Don't be scared by the bursting losses, NIO is approaching the "good days"

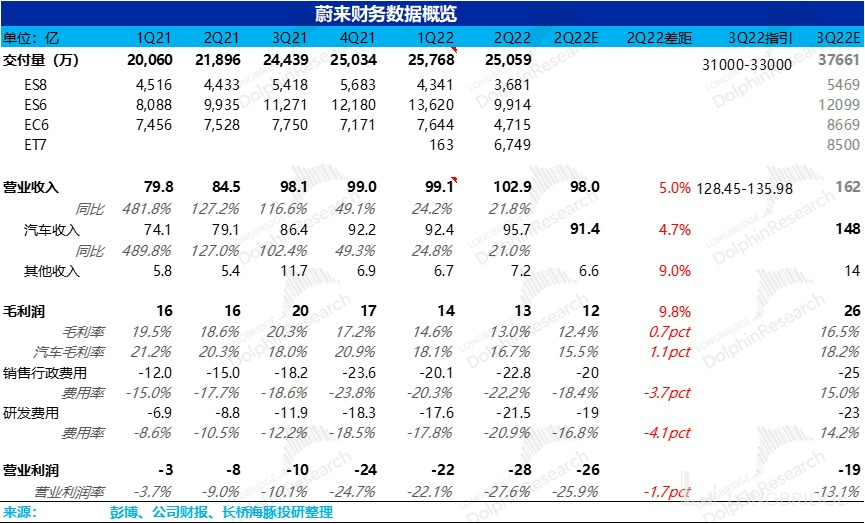

$NIO.US released its 2022 Q2 financial report before the opening of the US stock market on September 7th Beijing time, and the highlights are as follows:

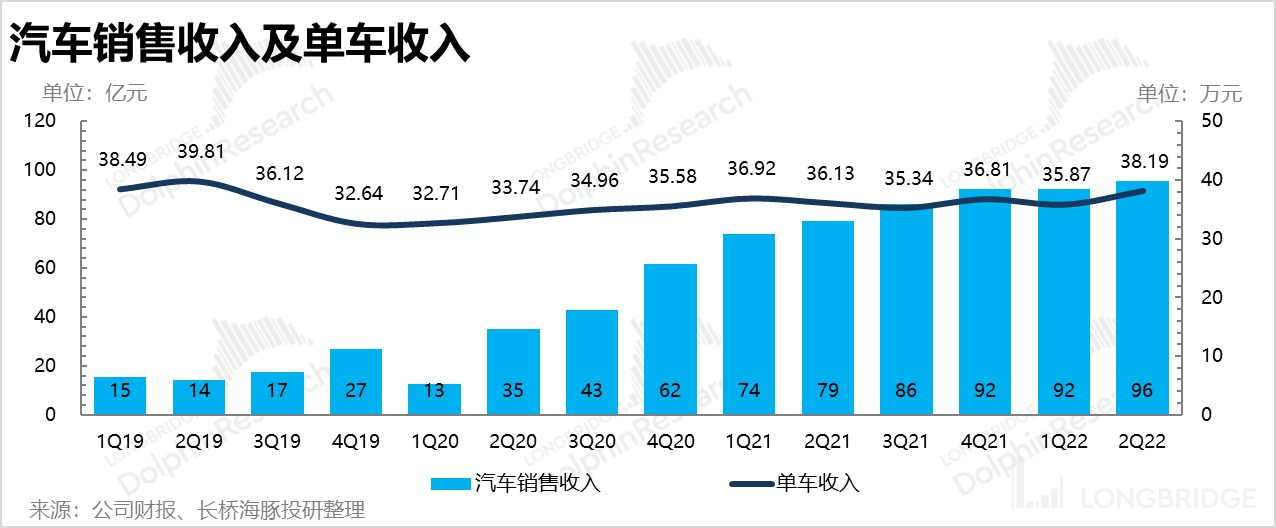

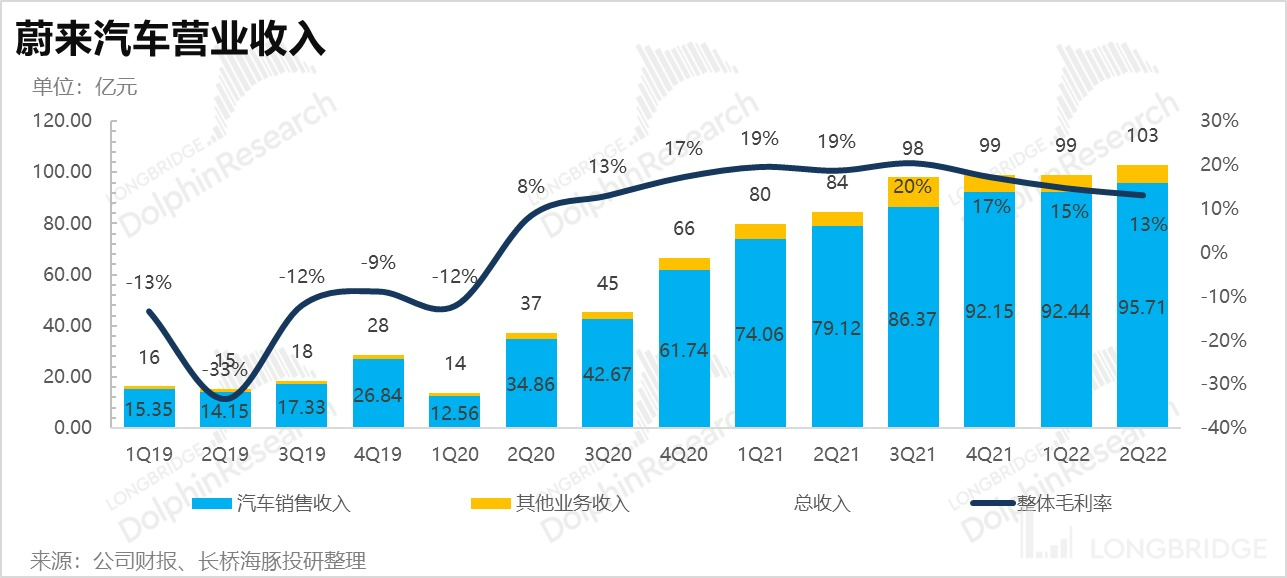

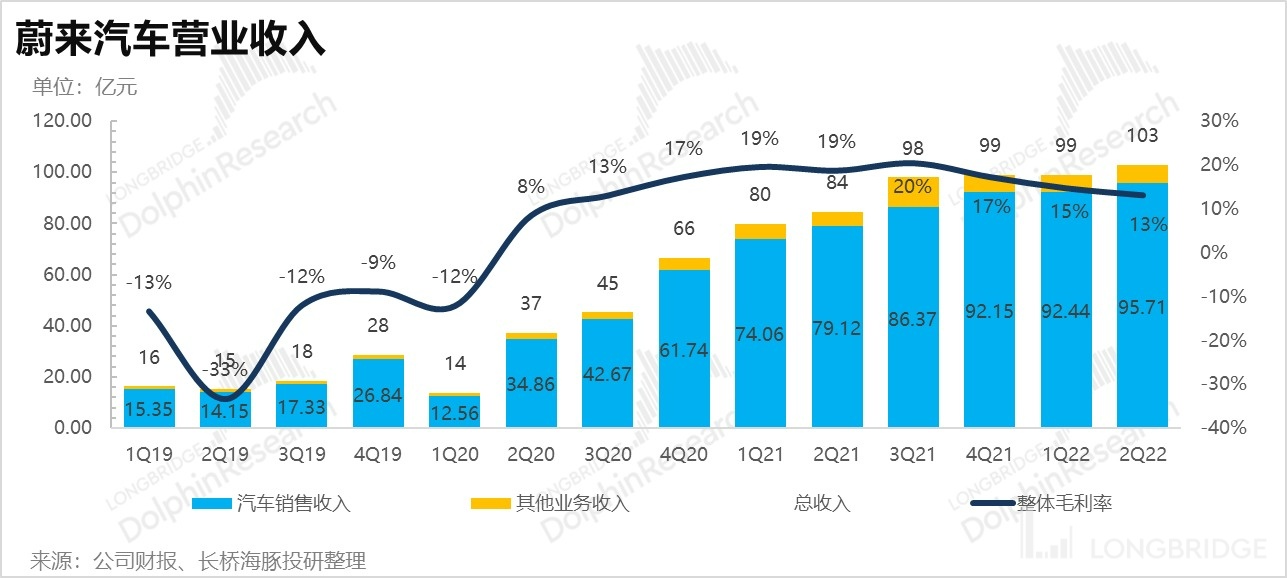

1. Soaring unit price, revenue is still good: As a high-end electric vehicle brand, in the second quarter, the unit price of NIO-SW.HK increased by over twenty thousand compared with the same period last year and the previous quarter, driving the overall revenue to 10.3 billion, which is five billion more than the market expected.

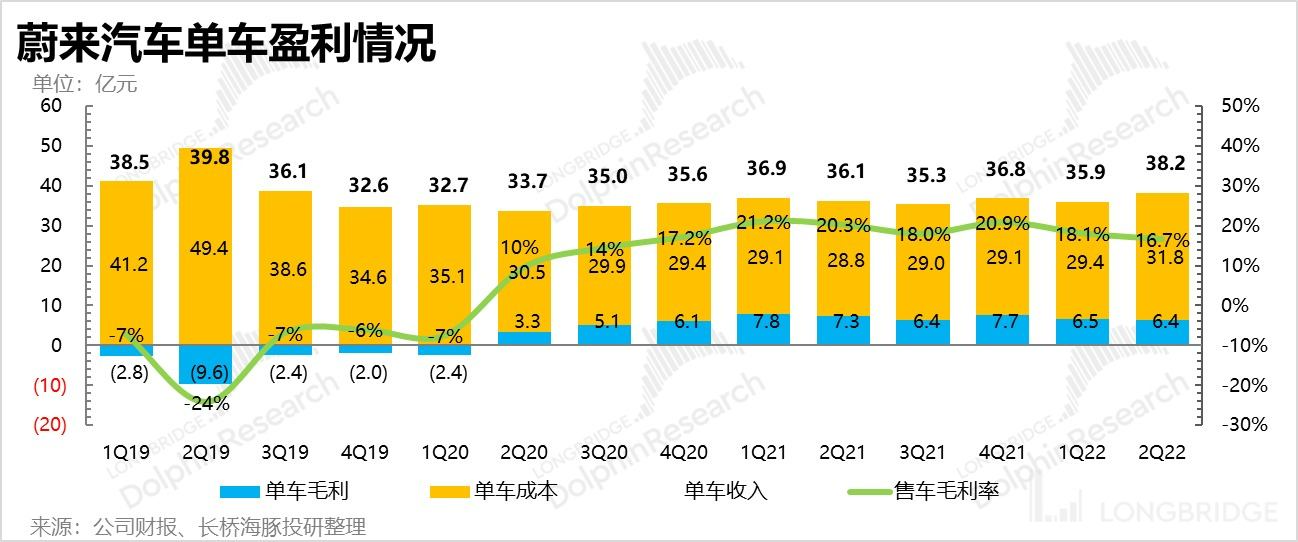

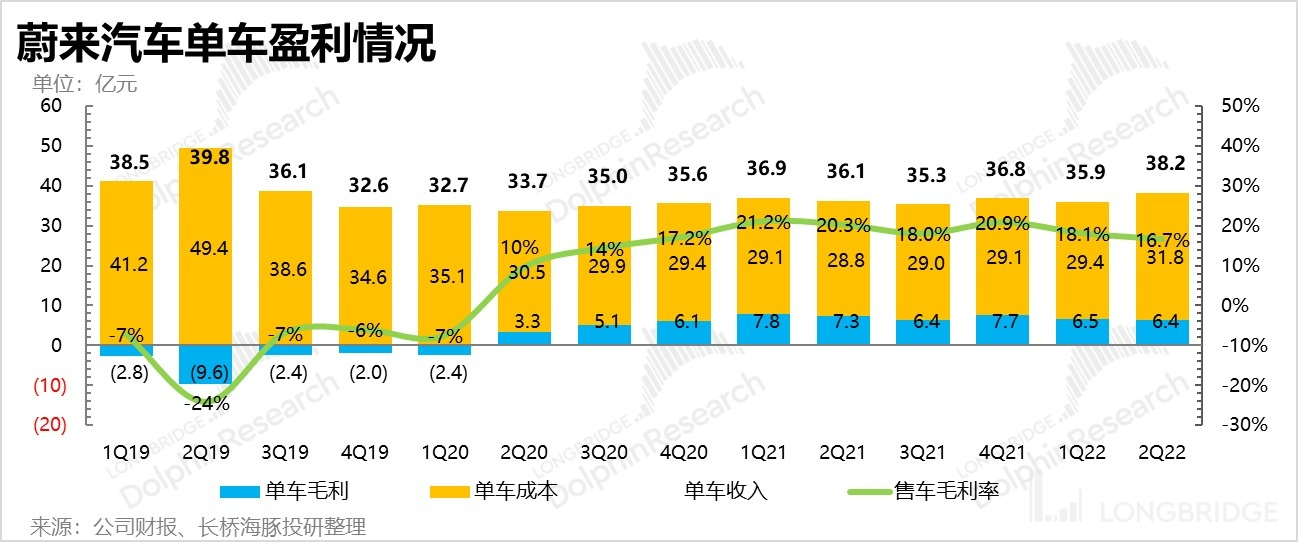

2. The reversal of automobile gross profit: In the second quarter, the gross profit margin of automobiles reached 16.7%. Although it is still lower than the level of more than 20% before the pressure of rising prices in the battery industry chain, it suffered from the gross margin "Waterloo" caused by most new energy vehicles in the second quarter encountering cost transmission and unpresented orders yet to be delivered. The market has similar expectations for NIO. In fact, NIO's automobile gross profit margin was held better than the market expected.

3. The profit is still not good? Don't be too picky: Under the circumstances where both revenue and gross profit performance can still be good, NIO Motor's operational losses reached 2.8 billion, which is two billion more than the market expected. This situation accompanied by strong marketing and sales investment and continued high research and development investment due to the early launch of new car models and pre-volume sales are not problems. As long as these can follow up with the sales volume of new models, the profit margin can be improved consistently, which is the real core of the profit end.

4. The performance of Q3 guidance is average: The Q2 sales guidance is between 31,000-33,000 vehicles, and Bloomberg guidance is 38,000 vehicles. Dolphin Analyst here is more inclined to think it is due to the slow update of data by Bloomberg, which has little reference, leading to the inconspicuous consistent expectation of the revenue end.

Regarding the company's implicit expectation of guidance, the company estimates that the September sales will be between more than ten thousand to twenty thousand, considering that the ET5 will not be delivered until the end of September. It is basically within the estimated range of Dolphin Analyst, and there are no surprises or scares. Therefore, the corresponding income guidance is between 12.8 billion and 13.6 billion, and the implied unit price expectation is slightly conservative.

Overall Opinion of Dolphin Analyst:

The profit in this quarter seems to be lower than expected by the market, but it is more because of the "sedimentary" investment in the early launch period of new cars and platforms, which is not a particularly significant problem as long as the subsequent sales volume of new cars perform well. The core still depends on the sales volume of new cars.

Regarding the sales volume expectations of new cars, although the Q3 revenue guidance is average, it can be seen that NIO's vehicle sales volume, after several periods of downturn, should officially emerge from the "generation shift" bend starting from the third quarter. There is still the probability of the release of ET5, which will not cannibalize existing model user pools, and the vehicle matrix and brand momentum are significantly stronger than that of Lixiang and XPeng. And the other key focus of this quarter: the automobile gross margin index: NIO's actual answer is actually beyond market expectations. The reasons behind it are whether the new platform has better cost advantages or because the price increase has been reflected in this quarter's performance. We need to wait for management's more detailed explanation.

But regardless of the reason, it is undeniable that as the battery material prices fall from their high levels, and the factors of price increases in vehicle models are more integrated into revenue, the gross margin is highly likely to gradually recover. At the same time, due to its decent vehicle matrix and brand potential, NIO may be a company with better opportunities in the adjustment of the new energy vehicle stock price in the second half of the year, mainly in terms of new car contributions and potential purchasing pools rather than eating into the original vehicle models.

Subsequently, Dolphin Analyst will summarize the minutes of this earnings conference call for everyone. The conference call will focus on the orders and delivery status of ET 5 and ES 7, the increase in production capacity, battery swap stations, and most importantly, the impact trend of new models and platforms on the automobile gross margin rate. You can add the WeChat account of Dolphin Helper, and join the Dolphin investment research exchange group to get the conference call content at the first time.

I. NIO: leading or lagging behind in crossroads

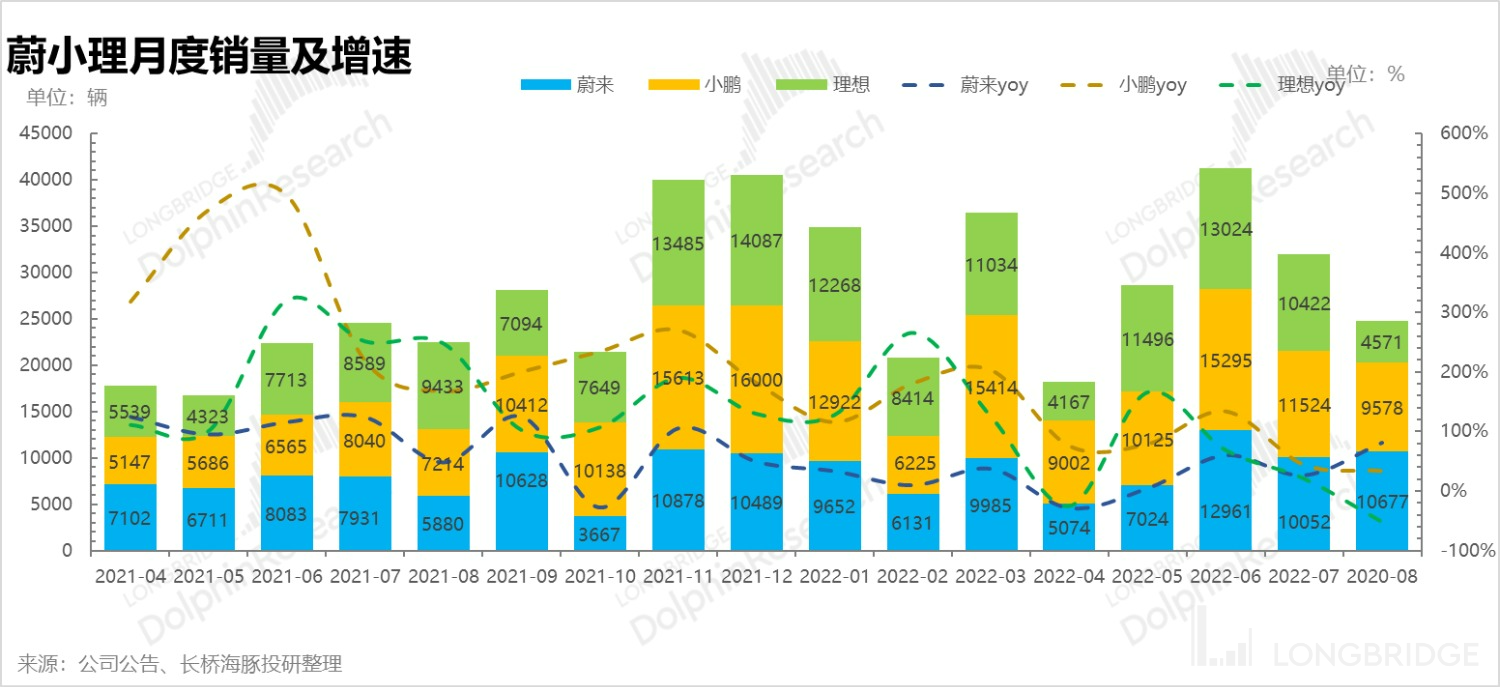

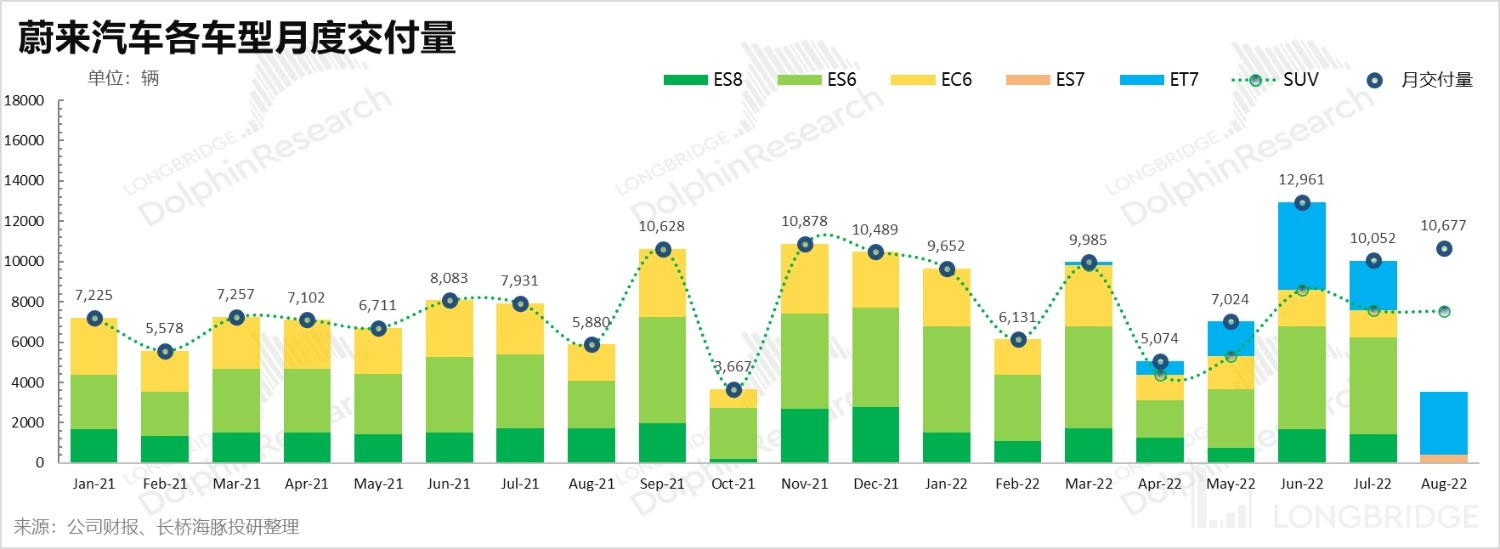

Vehicle delivery volume is the most critical indicator for new energy vehicle brands. However, every month, automakers will announce the sales data for the previous month. As NIO is the latest company to disclose financial reports among its peers, its sales for the current quarter are almost certain to be on par with its previous quarters.

Therefore, observing the sales in the quarterly report is more about anticipating whether the sales outlook for the month will exceed expectations based on the sales guidance for the new quarter.

NIO is expected to deliver 31,000 to 33,000 vehicles in the third quarter this time. It has delivered more than 10,000 units in both July and August, which means NIO's estimated delivery volume in September is expected to be between 10,300 and 12,000 units, which is slightly higher than the average level of July and August. If the delivery progresses smoothly, it may exceed 12,000 units.

Based on the trend of the past two quarters, NIO is the first company to step onto the "vehicle replacement" growth curve and the most likely to be the first to accelerate out of the curve.

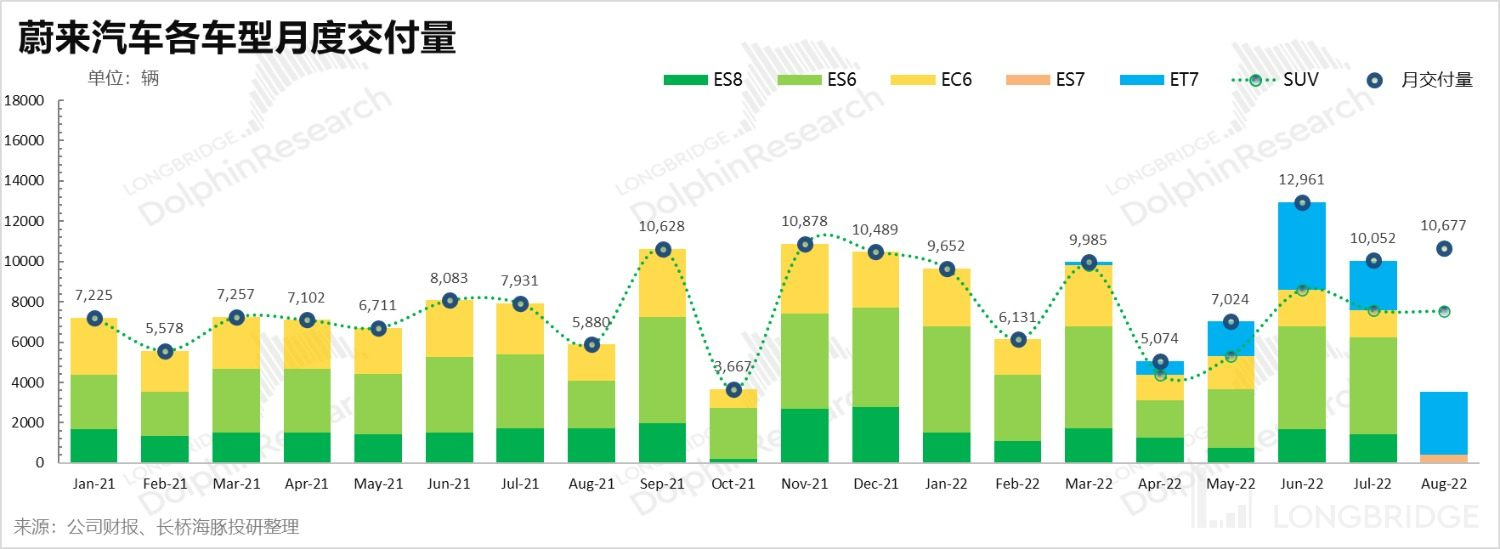

From the updated models, This year is a transitional year for NIO from the SUV/sports car 866 (ES8, ES6, EC6) to the NT2.0 platform 775 (ET7, ES7, ET5).

Among them, the new sedan ET7 began delivery in March, and sales are gradually increasing; the new SUV ES7 began delivery in August with hundreds of units, and it is also expected to gradually contribute some increments. By the end of September, the ET5, which has the true potential for sales, will start mass production and delivery, and based on the information disclosed by the company before, all the ET5 deliveries this year are backlog orders.

Therefore, NIO's delivery situation in the second half of the year is actually improving compared to Xiaopeng and Ideal, which can also be reflected from the actual sales in the second quarter and the delivery guidance in the third quarter. NIO has once again become the company with the highest sales guidance among the three.

The main difference between it and Xiaopeng and Ideal is that when the new models of Xiaopeng and Ideal were launched and had not yet been delivered, they more or less had the situation of mutual cannibalization between their new and old models, which did not bring incremental sales but mainly impacted internal sales.

For NIO, the return of its two major models, ES6, which had relatively high sales in the past, not only enabled the company to preserve its inventory but also gradually improved the situation by bringing new users to NIO.

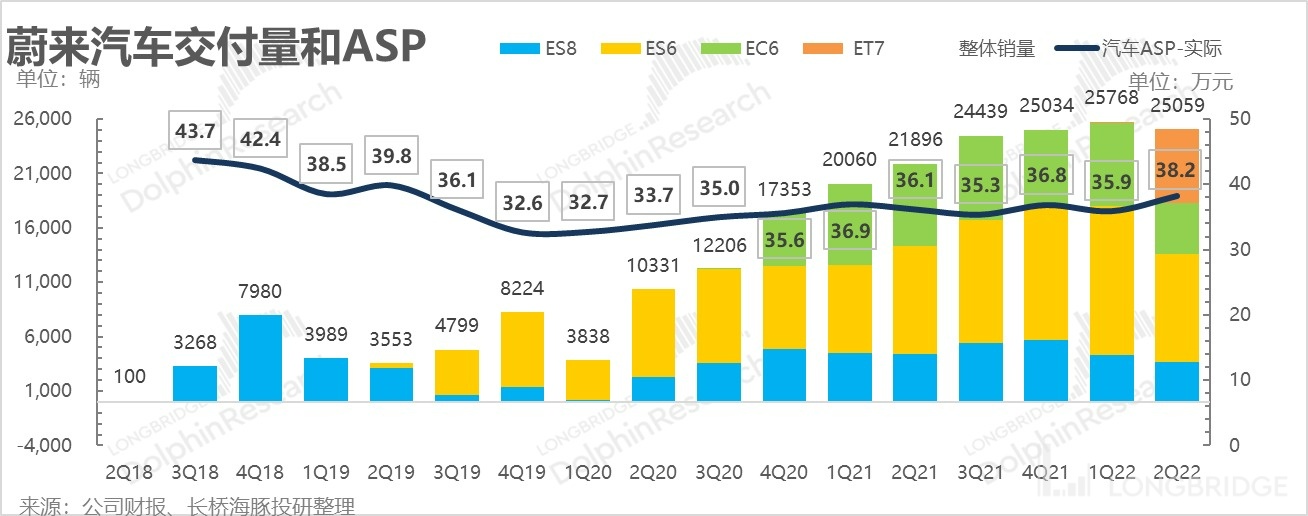

Actual delivery volume in the second quarter: In the second quarter of 2022, the company achieved a delivery volume of 25,100 vehicles, slightly exceeding the soft guidance of 23,000-25,000 vehicles, a year-on-year increase of 14%, and a month-on-month negative growth. The flat sales in the second quarter had some factors of changing generations.

2. Unit price boost, good revenue performance

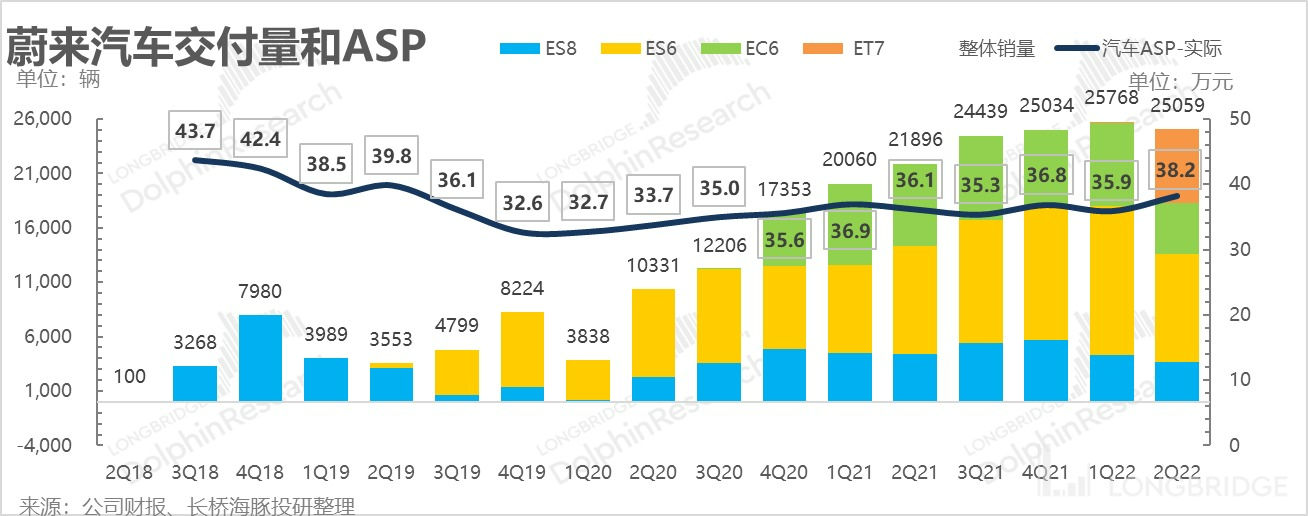

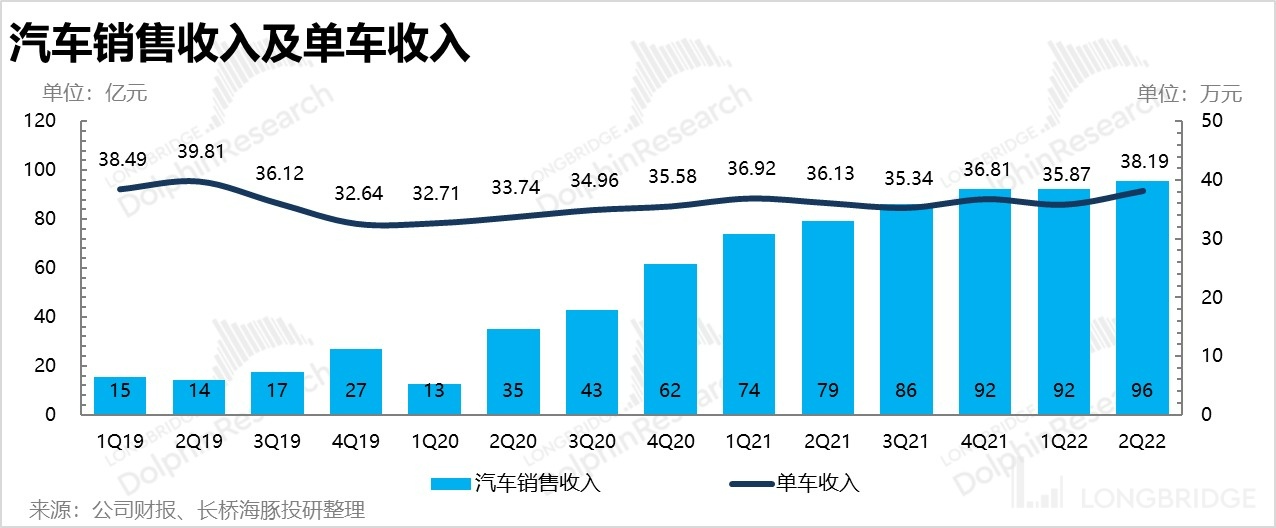

Unit price: The company's single vehicle income in the second quarter was 382,000 yuan/vehicle, a year-on-year increase of 20,600 yuan per unit, and a month-on-month increase of 23,000 yuan, which was quite impressive and exceeded the market expectation.

Considering the single vehicle gross profit margin in this quarter and the fact that the gross profit margin of automotive sales in the same industry is generally poor, NIO may have begun to deliver orders for price hikes after considering the perspective of battery cost pressure. Vehicles delivered after April 1 had already started to rise in price, which seems to indicate that NIO does not have as many backlog orders as previously thought. Another factor may be that the proportion of high-priced ET7 deliveries has increased, driving up the average price.

Finally, NIO realized automotive sales revenue of 9.6 billion yuan; after stagnating for a quarter, there is finally some hope of returning to growth, and the automotive sales revenue in this quarter exceeded the market expectation because the single vehicle price was higher than expected.

3. Did the gross profit margin fall significantly under battery cost pressure? No, it did not.

Although NIO's profit performance was relatively average in the second quarter, the gross profit margin of its automotive business actually performed well. As per market expectations, the gross profit margin in the second quarter should have been poor, mainly due to the fact that the battery factory began to transmit pressure to the upstream for increased costs. If there are backlog orders, the effect of price increase cannot be immediately reflected in the second quarter. This is evident in the cases of Geely, Xiaopeng, and Weilai according to Dolphin Analyst.

In this quarter, the actual gross profit margin for Weilai's automobile sales business is 16.7%, which is significantly higher than the market expectation of 15.5%. Dolphin Analyst estimates two possibilities here:

(1) There are fewer backlog orders for Weilai's original 866 model, so the effect of price increase can be relatively immediate;

(2) ET 7 (priced at 448,000-526,000 yuan) is the first sedan under the new platform NT 2.0. Does the new platform bring a certain cost-reduction effect? This can be explained by Weilai itself during the conference call.

But from the results, in the second quarter, under high unit price and high cost, Weilai's single-car gross profit was 64,000 yuan, which is only 1,400 yuan less than the first quarter and did not lose control as other new energy vehicle companies did.

IV. Other Businesses: Still Suffering Heavy Losses

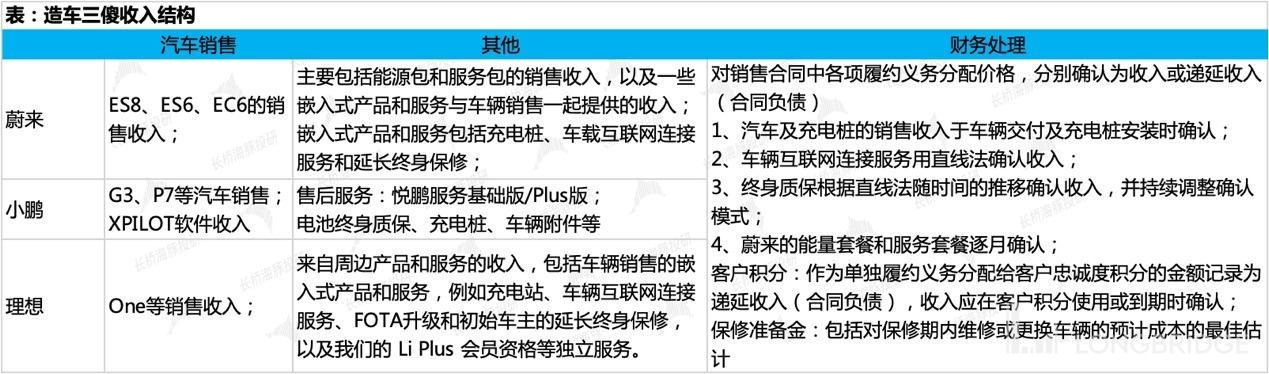

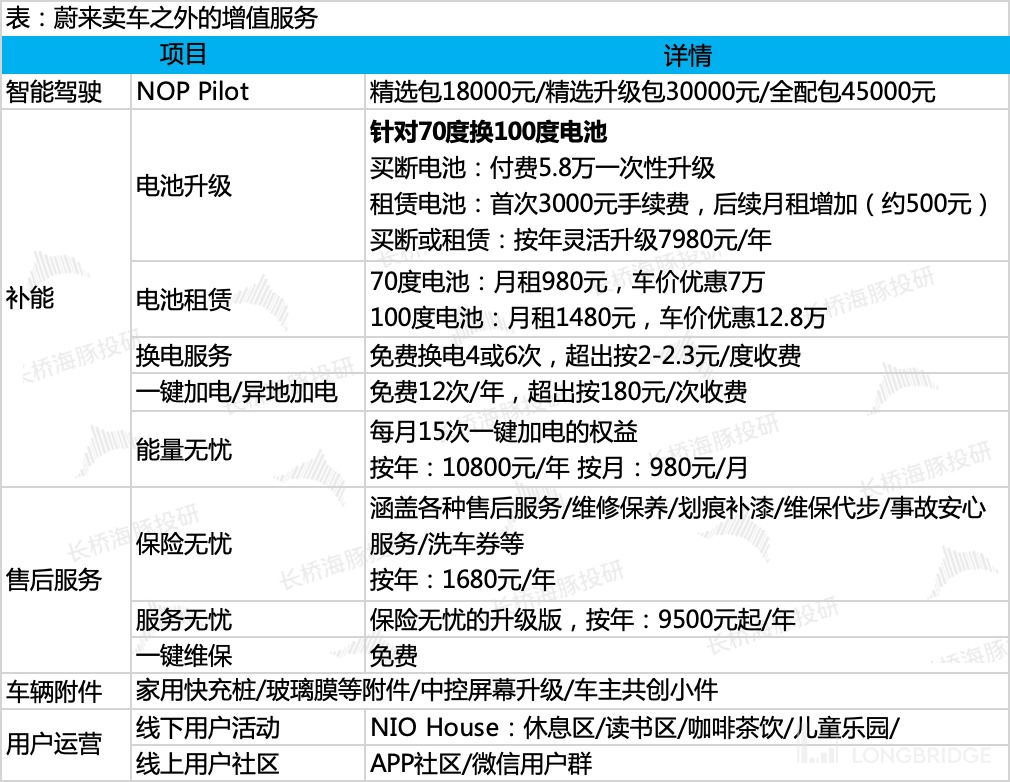

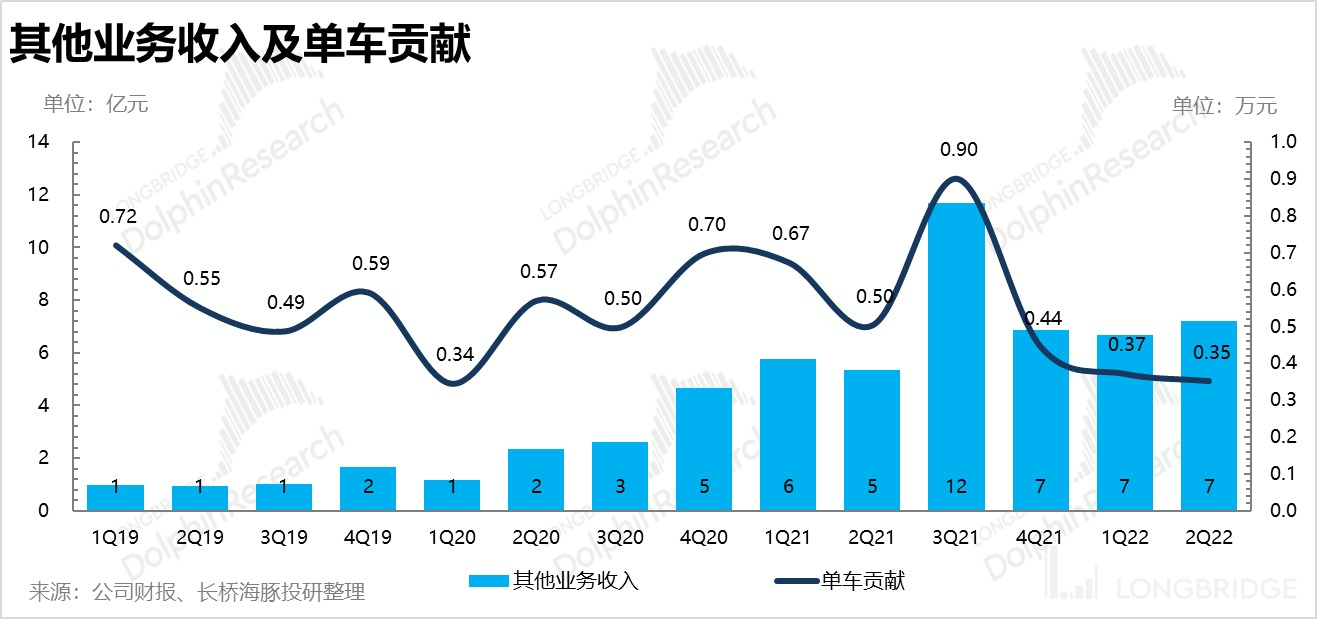

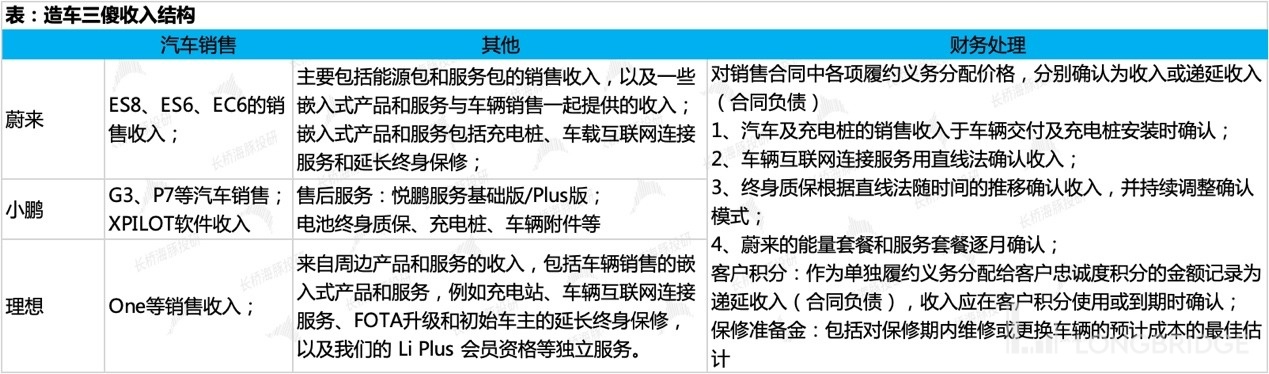

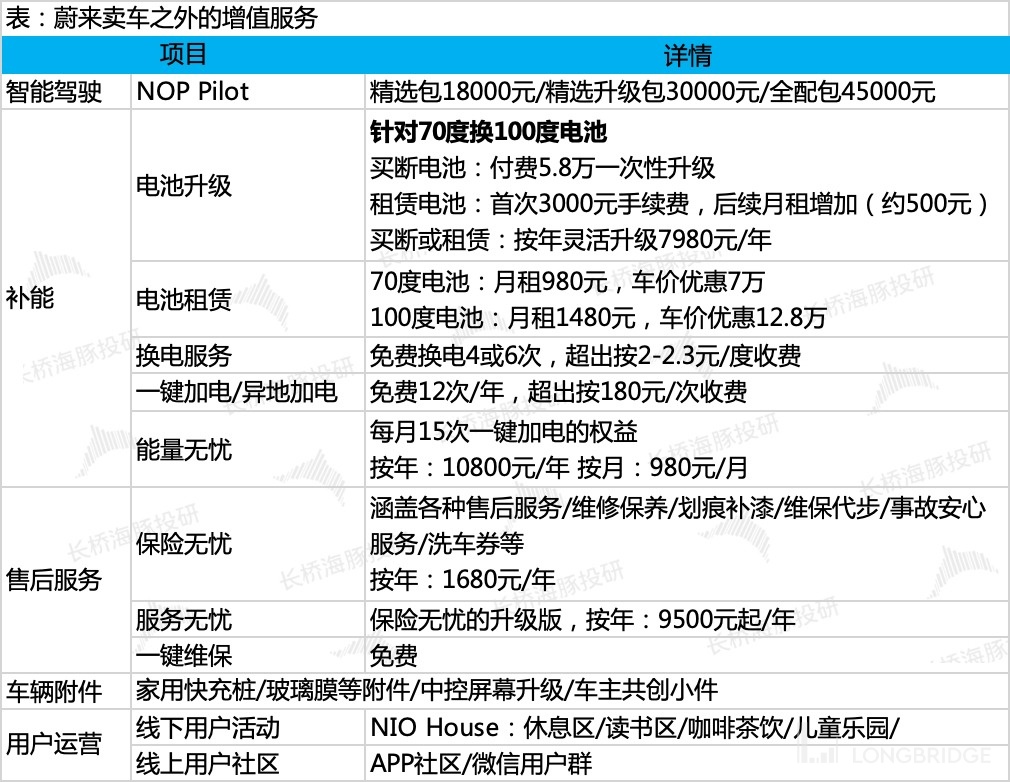

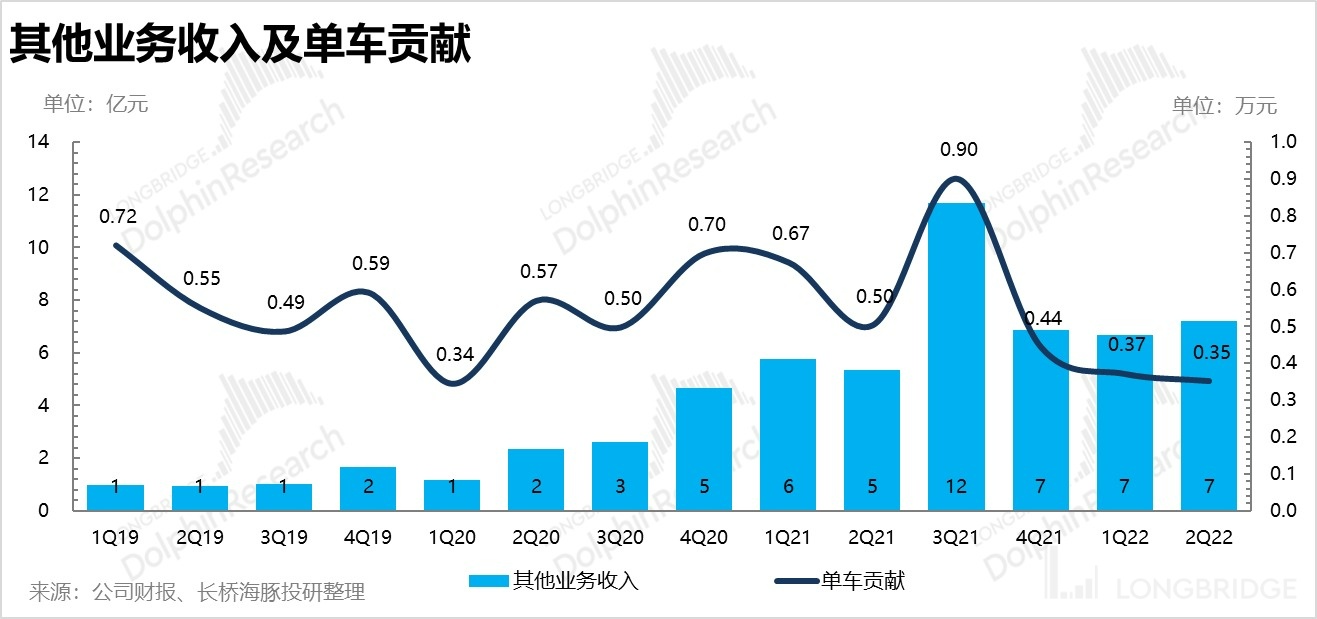

In addition to automobile sales, Weilai's other businesses mainly include revenue from sales of energy packages and service packages, as well as revenue generated by embedded products and services such as charging piles, vehicle connectivity services, etc., which are sold together with vehicle sales. The company has always maintained a high-end strategic positioning, hoping to bring better services and experiences to car owners through better brand management and user communities with a relatively high gross profit margin.

From the revenue structure and the implementation of ecological operations, the company's business model is at the forefront: the new car ET7 is equipped with the NAD autonomous driving system and the full function adopts a "pay-per-month" service subscription model, with a monthly fee of 680 yuan. In the first quarter of 2022, the ET7 started to be delivered and it can be observed whether the monthly subscription can become a major source of software revenue.

Data source: Company's financial report, Dolphin Research

Data source: Company's official website, Dolphin Research

In the second quarter of 2022, the company's other businesses achieved a revenue of 720 million yuan, a year-on-year increase of 35%, and a gross profit margin of -35%, continuing the poor performance of the previous quarter. Based on the accumulated delivery volume, the stock cars of the company contributed 3,500 yuan in revenue per car in the fourth quarter of 2021, and the absolute value continued to decline. Apparently, this still seems to be in the overall investment period and not contributing to revenue, but contributing to losses.

Business Operations: Good Gross Profit, Average Revenue Guidance

The company achieved a total revenue of RMB 10.3 billion in Q2, a year-on-year increase of 22%, which hit the upper end of the performance guidance range (RMB 9.3-10.1 billion).

Despite an already clear sales volume, the higher vehicle prices than expected in the automobile sales business has caused the revenue to exceed expectations. This is due to the improvement in the vehicle model structure and the possibility of the vehicle price increase.

Approximately between RMB 12.845 to 13.6 billion is the projected revenue guidance for Q3. If we simulate the vehicle sales volume guidance, the single vehicle price may decrease by around RMB 6,000 compared to Q2. Unless the guidance is conservative, this is relatively lower than Dolphin Analyst’s prediction.

Dolphin Analyst originally estimated that compared to the ES6, the prices of the new cars ES7 and ET7 aren’t cheap. ET5, which is relatively cheap, is not expected to be delivered until the end of September, so it will not disturb the overall price significantly. The probability of price increase lies more in the rise of the percentage of these two models, rather than the decline of their prices. Unless there is an explanation from the company in the conference call, significant delivery of ET5 at the beginning of September seems unlikely.

Gross Profit

Due to the good performance of the automobile business this quarter, the overall gross profit margin was not as bad as the market expected, reaching 16.7%, which is at least 1% less than the market expectation.

As the pressure on raw material prices alleviates, and vehicle price increases become more fully reflected, there is hope for NIO's gross profit margin to further improve.

Don’t Be Scared by Nearly RMB 3 Billion in Losses: High Investment in the Early Stage of New Car Replacement is Normal

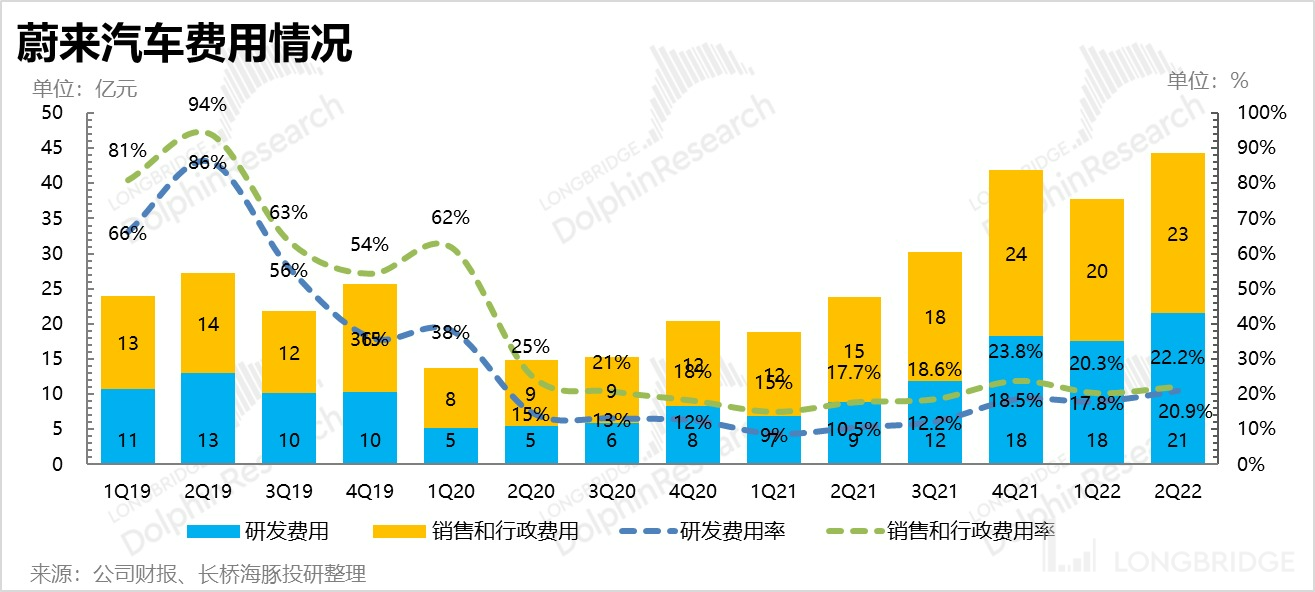

Despite the better-than-expected automobile revenue and good gross profit of the vehicle business, NIO's performance results did not meet market expectations, mainly because R&D and market investment this quarter were too high.

(1) R&D expenses: R&D costs are one of the quantitative indicators of a company’s technological strength in the market and are basically rigid expenses at the current stage. This quarter, the company's R&D expenses were RMB 2.15 billion, and the R&D expense ratio has exceeded 20% once again in the past two years, reaching 21%. The main reason for the high growth rates is due to the introduction of new products and new technologies that require additional recruitment, leading to investment that is unrelated to revenue and continuous rigid growth.

Moreover, NIO has too much to research and develop currently. In addition to the new models launched under the “NIO” brand, the company plans to launch a new mid-to-high-end brand called “ALPS” in the next year in the range from RMB 200,000 to RMB 300,000. Reportedly, another new brand, “Firefly Plan” with a lower-end positioning and a price range of RMB 100,000 to RMB 200,000, is also set to launch in that year. In terms of automobile production capacity, the company plans to have a capacity of up to 1 million vehicles in the F2 factory in Neo Park, which will be put into operation in the third quarter and will take three to four months to ramp up. In addition, a battery factory needs to be established at this location, with a planned production capacity of 100GWh/year.

Moreover, the development expenses are difficult to reduce, and can only be lowered by increasing the revenue. This includes the mass production of ET7's semi-solid-state batteries, the self-developed ADAM supercomputing platform, and the planned autonomous driving AI chips.

- Sales and administrative expenses continue to rise: Sales expenses are related to the expansion speed of the sales network and the release rhythm of new cars. In the second quarter, the propaganda and sales of the new car ES7 corresponded with increased expenses, almost reaching 2.3 billion yuan. The sales expense ratio was also high, exceeding 22%.

As for the trend, the absolute value is expected to be difficult to improve in the short term, mainly because of the cycle of exchanging old and new cars. New car sales still need to ramp up, but corresponding sales personnel, network layout, and other investments need to continue.

Overall, whether it is research and development or sales expenses, they can only be diluted by the revenue growth after the new car's increase. It cannot be expected that these two expenses will grow conservatively in absolute value.

This quarter's operating profit was poor due to the high investment period for the early sales and promotion of new cars and the intense R&D investment. However, due to no significant increase in sales volume, the profitability was still weak. The company achieved a loss of 2.8 billion yuan in operating revenue in the second quarter, close to the market's expected loss of 2.6 billion yuan. The operating loss rate was nearly 28%.

This is Dolphin Analyst's commentary on NIO's second-quarter financial report. Dolphin will then summarize the minutes of this performance briefing for everyone. Please stay tuned.

For more in-depth research and tracking reviews of NIO by Dolphin, please click:

Financial Report:

On June 9, 2022, Q1 financial report interpretation, "NIO is still weak, relying solely on new cars?"

On June 9, 2022, Q1 financial report conference call, "NIO's gross profit margin in Q2 will be worse. Will NIO make a comeback in the second half of the year?"

On March 25, 2022, the 2021 fourth quarter report commentary, "NIO: Under pressure, will it continue in the dark or see the light?" 2022 is the year for NIO to accelerate fully, according to the summary of the Fourth Quarter Report Meeting in March 2021. In November of the same year, a review of the Third Quarter Report was conducted, entitled "After the Ankle-Chop, Will NIO Perform Deep Squat Jumps in the First Half of Next Year?" In addition, in the same month, the summary of the Third Quarter Report Meeting was titled "NIO: No Need to Worry Too Much about Periodic Delivery Delays and Margin Pressure (Meeting Minutes)." The review of the Second Quarter Report was entitled "What Is NIO's Future After the Outbreak?" on August 12th, 2021. An updated perspective on the Second Quarter Report was released on August 15th, 2021, entitled "NIO: High Valuation Vs. Low Delivery, Beware of the 'Future' in Front of You."

Highlights:

On June 29th, 2022, a Hotspot Review was conducted entitled "This Negative Report on NIO Could be More Heartfelt."

** Research:**

On June 16th, 2022, a summary of the new car release was released, entitled "Rapid Release, Rapid Delivery, NIO's Second Half of the Year Has Prospects." On December 21st, 2021, a NIO DAY study was conducted titled "ET5, a Bestselling Model, Will NIO Reignite the 'Future'?"

In-Depth Analysis:

On June 9th, 2021, the First Part of the Three Idiots Comparative Study was released, entitled "New Forces in Car-Making (Part I): Investing in the Right Person and Doing the Right Thing—Taking Stock of the People and Events in New Forces." Also, on June 23rd, 2021, the Second Part of the Three Idiots Comparative Study was released, entitled "New Forces in Car-Making (Part II): As Market Enthusiasm Wanes, What Can Three Idiots Rely on to Consolidate Their Position?" On June 30, 2021, a comparison study of new carmakers - Part II "New Car Forces (II): Fifty Days of Doubling, Can Three Fools Continue to Run Wild?".

Risk Disclosure and Statement for This Article: [Dolphin Analyst Disclaimer and General Disclosure](https://support.longbridge.global/topics/misc/dolphin-disclaimer" \t "_blank")