Label-tearing Moment: Will BYD Experience the Magnificent Transformation of "Money-Making Machine"?

$BYD.SZ released its H1 2022 performance on the evening of August 29, Beijing time, after Hong Kong stocks closed. The main points are as follows:

**1, ** H1 revenue of 150.6 billion, corresponding to about 41% of the market's expected annual revenue; net profit attributable to the parent company of 3.6 billion, which stands at the top of the company's guidance, is consistent with the market's expectations.

2. Finally, will we welcome a $BYD.HK with cars to sell and more money to make? Since sales volume and profit have been set in the company's announcement and guidance, the trend of profit is more important. From the second quarter, it seems that BYD's problem of selling cars without making money has finally undergone structural improvement.

a. After excluding BYD Electronics' weak revenue and profit and 900 million non-reflective operating ability foreign exchange gains, the actual profit performance is still very good even if it is traced back to history. The H1 of this year may be defined as the turning point of BYD's electric car profit release.

b.Dolphin Analyst has gone through the details and believes that the release of profits with high quality and quantity is mainly due to the stronger release of profit from the automotive business. The reason behind this is that fuel vehicle production capacity has become a thing of the past, and when inefficient fuel vehicles have to be either scrapped or production lines changed (reflected in the higher asset impairment fees since the fourth quarter of last year), it leads to a significant decrease in the overall depreciation expense rate, allowing BYD to finally go into battle lightly and release the logic of profits after the sale of new energy vehicles and the expansion of income. Therefore, BYD's profit release can have strong continuity and sustainability, especially on the gross margin side.

c. On the expense side, due to the overall expenditure being mainly on human expenses, the increase in sales volume has caused the after-sales service fee to show a non-linear explosive growth trend. At the same time, the personnel expenses and logistics expenses in the overall expense side have increased rapidly. In the end, BYD has not reflected its operating leverage ability after the release of income on the expense side.

3. Helpless consolidation of similar items: BYD has also learned from the mature internet peers and consolidated its so-called similar items- the automotive business and secondary charging battery business are disclosed together, and no longer separately disclose the market's key focus on automotive business revenue and gross margin, causing the visibility of the automotive business to decrease a lot, only allowing for fuzzy analysis.

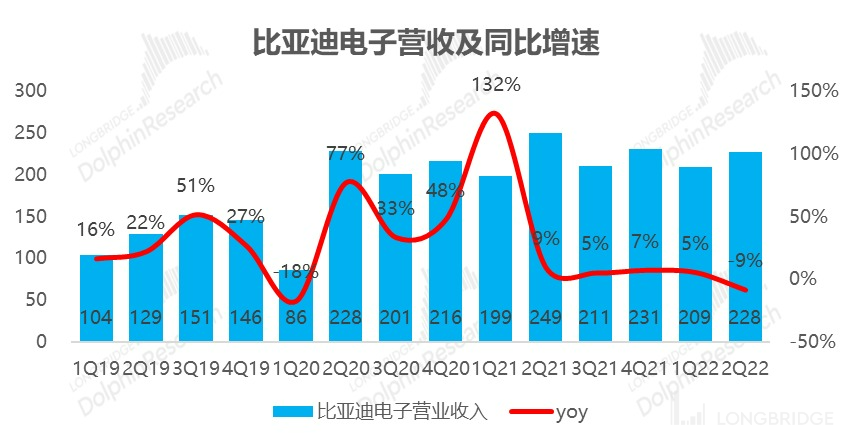

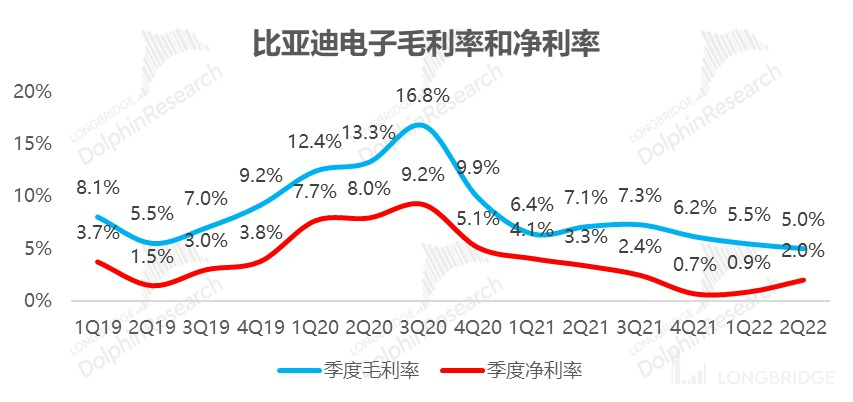

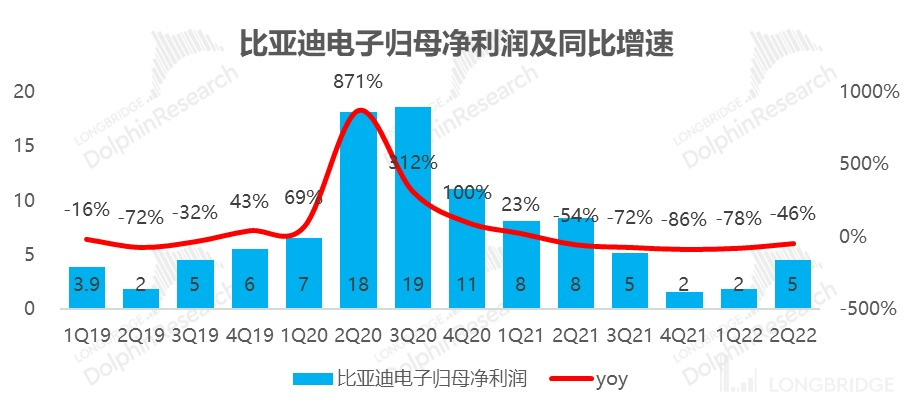

4. Declining phone and component business performance at BYD Electronics.HK: The revenue in the second quarter directly changed from the previous 5% growth to a 9% decline, and the gross profit declined even more severely. With some non-operating other income, the net profit margin in the second quarter seems to have increased somewhat, but the profit quality is relatively poor. The overall situation is a microcosm of a mature industry being hit by the epidemic without any bright spots.

Overall view of Dolphin Analyst:

Overall, the real gold content information of this financial report is to understand the quality of BYD's profit release in the first half of this year and how much continuity it will have in the future. Especially in the second quarter, when the income and cost of the entire vehicle factory were mismatched, how did BYD go against the trend? However, from the perspective of incremental information at the margin, BYD's performance in general is satisfactory—the profit release is mainly from the car-related business.

Moreover, profit release is more from the release of gross profit margin after unburdening the production line of fuel vehicles and re-entering the market with lighter weight. This factor is obviously sustainable. Looking forward, the battery material cost in the variable cost part of car manufacturing has fallen from a high level, and the improvement of gross profit margin is almost certain.

Therefore, the more important thing to track is back to the revenue end: in the second half of the year, including hybrid cars, various car factories will release new competitive models, when the car manufacturing capacity is generally released in the market, whether BYD's domestic new energy vehicle market share can remain at the level of 30% per month, is a problem that can be continuously tracked.

However, roughly speaking, Dolphin Analyst is not very worried about this at present. One is because BYD still has a large backlog of orders, and the other is that at present, in order to meet domestic demand, BYD basically has no time to care about the overseas market, as long as there is production capacity, there is little pressure for BYD's electric vehicles to go abroad.

PS: BYD is a company with a complex business structure, covering automotive, mobile phone components and assembly, secondary rechargeable batteries, and photovoltaics. However, Dolphin Analyst's in-depth articles on BYD completed in July last year, "BYD: The Best Battery Manufacturer For Car Manufacturers" and "BYD: Seeking Stability And Prosperity After Skyrocketing", have helped readers find the core. Although there are too many businesses, it is still important to look at the automotive business. If you need to understand this company, you can review our two analyses above.

This article is an original article by Dolphin Analyst and may not be reproduced without authorization. It is recommended that interested users add the WeChat account "dolphinR123" to join the Dolphin Research Circle and exchange global asset investment views together!

Here is a detailed analysis of BYD's performance in the first half of this year:

1. Keep up with the trend: "merge similar items" together

As the internet industry that Dolphin Analysts have seen has grown old and become heavily regulated, categories generally disappear or regardless of whether they are "similar", companies will say that they are "merging similar items" and disclose them together.

This time, as a leader in the booming new energy industry, BYD also started doing this from the first half of this year. The company's explanation is: Due to the growth of electric vehicles, the main business in the secondary rechargeable battery business this time is highly positively related to electric vehicles, so "similar items" are merged. After the merger,

(1) Automobiles is almost a big melting pot in this big category of business: "Manufacturing and selling automobiles, automobile-related molds and parts, automobile leasing and after-sales services, automobile power batteries, lithium-ion batteries, photovoltaic products and ferroelectric battery products, rail transit and related businesses, and epidemic prevention materials revenue." (2)Mobile Phones This category includes "mobile phone components, assembly, and other products, including the manufacture and sale of mobile phone and electronic product components and the provision of assembly services for epidemic prevention supplies."

But what's even more amazing is that in the company's explanation, the income from epidemic prevention supplies seems to be included in both categories. After reading the updated business categories, let's take a look at the real performance progress.

** 二、Automotive Business: Explosive Sales Volume is Normal, and Profit Release is More Gratifying**

【1】Car Sales: The Beautiful Days of Plug-In Hybrid and Pure Electric Dual-Wheel Drive

Since car sales are announced monthly, the sales data has long been clear:

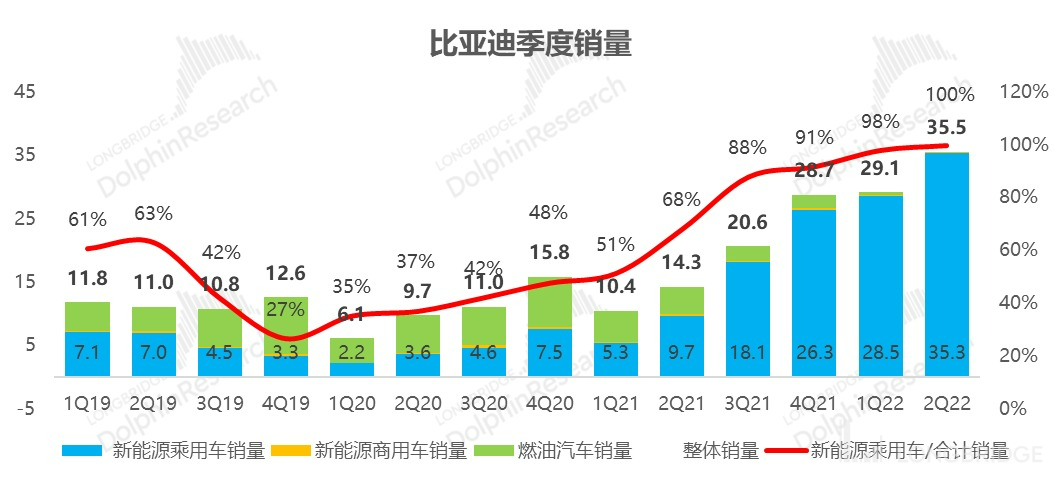

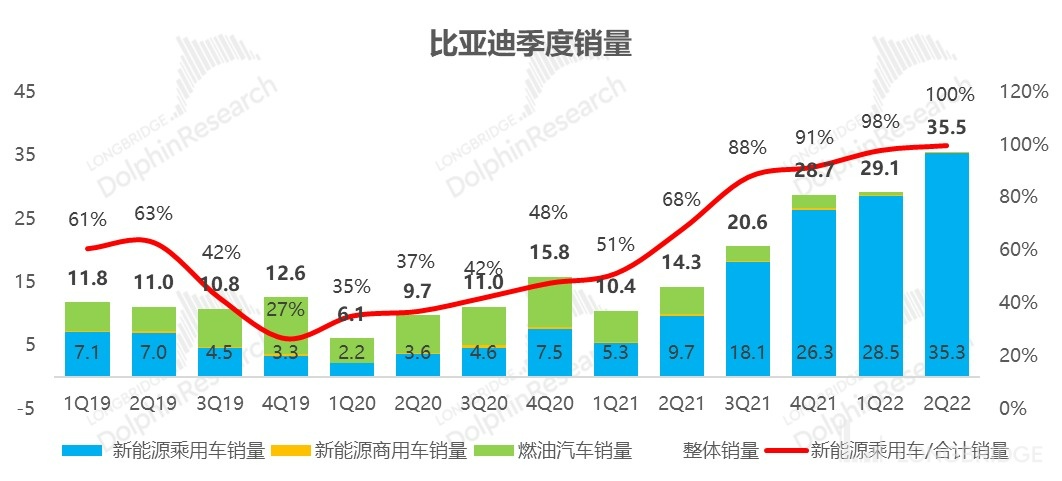

(1) Overall, BYD stopped delivering fuel vehicles since March and fully embraced new energy. Therefore, there were no fuel vehicles in the second quarter.

(2) Among new energy vehicles, commercial vehicles currently deliver only a few hundred units per month, corresponding to the company's massive delivery of passenger cars, basically a negligible decimal point, so it is not important. The real core comes from new energy passenger cars - pure electric, plug-in hybrid, dual-wheel drive, driving BYD's delivery volume to new heights.

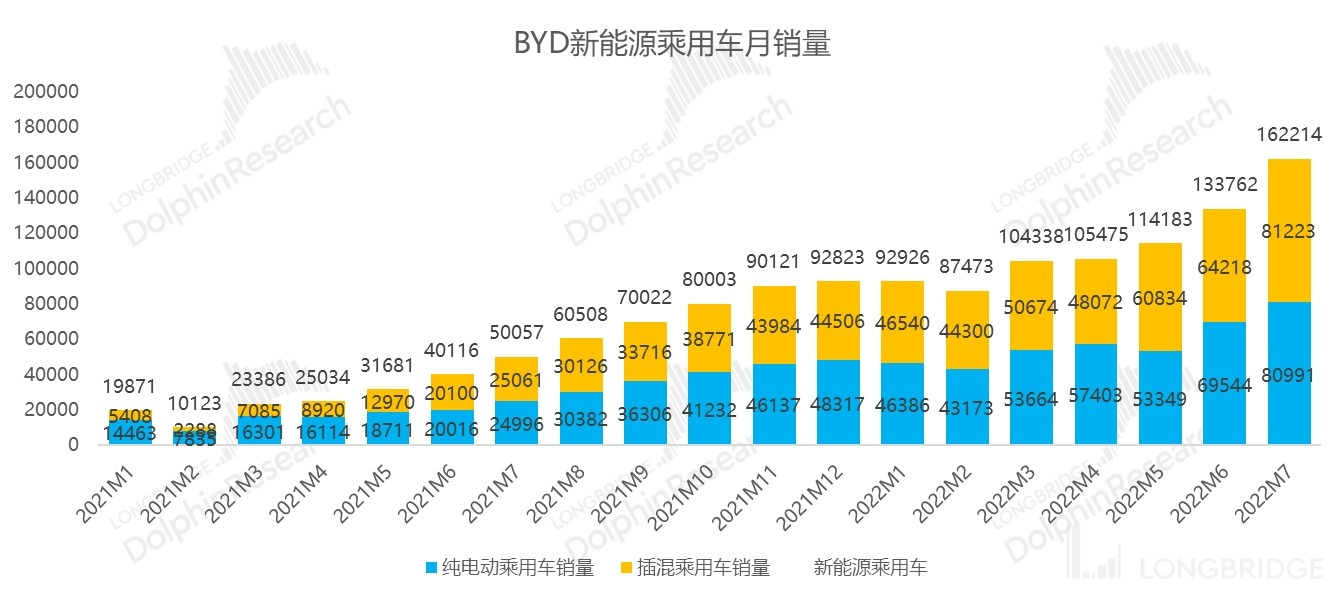

(3) Although the first quarter was affected by the epidemic, BYD's delivery was not particularly affected, and sales remained stable. In the second quarter, it climbed to new heights, delivering 355,000 vehicles in a single quarter. In July, it set a new record with 162,000 vehicles delivered in a single quarter. Judging from the production and sales situation, they basically produce and sell as much as needed, and supply and demand are very tight.

Data source: company announcement, Dolphin Analyst research and collation

Data source: company announcement, Dolphin Analyst research and collation

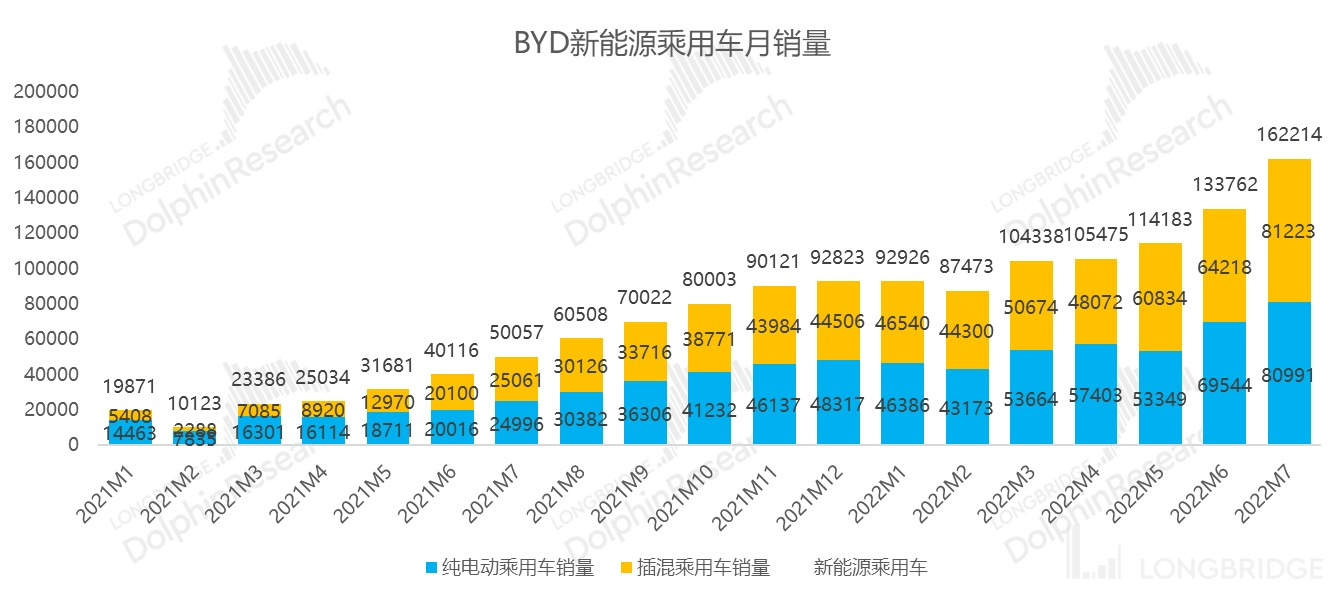

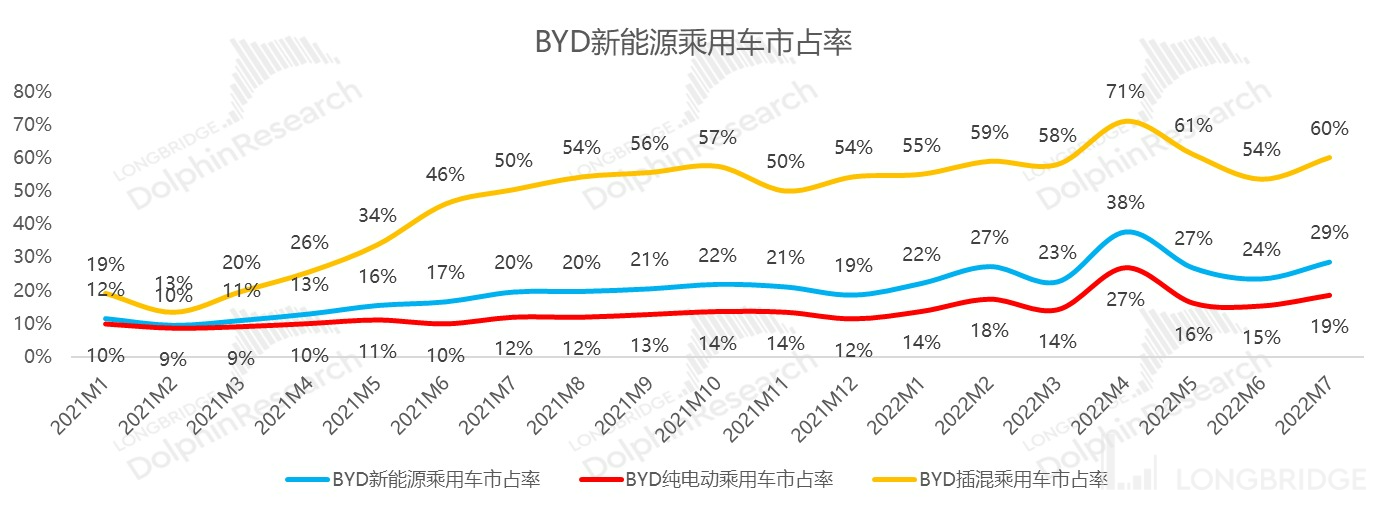

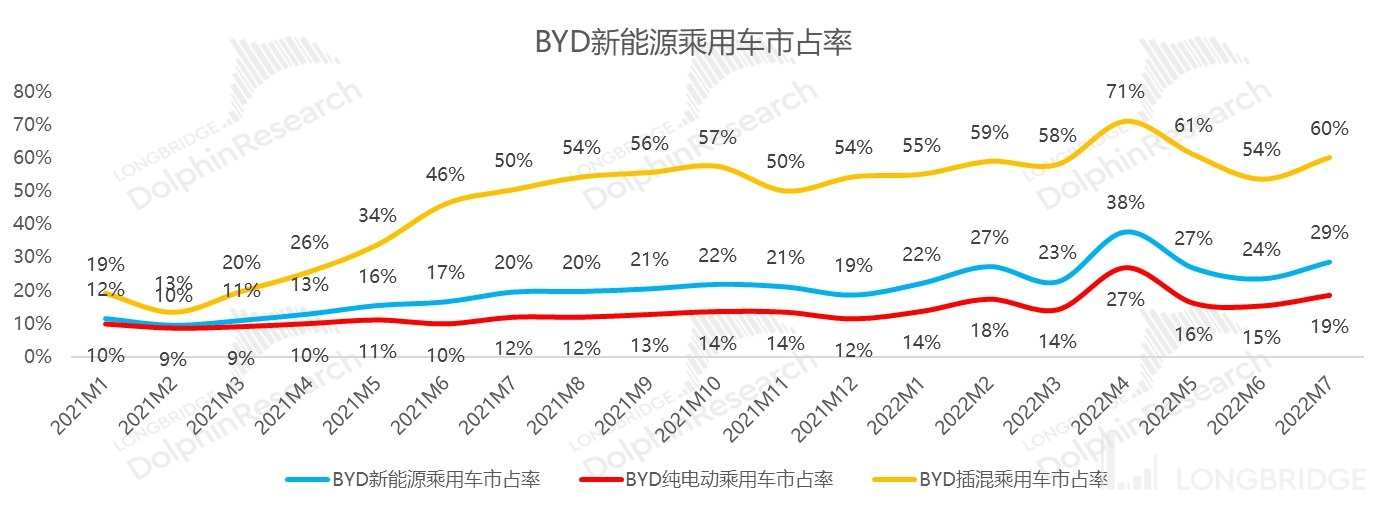

(1)Plug-In Hybrid Dominance: In the first half of the year, BYD was still the undisputed leader in the domestic plug-in hybrid market. For every ten plug-in hybrid cars sold in China, six were BYD's. With the DM-i platform, BYD's various Wangchao series DM-i models basically exploded, especially the Qin Plus, Song, Tang and other DM-i models.

In addition, the newly released Destroyer 05 series also performed well, with nearly 7,500 units delivered in a single month from March to July.

(2)Pure Electric Market Share Continues to Rise: The market share has risen from 14% at the beginning of the year to 19% in July. Driven by the blade battery and e3.0 platform, BYD's pure electric brand Dolphin has delivered over 10,000 vehicles in a single month since last August to this July, and will soon release the high-end pure electric coupe series Sea Lion with a price of more than 200,000 RMB.

(3) The dual force of pure electric and plug-in hybrid models has driven the company's overall market share to 26% in the first half of 2022.

Data source: Company announcement, Dolphin Research and Analysis.

[2] Will the downward trend in average selling price (ASP) of single vehicle slow down, and will there be a period of upward release of ASP and profit?

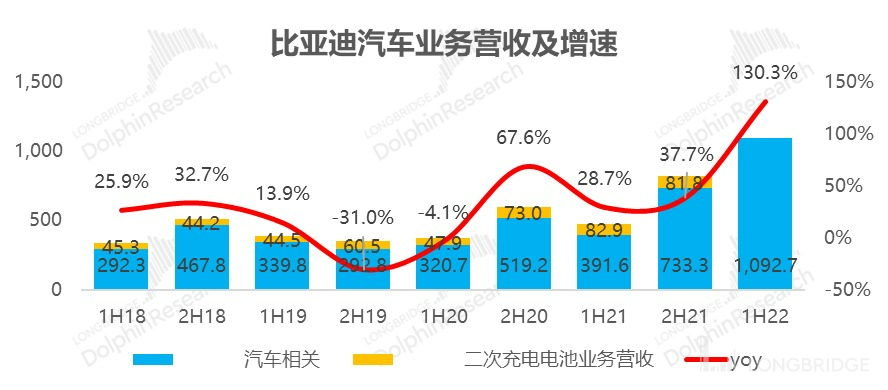

Starting from this quarter, due to the addition of second-charging and battery business in the automobile business, it is unable to clearly calculate the trends of single vehicle revenue, cost, and corresponding gross profit.

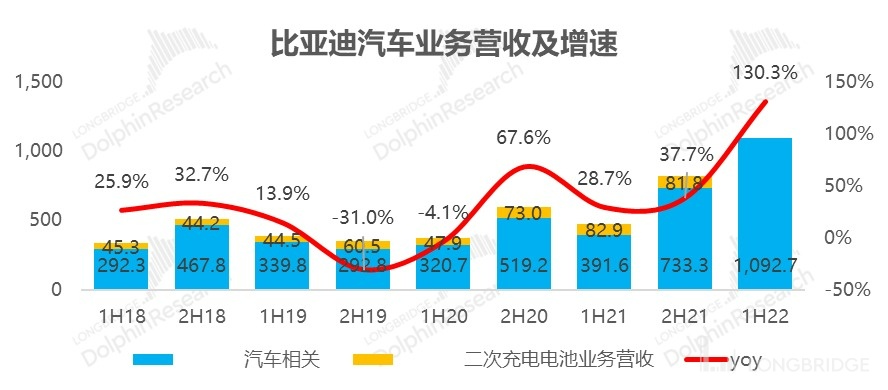

However, from the overall year-on-year comparison, it is obvious that BYD started to implement an aggressive pricing strategy of gaining market share without profit since last year, resulting in a surge in sales but a serious decline in the average selling price of each car. But by the first half of this year, it has been a whole year and the overall drag of the single vehicle average price has become less significant, as the synchronization between sales and revenue growth rate has become stronger.

Data source: Company announcement, Dolphin Research and Analysis at Longbridge: Note that year-on-year comparison includes the total year-on-year comparison of batteries and second-charging under the new criteria;

Meanwhile, will the success of new energy strategy and the abandonment of inefficient fuel car production lines mean that as long as there is sales volume, BYD will have hope of gradually releasing scale effects? Dolphin Analyst will try to observe the cost and expenses to try to understand this question.

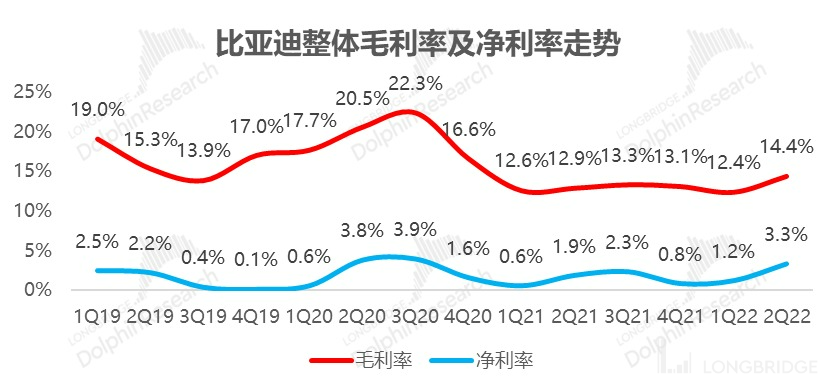

[3] Attention! The gross profit is being released and the quality is even higher. Including the second-charging business, the gross profit of BYD's automobile business has finally started to look like something this quarter.

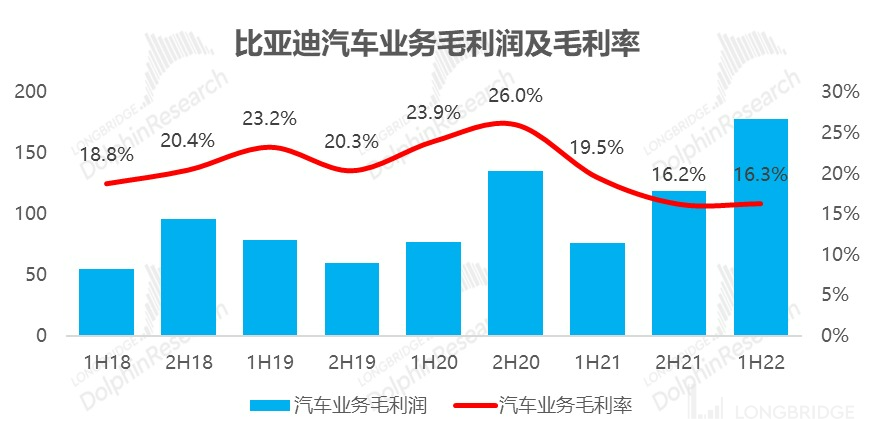

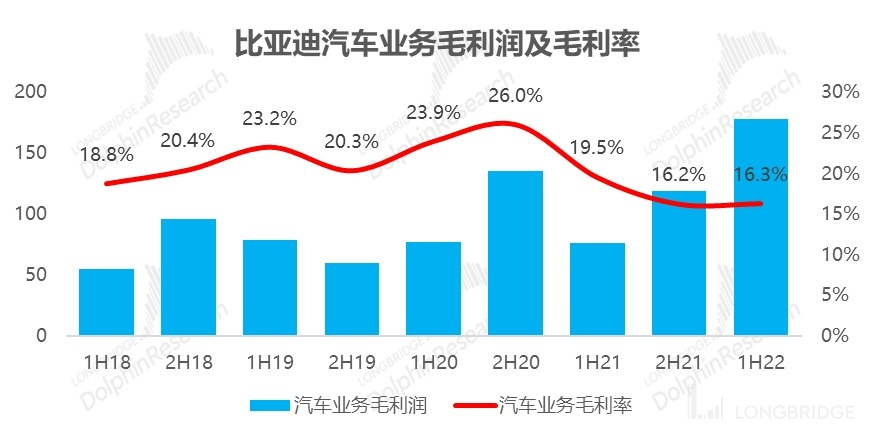

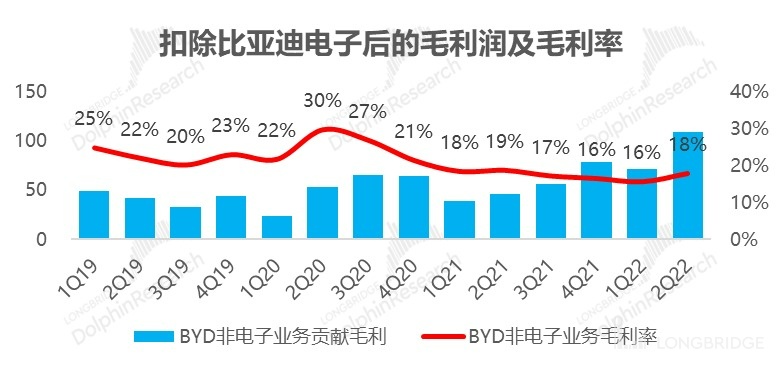

In the first half of 2022, the company's automobile gross margin was 16.3%, which has finally improved after suffering from the worst gross margin in the second half of last year. Note that this gross margin should be even higher for the automobile business alone, as it includes the lower gross margin of the second-charging battery business in the same criteria.

If combined with the overall profit trend of the second quarter, one can see more clearly that, even in the second quarter when battery material prices remained high and the average gross margin of the whole vehicle factory was breached, the relevant automobile business of BYD went against the trend and rose instead. The reason will be revealed later.

Data source: Company announcement, Dolphin Research and Analysis; Note that the first half of 2022 gross margin is the total gross margin of batteries and second-charging under the new criteria, and other factors remain unchanged;

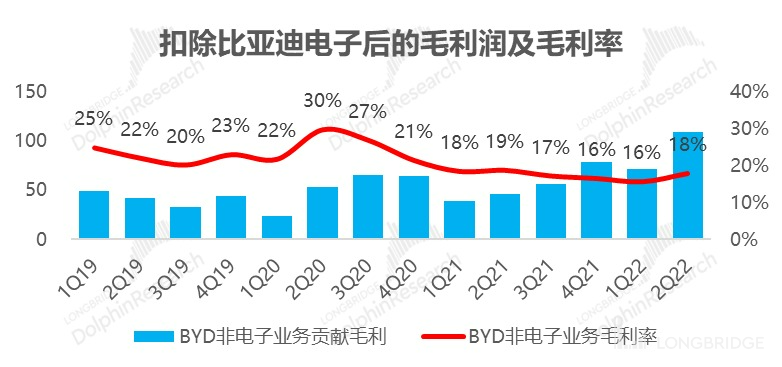

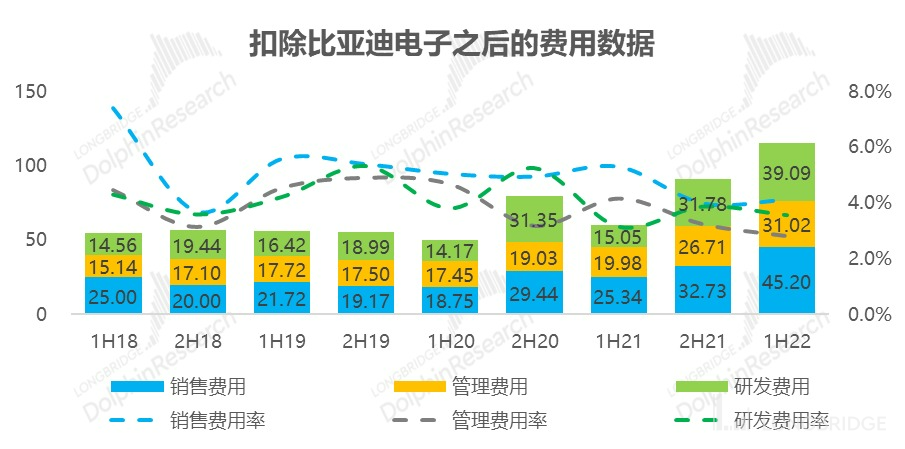

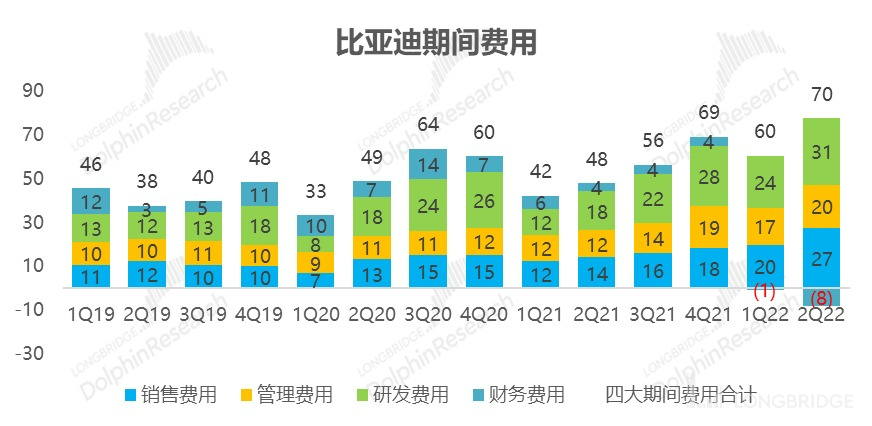

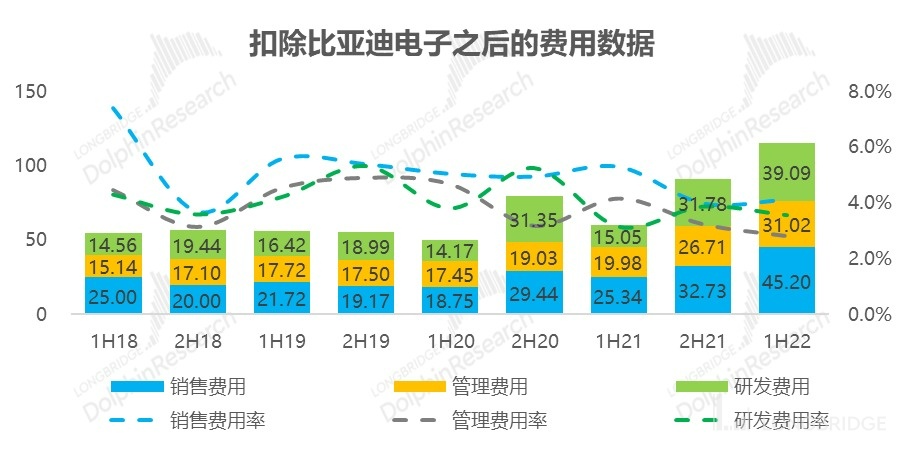

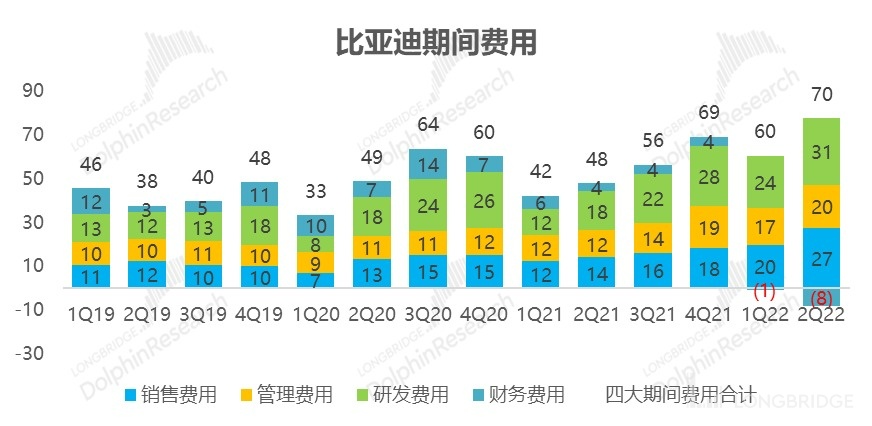

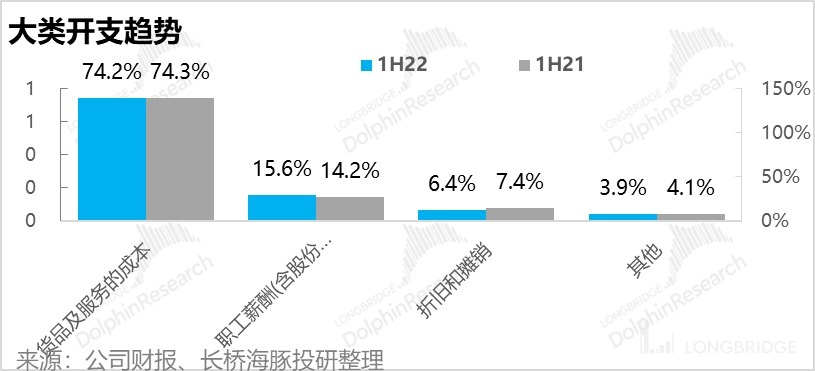

[4] The release of cost leverage is not significant. The cost is mainly variable costs. If observed closely, there seems to be a small improvement in management and other costs in the first half of the year. However, if we look at each quarter separately, we can see that with the clarity of the situation in the later phase of the epidemic, along with the launch of new cars, the pace of investment on the cost side has become more obvious in the second quarter, and the so-called scale effect is actually reflected only slightly in the management cost. In the first half of the year, the only noticeable change in financial expenditure was due to the appreciation of the Hong Kong dollar against the US dollar, which resulted in a relatively large exchange gain on BYD's foreign currency assets. However, since the company sells cars and not currency, this gain is not worth praising and is not sustainable.

Source: Company announcement, Dolphin Investment Research

[5] Soul-searching: Can BYD really make money selling cars?

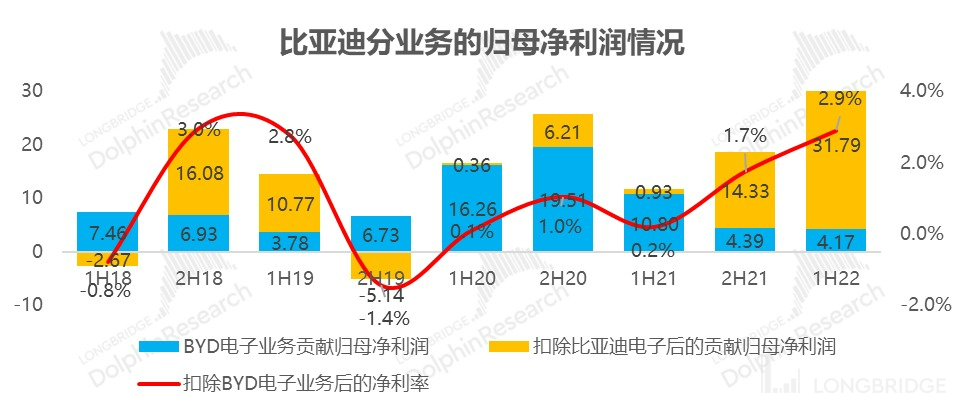

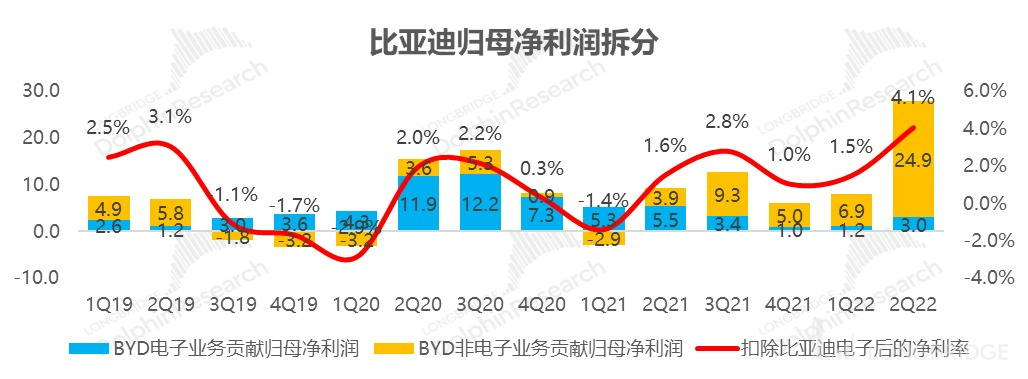

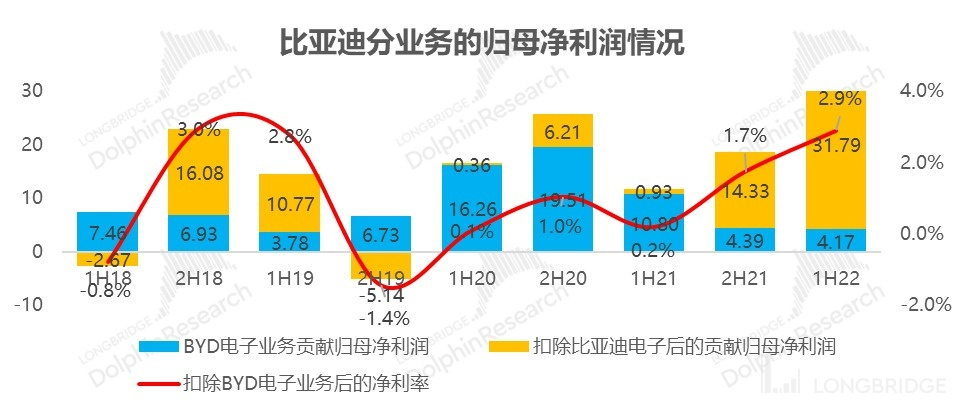

Judging by the performance results, as a large car-selling company that only passes through cash flow but does not earn money, BYD has finally made money in the first half of this year, with a net profit attributable to the owner of RMB 3.6 billion, reaching the upper limit forecasted by the company.

Even after deducting the net financial income of 900 million yuan, the profit in the first half of the year was 2.7 billion yuan, which is a "huge profit" that has not been seen for a long time. From a semi-annual perspective, BYD has only reached this profit level in the second half of 2016.

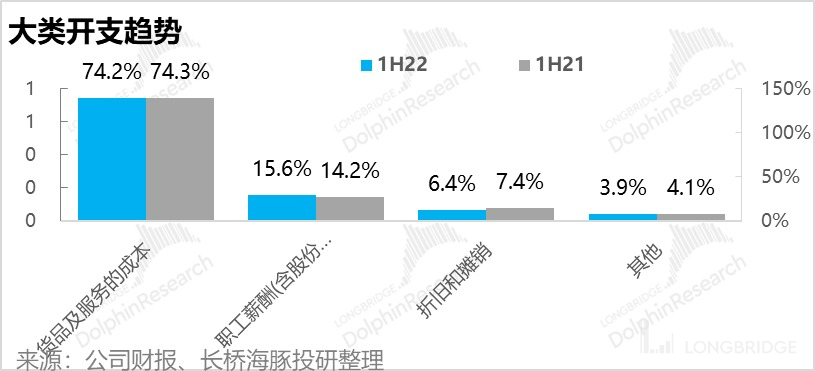

And as the Dolphin Analyst mentioned earlier, the leverage effect of expenses is not obvious, and the main source of profit is actually the release of gross profit. In the first half of the year, the price of battery materials generally increased, but the variable cost was already very high and did not have much impact. From the breakdown of expenses, it can be seen that the improvement in gross profit margin is actually mainly achieved by amortization and depreciation, which are considered "fixed" costs.

This is mainly because the cost of goods sold is basically the same as the increase in revenue, and employee expenses increase faster than revenue, so only the top three in total expenses, the depreciation and amortization expenses rate, are significantly reduced.

If you look further, you will find that BYD's profit release from its automotive-related businesses mainly comes from the second quarter. However, if you look at competitors, most of the car manufacturers in the industrial chain experience their darkest period of profitability in the second quarter - battery factories start passing on battery price increases, while the orders delivered by car factories are still at the pre-rising price level, resulting in extremely unattractive gross profit for most companies, with the eventual winners being battery material companies.

However, when we look at BYD in reverse, we can see that if there is any change in the first half of the year, the core lies in the fact that the inefficient fuel car production line was finally shut down and completely discontinued from Q2 onwards.

The Dolphin Analyst estimates that the key is here, as there was no corresponding depreciation and amortization (corresponding to a 600 million asset impairment loss in Q4 last year, and still at a relatively high level of 200 million in the first half of this year) or it was transformed into a new energy vehicle production line that could produce more efficiently, which resulted in profit release through economies of scale. Also based on this, Dolphin Analyst believes that BYD's related business gross margin release in the second quarter has sustainability. For the subsequent outlook, BYD's own battery has better cost control ability as the battery material prices fall from the high level and with the gradual end of asset impairment, the new production line is used to produce more efficient new energy vehicles. Therefore, there is reason to believe that BYD's profit release will further manifest in the second half of the year.

Now Dolphin Analyst is relatively concerned about the revenue side: in the second half of the year, various automakers including hybrid cars are launching new models, and the production capacity is in place. Whether BYD's domestic new energy vehicle market can maintain a monthly market share of 30% remains to be seen. However, overall, Dolphin Analyst is not very worried about this, one is that BYD still has a large backlog of orders, and the other is that currently, in order to meet the current domestic demand for orders, the overseas market is basically neglected. As long as there is production capacity, with the current competitiveness of BYD electric vehicles, there is little pressure to go overseas.

Data source: company announcements, Dolphin research and analysis

"II. Mobile phone parts and assembly: hit harder by the epidemic"

Mobile phone parts and assembly is not the core business of the company's valuation, but it is the second largest contributor to the company's revenue, and it covers many businesses, so Dolphin Analyst will provide a brief analysis.

"This business still had a positive growth of 5% in the first quarter, but in the second quarter, it was hit hard by the epidemic, downstream shipments were too poor, and revenue fell by 9% year-on-year."

Data source: company announcements, Dolphin research and analysis

"Revenue lags behind, profits worsen, especially the gross margin hit a new low based on the 5.5% in the first quarter, and the improvement of net profit margin was mainly realized by non-operating income net amount."

The final net profit attributable to the parent company in the second quarter was only 500 million yuan, down 46% year-on-year, far exceeding the 9% decline in revenue, which represents the general situation of contract electronics manufacturing in the downstream industry under the double impact of the epidemic.

Data source: company announcements, Dolphin research and analysis

Data Source: Company Announcement, Dolphin Research Compilation