Unity: Significant recovery in proprietary technology issues, currently facing short-term macro pressure (minutes of telephone meeting)

The following phone summary will provide incremental information for Unity's Q2 financial report. For financial report analysis, please refer to " [Unity's Crazy Capital Operations and MiHaYo's Short-Term Concerns] (https://longbridgeapp.com/topics/3286776)".

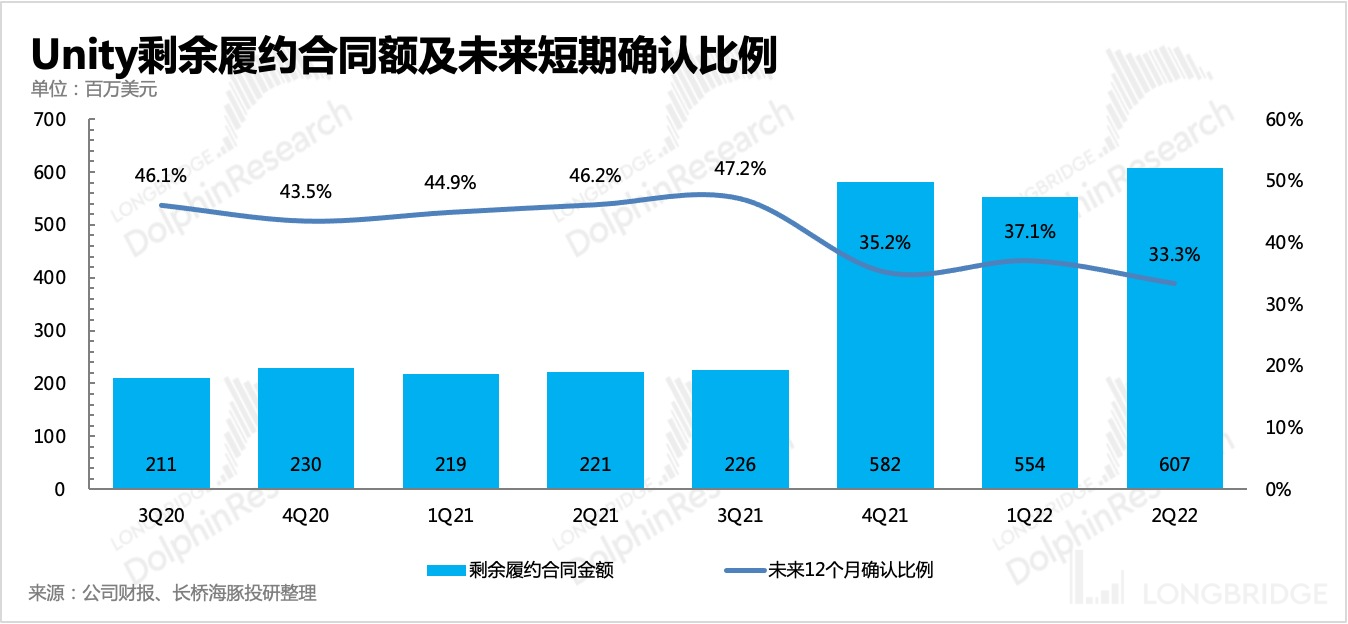

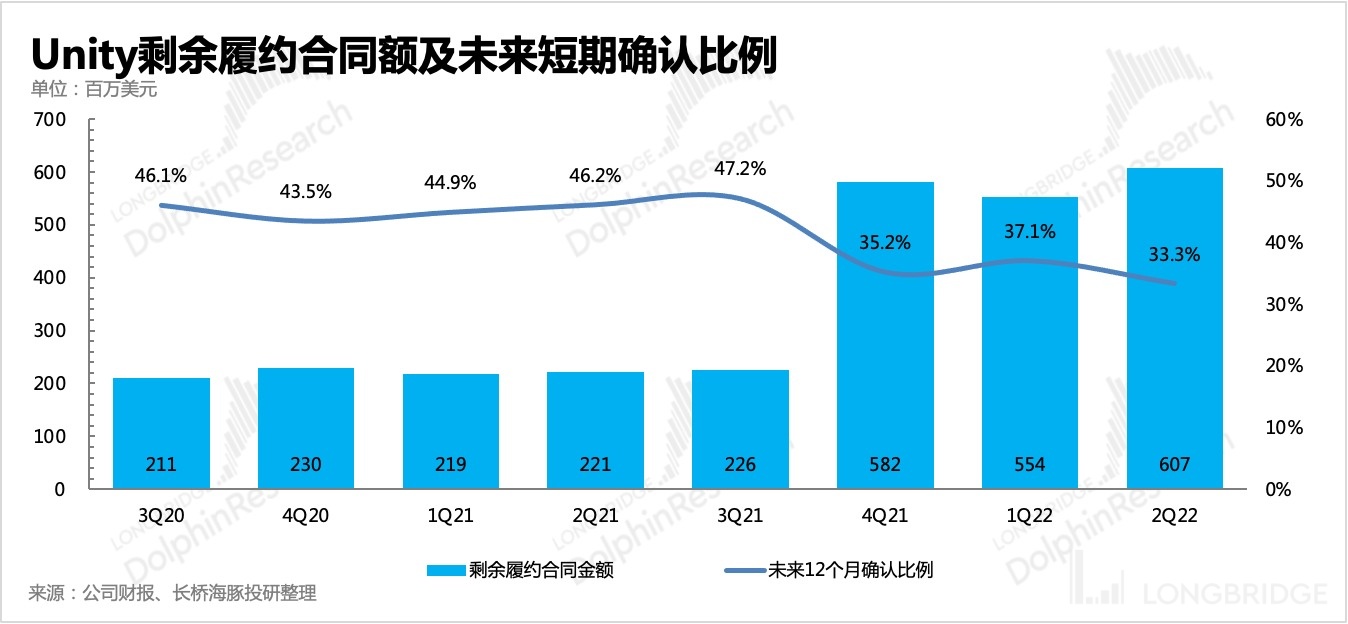

I. One Key Indicator Disclosed - Affecting Judgment of Create Business The complete financial report submitted to the SEC that Dolphin Analyst is concerned about is the remaining performance obligation (RPO). However, it should be noted that this indicator is different from the deferred revenue situation and increased sequentially in Q2.

- Generally, the remaining performance obligation (RPO) = short and long-term deferred revenue (billed/received) + un-billed performance obligations.

- In Q2, Unity's RPO was US $607 million, an increase of US $54 million from Q1, with a better growth rate than before, presumably due to the company's ability to expand non-gaming markets after acquiring Weta and Ziva.

- The difference between RPO and deferred revenue changes is due to the significant increase in un-billed performance obligations. An increase in this indicator generally indicates that SaaS software companies have signed more long-term contracts with customers. They do not require customers to prepay contract fees in order to bundle long-term cooperation relationships.

For example, subscribing to a one-year service requires payment of a one-year fee upfront. However, if the company signs a service contract for more than three years, it may offer customers some discounts (which will not result in a larger deferred revenue than an increase in RPO), and it will relax customer prepayment conditions. There will be an increase in deferred revenue but not in RPO in the current financial report. 4. The proportion of contract amounts that are expected to be confirmed in the short term in Q2's remaining contract amount has slightly decreased, indicating that more contract amounts will be recognized as revenue in the future.

5. Combined with <1-4>, Unity's Create business not only did not face the crisis of declining customer subscription intentions but also bound more future payment power of customers, and the potential revenue with certainty is increasing.

II. Management's Remarks

1. CEO:

(1) First of all, we have received the merger proposal from Applovin, but we will not comment on this proposal at present.

(2) The data for Q2 2022 is consistent with the data we updated last time, but it is far below our growth and value creation standards. The revenue of US $297 million increased by 9% year-on-year, slightly higher than the expected revenue of US $290 million to US $295 million. Although progress has been made, we still lower Unity's full-year revenue expectations to US $1.3 billion to US $1.35 billion because revenue growth is slower than the model. We attribute this to recent negative macroeconomic factors and the complexity of accurately predicting changes in monetization revenue.

Quarterly revenues for Create were once again strong, reaching $121 million, a year-over-year increase of 66%. As we transition from 2D to real-time 3D, we have established a large Create business driven by innovation and market demand, which provides a more attractive and interactive experience. Unity is no longer just about games, as success beyond games extends to testing. In 2021, non-game business accounted for 25% of total Create business, rising to 33% in the fourth quarter of 2021. By the end of the second quarter of 2022, our non-game business accounted for 40% of Create's total business. This mixed expansion is taking place against a backdrop of historically strong returns for our game business.

Although operating progress is good, the monetization performance still disappoints. Efforts have been made in product and engineering to ensure that the monetization business remains stable.

2. Create Solutions Leader:

(1) In July, Unity games accounted for 80% of the most popular games on Oculus Quest, and 72% of the top-selling games. Overall, Unity has a very large coverage and business scope in the gaming industry.

(2) Regarding Create business beyond games, I would like to share some of our customers' highlights.

In the second quarter, we expanded our relationship with Obayashi, one of the three largest construction companies in Japan, to help them develop a digital platform to improve their main efficiencies in the construction process. Specifically, their internal users will use real-time 3D as the basis for design and construction work. Obayashi chose Unity because they believe our solution is the most scalable and extensible. Also in the second quarter, we signed the largest digital twin agreement to date with CACI Corporation. Through this relationship, Unity will help the government define human-machine interfaces for use in aerospace and other fields. We will continue to strengthen our cooperation with Mercedes Daimler. Starting in 2024, all Mercedes Daimler cars will be equipped with human-machine interfaces manufactured by Unity.

3. Operate Solutions Leader:

(1) Last quarter, in addition to external factors such as the competitive environment, there were two issues affecting profitable business. One is the problem of data quality, and the other is the accuracy problem of the Audience Pinpointer product.

Regarding data quality issues, we have removed bad data inadvertently captured during the model interaction process and strengthened the monitoring and observability capabilities of our machine learning models to mitigate these rare types of events. On the Audience Pinpointer side, we have increased investment and innovation in models and customer experience to address scalability challenges in the past, improving performance and accuracy significantly. For example, Trailmix is a studio that makes the popular game Love & Pies, which won the Best Casual Game award at the TIGA Games Industry Awards. The studio has always worked with Unity. With Audience Pinpointer, the studio is able to test target users and accelerate user growth journey and improve user retention rates. The first day user retention rate reached 60% and the 30th day retention rate reached 20%.

(2) On Unity Gaming Services (UGS) updates:

UGS is a set of tools and services designed to simplify the ability of every developer to create, host, and manage games in the cloud. In this quarter, we will launch multiplayer game server hosting and competition creator self-service functions to provide AAA-level multiplayer game services for developers of all sizes.

Q: As you said, non-gaming revenue from Create accounts for 40%. How will this ratio evolve over time?

A: Our market entry channels are similar to a continuous flow from the top of the funnel, and the same customers will conduct second and third transactions. As people continue to learn about Unity's real-time 3D, we are also signing larger agreements. On the other hand, we have been building unique solutions, and various industries are studying how to use real-time 3D technology.

For example, tools like Forma are used in many product configurators, automotive, and other fields. When we understand the needs of these customers, we build functions that can be combined with the core Unity engine in the editor to enable customers to use them. Therefore, we seek partners like Capgemini to enable channel partners to provide help in a similar way.

When we were preparing for our first IPO roadshow, many investors were very concerned that our expected non-gaming revenue would catch up with our gaming business within 3 to 5 years, but in fact, games are still growing strongly.

Frankly speaking, there are still many industries where the core is real-time 3D. They create real-time digital twins to simulate the future and understand the present situation at the same time. This technology will make their own business stronger and customer relationships more stable. So we are entering this platform in a bigger way than a year ago or a quarter ago. We feel very positive about the future trend of real-time 3D.

Q: Regarding Operate, you mentioned how you handle the influence of macro and competitive data well. Can you provide details on the protective measures that have been implemented? A: Most of Operate's business operations are in the gaming industry, and we highly value experts' discussions on the gaming industry and economic recession, among others.

First of all, at a macro level, the gaming industry is still a continuously growing strong industry. Looking back at the past five or six economic recessions, the gaming industry has maintained double-digit growth for almost any three-year period.

Indeed, short-term headwinds occasionally occur. At the current stage, we are still addressing the high engagement of people in games when they stay at home after being infected with the new coronavirus. However, we are facing headwinds in growth driven by macroeconomic factors. Compared to the double-digit growth rate we have seen over the years, the gaming industry will face resistance in the near future.

To address the issues on our own platform, our team has convened eight task groups who work seven days a week, focusing on tasks like data elasticity, redundancy to develop new products and features. They showed me many prospective revenue indicators, but we need a more precise Audience Pinpointer to achieve revenue growth.

During this period, we become cautious and disciplined in resources. We invest twice the funds in advertising products and services. Without any other unnecessary expenditures, this is actually a way to create results for our customers with less money, such as finding more installations with less money. It means we need innovation to speed up model development, such as pushing the boundaries of machine learning, delving into optimization opportunities for each part of the system, and ensuring that the system is flexible enough to predict further events.

Q: First of all, I am curious how you consider pushing platform usage by providing additional incentives to clients in a seemingly difficult advertising market. Secondly, with the growth of solution and product ranges, do you think bundling products together flexibly maximizes revenue now?

A: We do not frequently use incentive measures because this is usually a very short-term solution that does not bring long-term returns. We are very clear that we should focus on the long term instead of the quarter, which can sometimes frustrate investors. But focusing on the long term will produce higher NPV, which is important to us.

Secondly, we are in the early stages of UGS. UGS is a very powerful tool, product and feature combination, which every user needs when pushing games or applications to the market. Some gaming companies encounter Waterloo in the ecosystem and SDK when they first enter the network or mobile field, and the team is very concerned about this. We have incorporated all services into it, establishing a system, which is a huge advantage.

Although not every link and part has been tested, we have received good feedback from customers.

Q: If there were no data quality and Pinpointer issues earlier this year at Operate, would operating revenue reach 160 in this quarter's report solely due to macro factors? If not, what else needs improvement in tool improvement and expense expansion? A: In terms of specific numbers, early headwinds were difficult to distinguish between macro factors and those caused by Audience Pinpointer and data. But currently, the data issue has been resolved and our Audience Pinpointer product is getting stronger every day. So now, we see that slow growth in advertising spending is mainly due to macro factors.

Q: In joint ventures in China, the China region accounted for 15% of your revenue last year, which is already a significant business. What can joint ventures allow you to do that you can't do now?

A: Regarding China, first of all, I want to congratulate Luis and some members of his team, as well as Junbo, for the incredible work they have done in China, which will enable us to achieve sustained and higher levels of growth in the coming years.

We have managed to make many leading technology companies our partners, which support us in the gaming industry and beyond.

Finally, the China business does not account for 15% of our total business revenue, but only 15% of Create business (total revenue is less than 5%), about $50 million in 2021.

Q: Does the $1 billion valuation for splitting the Chinese business mean that there will be $1 billion in cash flow after the split, and that the Chinese business will be accounted for as non-controlling income on the IS statement?

A: We will still hold a majority stake in the joint venture in China and control the board. The Chinese company will receive a $220 million investment from us, but this money will be retained in the joint venture. So there is actually no cash flow into the parent company's financial statements.

(Dolphin Analyst: So Unity holds 78% of the shares and is still the controlling company.)

Q: Can you talk more about the cooperation with Microsoft Azure and how the partnership with Azure can bring new technological capabilities to developers?

A: We are very happy to deepen our collaboration with Microsoft. Before that, we had close cooperation on Xbox and HoloLens. When we talk about real-time 3D, we also mention digital twin technology.

Real-time 3D files are generally very large, and high cloud computing capabilities are required for developers in both the development process and actual applications. Working with Azure can help us build technology integrations for creators in gaming, digital twins, art, and other fields.

Risk Disclosure and Statement of this article: Dolphin Research Disclaimer and General Disclosure