Stumbling to the "worst," China Feihe is standing at the starting line for takeoff

China Feihe (6189.HK) released its mid-year report for 2022 on August 29th, Beijing Time. The key financial points are as follows:

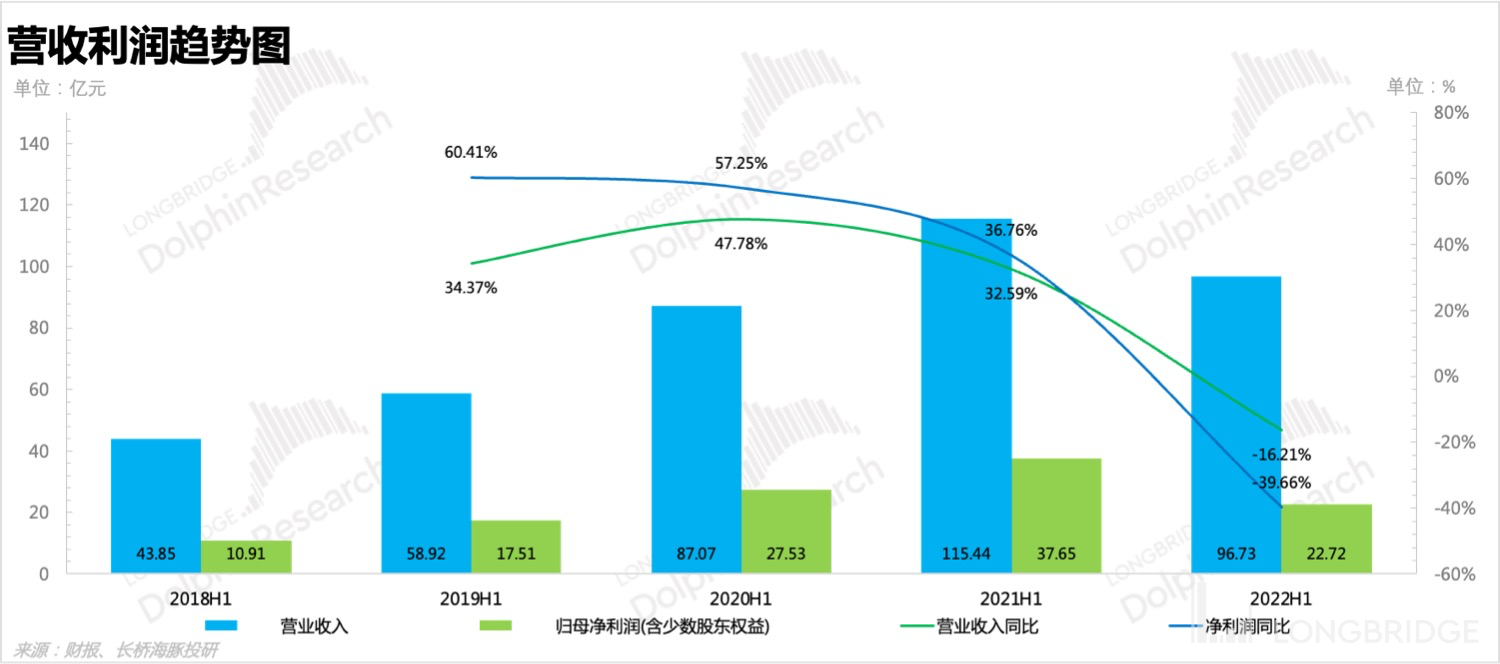

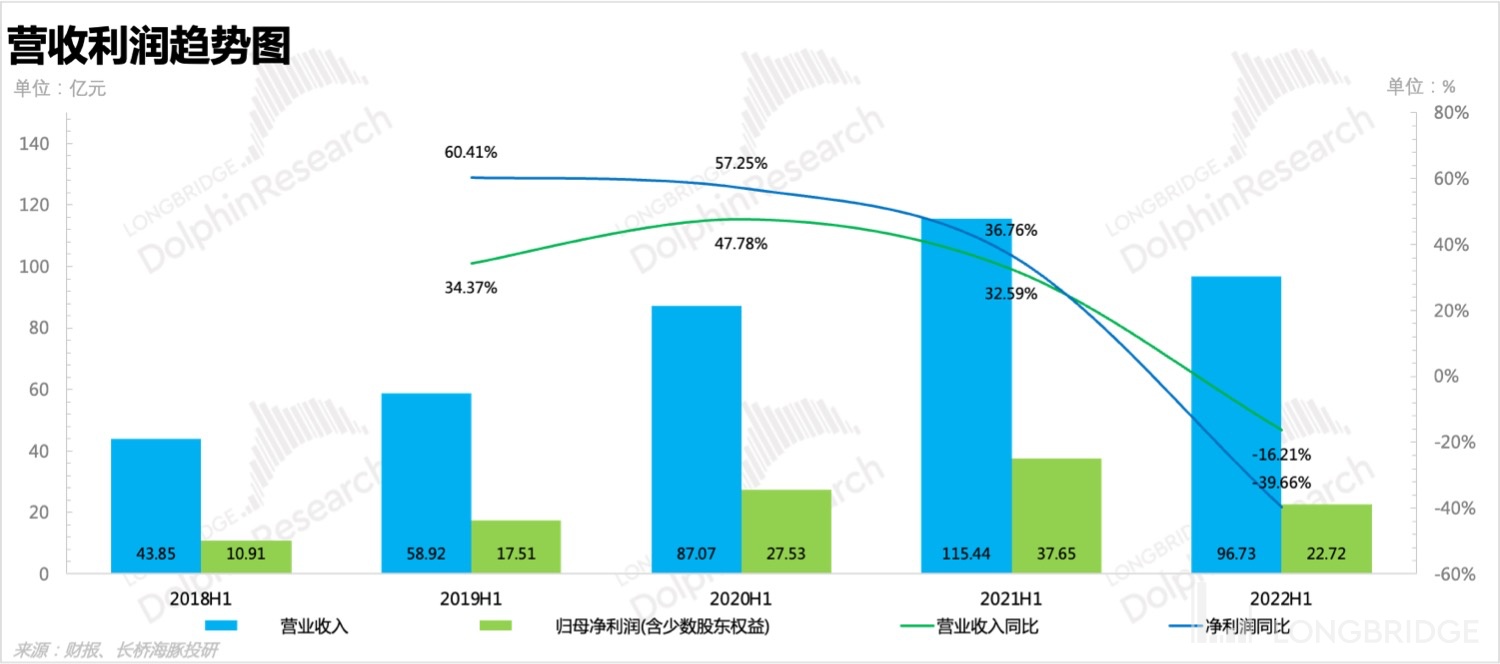

1. Revenue lower than expected: The demand has decreased, combined with a concentrated clearance of channel inventory. China Feihe only achieved a revenue of CNY 9.673 billion in the first half of 2022, a year-on-year decrease of 39.66%, which is a surprising decline and reflects the dire state of management! The specific reasons are as follows:1) The impact of a significant drop in the birth rate in the first half of 2021 is beginning to manifest in the first half of 2022; 2) Against the backdrop of the imminent implementation of the new national standard, China Feihe's channel has opted to adopt a "fresh strategy," making efforts to clear out old products while slowing the sales of new ones.

2. Net profit attributable to shareholders lower than expected: Star Feifan and other high-gross margin products cleared out channel inventory, with large end-customer discounts and the increase in sales proportion of low-gross margin products, as well as higher R&D expenses, ultimately resulting in a net profit attributable to shareholders of only CNY 2.272 billion in the first half of 2022, a year-on-year decrease of 16.21%, which is significantly down! The specific reasons are as follows:1) Under the pressure of the new national standard, brand owners are all making efforts to clear out old products, leading to increased competition, with large end-customer discounts increasing; 2) Feihe has increased its R&D efforts in new products, leading to higher R&D expenses; 3) In the context of Star Feifan clearing out channel inventory, the proportion of low-gross margin products, such as adult powder and children's powder increasing, contributing relatively weakly to profits.

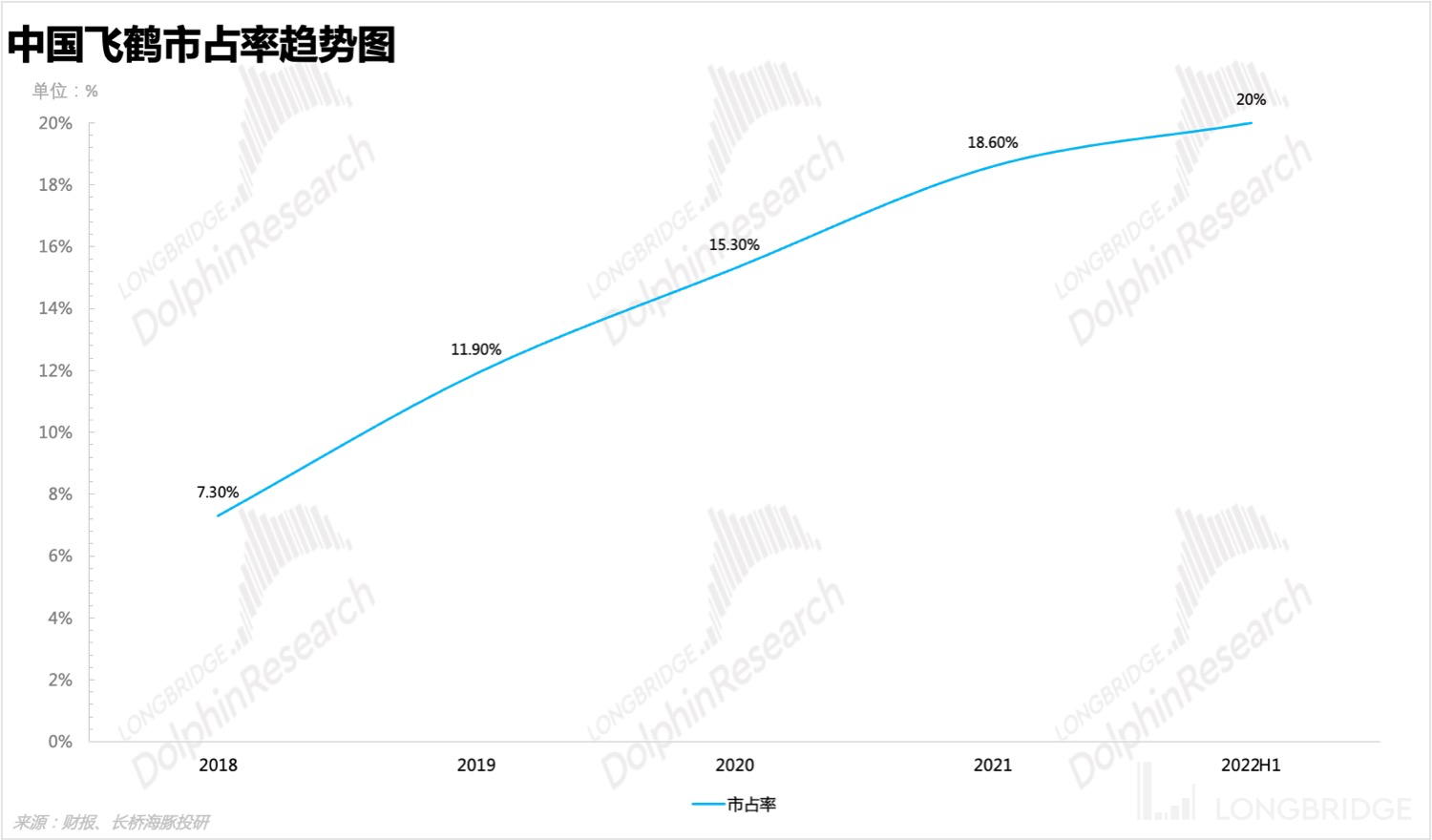

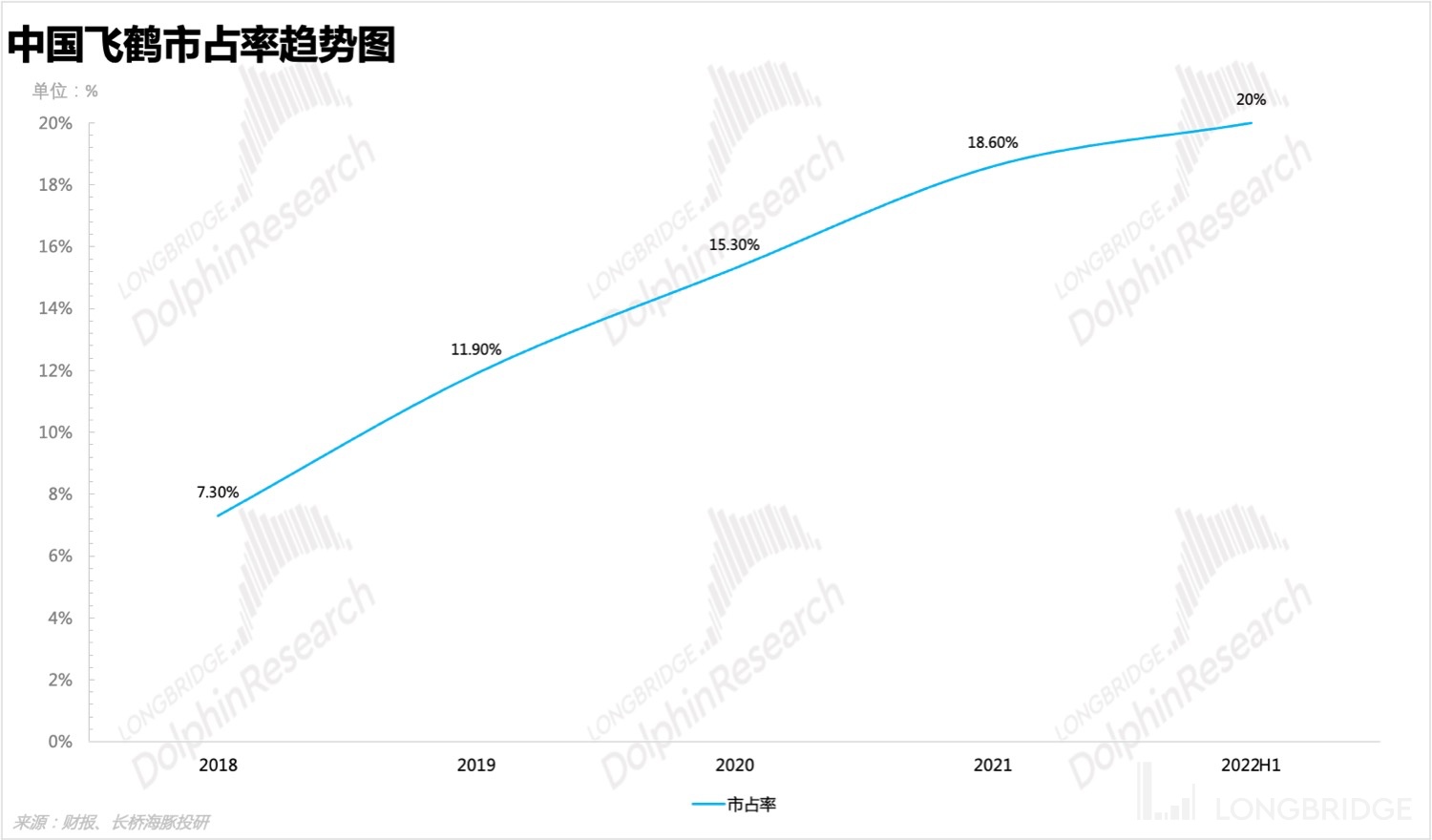

3. Slowing market share growth, target of 30% delayed: China Feihe's penetration rate and market share in low-tier cities have reached a relatively high level, while in high-tier cities, it is forced to face competition from international brands, which has led to a significant slowdown in the company's expansion speed. In addition, the epidemic has also affected the effectiveness of Feihe's offline sales activities (the core sales method of China Feihe), so the pace at which Feihe's market share is increasing has slowed down and it is estimated that the goal of reaching 30% by 2025 will have to be delayed!

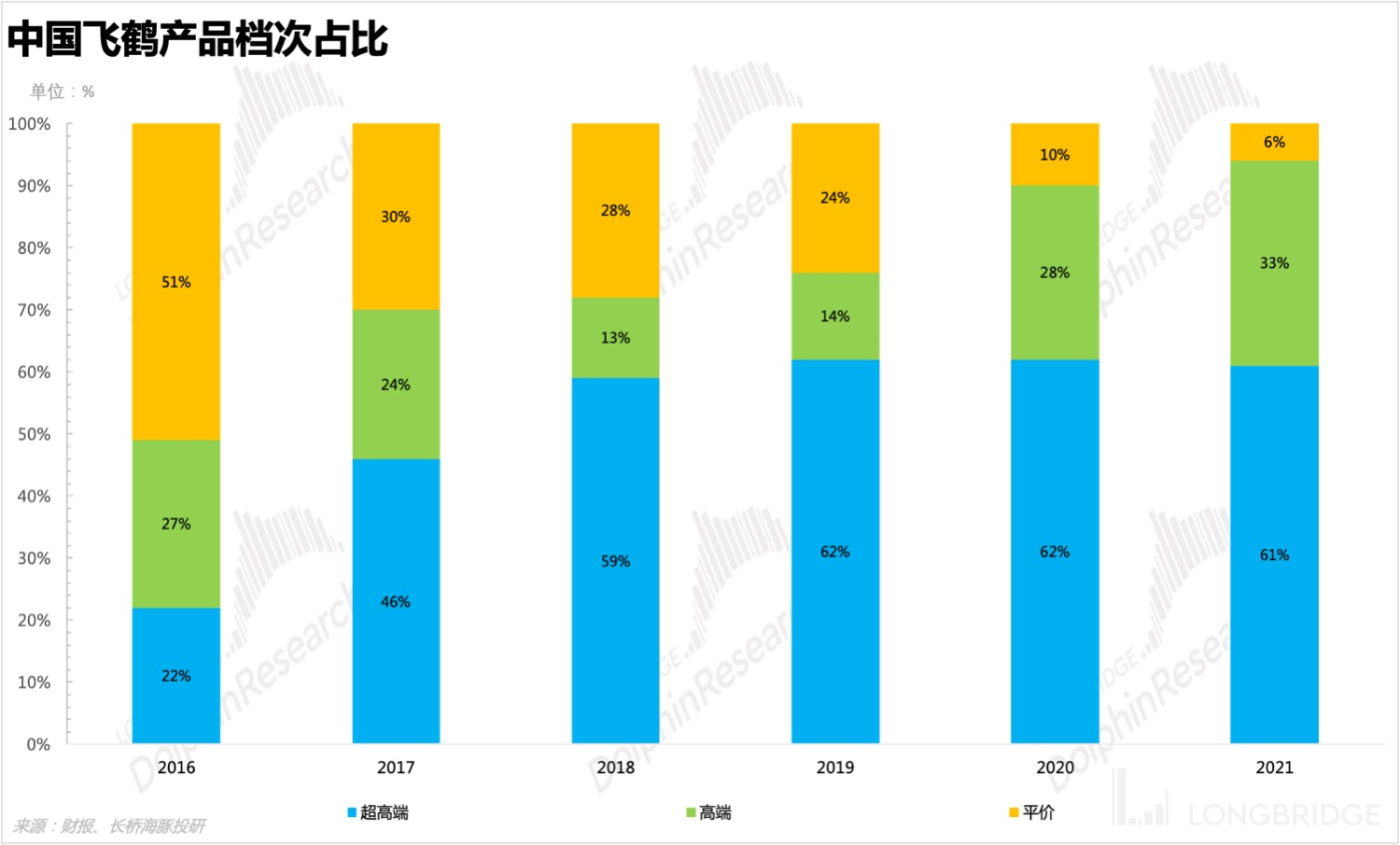

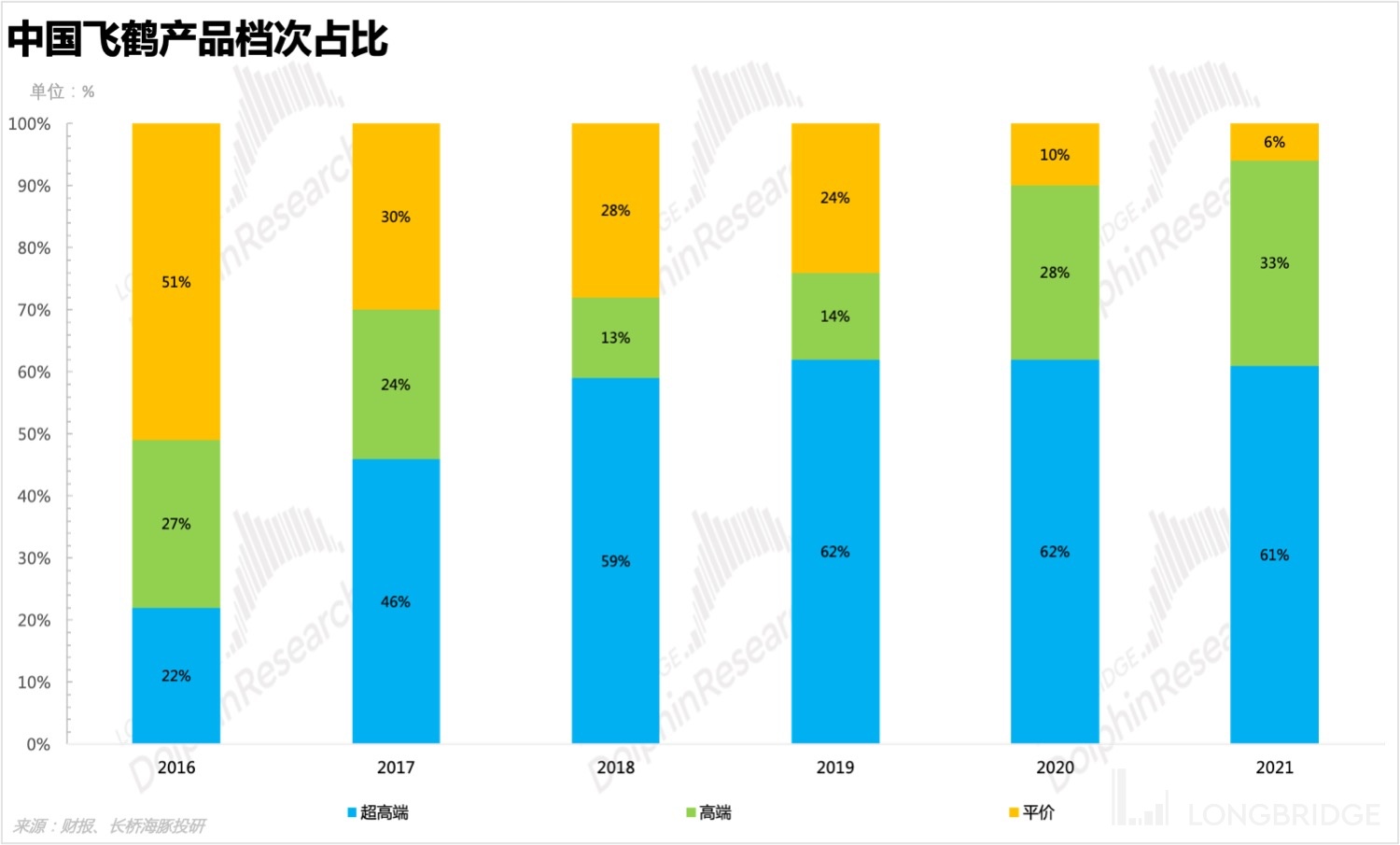

4. Results of product structure upgrade limited: In the first half of 2022, China Feihe maintained its position as the leader in the high-end market, with a market share of 25.3%, and also in the super high-end market, with a market share of 26.4%. If you look specifically at Feihe's product structure, high-end and above products account for around 95% of its products. In this situation, the effect of further upgrading the product structure is limited, so even though Feihe launched super high-end products and more refined products in the first half of the year, their contribution to revenue was limited.

5. Price control effect is still good: In the first half of 2022, China Feihe continued to clear out inventory while also limiting the minimum sale price. In addition, it introduced a price protection system in April, and now channels' inventory has been mostly cleared out. Meanwhile, the price level of Star Feifan has also improved compared to the previous period.

Opinions of Dolphin Analyst:

- The performance in the first half of the year was lower than expected, but it was also operating at an absolute bottom. The number of newborns has declined, leading to a decrease in demand. In addition, under the pressure of the new national standard, brand owners are clearing out old inventory, leading to increased competition, not to mention the restrictions imposed by the epidemic on China Feihe's offline activities. Ultimately, this has led to a significant gap in revenue and profit performance in the first half of the year compared to expectations, and the growth rate of market share has also slowed down.

-

Feihe has currently completed 80%-90% of inventory clearance. With the decrease in inventory levels, sales in the second half of the year are expected to return to normal levels, providing a basic guarantee to sales volume. However, Feihe's penetration rate in lower-tier cities is already quite high, and expanding into higher-tier cities will require going head-to-head with international brands. Therefore, the sales growth rate of products will slow down compared to previous periods, and the speed of increasing market share will also slow down. In addition, as high-end products are expected to recover to normal sales in the second half of the year, coupled with the gradual reduction of cost pressures, the gross profit margin is expected to increase.

-

Looking ahead to the upgrading of Feihe's product structure in the second half of the year, its high-end products already account for a high proportion. There is limited room for income growth driven by higher-priced products. The core driving force for growth may depend on the expansion of new product categories.

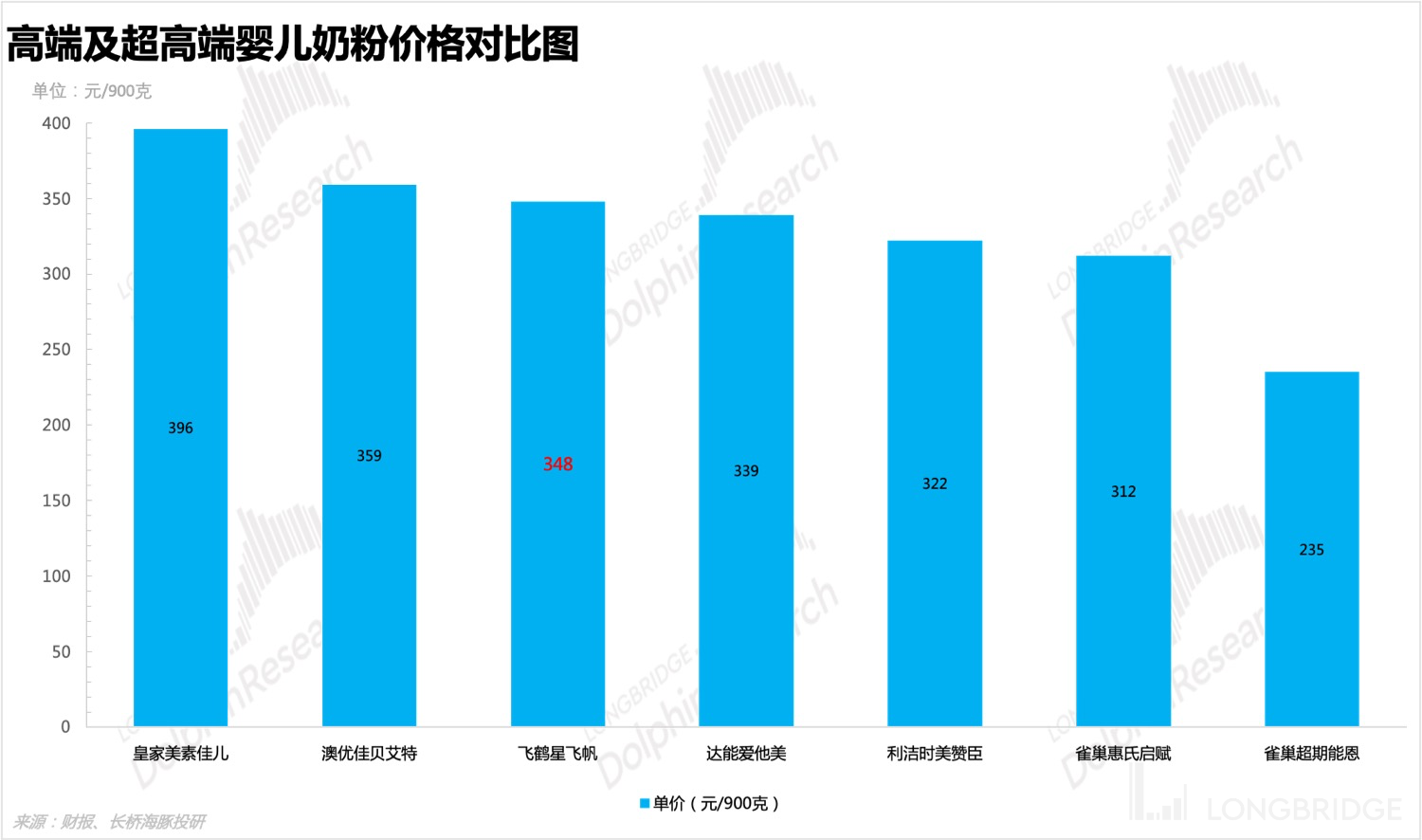

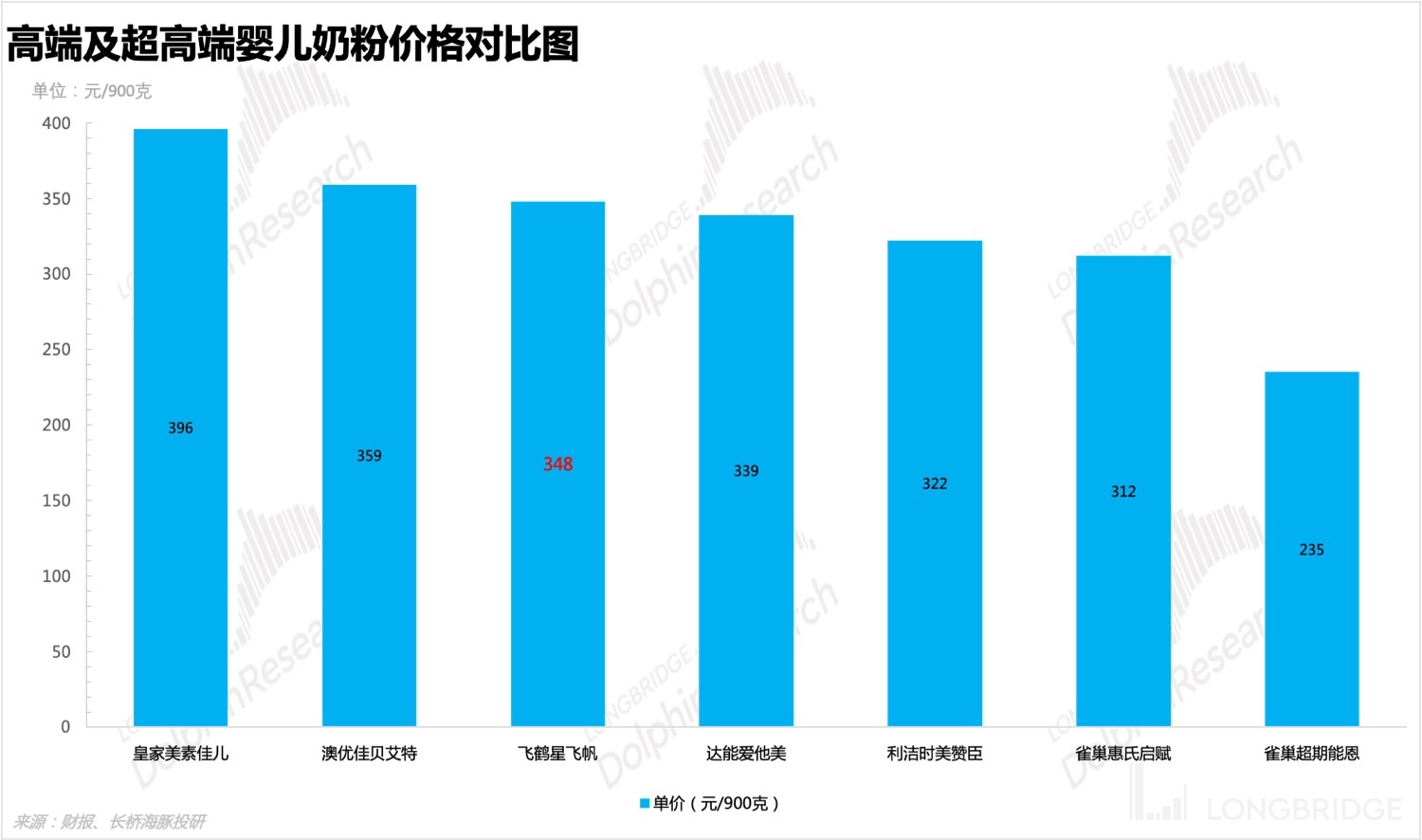

When most consumer companies face a decline in industry demand, they often rely on structural upgrading of their products to achieve growth, such as the beer industry. This is also the case for the milk powder industry. However, in the case of Feihe, the road of product upgrading is not so suitable. On the one hand, Feihe started with high-end products itself, and as mentioned earlier, the proportion of high-end and above products has reached around 95%. On the other hand, Feihe's product pricing is currently difficult to be even higher than that of big international brands. Under such circumstances, continuing to challenge international big brands and seizing the time to expand product categories seems to be a good choice. Therefore, as the Dolphin Analyst, I will carry out a quantitative and qualitative analysis of the financial report from this perspective.

Body:

I. Multiple factors lead to a decline in sales

1. Slower expansion in the first half of the year

Feihe's penetration rate and market share in lower-tier cities are already at a high level. Relying on sales in lower-tier cities, its market share in high-end and ultra-high-end markets remained first in the first half of the year, reaching 25.3% and 26.4% respectively. However, in higher-tier cities, Feihe had to face competition from international big brands, which greatly slowed down the company's expansion speed and sales growth rate. Moreover, the proportion of Feihe's high-end and above products has reached 90%, and the growth brought by further upgrading the product structure is indeed limited, which is one of the reasons why Feihe's launch of the goat milk powder Xingfeifan in the first half of the year, which aimed to refine products further, finely segment consumer groups, and meet more specific demands, did not have a significant impact.

2. Important tasks for the first half of the year is to clear channel inventory

At the end of 2021, channel inventory rose to about 2 months, which was the highest level in the history of Feihe, due to the pressure of the epidemic and the new national standard, the action of clearing channel inventory was launched in the first half of this year. This is one of the important reasons for the decline in sales in the first half of the year. Currently, the channel inventory of Feifan series products is about 1.2 months, and the channel inventory of other products is about 1.5 months. The overall situation is still good and has returned to normal.

3. The role of expanding new categories in sales growth has not yet been reflected

Feihe is currently mainly targeted on infant formula milk powder, but it is also strengthening the expansion of children's powder and adult powder. In the first half of the year, the "Aiben" brand was launched, mainly aimed at adults, especially the elderly group. There are products that target bone health, the cardiovascular system, and lactose intolerance. Although the future is promising, it has not yet been fully launched.

II. Controlling price, stable price range

The channel inventory of China Feihe in the first half of the year was relatively high, about 2 months, so the action of clearing the channel inventory was launched in the first half of the year. However, in order to ensure the stability of the price range, Feihe has set the lowest sales price and has penalties for dealers who violate sales regulations. In addition, Feihe prints codes on its Star Feifan series products for product tracking to prevent smuggled goods and maintain price stability.

III. Decline in gross profit, increase in sales expense ratio

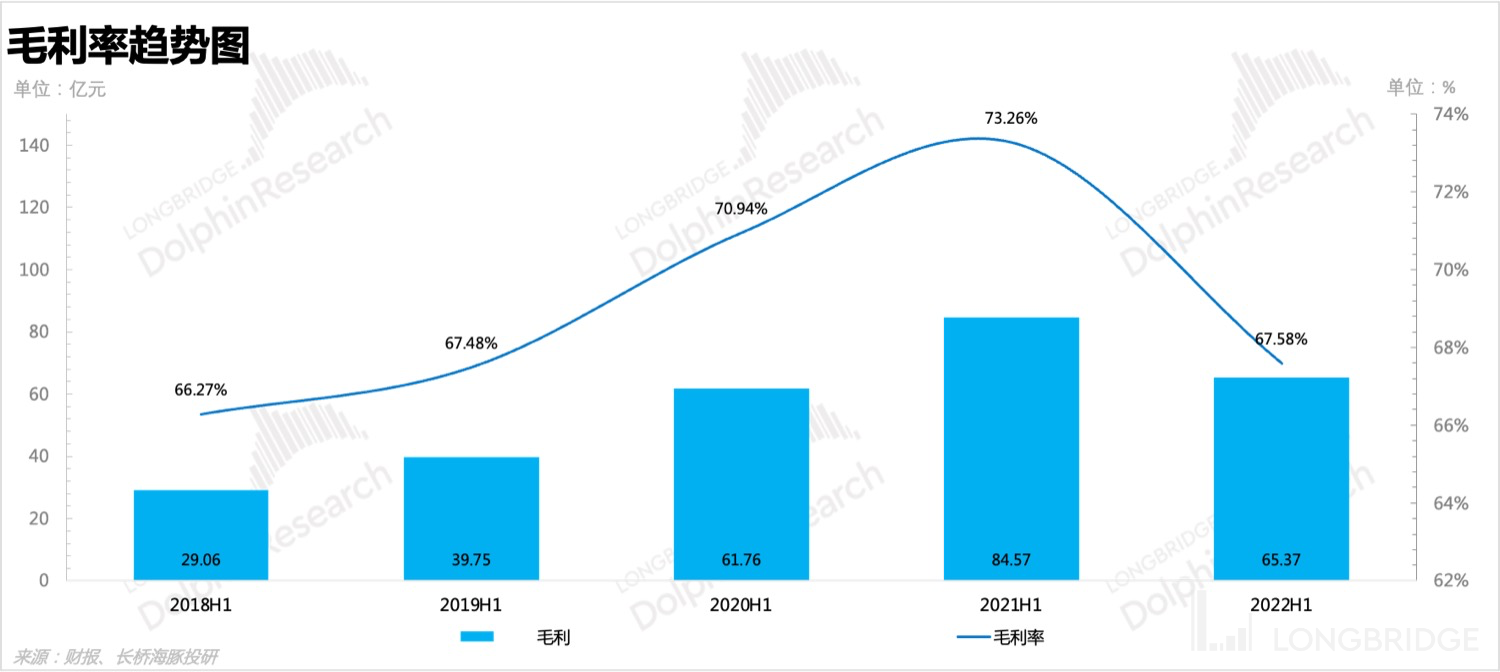

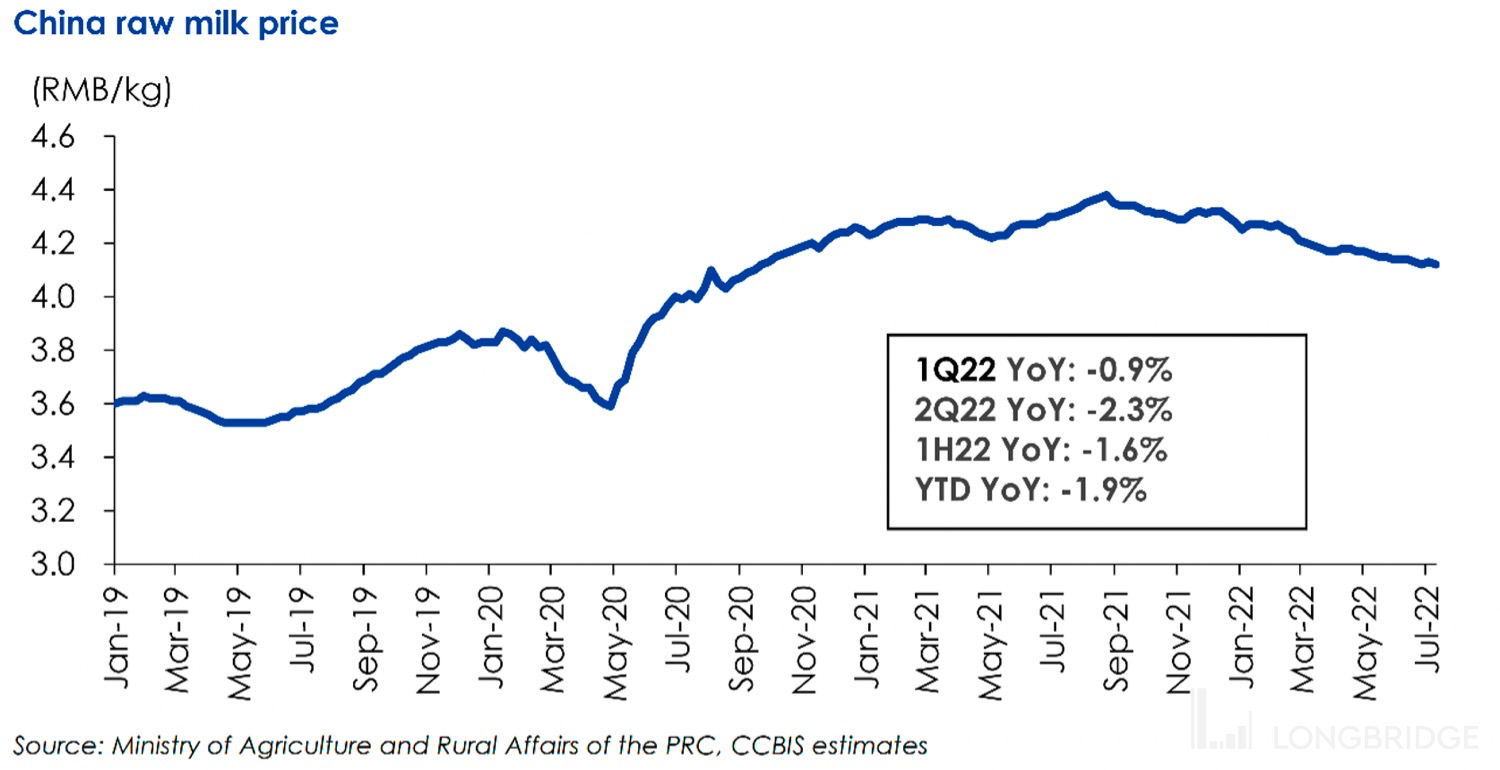

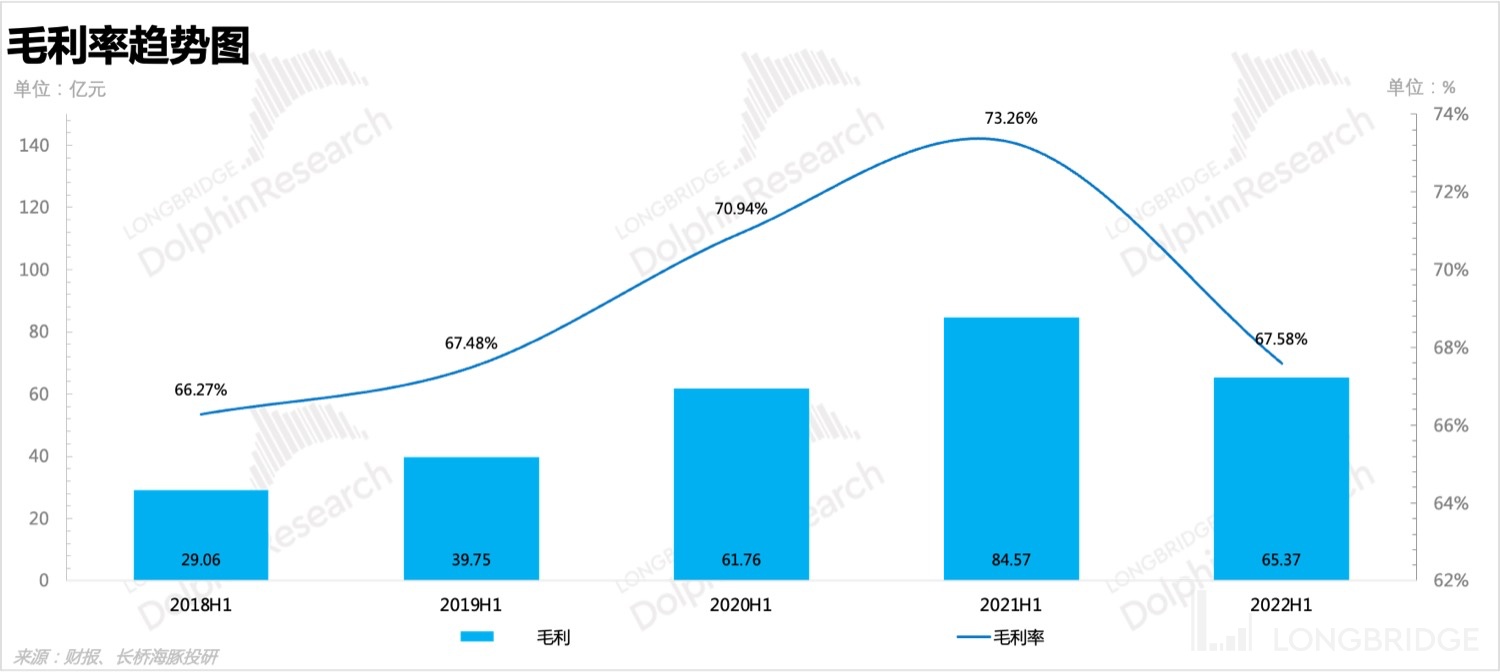

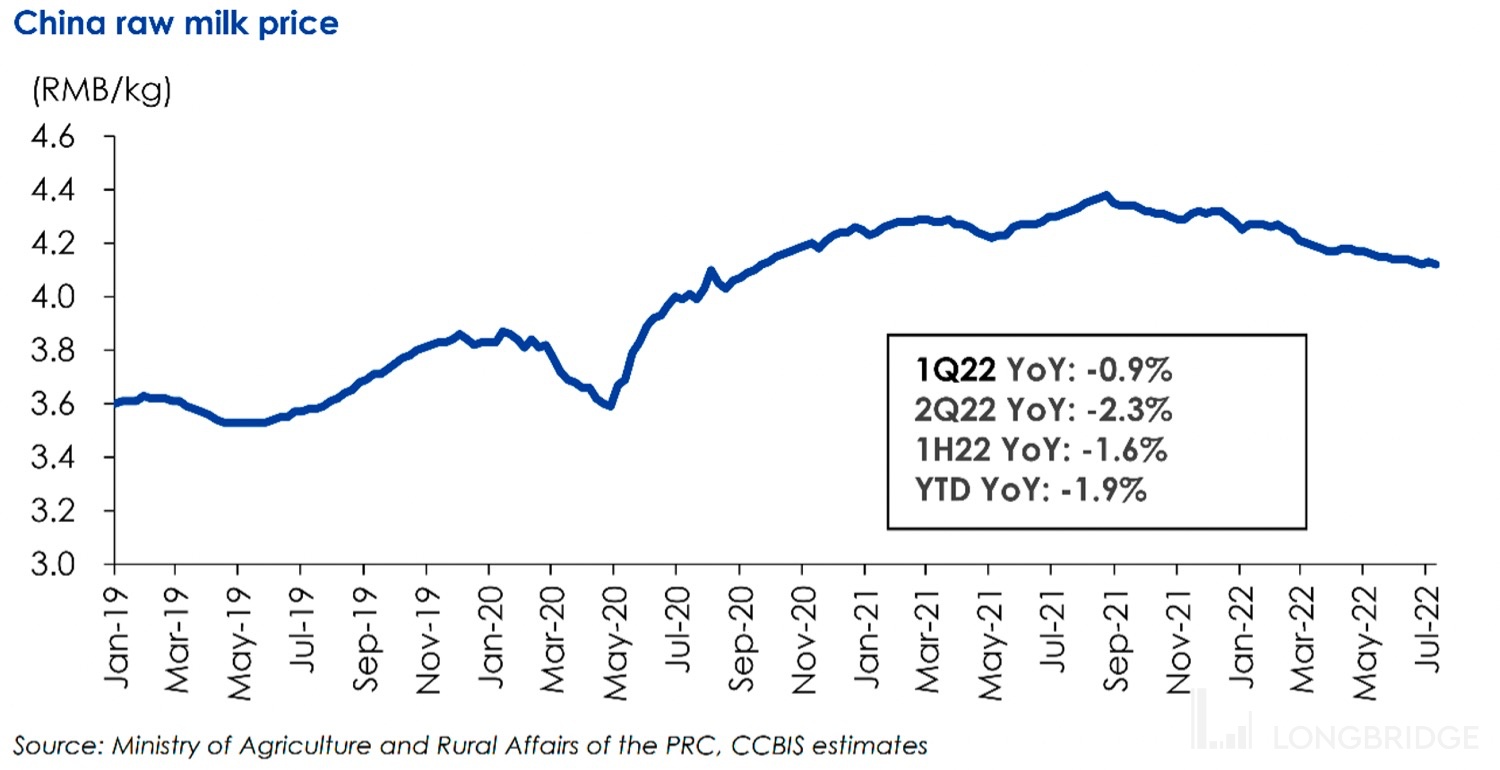

In the first half of the year, the gross profit declined by 5.68%, reaching 67.58%. The main reasons for the significant decline in gross profit are: 1) While high-end infant milk powder such as Star Feifan were clearing the channel inventory, the sales ratio of low-margin adult powder and children's powder increased; 2) the price of raw milk remained high; 3) Feihe increased the quantity of raw material milk sold to third parties.

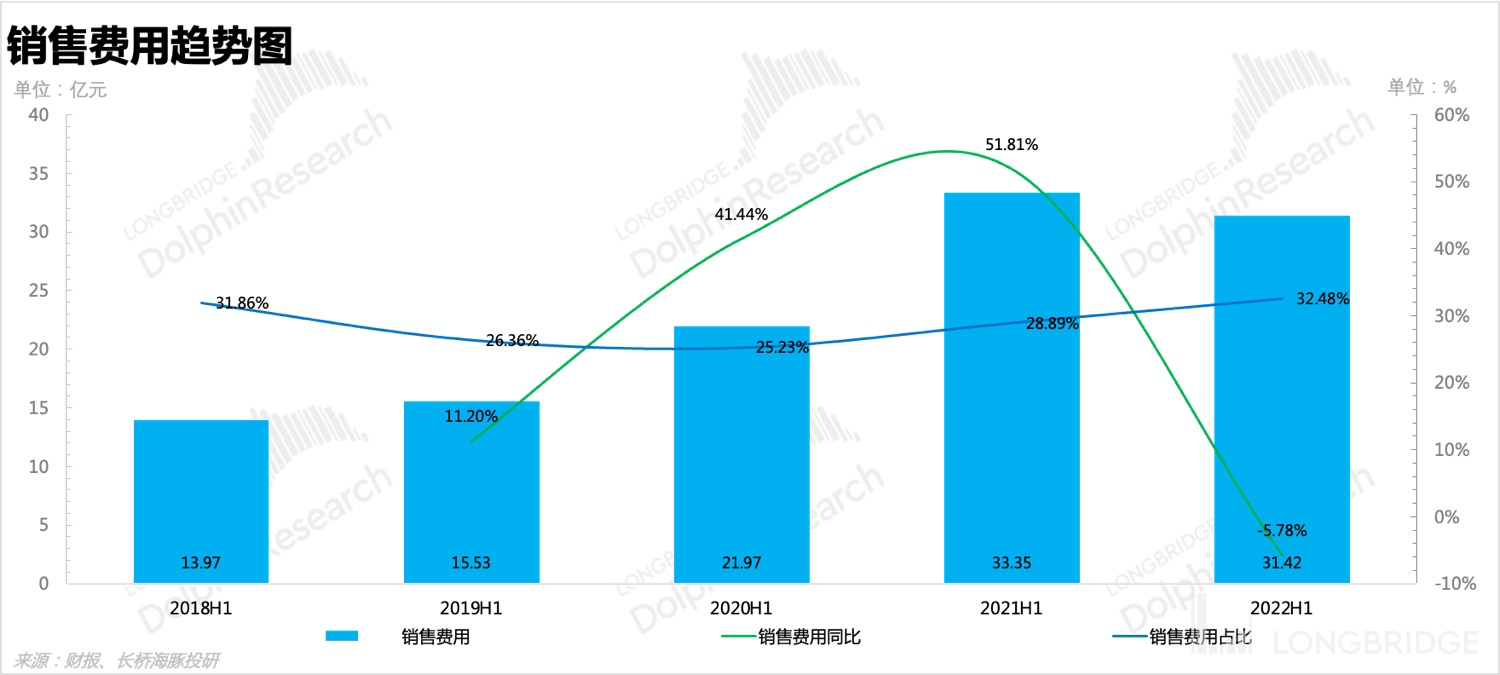

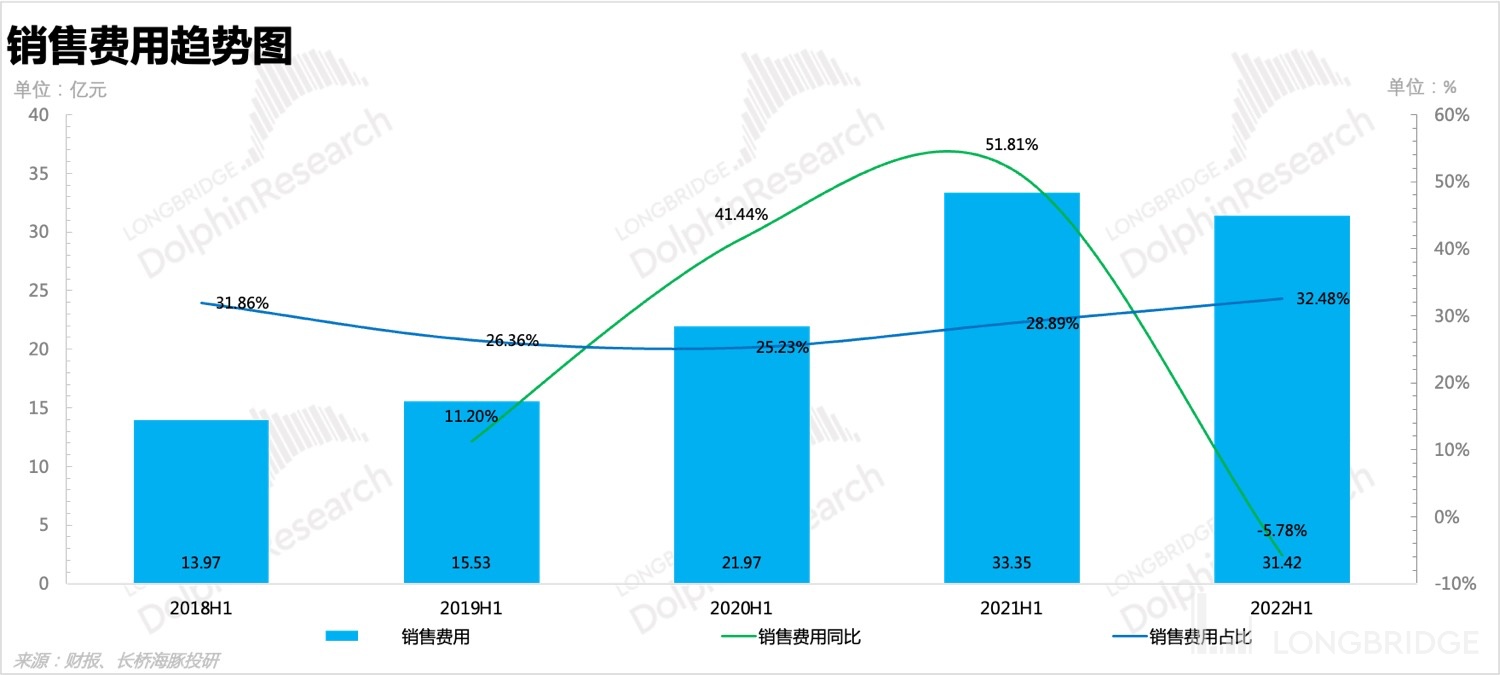

Although fewer promotional activities were carried out in the first half of the year, the sales expenses decreased by 5.8% year-on-year, but the proportion increased by 3.59%, reaching 32.48%. This means that they had only been trying to clear inventory through promotional activities but did not bring in much real income.

IV. Normal sales recovery in the second half of the year, reduced cost pressure

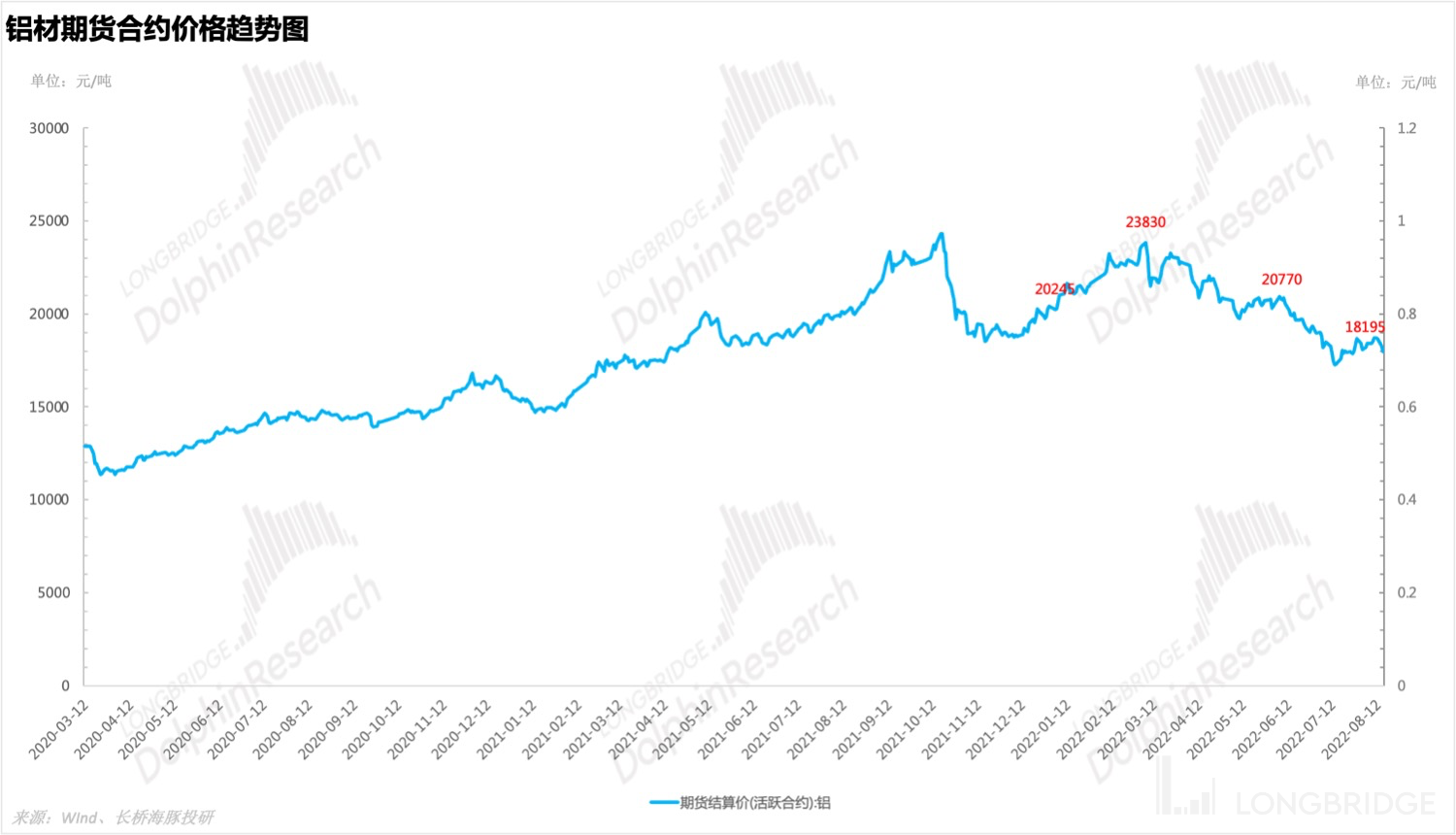

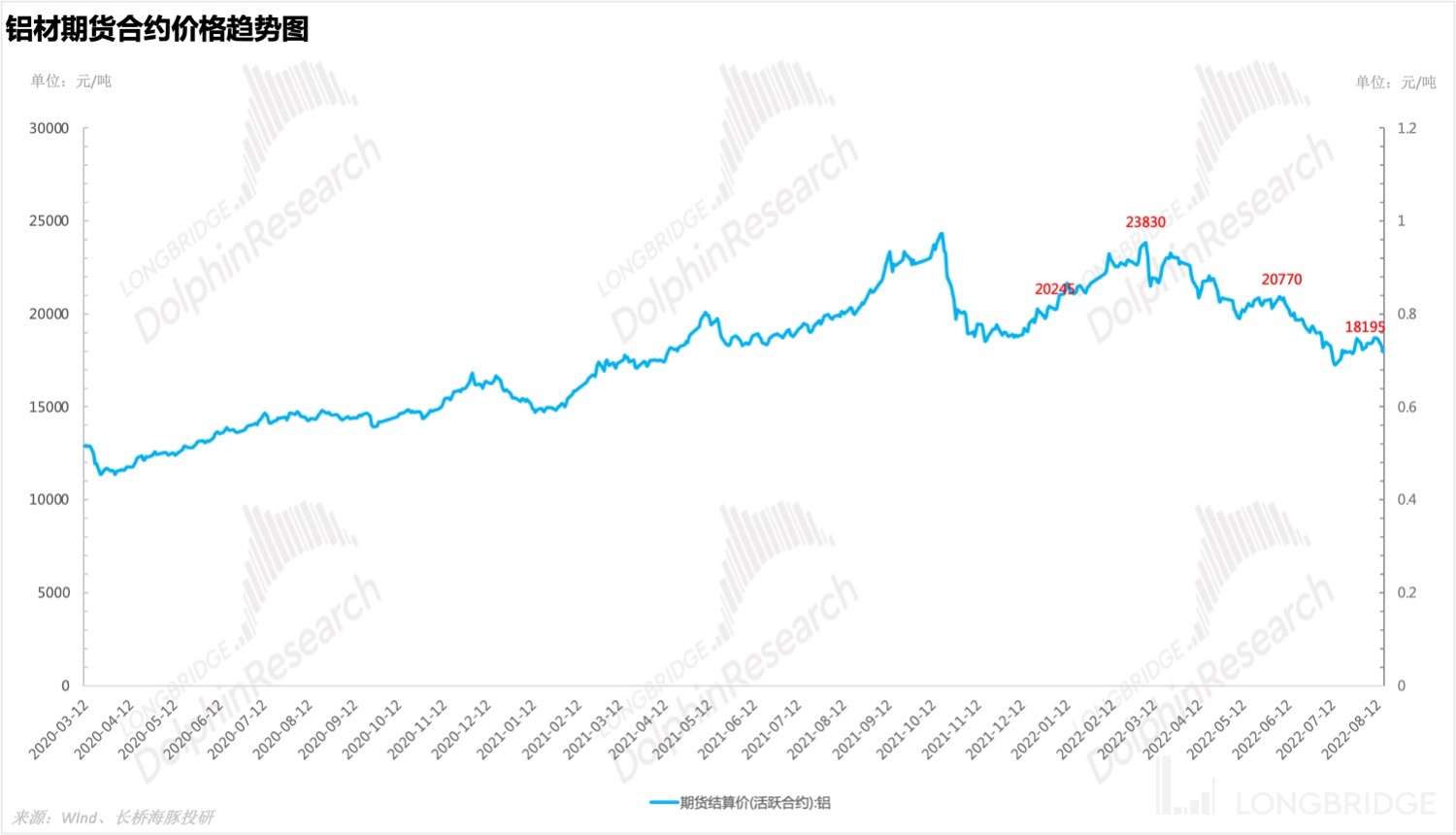

The negative impact of channel inventory on sales in the second half of the year will gradually be lifted. Feihe can easily respond to the new national standard, but it is still difficult to compete with international brands in first-tier cities. If it relies solely on high-end infant milk powder sales, it is highly unlikely that sales growth will return to the fast lane, but the children's powder and adult powder products have the potential to create a second growth curve. 2022 first-half fresh milk prices are declining and are expected to continue to fall in the second half. In addition, the price of aluminum is lower than the first half of the year, so the cost pressure in the second half will be lower and gross profit will increase.

Dolphin Analyst "China Feihe" historical articles:

Earnings season

August 18, 2021《China Feihe: "Emotions Cannot Kill High Growth"》

March 29th, 2022《China Feihe: Winter Is Coming? Short-term milk powder growth emerging quietly"》

Risk disclosure and statement of this article: Dolphin Analyst Disclaimer and General Disclosure