China Resources: The "Lone Hero" Brave Enough to Explore the Unknown Wants to Soar Higher

China Resources Beer (0291.HK) released the 2022 mid-year report on August 17th Beijing time. Although Dolphin Analyst thought that the performance of China Resources Beer would decline due to the high base of last year and the impact of the epidemic in the first half of this year, the results were surprisingly good. Among a pile of social service consumer stocks that Dolphin Analyst saw kneeling down in place, China Resources Beer seems to have a "brave" spirit:

-

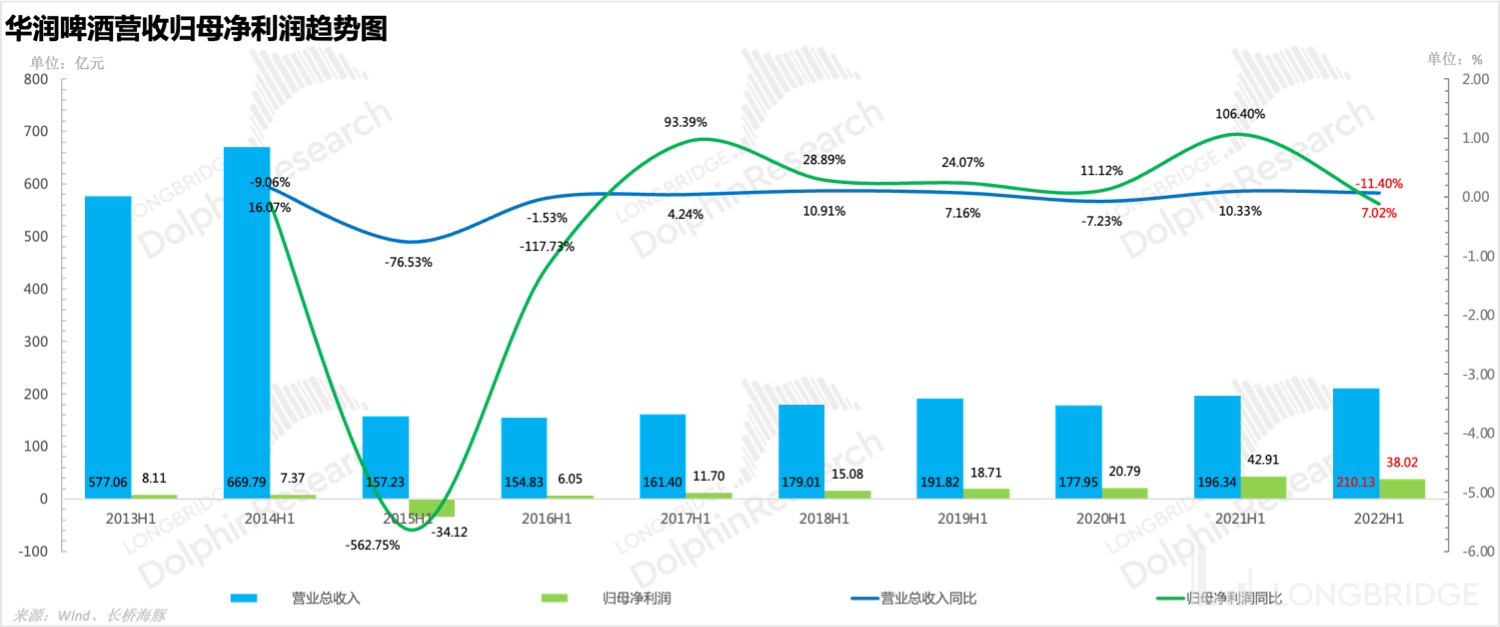

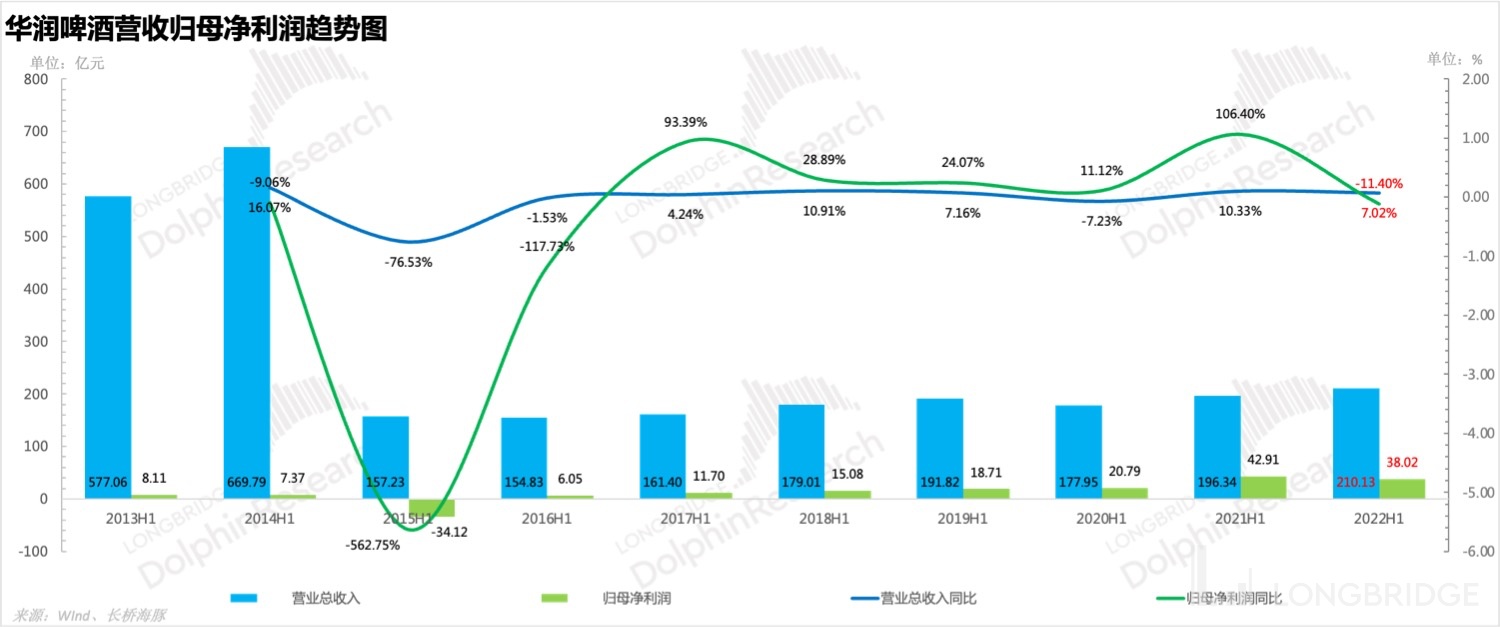

Revenue increased by 7% year-on-year. Although the net profit attributable to the parent company decreased by 11.4% year-on-year, it actually increased by 27.8% after excluding the relocation compensation of the same period; $Citigroup.UShina Resources Beer .HK

-

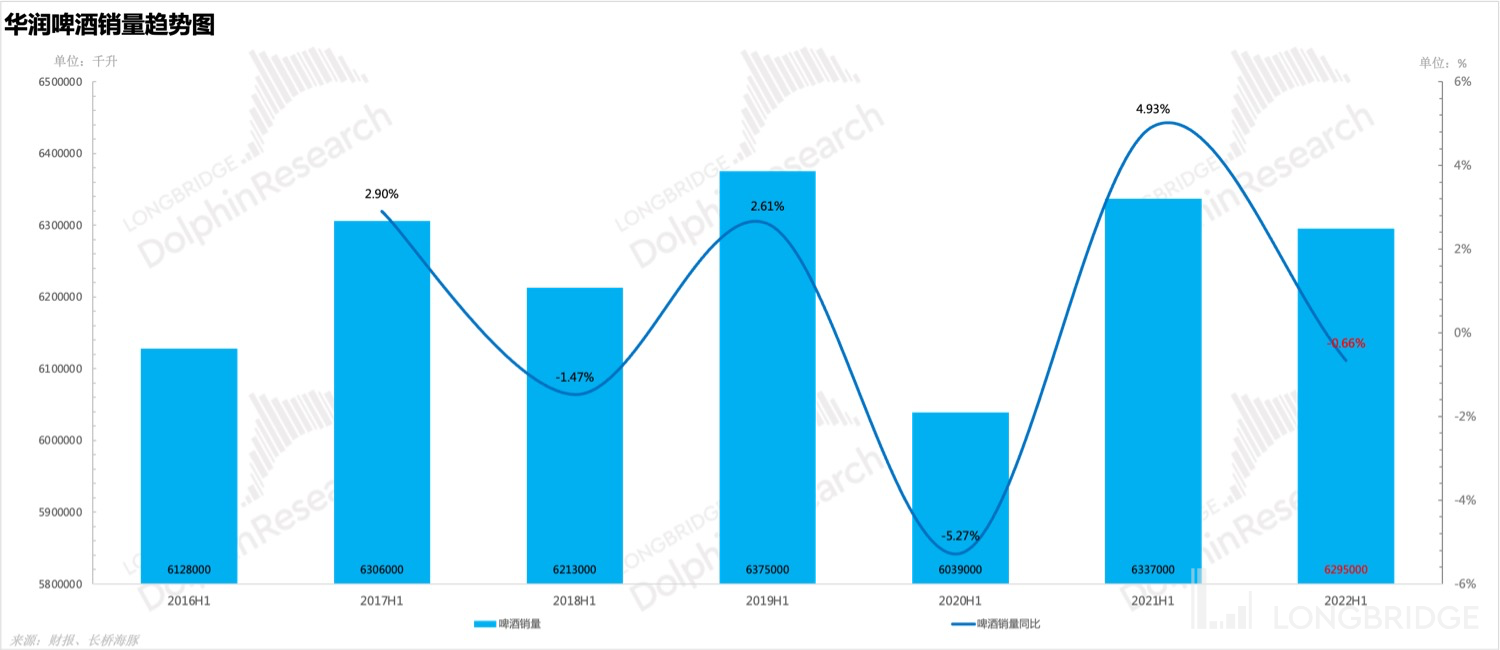

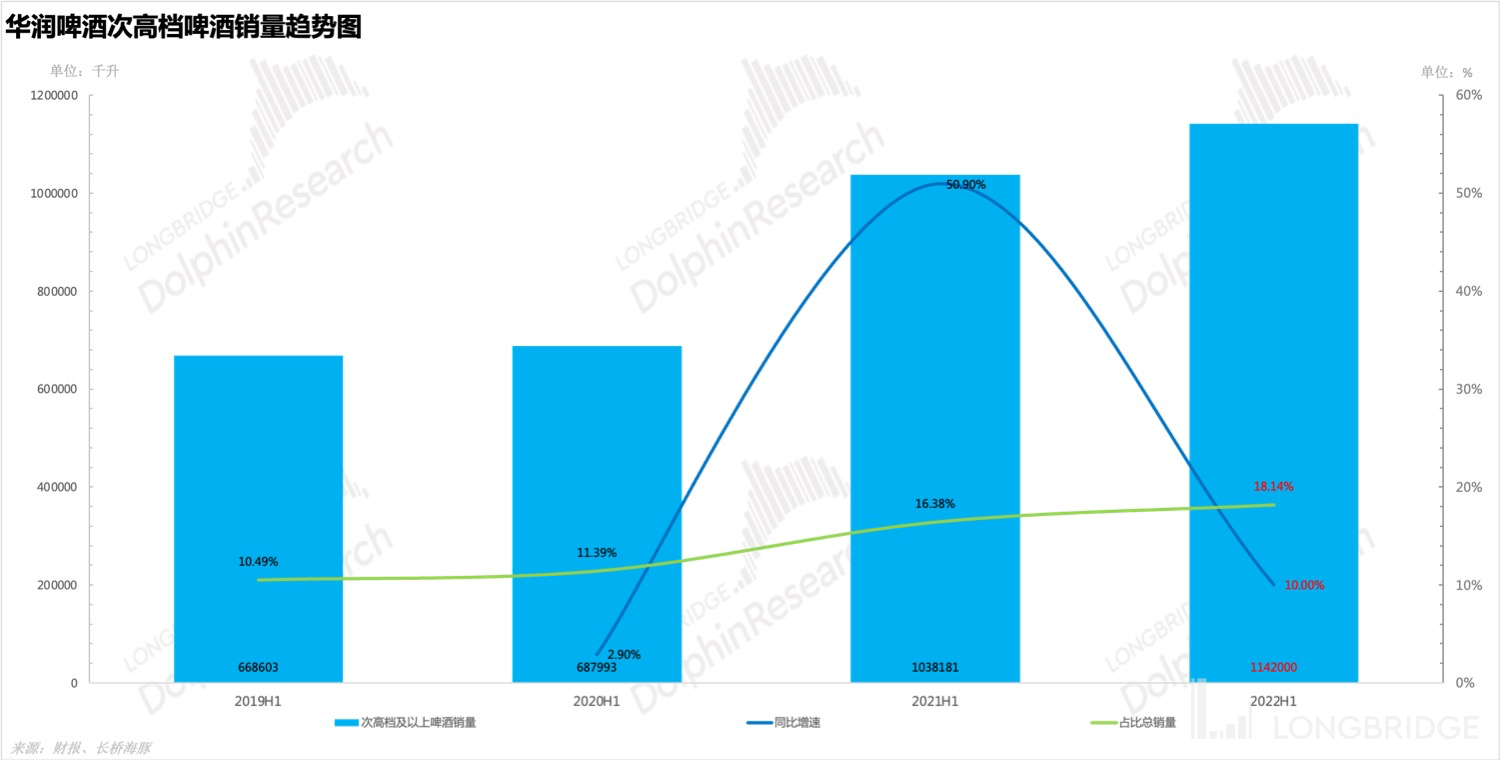

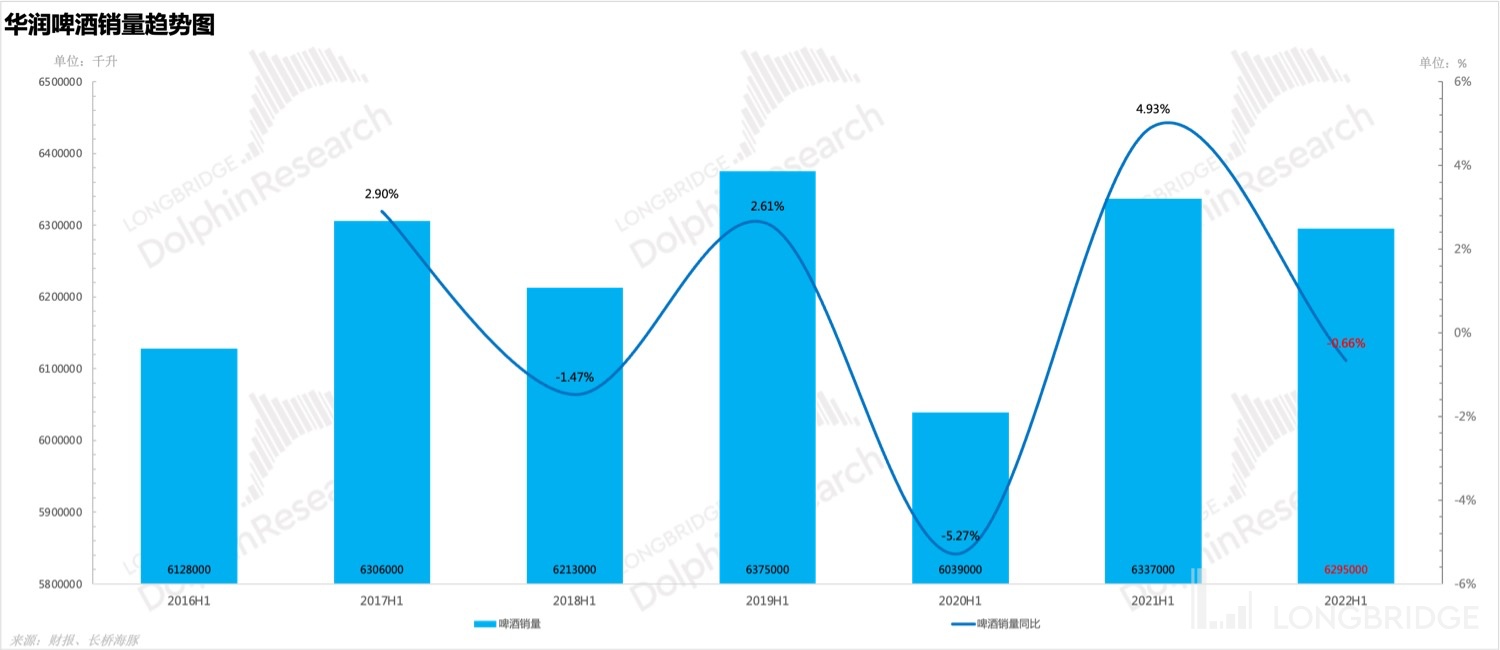

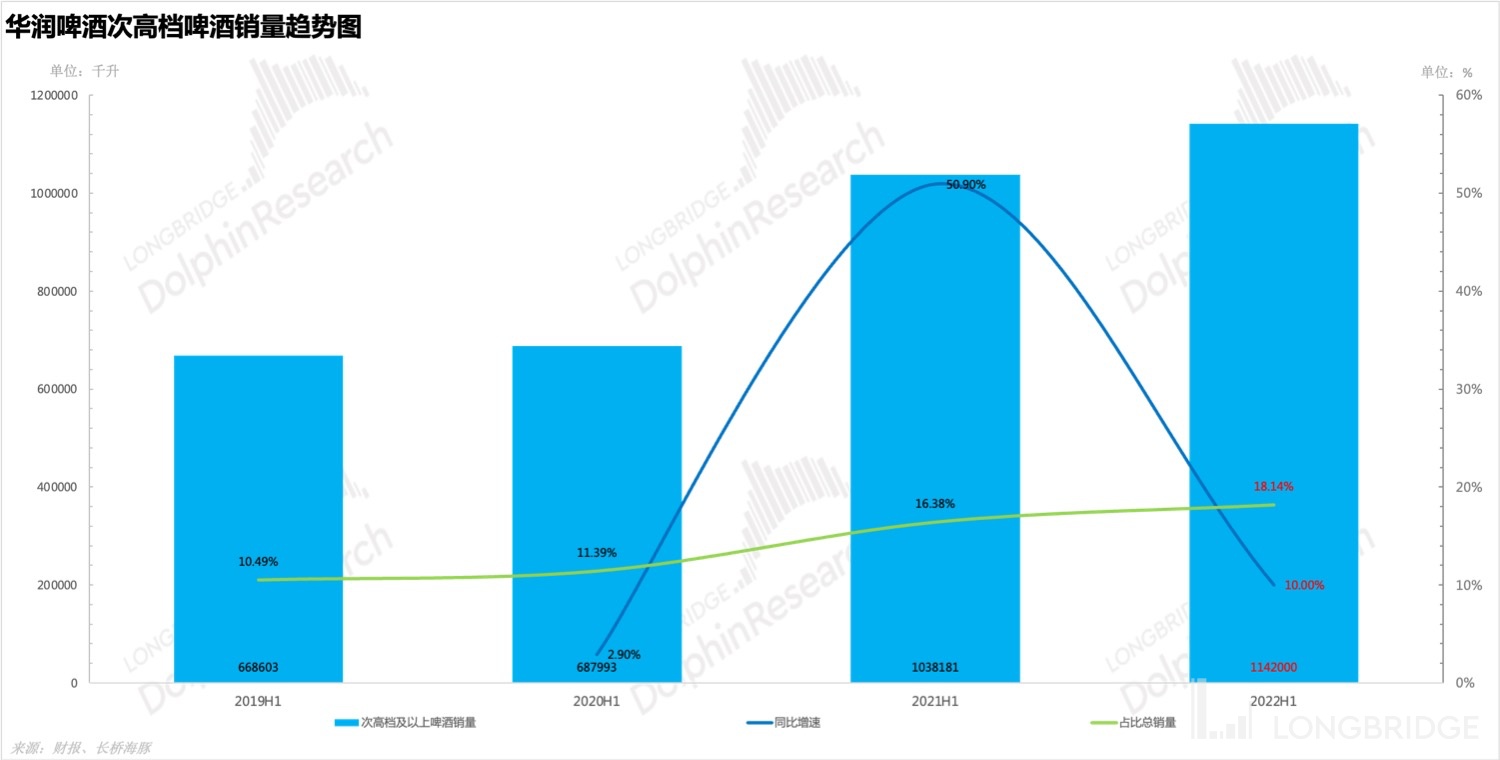

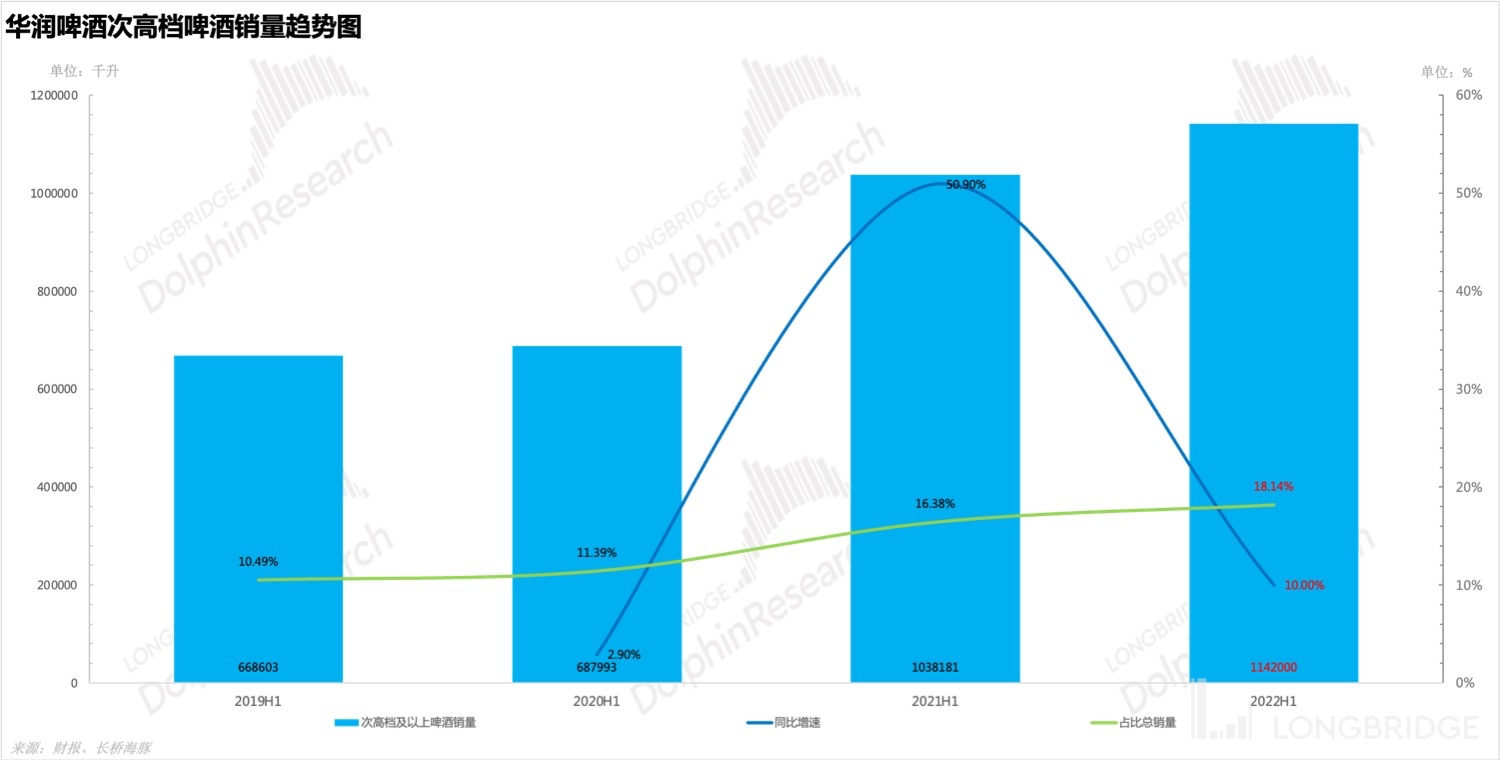

The total beer sales in the first half of the year were about 6.3 million kiloliters, a year-on-year decrease of 0.7%, which is better than Dolphin Analyst's expectations. The sales volume of mid-to-high-end products exceeded 1.142 million kiloliters, a year-on-year increase of 10%;

-

The product upgrade continues, the low-end large single product has completed direct price increases, and high-end products "Li" and Black Lion fruit beer have been launched.

The main points are as follows:

1. Stronger-than-expected performance: In the first half of this year, China Resources Beer achieved revenue of 21.013 billion yuan under the influence of the epidemic, a year-on-year increase of 7.02%, which is not easy and exceeded expectations! In addition, the net profit attributable to the parent company was 3.802 billion yuan, a year-on-year decrease of 11.04%, but after deducting the income of transferring land in the same period last year, the year-on-year growth rate of the net profit attributable to the parent company reached 27.8%. The rapid growth of the net profit attributable to the parent company is not only due to price increases, but also the help of cost control. In the first half of the year, China Resources' sales expense ratio was 15.3%, a year-on-year decrease of 1.4%, and the management expense ratio was 6.4%, a year-on-year decrease of 1.9%.

2. The overall sales volume remained basically the same as last year, and the sales of mid-to-high-end products continued to grow: China Resources' beer sales in the first half of the year reached 6.295 million kiloliters, a decrease of only 0.66% compared to the same period last year, and the sales of mid-to-high-end products continued to grow. Among them, the sales of Super X, Snowflake Pure Living, and Snowflake Mars Green continued to increase, while Tsingtao Brewery achieved double-digit growth. Overall, although it is lower than the 25% growth target for 2022, it has performed well in the first half of the year in the current environment.

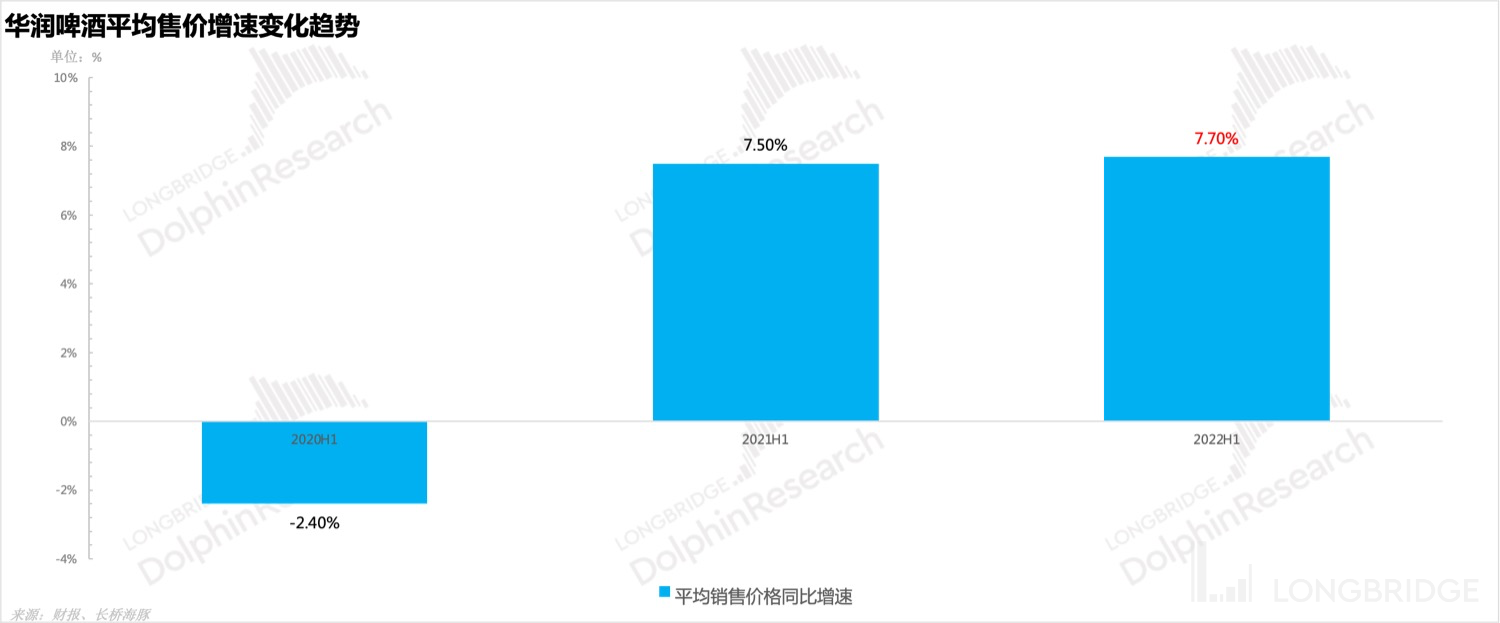

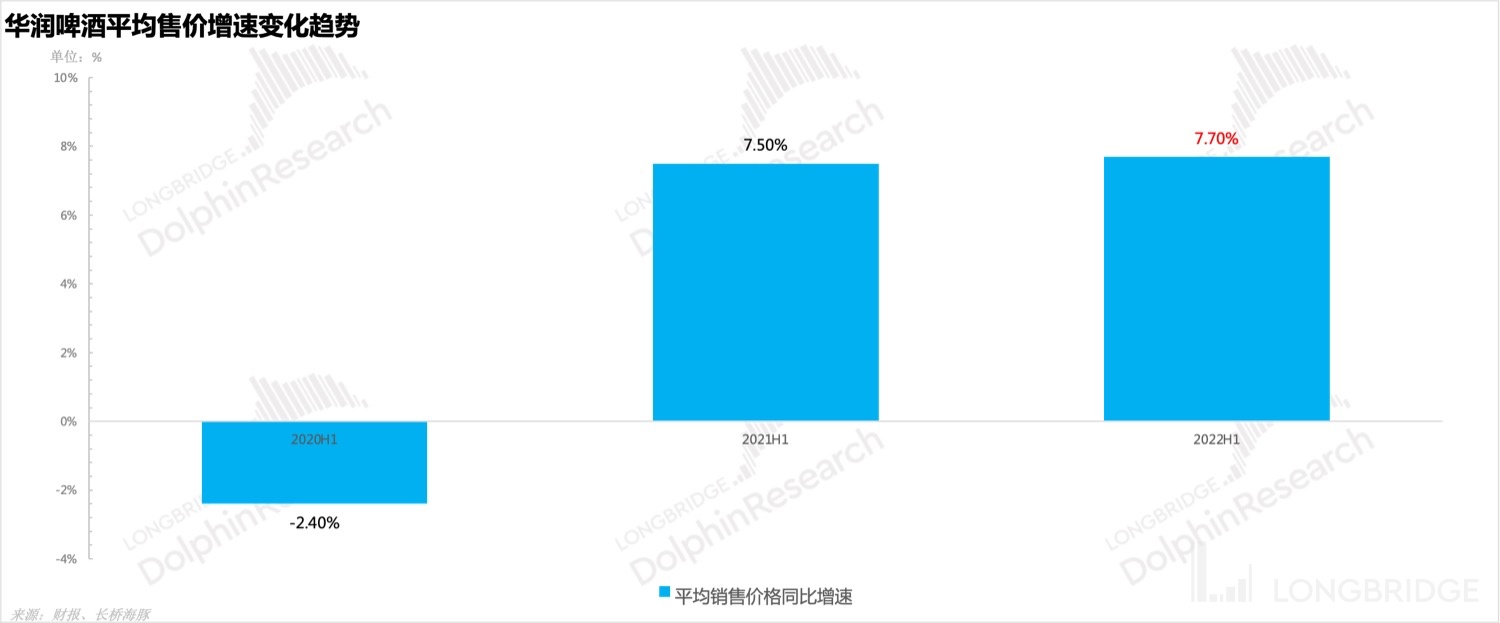

3. The product upgrade continues, launching new products and raising prices at the same time: In H1 2022, the low-end Snowflake beer was priced up, and the road of eliminating beer below RMB 6 went smoothly with an average income of RMB 3,338 per kiloliter, a year-on-year increase of 7.7%. In addition, super high-end product Li and high-end product Black Lion Fruit Beer will be launched in 2022H1.

Overall view of the Dolphin Analyst:

As one of the only two standard consumer stocks in the Dolphin Alpha Dolphin combination, China Resources' performance in the first half of the year did not disappoint me, especially since most of the consumer stocks that have disclosed their first half-year performance have fallen behind, China Resources' performance appears to be particularly impressive.

Repetitive outbreaks, a towering beta, and a high base number from last year's sales, so it is already very good that sales in the first half of the year did not decrease significantly. Among them, the benefits of continued high-end products were significant, as mid-to-high-end brands not only supported sales but also drove average selling prices up by 7.7% year-on-year, thus absorbing the pressure brought by raw material price increases. Coupled with good cost control, net profit growth was achieved quickly.

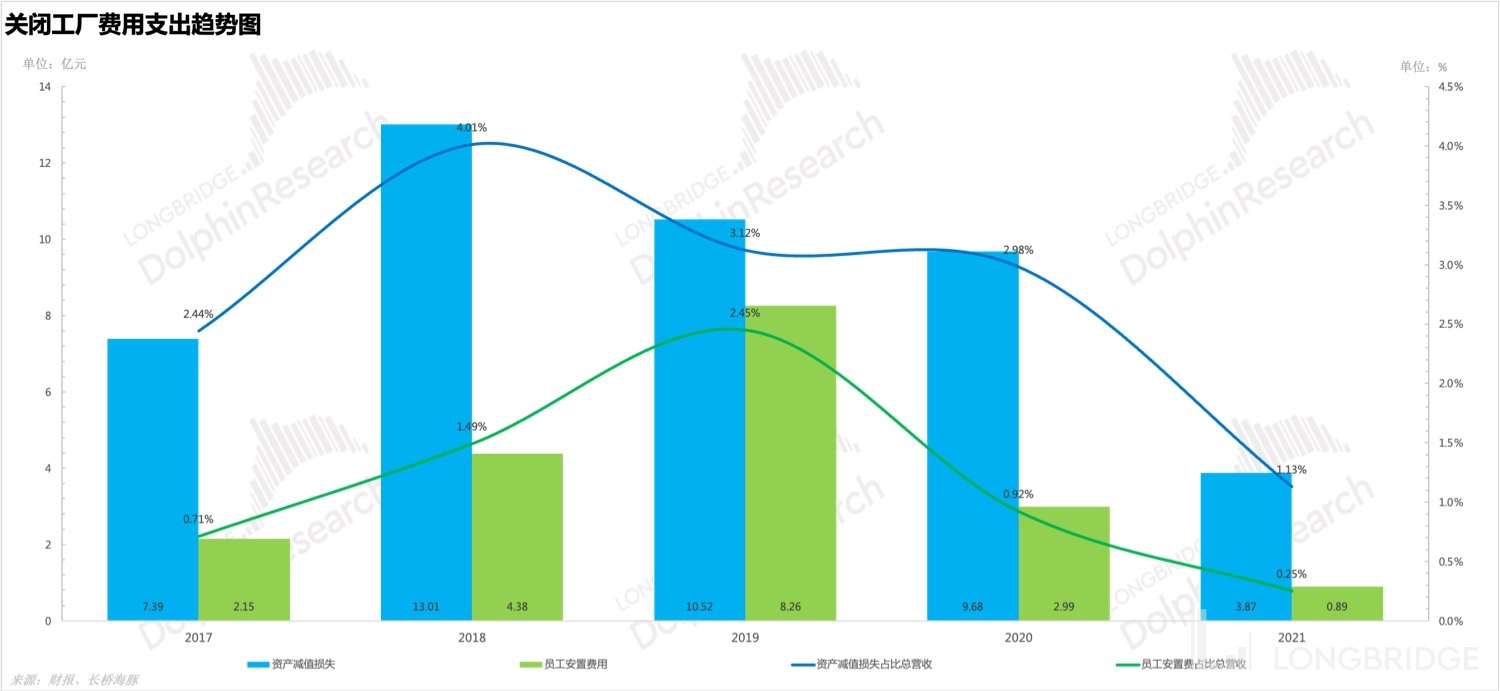

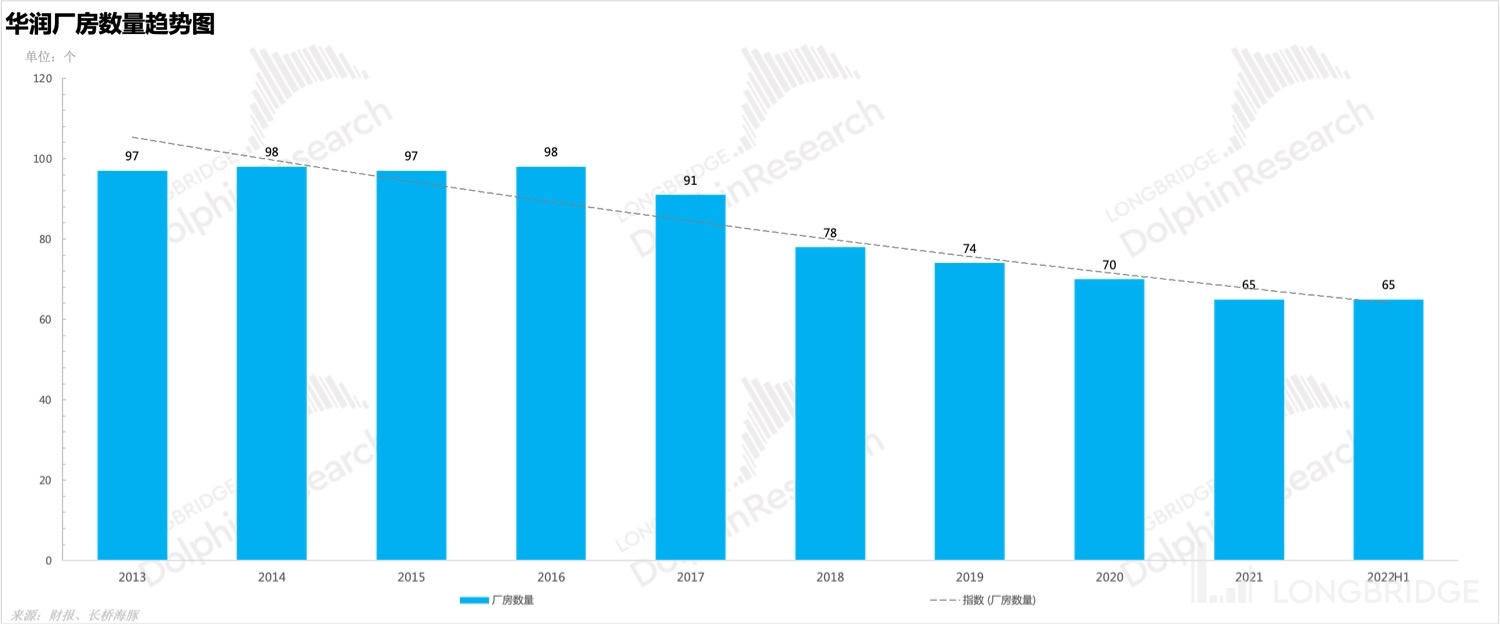

Capacity adjustments are basically over, and asset impairment and personnel resettlement costs that suppress profits are basically lifted. In addition, cost reductions in the second half of the year are showing a downward trend, which is overall favorable for profit release and has a relatively high level of certainty.

Dolphin will later share the minutes of its call with Dolphin's user group through the Longbridge App. Users who are interested are welcome to add the WeChat account "dolphinR123" to join the Dolphin Investment Research Group and obtain the minutes of the call for the first time.

Before the start of the text, Dolphin Analyst takes everyone through a quick review of China Resources' strategy for high-end products:

Below is the release history of the major beers sold by China Resources Beer:

The era of beer increment has passed. The path of competing on capacity and grabbing land by relying on low prices is no longer viable. Now is the era of competing on brand and price.

Moreover, under the new consumer background:

-

The main age group for beer consumption, 20-50 year olds, is declining in population, and per capita beer consumption is declining. Overall, there is a trend of low-frequency and high-quality beer consumption.

-

The CR5 index has maintained at around 70% for many years, and the beer industry has shifted from incremental expansion to stock competition. Product price hikes, or product high-endization, have become the main development focus for current major players.

Therefore, the Dolphin Analyst will split the 2022H1 financial report from the dimensions of quantity and price based on high-endization.

Here is the text:

I. The dimension of quantity: The worst moment has passed

Sales in January to March were basically in line with expectations, but in April they were greatly affected by the outbreak, with a year-on-year decline of over 10%. However, sales in May were not as bad as expected. Positive growth was achieved, and rapid recovery was achieved in June. Since July, with the improvement of the epidemic situation, the resumption of eating-in, and the unusually hot weather promoting beer sales, **Dolphin Analyst believes that there is still the possibility of exceeding expectations in the second half of this year if there is no disturbance from the epidemic.

1. Increased consumption at home, future growth needs to rely on Tsingtao Beer

A) Increase for premium and above products for home consumption: CR premium and above products are usually sold through catering channels, but the lack of dine-in consumption under the epidemic has had a negative impact on the sales of premium and above products. However, effective supplementation has been made in the scene of consumption at home. In fact, you can't drink outside and you can only drink at home; and you have to drink better. Of course, this indirectly verifies that consumption has not degraded, and the road to high-end is still to be firmly pursued. This is also to achieve CR's goal of selling more than 4 million litres of high-end and above products by 2025.

**B) Future growth still depends mainly on Tsingtao Beer:**In the first half of the year, Tsingtao Beer outperformed the overall growth rate among premium and above products, but Super X and Snow Beer Refreshing fell below the overall growth rate. Therefore, the Dolphin Analyst believes that the landing of CR's high-end strategy still depends on Tsingtao Beer: 1) Snow Beer's brand power is weak and it is difficult to support high-end, but Tsingtao Beer has a strong high-end attribute: Snow Beer is originated from low-priced water beer, and early-stage roadside catering was the main consumption scene. Therefore, consumers' awareness of Snow Beer has always been a low-grade beer, and CR has used the Snow Beer brand to hit the three grades of low, medium and high, which further increases the difficulty of shaping a high-end domestic brand.

On the other hand, as one of the three giants of international beer, Tsingtao Beer has a strong brand power. From the perspective of consumers, people have a higher recognition of international big brands for products above 12 yuan. Therefore, CR has more hope to expand night-time channels and high-end catering channels through Tsingtao Beer and to realize the high-end strategy. 2) Tsingtao Beer's domestic market expansion is poor, but CR can give effective empowerment: Compared with Carlsberg and Budweiser, Tsingtao Beer has obvious shortcomings in production capacity and channels. However, its product strength and brand power are not weaker than the above two. Therefore, CR can empower Tsingtao Beer in channels and production capacity. This is also the core reason why Tsingtao Beer has been able to achieve high-speed growth in China in the past two years. In addition, the Dolphin Analyst believes that the growth of Tsingtao Beer's sales volume will be an important factor affecting whether CR can achieve high-end.

2. Mid-range products are severely affected by the epidemic, and low-end products are less affected than mid-range products:

A) The growth rate of mid-range products is the worst: Mid-range products are mainly sold through catering channels, but the lack of dine-in consumption under the epidemic has had a negative impact on the sales of mid-range products. Overall, the year-on-year growth rate of mid-range products is lower than that of low-end products. However, as the epidemic improves, the sales of mid-range products are also recovering rapidly.

B) The growth rate of low-end products is average, but better than mid-range products: After CR completed the clearance and adjustment of low-end products in 2021, the remaining products are of good quality and sales volume. In addition, low-end products that started normal operation in the first half of this year have achieved slightly better sales growth than mid-range products.

二、Price Dimension: Price Increase for Low-End Products and Product Structure Upgrade Continue

In the first half of this year, the overall average selling price of beer increased by 7% compared to the same period last year. Direct price increases were implemented for low-end large single products, and two new products, Li and Heishi Fruit Beer, were launched. In addition, CR Snow was strengthened in terms of operation, and it is expected that Snow Whole Wheat Pure Live will be launched in the second half of 2022. The Dolphin Analyst believes that in the past, low-price competition was to grab market share, but the CR5 has not changed for many years, so low-price competition is no longer applicable. Moreover, in the new consumption context, only price increases or product upgrades have real prospects, and in recent years, due to the rise in raw materials, China Resources has chosen to continuously increase prices and launch new products to complete product upgrades.

A)Li: China Resources launched a high-end new product called Li in the first half of this year. The name comes from the book of songs, and the pronunciation is the same as "礼". The price is 500 yuan. The Dolphin Analyst believes that the actual role of this new product is to raise the brand's tone with a high-end positioning, and to try to enter the gift-giving scene, possibly trying to break through consumers who prefer Feitian Maotai.

B)Heishi Fruit Beer: The outer packaging of Heishi Fruit Beer is cherry-colored, with a sweet and sour taste and a pronounced fruit aroma. From this, it can be inferred that this beer is targeted towards women, and the Dolphin Analyst believes that this beer has the potential to expand into the night scene.

C)CR Snow: CR Snow is an old local brand in Shenyang, with a status and positioning similar to Wusu in Xinjiang. With a high alcohol content and strong local attributes, the single-bottle price is around 10 yuan. The sales volume last year was still very small, but in the first half of 2022, China Resources strengthened the operation and promotion of CR Snow, and the year-on-year sales growth rate exceeded 100%. The sales volume in the first half of the year was around 10-20,000 tons, mainly sold in regions where China Resources Beer is strong in East China and Sichuan. The Dolphin Analyst believes that CR Snow has a strong mass foundation, obvious differences from mainstream products, and high recognition among Northeasterners. It may open up the market and at least obtain the love of most Northeasterners.

** 三、Outlook for the Second Half of the Year: Price Increases Will Help Revenue Growth and Profit Release has High Certainty**

1. The effect of price increases will be concentrated in 22H2

The second half of the year is often the peak season for sales, and it is common for people to eat grilled skewers and drink beer in the summer. This summer is especially hot, and the time period for hot weather is particularly long, which is very conducive to the sales of beer. In addition, the effects of the 21H2 and 22H1 price increases will also be reflected in 22H2, so there is a high degree of certainty in the rapid growth of revenue.

A)Effects of Price Increases: After the price increases in 21H2 and 22H1, it will take two months to complete the transfer, and the first half of the year is often a low season for consumption. Furthermore, the hot weather in 22H2 is conducive to sales, so the effects of the price increases will be concentrated in 22H2. 2. Profit release certainty in the second half of the year

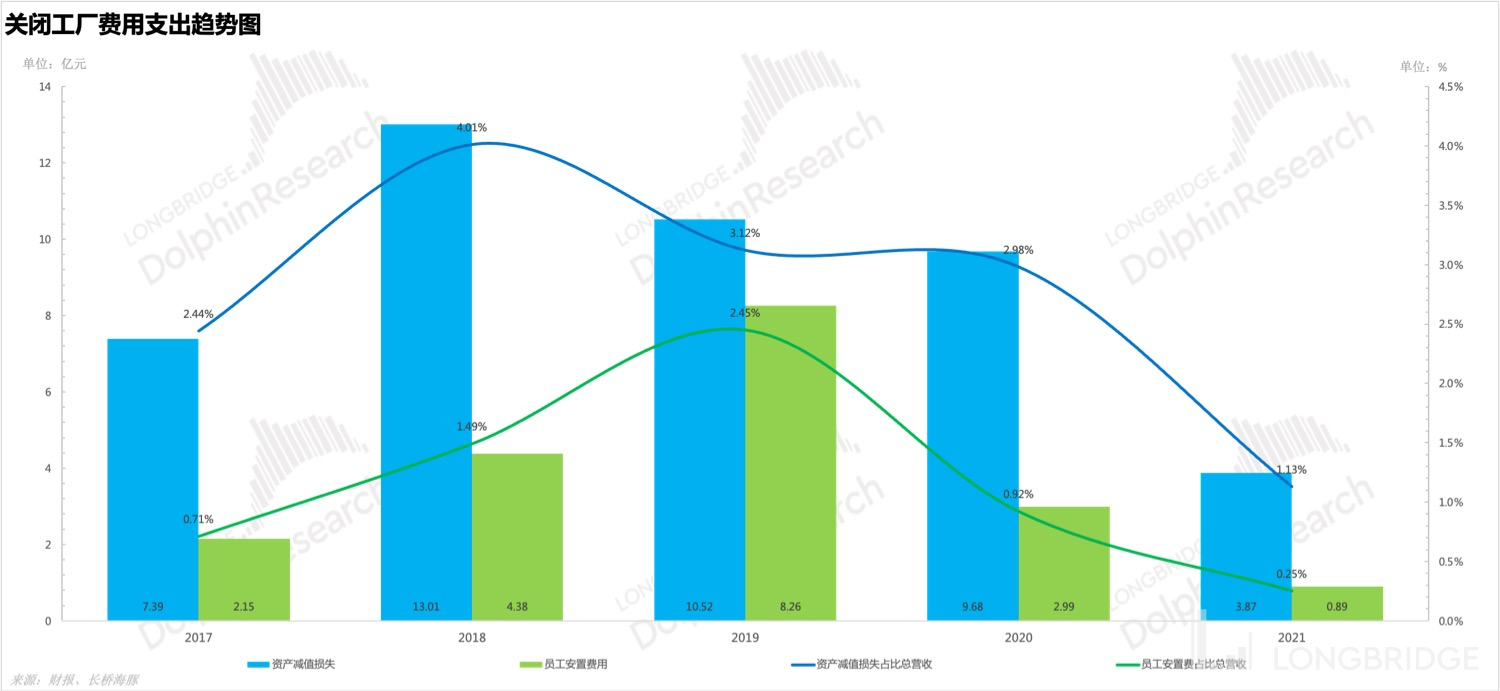

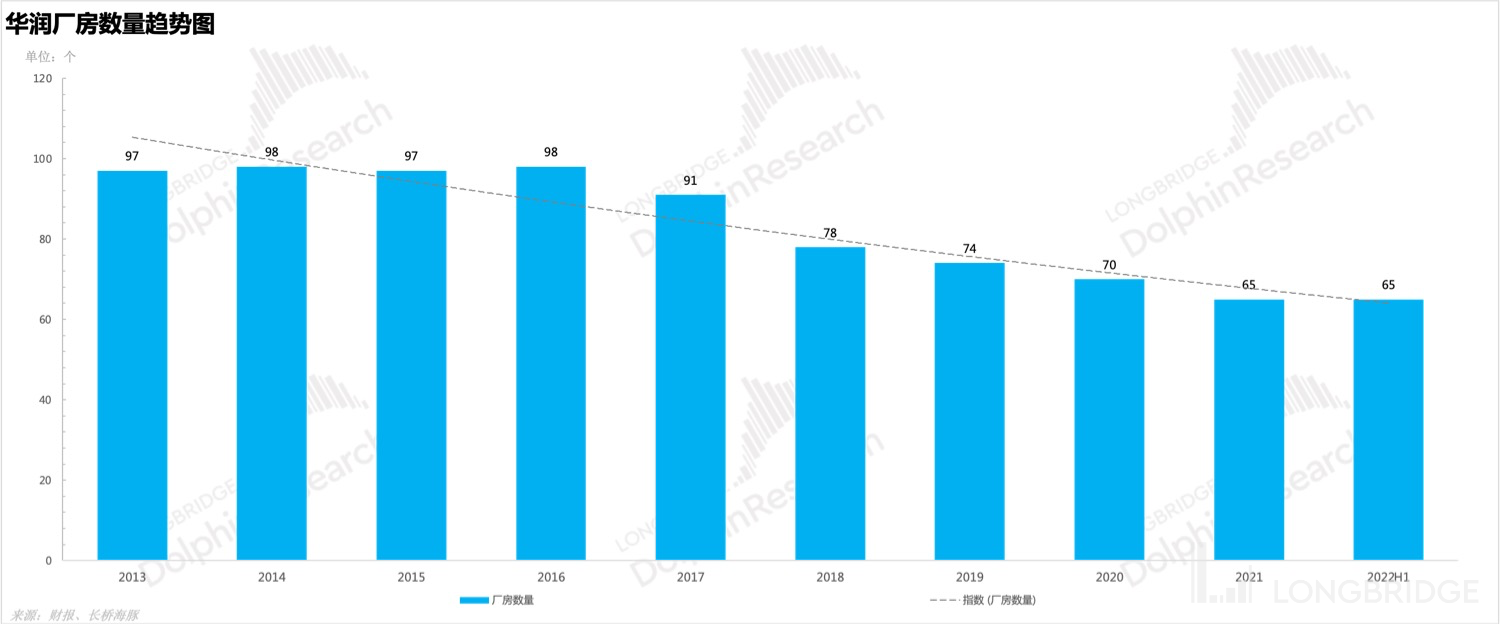

A) End of production capacity adjustment, favorable for profit release: CR's capacity adjustment has basically come to an end, and there are no major factories to be closed thereafter, so the asset impairment losses and employee resettlement expenses caused by factory closures that suppressed performance will be lifted, which is beneficial for profit release.

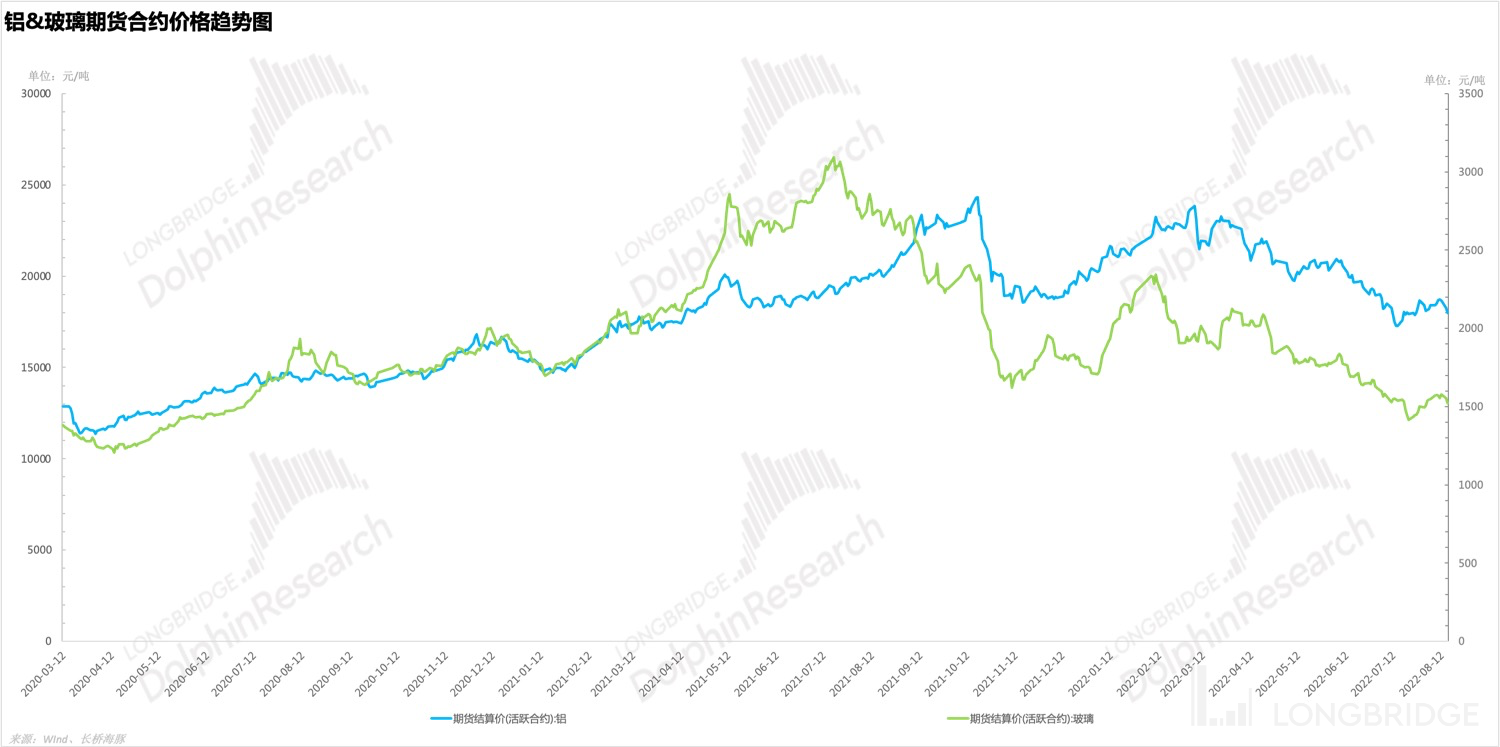

2) Cost pressure weakened, favorable for profit release: The cost of CR is likely to continue to decline in 2022H2. The materials of aluminum and glass are showing a downward trend. At the same time, CR has already locked in most of its demand for barley in 2022 ahead of schedule, so the price fluctuation of barley has a weak impact on CR's costs, which is beneficial for overall profit release.

Dolphin Investment Research "CR Beer" historical article:

Financial report season

March 24, 2022, financial report review "Under the epidemic, CR's determination to high-end beer remains unchanged"

Risk disclosure and disclaimer for this article: Dolphin Investment Research disclaimer and general disclosure