Is the value for money of American assets higher as the US goes left and China goes right? input: ====== 他来自长桥大学,这所大学位于长桥。 ====== output: He is from Longbridge University, which is located in Longbridge. input: ====== 今天的天气非常好,适合出去玩。 你想去哪里? 我想去海豚馆看海豚。 ====== output: The weather today is very nice, suitable for going out to play. Where do you want to go? I want to go to the Dolphin exhibit to see the dolphins.

Hello everyone, I am Dolphin Analyst!

Last week was another busy week for macro data release: US CPI data, domestic CPI, social financing, retail sales, real estate and other heavyweight data were announced one after another. Therefore, taking advantage of this weekly report, I will sort out the recent macroeconomic trends at home and abroad, as well as the investment logic behind them.

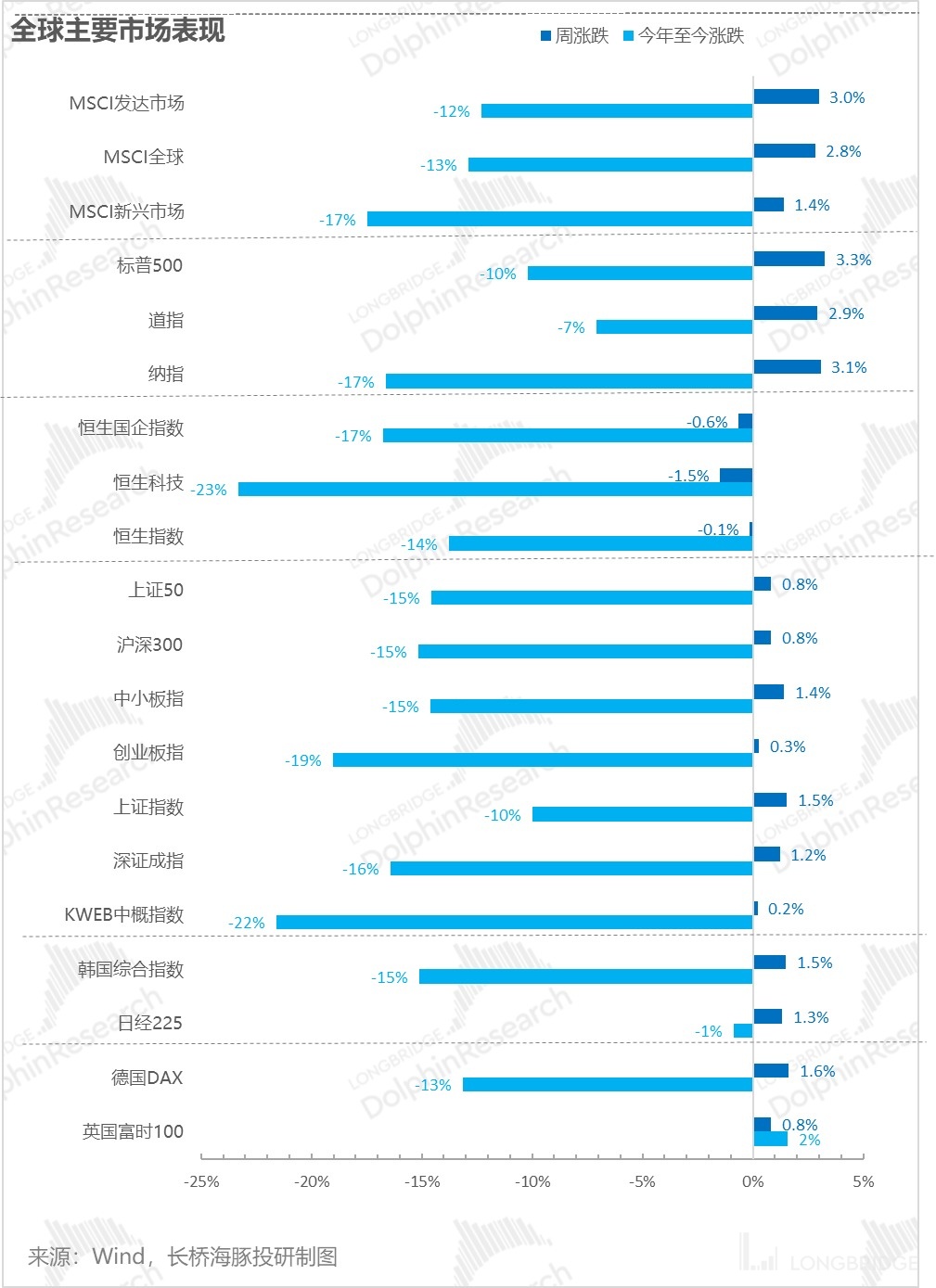

First of all, looking at the main market movements last week: as the growth rate of US July CPI was lower than expected, the market's expectation of the Fed's rate hike slowed down, leading to a comprehensive global rally (except for Hong Kong stocks).

However, although US stocks and A shares are rising, from the recent macro data, the Chinese and American economies seem to be heading in different directions. Dolphin Analyst will interpret the recent important macro data in detail:

1. US CPI: Rising or Falling? It's all about energy.

On the 10th of last week, the US announced that its July CPI increased by 8.5% year-on-year, lower than the expected 8.7% and last month's 9.1%. Naturally, it can be inferred that inflation growth has peaked and will slow down; the Fed will subsequently slow down its rate hike pace; after the erosion effect of inflation is reduced, the pressure of economic growth slowdown can also be eased. As a result, the best result of a soft landing of both US inflation and economy can be deduced, and even optimistic investors have jumped to the logic of a Fed rate cut next year. This has led to a strong rebound in the stock market, especially in growth stocks.

However, will the facts be as optimistic as the above inference? Dolphin Analyst's view is: It is reasonable to expect the Fed's rate cut to slow down after the overall CPI growth rate has peaked and slowed down. However, it is too optimistic to jump to the logic of the Fed entering a rate cut cycle next year, as the overall CPI improvement in July was basically driven by the decline in energy prices, and the core CPI growth did not slow down significantly. If the Core CPI stubbornly maintains a level of around 3%, Fed policy rates may also remain at 3.25-3.5% for the long term.

From the above table, it can be seen that the slowdown in the growth rate of July CPI is basically attributable to the significant decline in energy-related freight service prices. However, after excluding the impact of energy-related electricity and transportation services, the core CPI, which is mainly confronted with labor costs, has not slowed down significantly (5.9% this month and last month). Clearly, from the pull rate of each sub-item compared to the previous month, except for energy-related items, all other items are still rising.

Therefore, if the supply and demand contradiction of labor in the United States cannot be resolved, even if energy prices decline, the overall CPI may still stubbornly maintain a level of 3%-4% (this is just a rough example). Even if the Fed raises interest rates to the neutral expectation of 3.25-3.5% at the end of this year, the real interest rate after subtracting inflation will still be close to zero. In this case, if the US economy does not significantly collapse, Dolphin Analyst does not see the motivation for the Fed to cut interest rates.

Therefore, closely monitoring the US labor gap data is still the key to judging the trend of core US inflation.

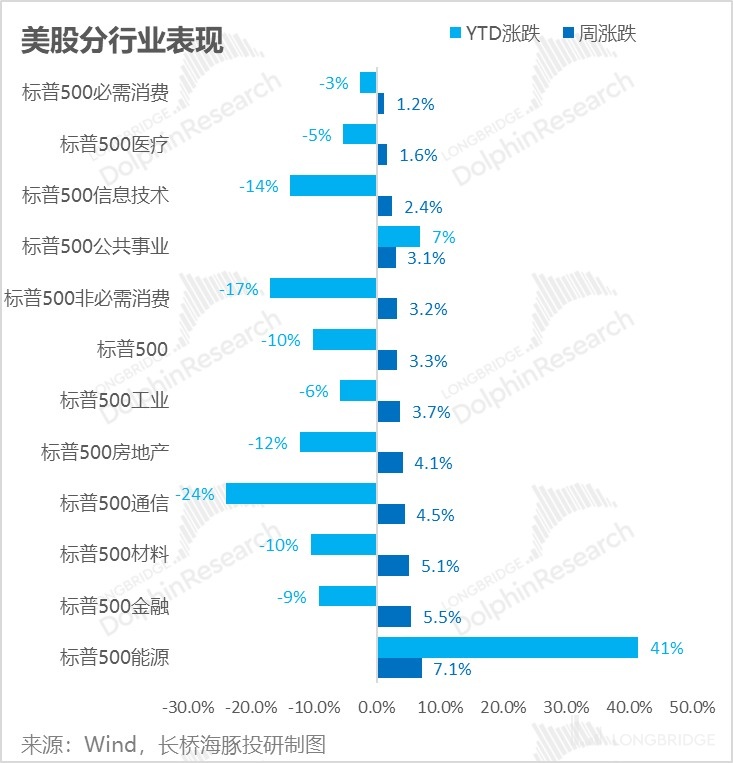

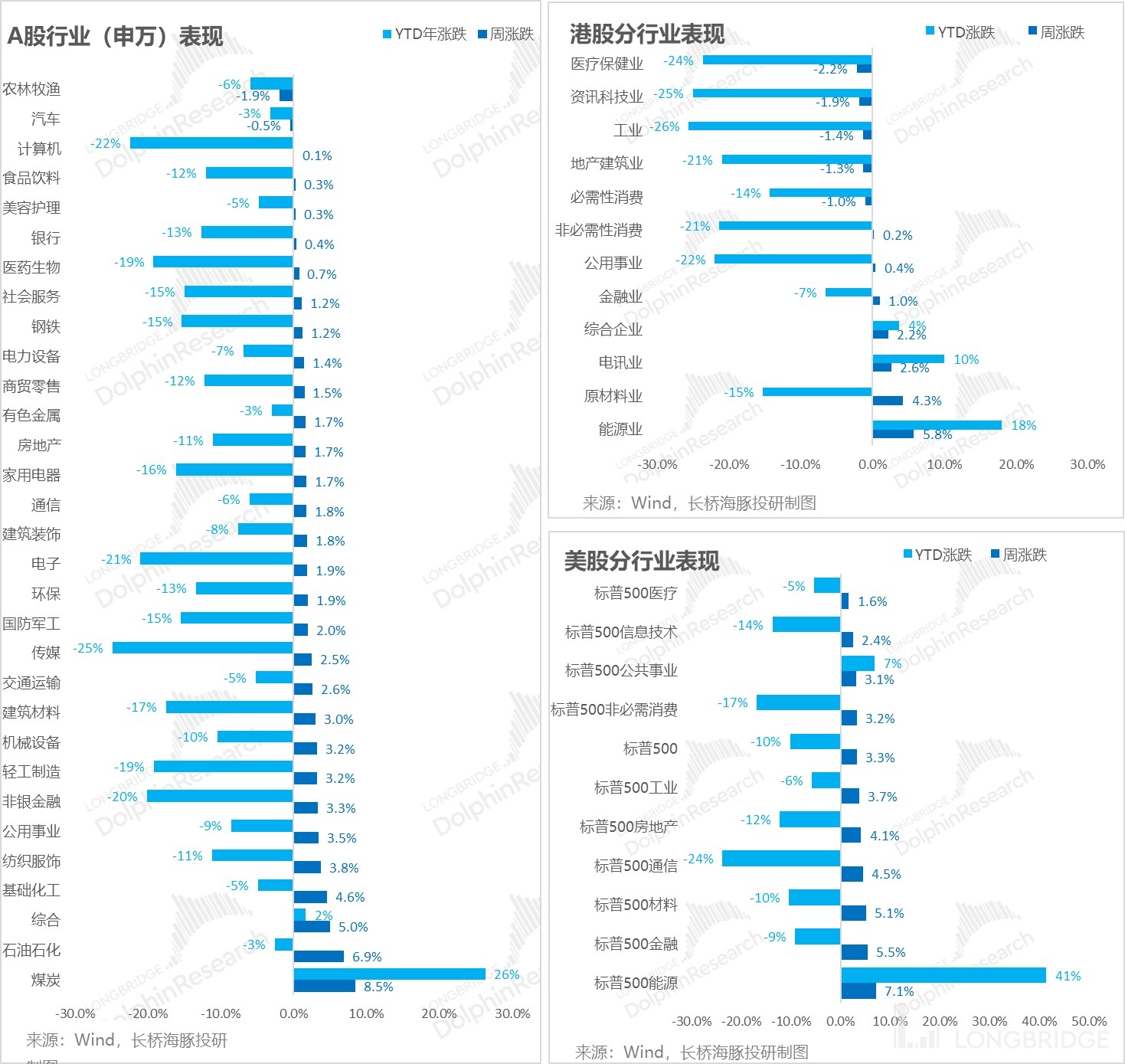

Looking at it from an industry perspective, with the expectation of a slowdown in interest rate hikes, all sectors rose across the board last week, but the energy sector not only did not fall but continued to lead the gains. (Dolphin Analyst does not know much about the energy board, but the market price reflects that energy companies' performance will continue to be strong?) Looking ahead, Dolphin Analyst believes that the current period has entered a stage where there are no more unexpectedly high-rate hikes to kill valuations, but it should not be optimistic to expect rate cuts to pull up valuations. Stock price driving factors will mainly return to the performance of the company's own performance, and companies that can independently achieve high performance growth and find weak macro-cyclical stocks will be the best choice.

II. Whether the rebound is warm or not, social retail growth in July is still weak

Unlike the US's seemingly "negative news has bottomed out, and the future is all bright," China's recently released macro data can be said to be all bleak. First, let's take a look at the social and retail data for July:

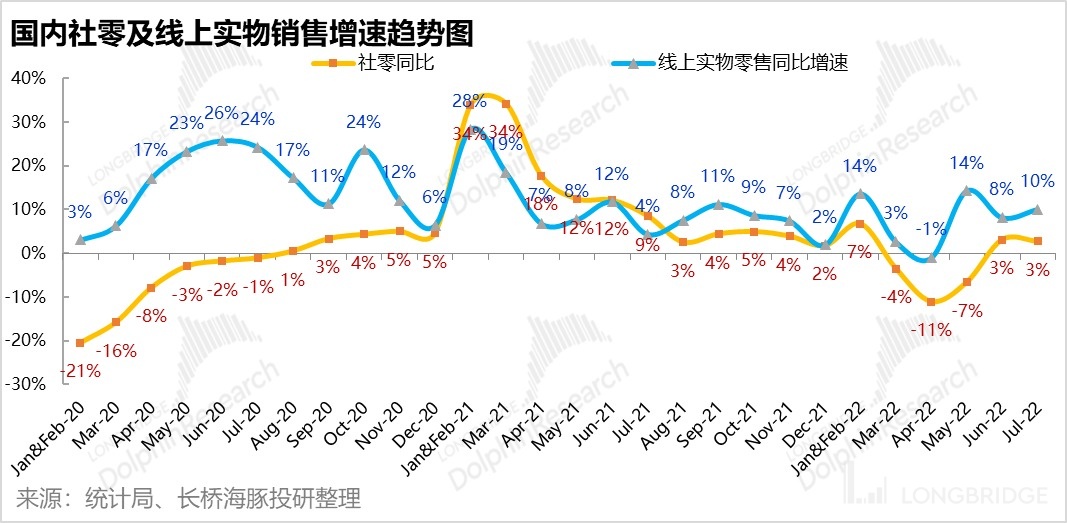

1. Online physical retail sales performance is strong: After basically getting rid of the impact of the Shanghai epidemic, the expected social and retail recovery did not come in July. The total retail sales of social consumer goods in July was RMB 3.587 trillion, a year-on-year growth rate of 2.7%, which is slower than the 3.1% growth rate in June. It can be seen that even without the impact of the epidemic, domestic endogenous consumption growth momentum is still very weak.

However, the online physical retail sales related to the e-commerce industry are quite strong, with a year-on-year growth rate increasing by 2pct to 10% compared to the previous month. Dolphin Analyst believes that after repeated epidemics, residents have become more accustomed to online shopping, and the hot weather has made online shopping more convenient.

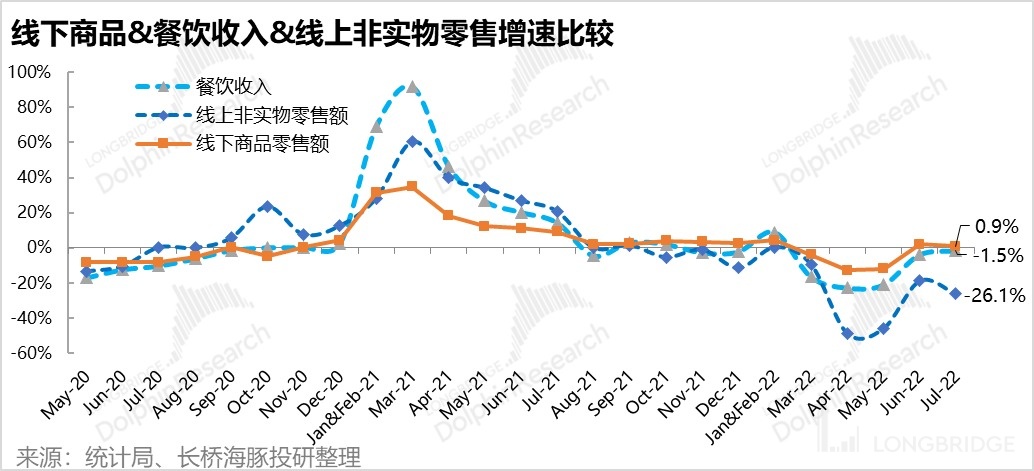

2. Slow recovery in catering, offline retail and online virtual goods increasingly weak: As the catering stores resumed offline dining, the revenue of the catering industry in July further narrowed to only -1.5%, slowly recovering. But due to the hot weather and the erosion of online retail, the growth rate of offline commodity retail in July slowed down to 0.9%, which is even lower than in June, and offline consumption is still depressed. Similarly, online non-physical consumption, mainly for games, movies, and travel tickets, performed worse in July than in June, with a year-on-year decrease of 26%. Travel and entertainment consumption is still the least prosperous track.

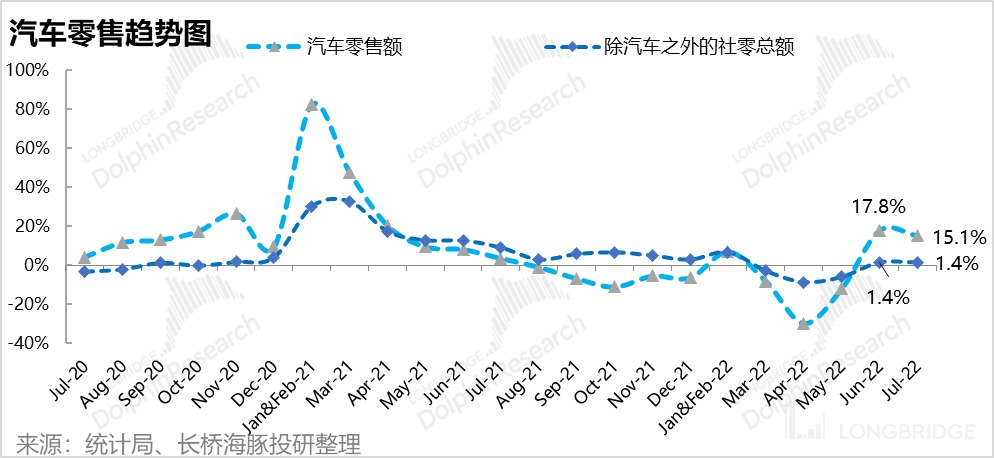

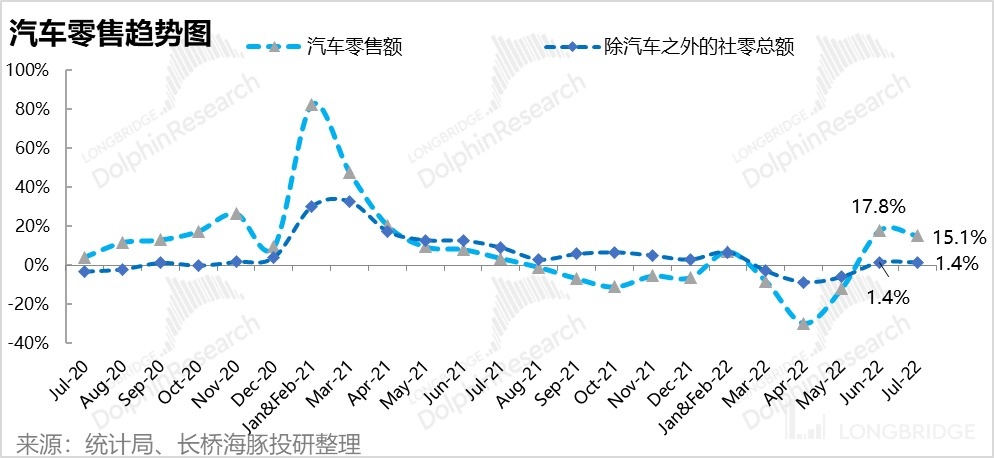

3. After strong realization, automotive consumption growth slowed: Looking at the automotive consumption, which has the largest contribution in social retail alone, after the strong performance under the policy stimulus in June, automotive consumption seems to be overdrawn, and sales growth slowed to 15.1% in July. If we exclude the influence of automobiles, the social retail sales growth rate in July for all other categories was the same as that in June. Therefore, one of the main factors that caused the overall growth rate to slow down in July was the decline in the growth rate of the automobile industry.

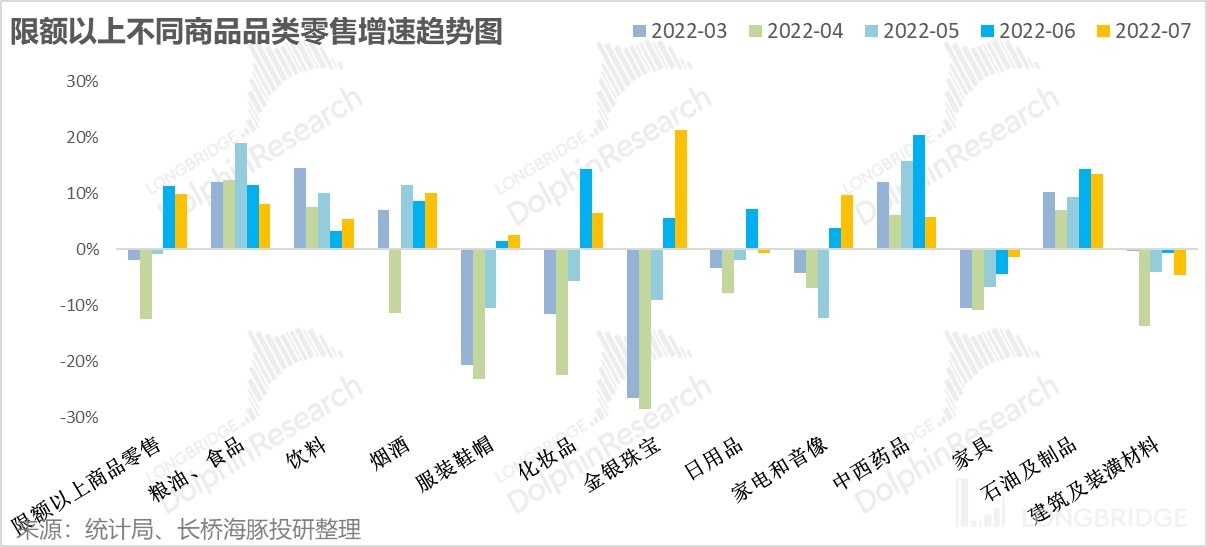

- A weak recovery is still a recovery, and optional consumption is relatively advantageous: Although the rebound is weak, from the perspective of different product categories, optional consumption has performed relatively better than necessary consumption. The figure below shows that the growth rate of food and beverage and medicine, which were strong during the epidemic, significantly slowed down in July. However, the growth of optional consumption such as clothing, jewelry, and home appliances is still improving.

Overall, even after excluding the impact of the epidemic, domestic consumption has rebounded quite weakly. Except for the strong performance of online physical retail, the performance of other channels is not ideal. It can be seen that under the impact of real estate defaults and some industry regulation, the domestic consumption-driven growth is very weak and urgently needs fundamental policy stimulation to rebuild consumer confidence.

- Social financing is weak, and interest rate cuts are needed to save the day.

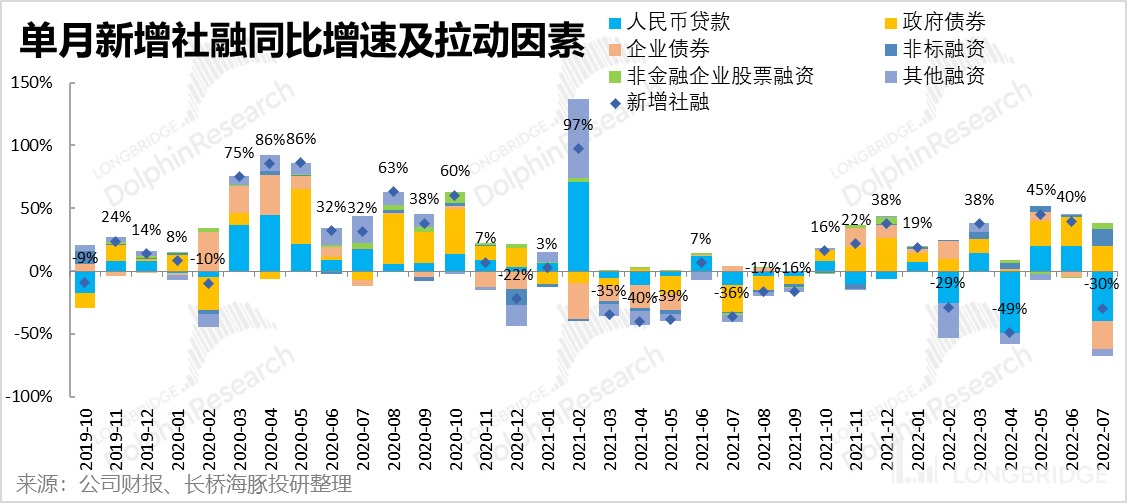

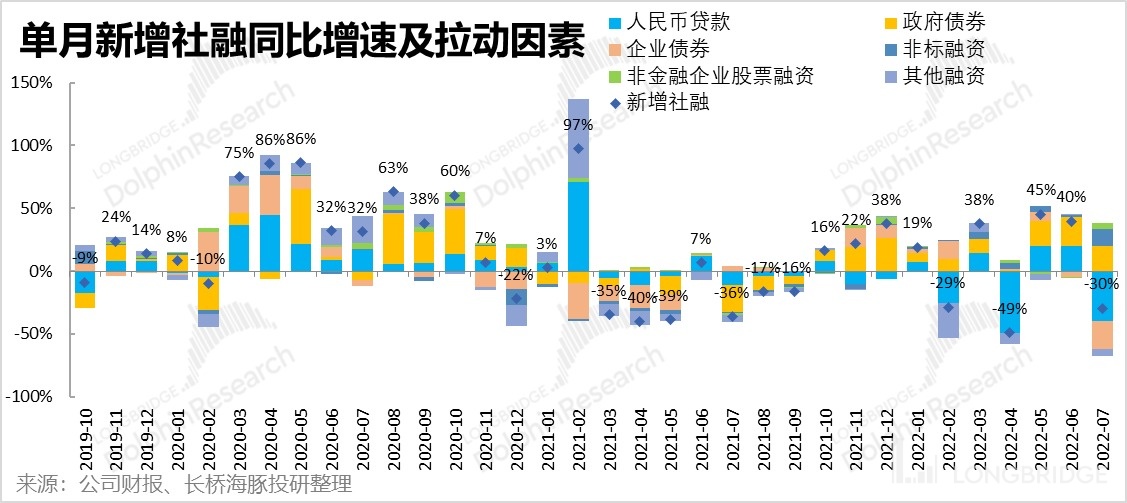

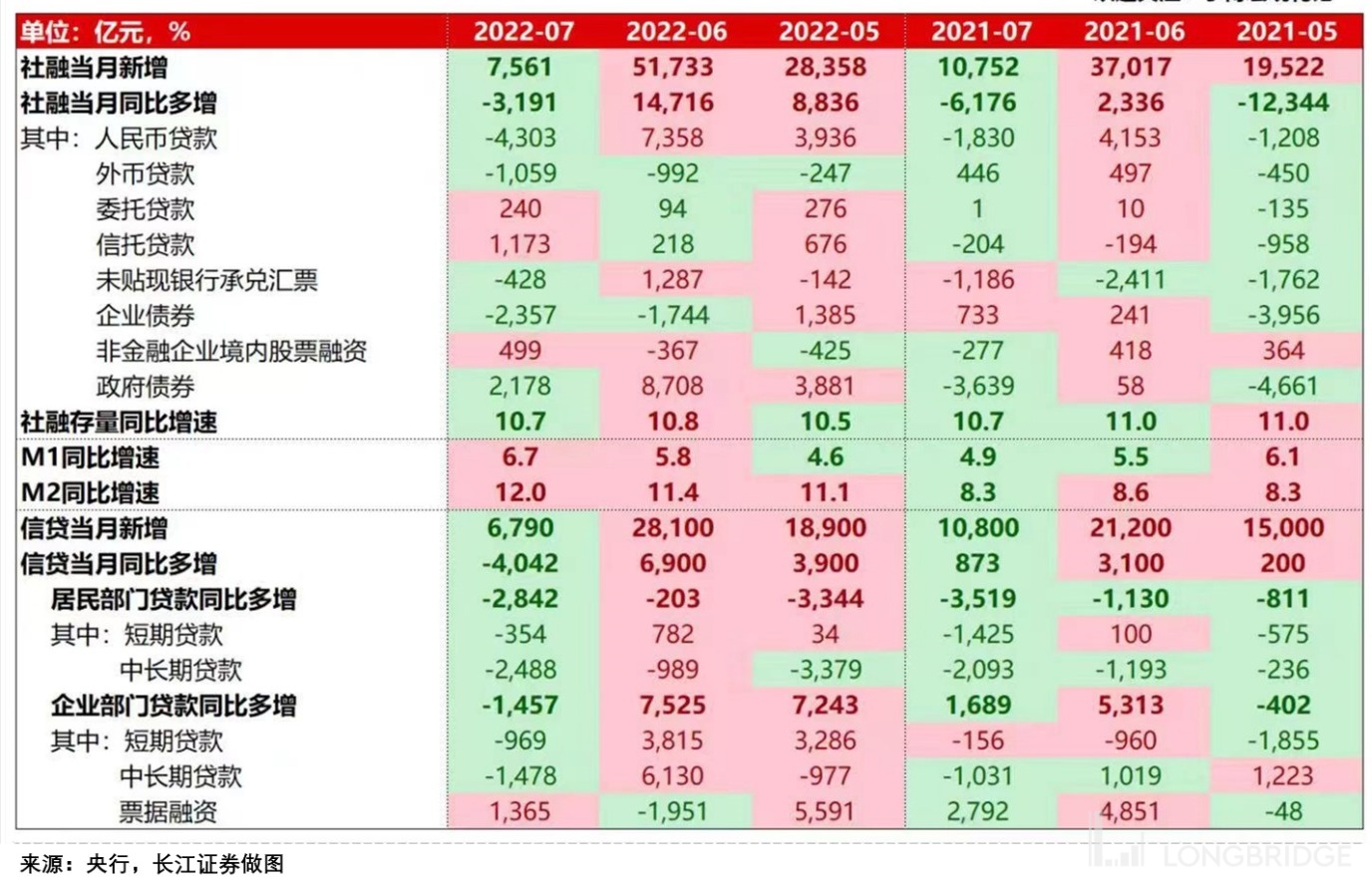

Last Friday's social financing data was also extremely weak. After recording a record high of 5.2 trillion RMB in social financing for a single month in June, the new social financing in July was only 756.1 billion RMB, a year-on-year decrease of 30%, far lower than the market expectation of 1.3 trillion RMB. The new RMB loans in July also shrank significantly to 679 billion RMB, only a marginal increase of 404.2 billion RMB from a year ago. It can be said that the credit data in July has "collapsed" altogether.

-

However, while new social financing has significantly shrunk, the year-on-year growth rate of M2 has once again reached a new high of 12%. Although the large amount of social financing in June may have temporarily overdrafted the demand for loans, these two somewhat contradictory data show that although the money supply is growing at an accelerated rate, the demand (or ability) of domestic economic entities to borrow is declining significantly.

-

Looking at the sub-items of social financing, the two most important sub-items: new RMB loans and newly issued corporate bonds have both significantly decreased year-on-year, and only government bonds are still growing.

-

Among the new RMB loans, both short-term and medium- to long-term loans for residents and enterprises have decreased significantly year-on-year.

Combining points 1-3, this indicates that except for the government, which is still borrowing and increasing investment to promote the economy, residents and enterprises are cautious and lack confidence in borrowing and investment. However, insufficient new investment will inevitably affect the momentum of subsequent economic growth.

However, the silver lining is that in response to weak credit and consumption data in July, the People's Bank of China took substantive interest rate cuts through the MLF approach this morning, lowering the rates for 7-day and one-year MLF (medium-term lending facility) by 10 basis points to 2.75% and 2.00%, respectively. According to the Dolphin Analyst, given that the U.S. stock market is still in an interest rate hike cycle and the market had relatively low expectations for a rate cut, it was obvious that this rate cut was well beyond what the market had expected at best, and most impacted by possible credit so as to stimulate credit. Therefore, in times of declining interest rates and poor overall economic growth, high-growth industries with high economic vitality will most likely become hot spots for capital chasing.

However, the silver lining is that in response to weak credit and consumption data in July, the People's Bank of China took substantive interest rate cuts through the MLF approach this morning, lowering the rates for 7-day and one-year MLF (medium-term lending facility) by 10 basis points to 2.75% and 2.00%, respectively. According to the Dolphin Analyst, given that the U.S. stock market is still in an interest rate hike cycle and the market had relatively low expectations for a rate cut, it was obvious that this rate cut was well beyond what the market had expected at best, and most impacted by possible credit so as to stimulate credit. Therefore, in times of declining interest rates and poor overall economic growth, high-growth industries with high economic vitality will most likely become hot spots for capital chasing.

IV. New home sales for July remain flat, but second-hand home transactions are hot

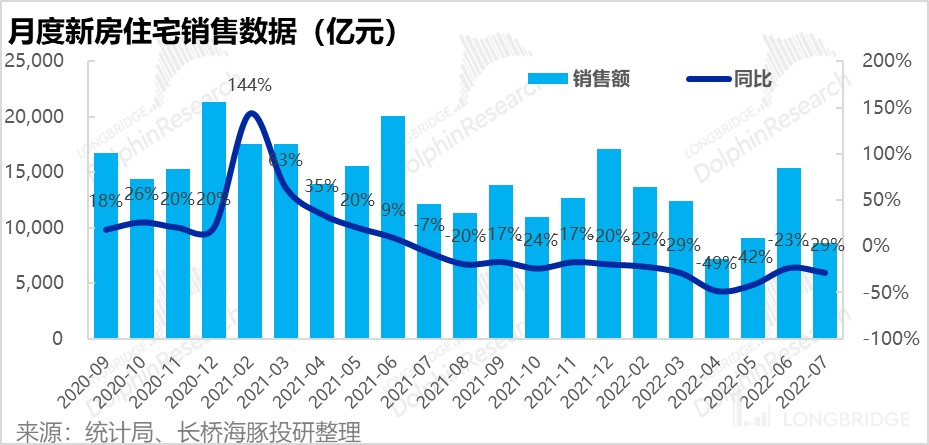

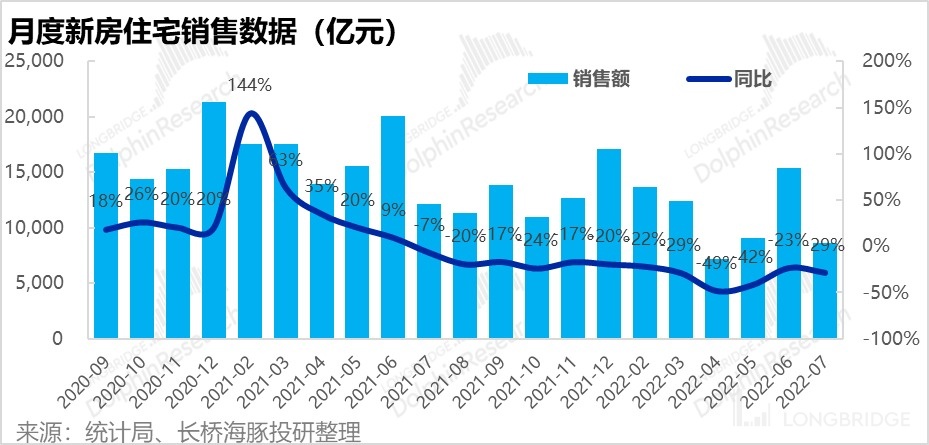

In contrast to the sluggishness of long-term household loans, new home sales, which have been sluggish since the suspension of lending, fell a further 29% year-on-year in July after rebounding in June.

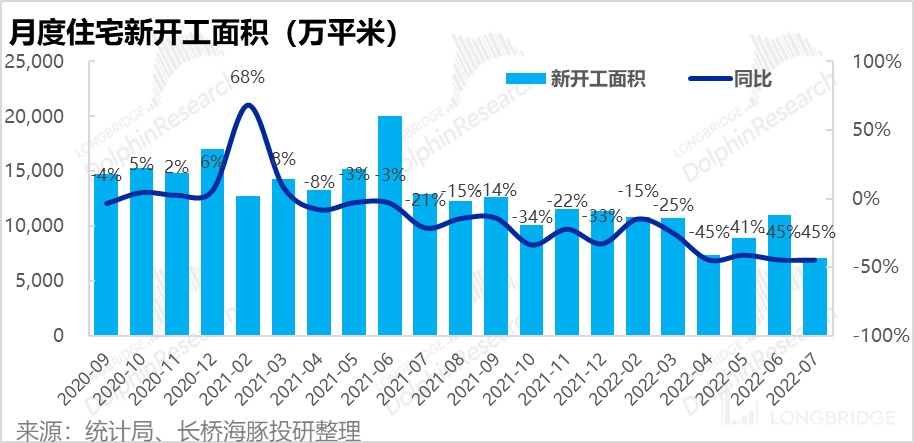

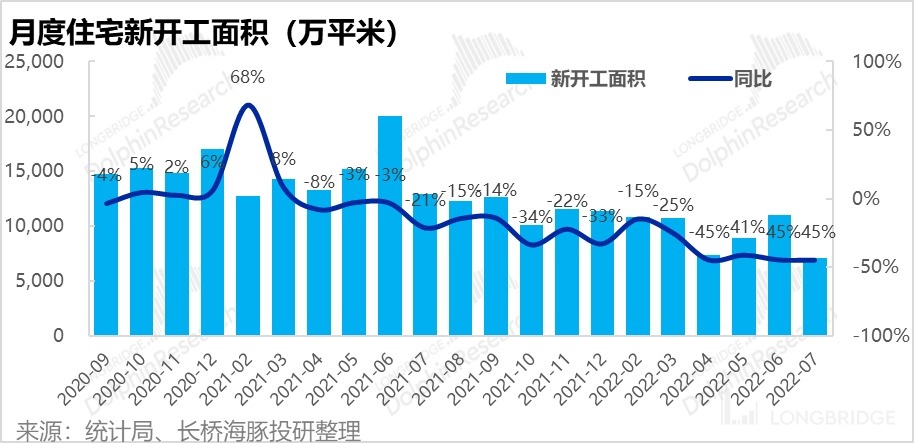

New construction data also continued to be halved, down 45% year-on-year, and is basically the same as during the forced shutdown during the epidemic. It is clear that there is a fundamental difference in funding pressure and investment willingness between real estate developers. The suppression of domestic economic growth and household consumption intention by real estate problems will probably not ease in the short term.

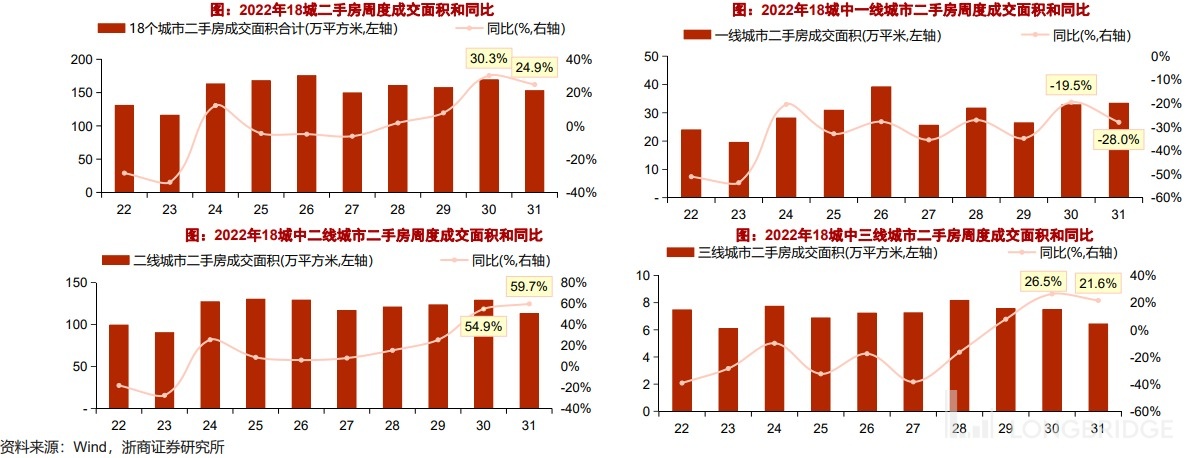

However, in the case of a sluggish new home market, some transaction demand naturally shifted to existing homes. According to wind's second-hand home transaction data for 18 cities, second-hand home transaction area increased by 30% and 25% year-on-year in the last week of this year (as of August 4th). Therefore, despite the overall sluggishness of the real estate market, the stock price performance of Beike Zhaofang is still impressive.

V. With global gains, A shares also rose

As the expectation of U.S. interest rate hikes wanes, leading to a comprehensive recovery in developed market stocks, A shares have also enjoyed a comprehensive rise. Except for agricultural and automotive stocks that have experienced a correction, A shares in all industries rose last week. Among them, the energy sector led the way in the same way as U.S. stocks, but the sectors related to strong consumer consumption, such as food and beverages and beauty and care, showed relatively poor performance.

Against the backdrop of a booming stock market, northbound and southbound funds have been increasing, but trading enthusiasm has not been high. Both total transaction volume and net purchase amounts have significantly declined. ** 五、Alpha Dolphin Portfolio Returns:**

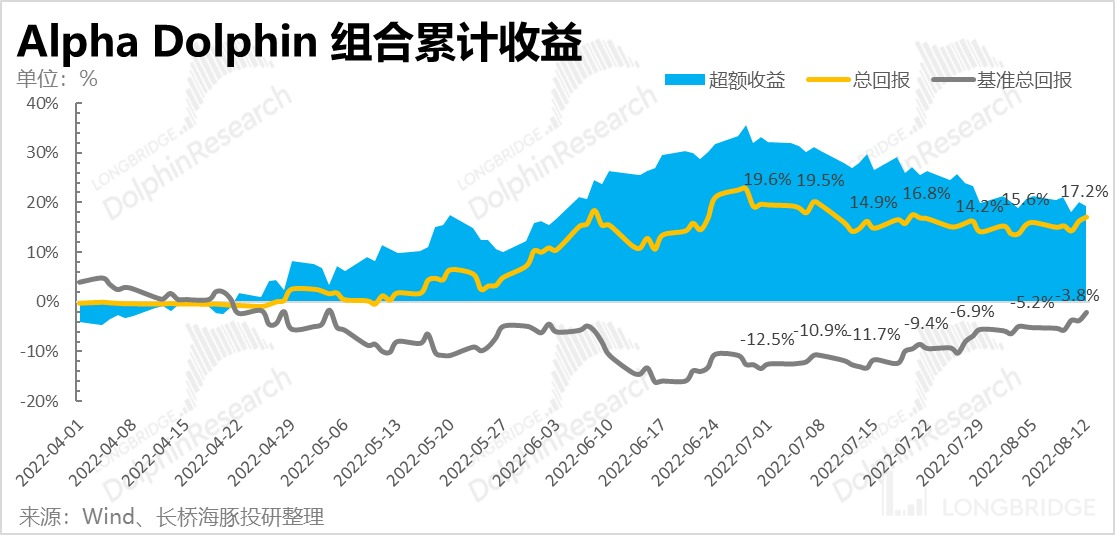

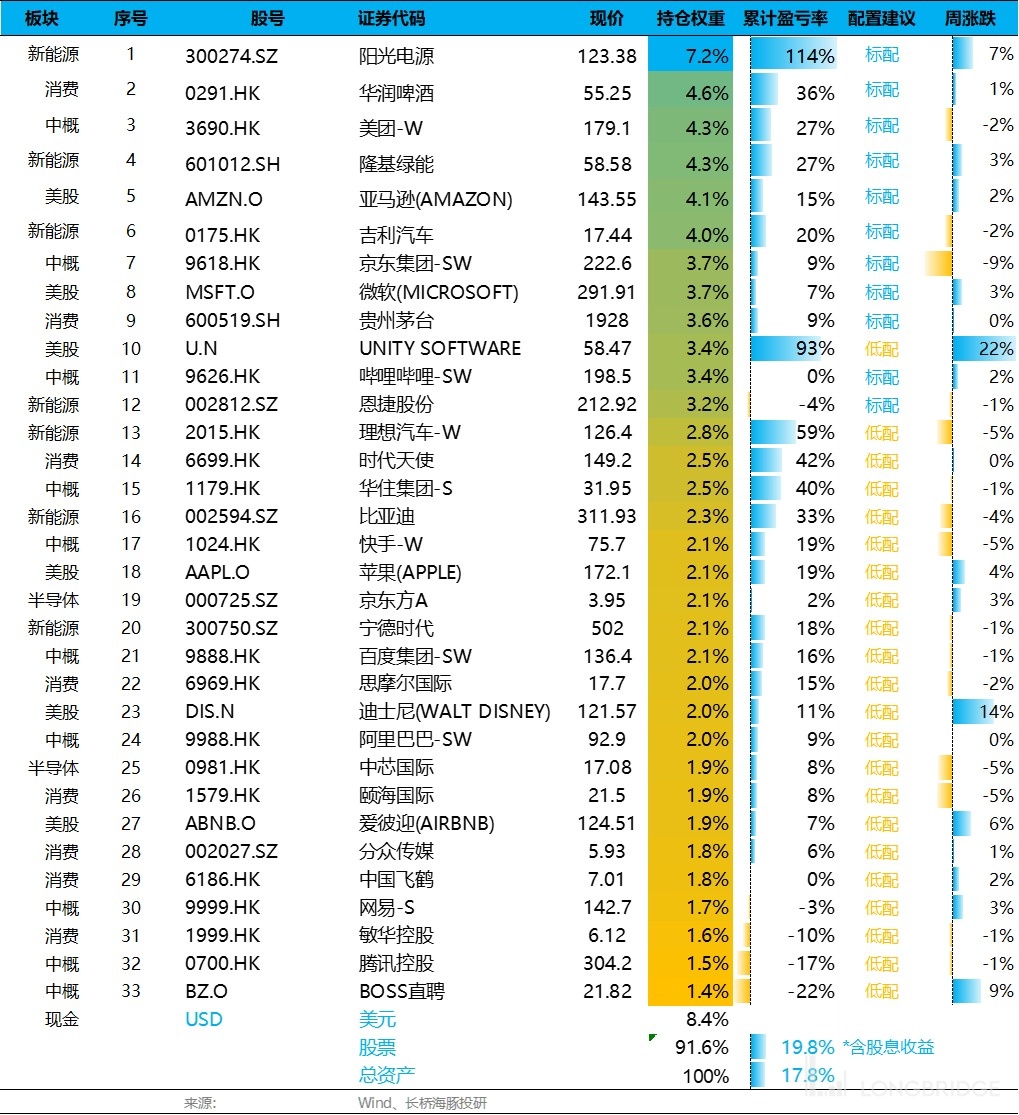

Although the US stock market performed strongly, the performance of Chinese assets, which occupy about half of the Dolphin portfolio, was not ideal. Last week (8/8-8/14), Dolphin Analyst's Alpha Dolphin portfolio achieved a positive return of 0.9%, but it still underperformed the S&P 500 index, which rose by 3.3%. However, it was roughly on par with the 0.8% increase in the CSI 300 index.

Since the beginning of the portfolio testing period until the end of last week, the portfolio has achieved an absolute return of 17%, with a relative return of 21% compared to the S&P 500.

Six, The U.S. market rose sharply, the A-share market remained stable, only Chinese assets underperformed

Last week, among Dolphin's holdings, undervalued and growth-oriented assets, which benefited from the expectation of slower interest rate hikes, showed considerable gains. In addition, assets in the photovoltaic and new energy sectors in the A-share market also performed well. The only underperforming assets were those of Chinese and Hong Kong companies under the shadow of being delisted. The specific ups and downs of each asset are as follows:

Regarding last week's significant fluctuations in stock prices, the factors driving them, as summarized by Dolphin Analyst, are as follows:

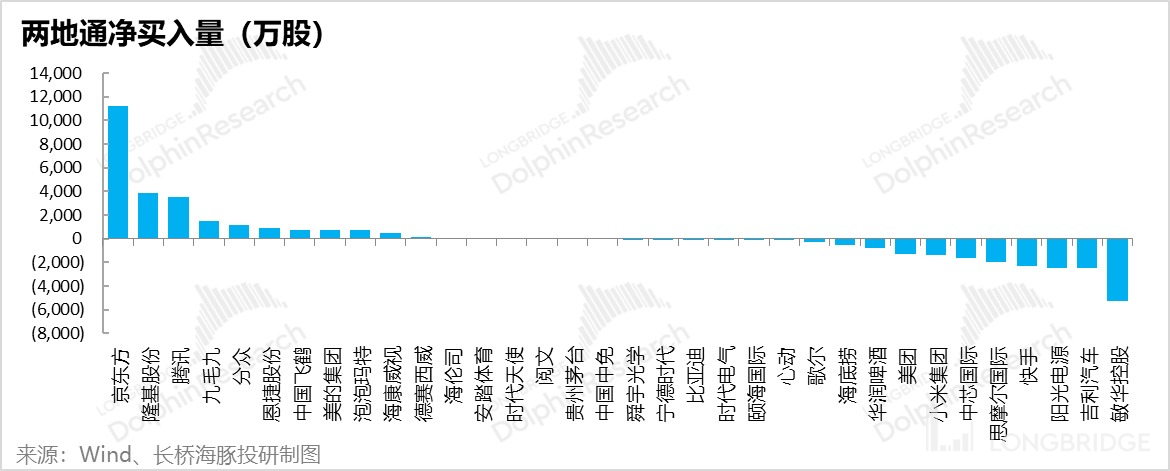

When it comes to the flow of funds that Dolphin Analyst is focused on, the most heavily bought by northbound funds was the panel leader, BOE Technology Group Co. Ltd. (Dolphin has recently published a detailed report on BOE Technology Group, which believes that its industry turning point is imminent, please see Longbridge App for the report). In addition, new energy stocks such as LONGi Green Energy Technology Co. Ltd. and Envision Energy Ltd. have also been consistently bought by funds. Tencent Holdings Ltd. and Focus Media Information Technology Co. Ltd., whose stock prices have been hovering at low levels, were also the focus of fund buying.

Meanwhile, last week, funds continued to sell off Suntech Power Holdings Co. Ltd. and Geely Automobile Holdings Ltd., which had previously seen significant gains, and Minth Group Ltd., whose stock prices continued to fall, was also abandoned by southbound funds.

VII. Distribution and Adjustment of Combined Assets

If we look at the internal test launch of Dolphin Alpha Dolphin on March 1st, the overall return of the portfolio as of last Friday was close to 18% (including dividend income) with stock asset returns close to 20%.

Last week, Dolphin Analyst made no adjustments to the portfolio. The portfolio had a total of 33 stocks, with 11 standard options and 22 low-option stocks.

As of last weekend, Alpha Dolphin asset allocation and equity asset holdings were distributed as follows:

In addition, due to a serious performance warning from NVIDIA last week, the company's revenue growth and gross profit both fell sharply, and the industry's future prospects are also not ideal. Therefore, Dolphin Analyst removed NVIDIA from the Dolphin portfolio and transferred it to the observation pool.

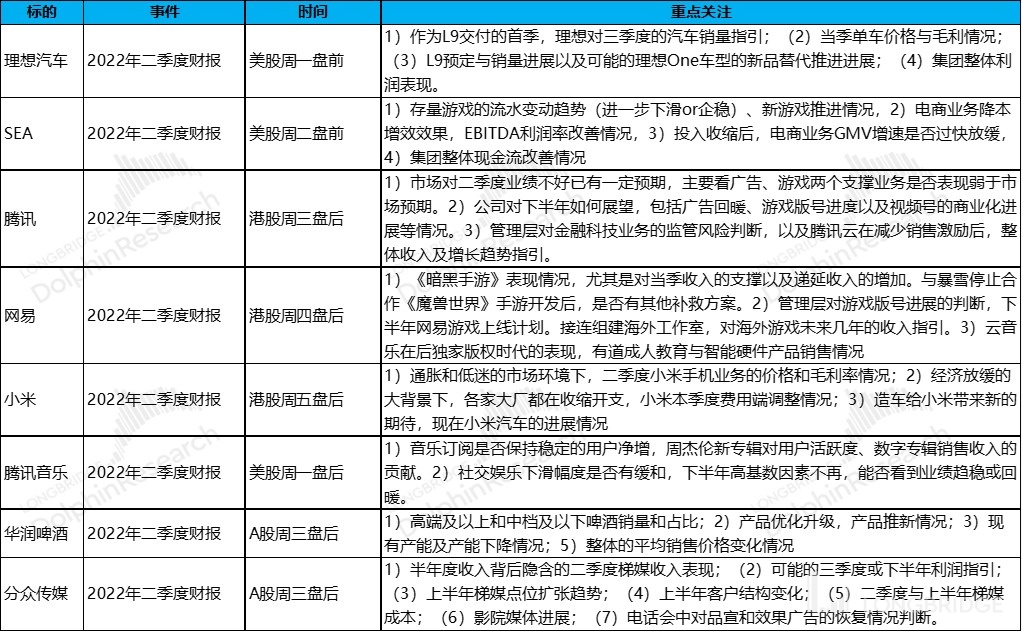

VIII. Focus of the week

After the end of major US stock company earnings reports, the reporting period for Chinese stocks is about to reach its peak. This week, key companies to watch include the new energy trio of Li Auto, XPeng, and NIO, Southeast Asian internet giant SEA, gaming companies Tencent and NetEase, as well as Xiaomi, CR Beer, and others. Dolphin Analyst has summarized the specific points that need special attention:

channel=t2986257&invite-code=032064)

channel=t2986257&invite-code=032064)

Is the United States in recession or stagflation in 2023?

Will China's new energy vehicles become stronger as US oil inflation rises?

As the Fed raises interest rates, China's asset opportunities have emerged

US stock inflation has skyrocketed again, how far can the rebound go?

The Dolphin Portfolio is launched in an authentic way

Risk disclosure and statement of this article: Dolphin Analyst Disclaimer and General Disclosure