Layoff Can't Save Xiaomi from Its Dilemma

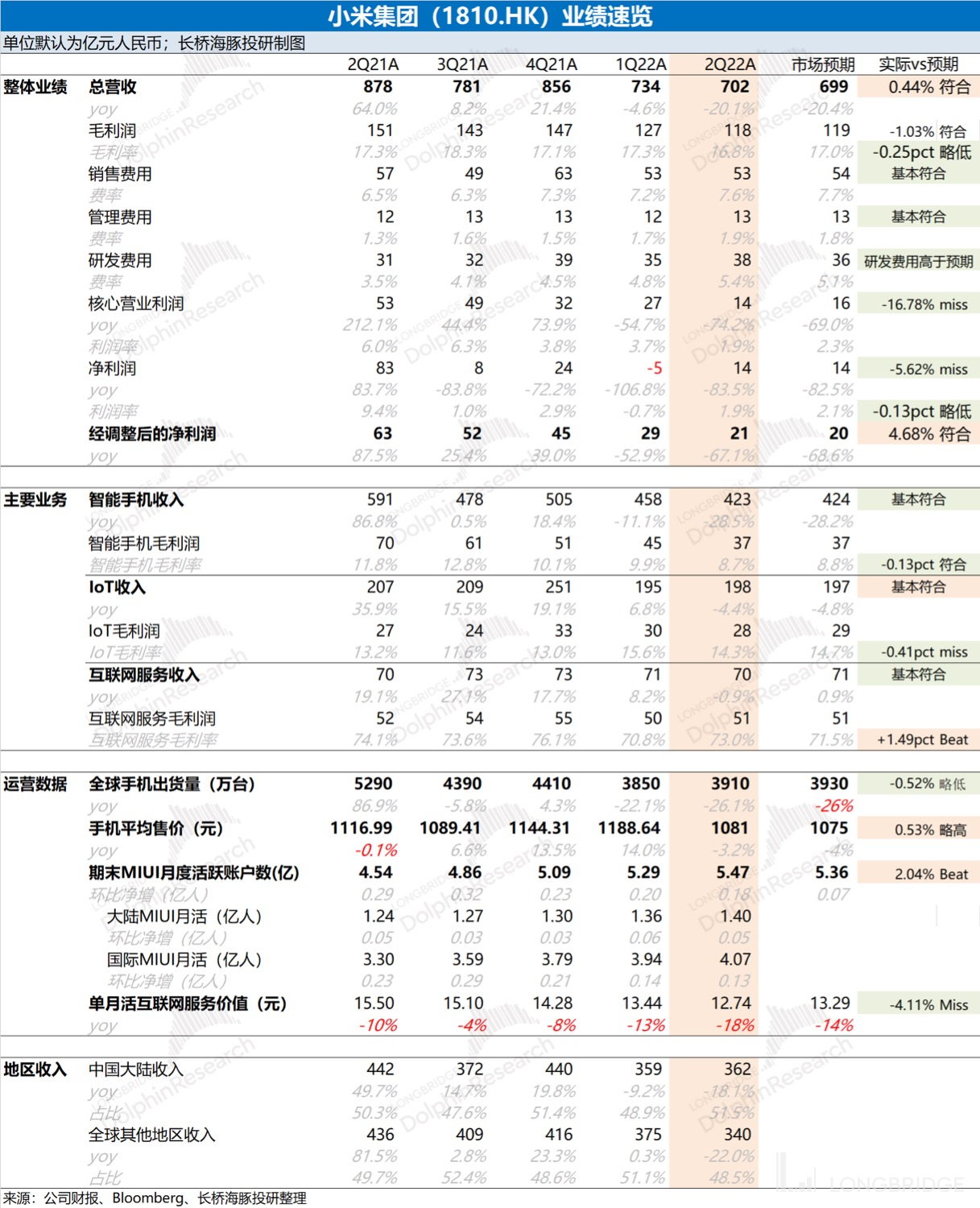

Xiaomi Group (1810.HK) released its 2022 Q2 earnings report (ending June 2022) after the Longbridge Hong Kong stock market on the evening of August 19, 2022. The main points are as follows:

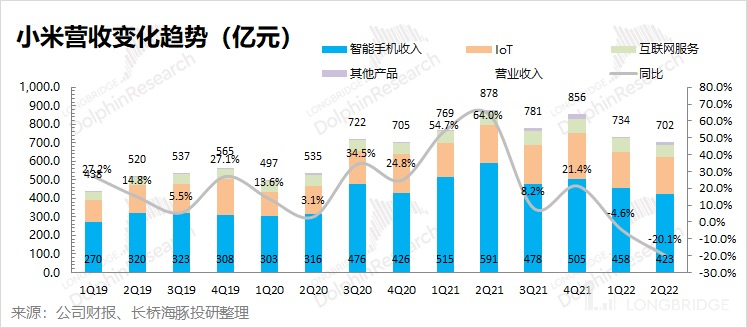

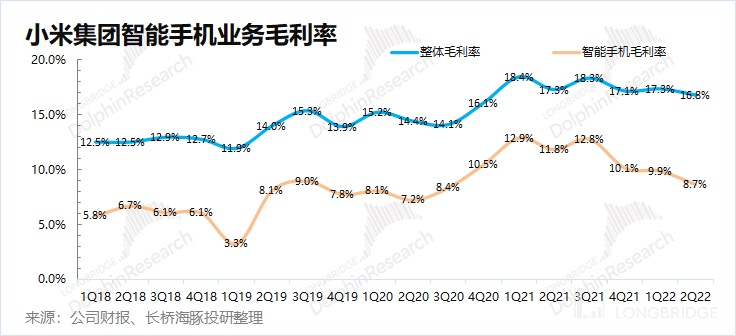

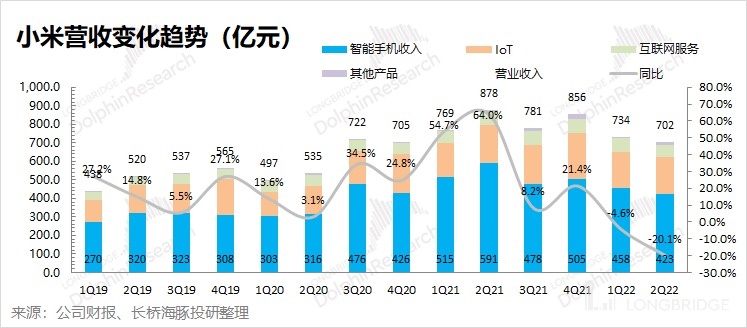

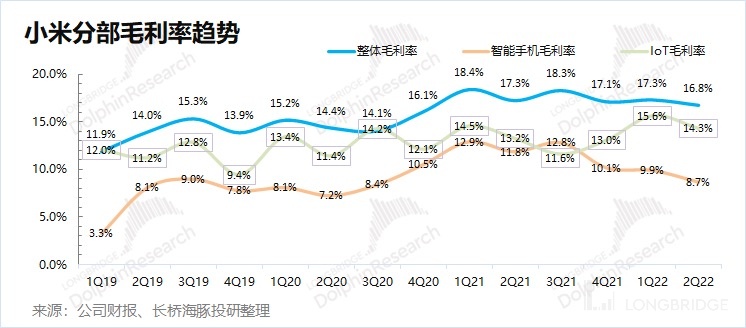

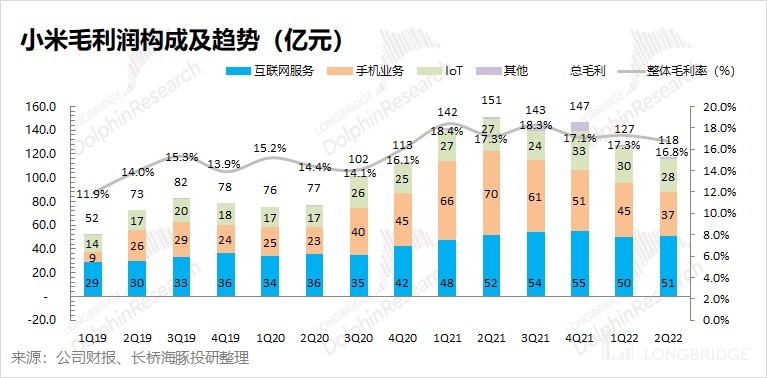

1. Overall performance: The smartphone business is the main culprit for the decline. Xiaomi Group-W.HK's total revenue in this quarter was CNY 70.2 billion, a year-on-year decrease of 20.1%, in line with market expectations (CNY 69.9 billion). The company's revenue declined in this quarter, mainly due to sluggish smartphone business. Xiaomi Group's gross profit margin in this quarter was 16.8%, a year-on-year decrease of 0.5 percentage points, in line with market expectations (17%). The company's promotional activities to clear inventory continued to affect the gross profit margin.

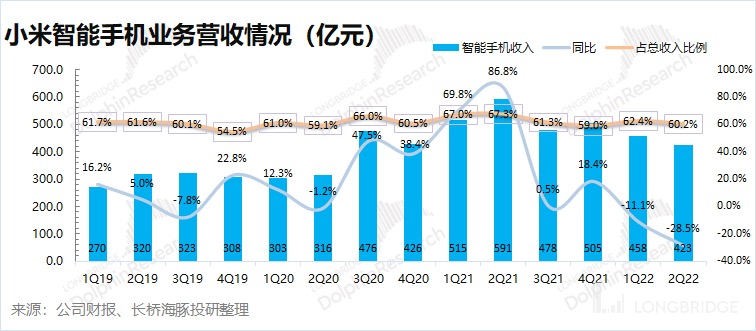

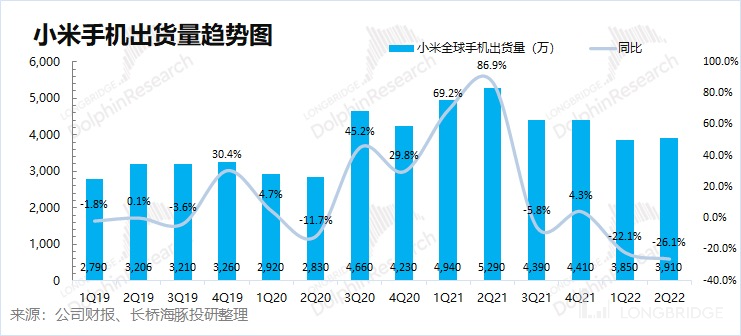

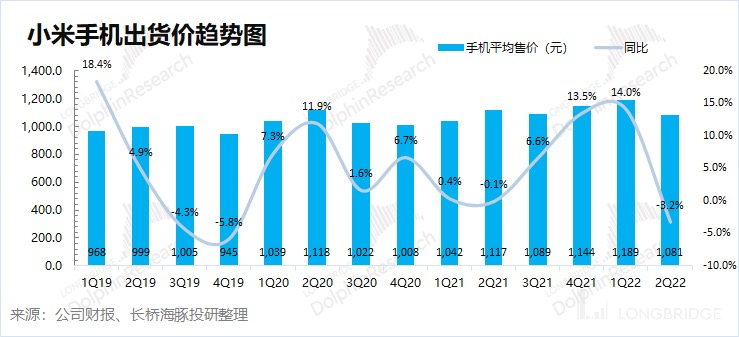

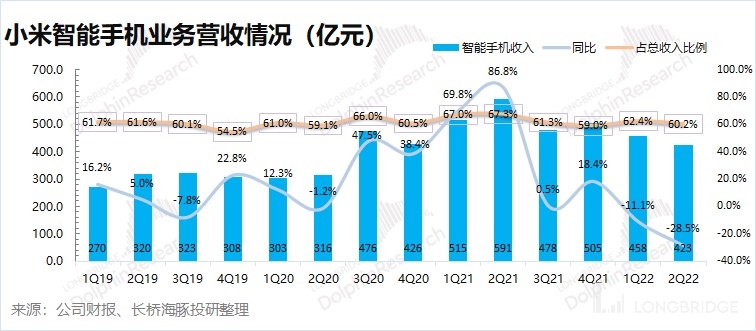

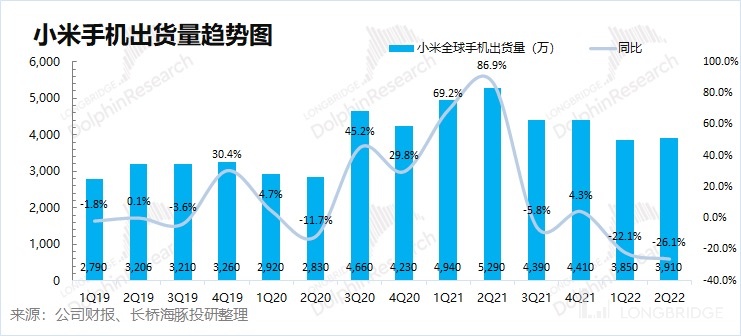

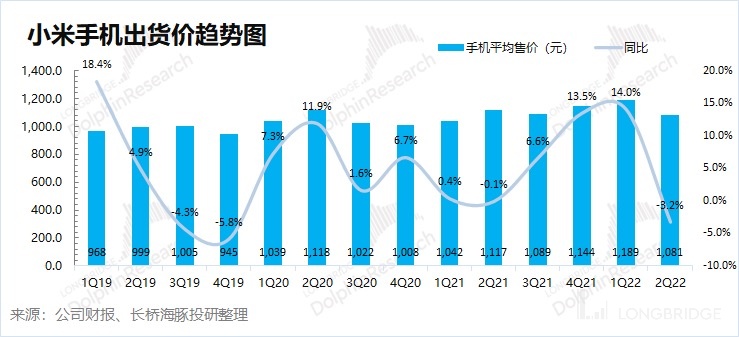

2. Smartphone business: its first simultaneous decline in volume and price in two years. Economic slowdowns have suppressed market demand. Smartphone shipments decreased by nearly 13 million units compared to the same period last year, and smartphone shipments fell by 26.1% year-on-year. The continuous increase in smartphone average selling price in the previous quarters came to an abrupt end in this quarter. With a high inventory, the company started to reduce prices and the smartphone average selling price fell to CNY 1081, down 3.2% year-on-year. Dolphin Analyst estimated that the Chinese market declined by approximately 3 million units and the Indian market declined by approximately 2.7 million units this quarter.

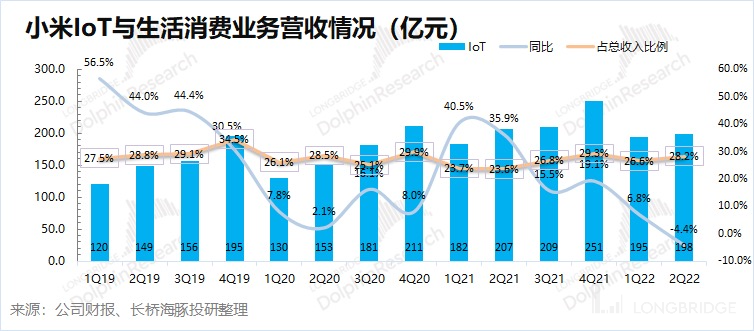

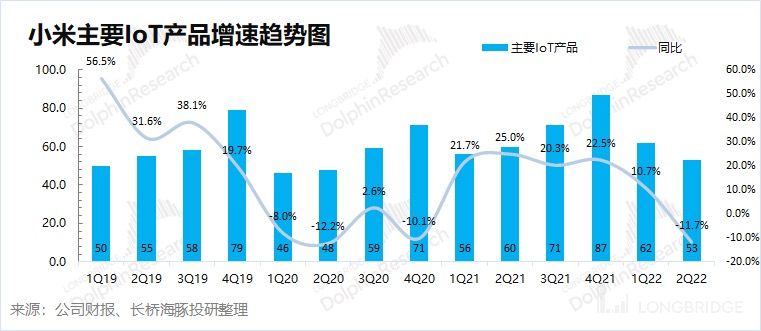

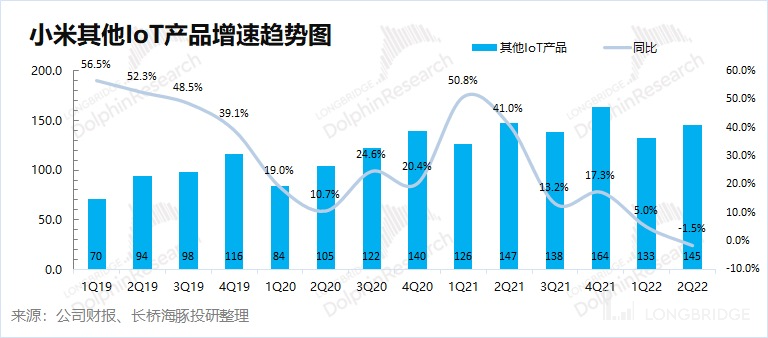

3. IoT business: “white goods” became the only bright spot. In the era of the Internet of Things, the market once expected double-digit growth in the IoT business, but negative growth appeared in this quarter. Due to the drag of notebook computers, the main IoT products experienced a double-digit decline in this quarter. Only "white goods" such as air conditioners achieved growth of more than 30% in the IoT business in this quarter, and the performance of other IoT products implies sluggish demand.

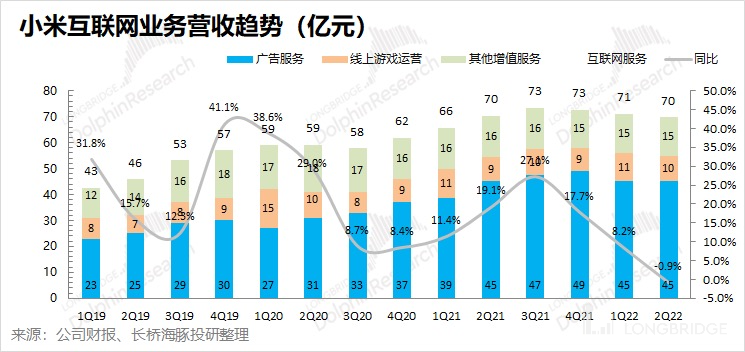

4. Internet services: first decline, macro impact on advertisers' budgets. Internet business experienced its first decline in this quarter. From the perspective of users, the company's user base in this quarter increased net both domestically and overseas. However, the ARPU value of a single domestic user is "disturbing". Dolphin Analyst estimated that the ARPU value of a single domestic user this quarter was only CNY 37.6, a year-on-year decrease of 21.2%. Against the backdrop of an economic slowdown, domestic advertisers began to reduce their advertising budgets, directly affecting the largest part of the advertising business in the Internet business. Although Xiaomi's hardware entry has certain risk resistance capabilities, it cannot resist the overall situation.

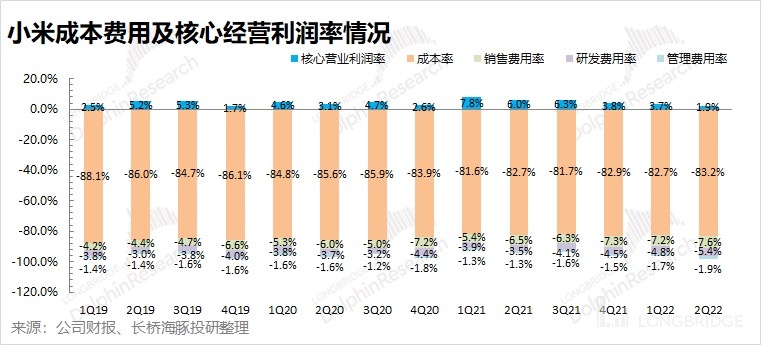

5. Cost and performance: layoffs cannot stop the increase in investment in automobiles. Roughly speaking, Xiaomi's cost side reached a new high in this quarter. However, Xiaomi has been secretly laying off employees, and the continuously rising expenses mainly come from investment in innovative businesses such as automobiles. The total number of Xiaomi employees in this quarter decreased by 924, joining the ranks of Internet layoffs. Although the cost side has risen instead of falling, more than CNY 600 million in expenses were brought by the automotive business in this quarter. Before the automobile sales were formed, this part will directly increase the company's cost items.

Overall, although Xiaomi "completed" market expectations in this quarter, "disastrous" is revealed in every aspect of the financial report. In this quarter, Xiaomi's major areas have experienced declines, and the IoT and Internet businesses have experienced their first decline. The smartphone business has directly declined by nearly 30%. Certainly, the market has already expected the "disaster" of the company's performance this quarter, and the performance has not shown a significant miss.

But for investment, the main goal is to buy the future. What is the direction of this financial report? As Xiaomi is a "combined software and hardware" company, we will look at the hardware and software separately.

1) Hardware (mobile phones and IoT): This quarter was really bad, and there is no sign of improvement now. The shipment of mobile phones in this quarter was less than 40 million, and IoT products also declined. It can be said that this is Xiaomi's most difficult quarter recently. However, there is no sign of improvement in the market and financial report. ① The inventory continues to rise in this quarter in the financial report. The promotion in the second quarter did not decrease the inventory level. ② The demand for the mobile phone market is still weak, and the company's guidance for the second half of the year estimated that Android phones will still have a two-digit decline. ③ India, Germany, and other countries have begun to put pressure on Chinese companies such as Xiaomi. Xiaomi's market share in India dropped by 8.8% this quarter, and the risk still exists. The three major risks on the hardware side still exist.

2) Software (Internet services): Internet services have shown a decline for the first time this quarter, mainly affected by the macroeconomic situation. If the economic growth rate continues to slow down or remain low, there is a risk of further budget contraction for advertisers. Even with the hardware entrance, Xiaomi is difficult to survive in the overall contraction of the advertising industry budget. The risks on the software side also exist.

Overall, under the suppression of numerous risks, Xiaomi's stock price has indeed fallen below 12 yuan. But from this financial report, Dolphin Analyst did not see any signs of risk release. Looking purely at the decline in Xiaomi's stock price, it seems not expensive.

In the context of the decline in various businesses and the suppression of multiple risks, Xiaomi's performance has the risk of downward revision. Xiaomi is no longer a company that earned 20 billion yuan a year like last year. Xiaomi's adjusted net profit for the whole year may be less than 10 billion yuan, and its market value corresponds to a valuation of 25 times (the valuation is close to Apple). Actually, the valuation is not low.

Under the heavy risk, Xiaomi has also started to cut costs and reduce staff, trying to get through the most difficult times. Xiaomi's "counter-cyclical resurrection" needs to see these layers of risks gradually released or new growth brought by the auto business.

Below is the specific analysis of Dolphin Analyst on Xiaomi's financial report:

I. Overall performance: mobile phones are the main culprit for performance decline

1.1 Revenue side

In the second quarter of 2022, Xiaomi Group's total revenue was 70.2 billion yuan, a year-on-year decrease of 20.1%, in line with market expectations (69.9 billion yuan). The company's revenue this quarter decreased by about 15 billion yuan year-on-year, most of which came from the downturn in the mobile phone business. Under various unstable factors such as the economic slowdown and the pandemic, the overall demand for the mobile phone market was weak, and Xiaomi's mobile phone business suffered a significant decline.

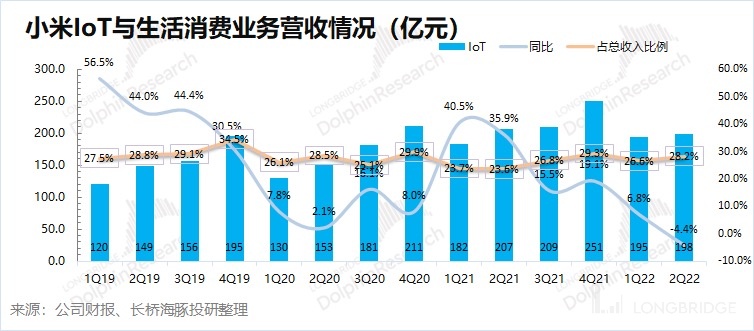

In the current quarter, Xiaomi Group's main businesses had revenue breakdowns of 60.2%, 28.2%, and 9.9% for smartphones, IoT, and internet services, respectively. Xiaomi's smartphone business remains the company's largest source of revenue, but its share of the company's total revenue continues to decline due to the business' sluggish performance.

1.2 Gross Profit Margin

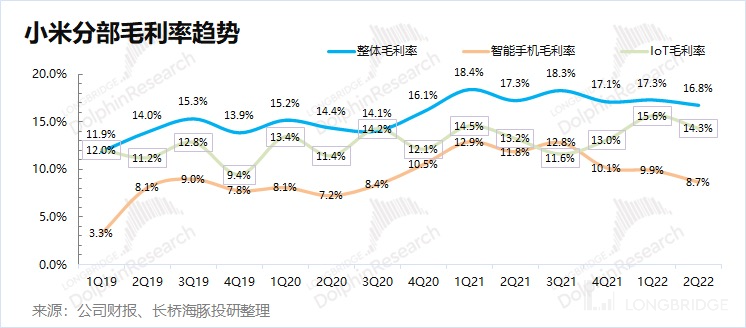

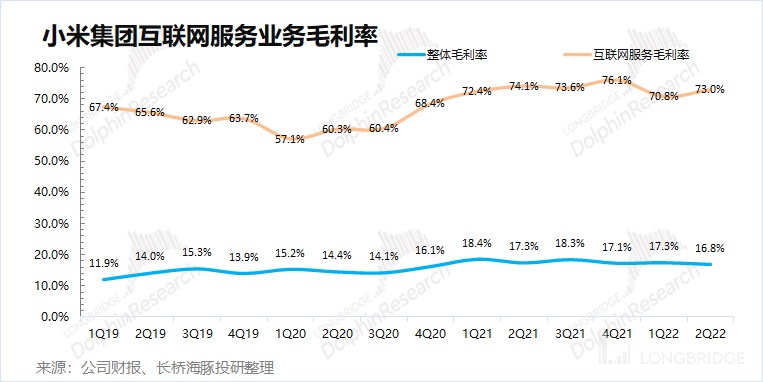

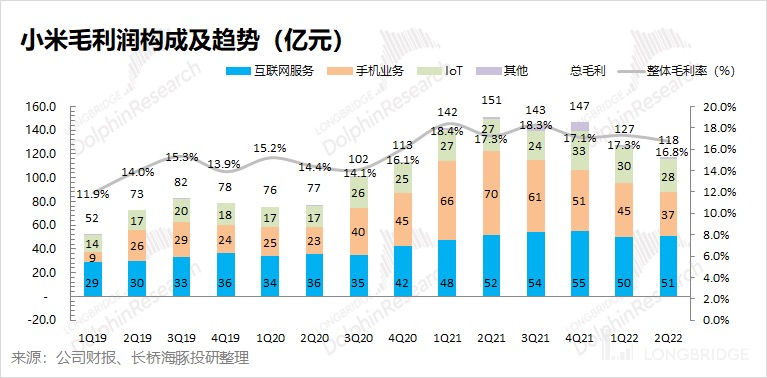

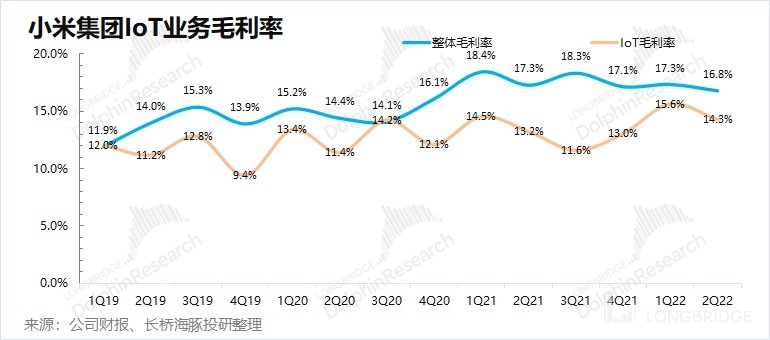

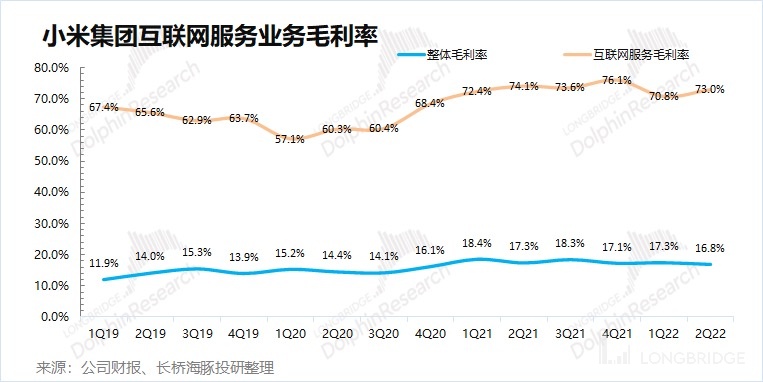

In Q2 2022, Xiaomi Group's gross profit margin was 16.8%, a 0.5% YoY drop, slightly lower than market expectations (17%).

As Xiaomi's hardware revenue accounts for 90% of its total revenue, the company's gross profit margin is mainly affected by the hardware product side. The gross profit margin for the hardware side has declined, mainly due to weak market demand. The company has increased its promotions to clear inventory. The gross profit margin for the software side (internet services) has also declined, mainly due to the reduction in pre-installed business related to smartphone shipments, leading to a decline in advertising business gross profit margin.

II. Smartphone Business: The First Time in Two Years That Both Volume and Price Decreased.

In Q2 2022, Xiaomi's smartphone business achieved a revenue of CNY 42.3 billion, a YoY decrease of 28.5%. The decline in the company's smartphone business in the current quarter comes mainly from a significant drop in shipments, with the decline in shipments coming from both domestic and overseas markets.

Dolphin Analyst has analyzed Xiaomi's smartphone business by volume and price to see the main driving force in this quarter's smartphone business:

Volume: In Q2 2022, Xiaomi's smartphone shipments were 39.1 million units, a YoY decrease of 26.1%, still not returning to the quarterly shipments of 40 million units. The significant decline in the current quarter's shipments of Xiaomi smartphones is mainly due to the general sluggishness of the overall smartphone market. Global smartphone shipments fell 8.7% this quarter, with domestic manufacturers such as Xiaomi and OV leading the way with declines of over 20%. The main factors behind this include 1) a slowdown in economic growth leading to weak overall market demand; 2) the domestic epidemic directly affecting offline market sales; 3) intensified regulation of Chinese smartphone brands in some overseas markets.

Of the 13 million smartphones that Xiaomi dropped YoY this quarter, approximately 3 million plunged domestically in China, and 10 million plunged overseas. In addition to the economic slowdown, there are factors such as the epidemic and Honor in the domestic market; and factors such as each country's policies in overseas markets.

Price: The average price of Xiaomi smartphones in the second quarter of 2022 was RMB 1081, a year-on-year decrease of 3.2%. The main reasons for the price decline this quarter are: 1) a relatively high proportion of low-priced smartphones in overseas markets, bringing structural impact; 2) the company has increased the promotion efforts of its products with high inventory levels.

Xiaomi's high-end strategy still has a certain effect on the increase of the company's smartphone ASP. The average price of the company's smartphones has risen from around RMB 1000 in the past to around RMB 1100, and the ASP of the company's smartphones has also shown an upward trend in the past few quarters. However, due to the recent weak market demand, the company has adopted promotion measures to digest the inventory of smartphones, resulting in a decline in the average price of its smartphones.

The gross profit of Xiaomi's smart phone business in the second quarter of 2022 was RMB 3.66 billion, a year-on-year decrease of 47.6%, accounting for 31.1% of the company's gross profit. The significant decline in the gross profit of Xiaomi's mobile phone business this quarter is due to both the decrease in revenue and the obvious decline in gross profit margin.

The gross profit margin of the smart phone business this quarter is 8.7%, a year-on-year decrease of 3.1 percentage points. Due to the influence of traditional promotional factors in the second quarter, the gross profit margin of the smart phone business has a seasonal decline. However, compared with the same period last year, the gross profit margin of smartphones has declined significantly, mainly due to the weak demand in the smartphone market this year and the high inventory level of the company's smartphones. The company's increased promotional efforts have affected the gross profit margin, and the appreciation of the US dollar has also increased the company's sales costs.

3. IoT business: "White goods" become the only bright spot in weakness

Xiaomi's IoT business achieved revenue of RMB 19.8 billion in the second quarter of 2022, a year-on-year decrease of 4.4%. This is mainly affected by the global macroeconomic environment and the weakening demand for some IoT products in overseas markets.

The second quarter was originally the traditional peak season for promotion, but there was no obvious seasonal growth in this quarter. Instead, the slowdown in macroeconomic growth has suppressed the demand for such optional consumption of electronic products.

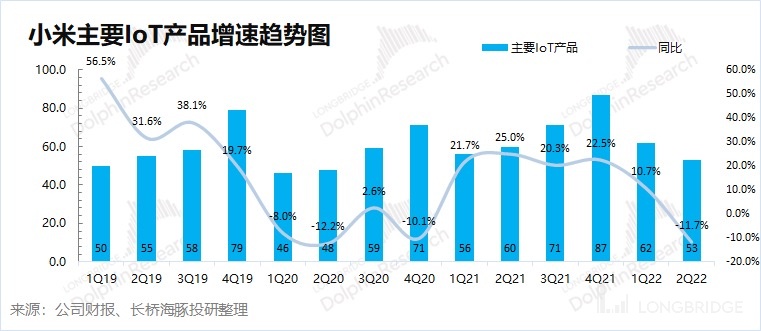

Xiaomi's main IoT products mainly include TVs and notebooks. In the second quarter of 2022, the revenue of the main IoT products reached RMB 5.3 billion, a year-on-year decrease of 11.7%, mainly due to the decrease in the shipment volume of notebooks. After the epidemic, the demand in the PC market contracted. According to data from IDC, global PC shipments in the second quarter decreased by 14.7% year-on-year.

Xiaomi Smart TV achieved a year-on-year increase in shipments in the second quarter of 2022, reaching 2.6 million units worldwide. Xiaomi TV has ranked No.1 in shipments for 14 consecutive quarters in mainland China, and has been consistently ranked in the top five globally.

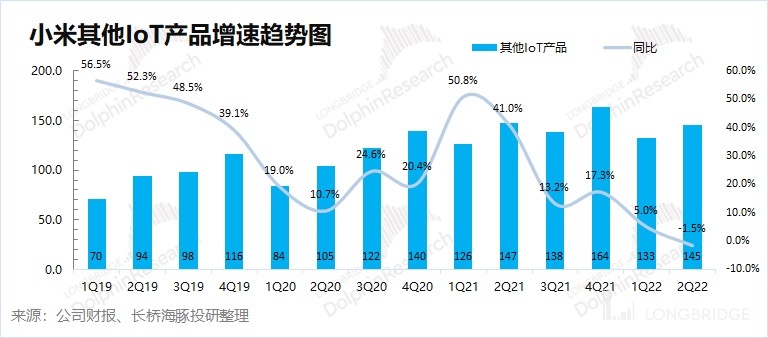

In the second quarter of 2022, Xiaomi's other IoT products generated a revenue of 14.5 billion yuan, a year-on-year decrease of 1.5%. The main reason for the year-on-year decline was the weakening demand for some IoT products in overseas markets, and the smart large appliances business made up for the overall decline.

The bright spot in this quarter is that smart large appliances (air conditioners, refrigerators, washing machines) continue to achieve more than 25% year-on-year growth, mainly due to the increase in smart air conditioner shipments. The company's air conditioning product shipments in the second quarter exceeded 1.2 million units, a year-on-year increase of 35%, and the cumulative shipments as of July have exceeded 2 million units for the whole year of 2021.

By comparison, it can be seen that in the case of the decline of the entire IoT product business, other products except for home appliances performed poorly this quarter.

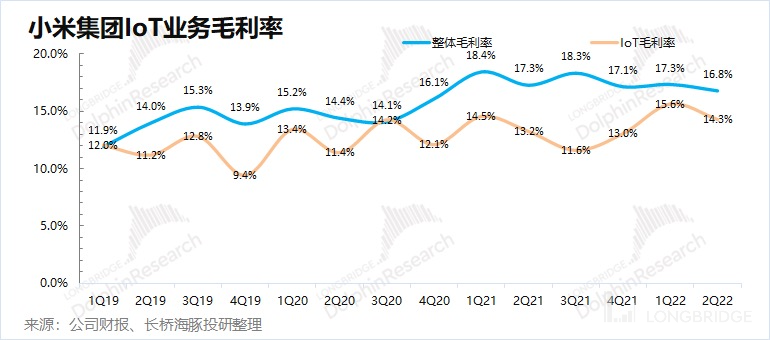

In the second quarter of 2022, Xiaomi's IoT business gross profit was 2.83 billion yuan, a year-on-year increase of 3.1%. The main reason for the increase in profit margin while the revenue declined was because the gross profit margin of IoT business this quarter increased year-on-year.

The gross profit margin of IoT business in the second quarter was 14.3%, an increase of 1.1 percentage points year-on-year. The IoT gross profit margin has been increasing year-on-year since it hit a low of 11.6%, confirming Dolphin Analyst's view in the March financial report review "Xiaomi in conformity: tasteless food, pity to discard", which was "the decline of panel prices drives the recovery of the business gross profit margin from the cost side."

However, now that panel prices have fallen below the cash cost, the panel prices will definitely hit bottom and rebound in the medium and long term, and the cost pressure on Xiaomi's IoT business will have a suppressive effect on the gross profit margin.

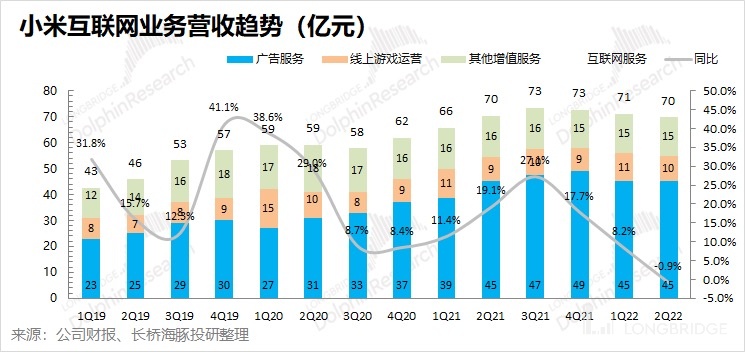

4. Internet services: first decline, macro impact on advertiser budgets 2022 Q2 Xiaomi Internet Service Business Achieved Revenue of 7 Billion Yuan, down 0.9% YoY, accounting for 9.9% of total revenue. Internet service revenue has declined for the first time due to macro-environmental impacts, which had a significant impact on the advertising budgets of mainland Chinese advertisers.

Let's look at the various subcategories of internet services:

① Advertising Services: The largest component of the company's Internet services. Xiaomi's advertising revenue in Q2 reached 4.5 billion yuan, a YoY increase of 0.6%, but the growth rate slowed mainly due to mainland China's influence.

This quarter, pre-installed advertising revenue in mainland China was affected by the decrease in advertising budgets of domestic advertisers, with large fluctuations in the shipment volume of mobile phones. Overseas advertising revenue still grew more than 50% YoY, mainly due to the deepening of the user scale and ecological services in overseas regions.

② Gaming Revenue: Remained stable. Xiaomi's gaming revenue in Q2 was 1 billion yuan, a YoY increase of 4.7%, achieving contrarian growth. The main benefits were the growth of the company's active gaming users and increased stickiness. The overall risk resistance ability of the company as the hardware entrance was strong.

③ Other value-added businesses: Xiaomi's other value-added business revenue for Q2 was 1.5 billion yuan, and the financial technology business continued to shrink.

From the performance of Xiaomi and Apple's value-added business, companies that occupy the hardware entrance have relatively strong risk resistance ability, but the advertising industry still cannot withstand the impact of the overall economic environment. In the overall advertising industry, the influence of mainland China is greater than that of overseas markets.

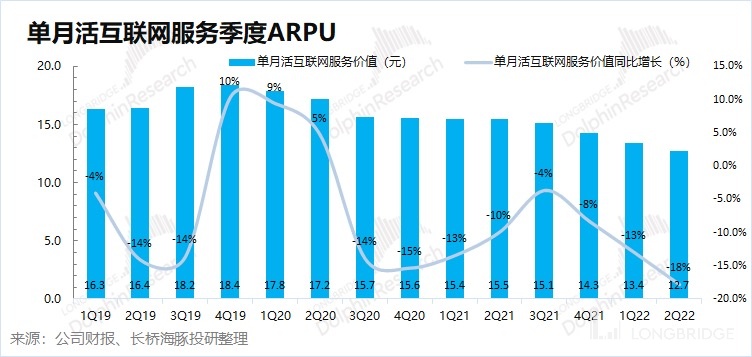

Dolphin Analyst separated Xiaomi's internet service business into quantity and price:

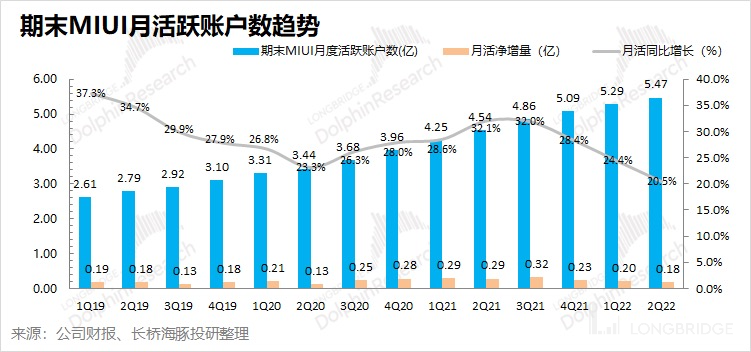

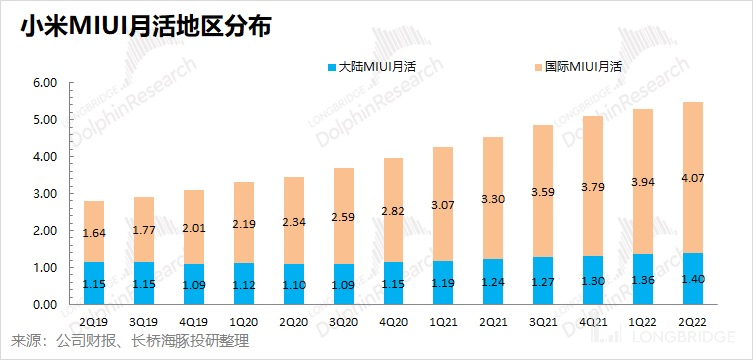

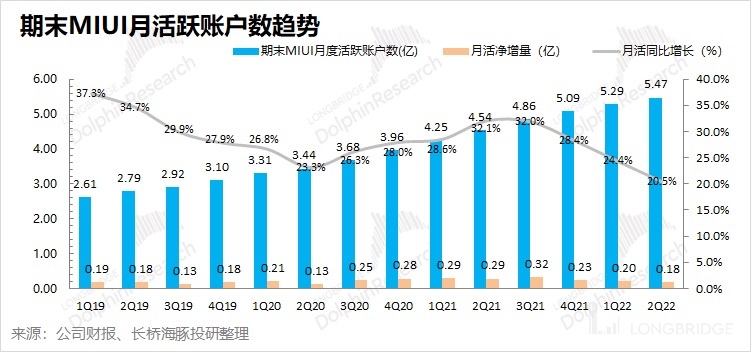

MIUI User Base: As of June 2022, the monthly active users of MIUI reached 547 million, a YoY increase of 20.5%. From Q1 2018 to the present, Xiaomi's MIUI user base has continued to achieve growth of more than 20% for 18 consecutive quarters. Although internet service YoY revenue declined this quarter, the user base is still showing growth.

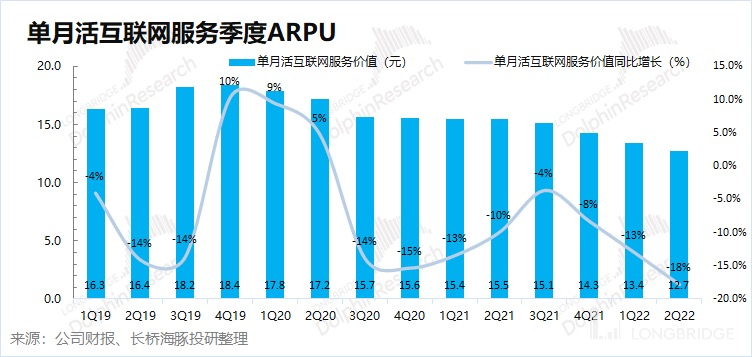

ARPU Value: Based on the MIUI user base, we calculate the ARPU value for each quarter. In the second quarter, Xiaomi's Internet service ARPU value was 12.7 yuan, a YoY decrease of 18%. The reason for the decline in Xiaomi's ARPU value this quarter was due to the decline in domestic users' ARPU value (due to the decline in domestic advertising business) and a significant increase in the proportion of low ARPU overseas users.

Q2 2022 Xiaomi's Internet Services Business Gross Margin was RMB 5.09 billion, down 2.4% YoY. The YoY decline in the Internet gross margin this quarter was due to a decrease in revenue from the pre-installed business related to intelligent smartphone shipments, which led to a decline in the advertising business gross margin.

Q2 2022 Xiaomi's Internet Services Business Gross Margin was RMB 5.09 billion, down 2.4% YoY. The YoY decline in the Internet gross margin this quarter was due to a decrease in revenue from the pre-installed business related to intelligent smartphone shipments, which led to a decline in the advertising business gross margin.

The rise in Internet services gross margin was mainly due to the structural boost brought about by the increase in high-margin advertising business. However, under the influence of many unstable factors in this quarter, the overall expenditure of the advertising industry has tightened, affecting the increase in revenue of the company's advertising business, which in turn affects the business gross margin.

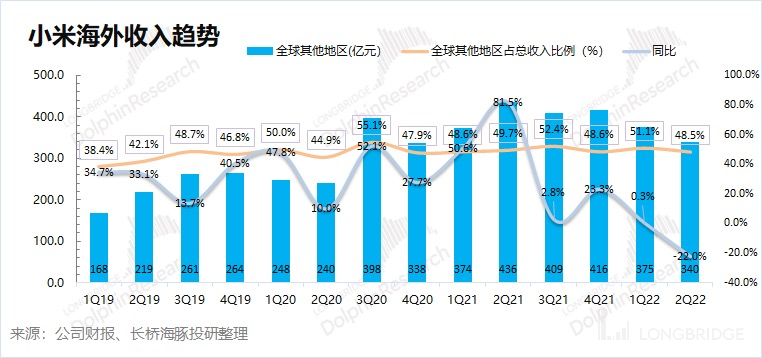

V. Overseas Market: Policy Risks of "Going global" Under Unstable Environment

In Q2 2022, Xiaomi's overseas revenue was RMB 34 billion, down 22% YoY, and the revenue share fell to 48.5%. Impacted by the significant decline in overseas smartphone shipments, the company's overseas revenue saw a significant decline in this quarter.

Xiaomi's overseas Internet revenue still achieved a growth of 52.1% this quarter, while the significant decline in the company's overseas revenue mainly came from the hardware business. Under the influence of unstable factors such as regional conflicts, epidemics, overseas logistics, and various national policies, it directly affected the export of Xiaomi's smartphones and IoT products. According to the analysis of Dolphin Analyst, Xiaomi's smartphone shipments in overseas markets (excluding China) in Q2 decreased by 27% YoY.

A part of Xiaomi's success comes from "globalization", and currently nearly half of Xiaomi's revenue comes from overseas markets. Although the "globalization strategy" can to some extent diversify Xiaomi's risks, the instability of multiple regions directly affects the development of Xiaomi's business. ①Mainland China market: Xiaomi's smartphone shipments in Q2 decreased by about 3 million units YoY, mainly due to direct effects on consumer demand such as epidemic control; ②India market: Xiaomi's smartphone shipments in Q2 decreased by about 2.7 million units YoY, mainly due to local government policies affecting consumer purchasing choices; ③Other markets: Xiaomi's smartphone shipments in Q2 decreased by about 7 million units YoY. The overall market demand was weak, and Xiaomi was still affected by the Russia-Ukraine conflict and unfriendly policies of some European countries in Q2.

As Xiaomi Group operates on the business philosophy of "hardware + software", although overseas smartphone shipments have declined YoY, the number of overseas users on the software side continues to grow (new purchases exceeding replacements). Looking at the distribution of MIUI users, Xiaomi has already had 547 million MIUI users by the end of this quarter, of which more than 400 million came from overseas markets. In other words, although Xiaomi is from mainland China, the company's overseas users now account for nearly three-quarters of the total. Due to the significant differences between domestic and foreign users, the per capita ARPU value of foreign users is much lower than that of domestic users. Therefore, the higher proportion of overseas users structurally lowers the company's ARPU level. In this quarter, Xiaomi's Internet service ARPU value was 12.7 yuan, a year-on-year decrease of 18%. The main reasons for this are the growth of overseas users and the decline in domestic ARPU values.

According to Dolphin Analyst's calculation, Xiaomi's ARPU value for domestic users in the second quarter was 37.6 yuan, a year-on-year decrease of 21.2%, mainly due to domestic advertisers reducing their budgets. In contrast, the ARPU value for overseas users in the second quarter was 4.18 yuan, a year-on-year increase of 23.3%, and it still shows an upward trend.

In the context of slowing economic growth, overall advertising and other Internet services began to tighten budgets. Compared with overseas advertising industries, the domestic advertising industry is more affected. In addition, overseas Internet services still benefit from the dual leverage of user growth and ARPU value, but attention should also be paid to policy risks in multiple regions overseas.

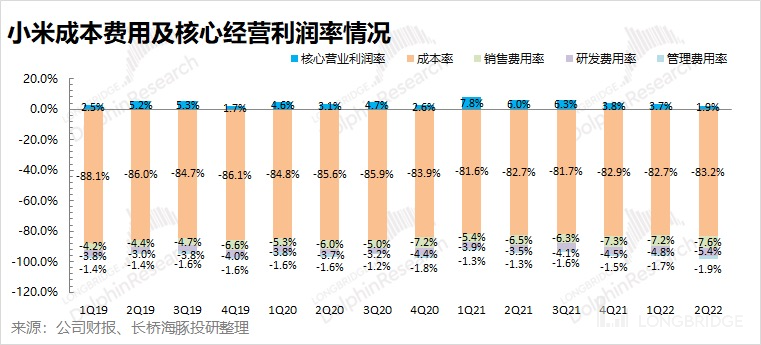

Sixth, cost and performance: layoffs cannot prevent the increase in investment in the auto industry.

In the second quarter of 2022, Xiaomi's total expenses for the three items amounted to 10.41 billion yuan, a year-on-year increase of 5.2%. The operating expense ratio increased by 3.5 percentage points, mainly due to the growth of research and development expenses and management expenses. Although Xiaomi itself is doing cost control, the decrease in the total number of employees (more than 900) this quarter was not enough to offset the continued increase in costs due to research and development investment in projects such as cars.

① Research and development expenses: 3.76 billion yuan this quarter, a year-on-year increase of 22.8%, accounting for 5.4% of revenue. R&D expenses continued to rise, mainly due to an increase in R&D spending related to innovative businesses such as smart cars. The number of Xiaomi's R&D personnel decreased this quarter, with a net decrease of 302 people for the quarter. However, the main reason for the increase in R&D investment is the investment in projects such as smart cars, rather than the contraction of the mobile phone business.

This quarter, the research and development expenses included research and development expenses for smart electric vehicles amounting to 611 million yuan, which increased the impact on the research and development expense ratio by approximately 0.87 percentage points. Before revenues from Xiaomi's cars were realized, the increase in research and development expenses increased the company's cost level. From the perspective of R&D expense ratio, Xiaomi's R&D expense ratio, which was originally around 3% has increased to over 5.4% and will continue to remain at a high level in the future.

② Sales expenses: 5.33 billion yuan this quarter, a year-on-year decrease of 6.1%, accounting for 7.6% of revenue. The decrease in sales expense ratio this quarter was mainly due to the reduction in advertising and publicity expenses, which were highly correlated with changes in product sales. ③Management Expenses: RMB1.32 billion this quarter, a year-on-year increase of 14.4%, accounting for 1.9% of revenue. The overall proportion has slightly increased, and the growth mainly comes from the increase in expenses for the new office building, including depreciation and amortization expenses.

In the second quarter of 2022, Xiaomi's overall gross profit margin was 16.8%, a year-on-year decrease of 0.5 percentage point, mainly due to the year-on-year decrease in the gross profit margin of the mobile phone business and Internet service business.

The decline in the gross profit margin of the mobile phone business is mainly due to the weak demand in the mobile phone market, coupled with unstable factors such as the epidemic and policies in various regions. The company's shipment volume has plummeted this quarter, and the high inventory has prompted the company to reduce prices and give profits. With the decline of the mobile phone business, Internet services have become the company's largest source of gross profit. However, in the quarter, the gross profit margin of the two main sources of gross profit rate has decreased, dragging down the company's gross profit margin level.

The adjusted net profit in the second quarter of 2022 was RMB 2.1 billion, which met the market's expectation of RMB 2 billion. Xiaomi's financial report for this quarter basically met market expectations.

Dolphin Xiaomi Group's historical articles:

Financial Report Season

May 19, 2022 conference call "Internal and External Dilemma of Xiaomi, What Does the Management Say? (Xiaomi 22Q1 Conference Call)"

May 19, 2022 financial report commentary "Internal and External Troubles, Xiaomi is Not the Best Choice"

March 22, 2022 conference call "Xiaomi Group: What Does the Management Say After the Unremarkable Financial Report? (Minutes of the Conference Call)"

March 22, 2022 financial report commentary "Xiaomi is Unremarkable: Tasteless Food, Waste of Material"

November 30, 2021 conference call "What Does Ideal Auto Rely On to Compete With Xiaomi, Which Released Pure Electric Vehicle Model Before and After? (Summary of the Conference)" 2021年11月23日电话会《缺货引发手机下滑?听听小米管理层怎么讲(小米电话会)》

2021年11月23日财报点评《大起大落,小米是要哪来哪去?》

2021年8月26日电话会《小米集团:靓丽的成绩单后,听听管理层聊了啥》

2021年8月25日财报点评《别再怀疑了,小米再登 “神坛”》

2021年5月26日财报点评《战绩显赫,小米要来戴维斯双击?》

2021年3月25日电话会《缺芯、互联网/IoT 龟速、造车?小米是这么回答的!》

2021年3月24日财报点评《预期差大到令人怀疑人生,小米到底怎么回事?》

** 深度 **

2022年6月17日《消费电子 “熟透”,苹果硬挺、小米苦熬》

2021年12月1日《荣耀攻城,小米再遭 “生死劫”》

2021年11月24日《小米深跌背后,到底哪里出问题了?》

2021年6月11日《2021,小米 “脱胎换骨”| 海豚投研》

2021-03-16 "Dolphin Research | A turn of events, is Xiaomi finally getting rid of bad luck?"

Live

2022-05-19 "Xiaomi Group-W(01810.HK) 2022 Q1 earnings conference call"

2022-03-22 "Xiaomi Group (1810.HK) Q4 and full-year 2021 earnings release"

2021-12-28 "Lei Jun X Su Bingtian · Xiaomi New Year Live Broadcast"

2021-11-23 "Xiaomi Group (1810.HK) 2021 Q3 earnings conference"

2021-09-15 "Let the Magic Begin—Xiaomi New Product Launch"

2021-08-25 "Xiaomi Group-W(01810.HK) 2021 interim results release conference"

2021-08-10 "2021 Lei Jun Annual Speech"

2021-05-26 "Xiaomi Group (1810.HK) 2021 Q1 earnings conference call"

2021-03-30 "Xiaomi Spring New Product Launch DAY2"