Optimization and adjustment, can Helen's Company emerge from the darkest moment?

There is no live music, no DJ and the store location is somewhat remote, but Helen's managed to stand out and win the hearts of young people with its less-than-10-yuan-per-bottle beer and subsequently expand its chain stores. This is the story of Helen's up until its 2021H2 IPO.

However, Helen's was severely affected by the pandemic in 2022H1. With 500 stores unable to run normally and the additional time needed for recovery, the company had to optimize and adjust its existing stores to stop the bleeding. Additionally, it was necessary to generate more revenue by adjusting its expansion strategy and store operations. Dolphin Analyst believes that Helen's darkest hour is about to pass.

A) Stop the bleeding, approaching the end

-

Store adjustments: Over the course of Q4 21, the 171 new stores added were heavily impacted by the pandemic, and the operating rhythm of the new stores was disrupted. Meanwhile, the old stores could not operate normally due to the lack of consumer scenarios. Ultimately, they could not withstand the continuous fixed cost expenditure (personnel + rent), forcing the company to choose to close and adjust about 100 existing stores in the first half of 2022. This decisive amputation has brought hope to customers and the company, with the process completed in August.

-

Personnel reduction: In addition to closing some stores in the first half of 2022, Helen's chose to downsize, which Dolphin Analyst believes is the only choice. From a single-store perspective, personnel and rent account for the bulk of the fixed costs. To continue operations, rent cannot be avoided; therefore, the company can only reduce the number of store employees, with the average number of employees per store dropping from around 13 to around 9. This results in a significant decrease in labor costs and a more lightweight single-store model.

B) Adjust strategy, actively generate revenue

- Focus on expanding to third-tier and lower-tier cities: Due to the unpredictable pandemic and strict control policies, the impact of the pandemic on third-tier and lower-tier cities is relatively weak because of lower population mobility. Even if a few stores are affected due to the pandemic, it is not impactful on the larger scale of these cities. Therefore, Dolphin Analyst thinks that shifting the store expansion focus to third-tier and lower-tier cities is a good choice. From a single-store perspective, Helen's profitability is stronger in lower-tier cities.

Therefore, starting in the first half of the year, Helen's chose to focus on opening stores in third-tier and lower-tier cities, and tried to introduce franchise models, particularly in lower-tier cities to share profits and risks and enhance its ability to withstand the pressure during the pandemic. Of course, this should also facilitate the reopening of county-level markets.

- Increase the average spending per customer: It is difficult to directly increase prices under Helen's existing value-for-money business model. Thus, Dolphin Analyst believes that the company can only increase the average spending per customer by encouraging customers to consume more alcohol and snacks or by increasing the sales of heavily flavored barbecue products. In the first half of the year, Helen's tried to add barbecue SKUs to some of its stores and develop some snacks. However, the average spending per customer of stores with the added barbecue SKUs has not shown any significant changes so far. The situation still needs to be observed closely, as the reality may be different from the ideal. Regarding direct price increases, Dolphin Analyst would like to elaborate that Longbridge also considers direct price increases. After the increase, the single-store model in first-tier cities will be more appealing. If the store operating data does not show a significant decline after the price increase, it can be considered a successful unlocking of the store space in first-tier cities.

Based on the latest changes, Dolphin Analyst has re-analyzed Longbridge, focusing on the following main issues:

- What is the ceiling for the number of Longbridge pubs?

A. If a price increase can be achieved, how much store space is there in first-tier cities?

B. If success in opening up fifth-tier and below cities can happen, how much incremental growth can be expected?

-

What is the geometric impact of reducing labor costs, increasing BBQ SKU, and direct price increases on the single-store model?

-

What is the reasonable valuation based on the latest revenue and profit forecast?

The text below remains unchanged, the conclusions are as follows:

- The theoretical store space is around 2,500, and the reasonable store space is around 2,000.

Some institutions call the pub space to be around 5,000, and some estimations are based solely on the number of college students, which gives around 2,500. Both methods have significant defects. Therefore, Dolphin Analyst has re-estimated the pub space using two different methods, one based on the number of colleges and the other based on the number of college students, fully considering the number of business districts in different line-level cities.

By combining both results and fully considering the factors of direct price increases in first-tier cities and the successful development of fifth-tier and below cities, the ideal pub space is around 25,000, with the space in first-tier cities around 330 and the store space in fifth-tier and below cities increasing by around 340. If the competition factor is considered, Dolphin believes that the reasonable pub space for Longbridge is around 2,000.

- The effect of reducing labor costs is obvious, but the effect of increasing BBQ SKU needs to be observed.

From a single-store model perspective, the reduction in labor costs is significant after layoffs, with the most prominent reduction in first-tier cities. Labor costs dropped to 24.66%. Additionally, in first-tier cities, after a 10% price increase, most products still have a relatively better price-performance ratio than competitors, which is beneficial for expanding into first-tier cities.

If the sales per customer's price for adding BBQ SKU does not increase by at least 5%, it will only increase the difficulty of store and supply chain management, which is not worth the effort. Therefore, in the later stage, the price changes for new BBQ SKU stores still need to be observed.

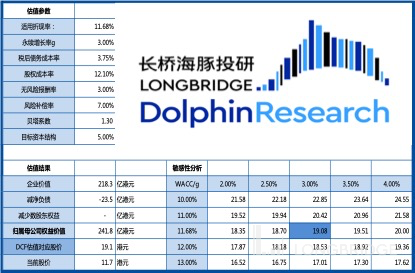

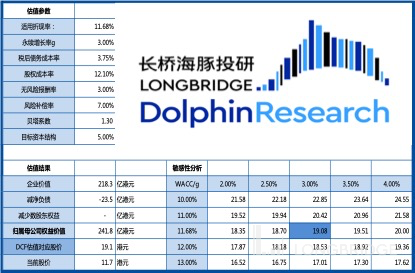

- Longbridge's reasonable valuation under the latest revenue and profit forecast is HKD 24 billion, corresponding to a share price of HKD 19.08.

Taking into account the impact of store operations on the single-store model, and without considering the store expansion space in first-tier cities and fifth-tier and below cities, based on the latest revenue and profit forecast, the DCF valuation corresponds to HKD 19.08 per share for Longbridge.

This article is an original article from Longbridge Investment Research. It cannot be reproduced without permission. Interested users are recommended to add WeChat ID "dolphinR123" to join the Longbridge Investment Research Circle to study global asset investment views together! The following is the main text:

1. Is it reasonable to have 2500 taverns when the reasonable tavern space is only 2000?

The Dolphin Analyst found that some organizations in the current market have claimed to have 5000 stores, while others have only calculated up to 2500 based on the number of college students. There are obvious shortcomings and differences in both methods. Therefore, the Dolphin Analyst recalculated the space for college stores (stores near colleges) and commercial district stores (stores in urban commercial districts). The space for college stores is around 1400, and commercial district stores around 1100. The ceiling for the number of stores is around 2500 but considering the competition factor, reasonable tavern space in the future will be around 2000.

1. Estimating the space for college stores based on the coverage rate in benchmark cities

The Dolphin Analyst's methodology for estimating the space for college stores using the coverage rate in benchmark cities is as follows:

A) First, select 2-5 benchmark cities in different tiers based on the number of stores and the best business situation.

B) Then calculate the tavern coverage rate (number of taverns/number of ordinary colleges in the city) for each benchmark city and take the average.

C) Next, use the average tavern coverage rate of benchmark cities to calculate the space for taverns in the target city (average tavern coverage rate * number of colleges in the target city), and finally obtain the ceiling for the number of taverns in different cities.

The detailed calculation results and process are as follows:

Using the benchmark city college coverage rate to estimate, the space for college stores is approximately 1630.

A) First-tier cities: Shanghai was selected as the benchmark city in first-tier cities, and the high school store space in Beijing, Shenzhen, and Guangzhou was estimated based on the calculated tavern coverage rate of the benchmark city, resulting in a total of 109 high school store spaces. It was concluded through a comparison of the current number of stores that the future expansion space for high school stores will mainly be in Beijing and Guangzhou.

B) New first-tier cities: Hangzhou, Wuhan, and Changsha were selected as benchmark cities in new first-tier cities. Considering that the business situation of approximately 10% of the stores in Wuhan did not reach expectations after the doubling of store counts last year, Wuhan's tavern coverage rate was reduced by 10%. It was concluded that the average tavern coverage rate of benchmark cities was 0.77. In addition, considering the abundance of tavern business formats and the high chain operation rate in Chengdu, Chongqing, and Qingdao, the coverage rate of these three cities was reduced to 0.5. Finally, it was estimated that the space for college stores in new first-tier cities is 476.

C) Second-tier cities: Select Shenyang, Fuzhou, and Shaoxing as benchmark cities in second-tier cities, and then use the calculated average coverage to calculate the space of other city stores. The final result is 454 stores.

C) Second-tier cities: Select Shenyang, Fuzhou, and Shaoxing as benchmark cities in second-tier cities, and then use the calculated average coverage to calculate the space of other city stores. The final result is 454 stores.

D) Third and fourth-tier cities: Based on the calculation method, there are 587 store spaces in third and fourth-tier cities, of which there are 422 high school store spaces in third-tier cities and 165 high school store spaces in fourth-tier cities.

E) Fifth-tier and lower cities: The Dolphin Analyst believes that calculating the coverage of high school campuses in fifth-tier and lower cities using the benchmark city method is not applicable. The main reasons are as follows:

-

The number of colleges and universities in fifth-tier and lower cities is small, and they are all basically undergraduate or higher vocational education institutions with small population scales. The error obtained from the above method will be relatively large.

-

The relative area of fifth-tier and lower cities is small. The integration of schools and cities is high, and they are basically in the urban area. The distance to the core business district of the city is relatively close. In this case, it is more conducive to open a tavern near the commercial district.

2. Calculating the space of high school stores based on the number of students

The Dolphin Analyst's process and results for calculating the space of high school stores based on the number of students are as follows:

A) Firstly, determine the population base required for a single bar to operate well. The Dolphin has calculated this using two ideas:

1)The first idea: A single customer generally consumes 4-5 bottles of beer (350ml) in a bar, and then consumes some snacks, basically spending about 55 yuan. The Dolphin referred to the average annual income of a single bar in 21 to believe that a bar would achieve a relatively good operating status with an annual income of 3.5 million yuan. Therefore, under the assumptions of 3.5 million yuan in annual income and a unit price of 55 yuan, the required number of people is calculated, then divided by the average annual consumption frequency per capita (calculated based on data from Netease consumption survey), and the number of people required for consumption is finally calculated based on a penetration rate of 70% (penetration rate data refers to the results of brokers’ consumer surveys).

2)The second idea: Considering that an average bar has 50 seats, a table stays for about 3 hours, and the turnover rate is basically maintained at around 2.67, 135 people are required to maintain a good operating status per day, which is equivalent to 49,000 people per year. Then, based on the average annual consumption frequency per capita and the penetration rate, the required population base is finally calculated.

B) After obtaining the average population base required, divide the number of students in each province and city by the average population base to obtain the space of high school stores. The Dolphin calculated that the store space for high school stores is approximately 1402 based on the above method.

3. Measuring the Store Space of Business Districts Based on Benchmarking City Coverage Rate

The results and ideas of Dolphin Analyst for measuring the store space of business districts based on the benchmarking city coverage rate are as follows:

A) Data Deduplication: In most cases, there will be business districts near universities, and university stores often open around the business district. Therefore, Dolphin Analyst first deduplicates different levels of cities' shopping mall quantities by subtracting the number of universities, and finally obtains the number of uncovered shopping centers;

B) For First- to Fourth-Tier Cities: Select benchmarking cities, measure the coverage rate of business district stores in benchmarking cities (number of business district stores/number of shopping centers in benchmarking cities), take the average, and finally estimate the store space of business districts in first- to fourth-tier cities to be around 770.

C) For Fifth-Tier and Lower-Tier Cities: Considering that large shopping centers in cities usually only have 1-2, and the urban areas are relatively small, and the number of young people is relatively limited, it is basically good if a city can open a Longbridge. In addition, considering that some cities or regions are not suitable for opening Longbridges, such as remote county-level cities in Inner Mongolia, Xinjiang, Tibet, and Heilongjiang, Dolphin Analyst conservatively estimates that only 80% of the 128 fifth-tier cities in China can open Longbridges, and only 60% of the 397 county-level cities can open Longbridges. Therefore, the store space of business districts in fifth-tier and lower-tier cities is about 340;

In addition, Dolphin Analyst wants to emphasize the store space of the down-market stores a little more. In mid-May, Helen's (a Longbridge brand) new store opened in Lichuan (a county-level city) in cooperation with local developers, and the sales volume can reach over 20,000 per day. The fact that a single store is performing so well seems to be a key to unlocking the market in county-level cities. However, the profit-sharing model and single-store model have not yet been released, and the specific situation needs to be observed. We also need to track and observe the expansion of similar stores to confirm whether Helen's has successfully unlocked the store space of 340 Longbridges in fifth-tier and lower-tier cities.

2. How Would Layoffs, SKU Expansion, and Price Increase Affect the Single-Store Model? 2022H1 Helen's suffered from the epidemic and was under pressure to perform. To stop the bleeding and promote recovery, cost-cutting for rent and staff were inevitable. Helen's attempted to reduce the rent, but it was less effective than directly reducing labor costs. Recovery focused on increasing the unit price. However, Helen's growth was limited due to high cost-effectiveness, which meant they had to be cautious when raising prices. Considering the prices and average incomes in first-tier cities, increasing product prices would be a likely option. Other methods for increasing the unit price include expanding SKU variety to meet customer needs, or encouraging customers to stay longer, because people get drunker the longer they drink. The more time customers spend, the more money Helen's makes.

A) Reducing Labor Costs Through Layoffs In 2022H1, Helen's downsized personnel, reducing about 9 positions from their original 13 in each store. According to Dolphin Analyst, employee costs in first-tier cities decreased by about 6%, by about 5% in second-tier cities and about 4.5% in third-tier cities and below.

B) Increasing BBQ SKU In some stores, Helen's tried to increase their barbecue SKU. This required hiring 1-2 barbecue chefs, and 1-2 barbecue grills per store. This will result in an estimated increase of about 2% in labor costs for each store model. The upfront costs of equipment are around 300-500 yuan, which can be considered negligible.

C) Directly Increasing Prices in First-Tier Cities If Helen's raises prices in first-tier cities by 10%, the unit price will increase by 10%, and the final operating profit per single store will increase by about 5%.

1. Personnel Reductions Have the Most Obvious Effect in First-Tier Cities After the downsizing, the staffing configuration of each store will be about one store manager, two full-time employees, and six part-time employees. Employee costs have clearly decreased, with the most obvious effect in first-tier cities. Specifically, in single store models, labor costs in first-tier cities decreased from 31.73% to 24.66%, with operating profit increasing by 15.54%. Second-tier labor costs decreased from 25.29% to 21%, with operating profit increasing to 23.79%. Third-tier labor costs decreased from 22.24% to 17.26%, with operating profit increasing to 30.58%.

2. Increasing BBQ SKU Increases Costs and Unit Prices Are Yet to Be Observed Adding BBQ SKU in Helen's existing stores means adding approximately one electric grill and one barbecue chef. The number of new SKU is estimated to be limited, primarily increasing the variety of snacks. This satisfies some customers' demands for barbecue, especially in the summer. When focusing on single store models, cost increases are inevitable due to the increase in personnel and equipment. Whether there will be an increase in unit price, remains to be seen. **

Overall, adding one more barbecue master and then promoting a 5% increase in customer unit price will have almost no impact on the store's operating profit. Considering the increase in equipment depreciation and power consumption, the overall impact will be relatively flat. Therefore, Dolphin Analyst believes that after increasing the barbecue SKU, the customer unit price needs to increase by at least 5% in order to make sense. Otherwise, it will only increase the difficulty of store and supply management, which is not worth the effort. It is also necessary to observe the changes in customer unit price of new barbecue SKU stores in the later stage.

3. Raising prices to improve the profitability of first-tier city stores and unlock space for first-tier city stores

From the perspective of the single-store model, the high cost-effectiveness model limits the customer unit price, which in turn limits the total store revenue. However, the labor and rental costs in first-tier cities are significantly higher than in other cities, which ultimately results in Longbridge's low operating profit for its first-tier city stores. According to the latest data calculations after layoffs, it is only 11.02%, and after deducting 8.2% of the headquarters expenses and taxes, the net profit is only about 2.15%. This is really all talk and no action. Of course, this also limits Longbridge's expansion space in first-tier cities. In order to solve this problem, in addition to cost compression, raising prices directly can also be a solution.

Dolphin Analyst believes that the price level in first-tier cities and the consumption ability of young people are stronger than in other lower-tier cities. Under the premise of ensuring price competitiveness compared to competitors, it is possible to raise prices in first-tier cities. Therefore, Dolphin Analyst chose to focus on laying out in first-tier cities and comparing prices with Perrys, which has a cost-effectiveness positioning. It is found that even after Longbridge increases the price of third-party branded drinks by 10%, it is still cost-effective compared to Perrys. In this case, even if the price of self-branded drinks is not raised, the consumption ratio of self-branded drinks can be promoted, further improving store profitability.

In addition, Dolphin Analyst calculated the specific impact of price increases on store operating profit and found that the impact on first-tier city stores is more pronounced. As the operating profit of first-tier city stores improves, it can further unlock the space of about 330 stores.

Three. What is the reasonable valuation given the latest situation?

Below are Longbridge's revenue forecast results and ideas:

** A) Tier 1 Cities

1) Number of Stores: Considering that in Tier 1 cities, store operating profit and net profit (excluding headquarter expenses and taxes) are both very low, especially net profit, Dolphin Analyst believes that Longbridge will not expand massively without a price increase. Therefore, there will be a net increase of 5 stores in Tier 1 cities per year. If Longbridge increases prices in Tier 1 cities, it will unlock up to 330 store locations.

2) Daily Orders: Tier 1 cities were severely affected by the pandemic in 2022. Also, Longbridge's bars have been identified by regulators as entertainment venues similar to nightclubs and KTV, resulting in stricter supervision than chain restaurants. This slow recovery in normal business operations compared to restaurants means Tier 1 cities were heavily affected by the pandemic, leading to an overall 50% year-on-year decrease in daily orders in 2022. However, it is expected to recover significantly in 2023 and then maintain a stable state.

3) Average Order Value: As Longbridge is limited to a high cost-effective growth mode, raising prices is not common. Dolphin Analyst believes that in the future, we should pay more attention to whether Longbridge will increase prices in Tier 1 cities. If prices go up, it may unlock the revenue level and store space in Tier 1 cities.

B) Tier 2 Cities

1) Number of Stores: Considering that most store adjustments have been completed in the first half of 2022 and Longbridge will focus on expanding to Tier 3 and lower cities, it is expected that there will be a net increase of 30 stores in 2022. By 2023, the pandemic will have eased, and Longbridge will resume its expansion will maintain at a net increase of around 70 stores per year until the total number of stores reaches around 740 by 2026.

2) Daily Orders: The pandemic will have a minor impact on Tier 2 cities. Hence, a small decline in daily orders is expected in 2022, followed by a significant recovery in 2023, and maintaining at around 125 daily orders.

3) Average Order Value: The average order value remains unchanged in 2022, followed by an annual growth rate of around 2% based on the CPI.

C) Tier 3 and 4 Cities

1) Number of Stores: Tier 3 and 4 cities were less affected by the pandemic. Also, the single-store model performs better in sinking markets, making these cities the primary source of store growth. It is expected that there will be a net increase of 125 stores in 2022, followed by a net increase of 150 stores per year in 2023 and 2024. By 2025, the net increase will be 100 stores, and it will drop to 50 in 2026.

2) Daily Orders: The daily orders in Tier 3 and 4 cities are expected to remain at around 105.

3) Average Order Value: The average order value is expected to grow slowly due to the limited growth model and the fact that users in the lower-tier market are more sensitive to price. It is expected to see minor changes based on the CPI.

D) Fifth-line and County-level Cities: The profit forecast does not take into account the revenue brought by fifth-line and county-level cities. On the one hand, Dolphin may expand its presence in the lower-tier market through franchise, and the specific revenue is still uncertain. On the other hand, the lower-tier market is currently in the testing stage, and it is expected to start small-scale testing in 20 stores in fifth-line or county-level cities in August. The test result will be released around November, so the specific situation is still to be observed.

The following are Dolphin's profit forecast and core cost results:

A) Raw Materials and Consumables: The increase in the proportion of self-owned drinks in the short term will promote the decrease in the proportion of raw materials and consumables. In 2021, the proportion of self-owned drinks is about 77%, and it is expected to increase to about 80%. The improvement of 3% of self-owned drinks can bring about a decrease of about 1.5% in proportion. Based on the data of 2021, the proportion can be reduced to about 30%;

However, considering that the promotion intensity will increase in 2022, it is expected that the proportion of raw materials will be about 33% this year. In 2023, when the epidemic situation improves and promotion weakens, the proportion of raw materials is expected to recover to about 31%. The proportion situation in the future will mainly be affected by changes in raw material prices.

B) Employee Benefits and Human Resource Services Expenses: In the first half of this year, Dolphin completed the layoffs of store employees, and the number of store employees decreased from about 13 to about 9. Considering the situation of reserving employees for store expansion in the second half of the year, the proportion is expected to decrease to 29.55%. In the next two years, considering the main expansion of lower-tier cities, the labor cost is expected to gradually decrease and be maintained at around 20%;

C) Depreciation of Leasehold Improvement: Dolphin optimized and adjusted 100 stores this year, and most of the stores are in first- and second-tier cities. In addition, considering that Dolphin will focus on expanding into the lower-tier market in the next few years, the proportion of depreciation of leasehold improvement will gradually decrease to about 12.5% in these two years.

The following are Dolphin's DCF valuation results:

Regarding DCF valuation, in addition to the core variables already shown in the chart, Dolphin Analyst would like to add two points: 1) The valuation assumes that the number of stores in first-tier cities will remain basically unchanged. If the price is increased later, it may further unlock the space for store expansion. 2) Whether the county-level market can be successfully developed needs to be further observed, so the valuation does not take into account the contribution of the county-level market to the valuation.

Dolphin Analyst "Helen Department" historical report:

Financial report season

March 29, 2022 "Helen Department: Own products maintain growth engine, expansion cannot stop"

Depth report

January 08, 2022 "Helen Department (Part I): The business behind the" small pub ""

January 11, 2022 "Before 2023, how much meat can Helen Department still eat?"

Risk disclosure and statement for this article: Dolphin's disclaimer and general disclosure