Let's talk about Yuewen's performance in the first half of 2022.

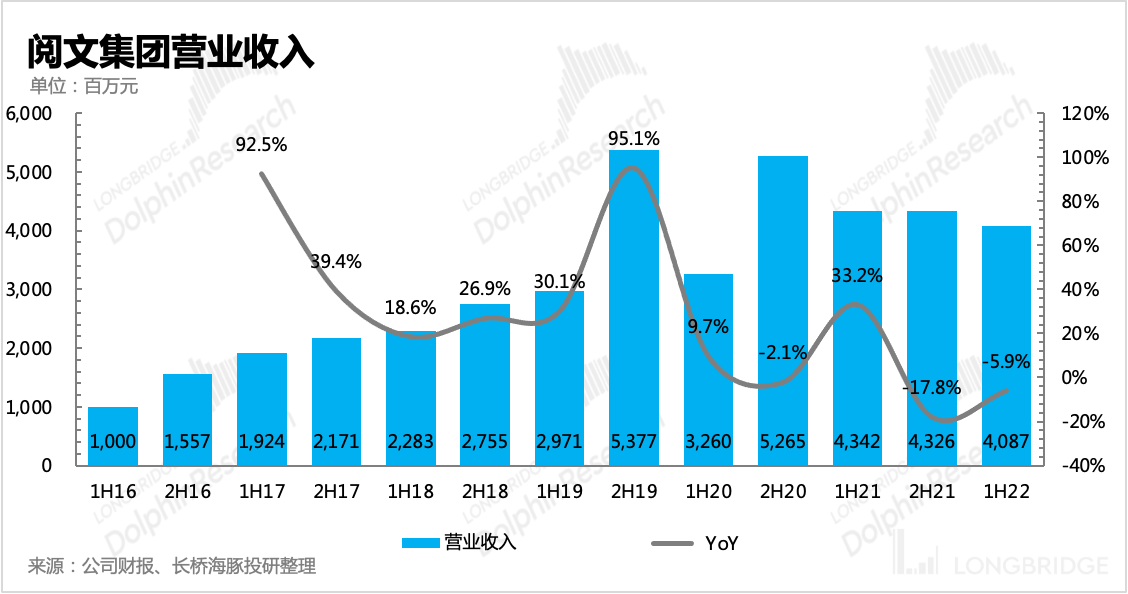

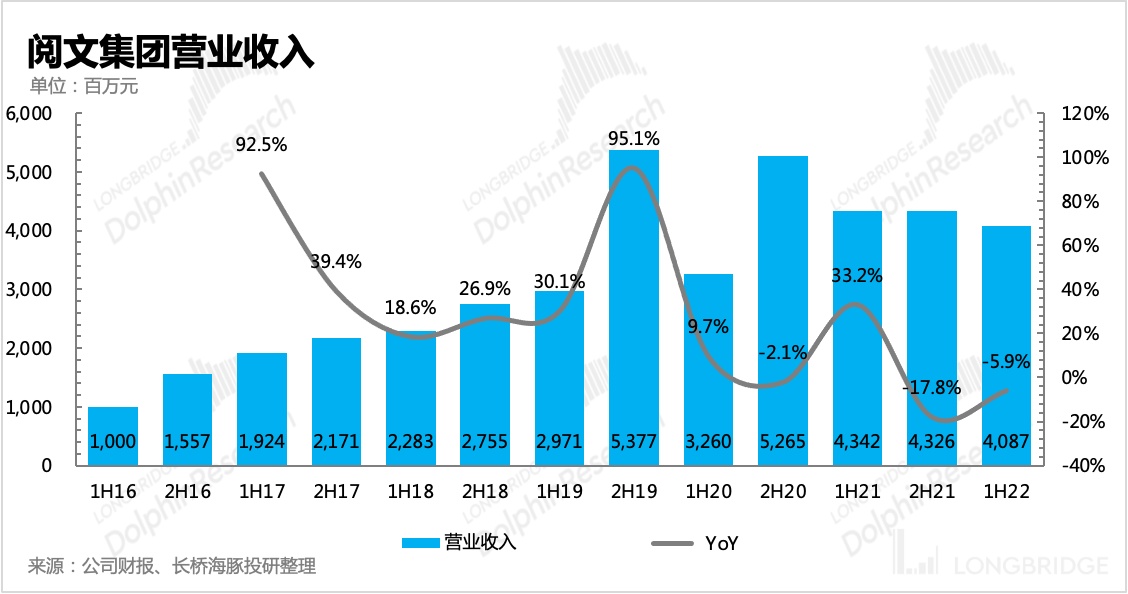

Wen Group just released its first half performance for 2022. In short, it is evident that cost savings have resulted in increased efficiency, but short-term growth prospects are somewhat worrying.

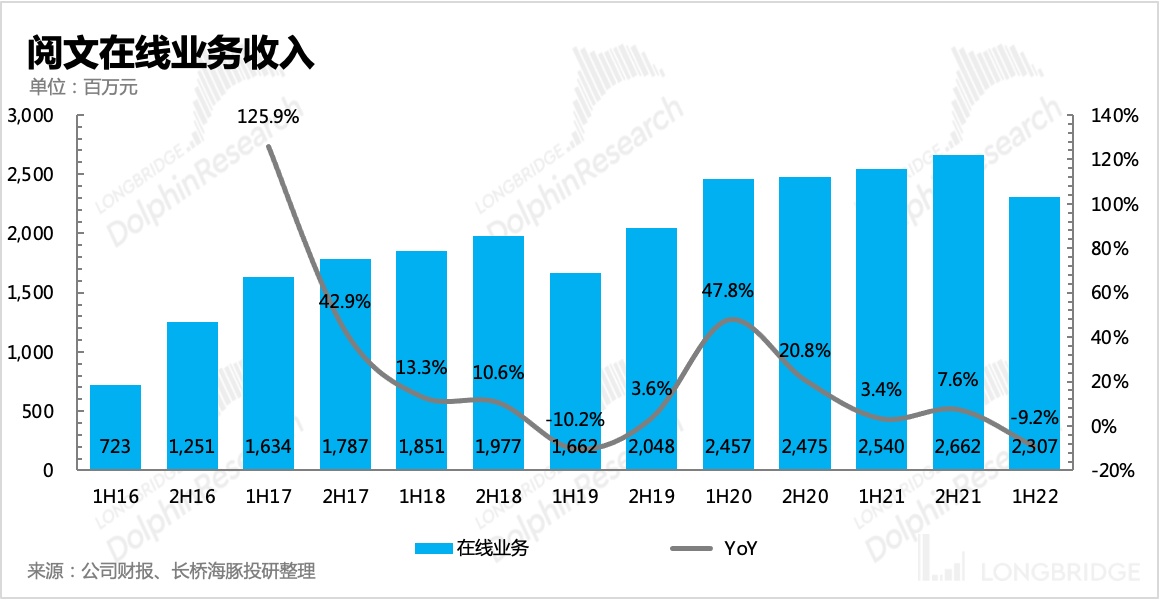

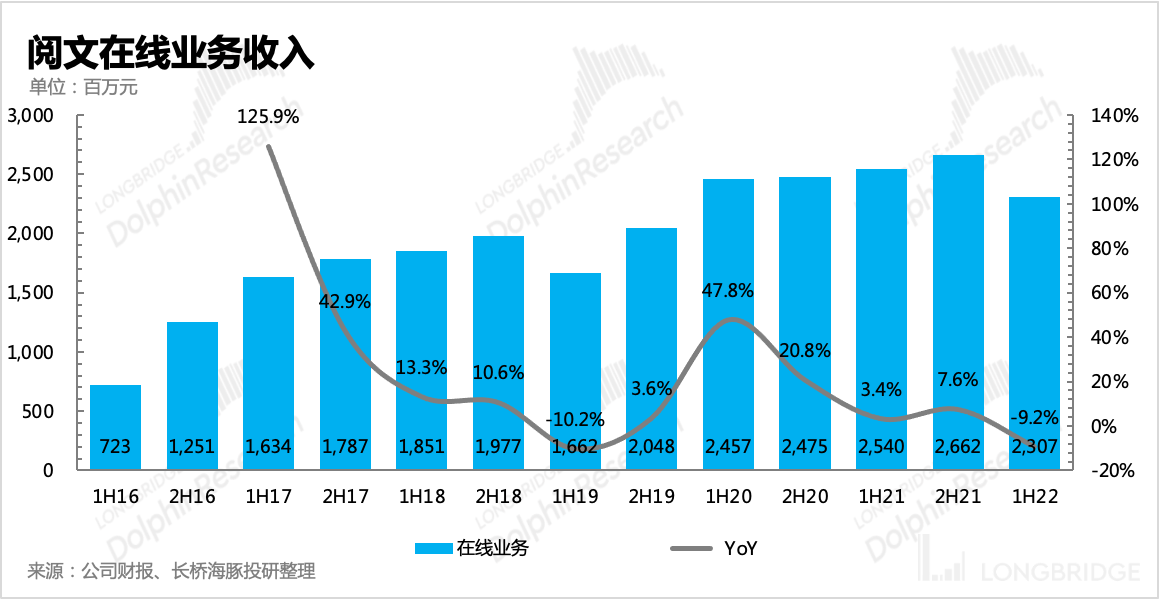

- In terms of revenue, despite the strong replacement of Xinli, the online literature business is still not performing well, and it is still difficult to raise overall performance.

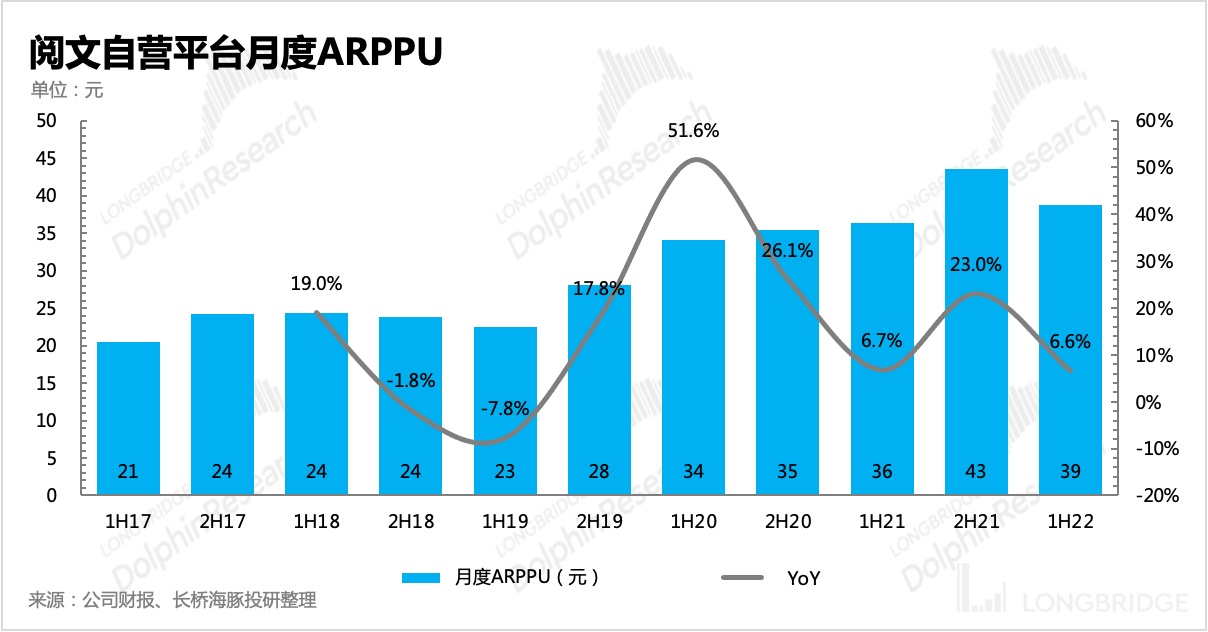

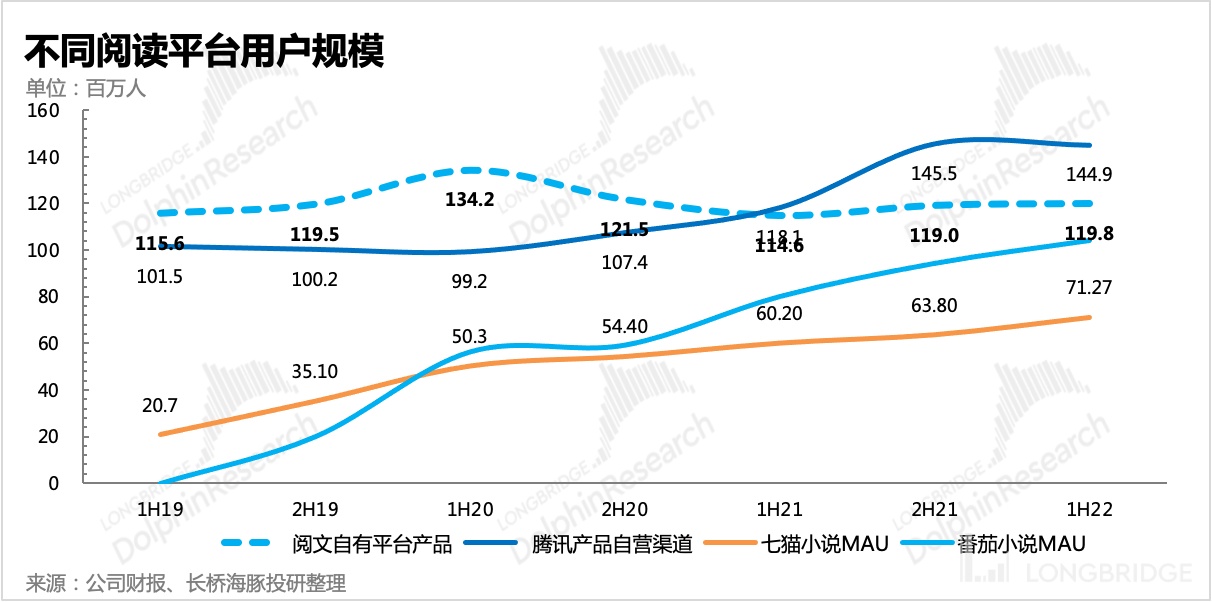

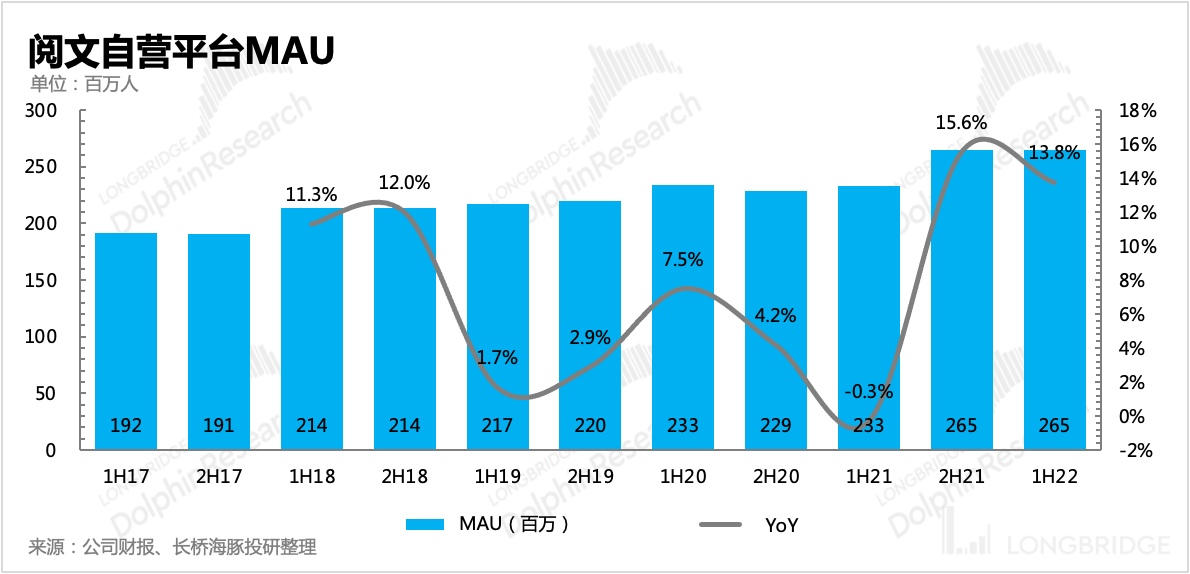

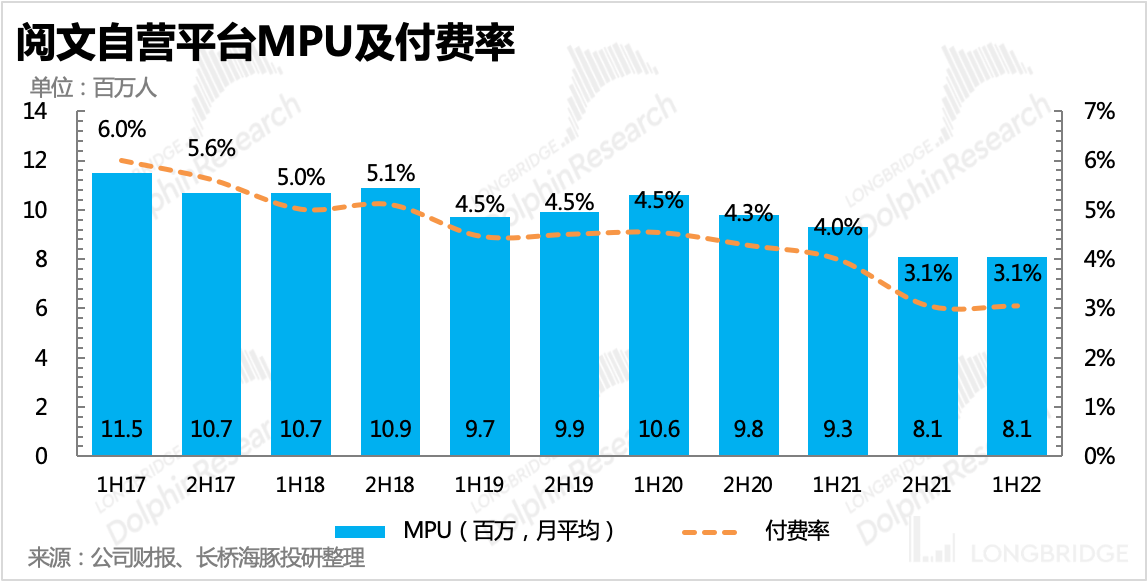

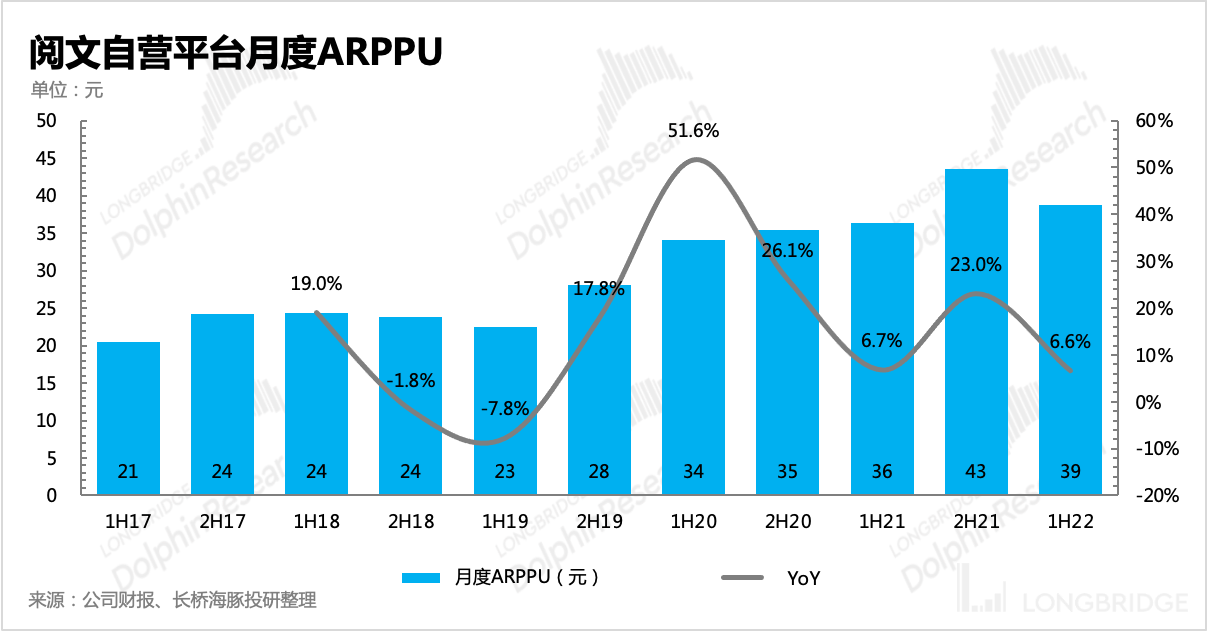

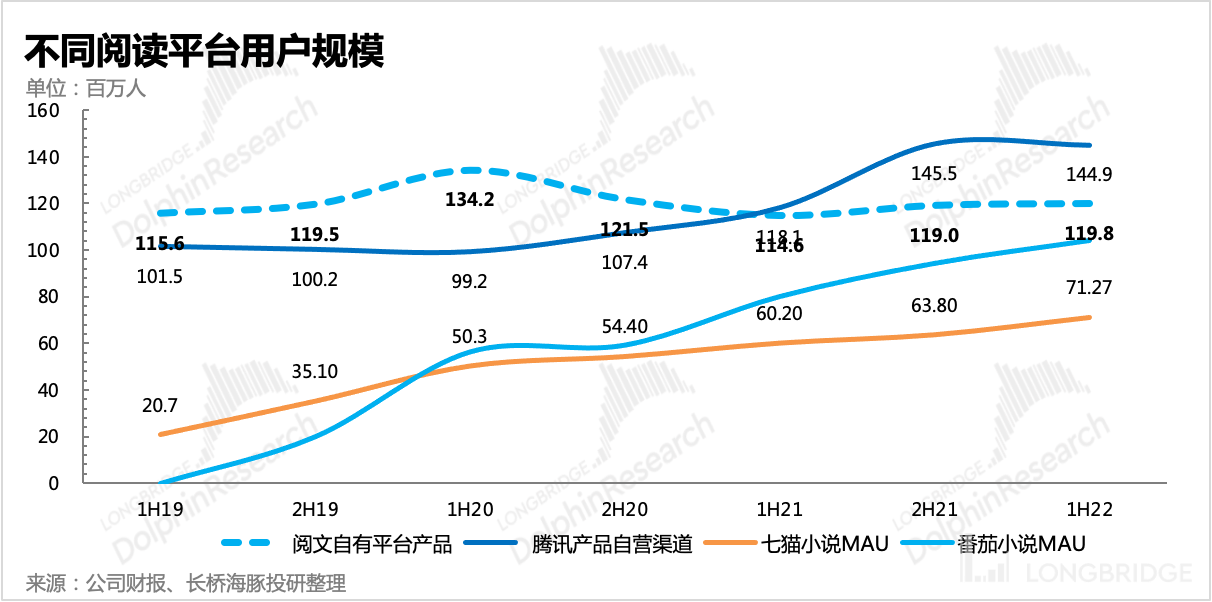

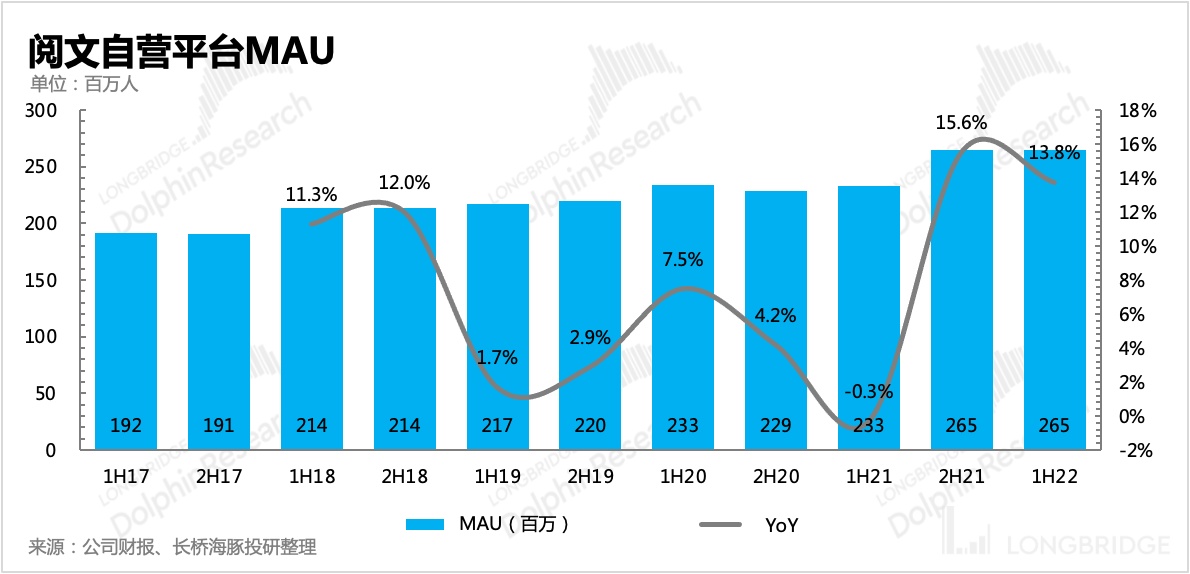

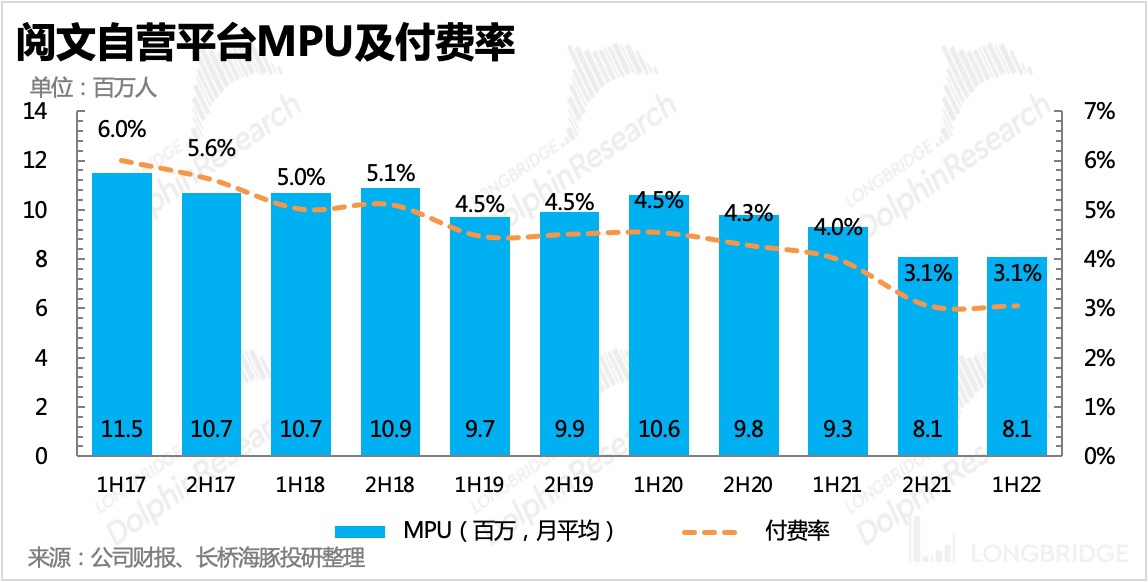

(1) The number of paid readers and prices have dropped, but free reading has not taken off. Compared with last year, the number of users has only increased by one million in the first half of this year. Tomato and Qimao both had increases of 10-20 million users.

(2) Third-party platform licensed revenue has also declined significantly year-on-year.

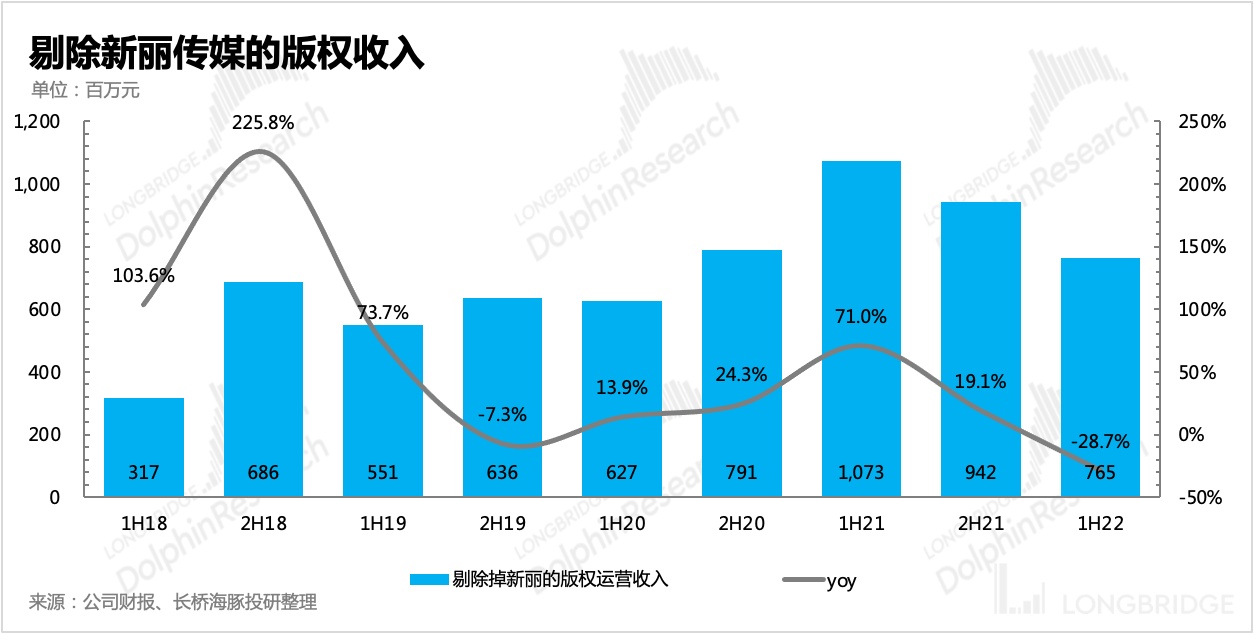

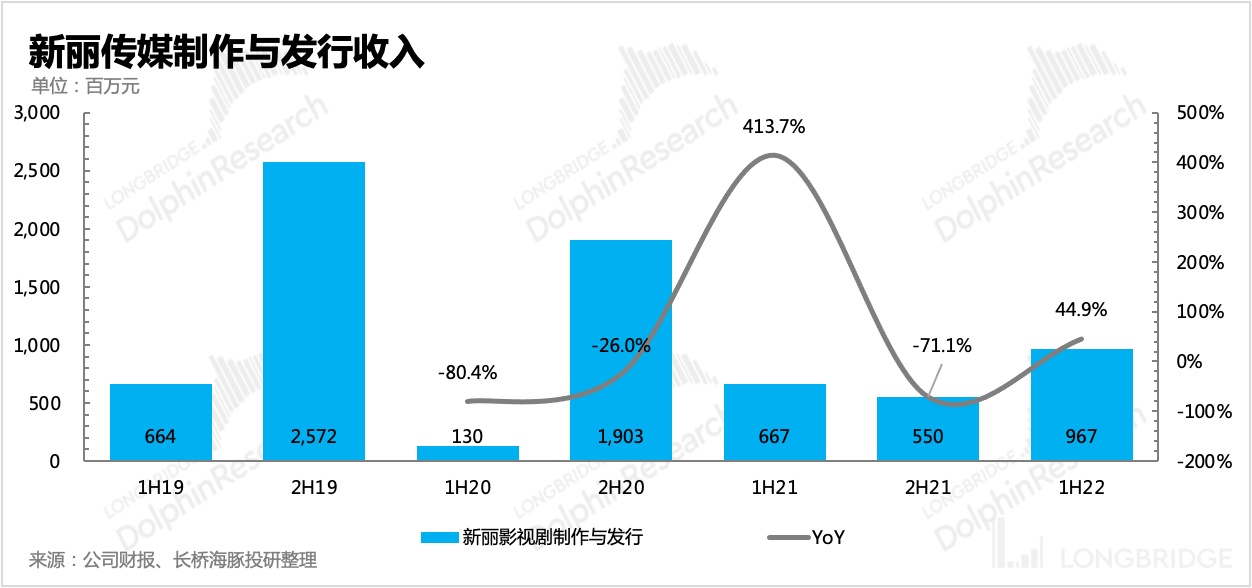

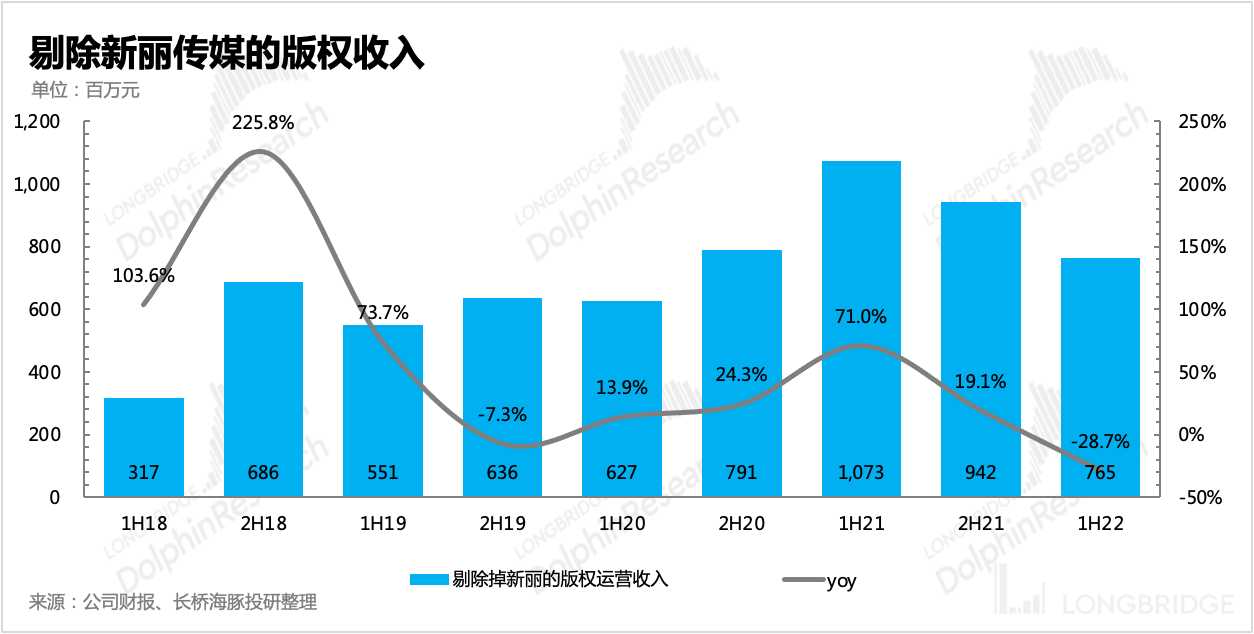

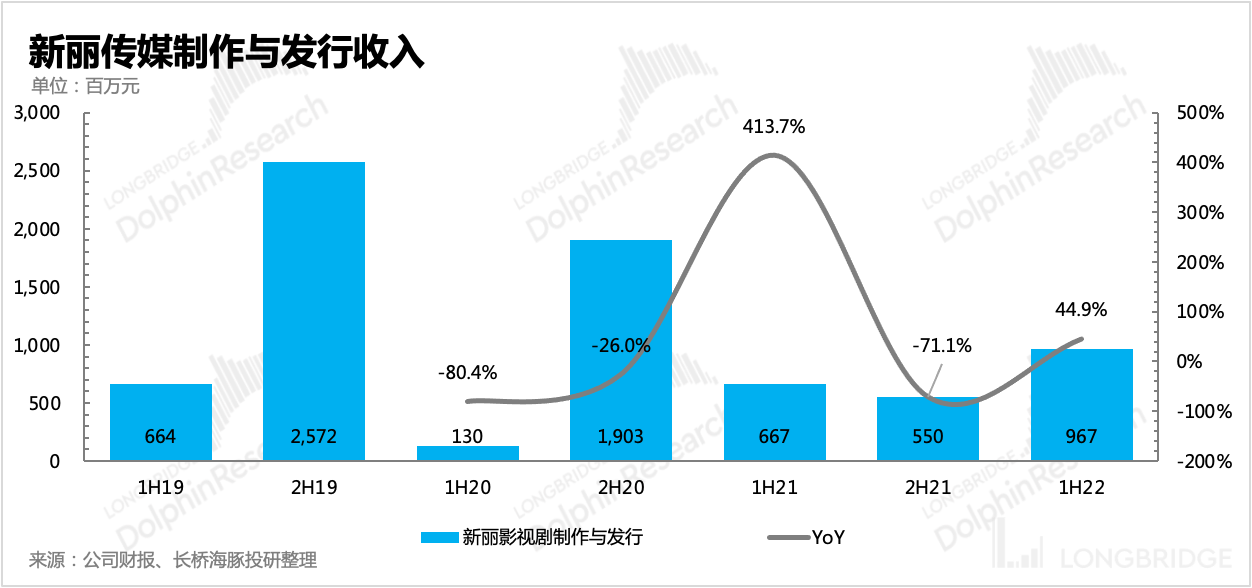

(3) As for copyright revenue, the growth is basically due to Xinli. Xinli broadcasted more TV dramas in the first half of the year, and there were also several movies with decent box office results, such as "Léon: The Professional". However, if revenue from Xinli is excluded, copyright revenue fell by nearly 30% compared to the same period last year.

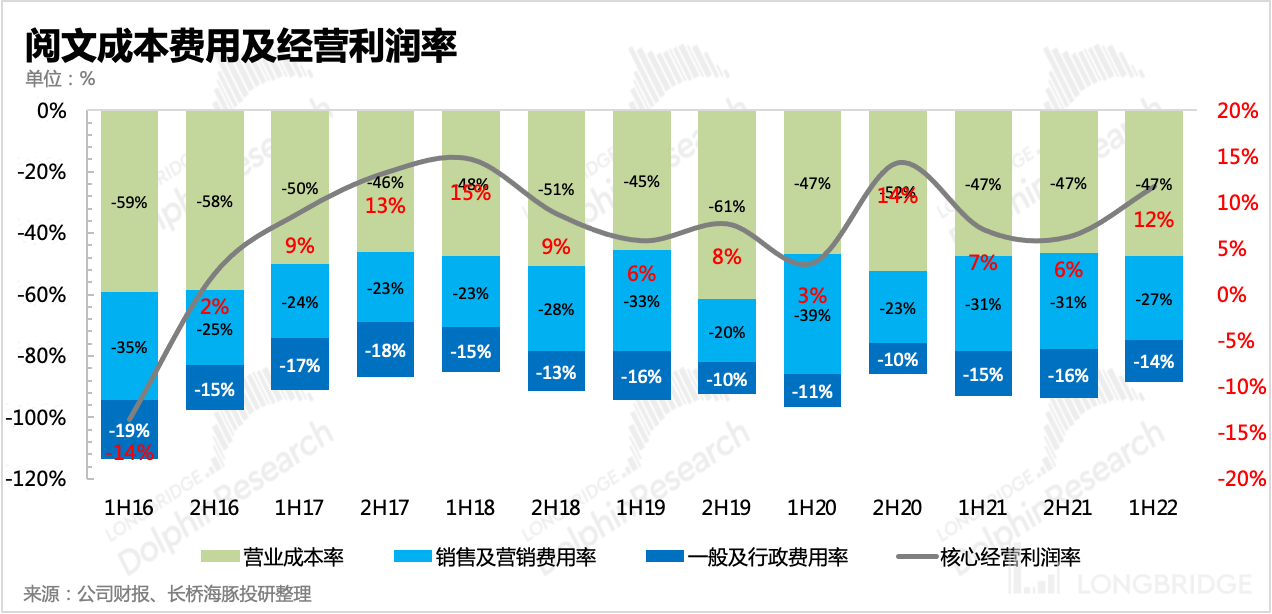

- Since revenue did not increase, profits were squeezed out through pure cost savings. Operating costs were reduced by 6% (mainly due to lower content costs and platform distribution costs), sales expenses decreased by 18% year-on-year, and administrative expenses also declined by 12%. Finally, core operating profit increased by 57%.

Specific data is as follows:

The risk disclosure and statement of this article: Dolphin Disclaimer and General Disclosure