Growth is gone yet still losing money, what can Sea do to save its valuation? input: ====== 说到云游戏,估计你能想到的就是 “云端的游戏库”、“需要流畅的互联网”、“电视上玩游戏”,云游戏时代早已到来。 ====== output: When it comes to cloud gaming, what might come to mind are "game libraries on the cloud", "reliance on smooth internet connectivity", "playing games on TV", and the era of cloud gaming has already arrived. input: ====== 今年已经是台湾最严重的旱灾,蔡英文今天到台南安南区土库里一带进行视察,她认为该区已经进入严重缺水状态,包括现场的千亿虫害、田间休耕地都要面临严峻挑战。 ====== output: This year marks Taiwan's most severe drought and President Tsai Ing-wen conducted an inspection in Tuku area, An Nan district, Tainan today. She believes the area has entered a serious water shortage state and faces daunting challenges including on-site pest infestations and fallow fields. input: ====== 金城武变中年大叔,少女杨丞琳变成熟女!同台戏码超害羞竟「走光了」 ====== output: Takeshi Kaneshiro transforms into middle-aged uncle and Rainie Yang becomes a mature woman! Their performance on stage is extremely shy which even leads to an accidental exposure.

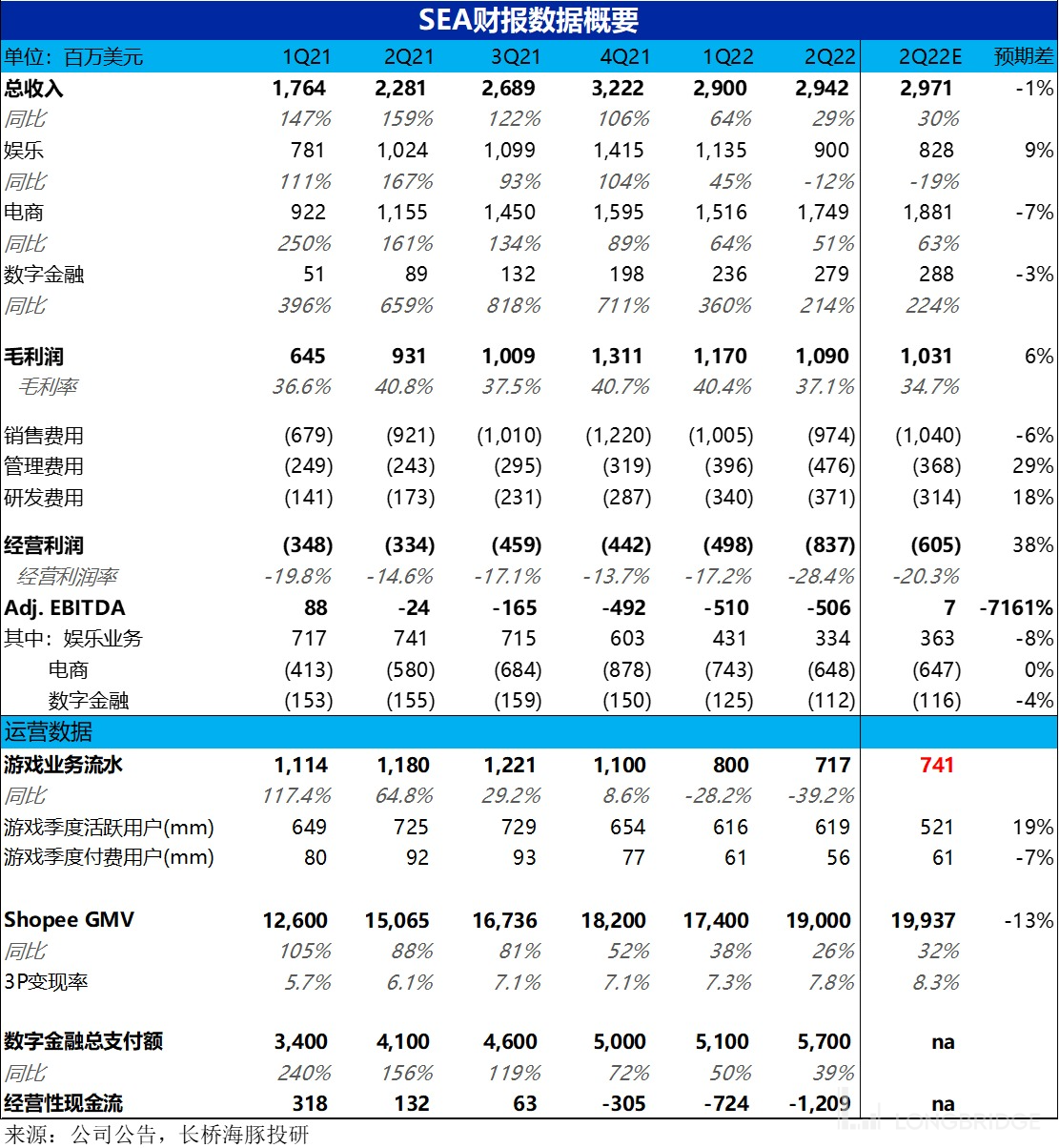

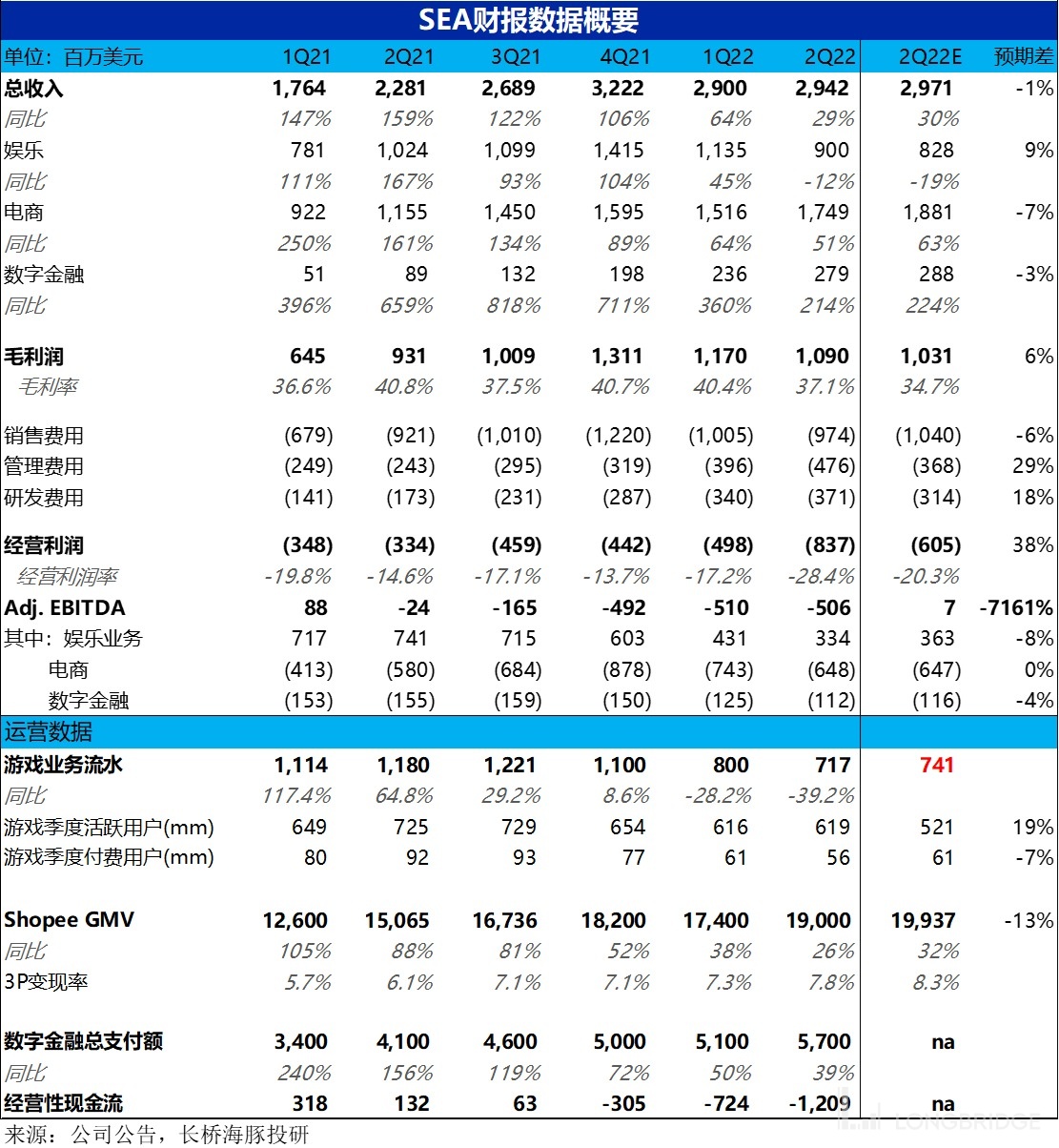

On the evening of August 16th before the US stock market opened, SEA Donghai Group released its Q2 2022 financial report. Overall, the revenue growth of various businesses was not outstanding compared to expectations, and the expected profit improvement did not materialize as scheduled, so the overall performance outlook is not good. Specifically:

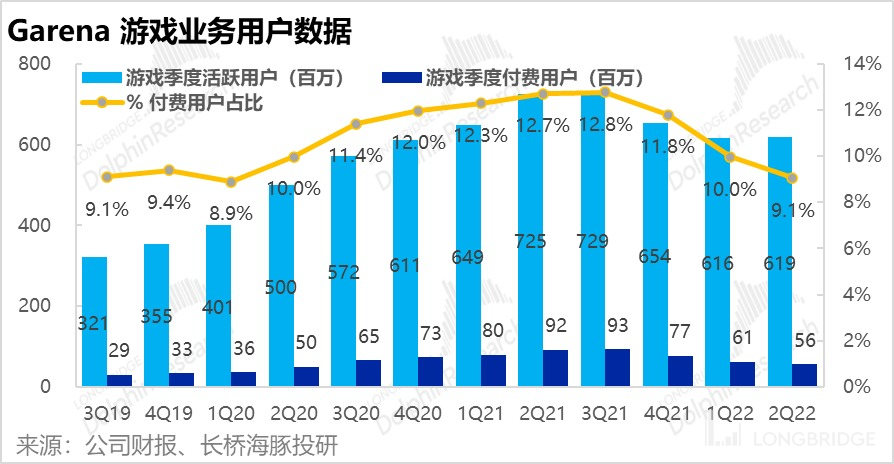

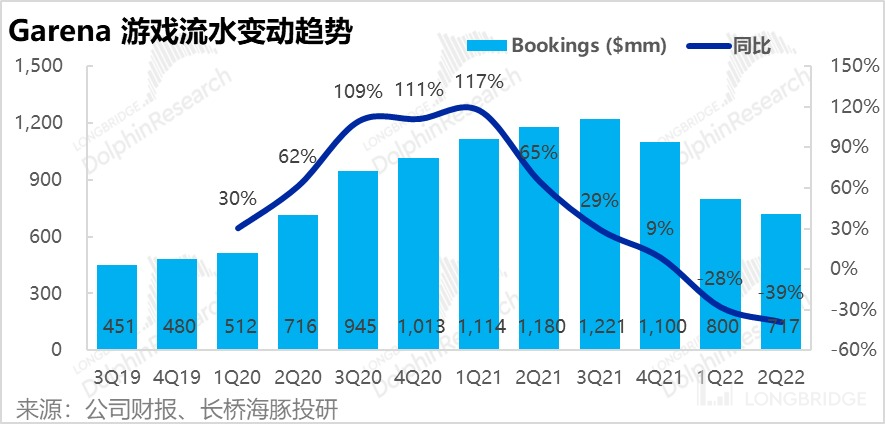

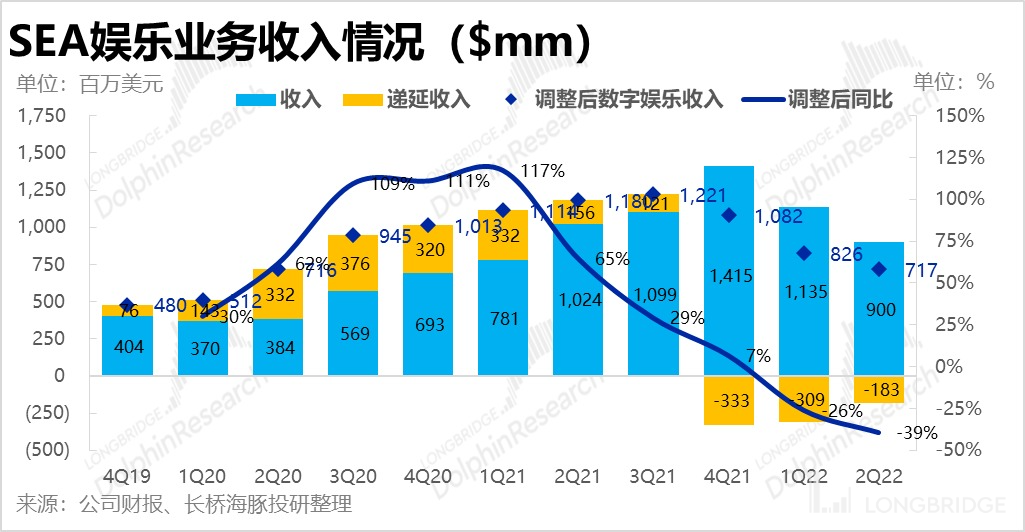

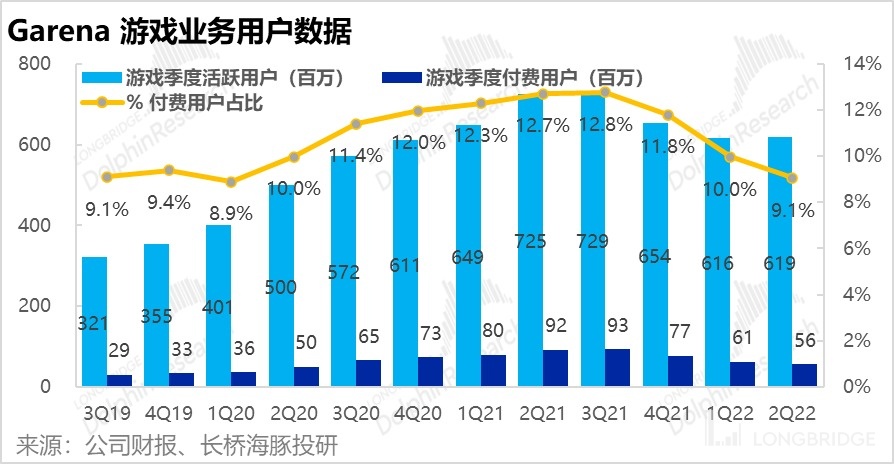

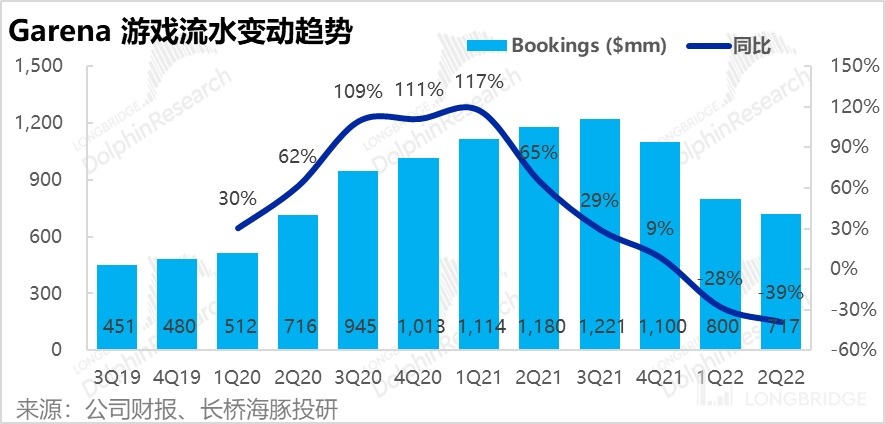

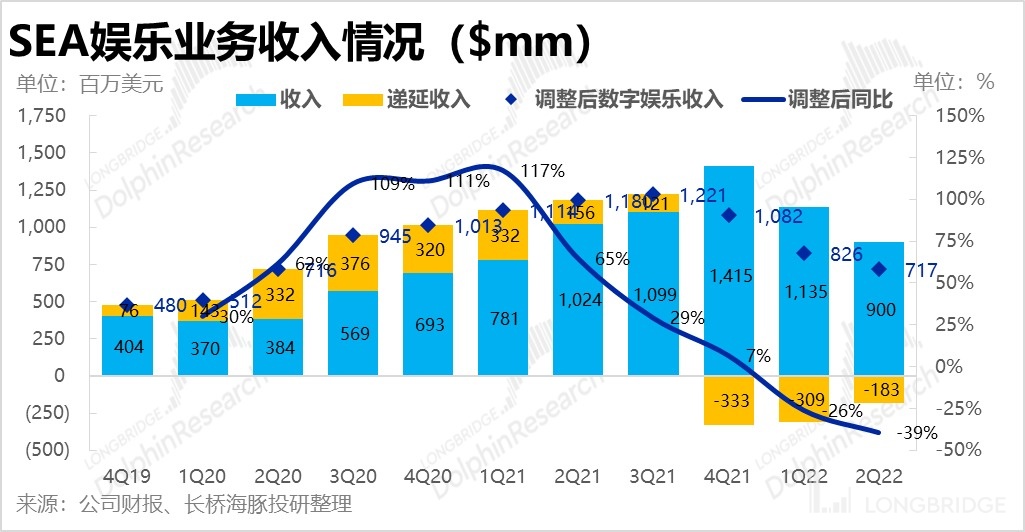

1. Garena gaming business: Due to increased promotion efforts, the number of game users this season greatly exceeded expectations. Quarterly active users not only did not decrease but also increased by 61.9 million, far exceeding the expected 521 million. However, the number of actual paying players continued to decline by 5 million, causing Garena's quarterly revenue to plunge by 40% YoY to $717 million, lower than the expected $740 million. Therefore, while marketing activities stabilized the player base, the willingness of players to pay and the revenue-generating ability of Garena are still declining. Additionally, the core issues of the gaming segment regarding the lack of significant progress on new games remain unresolved.

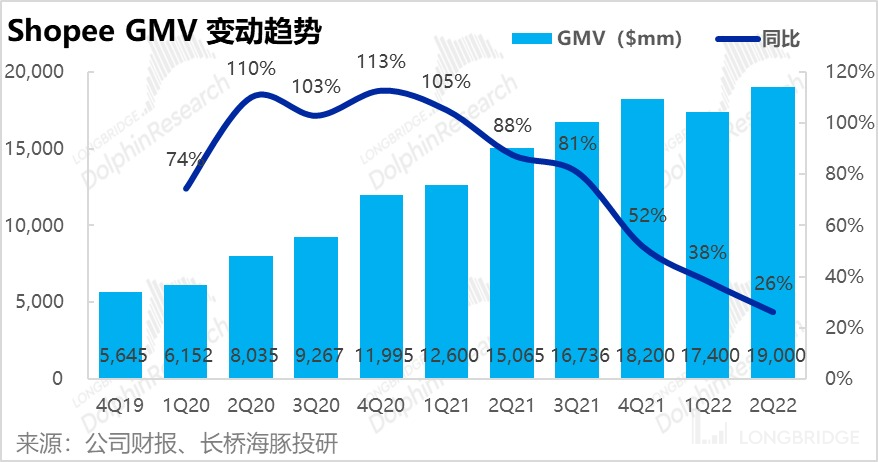

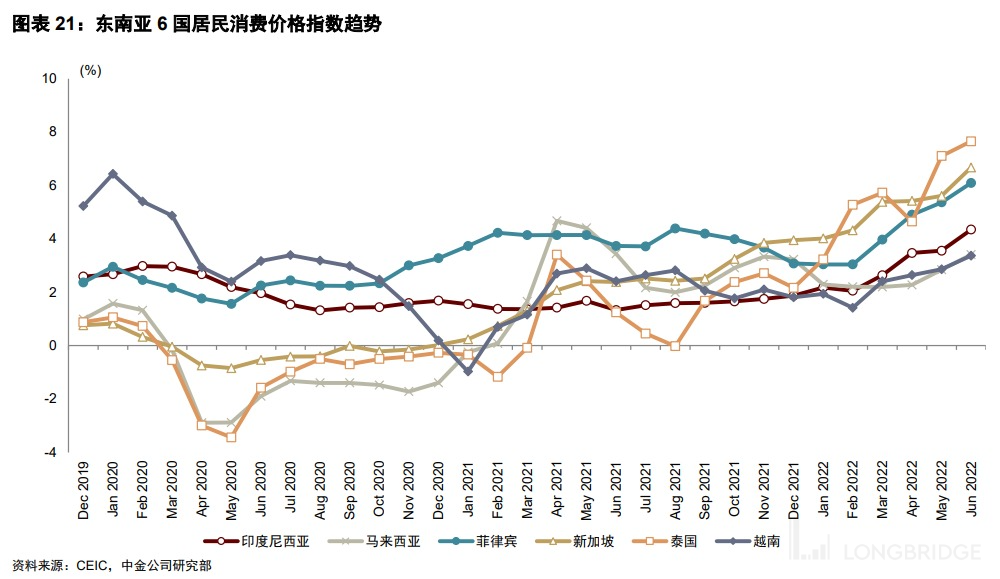

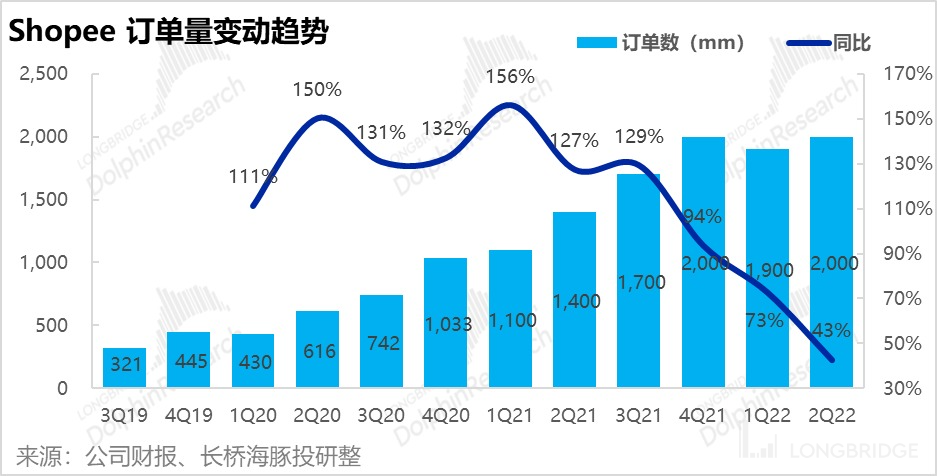

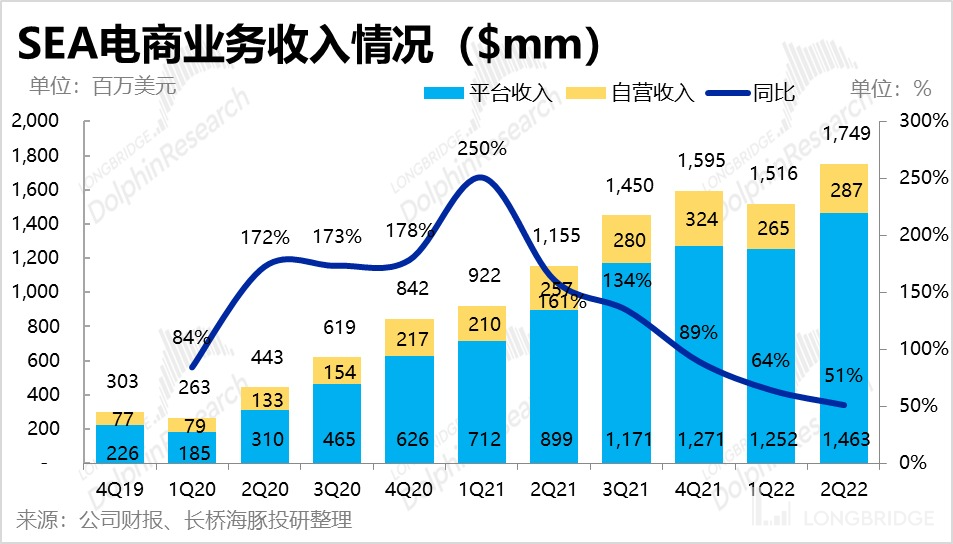

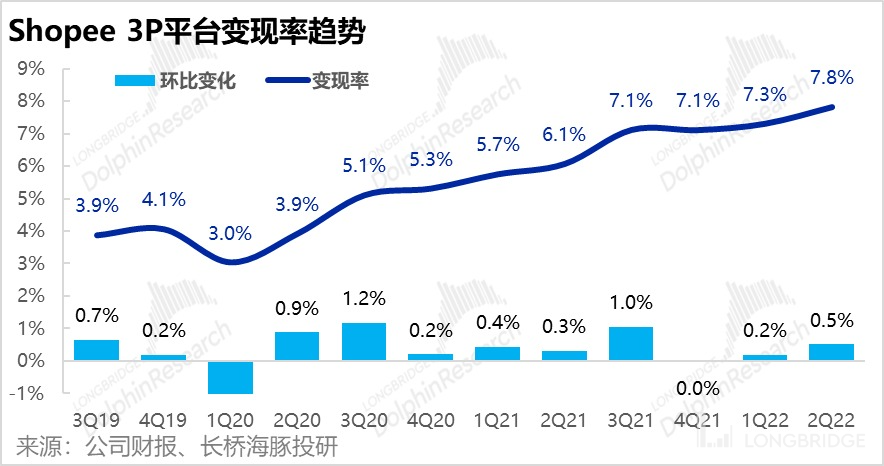

2. Shopee e-commerce business: Due to the combined impact of the appreciation of the US dollar, inflation worldwide, and the recovery of offline consumption, this season’s Shopee GMV growth rate has once again declined to 26%, amounting to CNY19 billion, lower than the market's lowered expectation of CNY19.9 billion. Fortunately, by optimizing monetization rates in core markets such as Southeast Asia (an increase of 50 basis points to 7.8% MoM), Shopee's revenue still achieved 51% growth to $1.75 billion. However, it still fell short of the excessively optimistic market expectation of $1.88 billion due to the growth slowdown caused after the company shifted its strategic focus from scale to profit.

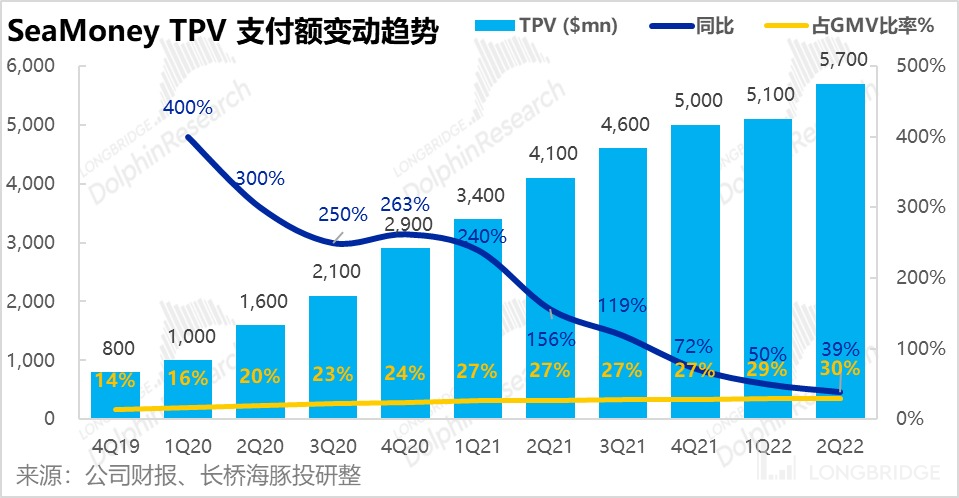

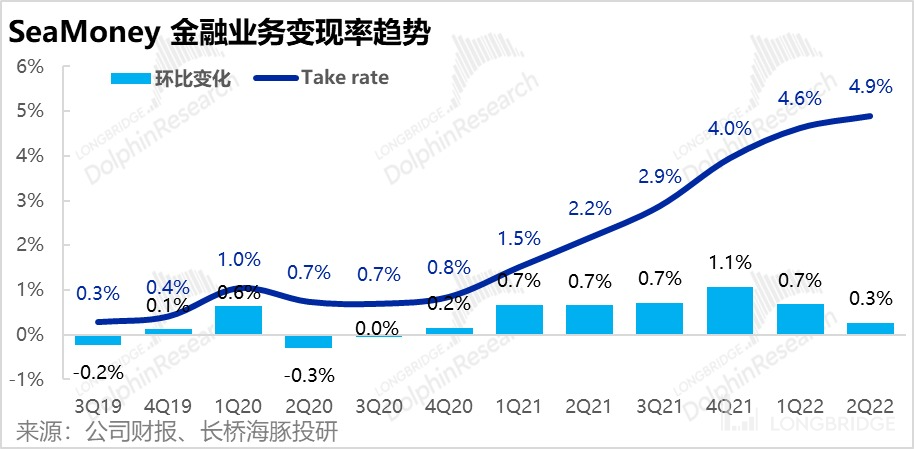

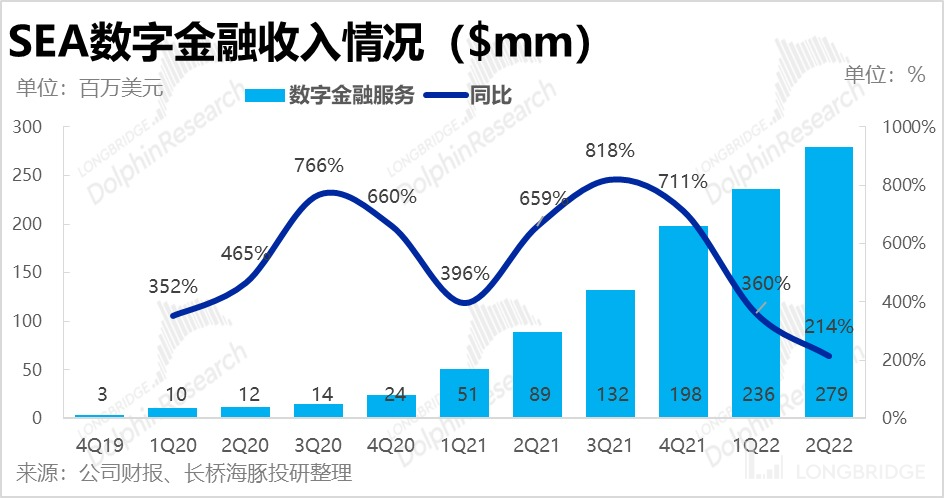

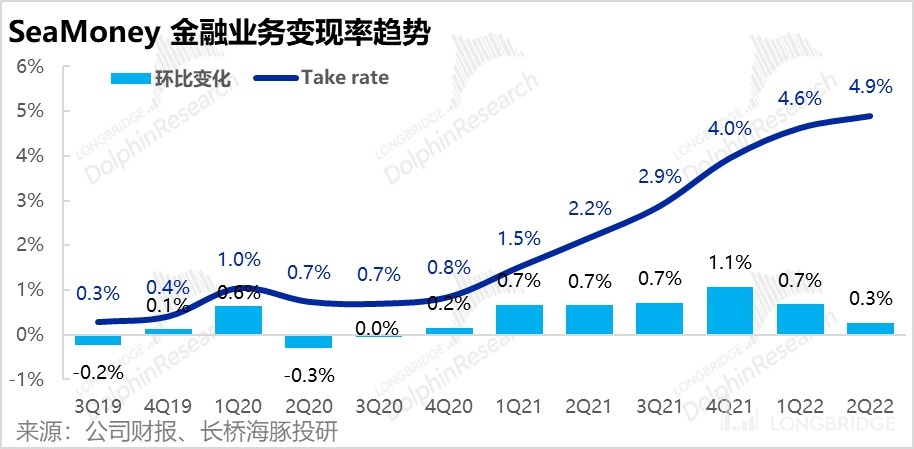

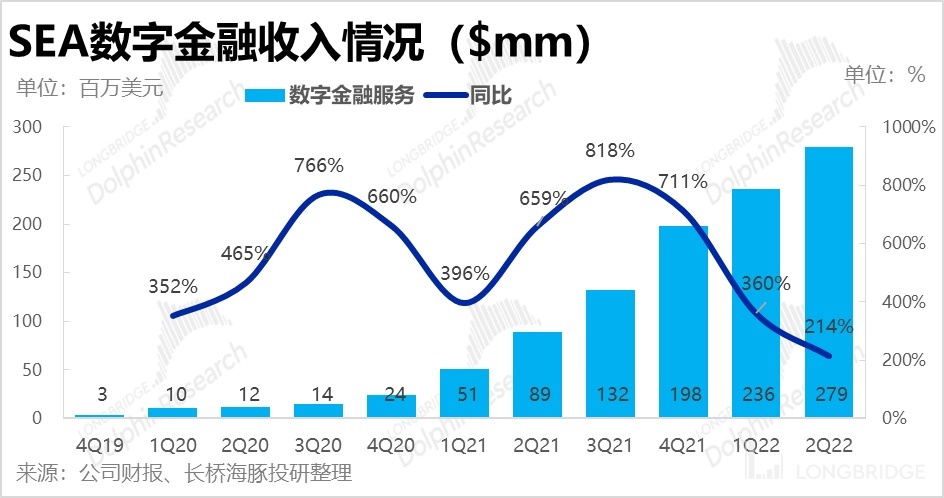

3. SeaMoney digital finance: The financial business is still growing rapidly, with TPV reaching $5.7 billion this quarter, and a new high in MoM net increase. At the same time, due to growth in non-payment revenue, the monetization rate has once again increased MoM by 30 basis points to 4.9%, driving revenue to continue to skyrocket YoY by 2.1 times to $280 million.

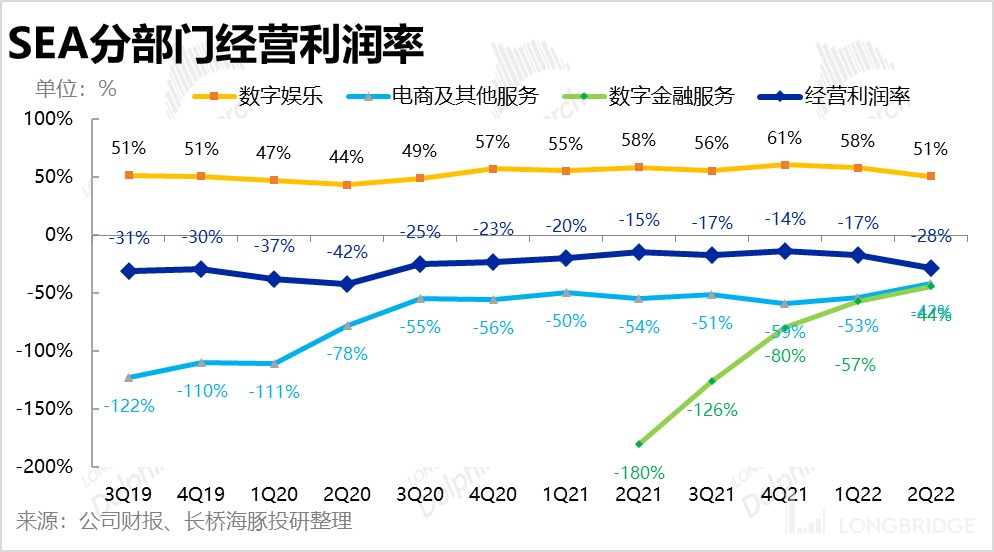

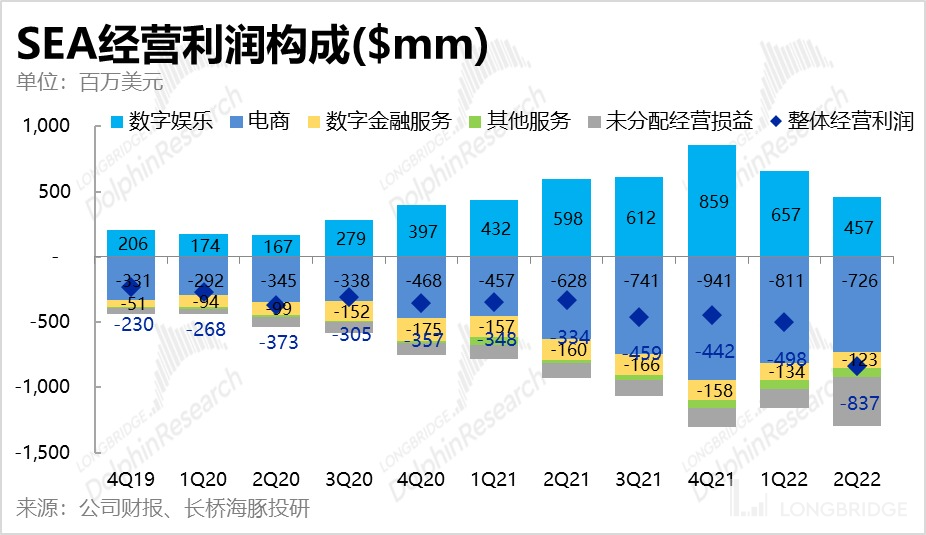

4. Growth slows down but profit release improves, viewed by segment:

a. For the gaming business, the decrease in payment rates and the increase in activity investment led to a decrease in gross profit margin from 73% to 71%. Meanwhile, the joint effect of marketing investments made to retain users and R&D investments made for self-developed games led to a significant deterioration in the operating profit margin of the gaming segment from 58% to 51%. The EBITDA of the segment excluding equity incentives and deferred impact was $330 million, lower than the expected $360 million.

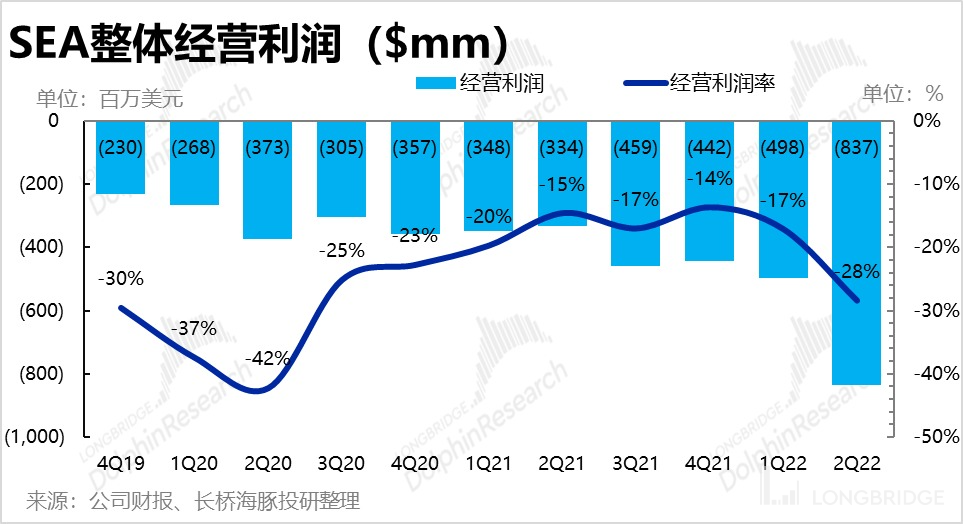

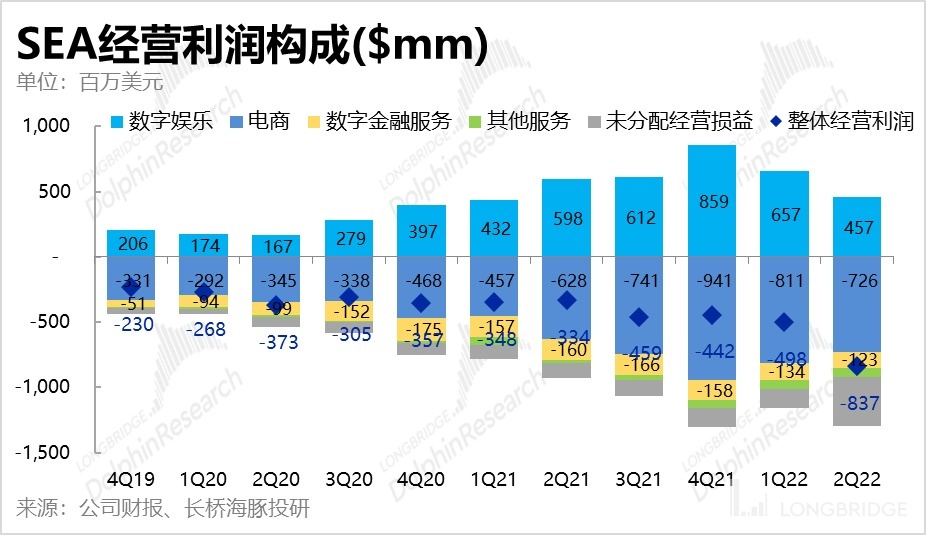

b. With the help of the company's active contraction to core markets and multiple increases in monetization rates, this season's Shopee segment's operating loss rate has significantly improved from 53% to 42%. Adj. EBTIDA is a loss of $650 million, roughly in line with market expectations. However, considering that this season's e-commerce revenue fell short of expectations, the actual profit improvement is still slightly below the market's expectations. 5. Overall profit further deteriorated: The gaming and e-commerce sectors did not perform well in terms of profit release. However, at the group level, due to the doubling of the total number of employees within 21 years and the significant increase in R&D personnel, including game development, the overall management and R&D expenses of the company still doubled at a rate of about 100% this quarter. Therefore, although the marketing expenses with the maximum elasticity have basically stopped increasing, the overall operating losses of the company still expanded significantly to RMB 837 million, far higher than the market's expected loss of RMB 600 million.

Even after deducting the goodwill impairment of US$170 million in this quarter, the adjusted EBITDA loss of the company as a whole of RMB 510 million is still higher than the expected loss of RMB 480 million.

Therefore, despite the company's strategy of sacrificing growth for profits, the degree of actual profit improvement is still lower than the market's expectations.

Dolphin Analyst's viewpoint:

Overall, the core problem of SEA's financial report this quarter is: even though the company has shifted its strategic focus to profits, the decline in Garena's profitability has not improved, and Shopee, which sacrifices growth for profits, has not improved its profitability as expected while also growing slower than expected. It can be said that any turning point signal expected by the market has not appeared. Moreover, under the adverse macro environment and increasingly severe profit pressure, after already lowering guidance once, the management announced this time that it would abandon the guidance of Shopee's business revenue. From this point of view, the growth situation in the second half of the year is likely to be even worse. Overall, SEA is still in a painful transitional period.

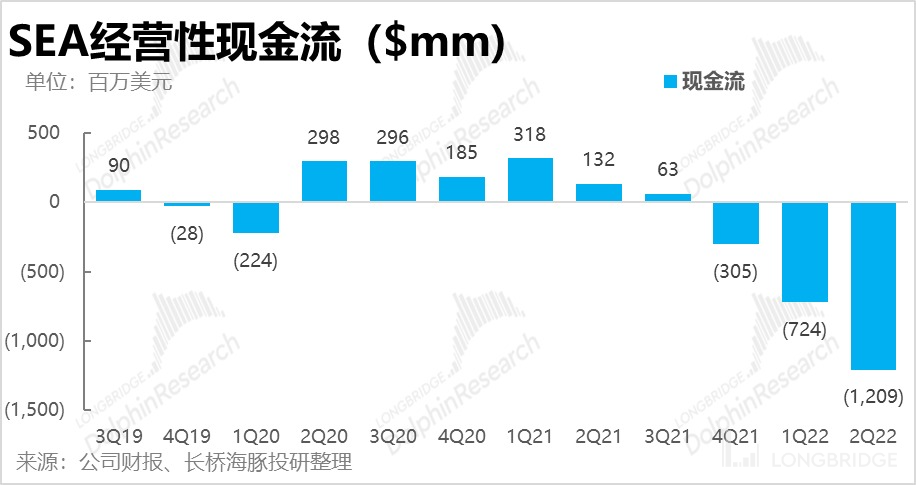

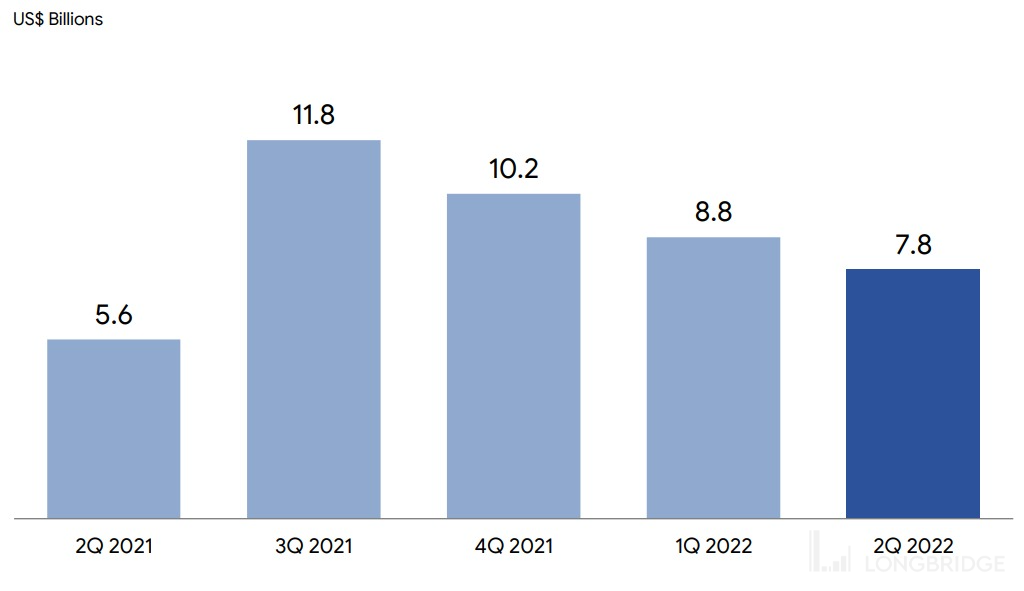

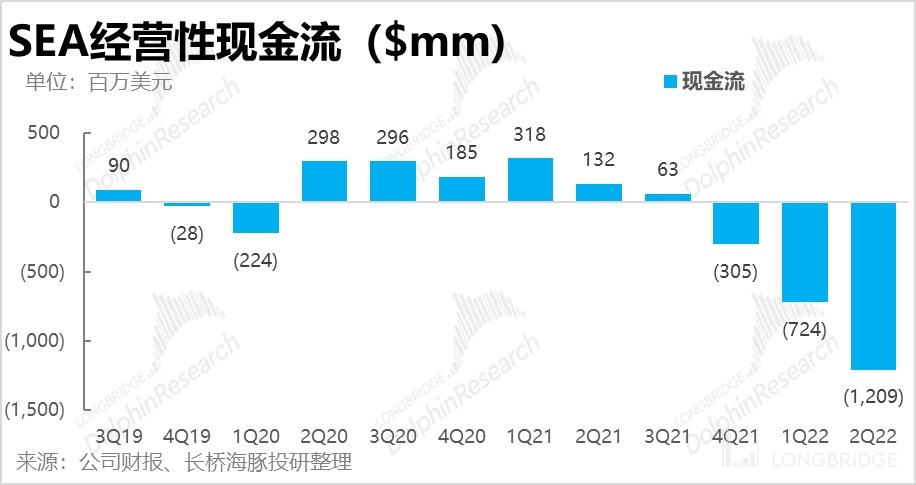

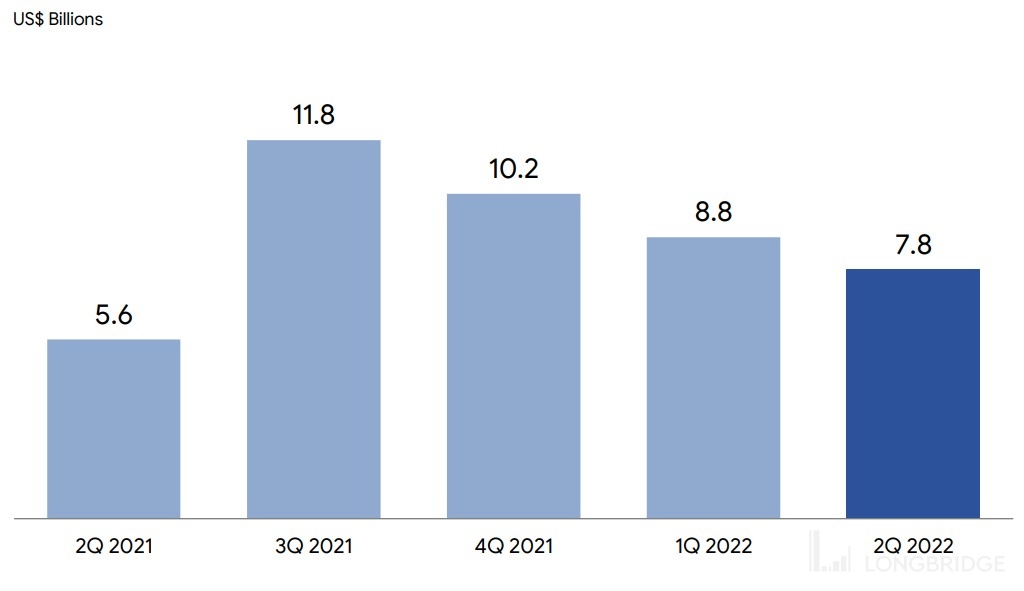

From the perspective of cash flow, the net operating cash outflow was once again as high as US$1.2 billion this quarter, and the company's cash and cash equivalents at the end of this quarter also continued to decline to only US$7.8 billion. It can be seen that the pressure on the company's funding is becoming greater and also a potential risk.

The following is a detailed interpretation of the financial report:

I. Garena Games: User stabilization, but hematopoietic ability continues to decline

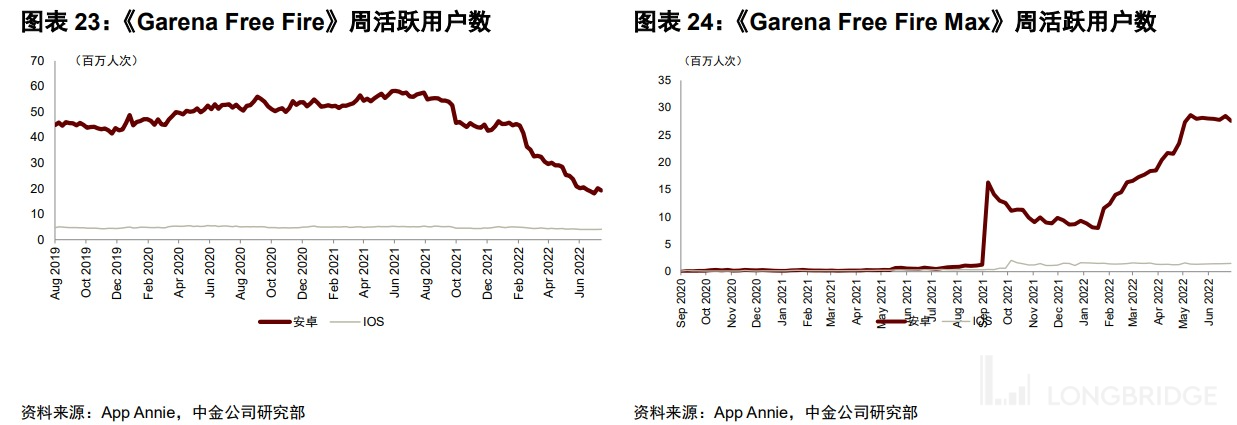

After several quarters of user loss and revenue shrinkage, the market has been waiting for the turning point of Garena games characterized by user and revenue stabilization and the release of the company's blockbuster new games. As of the second quarter, it is expected that the number of users will stabilize, but revenue has not yet bottomed out, and there is no sign of a blockbuster game release in the company's game pipeline.

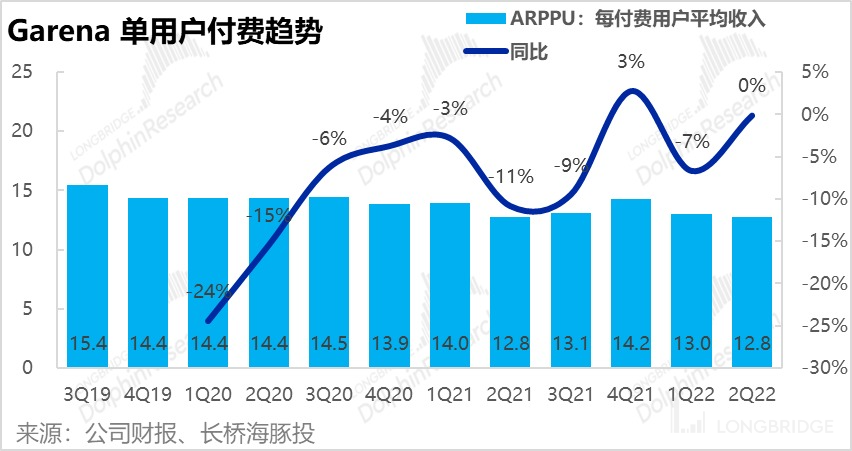

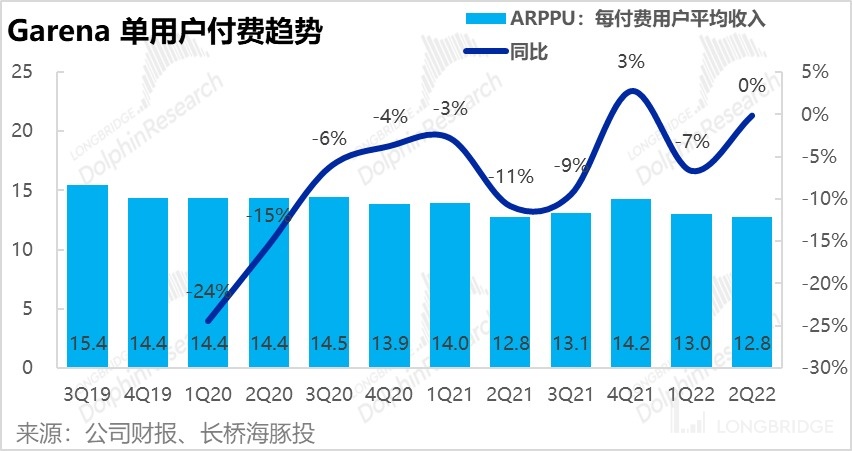

Firstly, from the perspective of user data, the quarterly active users of Garena unexpectedly stopped falling and turned to growth on a month-on-month basis. The number grew from 61.6 million last quarter to 61.9 million, far exceeding the market's expected decline to 52.1 million. However, the number of paying users that truly generate cash flow decreased again on a month-on-month basis to 56 million, a decrease of nearly 40% year-on-year. It is reported that in order to retain users in the future and keep the game community active, Garena has increased its promotion and event efforts this season, which seems to have had a significant effect (but also led to increased spending). However, most of the players obtained through "smashing money" are still "freeloaders", and as the game product line continues to age, players' willingness to pay continues to decrease.

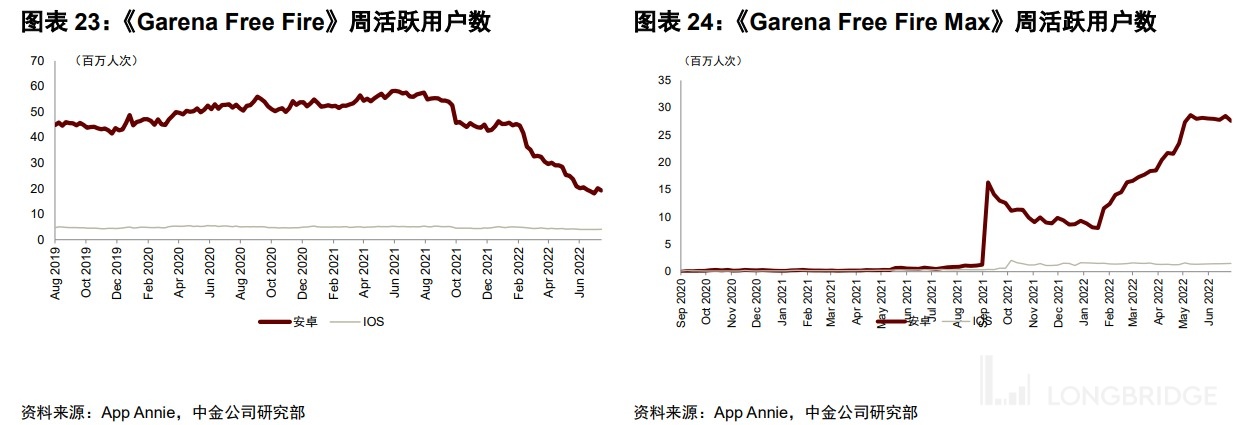

According to data from professional agencies, the weekly active users of Free Fire have decreased by nearly half, but they have now basically stabilized, and a considerable portion of the lost users have been taken over by the high-definition version, Free Fire Max. Therefore, after three consecutive quarters of declining users, Garena's active user count may enter a plateau period and not have a significant loss.

Fortunately, although the total number of paying players continues to decrease, the average amount of payment per loyal player remained unchanged from the previous quarter. Therefore, the game revenue for this quarter was 717 million US dollars, a decrease of 39% compared to last year, which is almost equivalent to the degree of loss of paying players.

Therefore, although the game business confirmed revenue of 900 million in this quarter, a decrease of 12% compared to last year, which seems better than the market's expected 830 million US dollars; the main reason is still that the company accelerated revenue recognition, and the deferred income balance of game business decreased by 180 million US dollars this quarter. If the deferred impact is excluded, the adjusted game business revenue is 720 million, a year-on-year decrease of 39%, which is lower than the market's expected 740 million. Therefore, the revenue-generating ability of the game business is still deteriorating.

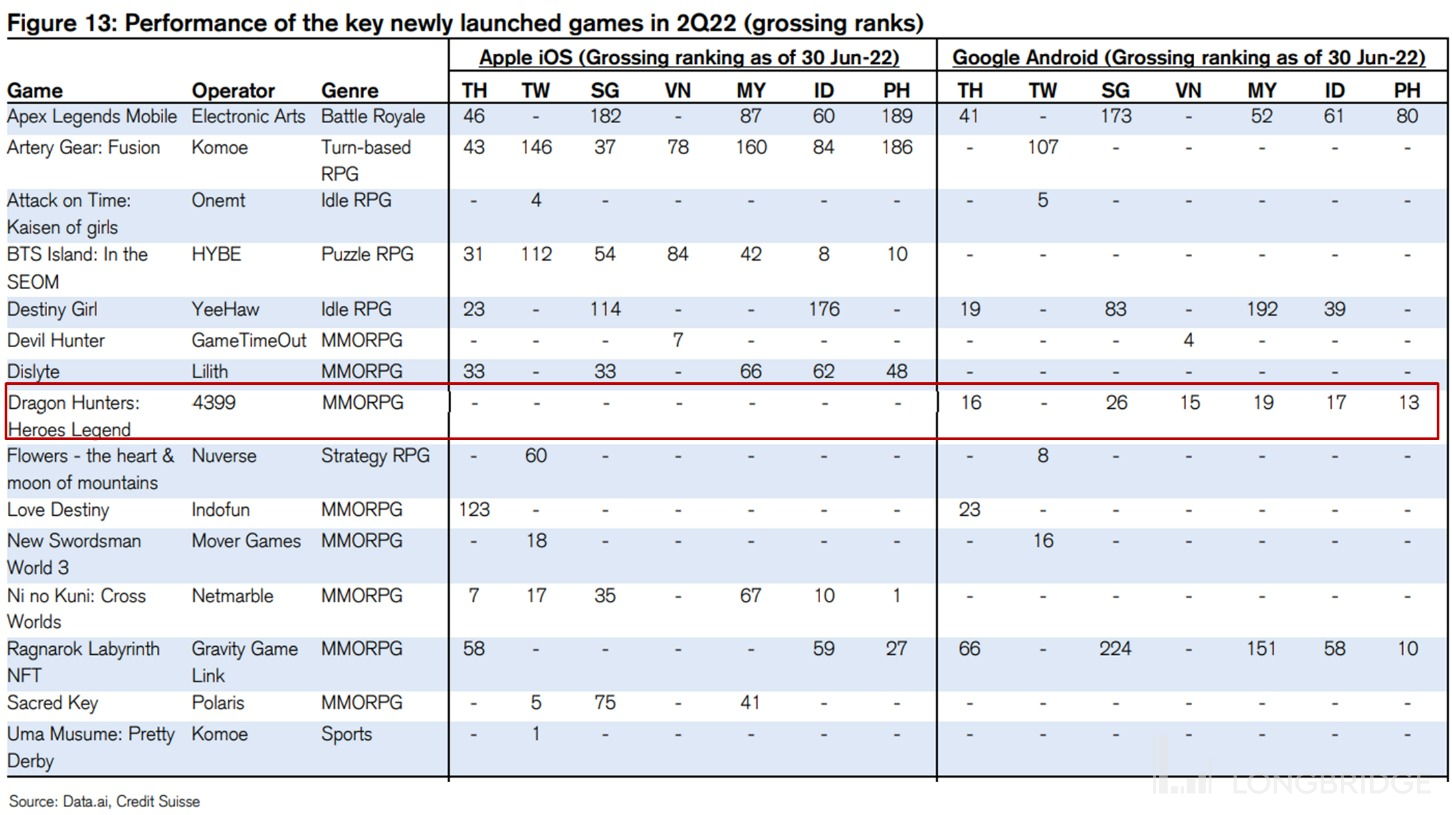

Among the games newly released by Garena in the second quarter, the ones that are worth paying attention to are Apex Legends mobile version developed by EA, Dislyte Perceptionist developed by Lilith, and Dragon Hunter Legend under 4399. The latter two games are relatively popular in the released regions, but they have not yet contributed considerable income. The company still urgently needs a blockbuster new work.

Shopee E-commerce: Exchange Growth for Profit Performance Disappointing

Due to the deterioration of the company's game revenue-generating ability, Sea has shifted its strategic focus from growth to profit for its Shopee e-commerce business since the fourth quarter of last year. As a result, it has successively launched in the French, Indian, and Spanish markets, and has also shrunk in other South American countries outside of Brazil. Whether the e-commerce business can quickly break even is also a matter of great concern to the market. However, from the performance of this quarter, the slowdown in the growth rate of the e-commerce business was slightly faster than expected, and the improvement in profitability was not as good as expected.

Firstly, this quarter Shopee achieved a GMV of 19 billion USD, a year-on-year growth rate further decreased to 26%, and lower than the expected 19.9 billion USD. Although the market has anticipated the negative impact of the appreciation of the US dollar, inflation worldwide and the recovery of offline consumption on e-commerce consumption in Southeast Asia and South America, and has revised its expectations downwards, Shopee's actual performance is still somewhat poor. It can be seen that the company's voluntary contraction has had a considerable drag on growth.

From the perspective of price and volume driving, due to the company's slowing down the pace of opening up new markets and focusing on the core markets of Southeast Asia and Brazil, the decline in Shopee's average order value has decreased significantly. However, at the same time, Shopee's order growth rate this quarter has further slowed from 73% in the previous quarter to 43%, thus dragging down the growth of GMV.

Translated into e-commerce revenue, this quarter's revenue was 1.75 billion USD, a year-on-year growth of 51%, and the growth rate is still considerable. However, the revenue was still lower than the market expectation of 1.88 billion USD.

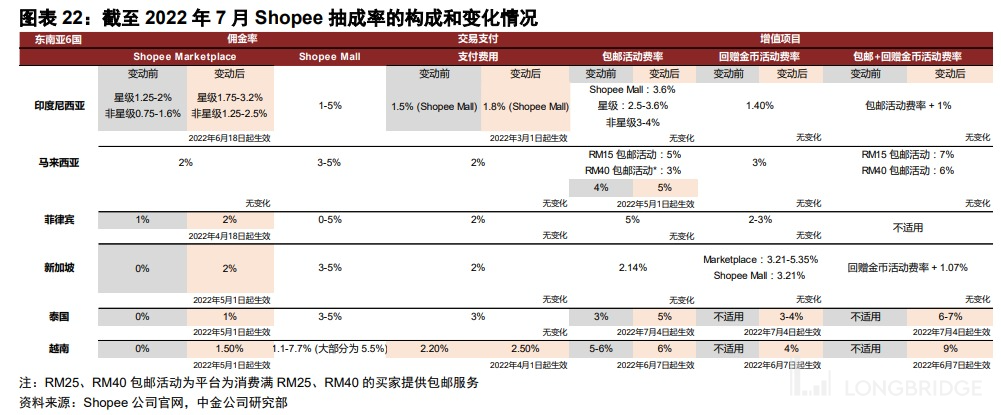

However, revenue growth is significantly higher than GMV growth, reflecting the company's measures to improve the profitability of its e-commerce business and increase its realization rate. Calculated by the Dolphin Analyst, Shopee's e-commerce business realization rate this quarter was 7.8%, an increase of 50 basis points quarter-on-quarter. According to Shopee's disclosure on its official website, the company has raised commission fees, payment fees, and postage rates in various Southeast Asian markets since April this year. In July, it also announced its decision to raise the cash-out rate in Thailand. Therefore, it is expected that Shopee's cash-out rate will continue to increase in the third quarter.

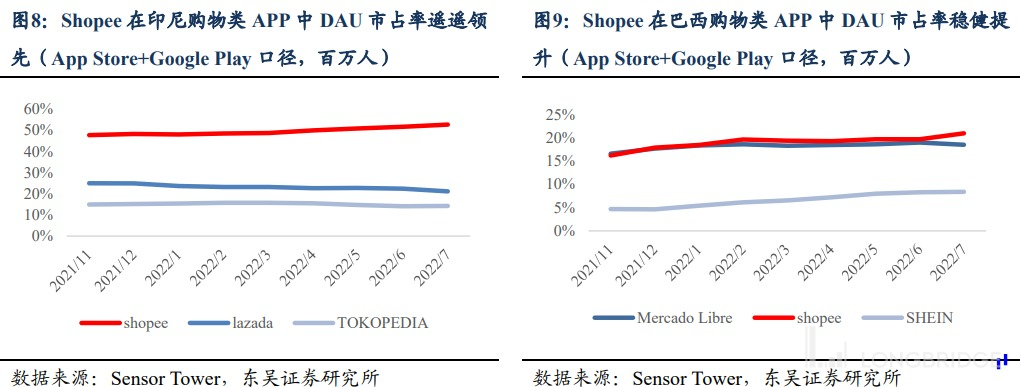

However, in terms of competition, Shopee sits steadily in the first place in the user market share of its largest market in Southeast Asia - Indonesia's shopping app, and is still rising. In the Brazilian market, Shopee has also recently widened the gap with second-place Mercado Libre.

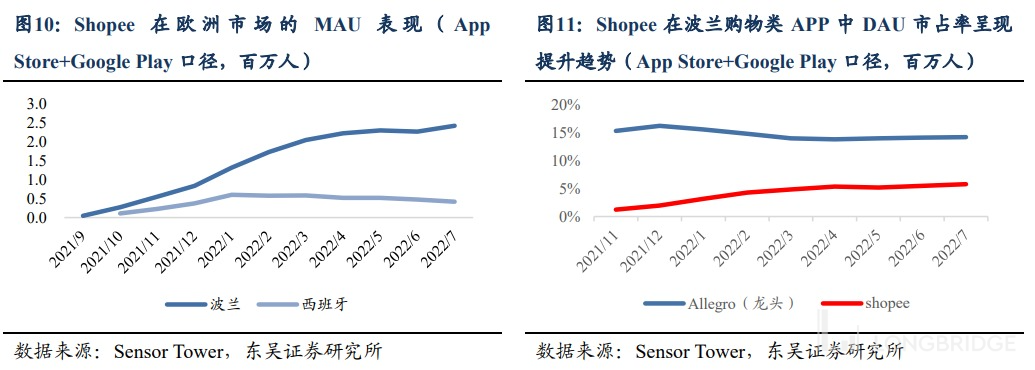

In the European market, Shopee currently performs best in Poland (the Dolphin Analyst previously believed that Shopee is more likely to succeed in relatively underdeveloped markets) and is gradually reducing the gap with the local e-commerce leader.

Therefore, Shopee's competitive position in the existing market is still quite stable, but it is greatly affected by the macro-level adverse factors.

SEA's emerging digital financial business - SeaMoney, achieved a TPV of $5.7 billion on the platform this quarter, a year-on-year increase of 39%. Although the growth rate seems to be slowing down, from the perspective of revenue growth, the actual growth is accelerating in this quarter. As of the end of this quarter, SeaMoney has had 52.7 million users, with an increase of 3.7 million users from the previous quarter.

In addition to the rapid growth of TPV, SeaMoney's monetization rate is also continuing to improve, reaching 4.9% this quarter. (It should be noted that, in addition to the fees based on TPV, revenue from other lending businesses is also growing, thereby driving the monetization rate under the TPV scale to increase rapidly). Due to the double growth of TPV and realization rate, SeaMoney's revenue in this quarter was US$280 million, an increase of 2.1 times year-on-year, but still slightly lower than the expected revenue of US$288 million.

Overall, as an emerging business, SeaMoney's digital financial business is still growing rapidly. However, due to its small revenue scale and inability to contribute positive EBITDA, this business cannot currently contribute to the company's valuation.

4. Overall performance: the revenue of each business exceeded expectations and slowed down, and the improvement of profits was also not good.

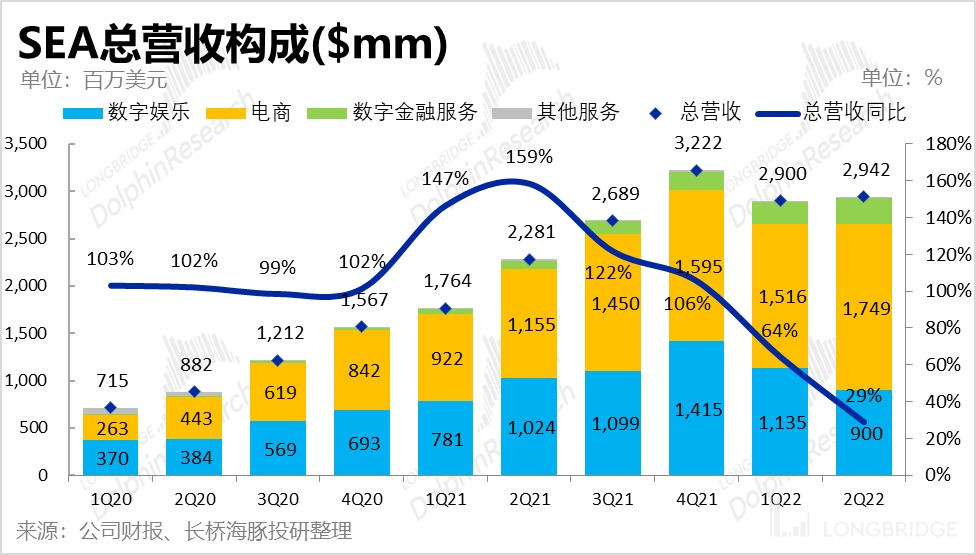

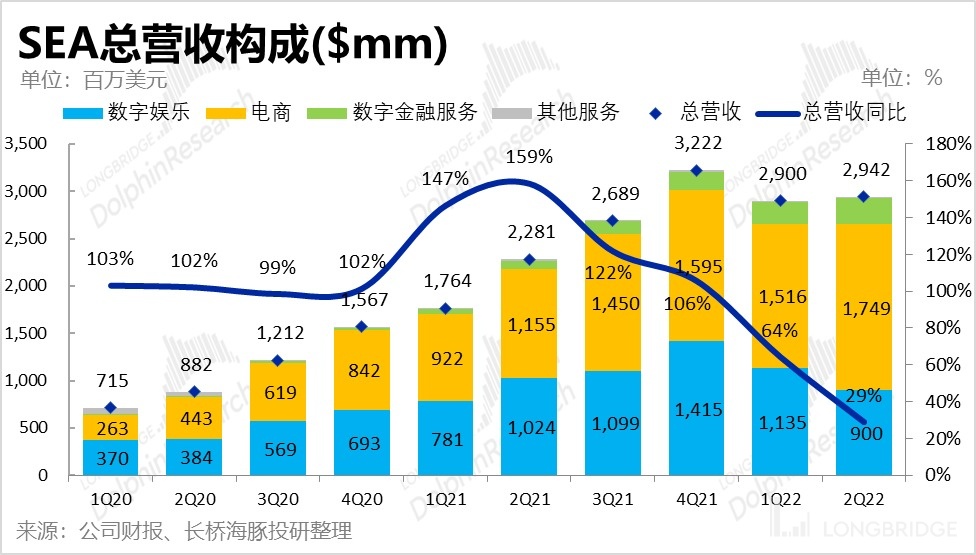

Due to the lower-than-expected revenue growth of games (excluding deferred impacts), e-commerce, and financial businesses, the overall revenue performance of the company is naturally not good. This quarter achieved a total revenue of US$2.94 billion, lower than the expected 2.97 billion yuan, and the year-on-year growth rate also slowed to 29%.

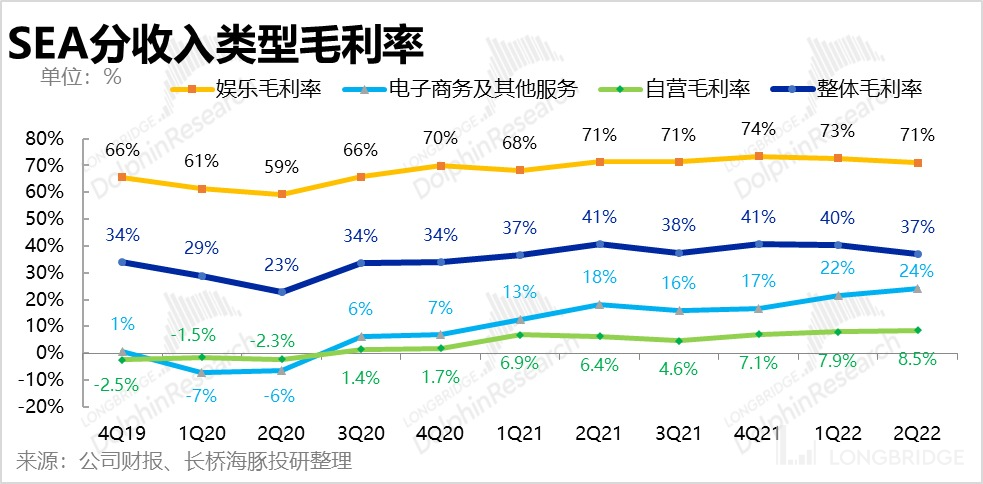

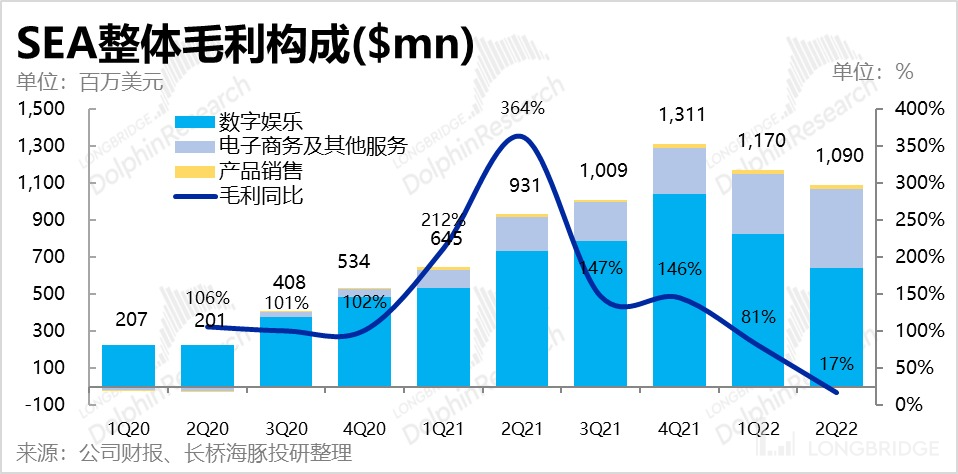

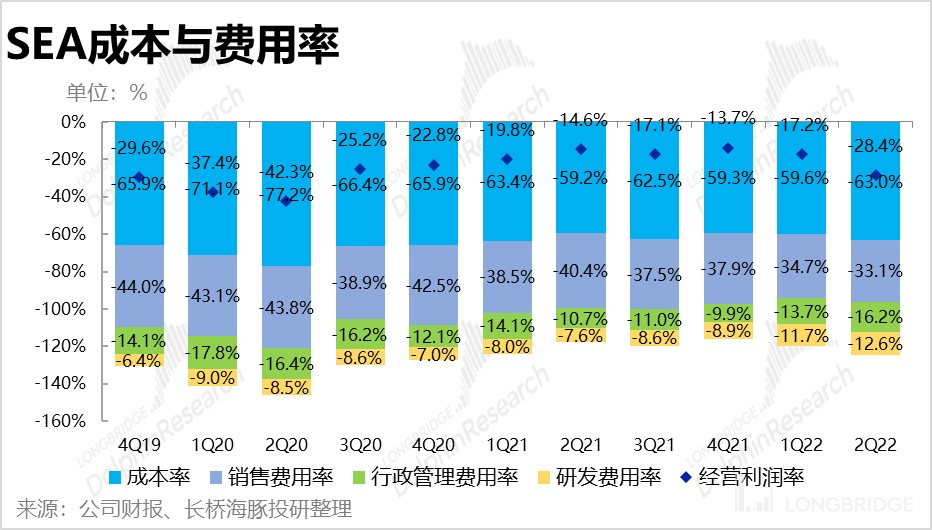

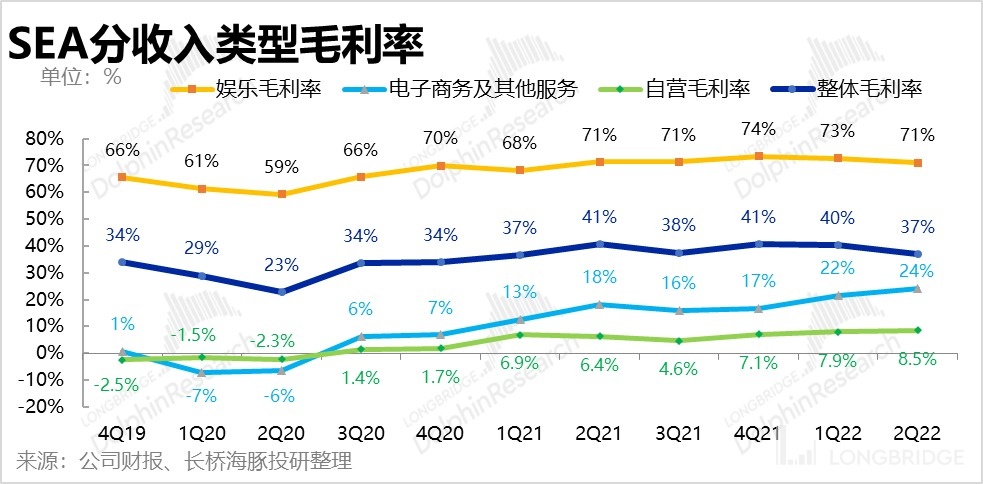

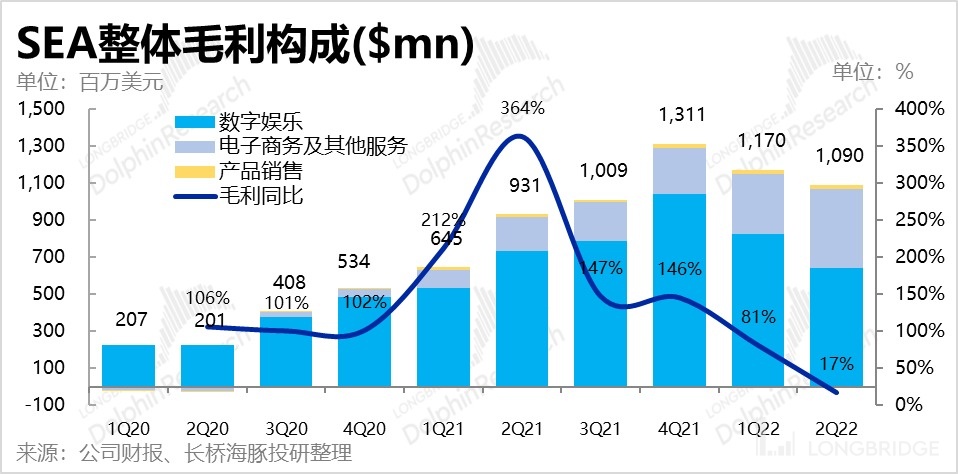

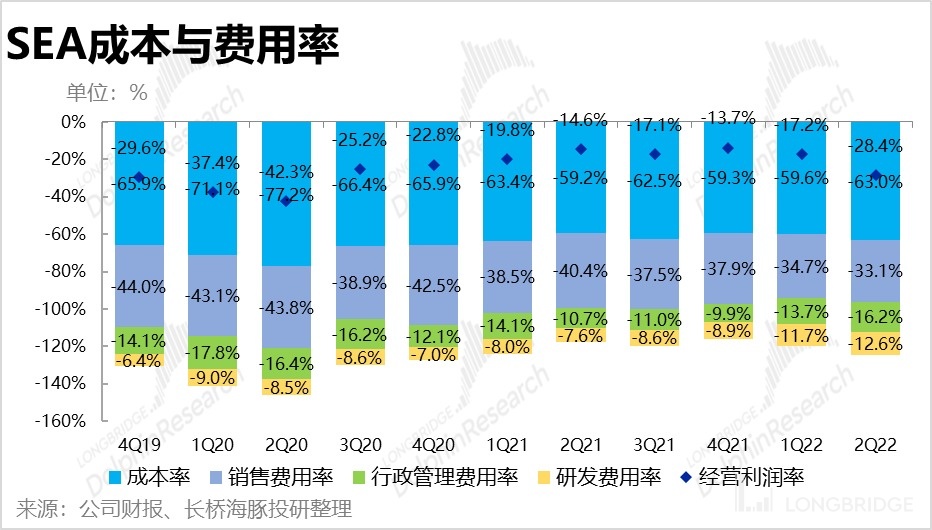

In addition to the poor revenue growth rate, due to the decrease in the proportion of paid players in the game business, and the increase in promotional expenses such as activities, this quarter's game gross profit margin dropped from 73% to 71%. Although the e-commerce and financial businesses have increased their gross profit margin under the strategic contraction, focusing on core markets and improving realization rates, due to the decrease in the proportion of high gross profit game business in the revenue structure, the overall gross profit margin of the company this quarter still significantly dropped from 40% of the previous quarter to 37%.

Due to the slowdown in revenue growth and the decline in gross profit margin, although the company's gross profit has continued to increase year-on-year, the gross profit has actually declined for three consecutive quarters on a quarter-on-quarter basis.

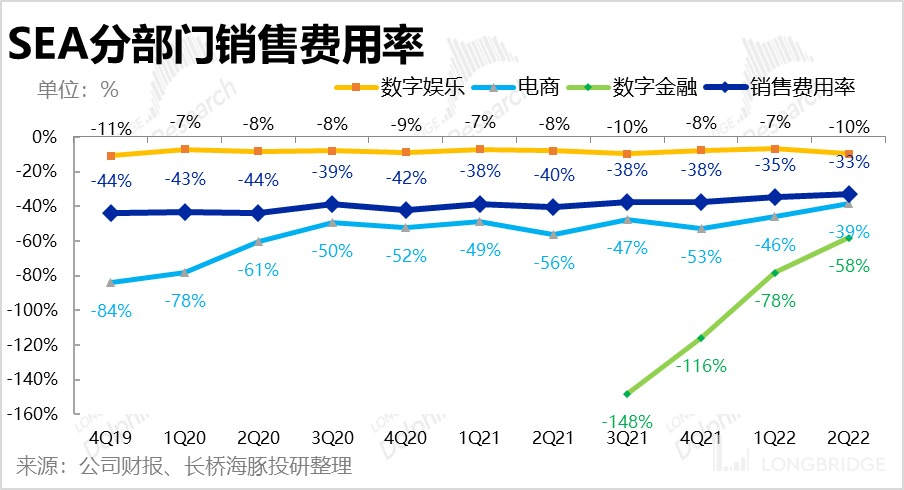

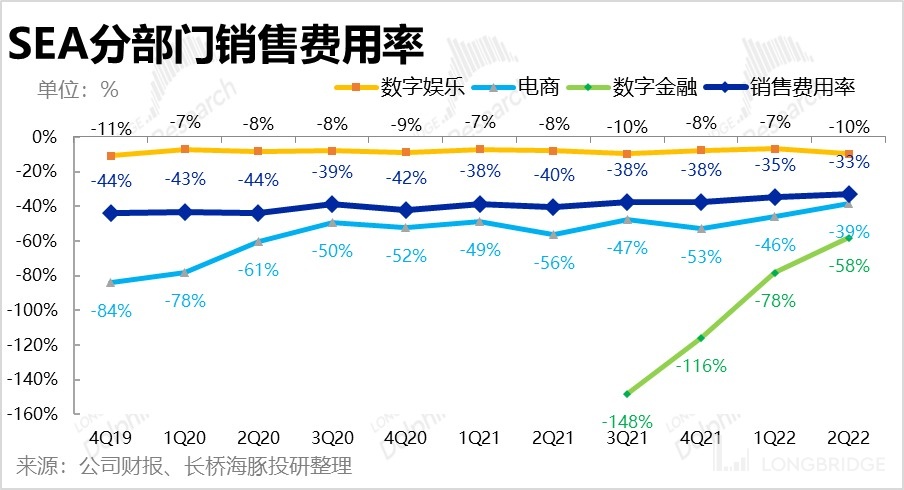

From the perspective of operating expenses, under the background of cost reduction and efficiency increase, the most elastic marketing expenses have grown rapidly, with a year-on-year growth of only 6% this quarter, and the percentage of revenue has also decreased by 2pct. Specifically, in order to retain players, the marketing expense ratio of the game sector in this quarter has increased from 7% in the previous quarter to 10%. The marketing expense ratio of the e-commerce and financial sectors has also narrowed significantly.

However, although the flexible marketing expenses have been successfully controlled, administrative expenses and R&D expenses are still increasing rapidly this quarter. Specifically:

-

Administrative expenses soared by 96% YoY, mainly due to the significant increase in bad debt losses caused by the rapid growth of SeaMoney's financial business. In addition, the overall increase in the number of employees in the company was also one of the reasons (according to the company's annual report, the company's overall number of employees doubled by the end of 2021 compared to 2020);

-

R&D expenses also increased sharply by 115% YoY, but the growth rate was slightly slower than the previous quarter. The company explained that this was mainly due to the significant increase in R&D personnel. As the company strengthened its self-developed game development capabilities, the number of developers increased from 5,000 to 11,000. Therefore, the growth of R&D expense ratio is reasonable.

Therefore, although the gross profit margin has declined, although marketing expenses have decreased, R&D and management expenses are still expanding significantly. Although the company claims to focus more on profits, the operating loss rate this quarter still increased significantly from 17% to 28.4%, and the company's operating loss expanded to 837 million, significantly higher than the market's expected 610 million (However, this includes the impact of confirming a goodwill impairment of 170 million this quarter). Therefore, while revenue growth has slowed down, the company's profit situation has not only not improved, but has further deteriorated.

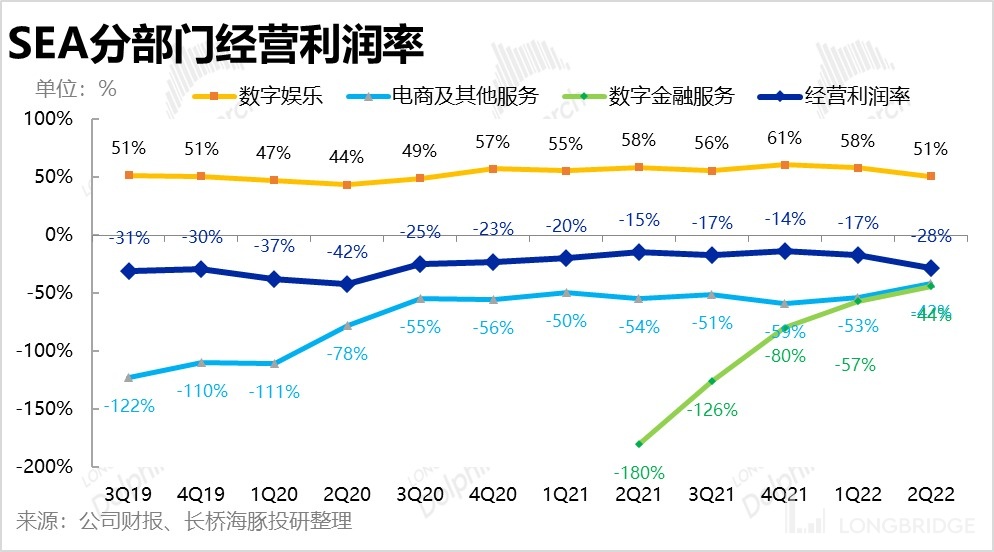

V. Profitability by Segment

1. Games segment: Due to the decrease in the proportion of paying users, the gross profit margin has declined, but the promotion and R&D expenses that attract users have grown against the trend. The operating profit margin of the gaming business this quarter has decreased from 58% to 51%. The adjusted EBITDA is 330 million, lower than the expected 360 million;

2. E-commerce segment: Due to the measures taken by the e-commerce business to control costs and improve monetization, the operating loss rate this quarter improved from 53% to 42%, and the reduction of costs and increase of efficiency achieved considerable success. The adjusted EBTIDA was a loss of 650 million, which was basically in line with the market's expectations. However, considering that the revenue of the e-commerce segment this quarter was lower than expected, the actual improvement in profit was slightly below the market's expectations; From Average Profit Perspective: This quarter, Shopee's average (excluding share-based compensation and goodwill impairment) adjusted EBITDA loss was USD 0.33, compared to USD 0.4 for the previous quarter.

Excluding headquarter cost allocation, Southeast Asia's average adjusted EBITDA loss was 1 cent, compared to 4 cents in the previous quarter.

The average adjusted EBITDA loss in South America this quarter was USD 1.42, compared to USD 1.52 in the previous quarter.

3. Financial Sector: As revenue scales rapidly, the operating loss rate of the financial business has also significantly narrowed to 44%, and the adjusted EBITDA is in line with the market's expectations at a loss of USD 112 million.

4. Group Level: In addition to the above sectors, the unallocated operating losses at the group level this quarter was a significant increase at USD 369 million, up from USD 144 million in the previous quarter, which also dragged down the group's overall operating loss.

VI. Cash Flow

From the perspective of cash flow, the net operating cash flow was a large outflow of USD 1.2 billion for the quarter. At the end of this quarter, the company's cash and cash equivalents continued to decline to only USD 7.8 billion. It can be seen that the company's financial pressure is increasing, which poses a significant risk.

Past Research:

May 17, 2022 Telephone Conference Call "Diversify Gaming Business, E-commerce Business to Make Profits (SEA Conference Call Summary)"

May 17, 2022 Financial Report Review "SEA: The Gaming Industry is Aging, E-commerce Stands Alone"

March 2, 2022 4Q21 Telephone Conference Call "SEA Conference Call Summary: Strategy Reversal, Game Entertainment Promotes Diversification, E-commerce Enhances Efficiency"

March 2, 2022 4Q21 Financial Report Review "SEA Wants to 'Refine': E-Commerce and Gaming Have Different Prospects." On January 5th, 2022, "Is 'Little Tencent' scaring Tencent's younger brothers? Sea's significance is different" was released.

On January 10th, 2021, "Is it better to stay put or expand overseas? Southeast Asia is still the 'land of dragon's prosperity' for SEA" was published.

On January 24th, 2021, "Integration of 'Taobao + Tencent + Alipay', the ultimate form of the Internet - SEA's journey goes beyond billions of dollars" was published.

Risk disclosure and statement for this article: Dolphin Analyst Disclaimer and General Disclosure