Glorious Future: Why Did VR, with Doubling Growth, Hit the Pause Button?

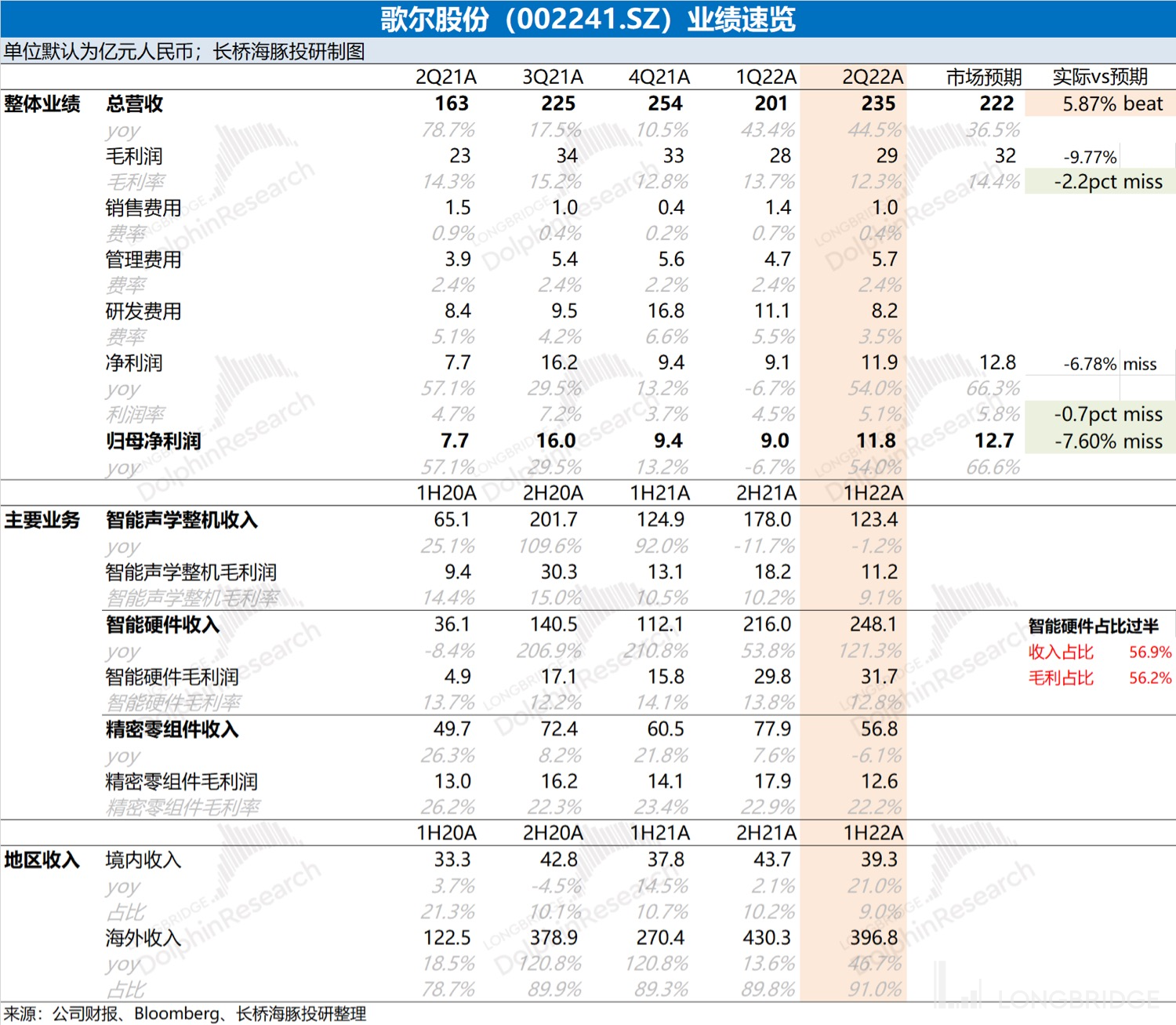

GoerTek released its Q2 2022 financial report (ended in June 2022) after-hours on the A-share market on the evening of August 29, 2022 Beijing time. The main points are as follows:

-

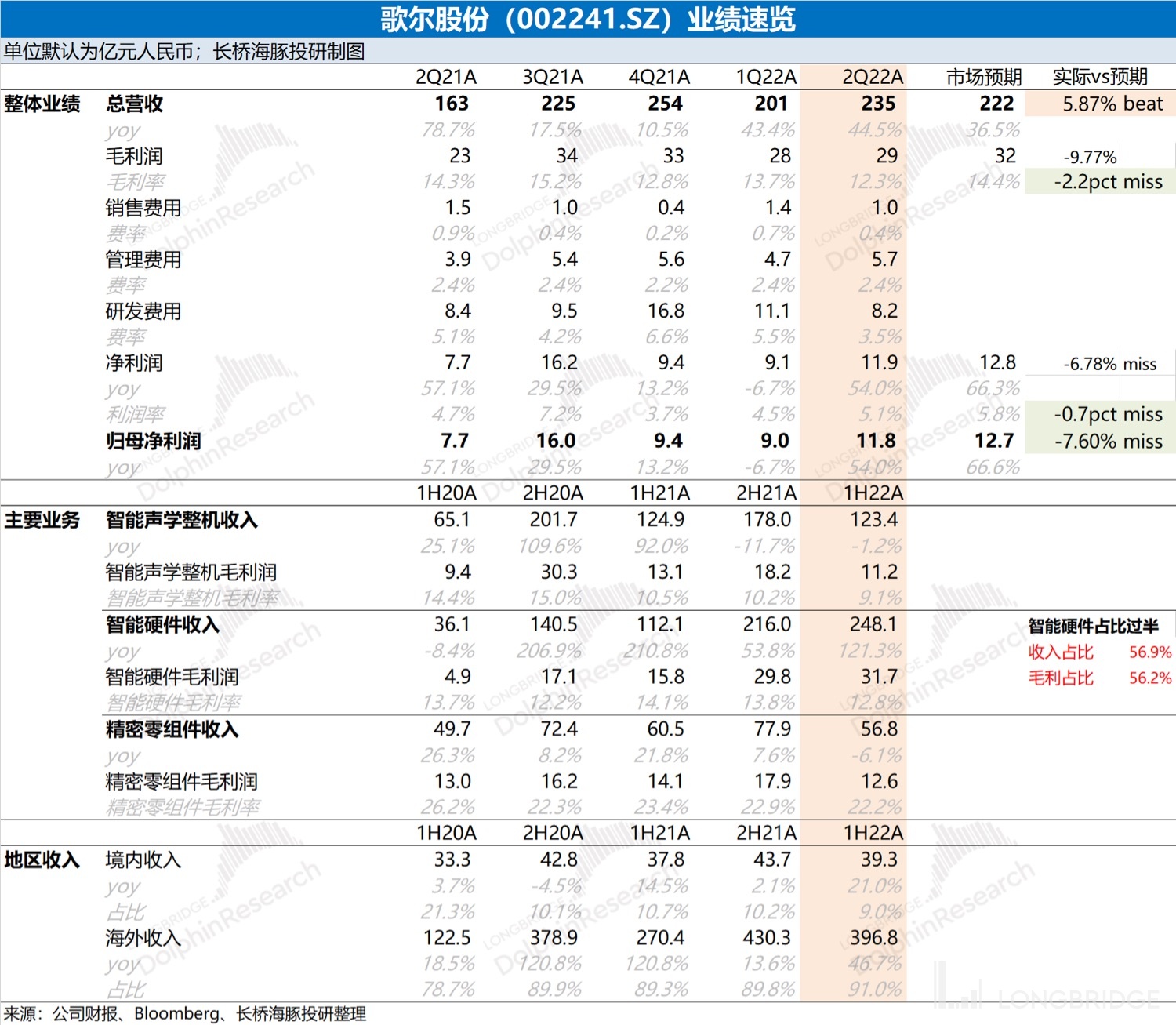

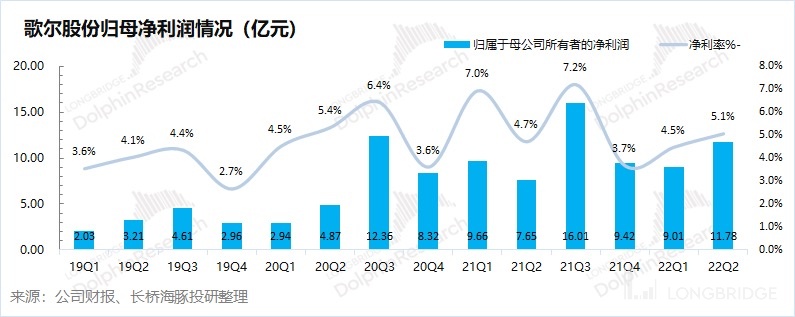

Performance overview: In the midst of a downturn, revenue still exceeds expectations. ① GoerTek's total revenue for this quarter is RMB 23.5 billion, a year-on-year increase of 44.5%, exceeding market expectations (RMB 22.2 billion), and growth is mainly due to the doubling growth of intelligent hardware businesses such as VR virtual reality and smart game consoles. ② The company's gross profit margin for this quarter is 12.3%, a year-on-year decrease of 2 percentage points, which is significantly lower than market expectations (14.4%). Under inflation pressure, the manufacturing sector where the company is located is subjected to cost pressure, and the gross profit margin of the three major businesses of the company has all decreased to some extent in the first half of the year. ③ The company's net profit attributable to shareholders for this quarter is RMB 1.178 billion, a year-on-year increase of 54%, which is located at the lower limit of the company's previous forecast (RMB 1.176-1.522 billion);

-

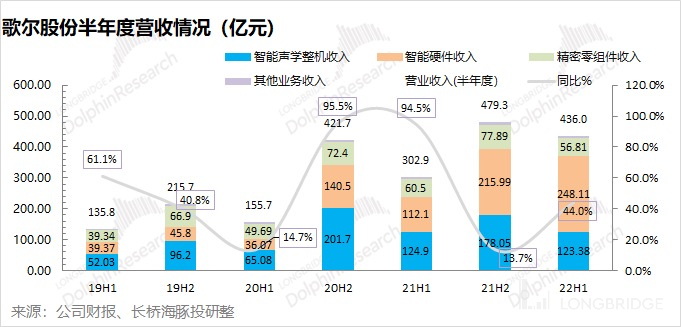

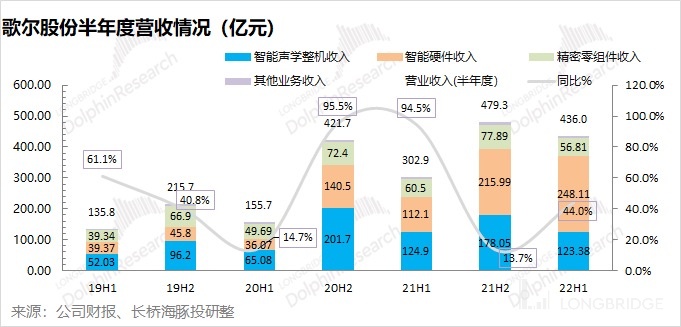

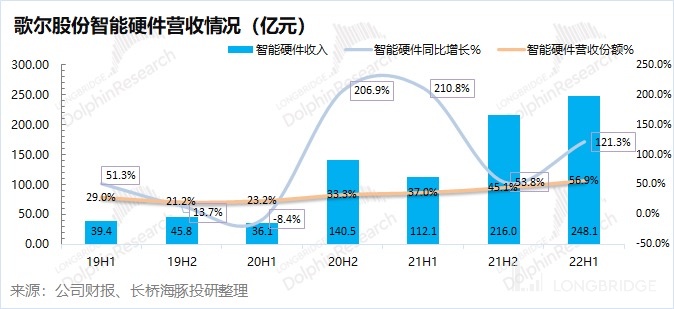

Various core business lines: Take off consumer electronics, stick the VR label. Intelligent hardware revenue and gross profit account for more than half for the first time, making GoerTek branded with the VR label. In the first half of the year, amidst the downturn of consumer electronics and mobile phone markets, while GoerTek's intelligent acoustic equipment and precision components businesses showed some decline, its intelligent hardware business achieved growth of over 100% due to the growth of downstream demand. With the growth of the intelligent hardware business, the impact of the sluggish consumer electronics business on the company has weakened, and the company's VR attribute has become more and more prominent.

-

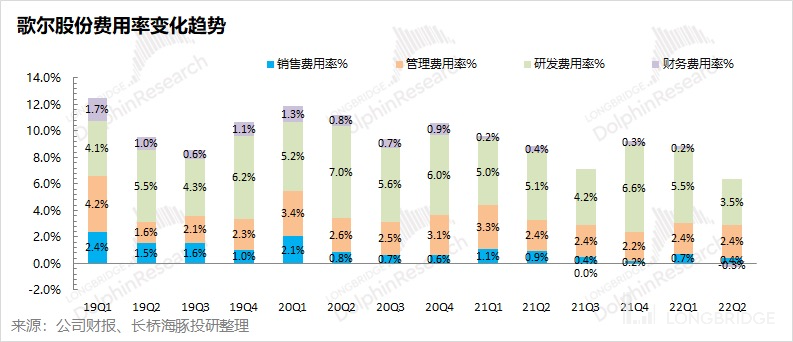

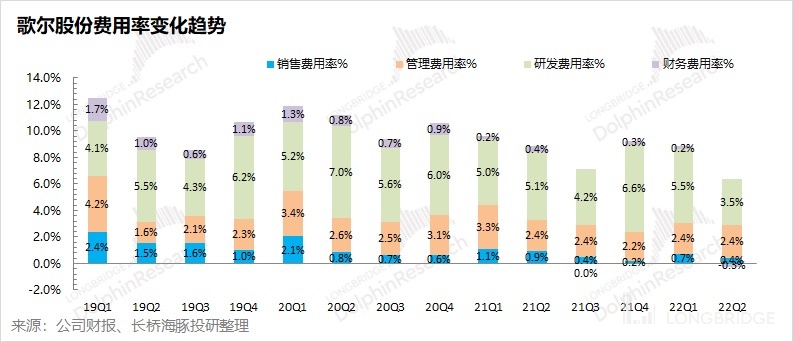

Expenses and business situation: Reasonable operating indicators and effective expense control. With the scale effect of the company's business growth, the expense ratio of the company shows a downward trend. The company's four expenses for this quarter only totaled RMB 1.433 billion, a year-on-year decrease of 0.6%, and the expense ratio for the four expenses was only 6.1%. This quarter, through controlling expenses, under the background of inflation pressure on the gross profit margin, a year-on-year increase in the net profit margin was still achieved.

-

Next quarter's performance expectations: GoerTek expects to achieve a net profit attributable to shareholders of RMB 3.832-4.332 billion for the first three quarters of 2022. Combined with the performance situation in the first half of 2022, the company is expected to achieve a net profit attributable to shareholders of RMB 1.753-2.253 billion in the third quarter (better than the market's expected RMB 1.772 billion), a year-on-year increase of 9.5%-40.71%. The business in the third quarter is still mainly driven by intelligent hardware businesses represented by VR virtual reality, and there is an investment income of approximately RMB 290 million from the disposal of equity interests in investee companies.

Overall, GoerTek's performance for this quarter is actually acceptable, but what is unsatisfactory is the guidance for the next quarter. Judging from the Q2 financial report performance alone, the gross profit margin is lower than expected, but revenue still performs "better than expected". In the first half of the year, due to the overall sluggishness of the mobile phone and consumer electronics market, GoerTek's intelligent acoustic equipment and precision components businesses still showed signs of decline. However, with the doubling growth of the intelligent hardware business, the company has returned to high growth in the first half of the year. In the current economic slowdown, the high growth of intelligent hardware businesses represented by VR virtual reality and game consoles is still precious. However, the Q3 profit guidance shows a non-deductive net profit of only 1.457-1.759 billion yuan, which is flat year-on-year (-9.44% to +9.32%). As smart hardware accounts for more than half of the company's business and showed a doubled growth trend in the first half of the year. Under this circumstance, getting this non-growth guidance in Q3 is still dissatisfying. Dolphin Analyst believes that Apple will release new products for phones and Airpods in the second half of the year, and the two businesses currently account for a gradually decreasing percentage, so the impact on the company's performance won't be too significant. The most likely reason for the poor Q3 performance is that Meta cut back on orders this quarter (combined with Guo Mingchi's previous expectation of a reduction in Oculus shipments in 2022).

From this interim report, GoerTek has transformed into an intelligent hardware company represented by VR and gaming consoles, and mobile phones and consumer electronics businesses have had a decreasing impact on the company. The poor Q3 performance guidance will put pressure on the company in the short term, but judging from the 100%+ growth of intelligent hardware in the first half of the year and the new product releases of Pico and Oculus in the fourth quarter, the VR virtual reality market still has growth potential in the second half of the year. The cutback of Meta.US's order was mainly for the old products to reduce inventory and focus on new products and their own company's performance. Affected by the product cycle gap, Goertek's short-term performance is under pressure.

Pico and Oculus continue to make new product layouts, and Apple.US, Tencent.HK, and other manufacturers are also focusing on virtual reality devices. With new products coming out, the VR/AR field still has the potential to achieve high growth under the backdrop of economic slowdown. As an industry manufacturing leader, Goertek's short-term performance is affected by order adjustments, but in the long run, it is still expected to achieve the "third growth curve" through VR/AR.

The following is Dolphin's specific analysis of Goertek's financial report:

I. Overall performance: poor, but revenue still exceeds expectations

1.1 Revenue side

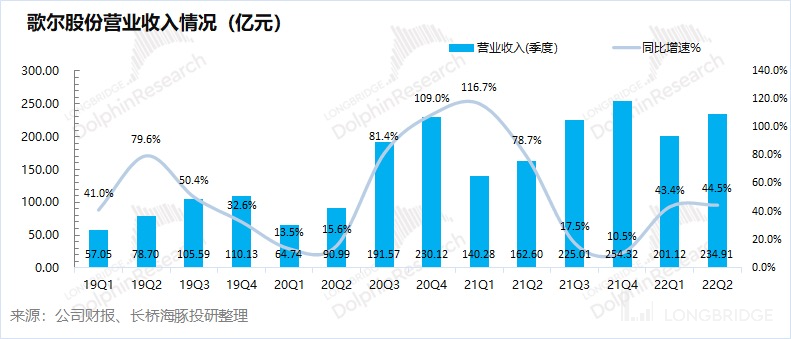

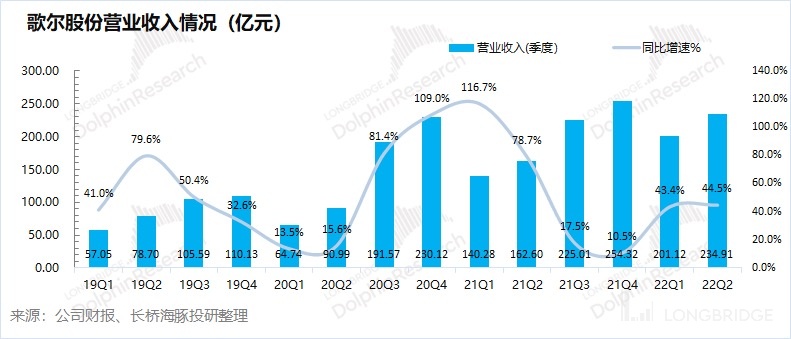

Goertek's total revenue for Q2 2022 was 23.5 billion yuan, a year-on-year increase of 44.5%, exceeding market expectations (22.2 billion). The company's revenue has continued to grow at a rate of over 40% for two consecutive quarters, breaking out of the "quagmire" of deceleration in the second half of last year.

The reason why Goertek was able to achieve independent growth in the sluggish consumer electronics/phone market in the first half of the year was mainly due to the doubled growth of its smart hardware businesses including VR virtual reality and intelligent gaming consoles.

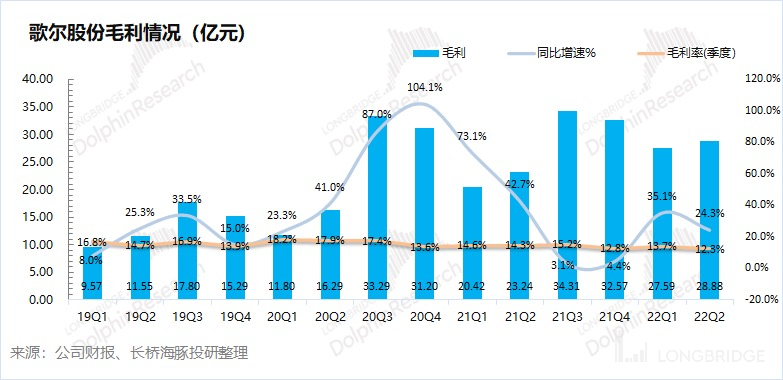

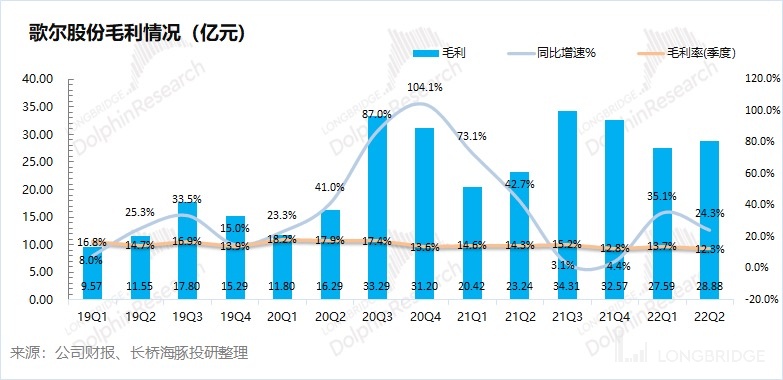

2.2 Gross margin side GoerTek Q2 2022 Achieved Gross Profit of RMB 2.89 Billion, a YoY Increase of 24.3%. The growth of gross profit was mainly driven by revenue, and the gross profit margin showed a certain decline under the influence of inflation and costs.

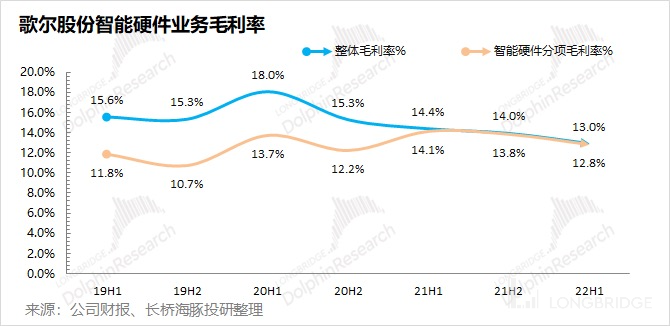

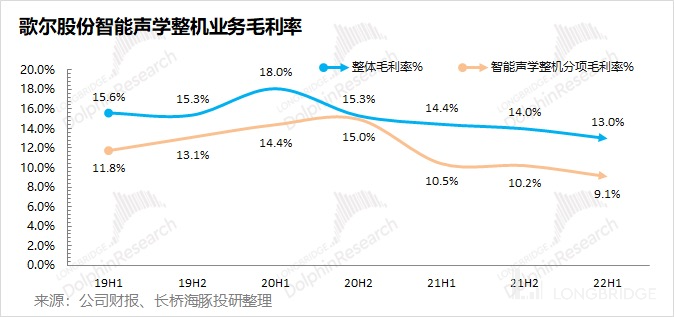

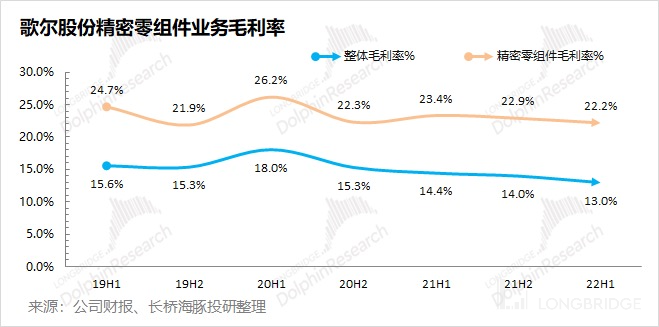

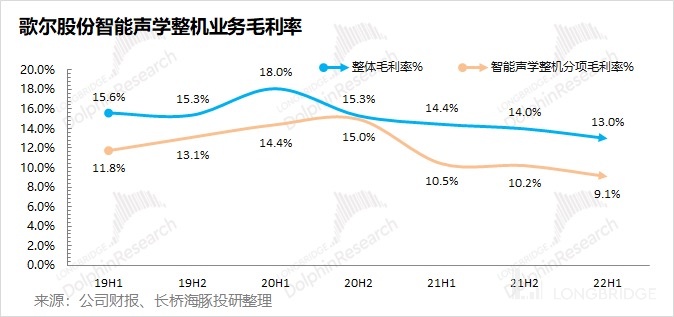

The company's gross profit margin this quarter was 12.3%, a YoY decrease of 2 percentage points, significantly lower than market expectations (14.4%). Under inflationary pressure, the manufacturing sector in which the company is located was under pressure from cost increases. In the first half of the year, the gross profit margins of all three major businesses of the company have declined to a certain extent. With the increase in the proportion of smart hardware business, there is also a structural impact on the overall gross profit margin of the company.

II. Each Core Business Line: Tear off Consumer Electronics and Attach VR Label

After experiencing two rounds of growth in mobile phones and consumer electronics (AirPods), GoerTek has begun its "third growth curve" with VR/AR smart hardware as the leader. In the weak market environment in the first half of the year, GoerTek's smart hardware business achieved 100%+ growth again.

In the smart hardware business, it is mainly composed of AR/VR devices (Meta's Oculus, Pico, etc.), and PS game consoles. With the continuous high growth of the business, the proportion of smart hardware business (revenue and gross profit) in the company has exceeded 50% for the first time. GoerTek has torn off the label of "consumer electronics" and become a company mainly engaged in smart hardware business.

2.1 Smart Hardware Business

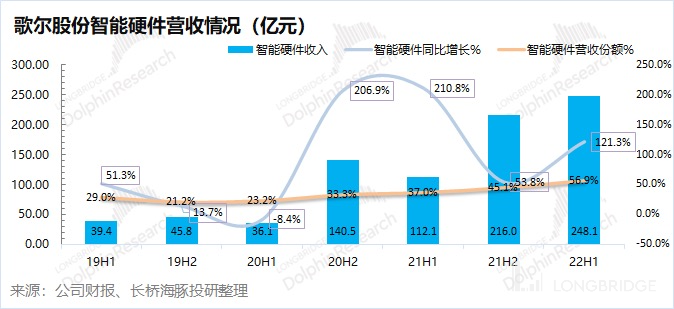

GoerTek's smart hardware business achieved a revenue of RMB 24.81 billion in the first half of 2022, a YoY increase of 121.3%. With the growth of shipments of Oculus, Pico, and PS products, the smart hardware business has become the largest source of revenue growth for the company and has surpassed 50% for the first time.

GoerTek's smart hardware business achieved a gross profit margin of 12.8% in the first half of 2022, a YoY decrease of 1.3 percentage points. Under the influence of inflation, the company faced great pressure in terms of production costs, which squeezed the company's gross profit margin.

Dolphin Analyst believes that Pico and Oculus will release new products successively in the second half of the year, which is expected to continue to bring growth momentum to the company's smart hardware business. In the current economic slowdown, high-growth products or industries are needed to resist downward pressure on the economy. For the VR/AR industry, Apple is also expected to launch a new MR product in the future, continuing to promote industry development.

2.2 Intelligent Acoustic Assembly

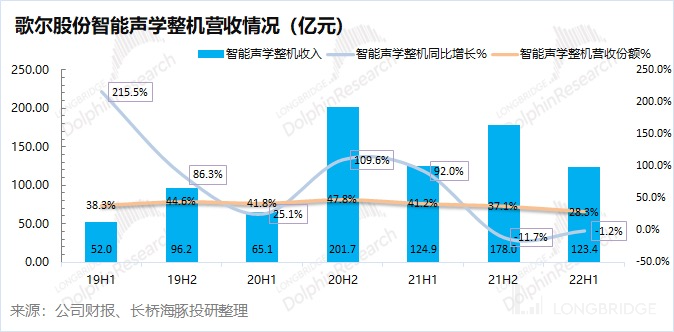

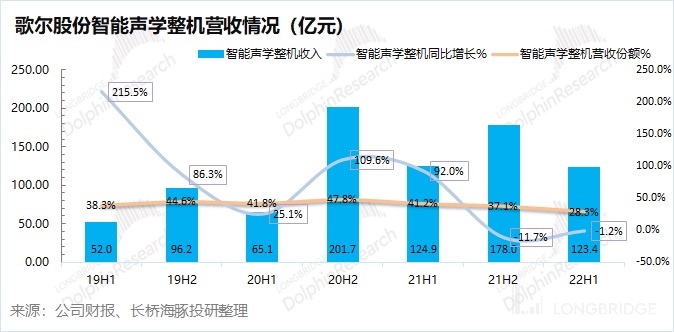

GoerTek's intelligent acoustic assembly business achieved revenue of 12.34 billion yuan in the first half of 2022, a year-on-year decrease of 1.2%. GoerTek's intelligent acoustic assembly business mainly undertakes Apple's AirPods series products.

The past performance of the company's intelligent acoustic assembly business is also similar to the product cycle of AirPods. After experiencing nearly 100% growth from the second half of 2020 to the first half of 2021, it started to decline from the second half of 2021. Apple originally wanted to use the new AirPods to drive secondary growth, but from the performance after the new product was released, the market did not respond positively. Apple's wearable business this quarter also declined by 7.7%.

Fortunately, GoerTek has torn off the label of consumer electronics and has found the third growth curve. The proportion of the company's intelligent acoustic business has further declined to below 30% this quarter.

The gross profit margin of GoerTek's intelligent acoustic assembly business continued to decline to 9.1% in the first half of 2022, a year-on-year decline of 1.4pct. While inflation has increased costs, weak terminal demand has also affected the company's product shipments.

Dolphin Analyst believes that as AirPods products enter mature markets, business growth will no longer be high, and more will be similar to the replacement demand of PCs and iPads. The proportion of intelligent acoustic business in the company's business will also further decline.

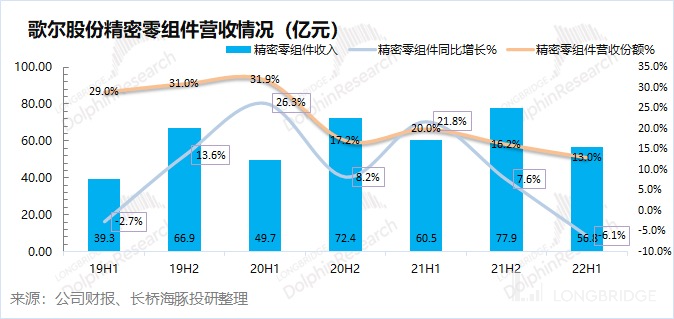

2.3 Precision Zero Component Business

GoerTek's precision zero component business achieved revenue of 5.68 billion yuan in the first half of 2022, a year-on-year decrease of 6.1%. Goer's precision zero component business mainly includes electronic devices such as MEMS and mic, with the largest downstream application field in mobile phones.

Precision zero components were most affected by the sluggish mobile phone market in the first half of the year, but GoerTek's decline was better than the overall mobile phone market's double-digit decline, mainly due to the relatively stable performance of major customers in Goertek's mobile phone business. It is reasonable for precision zero component business to decline in the context of the weak mobile phone market in the first half of the year.

GoerTek's precision zero component business gross margin in the first half of 2022 was 22.2%, a year-on-year decrease of 1.2pct. The decline in the company's gross margin of precision zero components is mainly due to the influence of rising raw material prices and weak downstream demand. Dolphin Analyst believes that the release of new machines by major customers in the second half of the year will boost precision component production. However, there is still the issue of high inventory and insufficient hauling power from Android customers. Overall, the company's precision component business is expected to improve in the second half of the year, but a significant rebound is still unlikely.

Three. Cost and Operational Status: Reasonable Operating Indicators, Effective Cost Control

3.1 Operating Indicators: Accounts Receivable and Inventory Maintaining a Relatively Reasonable Balance

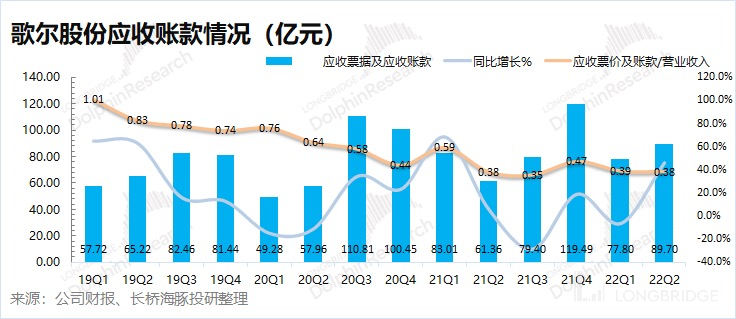

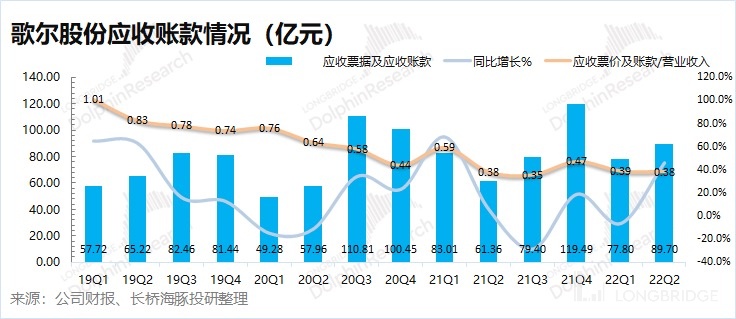

① Accounts Receivable: In Q2 2022, Goertek had accounts receivable of RMB 8.97 billion, a YoY increase of 46.2%. Based on the accounts receivable-to-revenue ratio, Goertek's accounts receivable increased slightly to 0.38 this quarter but remained at a relatively reasonable level overall.

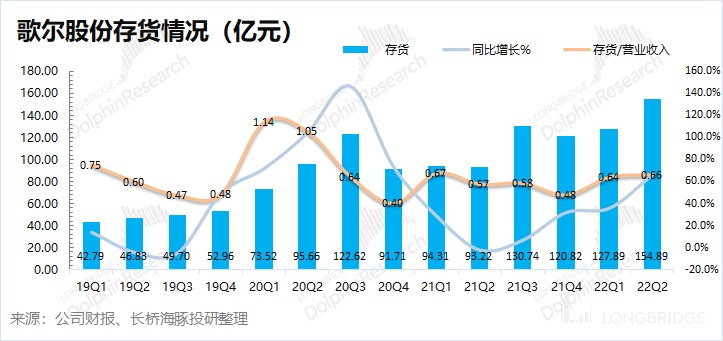

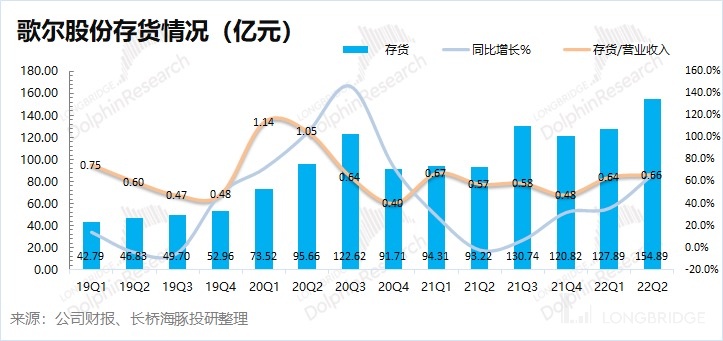

② Inventory: In Q2 2022, Goertek had inventory of RMB 15.489 billion, a YoY increase of 66.2%. Based on the inventory-to-revenue ratio, Goertek's inventory continued to rise to 0.66 this quarter. Although Goertek's inventory level is higher than in 2021, it remains at a relatively reasonable level, mainly due to weakening demand for Airpods and mobile phones.

3.2 Cost Situation: Cost-to-Scale Ratio Tends to Decrease Under Economies of Scale

In Q2 2022, Goertek's four expenses totaled RMB 1.433 billion, down 0.6% YoY. The cost-to-scale ratio was 6.1%, which decreased mainly due to the decrease in sales expenses and increase in exchange gains.

-

1) Sales Expenses: Sales expenses were RMB 104 million this quarter, a YoY decrease of 29%. The sales expense ratio was 0.4%. The decrease in the company's sales expenses is mainly due to its good customer relations and economies of scale, which have caused the sales expense ratio to decrease to below 1% for five consecutive quarters.

-

2) Management Expenses: Management expenses were RMB 572 million this quarter, a YoY increase of 47.9%. The management expense ratio was 2.4%. As the company's revenue grows, the management expense ratio tends to decrease below 3% due to economies of scale.

-

3) Research and Development Expenses: Research and development expenses were RMB 822 million this quarter, a YoY decrease of 1.6%. The research and development expense ratio was 3.5%. The company's research and development expenses are the largest of the four expenses and are mainly focused on increasing research and development investment in the VR and other precision components fields. 4) Financial expenses: This quarter's financial expenses were -0.66 billion yuan, compared to positive figure in the same period last year, with a financial expense ratio of -0.3%. The change in the company's financial expenses is mainly due to the increase in interest and exchange gains.

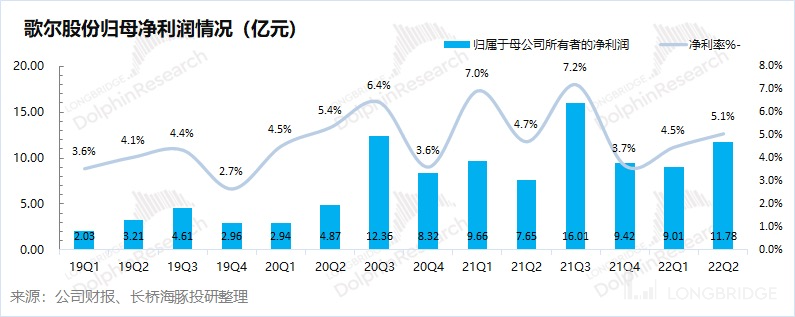

3.3 Net profit: Expected to reach a new high next quarter after business transformation

GoerTek's net profit attributable to shareholders in the second quarter of 2022 was 1.178 billion yuan, a year-on-year increase of 54%, which was lower than the market expectation of 12.7% and located at the company's previous lower limit forecast (11.76-15.22 billion yuan). The main reason why GoerTek's profit this quarter did not meet expectations was that the gross profit margin declined more than expected, which was mainly due to inflation and weak downstream demand.

The company's net profit margin in the second quarter of 2022 increased to 5.1%. The increase in net profit margin was mainly due to the company's control of the expense ratio. Although the gross profit margin was under pressure, the company pulled the gross profit margin back to a historically reasonable level through the control of the expense ratio. With the release of new products such as Apple, Oculus and Pico in the second half of the year, the company's Q3 net profit margin and profit are expected to be further released.

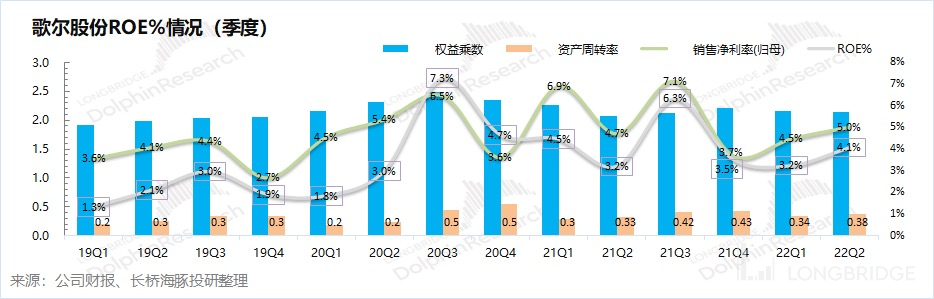

IV. Return on Equity: ROE Returns to Growth

GoerTek's return on equity in the second quarter of 2022 returned to 4% after experiencing the pains of business transformation. The company's ROE returned to growth without falling into the low point that existed at the end of 2018.

Analyzing ROE%, starting with the breakdown of each factor:

1) Sales net profit margin: GoerTek's sales net profit margin reached 5% in the second quarter of 2022, up by 0.3% from the previous quarter.

2) Equity multiplier: GoerTek's equity multiplier in the second quarter of 2022 was 2.14, remaining stable (-0.01).

3) Asset turnover rate: GoerTek's asset turnover rate in the second quarter of 2022 was 0.38, slightly up by 0.04 from the previous quarter.

GoerTek's ROE% was below 4% in the previous two quarters. The market had concerns that the company would return to the low point of 2018. However, relying on the continuously growing smart hardware business, GoerTek is expected to break away from the drag of the consumer electronics and mobile phone market and achieve independent growth.

The high growth of smart hardware continued to bring in the improvement of asset turnover rate, while the control of expenses also increased the company's net profit margin. The company's ROE% reversed its downward trend this quarter and returned to 4%.

Dolphin Analyst's Historical Articles Review of GoerTek Inc.:

Dolphin Analyst's Historical Articles Review of GoerTek Inc.:

Earnings Season

April 27, 2022 Earnings Review: "VR High Growth, GoerTek Points to Strong Performance Against the Market Trend"

March 30, 2022 Earnings Review: "GoerTek Inc.: 'Collapse' is Only Temporary, Future is Still in VR"

August 27, 2021 Earnings Review: "GoerTek Inc.: 'VR Light' Overwhelms the 'Loneliness' of TWS Earphones"

In-depth Analysis

June 17, 2022 Industry In-depth Analysis: "Consumer Electronics is 'Matured', Apple is Resilient, and Xiaomi is Suffering"

August 20, 2021 Company In-depth Analysis Part 2: "GoerTek Inc.: Metaverse is Too Far, VR Game Console is Already 'Hot'"

July 23, 2021 Company In-depth Analysis Part 1: "GoerTek Inc.: What's Behind Another Plunge of the Fruit Chain Dragon Head?"

Risk and Disclosure Statement of this article: Dolphin Disclaimer and General Disclosure of Investment Research

!

!