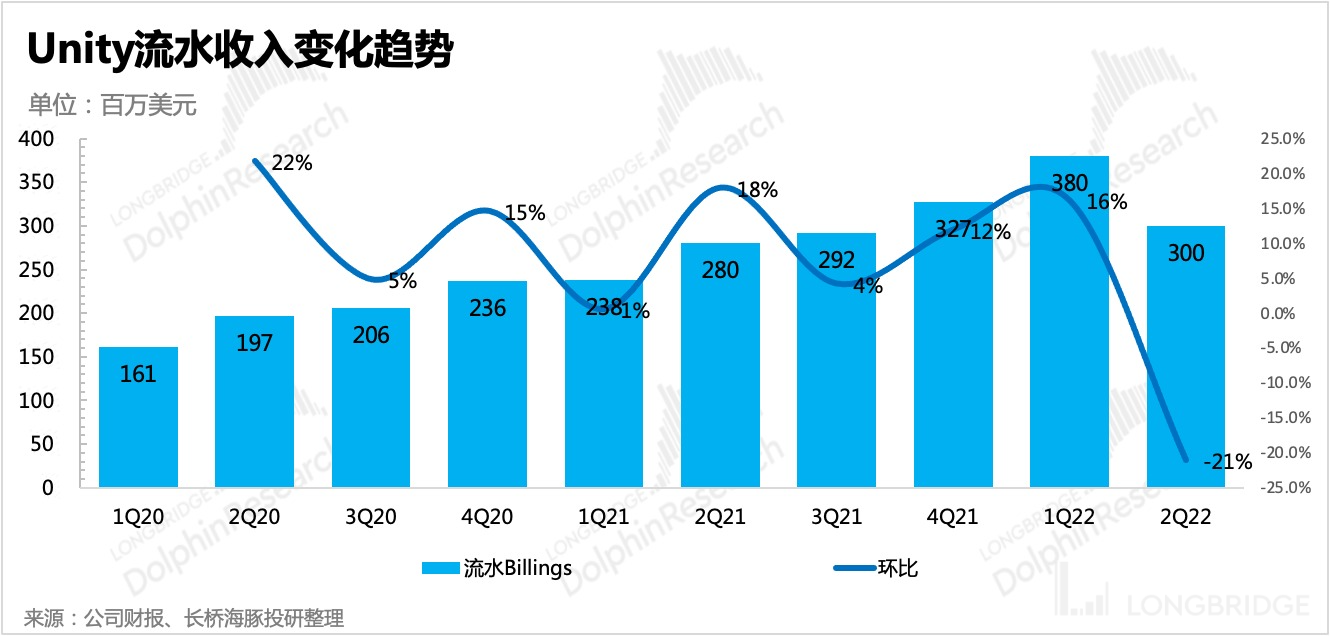

From the deferred revenue, we can also see that since the merger with Weta, Create's long-term contract scale has increased significantly. However, in the second quarter, the deferred revenue did not increase compared to the previous period, and the revenue also decreased compared to the previous period, indicating that the short-term increase in subscriptions may have been affected by the cooling off of the gaming industry's popularity.

3. Customer Distribution

3. Customer Distribution

In the past 12 months of the second quarter, the number of customers whose revenue exceeded $100,000 was flat compared to the previous quarter. The revenue expansion speed of customers with over one year of seniority was 121%, which was significantly slower than the previous quarter and lower than market expectations. Although there was a short-term impact from Operate in the second quarter, the expansion speed slowed significantly, which may be related to the insufficient payment capacity of Create's old customers, and fundamentally, it may also be related to the overall game industry environment. Here, attention can be paid to the management's outlook on the game industry during the conference call, as well as the company's expansion progress in non-gaming industries.

II. Profit: Changes in Revenue Structure Affect Gross Margin, But Expense Growth Slows

Unity provides an advertising bid matching platform, mainly acting as an agent and cannot actively control the advertising inventory and delivery. Therefore, when confirming revenue, after a certain proportion of revenue sharing is collected, most of it is calculated by the net method, so the gross profit margin of Operate business mainly based on advertising revenue (accounting for about 80%-90%) will be high.

In the second quarter, the proportion of Operate business revenue declined further from 58% in the previous quarter to 53%. At the same time, Create business, which currently has not a high gross profit margin (the charging fee is lower than that of its peers), increased by 4 percentage points. Therefore, changes in revenue structure led to a weaker overall gross margin.

However, according to the revenue proportion of the subdivided business, the gross profit margin of Create in the second quarter should have a slight increase compared with the previous quarter, given that the gross margin of Operate may be weakened.

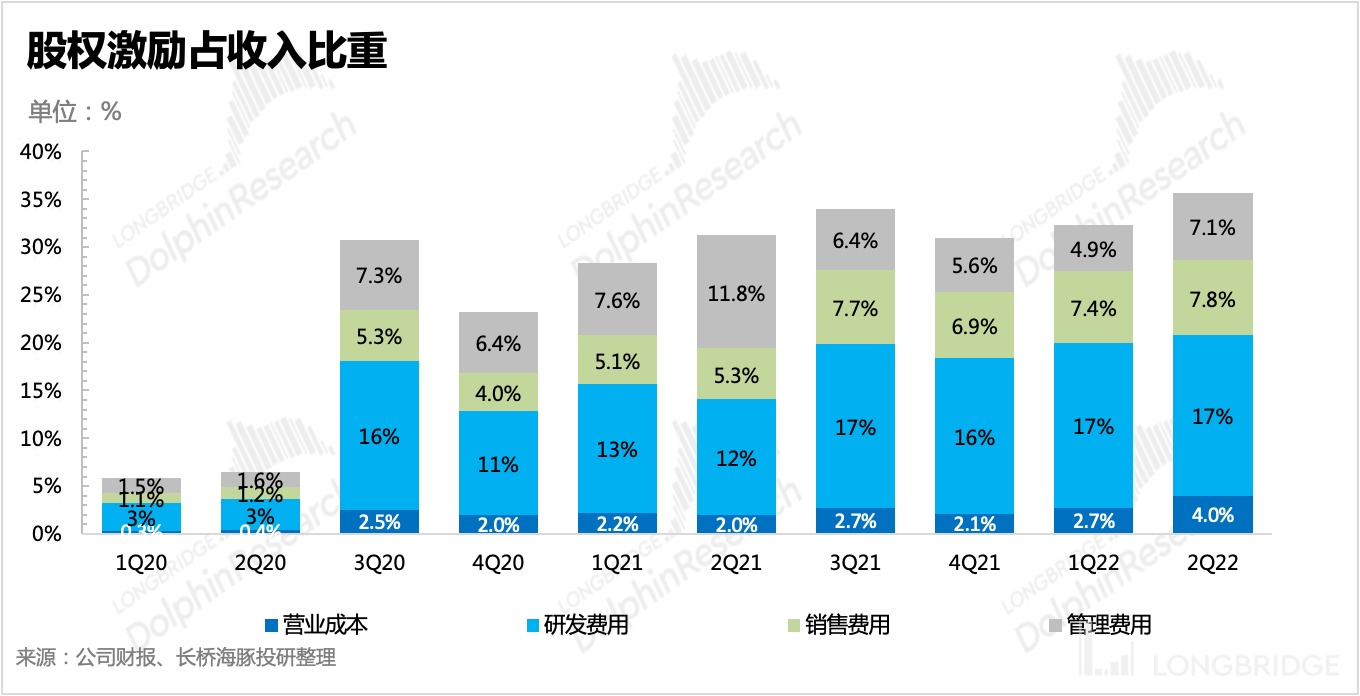

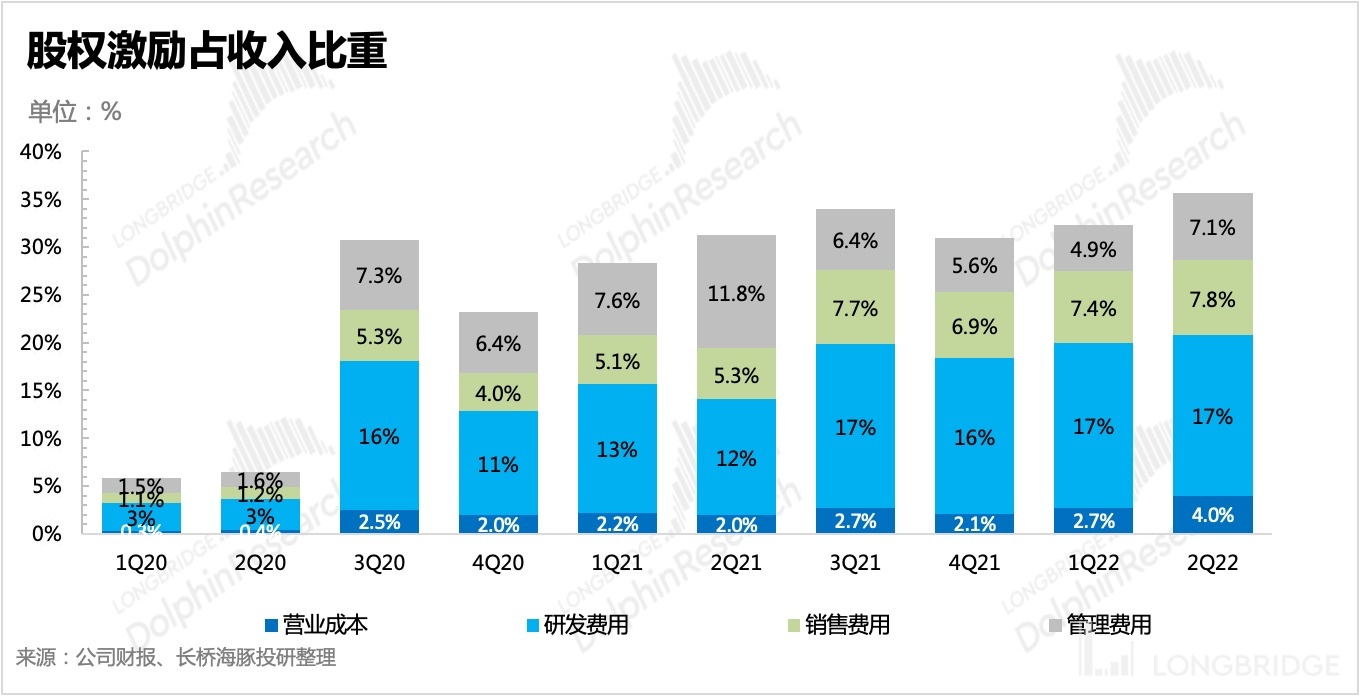

The growth rate of management expenses, sales expenses, and research and development expenses all slowed down significantly compared with the previous quarter. Although the scale of R&D expenses did not slow down significantly, the expenditure was smaller than expected by the market. Ultimately, the Non-GAAP operating loss was significantly better than the guidance. However, high stock incentive expenses still accounted for more than 30% of the overall cost, and Unity has recently been rumored to lay off hundreds of people, with compensation expenditures expected to slightly increase expenses in the third quarter.

III. Normal Operations Face Little Pressure in Cash Flow

III. Normal Operations Face Little Pressure in Cash Flow

Although the management has set a goal to achieve positive Non-GAAP operating profit by this year's Q4, the short-term cash flow for Unity is still a critical operational indicator to monitor, due to the unfavorable profit model and market environment. As of the end of Q2, the company had a total of 1.17 billion U.S. dollars in cash (cash and cash equivalents, restricted cash) on its books, which is flat compared to the previous quarter. In addition, it also has approximately 590 million U.S. dollars in marketable securities, which can be quickly realized to ease cash flow pressure when needed.

The net cash flow from operating activities was negative 43 million yuan in Q2, and the free cash flow after capital expenditures was negative 58 million yuan. Although the cash flow has not yet turned positive, the current cash reserves can still support the normal operation of the company.

IV. Merging with IronSource, A Blessing or A Curse?

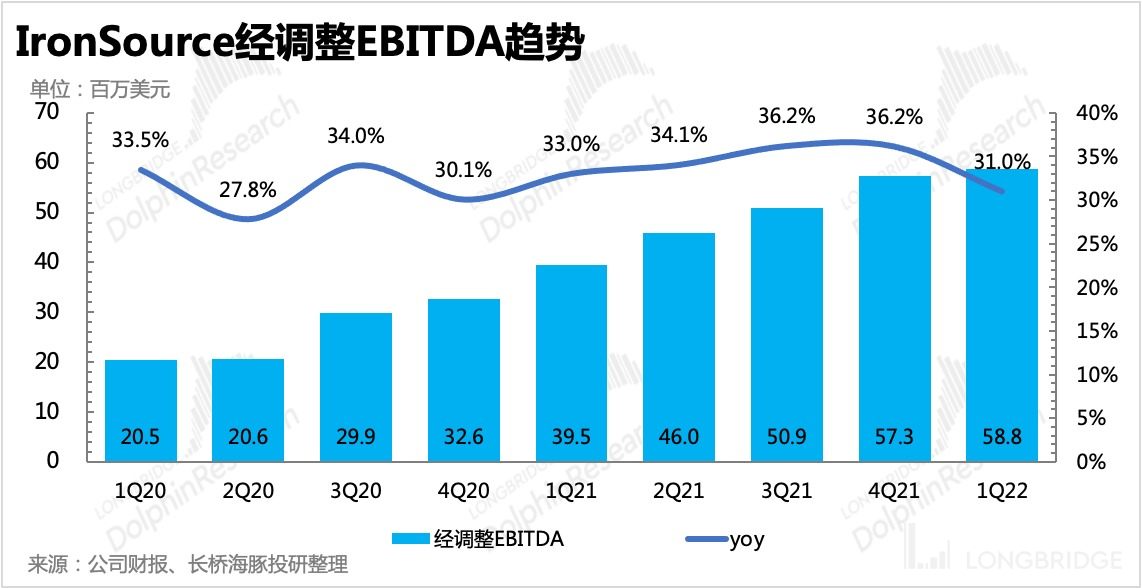

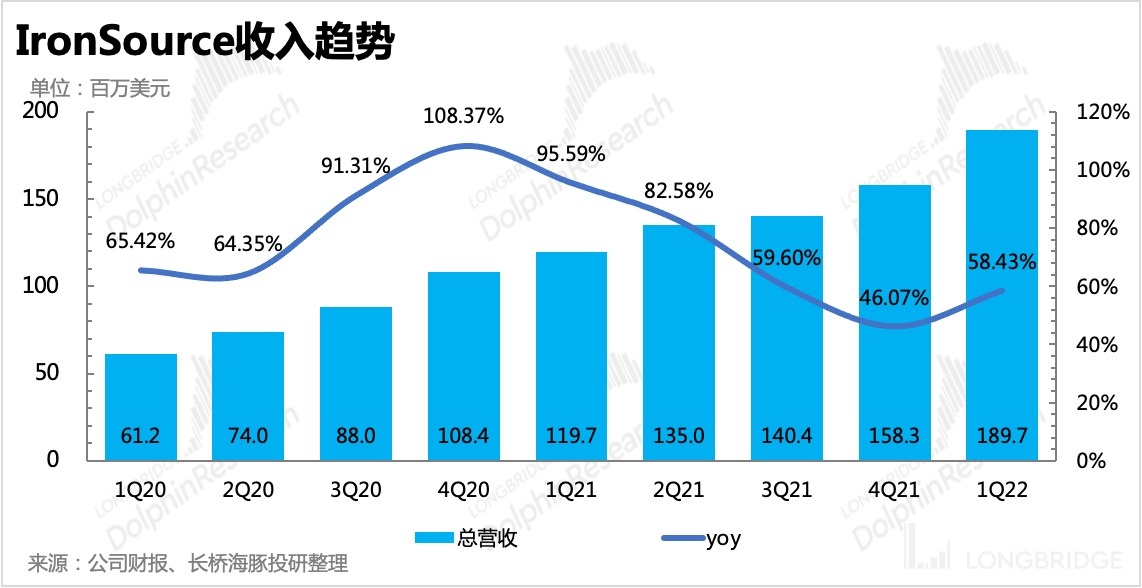

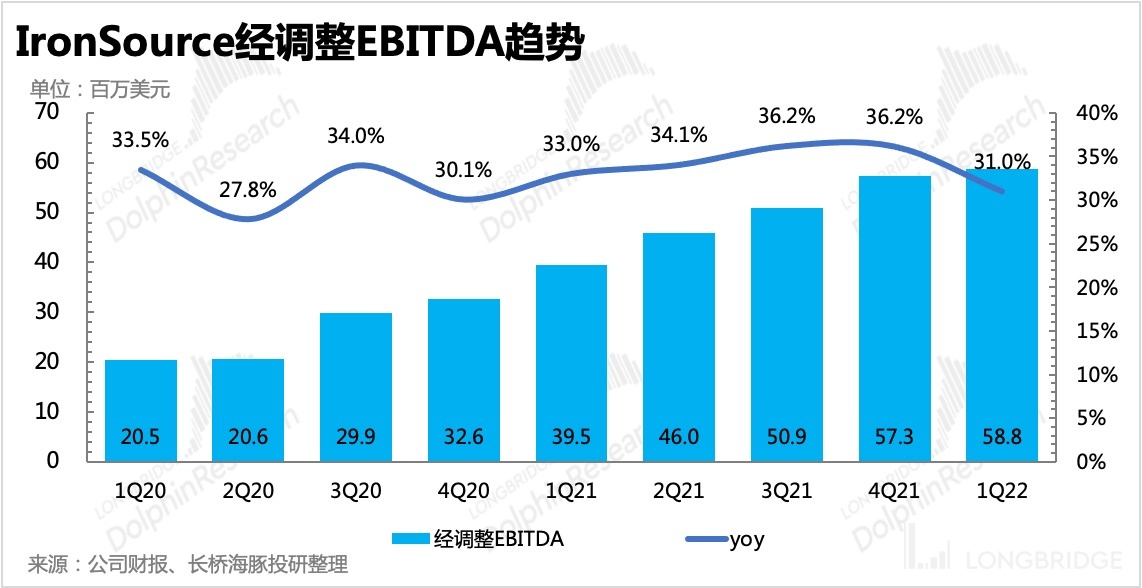

Finally, let's briefly discuss IronSource. On July 15th, Unity suddenly announced the merger with IronSource through stock exchange, with an acquisition price of 4.4 billion U.S. dollars, which is basically equivalent to 23 times IronSource's adjusted EBITDA in 2021.

For a high-income growth company that achieved profitability and whose growth rate was still close to 60% in the previous quarter, this valuation is not expensive, but the promised price is much higher than IronSoure's market price (2.5 billion) at that time. However, IronSource was valued at 11.1 billion when it went public through SPAC. Growth stocks that went public via SPAC during the cooling period are generally more abandoned by funds, so there is a certain degree of undervaluation.

However, when the merger plan was released, the market still had complaints about "excessive premium rates" and "equity dilution". In addition, the full-year guidance was slightly lowered at the same time, resulting in a very negative market response on that day. Although Unity has given the expected outlook after the merger (it is expected to achieve 1 billion in adjusted EBITDA by 2024), some investment banks have expressed negative opinions, mainly based on the logic that the high-growth period of both companies is coming to an end. So what kind of company is IronSource? Why did Unity buy it "at all costs"?

1. Despite the low revenue, it has a significant impact

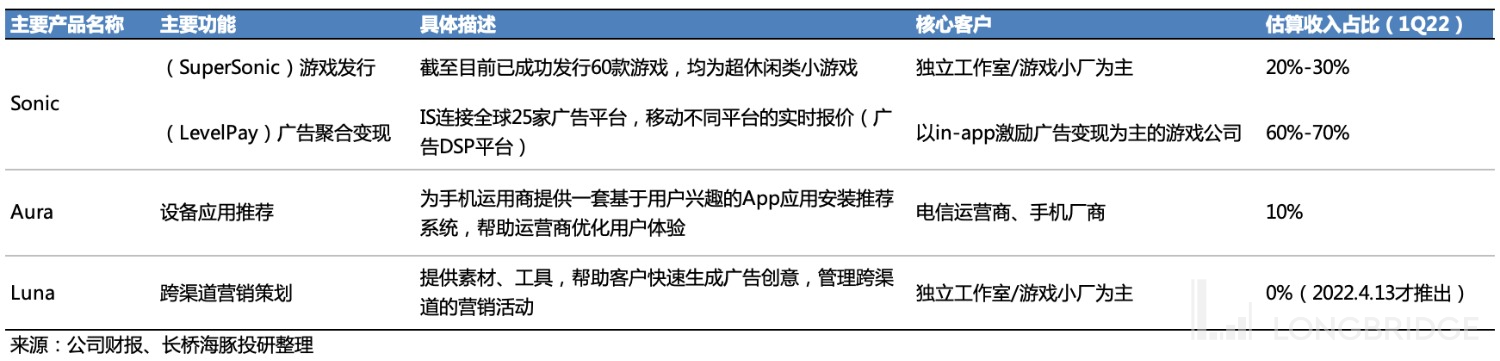

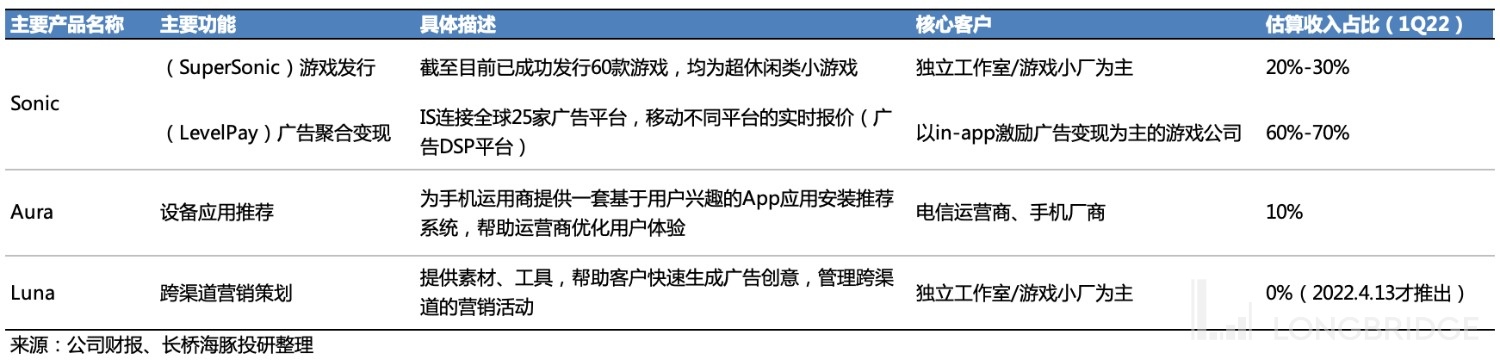

Simply put, IronSource is a mobile advertising platform that can be seen as a more complete "Operate" solution for Unity. IronSource currently has three main products (Sonic, Aura, Luna), and besides Luna, which was launched in April this year and has no revenue, the platform that contributes the most to revenue is LevelPay.

Although IronSource has a game publishing business that Unity does not have, it is better known in the market as a role in mobile marketing platforms.

In AppFly's latest "Comprehensive Performance Report on Advertising Platforms (14th Edition)," IronSource's user retention index is ranked 6th and 5th in the Android and iOS versions respectively, with only Google, Meta, Unity, Mintegral, Applovin, and Apple's Search Ads ranking ahead of it.

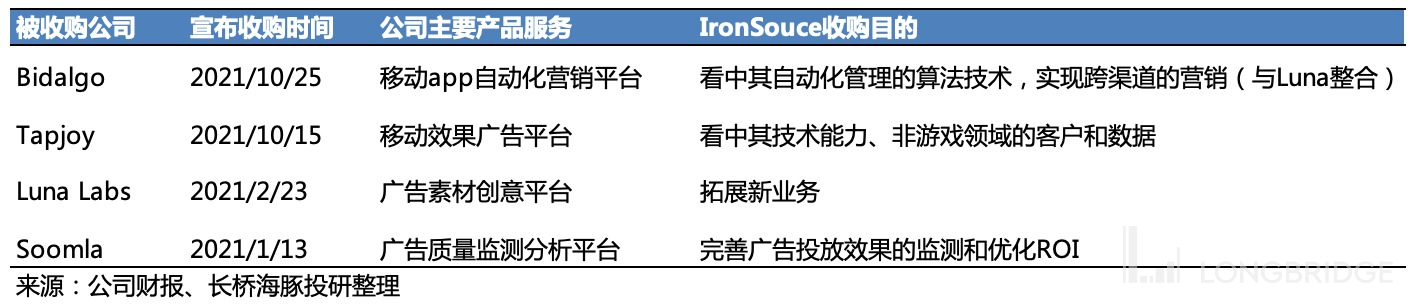

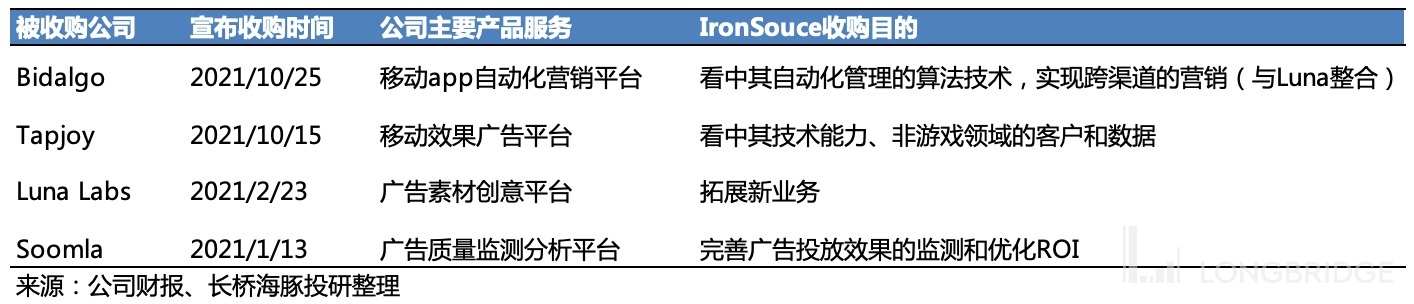

Since it went public and received financing in 2021, to maintain its position in fierce competition in advertising channels, IronSource has entered a crazy buying mode again after five years, acquiring four peer companies within a year. (Competitor Applovin also went public in the same year and expanded its territory by acquiring everywhere.)

2. Unity mainly values IronSource's data and customer resources

In "The Unclear Metaverse and the Clear Unity" mentioned by Dolphin Analyst, one difference between Unity and Unreal is that Unity does not create games to compete directly with customers. The IronSource merger not only improves Unity's existing advertising business in "Operate," but also supplements its game publishing capabilities.

(1) IronSouce has a massive amount of user data that can help improve the precision and conversion rate of Unity Ads.

- The game app released by SuperSonic has been downloaded more than 2 billion times in total (not representing 2 billion people, as there are multiple downloads for each game's version). IronSource announced its agreement to acquire Unity Ads, a division of Unity Technologies, for $1.2 billion earlier this month. This acquisition follows IronSource's recent acquisition of Luna Labs and marks its continued expansion into the gaming industry.

The cons of the acquisition are, initially at least, relatively few and far between. IronSource's strengths in creating and managing marketing campaigns will enable Unity to better retain and monetize its users, while IronSource's game publishing capabilities will enable Unity to capitalize on the opportunity to share high-quality games with the growing numbers of players.

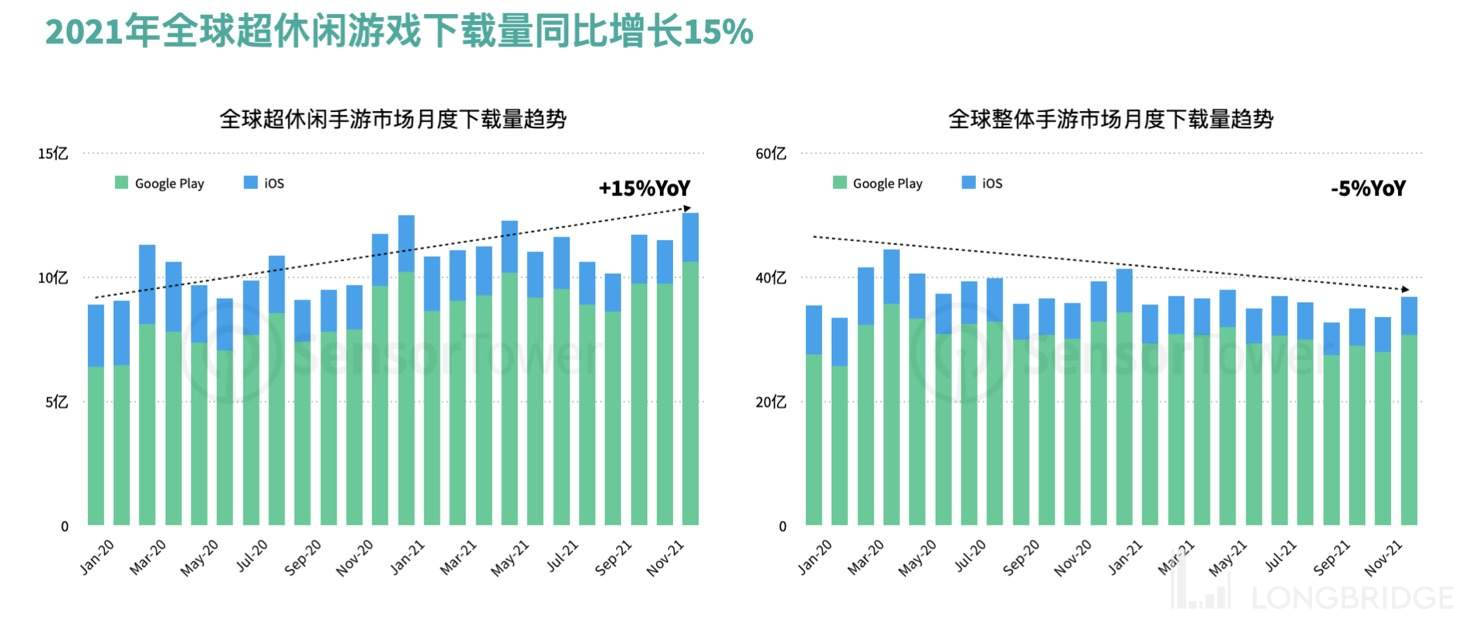

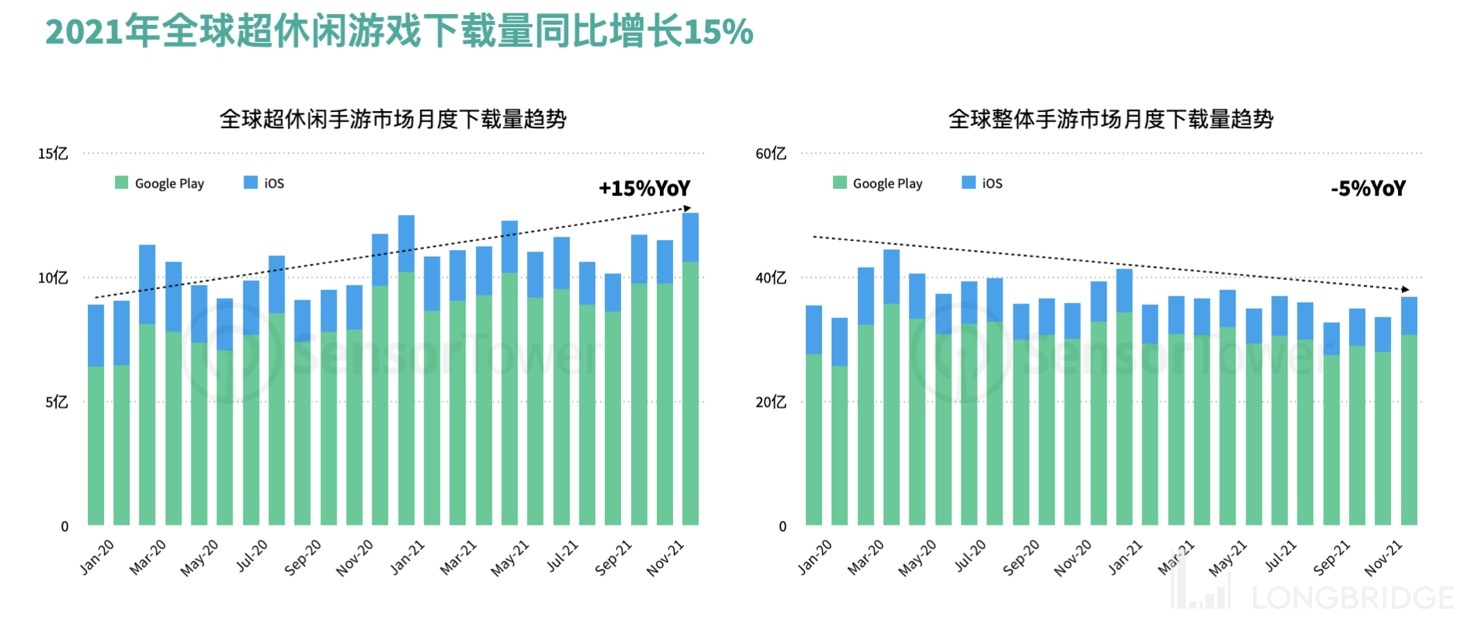

These factors, combined with IronSource's ability to market itself as a "one-stop-shop" for mobile game developers, make the merged company a powerful force in the gaming industry. Possible risks: The two parties rely heavily on the gaming market (with Unity accounting for 90% of revenue and IronSource at 85%), and it cannot be denied that the gaming industry saw good growth last year, especially in hyper-casual games, with downloads increasing against the trend.

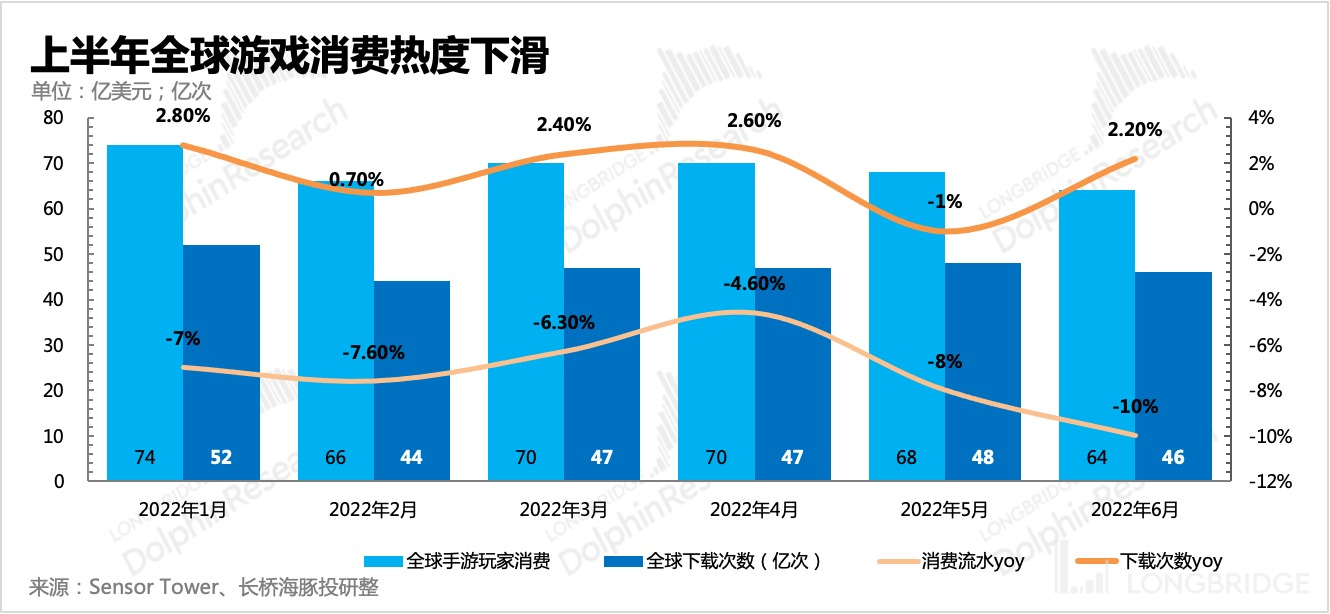

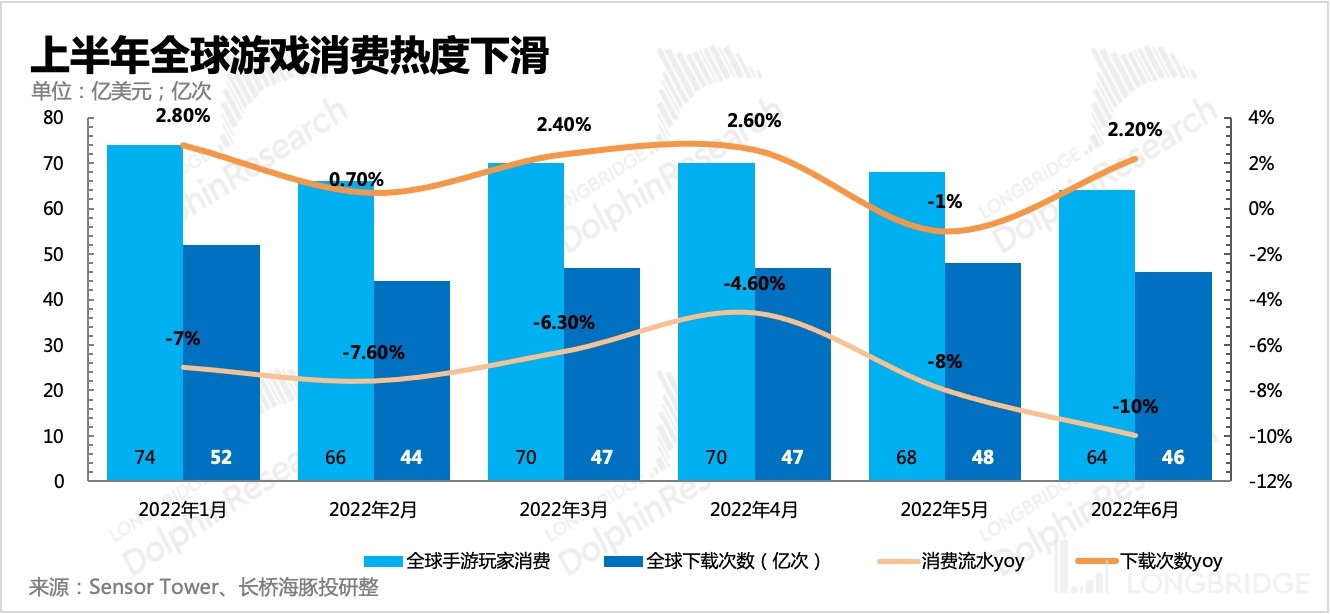

However, since the beginning of this year, the hype around the gaming industry has clearly faded, with revenue from the first half of the year dropping compared to the same period last year. Although there may be more games turning to advertising for monetization, the short-term drop in demand has had a significant impact.

In addition, there is also significant pressure on mobile advertising in the second half of the year. Although there are reasons such as high base numbers, fierce competition (Apple IDFA, TikTok, etc.), and sustained inflation, they are all factors that restrict the growth of game consumption and affect the marketing budget of advertisers.

Dolphin Research Analyst's report on "Unity":

Financial report analysis

May 11, 2022 telephone conference call transcript: "Unity: Second-quarter guidance is affected by internal issues, long-term effects are not yet clear (conference call summary)"

May 11, 2022 financial report review: "Unexpected thunder, is the shovel stock of the metaverse, Unity, also collapsing?"

In-depth analysis

April 1, 2022: "Several interesting points from the "2022 Unity Global Games Report""

March 17, 2022: "[Unity: Betting on the imagination of the "metaverse"] (https://longbridgeapp.com/topics/2119703)"

March 9, 2022: "Unity: Clearing Up the Metaverse's Uncertainty"

Risk disclosure and disclaimer for this article: Dolphin Research & Analysis's disclaimer and general disclosure statement