Meituan Dominates the Market with Confidence? Customization is the True Essence

Dolphin Analyst: The real companies that boost morale have arrived as the release of Q2 Chinese Concept Assets is nearing its end. Meituan- W.HK released its Q2 2022 financial report after the Hong Kong stock market closed on August 26th. Just look at the results:

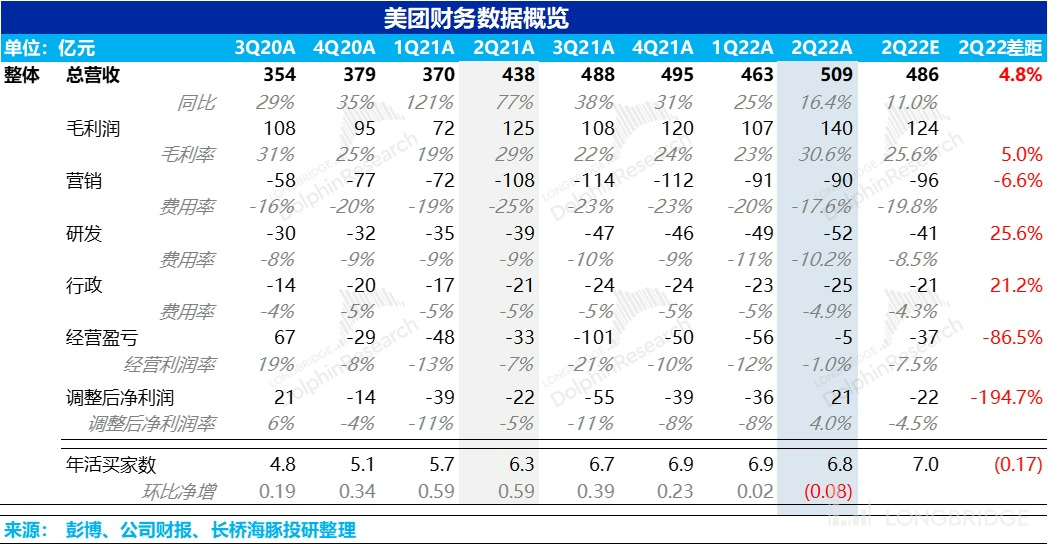

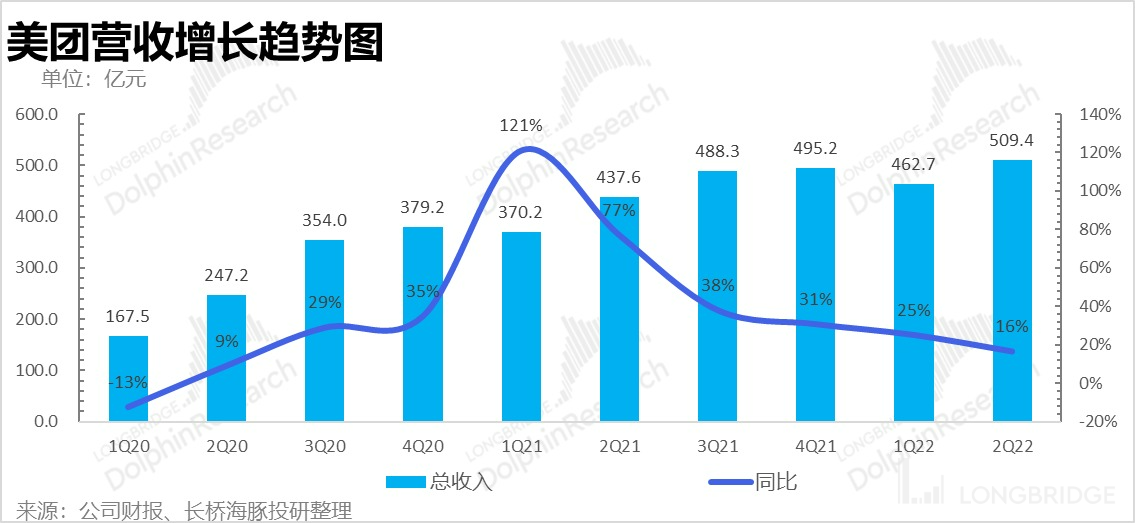

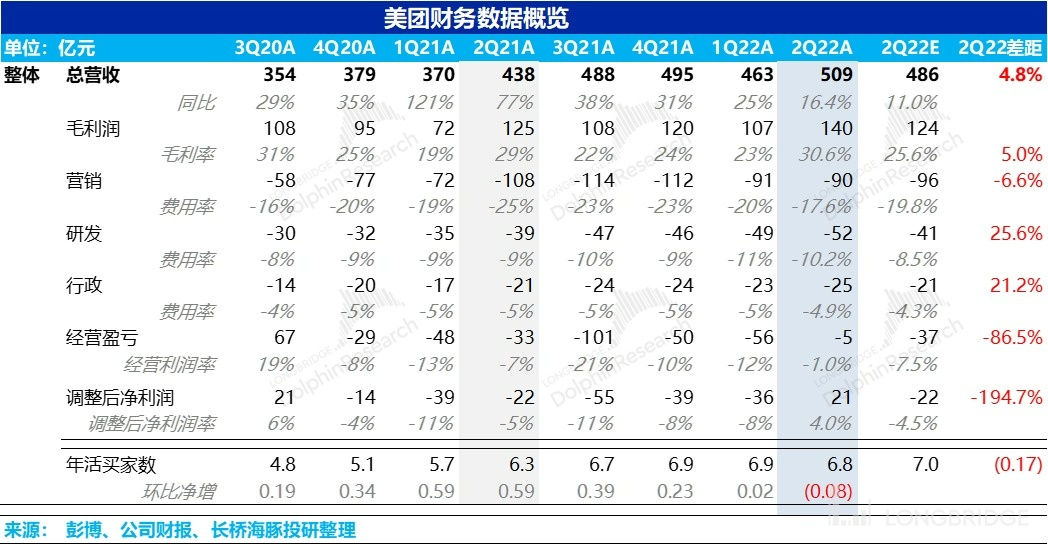

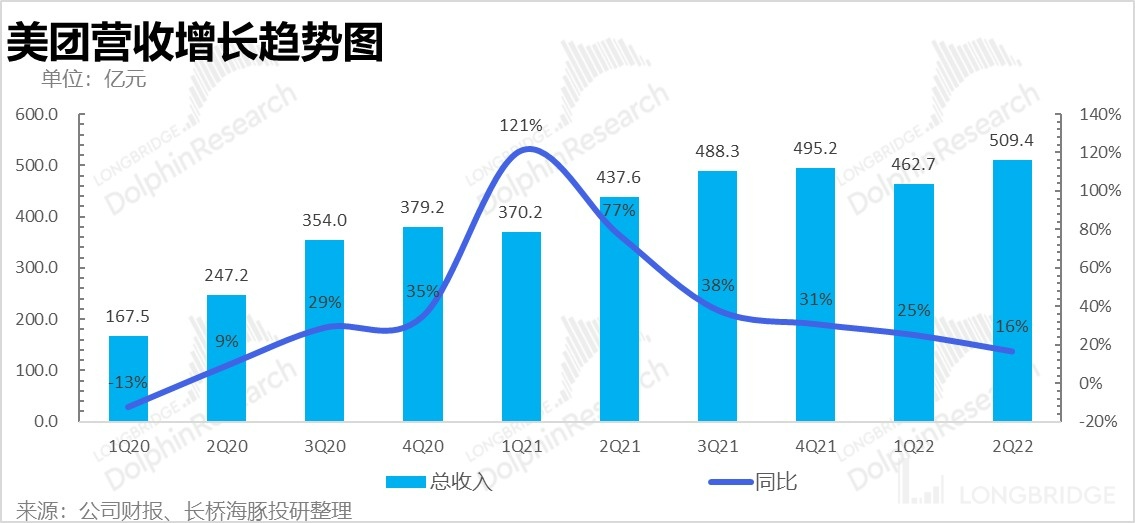

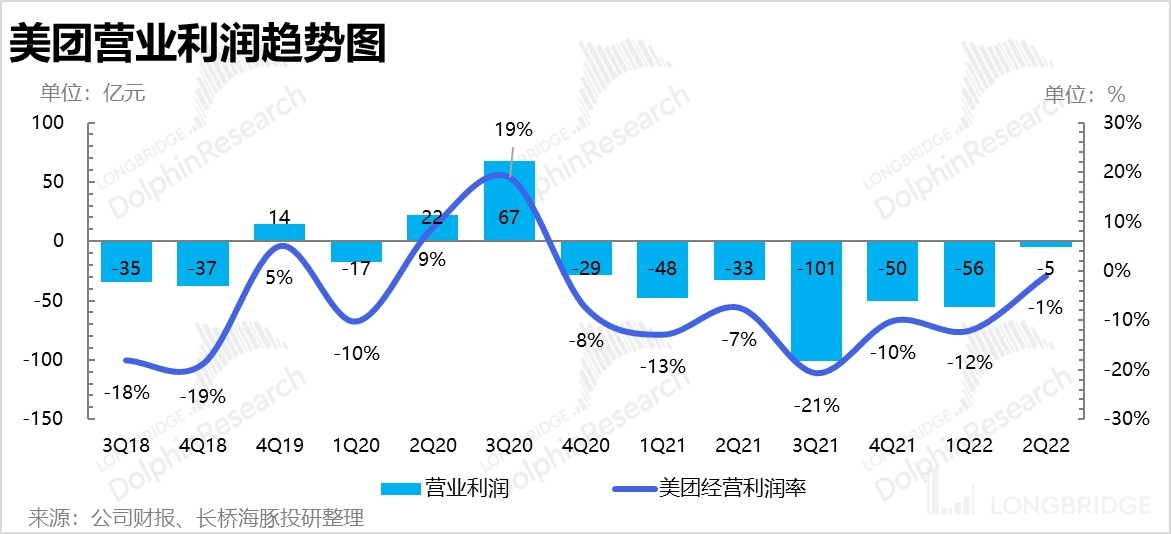

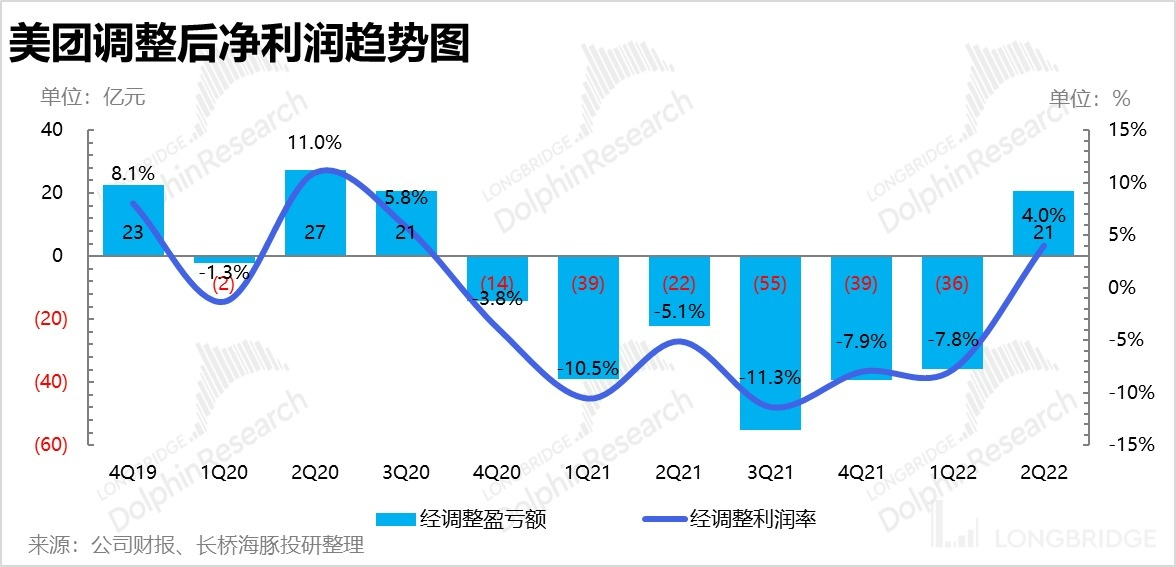

Total revenue of CNY 50.9 billion, a YoY increase of 16.4%, nearly CNY 2.5 billion more than the market's expectation, and an adjusted net profit of CNY 2.1 billion, while the market expected a net loss of CNY 2.2 billion. Although both figures are CNY 20 billion, they are vastly different due to being one positive and one negative.

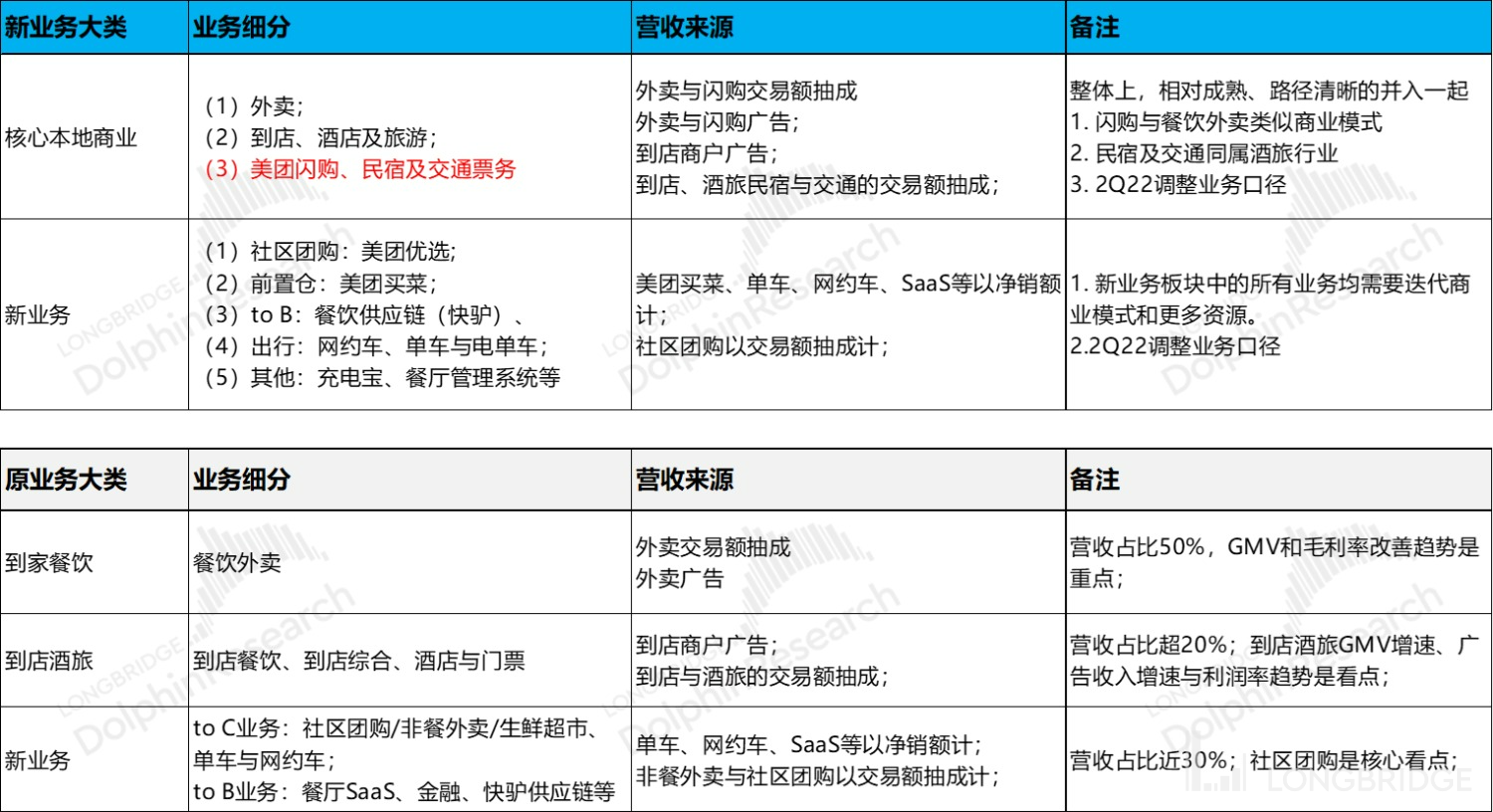

In this quarter, Meituan (ADR).US has undergone an almost "facial transplant" on its disclosure caliber, which is vastly different from the previous one. Dolphin Analyst has made a detailed explanation of this new disclosure caliber, adjustment path, and its underlying logic in the main text. Make sure to read the whole thing.

Mature businesses that share the same logic are mixed together, resulting in a complete loss of focus on takeaway volume and takeaway unit economics, which were previously the key focus. The recovery rate of in-store businesses is also difficult to determine, and we can only make a rough estimate. Dolphin Analyst has analyzed the difference between the new and pre-financial disclosure caliber to determine the source of this discrepancy and the underlying business logic of Meituan:

-

Takeaway recovery is relatively fast: From the perspective of overall orders for JIT-type takeaways + flash purchases, takeaway orders should have slightly increased (Dolphin Analyst estimates 4-5%), rather than the market's expected zero growth.

-

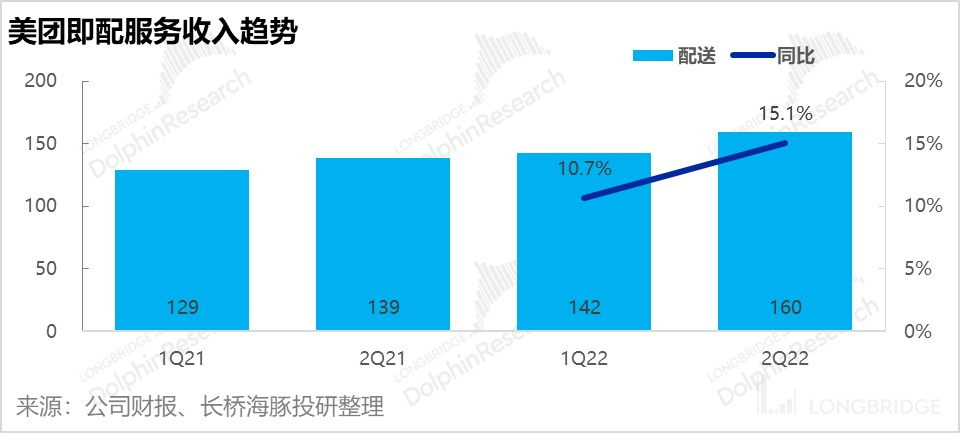

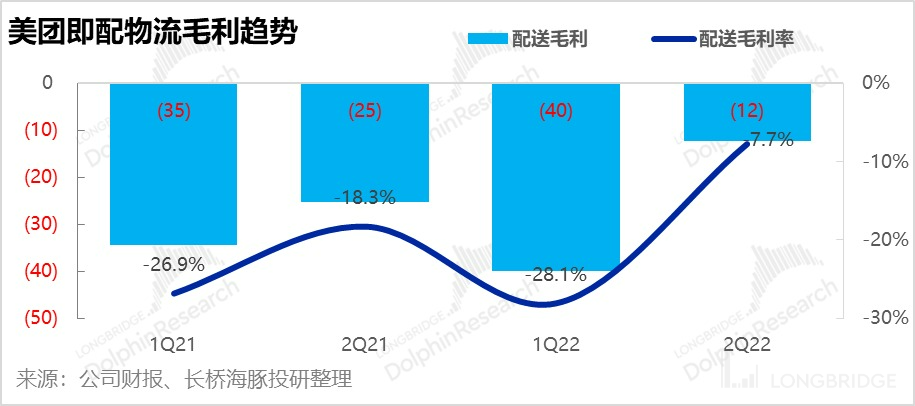

Logistics is Meituan's true intrinsic soul? This is the most important and critical part of this financial report! Meituan's takeaway and flash purchase businesses can be subdivided into online product information dissemination, trading, and offline delivery functions. They respectively correspond to commercial flows' advertising and commission income and logistics income.

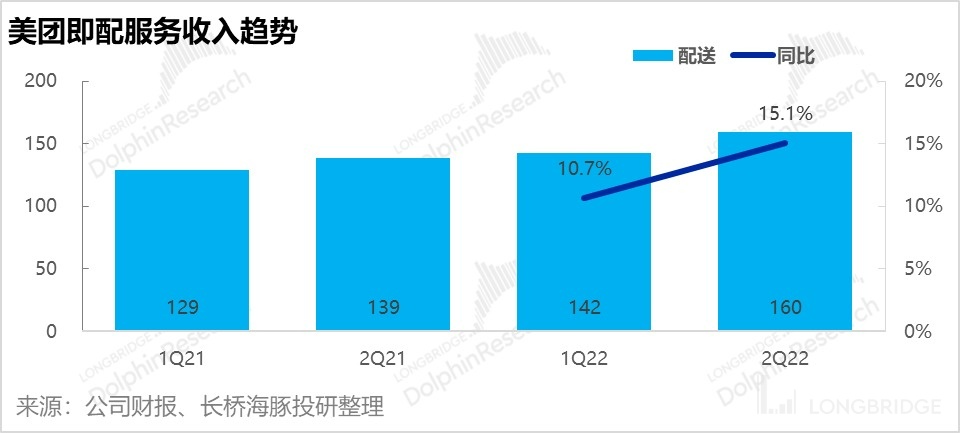

In this quarter, the logistics income can be described as "exploding" compared to expectations: as the revenue item with the largest contribution, the income from matching logistics accelerated its growth to 15%.

Considering that the growth rate of JIT orders is less than 8%, the growth of this income is actually the result of the current takeaway realization rate (Meituan no longer discloses) rising. Moreover, it should be a relatively significant upward trend under the epidemic situation, resulting from users paying less subsidies and users paying more for the deliverymen. Meituan subsidizes less.

This profitability reason is probably the same as the reason why Alibaba disclosed the realization of Ele.me's unit economics when publishing its financial report. Dolphin Analyst also pointed out the possibility of Meituan exceeding expectations at the time.

-

In-store hospitality is not as bad as previously estimated: Previously, the company estimated that the YoY decline of the Q2 in-store hospitality was 22-23%, but based on the gap between the new and old calibers, Dolphin Analyst roughly estimates that the YoY decline of this part of the business should be about 15%, not as bad as the company had said, and the short-term recovery should be relatively fast under the epidemic situation.

-

Rapid reduction of losses in community group purchases: The new business now excludes flash purchases and OTA-like homestays/transportation ticketing; Dolphin Analyst estimates that the income from this part is approximately CNY 2-3 billion, and the loss is about CNY 500 million. This adjustment does not have a significant impact on the judgment of the new business.

The total loss of the new business this quarter was CNY 6.8 billion, while the market expected a loss of CNY 8.1 billion. Even after deducting the loss of approximately CNY 500 million incorporated into the core local commercial (matching e-commerce + in-store + OTA) business, the reduction in losses still significantly exceeded the market's expectations, mainly due to the rapid contraction of Meituan's community group purchase business.

Dolphin Analyst's Perspective:

The market is currently worried that Tencent, the major shareholder of Meituan, may sell its stake in Meituan, causing the stock price to plummet. However, it is important to note that for companies with strong fundamentals and logical operations, if shareholders really sell their shares, most investors will see this as a buying opportunity, because with a strong performance and at a certain price point, funds will be willing to take over.

This earnings report once again proves that Meituan's underlying business remains robust and investors' willingness to take over is logical and unfaltering.

Furthermore, the more important information conveyed in this earnings report is that logistics and delivery are complementary, and for immediate delivery businesses, although logistics losses are significant, they are likely to be the core pillar of barriers to the commercial flow, and after the establishment of commercial barriers, logistics can gradually reduce losses and even move towards breakeven.

Previously, Wang Xing mentioned on a conference call, "The past ten years have been the flow of information, and the next ten years will be the flow of goods through technology. The core is procurement and supply to enable the movement of goods."

At the time, Dolphin Analyst had some difficulty understanding, but now it seems that Meituan's layout of offline operations, led by Huang Bingjun, seems to be becoming the core support of Meituan's business barriers, and the meaning of this sentence is gradually emerging.

For those interested in understanding the logistics portion, you can refer to Dolphin Analyst's previous analysis, "Meituan, JD.com, why are they performing well despite the downturn in the industry?".

Looking ahead, although the epidemic may continue to suppress in-store businesses for a while, the relatively resilient delivery business, coupled with the significant room for reduction in losses in new businesses, Meituan, as the leader of the second-tier market value in China's Internet sector after Tencent and Alibaba, actually does not have any special need to worry.

Dolphin Analyst will subsequently share the minutes of the conference call with Meituan's user group through the Longbridge App and Dolphin's research group. Interested users are welcome to add the WeChat account "dolphinR123" to join the Dolphin research group and be the first to get the minutes of the conference call. The following is a detailed content summary:

I. Another Well-Thought and Tactful Adjustment in Meituan's Business plan

Among all the companies that Dolphin Analyst has looked into, in terms of the speed of adjusting business plans, Meituan is probably the leader in the internet industry, as no one dares to say that they are second, even compared to JD.com, which frequently adjusts its business plans annually.

Before the earnings report this time, Dolphin Analyst wants to summarize the adjustment process of Meituan's business plan since it went public in 2018, and more importantly, to sort out the commercial logic behind Meituan's adjustment of business plans:

(1) When it went public, Meituan disclosed detailed GMV and gross profit situation of delivery services, in-store accommodation, and new services; the disclosure behind these was to demonstrate Meituan's overall business layout, able to hit low-frequency with high frequency, to stand on the flow foundation and to launch unlimited attacks. (2) First adjustment: only disclose the GMV of catering takeout, and there is no GMV for the other two businesses; and do not provide gross profit for sub-business items, but classify operating profit, guiding the market to estimate the value of Meituan using the method of business unit segments.

(3) Second adjustment: the delivery service of catering takeout is separately listed, and the corresponding revenue and cost are disclosed, guiding the market to pay attention to the fact that although Meituan's local business empire's business flow service is profitable, logistics is losing money, and this loss is different from the net profit loss of other logistics companies. It has been losing money since gross profit. It implies that Meituan has not exploited the labor of the delivery drivers. Its logistics business has always been in a "subsidized" state.

At the same time, the market is given such an expectation: keep up with the peers such as Dada, and perhaps the logistics business of local life does not need to lose money so exaggeratedly, at least not negative at the gross profit level.

(4) Third adjustment: The core indicators of GMV for take-out transactions were hidden again last quarter and the number of hotel room nights was cancelled. Why? Dolphin Analyst's inference is to guide the market not to pay too much attention to the realization rate between GMV and revenue of the take-out business, so as to avoid unnecessary misunderstanding.

In the view of Dolphin Analyst, this is mainly because most people in the market are unable to distinguish between practical aspects such as commission and financial aspects such as technical service fees and delivery fees. What Meituan earns is the money raised by the increase in realization rate.

Of course, the improvement of this realization rate can mainly be achieved by reducing user subsidies after the market structure is stable, but it appears as if the realization rate of takeout has increased again. The market is easily linear in reasoning whether Meituan has increased its exploitation of merchants. How bad the understanding is.

(5) This is already the fourth adjustment, and this time it is basically a reversal of the previous logic, turning the previously high-frequency businesses in the local life field (to-store catering, catering takeout) into low-frequency ones (travel and leisure, to-store comprehensive), and using mature traffic as the basis for exploring new businesses. Look at the new disclosure criteria:

The division idea behind this is probably as follows:

(1) Put together businesses with the same business logic and business path: catering takeout and Flash Purchase, which were originally in the new business, are actually the same in form-they are both on-site businesses, one is delivery and the other is other things besides food (everything to the home), using the same Delivery and service fulfillment system. Of course, the Flash Purchase business is relatively new, and its unit economics is currently not as good as catering takeout.

Similarly, homestay and transportation ticket + hotel are comparable to Ctrip's OTA business, which belongs to businesses with similar business logic, and this time they are also placed with travel and leisure and to store.

(2) If it is only about putting together businesses with the same business logic and business path, it is not a big move. The main problem this time is that the instant delivery type businesses and the local service businesses that do not require offline logistics fulfillment are mixed together and referred to as "core local businesses" by Meituan as the local life hegemon. But compared to the hotel/travel and in-store lifestyle businesses, the dining business is high-frequency while the others are low-frequency, one requires performance while the others don't, one is transactional while the others are content-oriented. Their logics are not quite the same so the valuation may differ when combined. This makes it difficult to interpret Meituan as a whole and even harder to value each sub-business separately.

However, from the company's standpoint, if they do not disclose this information, it may be difficult to estimate the exact average profit per order for their core food delivery business. Even quantitatively, it is unclear how profitable Meituan's food delivery business is this quarter. It seems that a good company has to go through such painstaking and reserved efforts.

(3) Corresponding to the restructuring of business framework, each business's operating data disclosure has also been adjusted. For example:

a. Previously it was food delivery orders, now it includes instant delivery orders, not just deliveries but also flash sales;

b. Earlier the revenue/cost of food delivery services was newly disclosed, now it corresponds to the revenue and cost of instant delivery services, also taking into account logistics services for flash sales;

c. Corresponding to revenue business framework adjustments, the company's operating profit classification has also made significant adjustments with operating profit disclosure now restricted to core local commerce and new business.

After comprehensive analysis, the amount of operating information has become very limited, and the profitability of the food delivery business can only be reasonably estimated through instant delivery order volume and instant delivery logistics gross margin. Below, Dolphin Analyst will share with you the information available in this quarter's financial report:

II. Judging from the volume of instant delivery orders, the volume of food delivery orders is still growing steadily

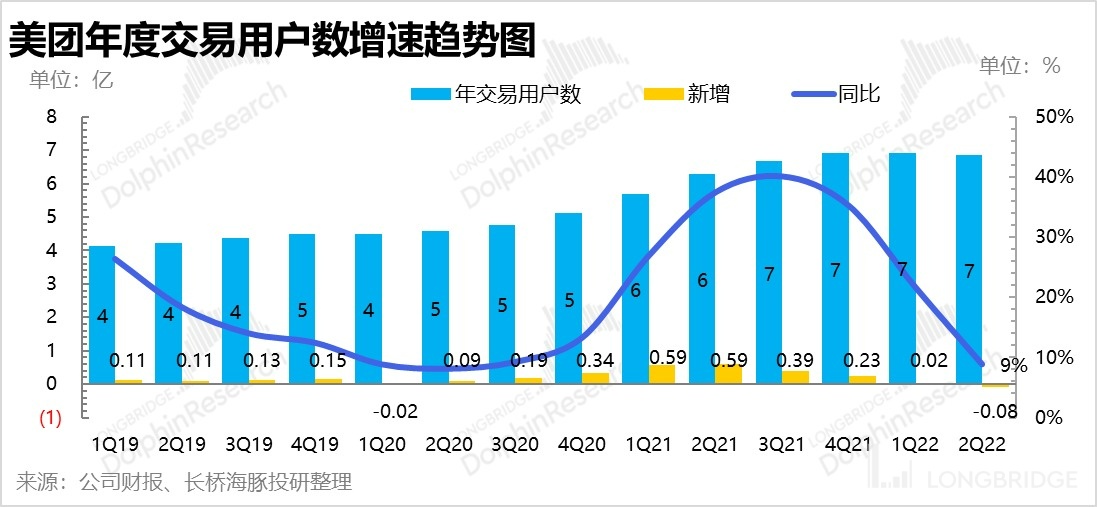

This quarter, the volume of instant delivery orders including flash sales and food delivery is 4.1 billion orders, equivalent to a daily average of 45 million orders, a year-on-year growth of 7.6%. It seems that achieving the company's long-term goal of 100 million daily orders by 2025 is still a considerable challenge even if it only recovers to within 20% of the original growth rate.

According to the company, the volume of transactions for flash sales is roughly 4.2 million orders per day with a year-on-year increase of 40%+, while food delivery orders increase by about 4-5% YoY, with a total of about 4.1 billion orders. In conclusion, the food delivery business is still growing steadily rather than breaking even as previously stated by the company.

Dolphin Analyst estimates that the reason for exceeding expectations is that Meituan's food delivery business has seen a rapid recovery since the lifting of the restrictions in Shanghai in June. For about a month after the opening, only food delivery was allowed but not dining in.

Furthermore, an estimated rough calculation shows that the daily average volume of flash sales in the second quarter was approximately 4.2 million orders (compared to 3 million orders in the same period last year), which is only slightly more than a tenth of the food delivery business. The company previously set a long-term goal of having flash sales achieve a daily volume of 10 million orders.

However, it seems that reaching this goal for flash sales is achievable, possibly even easier than for food delivery. After all, the food delivery business has not yet achieved half of its targets, and its growth rate is now around 15%, which falls into the middle-range growth interval of around 15% and flash sales have higher growth potential.

III. Core Local Commerce: Delivery is the key component for Meituan at critical moments?

In the second quarter, the revenue for instant delivery services was CNY 16 billion, with a surprising increase rate of 15%, which should mainly come from logistics revenue. Moreover, considering that the year-on-year instant delivery order volume growth rate should have slowed down, the delivery price should have surged quite a bit during the pandemic.

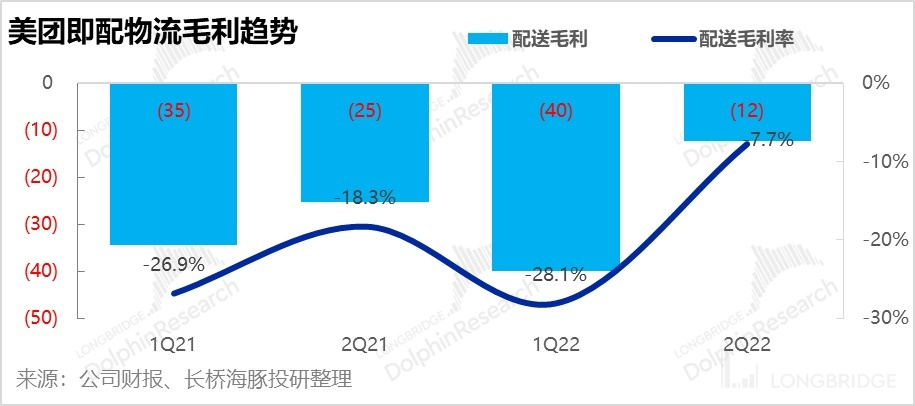

Meituan's instant delivery logistics is in short supply due to the pandemic, and under the situation of Meituan shrinking the stimulus for consumption, the gross loss of logistics and delivery has been directly reduced to 1.2 billion yuan. From four quarters of available data, the previous least loss was 2.5 billion yuan.

This to some extent explains why the company's profit this quarter exceeded market expectations by such a large margin. It is highly likely that the front-end user subsidies and back-end delivery subsidies have been reduced, and the resulting savings are all gross profit.

Including instant delivery logistics, the overall core local business revenue was 36.8 billion yuan, a year-on-year growth of 9%, which has slowed down significantly compared with the previous quarter's 19% during the pandemic.

In addition to the delivery revenue, which accounts for the largest proportion of revenue in this business, there are also commission revenue and advertising fees with the nature of the Tmall technology service fee, which together total 19.8 billion yuan. Advertising revenue only contributed 40% of this.

Compared with the same period last year, commission income increased by 2.5% year-on-year, and marketing increased by 1.4%. It has been extremely difficult during the pandemic, especially since the time when the in-store business was closed and the impact was significant, as marketing advertising was the main focus.

IV. New Business: Shrinking Group Buying, Advancing Grocery Purchasing, and Rapidly Reducing Losses

After removing the flash purchase and homestay/transportation ticketing businesses which caused a loss of over 200 million yuan, the new business in the second quarter was 14.2 billion yuan, a year-on-year increase of 41%, which was not a large decrease compared to the 46% decrease in the previous quarter.

- After adjusting the new business in this way, the main income that should be calculated by commission is probably the community group buying. The commission income from the new business this quarter was only 320 million yuan, a year-on-year decrease of 25%, as opposed to a 10% decrease in the previous quarter.

Considering that there are not many group purchases in first-tier cities severely affected by the pandemic, this decline is mainly due to the rapid shrinkage of Meituan's group buying business. According to media reports, Meituan stopped its community group buying business in Beijing and other provinces as early as April due to poor performance.

-

The main income in this sector should be the net sales of the grocery business, and there has been a 44% year-on-year increase during the pandemic, which has not slowed down significantly. Judging from the withdrawal of community group buying from first-tier cities, front-end warehouse businesses such as Meituan Grocery should dominate in first-tier cities in the future. Moreover, Meituan Grocery performed well during the pandemic, and its supply chain from logistics to commerce was considered relatively stable.

-

Since the loss from flash purchases and homestays is not significant, estimated by the Dolphin Analyst to be around 200-500 million yuan, the judgment on the severity of losses for the new business was adjusted.

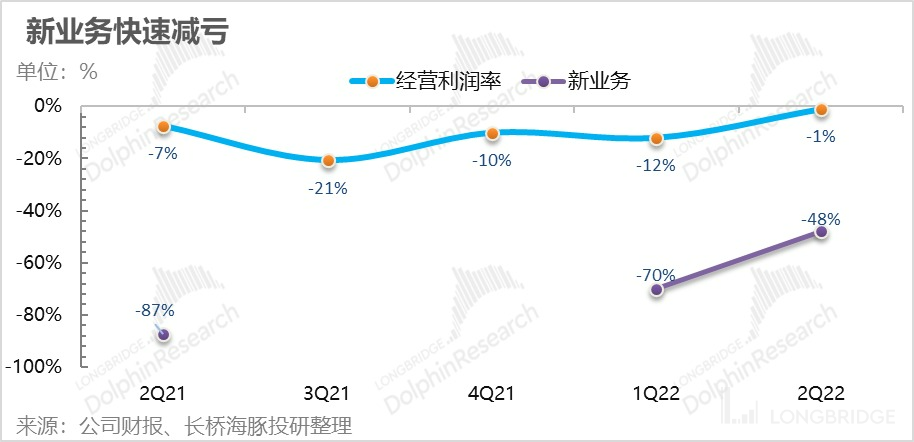

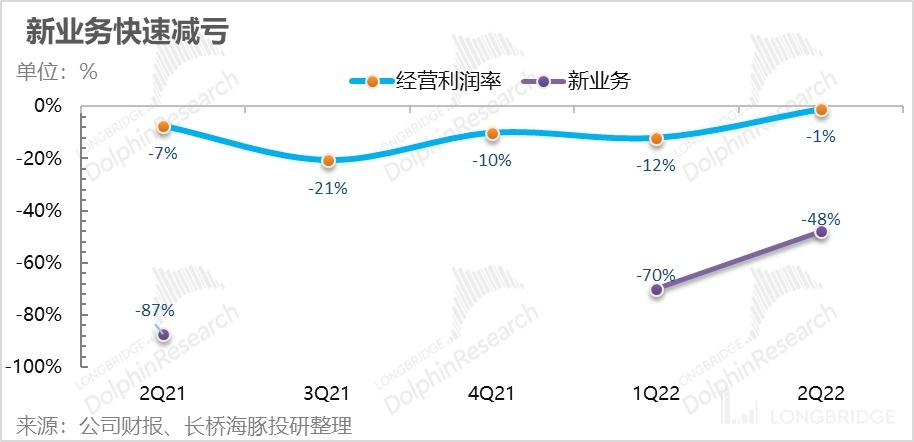

Under the new method, the new business had a loss of only 6.8 billion yuan this quarter, compared to 8.5 billion yuan in the previous quarter, which represents a significant reduction in losses. The loss rate also indicates a rapid narrowing of losses for the new business.

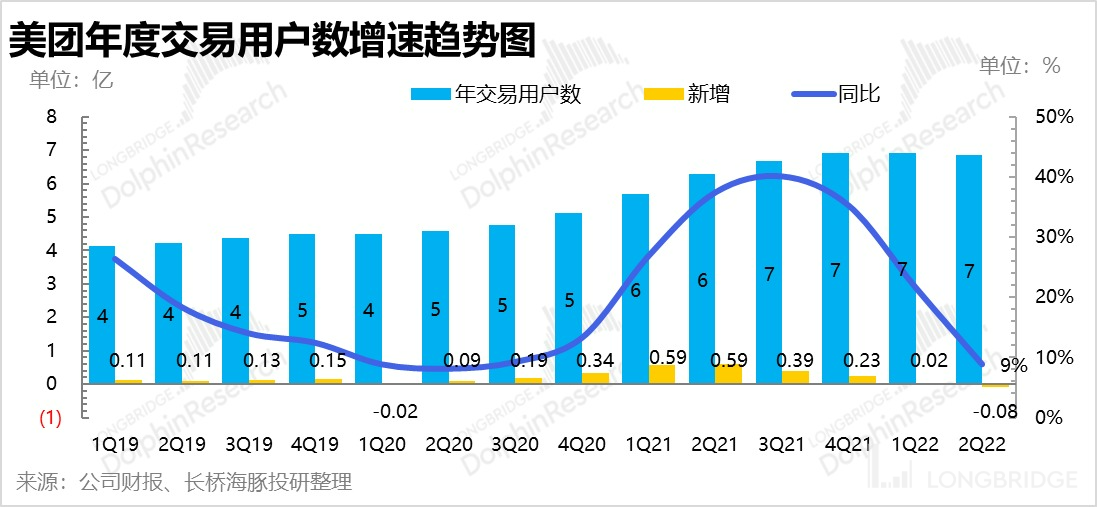

Additionally, the rapid contraction of the community group purchase corresponded to the direct reduction of the annual active buyers of Meituan in this quarter, knowing that during the peak of community group purchase, over 60 million users can be added in a quarter. This seems to indicate that the stickiness of group purchase users is relatively poor, and how to resonate with Meituan's existing business and improve the stickiness of new users of group purchases is a problem.

V. Business Performance: Unexpectedly exceeding expectations

Since there is too little information about the divisions, the Dolphin Analyst will focus on the overall business performance in the following:

1) The overall revenue in the second quarter was 50.9 billion yuan, a year-on-year increase of 16%, significantly exceeding the market's consensus forecast of 48.6 billion yuan. The Dolphin Analyst noticed that the brokerage performance outlook published before the financial report's release date had raised the overall revenue judgment. However, there were very few brokers who expected the revenue to exceed 50 billion yuan.

Combined with the market's expected situation for new businesses, Dolphin Analyst estimates that the resilient part is the core local business, particularly the combination of logistics and delivery known as "Ji Pei."

Of course, the Dolphin Analyst also estimates that the offline business should not have declined by 23-23% as severely as the company's original estimates. After the epidemic recovered, the catering part recovered relatively quickly, and the contraction range may be around 15%.

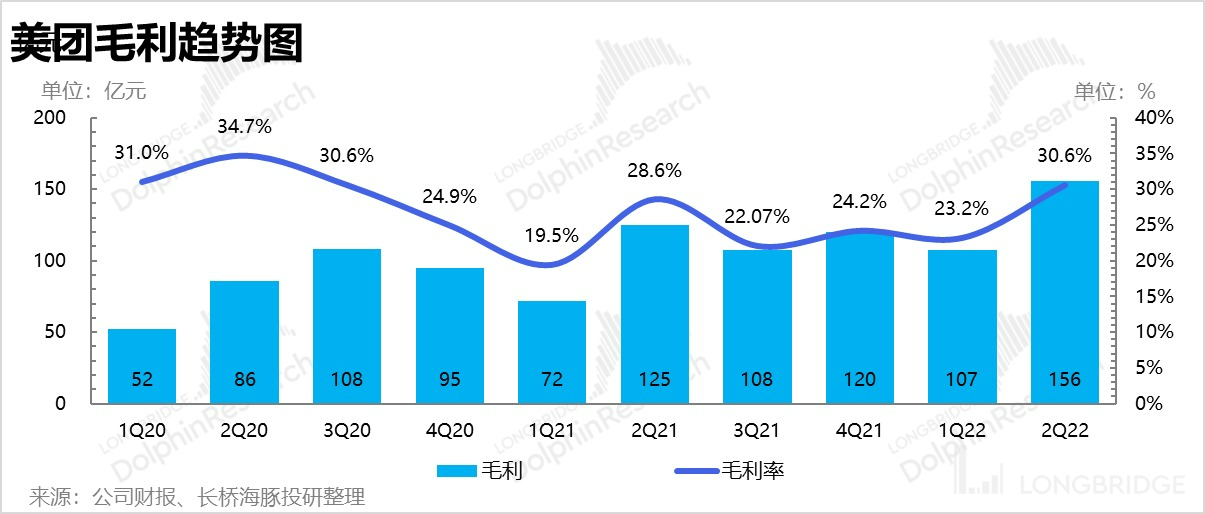

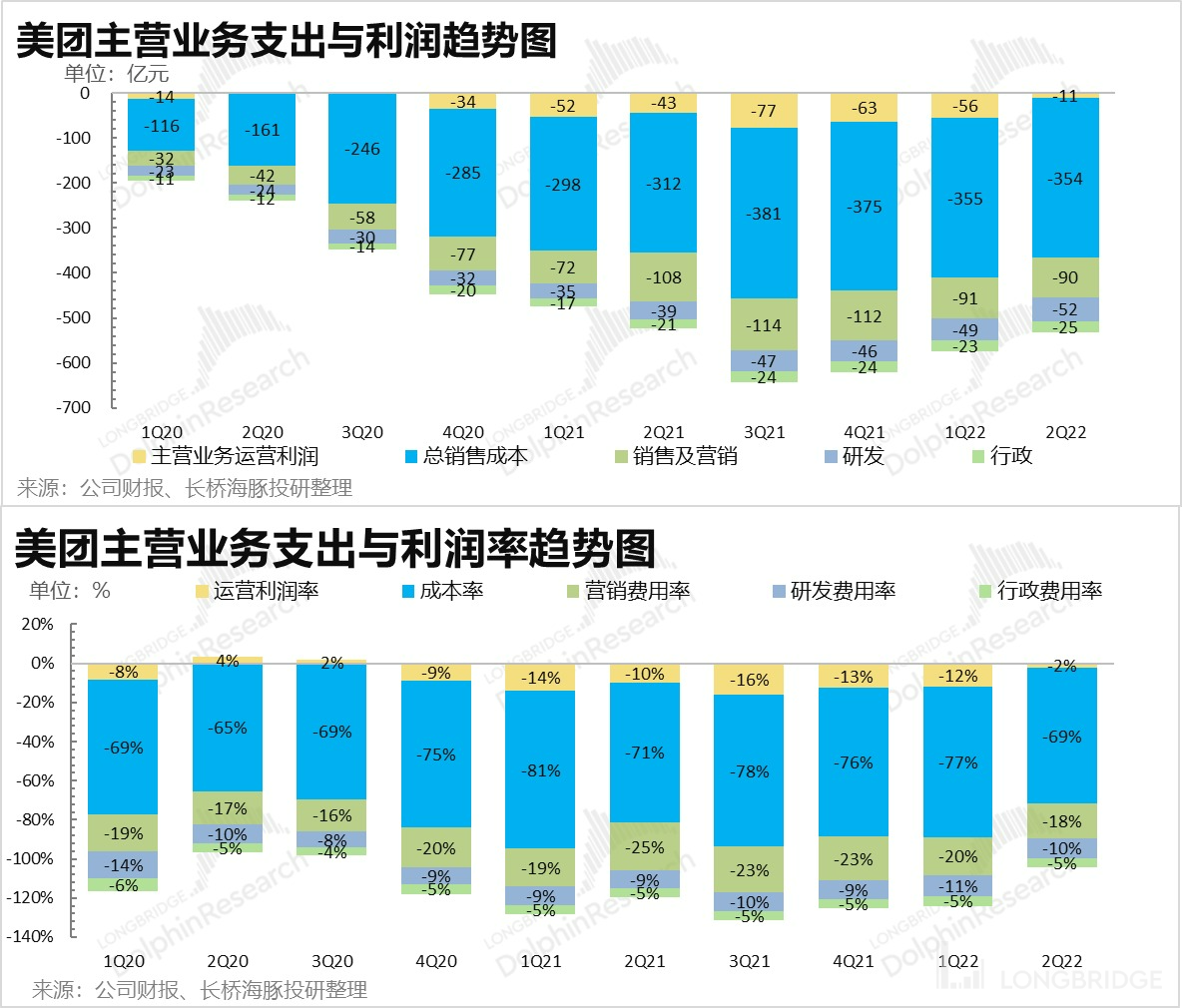

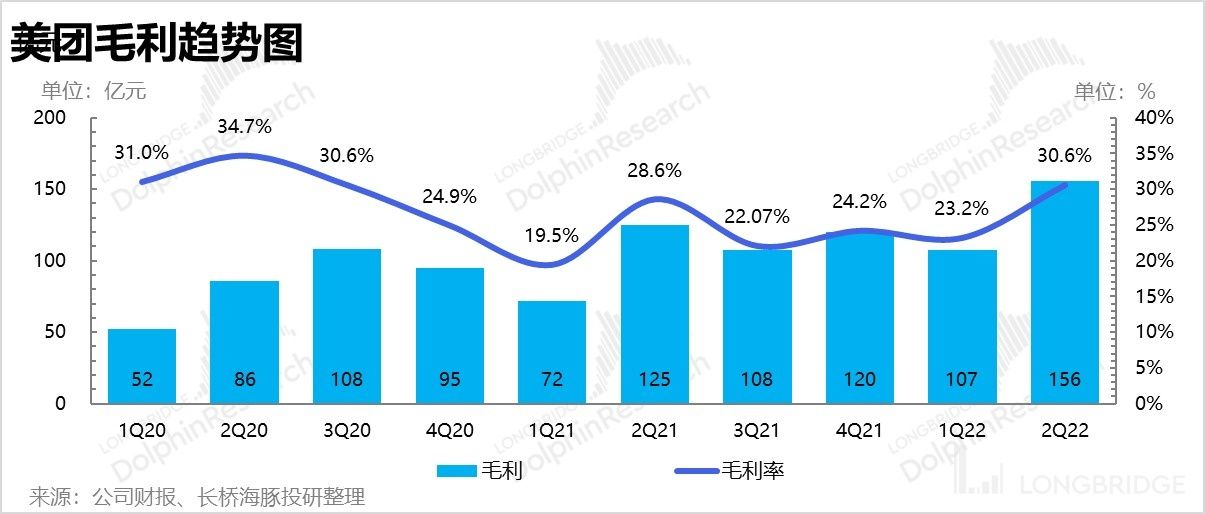

2) The gross profit in this quarter was 15.6 billion yuan, with a gross profit margin of 31%, which is far higher than the market's expected 26%. Since Meituan's main cost is the delivery costs of the riders, the reduction of delivery costs has been reflected in the significant improvement in the gross profit of the "Ji Pei" business. A rough estimate shows that this part has saved at least 1.5 billion yuan in profit, which is the core reason for the gross profit margin to exceed expectations.

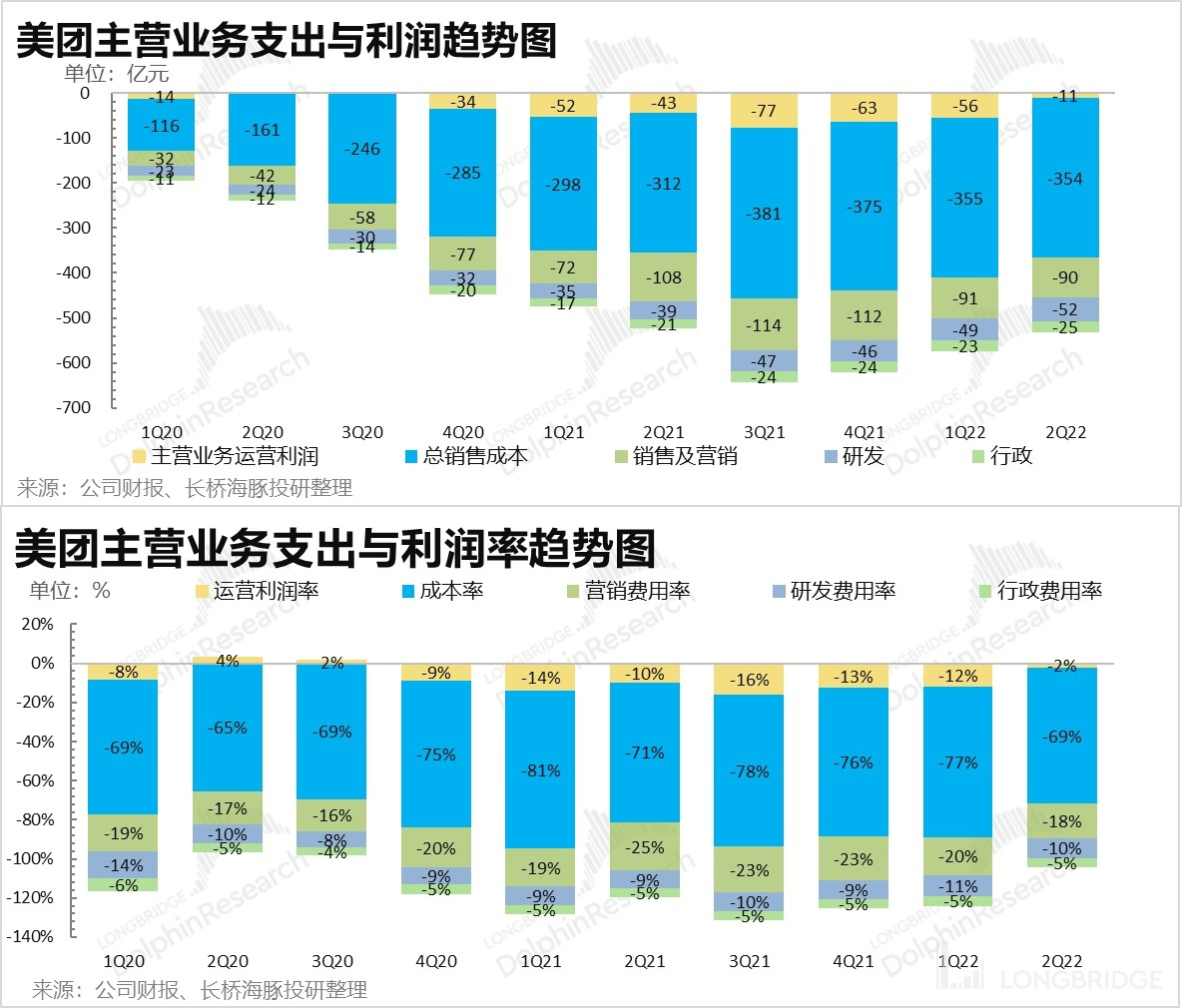

3) Less advertising and incentive expenses make Meituan's spending not too excessive.

The high-frequency business in the "take-out" and "in-store" sections, which is a stable position, does not require too much spending on sales. Since the flow rate brings stickiness, there is no need to buy too much traffic to consume sales expenses.

However, the sales expenses have been increasing rather than decreasing since Meituan went public, mainly because Meituan has been developing new businesses. Thus, whenever it invests in a new business, the cost is added, which further increases the sales expenses. When it first went public, the investment was in catering, followed by ride-hailing and bike-sharing, and now in local retail (group purchases and grocery shopping). However, the Dolphin Analyst sees that few new businesses have succeeded so far. Meituan's sales expenses decreased rapidly in Q2 2022 by 17% to 9 billion, even though the group buying business was not successful. Of this, sales promotion advertising and user incentive expenses related to marketing and customer acquisition were 4.3 billion, a nearly 35% decrease YoY.

In addition, research and development and administrative expenses centered on personnel costs did not slow down, with YoY growth of over 20% and 30%, respectively. Overall employee salary-related expenses increased by over 25%, and the effect of Meituan's layoffs was not evident at least in the second quarter.

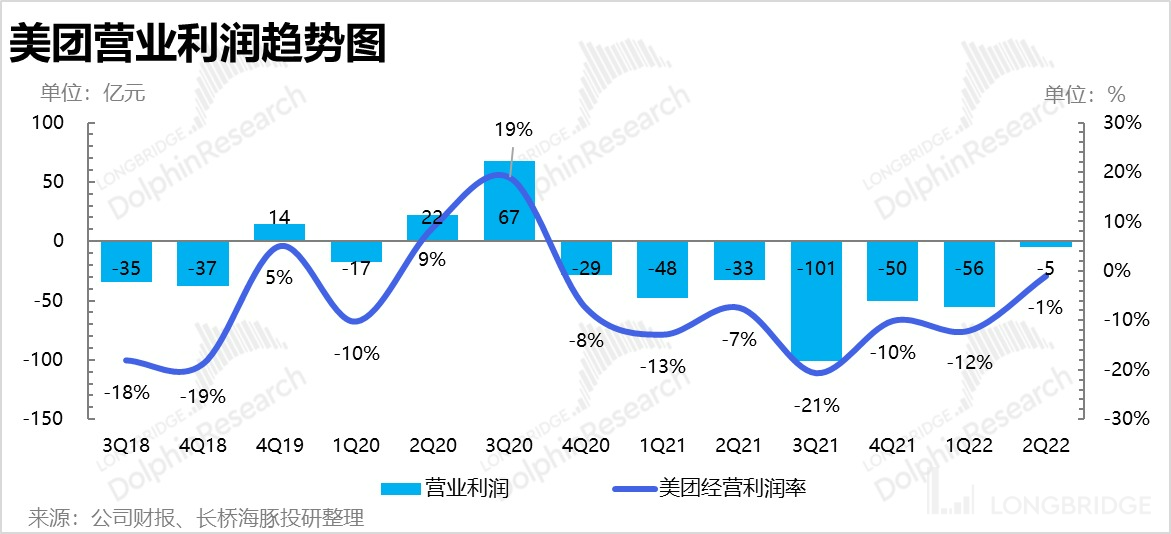

4) Significantly reducing losses against the trend, credit to delivery and group buying

Overall, thanks to the income resilience brought by the accelerated growth of the instant delivery business and the rapid decrease in losses in this area, together with the rapid shrinkage of the community group buying business, which was reflected in the rapid decrease in advertising promotion and user incentive expenses, Meituan's operating loss was only 500 million. This significantly exceeded the market's expectations of a loss of 3.7 billion. Dolphin Analyst noted that some optimistic market expectations were even less than 2 billion in losses.

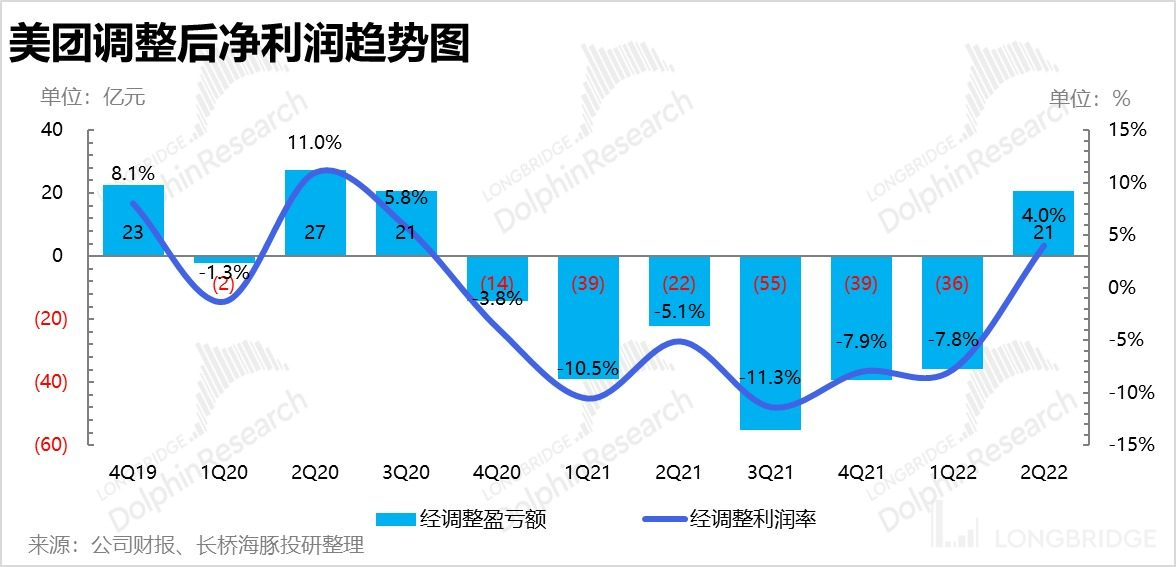

If adjusted net profit (excluding share-based compensation, etc.) is viewed: 2.1 billion this quarter, the market expected -2.2 billion. The gap is too significant.

The significant difference is not only because of the relatively good profit and loss, but also because this quarter's share-based compensation was relatively high, accounting for 4.6% of revenue, which is at least one percentage point higher than in the past. This caused the profit after removing this cost factor to appear particularly high.

Financial Report Season:

April 22, 2022 "Negative performance in the store, hotels suffer the most, flash purchases burst out, and consumption coupons are effective"

June 2, 2022 "As long as Meituan doesn't drop the ball, it's enough. Rapid recovery is more important."

March 25, 2022 "Everything at Home: Is Flash Purchase the new star of Meituan's sky? (Summary of telephone meeting)" On March 25, 2022, Meituan held the Q4 2021 earnings conference call.

On November 26, 2021, Meituan held the conference call for meeting minutes: "Aiming for Retail, but with Much Room for Improvement".

On November 26, 2021, Meituan's Q3 2021 earnings were reviewed. "Is losing over 10 billion RMB a demonstration of daring or a reflection of unreliability?"

On November 26, 2021, Meituan-W (3690.HK) held the Q3 2021 earnings conference call.

On August 30, 2021, Meituan's Q2 2021 financial results were reviewed. "Will their shrinking valuation lead to abandonment? Meituan's response is quite steadfast."

On August 30, 2021, Meituan held the conference call "Longing for the Vast Ocean of Retail: Wang Xing's Vision for Meituan"

On August 30, 2021, Meituan-W (3690.HK) held the Q2 2021 earnings conference call.

On May 31, 2021, Meituan's financial results were reviewed. "Meituan: Outstanding Delivery vs. Disastrous Group Purchase, Will They Stand Firm or Retreat?"

On March 29, 2021, Wang Xing stated that "It is the best opportunity for Meituan in the past decade!"

On May 28, 2021, Meituan-W (3690.HK) held the Q1 2021 earnings conference call.

On March 26, 2021, Meituan's Q4 2020 earnings were reviewed. "The 'Burning Money' Style Return of Meituan: Can the Market Accept it This Time?" Depth:

"Meituan, JD, why are they performing better after competing fiercely with inventory?" on April 22, 2022.

"What value is left for Alibaba and Tencent as the cycle weakens?" on April 13, 2022.

"Meituan Youxuan: Meituan's next 'impressive curve'?" on October 25, 2021.

"Pay fines, join social insurance, how much faith does Meituan have left?" on October 22, 2021.

"After the e-commerce traffic melee between the insane Alibaba, Meituan, and Pinduoduo, are there any real barriers?" on September 22, 2021.

Hot Topics:

"On May 16, 2022, 'The epidemic does not retreat, and consumption lies flat.'"

"It's time to include the growth observation index of Meituan's catering takeaway in the restaurant industry in the US."

"On August 6, 2021, 'The Dolphin Analyst talks about Meituan's views on the key price point."

"On May 10, 2021, 'If Meituan's riders' outsourcing becomes formal, how will it affect valuation?""

"Meituan's fine is quite light" on October 8, 2021.

"On April 19, 2021, 'Meituan's distribution and Tencent public welfare: Will giants be killed?'" This article's risk disclosure and statement: Dolphin Research's Disclaimer and General Disclosure