After Double-Pressure, BOSS Zhipin Returns to Countdown of Growth

Hi everyone, I'm Dolphin Analyst!

Before the US stock market opening on the evening of August 23, BOSS Zhipin released its Q2 2022 financial results. As a member of the recruitment industry, which is greatly affected by macroeconomic expectations, it was difficult to achieve satisfactory results in such an environment in Q2. Of course, the market expected this, and it is more concerned about the situation in Q3.

Overview of specific core indicators:

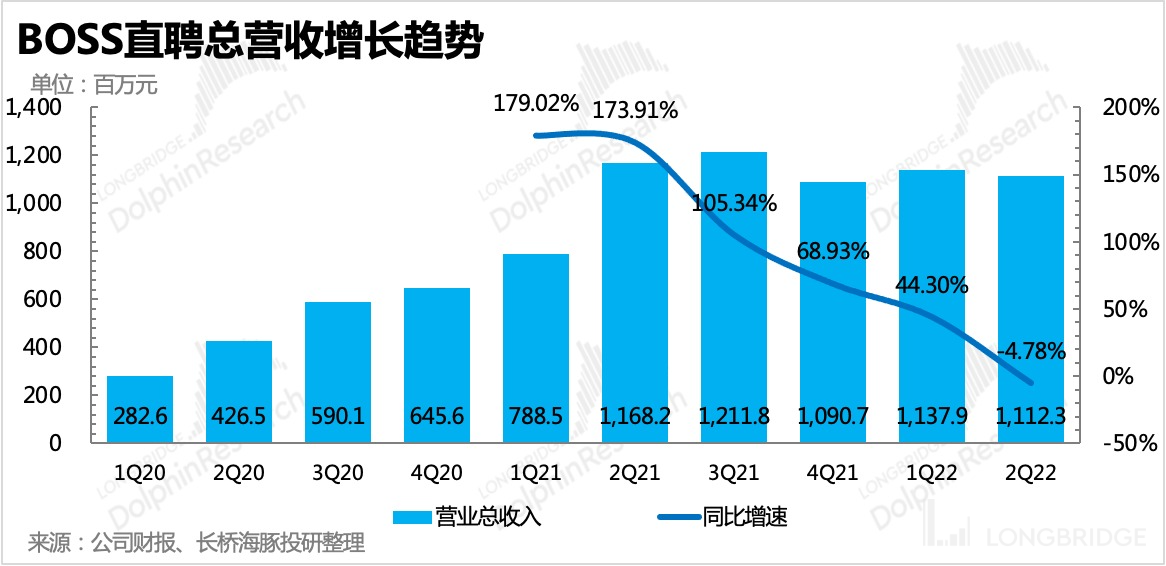

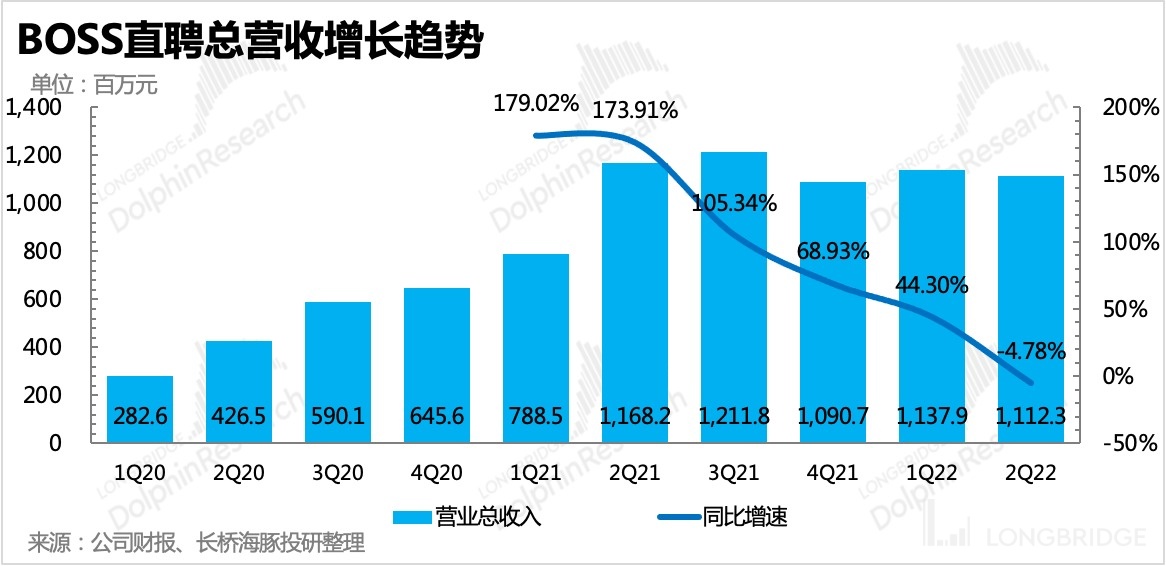

(1) Revenue was RMB 1.112 billion, which is close to the lower end of the guidance, weaker than the super-guidance performance in the past, and down 4.8% year-on-year. Q3 guidance is RMB 11.5-11.6 billion, a year-on-year decline of 4.3% to 5.9%, which is lower than market expectations. Although the operating indicators have been picking up since Q3, the repair of financial indicators needs to wait until Q4.

(2) Gross profit margin remained stable, and in Q2, the marketing expenses for customer acquisition continued to shrink as it was still in the registration freeze period. The research and development and management expenses continued to grow, reflecting the company's continuing investment in product optimization.

The final adjusted operating profit (excluding the impact of equity incentive expenses) was RMB 220 million, a year-on-year decrease, mainly due to the decline in income and the erosion of gross profit margin after the increase in server costs.

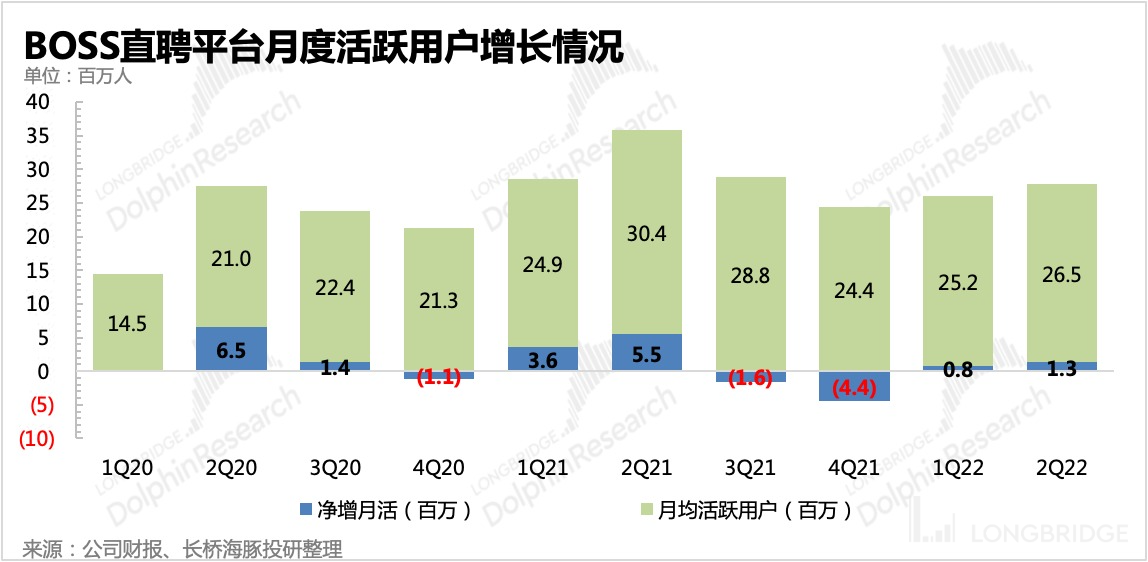

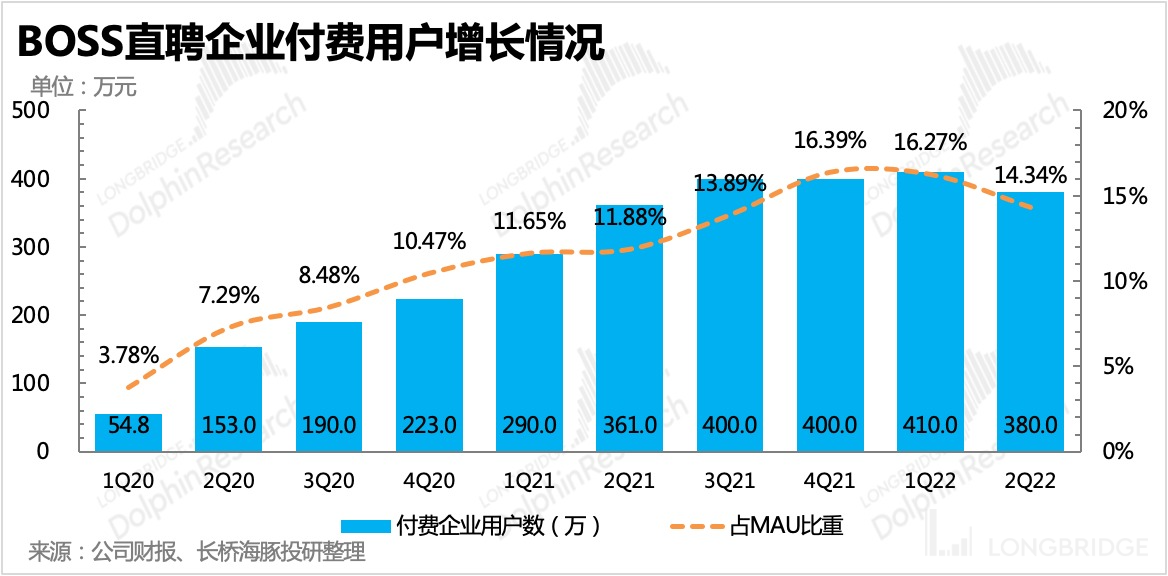

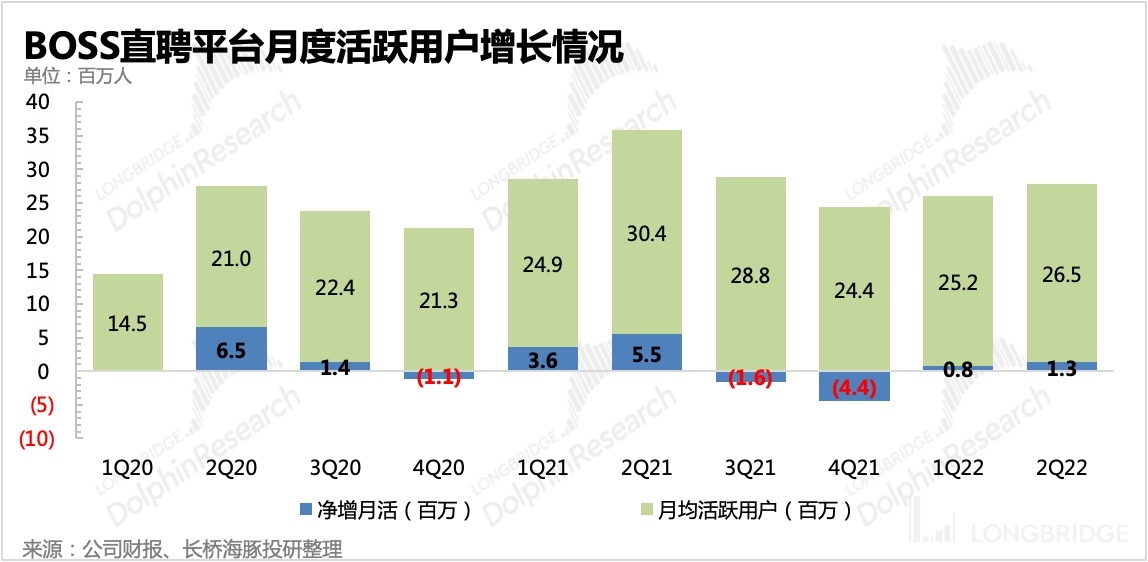

(3) In Q2, recruitment was significantly affected by the epidemic, and the number of paid corporate users decreased to 3.8 million on a month-over-month basis. However, at the same time, under economic pressure, job seekers were more active, and the monthly active users increased by net 1.5 million MoM to 26.5 million.

During the conference call, the management revealed that since the resumption of registration, there have been 10 million new registered users, and it is expected to increase by 25 million in the second half of the year. Dolphin Analyst believes that if the current registration activity conversion rate of 20%-25% is used, it is expected to increase by 5-6.25 million monthly active users.

(4) As of the end of Q2, the balance of cash and cash equivalents (cash + short-term investments) on the company's books was RMB 13 billion, and the net operating cash inflow in Q2 was RMB 187 million, which was slightly lower MoM but is expected to recover with the business season. The total accounts payable and other short-term payables were approximately RMB 800 million, so there is no cash flow pressure for the time being.

Dolphin Analyst's perspective

Based on forward-looking financial indicators and the company's revenue guidance, there is currently no sign of performance improvement in Q3. However, the management disclosed many operating indicators during the conference call, especially after the epidemic was lifted in June, registration resumed in July, and the activity of job seekers and recruitment companies increased after the slow economic recovery.

Dolphin Analyst believes that short-term operating data rebound is not ruled out due to temporary factors such as the lifting of the epidemic, graduation season, and initial recovery crowds, etc. The key issues that respectively affect the short and long term logic of BOSS Zhipin are whether the economic recovery is robust and whether the introduction of new players such as Kuaishou will affect the long-term space discount.

Regarding the above two issues, Dolphin Analyst believes that it may require further judgment whether the long-term logic will be weakened by the competition, but while maintaining caution, we also have confidence in BOSS Zhipin. At the end of Q2, "Kuai Zhaogong" had cooperated with 100,000 companies. The grassroots research is optimistic about talent labor service agencies, and the current high proportion of job positions is more biased towards traditional blue-collar recruitment in factory workshops. In other words, the most direct influence of "Quick Recruitment" should be the recruitment business of local classified information websites, such as 58 Tongcheng. The impact on BOSS Zhipin's future growth space is more, but it also depends on the follow-up business operation of "Quick Recruitment" and the expansion of the recruitment enterprise field.

In the short term, it mainly depends on economic recovery. Under normal circumstances, the shrinkage and expansion of small and medium-sized enterprises' own businesses will vary greatly when the economy has a marginal turning point. Most of BOSS Zhipin's customers are small and medium-sized enterprises, which indicates that BOSS Zhipin is facing greater pressure than its peers since the second quarter, but on the other hand, when the economic margin is upward, it may release higher elasticity.

Although the macro data in July showed that the current economic recovery pace is slower than expected, the direction of recovery is determined. Therefore, corresponding to the valuation of BOSS Zhipin, it may still undergo a bottoming process with the swing of economic expectations in the short term, but the improvement of performance repair + business operation after the restoration of registration will eventually be reflected in the stock price of BOSS Zhipin.

Detailed interpretation of this season's financial report data

1. The expected decline in revenue is within expectations, and data improvement still depends on the fourth quarter

Although the company gave guidance for the second quarter, in such a poor macro environment, the market's expectations for BOSS Zhipin are relatively conservative. The final revenue beat was small, achieving 1.112 billion yuan, a year-on-year decrease of 4.8%. Indeed, the revenue side has suffered a lot of pressure from the macro environment and frozen registration.

According to the company's guidance for the third quarter, the short-term income confirmation cannot fully reflect the expectation of economic recovery and recruitment warming. The third quarter revenue guidance is in the range of 1.15-1.16 billion yuan, slightly lower than the market's expectation of 1.17 billion yuan.

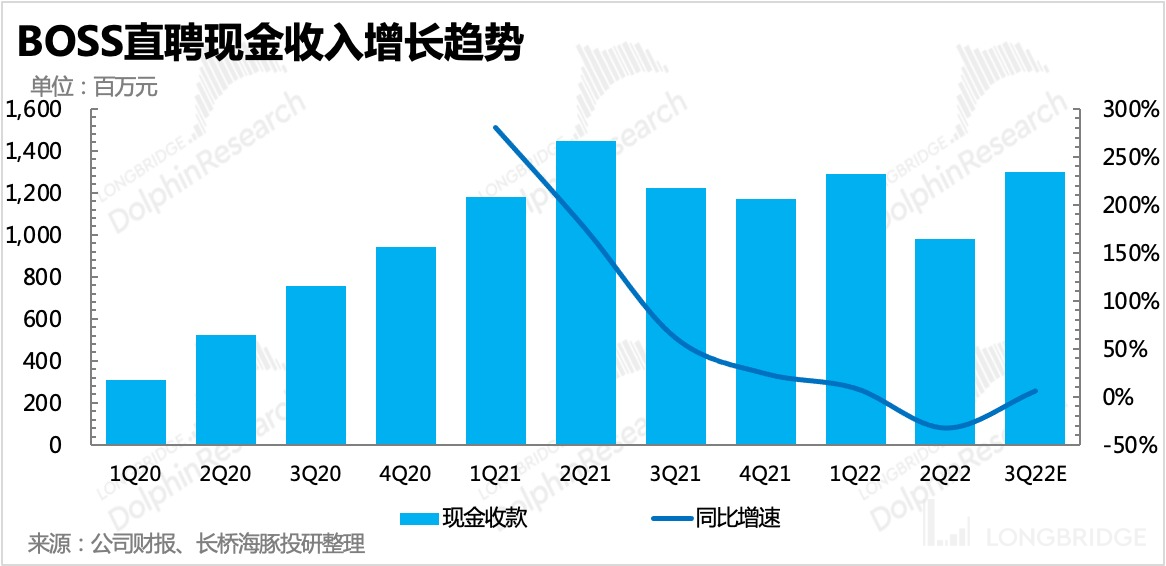

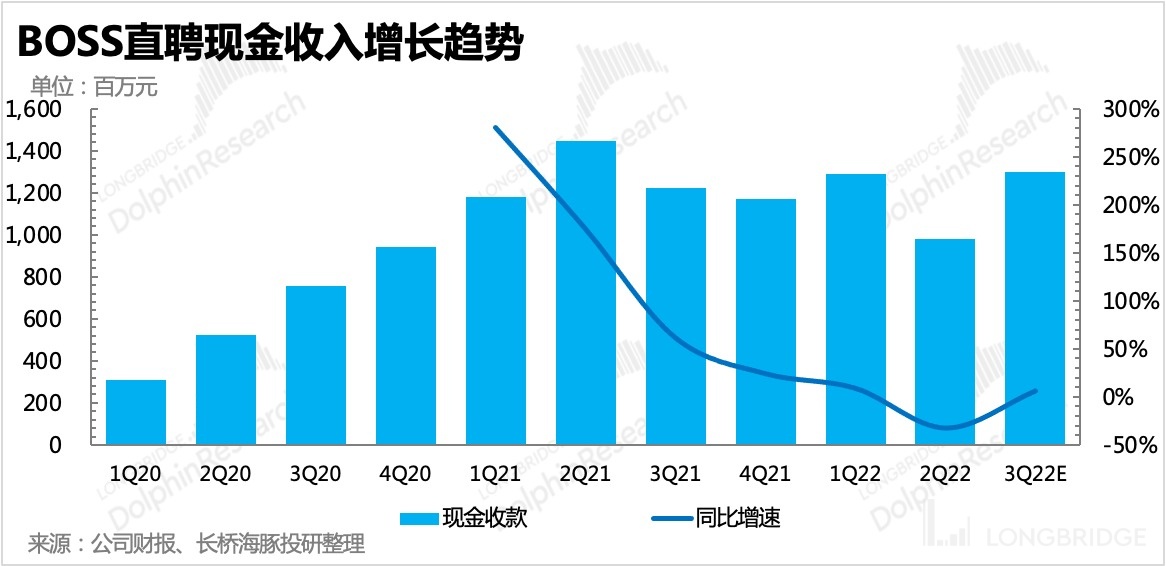

From the indicator of "cash income", which can better reflect the current customer situation, we can also see the headwind environment that BOSS Zhipin is currently facing. In the second quarter, BOSS Zhipin's cash income decreased by 32% year-on-year and also shrunk quarter-on-quarter. The cash income in the second quarter was so bleak that the epidemic is probably the main reason. Due to the uncertainty of control policies and economic pressures, enterprises will significantly reduce their willingness to recruit.

However, since the third quarter, with the lifting of the lockdown in Shanghai and the restoration of App registration, BOSS Zhipin's business data have been improving, and cash income has also returned to growth.

The company expects the cash income in the third quarter to be 1.3 billion yuan, a year-on-year increase of 6.5%. However, it is worth mentioning that this includes some incremental demand brought by the delayed recruitment needs of some enterprises due to the lockdown in the second quarter. If compared with the situation in the same period last year, the incremental part of the third quarter is not enough for the recruitment needs of enterprises to fully recover, that is, the overall cash income in the second and third quarters is only 85% of last year's.

In other words, although it has been unblocked and registration has been restored, enterprises spend much less money on BOSS Zhipin than they did last year. But according to some expected data disclosed by the management during the conference call: (1) It is expected that there will be a net increase of 25 million registered users in the second half of the year.

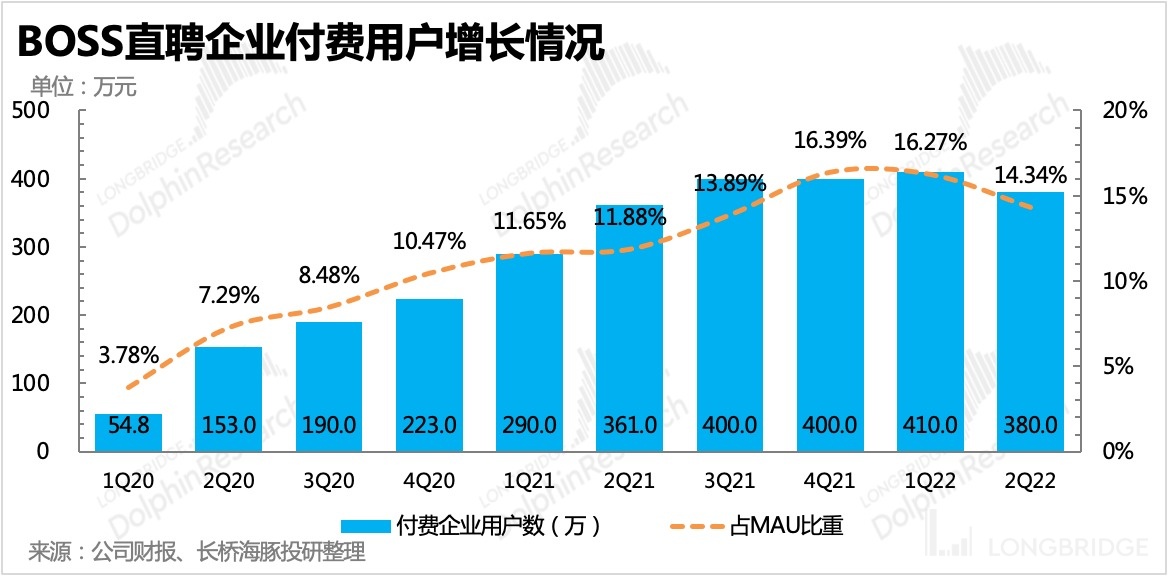

(2) The enterprise payment rate has actually remained stable. The decrease in the number of paying enterprises/MAU is due to the higher activity of job seekers than that of recruiters in the second quarter.

(3) As of now, there are over 100 million registered users.

Based on (1) and (3), the current "monthly active users/registered users" ratio (26.5%) implies that with the addition of 25 million new registered users in the second half of the year, considering a habituation process, we calculate the expected increase in monthly active users at 5 million, using a ratio of 20% for "monthly active users/registered users". We predict an increase of 3.5 million and 1.5 million in the third and fourth quarters respectively.

Furthermore, by using the enterprise payment rate level between Q1 (16.3%) and Q2 (14.3%) (~15%), we calculated the number of paying enterprise customers in the third and fourth quarters to be 4.5 million and 4.72 million respectively, with a significant recovery expectation from the second quarter's 3.8 million.

Thus, the Dolphin Analyst believes that the margin of BOSS Zhipin is expected to improve significantly in the fourth quarter performance.

Another question is whether the second quarter was a temporary impact caused by industry headwinds or a sustained impact caused by competition:

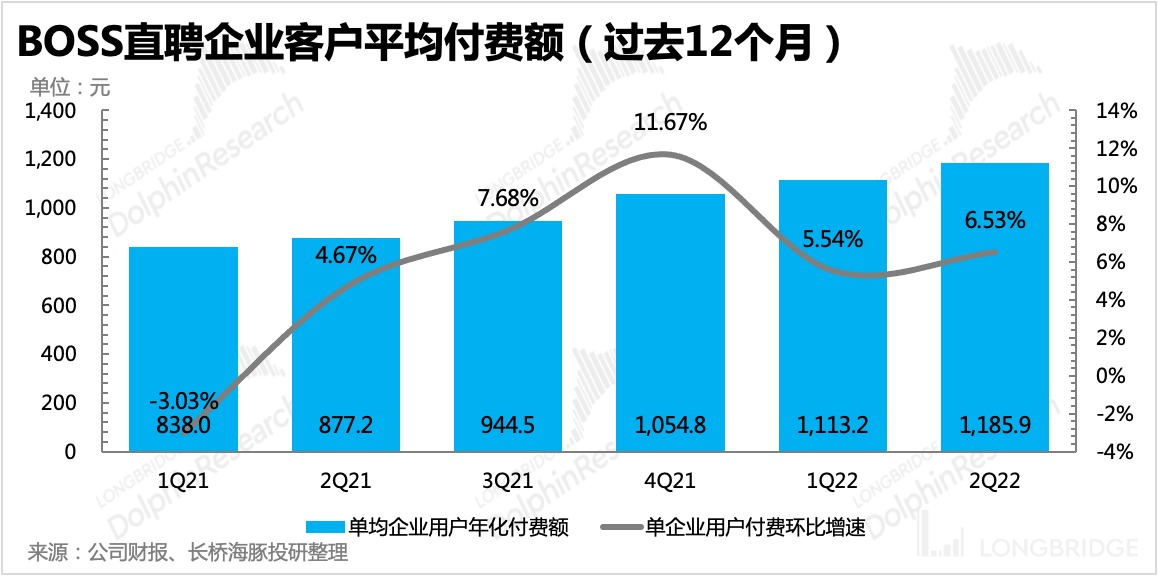

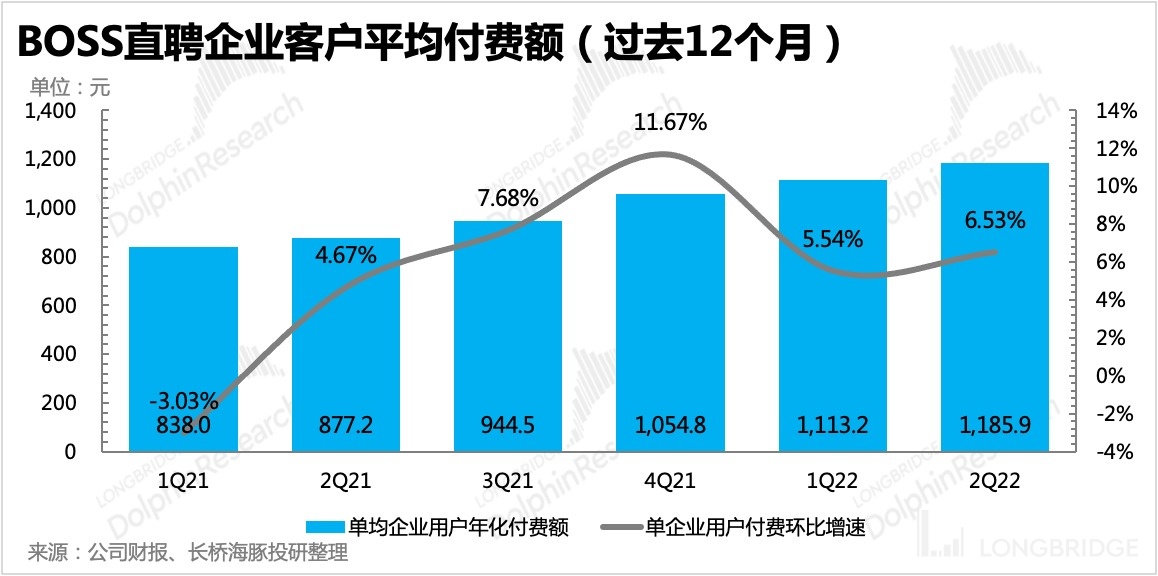

- On the one hand, from the perspective of BOSS Zhipin's own indicators, although overall monthly active users are increasing and the number of paying enterprises is stable, the average payment per user in the past 12 months has been growing against the trend. Of course, this does not mean that companies are increasing their recruitment budgets in such a poor economy, but rather that small and medium-sized enterprises are "disappearing" faster in the economic downturn.

- Combined with the second quarter operating data of Tongdao Liepin - YoY growth in active users was 16%, YoY growth in paying enterprise customers was 0.8%, and YoY growth in paying ARPU was 17%, mainly driven by the growth in ARPU per user. In an economic downturn, the specific recruitment budget of certain companies will not increase by 17% directly; therefore, the growth in average ARPU may primarily be due to changes in customer structure - in the context of the epidemic, medium and large enterprises with higher paying power have relatively stable recruitment plans and continue the trend of online recruitment, but for small and medium-sized enterprises, recruitment budgets are shrinking, and revenue contribution to online recruitment platforms is decreasing. BOSS Zhipin, which mainly serves small and medium-sized enterprise customers, will be more affected during the economic downturn phase, as we can see from the comparison with Liepin.

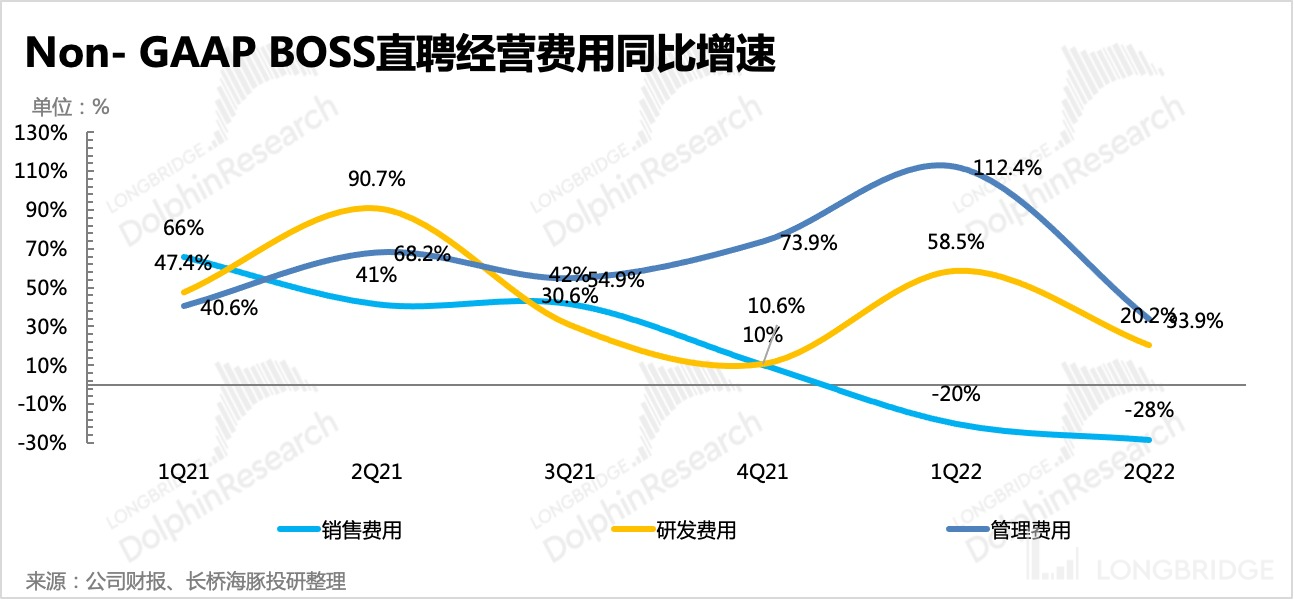

Second, profit source: Ultimate compression of customer acquisition and promotion expenses As the financing environment becomes cooler, income is under pressure, and all BOSS Zhipin can do is to continue to release profits and survive through the downturn. This is also what BOSS Zhipin has been doing for three consecutive quarters - reducing promotion and marketing expenses. In the second quarter, due to the epidemic, recruitment declined significantly, and the company promptly reduced unnecessary customer acquisition and promotion expenses. Excluding stock incentive expenses, sales expenses under the non-GAAP index dropped by 28% year-on-year, and other expenses continued to increase, reflecting the continuous investment in product technology maintenance and upgrades. However, the growth rates of R&D expenses and management expenses both significantly slowed down in the second quarter.

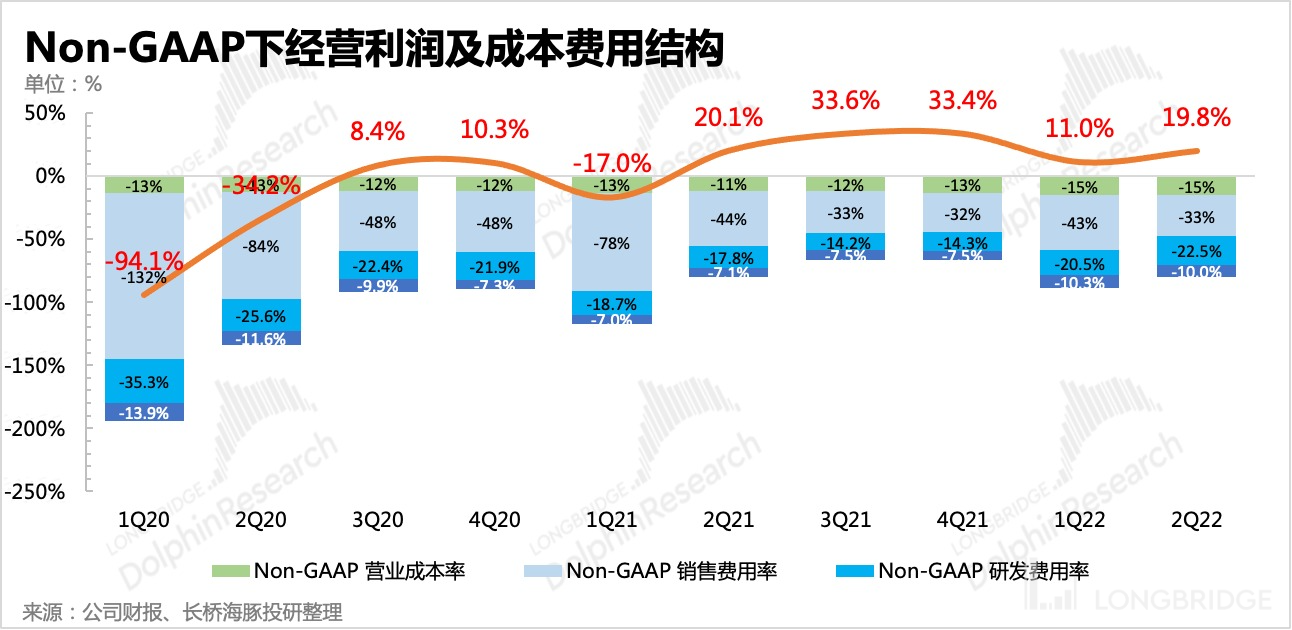

In the end, the non-GAAP operating profit was RMB 220 million, a year-on-year decrease of 6%, mainly due to the decline in revenue and the impact of the server cost increase on gross profit margin. The operating profit margin was 19.8%, approaching the company's full-year target for this year.

The non-GAAP net profit was RMB 257 million, a year-on-year increase of 4.3%. Compared with the decline in operating profit, the increase in net profit mainly comes from a significant increase in financial income this quarter. However, this has nothing to do with the development of the core business, so Dolphin Analyst still tends to look at the changes in non-GAAP operating profit.

BOSS Zhipin's previous articles by Longbridge: Quarterly reports:

June 25, 2022 phone conference call: "After the end of the epidemic, the service industry demand rebounded the most, and the competition has not yet seen a threat (BOSS Zhipin phone conference call)"; June 25, 2022 financial report review: "BOSS Zhipin: Resisting the headwinds, waiting for the 'seal' to be lifted"; March 24, 2022 phone conference call: "Continuing to do stock refining operations before the unsealing (BOSS Zhipin phone conference summary)". 2022/3/24 Financial Report Review: "BOSS Zhipin: Lay a Solid Foundation Today, Build a Great Wall in the Future."

11/25/2021 Financial Report Review: "BOSS Zhipin: Facing Pressure from Regulations and Macroeconomics, Make Money First (Including Key Points from Phone Conference Minutes)."

In-Depth

12/13/2021 "BOSS Zhipin: Recruiting Version of Pinduoduo, Expensive for a Reason?"

11/4/2021 "BOSS Zhipin: The Ultimate BOSS in the Recruitment Industry?"

Risk Disclosure and Statement for this article: Dolphin Analyst's Disclaimer and General Disclosure.