Xiaopeng's "profitability" is still distant

Xpeng Motor (XPEV.N/9868.HK) released its second quarter earnings report for 2022 before the Hong Kong stock market closed and the US stock market opened on August 23. The key points are as follows:

1. The second quarter performance basically met expectations. The early release of the delivery volume set the tone for the overall performance, and both revenue and profit basically met expectations. In 2022, ASP will increase due to the dual-drive of model structure and price increase, while the cost side still puts pressure on the gross profit margin. The cost expenditure continued to increase this quarter, and the final operating loss expanded. The company is far away from profitability.

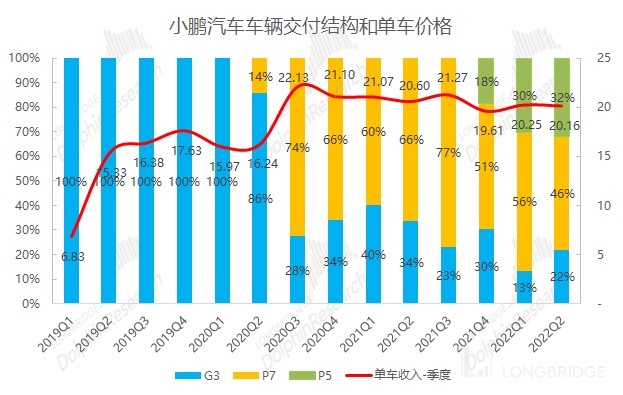

2. The ASP of the automotive business is stable, and it is expected to improve in the second half of the year. Based on the clear delivery volume, the gap in expected revenue from automotive sales mainly comes from changes in ASP. At present, there are mainly two factors affecting ASP: price increase and changes in model structure. The company's ASP in the model structure decreased in the second quarter. The proportion of the cheapest G3 increased from 13% in the first quarter to 22% this quarter, while the proportion of the most expensive P7 decreased from 56% to 46%. Fortunately, the price increase effect at the end of March was partially released this quarter, which offset the pressure of ASP's decline at the model structure level. In the third quarter, price increase is basically a done deal. The company started to raise prices at the end of March, and the order delivery will be fully reflected in the third quarter. At the same time, after the delivery of the G9 in the third quarter, ASP is also expected to be boosted. Therefore, Dolphin Analyst speculates that Xpeng will probably show an ASP increase in the second half of the year.

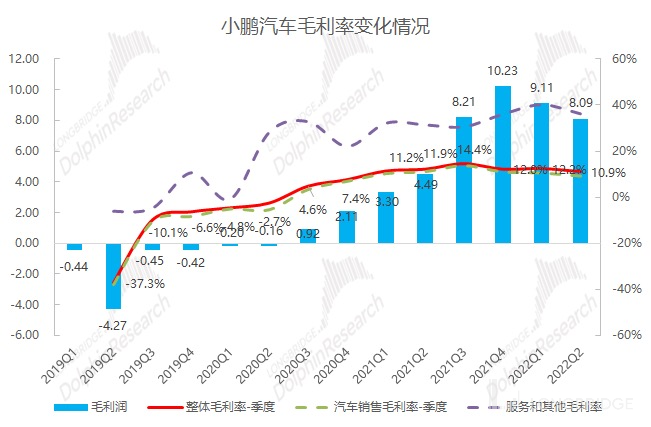

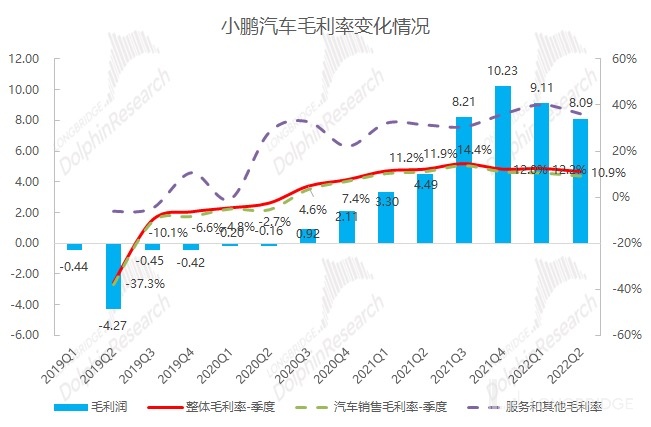

3. Cost damages gross profit margin, still prioritize sales volume over profitability. Xpeng has the lowest gross profit margin among the three new forces. NIO and Ideanomics' gross profit margins are around 20%, while the company's automotive sales gross profit margin is still struggling around 10%. Since 2022, the price increase of power batteries has driven the price increase of entire vehicle manufacturers, and the company's gross profit margin in the first quarter was not significantly damaged, mainly because of the role of low-priced battery inventory. However, the impact of battery price increases appeared in the second quarter, and the automotive gross profit margin fell below 10%. The gross profit margin in the third quarter is expected to rebound slightly after the release of price-increased orders in late March and delivery of G9. But compared with profitability, it is currently more important for Xpeng to get the "volume" up and running. Dolphin Analyst estimates that Xpeng's gross profit margin in the second half of the year will still be lower than the other two, even if it is slightly boosted.

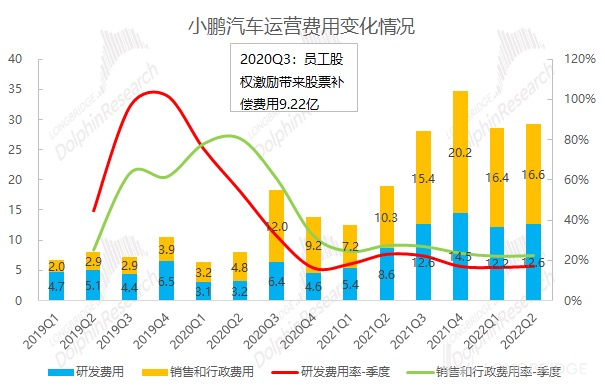

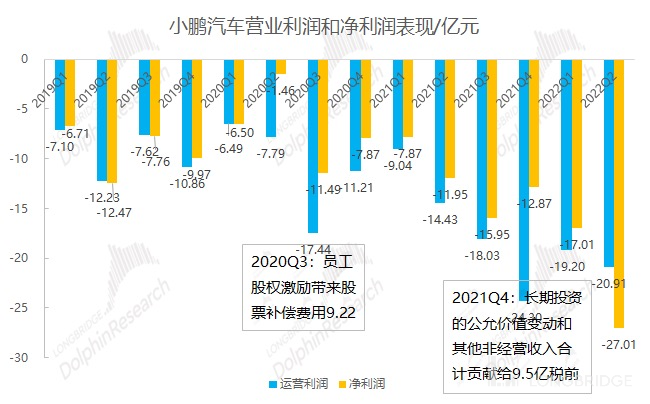

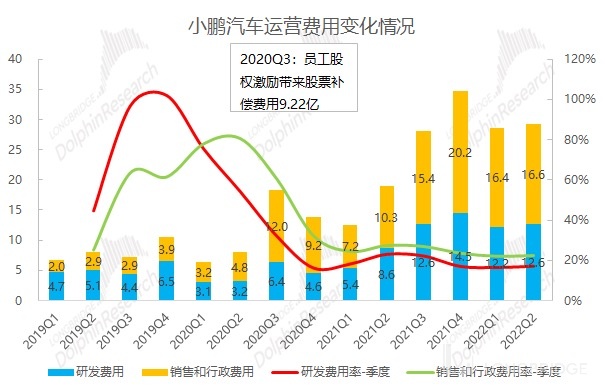

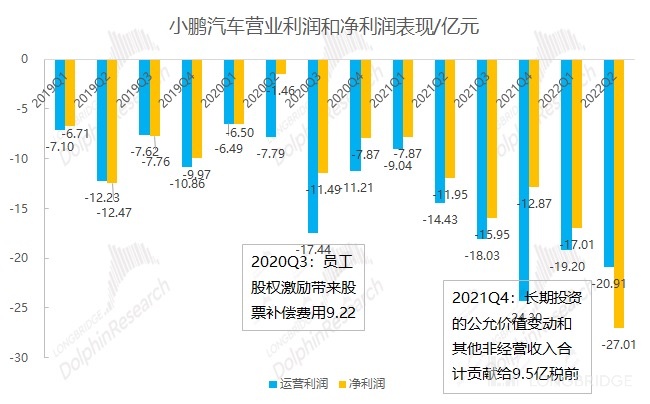

4. High investment in R&D/sales, rigid costs squeeze profits. R&D expenses and sales expenses are sustainable, and both expenses continue to maintain high investment this quarter. High R&D investment is Xpeng's strategic positioning of "smart and full-stack self-research"; high sales investment is Xpeng's current demand to continue to expand its network and reach more end customers. Therefore, Dolphin Analyst believes that these two costs of Xpeng are relatively rigid and will squeeze the company's profits for a long time. In the second quarter, in the case of weak income/delivery volume, rising costs and expenses, the company's operating loss continued to expand this quarter. 5. Outlook for the Third Quarter Shows Limited Advantage in Delivery Volume, but ASP Is Expected to Increase. Compared with the guidance of 27,000 to 29,000 units from Ideal Automobile, the company's guidance for the third quarter delivery volume is 29,000 to 31,000 units, which still has a leading edge but not by much. Based on the revenue guidance, the company's ASP in the third quarter is estimated to be around RMB 217,000, an increase of RMB 15,400 (7.6%) compared to the previous quarter. From the perspective of the increase in growth rate, the gross profit margin is expected to rebound in the third quarter.

Overall view: Although Xiaopeng's financial report has met market expectations, it is still unsatisfactory. The monthly disclosure of delivery volume has been fully digested by the market. The main dissatisfaction lies in 1) the decrease in ASP instead of an increase. Although the impact of price hikes may be postponed, the average price this quarter has decreased. The reason behind this was that during this quarter, the focus of deliveries shifted towards the lower-priced G3 and P5, while the proportion of P7 decreased significantly; 2) automobile gross profit margin fell back to single digits. When high-end breakthroughs cannot be sustained, and the delivery volume does not take off, the company has very low bargaining power in the industrial chain. In the second quarter, despite the surge in battery prices upstream, the company could only accept the erosion of gross profit margin caused by the rise in costs.

Looking ahead to the third quarter, Xiaopeng has not provided an outstanding guidance. Although the second quarter may have been affected by epidemic lockdowns, the delivery guidance for the third quarter remained at 29,000 to 31,000 units, which is still "sliding" compared to the second quarter. Combined with the 11,500 units delivered by the company in July, the monthly average delivery volume from August to September is only about 10,000 units. As the impact of the epidemic and the shortage of chips gradually weakens and the supply side gradually improves, the weakness in delivery volume makes the market more concerned about the demand side.

According to the guidance calculation, Xiaopeng's automobile average price will increase in the third quarter, mainly due to the release of price hike orders in late March and the start of deliveries for G9, which will to some extent increase the gross profit margin. However, due to the increase in battery costs and the pressure on sales, the company's gross profit margin is unlikely to improve significantly, and its sustainability is questionable. Dolphin Analyst believes that at this stage, the most important thing for the company is still how to boost "volume", which will also affect vehicle prices and sales network layout, and will create pressure on the company's profits. Xiaopeng is still far away from "making money."

The following is Dolphin Analyst's specific analysis of Xiaopeng's financial report:

I. Delivery Volume Advantage Diminished, ASP and Other Business Income Increased:

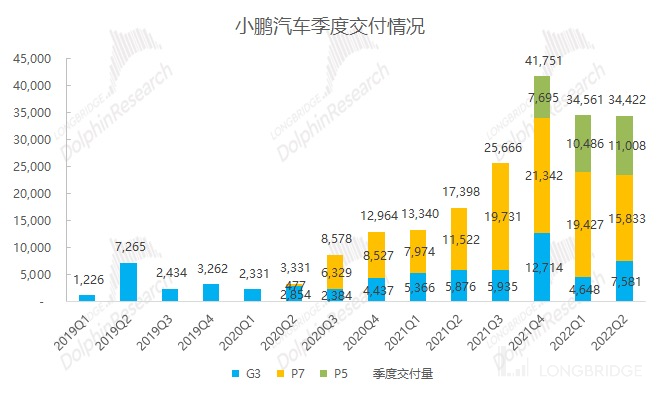

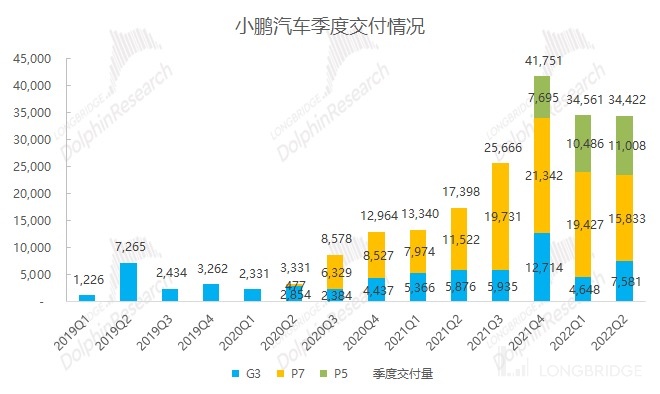

1.1 Delivery volume still ranks first among the 3 small EV makers: In the second quarter of 2022, the company achieved a delivery volume of 34,422 units, a year-on-year increase of 98% and a quarter-on-quarter decrease of 0.4%. It still ranked first among the 3 small EV makers, exceeding Xiaochao Company's guidance of 31,000 - 34,000 units. In the second quarter, the delivery volume was affected by factors such as the lockdown in Shanghai, but Xiaopeng still managed to meet the guidance target.

Data source: Company financial report, Dolphin Investment Research

Data source: Company financial report, Dolphin Investment Research

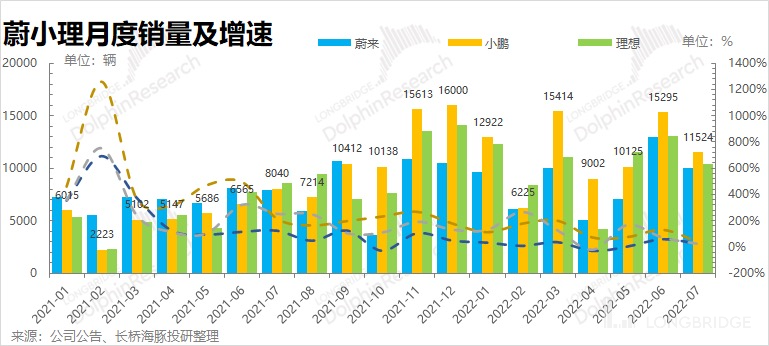

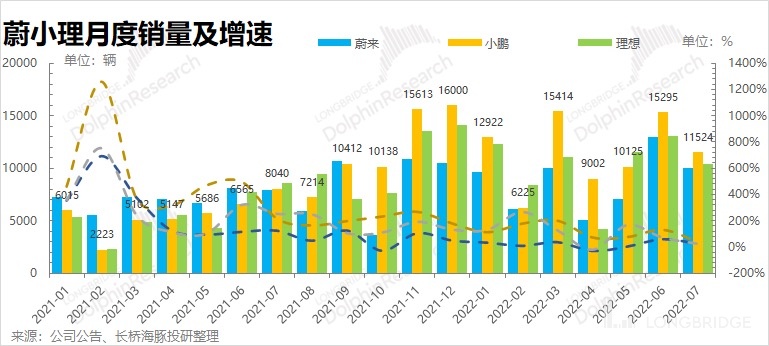

Compared with NIO and Xiaopeng Motors, the company's current delivery data is still the best, maintaining its position as the leader in delivery among the three new forces represented by Weilai, Xiaopeng and Li Auto. The reasons for this are related to the company's overall positioning being lower, the acceleration of franchise channels and the rhythm of product launch.

- In the second quarter, the company did not lower its guidance and still had the highest delivery volume. One of the reasons for this is that the company's factory is far from the Yangtze River Delta and the product market is more centralized, so it is less affected by the epidemic;

- Looking ahead to the third quarter, the company's delivery guidance is 29,000-31,000 vehicles. Excluding the sales volume announced in July, it means that Xiaopeng Motors' average monthly delivery volume in August and September is only around 10,000 vehicles. At the same time, Xiaopeng's delivery advantage among the three new forces in the first-tier cities has been caught up with compared to Li Auto's delivery guidance (27,000-29,000).

- Looking at the cumulative sales volume from January to July 2022, Xiaopeng's cumulative delivery volume is 60,879/80,507/70,825 vehicles, and the company maintains its leading position. However, looking at the recent sales volume in July and the delivery guidance for the third quarter, Xiaopeng's past advantages have been caught up with. Based on the latest shipment volume in July, Xiaopeng still leads with 11,500 shipments, while NIO and Li Auto also have shipments exceeding 10,000. Although Xiaopeng's G9 will begin delivery in September, it is expected that G9 will not be able to boost the company's delivery volume in the short term, according to the guidance.

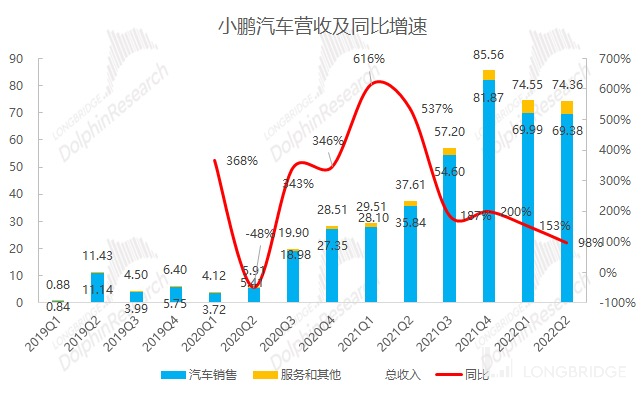

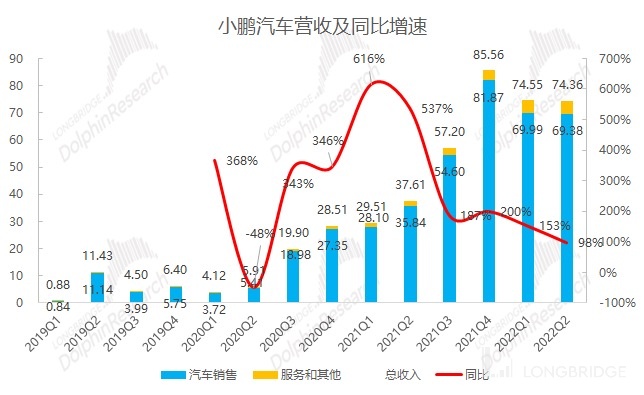

1.2 ASP basically stable, revenue slightly better than expected: The company achieved a total revenue of RMB 7.436 billion in the second quarter of 2022, which exceeded the company's guidance (RMB 7.1-7.2 billion) and slightly exceeded Bloomberg's consensus forecast of RMB 7.23 billion. As the company's monthly delivery volume is disclosed, the market has already digested it. The main reason for the better-than-expected result is due to the company's average selling price per vehicle and services and other businesses.

- The revenue from automobile sales was RMB 6.938 billion, a month-on-month decrease of 1%, mainly due to the impact of epidemic risk control on the company's delivery volume. Looking at the two factors of volume and price separately, the second-quarter ASP of the company's automobile sales was RMB 201,600, a decrease of RMB 9,000 from the previous quarter, mainly due to changes in vehicle structure;

- The revenue from services and other businesses was RMB 498 million, with a year-on-year and month-on-month growth mainly due to the increase in service, parts and accessory sales, which has a direct relationship with the increasing cumulative delivery volume. The quarterly contribution of single vehicle calculated according to the cumulative delivery volume is about RMB 2,600, a decrease of RMB 300 from the previous quarter;

- The company expects to achieve a revenue of RMB 6.8 billion to RMB 7.2 billion in the third quarter. Compared with the delivery volume guidance, it implies that the company's ASP will be greatly increased from RMB 201,600 in the second quarter to about RMB 217,000, mainly due to the start of delivery of vehicles with full-price increase and the impact of the high-price G9 model.

Data Source: Company Financial Report, Dolphin Investment Research

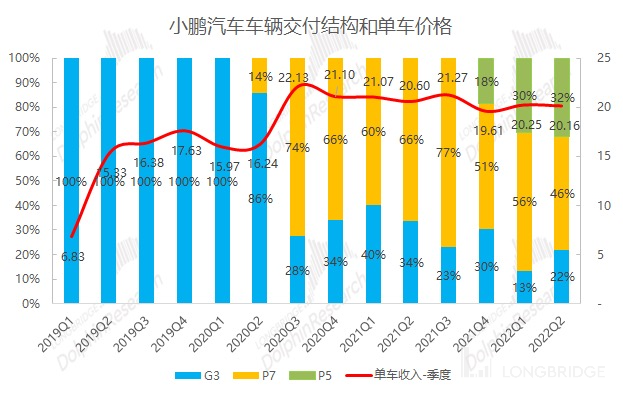

1.3 Changes in vehicle structure were the main reason for the decline in ASP of the company in the second quarter: The overall ASP of the company's automotive sales in the second quarter was RMB 201,600, a slight decrease of RMB 900 from the first quarter's RMB 202,500, which was not significant (the impact of price increases was not evident this quarter).

At present, the main factors affecting the overall ASP of the company are price increases and changes in vehicle structure. The slight decrease in ASP in the second quarter was mainly due to changes in vehicle structure.

- In terms of vehicle structure, P7 is more expensive than P5, and P5 is more expensive than G3. From the delivery structure in the second quarter, the cheapest G3 has increased to 22% in proportion, the delivery volume of the mid-range P5 remains at 32%, and the delivery volume of the most expensive P7 has decreased to 46%. The increase in the proportion of low-priced models and the decrease in the proportion of high-priced models are the main reasons for the decline in ASP this quarter.

- Starting from March 21, 2022, the company's three models have been raised in price, with a price increase of 10,000-30,000 yuan for P7 and 10,000-15,000 yuan for P5 and G3. Considering the time difference between ordering and delivery, the impact of the price increase on ASP will be partially reflected in the second quarter, and basically fully reflected in the third quarter. Therefore, if there is no price increase, the structural impact will cause a greater decline in the company's ASP this quarter.

- Due to the complete realization of the price increase factor and the start of G9 delivery, the company is expected to achieve a significant increase in ASP in the third quarter. However, from the trend of the structural end, the focus of Xiaopeng's overall shipment is shifting to the middle and low-end models.

Data Source: Company Financial Report, Dolphin Investment Research

II. Cost damages gross profit margin, or sales before profit

Making cars is a business with large early investment and a long investment payback period. It needs to go through the process of model mass production-sales climbing-scale effect-highlighted gross profit margin-positive net profit-back to this long process. In 2020, the hot new energy vehicle market led new car-making companies to achieve quarterly gross profit margin, and currently they are in the stage of gross profit margin climbing and net profit loss narrowing.

Xiaopeng's business structure is simple, and the overall gross profit margin depends on the gross profit margin of automotive sales. In the second quarter of 2022, Xiaopeng's overall gross profit margin was 10.9%, a decrease of 1.3 percentage points from the previous quarter, slightly lower than Bloomberg's consensus expectation of 11.1%.

-

Automotive sales gross margin was 9.1%, a decrease of 1.3 percentage points from the previous quarter. The decrease in automotive gross margin was mainly affected by factors such as the battery factory's price increase, which squeezed the company's automotive gross margin.

-

Compared with NIO and Xpeng's gross margin of close to 20%, Xiaopeng's gross margin seems to have a relatively large room for improvement, but it is currently difficult to deduce the trend of gross margin improvement due to cost reasons. In addition, the change in the company's vehicle model structure is also the reason affecting the change of the gross margin of the company (the later launched P5 is not a profitable vehicle model, and middle-to-low-end vehicle models often need to rely on scale advantages to improve profitability, but it is currently not at the stage of extreme scale effect). The G9 launched in the third quarter is expected to improve ASP and gross margin, but the delivery of G9 still needs to be determined.

-

Looking ahead to the three quarters after 2022, battery factories generally raised prices in the second quarter, and the pricing method of batteries changed to be linked to metal prices. Even if the lithium price in 2022 rebounds, it will most likely remain at a high level. New energy vehicle companies are facing continued cost pressures, and price increases have become the way to transmit pressure. The whole vehicle factories in 2022 face the difficult balance between profitability and sales volume, and it is difficult to return to the trend of profit improvement.

Xiaopeng Motors is the new power company with the lowest gross margin among the three companies, Xiaopeng, NIO and Xpeng. Both the company and the market expect to see the company's gross margin improve as delivery volume increases, and to get rid of losses and strive for better profitability. This is not only a problem for new power companies, but also for all companies.

Data source: Company financial report, Dolphin Research

3. R&D/Sales Maintain High Investment, Rigid Costs Squeeze Profits

Xiaopeng Motors is positioned to be empowered by intelligence for sales and brand, which is bound to continue to increase R&D to form and solidify advantages. At the same time, the company is in a stage of rapid expansion and needs to increase investment in sales and service networks. Based on the company's long-term strategy, it is difficult to reduce costs in the short term, which will also form suppression on profits.

Data source: Company financial report, Dolphin Research

3.1 R&D Maintains High Investment, Firm Determination to Monetize Software: "The R&D expenditure in the second quarter of 2022 was RMB 1.26 billion, and the R&D cost ratio was 17%." R&D costs continue to be lower than those of Ideal Motors, and it is speculated that Ideal Motors increased its R&D investment to develop a pure electric platform.

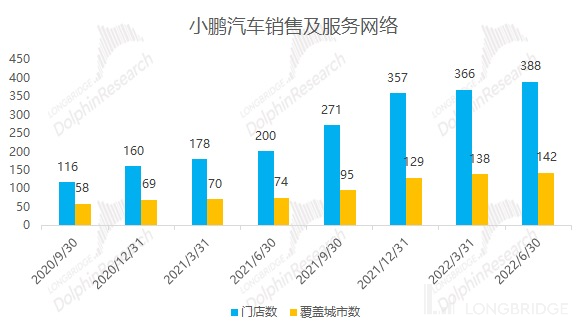

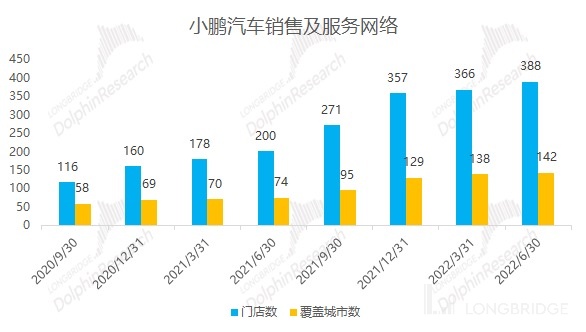

From the perspective of enterprise tone and strategy, Xiaopeng's choice is the one that needs to burn money the most in R&D. Xiaopeng Motors defines itself with two labels: making smarter cars that understand China better and fully self-developed. At the same time, Xiaopeng is determined to increase sales volume, proving the company's determination and confidence in later software monetization. Therefore, Xiaopeng must require a large amount of pre-R&D investment to accumulate strength for future development. 3.2 Focusing on Sales Delivery Volume and Continuously Expanding Sales Network: In the second quarter of 2022, the sales and administrative expenses amounted to approximately RMB 1.66 billion, accounting for 24% of the revenue, with a continued upward trend. Even under the impact of the epidemic, the company added 22 new stores in the second quarter, maintaining the momentum of store expansion.

As of the end of June 2022, the company had a total of 388 nationwide sales stores, with a sales network of a combination of directly operated and distribution models (while NIO and Ideal are all directly operated). The distribution mode was added in 2021, and sales commissions of franchised stores began to be reflected in financial reports from the second quarter of 2021.

With the appearance of many new models from various manufacturers, we have seen that Xiaopeng has shown a lack of growth in recent months. Dolphin Analyst believes that at the current stage of new energy vehicles, the most important thing is to get the "quantity up and running." Xiaopeng continues to expand its sales network by exploring new cities, which is also the company's focus in breaking the bottleneck of volume. Although Xiaopeng's product strategy is aimed at higher-level advanced driver assistance systems, delivery volume is still the core of market concern and company survival at this stage. Both offline networks and franchise models will help to reach more market demand, but it is also inevitable to see the decline of single-store sales data for Xiaopeng under the current sales model. Whether the existing sales model can revive Xiaopeng still needs to be further observed, along with the company's vehicle delivery volume.

Source of data: Company financial reports, Dolphin Research and Investment

3.3 The company had a business profit loss of RMB 2.09 billion and a net loss of RMB 2.7 billion in the second quarter of 2022. The slight drop in operating profit was mainly due to the decline in the gross profit margin and the increase in expenses. As for the net loss of RMB 2.7 billion, which exceeded the operating profit by RMB 700 million, it was primarily due to the company's foreign exchange transaction exchange loss of RMB 900 million this quarter.

Source of data: Company financial reports, Dolphin Research and Investment

The above is Dolphin's interpretation of Xiaopeng's second quarter report. Concerning the progress of intelligent driving system technology and software monetization, specific planning of new models, the company's export strategy, and supply chain issues, Dolphin Analyst will track whether there are relevant interpretations in the company's performance briefing and will organize them accordingly.

The in-depth research and tracking comments on Xiaopeng by Dolphin include:

Comparative Study of the Three Stooges - Part 1: "New Forces of Car Manufacturing (Part 1): Investing in the Right People and Things, Examining the People and Things of New Forces of Car Manufacturing"

Comparative Study of the Three Stooges - Part 2: "New Forces of Car Manufacturing (Part 2): As Market Enthusiasm Cools Down, How Do the Three Stooges Consolidate Their Position?"

Comparison Study of Three New-Energy Vehicle Companies - Part II

- Review of Q1 2021 - "NIO: Tesla's Negative Impact vs. XPeng's Surprising Performance"

- Review of Q2 2021 - "XPeng: Healthy Financial Report and 'Intelligent' Heart"

- Q2 2021 Earnings Call - "XPeng: Roll Up Sleeves and Work Hard"

- Review of Q3 2021 - "XPeng: How Far Away from Being the 'Chinese Version of Tesla' Despite Winning the New-Energy Champion?"

- Q3 2021 Earnings Call Summary - "XPeng: Exploring Robotaxi Business and Advancing Intelligence Further?"

- Review of Q4 2021 - "XPeng: Selling More But Losing More, Is It a Joke or Brilliance?"

- Q4 2021 Earnings Call Summary - "Rapid Channel Sinking Opens the Delivery Volume Ceiling for XPeng"

- Review of Q2 2022 - "XPeng: Sales King or Loss King, Does the Market Still Buy the Trick?"

- Q2 2022 Earnings Call Summary - "XPeng: Q3 Will Demonstrate the Result of Price Hike and Significant Margin Improvement"

Risk Disclosure and Statement: Dolphin Analyst's DISCLAIMER AND GENERAL DISCLOSURE