Tencent Music: Performance decline eases, but recovery signals are still early

Hello everyone, I am Dolphin Analyst.

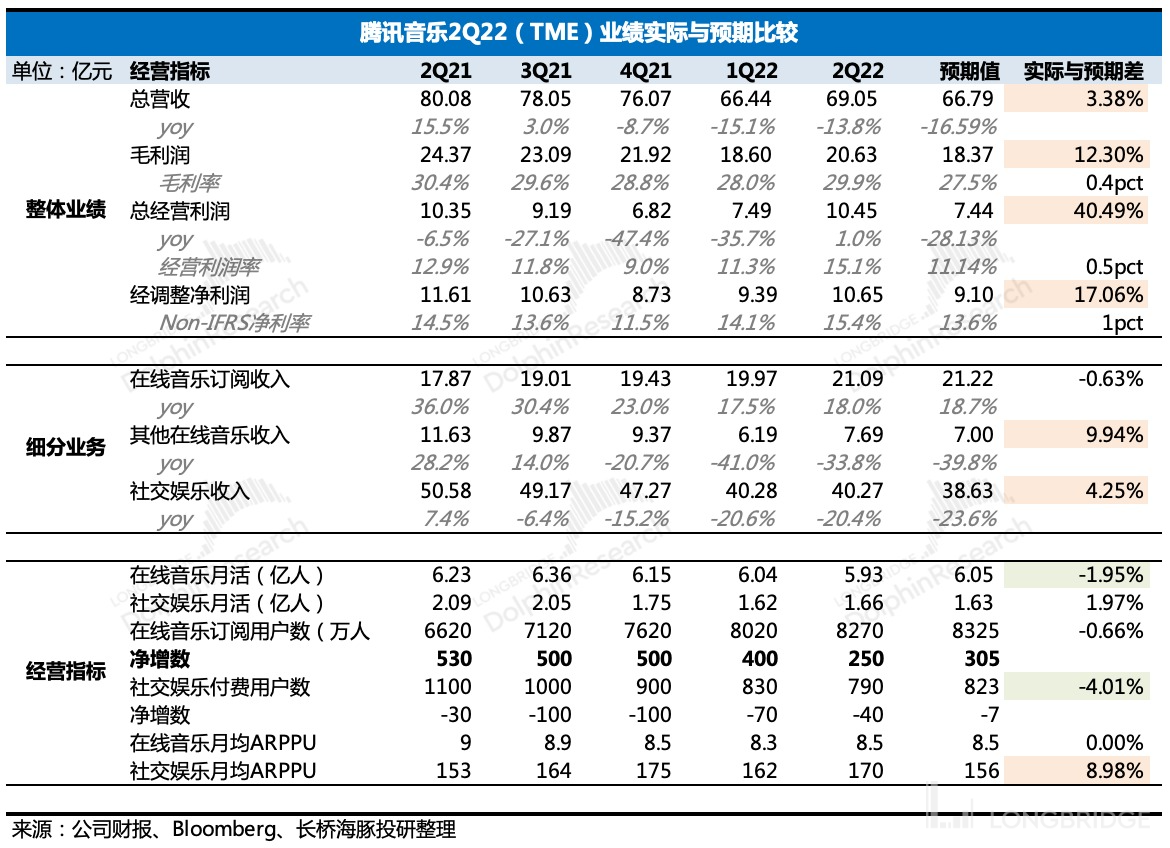

This morning (August 16, Beijing time), Tencent Music Entertainment Group (TME) released its second quarter results. Overall, Tencent Music delivered an "exceeding expectations" performance in the face of market pessimism. However, in terms of business growth, under the pressure of macro factors and competition, while the performance decline has slowed down, no clear signals of recovery can be seen for the time being.

Nevertheless, Tencent Music is still cash-rich. As of the end of the second quarter, its cash + deposits + investments totaled RMB 25 billion, exceeding half of its market value. Moreover, despite the various operational difficulties, normal operations can still generate positive cash flow for the company every quarter.

Let's take a look at the specific core indicators:

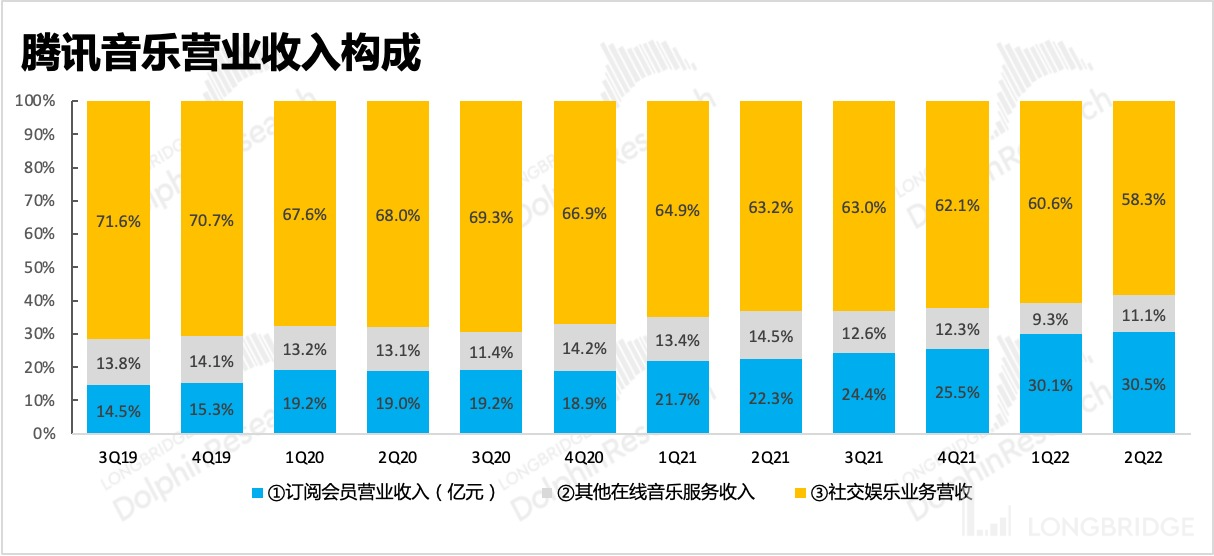

- Slowdown in revenue decline exceeded expectations, but there is pressure on Q3 live streaming revenue.

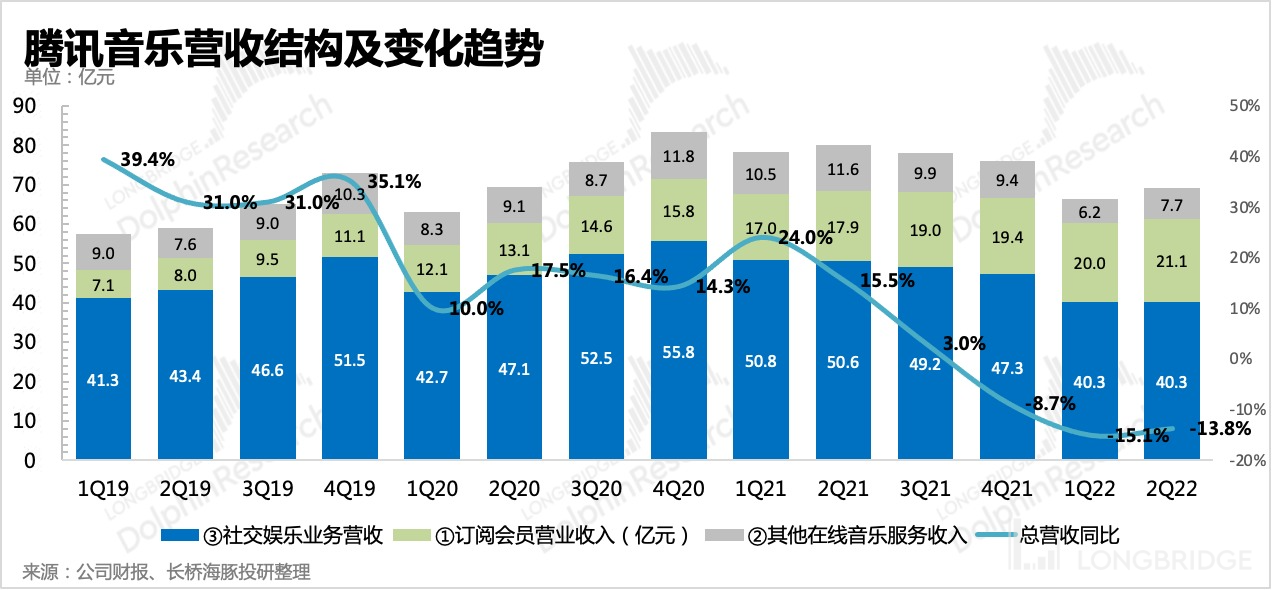

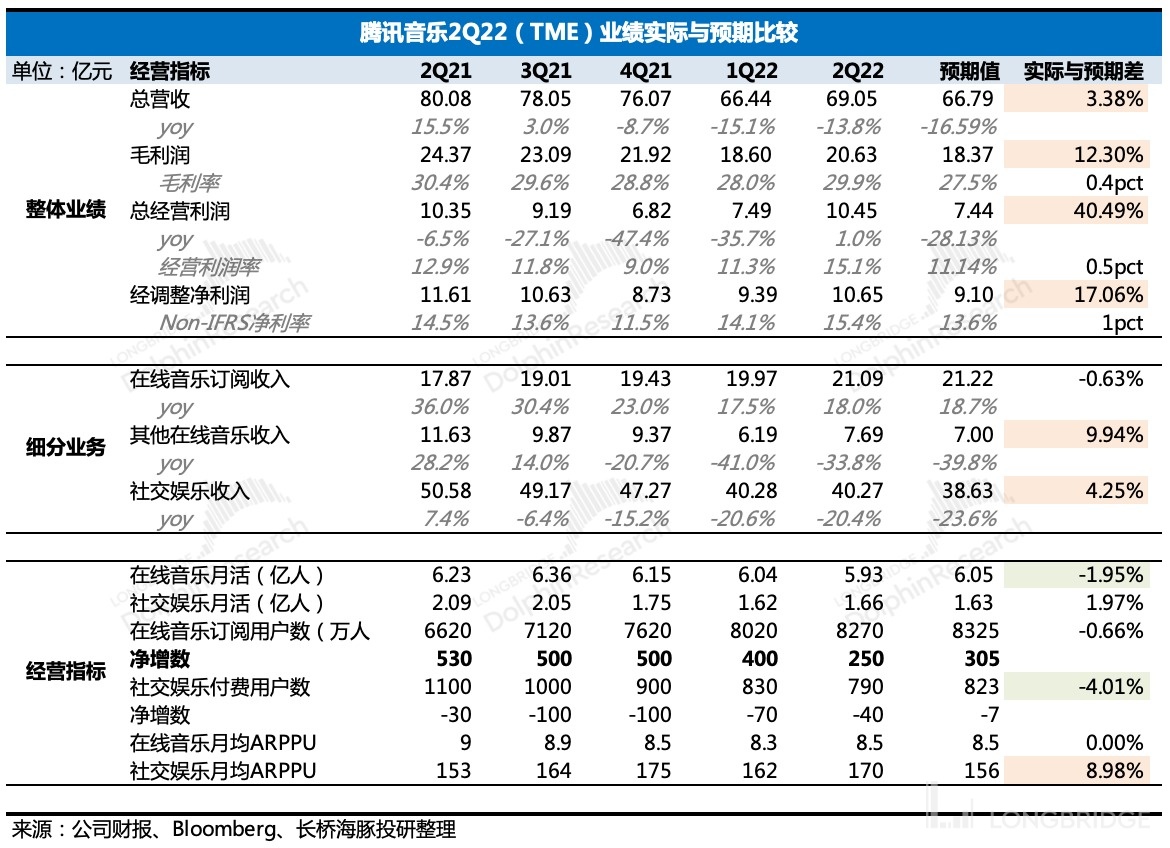

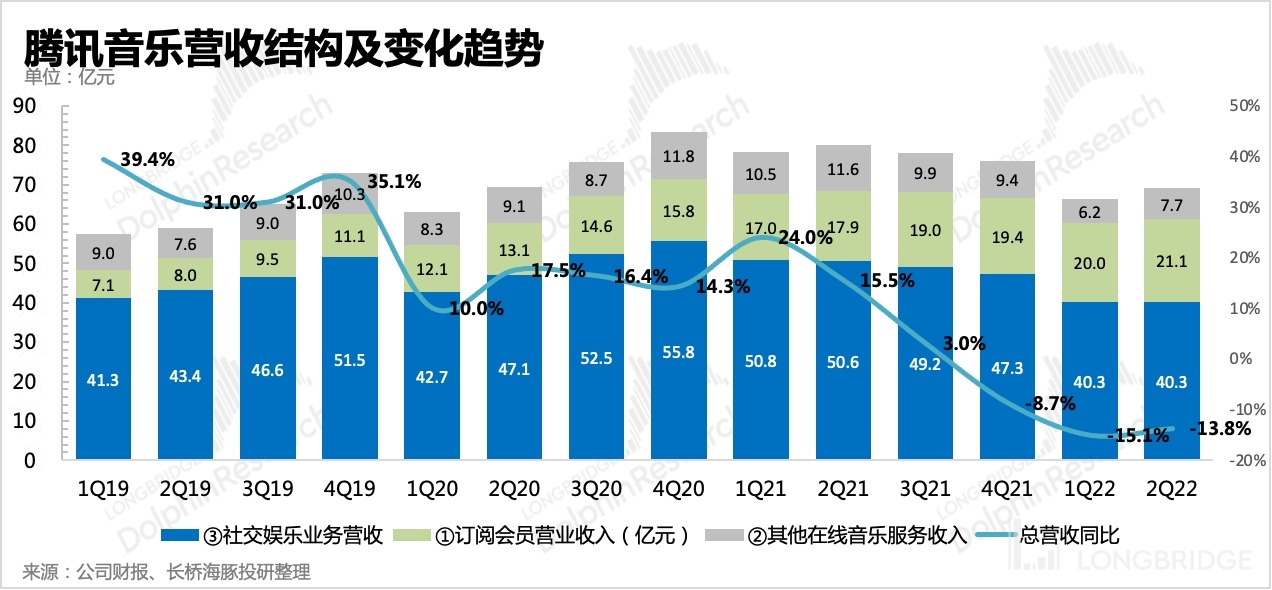

(1) Total revenue in the second quarter was RMB 6.9 billion, a year-on-year decrease of 13%, slightly slower than in the first quarter, and exceeded the relatively pessimistic market expectations.

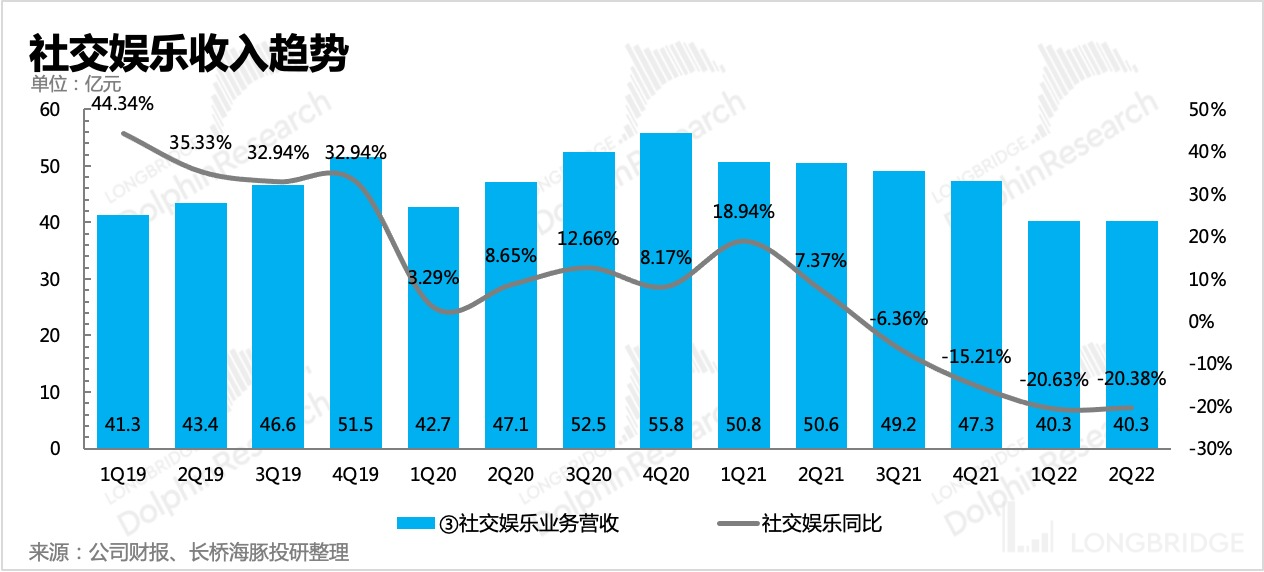

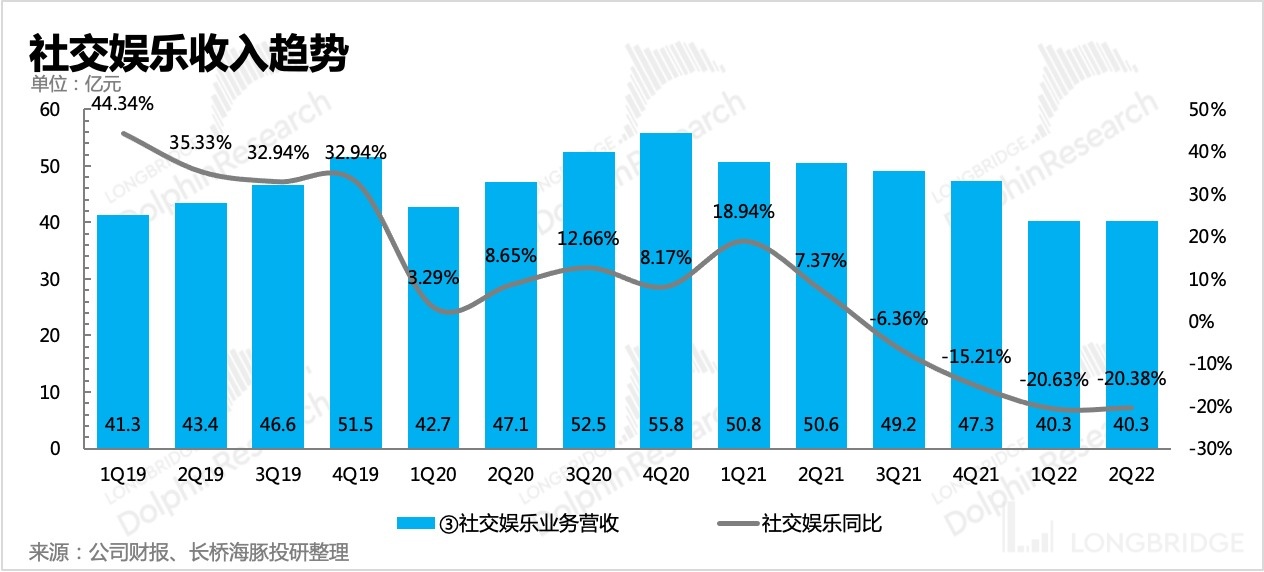

(2) The surprising thing is that the weakening of social entertainment revenue is not as severe as imagined, mainly due to the fact that the market has incorporated too much regulatory risk and economic pressure into its expectations.

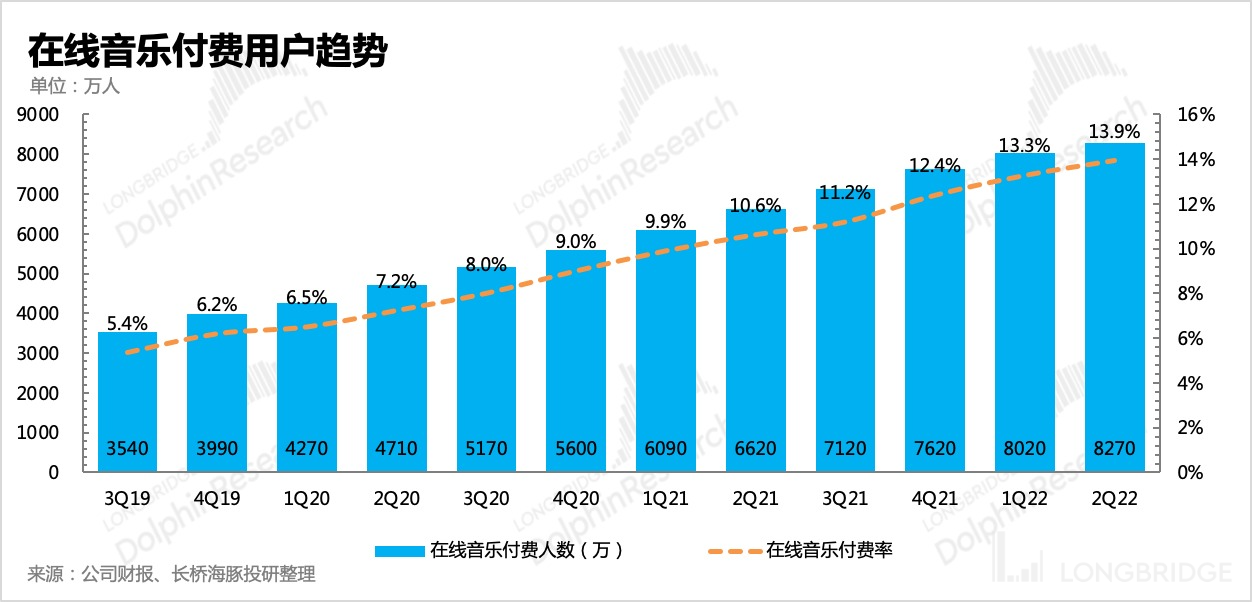

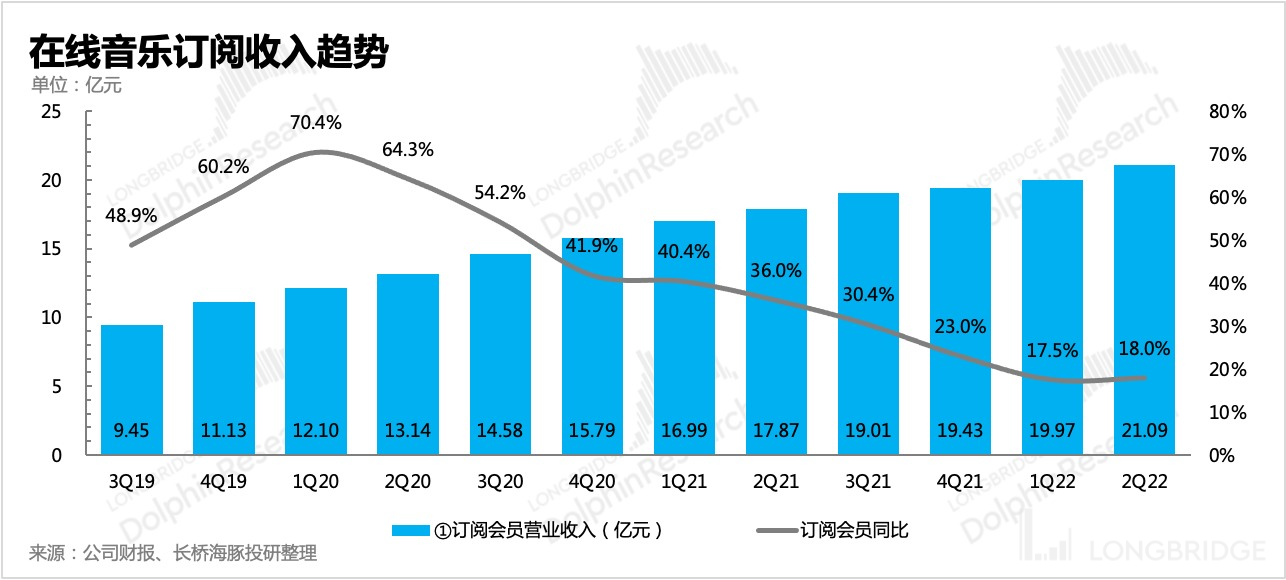

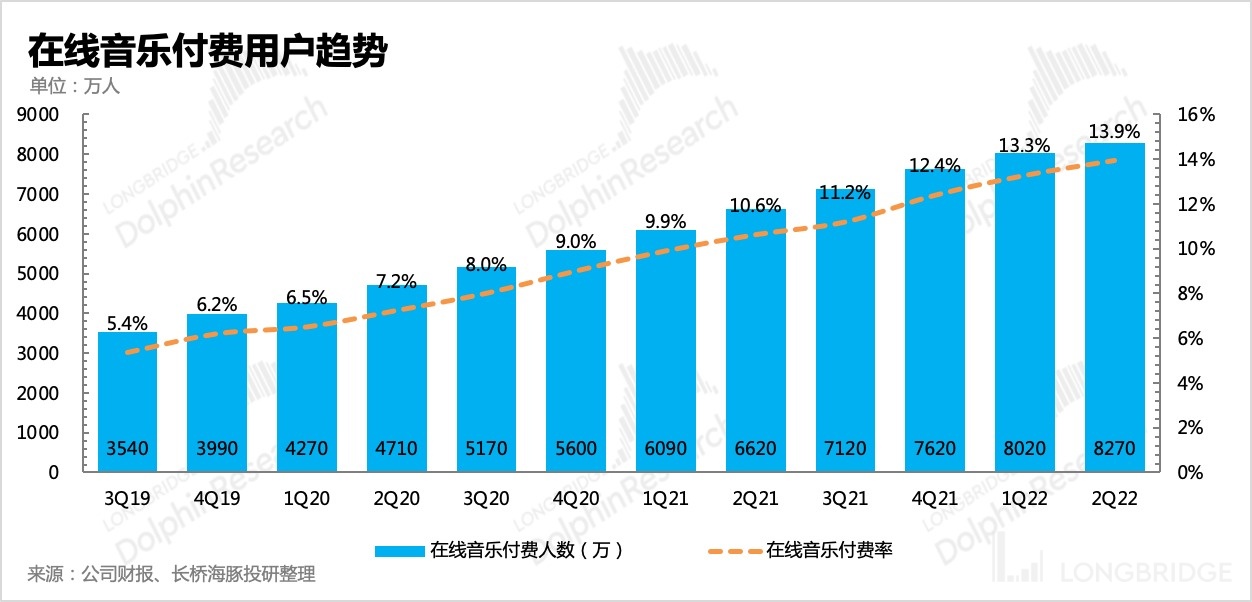

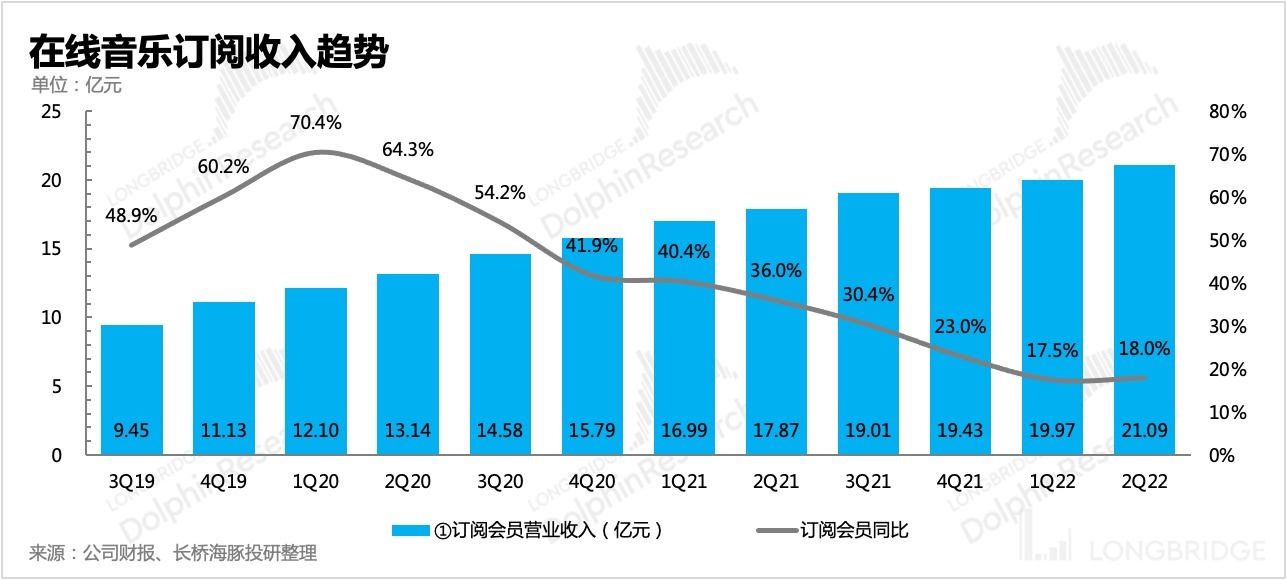

(3) Music subscription revenue is stable, but unlike in the past when revenue growth relied on net user growth, this time it depends on the increase in ARPPU after the reduction in promotions to drive revenue growth. However, the number of paying users in the second quarter was lower than expected, reflecting changes in the company's strategic direction.

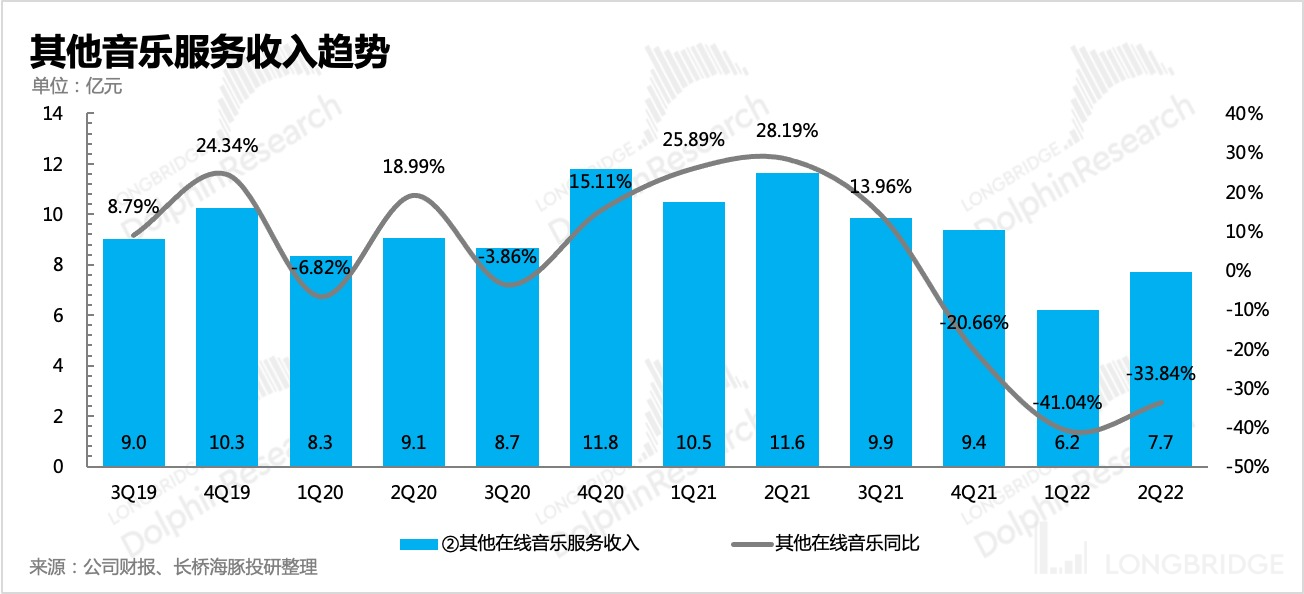

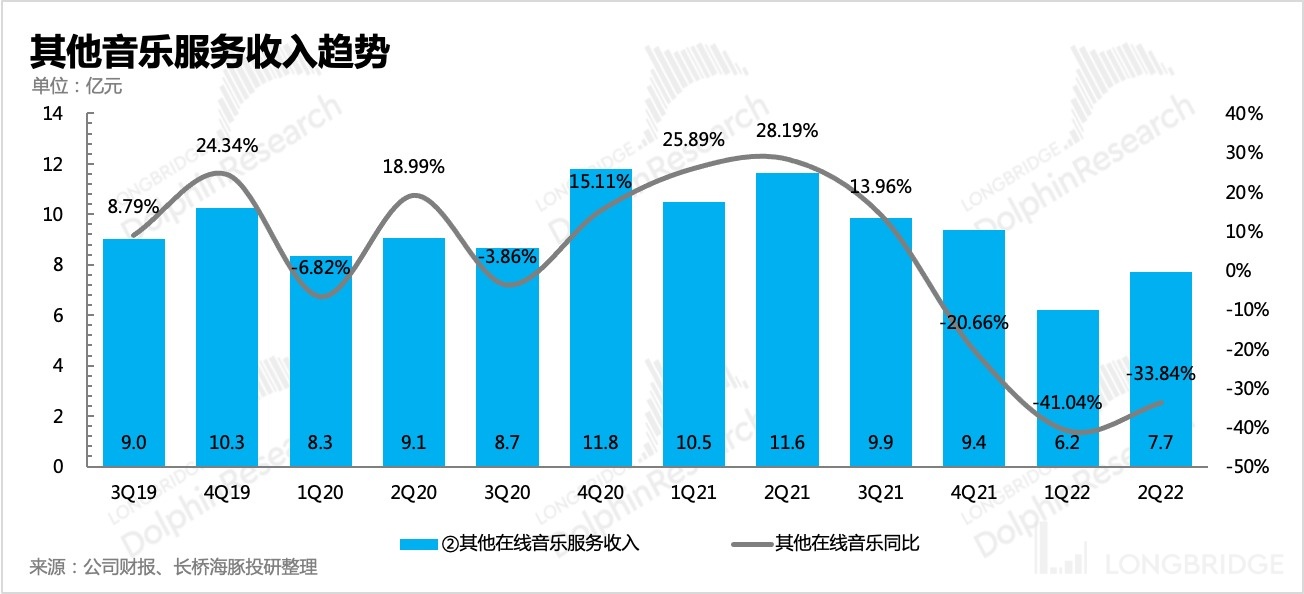

(4) Other online music revenue (including QQ Music advertising, copyright authorization, digital album sales, etc.) decreased by 34% year-on-year, slightly easing from the first quarter. In the third quarter, there will be Jay Chou's new album sales revenue of RMB 180 million, as well as the base effect of the Ministry of Industry and Information Technology's advertising rectification, which is expected to significantly slow down the downward trend.

- Marketing expenses continue to be significantly reduced, and cash flow is healthy.

In the second quarter, cost reduction and efficiency improvement continued, with gross profit margin increasing month-on-month, and marketing expenses once again decreasing by more than 50% year-on-year, still due to team optimization and more use of internal traffic. General and administrative expenses increased year-on-year by 6% after excluding the cost of secondary listing in Hong Kong, with most of the incremental expenses used for research and development.

The ultimate result of cost reduction and efficiency improvement is that profit significantly exceeded market expectations. However, it's worth noting that some of it was due to occasional gains and losses. However, even after excluding this factor, the second quarter profits still exceeded market expectations, and the decline rate compared to the first quarter was much slower.

As for the cash flow of Tencent Music, the problem is not how to maintain healthy cash flow survival, but how to make good use of these funds for investment. After the trend of live streaming business declines, how to create a new growth curve to fill the gap.

Dolphin Analyst will later share the summary of the conference call with Longbridge App and the Dolphin user group. Interested users are welcome to add the WeChat account "dolphinR123" to join the Dolphin Research Group and receive the summary of the conference call in the first time.

Dolphin Analyst Opinion

We all know that Tencent Music is under great short-term pressure. Perhaps the downward trend may ease after the impact of the high base period fades away in the second half of the year. However, in the third quarter, it will be fully affected by live broadcast supervision. The specific impact is temporarily unable to be quantified by the Dolphin Analyst. We can pay attention to the relevant statements of the management on the conference call.

Considering Tencent Music's low valuation (PB less than 1.1), although it has suffered from short-term valuation and performance shocks, it is a value stock with bottom certainty and upward growth potential that is temporarily unclear from a long-term perspective. It has profit but the market is unwilling to give high valuation. In short, what TME lacks is growth, essentially the excavation and value rediscovery of music assets:

-

The future main line may still return to digital music itself, whether it is the industrial chain of independent musicians or alternative publicity and performance platforms for debut singers, TME Live and other virtual concertservices.

-

Long audio is a longer-term growth business line that the company is currently exploring, but a more suitable scenario for Chinese users still needs to be developed.

Therefore, the Dolphin Analyst believes that before Tencent Music truly explores a sustainable and promising new monetization path, it is suitable to lay out the bottom value around it for short-term repairs and rebound opportunities, while in the medium and long term, we can pay attention to signs of its difficulties being reversed.

Detailed Analysis of this Quarterly Report

User Scale: Continuously declining MoM, Subscription Volume below Guidance

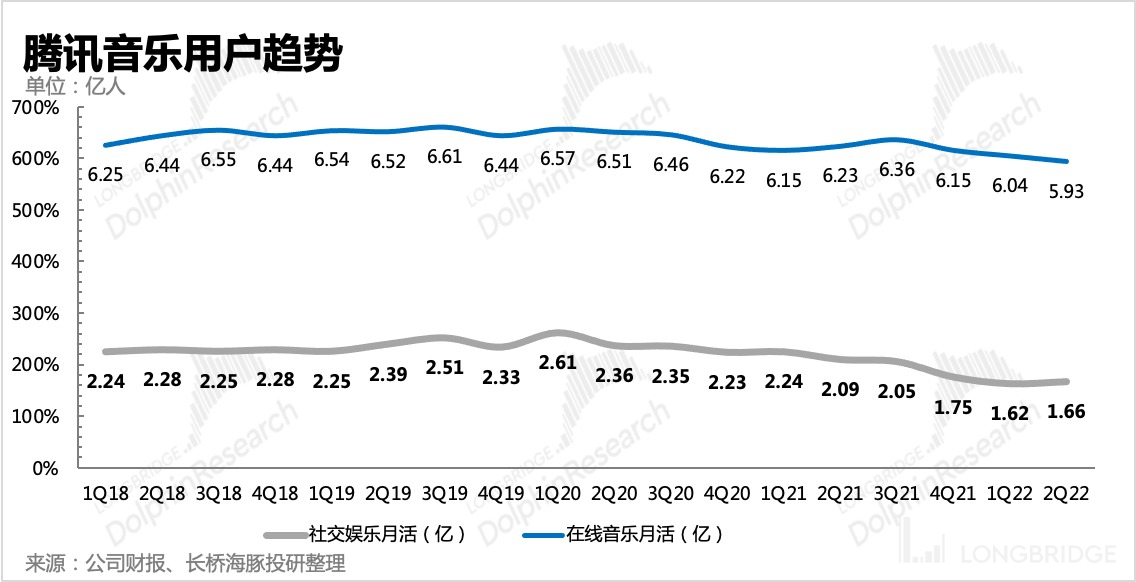

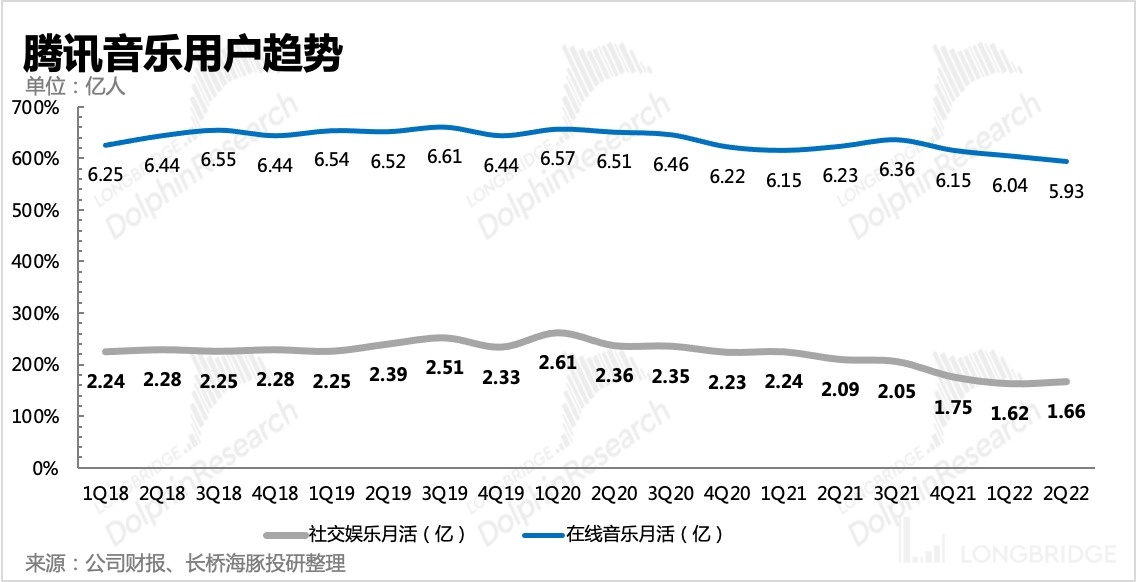

The MoM decline in monthly active users for several consecutive quarters can be seen. Without activity stimulation, online music MoM is basically a process of reaching the peak of stock and gradually losing. In the second quarter, the average monthly active users of online music fell below 600 million, and social entertainment MoM may show a slight rebound due to epidemic control measures in the secondquarter.

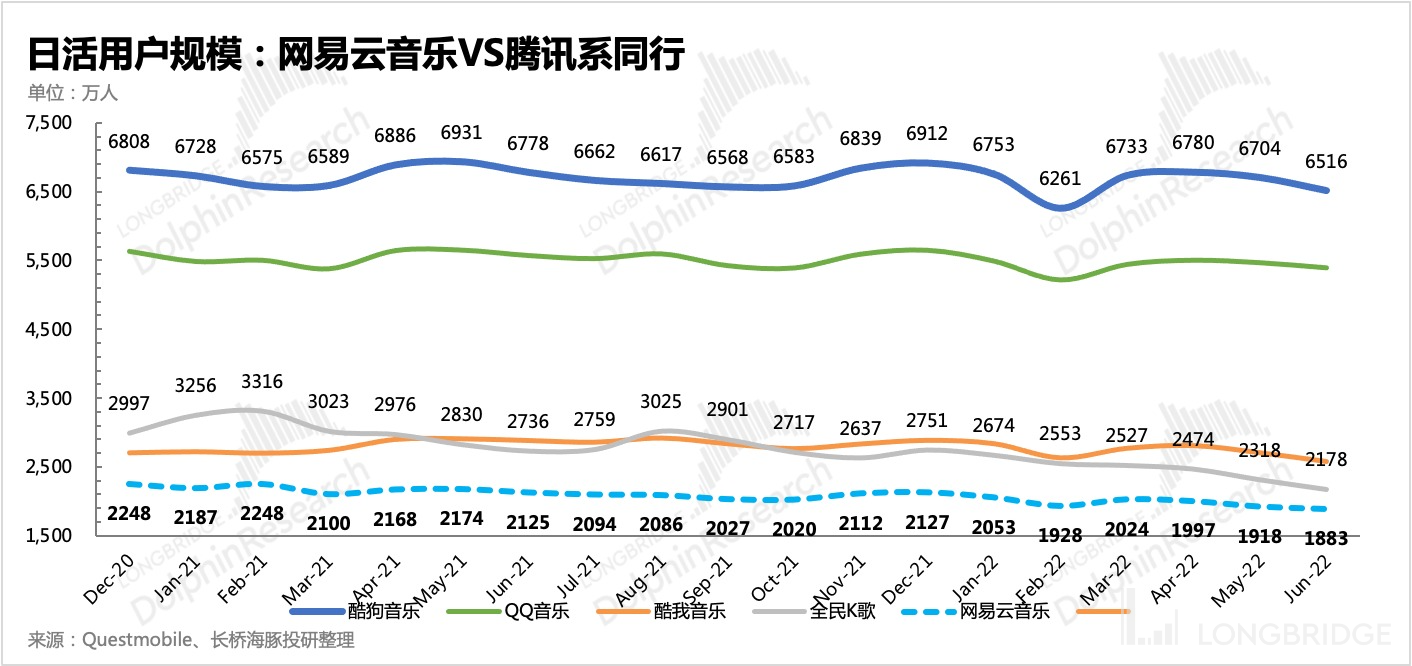

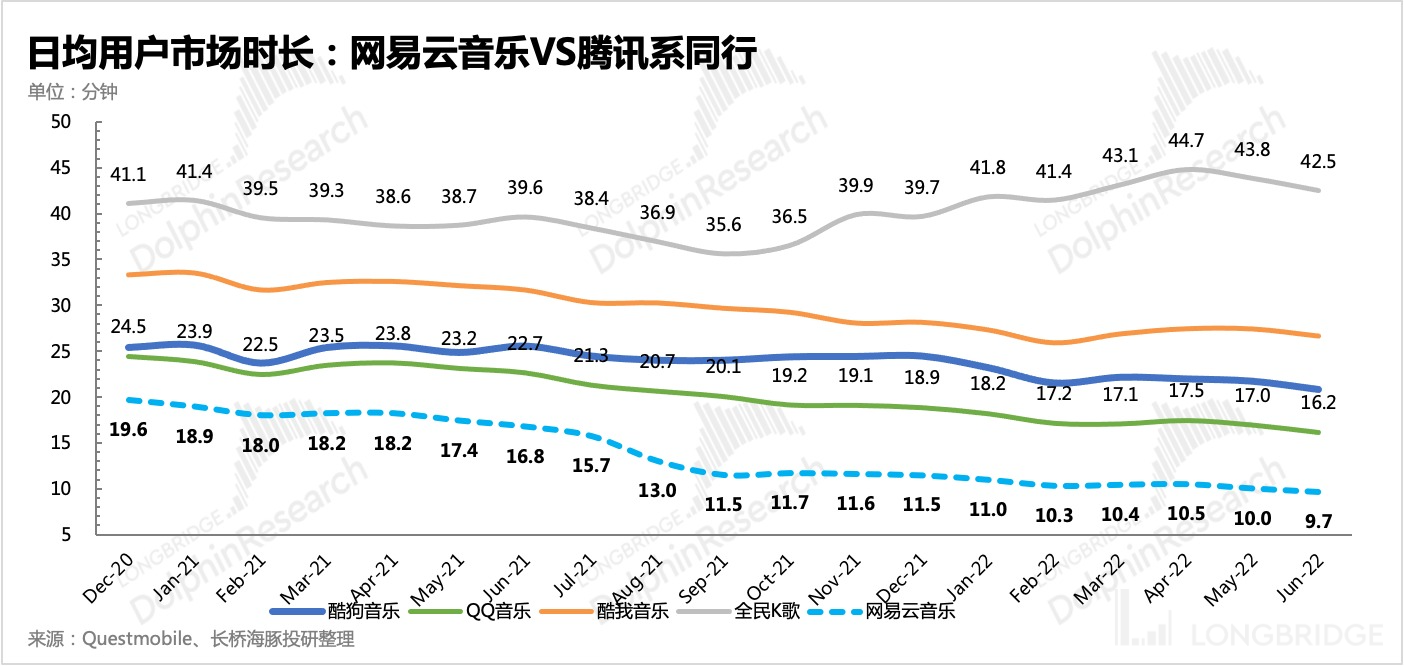

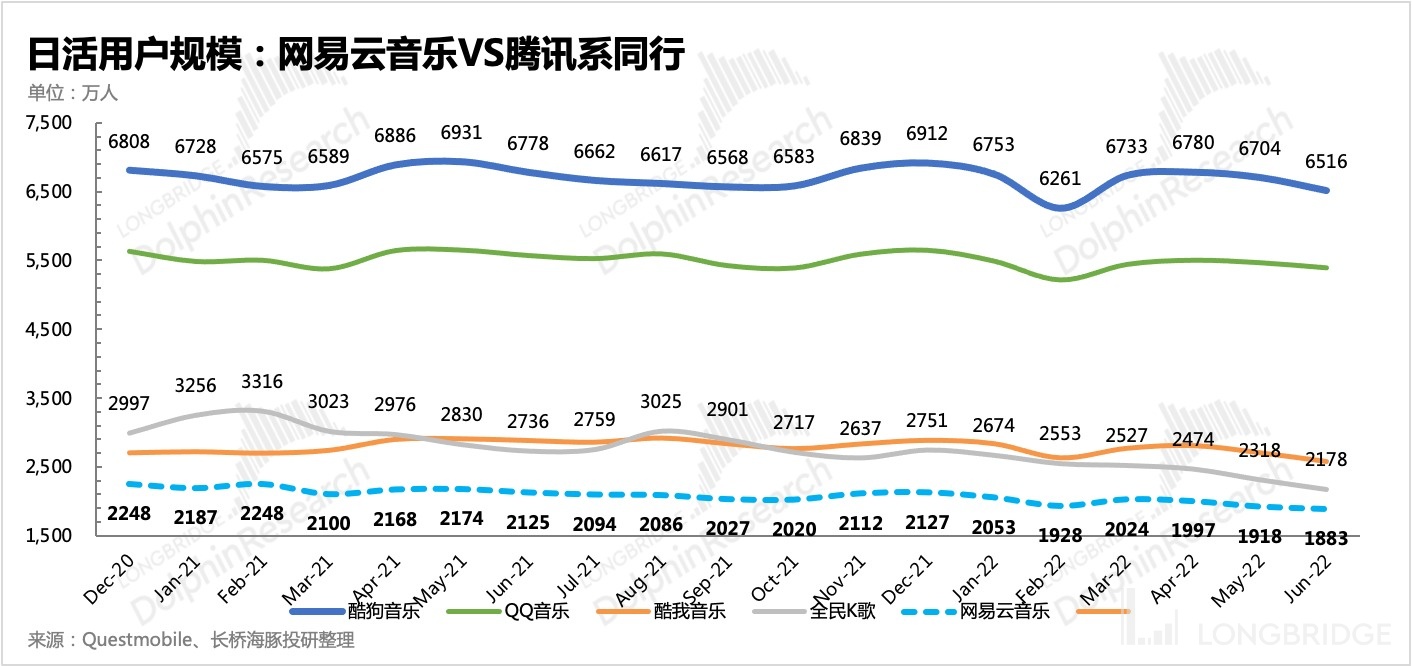

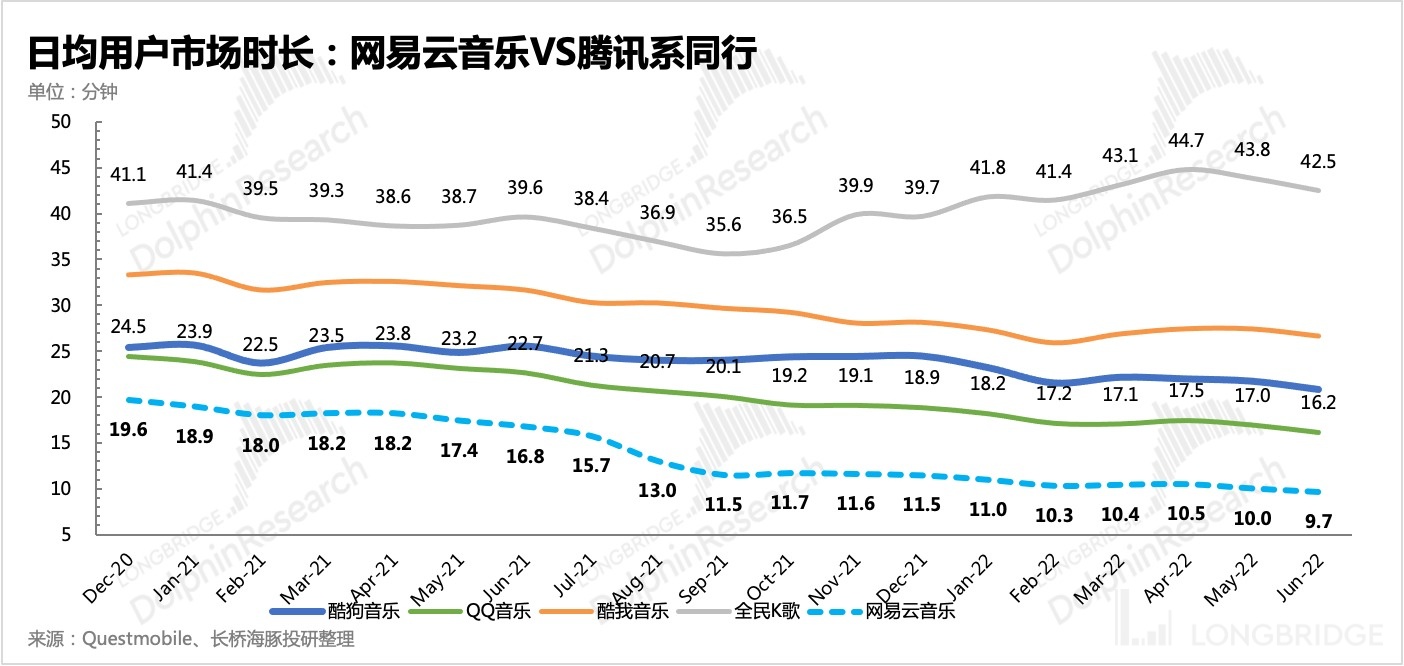

Compared with internal competition in the industry, external competition has a greater impact. At least from the performance of direct competitors-Cloud Music, it has not gained any obvious benefits in the post-copyright era.

However, under the influence of macro and competition factors, as well as the potential peak of loyal user scale, the effect of the "paywall strategy" this quarter has also been discounted. The net increase in online music subscribers is only 2.5 million QoQ, lower than the guidance range of 3-4 million subscribers given at the beginning of the year.

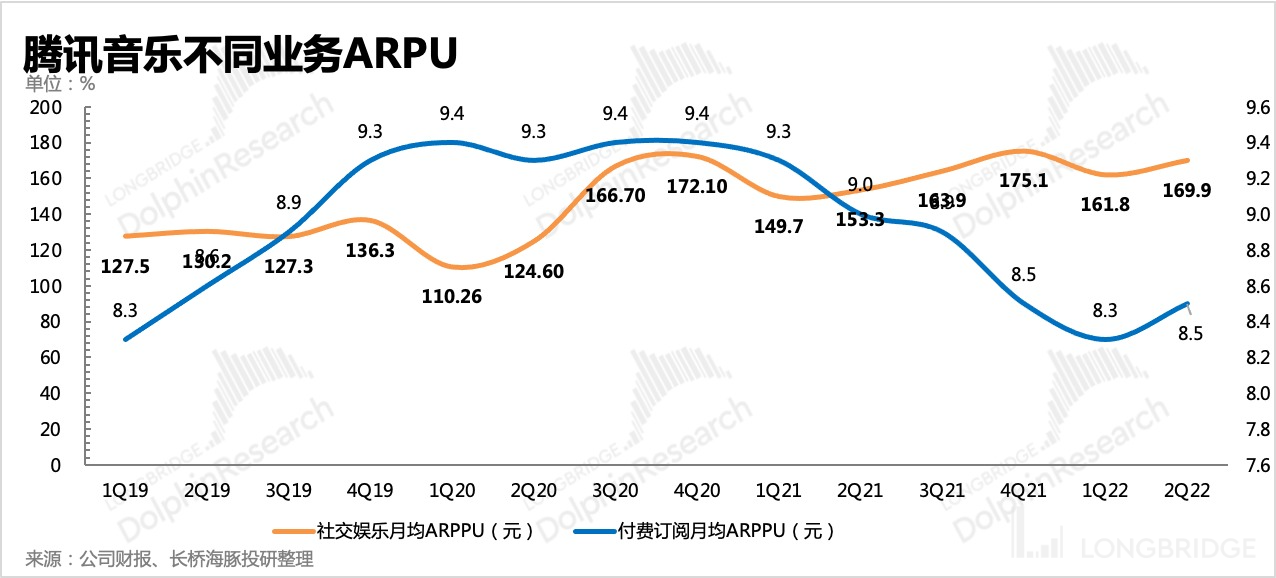

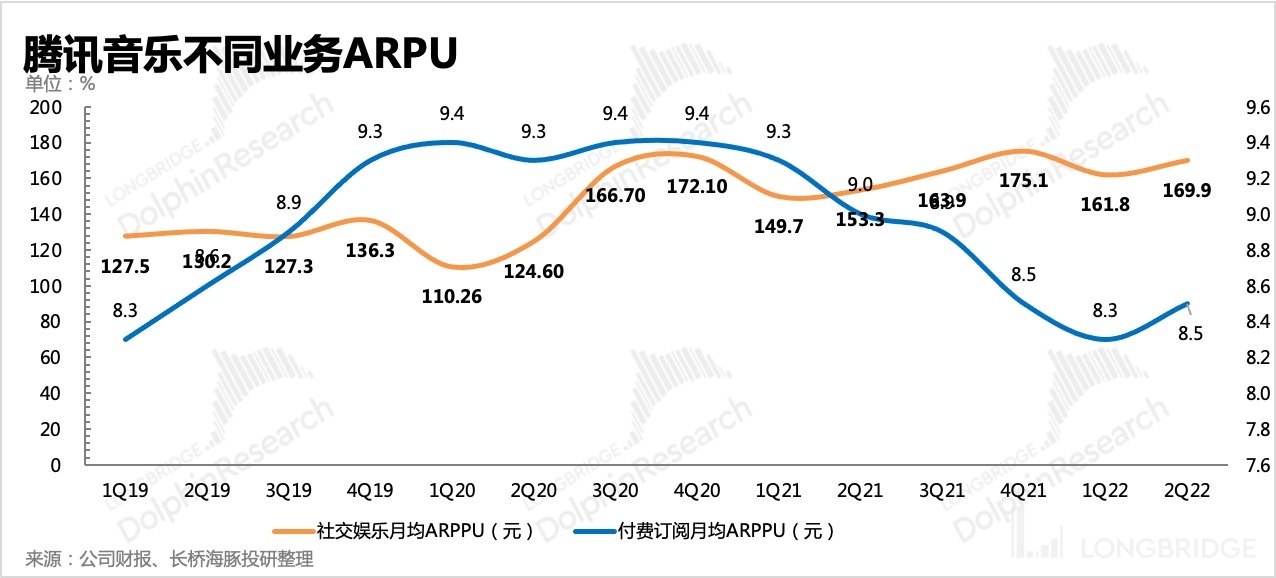

In fact, in the conference call of the previous quarter, the management has already revealed that the growth situation is not good (if there is good ARPPU growth, then low user growth is not a problem), and looking at the ARPPU of individual payment amount, from 8.3 yuan in the first quarter to 8.5 yuan in the second quarter, it also confirms the management's statement and the company's current strategic direction change-abandoning the excavation of "non-loyal users". The focus of the pay-per-view willingness is to serve "loyal users" and optimize the music subscription profit model by increasing single user payments.

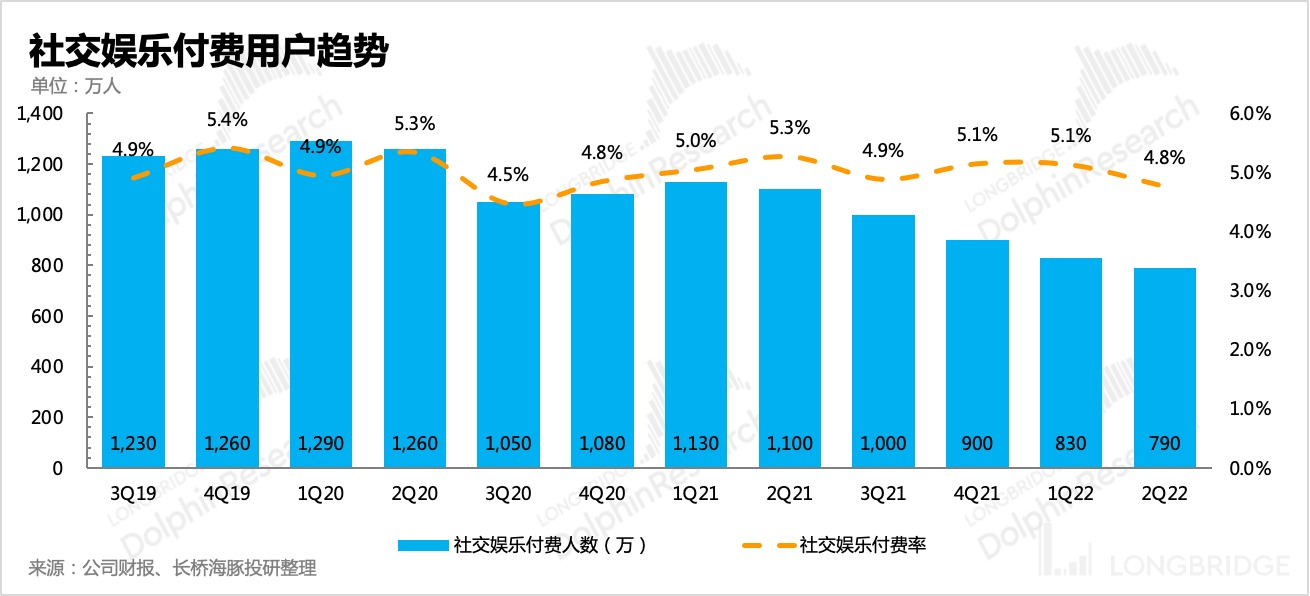

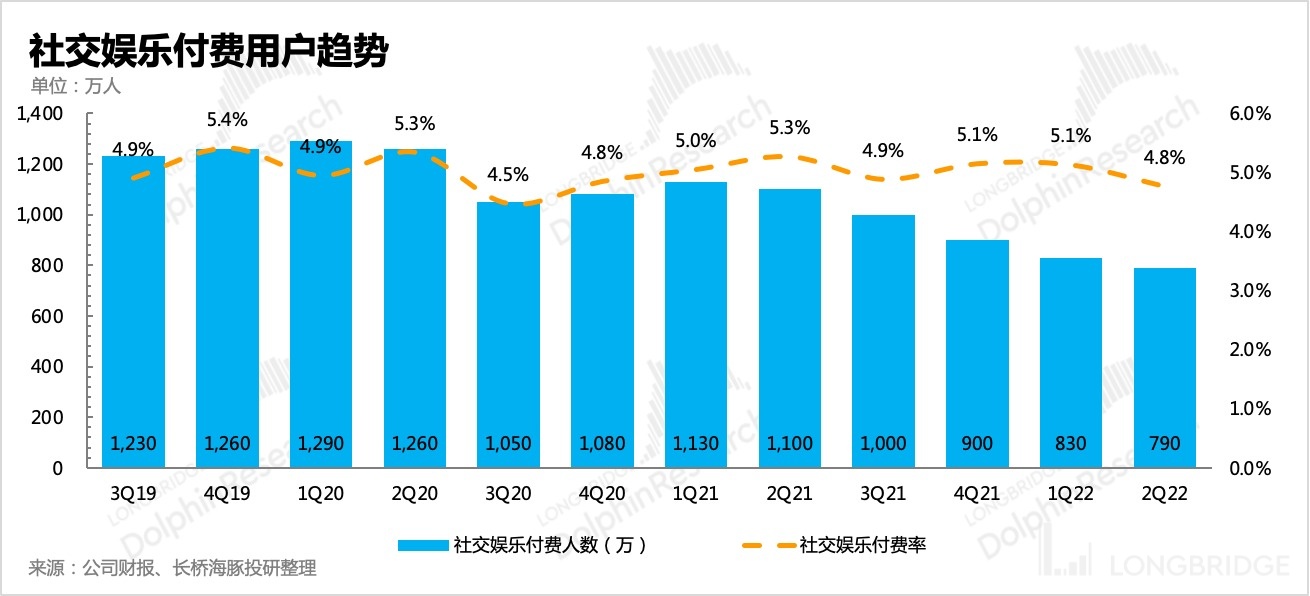

In terms of social entertainment, the number of active users rebounded slightly this quarter due to the partial blockade of some cities caused by the epidemic. However, consumer willingness has weakened, and the number of paying users continues to decline to 7.9 million people. From the perspective of the combination of increased active users but decreased paying users, the second quarter should have been more affected by macroeconomic pressure, making users tighten their wallets.

The ultimate reflection of single user payment is the reduction in music subscription promotions (online music ARPPU increase compared to the previous month) and the increasing strength of the king of the live broadcast list (social entertainment ARPPU increase compared to the previous month).

It is worth mentioning that from the performance of this quarter, the live broadcast supervision regulations implemented on March 1st (canceling the list, canceling PK, etc., and prohibiting minors from watching live broadcasts after 10 pm) does not seem to have a significant impact on the live broadcast business. However, Dolphin Analyst understands that the actual implementation of the regulatory regulations began in June, so the second quarter performance only reflects one month of regulatory pressure effect, and there is also a process during the initial rectification period, which is difficult to change in place. Therefore, it is feared that it will not be until the third quarter that the significant impact of regulation on performance can be truly seen, especially given the base effect.

2. Income: The downward trend slows down, and there is still pressure on live broadcasts in the third quarter

The total revenue in the second quarter was 6.9 billion yuan, a year-on-year decrease of 13.8%, and the decline in the second quarter was slightly slower than that in the first quarter, exceeding market expectations. However, the second quarter had factors such as epidemic containment, which played a certain supportive role in the social entertainment business, and the live broadcast regulatory regulations were officially implemented in June, so social entertainment itself may be a bit "overvalued" this quarter.

For a detailed breakdown:

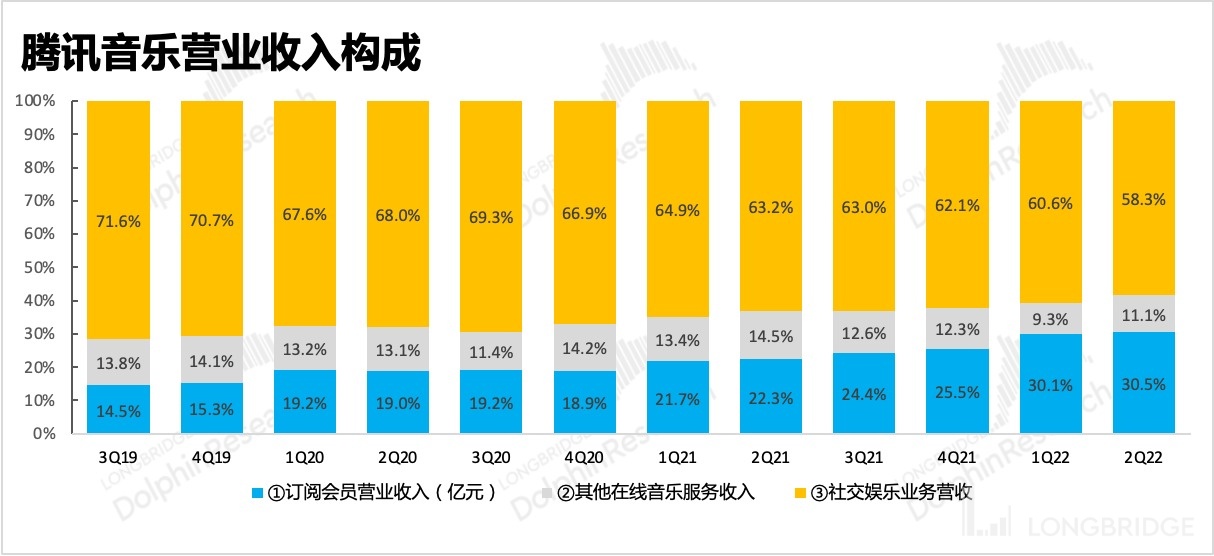

- Online music revenue was 2.88 billion, a year-on-year decrease of 2.4%. Among them, membership subscription income steadily increased by 18%, while other online music services mainly based on copyright transfer, digital album sales, and QQ Music advertising, the income decreased by nearly 34% year-on-year. Behind the decline are factors such as the cancellation of exclusive copyright cooperation, fan culture rectification (limiting the number of album purchases, reducing brushing rankings), and poor advertising. However, the turning point for the decline in performance of other online music services has already arrived according to the trend. Coupled with the well-known fact that Jay Chou's album sold well (selling 6 million copies by the end of July, at 30 yuan per copy, earning 180 million in revenue), this business is expected to focus on recovery in the second half of the year.

Secondly, the social and entertainment revenue was 4 billion, a year-on-year decrease of 20.4%, with a decline similar to that of the first quarter. The market originally expected a more pessimistic outlook, mainly considering the impact of live broadcast supervision. Although the new regulation for live broadcast supervision was issued in March, it was officially implemented in June. Therefore, if we only look at the second quarter, the actual regulatory impact is smaller than expected.

In addition, the large-scale epidemic blockade in some cities in the second quarter caused a small rebound in live broadcast popularity, but the majority of viewers were "freeloaders". Real users who are willing to pay are actually decreasing. Therefore, if we remove the influence of the blockade, the heat of live broadcasting should be discounted, and Tencent Music's social and entertainment revenue may also be overstated.

Looking ahead to the third quarter, the regulatory impact is expected to officially manifest, including the cancellation of the leaderboard and the cancellation of PK, which will set an invisible payment red line for "pay-to-win" users. When the average person reduces the number of times they open their wallets and the top players lose interest in their spending, the sunset of the live broadcast scene will only accelerate.

Thirdly, we will continue to reduce costs and increase efficiency, and profits will greatly exceed expectations.

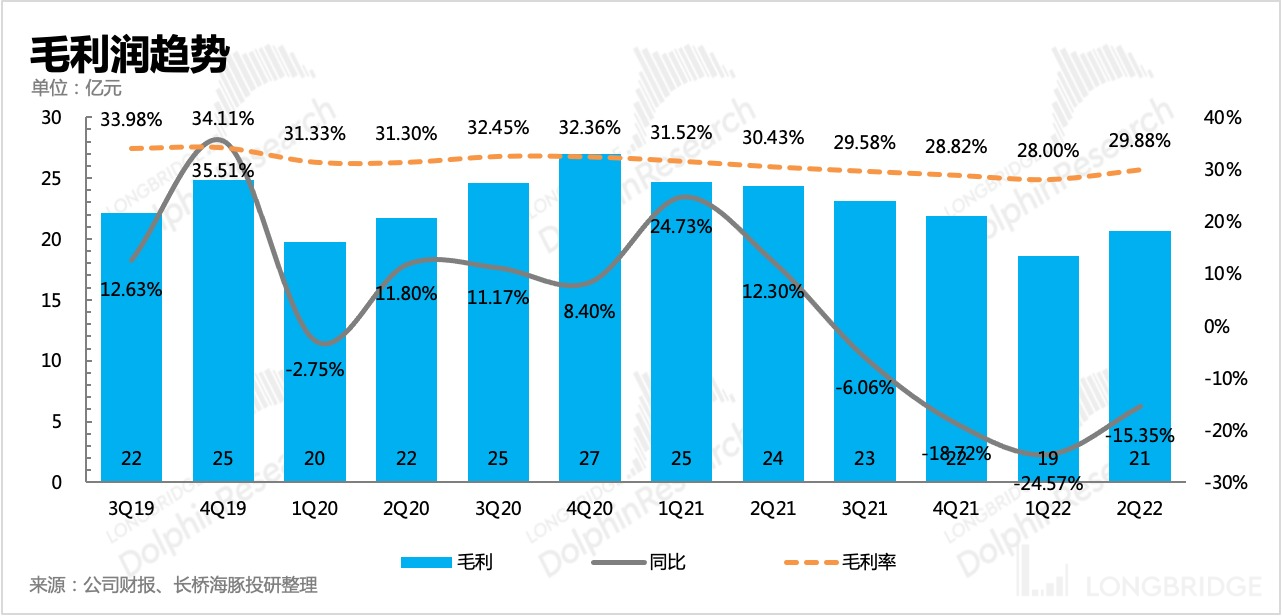

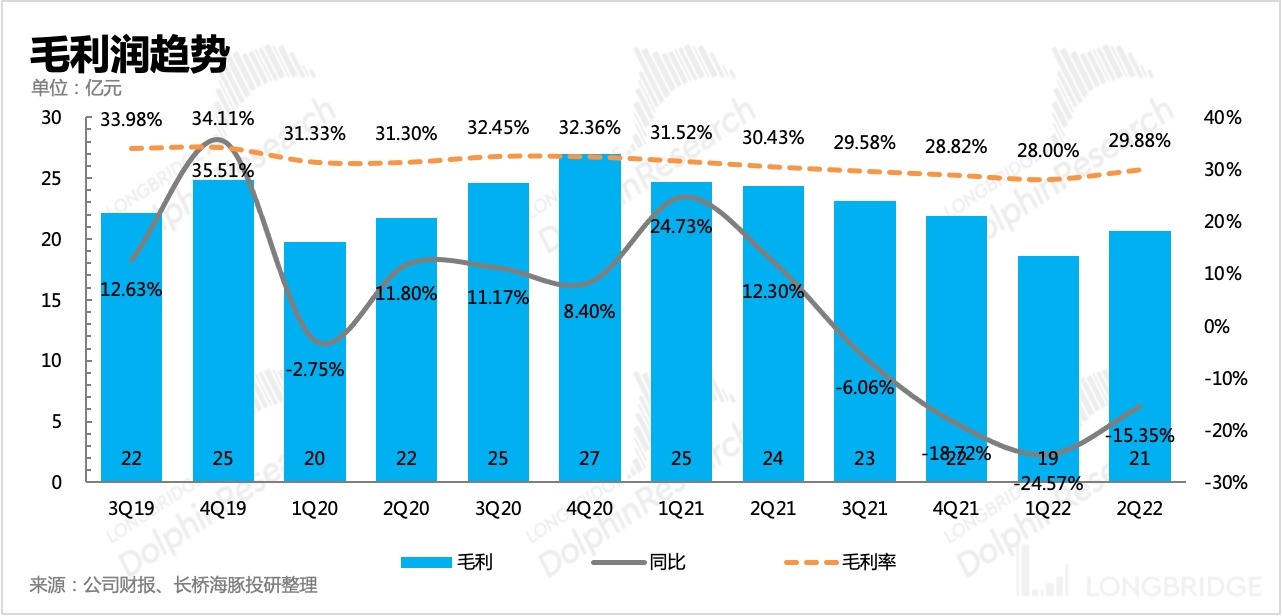

In terms of costs in the second quarter, they were mainly affected by the decline in social and entertainment revenue and the adjustment of the revenue-sharing ratio. The expenditure on live broadcasting revenue-sharing decreased, resulting in a year-on-year decrease, and the cost reduction was higher than that of the first quarter, resulting in an increase in gross profit margin from 28% in the previous quarter to 30%.

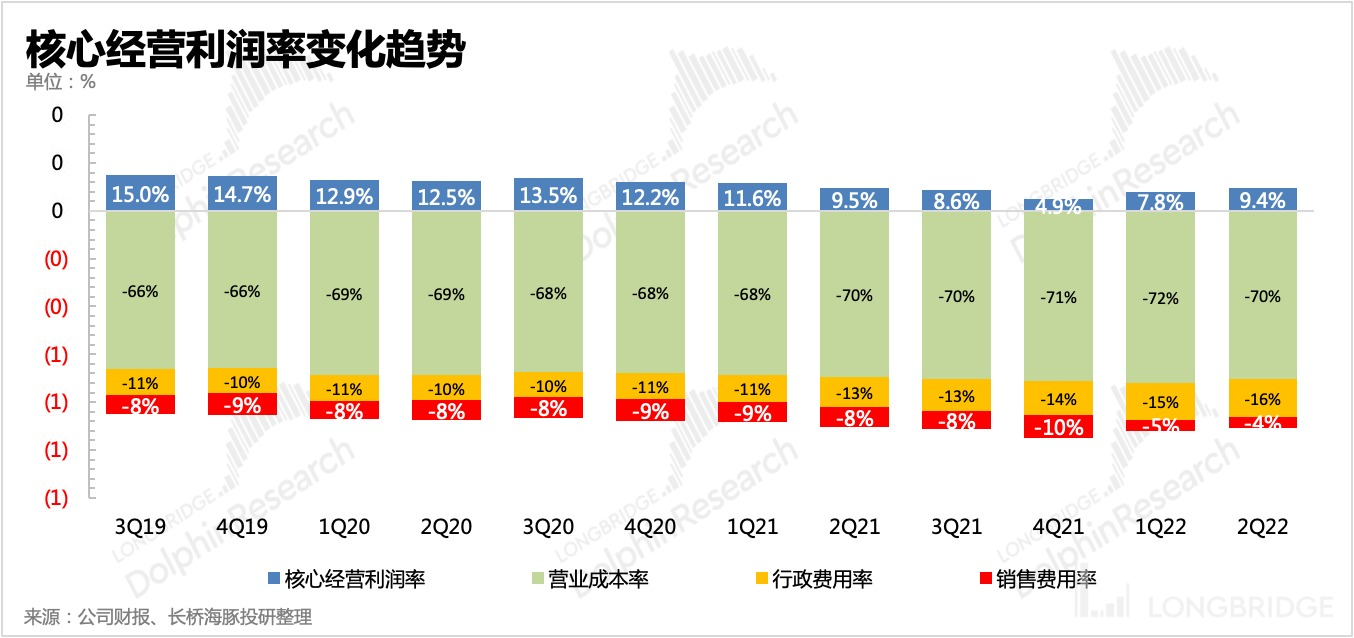

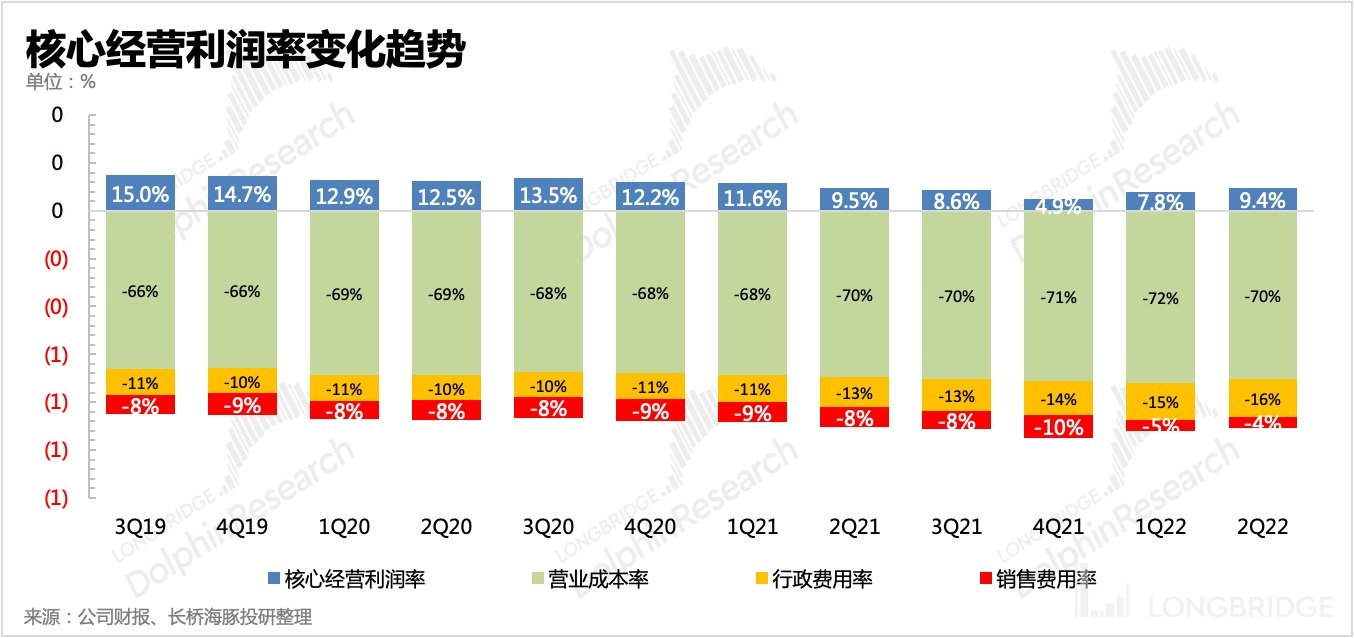

In terms of expenses, we continued the aggressive cost-cutting action in the first quarter. Sales expenses decreased by 55% year-on-year, and although general administrative expenses (including management expenses and research and development expenses) increased by 10% year-on-year, about 0.5 billion of that was for the preparation of Tencent Music's second listing in Hong Kong. After excluding that, general administrative expenses increased by about 6% year-on-year, with a significant decrease in growth rate compared to the first quarter. The ultimate result of "reducing costs and increasing efficiency" is a significant release of profits. The core operating profit in the second quarter was 650 million yuan, which was still a 15% year-on-year decline, but the profit margin increased by 1.5 percentage points compared to the first quarter.

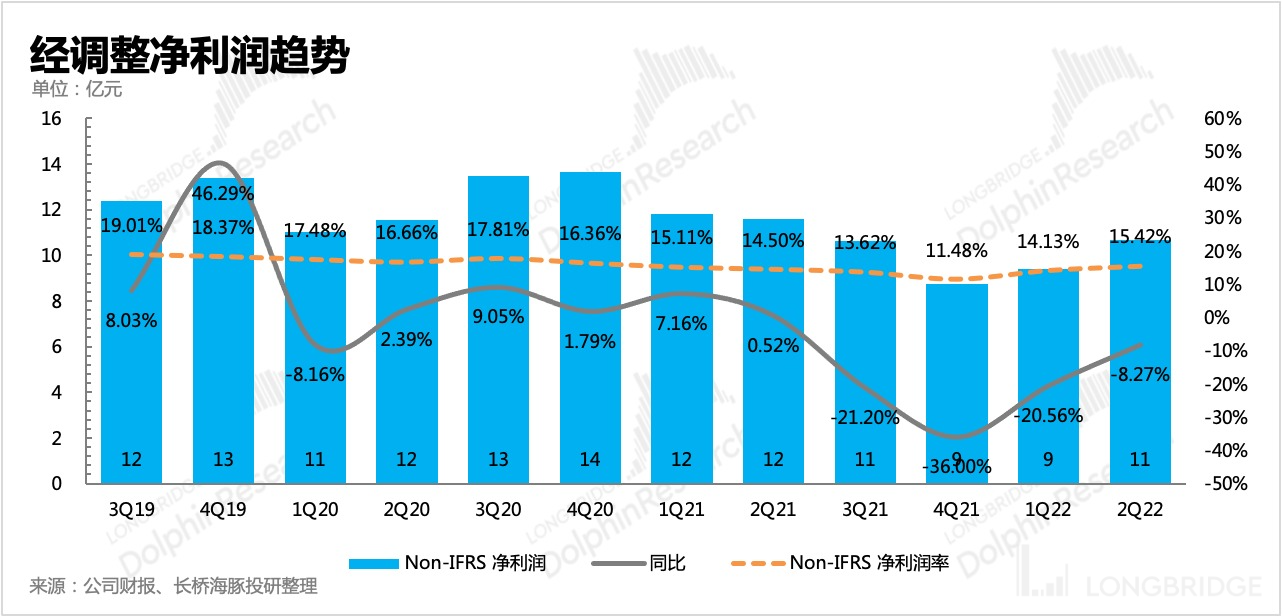

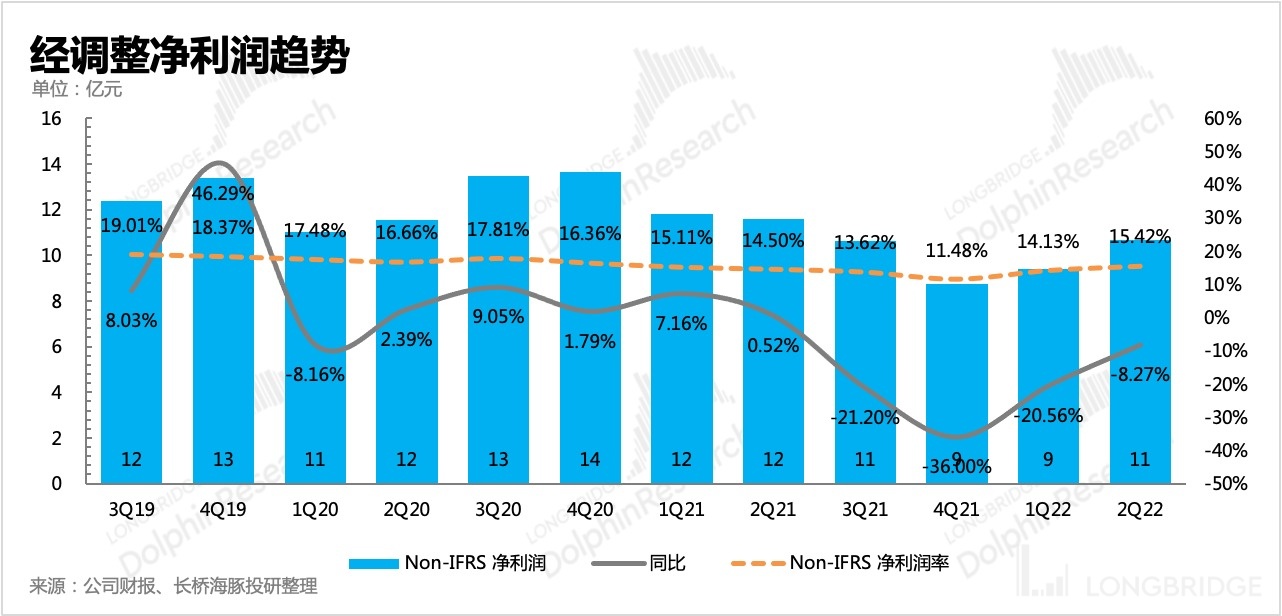

The company's own cost reduction and efficiency improvement have exceeded expectations, and after occasional increases in other gains and losses (~248 million), the company's operating profit and non-IFRS net profit have exceeded expectations. In the second quarter, adjusted net profit reached 1.065 billion yuan, exceeding the consensus expectation (~910 million). The net profit margin is 15.4%, a slight increase from the previous quarter.

Under the guideline of "saving, saving, and saving", as the external traffic shows an overall upward trend, the linkage between Tencent Music, its parent company, and its brother companies has significantly increased. Opening up internal traffic and strengthening content cooperation will also enable Tencent's channels to have more ecological synergy in competing against external peers.

For Tencent Music, the second quarter mainly reflected in:

-

Collaborating with Tencent Games to create 15 game songs

-

Co-launching the Chinese theme song "Love (Time To Shine)" for the NBA Finals with Tencent Sports

-

AI-enhanced recording playback of Leslie Cheung and Jay Chou's concerts on Video Number

Finally, as of the end of the second quarter, the company had a total of RMB 25 billion in cash and deposits + investments. Although revenue growth has slowed down significantly, the operating cash flow is still healthy after cost reduction.

Unlike some internet platforms that are still burning money, the dilemma facing Tencent Music now is not survival, but finding their own future growth. The key to unlocking Tencent Music's valuation is how to spend their rich funds wisely, and how to shoulder the new growth curve as the trend of social entertainment revenues, such as live broadcasting, declines.

Dolphin Analyst's "Tencent Music" historical articles:

Earnings Season

May 17, 2022 Conference Call: "The impact of new live broadcast regulations will become apparent throughout the year, and cost reduction and efficiency improvement are the top priorities this year (Tencent Music Conference Call)"

May 17, 2022 Earnings Review: "Tencent Music: It's still early in the spring, and there is plenty of grain"

May 22, 2022 Conference Call: "Tencent Music Conference Call: Management was frank and honest, and Q1 pressure was the highest of the year (Conference Call Summary)" 2022 年 3 月 22 日财报点评"腾讯音乐:破净的音乐价值,需要被 “听见”"

2021 年 11 月 9 日电话会议"版权丢失后竞争威胁加剧,腾讯音乐选择抱紧 “兄弟们” 的大腿(电话会纪要)"

2021 年 11 月 9 日财报点评"腾讯音乐:后版权时代守家不易,反转仍需等待"

2021 年 8 月 17 日电话会议"腾讯音乐二季度电话会议纪要:越来越注重【多产品多品牌协同】策略"

2021 年 8 月 17 日财报点评"没了独家,腾讯音乐靠什么看家?"

2021 年 5 月 18 日电话会议"腾讯音乐 Q1 电话会议纪要:看新管理层如何展望未来?"

2021 年 5 月 18 日财报点评"Dolphin Analyst| 用户规模下滑趋势未改,腾讯音乐反攻的号角还不够响亮"

2021 年 3 月 23 日电话会议"我对腾讯音乐的判断乐观了一点 “Q4 电话会议”"

2021 年 3 月 23 日财报点评"腾讯音乐进击背后的尴尬:用户持续流失"

深度

2021 年 4 月 7 日"看不下去了,腾讯音乐被误伤了!(下)"

2021 年 4 月 1 日"看不下去了,腾讯音乐被误伤了!(上)" Live Broadcast

May 17, 2022, "Tencent Music Entertainment Group (TME.US) First Quarter 2022 Earnings Call" (https://longbridgeapp.com/lives/12379?channel=nl12379&invite-code=FRQWBJ)

March 24, 2022, "Tencent Music Entertainment Group (TME.US) Fourth Quarter 2021 Earnings Call" (https://longbridgeapp.com/lives/9149?channel=n9149)

November 9, 2021, "Tencent Music Entertainment Group (TME.US) Third Quarter 2021 Earnings Call" (https://longbridgeapp.com/lives/3927?channel=nl3927&invite-code=032064)

August 17, 2021, "Tencent Music Entertainment Group (TME.US) Second Quarter 2021 Earnings Call" (https://longbridgeapp.com/lives/1461?invite-code=032064)

Risk Disclosure and Disclaimer of this article: Dolphin Research Institute Disclaimer and General Disclosure (https://support.longbridge.global/topics/misc/dolphin-disclaimer)